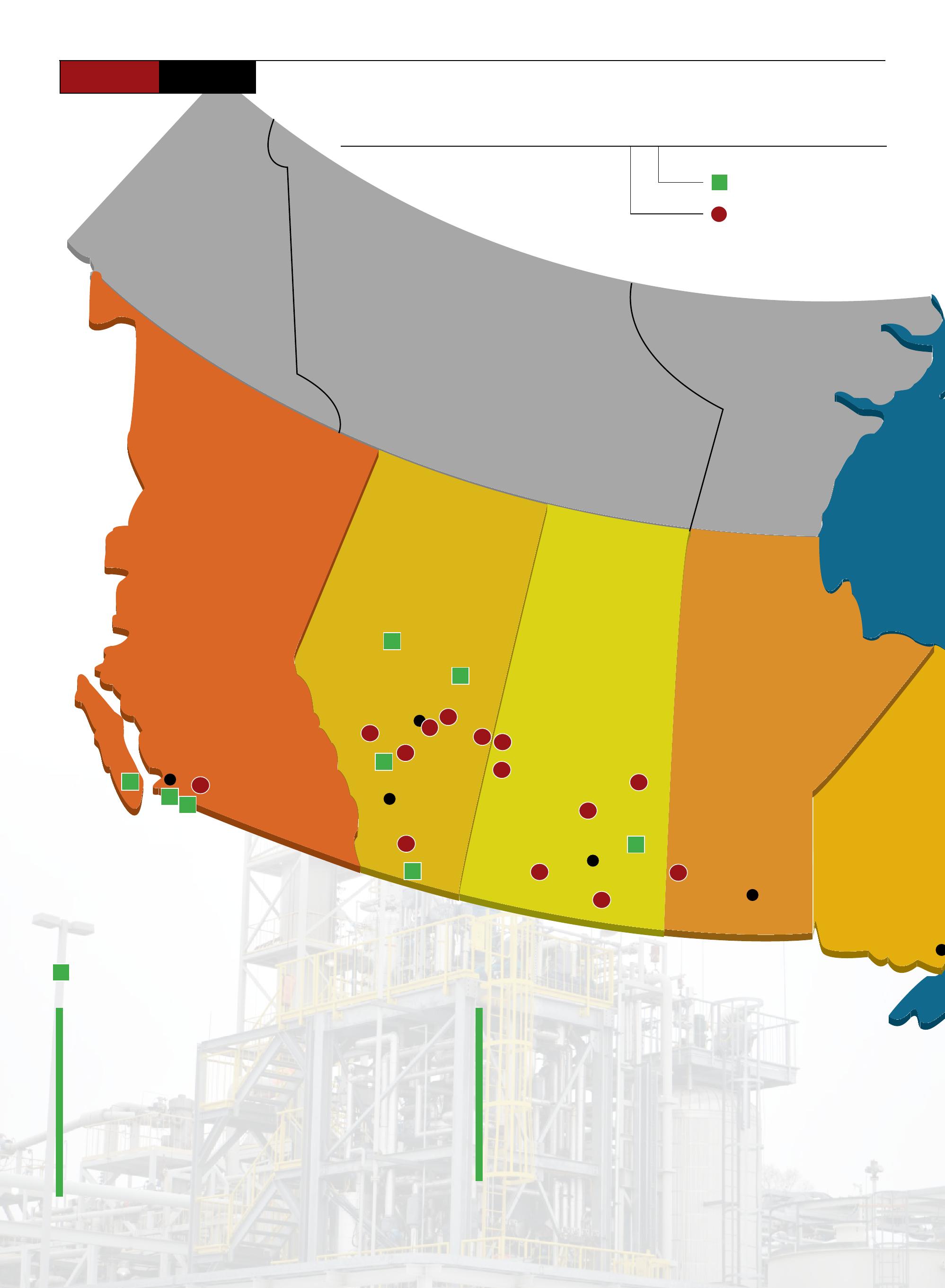

12 Biofuel map

Mapping out biofuel production across the country.

14 Biomass quality

FPInnovations embarks on a project to determine the best practices when handling biomass.

17 International Bioenergy Conference & Exhibition Showguide

29 Breaking down barriers to growth

Canadian regulation holds the biofuel industry back as other countries benefit from advances in pre-treatments.

33 Europe bound

Belledune develops the infrastructure to safely handle wood pellets.

36 Biochemical leader

Sarnia grows into national hub for biochemical industry.

“Pretreatment

ver the past couple of months, I’ve been to opposite ends of the country where the forest industry in two regions have both struggled to recover from the global financial crisis.

In Atlantic Canada, the forest industry has lost about 15,000 jobs in the last decade with newsprint production suffering the greatest losses. The strong Canadian dollar was a big factor that hurt the region’s export performance, but Atlantic forest exports have risen steadily as the Canadian dollar has fallen. Despite recent comebacks, the industry struggles still.

at the log prices the operating mills can afford to pay. Sawmill residuals are sold to local pulp mills and hog, bark from sawlogs, is an unwanted by-product.

Over this time, the region has lost a lot of capacity in the pulpwood sector, which has left a large inventory of underutilized chips. The Canadian Wood Fibre Centre (CWFC), has been looking into new techniques to make better use of the region’s wood fibre.

On the B.C. Coast, an increasing element of the timber harvest is log exports while softwood lumber production peaked in 1987 at 4.674 billion bf and was at 1.332 billion bf in 2012. Because of the humid climate, the moisture content in the wood is high, requiring more time and money to dry. Much of the lumber produced is sold green, and this has limited export opportunities to Europe (which requires all Canadian lumber be kilndried or heat-treated) and Japan (which implemented new building laws for earthquake-proof buildings and a switch to more stable kiln-dried lumber).

Poor sawmilling economies at B.C. coastal mills have caused many manufacturing plants to close. More and more timber has become too expensive to harvest

Though both regions have unique reasons for mill closures, what they have in common is an abundance of underutilized wood fibre. As manufacturing plants have closed, sawmills and logging contractors have found themselves with fewer customers for their chips, sawdust, tops and limbs. In order for the forest industry to remain stable over the long run, woody biomass must fetch a value in the marketplace.

As regions that were hardest hit by the U.S. housing market and global financial crisis continue to recover, the ones that find innovative markets for their biomass will be the most competitive. A focus on improving productivity and developing the higher end of the production cycle is important to the wood products industry. Advanced building materials and systems will give the Canadian industry an advantage. But as a country we must extract biochemicals, develop biofuels and use residuals to make wood pellets and chips for our domestic markets in order to build a strong economy.

Any forest industry that has unwanted by-products is uncompetitive. Rather than penalize log exporters to encourage more wood manufacturing, regulators should consider innovative ways to make all wood fibre more domestically valuable. •

Volume 14 No. 3

Editor - Amie Silverwood (289) 221-8946 asilverwood@annexweb.com

Associate Editor - Andrew Macklin (519) 429-5181 amacklin@annexweb.com

Contributors - Christopher Rees, Treena Hein, Gordon Murray, Jean-Luc Bernier, Stephanie Thorson

Editorial Director/Group Publisher - Scott Jamieson (519) 429-3966 ext 244 sjamieson@annexweb.com

Market Production Manager

Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

National Sales Manager

Ross Anderson Ph: (519) 429-5188 Fax: (519) 429-3094 randerson@annexweb.com

Quebec Sales Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

Western Sales Manager Tim Shaddick - tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Media Designer - Gerry Wiebe

Canadian Biomass is published six times a year: February, April, June, August, October, and December.

Published and printed by Annex Business Media.

Printed in Canada ISSN 2290-3097

Circulation

Carol Nixon email: cnixon@annexweb.com P.O. Box 51058 Pincourt, QC J7V 9T3

Subscription Rates: Canada - 1 Yr $49.50; 2 Yr

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2014 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

Rentech, Inc. announced that it has acquired New England Wood Pellet (NEWP), the largest producer of wood pellets for the U.S. heating market.

NEWP, established in

1992, operates three wood pellet facilities with a combined annual production capacity of 240,000 tons. The facilities are strategically located in the U.S. Northeast, which is the

largest domestic market for consumption of wood pellets for heating. NEWP generated EBITDA of approximately $7.4 million in 2013.

Rentech owns two pellet plants currently under

With no slowdown in sight, North American wood pellet exporting companies keep building new facilities to manufacture pellets for the European market, according to the latest market update from Wood Resources International.

Export volumes hit a new record high in the 4Q/13, and the total shipments for 2013 were up almost 50% from the previous year – more than double that in 2011. The total value of wood pellet exports reached over 650 million dollars last year.

