Automated production of wet-glue or in-mold labels (IML). Speedmaster XL 106 for peak label production.

Engineered for demanding materials like in-mold and wet-glue labels, the Speedmaster XL 106 combines high-speed production with precision drying and automation. It delivers exceptional productivity, reduces waste, and offers energy-efficient solutions for sustainable, top-quality label printing. heidelberg.com/ca

ISSN 1481 9287. PrintAction is published 6 times per year by Annex Business Media. Canada Post Publications Mail Agreement No. 40065710. Return undeliverable Canadian addresses to: Circulation Department, 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1. No part of the editorial content in this publication may be reprinted without the publisher’s written permission. © 2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of this publication. Printed in Canada.

The impact of tariffs on Canadian businesses

A new generation of low- and no-code applications 18 Innovate or fall behind

The future of direct mail in a digital world

Innovative paper packaging solutions are transforming the CPG industry

24 Transform retail with hi-quality POS

Navigating the challenges and opportunities in large format printing

DEPARTMENTS

GAMUT

5 News, People, Installs

10 Calendar

NEW PRODUCTS

26 A preview of the technologies on display at Graphics Canada Expo 2025

SPOTLIGHT

30 Antony Rubino, managing director, Resource Integrated

FROM THE EDITOR

4 Nithya Caleb

Modest growth in design, publishing

INSIDER

8 Bob Dale and Ken Freek

Be prepared, minimize risk

CHRONICLE

10 Nick Howard Baums away!

TECH REPORT

20 Alec Couckuyt

Postpress innovations at Hunkeler 2025 12 24 30 15

E27%

According to Statistics Canada, graphic design services accounted for 27.2 per cent of the specialized design services industry in 2023.

arlier this year, Statistics Canada released some of its annual industry survey results. While it no longer conducts a dedicated survey on the printing industry, results of annual surveys on periodicals, advertising and design offer key insights into the state of our client’s businesses. According to Statistics Canada, growth slowed down in the specialized design services industry, as well as advertising and related services industry in 2023, the year for which we have comprehensive data. This follows two consecutive years of double-digit growth.

Operating revenues in the specialized design services industry, which includes interior, industrial, graphic and other specialized design services, only rose 3.6 per cent in 2023 to $4.5 billion. Operating revenues only rose 7.8 per cent compared with 2022 to $14.4 billion in the advertising industry.

According to StatsCanada, interior design services continued to be the largest sector in the specialized design services industry in 2023, accounting for 46.3 per cent of sales, followed by graphic design services (27.2 per cent).

Operating expenses, especially salaries, wages, commissions and benefits, increased by 5.8 per cent to $3.6 billion in 2023. As the increase in operating expenses outpaced growth in revenues, the operating profit margin (20.8 per cent) declined, reaching its lowest level since 2013 (20.6 per cent).

In terms of trends, StatsCanada noted, “While digital design tools have been around for several years, their use surged during the pandemic and continues to rise, particularly in the interior design services industry. Artificial intelligence (AI) is being integrated into various aspects of the design process, from enhancing workflows to automating image rendering and generating design samples. As AI continues to evolve, designers will have to adapt to stay competitive. Additionally, the industry is experien-

cing rising demand for web-based design services, driven by the growth of e-commerce and increased consumption of online content.”

Operating revenues in the Canadian periodical publishers industry saw modest growth in 2023, increasing 1.9 per cent (+$19.3 million) from 2021, after a significant decline from 2019 to 2021 (-$175 million). Operating revenues in the industry were $1 billion for 2023.

Following a significant decline in operating expenses in 2021 (-16.8 per cent) as periodical publishers cut costs, operating expenses for the industry grew 5.2 per cent to $955.5 million in 2023. With growth in industry expenditures outpacing revenue growth, the operating profit margin fell to 6.3 per cent.

In 2023, the largest component of sales for the periodical publishers industry was once again advertising (50.1 per cent of total sales). Custom publishing sales shrunk to two per cent of total sales in 2023. Event, conference and trade show sales grew to 5.8 per cent of total sales.

The digital shift in the industry was also evident in the distribution of titles. In 2023, the majority of titles were published in both print and digital forms (63 per cent), while the share of print-only titles (27.5 per cent) continued to drop.

In advertising, all provinces and territories experienced growth in operating revenues in 2023. In Ontario revenues were up $680.4 million, or 8.3 per cent.

With operating expenditure growth (+9.5 per cent) outpacing revenue growth, the operating profit margin dropped to 13.9 per cent in 2023, its lowest level since 2016 (13.3 per cent). As with all industries, AI tools are becoming sophisticated and more widely adopted in the advertising and related services industry. AI is being used to generate content, create budgets, analyse brand engagement, etc. How are you using AI? I’d love to know.

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal 416-510-5113 apotal@annexbusinessmedia.com Fax: 416-510-6875

Mail: 111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1

Editor Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

Contributing writers

Bob Dale, Ken Freek, Nick Howard, Abhay Sharma, Jennifer Davey, Alec Couckuyt, Elena Knight and Andrew Hind

Associate Publisher Kim Barton kbarton@annexbusinessmedia.com 416-435-9229

Media Designer Lisa Zambri lzambri@annexbusinessmedia.com

Account Coordinator Melissa Gates mgates@annexbusinessmedia.com 416-510-5217

Audience Development Manager Urszula Grzyb ugrzyb@annexbusinessmedia.com 416-510-5180

Group Publisher/VP Sales Martin McAnulty mmcanulty@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

Subscription rates

For a 1 year subscription (6 issues): Canada — $43.86 +Tax Canada 2 year — $71.91 +Tax United States — $99.96 Other foreign — $194.82 Single Issue — $8.00 + Tax

All prices in CAD funds

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

Occasionally, PrintAction will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Business Media Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

ISSN 1481 9287

Mail Agreement No. 40065710 printaction.com

NITHYA CALEB Editor ncaleb@annexbusinessmedia.com

industries. Ampersand, meanwhile, brings nearly 50 years of experience in large format, offset and digital printing as well as direct mail fulfillment and packaging.

Resource Label Group, a full-service provider of label and packaging solutions, acquires Imprimerie Ste-Julie, Sainte-Julie, Que. Owned and operated by sisters Caroline Fournier and Marilène Fournier, Imprimerie Ste-Julie has cultivated a strong reputation across Quebec, serving businesses that seek customized, creative and sustainable label solutions to enhance their products. Imprimerie Ste-Julie is Resource Label Group’s 34th acquisition.

A recent Smithers report found that demand for offset litho has fallen in value by 2.5 per cent CAGR from US$354.4 billion in 2019.

“The Future of Digital vs. Offset Printing to 2029” report forecasts this trend to continue, and that the demand for offset litho will decline to US$307.9 billion in 2029. On the other hand, digital printing has grown rapidly in value by 3.4 per cent CAGR to US$165.5 billion in 2024 and is forecast to grow by a further 4.8 per cent CAGR across 2024–29.

The decline in offset litho comes from reduced demand for publication print. Digital printing is taking an increasing share of production volumes in some segments, including books and advertising. There is strong growth in flexo and gravure though.

SinaLite was recently selected as a 2025 regional finalist in the Canada’s Best Managed Companies program. Led by Deloitte, the program recognizes private Canadian companies that demonstrate exceptional leadership, innovation, and business performance. Since its founding in 1999 as a small mom-and-pop print shop, SinaLite has grown to serve over 20,000 print service providers across Canada and the United States.

Sun Automation Group enters into a strategic partnership with Kolbus Group, a manufacturer of corrugated machinery. Effective immediately, Sun will serve as the exclusive U.S. and Canadian agent and distributor for Kolbus machinery, parts, and service, including the RD rotary die cutter and BX Motion product lines. Additionally, Sun will manage aftermarket parts and service for Hycorr rotary die cutters.

Heidelberg turn 175. Together with customers, employees and partners, Heidelberg is celebrating its anniversary year with numerous events and activities. In the summer, there will be a week of celebrations at the Wiesloch-Walldorf headquarters including an anniversary ceremony with guests from all over the world. Family days are planned for employees at individual locations. What began over a century-and-a-half ago as a bell foundry in Frankenthal in the Palatinate region of Germany has developed into a leading global technology company and total solutions provider for print shops and packaging applications. Heidelberg sees growth potential of more than €300 million in sales for all strategic initiatives by the 2028/2029 financial year. The company generates more than 50 per cent of its turnover in the packaging segment. Heidelberg has around 9,500 employees worldwide with presence in 170 countries.

