Label

Label

heidelberg.com/ca/events

ISSN 1481 9287. PrintAction is published 6 times per year by Annex Business Media. Canada Post Publications Mail Agreement No. 40065710. Return undeliverable Canadian addresses to: Circulation Department, 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1. No part of the editorial content in this publication may be reprinted without the publisher’s written permission. © 2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of this publication. Printed in Canada.

FEATURES

10 Hot and

Why the decal and sticker market continues to boom 13 Tips

Stay ahead of threats with these strategies to combat cybercrimes

Label printing: The silent powerhouse 10 13 22 16

The Italian printing industry showcased excellence at Print4All 2025

DEPARTMENTS

GAMUT

5 News, People, Installs

8 CALENDAR

SPOTLIGHT

22 Irfan Rajabali, president, E.B. Box

COLUMNS FROM THE EDITOR 4 Nithya Caleb What happened at Landa INSIDER

8 Bob Dale Building a sustainable workforce

CHRONICLE

9 Nick Howard Heidelberg geist

TECH REPORT

21 Alec Couckuyt

ILanda Digital Printing has sold more than 50 presses worldwide.

hope your summer is going well. As you may know, it’s been an interesting year for our industry. First, it was tariffs and then another strike by Canadian postal workers. While all CUSMA-compliant products are free from tariffs, business confidence is low due to market uncertainty. And companies are being impacted. In April, digital postpress equipment manufacturer Highcon Systems filed for bankruptcy and is looking for a buyer. The same story, but in a larger scale, is currently playing out at Landa Digital Printing. Founded by Benny Landa, the poster boy of innovation in print technology, the company and its patented nanography technology has received rave reviews. It sold more than 50 presses worldwide including one to Mitchell in Burnaby, B.C. However, the company, has a debt of approx. NIS1.75 billion ($710 million).

A ‘cash flow crisis’ forced Landa Digital Printing to file for creditor protection, which has been granted. Until the end of August, Landa’s creditors cannot sue the debt-ridden company while it tries to find a buyer. So what happened to this once promising company with a critically acclaimed technology founded by a wellrespected inventor?

Loss from the start

In a nutshell, Landa spends more than it earns. Its presses cost more to build than the actual selling price. The company has never broken even despite the US$1.3+ billion invested into it since its inception in 2011.

According to David Zwang (WhatTheyThink), the unit price of Landa’s presses is US$3.5-US$4 million, which is a heavy investment for PSPs. Globally, PSPs have paused major capital investments due to economic uncertainties and tariffs. So, even though many companies including Cimpress professed interest in buying a Landa equipment at Drupa 2024, they only received 11 orders despite spending US$10-15 million in marketing at the event.

Further, the war in Israel has been very challenging for companies. More than 25 per cent of Israel’s workforce has been drafted, so Landa’s operating costs have been nearly four times higher than its

average monthly revenue in the first five months of 2025.

Additionally, one of Landa’s main investors, Susanne Klatten, retired and handed over her business operations to her children, who decided to no longer fund Landa, which is understandable. Investors want returns and Landa has only accumulated losses.

Call it unfortunate coincidence or a strategic mishap, but two of the companies Landa invested in are now up for sale— Landa, as mentioned, and Highcon. The latter’s cutting machines cost around US$1.5-2.5 million!

The Israeli business news site Globes explained that while Landa is not to be blamed for Highcon’s misfortunes, “both companies suffered from the same problem: a slow process of development, sales and production. Customers generally have to come to Israel to gain an impression of the product and to buy it, something that has become almost impossible since October 7, 2023. Continuous maintenance is also required for seven to nine years, and many customers were concerned that the war would prevent Israeli companies from providing reliable service. Recognition of revenue is not immediate: it stretches over years, like a leasing plan, which in the end undid the balance sheets of the two companies.”

While it’s easy to blame Landa for the company’s troubles, the reality is much more complex. Deep-tech invention requires years of investment and a huge change in consumer mindset. As Sophie Shulman explains in CTech by Calcalist, Landa machines require “special infrastructure, ventilation, electricity, and air pressure.” There are not too many PSPs with the capacity to significantly modify their plants. However, it’s too soon to write off a visionary like Landa or his machines. Just like printing houses eventually embraced the Indigo presses, long after it was sold to HP in 2002, Landa may find wider acceptance in time.

NITHYA CALEB Editor ncaleb@annexbusinessmedia.com

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal 416-510-5113 apotal@annexbusinessmedia.com Fax: 416-510-6875

Mail: 111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1

Editor Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

Contributing writers

Bob Dale, Nick Howard, Olivia Parker, Treena Hein, and Alec Couckuyt

Associate Publisher

Kim Barton kbarton@annexbusinessmedia.com 416-435-9229

Media Designer Lisa Zambri lzambri@annexbusinessmedia.com

Account Coordinator

Melissa Gates mgates@annexbusinessmedia.com 416-510-5217

Audience Development Manager Urszula Grzyb ugrzyb@annexbusinessmedia.com 416-510-5180

Group Publisher/Director of Production Paul Grossinger pgrossinger@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

Subscription rates

For a 1 year subscription (6 issues): Canada — $43.86 +Tax Canada 2 year — $71.91 +Tax United States — $99.96

Other foreign — $194.82 Single Issue — $8.00 + Tax All prices in CAD funds

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

Occasionally, PrintAction will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above. Annex Business Media Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

ISSN 1481 9287 Mail Agreement No. 40065710 printaction.com

The Canadian International Trade Tribunal is conducting a preliminary inquiry into alleged injurious dumping and subsidizing of thermal paper rolls by China.

TC Transcontinental acquires Middleton Group, a provider of retail services and point-ofpurchase display solutions. Founded in 1952 and based in Markham, Ont., Middleton Group employs 65 people and provides creative, end-to-end retail marketing solutions such as large-format printing, custom retail fixtures, and display systems. This acquisition supports TC Transcontinental’s plan to grow its in-store marketing activities.

Print eProductivity Software (ePS) acquires Avanti Systems, a Toronto-based provider of print management information system software to customers in the United Kingdom, the United States, and Canada, from Ricoh. The acquisition strengthens Print ePS’ position in the mid-market print segment and expands its global technology portfolio. Ricoh decided to move forward with the sale to focus its resources on the company’s print workflow solutions that are compatible with digital print systems, a key business growth pillar for the company.