The expansion in Canadian pellet export has been less dramatic than that of the U.S., but 2013 volumes were still over 50% higher than in 2011, with British Columbia shipping a majority of the volume. In Canada, there have been two recent developments of interest: 1) the first regular shipments of pellets to South Korea started in the second half of 2013; and, 2) exports from Eastern Canada from Quebec, Nova Scotia and New Brunswick increased during this same time period.

Eastern Canada will see additional pellet export volumes later in 2014 when Rentech begins operation at its two pellet facilities now underway in Ontario. As reported in the NAWFR (www.woodprices.com), a Quebec pellet export facility under construction at the Port of Quebec is the first dedicated infrastructure for pellet exports along the St. Lawrence Seaway. Its presence, when completed, reduces the heretofore substantial entry barrier for a number of smaller pellet companies which are interested in the international market.

In the 4Q/13, export volumes from the Eastern provinces accounted for 25 per cent of Canada’s total pellet exports, a share that is likely to increase in 2014 and 2015.

W2 Energy, Inc. has begun production at its biofuel plant in Cambridge, Ont.

The company has tested various small batches of fuel and now is confident the plant is running well and will produce ASTM specification fuel on a consistent basis.

The company will begin production on a batch basis, and using cash flow from sales they will ramp production up while remaining cash flow positive. Once it reaches a consistent production rate the company will apply for credit lines that will allow it to move to full production

construction in northern Ontario: the Atikokan plant, with an expected capacity of 125,000 tons, and the Wawa plant, with an expected capacity of over 400,000 tons.

Fortress Paper Ltd. announced that the Fortress Specialty Cellulose mill located in Thurso, Quebec, has successfully been awarded by Hydro Quebec a power supply agreement for an additional 5.2 megawatts of power to be produced at its cogeneration facility.

Once finalized, the amount of green power supplied by the FSC Mill’s cogeneration facility to Hydro Quebec will increase from the current amount of 18.8 megawatts of power to 24 megawatts of power. This increase will result in significant incremental revenue, which will translate into an anticipated overall cost savings at the FSC Mill of approximately $2.7 million annually with an opportunity for further optimization.

The FSC Mill is expected to begin delivering the additional power in April 2015, at the latest, with a provision to start delivering power as early as the fourth quarter of 2014.

and beyond.

Mr. Michael McLaren, CEO, states, “We are very excited now to be finally here and in the biofuel business. Our current plan is to ramp up production with our system to its maximum of 7,500 litres of waste vegetable oil per day. Once we hit those targets we will expand the plant to double that capacity to 15,000 litres per day.”

Now that W2 Energy has begun production, the company plans to apply for the government biofuel production subsidy.

November 17-19, 2014

Vancouver Marriot Pinnacle Hotel

Vancouver, BC

North American wood pellet exports are projected to grow at an unprecedented rate.

At the WPAC AGM & Conference you will receive the insider information that you need in order to meet the dramatic increase in Europe bound pellet exports.

Get the insider news and connections by joining us at this must-attend event!

Expert, comprehensive insight from industry experts on the following:

• Canadian pellet industry developments

• Developments in Europe and Asia

• Fibre sourcing

• Domestic pellet market development

• Transportation and logistics

• The sustainability debate

• Safety practices and much more

Sponsors GOLD Sponsor

Media Sponsor

Sponsor

TAn

By Gordon Murray

he Argus Biomass Trading Conference in London, England, held annually in April, has gained a reputation as one of the “must-attend” gatherings of international power utilities, traders, ports, terminals, ocean shippers, pellet producers, equipment manufacturers and other sectors of the international wood pellet industry. This year’s event lived up to its billing. About 15 WPAC

several projects in the pipeline.

“The European pellet market consumed 19 million tonnes of wood pellets in 2013.”

Julian Skinner of Eggborough Power reported that the company is now uncertain whether it will convert from coal to biomass. Unless the U.K. Department of Energy and Climate Change (DECC) makes new CfD funding, the Eggborough Power Station could close in the next year or so. Eggborough is continuing to press DECC for an investment contract. Julian predicts that coal power generation will be uneconomic within the next two years due to the new U.K. Carbon Price Floor.

the Renewable Heat Incentive is driving growth of the U.K. heat market. He expects that, for the first time ever, in 2014 the U.K. heat market will outpace domestic pellet production and that residential-grade pellet imports will be required. There are one million homes in rural U.K. not served by gas and they are prime targets for wood pellets.

members made the trip to London.

The European pellet market consumed 19 million tonnes of wood pellets in 2013 – 10 million tonnes in the heat sector, and 9 million tonnes in the power sector. The heat sector is growing at least as rapidly as the power sector. The average price of residential wood pellets has increased by about €40€ per tonne over the past two years, according to Christian Rakos of the European Pellet Council. The largest European producing countries are now Germany, Sweden, Latvia, and Portugal. The largest European consumers are the U.K., Denmark, Germany, and Italy.

The US south now has 4.5 million tonnes of annual pellet production capacity, with a further 3.0 million tonnes set to come on line. In contrast, Canadian production capacity has temporarily stalled at 3.2 million tonnes, although there are

Italy consumed 3.29 million tonnes of wood pellets in 2013, reported Paolo Perini of Mefisto Pellets, of which the heat market accounted for 90 per cent. The Italian government supports pellet stove installations via a 50 per cent cost rebate, which is administered through personal income tax returns. Presently, domestic pellet production accounts for just 20 per cent of Italian pellet consumption. This is due to the scarcity of feedstock and high-energy costs.

Eric Vial of Propellet France told the audience that French pellet consumption has now outpaced domestic production and France will now be importing pellets for the country’s 250,000 pellet stoves. Bagged pellets account for 66 per cent of the market, while bulk pellets account for 34 per cent. Within France there is a fleet of 130 dedicated pellet delivery trucks. France is set to follow Italy in terms of market growth.

Richard Smith of Verdo reported that

Arnold Dale of Ekman predicted that European pellet consumption will be 28 million tonnes of wood pellets by the end of 2015 and 42 million tonnes by the end of 2020. In comparison, Korea and Japan will consume three million tonnes by 2015 and seven million tonnes by 2020. Japan is the most difficult to predict because of its uncertain policy environment. Russia is best situated to supply Asia with pellets, but investment will likely remain stalled until the political environment is stabilized.

Although the biomass power sector is on the right track with its positive engagement strategy, it must remain vigilant by maintaining stakeholder communication as a high priority.

Conference delegates learned a great deal over two days of presentations, and the experience was significantly enhanced by the opportunity for face-to-face meetings with many of the most influential members of the international wood pellet industry. •

Gordon Murray is executive director of the Wood Pellet Association of Canada. He encourages all those who want to support and benefit from the growth of the Canadian wood pellet industry to join. Gordon welcomes all comments and can be contacted by telephone at 250-837-8821 or by email at gord@pellet.org.

rBioproduct clusters can bring value to hubs across Canada.

By Christopher Rees

ecent bio-related events in Europe have focused on bioproduct clusters and distributed biorefineries. The goal of clusters is to develop the highest degree of value-added bioproducts in geographic areas outside of the largest urban centres and close to domestic sources of biomass. Undoubtedly, the ports will be the likely setting for the largest biorefineries involved in significant international

tomoRRow’s

“We seek to expand the Sarnia model to other areas of Canada.”

This concept was outlined and discussed at the Tomorrow’s Biorefineries in Europe conference, held in Brussels in February. It was noted that the fledgling biorefinery industry in Europe relies primarily on starch and sugar-based feedstocks but that the future lies in alternative non-food feedstocks (cellulosic). This was the thinking that led the European Commission to begin three major biorefinery research projects in 2010 whose results were reported in Brussels.

from CanBio representatives attending the World Biofuels conference held in Amsterdam in early March and the IEA Task 32 Torrefaction Workshop in Austria in January provided complementary information for further Canadian cluster development.

CanBio and Bioindustrial Innovation Canada (BIC), which now seek to expand the Sarnia model to other areas of Canada, are on the same wavelength in supporting bioproduct cluster development from which distributed biorefineries can emerge.

trade flows – much like the oil refineries model. But Europe envisages a host of smaller biorefineries, capable of primary biomass refining and conversion up to intermediate products, along the full-value chain of materials, chemicals and energy. Such integrated biorefineries may have a biofuel platform or go directly from biomass to chemicals and act as suppliers to the larger biorefineries.

Europe has already laid the groundwork for this approach by fostering regional “clusters,” several of which are focussed on bioproducts and related clean-tech. Two prominent examples include the Saxony region in Germany and the Champagne-Ardenne region of France. The cluster concept and distributed biorefineries go hand-in-hand, with the cluster providing the overall supportive hard and soft infrastructure from which biorefineries can emerge.