Allcard, a producer of gift, loyalty, insurance and identification cards, acquires Ampersand Printing, Guelph, Ont. Allcard also provides custom-printed packaging for customers in the food and beverage and health and beauty

Gelato’s 2025 State of Print Production Report highlights major industry trends, including the rising adoption of AI, the growing demand for personalization, and the shift toward digital printing. A resounding 80 per cent of respondents identified AI-driven tools and automation as essential for improving workflows, reducing costs and fostering innovation. While there is strong recognition of AI’s potential, only 55 per cent are actively investing in these technologies to stay competitive, signalling room for further adoption. A notable 70 per cent of printers note that personalization and customization are driving customer preferences, with printers adapting to deliver unique, on-demand experiences and restructure processes for micro-orders. Additionally, 65 per cent of survey participants emphasize the role of e-commerce integration in reshaping the industry and creating new revenue opportunities.

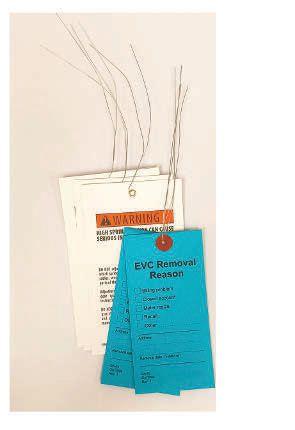

Advantag

Canada, a family-owned tag manufacturer, recently acquired

Domfile

Laurentide

Advantag had previously acquired the tag manufacturing division of Deco Tags & Labels in Ontario and Prestige Tag & Label. Its products are primarily made from cardboard paper and raw tag stock of various thicknesses and materials. The company employs more than 30 people at its Drummondville and Montreal facilities.

Heidelberg Canada appoints Christopher Moro as digital business driver. In his role, Moro is responsible for expanding the footprint of Heidelberg’s digital product portfolio in Canada, including its recently released industrial inkjet press, the Jetfire. Moro will report directly to Harold Hoff, VP of sales & service for Heidelberg Canada.

Moro began his print career in 2004 with a manufacturer of digital printing equipment. After nine years, he took on the role of VP of sales & operations at a commercial printer in Canada’s Niagara region, where he spent seven years building a high-performing team that fuelled the company’s growth and success. Known for his talent in building exceptional customer sales and support teams, Moro’s most recent role was at a niche marketing agency specializing in multi-channel strategies for the automotive industry, where he focused on ensuring client satisfaction.

Roland DGA appoints Kenny Ginn to the newly created position of sales manager – digital fabrication. Ginn’s new responsibilities will be focused on driving sales growth for specific Roland DG products in the U.S. and Canadian markets.

Standard Finishing Systems changes its North American sales team to help the company achieve its strategic goals. Karl Belafi, formerly Standard’s territory sales manager for all Canadian provinces, has been promoted to regional sales manager for Canada and the western United States, including Washington, California, New Mexico, and Wyoming. Virginia DaCosta, who joined Standard in 2022 as an account sales manager, has been promoted to territory sales manager for eastern Canada covering Ontario, Quebec, and the Maritime provinces. Steve Martinez, previously Standard’s strategic account manager, has been promoted to national sales manager where he will be working closely with Steinke, to manage all field sales activities across the U.S. and Canada.

General Formulations promotes Dan Collins as vice president of purchasing & production. Collins has more than 20 years of experience in operations, manufacturing, and multi-channel product distribution with P&L ownership. Since joining General Formulations in November 2023 as finishing plant manager, Collins has played a pivotal role in streamlining production operations and driving continuous improvement.

City Press, Winnipeg, installs the first HP Indigo 15K digital press in central Canada.

OCP Custom Graphics, Calgary, Alta., recently celebrated its 70th anniversary. To mark this milestone, the company upgraded its operations with a new platesetter from Heidelberg.

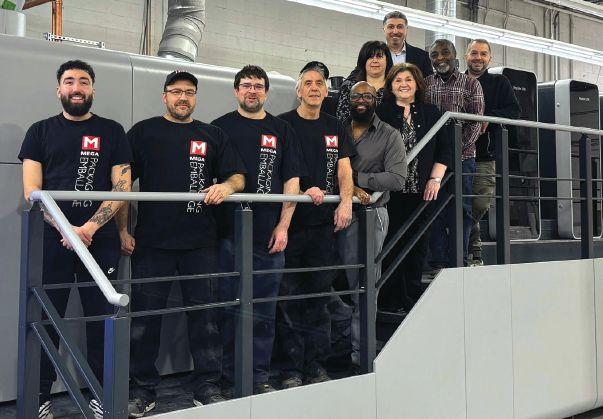

Emballages Mega Packaging, Montreal, begins full-scale production on its new Koenig & Bauer Rapida 106 six-colour hybrid UV press with coater. This is the first Canadian installation of Koenig & Bauer’s new generation hybrid UV press.

By Bob Dale and Ken Freek

t’s the age of uncertainty with fractured relations between governments in North America. Tariffs, lack of clarity on how much and when have created significant concern. While the specifics may not be clear without significant research, it is good to be prepared.

The biggest issue will be the impact to the economy, not only due to tariffs, but also due to the uncertainty. The printing and packaging industry depends heavily on a steady flow of raw materials and finished products between the U.S. and Canada. Tariffs now add a significant cost burden.

Canada is a major supplier of pulp and paper to U.S. printers and packaging companies. U.S. tariffs on Canadian paper exports increase costs for U.S. companies.

U.S. newspapers depend heavily on newsprint from Canada, so tariffs could accelerate the ongoing decline of the U.S. newspaper industry.

The 25 per cent tariff on aluminum and steel impacts lithographic printing plates. U.S. and Canadian printers that rely on Canadian aluminum for their printing plates will face higher production costs, which may be passed on to customers.

Tariffs impact corrugated and paperboard cartons, plastic bags, lids, and closures. U.S. exporters of packaging materials face decreased demand, while Canadian businesses pay more for imported materials needed for packaging production.

Shipping finished goods and materials requiring further processing across the border has become more expensive and complex. Many products in the printing and packaging supply chain cross the U.S.-Canada border several times. With each crossing now subject to tariffs, costs multiply, making finished goods more expensive.

New tariffs mean additional customs compliance requirements, causing delays. Companies must reconsider their cross-border supply chains, determine if they’re still viable or if domestic sourcing and production adjustments are necessary.

Canada’s retaliatory tariffs target $2 billion worth of U.S. pulp and paper.

When it comes to tariffs on raw materials like paper, pulp and aluminum, it’s advisable to diversify suppliers, negotiate long-term contracts to lock in prices where possible and explore alternative materials (e.g. synthetic substrates, alternative packaging).

Consolidate shipments to minimize the number of border crossings, invest in customs compliance training for staff, work with customs brokers to streamline cross-border processes, and build appropriate time into production schedules to account for custom delays. Additionally, increase inventory levels for critical materials.

Implement dynamic pricing to account for tariff-driven cost increases. Explore opportunities for process

efficiencies to offset higher material costs. Communicate transparently with customers about price changes and ensure there are appropriate escalation clauses in contracts.

Maintain a flexible, high-level risk mitigation strategy rather than a rigid disaster plan. Develop scenario planning for different potential tariff outcomes, educate customers about the impact of tariffs on pricing and supply chain issues and collaborate with them on cost-saving initiatives. Consider offering value-added services to strengthen relationships and offset cost increases.

Conduct bi-weekly production team review sessions to discuss what went well, what could be improved, and what you should stop doing as a company. Ensure the plant layout is optimized for efficiency and make smart capital investments in order to increase productivity. Advance planning and reviewing options will help to prepare your firm for facing the uncertainty that’s going to be the norm for some time.

BOB DALE is vice-president of Connecting for Results (CFR). He can be reached at b.dale@cfrincorporated. com. KEN FREEK is business improvement specialist with CFR. His email ID is k.freek@cfrincorporated.com.

April 22-25, 2025

Hybrid Fusion Amsterdam, The Netherlands

April 23-25, 2025

ISA International Sign Expo 2025 Las Vegas, Nev.

April 23-25, 2025

PPC’s 2025 Spring Outlook & Strategies Conference Indianapolis, I.N.

May 4-7, 2025

FTA Forum, Infoflex 2025 Pittsburgh, Pa.

May 6-9, 2025

FESPA Global Print Expo 2025 Berlin, Germany

May 7-9, 2025

Odyssey Expo 2025 Atlanta, Ga.

May 13-14, 2025

Print & Digital Convention Düsseldorf, Germany

May 27-May 30, 2025

Print4All Milan, Italy

June 10-12, 2025

Amplify Print Rosemont, Ill.

June 16-18, 2025

Color Impact 2025 Rochester, N.Y.

