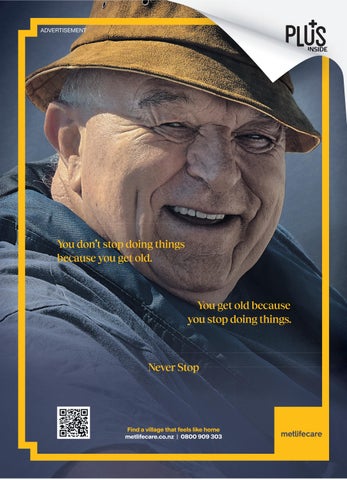

Retirementlivingcomeswithmanyperks,buthow dothecostsstackup?Fromcapitalsumstovillagefees, ourMoneyMattersguideexplainsallthecostsassociated withvillagelifesoyoucanmakeaninformedchoice.

UseyourcameratoscantheQRcodeandfollowthelink todownloadyourfreeguidetoretirementvillagecosts.

Findavillagethatfeelslikehome metlifecare.co.nz | 0800909303

Superuncertainty: willNZSuperbe therewhenyou retire? Universal,simple,andenviedaroundtheworld, NZSuperisfacingnewchallengesfroman ageingpopulationandshiftingpublicopinion. Here’swhat’satstakeforfutureretirees.

NZSuperhaslongbeenthebedrock ofretirementincomeformostKiwis.

Comeage65,manyplantocheckoutof theofficeorfactoryforthelasttime.NZSuper willbeallorpartoftheirincome.

Currently,everyoneover65whomeets residencyrulesgetsNZSuper,regardlessof incomeorassets.

Butwithanageingpopulationandrising costs,NZSuper’sfutureisuncertain.Willit stillbetherewhenyouneedit,andwillitbe enough?Manysay“no”.

Thenumbers

Let’slookatthenumbersfirst.Asingle personlivingalonegets$519.47aweekafter tax[$27,012]ayear,andacouplegets$799.18 combined[$41,558ayear].Isthatenoughfor youtoliveon?

IfNZSuperisyouronlyincome,you’lluse the‘M’taxcode.Ifyoukeepworkingafter65 orhaveotherincome,you’lluseadifferenttax codeandmaygetlessinhand.

Retireesandpeopleonthehomerunto

retirementoftenbelievethey“deserve”their pension,becausethey’veworkedalltheir livesandpaidforit.Thatisn’ttechnicallytrue. NZSuperisapay-as-you-goschemefunded directlyfromcurrenttaxrevenue.In2024,it cost$21.57bn,upfrom$15.52bnin2014.

AlthoughNZSuperisunderfiscalpressure, itremainsoneoftheleastexpensivepensions intheOECDasashareofGDPandisexpected tostaybelowtheOECDaveragefordecades. NewZealandisprojectedtospend5.2% ofGDPonNZSuperthisyear,comparedto theOECDaverageof8.9%.Somecountries suchasItaly,France,FinlandandGermany havepensionsthatcostdoubledigitsasa percentageofGDP.

ThedollarfigureNewZealandspendson NZSuperisexpectedtocontinuerisingasthe populationages.Projectionsshowthatbythe late2050s,oneinfourNewZealanderswill beagedover65,significantlyincreasingthe financialburdenonfuturetaxpayers.

NZSuperisbecomingmoreexpensiveas thepopulationages,buttheNZSuperFund helpsaddressthis.Thegovernmentinvests intheFundmostyears,buildingapoolof moneytohelppayforfuturesuperannuation costs.Fromthe2030s,withdrawalsfromthe FundwillhelpcoverNZSuper,easingthetax burdenonyoungergenerations.

Generationgrievance:theresentmentof youngerpeople

Headovertosocialmediaandthereisalot ofvitriolaimedatolderpeople.Manyyounger NewZealandersseeitasunfairthatNZSuper ispaidtoallover65sregardlessofincome orwealth.Theysay,‘whyshouldsomeone earning$50,000,$100,000,oreven$1mfrom theirdayjobaftertheageof65bepaidNZ Superaswell’?

Policydebates,suchasproposalstoraise thepensionageormeanstestNZSuper, ofteninflamegenerationaltensions.Younger

4-5DAYS 9DAYS

Photo Gett Im es

people,alreadyfacinghighstudentdebt, unaffordablehousingandinsecurework,see thesystemasfavouringoldergenerations whotheybelievebenefitedfromcheaper educationandhousing,andarenow guaranteedastatepensionregardlessof need.

DespiteregularproclamationsthatNew Zealandcan’taffordit,fewmembersofthe publicwouldwantNZSuperdisbanded. Around60%ofsinglesand40%ofcouples relysolelyonNZSuperastheirmainoronly sourceofincome.Povertyamongolder peoplewouldrisesharplyifitwasdisbanded.

What’smore,today’svitriolistomorrow’s reality,becausethosesameyoungpeoplewill onedayreachretirementagethemselvesand mightwantNZSuper.

Butwecanaffordit,sayscommissioner RetirementCommissionerJaneWrightson haspubliclyrejectedclaimsthatNZ Superisunaffordable,andpointstothe argumentthatNZ’scostsareonthelower sideofOECDcountries.“ClaimsthatNZ Superisunaffordablearenotsupportedby independent,publiclyaccessibleanalysis.” Sheadds:“Currentandprojectedexpenditure doesnotrepresentaninternationallyhigh proportionofGDPandage65isnotrelatively lowcomparedtoourpeers.”

InFebruary2024,onthereleaseofapaper NZSuperIssuesandOptions,whichprovided acomprehensiveanalysisofretirementpolicy, Wrightson,describedNZSuperasa“taonga” thatprotectedolderNewZealandersfrom povertyandunderpinnedtheirdignityand participationinsociety.

“NZSuperisavitalpartoftheretirement incomesystemandneedstobefair,stable, andaffordableforcurrentandfuture generations,”Wrightsonsaidatthetime.But sheacceptsthattomorrow’spensionerswill notbeinthesamepositionastoday’s.“We needawayforpoliticianstotakealonger term,andpurposefulapproach,sotheright decisionsaremade.”

HowNewZealandcouldcutNZSuper OptionsforcuttingthecostofNZSuper comeintwomainflavours.Oneisraising theageofeligibilityfrom65,whichdelays whenpeoplecanaccessNZSuperandsaves thegovernmentmoneybyreducingthe numberofyearspeoplereceiveit.Theother is“means”testing,whichlimitspayments basedonhowmuchotherincome,orassets, someonehas.

Meanstestingtocontrolcosts,similarto Australia’ssystem,mightdisqualifyabout20% ofretireesbutsavesignificantgovernment spending.

ResearcherssuchasSusanStJohn (UniversityofAucklandRetirementPolicyand ResearchCentre)havemodelledhowtesting ora“claw-back”throughthetaxsystemcould work,arguingitcouldgeneratesignificant savingsandtargetsupporttothosewho needitmost.However,StJohnandothers alsohighlightthatmeanstestingispolitically sensitiveandhistoricallyunpopularinNew Zealandduetoconcernsaboutfairness, complexityandstigma.

IndependenteconomistCameronBagrie arguedinJune2025,inaBusinessDesk opinionpiece,thatmoremeanstestingofNZ Superisinevitableunlesswearepreparedto paymoretax.

