By Tim Anderson |

By Tim Anderson |

In the early days of aircraft maintenance, the path to obtaining a license was simple. In most cases, you would secure a position with a seasoned engineer who was willing to take you under their wing as an apprentice. This arrangement allowed you to learn the trade by doing hands-on work while under the vigilant guidance of an experienced professional. Over time, as you demonstrated growing competence, you would eventually earn the right to obtain a full license.

It was 100 per cent on-the-job training, picking up everything from technical know-how and safety practices to understanding aviation regulations. You also gained exposure to the culture of the industry, developing a deep sense of responsibility and accountability. This mode of learning was a textbook example of mentorship, and it proved incredibly valuable as apprentices benefited from daily interactions with mentors who shared their expertise and passion for aviation.

The aircraft maintenance

industry has evolved a great deal since then. Today, you can still follow the traditional apprenticeship path to earn an Aircraft Maintenance Engineer (AME) licence. Typically, this involves four years of apprenticeship work, completing a logbook, and passing a series of Transport Canada (TC) exams. However, a different route has become far more popular over the past few decades: attending one of the many Approved Training Organizations (ATO) nationwide. Most ATOs are colleges, though some operate as specialized

training centres outside of the standard college framework. Notably, many of these institutions have gained approval from Transport Canada to provide courses that grant students accreditation if completed to the necessary level. This accreditation means that part of the time students spend in the program, and their in-school exams, are counted toward the requirements for an AME licence.

This shift toward collegebased training has proven an excellent pathway for many aspiring AMEs. ATOs offer

structured learning environments with labs, workshops, and classroom study, exposing students to a broader spectrum of aircraft maintenance knowledge. Graduates leave with a strong foundational understanding of aircraft systems, regulatory requirements, and more. Upon graduation, they are prepared to work across the industry on virtually any type or category of aircraft. However, while this flexibility is beneficial, it has also highlighted a growing gap: new hires may have the basics down, but the specialized knowledge that individual companies need takes time and experience to develop.

In the past, newcomers naturally gained these specialized skills through an apprenticeship. They would learn daily from experienced engineers, gaining a deeper understanding of the needs of different aircraft, components and systems. These mentorship relationships fostered technical competence, professional maturity, problemsolving abilities, and a sense of belonging within a specific workplace culture. With the more academic approach now predominant, however, some assume that once a student has graduated from an ATO, they would immediately be able to perform at a more specialized level than their foundational basic training provides.

Unfortunately, this is not the case. While ATO graduates possess a robust foundational skill set, they still need time to adapt to their new company’s particular demands, systems and specialized procedures. Without structured mentorship programs, some newcomers are thrown into a sink-or-swim environment. They may face intense pressure to meet demanding workloads, keep up with quick turnarounds, and troubleshoot complex mechanical issues with minimal experience. Under these conditions, the learning curve becomes extraordinarily steep and mistakes or misunderstandings can occur.

The cultural shift from traditional mentorship to a more hands-off approach in many

organizations is taking its toll. When new entrants feel unsupported, this disparity in expectations can lead to frustration, burnout and a disheartening sense that the industry is not what the newcomers thought it was. Many of these new AMEs end up leaving the field entirely, a troubling trend that has consequences not just for the individual but for the broader aviation maintenance industry as well.

Adding to this problem is a demographic shift that the industry is currently experiencing. The pandemic accelerated retirements among the Baby Boomer generation of AMEs, many of whom decided it was time to step away from the workforce. These retirements, combined with organic growth in the aviation sector, have led to a pressing need for qualified maintenance personnel. If the cycle of unstructured onboarding and rapid burnout continues, the industry faces a worrying shortfall of skilled technicians and engineers.

A balanced approach is

necessary to tackle this challenge, utilizing the best aspects of the ATO system alongside a structured mentorship component. I am not suggesting that the industry return entirely to the old method or insufficiently prepare newcomers. Instead, the solution lies in a comprehensive support system for new AMEs from start to finish.

By establishing a formal mentorship framework, organizations can ensure everyone has a clear pathway, with milestones indicating when they are expected to achieve certain competencies or work on specific maintenance tasks. This structure also helps companies forecast their human resource needs more accurately. They can track each apprentice’s progress, anticipate how many fully licenced AMEs they will have in one or two years, and plan recruitment efforts to avoid sudden personnel shortages. Another advantage of structured mentorship is that it can dramatically improve retention. When new hires know they are

supported, they are far more likely to stay committed. Rather than feeling like they are perpetually on the brink of failure in a sink-or-swim environment, they develop a sense of progression and achievement. Clear objectives and measurable milestones give them a tangible way to see their own growth. As a result, they build loyalty and pride in their work. This reduces turnover, saving companies the time and expense involved in recruiting and training replacements.

Combining strong accreditation with hands-on mentorship provides the most effective path for developing skilled, knowledgeable, safe and confident AMEs. By ensuring that newcomers receive support and are both academically and physically prepared for the realities of the industry, we can establish a system to guarantee the sustainability of our sector. | W

Tim Anderson is a professor at Fanshawe College’s Norton Wolf School of Aviation and owner of Anderson Aviation Services.

By Phil Lightstone |

The Canadian The Canadian government on March 4 imposed 25 per cent tariffs on $30 billion in goods imported from the United States and in 21 days planned to up that total to $155 billion in retaliatory measures after U.S. Donald Trump signed an executive order to apply 25 per cent tariffs on all Canadian imports, with energy at 10 per cent.

The first phase of Canada’s response includes products such as orange juice, peanut butter, wine, spirits, beer, coffee, appliances, apparel, footwear, motorcycles, cosmetics, and pulp and paper. A detailed list of these goods can be found at www. canada.ca. From an aviation perspective, aircraft tires are in scope to the Canadian tariff. Tariffs to be imposed on an additional list of imported U.S. goods worth $125 billion include steel and aluminum products, certain fruits and vegetables, aerospace products, beef, pork, dairy, trucks and buses, recreational vehicles, and recreational boats.

On March 6, Trump agreed to exempt automobiles from newly imposed tariffs on imports from Canada and Mexico for the next month at the request of the three largest U.S. automakers. The U.S. administration also reiterated that reciprocal tariffs on goods from all nations that place fees on U.S. exports will go into effect on April 2. The Canadian countermeasures have been delayed, but if implemented would remain in place until the U.S. eliminates its tariffs against Canada. Of course, as the first weeks of 2025 have shown, all of these measures and threats can change in a heart, but the tariff burden is unlikely to dissappear anytime soon.

The General Aviation Manufacturers Association (GAMA) 2024 Year End report noted a total of 4,118 aircraft and helicopters were shipped in 2024 with total billings of US$31.18 billion. European manufacturing accounted for 859 aircraft. GAMA issued a statement before the first tarifff reprieve. “Given the global nature of the aviation manufacturing industry, these proposed tariffs, as well as potential reciprocating tariffs, could have an enormous impact with many unintended consequences on the

industry.” It noted that almost half the total revenue from general aviation manufacturers comes from exports, about $5.2 billion in 2023. “Tariffs would affect the intricate and very complex global supply chain that can take years to establish given that it relies on suppliers with unique capabilities that are highly regulated and therefore cannot be easily replaced.”

