BY SAUL CHERNOS

Two bridge cranes, working in tandem to hoist 800 metric tonnes during a load test at Nalcor Energy’s Muskrat Falls generation facility on the lower Churchill River in Labrador this past summer, showed that a little cooperation can go a long way.

From the time ground was broken in 2012, heavy lifters of all kinds have seen duty, from mobile rough terrain cranes handling various components to enormous Hydro Mobile F300 elevator-like hoisting platforms provided by Montreal-based AGF Access Group.

BY SAUL CHERNOS

When using cranes to install a roller coaster, it’s perhaps only fitting that work crews experience the ride of their lives.

The Yukon Striker will not only be the newest kid on the block but one of the wildest when Canada’s Wonderland theme park north of Toronto re-opens for the season in late April.

Imagine ambling along at moderate speed, hovering briefly at the precipice of a 90-foot drop, then plunging 75 metres at 90 degrees into an underwater tunnel.

Currently in its final stages of installation, the Yukon Striker is billed as the world’s tallest, fastest and longest dive coaster. The Swiss-built ride is 1,105 metres long and designed to reach speeds of 130 km/h, drop 75 metres in a single dive, and soar through four inversions including a complete 360-degree loop. The coaster features one of the world’s largest inversions, where the tracks — and the world — flip topsy-turvy.

CAPP discuss outlook for 2019, goals for 2020, and beyond

BY ANDREW SNOOK

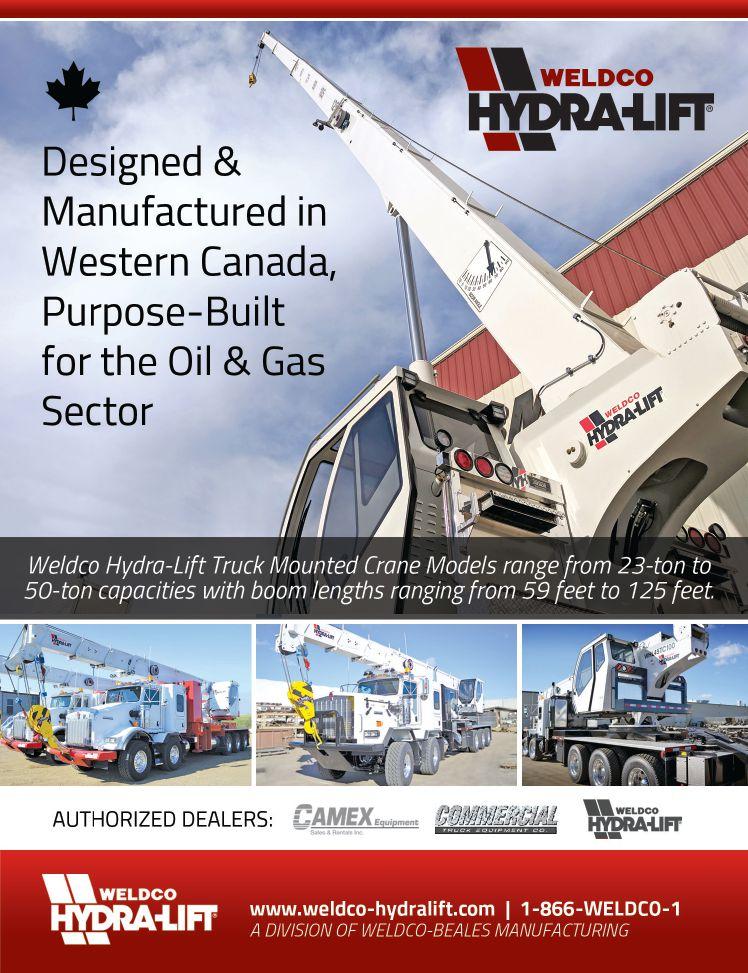

Alberta’s oil and gas sector should be expecting another challenging year ahead, according to the Canadian Association of Petroleum Producers (CAPP).

Ben Brunnen, vice-president of oil sands operations and fiscal policy at CAPP, says the association expects 2019 to be another “batten down the hatches” year for the industry.

“2019 is going to continue to be a challenging year for the oil and gas sector, coming off what I would say was a particularly challenging year in 2018,” he says. “Investment in our sector in 2019 is expected to decrease by about 10 per cent, year over year... a second consecutive year of decline.”

Investment in Alberta’s oil sands has been experiencing the most challenging market, now in its fifth straight year of declining investment.

