Making the invisible visible 12 16 22 6

A close look at the fast-growing DTG printing market and the technologies fuelling demand

GAMUT

5 News, People, Installs

8 Calendar

NEW PRODUCTS

20 Introducing new solutions from Bobst, Ricoh, Sun Chemical and Zünd

SPOTLIGHT

22 Sean Murray, president and CEO, Advocate Group

ISSN 1481 9287. PrintAction is published 6 times per year by Annex Business Media. Canada Post Publications Mail Agreement No. 40065710. Return undeliverable Canadian addresses to: Circulation Department, 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1. No part of the editorial content in this publication may be reprinted without the publisher’s written permission. © 2022 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of this publication. Printed in Canada.

COLUMNS

FROM THE EDITOR

4 Nithya Caleb

The state of AI adoption

INSIDER

8 Bob Dale and Morris Slemko

Cash flow management

CHRONICLE

10 Nick Howard

Meet the younger Tanzer brother

TECHNOLOGY REPORT

16 Jan Sierpe

The latest McKinsey Global Survey on artificial intelligence (AI) indicates AI adoption is growing, and that the benefits remain significant.

The survey was conducted from May 18 to June 29, 2021. It covered nearly 1,800 respondents from across a range of industries around the globe.

Fifity-six per cent of participants in the latest McKinsey survey on the state of AI around the world reported using AI in at least one function.

The survey content and analysis were developed by Michael Chui, a partner of the McKinsey Global Institute and a partner in McKinsey’s Bay Area office in the US; Bryce Hall, an associate partner in the Washington, DC, office; Alex Singla, a senior partner in the Chicago office; and Alex Sukharevsky, a senior partner in the Moscow office.

Fifty-six per cent of survey respondents reported AI adoption in at least one function, up from 50 per cent in 2020. AI adoption was common in service operations, product and service development, and marketing and sales. The top three use cases were service-operations optimization, AI-based enhancement of products, and contact-centre automation.

The results also indicate AI’s impact on the bottom line is growing. The share of respondents reporting at least five per cent of earnings before interest and taxes that’s attributable to AI has increased year over year to 27 per cent, up from 22 per cent in the last survey.

Respondents also reported greater cost savings from AI than previously. The biggest year-over-year changes was in product and service development, marketing and sales, and strategy and corporate finance. Nearly two-thirds of the respondents said their companies’ investments in AI will continue to increase over the next three years.

This is the fourth annual survey on the state of artificial intelligence by McKinsey, and for the first time, MLOps (machine-learning operations, meaning best practices for the commercial use of AI) and cloud technologies emerged as critical differentiators.

The survey looked at the practices of companies seeing the biggest earnings boost from AI (high performers) and found they were not only following best practices, such as including MLOps, but also spending more efficiently on AI and taking advantage of various cloud technologies.

“There’s evidence that engaging in such practices is helping high performers industrialize and professionalize their AI work, which leads to better results and greater efficiency and predictability in their AI spending. Three-quarters of AI high performers say the cost to produce AI models has been on par with or even less than they expected, whereas half of all other respondents say their companies’ AI project costs were higher than expected. Going forward, the AI high performers’ work could push them farther ahead of the pack because both groups are planning to increase their spending on AI by roughly the same amount,” said the report’s authors.

The survey also found high performers run 64 per cent of their AI workloads on public or hybrid cloud, compared with 44 per cent at other companies. “This group is also accessing a wider range of AI capabilities and techniques on a public cloud. For example, they are twice as likely as the rest to say they tap the cloud for natural-language-speech understanding and facial-recognition capabilities,” said the report’s authors.

High performers are more likely than other organizations to engage in a range of activities in order to mitigate their AI-related risks—an area that continues to be a shortcoming for many companies’ AI efforts.

Cybersecurity was the most recognized risk among respondents. When asked why companies aren’t mitigating all relevant risks, survey respondents said it’s because they lack capacity to address the full range of risks they face and have had to prioritize. The secondmost common response from those seeing lower returns from AI adoption is that they are unclear on the extent of their exposure to AI risks.

Access the full report at www.mckinsey.com/business-functions/mckinsey-analytics/our-insights/global-survey-the-state-of-ai-in-2021.

Reader Service

NITHYA CALEB Editor ncaleb@annexbusinessmedia.com

Print and digital subscription inquiries or changes, please contact Barbara Adelt, Audience Development Manager

Tel: 416-510-5184

Fax: 416-510-6875

Email: badelt@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Editor

Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

Contributing writers

Bob Dale, Morris Slemko, Nick Howard and Jan Sierpe

Media Sales Manager

Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

Media Designer

Lisa Zambri lzambri@annexbusinessmedia.com

Account Coordinator

Alice Chen achen@annexbusinessmedia.com 416-510-5217

Group Publisher/VP Sales

Martin McAnulty mmcanulty@annexbusinessmedia.com

COO Scott Jamieson sjamieson@annexbusinessmedia.com

Subscription rates

For a 1 year

subscription (6 issues): Canada — $43.00 +Tax Canada 2 year — $70.50 +Tax United States —$98.00

Other foreign —$191.00

All prices in CAD funds

Mailing address

Annex Business Media 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

Occasionally, PrintAction will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Business Media Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

PrintAction is printed by Annex Business Media Printing on Creator Gloss 80lb text and Creator Silk 70lb text available from Spicers Canada.