Canadian aircraft manufacturers in the report included: Bombardier at 146 aircraft and US$7.0 billion in billings; Diamond Aircraft with 252 aircraft and US$205 million. Bombardier’s current backlog is valued at US$14.4 billion (as of December 31, 2024). De Havilland’s aircraft sales and deliveries are not publicly disclosed.

The National Business Aviation Association (NBAA) issued a statement that applauded the first pause in the tariff action, saying that the industry is reliant on a complex system of international agreements that ensure safe production of aviation products.

In a press release, the NBAA noted: “Disruptions to this system have profound consequences, and workarounds that meet the exacting regulatory requirements take months or years to establish – challenges clearly demonstrated during the COVID pandemic. As with the pandemic, NBAA

has concerns regarding tariffs, or anything else that could disrupt the industry’s unique supply chain, and the jobs, economic growth, manufacturing leadership and innovative edge that depend on it.”

In a February 3, 2025, briefing document, the Canadian Business Aviation Association (CBAA), stated: “This Executive Order signals a significant shift in U.S.-Canada trade relations, with potentially broad economic consequences. If Canada responds with countermeasures, the business aviation industry may see disruptions in cross-border travel, higher operating costs, and potential regulatory hurdles. The situation warrants close monitoring, especially for stakeholders in aircraft operations, manufacturing, and supply chains.”

Anthony Norejko, President and CEO of the CBAA, added: “Canada needs to negotiate from a position of strength. With the Luxury tax and an impending tariff, BA will be seeing serious headwinds during these tumultuous times. We need a strong Canadian government with serious leaders who can help navigate these issues.”

From an economist’s perspective, the financial impact of tariffs is designed to protect domestic labour. However, in this case, the weaponization of tariffs was strictly used to achieve other political goals.

Economically, for many airframe manufacturers (e.g. Piper, Kodiak, Textron), Pratt and Whitney turbine engines, used on Piper M700, Kodiak and others, would increase their Cost of Goods Sold by 25 per cent. On a US$ 1 million engine, for example, this would increase the cost of the aircraft by US$250,000. However, the OEM may choose to add margin to their Cost of Goods Sold, say by 25 per cent. This would see the end user acquisition cost increase by US$312,500. For Canadian purchasers, the aircraft’s price (2025) of US$4.3 million would increase to US$4.6 million. However, if Canada extends its tariff (25 per cent) to the aviation sector (the current proposed phase one tariff has aircraft tires in scope) the price of the Piper M700 would increase to US$5.8 million (an impact of US$1,471,875).

Aircraft manufactured in Canada like Diamond, Bombardier and De Havilland products could become uncompetitive. Large fleet sales to American Flight Training Units, may be impacted, causing OEMs to reduce their Canadian labour force. From a taxation perspective, corporate tax contributions to the Canadian coffers would be reduced. Smaller Canadian manufacturers, like Insight, which began designing and manufacturing Graphic Engine Monitors in 1981, will be at a competitive disadvantage against U.S. instrument manufacturers. Insight is taking a wait and see approach.

As U.S. Customs and Border Protection (CBP) and Canadian Border Services Agency (CBSA) become acquainted with the tariffs, customs clearance delays may occur as imported aircraft await inspection and possible documentation issues. Aircraft importation is a complex process that involves navigating many taxation, regulatory and compliance issues. Customs duties, GST/HST and regulatory compliance will impact financial and legal considerations, which for the uninitiated could cause delays, additional costs and potential penalties.

The first step in the importation process is to understand the regulatory requirements imposed by Transport Canada and the CBSA. These regulations govern everything from the condition and documentation of the aircraft to the payment of applicable duties and taxes. Currently there is some Fear, Uncertainty and Doubt (FUD) regarding the process.

Eric Martel, President and CEO, Bombardier on February 6, 2025, stated: “In light of the rapidly evolving landscape stemming from the February 1, 2025, executive orders signed by the President of the United States regarding new tariffs, Bombardier has elected to defer providing guidance and 2025 objectives.”

Bombardier customers operate a fleet of more than 5,100 aircraft, supported by a vast network of Bombardier team members worldwide and 10 service facilities across six countries. In 2024, Bombardier delivered 124 aircraft, with 50 to 60 per cent of the Challenger aircraft delivered to U.S. customers. With sophisticated customers who understand the financial markets, Bombardier has not seen sales decline in Q4 of 2024 and Q1 of 2025. Bombardier’s U.S. presence sees activity in 47 states, with over 10,000 jobs delivered directly by Bombardier and its suppliers. A tariff and rate adjustment would see a greater impact in the U.S. than Canada, but the company no doubt has been busy running financial modelling based upon a variety of scenarios.

On February 20, 2025, Daher released the following statement: “As the scope of the Trump administration’s tariffs is evolving, it is too early to assess potential effects for operations, pricing, the supply chain, etc. Because the aerospace industry is so interconnected and worldwide in scale, tariffs could bring harm to both America and Europe. The industry’s importance to the U.S. economy is underscored by the recent study sponsored by GAMA and seven other associations, which determined that general aviation supports a total of 1.3 million jobs and a total of $339.2 billion in total economic output in the U.S. As a reminder, general aviation was excluded from tariffs eight years ago during the first Trump administration

based on its “interconnectivity” with the U.S. economy. In 2023, Daher announced its intention to create a third final assembly line for the company’s TBM and Kodiak general aviation aircraft families. The primary purpose of this new final assembly line – to be located at Daher’s Stuart, Florida aerostructures manufacturing facility – is to provide additional output in response to the continuing sales success for both the TBM (built in Tarbes, France) and the Kodiak (built in Sandpoint, Idaho). Based on the current political climate, creating additional production capacity for TBMs that are “built in America” could represent another advantage for Daher’s new Stuart, Florida, final assembly line.”

Interestingly, the current tariff wars fly in the face of the North American Free Trade Agreement (NAFTA). On November 30, 2018, Canada, the United States and Mexico signed the new Canada-United States-Mexico Agreement (CUSMA), during the G20 leaders’ summit in Buenos Aires. Under the agreements, tariffs on virtually all originating goods traded between the U.S., Canada and Mexico were eliminated in 2008, except for Canadian agricultural goods in the dairy, poultry, egg and sugar sectors (which are exempt from tariff elimination). The wide scope of the agreement is indicated from the outset in agreed objectives. The Agreement will: eliminate barriers to trade in goods and services between the three countries; facilitate conditions of fair competition within the free-trade area; significantly expand liberalization of conditions for cross-border investment; establish effective procedures for the joint administration of the Agreement and the resolution of disputes; and lay the foundation for further bilateral and multilateral co-operation to expand and enhance the benefits of the Agreement. The agreement was replaced in July 2020 with the United StatesMexico-Canada Agreement (USMCA). The current situation initiated by the U.S., appears to contravene this agreement. | W

By Phil Lightstone

The Pitt Meadows Regional Airport, CYPK, is Canada’s nineth busiest airport and British Columbia’s third busiest. The airport has almost 500 aircraft, including float planes, approximately 350 hangar bays (with more than 100 bays under development), 11 Flight Training Units and 50 businesses employing 350 people. Aircraft movements have been steadily increasing since 2020 with more than 200,000 movements projected for 2025. The airport, owned by the Pitt Meadows Airport Society, occupies more than 700 acres of land adjacent to the Fraser River. A financially sound airport, YPK is your gateway to Canada’s future aviation economic hub.