Publications Mail Agreement #PM40065710 RETURN UNDELIVERABLE

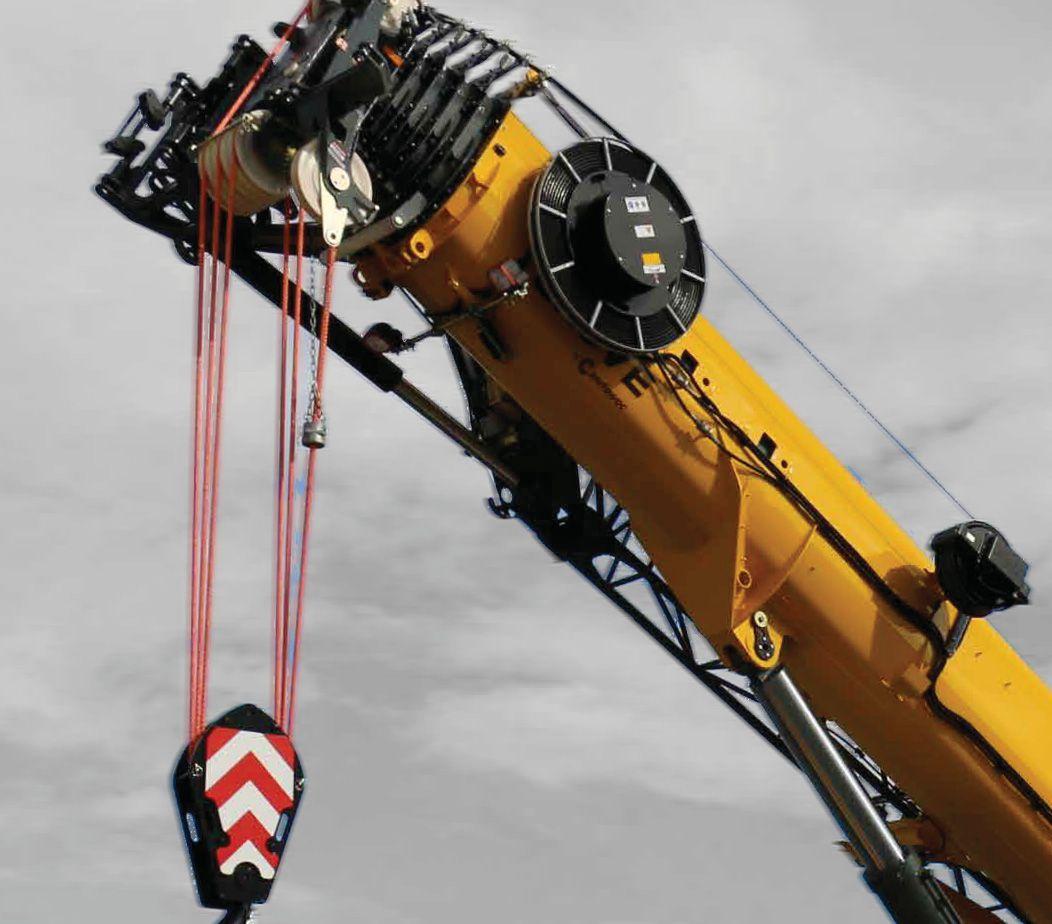

Superior lifting capacities, on-line load chart calculation

Great variety of boom configurations

Quick and easy assembly

Easy and cost-effective transportation

Liebherr-Canada Ltd. 1015 Sutton Drive, Burlington, Ontario L7L 5Z8

Phone: +1 905 319 9222

E-mail: info.lca@liebherr.com www.facebook.com/LiebherrConstruction www.liebherr.ca

Editor – Andrew Snook

asnook@annexbusinessmedia.com • 289-221-8946

Account Manager – Amanda McCracken amccracken@annexbusinessmedia.com • 226-931-5095

Media Designer – Svetlana Avrutin

Regular Contributors

Saul Chernos, Doug Younger, Nelson Dewey, Matt Jones, Judy Mellott-Green Group Publisher – Scott Jamieson • sjamieson@annexbusinessmeda.com

President & CEO – Mike Fredericks

Circulation Manager – Barbara Adelt • badelt@annexbusinessmedia.com

Subscriptions – Bona Lao – blao@annexbusinessmedia.com Tel: 416-442-5600 • 1-800-668-2374 (CDN) , ext. 3552 Fax: 416-510-6875 or 416-442-2191 • www.craneandhoistcanada.com

Annex Privacy Officer – Privacy@annexbusinessmedia.com Tel: 800-668-2374

Crane & Hoist Canada is published six times a year by Annex Business Media. Reference to named products or technologies does not imply endorsement by the publisher. A subscription to Crane & Hoist Canada (six issues) is $37 + Tax per year in Canada. For subscriptions in the USA the price is $37 USD. Send cheque or VISA/ Mastercard number to Subscription Department, Crane & Hoist Canada, 111 Gordon Baker Rd., Suite 400, Toronto ON M2H 3R1. Fax orders to 416-510-6875. Or subscribe online at www.craneandhoistcanada.com

RETURN UNDELIVERABLE CANADIAN ADDRESSES TO: Crane & Hoist Canada. CIRCULATION DEPT.