Believe me, it has been an inspiration to me to see what enthusiasm and plenty of fast work can accomplish. –Russell Ernest Baum

By Nick Howard

Two well-dressed athletes leaned against the lobby wall of a swank L.A. hotel. It was

December 6, 1949, and Mohammad Reza Pahlavi, the Shah of Iran then, was enjoying a swim in the hotel’s pool, unaware of the athletes’ insistence on meeting him. Those two young men were no ordinary jocks. Glenn Davis, a West Point U.S. army football star, had just won the 1948 Heisman trophy, and Bob Mathias would soon be a two-time Olympic Decathlon gold medallist at the 1948 and 1952 games. They were there to present an illuminated scroll that was signed by a dozen prominent athletes to the 30-year-old Shah, along with an invitation to a party in his honour at businessman Russell Ernest Baum’s Philadelphia mansion.

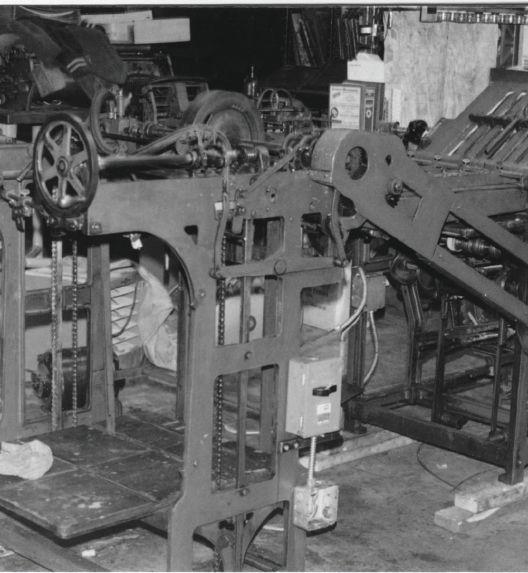

Hobnobbing with the rich and powerful was the centrepiece of Baum’s extraordinary private life. However, it was his business acumen that took on legendary proportions. Baum was a fantastic salesman and promoter of graphic arts machinery, notably the paper folder known all over North America as the Baumfolder, which commanded a significant market share for over 50 years in the continent.

Baum could sell sand to the Bedouins

Born in 1885, Russ Baum was a gifted marketer. In 1917, he was listed as a ‘supplier of labour-saving machinery for offices’. He usually made calls around Philadelphia and hustled up business. When he heard about Liberty

Folder, a new company in Sidney, Ohio, he saw the chance to make a fortune. Incorporated in 1918, Liberty manufactured hand-fed machines with buckle and knife folds. The Models 90 and 289 were nothing special compared to the ones from larger competitors such as Dexter, Cleveland, Chambers, and Mentges. All of these early contraptions would have been ideal film props in Charlie Chaplin’s 1936 movie Modern Times when viewed through the prism of today. European machinery might as well have been on the moon because no American would go for a Brehmer or Cundall (Stahl and MBO, both leading players today, didn’t exist until 1949 and 1965, respectively). However, what Liberty lost in technology was counterbalanced by price; it was the cheapest. Baum quickly cut a deal with Liberty’s owners for exclusive sales rights in eastern U.S., followed shortly by all of America and Canada. Then he got to work liberally using na-

tionwide print ads, extolling the incredible virtues of his aptly nicknamed ‘Gold-Mine,’ Baumfolder. Another unique ploy was organizing multi-day demonstrations followed by hitting the road to close newfound leads. No wasn’t in Baum’s vocabulary. He outworked his competitors, latching onto potential buyers tighter than the shark in Jaws grabbed hold of Robert Shaw. It didn’t take long, and by 1927, Baum had succeeded in carbonating a once staid and ignored segment of bindery. Baum outsold all competitors while dropping Liberty’s name, thus creating the impression that he, Baum, was the manufacturer.

In late 1929, Baum held a show at King Edward Hotel in Toronto. The directors of Sears, then a newly formed machinery firm, struck a deal with Baum that would change their fortunes. In March 1930, Sears held a show in Montreal, which was a hit. A young 23-year-old Tom Sears listened to Baum, and they

both worked long days to rack up 23 orders in the Montreal area. It is a phenomenal lesson that Baum and Tom would never forget: Hard work trumps everything. In an April 1930 memo to his staff, Baum wrote, “Believe me, it has been an inspiration to me to see what enthusiasm and plenty of fast work can accomplish.”

During the dark days of the Great Depression, Baum forged ahead, never taking no as an excuse. He soon found it beneficial to hire well-known athletes to sell products. Glenn Davis, Charles Nash, and George Guida were well-known and well-disciplined.

Then, there would be a constant barrage of advertisements in all printing publications. Baum wrote most of the ad copies, arguing why having a Baumfolder would turn a bindery into a profit centre. He kept up these messages, posting attractive prices and lay-away plans printers could easily understand: Buying a Baumfolder was a license to print money! Meanwhile, trouble was brewing at Liberty Folder. In 1949, a lawsuit brought by a minority shareholder accusing the manager,

C.R. Anderson, of fraud and embezzlement caused Liberty to go into receivership. Baum had already held 90 per cent of Liberty’s shares since 1947, and the whole arrangement could have ruined him. To complicate matters, Liberty had only sold to Baum’s company. The scandal was resolved by 1952, and Baum took complete control of Liberty.

In 1961, Baum sold his interest in Liberty to Chicago’s Bell & Howell, and the Baumfolder company would deliver over 30,000 Baumfolders. This indicates just how successful Baum was. He amassed a fortune of close to $100 million in today’s value. Plenty of ownership changes took place after B&H, including a brief management buyout in 1985, a sale to East Asiatic Company (EAC) in 1987, a sale to Stahl GmbH in 1991 and finally, Heidelberg in 1999 (with Heidelberg’s purchase of Stahl). With Stahl breathing down their neck, Baumfolder tried to update and modernize their machines, but to no avail. Stahl was a much superior machine. The introduction of the Auto-Set in

the early 1970s sealed Baumfolder’s fate. The Auto-Set attempted to emulate Stahl with tool-less roller settings but failed. Once MBO arrived, the die was cast, and the Baumfolder, although still in business today, is a shadow of its former glory.

Russ Baum was 75. A lifelong bachelor when he sold to B&H in 1961, he was still hosting spectacular parties with celebrity guests, including the Shah of Iran.

Baum’s ability to sell the Baumfolders and himself provides a master class on personal branding and doing extraordinary things by sheer will. In 1979, at the age of 95, Russell Baum died. He was a superstar in selling and offered a lesson for everyone wanting to achieve great things.

NICK HOWARD, a partner in Howard Graphic Equipment and Howard Iron Works, is a printing historian, consultant, and certified appraiser of capital equipment. He can be reached at nick@howardgraphic.com.

By Nithya Caleb

The current trade war with the U.S. is causing havoc in Canada. The Trump administration’s tariff-on, tariff-off approach is creating uncertainty. At the time of writing this article, the U.S. had levied 25 per cent tariffs on steel and aluminum imports (perhaps they’re removed by the time you read this article), which are detrimental to Canada’s economy.

Businesses are looking for new opportunities to weather tensions with our largest trading partner. I spoke to a few print service providers to get a sense of the impact of trade tensions with the U.S. and how they’re managing it.

Just like other industries, many Canadian printing companies have U.S.-based clients and source U.S.made raw materials like inks, paper, printing plates. Additionally, companies such as Hemlock Printers, CJ Graphics, Simpson Print, etc. have operations in the U.S. Hemlock, for instance, uses U.S.-based binderies to finish some of their products. It pur-

chases significant volumes of U.S.-manufactured materials.

“We are another example of a business that has grown and evolved based on the decades long trading relationship between Canada and the US… I believe we are great example of a business that is bringing economic benefits to both sides of the border,” said Richard Kouwenhoven, president and CEO, Hemlock Printers.

Sweeping tariffs would have immediate, negative impacts on printers.

“Like so many businesses across Canada, the tariffs would have had an immediate impact on our business. We ship our printed products across the border on a daily basis, primarily to western U.S. states. We are exporting a wide range of digital, offset and wide format products, as well as processing a range of mail and fulfillment orders for our U.S. customers,” shared Kouwenhoven.

While Mitchell Press, also based in Burnaby, B.C., doesn’t have a ton of U.S.-based work, they’re being affected by Trump-induced trade tensions.

“We’re already seeing a bit of a

The Trump administration’s tariff-on, tariff-off approach is creating uncertainty, making it challenging for companies to plan.

slowdown simply because of the uncertainty around it. Our Canadian clients are looking for stability. They’re delaying jobs. They’re getting more urgent, last minute rather than planning months out, which is always what everybody would love to see, especially for supply chain management,” explained Scott Gray, executive vice-president, Mitchell Press.

