FLEX BOOM

Automated production of wet-glue or in-mold labels (IML). Speedmaster XL 106 for peak label production.

Engineered for demanding materials like in-mold and wet-glue labels, the Speedmaster XL 106 combines high-speed production with precision drying and automation. It delivers exceptional productivity, reduces waste, and offers energy-efficient solutions for sustainable, top-quality label printing. heidelberg.com/ca

12

16 30

18

ISSN 1481 9287. PrintAction is published 6 times per year by Annex Business Media. Canada Post

Publications Mail Agreement No. 40065710. Return undeliverable Canadian addresses to: Circulation Department, 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1. No part of the editorial content in this publication may be reprinted without the publisher’s written permission. © 2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of this publication. Printed in Canada.

FEATURES

12 The rise of flexible packaging

Manufacturers must consider flexible packaging services to capitalize on its popularity

16

Navigating growth

How Simpson Print is preparing for the future

18 State of the industry

Insights from a Canadian-wide survey

21 Print history

Discover the fascinating world of printing at Howard Iron Works Museum

23 A step towards greener graphics

Eco-inking can help reduce the environmental impact of printed materials

DEPARTMENTS

GAMUT

5 News, People, Installs,

10 Calendar

NEW PRODUCTS

28 Introducing new solutions from Xante, HP, Fujifilm, Huge Paper, XSYS, NJM and X-Rite

SPOTLIGHT

30 Brandon Townsend, president, Promotional Print and Packaging

COLUMNS

FROM THE EDITOR

4 Nithya Caleb

Companies brace for a tough 2025

CHRONICLE

8 Nick Howard Uptime to downtime in seconds

INSIDER

10 Bob Dale

Associate with winners

TECH REPORT

26 Alec Couckuyt To B2 or not

Companies brace for a tough 2025

WAccording to Ricoh’s 2024 North American Workplace Fulfillment Gap Index, only 21 per cent of employees in the US and Canada feel completely fulfilled at work.

e knew 2025 isn’t going to be easy, but the outlook is actually cloudy. Bank of Canada’s (BoC’s) 2024 Q4 Business Outlook Survey found that while overall business sentiment is subdued, companies are anticipating improvements in sales activity. This can also translate into long pending capital investments. However, companies are expecting higher input costs due to trade tensions with the US. To be clear, at the time of going to press, no tariffs were imposed on Canada by the US. However, by the time you’re reading this, President Trump may have imposed some tariffs on Canadian goods & you’re probably spending your day trying to find a way to manage the fallout. Hopefully, it’s still a probability and on that note, I’m going to share findings from BoC’s Q4 survey.

According to the survey, only 15 per cent of firms are planning for a recession in Canada in 2025, which is a huge improvement over the 38 per cent of companies that reported this 12 months ago.

In the Business Leaders’ Pulse in December 2024, BoC asked participating companies about the expected impact of the new US administration on their business. Forty per cent of the respondents anticipated negative effects like higher input costs. This has forced some companies to “revise down their outlook for sales, investment and hiring”. Further, some businesses plan to raise prices to pass along the higher costs, but others are intending to cough up the additional costs to remain competitive.

In terms of investment, more firms are considering implementing previously delayed investment plans, thanks to lower interest rates. However, the investment would be small, and it may be pushed to the backburner if President Trump’s policies negatively affect our economy. As you can guess, we’re not in the clear yet. For an in-depth look into the state of the printing industry, go to Pg 18.

Workplace fulfillment

I don’t want to be the bringer of negative news, but Ricoh’s 2024 North American Workplace Fulfillment Gap Index must

be highlighted. The Index is based on a survey of more than 2,000 U.S. and Canadian adults between ages 18-64 who are employed full-time. The survey found, “Employers are falling short of their employees’ expectations to invest in organizational priorities that matter most to their fulfillment: work/life balance, purpose-driven work, a frictionless environment, and a growth-oriented culture. Workers ranked their overall fulfillment at a 6.89 out of 10, with pronounced fulfillment gaps between onsite (6.92) and remote workers (6.61).”

Per the survey, most employees (51 per cent) felt less fulfilled compared to five years ago. Less than a quarter (21 per cent) were completely fulfilled through their work. The findings also showed a difference between the United States and Canada, with Americans (29 per cent) more likely to be fulfilled at work compared to Canadians (14 per cent).

More than 80 per cent of the surveyed employees said workplace fulfillment is a deciding factor in whether to stay in the company or quit.

One essential factor in workplace fulfillment was comradery with colleagues. The survey found a correlation between feeling more disconnected from coworkers (47 per cent) to feeling less fulfilled at work (51 per cent). Nine in 10 (91 per cent) employees said the culture among those they work with is important to feeling fulfilled in their job, with hybrid workers more likely to say this than onsite workers.

As Amy Loomis, research VP at IDC, said, “With employee attraction and retention challenges on the rise in a complex talent market, companies must go beyond simply offering traditional benefits to offer workers of all ages and backgrounds a meaningful path forward for career development.”

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal 416-510-5113 apotal@annexbusinessmedia.com Fax: 416-510-6875

Mail: 111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1

Editor

Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

Contributing writers

Bob Dale, Nick Howard, Jack Kazmierski, Fabrice Peltier and Alec Couckuyt

Associate Publisher

Kim Barton kbarton@annexbusinessmedia.com 416-435-9229

Media Designer Lisa Zambri lzambri@annexbusinessmedia.com

Account Coordinator

Melissa Gates mgates@annexbusinessmedia.com 416-510-5217

Audience Development Manager Urszula Grzyb ugrzyb@annexbusinessmedia.com 416-510-5180

Group Publisher/VP Sales Martin McAnulty mmcanulty@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

Subscription rates

For a 1 year subscription (6 issues): Canada — $43.86 +Tax Canada 2 year — $71.91 +Tax United States — $99.96

Other foreign — $194.82 Single Issue — $8.00 + Tax

All prices in CAD funds

Mailing address

Annex Business Media 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600

Fax: 416-442-2230

Occasionally, PrintAction will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above. Annex Business Media Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

ISSN 1481 9287 Mail Agreement No. 40065710 printaction.com

NITHYA CALEB Editor ncaleb@annexbusinessmedia.com

CCL Label opens a new 44,000-sf building in SaintBruno-de-Montarville, Montreal, that’s entirely dedicated to label production, mainly for the pharmaceutical industry. The opening coincides with the 40th anniversary of CCL’s operations in Quebec and the 20th anniversary of the acquisition of Graphiques Apex. Previously owned by WetStyle, the new building has been renovated and transformed to better accommodate CCL Label Montreal’s operations at a cost of $4.8 million.

Legal victory for Mitchell Press: The Supreme Court of British Columbia has dismissed a petition by Daniel Castilloux, former CEO and a minority shareholder at Mitchell Press, requesting a liquidation of the nearly 100-year-old company under the Business Corporations Act.

Solisco Printer acquires Groupe ETR, a printer based in Quebec City, Que., and specializing in digital and large-format printing. This acquisition enables Solisco to offer a one-stop shop for its customers, from more targeted projects involving personalization to large print runs and large-format signage.

Labelink buys International Label & Printing (IL&P), a printing converter with strong

ties to the consumer packaging sector. Located in Chicago, this strategic acquisition not only enhances Labelink’s presence in the U.S., but also accelerates the company’s ambitious plans to expand footprint in North America. IL&P will now operate under the Labelink USA name.

Xerox is acquiring Lexmark International from Ninestar, PAG Asia Capital, and Shanghai Shouda Investment Centre in a deal valued at US$1.5 billion. This acquisition is expected to strengthen Xerox’s core print portfolio and build a broader global print and managed print services business. Lexington, Ky.-based Lexmark is a provider of imaging solutions and technologies including a line of printers and multifunction printers.

Koenig & Bauer realigns its business divisions. The number of segments will be reduced from three to two, namely Paper & Packaging Sheetfed Systems (P&P) and Special & New Technologies (S&T). The group’s focus will be on the high-growth packaging market. All activities

of the Sheetfed segment will be consolidated within the new P&P segment. Corrugated cardboard activities for the Chroma series bundled under the Celmacch joint venture will be allocated to this segment. The activities of the Koenig & Bauer Durst joint venture will continue to be based here. This segment will specialize in solutions for folding box and corrugated cardboard box markets. The Special & New Technologies segment will consolidate the activities of the Special segment (banknote and security printing, systems for industrial marking and coding and special systems for metal and glass/hollow container direct printing), as well as the other activities of the former Digital & Webfed segment.