The three projects, Eurobioref, Biocore and Suprabio, mobilized over $100 million in funding and included over 70 partners from academia, research and industry, spread over 15 countries. The funding platform which led to these projects has now been followed by the Horizons 2020 program representing a funding commitment of $118 billion. More detailed work on moving towards the commercialization of the technologies, processes and models developed under the three research projects will continue.

The application of distributed biorefineries to the Canadian context was discussed by a CanBio Western Members Roundtable held in Vancouver in March. Participants were optimistic about the potential for such biorefineries in both B.C. and Alberta over the next 10 years. Feedback

Bioproduct clusters and distributed biorefineries will be one of the central topics at the CanBio Annual Conference to be held in Thunder Bay during “Bioeconomy Week” from September 8 to 12. In fact, Thunder Bay provides a great example of the potential for a cluster and distributed biorefinery. The OPG power generation plant has excess heat and space for co-location of new bio-industry ventures. While Thunder Bay does not have the chemical-industry base of Sarnia, it does have a wealth of biomass resources and advanced forest product companies. In addition, it has growing bioeconomy research and development expertise at Lakehead University and Confederation College, as well as at CRIBE. Attendees at the CanBio Conference will have a chance to see the facilities and explore the prospects first-hand. This is an opportunity not to be missed. Registration for the event is now open (see www.canbio.ca). •

Christopher Rees is the Advisor to the Chair at CanBio and a Managing Partner at Suthey Holler Associates.

1 BIOX COrp HamIltOn Ont.

2 CIty-Farm BIOFuel ltd.

4

5 Great lakes BIOdIesel Welland Ont.

6

7

8 metHes enerGIes Canada InC sOmBra Ont.

1

2 enerkem alBerta BIOFuels edmOntOn alta.

3 enerkem InC. sHerBrOOke Que.

4 enerkem InC WestBury Que.

5 enerkem InC. (vanerCO) varennes Que.

6 GreenFIeld speCIalty alCOHOls CHatHam Ont.

7 GreenFIeld speCIalty alCOHOls JOHnstOWn Ont.

8 GreenFIeld speCIalty alCOHOls tIvertOn Ont.

9 GreenFIeld speCIalty alCOHOls varennes Que.

10 GrOWInG pOWer HaIry HIll HaIry HIll alta.

11 Husky enerGy InC. llOydmInster sask.

16 nOramera BIOenerGy COrp. WeyBurn sask.

17 nOrtH West termInal ltd. unIty sask.

18 permOleX InternatIOnal lp red deer alta.

19 pOund-maker aGventures lp lanIGan sask.

20 sunCOr st. ClaIr etHanOl plant sarnIa Ont.

21 terra GraIn Fuels Belle plaIne sask.

22 arCHer danIels llOydmInster alta.

23 letHBrIdGe BIOGas letHBrIdGe alta.

24 WOOdland BIOFuels InC. sarnIa Ont.

12 Husky enerGy InC. mInnedOsa man. 13 IGpC etHanOl InC aylmer Ont. 14 kaWartHa etHanOl HavelOCk Ont. 15 masCOma COrp. draytOn valley alta.

25 seaWay GraIn prOCessOrs InC COrnWall Ont.

26 IOGen COrp OttaWa Ont.

27 praIrIe Green reneWaBle enerGy InC HudsOn Bay sask.

28 FarmteCH enerGy COrp. OsHaWa Ont.

29 kaWartHa etHanOl InC HavelOCk Ont.

30 upper Canada etHanOl BatH Ont.

31 upper Canada etHanOl lOyalIst Ont.

32 lIGnOl BurnaBy B.C.

FPInnovations embarks on a project to determine the best practices for biomass.

Threeyears ago, FPInnovations began a multi-year project to unravel everything there is to know about woody biomass. Research efforts so far have focused on identifying critical biomass attributes, quantifying new opportunities to increase the fibre basket, defining best practices and testing the most promising technologies related to producing, storing and supplying woody biomass.

One element that has proven to be important is what FPInnovations’ Fibre Supply researcher Sylvain Volpé calls feedstock quality.

“The definition of a high quality feedstock depends ultimately on its end use. For example, because of the way they are designed, different types of biomass boilers require different types of biomass. Small boilers ideally need small wood

By Jean-Luc Bernier

chips of uniform size with low moisture content (MC) whereas big boilers can use bigger chips with higher MC and more contaminants,” explains Sylvain Volpé.

Identifying the optimal quality characteristics for each use and product can benefit the industry. Boiler efficiency, for example, can be improved by up to five per cent if biomass moisture is reduced from 50 to 40 per cent. For a single boiler using 25 green tonnes/hour of biomass at 50 per cent moisture content (≈210,000 GMt/yr), improved feedstock management can save up to $1.2million/year. This includes transportation fuel costs and emissions since less weight is being transported.

Apart from moisture content, the characteristics that make up forest biomass quality include particle size distribution, called granulometry, as well as

shape and calorific value, but also the presence of specific elemental chemicals, bark, foliage and inorganic contaminants. Recognizing these characteristics is important, Volpé says, when considering the efficiency of the supply chain for delivering fibre to the end user in the most appropriate form.

These characteristics depend on a number of parameters such as source (log, branches), equipment (chipper or grinder, operating conditions), initial moisture content, local climate, log dimension, wood species, contaminants as well as equipment operator experience.

As demonstrated earlier, moisture content is one of the key characteristics in determining the calorific value of biomass. An important part of FPInnovations’ focus in

In some cases, feedstocks that have been finely broken down are delivered at higher than optimum moisture content and their addition to other drier biomass may compromise overall biomass quality.

FPInnovations’ focus is to identify and test cost-effective, low energy strategies for measuring and reducing moisture content of biomass at various points along the supply chain.

this field is to identify and test cost-effective, low energy technologies and strategies for measuring and reducing moisture content of biomass at various points along the supply chain. With the financial support of Natural Resources Canada, FPInnovations has demonstrated the potential to reduce moisture content by 10 to 30 per cent in harvest residues by using proper piling and covering techniques. However, because of the need to rehabilitate and renew roads or to minimize fire risks, not all forest residues can be left in place for seasoning. In these cases, feedstocks that have been finely broken down are delivered at higher than optimum moisture content and their addition to other ‘drier’ biomass may compromise overall biomass quality.

Practical ways of economically drying this biomass to the desired moisture content are needed in order to ensure

• The Bioeconomy Horizon

• Tomorrow’s Biorefineries

• Power Panel

• Ontario Bio-heat and CHP Advances

• Biomass Supply

• Next Generation Biofuels

• Advanced Biomaterials and Biochemicals

• The Way Ahead Panel

• North Americas largest capacity 100% biomass fueled power plant

• The worlds first coal to advanced biomass facility

• Regional bioenergy research clusters

• Biorefinery pilot plant

optimal conversion efficiencies. Other industrial activities involve biomass drying. For example, low energy driers are commonly used for drying peanuts and other agricultural products, and OSB flakes are routinely dried before

they’re used to make panels and there are many new technologies that claim to dry biomass. However, doing so in an efficient, economical and timely manner requires specialized equipment and handling.

The CanBio Conference and AGM will take place on September 10/11

The Canbio conference program will cover the latest developments in bioenergy, biomaterials and biochemicals particularly from the point of view of project development and opportunities for local areas. The concept of “distributed biorefineries” will be a focusing theme.

Storage also influences the quality of woody biomass. If this is not done properly, there can be excessive loss of biomass through biological and chemical degradation, notwithstanding the very real risk of fire. Current thinking on biomass pile management to reduce losses during storage have been summarized in an FPInnovations guide entitled ‘Hog Pile Management.’ While a very good practical synopsis of best practices, this document also highlights the need to understand the degradation processes, and how to monitor and manage them.

Searching for new ways to characterize, produce, manage and store biomass from the forest is one of FPInnovations’ important ongoing mandates. Future research efforts related to biomass quality include the development of methods to recover biomass from sawmill heritage piles, log yards and other forest-origin sources while reducing the presence of contaminants as well as monitoring of tarping and in-woods storage drying efficiency practices and technologies. •

Seeger Green Energy is the undisputed market leader in finding a balance between one-time capital expenditures (CAPEX) and ongoing operating expenditures (OPEX). With three decades of international renewable energy leadership, no one is more qualified to help you achieve success in the pellet market. Get in touch and find out more.

welcome to the 6th international Bioenergy Conference and exhibition. over the three days of the conference, there will be many opportunities to learn more about the industry here in British Columbia as well as the latest global trends in technology, project development, and regulations. we are pleased you can join us in the centre of one of the largest biomass fibre baskets in the world.