Regarding the magazine printing side of the business, Gray has noticed that clients might be changing their quantity or distribution method.

“They still want to produce it, but a lot of publications are kind of on the edge right now,” he shared.

Mitchell has decided to not absorb the additional cost of tariffs as margins are tight.

“When it comes down to it, [we’ll] have a discussion with the client and sort of negotiate the best possible outcome,” he said.

Several of the manufacturers I spoke to declined to publicly comment on the trade dispute. However, Timothy Saur, PhD, CEO, North America Group, Durst, was willing to share Durst’s perspective.

“Fortunately, we do not see tariffs directly affecting our products at present. If tariffs start to impact our products or services, we

are dedicated to collaborating with our customers to mitigate any effects on the business. We oppose tariffs or any actions that hinder the competitive and free flow of capitalism. This is a moment for our industry to unite and remain together, not be divided by the political whims of government officials. We are one industry, all in this together, and we must support each other to minimize any impact,” he said.

Saur was candid about the impact of tariffs on his customers. “The unpredictability and constantly shifting policy positions are detrimental to businesses. This issue is not limited by region; all companies seek policy stability to make decisions with fewer significant variables. When there is considerable uncertainty, markets tend to become paralyzed or stagnant. Often, inaction is perceived as a better choice. Consequently, a slowdown appears likely until we see more consistent policies that instill confidence in business leaders about the future economic landscape,” he said.

As mentioned earlier, many Canadian companies source materials from the U.S. Toners, certain types of ink, printing plates,

Workflow bottlenecks limit your potential. We redefine what’s possible.

Our solution automatically checks, fixes, optimizes, and imposes files with:

• Industry-leading speed to meet tight SLAs

• Consistent quality across all jobs and locations

• Optimized resources from materials to labor

• On-the-fly processing for agile job planning

Built to scale effortlessly and compatible with any printing process—immediate benefits, future-proof investment.

Ready to streamline prepress at scale?

parts and equipment, can only be sourced from the U.S. Mitchell needs heatset web rolls, which are primarily bought from the U.S. They could source the paper from Europe or Korea, but options are limited.

“We’re doing some tests on [nonNorth American papers] and so far, [have had] positive results. But the challenge with that is if we say go, it’s three months until we see the first container,” explained Gray.

In terms of packaging paper, which comes from the U.S. and Europe, Jay Mandarino, president and CEO of CJ Graphics, found European suppliers have lowered their pricing, so “it’s less expensive to get paper from Europe.”

While inks for litho presses are made in Canada, the toners for inkjet presses are produced in the U.S., which would inevitably jack up prices.

The one silver lining in these trying times is the weak Canadian dollar. As Gray explained, many U.S.-based retail-related businesses with Canadian divisions who might have been managing it from the States are now finding it’s cheaper to source printed materials in Canada due to a discounted dollar.

“The weakening loonie does provide some degree of cushion to our business in reducing the overall impact of any tariffs, but we are also sourcing U.S. materials and U.S. services, which are now more expensive. The higher cost of U.S. suppliers will encourage us to seek out alternate Canadian-based suppliers both for materials and trade finishing wherever possible. Overall, the currency volatility is another changing variable for us to manage and creates additional uncertainty,” added Kouwenhoven.

Considering the motivation to nearshore printing, it’s possible for commercial printing companies to land new businesses.

Companies don’t want to take the risk of having things held up at the border, so CJ Graphics has “picked up a couple of really nice jobs.”

One of the sectors CJ Graphics specializes in is entertainment.

“Typically in the entertainment industry, some of the non-printed material like signage, displays and photo booths are done in the States and then shipped here. So we’re doing those now. They realize it’s just becoming more of a challenge to get things across the border as deadlines are getting tighter and things are becoming last minute. It’s not worth the risk. With the low Canadian dollar, it’s advantageous. Otherwise, they’re paying more for something to be shipped from the U.S.,” said Mandarino.

Nevertheless, companies are inevitably experiencing higher input costs due to tariffs. Mandarino advises strategic alliances, partnerships or mergers with large-sized companies to increase your financial security.

Mitchell is mulling several options including partial production in the U.S. that would substantially transform the products and mitigate the need for tariffs; binding, finishing, and/or packaging in the U.S.; or opening a U.S. entity and do finishing or distribution down there.

“It’ll avoid some hassles, but I don’t think it’s going to avoid any tariffs. There would be also extra cost for setting up and maintaining a legal entity. Now, can [the product] be classified under a different tariff code? [We don’t know] as the rule book hasn’t been written. Can we break it up into 80 orders of under US$800

Printing plates are going to be more expensive due to the tariffs.

[the de minimis provision, which allows packages worth less than US$800 to enter the country duty-free] per shipment? Then shipping would kill you,” explained Gray.

Hemlock has a small task force that’s focussing on making sure products can continue to flow across the border without interruption.

“We want to make sure all of our products are correctly classified and valued, which includes both finished and work-in-progress products. We are writing policies to ensure our team follows a rigorous and consistent approach to both classifying and valuing the product being shipped. We have been working with our customs broker to make sure our account and paperwork are set up in an optimal way to ensure we avoid any disruptions and avoid any impact these tariffs may have on our customers. We are also looking at a number of strategies, including revising our transfer pricing methodology and sourcing warehouse space in the U.S. to minimize the financial impact to help us get through it while maintaining our competitiveness within the U.S. market. The amount of tariff and how long they are imposed is out of our control, so our focus needs to be on how to keep the business running while they are in place, and work within our industry and the wider business community to get them removed,” shared Kouwenhoven, who strongly believes in the North-South trade corridor. He is optimistic about the future.

“Despite the current situation and the possibility of a protracted trade dispute, we are committed to navigating our way through this as we have built a strong reputation and customer base in the U.S. and we believe we continue to be uniquely positioned in the U.S. market to continue to grow,” he said.

This optimism is shared by Mandarino too.

Sonoco levies a $70 per ton price increase for all grades of uncoated recycled paperboard.

“This is all going to blow over. I personally believe Canada needs the United States as much as the United States needs Canada. It’s been a partnership for many, many, many years and will continue to be that way,” he said.

Let’s hope their optimism is infectious and helps us navigate the next few months that will no doubt be challenging.

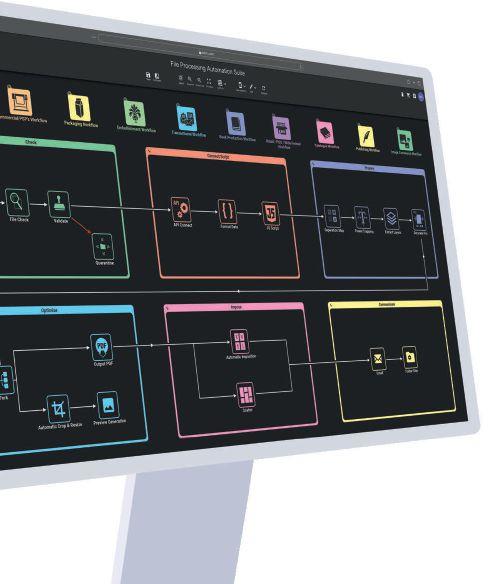

A new generation of automated workflow tools are offering friendly interfaces with drag and drop applications requiring zero coding experience.

A new generation of low- and no-code applications is here

By Abhay Sharma

When talking about workflow automation today, the focus has moved from traditional monolithic enterprise solutions to smaller apps that help us automate our personal and business lives and activities. In the past workflow automation referred to preflight, trapping, imposition and proofing. Today users seek to automate many aspects of our business and professional activities. We see growing interest in apps and utilities offering a friendly interface with drag and drop tools that

require zero coding experience (i.e. automation without the need to purchase a complex workflow solution and hire an IT support team). We are moving to a world of ‘automation for the masses’. A big player in this area is Microsoft with a user-friendly, powerful suite of Power automation tools that provide low- and no-code applications. New generation products are mostly cloud-based and fully AI-enabled. In this new scenario, enterprise solutions don’t apply.

The concepts and benefits of automation are well established. Automation refers to a series of workflow

steps in a particular order, where the output of one step is the input for the next step. The process is optimized, automated and performed within seconds by a computer. Tasks are not prone to human error or delayed due to sick days. The computer-based process produces data analytics and reporting. Automation of repetitive tasks allows employees to focus on higher-level cognitive tasks. In terms of recruiting and retention, the current TikTok generation will soon become bored with mundane, rote tasks, but will rise to the occasion if offered creative technical challenges. An umbrella term for modern automation is robotic process automation (RPA), which refers to (usually AI-enabled) automation widgets and apps and not a Dalek-style physical robot or a car assembly-line robotic arm.