A consortium of MAVCO Investments and Avenue Capital Group sign a definitive agreement to acquire Hubergroup. Based in India, MAVCO Investments is a private investment vehicle belonging to select members of the Murugappa family. Avenue Capital Group is a global investment firm. This investment allows Hubergroup to capitalize on high-growth opportunities across geographies.

Lecta spins-off of its self-adhesives business unit from Torraspapel S.A.U. Lecta Self-Adhesives España, S.L.U., which is the new company’s name, will maintain its headquarters in Barcelona, Spain, and take over all activities, agreements and commercial relationships relating to Lecta’s self-adhesives business , including all its self-adhesive products.

Highcon and Hybrid Software partner to elevate the digital die cutting workflow for packaging and display converters. At the core of this collaboration is a customized version of Hybrid’s Packz software for Highcon’s Digital Die Cutting Workflow Package.

Global Graphics Software, a Hybrid Software company and developer of smart software components for print OEMs, extends its strategic partnership with Mimaki Engineering, a Japanese manufacturer of wide-format inkjet printers and cutting systems. The renewed agreement will enable Mimaki to continue licensing Global Graphics’ Harlequin Core technology for its RasterLink RIP software.

Pantone reveals its 2025 Colour of the Year The Pantone 17-1230 Mocha Mousse “is a delectable brown that nurtures us with its suggestion of chocolate, cocoa, and coffee. Pantone 17-1230 warmly welcomes, inviting consumers to reach out and engage, making it an enticing shade for a variety of products from food and beverage to cosmetics to any product made with natural ingredients or dedicated to wellness,” said a company statement.

After 25 years at Koenig & Bauer, Ralf Sammeck, CEO of Koenig & Bauer Sheetfed, member of the executive board and CDO of Koenig & Bauer AG, will retire on June 30, 2025. Markus Weiss took over as managing director/ CEO of Koenig & Bauer Sheetfed on February 1, 2025. He will be a member of the group management reporting to the executive board. In 2000, Sammeck began his career as sales director at Koenig & Bauer and became CEO & President of Koenig & Bauer North America in 2002. He has been a member of the executive board of Koenig & Bauer AG since 2007. As CEO, he is responsible for the Sheetfed segment and also for the tasks of the CDO. For around 18 years he has played a key role in steering the strategic direction of this segment. Under his leadership, the market share tripled, and the product portfolio was expanded to include prepress software and postpress machines as well as digital printing.

To bolster their growth strategies, PDI, Montreal, acquires a second VarioPrint iX3200 and an ImagePress V1350 digital colour press from Canon Canada.

Actega appoints Stuart Hayes as the new managing director for North America. Hayes brings over 25 years of experience in the specialty chemicals industry, having held various operational, strategic, managerial, and sales positions. His tenure at companies like BASF and Evonik, including a three-year period in Germany, has equipped him with an international perspective and a comprehensive understanding of multi-functional environments.

Hybrid BrandZ, a business unit of Hybrid Software, forms a dedicated North American team to strengthen its coverage and drive growth across the United States and Canada. This team will jointly be led by Heath Luetkens and Scott Pellicone

Pellicone joins Hybrid BrandZ with a background in sales and business development from his many years in creative services and print production leadership roles at AGI-Shorewood, ASG/ Spark!, RR Donnelley, and Quebecor as well as in his own manufacturing business. Pellicone will concentrate his efforts in eastern USA and Canada. Luetkens brings a wealth of industry experience to the team, having been instrumental in expanding Hybrid Software’s presence in 3D rendering and photorealistic rendering as business manager for iC3D.

Pro Lettrage Drummond in Drummondville, Que., specializes in digital printing for industrial stickers. It integrates Rollem’s 42-in. semi-slitter into its sticker production line. Resource Integrated in Aurora, Ont., adds the next-gen Agfa Anapurna Ciervo H3200 hybrid wide-format printer. This is the first North American installation of this press.

DRIVING THE DIGITAL TRANSFORMATION

In the graphic arts industry, Müller Martini has long been a leading provider in the field of digital transformation processes — we will be demonstrating this convincingly at our Printing United booth. Müller Martini — your strong partner!

We offer solutions

As a solution provider, we advise you holistically by showing you how you can strengthen and expand your business with the help of digitalization.

Earn more money

We show you ways in which you can reduce costs in an increasingly digital environment, generate more sales and therefore earn more money.

Smart Services for you

Learn more about the benefits of our MMServices program and the advantages of comprehensive life cycle management at drupa.

Digital Transformation

We use the latest equipment to show how we can accompany you on your path into the increasingly digitalized future.

Uptime to downtime in seconds

Avoid electrical explosions that inevitably cause plant shutdowns

By Nick Howard

sn’t it typical how we don’t truly appreciate something until it’s gone? Consider cancelled or delayed airline flights, your wi-fi on the blink just in the middle of streaming a movie or, worst of all, a tragic automobile accident nobody saw coming. Appreciation of life’s pleasures is often best reflected after an event.

ISpeaking of disruptive elements, it brings up a topic every printer faces today or in the future. This ticking time bomb of sorts that, when brought up, is about as exciting as a trigonometry class. I’m talking about electricity, specifically the incoming main distribution hardware each business has tucked away in the plant. Without electricity, nothing gets printed, bound or delivered. The factory’s main incoming electrical equipment is not on many people’s radars. Nothing is in motion, so what could go wrong? Plenty, as it turns out.

High-voltage electricity, typically 600 volts in Canada, arrives at the electrical distribution panel in your plant. From the main disconnect (resettable breakers or fuses), electricity moves through a bus system or conduit to disconnect switches, silently feeding your equipment. Generally, electrical distribution is never looked at. However, it’s a time bomb waiting to cause complete chaos.

Preventative maintenance

Many insurance companies now demand yearly inspections. Why? If the main distribution panel is ignored, connections loosen due to high temperature and amperage fluctuations during a typical working day. These lugs or connections loosen from thermal expansion and contraction.

An ignored bus panel blew up because of loose fasteners and bus bars. Annual preventative maintenance is recommended to avoid such incidents.

What was once a tightened-up fastener is now loose, causing increased resistance. In turn, this higher resistance then creates increased heat. Loose bolts and lugs are the reason panels must be inspected. Resistance equals heat generation, which works on the same principle as a standard electrical resister or stove-top calrod cooking element. Dust and accumulated dirt often found inside a neglected panel can act as a catalyst, causing potential explosions including fires combined with extremely high heat. Electrical fires are the source of many tragic deaths each year. These can be prevented.

bar connections had to be custom manufactured. Finally, the panel had to be inspected before turning it back on. Although this incident caused the plant to be down for over 48 hours, think of the cost in production, wages, and potential lost business.

When a bus panel blew up because of loose fasteners and bus bars, the workplace had to shut down operations for more than 48 hours to repair the damage.

The immediate effects of an electrical fire are indeed immediate—no power! All your equipment, phones, and computers will shut down or, eventually, once your UPS systems expire. However, this is only the beginning of the nightmare. Many hardware systems have proprietary or made-to-order parts and may not be readily available, particularly with more significant 800 to 2,400-amp services. Lack of quick replacements on their own could cause delays that could take days or weeks to correct.

In the photo, one can see the damage caused when an ignored bus panel blew up because of loose fasteners and bus bars. To rectify this incident, the breaker’s primary bus

Annual electrical preventative maintenance is a brilliant choice at a minimal cost. This typically involves having your electrician or specialist company remove the case panels, vacuum the enclosure, and re-torque all connections. An infrared inspection is also widely available, and it will spot any hot spots quickly because infrared detects elevated temperatures.

Today, we are inundated with suggestions and warnings, which we never take seriously. Don’t make the mistake of not taking action. As the Hartford Steam Boiler Inspection and Insurance Company says, ‘Keep it clean, dry and tight’. If you’re unsure how to get started, contact a qualified industrial electrician.