ISSN 1481 9287

Mail Agreement No. 40065710

January/February 2022 | Vol. 61, No. 1 printaction.com

HP introduces HP xRServices, powered by Microsoft Hololens 2. This solution creates a virtual-real world combination in which customers can connect with HP engineers through mixed reality.

Wearing the Microsoft Hololens 2 headset and supported by HP xRServices solution, users will get the feeling of being physically present with a virtual coach who will guide them through the process, meaning no time is wasted on long service calls.

Paper Excellence B.V. and Domtar Corporation have received Canadian Competition Act approval for their business combination whereby Karta Halten B.V., an affiliate of Paper Excellence, will acquire all of the issued and outstanding shares of Domtar common stock for $55.50 per share in cash pursuant to an agreement and plan of merger dated May 10, 2021. Following the merger, Domtar’s pulp mill in Kamloops, B.C., must be sold to resolve the commissioner’s concerns about the merger’s implications on the purchase of wood fibre from the Thompson/Okanagan region, British Columbia.

Sydney Stone acquires Philips Graphics Services. Its owner Henry Stojanowski joins Sydney Stone’s service team. Existing customers of Philips Graphics have the option to continue using the same phone number they have in

the past to schedule service. They can also call 1-800-6686055 or 905-673-9641, or e-mail their requests to service@printfinishing.com.

Hybrid Software Group partners with Ecologi, a platform that facilitates the funding of carbon offset projects and tree planting around the world, to offset its carbon footprint.

The company has offset 655 tonnes of CO2e and contributed to environmental projects across the globe, such as solar power generation in Tamil Nadu and Telangana, India, and using waste biomass to produce electricity in Chile.

The International Hologram Manufacturers Association honoured Hazen Paper for the second year in a row for “Best Applied Decorative/Packaging Product” at the 2021 Excellence in Holography Awards. Hazen captured the judge’s attention with the 2020

enshrinement yearbook produced for the Naismith Memorial Basketball Hall of Fame in Springfield, MA. The book employed holography to create a dynamic, 3D image of the Hall of Fame’s iconic dome and spire and its panoramic interior, which was overprinted with a collage of the year’s inductees in action. The back cover featured holographic treatment of Connecticut’s Mohegan Sun, the location of the enshrinement ceremony.

Calgary-based on-demand print and information solutions provider WCD used Drytac Protac AMP film with antimicrobial protection to help prevent the spread of COVID-19 at a warehouse.

Drytac Protac AMP functioned as a laminate and was applied to surfaces throughout the kitchen area. The clarity of the film meant the graphics design underneath was clearly visible.

Additionally, Protac AMP did not impact the performance of the graphics or the food preparation surfaces.

Konica Minolta Business Solutions (Canada) receives a Buyers Lab 2022 Pick in the Document Imaging Software category. This accolade recognizes the most impressive solutions evaluated by Keypoint Intelligence during a 12-month test cycle. Konica Minolta’s Dispatcher Phoenix Document Workflow Solution also won the award for Outstanding Workflow Automation Platform.

Bobst had implemented a price increase of up to five per cent on all machines and related peripherals. An average cost increase of five per cent on spare parts has also been rolled out. According to Bobst’s procurement data, the prices of raw material and freight costs have risen significantly.

Significans Automation partners with software developers Tilia Labs and Motionalysis to offer a comprehensive workflow automation solution to its print and packaging customers. Clients using Tilia Labs’ planning and imposition software along with Motionalysis’ tools for measuring actual performance can now integrate their systems and maximize their hardware and software investments.

The Canadian Print Scholarships introduces a new job board that is exclusive to its donors and recipients of Canadian Printing Industries Scholarship. The job board is designed to help donors and their HR team recruit, hire and build brand awareness. Donors will have access to an exclusive scholarship community of students and graduates of which more than 90 are currently enrolled in post-secondary graphic communications programs across Canada.

Cincinnati-based Michelman announces executive leadership changes. Dr. Rick Michelman is the new president & CEO. Andrew Michelman, the company’s chief business development officer and EVP, Asia and Fibers & Composites, will assume additional leadership responsibility for Michelman’s Americas region and Coatings business segment. Paul Griffith, Michelman’s chief marketing officer & EVP, EMEA and Agriculture, will add leadership of its Printing & Packaging business segment to his responsibilities. Jason Wise assumes the role of chief financial and risk officer.