Trico Packaging & Print Solutions, Ottawa, files for bankruptcy. The company has a liability of $5,652,832. The largest creditor is Scotia Bank (Roynat) at over $2.5 million. Trico’s owner Michael Hothi as well as his other companies like Canadian Printing

Resources and Maracle Press are also owed money. Both companies have shut down due to Trico’s bankruptcy.

The Digital Imaging Association joins (DIA) PAC Global. Established in 1987, DIA offers expert-led learning and peer networking opportunities for printing and imaging professionals. Joining PAC Global’s portfolio of programs including PAC Awards, PAC IOU, PAC

ED, and PAC NEXT, the new initiative will be branded PAC Digital Imaging.

Markem-Imaje makes a major investment in its Keene, N.H., facility to expand production capacity for its wax-based Touch Dry inks. The expansion adds a new ink production line at the company’s EcoVadis Platinum Sustainability-rated site in Keene.

Keypoint Intelligence releases new forecasts analyzing digital printing trends in four key packaging markets: corrugated, flexible, folding cartons, and narrow web labels. The findings show that while digital printing still accounts for a small portion of total production, adoption is expanding as packaging needs evolve.

After five years of leading recruitment at Connecting for Results, Heather Black launches her own firm. With more than 30 years of experience across print, marketing, and communications, Black brings a deep understanding of how the industry works and what it takes to build strong, lasting teams across leadership, operations, and production. Freely Connect Recruitment supports employers with full-cycle recruitment, job description development, hiring strategy, and employer brand consulting.

Canflexographics adds Canadian-manufactured Rotoflex finishing equipment to its portfolio of brands. Owned by U.S.-based Mark Andy, Rotoflex offers high-performance inspection, slitting, die-cutting, and rewinding systems that are built in Canada. Canflexographics is Mark Andy’s exclusive Canadian partner. It provides support, training, and sales expertise for Mark Andy’s full portfolio of flexographic and digital printing equipment.

Printing United Alliance launches the Unified Printing Taxonomy, a classification system for products and services across the printing and graphic arts industry. The taxonomy was developed in partnership with I.T. Strategies and Zwang. An advisory board comprising industry leaders helped the Alliance refine the framework that was initially launched in 2021. Members of the original taxonomy advisory board—including representatives from Printing United Alliance, Epson America, FESPA, Fortis Solutions Group, Fujifilm Dimatix, HP, Hunkeler, Intergraf, Koenig & Bauer, M&R, and Ricoh Americas—have contributed to and endorsed this release.

Konica Minolta Business Solutions (Canada) launches BlueIrisIQ, a new division focusing on intelligent information management services. BlueIrisIQ will offer AI-powered solutions to streamline data complexity and provide an automated approach to business operations.

Koenig & Bauer promotes Aleks Lajtman, a member of the Canadian Printing Awards jury, to director of sales, Canada. Lajtman joined Koenig & Bauer as its sales manager-Canada in 2017. He has 26 years of experience in the Canadian market. He has developed strong partnerships with leading printers who rely on his expertise. His experience in working in printing companies as well as product management and business development have enabled him to be a trusted advisor for printing companies of all sizes and all segments.

Tecnau appoints Francis McMahon as the new president of Tecnau Americas and the company’s CMO. He takes over from Jeff Kewin who retired as president of Tecnau Americas and Asia Pacific and joined the company’s board. McMahon brings extensive experience in the printing and digital imaging industry, having held senior leadership positions at Kodak and HP, and most recently serving over a decade as executive vice president of production printing at Canon Solutions America.

Huge Paper creates a dedicated Sign and Display Division which will be led by printing industry veteran John White. With over 30 years of experience in the field, White, a print engineer, knows how to solve problems before they happen. His in-depth knowledge of vinyls, synthetics, and pressure-sensitive materials allows him to match the right substrate to the right application and quickly resolve technical challenges.

Durst promotes Steve Lynn to the newly created role of executive director, North America. With 30 years of experience in the industry, Lynn specializes in large, complex technical solution sales. Tim Saur, president and managing director of the Durst North America group, said, “Steve’s proven expertise, incredible work ethic, and deep understanding of the industry make him the ideal choice to guide our next growth phase.”

Christopher M. Petro has been appointed to the newly created position of vice president of strategic alliances at Muller Martini. Previously, Petro served as VP of sales, strategic accounts, at Canon USA where he led the strategy, execution and growth of the company’s top-tier accounts. Before joining Canon, Petro was the CEO at GlobalSoft Digital Solutions, an international print/digital service provider that he co-founded. He has more than 35 years of digital printing experience.

E.B. Box, a custom folding carton manufacturer in Richmond Hill, Ont., adds a second facility, which doubles its square footage, and installs a second Speedmaster XL 106 from Heidelberg.

KG Graphics Finishers, Oakville, Ont., purchases a new Komori GL640C advance EX with UV curing on a 12-in. raise with PQA-S camera system from Komcan.

Best Deal Print & Packaging, Toronto, installs a new MBO T800 automated folder paired with A80 stacker and COBO robotic arms.

Raised Spot UV

• Raised Metallic Foil

Gloss, Matte or Suede Lamination

Sept. 11, 2025

OPIA Golf Classic

Milton, Ont.

Sept. 21-23, 2025

FTA 2025 Fall Technical Conference

Orlando, Fla.

Sept. 29-Oct. 1, 2025

Pack Expo

Las Vegas, Nev.

October 2-3, 2025

Sign Experience Canada Niagara Falls, Ont.

Oct. 22-24, 2025

Printing United Expo Orlando, Fla.

November 1-3, 2025

Book Manufacturers

Institute Fall Annual Conference

St. Augustine, Fla.

November 5-7, 2025

Paperboard Packaging Council 2025 Fall Meeting & Leadership Conference Vancouver

November 6, 2025

Canadian Printing Awards

Toronto

By Bob Dale

he printing industry—along with many others—is facing an unprecedented challenge driven by demographic shifts, economic uncertainty, and geopolitical events. While companies may not be actively hiring because of growth, the need to replace experienced staff who are retiring or leaving the industry remains critical and will persist for years to come.

Tthemselves. Funding programs also exist to support some of these activities.

to reach the right audiences—especially youth, newcomers, and underemployed workers.