NICK HOWARD, a partner in Howard Graphic Equipment and Howard Iron Works, is a printing historian, consultant, and certified appraiser of capital equipment. He can be reached at nick@howardgraphic.com.

February 24-27, 2025

Hunkeler Innovationdays 2025

Lucerne, Switzerland

February 24, 2025

Bobst Atlanta Competence Center Open House Cumming, Ga.

March 10-12, 2025

Print UV 2025

Las Vegas, Nev.

March 25-28, 2025

TAGA NextGen Boulder, Colo.

April 9-11, 2025

Graphics Canada Expo Mississauga, Ont.

April 22-25, 2025

Hybrid Fusion

Amsterdam, The Netherlands

April 23-25, 2025

ISA International Sign Expo 2025

Las Vegas, Nev.

May 4-7, 2025

FTA Forum, Infoflex 2025 Pittsburgh, Pa.

May 6-9, 2025

FESPA Global Print Expo 2025 Berlin, Germany

The Manitoba Print Industry Association is a model for other trade organizations and reinforces the theory that well thought out programs encouraging active participation helps associations grow and industries prosper.

Associate with winners Spotlight on the Manitoba Print Industry Association

By Bob Dale

In fall 2024, I attended the Manitoba Print Industry Association’s (MPIA’s) Name in Print award ceremony that recognizes provincial members of the print community who have made significant contributions to the industry. The event also demonstrated what a successful regional print association can look like at its best.

MPIA is a regional association affiliated with the Canadian Printing Industries Association (CPIA). There are regional affiliates in all provinces as well as an equipment dealers’ association. It is beneficial to participate in industry associations. According to a 2024 report on the state of the print

industry by Printing United, respondents affiliated to regional associations reported 46 per cent higher EBITDA than the 2023 S&P Small Cap average for firms in the commercial printing industry.

MPIA is a vibrant organiza-

tion, led by president Ted Gortemaker and administered by association manager LeeAnne Carter.

They are a young team with an active board that enjoys support from several industry veterans. Volunteers donate

time and skills for website development and design, finance and organizing events. They engage with their network, government contacts, other associations and suppliers who can help the association provide value to members.

MPIA’s website is an interactive hub for members and can be used to sign up for events and training sessions and pay invoices. It is also hosts recordings of training webinars. MPIA has an active job board that industry employers and jobseekers can use. Many of the features on the website reduce administrative tasks, making better use of volunteer and administrator’s time. Additionally, the association actively uses social media and email blasts to engage members and interested industry professionals.

Members are united in the goal of helping address issues facing the industry, such as the need to recruit youngsters. The association sponsors education and training programs like

$1M

By actively engaging with provincial representatives, the Manitoba Print Industry Association has succeeded in arranging an investment of over $1 million for graphic arts training programs at Manitoba Institute of Trades and Technology.

press operator certificate courses and software courses on Illustrator, InDesign, Excel as well as staff recruitment and retention strategies.

Members include large, medium and small print firms from across Manitoba. Many actively benefit from using the training programs for their staff. Training programs are often cross sector, meaning that other industry associations also participate in them. Training is provided free or for a modest fee. Non-members can also participate albeit at higher rates.

Even MPIA’s networking sessions include a segment on helping members grow and prosper. For example, brainstorm sessions exploring strategies for industry growth, uncovering opportunities to innovate and thrive, and sharing insights on how MPIA can better support businesses. This year, MPIA plans to expand some of the corporate partnership programs that offer valuable products or services at discounts to members.

One area that MPIA has excelled at is active engagement with government agencies at provincial and federal levels. At one-point, provincial representatives sat on the association’s board. This level of engagement has succeeded in arranging an investment of over $1 million for graphic arts training programs at Manitoba Institute of Trades and Technology (MITT) within the past 10 years.

While Manitoba is one of the smaller provinces in Canada, there are many successful print companies serving local, national and international clients. MPIA is a model for other trade organizations and reinforces the theory that well thought out programs encouraging active participation helps associations grow and industries prosper.

BOB DALE is co-founder of Connecting for Results. He can be reached at b.dale@cfrincorporated.com.

CPG companies are opting for flexible packaging as it’s versatile and offers superior barrier protection.

FLEX PACKAGING SKILLS TO GROW

Manufacturers must offer flexible packaging services to capitalize on the product’s growing popularity

By Jack Kazmierski

Take a stroll through any grocery store and you’re sure to see aisle after aisle of consumer goods in flexible packaging. The popularity of flexible packaging is undeniably on the rise with CPG companies, and for good reason.

According to Tony Corsillo, VP of growth and client happiness at Tempo Flexible Packaging, today’s boom in flexible packaging is being driven by several factors including economic benefits, extended product shelf life and sustainability demands.

“Consumers are increasingly demanding eco-friendly packaging, and

brands are responding by setting ambitious ESG [environmental, social, and governance] targets, and emphasizing corporate responsibility,” says Corsillo. “Flexible packaging aligns perfectly with these goals, offering both sustainability and economic advantages.”

Moreover, flexible packaging uses lightweight materials that require fewer resources to both produce and transport them.

“Its ability to be precisely sized and shaped eliminates excess material, ensuring only what’s necessary is used, which significantly reduces waste,” he says.

Beyond its environmental advan-

tages, flexible packaging delivers cost savings by lowering material use, reducing transportation expenses, and minimizing waste-related costs, which makes it a win for businesses’ bottom lines.

“It also provides superior barrier properties and product protection, which helps extend shelf life and reduce spoilage—an essential benefit for both manufacturers and retailers,” says Corsillo.

Flexible packaging is incredibly versatile, making it suitable for a wide range of consumer products. Corsillo notes that its adaptability in design, material selection, and functionality means there are very few products that wouldn’t benefit from some form of flexible packaging. Whether it’s food and beverages, personal care items, household goods, or even pharmaceuticals, flexible packaging offers customizable solutions that meet the unique needs of different industries.

“Its lightweight nature, superior barrier protection, and ability to accommodate various shapes and sizes make it an ideal choice for many applications,” he says.

Looking at flexible packaging from a cost perspective, Corsillo explains that it can deliver substantial

Flexible packaging can meet the unique needs of different industries.

400

HP Indigo has sold close to 400 presses globally.

savings, but the extent to which it can “depends on the machinery upgrades and supply chain adjustments required to make the transition. While there may be upfront investment costs, these are often offset by longterm savings in material usage, transportation, and waste reduction, making it a worthwhile investment for many companies.”

Options and priorities

Selecting the right flexible packaging material is a critical decision that should be guided by expert advice, Corsillo adds.

“Partnering with a trusted packaging provider is essential. An experi-

enced partner will take the time to understand your specific goals— whether they’re related to sustainability, cost efficiency, or product protection—and recommend materials and designs that align with your needs and priorities.”

Eli Mahal, head of L&P marketing at HP Indigo, notes that flexible packaging is particularly suitable for food. “If you can move from the two-container strategy [where you have a bag within a cardboard box], and move to just one container, which would be a pouch, then you can save a lot,” he says, adding that this strategy will only work if the end result is consumer-friendly. “Con-

The flexible packaging industry is at the forefront of sustainability and innovation, with an ongoing focus on balancing environmental responsibility with high performance and consumer appeal.

– Tony Corsillo

sumers have to accept this type of packaging.”

Mahal adds that the look and feel of the final product is paramount, and that the choice of materials, colours, inks and overall design can convey a range of messages to consumers. For example, a package with a matte finish might convey a message of quality and prestige, while a package that looks more like paper comes across as more environmentally friendly and recyclable.

Printing methods

When it comes to printing methods, Mahal explains some of the pros and cons of flexo, digital and gravure.

“By far, CI flexo is the most common way to make flexible packaging, and solvent inks are commonly used. Then you have different types of lamination—we see primarily solvent-based and solvent-less. When it comes to digital print, most of our customers will use solvent-less to shorten the time between print

CI flexo is the most common way to make flexible packaging.

The HP Indigo 200K digital press.

lamination and delivery. When you need high quality, you can use gravure, and then you also have digital printing.”

Mahal notes that the boom in flexible packaging can offer commercial printers new business opportunities, but that the transition is complex and challenging.