Most readers are familiar with the established, brand name prepress workflow systems used in commercial print and packaging. These systems allow CSRs to work on content, for production to impose and gang jobs, and for key decision-makers to monitor progress and bill completed jobs. These systems have proven to be an uphill struggle. They have a large purchase price and ongoing, annual maintenance and update contracts, technology requirements, a steep learning curve, and a lack of open architecture and third-party connectors. These proprietary, monolithic prepress systems require long-term term investment. With the rate of M&As in our industry we should think carefully before committing.

An alternative to large prepress workflow solutions is a new generation of RPA products that have several advantageous features, including:

• low-code or no-code;

• visual, user-friendly, drag and

drop;

• AI-enabled, AI-assisted;

• true automation of processes (as opposed to automating the steps within a prepress software product);

• configured to work with cloudapps (Dropbox, Google Docs, Teams, etc.); and

• open, non-proprietary connectors to reach out to a post on X, etc.

Consider a powerful ecosystem from Microsoft that stretches from user level Power apps to Visual Studio and SQL Database. These automated processes can save email attachments from Outlook to Google Drive or can keep an eye on X and email you new tweets about a certain keyword. The Copilot AI function can assist by offering coding suggestions as users write scripts, actions and flows. We can automate in Teams and ask if there were any questions that you missed in a meeting, and the system will quickly scan across what was said, and what was typed in the chat to see

The new AI-enabled Microsoft Power platform adds automation via low- or no-code apps that integrate with familiar apps like Teams, OneDrive, Excel and Outlook.

if anything was left unanswered. Automation can help with advanced data analysis, and ‘give me another way to look at that data’ in Microsoft Excel. Power Pages is a web-page publishing portal with dynamic, intelligent, data-driven content. In my workflow class, students use Power Automate to create a flow for a professional photographer to automatically rename a wedding photoshoot from IMG_6601. JPG, IMG_6602.JPG to Andrea-Trung_6601.JPG, Andrea-Trung_6602.JPG. We all spend hours with email overload. Now, with flows such as ‘prioritize my inbox,’ you can quickly get to the messages that matter, analyzing your inbox based on the content of your email and the context of your role—like who you report to and the email threads where you’ve been directly addressed vs. copied with 10 others.

As everybody already has some level of Microsoft account, these apps are readily available. Plus, we are all familiar with Microsoft 365 apps, so very little training is required.

Microsoft’s Power platform reaches beyond Microsoft products to Google Drive and X. Everything is supported by an AI-assistant called Copilot.

What are the use cases for desktop automation and AI? Here is how I teach automation at the Toronto Metropolitan University. We use Photoshop actions to automatically add a frame to an image, make an image into greyscale and add the photographers’ copyright logo in the lower right-hand corner. We use macros in Google Sheets to automatically calculate the number of students that received good, average or fail grades. We use a script in Acrobat to add a header and footer, and a front cover to a PDF document. In MarketDirect StoreFront we design

and order a business card that is imposed and printed on our digital press with no user intervention. With IFTTT phone app we schedule the current weather report to be sent as an email or text message at 7 a.m. everyday. With Adobe Express we create a social media post to advertise an upcoming campus event and automatically format the same content for posts on Facebook and Instagram. With Power Automate we create a flow to automatically rename, reduce size, and zip files on our desktop.

Sticker Builder allows the user to take a selfie, removes the background, adds a cut line and sends a print-ready pdf to the print queue. With Enfocus Switch we filter and route Word and Photoshop native application files into print-ready pdfs.

There are many use cases for automation in coding, reporting, sales, CRM, customer service, human resources, etc. It is easier and faster than ever before to route files, inquiries and documents. Often, we see that automated processes can work internally

Photoshop supports automation of processing steps and IFTTT is a phone app for automation.

on the efficiency and productivity side and later be deployed to customer-facing applications. There are many low-hanging fruits that can be easily and quickly automated, and the software tools are often already being used, but without automation. Photoshop, Google Sheets, Adobe Express, IFTTT phone app, etc., can be automated and are right there with menus that we don’t use. Remember, whenever a task is done more than once, it should be automated.

Departments should start with pilot projects for things such as chatbots to help operators retrieve information faster or tools to summarize or route PDFs or process documents like receipts. A company-wide culture needs to tactfully and considerately promote and adopt automation to overcome the feeling that AI and automation are going to replace jobs, when really, automation simply removes the mundane aspects of work and makes us more productive.

ABHAY SHARMA is a professor at the Toronto Metropolitan University.

New technological solutions are making direct mail more efficient, targeted, and measurable.

By Jennifer Davey

In an era where digital ads are ubiquitous, direct mail remains one of the most effective ways to capture attention. Direct mail achieves response rates of up to 10 times higher than digital marketing, proving that a well-crafted piece of mail can leave a lasting impression. However, as consumer expectations evolve, direct mail must adapt. Technological advancements eliminate previous pain points, making direct mail more efficient, targeted, and measurable.

Direct mail service providers now possess potent tools to assist clients in executing smarter and more effective campaigns. Digital colour

printing streamlines production, reduces waste, and delivers consistent, high-quality results. With these enhancements, automation, and improved workflow solutions, direct mail is transforming into a seamless and cost-effective marketing tool.

Consumers are inundated with digital content as countless notifications and fleeting online impressions vie for their attention. In this saturated environment, print provides something distinct—a physical presence, credibility, and a respite from the digital clamour. Direct mail must now do more than arrive in a mail-

box; it must demonstrate its value within a marketing budget.

While digital marketing dominates in scale, direct mail presents a unique advantage: engagement. A printed catalogue or mail piece doesn’t disrupt a customer’s day like a digital ad. Instead, it offers a tangible, immersive experience recipients can explore at their own pace.

To remain effective, direct mail must go beyond design—it needs precision targeting and execution. Data analytics, automation, and personalization advances allow businesses to refine their messaging, improve response rates, and strengthen connections with their audience.

A powerful mail campaign goes beyond mere printed words—it encompasses the tactile experience, the thrill of delivery, and the lasting impression it leaves behind. From the excitement of opening a thoughtfully designed envelope to the effect of custom packaging and personalized content, every detail turns an ordinary piece of mail into a memorable moment that customers engage with instead of discarding.

Economic uncertainty often leads to reduced marketing budgets, particularly in Canada, where businesses typically respond swiftly to financial concerns. While exercising caution is understandable, tough times necessitate adaptation and investment. Management consultant Peter Drucker noted, “The best way to predict the future is to create it.” Similarly, Henry Ford cautioned, “Stopping advertising to save money is like stopping your watch to save time.” A long-term perspective enables businesses to navigate uncertainty and emerge stronger when

Direct mail achieves response rates of up to 10 times higher than digital marketing.

conditions improve. The industry must continue to evolve. To stay competitive:

• invest in people and equip them with the best tools;

• upgrade equipment to improve efficiency and quality;

• leverage AI and automation for more intelligent workflows;

• strengthen messaging, production, and targeting; and

• partner with organizations to maximize reach and improve direct mail effectiveness.

Hiring great people is as crucial as upgrading technology. Tools like Acrobat Pro enable hybrid work environments, remote collaboration and streamlined production.

Inkjet printing has evolved to rival the quality of offset printing, making short-run and personalized print jobs more cost-effective. For the direct mail industry, this streamlines workflows, enabling faster project management and reducing production times—allowing messages to reach homes more promptly.

Gone are the time-consuming days of shipping physical proofs. Online proofs provide speed and simplicity. Data cleansing technology has also become faster and simpler to use. Tools such as 2D barcodes allow for scanning during production, ensuring accuracy and integrity.

One must leverage technology, data, and automation to create smarter, more impactful campaigns.

API integrations enable businesses to connect CRM, e-commerce, and direct mail platforms, enhancing efficiency. Even if employing a full-time developer isn’t practical, consider hiring a contractor to implement a few workflow optimizations.

While concerns about AI and data security persist, businesses should adopt technology while remaining cautious. AI might seem like a wornout subject, but staying informed is crucial; those who ignore it risk being left behind.

If you haven’t explored AI yet, start small—register for a free ChatGPT account to help craft challenging emails or create formulas in spreadsheets. Once you feel comfort-

able, develop personas, identify pain points in your facility, and consider how AI could assist in addressing them. Potential AI-driven improvements in direct mail include:

• catching errors that human reviewers might miss;

• helping businesses make data-driven decisions;

• assisting staff in writing clear and more concise messaging; and

• objective insights free from bias. Remember that AI can be used in a closed system to conform to data security concerns.