Fifty-six per cent of the respondents to the 2024 Connecting for Results/Canadian Printing Industries Association Industry Survey reported significant difficulty in attracting skilled tradespeople.

According to the 2024 Connecting for Results/Canadian Printing Industries Association Industry Survey, approximately half of the responding Canadian printers reported significant difficulty in attracting skilled tradespeople (56 per cent of respondents) and sales professionals (47 per cent). This issue is not isolated; it reflects a systemic labour challenge that demands a co-ordinated, long-term solution.

Numerous initiatives are underway to address different parts of the labour challenge. These include efforts to raise awareness and attract talent from a range of sources, such as youth, underemployed workers, skilled immigrants, and those seeking second careers. Training and education programs are being offered by public institutions, industry associations, and companies

However, despite these efforts, the challenges persist. Many stakeholders are acting independently, but without alignment, their collective impact is limited. For instance, governments offer funding and financial incentives, but they’re limited to long-term programs and are specific to the industry. Private companies can offer on-thejob training and apprenticeships, but they cost money and time. Also, small firms don’t have the HR capacity to create professional development programs. Similarly, industry associations who can provide certifications have limited resources.

Accurate, up-to-date labour market data is needed to forecast current and future hiring trends. This data should be collected from government sources, companies, and trade associations.

The industry must deliver positive, fact-based messaging to counter misconceptions. Print remains an essential communication tool and continues to evolve with new technologies. Communication channels must be established or expanded

A co-ordinated approach to funding is essential. This includes investment in labour market research, awareness campaigns, and training at all levels—entry-level, advanced, and ongoing skill development.

Central co-ordination is needed to catalogue available training programs and match candidates to appropriate opportunities in the industry.

Practical supports must be put in place to help individuals who are training or relocating for work in the print industry.

A properly resourced co-ordinating body, such as a national sector council, should be established to align these efforts, manage implementation, and ensure accountability.

The challenges are real, but so are the opportunities. We invite your input on how to address the labour crisis in the industry. Your insights can help shape practical, industry-led solutions. Let’s work together to build a resilient, skilled workforce for the future.

BOB

DALE is vice-president of the consulting firm Connecting for Results. He can be reached at b.dale@cfrincorporated.com.

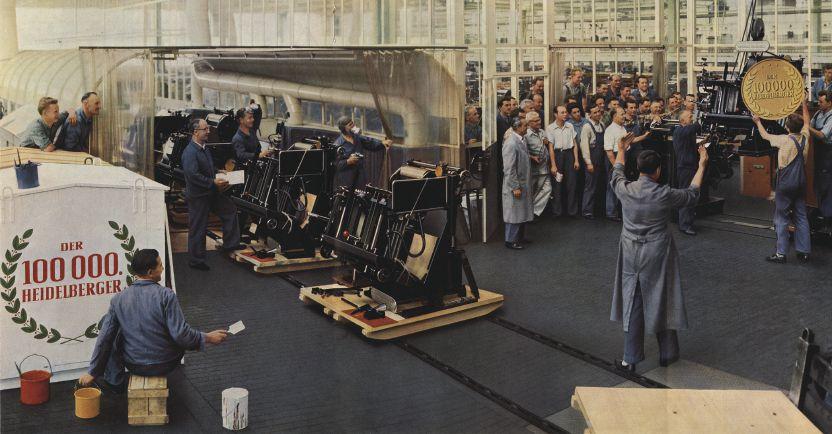

By Nick Howard

Heidelberger Druckmaschinen (Heidelberg) is celebrating its 175th anniversary this year. Founded in 1850, Heidelberg has had plenty to celebrate over the years. The milestones include the 1914-launch of a little printing press, the T platen, at the Bugra trade show in Leipzig, Germany. Later, in 1926, Heidelberg adopted Henry Ford’s assembly line production system, creating thousands of T platen presses that were then sold all over the world. In total, 165,000 of these operator-friendly machines would dominate the industry and were truly loved by every printer.

This is where the legend of Heidelberg emanated and continued to grow with other platforms, culminating with the Speedmaster press in 1975. Heidelberg took a different path to greatness than fellow German companies, Manroland and Koenig & Bauer. Koenig & Bauer emphasized rotary newspaper and publication presses, building enormous clout in what was then a lucrative and expensive field. Once a major producer of cylinder and rotary letterpress equipment, Koenig & Bauer also branched into niche segments such as gravure and currency presses. In so doing, they left the small-format market to others. Manroland, an early pioneer in offset, quickly grew to dominate the sheetfed field and, like Koenig & Bauer, was much larger than Heidelberg by the mid-20th century. Heidelberg wisely remained focused on the small press segment.

Heidelberg sprouted wings by the first Drupa in 1951, producing cylinder presses and platens in various sizes. The modern T platen, first shown at a 1950 trade fair in Chicago, Ill., would remain a bestseller until production ended in 1985. Meanwhile, standard platen operational elements were incorporated into various new models, including the wildly popular GTO,

Taken in 1959, this photo shows employees celebrating the sale of Heidelberg’s 100,000th press.

1850

The year Heildelberg was founded.

which debuted at Drupa 1972. The first Speedmaster 72V (20 x 28 in., four colour) was displayed in Chicago at Print 1974. Commonality of design and simplicity of operation were some of the key elements of Heidelberg presses that drew thousands of clients. Now covering every sheet size from 10 x 15 in. to 28 x 40 in., Heidelberg leapfrogged over Miller-Johannisberg and Manroland, as small printers grew with Heidelberg’s offset presses. The GTO was followed by the M-offset, a larger carbon copy. Soon, printers discovered they could make money and provide full colour and perfecting by avoiding the larger format sizes because Heidelberg tended to expand each model range. Run lengths were also getting shorter, giving small-format printers an edge. Each model borrowed from the previous one, as Heidelberg’s reputation grew into a lifestyle desired even by those who didn’t own one yet. Printers who operated Heidelbergs were perceived to be in a special class.

1951

The year the first Drupa show was held.