This year will be the biggest and best conference yet. we expect over 400 delegates, 60 exhibitors and 42 speakers representing countries from around the world and from all parts of the bioenergy sector. on wednesday, June 11, we will be featuring the 4th international Partnerships Forum and Business-to-Business Meetings. By bringing together some of the world’s leading bioenergy companies and organizations in an intensive, relationship-focused business environment for one day, we offer you the chance to get more done, more efficiently, and for less cost.

Pratt & Whitney 3 www.pwc.ca Pinnacle Renewable Energy 14 www.pinnaclepellet.com Uponor Ltd. 25 www.uponor.ca

Thursday, June 12, features an executive Panel exploring Pathways to Prosperity, a discussion about key issues facing the bioenergy industry, followed by a plenary presentation examining Pathways to Sustainability. Finally, our concurrent sessions will delve into bioenergy policy and examine markets and investments.

Company 36 www.m-e-c.com

Biomass Energy Lab 4 www.biomassenergylab.com Davis LLP 15 www.davis.ca Cogent 26 www.cogentpowerinc.com Urecon

Jansen Combustion 6 www.jansenboiler.com

Scheuch Inc.

University of Northern BC 17 www.unbc.ca

Power 28 www.altentech.co

The conference continues with four streams on Friday, June 13. The first sessions of the morning will feature bioproducts and biorefineries, as well as bioenergy for power and heat. The conference concludes with a spotlight on pellets and community energy production.

7 www.scheuch.ca MP Combustion 18 www.mpcpsystems.com

Metso 5 www.metso.com Wellons 16 www.wellons.ca Altentech Power 27 www.altentech.co Wolftek 38 www.wolftek.ca Excel Transportation Inc www.exceltransportation.ca IBEW Local 993 www.ibew933.org Brunette Industries 49 www.brunetteindustries.com

LSJ Publications 8 www.forestnet.com/lsj BC Bioenergy Network 19 www.bcbioenergy.com Andritz 30 www.andritz.com

Bandit Industries 9 www.banditchippers.com Conifex 20 www.conifex.com

Andritz 51 www.andritz.com

Canadian Biomass Magazine 52 www.canadianbiomassmagazine.ca

on Friday afternoon there will be a tour of Nechako green energy in Vanderhoof, during which you’ll see an integrated sawmill, planer mill, pellet mill and first-of-its-kind oRC system designed by Turboden.

Buettner 10 www.buettner-dryer.com Buhler 21 www.buhlergroup.com

Proton Power 11 www.protonpowerinc.com BC Hydro 22 www.bchydro.com

And, of course, we look forward to hosting you at a number of social and networking events on tap at this week’s conference, including the welcome Reception on wednesday evening at British Columbia’s green university, university of Northern B.C.; the enbridge-sponsored gala dinner at the Prince george Civic Centre on Thursday night; and two significant Keynote Luncheon Addresses on Thursday and Friday.

Again, welcome to Prince george. Thank you for attending, and we look forward to meeting and talking with you.

June

Beginning in Vancouver, the tour will take delegates through the interior of the province, with industry stops including a sawmill, power plant, pellet plant, an active logging operation, a pulp mill cogeneration facility and Canada’s green university, as well as sightseeing opportunities and unique cultural experiences.

June 8 Vancouver to Merritt

June 9 Merritt to Quesnel

June 10 Quesnel to Prince george

wednesday, June 11

10:00 - 17:00 international Partnerships Forum Registration and welcome Reception – Coast inn of the North 11:00 Business to Business Meetings – Coast inn of the North

17:30 international Partnerships Forum Networking Reception – Coast inn of the North

Jansen Combustion 6 www.jansenboiler.com

Scheuch Inc. 7 www.scheuch.ca

June 11 6th international Bioenergy Conference and exhibition

LSJ Publications 8 www.forestnet.com/lsj

Bioenergy Network 19 www.bcbioenergy.com

17:30 - 19:30 6th international Bioenergy Conference welcome Reception – university of Northern B.C.

Bandit Industries 9 www.banditchippers.com

Buettner 10 www.buettner-dryer.com

Proton Power 11 www.protonpowerinc.com

ThurSDay, June 12

7:00 - 8:00 6th international Bioenergy Conference, exhibition Registration and Continental Breakfast

8:00 - 8:30 welcome

8:30 Keynote address

• Chris Turner – Author, “The Leap: how to Survive and Thrive in the Sustainable economy”

9:00 - 9:45 executive Panel: Pathways to Prosperity

• gordon Murray – executive director, wood Pellet Association of Canada

• Ken Shields – Chairman of the Board, Canadian Bioenergy Association

• deborah elson – Vice-President, Stakeholder Relations, Canadian Renewable Fuels Association

• Joseph Seymour – executive director, Bioenergy Thermal energy Council

Moderator: Scott Jamieson, Publisher, canadian Biomass Magazine

9:45 Refreshment break in the trade show

10:15 - 12:00 Plenary Session: Pathways to Sustainability

• dr. william Strauss – Founder/owner, FutureMetrics, Founder/director, Maine energy Systems

• Bruce duguid - head of Sustainability, uK green investment Bank

• Michael Bradley - director of Sustainable initiatives, Canfor Pulp

Moderator: David Dubois

12:00 - 13:30 Lunch in the trade show

13:00 - 13:30 luncheon Keynote address

• Jeffrey Simpson, Author and Columnist, globe and Mail

13:30 - 15:00

concurrent Session a1: Pathways to Policy

• Seth walker - Associate Bioenergy economist, RiSi

• Megan Smith - Forest Bioeconomy Program Specialist, ontario Ministry of Natural Resources

• dave Peterson - Assistant deputy Minister, BC Ministry of Forests, Lands and Natural Resource operations

• Bengt-erik Löfgren - Ceo, AFAB

15:00 - 15:30 Refreshment break in the trade show

15:30 - 17:00 concurrent Session a2: Pathways to Markets and investment

• Matthew Segal - Manager, Calvert Street group

• Matt Bovelander - Senior Consultant Bio Solutions, indufor Asia Pacific

• Kerry Lige – President & Ceo, Fibreco export inc.

14 www.pinnaclepellet.com

Biomass Energy Lab 4 www.biomassenergylab.com Davis LLP 15 www.davis.ca

Metso 5 www.metso.com Wellons 16 www.wellons.ca

LSJ Publications 8 www.forestnet.com/lsj

concurrent Session B1: Pathways to implementation – current and emerging Technologies

• Barry Zwicker - Ceo, Propel energy

• Jerry ericsson – President, diacarbon energy

• Larry gooder - Business development Manager, Borealis wood Power

• Moderator: elissa Meiklem, National Research Council

concurrent Session B2: Pathways to implementation – Biofuels/Biogas

• John Turner - director of energy Solutions, FortisBC

• deborah elson - Vice-President, Stakeholder Relations, Canadian Renewable Fuels Association

• Josh Lieberman - Program director, American Biogas Council

• dr. inder Pal Singh – President & Ceo, SBi Bioenergy inc.

16:30 Sessions end for the day

Bandit Industries 9 www.banditchippers.com

18:00 gala networking dinner in the trade show

Buettner 10 www.buettner-dryer.com

Proton Power 11 www.protonpowerinc.com

friday, June 13

7:00 - 8:00 Continental breakfast

8:00 - 9:45 concurrent Session a3: Pathways to Products – Bioproducts/Biorefineries

• Paul Lansbergen - Vice-President, Regulations and Partnerships, Forest Products Association of Canada

• Steve Price - executive director, Bio-Solutions, Alberta innovates

Moderator: Dr. Sam Weaver, President & ceo, Proton Power, inc.

9:45 - 10:15 Refreshment break in the trade show

10:15 - 12:00 concurrent Session a4: Pathways to Products – Pellets

• gordon Murray, wPAC: update on Canadian wood Pellet industry, international Market Situation and Current issues

• Brad Bennett, wPAC/Pacific Bioenergy: British Columbia wood Pellet Fibre Situation

• Michele Rebiere, Viridis energy: developments in the italian wood pellet market

• Vaughan Bassett, Pinnacle: update on Pinnacle’s new Prince Rupert pellet export facility

• John Arsenault, wPAC/QweB: Strategy for the development of the Canadian wood pellet heating market

Moderator: Mike curci, andritz

12:00 - 12:30 closing Keynote address

honourable Shirley Bond – British Columbia Minister of Jobs, Tourism and Skills Training

12:30 - 13:00 Luncheon in the trade show

13:00 - 17:00 industry tour to Nechako green energy

Aeon

Andritz Ltd.

BC Bioenergy Network

BC hydro

BC hydro

Beijing Panda Pellet

BM&M Screening

Borealis wood Power Corp.