Therearemanyargumentsforandagainst bothraisingtheageofeligibilityandmeanstesting.TheTeAraAhungaOraRetirement Commissionpaperprovidedacomprehensive overviewofNZSuperandoutlinedoptions tocutcosts,shouldsavingsbecomeessential. Itrecommendedtheageofentitlementto NZSupershouldremainat65.Onthesubject ofraisingtheageofeligibility,Wrightson

sayschangeswoulddisproportionately disadvantagemanualworkers,carersand thosetheycarefor,andthosewithpoor health,duetodifferencesinsavings,wealth andabilitytoremaininpaidworkafterthe ageof65.Women,Māori,andPasifikapeople areoverrepresentedinthosegroups.

“Theextrasupportneededtosupport somepeoplethroughtoalaterageof eligibilitywouldreducefiscalsavingsfrom raisingtheage.Politicalsupportforastable long-termsystemiscrucial.”

Thecommission’spapersaidthatincome [means]testingisafairerwaytoreduce expenditureonNZSupercomparedtoraising theageofeligibility.InthatscenarioNZSuper wouldnotbepaidtothosewhocontinueto earnsignificantincome,suchastwicethe medianincomeforaperiodafter65,orwhile significantincomeisbeingearned.

“EnhancementstoKiwiSavershouldalso besimultaneouslyconsideredwithanyNZ Superchange,toassistfutureretireesto maximisetheirprivatesavings,”thepaper said.

Citizenswouldbestbeservediftherewas along-termcross-partypoliticalaccordon theretirementincomesystem,thepaper noted.“Thisshouldincluderegularand independentscheduledreviews,sayevery nineyears,sosuccessivegovernmentshave robust,transparentdataavailabletothem.”

Politicalfaultlines:whatpartiesare(and aren’t)saying NZSuperisahighlysensitiveissue,and anypoliticalpartythatmovesbeyondvague promisesorminortweaksandactuallytries toimplementmajorreforms,risksasevere electoralbacklash,particularlyfromolder voterswhoarealargeandactivevotingbloc.

Ontheretirementage,National’s commitmenttoseniorsinitspolicymanifesto atthelastelectionwastokeeptheNZSuper ageat65until2044,whenitwillbegradually liftedto67.Thischangewon’taffectanyone bornbefore1979.Asof2025,Labour’sofficial policyistokeeptheNZSuperageat65,with noannouncedplanstoraiseit. Nomajorpartycurrentlyproposesmeans testingNZSuper.BothNationalandLabour haveexplicitlyruleditoutinrecentyears, andthecurrentgovernmenthasreiteratedits oppositiontomeanstesting,insteadfocusing oneligibilityageandothersettings. ResearchbyOtagoUniversityshowed widespreadpublicoppositiontomeans testing,withuniversalsuperannuationseen asfairerandsimpler.GroupslikeGreyPower andKaspanzarguethatmeanstestingwould increasebureaucracy,createdisincentivesto save,andleadtounderclaimingbythosein

need.Pastattemptsatmeanstesting,such asthe1980sand1990ssurtax,weredeeply unpopularandledtoavoidancestrategies andpoliticalbacklash.

Inthelatestbudgetthecurrentgovernment announcedthatthegovernment’sKiwiSaver contributionwillbemeanstestedforpeople earning$180,000ayear.SowhynotNZ Super?“IfIweretheGovernment,I’dbe exploringmeanstestingmoreandmore,” BagriewroteinBusinessDesk.Headdedthat raisingtheretirementagewouldnotfixthe problemaloneandthedrumswerebeating louderforchangestoNZSuper.

WillKiwiSaverreplaceNZSuper?

EversinceKiwiSaverwaslaunched, rumblingshavebeenheardthatsuccessive governments’long-termplanistouseitto replaceNZSuper.Theideaisthatpeople savefortheirownretirement,liketheydo inmanycountries.Inasensethat’swhat happensinAustralia,wherepeoplesaveinto theirSuper,andonlythepoorqualifyforthe government’sagepension.SuperinAustralia iscompulsoryandemployerscontribute12% ofpeople’sordinarytimeearnings.

KiwiSaverontheotherhandhasalways beenvoluntary,anddesignedtosupplement retirementincomeandhelppeoplemaintain theirpre-retirementstandardofliving.It wasnotdesignedtobeareplacementforNZ Super.

IsNZSuperstillsafeasyour“PlanA”?

FormanyKiwis,especiallythosewithout largeKiwiSaverbalancesorotherassets,NZ SuperisstillPlanA.Theuncertaintyabout itsfuture,whetheritwillbeenough,oreven existinitscurrentform,createsanxietyand complicatesretirementplanning.Evidence suggeststhatformanyretirees,NZSuper alonedoesnotcoveralllivingcosts,making additionalsavingsessentialforacomfortable retirement.

Here’showtheoutlookbreaksdown:

•ShortTerm:NZSuperremains secureanduniversal.TheRetirement Commissionandmajorparties,atleast inthenearterm,supportitscontinuation atage65.

•LongTerm:Risingcostsanddemographic pressuresmeanchangesarepossible ifnotinevitable.Thesecouldinclude raisingtheageormeanstesting.

•BottomLine:WhileNZSuperislikely toremainacorepartoftheretirement system,relyingonitasyoursole“Plan A”isincreasinglyrisky.Buildingup KiwiSaverandothersavingsismore importantthanever.

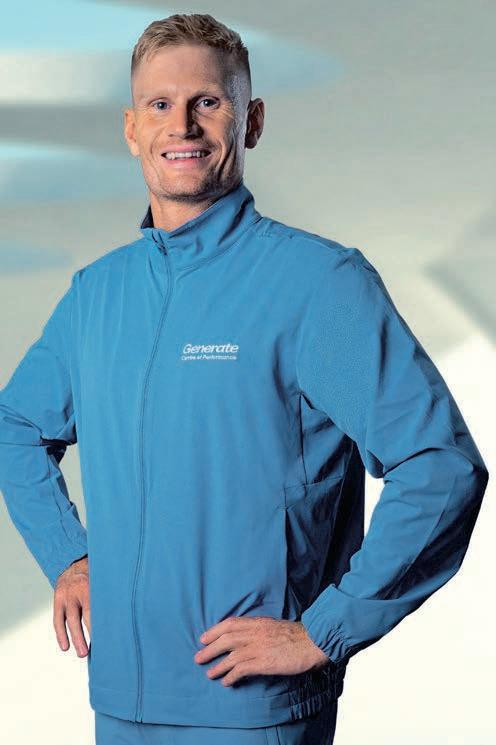

JaneWrightson,RetirementCommissioner

Racingahead:howKiwiinvestors canoutperforminAustralia AsBradPittbringsF1tothebigscreen,PieFunds showshowNewZealandinvestorscanfast-track theirportfoliosbyinvestinginAustralia.

ByDianaClement

Ifyou’veseentherecentF1filmstarringBrad Pitt,you’llknowthestory:veterandriver SonnyHayesiscalledbacktothegridto helpturnastrugglingteamintoracewinners. It’sareminderthatperformanceisn’tjust aboutspeed,it’saboutstrategy,adjustingto localconditions,andthestrengthoftheteam behindyou.