Canada is lagging in the adoption of robotics and collaborative robots (cobots). I was excited to see a cobot arm recently removing material from a folder and depositing it into trays at a large trade printer in the Greater Toronto Area. Robotics can enhance efficiency, improve quality, and boost safety—not by replacing employees but by enabling them to concentrate on higher-value tasks.

As technology becomes more accessible, adoption rates will rise. Forward-thinking businesses should monitor advancements in automation and assess where robotics could improve operations.

Direct mail service providers don’t have to invest in proprietary technology to offer advanced targeting and analytics. Instead, partnering with experts provides access to powerful resources like data visualization, mobile geolocation tracking, and predictive analytics without the burden of in-house development.

For example, Canada Post provides tools that enable businesses to combine various data sets, including customer demographics, store locations, competitor insights, and mobile foot traffic. Service providers who utilize these external resources can enhance targeting, boost campaign effectiveness, and deliver more strategic value to their customers.

The tools have improved, and expectations have risen; direct mail must evolve to meet them. Businesses that embrace innovation today will set the standard for the future of direct mail. The choice is clear: adapt, lead, and thrive, or risk being left behind.

This year’s event demonstrated the power of seamless integration between print and finishing technologies

By Alec Couckuyt

The Hunkeler Innovationdays 2025, held from February 24 to 27 in Zurich, Switzerland, has once again cemented its status as a premier event for highlighting advancements in digital printing and post-press finishing. This biennial gathering, known for its focus on automation and efficiency, brought together major press and finishing original equipment manufacturers (OEMs), demonstrating the power of seamless integration between print and finishing. The strong presence of exhibitors this year underscores the industry’s increasing focus on fully integrated solutions.

A key theme emerging from this year’s event was the increasing role of AI and

Muller Martini showcased three smart factory solutions at Hunkeler Innovationdays 2025.

machine learning in both print and finishing processes. More OEMs are adopting defect recognition software that detects and corrects errors in real time, ensuring uninterrupted production. This capability extends beyond printing, as finishing equipment is also leveraging AI-driven automation to optimize cutting, binding, and trimming accuracy.

Additionally, continuous self-diagnostics in both press and postpress systems are streamlining preventive maintenance scheduling, reducing unexpected downtime, and ensuring

Events like Hunkeler Innovationdays provide a glimpse into the future where seamless integration is the industry standard, redefining how print service providers maximize productivity and quality.

maximum uptime and productivity. These intelligent systems mark a significant step toward fully automated print production lines that enhance efficiency and output quality.

One of the most remarkable aspects of this year’s event was the level of collaboration between press and postpress manufacturers. As the industry shifts toward streamlined workflows, OEMs have partnered more closely than ever to highlight end-to-end solutions. The result? On display were fully automated production lines where printed materials move seamlessly from press to finishing with minimal manual intervention.

Most of the presses on display this year were inkjet-based, with a strong presence of both sheet-fed and rollfed solutions. The industry-wide push for high-speed, high-quality digital printing was evident, and finishing technology had to keep pace. By integrating intelligent cutting, binding, and embellishment solutions, these

partnerships aimed to deliver greater efficiency and higher-value print products.

Fujifilm showcased its latest high-speed, continuous-feed inkjet press, the Jet Press 1160 CFG, which is designed for high-volume commercial print applications, emphasizing precision, colour accuracy, and reliability. Fujifilm also partnered with finishing specialists like Hunkeler, Meccanotecnica, and Horizon to demonstrate how its presses integrate seamlessly with postpress solutions.

Canon presented its ProStream 2000 Series, a high-performance continuous-feed inkjet press known for delivering offset-quality prints at digital speeds. Alongside this, Canon’s VarioPrint iX3200, celebrating its 10th anniversary, showcased its versatility in sheet-fed inkjet production. With advanced postpress integration, Canon’s focus was on delivering complete production workflows that enhance efficiency and reduce turnaround times.

HP continued to push the boundaries of inkjet technology with its latest high-speed inkjet presses. Their modular approach allows businesses to scale production capabilities, with finishing solutions tailored for both commercial print and packaging applications. HP’s presence emphasized automation, sustainability, and cost-effectiveness in digital printing.

Kodak highlighted its latest high-speed Prosper 7000 Turbo inkjet press, highlighting the company’s commitment to high-quality digital production with a focus on sustainability. Kodak’s presses integrate with inline and nearline finishing solutions, enabling print providers to produce high-value applications with minimal waste.

Muller Martini displayed innovative solutions for a smart factory, combining Heidelberg’s Jetfire 50 inkjet press with the Hunkeler Starbook Sheetfolder, perfect binder, and InfiniTrim trimming robot. This integration demonstrated a fully automated book production workflow, emphasizing efficiency and precision. Additionally, Muller Martini highlighted the HP Advantage 2200 digital web press paired with the Hunkeler Starbook Plowfolder, further reinfor-

cing the event’s theme of seamless print-tofinish automation.

Hunkeler introduced its Gen8 Evo roll-tostack solution, designed with a focus on simple, ergonomic, and intuitive operation. This next-generation system improves job changeover and setup efficiency, making it easier for operators to transition between different production runs while maintaining high levels of productivity and precision.

Hunkeler Innovationdays 2025 demonstrated that the future of post-press finishing is all about integration and automation. The event underscored the industry’s drive toward intelligent finishing solutions that reduce manual handling, cut production costs, and improve quality.

With continued advancements in inkjet

Fujifilm’s Jet Press 1160 CFG is designed for high-volume commercial print applications.

printing and digital finishing, print service providers now have access to end-to-end solutions that deliver precision and speed. The partnerships forged at Hunkeler Innovationdays highlight a new era in the industry—one where print and finishing are no longer separate processes but part of a fully optimized production ecosystem.

As digital print and finishing technologies continue to evolve, the emphasis on automation and efficiency will only grow. Events like Hunkeler Innovationdays provide a glimpse into a future where seamless integration is the industry standard, redefining how print service providers maximize productivity and quality.

ALEC COUCKUYT is a business strategist, economist, published author, and speaker with extensive international management experience. He can be reached at alec@agcconsulting.ca.

ROLLEM INSIGNIA DIE-CUTTER

Sheet-fed production-built rotary die-cutter ideal for folding cartons, packaging, ID cards and shaped cards.

JETSTREAM XY FINISHING SYSTEM

High volume slit, score, perf, fold & glue. One-step system for direct mail, postcards and business cards.

ROLLEM 990 SLIT-SCORE-PERF

Economical and heavy-duty for shorter runs. All-in-one system packed with Rollem’s specialty functions.

paper packaging solutions are transforming the CPG industry

By Elena Knight

The packaging industry is poised for a transformative shift in the coming decade, particularly in paper-based packaging. This shift is driven by a growing movement against plastic packaging and the recognition of its environmental impact. Governments and brands are actively pushing for change through legislation and innovative packaging solutions.

Major brands are proactively seeking sustainable alternatives and spearheading the shift towards paper-based packaging. Absolut Vodka, for example, is testing a paperbased bottle for its flagship vodka product. Elin Furelid, global director of future packaging at Absolut, cited high recycling rates and the appealing tactile nature of paper as key factors behind their decision.

Another example is Diageo. It has partnered with Pilot Lite to establish Pulpex, a U.K.-based paper bottle company that creates customized paper bottles for liquid products. Diageo plans to package Johnnie Walker whisky in Pulpex bottles. According to Diageo, these containers actively contrib-

Major brands are proactively seeking sustainable alternatives and spearheading the shift towards paper-based packaging.

ute to Goal 12 of the United Nations Sustainable Development Goals by fostering ‘responsible consumption and production’. PepsiCo, Unilever, and Castrol have also joined forces with Pulpex to develop paper bottle solutions for their products.

Mars is experimenting with paper wraps for Mars bars. Nestle has developed a highspeed flow wrap line to package Kit-Kats in paper. Brands are driving innovation in the development of paper packaging solutions. They are investing in research and development to create packaging materials that are sustainable and functional. Through collaboration with packaging manufacturers, they are pushing the boundaries of what is possible with paper packaging, exploring advanced technologies and techniques to enhance its durability, resistance to moisture, and other desirable characteristics.

ment to environmental responsibility, further strengthening their brand image and market positioning.

Within the supply chain, the adoption of paper packaging creates opportunities for innovation and growth. Packaging manufacturers, paper suppliers, and other stakeholders can collaborate to develop new technologies and solutions that cater to the demand for sustainable packaging. This shift stimulates the development of a circular economy, where materials are recycled, reducing waste and minimizing environmental impact.

2023

In 2023, Absolut Vodka tested single-mould paper bottles for its flagship product.