BRuKS

Rockwood inc.

Brunette Machinery Co.

Business Sweden

Canadian Biomass

Clayburn Refractories Ltd.

Cogent industrial Technologies

College of New Caledonia

davis LLP

dieffenbacher

uSA, inc.

FeNgATe

(Ft St. James green energy)

Fink Machine inc.

FPinnovations

Frontline Machinery

iberdrola/iiC California

iBew Local 993

initiatives Prince george

isonor inc.

Jiangsu Yongli Leibherr Canada

LMM (Law-Marot-Milpro)

Logging & Sawmilling Journal

Ministry of international Trade

MP Combustion Process

Nordstrong equipment Ltd.

Northern outdoor

energy Systems Ltd.

Northland Chippers opticom

Prodesa

Propel Bioenergy

Proton Power inc.

Seeger green energy, LLC

Spartan Controls Ltd.

Turboden

uNBC

uNBC Continuing Studies

urecon Pre-insulated Pipe

Ventek energy

Vermeer BC equipment LP

wellons Canada Corp.

wonderware Pacwest woodland equipment

concurrent Session B3: Pathways to implementation – Bioenergy for Power and heat

• Alan Fitzpatrick - President, Nechako green energy

• Tony Madia - Vice-President, Corporate development, Conifex energy

• Joseph Seymour - executive director, Biomass Thermal energy Council

• Brent Boyko - director, Biomass Business development, ontario Power generation

Moderator: Sandy ferguson, conifex

concurrent Session B4: Pathways to implementation – community energy

• dominik Roser - Research Leader, Forest Feedstocks, FP innovations

• Karl Marietta - Vice-President, western Canada, FVB energy

• Jan Larsson - Partner, energy North

• Scott Beck - engineering Technologist, Village of Telkwa

Moderator: John Turner, fortisBc

UNBC’s Prince George campus is largely heated with two bioenergy systems that have served as a platform for education and research

#1 with Harvard for Campus

Sustainability in North America (2010)

- Association for the Advancement of Sustainability in Higher Education (AASHE)

LEED Platinum certification (2014)

2014 Canadian Green Building Award

- Canada Green Building Council

Voted #1 in Canada by Students for Environmental Commitment (2011)

- Globe and Mail

Environmental Stewardship Award (2011)

- Clean Energy Association of BC

Environmental Leadership Award (2011 & 2013)

- Prince George Chamber of Commerce

Finalist for the National EcoLiving Award (2011)

- Scotiabank

Technology Innovator Award (2011)

- Prince George Chamber of Commerce

Newsmaker of the Year (2010)

- Northern BC Business and Technology Awards

Excellence in Architectural Design (2011)

- City of Prince George

UNBC’s Most-Liked News Story of 2011 on Facebook: UNBC’s Bio-Plant Proves Emissions from Bioenergy can be on par with Natural Gas (2011)

Iogen evolves to meet demands of growing biofuel industry.

By Andrew Macklin

hasITbeen 10 years since Iogen became the first company to produce significant volumes of cellulosic ethanol using enzymatic hydrolysis processes. In the decade that has followed, the company has undergone an evolution that has allowed them to remain as a prominent provider of breakthrough biofuel technology.

The innovation demonstrated in 2004, along with the company’s alliance with Shell, caught the attention of the fuel industry across North America, landing Iogen on the cover of The Wall Street Journal amidst the incredible buzz generated south of the border.

“In America, they were saying wow, we have the capacity to produce 100 billion gallons of cellulosic biofuel without affecting our food supply,” says Iogen CEO

Brian Foody.

Over the next few years, the United States worked to develop its own policies for the use of renewable fuels. In 2007, the U.S. government released the Energy Independence and Security Act. The purpose of the bill was to reduce America’s reliance on oil and increase the production of renewable fuels. That led to the Renewable Fuel Standard mandate to produce 36 billion gallons of renewable fuel in the U.S.

the canadian aPPRoach

Canada took a different approach during that same time, choosing instead to focus on setting up commercial demonstration and large-scale production facilities. Sustainable Development Technology Canada set up a $500 million program that offered 40 per cent of the monies needed for the

construction of first commercial facilities for Canadian biofuel producers. That program was attractive for companies like Iogen, and Iogen was one of the first to apply for the new program to move its business venture forward.

The SDTC project, Foody explains, was a visionary project, as it provided an aggressive commitment to commercialization. But the program’s focus has some downfalls.

“Canada has done a very good job putting in place policies that help technology development and technology deployment,” says Foody. “The flipside is, in terms of market initiatives, there are jurisdictions in the U.S. that are ahead of Canada.”

In 2004, Iogen became the first company to produce significant volumes of cellulosic ethanol using enzymatic hydrolysis processes.

Iogen hoped that the SDTC funding would allow them to build a full-scale operation in western Canada, and they began working on building partnerships to find the right fit for the cellulosic ethanol facility.

Up until late in 2009, it looked as though the fit would be the shuttered Domtar pulp mill in Prince Albert, Saskatchewan. But in late-November of that year, Domtar announced that it was pressing forward with plans for demolition. A few weeks later, Iogen confirmed that talks with Domtar had indeed stopped. Just nine months after that, the project was dead – Iogen was left to find a new home.

For the next few years, the company continued diligently looking for a site that would make sense for a full-scale cellulosic ethanol facility. But, once again, they were unable to come up with a site that made financial sense based on the needs of the operation.

“We ended up having to do a reset,” explains Foody. “The project we were pursuing with Shell was stopped. We had to look and say, how can we move our technology forward less expensively.”

In November of 2013, Iogen and Raizen announced the start of construction of a commercial biomass-to-ethanol facility using Iogen’s advanced cellulosic biofuel technology.

In January of 2013, Iogen announced the sale of its enzyme business to Novozymes for $67.5 million CDN. The sale included the entirety of Iogen’s industrial enzyme business, which had been in operation since 1991. The sale allowed the company to focus on the development of its biofuel technologies.

Iogen worked out a partnership with a Shell partner, Raizen Energia Participacoes S/A, a company that represented the merger of Cosan and Royal Dutch Shell in Brazil. In November of 2013, Iogen and Raizen announced the start of construction of a commercial biomass-to-ethanol facility using Iogen’s advanced cellulosic biofuel technology. Located adjacent to Raizen’s Costa Pinto sugarcane mill, the $100 million plant will produce 40 million litres of cellulosic ethanol, at full capacity, using sugarcane bagasse and straw.

“The Brazilian industry is bottlenecked by the high cost of creating new sugarcane plantations,” Foody explains. “We needed to look at way to get more feedstock off the land.”

By using the waste products in the production of the ethanol, the amount of available feedstock has been increased by 40-50 per cent. That has given Raizen, the third largest Brazilian energy company, the ability to significantly increase their yield and will allow for expansion at a much lower cost.

Iogen used its extensive experience with cereal straw and corn stover to understand the differences in operation using sugarcane bagasse. After six months, Iogen was able to identify differences, troubleshoot any problems that arose, collect needed data, and make adjustments to the design to provide Raizen with a low-cost operation.

“We’re very excited to be working with a major industry player like Raízen to deliver large scale cellulosic ethanol production” says Foody. “Raizen is an incredibly dynamic partner with immense knowhow and expertise in first generation ethanol production. We share a common vision for the global potential of our technology and the importance of developing a successful first project. This project with

In January of 2014, Iogen announced the development of a patented drop-in cellulosic biofuel. The company has already been issued two patents for this new technology.

Raizen is a key step towards rolling our technology out around the world.”

Just two months after the announcement of the partnership, Raizen, in January of 2014, Iogen announced the development of a patented drop-in cellulosic biofuel, a game changer for the company. Iogen has already been issued two patents for this new technology.

The process involves using the residual material from the cellulosic material that is now a waste product and turning that into biogas through anaerobic digestion or gasification. The biogas is then converted to hydrogen, making it renewable hydrogen, and then the renewable hydrogen is blended in the refining process to produce hydrogenate petrochemicals, thereby effectively creating a gasoline that contains renewable hydrogen.

The opportunity for this technology is upwards of five billion gallons of drop-in renewable fuel, and it nearly doubles the yield in the production of cellulosic biofuel.

With new partnerships and product development in place, Iogen’s innovations are impacting the global biofuel market. As was the case 10 years ago, that means playing an active role in the development of the American biofuel industry. Iogen was a founding member of the Advanced Ethanol Council, and the company is continuously involved in policy discussions in Washington D.C.

According to Foody, the huge demand for renewable fuel, and even larger interest from investors, has made the U.S. a focal point for the biofuel industry.