The Pitt Meadows Airport Society is a not-for-profit entity governed by the City of Pitt Meadows and the City of Maple Ridge, both exceedingly supportive of the airport’s strategic direction. The airport’s board of directors include a mix of municipal employees and private sector members. The board’s President, Mark Roberts, is the City of Pitt Meadows’ Chief Administrative Officer (2015). He is serving his second term as President since joining the board in 2019.

Day-to-day airport operations rely on a small but mighty team of eight, flexing to 10 in the summer, led by Guy Miller, General Manager. Miller has an extensive aviation career, including roles as an RCAF fighter pilot; past member of the Fraser Blues aerobatic team; and a Cathay Pacific commercial airline pilot. In 2018 Miller joined the team at YPK to oversee an extensive airport revitalization project.

“In 2018 I found a time-worn airport with hangars approaching their useful service life, poor and lacking infrastructure, and an absence of strategic focus. The team embarked on a $9.7 million capital program to revitalize the airport, delivered over six years,” Miller says. “Our projects have touched nearly every piece of infrastructure at the airport, including lighting, signage, pavement, and fencing. These improvements allowed the airport to attract a slate of new private development, including a state-of-the-art terminal building, commercial operators, and enhanced hangars and commercial buildings. We have transformed YPK to become B.C.’s lower mainland’s gateway for the future of general and business aviation.”

The mission of the airport is to develop

an environment for the benefit of its stakeholders. YPK’s primary vision is to be a significant contributor to the North Fraser region’s economic diversity through quality aviation services and vibrant business activity at the airport.

Ensuring long-term financial sustainability and accountability is of vital importance to the airport. The continued success of its development will improve the airport’s financial revenue ensuring long term financial sustainability and economic prosperity. YPK is a profitable airport generating more than 90 percent of its revenue from longterm land leases. Each year’s operating profit is re-invested into next year’s capital and operating budget, enabling airport services to thrive and expand. A 2015 economic impact study, by the InterVISTAS Consulting Group, found that the direct impact of ongoing operations at the airport included: 340 jobs with an average salary of $54,000; $15 million in household income; $24 million contributed to Canada’s GDP. The total economic impact of the airport is: 590 jobs with an average salary of $54,000; $27 million in household income; $45 million contributed to Canada’s GDP. The airport is currently undertaking an updated

economic study to be completed in 2025.

YPK is centrally located within the lower Fraser Valley, equidistant from downtown Vancouver (a 45-minute drive or 11 minutes by helicopter), the Vancouver International Airport (CYVR), and City of Abbotsford. The site has excellent access to the region and beyond, being conveniently located just off the Golden Ears Bridge which connects to Highway 7, the major regional highway north of the Fraser River, and Highway 1, located to the south of the Fraser River.

The history of YPK dates back to 1957 when the federal government planned to create a secondary airport in the Lower Mainland due to the growing demand at YVR. Construction began in 1962 with the Department of Transport planning to spend $300,000 for utilities and developing gravel and grass runways on farmland. YPK opened on July 20,1963, and by 1972/1973 Pitt Meadows became one of the busiest airports in Canada with more than 250,000 annual aircraft movements. In January 1998, the districts of Maple Ridge and Pitt Meadows jointly took custody of the airport forming the Pitt Meadows Airport Society.

Today, the airport has three active runways: 08L/26R 2,485 feet x 75 feet; 08R/26L 5,063 feet x 100 feet; and 18/36, 2,484 feet x 75 feet. One FBO, Integrity Flight Support, services the airport, in addition to self-service fuel provider Aero Club of B.C. YPK is a CANPASS/AOE15 airport of entry for aircraft carrying no more than 15 passengers. NAV Canada operates a control tower at YPK, to help ensure a safe and controlled environment.

The Airport Society has created an environment attracting private investors and operators to build hangars, office complexes, maintenance facilities and a stateof-the-art terminal building. Recent multimillion-dollar upgrades and investments include repaved runways, taxiways, and aprons, expanded and redesigned Apron 1

with overhead night lighting. Opened in 2022, the Whiskey Charlie Café is open seven days a week offering a full breakfast and lunch menu, as well as liquor service for passengers. Telus has invested into YPK bringing highspeed fibre-based Internet services to the airport and its tenants.

In 2019, the airport terminal was moved to make room for a new two-level, 50,000-square-foot building which opened in January 2022. YPK has many new opportunities underway, including the Canadian Museum of Flight (CMF), which intends to build a new facility to house its collection through on ongoing fundraising campaign. Other YPK approved projects include: a 20-acre helicopter park with 275,000 square feet of hangar space, multiple hangars ranging in size from 10 to 50,000 square feet, a T-Hangar development delivering over 133,750 square feeet of hangarage, with the intention of focusing on aircraft storage, AMO and MRO operators and commercial aviation businesses.

As a result of pent-up business demand, the airport has embarked on the development of an eight-lot commercial aviation hangar subdivision located on its Northeast quadrant. Each lot will be approximately 1.2 acres in size with direct access to the airport infrastructure allowing for the movement of aircraft serving the new commercial aviation development. An exciting new project in the preliminary planning stage includes an 11-acre waterfront development. Adjoining the float base on the Fraser River, this revitalization project is considering a scenic boardwalk, boutique retail, restaurant and parkland.

“As the Mayor of this vibrant community, I am immensely proud of YPK Airport’s role as a robust economic driver,” Nicole MacDonald, Mayor of Pitt Meadows, says. “With the tireless efforts of the Pitt Meadows Airport Society and staff, YPK has evolved into a business-friendly aviation hub. In recent years, we’ve witnessed a

remarkable transformation of the airport... Receiving the 2022 BCAC William Templeton Trophy is a testament to the dedication and vision of the Airport Society and staff. This prestigious award reflects the exceptional initiative and achievement in elevating YPK to greater heights. YPK is not just an airport; it’s a symbol of progress for Pitt Meadows.”

Dan Ruimy, Mayor of Maple Ridge, adds: “As a hub for aviation training, emergency response, and commercial operations, [YPK] plays a crucial role in strengthening our economy and creating opportunities for residents and businesses. The potential for those in aerospace manufacturing, aviation component production, and rotary aircraft support is immense.”

Maxcraft Avionics Ltd. in 2008 was operating out of a leased hangar facility at YVR when the company’s President and GM, Daryl MacIntosh, determined it was time to build their own facility and find a better location for its type of operation. “At that time, with the Golden Ears bridge and the new Pitt River bridge under construction, I realized that Pitt Meadows would no longer be isolated and that its central location would become easily accessible from anywhere in the Lower Mainland,” MacIntosh says. “We broke ground in August 2008 and moved into our new hangar facility in May 2009. Our customers appreciate YPK for its uncomplicated air space enabling easy access by pilots unfamiliar with the area. The multiple runways and IFR approach capability ensure there are few days per year where aircraft are not arriving and departing.”