Konica Minolta Business Solutions U.S.A., Inc., hires Mike Lee as senior vice-president, chief information officer. In his role, Lee will be responsible for driving the company’s current digital transformation strategy within information technology across the business in the US, as well as supporting its efforts globally. He will also lead Konica Minolta’s IT organization and provide the vision and technical guidance needed to enable the company’s ongoing growth.

Jukebox Print acquires its first HP Indigo digital press. The 19-in. HP Indigo 7900 press is fully loaded with special capabilities to create raised and textured effects and print on thick substrates.

names Andrew Bailes-Collins as head of product management. Previously a senior product manager at Enfocus for the PitStop family of products, Bailes-Collins started his career in prepress, and for the last two decades has been working within product management with PDF-based prepress applications. Bailes-Collins is also technical officer of the Ghent Workgroup and is an industry expert in the utilization and tools for PDF workflows.

Nazdar appoints Shawn Butson as narrow web technical sales representative for USA’s Northeast region. Butson is responsible for providing technical support, increasing sales and creating customer awareness of Nazdar narrow web products.

Heidelberg appoints Ludwin Monz as the new CEO from April 1, 2022. He will take over from Rainer Hundsdörfer. Monz was previously the chair of the management board of Carl Zeiss Meditec AG. Monz was a member of the management board since 2007. He has a doctorate in physics from the University of Mainz and an MBA from the Henley Management College in the UK.

Ellis Paper Box in Mississauga, Ont., installs a new Komori GLX 6-colour 41-in. press with a coater.

Winnipeg-based Corporate Source Graphic Solutions has installed a Kongsberg X24 cutting table.

March 16-18, 2022

Print UV

Las Vegas, Nev.

March 22, 2022

Women in Manufacturing Virtual

April 20-21, 2022

Visual Graphics Industry Grand Rendezvous Laval, Que.

May 31-June 03, 2022

FESPA Global Print Expo Messe Berlin, Germany

June 02-June 03, 2022

2022 Supporting Women in Trades Conference

St.John’s, N.L.

June 07-09, 2022

EskoWorld 2022

Grapevine, Texas

June 14-16, 2022

Amplify Print Minneapolis, Minn.

Does it feel like you’re going the wrong way down a one-way street?

By Bob Dale and Morris Slemko

BBusiness challenges remain strong. Competitive pressures and limited paper supply were compounded by the challenge of assimilating the never-ending notices of paper and other consumable price increases.

ased on two industry surveys sponsored by PrintingUnited Alliance and conducted by NAPCO Research, 2020 sales decreased by 24 per cent for the industry as a whole although specific company results varied dramatically. However, in the first two quarters of 2021, sales rebounded 15 per cent. This increase is a bit misleading since there is still a large gap from 2020 to 2021. A decrease of 25 per cent requires an increase on the reduced amount of 33.3 per cent to just get even.

Many companies have developed a reliance upon government benefits. Programs ended or changed substantially in the fall of 2021, thus reducing the financial support. This is no surprise, as we all knew it was coming.

Business was recovering slowly until this last quarter. According to major Canadian paper merchants, demand for paper in this last quarter exceeded demand in the previous four quarters. Business challenges remain strong. Competitive pressures and limited paper supply were compounded by the challenge of assimilating the never-ending notices of paper and other consumable price increases.

Companies that took action during the pandemic to manage expenses to volumes,

Companies must take a close look at managing cash flow due to a substantial increase in raw material costs and freight rates, as well as a reduction in government subsidies.

improve efficiencies and conduct housekeeping (i.e. clean up estimating standards) fared better than those that did not. Further, there was a need to adopt a cautious approach to business recovery by gradually increasing costs while basing the additions on a realistic/ conservative projection of sales.

Short-term actions to improve cash flow include:

• aggressive collection of receivables;

• ensure jobs are priced profitably, with margin;

• prioritize good clients who pay within terms; and

• charge for and collect paper price increases.

Long-term actions include:

• develop reliable credit sources;

• manage relations with lenders and key suppliers;

• calculate and understand loan covenants imposed by lenders;

• be upfront with lenders and suppliers; and

• work together to build an achievable plan.

It is important to recognize the importance of cash flow. It is equally critical to understand the impact of other non-cash costs like depreciation. Business owners who rely too much

on cash flow projections for pricing do not build sustainable foundation to continue to survive and thrive. In the longrun, you must cover all costs in order to survive and prosper.

Cash flow refers to the net balance of cash moving into and out of a business over a specific period of time. Profit is the balance remaining when all of a business’s expenses recorded on an accrual basis (including interest, depreciation, amortization and taxes) are subtracted from its revenues for a specific period of time.

A company needs to manage its profits and its cash flow. It is possible for a company to be profitable and have negative cash flow (e.g. a company that is growing quickly needs cash to finance its increasing receivables and inventory). It’s also possible for an unprofitable company with decreasing sales to have positive cash flow in the short-run, as it reduces its receivables and inventory. Managing cash is critical for businesses, as cash is king!