As a result of the new development, Iogen is now actively consulting with the U.S. Environmental Protection Agency and the California Air Resources Board for approval for cellulosic LCFS and RIN credit generation.

“Biogas is produced today from landfills, wastewater treatment plants, waste digestion facilities, and farm digesters with well-proven technology,” says Foody. “We can now take biogas and make specification gasoline and diesel with renewable content using

well-proven existing refining operations. It is a win for everybody.”

Iogen also noted that the technology would be used in concert with two commercial-scale ethanol projects that they are developing in the U.S. The expected result of the use of the drop-in fuel is increased overall cellulosic biofuel yields per unit of feedstock, lower water usage per unit in the production of biofuel and lower overall capital costs.

“Iogen is a global competitor in the development of cellulosic biofuel technologies,” says Foody. “Working in the global industry means thinking about the U.S. market”

As for Canada, “policy makers need to make a choice” about what direction they will take with the idea of introducing a renewable fuel standard or low carbon fuel standard. Foody believes the will is there to do something, but what will be done remains to be seen. •

Canadian regulation holds the biofuel industry back as other countries benefit from advances in pre-treatments.

By Treena Hein

sIncethe 1970s when biofuel production began, pre-treatment methods – and the powerful substances such as yeasts and enzymes used in these methods – have come a long way.

“They have made an enormous difference in achievable yield of ethanol,” says Canadian Renewable Fuel Association President W. Scott Thurlow. “Research and development has been in perpetual state of innovation. Pretreatment using substances such as yeasts and enzymes allow us to derive more and more fuel from the same volume of feedstock material. This also allows us as a society to get more food and more fuel from the same amount of land.”

The efficiencies gained so far through pre-treatment processes have also made biofuel production greener. For example, water required in biofuel production has

decreased consistently over the last decade, and this is partly due to the contribution of enzymes, Thurlow notes.

Technological developments in pre-treatments have also led to better safety. New enzyme and yeast products are more pH-tolerant than those used in the past, and are being used to replace (much more dangerous) ammonia in front-end processing of ethanol.

The main purpose of the pre-treatment is to increase the reactivity of the cellulose and hemicellulose feedstock material

(corn, silage, woody biomass, straw) to the subsequent hydrolysis steps, to decrease the crystallinity of the cellulose and to increase its porosity. Only after pre-treatment are the sugar-containing materials accessible for hydrolysis, where lignin-free cellulosic material is split into sugars which are in turn fermented into biofuel.

The fruits of some of the enzyme research and development occurring here in Canada are approved for use in other markets, but these same domestic products are not yet allowed for domestic biofuel production.

Dr. Anthony J. Clarke (centre back) with his University of Guelph research group taken in October 2013

In a 2013 update of an international report called ‘Status of Advanced Biofuels Demonstration Facilities,’ scientists Dina Bacovsky, Nikolaus Ludwiczek, Monica Ognissanto and Manfred Wörgetter classify pre-treatment methods into three groups: chemical, physical and biological. “Well-known chemical pre-treatments involve concentrated and diluted acids,” the group explains. “They provide reduced corrosion problems and environmental issues but lower yields. Still other chemical pre-treatments being used and under investigation use ammonia, lye, organosolvents and ionic liquids.”

In terms of physical pre-treatment, Bacovsky and her colleagues note that steam explosion has been frequently applied in different parts of the world and delivers high yields of ethanol. They also note that

ammonia fibre explosion requires less energy input, but raises environmental issues. It requires that liquid ammonia be added to the biomass in question under moderate pressure (100 to 400 psi) and temperature (70 to 200°C) and then the pressure is rapidly released.

They list physical pre-treatment methods under development as liquid hot

“Enzymes produced by fungi and bacteria degrade cellulose naturally – without added heat, force, acids and so on – and if we better understand this powerful process, we can discover if there is something we might be able to apply in industrial cellulose production,” explains Dr. Anthony Clarke.

Clarke, a professor of Molecular & Cellular Biology at the University of Guelph, started researching the enzymatic breakdown of cellulose about eight years ago with Dr. Jacek Lipkowski and Dr. John Dutcher (Canada Research Chairs in Electrochemistry and Soft Matter & Biological Physics respectively), both also at U of G.

The scientists are studying three types of bacterial enzymes that work together to attack different regions of the cellulose polymer. “Most of the work so far has been to establish methodology to view the process as it’s occurring in real time,” Clarke explains. “That has been a big accomplishment that enables understanding to occur.”

It may be that in the future, the best course will be to genetically engineer bacteria to produce super-enzymes more powerful than those that exist now, or those that can withstand and work faster at higher temperatures and in acidic conditions, all of which will make the production of cellulosic ethanol more efficient.

water and CO2-explosion, which promise fewer side-products or low environmental impact respectively. The authors state that biological pre-treatment processes based on conversion by fungi and bacteria are not yet well-known or in much use.

The scientists created the report for an international group called ‘IEA Bioenergy Task 39 – Commercializing Liquid Biofuels.’ IEA Bioenergy was set up in 1978 by the International Energy Agency (IEA) to improve cooperation between countries that have national programmes in bioenergy research, development and deployment. Task 39 is a group of international experts working to commercialize sustainable transportation biofuels.

Dr. Jack Saddler is a Task 39 ‘Leader,’ as well as a professor in ‘Forest Products Biotechnology and Bioenergy’ and Dean Emeritus in the Faculty of Forestry at the University of British Columbia in Vancouver. Saddler is also a member of Montreal-based BioFuelNet Canada, a biofuels research network that is aggressively addressing the challenges impeding the growth of an advanced biofuels industry, while focusing on non-food biomass

feedstocks. It is based at McGill University.

Saddler agrees with Bacovsky and her colleagues about there being many ‘variations on a theme’ available in the cellulosic ethanol pretreatment arena – plenty of options are available in terms of which feedstock to use, how to pre-treat it and how to convert it. Of the three biofuel pretreatment methods (chemical, physical and biological) available, the scientists state that hydrotreatment (variations on steam explosion or dilute acid hydrolysis), as pursued by companies like Abengoa, Inbicon and Mascoma, currently accounts for most of the front-end commercial pre-treatments being pursued by the biofuel industry worldwide.

The interactive world map in the report references several cellulosic ethanol demonstration or pilot plants in Canada that use different processing methods. Tembec Chemical Group’s Temiscaming, Quebec demonstration plant uses thermochemical conversion of ligno-cellulosics into ethanol. Enerkem is building several commercial plants that use municipal solid waste (including woody biomass from construction debris and other sources), and they have a pilot plant in Sherbrooke, Quebec, and a demo facility in Westbury, Quebec (see the March/April issue of Canadian Biomass for details). Both use thermochemical conversion. Iogen Corporation has a demo plant in Ottawa that uses biochemical conversion of lignocellulosics into ethanol (see page 25 for details).

RegulatoRy haRmony

If the industry was asked to choose one aspect of biofuel pre-treatment in this country that needs attention, it might well choose the quest to allow the same enzymes and yeasts that are legal to use in other markets to be legally permitted for use here. “There are new products that are approved in Europe and the United States, but not yet approved in Canada,” Thurlow explains. “Regulatory barriers and inconsistencies like this are giving biofuels producers in the global marketplace a distinct competitive advantage over our producers here.” This disparity creates a situation where foreign biofuel producers can produce higher volumes, with more fuel to export, and potentially have the ability to undercut Canadian producers. Furthermore, the fruits of some of the enzyme research and development

occurring here in Canada are approved for use in other markets (helping to boost yields there), but these same domestic products are not yet allowed for domestic biofuel production.

The problem is being addressed, but it’s anyone’s guess as to when it will be solved. The main mechanism for harmonizing and streamlining industrial and commercial regulations in the U.S. and Canada is the joint governmental ‘Regulatory Co-operation Council.’ “Prime Minister Harper and President Obama and other representatives of both nations attend Council meetings regularly, but dialogue is constant,” Thurlow explains.

He says the Canadian Renewable Fuels Association provides information on regulatory disparities to the Canadian government for addressing within the ‘Regulatory Co-operation Council’ framework, but also works on the same issues with the Canadian Food Inspection Agency, Environment Canada and Health Canada.

“The development of new pre-treatments is limitless,” notes Thurlow, “but regulatory harmony is critical. Canada has a natural biomass advantage in terms of the volume of agricultural and forestry-related feedstocks we have available and the harvesting infrastructure we have in place, but we cannot turn that into a competitive advantage until we have a level playing field. We must have that for the industry to prosper as it should.”

But regulatory harmony is only one of many important recommendations that the CRFA outlines in its new vision and action plan entitled ‘Evolution and Growth: From Biofuels To Bioeconomy,’ released April 8th. In it, the association recognizes how far the industry has come already and is positive about the future: “A thriving and fully realized domestic renewable fuels industry is more than possible – it is viable and working in Canada. Now is the time to build off this successful platform and do more.”