As the saying goes, “Today’s peacock is tomorrow’s feather duster.” Heidelberg, the world’s largest press manufacturer since 1975, had to keep pushing or risk losing market share to Koenig & Bauer, Manroland, RMGT and Komori. The Speedmaster had to continue its ascent up the mountain. In 1986, the CD (carton diameter) Speedmaster appeared with a triple

diameter transfer cylinder. It quickly became a worldwide favourite. In 2004, drawing again on Drupa 2000’s launch of the newly designed CD74, the entirely new XL105 showcased the future, with XL106 and XL106-21 K models following close behind. Now, 175 years after its founding, Heidelberg continues to push boundaries. Instead of manufacturing all its products, it has forged new alliances to take advantage of the world’s largest sales network. Canon, Ricoh, Gallus (owned by Heidelberg), Manroland’s VLF format, and China’s MK Masterwork are collaborating with Heidelberg.

The reputational legend of Heidelberg has persevered like no other in the printing industry. And the company has continued to evolve, keeping it a top seller. As digital printing continues encroaching on offset, Heidelberg is today not just a machine builder, but also a supplier. During a 1988 Wiesloch/Walldorf factory trip, I noticed a large billboard outside one of the company’s assembly halls. It read, ‘Der Heidelberger Geist!’ (Heidelberg Spirit). That says it all.

NICK HOWARD, a partner in Howard Graphic Equipment and Howard Iron Works, is a printing historian, consultant, and certified appraiser of capital equipment. He can be reached at nick@howardgraphic.com.

By Treena Hein

Like the long-awaited summer sun, the sticker and decal market is burning hot right now in Canada—and strangely, one of the reasons for this is Donald Trump. Stickers and decals with ‘Canada is not for sale,’ and ‘No to 51st State’ have been hot sellers this year. Further, consumers want to buy Canadian, so businesses are using stickers and decals in droves to promote their made-in-Canada goods. Plus, they’re keen to work with Canadian print service providers.

The rise in popularity of stickers and decals is supported by various factors. Advances in digital printing technologies, inks and software are making it faster, easier and more cost-effective than before to print stickers and decals. According to Daniel Valade, product manager of digital print at equipment manufacturer Roland DGA, “The largest market has been, and continues to be, very basic, low-cost, roll-to-roll printed temporary decals and stickers for marketing campaigns or brand awareness.”

At Winnipeg-based Canada Sticker King, the biggest sticker/decal demands are for OEM graphics, Lexan overlays and doublesided window stickers for products, services and event promotions.

“Niche specialties continue to be strong for us,” says president David Boning. “We primarily manufacture our stickers/decals using wide format solvent and UV inkjet printers, and digital cutting systems.”

Indeed, Roland DGA reports there’s been a major shift into UV printing for high-end labels and decals, especially in the cannabis and CBD markets.

“The biggest shift we have seen is the move into the UV roll-to-roll market,” explains Valade. “UV inks give you an ability to print on specialty materials like reflective and holographic, and at the same time, they are conducive to new processes like UV DTF for high-impact conformable graphics.”

At The Printing House (TPH), they’re noting more sticker and decal orders from smaller businesses in personal services and food/hospitality to promote merchandise, services and events.

“This includes stickers and labels that not only showcase a brand, but also connect to online giveaways, websites and social media or promotions through QR codes,” explains Ray Welsh, program manager, brand engagement, The Printing House.

Boning also notes a rise in demand for QR codes. Beyond marketing, these codes are being used on equipment and in decals, replacing serial numbers for maintenance and supply chain tracking purposes.

Decals are increasingly popular due to their versatility. They’re also available in many formats, from static cling (reusable) and easy dot (easy application and swapping of graphics) to specialty laminates (e.g. non-slip for safety applications). Beyond these formats, Canada Sticker King is also seeing demand for vehicle-grade cast kaleidoscope and metallic vinyls, as well as air-release, spot adhesive, and reflective and matte aluminum foil. Boning’s team adds spot gloss effects using the digital gloss clear channel in their flatbed UV inkjet printers. Additionally, he reports that combining screen print with digital production “opens up an even broader range of ink options, such as fluorescent ink, glow-in-the-dark ink, black-light ink, thermochromic ink, gloss and matte UV clear. These can be combined with digital print on our flatbed inkjets or with spot colour screen printing.”

For decades, metallic sheens have provided a premium, eye-catching dimension to stickers and decals. The same is true today. As Welsh explains, the inherent light reflection creates a dynamic and sophisticated

Advances in digital printing technologies, inks and software are making it faster, easier and more cost-effective than before to print stickers and decals.

Decal ads on cars are great for advertising as they usually have an attractive mix of colour, graphics and text.

aesthetic that surpasses standard print finishes, enhancing shelf appeal for goods, overall brand perception and more.

In the metallics realm, TPH offers digitally printable metallic substrates, UV technology, and metallic decals. Welsh notes that the integration of UV technology with appropriate metallic substrates provides a streamlining in production of metallic decals and labels, with considerable advantages in both speed and quality.

“The efficiency of UV printing is particularly beneficial for producing samples quickly,” Welsh reports. “This enables designers and clients to promptly evaluate various metallic effects, colour renditions and design iterations, leading to faster approval processes and reduced development timelines.”

Welsh notes that among the many benefits of UV inks is their ability to cure instantaneously (upon exposure to UV light). This means postpress processing such as cutting and lamination can be done immediately. Additionally, UV inks cure precisely, even on challenging metallic substrates, easily reproducing fine details along with crisp text.

UV inks also exhibit exceptional adhesion to non-porous metallic surfaces, Welsh reports. This means customers receive durable decals and labels with enhanced resistance to scratching and exposure to light, moisture and chemicals.

“UV inks are also renowned for their vivid colour output and excellent opacity,” Welsh says. “This is crucial for printing on metallic backgrounds, as it ensures colours remain true and distinct, preventing them from being muted by the underlying metallic finish.”

He adds that the application of opaque white UV ink, for instance, can serve as a base to optimize the vibrancy of overlying colours.

As with other types of specialty printing, achieving excellence with metallics means correctly combining the correct printing technologies, substrates and inks. Do your due diligence before selecting your equipment and software, then gain proficiency in using them, along with the appropriate selection of materials and inks for the application.

1. Retro and nostalgia

Stickers and decals featuring design elements from decades ago evoke warmth, familiarity and connection. Consumers want to be reminded of the past, through everything from iconic pop culture references to specific fonts and patterns.