“Commercial printers are facing a relatively stagnant, if not declining market,” he says, “and they’re trying to find new markets. Some will go into packaging, but mostly folding cartons, because they’re using the same type of sheet-based offset technology that they’re more familiar with. So this is an easier diversification strategy for them.”

Other commercial printers will go into labels, Mahal explains.

“They have expertise in processing many jobs and delivering them to market in a very fast time,” he says. “If you look at the close to 400 presses we have worldwide, about a third were bought by label converters that are using this technology to diversify into flexible packaging, primarily standard pouches and shrink sleeves—which can be classified as both flexible packaging and as labels.”

The move into flexible packaging is more complex, Mahal adds, “and

it requires a lot of expertise. We have some customers that have made this migration, and have hired experts to help them do it, but moving from commercial printing into flexible packaging is not a very common diversification strategy today.”

Future of flexible packaging

Looking towards the years ahead, Corsillo notes that the future of flexible packaging is incredibly exciting, driven by innovation, sustainability, and evolving consumer demands.

Corsillo says that we will see innovations in sustainability, including the continued development of recycle-ready materials and mono-material structures that will improve recyclability. We’re also going to see more smart packaging, wherein technologies such as QR codes, NFC tags and temperature sensors will enhance consumer engagement and product traceability.

Additionally, advances in digital printing and design flexibility will

It’s important for packaging providers to recommend materials and designs that align with their client’s business needs and priorities.

allow for more personalized and targeted packaging options, while functional improvements will improve barrier properties for better protection and longer shelf life.

“The flexible packaging industry is at the forefront of sustainability and innovation, with an ongoing focus on balancing environmental

responsibility with high performance and consumer appeal,” says Corsillo. “As technology evolves, the possibilities for packaging solutions will continue to expand, offering CPG companies new ways to enhance their products and reduce their environmental impact.”

Your new production printing partner

Kyocera has dec ades of experience in helping business es to achieve their goals.

(15A household power)

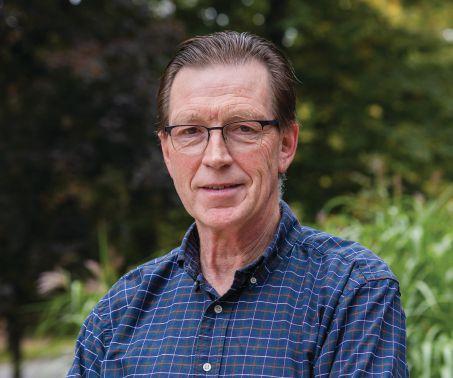

GROWTH BRINGS STRATEGIC SHIFT

How

Simpson Print is preparing for the future

By Nithya Caleb

In May 2024, Simpson Print in Bloomingdale, Ont., appointed Alec Couckuyt, an industry veteran with more than 30 years of professional experience, as interim company president and COO. Carla Johanns, who was the president, became the company’s CEO. I spoke to Johanns, who is a shareholder in the company, about these organizational changes.

“Our organization really experienced record-breaking growth since May 2020. I’ve had my most challenging year in running a business and that came from what I view as explosive growth and success. It was a very pivotal time for me and the company.

We needed an outside consultant to assess and develop a strategic plan that would allow us to navigate how we would become more deliberate in each of [our business] silos and ensure we continue to drive innovation, growth and most importantly, cost savings to our valued customers,” explained Johanns.

Couckuyt is a seasoned business strategist with extensive international management experience. He specializes in guiding organizations through strategic transformations. Before Simpson Print, Couckuyt was the interim president of Maracle, a mid-sized, 100+-year-old commercial printer in Oshawa, Ont.,

from June 2022 to Feb. 2024 where I suspect his focus was process improvement and business strategy. Maracle has since been acquired by Michael Hothi, owner of Ottawa-based Trico Packaging and Print Solutions and Toronto-based Canadian Printing Resources.

Given Couckuyt’s experience, Johanns believed he could help Simpson Print sharpen its focus and map out the next 60 years of growth. Johanns’ trust wasn’t misplaced. During the five months that he was there, Couckuyt provided a strategic roadmap for Simpson’s senior management to implement.

A decade of growth

In 2012, Johanns took over as company president to mainly help stabilize a business that was reeling

from the tragic death of its leader, Johanns’ younger brother. At that time, Simpson Print went from a $13-million business to just under $9 million.

“We lost almost $3 million in 90 days. I sat in the hallway and did what comes naturally: sell,” recalled Johanns, when I interviewed her in 2021.

Johanns, a goal-oriented individual, managed to successfully turn around the company’s fortunes. Simpson has now tripled its business to approx. $18 million.

The company offers structural design renderings, print fabrication including millwork, postpress and die cutting, fulfillment, logistics, in-store signage, OEM nameplate identification and labels, temporary display/ activations, packaging and installation and/or de-installation.

Johanns is aware of her strengths as a leader, which are creative thinking and agility. She also knows her weaknesses and has worked hard to enhance her leadership skills as well as to move a company that’s been ravaged by suicide from loss to growth.

“I’ve done a tremendous amount of executive coaching and mindful leadership programs since I came back here because I was aware of how fractured and dark the culture was after my brother’s suicide. I had to compartmentalize and create a bit of an armour around myself. I personally have been constantly challenged and must re-analyze and redefine myself,” she shared.

Johanns understood she couldn’t grow Simpson in the pre-COVID manner and needed new strategies, especially since her goal is to build an “empire in wide format in North America”. Equally important was Simpson’s organizational structure. Not in the distant past, Simpson had a middle management team, a lead supervisory structure and everybody reported to Johanns. Given the scale of growth, it isn’t sustainable for Johanns to singlehandedly manage the company’s daily operations. She must focus on the big picture, as the print

We needed an outside consultant to assess and develop a strategic plan that would … ensure we continue to drive innovation, growth and most importantly, cost savings to our valued customers. – Carla Johanns

industry is ever evolving and hyper-competitive.

Couckuyt built an organizational chart for Simpson and hired a director of operations, who Johanns can’t praise enough. Well done, Gopan Vakkeel Nair!

“He’s exactly what I had envisioned He is taking [Alec’s] strategic plan and is under the hood in the weeds driving those initiatives for me,” said Johanns.

Business goals

The number one goal for Simpson Print over the next two years is complete digitization of workflow.

“It is not an overnight process. There are 150 variables that impact outcome, and that includes people’s behaviour, people’s mindset, people’s relationship to organization and management, and how do you adapt to software,” shared Johanns.

Complete digitization will take time, as Simpson Print is one of the most diversified print companies in Canda. They have ISO-driven OEM clients that audit them on the label manufacturing side of the business. Another silo is large format retail where Simpson is heavily into events, activation, custom millwork installation and structural design.

“We are so much more than print. We have to be able to take your information from point of conception and everything that you provide us has to become a digital artifact. We [must] manage that digitally right through to logistics, warehousing and co-packing. That’s really the next chapter of this organization. On the retail side, we’ve taken our clients on the story of automation. So whatever their systems are, my systems are going to mirror and match them, so it becomes effortless really to work with us as a vendor,” explained Johanns.

Diversification is another focus area for Johanns.

“Our top 10 clients represent 67 per cent of my bottom line. I have a mandate to diversify this organization. The legacy of our last 16 years is 70-30 US-Canadian business split. I want it to maybe become a 50-50 split,” she said.

It is laudable Johanns recognized the structural issues within the Simpson organization and took the steps required to prepare the company for its next phase for growth.

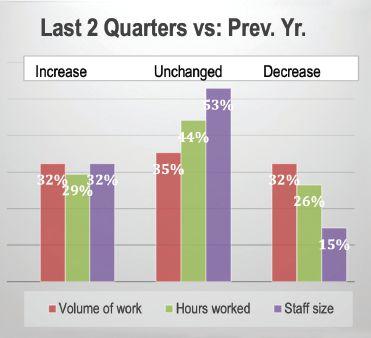

STATE OF THE INDUSTRY

By PrintAction Staff

Connecting for Results (CFR) and the Canadian Printing Industries Association (CPIA) conducted the 2024 Industry Insights Survey for Canada recently. With so many changes and dynamic challenges facing printers, the goal was to provide a better understanding of the current state of print in Canada. This online survey was conducted in July-August 2024 and had around 30-40 responses.