Thesameprinciplesapplytoinvestingand deliveringlong-termperformance,saysMike Taylor,FounderandCIOofPieFunds(“Pie”).

InJuly2025Pie’sflagshipAustralasian GrowthFundreachedamajormilestone, deliveringa10-timesreturnfororiginal investorsin2007.That’sanaverageannual returnof14.5%perannumfornearly18years.

Whilethat’saprettyrareoccurrenceinNew Zealandfundsmanagementcircles,it’sno fluke,saysTaylor.

WhyAustralia?

“Firstly,Australiahasabiggerpopulation,a faster-growingeconomy,andthey’rewealthier thanweare,”saysTaylor.“It’sabroader,more dynamicmarketwithgreaterpotentialfor outperformance.”

Thatscaleanddiversityarereflectedinthe numbers.TheNewZealandExchange(NZX) featuresaround120listedcompanies,while theAustralianSecuritiesExchange(ASX)has around1,900,withmuchgreaterliquidityand moreopportunities.

Australia’smarketisdrivenbyresourcesand

financials,sectorsthathistoricallybenefitfrom globaltailwinds.Thereisalsoadynamicsmall companiessector.

AnotheradvantageforKiwiinvestorsisthat Australiafeelsfamiliar,saysTaylor.“Many Kiwishavepersonalties,andsomewellknownAustralianbusinessesoperateinboth countries.Thatfamiliaritycombinedwiththe scalemakesAustralian-focusedgrowthfunds goodinvestmentsforKiwis.”

WhilePie’srangeofAustralasiangrowth fundsholdsomeNewZealandinvestments, mostofthebestopportunitiesarefoundin Australia,andyou’veprobablyneverheardof them,saysTaylor.

They’retypicallydynamicsmallandmedium sizedlistedcompaniesinsectorslikefinancials, healthcareandtechnology,headds. Therightraceplan:whyactivemanagement matters

Pie’sedgeintheAustralianmarketcomes fromitsactivemanagementapproach,which uncoversopportunitiesothersmightmiss. “Smallandmid-capcompaniesoftenlack analystcoverage,andthat’swhereourSydneybasedteamexcels,identifyingundervalued businessesandmanagingriskslikecurrency movementsandmarketvolatility,”saysTaylor.

“Wespendalotoftimegettingtoknow thecompaniesweinvestin.Wemeet management,checkinwithcompetitors,and stayclosetowhat’shappeningontheground. That’swhatsetsusapart.”

Unlikepassivefunds,whicharetiedtoindex

MikeTaylor,FounderandCIOofPieFunds(Pie)

weightingsandoftenfavourlargeincumbents, Pie’steamcanadjustsectorexposure,respond toeconomicshifts,andavoidspeculative trends,saysTaylor.LedbyPie’sHeadof AustralasianEquitiesMichelleLopez,the team’sdeeplocalknowledgeandnetworks allowittoinvestwithconviction.

“AllfourofourAustralasiangrowthfunds boastimpressivetrackrecords,”Tayloradds.“If you’reaNewZealandinvestorlookingtogrow yourportfolio,it’sworthaskingwhetherPie shouldbepartofyourstrategy.”

Caution:currencyandvolatilityrisks

WhileAustraliamaybefamiliartoNew Zealanders,investingthereisn’twithoutrisks.

Exchangeratemovementscansignificantly influencereturns,andtaxdoesn’talwaysalign neatlywithNewZealand’ssystem,saysTaylor.

TheASX’sbroaderexposuretominingand speculativetechorbiotechcompaniesbrings greatervolatility.Whilethesesectorscan offerabigupside,theycanreversequickly, especiallyifglobalsentimentorcommodity pricesshift.

“Theseriskscanbemanagedwithanactive fundmanagerlikePieinthedriver’sseat,”says Taylor.

“Forinvestorstryingtogoitalone,or throughpassivefunds,thatvolatilitycanbe hardertomanage.”

Thechequeredflag:closingoutthewin Whenitcomestoinvestingacrossthe Tasman,theopportunityisclear,saysTaylor. Australiaoffersafaster,broader,andmore rewardingracetrack.Butonlyifyou’vegot therightteaminplacetosteeryourportfolio throughthestraightsandchicanesofthe market.

So,ifyou’rereadytoshiftgearsand accelerateyourwealth,whynotputPieinthe driver’sseatofyourinvestmentportfolio.

Disclaimer:

Informationiscurrentasat31July2025.Returnsquotedare afterfeesandbeforetax.Nothinginthisarticleisintendedtobe financialadvice,allinformationisfactualonly.

PieFundsManagementLimited(“Pie”)istheissuerofthe fundsinthePieFundsManagementScheme(“Scheme”),the productdisclosurestatementofwhichcanbefoundatwww. piefunds.co.nz.

Pastperformanceisnotaguaranteeoffuturereturns.Returns canbenegativeaswellaspositiveandreturnsoverdifferent periodsmayvary.

Theinformationisgiveningoodfaithandhasbeenderived fromsourcesbelievedtobereliableandaccurate.However, neitherPienoranyofitsemployeesordirectorsgivesany warrantyofreliabilityoraccuracyandshallnotbeliablefor errorsoromissionsherein,oranylossordamagesustainedby anypersonrelyingonsuchinformation,whateverthecauseof lossordamage. Noperson,includingthedirectorsofPie,guaranteesthe repaymentofunitsintheSchemeoranyreturnsofunitsinthe Scheme.

hoto/Gett

KiwiSaverjitters:how tostaycalmwhenyour balancetakesatumble Everytimethere’samarketwobble,KiwiSaversgetnervous.

In2025,theusualupsanddownshavebeen madeworsebyamixofglobaluncertainty, includinginterest-rateshiftsandtariff threatsfromUSpresidentDonaldTrump, whichrattledsharemarketsand,inturn, KiwiSaverbalanceshereinNewZealand.

Butthere’snoneedtohitthepanic button.Historyshowsthedipsof2025and worseonesinrecenthistoryaregenerally temporary.LookbackattheGlobalFinancial Crisis,whereKiwiSaverbalancesfellthen recovered,ortheCovid-19crash,which turnedintoaboomwithinmonths.No-one has‘stolenmymoney’,it’sjustpartofthe lifecycleofinvesting.

Still,KiwiSaverproviderhelplinesrunhot, everytimejitteryinvestorsseetheirbalance fall.Somewanttoshiftintoconservative options.Switchingoutwhenmarketsslide canlockinlossesandleaveyouworseoff.

UnderstandingwhyKiwiSaverbalances fluctuatestartswithknowingwhat’sinside yourfund.MostKiwiSaverfundsinvestina mixofshares,bonds,property,andcash.The valueoftheseinvestmentsrisesandfallsin responsetochangesintheeconomy,and

yourKiwiSaverbalancereflectsthoseupsand downs.

Newsheadlinesandeconomicshiftscan nudgeyourbalanceupordown,sometimes withoutwarning.Butwhat’sactuallybehind thosemovements?Let’sbreakitdown.