•

For an interactive map of global biofuel projects visit: http://demoplants.bioenergy2020.eu/projects/mapindex.

A global report on biofuel facilities can be found online at: http://task39. org/files/2013/12/2013_Bacovsky_Status-of-Advanced-Biofuels-Demonstration-Facilities-in-2012.pdf.

The new CRFA vision and action plan is also online at: www.evolutionandgrowth.ca.

American-made hammermills and pellet mills from your partner in biomass pelleting equipment.

CPM OFFERS:

• Total pelleting system knowledge

• Around-the-clock customer support

• Large inventory of parts, with same-day shipment on many

• Test center for analyzing and improving pellets

By Amie Silverwood

OnAtlantic Canada’s eastern shore in northern New Brunswick, among the shortest routes between North America and Europe, the Port of Belledune has been building the infrastructure to safely transfer wood pellets onto ships bound for the European power plants that thrive on Canadian wood fibre.

The Port of Belledune has been around since the 1960s. In the 1980s, the port built Terminal II to receive the coal burned at the nearby power generating station. In the mid-90s, Terminal III was built for the more general purpose of shipping commercial commodities. It is 455 metres long and 100 metres wide to support two berths. The average depth is just over eleven metres.

In 2008, the port authority saw the need to build the facilities and equipment to handle wood pellets on Terminal III. Since then, it has loaded 55 vessels with pellets.

The port currently has two pellet producers as clients and has built bulk warehouses with a 45,000-tonne capacity between the two. The two buildings are fully equipped with dust and explosion suppression systems from the warehouses through the conveyor system that ensure the material is safely transferred from storage to the ships.

One of the advantages this port has over others is the vast amount of land it occupies. Located on Chaleur Bay in northeastern New Brunswick, it’s situated on a footprint of land with access to rail and roads but without the congestion that slows many urban ports. Included on the site is industrial land that was bought to bring additional industry to the area (storage, offices or manufacturing facilities would fit). The Belledune Port Authority has adopted an aggressive five-year plan that includes investments required to achieve potential new clients, and because of its location and abundant

land, there is little to limit expansion.

Because of the port’s location (short shipping routes to Europe and access to rail), the Port Authority is targeting pellet producers located as far west as Ontario. And now that the company has experience with wood pellets, it requires only six months to build the facilities to support a new pellet client.

“We have plenty of space to build new storage facilities and the capacity to handle large volumes as well as provide an aggregation location for shippers. In some cases it may make sense to go to the nearest port, but we feel if cooperation among shippers is realized or if the Port of Belledune were to be a hub for one of the large buyers there could be overall supply chain savings and efficiencies realized,” explains Jenna MacDonald, Director of Marketing for the Belledune Port Authority.

On Terminal III where the wood pellets are now stored and loaded onto the

• Features

• 48”

• Also

Once the process of filling the ship starts, it is a nonstop operation that transfers 10,000 tonnes of pellets in 24 hours.

vessels, the water is deep enough to fit a vessel that could carry a 35,000-tonne shipment, but if there is need for more, the port authority is willing to extend the dock into deeper water. This is a step that was taken in another terminal with ships that carry up to 65,000 tonnes in deep water ports.

Currently, the pellets are brought into the port by truck since both pellet producers are within 150 kilometres of the storage facilities. The pellets are brought in as they’re produced and stored at the port until the ship is booked and arrives for loading.

At the Port of Belledune, prevention is key so every precaution has been taken to prevent any hazards when handling wood pellets. Everyone on site has been trained in the safe handling of the pellets and precautions have been built into the storage and conveyor system as well.

“The pellets are monitored daily and workers on the terminal are always receiving new training,” MacDonald explained. “Also, health and safety procedures are updated consistently to ensure the highest quality standards at all times; this is key to having safe terminal operations at each stage of a cargo transfer, especially with products like wood pellets.”

The infrastructure has been in place since 2008 to make sure wood pellets are stored safely and gently loaded

Terminal III currently has two storage facilities for its wood pellet clients: one holds 20,000 tonnes of

onto the vessels. Ships come and go 12 months of the year so delays are built into the business plan. During cold winter months, they may be delayed due to ice conditions. And in the summer, ships may have long trips that are delayed at

other ports. In any case, being prepared with extra storage for overflow makes good business sense and prevents clients from having to shut down mills because of inadequate storage.

The pellets are monitored daily since

early detection is the key to preventing pellets from overheating with procedures in place to ensure the cargo is handled safely at each stage of transfer. If a monitor detects that the pellets have begun to self-heat, a wheel loader is on hand to disperse the warming spots and cool them down.

Once the ship arrives, the pellets are delivered on a string of conveyors that is connected directly to the ship loaders. It’s a closed system that’s sealed to contain dust within the dust suppression system through to a telescopic chute that gently deposits the pellets into the vessel to further prevent dust and pellet breakage.

The port operates 7 days a week, 24 hours a day and 12 months of the year. Once the transfer has begun, there’s relief for every piece of equipment so that it’s a non-stop operation. It takes an average of 24 hours to transfer 10,000 tonnes of pellets. Depending on the ship, the shipment can take between nine to 12 days between Belledune and the United Kingdom. •

Rhinoflex flexible pre-insulated piping has taken over the market for 4" and smaller pre-insulated pipe.It is a high quality product that has the lowest installed cost of any pre-insulated pipe.There are more than 300 miles of flexible pre-insulated pipe installed in the U.S.with more than 3,000 miles installed worldwide over the last 25 years!

Rovanco s Rhinoflex pre-insulated flexible piping is manufactured with either a PEX or Polyethylene (PE) carrier pipe and comes in the longest continuous lengths available in the marketplace.These long lengths result in few or no underground joints.This saves you up to 60% in labor costs — yielding a total installed savings of 25 to 40%!

Rovanco s Thousands of Miles of experience coupled with the tens of thousands of successful piping systems Rovanco has installed worldwide,assures you will get the correct product for your specific piping systems.

Contact Rovanco for a quote. The high price of copper has made Rhinoflex even more competitive.

Contact: CHAD GODEAUX,Product Specialist

Rhinoflex Pre-Insulated Piping Systems Phone:(815) 741-6700 Fax:(815) 741-4229

E-Mail:chad@rovanco.com

Rovanco Piping Systems 20535 S.E.Frontage Rd. Joliet,IL 60431

By Andrew Macklin

Oncethe cornerstone of Canada’s petrochemical industry, the border town of Sarnia, Ontario, has had to think smart to avoid the devastating impact of industries packing their bags and leaving town.

Sarnia’s potential downfall began in the early-2000s with the announcement that Dow Chemical was abandoning its Canadian operation and consolidating its assets in the American market. What could have been a serious blow for the community’s economy instead served as a necessary wake-up call, forcing local officials to come together to explore ideas for how to continue as a thriving industrial community. The result was a commitment to compliment its still-strong petrochemical industry with the growth of a biochemical sector.

oPPoRtunity KnocKs

Getting Sarnia’s biochemical industry moving forward has taken a collaborative effort of major partners from across the community and region. Western University (formerly the University of Western Ontario) worked with the Ontario Chemistry Value Chain Initiative, along with City and County officials, to establish a research park at the former Dow chemical site. An NSERC grant of $15 million in seed funding from the Centres of Excellence for Commercialization and Research (CECR) program in 2008 established the BIC, now known as Bioindustrial Innovation Canada.

Bioindustrial Innovation Canada is the

amalgamation of the former BIC and the Sustainable Chemistry Alliance. The BIC was integral in delivering funding and networking opportunities together for biochemical startup companies, providing the means necessary to commercialize new biochemical solutions. The BIC has worked to build the biocluster in Sarnia, bringing together networking and financing opportunities to help startup bio companies get projects off the ground. They built a Board of Directors that has provided these opportunities, as well as connections to materials, customers, feedstocks and labour.

In addition to the CECR funding, a $10 million grant for The Bowman Centre was applied for and received from the Ontario Ministry of Research and Innovation in order to provide the infrastructure at the research park to create bioindustrial lab and pilot plant space for emerging companies and technologies in the biochemical industry.

Those two building blocks have become the foundation for the Western University Research Park, providing funding, networking, research and development resources for the biochemical industry in Sarnia.

The collaborative efforts of the education, association, municipal and corporate stakeholders began to pay dividends a few years later when the Bowman Centre welcomed its first pilot plant.