BOB DALE is vice-president and MORRIS SLEMKO is the CFO of Connecting for Results, Inc. They can be reached at info@ connectingforresults.com.

By Nick Howard

IIn my previous column, I wrote about Eric Tanzer, and his leadership role in the graphic arts.

Eric had a younger brother. Born in 1913 into a Budapest printing equipment family, Siegfried, who went by “Fred,” Tanzer was seven years younger than Eric. The brothers learned the print trade while selling letterpress platens in their father’s firm.

Fred would soon play a pioneering role in the Canadian Printing scene. He was often the first to import machines never before heard of in the West (e.g. Komori), and go on to develop new markets.

In 1931, Eric immigrated to England just before anti-Semitism rose to the boil. However, Fred stayed on, all the way through the World War II. It is unknown how he and his family managed to evade the Hungarian NKVD and German SS, but somehow, they did. Daily life would have undoubtedly been soul scorching, and it’s possible those turbulent years helped Fred develop strong defences to guard against those who would threaten him or his future. One example was a conversation between Fred and my father, who worked for Fred between 1959 and 1964. Discussing the recent resignation of a key employee at the firm, my father asked Fred if the person could be lured back.

Fred’s response was, “I just tell myself he died, and I cannot bring back the dead.”

Married in 1946, Fred set sail for Israel in 1951. He soon altered course,

Siegfried Tanzer, centre, at the official opening of the Canadian Lithographic Institute inToronto.

Tanzer sold the first Komori press in the West in April 1956.

immigrating to Toronto the same year.

In the 1950s, Canada was a vast open country with sparse population. It embraced largely European immigrants while offering opportunities as boundless as a Saskatchewan sky. Indeed, Fred would devour his chance to build a new life in an industry he knew so well: printing.

Shortly after arrival, he was hired by the British firm, SOAG Canada. SOAG distributed several lines of machinery including the Printomatic stop-cylinder press through their sales office in Toronto. A few years later, around 1955, Fred seized the opportunity to purchase SOAG’s Canadian operation and changed the name to F.S. Tanzer Ltd.

Almost immediately, Fred introduced Canadians to many new agencies. Some were entering North America for the first time. Among them was Komori Printing Machinery Co. The first Komori press in the West would be sold by Fred when he flew to Japan in April 1956, and secured the sales rights of what was

then a two-colour, 39-in. model KW2. During that same period Fred received the agency for Hans Müller AG of Switzerland (now Müller-Martini). Additionally, Swiss manufacturer ColorMetal and the British firm, Waite & Saville, with the “Falcon,” fell under Fred’s control. Krause-Wohlenberg, the West German builder of diecutting platens and paper cutters, also proved a strong seller.

However, a much bigger fish was ready for netting, and in 1957, the East German combine of Planeta, Brehmer and Perfecta, became available. East German equipment was cheap, and Canadian sales quickly followed. Hostmann-Steinberg inks and other consumables would help round out a sizable stable of offerings by F.S. Tanzer.

Fred later secured the agency for Albert-Frankenthal (now owned by Koenig & Bauer). Albert was well known for stop-cylinder presses, and publication webs in gravure, letterpress and offset. In 1962, one notable Fred sale was to the United Church Publishing House in Toronto. A massive Albert Rotary letterpress web, designed to print books, was installed at their Ryerson Press fa-

cility (now home to CITY-TV). The press was a disappointment and not specified for the type of work Ryerson required. Rumours of inducements between seller and buyer clouded the Albert sale, as the press cost $650,000 ($6 million today). In 1971, the Albert was sold for scrap when no takers were found.

The East German Polygraph equipment would turn into a windfall in later years as many sheetfed Planeta presses would find homes, mostly in Ontario and Quebec. PZO-6 and PVO-6 (two- and four-colour) presses popped up in folding-box and commercial establishments. Then in 1965, Planeta built the Variant, a unitized press, which furthered Fred’s penetration into Canadian pressrooms. Planeta’s large-format carton “Variants” were quickly in vogue at many Canadian paper-box plants. Rolph-ClarkStone Packaging, Toronto Carton and Howell Litho & Cartons were heavy users of the 55-in. models because of the superior design for

Siegfried Tanzer was born in 1913 in Budapest.

board printing. Unfortunately, Fred lost control of most of the lines due to poor sales, but the East German equipment remained with him until his death at 68 in 1980.

Siegfried Tanzer immigrated to Canada in 1951.

My father worked for Fred as his salesperson for Quebec until 1964 when we relocated to Toronto. Fred was a taskmaster, and as my father later told me, difficult to work for. In looking back through time, I can see how Fred operated in the background, only embracing the light with an equipment sale that jolted his competition, such as selling two Planeta P-44 Variants to Commercial Printcraft in Woodstock, Ont. This ability to upsell eight printing units to one customer in the early 1970s was remarkable, especially for an unknown brand.The sale kept the competition whispering that it had to be the price when it was just crafty salesmanship.