2. Convenient decor change

Temporary wall decals are now a hot choice for changing up a room, adding a fast and inexpensive update to a home. Wall decals are expected to remain popular for the foreseeable future as they can be changed easily and there are so many options.

3. Digital connection

Stickers with QR codes link potential customers with a website or social media, enable exclusive product discounts or access to events. They also help build trust, showing consumers that a company can use today’s technology to provide them with convenience and connection.

4. Vehicle decals

Adding decals to cars for advertising or personal customization has picked up steam in recent years. Today’s decal ads on vehicles catch consumers’ eyes with attractive mixes of colour, graphics and text, up to and including ‘wrapping’ large parts of the vehicle.

5. Surface effects

Metallic, 3D, holographic, glitter look, colour gradients, gloss – anything that stands out will be popular.

6. Pop culture references

An innovative sticker or decal referencing trending memes, movies, music and so on is highly likely to be shared on social media, leading to more sales. Pop culture references in decals and stickers make businesses feel timely and relatable, causing potential customers to buy the product or service because of a perceived personal connection.

Achieving optimal results, says Welsh, typically comes down to practical experience and iterative refinement of product offerings.

“Mastering this involves understanding how specific metallic finishes (e.g. brushed, polished), ink formulations, lamination choices, and printing equipment capabilities interact,” he explains. Like others who are skilled, TPH team members “anticipate material behaviours and effectively troubleshoot potential issues,” says Welsh, “like ink adhesion inconsistencies, colour shifts or uneven metallic effects, ensuring consistent, high-quality output.”

For digital metallic printing, the team at Canada Sticker King uses a 64-in. solvent inkjet printer with a metallic silver channel, which prints under the process colours, enabling a full spectrum of tinting.

“Silver is defined as a spot colour in the RIP, and the CMYK component in the file establishes the tinting,” Boning explains. “Add lots of Y and a bit of M and you have gold, etc.” He adds that under printing white before metallic enables these effects on clear vinyls, but it can be challenging to manage customer expectations as it’s difficult to represent these effects at the proofing stage.

To grow in the sticker and decal space, stay informed on the newest technologies, materials, software and market trends. Build the skills of your team, and with proper marketing, the orders will grow.

By Olivia Parker

It is a misnomer to think printers only deal in physical media, as they handle data. Whether it’s personal data, such as mailing lists, proprietary creative assets, intellectual property, or customer communications, companies possess sensitive and confidential client information even before ink touches substrate.

As the print sector becomes increasingly reliant on digital systems, every business must proactively implement strong cybersecurity and data hygiene practices. Failure to do so can lead to legal repercussions, financial losses, operational disruptions, and reputational damage.

Recognizing the threats your organization faces, identifying vulnerabilities where cyberattacks may occur, and reviewing existing policies and response plans helps you protect your clients’ sensitive information.

According to the Canadian Centre for Cyber Security, the most common threats include:

• social engineering: tactics used to manipulate individuals into divulging confidential information;

• phishing: fraudulent e-messages that prompt users to click malicious links, download harmful files, or share sensitive data;

• malware: software that infiltrates networks, systems or devices to access sensitive information;

• ransomware: a type of malware that infects your device allowing criminals to make data inaccessible until a ransom is paid; and

• supply chain attacks: a cyberattack that targets trusted thirdparty vendors or software, using them as entry points into a company’s network.

Ransomware is especially pervasive and was cited as the top cybercrime threat in Canada’s National Cyber Threat Assessment 2025-2026. For example, in 2021, RR Donnelly experienced a ransomware attack, for which it was fined US$2.1 million by the Securities and Exchange Commission. In February 2025, U.K.’s leading book printer CPI’s IT systems were disabled, causing major production delays that hurt both CPI’s profits as well as their clients’. In April 2025, printing vendor Toppan Next Tech, which services DBS Bank and Bank of China’s Singapore branch, was targeted, exposing over 11,000 customers’ data and a supply chain weakness.

Printers are vulnerable to cyberattacks for several reasons such as:

• weak password protocols;

• heavy reliance on digital systems and data storage;

• poor file sharing methods;

• inconsistent data management practices;

• high employee turnover or changing clientele;

• unsecured networks and outdated systems/software; and

• resistance to change.

Small companies may assume they’re less at risk, but cybercriminals often target the easiest entry point, not necessarily the largest. Dr. Windhya Rankothge of the Canadian Institute for Cyber Security shares some of the key considerations for printers to combat vulnerabilities.

Strong passwords are your first line of defence to ensure only authorized individuals access your system. Use complex, unique passwords for each system or account. Change them regularly and store them securely. Avoid sharing passwords between

staff. If workstations are shared, assign individual user profiles and enable multi-factor authentication.

Every employee plays a role in protecting client data. Training staff to recognize phishing emails, using secure websites, creating strong passwords, and understanding data retention best practices is critical. Free courses are available through organizations like Harvard, Udemy, and the Canadian Centre for Cyber Security, but implementing that knowledge requires leadership.

“Resistance to change is challenging,” explains Dr. Rankothge, “People might not think these things are important and are used to the way things have been. Management must make sure they have a proper set of policies or guidelines for employees and clients.”

Having a cybersecurity plan and communication guidelines ensures that when a breach happens staff react appropriately. Clear data retention and data sanitization policies will also help minimize harm during a cyber breach.

A data retention policy defines what data is stored, how long it’s kept, and when it should be deleted. This policy helps ensure legal compliance and improves data management.

A data sanitization policy ensures permanent and secure deletion of sensitive data to prevent unauthorized recovery.

Dr. Rankothge emphasizes using Triple A (authentication, authorization, accountability) principles to prevent unauthorized access and protect sensitive information from cyber threats. “First, you authenticate by identifying the person. Second, authorization determines

what they can do. Sometimes authorization can be configured based on the role. Finally, there should be accountability to log and audit system activities,” she explains.

Ransomware tops the cybercrime threat list, per Canada’s National Cyber Threat Assessment 2025-2026.

Effective file handling practices are a big part of protecting your system and client privacy. Printers receive files constantly, often via USBs, CDs, email, or cloud platforms. These files can carry malware, especially when coming from unfamiliar sources as AI has made it more difficult to identify phishing emails.

“Transferring data through email is not bad,” says Dr. Rankothge, “But it must come through a proper, valid email address and follow company security protocols.”