Archipelago Technology, a packaging coating manufacturer, has responded to the demand for sustainable packaging solutions by introducing the Powerdrop technology, a large-scale inkjet printing system that jets viscous liquids as droplets with precision and consistency. Powerdrop enables packaging manufacturers to coat rigid paper containers, making them waterproof while keeping the inner paper core clean, so it can be recycled. Since Powerdrop uses highly concentrated coating fluids and has virtually no overspray there are major savings in energy use and overspray disposal, which gives it low running costs and low greenhouse gas emissions. With immense potential in this market, we can expect an influx of further innovations aimed at meeting the demand for sustainable paper packaging alternatives.

The shift from plastic and glass to paper packaging holds numerous advantages for various stakeholders. Consumers stand to benefit from the shift to paper packaging in several ways. Firstly, paper packaging aligns with their increasing demand for eco-friendly products and packaging. Additionally, paper packaging often has a tactile and aesthetic appeal that enhances the overall product experience. It can provide a premium, natural, and rustic feel that resonates with consumers seeking a more authentic and organic image. Further, paper packaging is lightweight and easy to handle, making it convenient for consumers to carry and dispose of responsibly.

Retailers can leverage the popularity of paper packaging to enhance their eco-friendly image and appeal to environmentally conscious shoppers. Additionally, retailers can collaborate with brands that prioritize sustainability and reinforce their commit-

Brands that embrace paper packaging can enhance their image and reputation by positioning themselves as environmentally responsible and forward-thinking. Sustainability is a growing concern for consumers, and brands prioritizing sustainable practices often enjoy increased customer loyalty and positive brand perception. By adopting paper packaging, brands demonstrate their commitment to reducing plastic waste and their efforts to contribute to a greener future. This can result in improved brand equity, customer trust, and a competitive advantage in the market.

Governments worldwide are implementing stricter regulations on plastic packaging, creating a regulatory landscape that incentivizes the adoption of sustainable alternatives. By proactively embracing paperbased packaging, brands can ensure compliance with evolving legislation and reduce the risk of fines or penalties. This proactive approach can enhance brand reputation and demonstrate a commitment to social and environmental responsibility.

The packaging industry stands on the brink of a major transformation, with paper packaging emerging as a leading alternative to plastic and glass. Notable brands across the food and drinks sectors are at the forefront of this shift, recognizing the importance of sustainability and seizing the opportunity to meet consumer demands. By embracing paper packaging, these companies not only contribute to a cleaner environment, but also benefit from increased consumer loyalty, improved brand image, and compliance with evolving regulations.

As the next 10 years unfold, the paper packaging revolution promises significant growth, innovation, and a more sustainable future for the industry. The collaborative efforts of brands, retailers, and policy-makers are key to driving this revolution forward, ultimately paving the way for a greener and more sustainable world.

ELENA KNIGHT is an editor at FuturePrint. This article is part of the Drupa Essential Series of Print.

Modern technology makes it possible to create stunning point-of-sale signages.

ByAndrew Hind

Aseamless and effective marketing journey is essential for retail businesses. A key element in the process of brand development is high-quality point-ofsale (POS) signage that engages customers and enhances the shopping experience. Effective and visually appealing POS signs can significantly attract more shoppers and boost sales. Technology has made it possible to create stunning POS signages. While POS is a huge revenue generator for large format printers, the technology is also used to create other types of promotional materials like trade show

signage and vehicle wraps. This wide range of application suggests printers making successful in-roads in this sector can potentially find no shortage of willing business partners.

“The selection of a partner should be driven by a combination of factors,” says Norman, “such as capabilities, relationship, reliability, and workflow to meet the business requirements.”

Wide ranging applications, flexibility and efficiency, and high quality makes large format printing particularly appealing.

North America is seeing sustained growth in large-format products, with volumes up 10 per cent in most markets. This segment, which includes

products such as banners, posters and signs, is particularly popular with small businesses looking to improve their brand awareness.

As president of SwissQprint America, Erik Norman has watched—and indeed participated—in the growth of this segment of the printing market over the last few years.

“We see growth in the large format print market being influenced by factors such as a full return to live events and shows [in the wake of the pandemic] and growth in retail signage and retail pop-up events,” he explains. “Other important factors include increased demand for higher value prints in various sectors such as home or commercial decor, and the shift from screen print to digital UV LED print methods for various industrial applications.”

Digital printing gives printers the flexibility to customize (and personalize) each printed piece to better connect with the targeted audience. Efficiency and quickness don’t come at a cost to print quality, either. Six-colour digital press technology can help produce stunning, detailed images that are nearly indistinguishable from offset prints.

New technology is the foundation of large format printing. SwissQprint, Agfa, and Durst are some of the world’s leading providers of large format printing solutions.

“Advancements in print equipment and the supporting workflow software are aiding growth,” explains Norman. “Examples include the ability to print direct to glass, or to offer highly scratch- or chemical-resistant inks for harsh surface environments.”

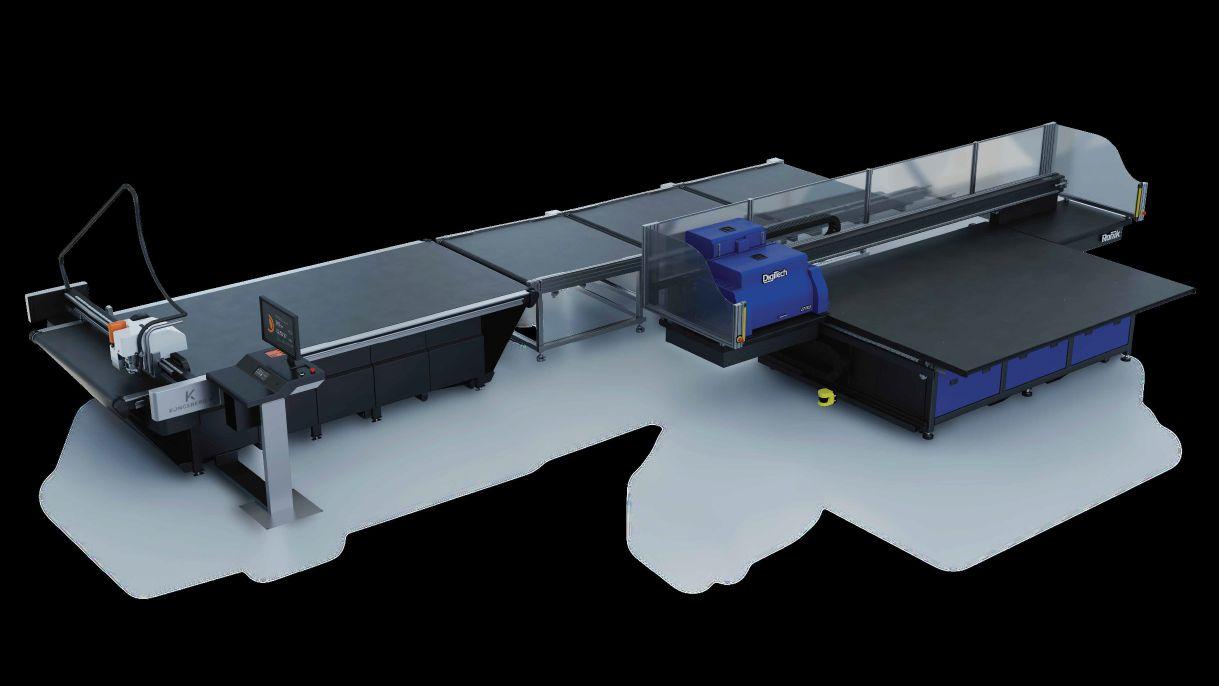

Other new or emerging technologies that are leveraged by successful large format printers include docket systems and online portals (with artificial intelligence in development), automated workflows (Esko, EPS), automated finishing (Kongsberg Precision Cutting Systems and Zund), automated material handling—all large format equipment suppliers offer automated feeding and stacking— and ink technology in the form of special colours and specific performance requirements.

There is significant potential in large format printing, which more and more printers are exploring.

Filigree patterns set the tone for this luxury display of gin. Selectively applied gloss varnish imparts a special radiance to the product.

Peter Spring is president of Burlington’s Category 5 Imaging, which produces printed materials for some of Canada’s largest brands. He’s naturally a fan of large format printing.

“Entering the market years ago was relatively easy as equipment could be used to produce a variety of products in low quantities. Today it is more challenging as equipment options have become market-specific to address shorter turnaround and longer run customer requirements,” he says.

“Margins have declined in recent years as the large format market emerges,” explains Spring, “but [they] remain higher than commercial printing in general.”