YPK is hosting its Airport Day on June 21, 2025, which routinely draws over 5000 attendees to take in the sights and sounds of this growing and critical infracstucture for Canadian aviation. flyypk.ca/development

BY JON ROBINSON

Canada’s 10 busiest airports, based on passenger volume, collectively accounted for moving more than 139 people in 2024, as these economic hubs continued a bounce back from the COVID pandemic – and in a couple of cases surpassed 2019 pre-pandemic passenger levels. New pressures from United States tariffs could once again impact the growth of regional

and international airports, but their infrastructure projects push forward. Below, we take a look at the country’s 10 busiest airports to see how passenger numbers are shifting, while also identifying some major capital projects.

A true global hub airport, Toronto Pearson

is Canada’s largest airport in terms of total passenger traffic, serving 44.8 million passengers in 2023 (2024 final numbers were not yet released). In 2019, just prior to the pandemic, 50.5 million passengers travelled through Pearson, 11 per cent higher than 2023. In 2020, passenger traffic because of the pandemic dropped to 13.3 million passengers. By the mid-2030s, passenger traffic numbers at YYZ are expected to reach 65 to 70 million. Since 2022, YYZ has added more than eight million international seats, according to its operator, Greater Toronto Airport Authority (GTAA). YYZ is now home to 54 airlines flying to more than 180 destinations worldwide.

A new project called Pearson LIFT is aimed at long-term investments in facilities and terminals. This includes more than 2,000 3D sensors installed across the ceilings of YYZ’s terminals, which leverage AI that captures, anonymizes and monitors passenger behaviour. Pearson LIFT is multi-billion-dollar investment consisting of three major programs. The first, called Accelerator, is focused on revitalizing existing airport assets. Next will come Gateway in an effort to prepare for passenger growth by expanding existing terminals. The third program, T1/T3 Revitalization, will focus on modernized retail, amenities and passenger processing spaces.

Vancouver International, YVR Canada’s second busiest airport, Vancouver International served 26.2 million passengers in 2024, an increase of 5.1 per cent from 2023 which saw 24.9 million travellers and up 114 per cent from 7.1 million passengers in 2021 during the last year of the COVID pandemic. YVR has all but returned to its pre-pandemic passenger levels, which reached 26.3 million in 2019 – a different of just 0.7 per cent when compared with 2024.

YVR in 2021 announced a commitment to achieve net-zero carbon emissions by 2030, noting the bulk of Sea Island emissions (more than 95 per-cent) are related to aircraft movements, traffic and nonAirport Authority buildings. The airport plans to invest $135 million over the next 10 years to meet its net-zero commitment. The YVR 2021 – 2024 strategic plan, based on response to the COVID pandemic, saw the airport begin to align its future growth with the regional economy, under a program called Gateway to the New Economy to explore and market new routes, and forge agreements with new carriers.

Canada’s third busiest airport, Trudeau International welcomed 22.4 million passengers in 2024, increasing 5.6 per cent from

21.2 million in 2023 and 124.6 per cent from 5.2 million in 2021. YUL in 2023 had already surpassed it pre-pandemic numbers, which reached 20.3 million in 2019 – making 2024 a 9.8 per cent increase over 2019. A total of 156 direct destinations were offered from YUL in 2024, including 33 in Canada, 34 in the U.S., and 89 international.

ADM Aéroports de Montréal (ADM), the non-profit airport authority for the greater Montréal area, is responsible for the management, operation and development of YUL and YMX Aérocité internationale de Mirabel. Under Flight Plan 2028–2035 ADM is preparing to launch several projects at YUL, including the addition of local parking areas and a new jetty for satellite boarding gates, the construction of dropoff areas, the opening of the REM station and the demolition of an existing multilevel parking lot.

Canada’s fourth busiest airport, Calgary International welcomed 18.8 million passengers in 2024, an increase of 2.2 per cent from 2023 with 18.5 million passengers. Its 2025 first quarter passenger numbers were up 2.19 per cent over the corresponding year ago quarter. YYC is operated by the Calgary Airport Authority (CAA), since 1992, which has also controlled YBW Springbank Airport since 1997.

CAA is focused on a $201 million construction project, which began in April 2024, to maintain airport safety, security and efficiency. The project includes the removal and replacement of the west runway, which involves full-depth structural and electrical rehabilitation. At the same time, the runway environment will also be modernized, including approaches, lighting and infrastructure. The west runway was originally constructed in 1939. The project is expected to continue in phases until December 2025. Phase 4 was completed ahead of schedule and the runway was reopened in December 2024. No further construction will occur during the winter months, and phase 5 – 9 of construction are scheduled to resume in spring 2025.

Canada’s fifth busiest airport, Edmonton International welcomed 7.9 million passengers in 2024, an increase of 5.6 per cent from 2023. YEG had a significant jump in transborder traffic from 2023 to 2024 of 28.3 per cent, from 737,613 to 946,154 passengers. International travel increased 7.5 per cent from 485,440 passengers in 2023 to 521,845 in 2024. Domestic travel increased by 1.0 per cent from 5,694,765 to 5,751,683.

Edmonton Regional Airports Authority, established in 1990, manages YEG and Villeneuve Airport (ZVL). In addition to YEG’s passenger traffic, Edmonton Airports oversees YEG’s air cargo operations in a multi-tenant Cargo Village. YEG is Canada’s most northerly 24-hour major airport with two runways in an open “V” configuration. YEG is also Canada’s largest major airport by land mass at just under 7,000 acres. YEG is the base for the Western Region Area Control Centre responsible for all aircraft movements over Alberta and most of northern Canada.

Canada’s sixth busiest airport, Ottawa International welcomed 4.6 million passengers in 2024, an increase of 11.7 per cent from 2023 with 4.1 million passengers and an increase of 118.9 per cent from 2021. YOW is short of its pre-pandemic levels when it reached 5.1 million passengers in 2019, a difference of negative 10.3 per cent. YOW predominantly serves the domestic market, accounting for 3.4 million passengers in 2024 or 74.5 per cent of total passengers. Transborder passengers in 2024

represented 16.1 per cent with 741,449 passengers and international accounted for 433,875 passengers or 9.4 per cent.

The first powered flight over Ottawa occurred in 1911, but a landing field wasn’t established until the 1920s, initially known as Hunt Club Field. YOW today partners with 10 airlines, including recent projects by Porter Airlines, which has made the airport its maintenance hub through a $65 million investment to build two aircraft hangars, over approximately 150,000 square feet. Porter’s YOW facilities will focus on maintaining the airline’s growing fleet of Embraer E195-E2 jets and the De Havilland Dash 8-400.

Canada’s seventh busiest airport, Winnipeg International welcomed 4.3 million passengers in 2024. The airport is operated by Winnipeg Airports Authority (WAA). Located at the geographical centre of North America, YWG provides 42 direct destinations with nine airline partners. Construction of YWG’s Multi-Tenant Air Cargo Logistics Facility is well underway, notes WAA, which currently accommodates 4,000 cargo flights a year.