•Wobblesintheglobaleconomycan spookmarkets.Itmightbecausedby talkofrecession,interestratechanges ortradetensions.Thatinturncanhit thesharesyourKiwiSaverisinvested in,whichinturnaffectsyourbalance. “Companyprofitsoftentakeahitin recessions,andthatcandragdownshare prices,”saysMarkLister,investment directoratCraigsInvestmentPartners. “Bondscansometimesdobetterin thosetimes,butitdependsonarangeof factors.”

•Inflationandinterestratesalsoplay arole.Higherinterestratescanslow theeconomy,affectingcompany performanceandinvestmentreturns.But whenratesfall,astheymightlaterthis year,marketscanbounceback,giving KiwiSaverfundsaboost.Thatsaid,arate

cutisn’tasurethingforyourbalance.It dependsonthewiderglobalpicture.

•Tradetensions,likepossiblenewUS tariffsdueinAugust,canmakeinvestors nervoustoo.Tariffspushupcostsfor companies,whichcandentprofitsand reduceshareprices.

•Localpolicychangesmattertoo. GovernmenttweakstoKiwiSaverrules, taxesorretirementsettingscanshiftyour returnsovertime.

•Andthenthere’sartificialintelligence(AI). It’snotjustatechbuzzword.Itcouldbe quietlyhelpingyourKiwiSaver.“Myview isglasshalffull,”saysLister.“Ithinkitwill improveproductivity.Itwillcreatejobs.It willallowustodomorewithless.”

Sowhatshouldyoudoaboutit?

Firstthingsfirst:neverpanic.KiwiSaver isdesignedtobealong-terminvestment. Bumpsalongthewayarenormal.Infact, reactingtoshort-termmarketdips,like switchingtoaconservativefundafteradrop, canlockinyourlosses.Mostpeoplewhostay thecourseendupbetteroffovertime.

Ifyou’refeelingunsure,reachoutbefore youreact.MoreandmoreKiwiSaver providers,suchasBoosterandAMP,are offeringfinancialadvicetomembers, sometimesthroughahelplineoronlinechat. Youdon’thavetofigureitoutalone.

It’sallworthcheckingwhetheryourfund stillsuitsyourlifestage.Ifyou’retenormore yearsfromretirement,abalancedorgrowth fundmightstillmakesense.Butasyouget closertoretiring,itcanbesmarttogradually moveaportionofyoursavingsintolower-risk investments.

Justbecarefulnottogotooconservative toosoon.Yourmoneycouldneedtolast25to 30yearsafteryoustopworking.Thatmeans itstillneedstogrowatleastalittletokeepup withinflationandsupportyourlifestyle.

Thetakeaway?Stayinginthegame, keepingcalmduringmarketdips,and checkinginonyourfundeverynowand thenisusuallyabetterstrategythanmaking knee-jerkchanges.Withtherightmix,your KiwiSavercanridethewavesandkeep growingevenwhentheheadlinesarenoisy.

Craigs Mark Lister

Retirewithconfidence: Whygoodadvicematters WithfewerthanhalfofKiwisfeelingretirementready,financialadvicecouldbethegame-changer

Ascost-of-livingpressurespersist,a growingnumberofNewZealandersare increasinglyanxiousabouttheirabilityto retire,butsmartfinancialadvicecouldmakeall thedifference.

AccordingtotheFinancialServicesCouncil’s (FSC)2025FinancialResilienceIndex,just44% ofNewZealandersfeelfinanciallypreparedfor retirement,downfrom50%in2024.Alarmingly, 55%ofKiwis–overtwomillionpeople–worry aboutmoneyonadailyorweeklybasis, underscoringwidespreadanxietyaboutlongtermsecurity.

Despitethepressure,manyarestill committedtosaving:TheRetirement Commission’sannualsurveyfound49%ofNew Zealandersareactivelysavingforretirement, and59%aresettinglong-termfinancialgoals –upfrom54%in2022.Butwithexpectations highandplanningoftenpassive,there’sareal riskoffallingbehind.

Thisiswherefinancialadvice–especiallyfor KiwiSaverdecisions–becomesvital.Research indicatesthatpeoplereceivingprofessional advicetendtobuildgreaterretirement balancesthanthosewhodon’tgetadvice.In NewZealand,theFSC’sBreakingThroughthe AdviceBarrierreport(2020)foundthatadvised investorsenjoyaround4%higherinvestment

returns,haveabout52%moreintheir Ki iSaver,andsave37%moreforretirement thanthose ithoutadvice

sana ard- inningKi iSaverandwealth provider,Generatekno sthatalongsidestrong fundperformance,expertadvicecanmake abigdifference Knownfordeliveringstrong long-termresults,they’reequallyapplauded fortheirfocusono eringno-obligation Ki iSaveradvicetoKi is Ninetypercentof Generatemembersjoinedthroughanadviser, aconnectiontheybelieve,along iththeir fundreturns,helpsexplain hytheiraverage Ki iSaverbalanceexceedsthenationalaverage acrossmultipleagebands mong36-to40-year-olds,Generate membershaveanaveragebalanceof$39,891; around$9,454morethanthenational averageof$30,437 crossallmembers,the nationalaverageKi iSaverbalanceis$37,079, comparedtoGenerate’s$42,001 “ hesenumberssho therealdifference advicecanmake,”saysStephanie hittaker, GenerateKi iSaver dviser “ nadviser canhelpyouchoosetherightfund,the rightcontributionrate,andmakesureyour Ki iSaverplanis orkingashardasitcanfor yourfuture”

Beyondbalances,advicehelpsKi ismake iser Ki iSaverchoices Eighty-fivepercentofGenerate membersreceivetheannualgovernmentcontribution, andover80%areinvestedingro thfunds,comparedto just46 nationally hilegro thfundsarehigherriskand notsuitableforeveryone,theyhavehistoricallydelivered betterlong-termreturnsthanconservativefunds,making themapopularchoiceformanylong-terminvestors

So, hiletheRetirementCommission reportsthatnearly56%ofKi is describetheirfinancialpositionas ‘uncomfortable’,there’saclearpathto amoreconfidentretirement Early, informedKi iSaveradvice,canhelp boostbalancesandkeeplong-term goalsontrack

Ifyou’renotfeelingretirementready,bookano-obligation conversation ithaGenerate Ki iSaveradviser;aninvestmentin yourfuturetodaythatcouldreallypay o do nthetrack ast erform nce is not in icative of future erformance The inform tion provi e is of a eneral nature an is not inten e as personalise financial a vice Alw s seek a vice from a professional financial a viser before makin an investment

Whenstronglong-term performancematters, KiwischooseGenerate.

Wanttoknowwhatittakestobeagoldmedallist? AskDameLisaCarringtonorFinnButcher. WanttoknowwhatittakestomaximiseyourKiwiSaver account?AskGenerate.

AllthreeofGenerate’soriginalKiwiSaverfundshave consistentlyrankedinthetopthreefor10-yearreturns intheirrespectivecategories.*

Withanationwidenetworkofexpertadvisers,it’snever beeneasiertogetKiwiSaveradvice—soyoucanfeel confidentyourplanfitsyourgoalsandmaximises long-termperformance. JointheKiwiSaverproviderputtingperformancefirst.