Some best practices include:

• configuring your email so it uses encryption to protect contents during transit;

• creating password protected files;

• validating new clients’ email addresses before accepting files;

• enforcing a file transfer protocol so clients share files using a consistent method; and

• enabling scanning for malware upon upload or download.

Don’t store files indefinitely. A clearly defined data retention schedule helps reduce risk. But it is also important to make regular system backups to enable fast recovery in the event of a cyberattack.

In February 2025, CPI’s IT systems were disabled, causing major production delays.

Applications and operating systems require updates to ensure they are not exposing your company to unnecessary risk. Printing companies may use a myriad of third-party software to keep operations running smoothly. However, “this software does not belong to the printing company,” explains Dr. Rankothge. “It is very important to keep computers and software up to date, so vulnerabilities are patched.”

Cybersecurity threats are omnipresent, and printing companies are vulnerable. But protecting your business doesn’t have to be expensive or complex. Small steps can go a long way toward building a resilient operation. In today’s digital-first print environment, securing your systems means protecting your clients, your reputation, and your bottom line.

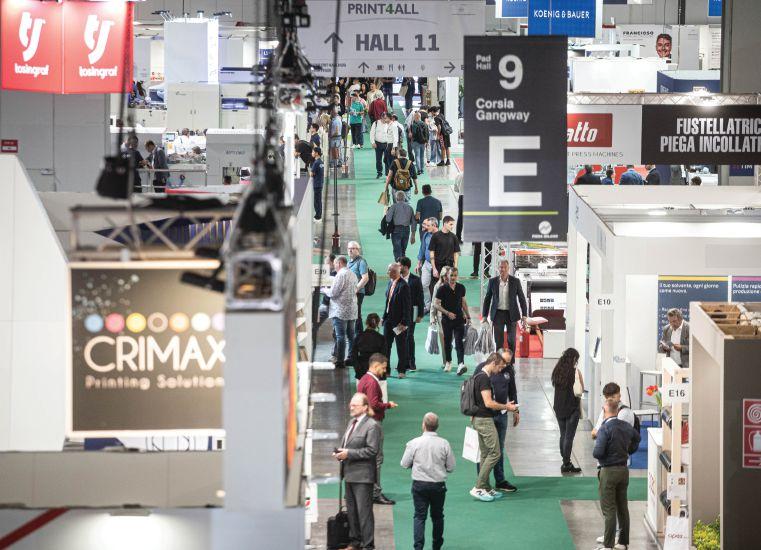

The Italian printing industry showcased excellence at Print4All 2025

By Nithya Caleb

Italy is home to many printing service and solutions providers, such as Bobst, Durst, Omet, Smyth, Uteco and Petratto, so I leapt at the opportunity to meet several of them at the Print4All 2025 trade show in Milano.

For four days, the show played host to more than 20,000 industry professionals from 68 countries and 245 exhibitors, largely showcasing solutions in converting, packaging, labelling, finishing, workflow, and commercial printing.

In many ways the Italian printing industry is like Canada. There too, many printing companies are familyowned SMEs. Therefore, on display

at Print4All were solutions that didn’t cost an arm and a leg. They were flexible, modular and affordable. This observation was seconded by Quebec-based Warren Brown, graphic communications consultant, PDI, who was part of the Canadian delegation. He explained that printers are constantly looking to bring cost efficiencies into the business to have an advantage in the marketplace. The show for him highlighted the industrywide move away from conventional litho to digital, but at a good cost. He was pleased to see innovative solutions in digital cutting, workflow, etc., at a price that was affordable for SMEs.

Kyocera has been at the vanguard of the production print industry for decades, thanks to our outstanding inkjet technology and constant innovations.

Kyocera’s inkjet solution production, providing a compromising quality Discover how we can make a difference for your

As Alexis, a content editor with Stratego consultancy, a member of the Print4All event planning team, explained, “We have very high competence in engineering and in creating solutions for small and mediumsized companies.”

Enrico Barboglio, general manager of ACIMGA, the Italian Manufacturing Association of Machinery for the Graphic, Converting and Paper Industry, highlighted that 60 per cent of the Italian companies’ sales comes from exports.

The winds of change that have been forcing Canadian printers to close operations, converge or diversify are blowing in Italy too. But Italian print service providers are flexible, creative, and have excellent relations with clients, so they have been successful in creating new markets with vertical applications, shared Alexis.

They survive because they have built their own niche and have a knack for creating luxury products. Alexis shared several examples of print shops offering unique solutions. For instance, some companies create labels for wine. While they aren’t very big, they are very skilled in creating special labels with all kinds of embellishments. Similarly, in book printing, there are companies that print a special kind of ‘skin’ with fine details or graphic novels, and they’re the only ones in Italy with that capability.

The Print4All 2025 show in Milano, Italy, played host to more than 20,000 visitors. Most of the solutions displayed at the show focused on digitalization, automation and sustainability.

Due to the heightened creativity on display among Italian printers and their interest in novel applications, it’s not surprising that many companies debut their equipment in Italy, often at shows like Print4All.

Digitalization, automation and sustainability were the key themes running through the technologies on display at the show.

The total number of exhibitors at the 2025 Print4All show.

The show began with Expo 2015, but under a different name. In 2018, Print4All was launched in the current format by ACIMGA, ARGI and Fiera Milano. The idea was to bring together solutions for the entire printing industry under one roof. This year’s edition had 245 exhibitors including HP, Ricoh, Canon, Fujifilm, Enfocus, Elitron, Epson, Hybrid Software, Koenig & Bauer, Xerox, Xeikon, Mark Andy, Roland DG, Soma, AsahiKasei, Winmoller & Holscher, Bottcher and Zund. As it’s impossible to mention all the products on display at the show, I’ll summarize as many solutions as space allows in no particular order.

Esko, a global provider of software and hardware solutions for the packaging industry, showcased its latest developments in prepress and automation software.

“With our latest software release unveiled recently, we used the booth

to demonstrate the productivity and efficiency gains that can be enjoyed by integrating solutions such as Automation Engine and WebCenter into the prepress workflow, or how Esko ArtPro+ and Flexo Engine can deliver consistent quality to our customers, and subsequently to their own,” said Giovanni Vigone, Esko regional business manager.

U.K.-based GEW showcased their Mercury UV lamp and UV LED curing systems for the printing and converting markets.