111 Gordon Baker Rd., Suite 400, Toronto ON M2H 3R1 ISSN 1923-788X

Next Advertising Deadline: March 22, 2019

Don’t miss the opportunity to be part of this exciting new industry publication. For more information, or to reserve space in the next issue, call Amanda McCracken at our Advertising Department Tel: +1-226-931-5095 • amccracken@annexbusinessmedia.com

Next Editorial Deadline: March 22, 2019

For writers’ guidelines and submission requirements get in touch with the editor, Andrew Snook, at 289-221-8946 Email: asnook@annexbusinessmedia.com

Hackers have been in existence almost as long as computers. Some of them are, in fact, quite harmless. People looking to test their skills against the strongest security systems strictly for the intellectual challenge - many of these bright minds are hired by governments and private companies to test their own systems against those who look to do harm.

For some hackers immersed in criminal enterprises, hacking holds the opportunity for identity theft, raiding bank accounts and holding individuals and companies’ data for ransom.

But not all hackers looking to perform criminal acts are looking for profit. Some hackers look to create chaos strictly for their own entertainment and, sometimes, specifically to hurt people.

I recently read a disturbing article in Forbes written by cybersecurity writer Thomas Brewster. Brewster wrote about a new type of hacking that has begun, and it’s dangerous as hell: the hacking of large construction cranes and other types of heavy equipment.

In the article, Brewster speaks with cybersecurity researchers who wanted to see if they could take control of tower cranes and other heavy equipment by reverseengineering communications from the radio frequency (RF) controllers.

Their success rate was disturbingly high.

They were able to take control of various types of heavy equipment across construction sites all over Italy, with tower cranes obviously holding the potential to do some of the most catastrophic damage if taken over; given their lifting capacities and the likelihood of their proximity to

densely populated areas in downtown cores of cities.

In addition to the potential for injury, this type of hacking could create huge spikes in costs of projects due to lost time stemming from equipment being stolen or being taken over and held for ransom.

The cybersecurity experts in the article do offer some suggestions for helping address this potential problem, such as ensuring a company is using modernized, standardized technologies that would create more opportunity to build fixes into the equipment where there may be vulnerabilities to hacking.

Now, for those of you sweating crane-sized bullets, here’s a little good news.

Some of the fixes to protect vulnerable equipment have already started rolling out over the past year. According to the article, the U.S.-government-funded Computer Emergency Response Teams has been working on communicating this issue to manufacturers and patches and workarounds are being created.

Read the full Forbes article and watch a video of a crane being taken over through hacking at the following link: https://www.forbes.com/sites/thomasbrewster/2019/01/15/ exclusive-watch-hackers-take-control-of-giantconstruction-cranes.

This may seem like an unlikely scenario, but the threat is very real. And construction companies around the globe will need to protect themselves, their employees and the public from this type of attack from chaos creators, terrorists, and criminal hackers for profit, now and in the future.

Stay safe out there.

As storage levels draw down and the value of Alberta’s oil increases, the province is increasing the limit on oil production.

Premier Rachel Notley’s decision to protect the value of Alberta’s oil has been instrumental in helping reduce the amount of oil in storage, which had been nearly twice the normal level and resulted in the resources owned by all Albertans being given away for pennies on the dollar.

In response to new storage data, Alberta is increasing production in February and March to 3.63 million barrels per day, which is a 75,000-barrel per day increase from the January limit of 3.56 million barrels per day.

“We’re not out of the woods yet, but this temporary measure is working. While it hasn’t been easy, companies big and small have stepped up to help us work through this shortterm crisis while we work on longer-term solutions, like our investment in rail and our continued fight for pipelines. I want to thank Alberta producers for working with us to protect the jobs and livelihoods of thousands of Alberta families and businesses, and your cooperation has been key to easing these limits ahead of schedule,” said Notley.

Alberta’s goal has always been to match production levels to what can be shipped using existing pipeline and rail capacity, while encouraging a reduction in storage levels.

Alberta is increasing production in February and March to 3.63 million barrels per day, which is a 75,000-barrel per day increase from the January limit of 3.56 million barrels per day.

The decision to temporarily limit oil production was applied fairly and equitably, and has been instrumental in saving jobs across the energy sector. Since the production limit was announced in December 2018, storage levels in Alberta have dropped ahead of schedule, declining by five million barrels to a total of 30 million barrels in storage.

Analysis based on independent data suggests storage levels have been decreasing roughly one million barrels per week since the start of 2019 and are on track to continue clearing the storage glut that led to unprecedented discounts for Alberta oil in late 2018.