*TheGenerateModerateFundhasranked1stfor10-yearreturnsintheNZMultiSectorModerateCategoryFundseveryquartersinceJune2023;mostrecentlyit ranked1stoutof14NZMultiSectorModerateFundsfor10-yearreturnsto31March2025.TheGenerateGrowthFundhasrankedinthetop3fundsfor10-year returnsintheNZMultiSectorGrowthCategoryeveryquartersinceJune2023;mostrecentlyitranked3rdoutof14NZMultiSectorGrowthFundsfor10-year returnsto31March2025.TheGenerateFocusedGrowthFundhasrankedinthetop3fundsfor10-yearreturnsintheNZMultiSectorAggressiveCategory everyquartersinceJune2023;mostrecentlyitranked3rdoutof8NZMultiSectorAggressiveCategoryFundsfor10-yearreturnsto31March2025.Source: MorningstarKiwiSaverSurveyMarchQuarterEnd2025,andallpreviousMorningstarKiwiSaverSurveyssinceJune2023.©2025Morningstar.AllRightsReserved. Theinformationcontainedherein:(1)isproprietarytoMorningstarand/oritsaffiliatesorcontentproviders;(2)maynotbecopied,adaptedordistributed;(3)isnot warrantedtobeaccurate,completeortimely. Pastperformancedoesnotguaranteefuturereturns.Investmentinvolvesriskandreturnscanbenegative aswellaspositive. SeePDSandadvertisingdisclosuresatgeneratekiwisaver.co.nz/disclosures.TheissuerisGenerateInvestmentManagementLimited.

Photo/GettyImages

HowtomakeyourKiwi nestegglast30years Coldbakedbeansinyour90s?Nothanks. Whenyouhangupyourworkclothes forthelasttime,itcanbedaunting, knowinghowtomakeyoursavingslastfor 25oreven30yearsfromretirementage65. Youdon’twanttorunoutofmoneyandsit aroundunabletoheatyourhouse. Itdoesn’ttakeamathswhizzor spreadsheetexperttomanageyourmoney. Fortunately,severaldrawdown[spending] rulesofthumbforretirementsavingsexist, suchasthe4%Inflatedand6%rules,which helpcreatesomestructureforspending downsavings.Twootheralternativesare theFixedDateandLifeExpectancyrulesof thumb.

Sorted.org.nzhasrecentlylauncheda RetirementNavigatorcalculatorthathas allfourdifferentrules.Sorted.org.nz/tools/ retirement-navigator

Howthe4%and6%ruleswork

Putsimply,the4%inflatedruleinvolves retireeswithdrawing4%oftheirsavings inthefirstyearandadjustingthisamount annuallyforinflation.Themodel,based onhistoricalmarketdata,aimstoensurea portfoliolasts30yearsormore.Formost people,thismeanstheirnestegg,nomatter

howsmallorlarge,shouldprovidearegular top-uptotheirNZSuperuptoage95.

The6%ruleallowsretireestowithdraw6% oftheirtotalretirementsavingsannually.The moneyisn’tgoingtolastaslong,butresearch showsthatpeopletendtospendlessasthey age.

Thesecalculationsarebasedonmoney investedinabalancedfund.Peoplecan chooseahighergrowthfund,whichshould maketheirsavingslastlonger.

Underthe6%rule,forexample,income fromagrowthfundwouldprobablylast toage104,andlessthan1%ofpeople areexpectedtolivelongerthanthis.Ina balancedfund,itwouldprobablylasttoage 94,andaconservativefundtoage89. TheFixedDateandLifeExpectancyrulesof thumb.

Theothertwoarethefixed-dateruleof thumbandthelifeexpectancyrule.Thefixeddateruleassumesyouwantyourmoneyto lastuntilafixeddate,suchas25yearsafter retirement.Eachyear,takeoutthecurrent valueofyourretirementfunddividedbythe numberofyearstothatdate.

Forthosewholikespreadsheets,thelife expectancyruleinvolvestakingoutthe currentvalueofyourretirementsavings

dividedbytheaverageremaininglife expectancyatthattime.

Withoutrulesoradvicefromafinancial adviser,it’seasytospenddownthecapital waytooquickly.Althoughthereareafew peoplewhohavetheoppositeproblem.They don’tspendenoughinretirementtolivetheir bestlives.

Noone-size-fits-allapproach Therearemanyvariablesinpeople’s retirementandhowtheymanagetheir money.It’soneofthemostdifficultproblems infinance.

Therearesomevariablesthatcanbe controlled.Theycanworklongerand keepearning,whichmeanstheystarttheir drawdownatalaterage.Otherscan’t necessarilybecontrolled,suchasinflation, andpossiblyhealth.

Don’tstressaboutchoosingarule

Don’tstressaboutwhichruleofthumb touse.HaveaplaywiththeSorted.org.nz calculator,oraspreadsheet,andgivesome thoughttowhichrulesyoucouldworkwith. “Seehowitgoes,thenyoucanflex[your ruleofthumb]ifyouneedto,”saysAlison O’ConnelloftheNewZealandSocietyof Actuaries,whichprovidedthecalculations

forthebackendofthecalculator.“Itjust meansyou’renottakenbysurprise.Perhaps thingsmightstillhappen.Youmighthaveto fallbackonNewZealandSuper,butatleast you’vethoughtabout[therisks].”

Whichruleworksbest?

Whenaskedwhichruleshepreferred personally,O’Connellgavealengthy preamblethatnooneistypical,andeveryone hasdifferentexpectationsoflongevity, partnersandfamilies,savingstrackrecords, andrisktolerances.

ButO’Connellsaysshelikesthelife expectancyrulepersonally.“Ilikethe eleganceandtheobjectivebehind[it]and wouldhappilydoaspreadsheettomanageit. Butthatisnotforeverybody.”

RecentresearchbytheSocietyonspending inretirementshowedpeoplespentmorein theearlyyears,andthatcouldfavourthe6% ruleofthumb,saysO’Connell.“The6%rule lookslikequiteagoodmatchforhowwe imaginemostpeoplewouldthinkabouttheir retirement.”

Sortedhasausefulretirementguide, whichyoucanfindat:Tinyurl.com/ SortedRetirementGuide

hoto/Gett Images

DebtinRetirement: Let’sTalkAbouttheElephantintheRoom BySashaLockley

WhenIwasyounger,Iassumedthatbythe timeIreachedretirement,I’dbedebt-free. Mortgagepaidoff,nocreditcardbalances,abit ofsavingstuckedawayfortravelandspoiling thegrandkids.That’sthedream,right?

ExcepthereIamat44,lookingatmy mortgageanddoingthemaths—andunless somethingchanges,I’llstillbemaking repaymentswellintomy60s.

Ifthat’strueforme,andI’vespentmycareer infinance,thenIknowI’mnottheonlyone.

AcrossNewZealand,moreandmorepeople arehittingretirementagewithamortgage,a personalloan,orcreditcarddebtstillhanging around.Theoldideaoffinishingworkwitha cleanslatejustdoesn’treflecttherealityfor manyKiwisanymore.

It’snotaboutbeing“badwithmoney” Debtinlaterlifeisoftenwhisperedabout,as ifit’sapersonalfailing.Butmostofthetime, it’sgotnothingtodowithbeingcarelessor irresponsible.