Airline partner highlights at WPG in

2024 included WestJet adding year-round, daily service to Montreal, as well as increased, daily, year-round service to Ottawa, and a new non-stop route from Winnipeg to Nashville and seasonal service to Los Cabos. Porter in 2024 at YWG began daily non-stop service to Ottawa, while Delta increased service to Minneapolis. United Airlines also returned to YWG in 2024 with daily, non-stop service to Chicago and Denver. The airport also completed its Runway 18/36 rehabilitation project (adding to the completion of its Runway 13/31 rehabilitation in 2019).

Canada’s eight busiest airport, Halifax International welcomed 4.0 million passengers in 2024, which the Halifax International Airport Authority (HIAA) notes to be an 11.2 per cent increase from 2023 – although still short of the 4.2 million passengers served in 2019. Domestic destinations remain its largest sector. Air Canada, the airport’s largest and longest-serving airline, will offer its non-stop Vancouver service up to twice daily in the summer of 2025 along with flights to other major centres across Canada. Porter, the airport’s second-largest carrier, will launch flights

between Halifax and Hamilton beginning in June. Regional connectivity will be supported by Pascan Aviation’s daily flights to Sydney, N.S., and Saint John, N.B., which were launched in 2024.

HIAA notes a record number of airline seats will be available for sale to international destinations, including Europe and the U.S. Air Canada will maintain its daily, year-round, non-stop flights to London Heathrow, while WestJet will offer transatlantic services connecting Halifax to Edinburgh, Dublin, and London Gatwick. WestJet also planned to introduce four weekly non-stop flights between Halifax and Paris.

Canada’s ninth busiest airport, Billy Bishop is owned and operated by PortsToronto, which traditionally welcomes approximately 2.8 million passengers per year. The terminal at Billy Bishop is owned and operated by Nieuport Aviation. Billy Bishop generates more than $2.1 billion in total economic output, supports 4,450 jobs, including 2,080 directly associated with the airport’s operations.

Billy Bishop offers service to more than 20 cities in Canada and the U.S., with connection opportunities to more than 100 international destinations via its airlines’ networks. According to a study by Destination Toronto, the Toronto region is home to 38 per cent of Canadian business headquarters and accounts for 18.5 per cent of Canada’s GDP. With an estimated 135 million people living within a 90-minute flight of Toronto. Billy Bishop also serves as a base for Ornge air ambulance services, two Fixed Base Operators, and a flight school.

Canada’s tenth busiest airport, Kelowna International welcomed 2.1 million passengers in 2024, an increase of 4.8 per cent from 2023 with 2.0 million passengers served. Its 2024 results represent an all-time high after reaching 2.0 million passengers in 2019 before the pandemic, an increase in 2024 of 4.9 per cent. In 2021 during the last year of the pandemic, YLW’s traffic dipped to 829,804 passengers, representing a 61.1 per cent decrease when compared to its 2024 results.

YLW provides more than 60 daily nonstop commercial flights with eight airlines. By 2045, YLW is anticipated to serve 3.5 million passengers annually, representing a 48.5 per cent increase. With a long runway of 8,900 feet, YLW is capable of accommodating large aircraft and cargo operations, holding multiple land use types and sizes, ranging from 0.5 to 40 acres. | W

OCTOBER 1 – 2, 2025

This year, we’re bringing you an event that’s bigger, better, and packed with more value than ever before. With two full days of immersive content, increased networking opportunities, and more ways to engage with industry stakeholders, this is the ultimate platform for showcasing your brand as a leader in wildfire suppression.

It’s time to elevate your presence — this is the must-attend event of the year, designed with your success in mind.

The Canadian Wildfire Conference is an educational program designed to unite air and ground personnel alongside its trade show component. The conference agenda includes a range of presentations from industry leaders to provide critical information on the challenges and opportunities of effective wildfire suppression.

Secure your exhibitor and/or sponsor spot today – spaces are limited.

that 78 per cent of southern Canadians placed a high level of importance on access to basic public infrastructure in the Arctic.

Fast forward to 2024, and Canadians still believe that Arctic infrastructure is important.

A more recent public opinion poll, this one conducted by the Observatory on Politics and Security in the Arctic, surveyed more than 2,000 Canadians from July 30 to August 12, 2024. One of us, Mathieu Landriault, is the director of the organization.

The main takeaway of the survey is that Canadians are highly supportive of Arctic infrastructure. They perceive it as strategic and part of nation-building, with 42 per cent considering it to be of national importance.

Respondents said there was a need to build additional infrastructure in the Arctic, even if other countries are involved in its development.

Partnerships with other countries to build Arctic infrastructure are seen as desirable by a majority of respondents, casting doubt on suggestions that the defence of Canada’s Arctic sovereignty must exclude other countries. On this point, building Arctic infrastructure is perceived as more important than any desire for national autonomy. (This sentiment may have shifted since the survey following 2025 tariff and annexation threats from the U.S.)

This urgency is also present when respondents were asked about whether the federal government should partner with private companies to build Arctic infrastructure. The message is clear on this note: more is needed, by any means possible.

On this last question, support was high across all regions and political affiliations. Levels of support vary from 70 per cent in the Prairies to 79 per cent in the Maritimes. In terms of political affiliation, 80 per cent of Liberal voters supported the idea, followed by 76 per cent of Conservatives and 72 per cent of New Democrats.

However, some infrastructure projects had more public support than others. Water, including treatment plants, and transportation infrastructure, including ports, received the greatest amount of support. Connectivity infrastructure, meantime, such as broadcasting systems, ended up at the bottom of the list of four different types of critical infrastructure.

These numbers paint a clear picture of support for Arctic infrastructure in Canada. The political cost of investing in this infrastructure is relatively low: Canadians want more Arctic infrastructure built, and they perceive these investments as strategic ones that benefit all of Canada.

The naval facility in Nanisivik, Nunavut, is an example. First announced in 2007, the facility is set to open in 2025, 10 years behind schedule and well over budget. Yet very little public and media attention have been devoted to these issues, and the political ramifications for successive governments have been non-existent.

The inclusion of Arctic infrastructure in Canada’s newest Arctic foreign policy shows the infrastructure gap is now being recognized as a serious concern, and resources are being mobilized to remedy these shortcomings.

It remains to be seen if all infrastructure will be improved as a result; some might be a harder sell for Canadians. More needs to be done to explain how, for example, connectivity infrastructure, including satellites and undersea cables, are crucial to living in the North, both as an economic lever and as a means of ensuring the safety of Northerners living on the land.

But the survey makes clear that prioritizing building Arctic infrastructure is a winning cause, politically speaking. | W

Prime Minister Justin Trudeau on April 8, 2024, at Canadian Forces Base Trenton introduced a new defence policy document, Our North, Strong and Free, to have Canada’s military take a bigger role in the North over the next two decades as climate change and increasingly aggressive foes threaten Arctic sovereignty. “Rising and disruptive powers like China and Russia mean NATO’s northern and western flank is the Canadian Arctic,” said Trudeau. Without submarines as part of the math, but definitely to be a prime focus of the policy, conventional or nuclear, the initial Our North Commitments are projected to boost Canada’s military spending to 1.76 per cent of GDP by 2030. Still well short of the two per cent NATO target.