Woodland Biofuels received funding for its waste-to-biofuel plant in April of 2010 through the Innovation Demonstration Fund. The $12 million facility uses its own proprietary gasification and three-step catalytic conversion process technology to produce sustainable biofuel out of just about any type of biomass, including both agricultural and wood waste. The plant was commissioned in late-2012.

The Woodland production of cellulosic ethanol involves the gasification of biomass into syngas using either the

air-blown or steam-blown gasifier. The syngas is conditioned and compressed before transferring to the ethanol reactor where catalytic chemical reactions convert the syngas to ethanol. The company then uses a well-established distillation process to purify the ethanol.

The second company to install a pilot facility in the Bowman Centre at the research park was KmX Corporation, which began operations in October of 2012.

KmX incorporated in 2004 after acquiring the rights to a pervaporation membrane technology. The company acquired a solvent recycling plant in New Church, Virginia, the headquarters for its U.S. subsidiary, KmX Chemical Corporation, and a demonstration facility for its membrane technologies.

At the Bowman Centre in Sarnia, the company is working on a fermentation and filtration system that will produce butanol. Fermenting biomass sugars into butanol can create a cellulosic biofuel that has the potential to be a gasoline substitute. Using biomass sugars to create bio-

chemicals and biofuels is a current focus for the BIC.

The third company involved in the Bowman Centre is GreenCore Composites. In February of 2013, GreenCore announced that it was moving its manufacturing facility from Mississauga to the Bowman Centre at the Western University research park. According to GreenCore president and CEO Geoff Clarke, “the move gives us space to install the new production line which we did not have at our previous location. It also allows us to configure the lines for greater productivity and locates us near the U.S. markets where we expect rapid growth.”

GreenCore’s technology involves extracting nano fibres from various species of wood in the production of thermoplastic materials. In some cases, the fibres are being used to replace glass fibres to create recyclable plastics. The automotive and sports equipment industries are just a few examples of industrial sectors testing with GreenCore at the Bowman Centre pilot plant.

The development of the research park has provided Lambton College and Western University with opportunities to provide complimentary education opportunities for their students.

Lambton College began an applied research program in 2004-2005, focusing on synthetic and polymer-based materials. As the school expanded on its research capabilities, they began engaging local and regional companies to look for research opportunities that would benefit both the school and the companies involved.

It was at this time that Lambton began working with GreenField Specialty Alcohols, who were interested in research involving biomaterials. The result of working with GreenField, and the expanding research capabilities at Lambton College, was an increase in projects involving the biosector.

“We felt that there was a demand, there was a need for a certain kind of expertise,” says Dr. Mehdi Sheikhzadeh, Dean of Applied Research and

Innovation at Lambton College. “No one in Ontario was offering specific training for bio-process operators.”

For Western University, the development of the research park has led to new opportunities within the biochemical sector.

“The research park is a tremendous opportunity, especially for Western students,” says Katherine Albion, director of The Bowman Centre. “Since the park was established, Western has developed a Green Engineering program; the school offers a number of bio-based courses and there are thesis projects underway for students here.”

There is also extensive work being done to build on bio-based educational opportunities by both Lambton and Western. Lambton will launch a new program stream focused on the biosector, called Bio-industrial Engineering Technology, scheduled to welcome its first class of students in the fall of 2015.

Western is looking to both expand on the courses offered at the research park and the complimentary tools that can be brought in to support the industries onsite.

“One of the opportunities we are currently pursuing is the development of an entrepreneurial centre,” says Tom Strifler, executive director of the research park. “Together with Lambton College and other local partners, we are hoping to set that up in the region. It also builds on what we are doing for our existing clients – that is a new focus area for us.”

Outside of the Lambton College/Western University centres, Sarnia opens up to a vast landscape of massive petrochemical properties. Many of Canada’s largest oil companies call Sarnia home, like Imperial Oil, Suncor, and Shell Canada, as well as major chemical manufacturers like NOVA, DuPont and Praxair.

Sarnia has been hit with a series of closures in its recent past, leaving large patches of land with built-up chemical infrastructure. That infrastructure provides a strong case for companies in the biochemical sector to think about building there.

That infrastructure is at the heart of Sarnia’s bio-industrial park, located amongst

the massive oil refineries along the eastern shore of the St. Clair River. The property already includes Lanxess, the world’s largest producer of synthetic rubber, along with TransAlta Energy, located at the adjacent Bluewater Energy Park.

The Sarnia bio-industrial park will also soon be home to the $110 million BioAmber bio-succinic acid production facility. BioAmber chose Sarnia over approximately 100 other locations for its new plant thanks, in part, to the existing infrastructure already in place. The plant expects to be operational some time during the first quarter of 2015.

Succinic acid is used as an acidity regulator in some food and beverage products, as well as in specialized polyesters and resins. The chemical is primarily derived from petrochemicals, but BioAmber has developed a system for creating bio-succinic acid from renewable feedstocks. At full production, BioAmber expects to produce 30,000 tonnes of bio-succinic acid per year.

The collaboration of industrial, municipal and educational partners has created

Brunette Machinery Company Inc. has introduced the Brunette SmartVIBE Vibrating Conveyor. The Brunette SmartVIBE has a simplistic design that includes no coil springs or external balance beams.

The patented design of the Brunette SmartVIBE enables the operator to vary the feed speed of the conveyor through the use of a variable frequency drive while maintaining the balance at all feed rates. This new technology allows systems to be optimized based on system loading and efficiency levels, rather than being fixed at a single speed.

The Brunette SmartVIBE is available in different widths and lengths complete with size-specific screening options and metal detection. This versatile conveyor is suitable for biomass, recycling, pellet manufacturing, sawmilling, plywood, OSB, food processing and agricultural industries.

Seattle-based Impact Bioenergy has created a unique technology that enables institutions and campuses to generate energy from their own food scraps and paper products.

The company has developed a proprietary portable bioenergy generation technology, called model AD185, which eliminates the need to transport waste by processing it on-site. The technology uses anaerobic digestion to extract biogas from the feedstock. Nutrient-rich compost is the ultimate end product after the biogas has been extracted. The AD185 requires less than 400 square feet of ground space. An energy storage unit (320 square feet) can be added for peak demand cycling. The equipment fits in an urban setting and includes features like gas lighting to visually engage passers-by with a compelling illustration of the energy value of food scraps. The system is pre-fabricated and can be installed in a single day with simple connections to building wiring, water, and sewage systems.

The unique aspects of the design include a skid-mounted food waste recycling and preparation system, digester, and power production unit. The AD185 is rated for a waste input of 1,000 lbs. per day (peak 2,000 lbs. per day) with 48-day residence time. It is a completely portable bioenergy plant that can be configured for electrical output or biogas supply to an existing furnace or boiler. Electrical output on a base-load 24-7 basis is 11.7 kW, with peak output at 35.1 kW. Odour is captured and treated with state-of-the-art, odourcontrol technology – including biofiltration, carbon filtration, and atomizing in a fully enclosed system.

Luiken, director of BTAC.

The result will be BTAC working with Lambton College to provide additional applied research and technology development resources, as well as research, technical, and training services for industrial partners in the biosector in Sarnia.

The roots of the Sarnia biocluster has now been established with a thriving Western University Research Park and bioindustrial partners throughout the

city’s landscape. But according to the BIC, there is still work to be done to grow the biochemical industry in the region.

“What we really need to fill this cluster out is a couple more major investments to come in and expand out the cluster,” says Sandy Marshall, chair of the BIC.

With the structure that has been built, there is little doubt that Sarnia will succeed in fulfilling that need. •

• Vibration Resistant

• 560 TV Lines

• Waterproof, IP68 Rating

• 700 TV Line

• 2.9, 4.3, 6, 8, 12, 16 mm lenses

• 2.9, 3.6, 4.3, 6, 8, 12, 16 mm lenses

• All Weather, Extreme Environment

• All Weather, Extreme Environment

• Heavy Gauge Di-Cast Metal Alloy & Titanium Components

• Heavy Gauge Di-Cast Metal Alloy & Titanium Components

• Tri-Axial Mounting System

• –60°C to +60°C

• Tri-Axial Mounting System

• –76°F to +140°F

• –60°C to +60°C and –76°F to +140°F

• Waterproof, IP68 Rating

• Vibration Resistant

By Stephanie Thorson

enewable Natural Gas (RNG) is a little known fuel that has enormous potential to economically reduce greenhouse gas emissions from transportation, a sector with high emissions.

In the same way that ethanol is blended with gasoline and bio-diesel is blended with diesel fuel, RNG can be blended with natural gas for compressed natural gas (CNG) vehicles or liquified natural gas (LNG) vehicles. The Biogas Association is working to develop RNG as a vehicle fuel to cost-effectively improve the environmental performance of the transportation sector.