PARTICIPATION

The responses were well balanced from all industry segments, including size, industry focus, and location. The

survey was translated and 26 per cent of the participants represented Quebec. Atlantic was 12 per cent, Ontario 50 per cent, and western provinces 12 per cent.

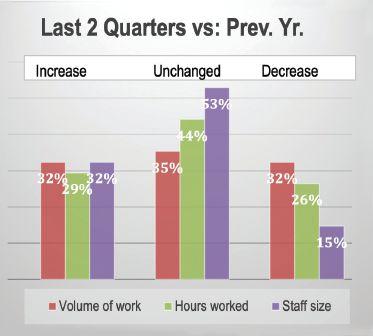

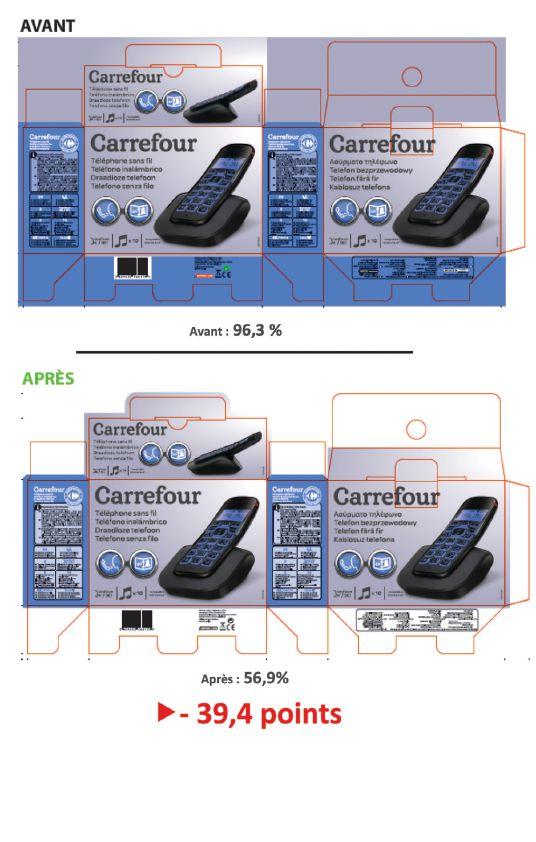

INDUSTRY CONDITIONS

Over the last two quarters, compared to the same period previous year, the companies reporting a sales increase (41 per cent) was balanced by the companies reporting a sales decrease (41 per cent). Therefore, it appears that printers are just ‘trading work’. Margins remained the same for 50 per cent, however decreased for 29 per cent of printers, and increased for just 21 per cent. It appears that some, but

not all, of the increased sales is coming at the expense of margins.

That being said, 41 per cent also indicated that they were able to raise prices greater than inflation, while 21 per cent were not. This may indicate that there is less work to go around, however production questions will confirm.

For the volume of work, those reporting an increase (32 per cent) was offset by those reporting a decrease (32 per cent). The gap of 10 per cent from those reporting revenue increase appears to confirm that there is less work to go around, and revenue increases may have been in part due to higher prices.

Have your say Comments from survey participants

Bankruptcies and/or plant closures are not a good look for our industry and will impact suppliers and other stakeholders. We are hopeful that everyone will be financially responsible and at the same time concerned that the cost of the market correction will impact the remaining businesses negatively.

As the industry changes, we need to constantly look for new products to produce. This isn’t very hard as I still feel there are many things our business can make; however, they require new equipment and different customers. This means radical investment in new equipment, and a significant amount more work for our sales team. All of which means higher costs and lower margins.

We are investing in finding environmentally friendly substrates—they are always move expensive and clients not willing to pay more.

Our direct mail division is a going concern as clients move budgets to digital.

Finding skilled labour, press operators in particular, is a challenge.

Succession planning is a priority.

The need and challenge to hire staff was either moderate or severe for 66 per cent of survey respondents. 66%

Our industry is shrinking, whether from companies getting acquired or closing entirely, or from the pool of applicants shrinking. Programs like GCM [Graphic Communications Management program at the Toronto Metropolitan University] and PELT [Print Entry Level Training program in B.C.] can only go so far. Our industry needs to do more to gain exposure in the workforce as a desirable career, and we need to do a serious deep dive into what we are paying our talent. I happen to work for a company who pays well, but we are one of only a few. Since the recession, print and supplier companies (especially small and medium sized) have tightened their wallets due to fear of failure financially and it is not helping our industry. Companies that come in and undercut all the prices do not help our industry. We cannot lead from a place of fear and always go for the cheapest option to win business; we must work smarter, provide better quality, service, turnaround, and we should have regulated price points to keep the market fair. This would push companies to turn to innovation and improving their offerings rather than just lowering their prices until they can’t afford to do business.

All factors play a part in making the business climate less desirable. Rising interest rates make borrowing riskier. Inflation makes life tough for our employees and puts a lot of pressure on us to keep their wages competitive. Inflationary pressures cause other businesses to pull back advertising dollars because they have less discretionary spending. Carbon taxes are robbing profits from printing companies and every other business as well which means less money to spend on investment or advertising. Machine costs are crazy high today. Parts are getting harder to find and prices are sometimes exorbitant. Our clients are producing same jobs with less quantity per job. Means we need to find more work to sustain our current capacity. With less work everywhere this makes things challenging. Rising transportation costs make it more difficult to compete outside of Canada and even further across Canada.

LABOUR CHALLENGES CONTINUE

The need and challenge to hire staff was either moderate or severe for 66 per cent of the respondents, with the following positions being the hardest to fill:

• skilled production labour – 56 per cent;

• sales staff – 47 per cent; and

• operations staff – 24 per cent. Companies have done the following to help overcome these issues:

• increase starting salaries – 74 per cent; and

• offer flex time / reduced hrs – 56 per cent.

To keep the current staff satisfied 53 per cent of survey respondents

have increased compensation so that it is greater than the cost of living. Many companies focused on ensuring employee satisfaction, offering workfrom-home options (29 per cent) as well as the ones mentioned above.

STAFF SKILLS DEVELOPMENT

Another interesting finding was to inquire into where job skills have changed. It turns out that sales skills were reported as the highest change at 59 per cent of the respondents.

• sales – 59 per cent;

• operations management – 47 per cent;

• production staff – 47 per cent;

• executive management – 44 per cent;

Our industry needs to do more to gain exposure in the workforce as a desirable career, and we need to do a serious deep dive into what we are paying our talent.

• production management – 44 per cent; and

• marketing – 29 per cent.

Bob Dale, co-founder of Connecting for Results that had conducted this survey, expressed surprise at sales as the skill with the most changes.

“Sales is the hardest position to fill for many companies,” he said. “The fundamentals are still there, but the approach and the tools need to change.”

AI IS EMERGING

While there is lot of media coverage about AI, members of the graphic arts community do not appear to be adopting it in great numbers. Here are the top applications as reported:

• market research/ content creation – 38 per cent;

• graphic design/ layout/ creative –29 per cent;

• sales – proposal development – 26 per cent;

• pre-press automation – 21 per cent;

• production analytics – 12 per cent;

• service and training – 12 per cent;

• estimating – 12 per cent;

• job intake - onboarding – 9 per cent; and

• scheduling and planning – 9 per cent.

THE FUTURE

The majority of respondents (53 per cent) indicated general conditions were similar while a sizable percentage (29 per cent) indicated that general business conditions were worse over the last two quarters.

It’s positive to see that a good number (32 per cent) believe conditions will improve over the next two quarters and 53 per cent believe conditions will remain the same.

During the first half of 2024, we heard a lot of anecdotal stories from printers from across Canada of the challenges they were facing. While our industry is facing difficult times, the feedback based on this survey indicates that while there are success stories an equal number of printers are facing challenges.

During a virtual meeting with printers from across Canada, there was one positive comment: pricing appeared to have stabilized in general, and printers are not seeing quotes that are appearing to be less than the cost of paper from competitors.

PRINT HISTORY COMES ALIVE

PrintAction Staff

The Howard Iron Works Museum is the culmination of a dream shared by husband-and-wife Nick and Liana Howard. Having spent their careers in the industry as directors of Howard Graphic Equipment, the couple decided to create a unique facility focused on the printing industry.