Our North, Strong and Free investments with an Arctic focus

• $218 million over 20 years to establish Northern Operational Support Hubs.

• $18.4 billion over 20 years to acquire a more modern, mobile, and effective tactical helicopter capability.

• $307 million over 20 years for airborne early warning aircraft.

• $1.4 billion over 20 years to acquire specialized maritime sensors to conduct ocean surveillance.

• $222 million over 20 years to build a new satellite ground station in the Arctic.

Our North, Strong and Free also commits to exploring options

• Acquire new vehicles adapted to ice, snow, and tundra.

• Enable Arctic and Offshore Patrol Ships to operate helicopters.

• Renew and expand Canada's submarine fleet through the acquisition of up to 12 conventionally powered submarines.

NORAD Modernization

• Announced in June 2022, the government is investing $38.6 billion over 20 years into capabilities that will modernize Canada's contributions to NORAD and strengthen the all-domain defence of Canada and North America including surveillance, command and control, and communications systems, infrastructure and support upgrades, air weapons systems, and science and technology investments.

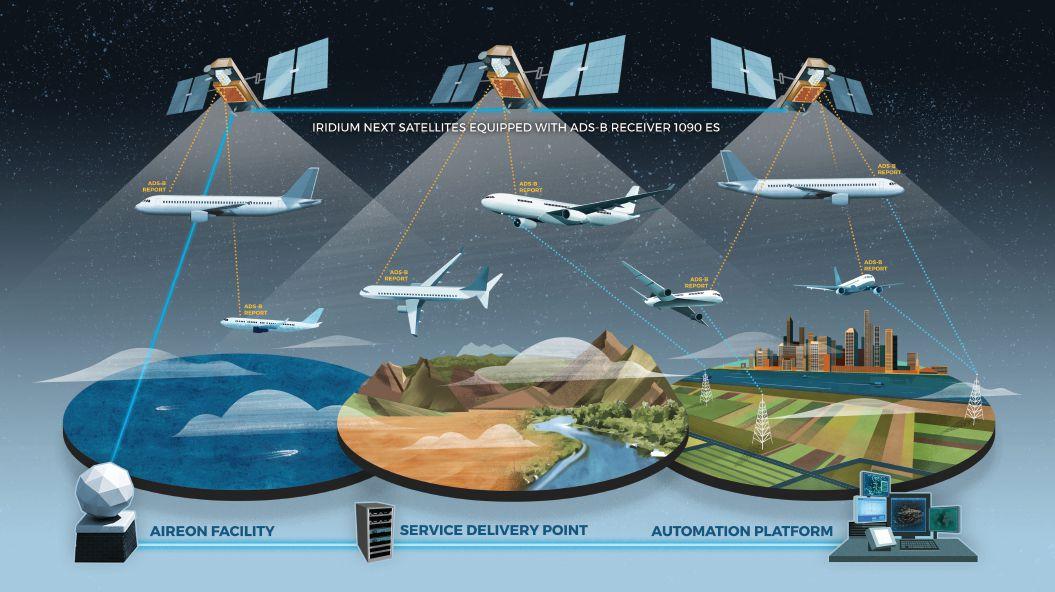

BY PHIL LIGHTSTONE

Automatic Dependant Surveillance – Broadcast, or ADS-B for short, was implemented in the U.S. using a ground network and in Canada using the Iridium satellite network delivering a near global coverage. With the U.S. mandate now five years old (2020) and Canada’s Class A and B airspace mandate arriving in May 2024, with a possible Class C, D, E mandate no earlier than 2028, more aircraft are equipping with ADS-B OUT transmitters. The FAA reports, that as of

July 2024, there were 168,144 N-registered aircraft equipped with ADS-B OUT. At any given time, ADSB Exchange may be tracking 15,000 aircraft worldwide, through its ADS-B and MLAT system of 14,000 active feeds. Monetization and economic benefit are an exercise of incremental revenue and cost avoidance.

ADS-B transmissions are not encrypted (the data is in plain text) allowing anyone with a receiver to receive and record the transmissions from any aircraft either airborne or on the ground. Organizations like

Flight Aware, Spire, ADS-B Exchange, FlightRadar24 and others, provide an Internet-based gateway to view unfiltered data from ADS-B, Mode S transponders and MLAT feeding systems.

Business aviation (BA) owners and operators have long been concerned about the ability for the public to use off-the-shelf hardware, applications and websites to track the movements of their aircraft. Securing ADS-B transmissions would not require the development of new security technologies, but could leverage off-the-shelf security technologies, techniques and processes. However, with more than 170,000 aircraft (worldwide) deployed with on-board ADSB equipment, the introduction of encrypted ADS-B would require a rip and replacement of the existing ADS-B transponders or the introduction of additional hardware to facilitate a “man in the middle” encryption of the outgoing and incoming traffic.

Further, ADS-B IN portable devices commonly used by general aviation (GA) pilots (ForeFlight Sentry, Garmin GDL, Stratus, uAvionix Ping USB, and others), which are designed to provide high-value TIS-B and FIS-B (traffic and weather information), would be rendered useless through encrypting traffic.

In 2024, The DeLand Muni-Sidney H Taylor Field (KDED) airport investigated charging landing fees to all aircraft (US$3.00 per 1,000 pounds) using ADS-B. With the loss of government funding, the municipality was looking at ways to increase its revenue (in addition to tenancy rents and fuel sales). Landing fees are a natural income generator. At a recent public meeting on the topic of landing fees, DeLand’s Airport Manager John Eiff confirmed the intent of the fee is to deter traffic, stating: “The primary reason we are even considering a landing fee is to protect ourselves from other airports that are signing up for this. We’ve got Orlando Executive, Kissimmee, Flagler, Ormond Beach and us that are considering landing fees. If we do not impose landing fees, airplanes that are using the other airports and paying landing fees, they will choose to come to DeLand and saturate our pattern to an unsafe level. For us to add a landing fee is kind of protection against this.” The initiative was placed on hold as the municipality considered the initiative. In the summer of 2025, the program will be revisited by the municipality’s airport commission. Eiff is confident that the land fee initiative will be approved.

Other Florida airports are considering ADS-B derived landing fees. Kissimmee Gateway Airport will be implementing landing fees, noting in a statement: “A growing number of Florida GA airport leaders recognize this approach as a reasonable means of revenue generation to assist

achieving financial stability. Landing fees would diversify revenue streams, support infrastructure upgrades and expansion, and assist in managing operating/maintenance and capital improvement costs. The landing fees would apply to transient aircraft to supplement the revenue needed for cost recovery and future capital improvement projects. This adheres to the user-fee principle, ensuring that those who benefit directly from the use of ISM facilities contribute fairly to their upkeep and expansion. Based aircraft owners will be exempted from landing fees since they contribute to revenue sources through ground and facility rental leases and are often engaged in bolstering the local economy through job production and purchasing of local goods and services.” On September 17, 2024 the City Commission meet and unanimously approved the ordinance. On October 15, 2025, the City Commission meet to consider approving the collection agency agreement and an option was introduce exempting landing fees (one per day per aircraft) for aircraft under 5,000 lbs (an impact of US$100,000).