Working under the radar brought wealth to Fred, who also held an in-

terest in Falcon Knitting Mills, a Toronto knitwear company, through relatives in Europe. In 1969, Fred (loaned) a new two-colour Planeta Variant P-24 press to the Toronto Lithographic Institute.

The differences between Eric and Fred Tanzer are vast but they both had the uncanny ability to find key equipment agencies before anyone else. Manroland, Komori, and Müller-Martini are three such firms that are today respected the world over. In a mid-1950s Canada or USA, you’d be hard-pressed to know these companies. There have never been two brothers, separated by thousands of miles, who have made such an impact.

HOWARD, a partner in Howard Graphic Equipment and Howard Iron Works, is a printing historian, consultant and Certified Appraiser of capital equipment. Contant him at nick@howardgraphicequipment.com.

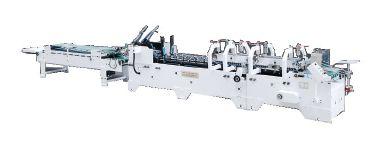

Direct-to-garmet (DTG) printing allows printers to manage complex designs in varied colours and quantities on multiple fabrics at a low cost.

A

By Treena Hein

Everyone in the printing industry is well aware that on-demand custom printing is growing fast and here to stay. In addition to direct mail, this category also includes custom apparel or direct-to-garment (DTG) printing, which allows customers to order one-offs, small batches, carry no stock and update designs easily. Innovation in DTG printers has kept pace with demand, and these machines now offer better colour and resolution than before.

DTG makes the ability to place a photograph, a complex design or a scan of your child’s latest finger

painting on fabric a very affordable and exciting reality for individual consumers, companies and organizations alike. Beyond printing on garments like T-shirts and hoodies, DTG machines can print on pillow cases, canvas pieces for wall art, shoulder bags, high-cut running shoes, curtains, hats, napkins and any other fabric surface you can think of.

Indeed, “the opportunities are endless,” says Sharon Donovich, product marketing manager at Kornit Digital. “With the trends and market challenges today, whether excessive inventory, time to market, prices of shipment from remote locations, social media in-

fluence or the need for sustainable solutions, the technology and business models must be disruptive and innovative. [With DTG], this can include opportunities for anyone really, from a business that needs a promotional T-shirt to personalized gifts, brand shoppers, e-commerce businesses, print service providers and more.”

DTG, says Donovich, can also supplement screen printing or heat transfer for the medium/small/oneoff orders that will not be profitable with other technologies, in addition to handling complicated designs and specialized applications like printing on zippers or buttons.

“There are many benefits,” she explains, “including ability to print short runs or one-offs in no time, in every shape and colour, quickly and sustainably with safe inks – and only after the finished piece has already been purchased.”

Robert Zoch, Kornit’s global content manager, adds that no matter where you are situated in the printing industry, “you’ve undoubtedly been impacted by commerce migrating to the internet. It is an ideal time to introduce efficient, eco-friendly, digital DTG printing.” He adds that during the pandemic, in many cases, on-demand printing shops repurposed their production floor using DTG technology to supply customized face masks and fulfil other unforeseen needs.

Zoch notes that the garment printing market has been evolving for some time from a focus on brickand-mortar retail stores to e-commerce. In fact, e-commerce doubled its total volume over the last 10 years during just a three-month period in 2020, he says.

“By 2024, it’s predicted that twothirds of apparel in the U.S. will be purchased online,” Zoch adds. “DTG is capable of delivering imprinted gear at the speed today’s buyers have come to expect. Further, available workflow solutions offer end-to-end visibility and control, integrating point of sale, product catalogs, production floor and shipping logistics to enable streamlined, cost-effective operations and superior customer experience.”

Koch also stresses the importance of another trend driving DTG

According to Grand View Research, the global market for custom apparel is estimated to grow with an expected compound growth rate of over 10 per cent every year. 10%

growth that Donovich touched on: the strong desire among today’s consumers to express themselves like never before via social media and in person. “Fast fashion, micro-moments and instant gratification are the norm,” Koch explains. “DTG means you can produce to meet demand resulting from events, causes and thought leadership in real-time and recreate images and memes in photorealistic detail. Any inspiration appearing on Etsy can appear on a garment, and DTG fulfillers can meet that need for private creators and creative online entrepreneurs.”

DTG makes every order profitable, he says, and removes all restrictions in terms of a printing firm having to say no to any job. Screen printing handles the large, low-colour jobs, while DTG manages complex designs in any colour in any quantity, on multiple fabrics as needed, and all for a low and consistent cost. He notes that he’s visited

countless print businesses that have grown at a staggering pace by supplementing e-commerce with DTG production even during the pandemic-induced recession in 2020.