Here’swhatIseeoverandoveragain:

• Housingcosts.Takingonbiggermortgages laterinlife,ortoppinguptohelpthekidsinto theirfirsthome.

• Healthandcaring.Medicalcosts,mobility aids,orhavingtostepintosupportapartner orparent.

• Familysupport.Lendingorgiftingto childrenandgrandchildrencanbegenerous butitcanalsostretchyourfinances.

• Economicshifts.Inflation,risinginterest rates,andstagnantsavingsreturnsallhit hard.

Thetruthis,lifeisunpredictable.Debtis justatool;sometimesitworksforus,and sometimesitworksagainstus.Theproblem isn’thavingit.Theproblemislettingitcontrol you.

Startbygettingclear

Ifyou’recarryingdebtintoyour50s,60s,or

Howabsorbent underwearcansave youstressandmoney

Retirementshouldbeatimetoenjoy therewardsofalifetimeofhardwork–travelling,spendingtimewithfamilyor simplyrelaxingathome.ButformanyKiwis, therealityofbladderleakage,whethercaused byage,healthconditionsorchildbirth,can quietlyimpactbothconfidenceandfinances.

Whileincontinenceisoftenseenasa medicalproblem,it’salsoafinancialone. Traditionalsingle-usepadsandlinersmay seemconvenient,butthecostsaddup quickly.Accordingtoindustryresearch, NewZealanderslivingwithincontinence mayspendthousandsofdollarsovertime onsingle-useproducts–moneythatcould otherwisebeinvestedinfamily,hobbiesor yourfuturesecurity.

That’swherewashableabsorbent underwearstepsinasasmartersolution. NewZealandcompanyConfitex,whichwas foundedbyKiwiinnovatorstenyearsagothis month,haspioneeredarangeofleakproof underweardesignedtoprovideeveryday protectionfromlight-to-moderatebladder

1. Listallyourdebts:Balances,interestrates, repaymentterms.

2. Knowyourincome:Superannuation, pensions,investments,part-timework.

3. Spotthegap:howmuchisleftafter essentialexpensesandrepayments?

Onceyoucanseeitallonpaper,youcan startmakingchoicesinsteadoffeelinglikedebt ismakingthemforyou.

Practicalstrategiesthatwork

•Consolidatewhereitmakessense.Ifyou’ve gotmultipledebtswithdifferentinterest rates,rollingthemintoonelower-rateloan cansimplifylife.Checkthefees,anddon’t stretchthetermlongerthannecessary.

•Tacklethehigh-costdebtfirst.Creditcards at20%+interestcanburnthroughyour retirementincomefast.Clearingthesefrees upcashforothergoals.

•Negotiate.Lendersmayagreetolower rates,interest-onlyperiods,orhardship arrangements,especiallyifyouaskbefore

Top5DebtMythsinRetirement

1.“Everyoneretiresdebt-free.”

•Rethinkhousing.Downsizing,rentingout aroom,orusingequityrelease(reverse mortgage)canfreeupcash,buttheseneed carefulthoughtandindependentadvice.

•Boostincomeincreativeways.Seasonal work,monetisinghobbies,orrentingout storagespaceorparkingcanallhelp. Ifyou’rehelpingyourparents

Forthoseintheir40sor50shelpingolder parents,rememberthis:moneyisemotional. Manyofourparents’generationgrewup believingdebtwassomethingtohide,so talkingaboutitcanfeeluncomfortable.Lead withempathy,notjudgement.Offertohelp compareloanoptions,setupautomatic payments,orattendabankmeetingtogether. Hopeandrealitycanlivesidebyside

Debtinretirementisn’tideal,butit’salso notadisaster.Withaplan,itcanbemanaged soitdoesn’trobyouofthelifeyouwant.That mightmeanadjustingyourspending,exploring newincomestreams,orchangingyourliving arrangements.

Andhere’sthebiggerpicture:retirement

Notanymore.Risinglivingcostsandhousingdebtmeanmanypeoplenowcarrymortgages, creditcards,orpersonalloansintotheir60sand70s.You’renottheoddoneout.

2.“IfIstillhavedebt,I’vefailedfinancially.”

Debtisatool,notajudgement.Therealmeasureiswhetheryoucanmanageitinawaythat supports,notsabotages,yourlifestyle.

3.“It’stoolatetomakeadifference.”

Evensmallchanges,likerefinancingahigh-interestloanormakingextrapaymentsonyour mostexpensivedebt,canhaveabigimpactovertime.

4.“Ishouldusemysavingstopayoffallmydebtimmediately.”

Sometimesthismakessensebutsometimesitleavesyoucash-poorandvulnerable.Always runthenumbersandconsideryoursafetynetbeforemakingbigmoves.

5.“Talkingaboutdebtwilljustworrymyfamily.”

Keepingitsecretcancreatebiggerproblemslater.Anhonest,proactiveconversationcan leadtosolutionsandreducestressforeveryoneinvolved.

Investinconfidence leakage.Discreet,stylishandcomfortable, theyreplacetheneedforbulkypads,offering peaceofmindwithouttheongoingexpense.

Thefinancialbenefits

Switchingfromdisposableproductsto reusableabsorbentunderwearmightcost alittlemoreupfront,butit’saninvestment thatpaysdividendsinthelongrun.Asingle pairofConfitexforMentrunksorJust’nCase women’sbriefscanbemachinewashedand tumbledriedoverandoveragain,soyou’ll nolongerneedtoputsingle-usepadsand shieldsinthetrolleyeverytimeyou’reatthe beyond,thefirststepisgettingaclearpicture. Iknowitcanfeelconfronting,butavoidingthe numberswon’tmakethemgoaway.

supermarket.Overtime,yoursavingscanbe substantial.

ConfitexforMenandJust’nCasebyConfitex underwearcomesinavarietyofsizes,styles, absorbenciesandcolours.Ifyou’reanew customer,Confitexrecommendsthatyou buyonepairfirstsoyoucantrialtheminthe comfortofyourownhomeandcheckthatthe sizeandabsorbencyarerightforyoubefore youstockuponmorepairs. Confidencewithoutcompromise Beyondthenumbers,thevalueof confidencecannotbeoverstated.Designed thingsgettootough.

isn’tasinglemoment.It’salongchapterof life—andjustasyouadaptedyourfinances inyour20s,40s,and50s,youcanadaptagain now.

Thepointisn’tjusttobedebt-free;it’stolive well.

Debtisanumberonapage,notalife sentence.Numberscanchangeandso canyourstrategy.Thesooneryoustartthe conversation,thesooneryougettomake thosechangesonyourownterms.

Sowhetheryou’relookingatyourown retirementfinancesorhelpingyourparents managetheirs,remember:thegoalisfreedom, notperfection.Andthatstartswithfacingthe elephantintheroomandshowingitthedoor, onestepatatime.

Abouttheauthor: SashaLockleyisthefounderandCEOof MoneySweetspot,asocialenterprisehelping Kiwisgetoutofdebtandbuildlastingfinancial wellbeing.At44,sheknowsfirst-handwhat it’sliketojuggleamortgagethatwillfollow herintoher60sandshe’sdeterminedtomake talkingaboutmoneyreal,hopeful,andshamefreeforeverygeneration.

tolookandfeeljustlikeordinaryunderwear, Confitextrunksandbriefsaremadefrom high-performancefabricsthatwickaway moisture,neutraliseodouranddryquickly –soyoucancontinueenjoyinggolf,social gatheringsorsimplyadayoutshopping withoutfearofembarrassment.