In 2015, a location was purchased in Oakville, Ont., and after significant renovations, Howard Iron Works opened to the public in 2016. Admission to the museum is free.

“We were always interested in the rich history of print, so it seemed right that in 2015, when we purchased a

building in Oakville, we would expand our collection (we had quite a few artifacts at Meadowpine Building in Mississauga, Ont., before). We had a year of extensive renovations to deal with, and this was probably the most difficult part of getting the museum up and running,” explained Howard, museum founder and longtime writer of the Chronicle column for PrintAction Museums are fascinating places. Stories of past lives, successes and failures portray humanity’s struggle to invent and improve. They’re not just buildings filled to the brim with artifacts or library shelves groaning under the weight of hefty leath-

er-bound books. History has always been important and has much to teach about how we understand the world around us. The Notre Dame Cathedral in Paris can in some ways be considered as a museum. Built between 1163 and 1260 AD, Notre Dame is a marvel in design and construction. After the devastating fire in April 2019, this magnificent structure reopened late last year to the public after exhaustive repairs. Craftspeople spent five years relearning almost lost skills to rebuild the Paris landmark. Notre Dame shares much in common with museums. Man has always sought to study the past, which helps form opinions of the future.

Remember the lesson

Roald Dahl once said, “Forget the mistake, remember the lesson.” Howard Iron Works shares that same desire to enlighten and educate the public about one of the world’s oldest and most crucial professions: Printing. From the most significant blunders to wild successes, the museum takes you on a historical ride through the ages, especially 1835 to 1950. Stories of betrayal, poor judgement and missed opportunities are threaded with phenomenal triumphs—each offering lessons on mistakes that are even repeated today. Along the way, print’s fascinating rise to dominance is revealed, along with language that has permeated our daily speech. For example, ‘cut to the chase,’ ‘out of sorts,’ ‘mind your p’s and q’s,’ ‘typecast,’ and even ‘stereotype’ have origins that can be traced back to printing.

Gripping historical facts envelop every display. People from all walks of life imagined or improved machinery and techniques to satisfy the public’s thirst for news and knowledge. The printing press singlehandedly provided the key to spreading literacy worldwide, and Howard Iron Works captures some of the pivotal moments in every form of technology, from letterpress to offset. Each display weaves a historical journey, often of

Howard

Iron Works

captures

some of the pivotal moments in the printing industry through the exhibits.

type, the museum has a restored 1925 Intertype, a Ludlow, and a rare Japanese-made Man Nen typecaster, complete with Mandarin matrices.

As North America’s largest printing history museum, Howard Iron Works has something for everyone. The museum also caters to events for the printing industry and groups seeking a unique venue. Heidelberg Canada held their GM at the museum in August 2024, and Smurfit-WestRock had their year-end party there.

2016

The Howard Iron Works museum, Oakville, Ont., opened in 2016.

stubborn, struggling innovators bereft of 21st-century skills who forged genuinely remarkable inroads. Some went on to do extraordinary things outside of print. The Harris brothers are just one example. Today, L3 Harris is an $18 billion company with only the name Harris as a connection to two Ohio brothers who devised fantastic machines in the late 19th and early 20thcentury and went on to become the world’s largest printing press builder of that time.

Learn from the past

Printing and bookbinding were once an art and a skilled trade. Apprenticeships were typical for anyone wishing to enter the business. Many did and thrived as new inventions constantly altered how printing was performed. From handset type to the Linotype, quality and speed increased, newspapers got fatter, books cheaper, and colour possible. Howard Iron Works has many stories to share.

“We plan to continue adding events to the museum. Each year, we have a Printing Fair, which is happening on September 27 this year. We hope to continue having young and old visitors. This past year has been terrific, and we want to maintain the museum as long as we are able,” said Nick.

Howard Iron Works occasionally restores its inventory stock and shares these with companies and public facilities.

“The William L. Clements Library at the University of Michigan, the Museum of Printing in Haverhill, Mass., MET Printers in Vancouver, Gilmore Printing in Ottawa all have Columbian Iron Presses on display emanating from our museum,” shared Nick.

Howard Iron Works seeks to enlighten and educate the public about one of the world’s oldest and most crucial professions: Printing.

For instance, who could fathom that two German immigrants would upend the printing industry in 1814 London with a remarkable press that quadrupled production? Koenig & Bauer (K&B) became overnight successes when they designed and built a cylinder press for the London Times newspaper. Today, K&B is the world’s oldest printing press manufacturer. Or that two Welch brothers living in Chicago would go on to become the world’s largest supplier of rotary newspaper presses. Virtually penniless in 1885, GOSS dominated the global newspaper industry for over 100 years.

If you are interested in typography, Howard Iron Works has extensive displays of foundry (lead) type, wood type, and several typecasting machines. Besides the ubiquitous Lino-

The Landmark Center in Boston, Mass., and Saint Bede Abbey Press in Illinois each have multiple examples of restored machinery on display. Hollister, a $235-million health sciences company that began in 1921 as the printing company of John Dickenson Schneider, has on display in their Libertyville, Ill., headquarters a restored Gordon hand platen supplied by Howard Iron Works, as this was their first printing press.

North America’s oldest Columbian press, owned by Montreal’s McGill University, was built in 1821, completely restored, and now on display in their library. In 2024, Howard Iron Works donated to the Toronto Metropolitan University a 150-yearold R. Hoe hand iron press.

Museums can be integral to understanding how business works. Our current levels of achievement, from the smartphone to the internet, share the same lessons as the rocky road of letterpress to offset and now digital printing. For some, a visit is learning about the past—for many, it’s how we contemplate the future.

Eco-inking optimizes ink consumption without compromising the quality and visual impact of the printed material.

A STEP TOWARDS GREENER GRAPHICS

Eco-inking can help reduce the environmental impact of printed materials

By Fabrice Peltier

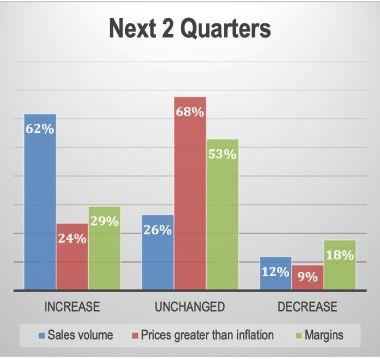

The common factor in many graphic creations, especially in packaging design, is that they are usually printed in large quantities to meet consumer demands. However, amid the focus on reducing packaging material consumption, one crucial aspect seems to have been overlooked: the environmental impact of printing inks. Often deemed insignificant, the inks used in graphic creations play a more substantial role than we might realize, both in terms of their ecological implications and economic considerations.

Understanding the composition of

ink reveals its complex nature, which consists of several components. The pigments, or colourants, provide the vibrant hues that capture attention and differentiate brands. The vehicle, or binder, acts as the carrier, enabling the ink to adhere to various surfaces effectively. Additionally, adjuvants are used to enhance ink properties, ensuring quick drying times or improved resistance to wear and tear.

Each graphic element, typographic character, shape, and colour thoughtfully chosen to convey the intended message represents a specific quantity of ink required for reproduction. By embracing eco-inking,

Eco-inking helps optimize ink consumption without compromising the quality and visual impact of the creations.

an ink saving process, designers can craft top-quality graphic designs while concurrently managing ink consumption during the printing process.

The eco-inking approach is best incorporated during the initial stages of design development, providing an intermediary step based on a well-conceived graphic proposal. However, forward-thinking designers may also consider eco-inking as an integral part of the entire design process, even at the conception of a brand’s graphic identity and guidelines.

The core objective of eco-inking is to optimize ink consumption without compromising the quality and visual impact of the creations. It seeks to achieve a harmonious balance between resource efficiency and creativity. Although changes made to ink usage might not be immediately apparent to consumers or readers, successful eco-inking initiatives have

Designers can reduce the environmental footprint of their work by implementing eco-friendly practices in materials selection and production processes.

demonstrated their potential to bolster a brand’s environmental credibility as well as resonate positively with the target audience.

Moreover, adopting an eco-design philosophy in graphics goes beyond reducing ink consumption; it encompasses a holistic approach to environmental stewardship. By implementing eco-friendly practices in materials selection and production processes, designers can reduce the environmental footprint of their work.