At its 100,000-sf facility in Markham, Ont., wholesale family-owned printer Sinalite “strictly services the print industry with apparel products,” explains vice-president Brian Meshkati. “So, the customers buying apparel from us are print brokers, sign shops and commercial print shops. They’re looking to expand their existing print product selection to their customers by offering custom apparel to them as well. We give our customers the ability to test the market, so they don’t need to risk investing hundreds of thousands of dollars on apparel equipment. They receive orders from their customers, order from us and mark it up to profit. If they see that the demand is there

Innovation in DTG printers has kept pace with demand, and these machines now offer better colour and resolution than before.

DTG enables printers to photo-realistically recreate images and memes resulting from events, causes and thought leadership in real time.

DTG means you can produce to meet demand resulting from events, causes and thought leadership in real-time and recreate images and memes in photorealistic detail. – Robert Zoch

and want to invest in equipment later on, they can.”

Meshkati says compared to commercial printing, the custom apparel printing market is growing at a substantially higher rate. While researching this type of printing, he

and his colleagues found a report published by Grand View Research which stated that in 2018, the global market for custom apparel had been worth over USD26 billion, with an expected compound growth rate of over 10 per cent every year to 2025.

At present, those ordering from Sinalite span various industries including landscapers and property management companies, construction contractors, retailers and restaurants. “We also see a lot of orders for personal use that allows customers to express themselves, and they can buy a single shirt,” says Meshkati. “In terms of garments, we print a variety of items. T-shirts are the most popular, followed by hoodies. We also print on sweatshirts, long sleeve shirts and tank tops. We actually saw increased custom apparel sales after the pandemic hit. We got over four times the usual number of T-shirt orders.”

Sinalite purchased its first DTG printer (a Kornit Digital ‘Storm,’ intended for sub-500 runs) a couple of years ago and during fall 2021, added a Kornit Digital Avalanche HD6. Meshkati says they’d found the Storm “a great machine in terms of quality.” Sinalite went with Kornit again because the machines do not require workers to take an additional pre-treating step. “We got the Avalanche to take on the higher volumes we were getting,” he explains. “We get a mix of single-piece runs, but also some orders that are in the hundreds of pieces, so it’s good to be able to do both.”

2/3

By 2024, it’s predicted that two-thirds of apparel in the U.S. will be purchased online.

Among the other DTG printers on the market, Brother, Omniprint, Roland and Epson each offer different machines for various volumes/ purposes. Brother has a video to help calculate ROI using basic and more complex factors on the purchase of a DTG printer. You can watch the video at https://vimeo. com/497738246.

Every company is constantly innovating to bring improved products to market, including more automation features. As a specific example, in terms of how Kornit machines have evolved and what new capabilities will be added, Donovich reports that in 2021 they introduced ‘MAX’ technology that provides higher quality with high-volume orders. In addition, the company’s XDi Technology enables embossed applications, mainly digital embroidery simulation, high-density embellishments and ‘heat transfer’ look and feel.

Commercial, labels, packaging – ultra short to long runs

The Rapida 106 X maximizes your capacity for the highest productivity for every market segment. Industry-leading technology ensures the fastest throughput for more sellable sheets on your floor – day in and day out! Print at up to 20,000 sheets per hour - even in perfecting. The ultimate in color and quality control, simultaneous makeready processes and proactive digital services are among the benefits which help you always surpass your goals. Rapida 106 X. The new performance benchmark in industrial printing.

rapida106x.koenig-bauer.com

By Jan Sierpe

Sustainable process optimization and waste reduction in packaging manufacturing is about adopting a low-cost strategy.

The gloss and colour appearance of paperboard or synthetic substrates is a vital visual attribute in marketing packaged products.The introduction of optical brightener agents (OBAs)

Optical brightener agents help reduce material waste and rework in packaging manufacturing.

on inline dispersion UV or AQ coatings in the printing process enhances the finished products.

Recently, I inspected various products at a supermarket in Dubai. To my surprise, many products had overprint coatings with OBAs. Cereal boxes substrate appeared whiter and cleaner. On close inspection

with a UV light, the inks revealed traces of fluorescence. Also, it appeared they have more flexible packaging for snacks such as cookies, power bars and ice cream than in Canada and the US.

Cost could make flexible packaging an ideal choice, even for highend premium ice creams such as

Quanta triple chocolate from IFFCO, my favourite.

The OBAs have a definite shelf life, but they last long enough to support the customer’s demand. Exposure to sunlight tends to fade OBAs.

For process control with OBAs in dispersion coatings, operators can visually check its application and be alerted to defects and reduce waste due to the coating’s applications.

Process excellence supported by the right tools becomes seamless. Effortless process controls introduce smooth operations. Workers support these kinds of process control without supervision as they understand the purpose and appreciate effective and practical applications.

The strategy of introducing OBAs in the offset or flexo printing process is low cost. It helps reduce material waste and rework, particularly in packaging manufacturing.

Optical brighteners (OB), OBAs, fluorescent brightening agents

Brightening agents emit glowing fluorescence light.