Further, while margins may be marginally lower than in the past, Spring points out there is no doubt that increased operator efficiency and being able to move from job to job faster—hallmarks of large format printing—represent enticing benefits to this segment of the printing trade.

Norman agrees, adding that the magic happens when a printer provides their business partners with unique options.

“We do see high margins when [companies] differentiate by offering higher quality and high value products,” he says. “Introducing embellishments, unique substrates drive an increase in margins.”

There is significant potential here, but like any business one must differentiate and offer something unique to make a real splash.

01/25

In January 2025, SwissQprint released a new generation of flatbed printers. Agfa also added a 2.5-m Anapurna Ciervo H2500 inkjet printer to its hybrid printer lineup.

Spring adds a note of caution. Systems and equipment for packaging, for example, are not suitable for other applications, such as retail signage. If one wants to compete in packaging, they need specific systems and equipment to ensure the business model is efficient and cost competitive. The same applies if one wishes to focus on retail signage.

For those considering entering this market, Norman has some advice.

“Consider the clients you serve and how you might expand your share of their business by adding large format capabilities,” he says. “Also look at new revenue opportunities in new markets. Additionally, evaluate your business model and determine what type of print system will best fit—true flatbed, hybrid system, roll to roll, etc. Then look at total operating requirements and how long you can operate the equipment.”

What about the potential return-on-investment for entering the POS printing market?

This is especially true for large format POS printing, however, because the pandemic ushered in a new, more austere era when it comes to marketing. Chief marketing officers (CMOs) have been under pressure to reduce costs, do less with more even as they balance budgets between digital marketing and traditional marketing. This may well impact the growth of this segment of the printing industry.

“The largest factor hampering growth is the rise in e-commerce,” explains Spring. “Retailers are allocating their marketing budgets based on the growing percentage of online sales. In-store (or brick-and-mortar) marketing budgets have changed dramatically over the past five years, a trend that is likely to continue.”

In the minds of many CMOs, anything offline seems old-fashioned and analogue. Printing companies must fight against this headwind and find a way to lure some marketing budgets back to traditional, in-store signage and away from the digital sphere. Problematically, across all markets and industries, marketing budgets still lag below pre-pandemic levels.

Predicting the future is always a fool’s errand. It’s hard to accurately foretell the growth of large format digital POS printing. As of today, it is a potential revenue stream that any printer would do well to explore.

The biennial Graphics Canada Expo returns to the Toronto International Centre, Mississauga, Ont., April 9-11, 2025. Here’s an overview of some of the solutions and equipment that’ll be showcased at the expo.

At Graphics Canada 2025, Landa Digital Printing will be showcasing the S11P and S11 Nanographic Printing presses at booth 5040. The presses have seven-colour configurations to match up to 97 per cent of Pantone colours and can print at 11,200 B1 sheets per hour on a range of off-the-shelf coated and uncoated substrates.

Konica Minolta will showcase its latest advancements in print technology at Graphics Canada Expo 2025, featuring solutions for production printing, label manufacturing, finishing, and workflow automation. The AccurioPress C14010S will make its Canadian debut at the show, featuring a fifth station for white toner and advanced colour management. The AccurioLabel 400 streamlines label production with precision and flexibility, while the AccurioShine 3600 with iFoil One delivers spot UV and foil embellishments in a single pass. Canon Experience

advancements in print technology at Graphics Canada. Learn how advanced workflow automation and colour management solutions can streamline production, reduce costs, and unlock new creative opportunities at the Canon booth, 5312.

Canon will highlight its workflow automation and colour management solutions at the expo.

Visitors to booth 5340 will experience the new SwissQprint flatbed range, represented by the Nyala model, which is 23 per cent faster than its predecessor with top speed of 2723 sf/h. The Nyala also features 10 freely configurable colour channels as well as a 126-in. roll to roll option. The flatbed Generation 5 prints at a maximum of 1350 dpi.

“Visitors will be able to witness efficient high-precision printing,” said Kevin Graham, sales territory manager, Canada, SwissQprint.

In booth 5412, Kongsberg Precision Cutting Systems, Ronik and Engview will showcase a complete production workflow—from design to finish— with the Canon Texas LTX2 by Ronik UV flatbed printer and Kongsberg C24 digital cutter.

Ricoh will feature the Ricoh Pro C9500 colour sheetfed digital press with fifth-colour capabilities. Also on display will be the EFI Pro 16h+ wide format hybrid UV LED flatbed printer that can create near-photographic images with up to 1200 x 1200 dpi resolution; the Ricoh Auto Colour Adjuster; and Scodix embellished print samples.

Additionally, OnPrintShop will be exhibiting its AI-driven print automation capabilities at booth 5300

Experience the Best-in-Class Automated Digital Solutions— Seamless Design, Print, and Cut with One-Operator Efficiency.

See It Live at Graphics Canada Booth #5412

Heading to International Sign Expo in Las Vegas on April 23-25, 2025? Scan here for free show pass & specials

Kongsberg PCS, Ronik and Engview will showcase a complete production workflow with the Canon Texas LTX2 by Ronik press and Kongsberg C24 digital cutter.

along with its reselling partner of 14 years, Ricoh. OnPrintShop’s web-toprint software includes an AI-powered ‘designer studio’ with image generator and content translator in 19+ languages and description creator. The OnPrintShop team will also share ready-to-use design templates, print estimators, and 3D visualizing and proofing tools.

The Vanguard VR6D-HS flatbed printer will be on display in booth 5528. The press features Ricoh Gen 6 printheads and an electromagnetic carriage drive. The 50 x 100 in. table surface is divided into four vacuum zones, and the fully adjustable UVLED curing lamps maximize the substrate and application possibility to better serve clients and brands.

In booth 5012, Infigo, Enfocus, Significans Automation and HP PrintOS will bring Canada’s national sport to life with a hockey theme, AI face swap technology and an automated workflow. Attendees can begin their

Check out

Ricoh’s Pro C9500 colour sheetfed digital press at booth 5300.

The Infigo, Enfocus, Significans Automation and HP Print OS booth at Graphics Canada will pay homage to hockey, Canada’s national winter sport.

booth tour with a headshot at a photo kiosk, then personalize their design using Infigo’s online editing tools. They’ll get a sense of how Infigo and HP’s PrintOS site flow integrate with third-party providers. In the end, they’ll receive a personalized souvenir postcard.

In booth 5400, Sydney R. Stone will showcase finishing and printing equipment from Morgana, Xante, Duplo, MOHR, and EBA. See the New FB 9500 Pro-T digital die cutter/creaser, the Morgana SC 7000 Pro T and B2-capable 7000 XL combine cutting-edge technologies for precise point-of-sale displays, packaging, and labels. Also check out the Xante X-36 UV inkjet flatbed

printer, offering full-bleed of 24 x 36 in. printing for indoor and outdoor signage as well as the Xante X-98 featuring an expanded 55 x 98 in. image area.

Delphax Solutions will showcase the ChromaPrime pre-coating unit running inline with the Elan 170 inkjet envelope printer in booth 5522.

The Vanguard VR6D-HS flatbed printer has 50 x 100 in. table surface and Ricoh Gen 6 printheads.

Over the past 12 months, Resource Integrated has made significant changes to its operations. It doubled its footprint by moving to a bigger facility in Aurora, Ont. The company also invested heavily in equipment, such as the Agfa Anapurna Ciervo H3200 hybrid wide-format press. When it was founded in 2004, Resource Integrated was largely into commercial printing. Over the years, it has diversified its offerings to include soft signage, vehicle and window graphics, retail fixtures, installations and various visual merchandising requirements. The company’s evolution offers a playbook for other commercial printers who are looking to diversify. Here’s an excerpt from an interview with company’s MD Antony Rubino.

What is the state of the print industry today, in your opinion?

AR: The print industry is undergoing significant changes due to technological advancements, shifts in consumer behaviour, and the global push toward sustainability. While some areas are growing, others appear to be falling behind. Digital printing technologies have become dominant while traditional print media is declining. An increase in distribution costs have also affected print volumes as clients scrutinize their print spend. Having said that, I know the industry can re-shape and evolve itself to address any type of challenge.

What attracted you to the industry?

AR: I was very fortunate to be introduced to the industry at an early age. I crossed paths, worked and learned the craft from several mentors/associates over the past 30 years. The combination of creativity and technology fulfils my entrepreneurial spirit. The impact we have each day with our diverse products and services keeps me motivated. I’m also mindful of the fact that my company’s success is due to a diversified team of employees and suppliers who are united by a common passion to continuously push the limits of what’s possible and produce outstanding results for our clients.

How can the industry attract more young people?

AR: It is important for industry members