Asustainablechoice

Thenthere’stheenvironmentaldividend. Everydisposablepad,liner,shieldorguard youthrowawaycontributestolandfillwaste, soifyou’reconsciousofthelegacyyou’re leavingforfuturegenerations,choosing reusableoptionsisanotherwaytoinvestina healthierplanet.

Thebottomline

Retirementshouldbeaboutlivinglifeon yourownterms,withoutunnecessarystress orexpense.Absorbentunderwearisnotonly apracticalsolutionformanaginglife’slittle leaks,butalsoawisefinancialinvestment.By choosingConfitex,you’rechoosingfreedom, dignityandlong-termsavings.

ConfitexforMenandJust’nCasebyConfitex underwearisavailableonlyfromtheofficial website confitex.co.nz,withdiscreetdelivery toyourdoor.OrderbeforemidnightonSunday 14Septemberandusethediscountcode NZHP2510 atcheckouttoreceive$10offevery pairinConfitex’s10thBirthdaySale!Fullterms atconfitex.co.nz

SashaLockley

Fromglasses tofreedom, thepowerof eyesurgery Fromlaserprocedurestoadvancedlensimplants, eyesurgeryisevolvingrapidly.Surgeonssayit’s timetorethinkoutdatedassumptionsaboutwho canbenefitfromvisioncorrection.

Imaginewakingupandbeingabletosee thealarmclockclearly.Orheadoutfora runwithoutworryingaboutyourcontact lenses.ForhundredsofthousandsofKiwis, visioncorrectionsurgeryhasturnedthose dailyannoyancesintodistantmemories.

Eyesurgeryhasadvancedinleapsand boundsoverthepast30years,andmany peoplewhowereoncetoldtheycouldn’t getvisioncorrectionsurgerycannowaccess life-changingtreatments,saysDrKaliopy Matheos,ophthalmologistwithEyeInstitute.

Askagain,becausetechnologyhas advanced.“Youmayhavebeentoldyour prescriptionwastoostrongoryouweretoo oldtoconsidervisioncorrection”shesays. “Butduetocontinuousadvancementsin visioncorrection,therearenowsuitablevision correctionsolutionsforalargepercentageof peoplewithrefractiveerrorsinvariousstages oftheirlife.”

DrNickMantell,managingdirectorand eyesurgeonatEyeInstituteagrees.“The othercommonmythisthatwecan’tcorrect astigmatism,”hesays.“Withbothrefractive laserandlenses,wecannowcorrectfor astigmatismandprovidenear-continuous focus.Wecandoalmosteverything.”

Howdothesesurgerieswork?

Lasereyesurgeryisthemostwell-known optionintheeyesurgeons’kete.Ituses laserstoreshapethecornea,solightfocuses properlyontheretina.Thethreetypesare SMILE™,LASIK,andPRK.“Forpatientsnot suitableforthesechoiceswecannowofferICL surgerywherealensisplacedinsidetheeye, behindtheirisbutinfrontofthenaturallens,” saysDrMantell.

Forthoseaged50andover,refractivelens exchange(RLE)replacesthenaturallenswith advancedmultifocalintraocularlens.It’sa gamechangerforpeoplewho’vestruggled jugglingmultiplepairsofglasses.

Althoughotherintraocularlenseshave beenaroundformorethan40years,newer lenstechnologyhasemerged,saysDrMantell. Traditionalintraocularlensesaimtoimprove bestcorrectedvisionaftercataractsurgery, howevermostpatientsneededglassesfor distance,ornear,orboth.

Thenewmultifocalintraocularlensesare provingpopular.“EightyearsagoImighthave usedamultifocallensinonein200patients, whereasnowI’musingitinabout70%of patients”saysDrMantell.“Theintraocular lensesofferapermanentsolution,andyou don’tfeelthem”

Glaucomabreakthroughsbringnewhope DrMatheosalsospecialisesinglaucoma surgery,wheretherehavebeensight-saving advances.Somerecentadvancementsinclude MIGS(minimallyinvasiveglaucomasurgery) anddevicessuchasthei-stentinfinite® whichcanbeperformedatthesametime asalensremoval/cataractsurgery.Other promisinginnovationsincludesustained releaseimplants,whichreleasemedication intotheeyeovermonths.

“Allthesetechnologicaladvancements inrefractiveandglaucomasurgerymean thatwehaveanopportunitytomakeareal differencetopeople’squalityoflifeand supporttheirfreedomandindependence,” shesays.

What’srecoverylike?Arethererisks?

Patientsoftenworryifsurgerywillhurt,or

“Whatsurprises peopleishow painlessitis,”saysDrMatheos.

Manypeoplearebackatwork withinafewdays.“Lasertendsto havethequickestrecovery,oftena dayortwo,”saysDrMatheos.“RLE andICLpatientsmighttakealittle longer,butmostarebacktonormal activitieswithinafewdays.

“ThebiggestcomplaintIgetis:‘I wishI’ddonethistenyearsago,”she says.

Aswithanysurgery,thereare risks:dryeyes,nightglare,ortheneed fortouch-upprocedures.Butserious complicationsarerarewhenperformedby experiencedsurgeons.

Thehumanimpact

Forbothdoctors,thebiggestrewardis seeinghowsurgerytransformspeople’slives. DrMatheoswillneverforgetapatientwho putherpoorvisiondowntogettingold.“The dayafterwedidcataractsurgery,wetook thepatchoff.Shewasintearsbecauseit wasthefirsttimeintwoyearsshe’dseenher granddaughter’sfaceclearly.”

Attheotherendofthespectrum,thereare youngpeoplewhogetsurgerysotheycan pursuecareers,suchasjoiningthepolice orarmedforces.“Beingabletohelppeople chasetheirdreamswhentheyoncethought itmightnotbeattainablebecauseoftheir vision,isaprettygreatfeeling.”

ForDrMantell,the mostmemorable transformationwas apatientwhohad beeninaterriblecar accident,withinjuries thatpreventedher puttingherownglasses on.“Wedidlaseron herandthat completely transformedherlife,”hesays.“Shewasa remarkableyoungwomanandhasevengone ontodoahalf-marathoninherwheelchair.” Thinkingaboutit?

Ifyou’vebeencuriousaboutvision correctionbutdidn’tknowwheretostart, bothsurgeonssaythefirststepisafree comprehensivevisioncorrectionassessment. EyeInstitute’sdoctorswilllookatyour prescription,eyehealth,andlifestyle,and adviseofthebestoptionsforyou. “Don’tself-selectout,”addsDrMatheos. “Youmightbesurprisedbywhat’spossible.”

how long the recovery willbe.

TOPINSET DrKaliopy Matheos BOTTOM INSET DrNickMantell

Applybefore youfly: theNZSuper portabilitytrap Kiwiseyeinganoverseasretirementfacea crucialquestion:whathappenstotheirNZ Superannuationpaymentsoncetheyleave?