Based in Quebec, Impack is an engineering company that designs and manufactures folder-gluer peripherals for folding carton and corrugated box packaging producers. They’ve been selling in-line window patchers, pre-feeders, box turners, packers, stackers, batch inverters, as well as counting and separating modules for more than 20 years. They were the only Canadian exhibitor at the show.

Flexo solutions provider Omet used geography to their advantage at the show. Since their innovation park and production facility was only 40 km away, they organized small trips, enabling industry professionals to attend live printing demonstrations and experience Omet’s technologies. They offer flexible packaging and label printing machines as well as tissue converters. For Omet, the show allowed them to highlight some of their strengths, such as modularity and flexibility. A majority of Omet’s flexo machines are customized to the client’s needs. So, each of the 2000 machines installed globally are unique. DTM Flexo represents Omet in Canada.

The Israeli-headquartered company partnered with Castelli, a manufacturer of premium and luxury notebooks and diaries. Castelli had recently installed a new Scodix Ultra SHD 6500 press. The press allows Castelli to offer enhanced print options, including intricate embellishments on B1 formats. Scodix’s SHD technology has enabled Castelli’s teams to add

detailed designs, including fine lines, intricate patterns, small text, and large flat foiling to their products. Scodix MLE also allows for structured layering (up to eight layers) of the polymer in a single pass-through repeated media rotation. At the show Scodix had on display a range of samples created in collaboration with Castelli and other partners.

APR Solutions offers manual and automated folding-gluing machines and double-sided tape application machines. Their Box line includes

three different machines that can cover a range of applications in cardboard printing. Box 1, which is the smallest machine, has a manual feeder and suitable for linear folding boxes. It can be upgraded to include varying degrees of automation depending on production needs. Box Plus 1 with automatic continuous feeder and automatic delivery table is suitable for producing linear boxes and snap lock bottom boxes. Box Plus 2 is a folding and gluing machine for crash-lock bottom folding boxes. In 2020, the company acquired Saroglia, specializing in die-cutting

and hot foils. Founded in Italy in 1911, Saroglia machines are suitable for hot and cold foil stamping and UV casting. The Saroglia FUB Gold 58x76 can work on max. sheet sizes of up to 22 x 29 in. and yield 2900 copies/hr.

“Our concept is to have machines that are very flexible in order to change quickly from one production to another,” said Fabio Casalegno, regional sales manager, APR Solutions.

Top: Nithya Caleb, editor of PrintAction with Emanuele Giusti of the Italian Trade Agency, Warren Brown, and James Oziel, president, Impress Digital/ Signs R Us.

Left: Members of the Impack team on the show floor. Impack was the only Canadian exhibitor at Print4All.

BW Converting demoed its Baldwin line of products focusing on surface treatment, curing, cleaning and inspection operations at Print4All 2025. The solutions included BW Converting’s Baldwin Corona Surface Treatment solutions; the Baldwin Rotor Spray system for application of anti-fog, anti-static and other specialty coatings to papers, films and fabrics; BW Converting’s Baldwin Unity LED curing system; the Baldwin FilmCylinderCleaner to remove contaminants from cast and chill cylinders in film extrusion; and the Baldwin Guardian PQV 100% Print Inspection system.

20k

The Print4All show attracted more than 20,000 visitors.

Siegwerk displayed its latest ink and coating developments for label and packaging printing including the newly launched nitrocellulose free inks for flexible packaging applications, the CIRKIT water-oil barrier coating solution, dual-curing UV solutions, as well as its new generation of low-odour UV offset inks and varnishes for paper, board and various plastic substrates.

Solimar Systems, a provider of workflow software solutions for print production and digital communications, partnered with Kyocera at Print4All 2025. Solimar staff demonstrated their Chemistry platform, which converts AFP, IPDS, and PDF print files into optimized PDF output. This optimized output is specifically designed to drive the Kyocera TASKalpha Pro15000c, TASKalfa Pro 15000cB, and TASKalfa Pro 55000c cut-sheet inkjet printers via JDF job tickets.

Uteco

Uteco Converting manufactures

printing and converting machines for flexible packaging applications. At Print4All, it joined its partners Bimec, CMG, ENCA, Smartjet, and Vision at the Flex-Converting Alliance to showcase a full range of products for flexible packaging providers including extrusion, printing, quality control and slitting equipment.

Several new trends emerged at the show, from tactile printing with multisensory effects to one-step digital embellishment, as well as the ability to print on a range of natural and recycled materials. We also saw significant innovations in the finishing sector, which is becoming increasingly smart and customized, suitable for short-run and bespoke production.

There were three focus areas at the show to highlight key growth opportunities for the market. Corrugated cardboard took

centrestage in the Corrugated Experience, a dedicated hub that showcased the potential of this material, which has evolved from a simple packaging medium into a high-impact visual communication tool.

PrintMAT celebrated the more creative side of printing, featuring applications from textiles to glass.

At the heart of the event was the WeArePrint4All Hub, which hosted training sessions, debates and networking opportunities. Girls Who Print also launched their Italy chapter at the show. The group seeks to break down barriers related to gender, sexual orientation, ethnicity, and disability within the printing and converting world. The next edition of Print4All will be held May 25-28, 2027, in Milano.

* Special thanks to the Italian Trade Agency (ITA), Rome, for making this coverage possible.

By Alec Couckuyt

Label printing has long been one of the silent partners in the printing industry. Quietly efficient, highly technical, and deeply integrated into almost every sector, labels haven’t always attracted the same attention as other print categories. But that’s changing.

Over the past few years, label printing has stepped into the spotlight, drawing attention not just from converters and niche specialists, but also increasingly from OEMs, commercial printers, and packaging providers.

One of the clearest signals that label printing has matured into a strategic battleground is the acceleration of hybrid press development. Major OEMs are fine-tuning their platforms to meet the growing demands of the label sector, which now expects quality, speed, and flexibility, all in one pass. Players like Durst, Heidelberg’s Gallus division, Fujifilm, Mark Andy, and Bobst have launched hybrid models that combine the reliability of flexographic printing with the precision and agility of digital. These aren’t just bolt-on technologies; they’re purpose-built systems designed for today’s market realities—short runs, serialized barcodes, high-end embellishments, and variable content at scale.