(FBAs) or fluorescent whitening agents (FWAs) are chemical compounds. They target the same objective and are used in many industries to enhance blue light and minimize the amount of yellow light, creating brightening visual effects to make things appear whiter.

These chemical compounds absorb light in the ultraviolet and violet, ranging from 340 to 370 nm of the electromagnetic spectrum and reemit glowing fluorescence light in the blue region between 420 and 470 nm.

The colour appearance of paperboard is vital for the esthetic value of packaged products. There is a level of expectation and instant association of the products’ quality with their visual packaging appearance. Its visual impact precedes the tactile

experience. Substrates used in packaging have three optical properties relevant to finished products: colour, brightness and whiteness. Brightness and whiteness are not the same. They have different properties with measurable parameters. The brightness appearance is the ability of a substrate to reflect blue light. Whiteness measures paper or substrate in the same way the eye sees it.

Using OBAs in coatings, the average observer’s lab values will remain unchanged even though they might display modest and measurable changes within the colour space—the higher the whiteness, the substrate appears whiter.

The brightness-meter tester determines the brightness level by measuring the intensity of the light reflection diffused on a scale of 100.

The whitest white Titanium dioxide was an essential ingredient for papermaking, plastic and polymers for its very high reflective index for over one hundred years.

Serving the US market for nearly a decade, RM Machinery (RMM) proudly brings our expertise to Canada’s printing industry. We deliver the highest quality sheetfed o set, digital inkjet, and flexo printing presses by partnering with the finest manufacturers in the industry.

RMM is the premier distributor in Canada for Mitsubishi, RMGT, and Miyakoshi printing presses; Böttcher rollers, blankets, and chemistry; Standard Horizon finishing systems; GEW UV curing systems and TOYO inks.

For years, Mitsubishi set the superior technology standard for Canadian printers. Today, RM Machinery returns that innovation to Canada, but with an even higher standard: Ryobi Mitsubishi Graphic Technology (RMGT).

We are stable, local, and o er the best-in-class technology. We maintain an ample supply of parts, and for as long as you own one of our supported presses, you are guaranteed ongoing service and support programs that are among the best in the industry.

RM Machinery Inc.

905-238-9797 • 1-855-RMGT-123

5250 Satellite Drive, Unit 9 Mississauga, ON L4W 5G5 www.rmmc.ca

Its use didn’t decrease because the Agency for Research on Cancer flagged and classified titanium dioxide as possibly carcinogenic to humans. The decline was due to economic and environmental reasons.

These additives’ effectiveness in enhancing the visual appearance of colour fabrics, plastics and printing substrates is well known. They produce a pleasing and whitening effect in many recycled substrates and paperboard stocks in order to compensate for the printing papers and board surface’s yellowish or grayish visual appearance.

This procedure assists inline visual inspection of dispersion coatings applications on the fly. It is effective as it helps to check, identify and eliminate waste at the source.

This method is applicable on any substrate, and is used mainly in the packaging and label industry.

This method is accomplished by including OBAs in UV and aqueous

dispersion coatings. The changes required to coating formulas should not increase the overhead costs.

Coating manufacturers would establish the ideal amount of OBAs to make possible the visual inspections, which typically range from one to five per cent of the OBAs’ components.

The coating applications are a simple, yet essential aspect of the finished product. The additional ingredient will not alter the coating’s gloss properties or the final visual appearance of the printed products. It will help assess the coating application’s evenness, minimize, or eliminate flaws and defects and enhance the substrate’s brightness.

1. Faster visual quality checks of coated areas during make-readies.

2. Helps to inspect coating layout, glue flaps and knockout during production.

3. Allows checking for smoothness and surface penetration of coating

4. Assists in checking for unwanted coating spillover or coating misting that could block paperboard piles.

5. Allows checking for evenness and low spots or unevenness during production runs.

6. Increase the finished product’s brightness as OBAs enhance the product surface.

7. Allows accurate register for spot gloss or matte coating applications.

To inspect coated areas of the printed sheet, the press operator, supervisor or QC staff only need a UV-A type of flashlight. Additional magnifying instruments aren’t required.

JAN SIERPE is an experienced and informed technologist focused on process optimization and waste reduction. He can be reached at sierpe.jan@gmail.com. For more info, wisit his website, www.sierpe.ca.

Bobst introduces the Masterline DRO rotary diecutter

Bobst launches Masterline DRO, a full line solution, from pre-feeder to palletizer. The machine has the capacity to produce more than 40 million m2 per year.

It features inside-outside printing in a single pass, complex diecutting capabilities and quick changeovers on the full line.

Zünd launches the new Precut Center software

With PreCut Center, Zünd launches a software that facilitates cut-file preparation for applications involving unprinted materials.

Zünd’s new software solution creates a “simple and highly efficient workflow for generating cut files for unprinted materials.”

PreCut Center is available in two versions, Basic and Pro.

Users can select the version and associated features according to their needs.