Kissimmee instituted recording landings on February 1, 2025, and were to begin invoicing March 1, 2025. Airport management are in the process of updating Electronic Flight Bag systems with their updated landing fees. There are several aircraft exempt from the landing fees based upon their usage. For owner/operators who choose not to

pay landing bills, under the State of Florida’s law, title 25 Aviation, chapter 329.40, the airport may: place a lien on the aircraft; a person is precluded from removing the aircraft (with a lien) from the airport, which has placed a lien on the aircraft. a person who removes or attempts to remove the aircraft is guilty of a misdemeanor (punishable with a fine up to US$10,000).

Monetizing ADS-B transmissions, leverages the notion that vendors with access to free public data (ADS-B transmissions) can use this resource to their economic benefit without the requirement to expend capital to build out the data transmission environment. ADS-B IN receivers are inexpensive and can feed cloud-based IT technologies. With the aircraft’s location, altitude, speed, registration and date/time in the ADS-B transmission, the programming effort to capture, manage and analyze the data against predetermined business logic is minimal (e.g. if aircraft’s location is airport N, aircraft’s altitude is at ground level and the airspeed has been diminishing from cruise to landing to taxiing and then to zero, then create a billing record). With aircraft registration public domain, automating the creation of an aircraft ownership record is a simple task. The process of determining a billing address will require some manual intervention but this is a onetime task (that is until the aircraft is sold).

Vector Airport Systems and VirTower provide an in-the-cloud airport

management and billing system, inclusive of capturing aircraft landing and departure data utilizing ADS-B. Vector Airport Systems (Vector) was founded in 2005 to offer airports a better way to manage aircraft landing fees. Its system, called PlanePass was first implemented at Massport's Hanscom Field, but has been implemented at dozens of airports around the United States. The system is capable of generating bills for landings, over flights, customs callouts and parking. The system is completely automated, billing the aircraft operator directly. With an in-house Customer Service and Collections Team, Vector has a 99.6 per cent collection rate. PlanePass also delivers detailed aircraft and operator data for a complete inventory of an airport's activity. This data has a multitude of uses, including environmental studies, planning and operations, grant applications and improving data for noise management. Vector installs hardware at the airport to receive aircraft ADS-B OUT and MLAT transmissions, satellite tracking, radar data and digital camera images. The hardware is monitored 24/7/365 and any hardware issues are managed by Vector. For aircraft not in the Vector system, Vector personnel will research the aircraft’s ownership to determine an appropriate billing address and contact information. Over time, the billing data will grow as more airports contract Vector’s services and aircraft are added to the system. The airport receives 17 per

cent of the collected revenue, without any more labour than due diligence and contract signature. Once the contract is signed, there are no other costs other than administering the contract.

The San Antonio International Airport (KSAT) started billing Landing and Customs fees on October 1, 2024, managed by Vector billing transient aircraft. A fee of US$20 is billed to aircraft with a maximum weight of 5,999 pounds. A variable rate is applied for BA aircraft based upon (per 1,000 pounds rounded up):

6,000 to 19,999 pounds US$3.50; 20,000 to 49,999 pounds US$4.50; and 50,000 to 999,999 pounds US$5.50. The reaction on a recent Facebook posting (Airplanes and Coffee group, a GA focused group) solicited 625 comments, most of which were not very flattering. Interestingly, in 2019, the city had received US$12,560,397 in Federal Air Transportation grants, while expenses were US$147,216,000 and revenue was US$104,298,000 (KSAT and Stinson Municipal Airport). The 2019 data indicates that the airport is operating at a loss.

The Aircraft Owners and Pilots Association (AOPA) reported on January 30, 2025, that the Greater Orlando Aviation Authority (GOAA), which controls Orlando International Airport and Orlando Executive Airport, has delayed a proposal to impose automated ADS-B-monitored landing fees. AOPA credits a flurry of input from local pilots just two days before the January 15 vote for the decision to reconsider the proposal. In a published report, AOPA Southern Region Manager Stacey Heaton, wrote: “It is rare for GA aircraft owners to be billed for landing fees, though the relatively recent creation of businesses that harvest ADS-B data from third-party providers and use it to generate invoices sent to registered owners on behalf of airport operators has been too tempting for many airports to resist – even as community members question whether the airports actually need the money. After months of claiming that GOAA had not established a landing fee policy, the board scheduled a January 15 vote. Just as abruptly, a January 13 meeting was called to hear from the public on the landing fee proposal. The short notice for that 4 p.m. meeting made it difficult for many to attend. AOPA emailed members in the region a call to action that was quickly amplified by word of mouth, and I was gratified to see more than 100 concerned pilots arrive for a standing-room-only event. Many members who were unable to attend in person sent emails voicing their concerns. The following evening, the GOAA board staff announced that airport leadership had opted to delay considering the landing fee proposal “pending review and refinement.”

On NAV Canada’s horizon is the modernization of the Canadian radar network. Unsubstantiated reports suggest that the cost of upgrading the secondary and primary radar sites could be north of $1.3 billion. With NAV Canada’s current financial situation (revenue, expenses, accumulated net loss and debt), funding the upgrade could be challenging. Over the past decade, NAV Canada has been decommissioning ground-based technologies like ADF and VORs (one site at ta time). Using ADS-B technology to augment or replace Canada’s national radar environment, creates a result where costs are downloaded to the user base. It is estimated the cost of equipage for the Canadian GA community could be more than $700 million (note: with some TIS-B and not FIS-B data uploaded to the cockpit using ADS-B) with the only tangible benefit being access to the airspace.

Augmenting Emergency Locator Transmitters (ELTs) with ADS-B data (providing enhanced search and rescue tracking) has the potential to provide SAR assets on scene faster and more efficiently. In 2023, Canadian SAR had 8,234 incidents including 1,718 cases of distress, with many of them false positives. Aireon Locate is a cloud ADS-B-based service that allows an aircraft’s location to be pinpointed, taking the search out of search and rescue. Aireon Located has the potential to reduce the number of resources and costs which the federal government expends on SAR.

Using ADS-B signals, as part of a usage based cloud delivered billing engine, provides smaller airport authorities with the ability to tap into a new revenue source, which historically would require more administrative costs than potential revenue. Some GA pilot/ owners take a dim view to paying landing fees and may not pay up. Collections is the next piece of the administrative puzzle that could require regulatory teeth to minimize bad debts. For BA operators, paying their fair share is a corporate culture. | W

As an aviation stakeholder, you would likely highlight commercial aviation’s crucial role in Canada when you meet with a federal politician or elected official. You know very well that Canada relies heavily on aviation, especially in the northern and remote regions, where there is often no other reliable mode of transport. You also know that the connectivity offered by aviation is a key economic enabler both domestically and internationally. So, where do you start? As there are so many issues, which ones are key?