Beyond ink use reduction

Eco-inking also presents a compelling advantage when it comes to recycling. Graphic papers, extensively used for packaging and marketing materials, undergo a deinking process during recycling to ensure the purity of the resulting paper.

By minimizing the quantities of ink used in printing, eco-inked papers facilitate the deinking process, reducing the consumption of chemicals and energy required to remove inks from the recycled material. This, in turn, minimizes waste production and contributes to a more circular economy.

For brand owners aiming to reduce costs, eco-inking offers a potential source of savings. Using fewer inks directly impacts expenses, and opting for CMYK—or even CMY—printing can deliver outstanding results at even lower costs and with a reduced environmental impact.

The efficiency of the eco-inking approach has been proven by its practical application. Developed over a decade ago, this innovative technique has been meticulously tested on over 250 consumer product packages in France. The results have been nothing short of remarkable, consistently achieving an average reduction of ink consumption by 20 to 25 per cent while preserving the visual appeal and message impact of the original creations.

In conclusion, embracing eco-inking is not only a means to enhance the environmental sustainability of graphic creations, but also an opportunity for designers to stand as pioneers of change in the ever-evolving landscape of design and consumer consciousness. Together, we can make a meaningful contribution to safeguarding our planet’s resources and ensuring a greener, more promising future for generations to come.

FABRICE PELTIER is an expert in packaging design and works as a consultant. He can be reached at www.fabrice-peltier.fr or LinkedIn. This article is part of the Drupa Essential Series of Print.

ROLLEM INSIGNIA DIE-CUTTER

Sheet-fed production-built rotary die-cutter ideal for folding cartons, packaging, ID cards and shaped cards.

JETSTREAM XY FINISHING SYSTEM

High volume slit, score, perf, fold & glue. One-step system for direct mail, postcards and business cards.

ROLLEM 990 SLIT-SCORE-PERF

Economical and heavy-duty for shorter runs. All-in-one system packed with Rollem’s specialty functions.

To B2 or not

Choosing the right digital printing press for your business

By Alec Couckuyt

The rise of production digital printing over the past decade and a half has transformed the printing industry, fundamentally altering how businesses approach efficiency, quality and personalization. Starting in the early 2010s, inkjet web presses revolutionized direct mail and transactional printing by replacing blackand-white toner-based continuous feed presses. The initial appeal lay in good enough colour quality, combined with personalization capabilities and the cost efficiencies of a ‘white factory’ production model.

By the mid-2010s, the quality of the technology improved substantially, opening new opportunities in book printing, where longer runs and higher volumes justified the transition to inkjet web presses. Meanwhile, the adoption of digital sheetfed presses, in the smaller B3 size (14 x 19 in.) started flourishing in commercial printing.

These presses carved out a niche in specialty printing, enabling short-run, quick-turnaround jobs with personalization and expanded colour options.

However, the emergence of larger B2 digital sheetfed presses has

The Canon VarioPress iV7 can print up to 4.5 million B2 images per month.

sparked the potential for a more significant disruption. These presses directly overlap with offset printing for shorter runs, faster turnarounds, and variable data applications, creating a critical decision point for printers: Is it time to invest in a B2 digital press? And if so, which one is right for your business?

Brief history of B2 digital printing presses

The Canon VarioPress iV7, which can produce 8,700 B2 sheets per hour, was launched in May 2024.

Fujifilm’s J Press

750S prints 3,600 sheets per hour.

The first steps toward B2 digital presses began in 2011–12 with Fujifilm’s JPress 720 (inkjet) and HP’s Indigo 10000 (liquid toner). While neither was a true B2 press (smaller image area), they signalled the beginning of a shift toward larger digital formats. By Drupa 2016, the Konica Minolta KM1, Komori IS29 and Fujifilm JPress 750S were gamechangers in the B2 space, offering offset-level quality and operational flexibility. More recently we have seen the introduction of Ricoh’s Pro Z75 and Canon’s VarioPress iV7 digital B2 presses. HP continuously expanded their presses’ flexibility and productivity, with the HP Indigo 18K and 100K, their most recent. Unlike their smaller B3 counterparts, which complement offset, B2 digital presses directly compete with

certain offset applications, especially as demand grows for shorter run printing and personalization. This convergence raises the stakes: Is investing in a B2 digital press a smart strategic move for your business?

Five strategic considerations for choosing a B2 digital press

When advising clients on major investments, I emphasize aligning decisions with their overarching business strategy and vision. Here’s how to approach your due diligence process using five critical business competencies.

1. Operational excellence

Your new press should enhance efficiency across your entire workflow. Evaluate how it integrates with existing equipment and software. Consider uptime, ink coverage, drying times, maximum image size (B2 vs. B2+) and post-press compatibility for processes like coating, folding, creasing or laminating. If you operate a 40-in. offset press, analyze which applications could move to the B2 press to maximize both machines’ utilization, balancing capacity and cost efficiencies between the two systems. In your analysis,

consider offset make-ready costs, including time, plates and substrates.

2. Talent optimization

One often overlooked, yet critical factor when investing in a new press, is your team’s ability to effectively operate and maintain the equipment. Talent optimization ensures you have the right people with the right skills in order to maximize the press’s potential.

Start by assessing the user-friendliness of the press. Is it intuitive for operators to use, or will it require significant training? Consider the level of maintenance required— some presses are designed to be highly automated, reducing manual intervention, while others may demand more hands-on expertise.

Pay particular attention to prepress capabilities, as much of the decision-making for digital presses happens upstream in the prepress workflow. File preparation, colour management, and workflow optimization are increasingly the responsibilities of prepress teams rather than the pressroom.

3. Market positioning and client differentiation

When evaluating a B2 digital sheetfed press, consider how it will enhance your differentiation. Can it help you offer faster turnaround times, unique substrates ( e.g. synthetics, metallics textured stock), or higher-quality output that others can’t match? Will it allow you to enter untapped markets or provide value-added services, such as personalization at scale or short-run packaging? A clear understanding of your competitive edge ensures that your investment supports your market positioning, helping you attract and retain high-value clients.

4. Business agility and workflow integration

Incorporating a new press into your business isn’t just about printing— it’s about ensuring that your entire workflow is streamlined and efficient and aligns with your goals for overall business agility.

This means examining how easily the press integrates into your current workflow systems, such as MIS, ERP, or CRM platforms. Auto-

The B2 digital sheetfed press market has evolved into a competitive arena, with manufacturers vying to differentiate their offerings through technological innovation, service models, and integration capabilities.

mation capabilities, combined with AI can further enhance agility by reducing manual intervention, minimizing errors, and optimizing turnaround times. Consider whether the press supports seamless connectivity, allows for remote monitoring, predictive analytics or offers smart automation features that simplify complex operations.

5.

Financial viability and ROI analysis

Finally, no investment decision can ignore the numbers. Financial viability involves a deep dive into both the direct and indirect costs associated with acquiring and operating a press.

Direct costs include the purchase price, installation, and maintenance. Indirect costs often involve energy consumption, consumables, downtime, real estate etc. At the same time, focus on revenue-generating opportunities the press unlocks. How many additional jobs can you take on? Will the press enable premium pricing due to better quality or unique capabilities?

Conduct a detailed ROI analysis, considering the payback period, total cost of ownership, and longterm profitability. Also, consider if tax incentives or government grants

Marc Gagnon and Alex Legue from Graphiscan with Steve Daigle from HP. Graphiscan, Quebec, installed the HP Indigo 100K digital press in early 2024. It was the first printer in eastern Canada to use this press.

are available for technological investments.

Making your next move count

The B2 digital sheetfed press market has evolved into a competitive arena, with manufacturers vying to differentiate their offerings through technological innovation, service models, and integration capabilities. Yet, the ultimate decision to invest in a press isn’t just about the specifications or price tag—it’s about the strategic fit with your business goals.

Beyond the five critical business competencies discussed, it’s essential to maintain a future-oriented mindset. The printing industry is in a constant state of evolution, as sustainability, automation, and AI integration reshape business operations. Choosing a press that aligns with these long-term trends can position your company as a forward-thinking leader in the industry.