Ricoh enhances its FusionPro document creation solution

Ricoh enhances its premier document creation solution, FusionPro.The suite of tools for the design and production of personalized marketing and

The Precut Center software from Zünd facilitates cut-file prep for unprinted materials.

communications allows companies to produce customizable documents for print and digital delivery. It integrates with Adobe InDesign and Acrobat to provide a plug-and-play interface forVDP document creation from almost any design file that can be converted to PDF.

The new release includes increased functionality to simplify the generation of FusionPro’s rules-based intelligent templates. It uses data to form targeted, relevant messaging.

Sun Chemical launches new varnish solutions for HP Indigo printed labels

Sun Chemical introduces a new range of UV varnishes for en-

hancing the label resistance of pressure-sensitive labels digitally printed on HP Indigo for personal care, household, chemical, beverage and pharma applications.

The new varnishes were specifically formulated to provide adhesion to HP Indigo ElectroInk. It is available as part of the SunEvo Protect LEP HD range of protective varnishes for HP Indigo. Two new products are available as part of the set: EV-LU028 Gloss and EVLU029 Matte.

The new set of varnishes do not require the addition of any press-side additives. The range can be printed using standard UV coating equipment.

Sean Murray is an enthusiastic ambassador of the printing industry. The 53-year-old, who lives in Pictou, N.S., urges companies to diversify and differentiate themselves from competition.

What is the state of the print industry today, in your opinion?

SM: The graphic arts and printing industries suffer from a complex identity crisis and are ripe for change. Our public relations challenges are fuelled by the traditionally hyper-competitive nature of our industry and misinformation spread by competitive sectors. I, however, challenge anyone to go through an hour of their day without encountering print.

While we do not have a monopoly on communication, our products are important in communication and marketing. We do have some challenges, such as inflation, labour shortage, supply chain bottlenecks and chronic overcapacity.

What attracted you to the print industry?

SM: Family connection brought me to the industry, and I have stayed for the innovative challenges and the opportunity to make a difference. My grandfather was in community media. After a few years of third-party ownership, my father Bruce Murray became a shareholder and led Advocate’s diversification into print. I actually started doing handwork at the age of seven. After university, I came to work in the business for a short time before a planned law degree. I bought out my father’s partner a few years later. Print brought me to “centre ice” for almost every opportunity and innovation in our community and economy. I was welcomed into boardrooms and CEO offices to help provide solutions. When you work in print with a solutions-based approach, you experience all facets of the economy.

How can the industry attract more young people?

SM: I have to go back to our industry’s identity crisis. Our industry is so much more than our reputation. Traditionally people have been attracted to our industry through mentors or friends. The Canadian

The graphic arts and printing industries suffer from a complex identity crisis and are ripe for change.

2004

Sean Murray became the president and CEO of Advocate Printing and Publishing Company.

Printing Industries Scholarship Trust Fund is working with educational institutions and students across Canada to change that. We all need to do our part to demonstrate that the printing industry is offering jobs of the future. We lead with a focus on sustainability and innovation. With a printing career, you can be engaged, challenged and central to growing our economy while constantly learning— who wouldn’t want that! Let’s stop keeping it a secret!

In such a competitive landscape, how can printers win more sales?

SM: Differentiation is key. Success will not be gained by selling the same services and products as competitors. Companies must define their market and allow space for others to define theirs. The “race to the bottom” attitude in our industry was driven through me-to commoditization that was created due to overcapacity of similar equipment and service offerings. Yes, more consolidation is needed, and it will happen through M&A and natural selection, but there is room for each of us to thrive with unique solutions-based offerings. We each need to ask ourselves, what gap would be created if we closed our

doors tomorrow. As leaders, we must guide our organizations to offer value that extends far past price.

What are some of the biggest opportunities in the print industry?

SM: Opportunity is everywhere, and the COVID-19 pandemic has created an inflection point for a reset. Through solutions selling rather than order taking, we can redefine print’s place in today’s communication mix. There is enormous potential with targeted, customized print, packaging, in-store marketing, and short-run products.

What do you think is the most exciting thing about print today?

SM: I find the entire value chain of print exciting. The thrill of meeting client goals does not get old. Perhaps one of the most exciting areas of growth is the convergence of traditional and digital media, and how we can leverage the best of both worlds, especially as print runs become shorter and targeted.

Murray’s responses were edited for length. For more Q&A Spotlight interviews, please visit www.printaction.com/profile.

The all new Acuity range from Fujifilm

With a track record of pioneering innovations, Fujifilm has helped thousands of sign and display printers transform their businesses. But in a world where change is constant, three years ago we decided to go back to the drawing board to define a new blueprint for UV inkjet print performance.

The result is a brand new range of Acuity printers designed and developed by Fujifilm that redefine price/performance and transform print ROI. They bring new meaning to versatility and value and reset the expectations around ease of use. And being developed by Fujifilm, they come fueled by the best UV ink on the market and a guarantee of outstanding quality and reliability.

The new range of Acuity printers designed and developed by Fujifilm.