The Air Transport Association of Canada (ATAC) is happy to share its top five key commercial issues, which it hopes federal parties will consider when drafting their campaign platforms. Each issue is accompanied by a short description and proposed solution that would greatly help the commercial aviation sector continue to offer Canadians the world-leading, safe, reliable, and sustainable service they have come to rely on in this vast country.

Aviation

the Competitiveness and cost-effective Air Travel System in Canada

Provincial governments have voiced their concerns about the severe impact of high federal fees and charges on air travel in Canada. They assert that federal aviation policy has resulted in Canada being one of the highest-cost jurisdictions in the world for airlines which is crippling the competitiveness of the air travel sector. Aviation policy in Canada must assist in overcoming the significant challenge of serving a relatively small population in the world’s second-largest country. The federal government must support Canada’s air travel system by adopting enabling policies resulting from direct industry consultation to promote competitiveness, sustainability, and cost-effectiveness.

The federal government must reinvest all the sums collected from aviation fees and charges, including airport land rent, back into the aviation infrastructure in Canada. It must ensure northern and remote aviation infrastructure is developed and maintained, along with back-stopping NAV CANADA and CATSA in the advent of another significant economic slowdown. The federal government must also recognize that the strict user-pay policy is detrimental to the growth of competitive air services in Canada.

The shortage of skilled human resources is crippling the aviation industry of Canada. A viable and lasting solution to this problem can only result from a joint industry-government effort. A concerted push to attract and retain skilled foreign workers, governmentbacked funding for pilot training, and less restrictive Transport Canada and Immigration, Refugees and Citizenship Canada regulations are all needed to attract and retain more people to the Canadian aviation industry.

The Government must not allow foreign carriers to exercise cabotage in Canada. Permitting foreign airlines to offer domestic air services in this country would seriously threaten the very existence of Canadian carriers and lead to Canadians being entirely dependent on foreign operators. Allowing cabotage would have dire consequences for domestic air services in Canada, especially in northern and remote regions of the country. Major world economies protect their domestic air services from foreign interference.

This is a critical time for the aviation industry to decarbonize and reduce its carbon footprint with lasting measures. Canada has an opportunity to be a leader in producing sustainable aviation fuels (SAF) that will provide economic and environmental benefits in every region of the country.

The aviation sector must remain competitive as it transitions to a net-zero future while at the same time creating new economic opportunities for Canadians. The Canadian government must act immediately to ensure production and distribution of Canadian SAF to meet its ambitious aspirational goals.

The goal is to request that the federal government introduce a SAF incentive to stimulate production investment in Canada and allow Canada’s biofuel industries to compete against the United States. SAF incentives are a critical element of a robust and comprehensive sustainable aviation policy that will be further developed jointly by the government and industry.

Pierre Ruel President and CEO Air Transport Association of Canada

On February 17, 2025, Delta Airlines flight 4819 from Minneapolis to Toronto, operated by subsidiary Endeavor Air, was involved in a significant accident upon landing at Toronto Pearson. Three Toronto Pearson stations responded with 10 aircraft fire and rescue vehicles, assisted by Mississauga Fire, Peel Paramedics, and Peel Police. Through a combination of luck, skill, heroism and aircraft design, the evacuation of passengers took place quickly and everyone aboard the ill-fated flight were able to exit the plane and make it on to the tarmac.

Post-accident investigations will provide more details about what contributed to the accident, and the strengths and weaknesses of the emergency response. But one point is already obvious: the positive outcome speaks to the importance of the institutions and expertise that keep our aviation system safe overall.

The response to the Delta Flight 4819 crash was an example of just how important inter-agency collaboration is in emergency response. Within minutes of the crash, not only were the airport’s firefighters on the scene to douse any flames and assist with the rescue of passengers, but other agencies were already providing aid. Mississauga Fire sent six vehicles to the airport as part of the mutual aid effort. Ornge, Ontario’s air ambulance system, also sent multiple units to the scene to help transport injured passengers to hospitals, aiding Peel Region paramedics who were also triaging passengers. Multiple agencies collaborated to save lives. This collaboration in emergency response isn’t developed on the fly, but instead follows a highly choreographed and practised set of plans.

Both the airport and partner agencies maintain air crash emergency response plans that lay out the details of how help will be requested, where aid will arrive and how to scale up the response as needed.

A primary reason the air crash response worked so well was preparation.

An important component of preparation at airports is regularly testing response plans and operations with specialized full-scale mock disaster exercises.

In these exercises, airport response personnel work through scenarios that simulate emergencies. Real emergency equipment is tested, volunteer victims participate in search-and-rescue scenarios and theatrical make-up is even used to simulate injuries. These exercises serve multiple purposes, including increasing familiarity with the plan for responders and creating real challenges that will help to find any potential weaknesses in the plan before a real event.

Another less desirable way responses can be improved is for an actual disaster to happen. Actual air crash disasters force plans to be activated, require response actions to be taken, and – ideally – foster adaptive learning through hard-won experience.

According to data from the Aviation Safety Network, there have been 23 aircraft accidents at or near Pearson Airport since 1939. As a testament to safety at Pearson, no casualties occurred in 18 of those 23 accidents. One past significant Pearson crash with no casualties is especially relevant to revisit now. In August 2005, Air France Flight 358 rolled off the runway during landing and caught fire.

All 309 people on board evacuated and survived. An organizational analysis of the 2005 accident highlighted that the crash investigation report “praised the seamless tracking of events and communication between the parties involved” in response.

Twenty years later, and Pearson CEO Deborah Flint said the crew, airport emergency workers and first responders mounted a “textbook response” to the Delta incident.

An investigation begins While the immediate response may have been over fairly quickly after passengers were successfully evacuated, the mutual aid and collaboration between agencies will continue in the months ahead.

The Transportation Safety Board of Canada (TSB), of course, launched a significant investigation into the incident shortly after the occurance. According to the most recent TSB data, the 2023 overall air transportation accident rate of 2.8 per 100,000 aircraft movements is among the lowest recorded by the federal agency since it began measuring such data in 2004. The TSB recorded 19 fatal air transportation accidents involving 33 fatalities in 2023. This is down slightly from 2022 and is 24 per cent below the average of 25 fatal accidents involving 40 fatalities over the 10 years from 2013 to 2022. Thirteen of the 33 air transportation fatalities in 2023 involved commercial operations.

While learning about what contributed to the crash of Delta Flight 4819 is important, we can also seek comfort in the fact that air travel in Canada continues to be a safe activity for passengers. | W

Jack L. Rozdilsky is an Associate Professor of Disaster and Emergency Management, York University, Canada. Eric B. Kennedy is an Assistant Professor, Disaster and Emergency Management, York University, Canada. This article was originally published by The Conversation.

As Canada's air navigation service provider,we work each and every dayto keep our skies safe and aircraft moving efficiently.

Explorethe linkto learn aboutthe excitingwork performed by NAV CANADA’s airtraffic controllers.

https://www.navcanada.ca/en/careers.aspx