Linking strategy and leadership

At its core, deciding on a B2 digital sheetfed press isn’t just an operational choice; it’s a strategic one. It reflects your company’s direction, priorities, and readiness to adapt to a rapidly changing market. As a strategist and industry advisor, I have guided businesses through similar pivotal decisions. I’ve seen firsthand how thoughtful strategy development and disciplined execution can drive extraordinary results.

If you’re considering your next step in digital printing, I’d encourage you to think not just about what your business needs today, but where you want to take it tomorrow. A wellchosen investment in technology, guided by a solid strategy, can position your company to thrive in this dynamic industry.

Whether you’re navigating a technology investment or shaping your company’s future, the principles of strategic leadership can be a powerful compass.

ALEC COUCKUYT is a business strategist, economist, published author, and speaker with extensive international management experience. He can be reached via email at alec@agcconsulting.ca.

Showcasing the latest offerings from HP, Fujifilm,

Huge Paper, Xante, XSYS, NJM and X-Rite

Xante’s new press

Xante introduces the X-24 UV Flatbed Printer. The X-24 builds on the X-16, and offers enhanced features, including increased production speed and 3D texturing capabilities. It has a dual-head configuration, equipped with Epson i3200 printheads. This allows print shops to choose between CMYK & White or dual CMYK heads. It’s designed with a 24 x 18 in. full-bleed print bed, supporting a wide range of media, including coroplast, wood, glass, and metal. It can handle substrates up to 6 in. thick.

New latex press from HP

HP launches its HP Latex FS50 and FS60 series of printers. The HP Latex FS50 is a scalable platform ready to address growing business needs, suitable for large PSPs seeking efficiency in super wide format printing. Similarly, the HP Latex FS60 prints at speeds of up to 89 m²/

hour. The scalable platform of the HP Latex FS50 and FS60 allows for easy integration of future enhancements while offering a longer lifespan and reduced environmental impact. With water-based odourless prints and no hazardous air pollutants , the HP Latex FS50 and FS60 series meet environmental certifications. The HP Latex FS50 is available worldwide, while the HP Latex FS60 is offered in selected regions.

New Revoria presses

Fujifilm launches four new midrange production presses in the Revoria Press series. The Revoria Press EC2100S (EC2100S) and Revoria Press SC285S (SC285S) are equipped with a specialty toner station in addition to its four-colour toners, enabling five-colour printing in one pass. The new Revoria Press EC2100 (EC2100) and Revoria Press SC285 (SC285) are four-colour presses. The

EC2100S and EC2100 presses print 100 pages per minute and are primarily utilized for commercial printing and quick printing applications, while the SC285S and SC285, with printing speeds of 85 pages per minute, are best suited for quick printing and in-house printing environments. The new presses can handle paper weights of 35 to 147 lb, and paper sizes from a minimum of 3.5 x 5.7 in. up to 12.9 x 51 in.

Huge Paper launches new synthetic papers

Yupo partners with Huge Paper to launch their newest synthetic product line, SuperYupo in Canada. SuperYupo is the first Yupo synthetic paper that can be printed on both sides with regular paper inks. It’s tear- and water-resistant, resistant to fading under UV light, and resistant to mineral oils.

XSYS’s new flexo plate

XSYS launches Nyloflex XSN, its newest innovation in flexographic plates for narrow web printing. The Nyloflex XSN is a flat-top dot plate compatible with thermal and solvent processing methods. The plate’s formulation prevents ink buildup on the plate surface, reducing the need for frequent cleanings.

NJM’s label splicer

NJM, a ProMach product brand, introduces a new Unisplice 413 automatic label spli-

NJM Unisplice 413 can handle label rolls up to 18 in. in diameter and web heights up to 5.25 in.

cing system. This proprietary technology detects when a label roll needs to be replaced and automatically cuts and joins the end of the expiring roll to the beginning of a new roll. Compatible with all pressure-sensitive labellers from NJM as well as those from other suppliers, Unisplice can be integrated with new and existing labellers in a wide range of applications including pharmaceuticals, nutraceuticals, medical devices, cosmetics, personal care products, foods, and chemicals. It can handle label rolls up to 18 in. in diameter and web heights up to 5.25 in.

X-Rite’s Judge LED light booth helps brands with LED-based colour assessments.

LED light booth byy X-Rite

X-Rite releases the Judge LED light booth, designed for precise visual colour evaluation as industries shift from fluorescent to LED lighting. This new light booth incorporates advanced LED technology to ensure compliance with environmental regulations and helps brands and suppliers transition to LED-based colour assessments.

Brandon Townsend / president / Promotional Print and Packaging

As president of Promotional Print and Packaging (PPP), Brandon Townsend is busy growing a young company. Based in Pickering, Ont., PPP operates out of a 125,000-sf facility where they manage every step of the print process from concept to retail. They offer design, wide-format printing, litho mounting, digital finishing, die-cutting, and co-packing. Townsend also runs Juicyflutes, a web-to-print platform specializing in custom packaging. Here, the 40-year-old shares his perspective on the print industry and why he loves being a part of one of the world’s oldest industries.

What is the state of the print industry today, in your opinion?

BT: Broader trends like the retirement of baby boomers and the challenges of succession planning, combined with financial pressures from the pandemic, have accelerated consolidation within the industry. Larger players continue to acquire smaller companies. This consolidation brings challenges and opportunities. While economies of scale can improve efficiency, they also highlight a critical need for companies to stay agile and focused on delivering value to customers.

What attracted you to the industry?

BT: I was born into the print world. My grandfather began his career in offset print and lithography in the 1950s, worked his way through the ranks in the paper industry until he became CEO. My father followed in his footsteps, working in sales for the same business. Meanwhile, my mother launched the company I lead today. While I grew up surrounded by print, what drew me in was not just the family legacy, but also the opportunity to grow a business. The unique challenges of navigating an ever-evolving industry, solving operational puzzles, and finding ways to innovate within a competitive landscape captured my interest. It’s the combination of tradition and innovation that keeps me passionate about the industry.

How can the industry attract more young people?

BT: Attracting young talent starts with visibility. Advocacy is key, as is partnering with programs like Toronto

Promotional

Print and Packaging has a 125,000-sf facility in Pickering, Ont.

Printers must adopt systems that enhance quoting accuracy, accelerate speed to market, and optimize internal supply chain planning.

Metropolitan University’s Graphic Communications Management and initiatives like PrintScholarships.ca. Internships and co-ops can provide hands-on experience to spark interest early. The industry also needs to showcase its tech-driven evolution, from advanced automation to sustainable practices, which resonate with younger generations. As print becomes more digital, it’s becoming more enticing to those who value creativity, problem-solving, and technology. By broadening its appeal and emphasizing innovation, print can attract a new wave of talent.

In such a competitive landscape, how can printers win more sales?

BT: Businesses need to focus on operational excellence powered by technology. Printers must adopt systems that enhance quoting accuracy, accelerate speed to market, and optimize internal supply chain planning. Success starts with understanding costs deeply, building sustainable pricing models, and ensuring that materials and resources are always in the right place at the right time. Equally important is investing in technologies and workflows that simplify processes. Ultimately, it’s not

about selling a service; it’s about delivering consistent value and demonstrating reliability, which builds trust and long-term relationships.

What are some of the biggest opportunities in the print industry?

BT: Brands are under pressure to meet environmental goals, and printers offering recyclable or reusable solutions will have a competitive edge. The shift toward short-run, high-quality digital printing for personalization is another growing market. Lastly, the integration of AI and ERP systems offers untapped potential to drive operational efficiencies and enhance customer experiences.

What do you think is the most exciting thing about print today?

BT: From augmented reality to innovative substrates and eco-friendly inks, there’s so much happening. Print remains one of the most impactful ways for brands to communicate and connect with consumers, which keeps it relevant and dynamic.

Brandon Townsend’s response was edited for length. For more Q&A Spotlight interviews, please visit www.printaction.com/profile.

The digital future for flexible packaging print

Built on FUJIFILM’s industry-leading, proven inkjet technologies, the J Press FP790 defines mainstream flexible packaging in the new era of digital print.

The J Press FP790 helps printers and converters adapt to changing market dynamics that are driving smaller print runs, shorter product life cycles, and faster delivery times. This groundbreaking new press sets a new standard for sustainable production and fits seamlessly into existing production environments. Learn more at print-us.fujifilm.com.