Whetherit’stoenjoyawarmerclimate, beclosertofamily,orsimply experienceanewlifestyle,retiring overseascanbeenticing.Retireessometimes findthemselvescaughtoffguard,however,by unexpectedreductionsorevencompleteloss ofNZSuperpaymentsaftermovingoverseas.

Ifyou’reheadingoverseasforashortstint, upto26weeks[sixmonths],youstillgetpaid NZSuperasusual.Ifyouwanttogoforlonger, readon

Notallcountriesaretreatedequally

Onthesurface,therulesseemsimple:ifyou qualifyforNZSuper,youcanreceiveitalmost anywhereintheworld,fromCostaRicato CambodiaorKazakhstan,solongasyoufollow therightprocess.

Buttherealityismorecomplicated. EspeciallyinAustralia,andanumberofother countriesthat

NewZealandhasSocialSecurityAgreements (SSAs)with.ThatincludestheUnitedKingdom, Ireland,Denmark,andtheNetherlands. Theseagreementsoverridetheusualrules andcansignificantlyreduceorcancelyourNZ Superentitlement,dependingonwhereyou live.Australiaisaprimeexample,andKiwi retireesarecaughtoutregularly.

TheimpactofmeanstestinginAustralia

ManyKiwiswantingtoretireinAustraliaare shockedtolearntheymaylosetheirNZSuper iftheymovetherepermanently.

Overtheditch,yourNZSuperwillonly bepaidifyouqualifyfortheAustralianAge Pension,whichismeans-andasset-tested. AKiwicouple,forexample,whoowntheir ownhome,andhaveassetsoverNZ$511,000 (A$470,000)wouldn’tqualifyfortheAustralian pension,andthereforewouldlosetheirNZ Superiftheymovetothe‘luckycountry’.

“Graham”,aKiwiwithfamilyonboth sidesoftheTasman,callsthis“unfair”and “inequitable.”HepointsoutthatwhileKiwis movingtoAustraliafacethesetoughtests, AustraliansretiringinNewZealandcanreceive fullNZSuperregardlessoftheirassets.

Graham’sNZSuperwascutby30%because hespentthatproportionofhisworkingyears overseasbetweenages20and65.Hewould havereceivedthefullNZSuperpaymentsif he’dretiredhere.

AnotherfishhookisthatonlyNewZealand citizens,notresidents,canapplyforthe Australianpension,catchingoutmany migrantswhohavelivedandworkedinNew Zealandfordecades.ItmeanstheyforgoNZ

SuperiftheymovetoAustraliainretirement. IncountrieswithoutSSAs,suchasFrance, Italy,orThailand,it’softeneasiertoreceiveNZ Super,thoughrulesvary.Specialarrangements alsoapplyinmanyPacificnations.

Theportabilitycatch:andother bureaucratichurdles

Whereveryouplantomove,there’sanother trapthat’seasytofallinto.Toreceiveyour NZSuperoverseas,youmustbelivinginNew Zealandwhenyouapplyforportability,the processthatallowsNZSuperpaymentsto continueoverseas.Ifyoumovefirstandapply later,yourpaymentscanbestopped.The portabilityapplicationprocesscanbeslowand frustrating.

PaulaRātahi-O’NeillfromWorkandIncome advisesapplyingatleastsixweeksbefore leavingandprovidingareliablepostaladdress toavoidmissingimportantcorrespondence. Lesser-knownquirksoftherulesinclude: •Pro-ratapayments:Ifyouhaven’tlived inNewZealandforyourfullworkinglife (ages20–65),youroverseasNZSuper paymentsarereducedproportionally.For example,living50%ofyourworkinglife inNewZealandmeansyouget50%ofthe fullpaymentoverseas,eventhoughyou’d likelyget100%here.

•Reducedratesoverseas:Whenyoutake NZSuperabroad,youloseeligibilityfor theSingleLivingAlonerate,Disability Allowance,andAccommodation Supplement.Thehighestratepayableis thesinglesharingrate.

Theemotionalandfinancialtoll

FormanyKiwiswithoutlargeKiwiSaver balancesorotherassets,NZSuperistheir primaryretirementincome.Theuncertainty aboutwhetheritwillbepaidoverseas,andat whatrate,cancauseanxietyandcomplicate retirementplanning.ManyretireesfindNZ Superaloneinsufficienttocoverlivingcosts, underscoringtheimportanceofadditional savings.

Whatyouneedtodoifyou’rethinkingof retiringoverseas

•Don’tassume:Therulesvarywidelyby countryandcanbecomplex.

•Applyearly:Submityourportability applicationwellbeforeleavingNew Zealand.

•Understandyourentitlements:Knowhow yourpaymentmaybereducedandwhich supplementsyouwilllose.

•Useofficialresources:TheTeAraAhunga OraRetirementCommission’s2023policy paperonportabilityisadetailedand helpfulguide.Findithere:Tinyurl.com/ NZSuperPolicyPaper

•Planfinancially:BuildKiwiSaverandother savingstosupplementNZSuper,especially ifretiringincountrieswithmeanstesting. Retiringoverseascanoffermanybenefits, butit’sessentialtounderstandtherules aroundNZSuperportability.Thesystemis complicated,withsomecountriesimposing strictconditionsthatcanreduceorstopyour pension.Withcarefulplanningandearlyaction, youcanavoidsurprisesandhelpensureyour retirementincomeremainssecure,nomatter whereyouchoosetolive.

Photo/Gett Images

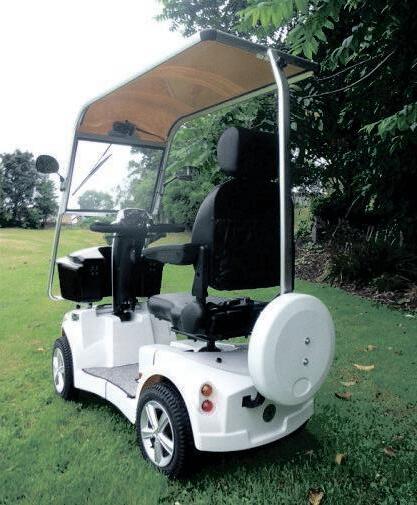

NORDICPOLARCRUISER SPECIFICATIONS:

WeightCapacity-230kg

WeightwithBatteries-160kg

MotorSize–24v/1400w

MaxForwardSpeed–15km/h

DistanceRange–upto50km

GroundClearance–12cm

Batteries–12v/75ahx2

OverallDimensions-1650x720x1400mm

FullFrontandRearSuspension

FREE3yearAA A

FREE3yearAAGetHomeSafe

SPECIFICATIONS:

WeightCapacity-200kg

WeightwithBatteries-132kg

Motorsize-24V1400WattBrushless

MaximumForwardSpeed-15km/h

DistanceRange-Upto50km

GroundClearance-13cm

Batteries-12V/75Ahx2

OverallDimensions-W750xL1350xH1600

FullFront&RearSuspension

Ourcompanyhasbeenoperatingvehicle garagesinNewZealandforover20yearswith anaverageannualturnoverofover4million NZDollars.Wehavealargemobilityscooter workshopwithanextensiveandfullrange of partsandaccessories.

techniciansavailableforyourpeaceofmind.

SPECIFICATIONS:

WeightCapacity–150kg