This hybridization is enabling new levels of creativity and efficiency. Labels have become more sophisticated in their design, more durable in their construction, and more personalized in their messaging, all without compromising turnaround

With hybrid presses, digital embellishment, durable screen applications, and new business models, label printing has become a focal point of the print industry’s broader transformation.

times or operational cost. In essence, the press itself is now a differentiator, not just a production tool.

While much of the momentum is around hybrid and digital-flexo platforms, screen printing continues to play a key role, particularly in the production of labels needing to endure time, weather, and wear, such as automotive decals, outdoor equipment, or long-lasting safety instructions.

This coexistence of technologies (digital, flexo, and screen) is not a sign of fragmentation but of specialization.

02/2025

Vancouver-based

Cettec Digital Imaging installed a Konica Minolta AccurioLabel 230 label printing press earlier this year.

Strategically, we’re also seeing movement on the business side of things. Commercial printers, many of whom have spent the last decade navigating commoditization and shrinking run lengths, are now actively exploring label production as a growth area. With existing expertise in colour management, workflow, and finishing, many commercial print shops find that stepping into label production is more evolution than revolution.

In parallel, some label printers are moving in the opposite direction, expanding into packaging, particularly short-run cartons and flexible packaging. The technologies are adjacent, the client bases often overlap, and the market demand for customization and fast delivery is only increasing.

We are watching a moment of convergence where the boundaries between print segments—commercial, label,

packaging, even industrial—are becoming less defined due to technological advancements, the increased emphasis on automation, digitalization, and integrated workflows.

MIS systems, web-to-print portals, variable data workflows, and smart finishing equipment are no longer nice-to-haves; they’re table stakes for staying competitive. At the same time, brands are demanding more from their printers: faster timelines, shorter runs, tighter colour tolerances, and increased sustainability.

For printers, this creates an ideal moment to reassess strategy. What are your core competencies today, and how can they evolve? Are you equipped to shift into adjacent markets? Do you have the right technology stack, sales capabilities, and operational mindset to support convergence?

These are not minor questions. They are, in fact, the strategic decisions that will shape the next five to 10 years in the print industry.

As convergence deepens, leadership teams are being challenged to rethink production capabilities and go-to-market approaches. Sales teams need to speak the language of multiple sectors. Estimating and workflow teams must adapt to greater complexity. And leadership must orchestrate these changes while keeping a clear eye on value creation. Convergence isn’t just a technical evolution, it’s a call for strategic clarity.

ALEC COUCKUYT is a business strategist with extensive international management experience. He can be reached at alec@agcconsulting.ca.

E.B. Box, a folding carton manufacturer in Richmond Hill, Ont., recently doubled its footprint by adding a second facility. Its president Irfan Rajabali joined the family business in 2007. He has used his financial and business skills to help E.B. Box grow along with his father Amin Rajabali, who is the company’s CEO. The company, which was already skilled in short runs, now has the ability to offer longer runs with faster turnarounds due to recent investments in automation and new tech. Folding carton is growing exponentially and, in this interview, Irfan gives us a sense of the opportunities in that sector.

What is the state of the print industry today, in your opinion?

IR: The print industry is in a period of evolution. On the commercial print side, we’re seeing some declines in volumes, but packaging is very different. Folding carton is growing due to plastics reduction related regulations. Food, health and CPG brands are pivoting to more sustainable options for their packaging. The real focus in that industry is speed, flexibility, sustainability and data. Customers want faster turnarounds and shorter runs but consistent, hi-end quality.

What attracted you to the print industry?

IR: E.B. Box is a second-generation family business. When I joined the business 18 years ago, it was a small company that was mostly doing standard box work. It’s really evolved into a company offering personalized packaging solutions for several large food brands. It was attractive back then for me because I looked at it as an industry that was yet to catch up with technology and innovation.

How can the industry attract more young people?

IR: We must shift the narrative of what print is. The plants are no longer messy or dirty. The facilities are very technology forward with data-driven machines. We need to show younger people the modern side of the business such as automation, digital workflows, colour management, and robotics. We want people to know there is a career path here. Actually, the wage rates and

The year E.B. Box was established.

compensation are quite competitive because this industry is growing. It’s our job as business leaders to tell that story a bit better and get some of the younger generation excited to be working in this industry.

Investments in technology have allowed us to do more with less.

While we have labour challenges, investments in technology have allowed us to do more with less. We also do internal training, so staff that are mechanically inclined can apprentice on some of our machinery with our more senior operators and hopefully transition into operators. Then there are training centres for some of these skills in other parts of the world like India and Dubai. We’ve been able to tap into that pool a little bit, although it’s becoming increasingly difficult due current immigration policies.

In such a competitive landscape, how can printers generate more sales?

IR: Price is extremely important, but it’s not everything. It’s also about solving problems. It’s about fast turnaround times. It’s about really understanding the customers and their needs, such as lowering inventory carrying costs or helping them with sku management. There’s a lot of other value additions that one can offer clients. We believe in partnering with our clients, integrating

with their teams and having a keen sense of how we’re helping them. It’s important to stay focused on continuing to deliver value.

What are some of the biggest opportunities in the print industry?

IR: The big opportunities are shorter runs and faster turnaround times. In food, where 92 per cent of our business is, people care about quality and safety. We’re a GFSI-certified facility, which is a key differentiator. Another opportunity is helping companies with their branding so that their products appeal to the Instagram generation. Packaging used to be generic; just plain white boxes. But brands now want their products to look and feel unique. There’s been a large growth in packaging as people want customization and uniqueness.

What do you think is the most exciting thing about print today?

IR: It’s exciting to see things come to life and to see the packaging we create on store shelves. It’s great to be part of a brand story and support them as their business grows.

Irfan Rajabali’s response was edited for length. For more Spotlight interviews, please visit www.printaction.com/profile.

November 6, 2025 | Palais Royale, Toronto, ON

Sponsor now

Nominate your favourite projects today

With the 4th generation J Press 750HS cut-sheet inkjet press comfortably leading the industry in speed, quality and efficiency, we set our sites on expanding into the flexible packaging market. The all new award-winning J Press FP790 flexible packaging press, supported by ColorPath and Fujifilm professional services, redefines mainstream flexible packaging.

It’s time you had the power to make more.