“I will never stop fighting for Albertans and Canadians to get top dollar for the resources that belong to them. We will adjust these production levels as necessary going forward and we will not waver in our fight for a Made-in-Alberta strategy to build new pipelines, access new markets and add value that creates jobs by upgrading more of our oil and gas here at home,” said Notley.

Source: Province of Alberta.

Canada’s Oil Sands Innovation Alliance (COSIA) announced today that its Chief Executive, Dr. Dan Wicklum, is stepping down after seven years as head of the organization.

Dr. Wicklum joined COSIA at its inception in 2012, leading the organization through its formation and launch to becoming a globally unique hub where companies have redefined what it means to collaborate to improve sector environmental performance and sustainability.

Under Dr. Wicklum’s leadership, COSIA’s portfolio of projects has delivered 981 technologies valued at $1.4 billion which has resulted in meaningful progress to reduce impacts to water, air and land. In addition, COSIA has created a comprehensive infrastructure of testing facilities and collaborations that poises the sector to further accelerate performance.

“COSIA’s member companies would like to thank Dr. Wicklum for his seven years of leadership and support of our vision to accelerate the pace of environmental improvement in Canada’s oil sands,” said Joy Romero, COSIA board chair and vice-president of technology and innovation, Canadian Natural Resources Limited. “We wish Dr. Wicklum all the best in his future pursuits.”

“It’s been a privilege to lead the organization and a pleasure to work with a truly committed team of member companies, staff, and partners, but I have decided to move on,” said Dr. Wicklum. “We have just completed a strategic planning process that will see COSIA accelerate innovation in key areas and step up its communications efforts. The proposed plan is intended to chart the course for the next five years, which provides an excellent opportunity for me to leave the organization on extremely solid footing and gives me the opportunity to pursue other interests.”

Dr. Wicklum’s final day at COSIA will be February 15, 2019. The board will be initiating a search for a new chief executive.

Source: COSIA.

continued from cover

Peter Switzer, director of maintenance and construction with Canada’s Wonderland, said the park last installed a new roller coaster in 2012. Seven years later, a refresh was due. Management purchased the Yukon Striker from Bolliger & Mabillard, which designed it and manufactured the steel track, support columns, trains and controls.

Riders will be able to thank a flock of cranes for the experience. With so much steel, crews called in multiple heavyweights. In fact, a one-day lift of the drop section alone required five machines.

Bill Woods, general foreman with the project’s structural erector, E.S. Fox, described the section as triangular in shape, with a base more than 61 metres long overshadowed by two supporting columns, each one metre in diameter, meeting at the top.

“It weighed in at approximately 130,000 pounds (59 metric tonnes) and about 80 feet (24.4 metres) between the two posts,” Woods said. “It’s like an A-frame but it’s at a 29-degree pitch, so it’s not vertical.”

Crews hoisted this somewhat twisted structure in segments, with a 620-ton-capacity Liebherr LTM1500 mobile crane grappling one column and a 275-ton Kobelco CK2750G crawler holding the other. A 90-ton Tadano GR900XL rough terrain crane was used to lift a motor that would be attached, while a 75-ton Tadano GR750XL rough terrain crane and a 45-ton boom truck handled additional connections that were spliced on.

“We had a boom truck and an RT crane with man-baskets to access the splices, then once the splices were made and the A-frame was assembled the 620 (Liebherr) was cut loose and transferred to the top of the A-frame and the Kobelco was disconnected,” Woods explained, describing further splicing and binding of parts.

“It all sounds easy but of course things don’t line up perfectly,” Woods added. “With a coaster everything’s got to be perfectly aligned within one or two millimetres. We had to use big hydraulic jacks beneath the column legs and also some cables to manipulate the columns in such a manner that we could attach it all and make it all line up correctly.” With a roller coaster, every piece or segment is unique, heavy and awkward, and considerable heights are involved.

“The largest piece we hoisted was 155,000 pounds (70.3 tonnes) and we set it at 217 feet (66 metres),” Woods explained. “We had three hoisting cranes and two cranes with man-baskets on them.”

On one patch of raised ground, crews had two 300ton cranes — a Demag AC250 and Grove GMK6300L — working in tandem with a boom truck to erect what’s known as an Immelmann. Named after an aerial combat repositioning manoeuvre, an Immelmann is a section of track where riders reach the top of a loop and return to a level position. “It’s got a twist in it,” Woods explained.

Perhaps the toughest aspect of the job was working within tight confines. While surrounded by wide-open spaces, the park itself is a tight-knit network of rides and concessions as well as artificial hills and a small mountain.

Crews typically used the 75-ton and 90-ton rough terrain cranes to offload the coaster sections, place them in a lay-down yard and put them on trailers to be shunted to the location where they would be erected. Some pieces would go up as one, others were spliced together, and a handful, including columns, required more than one crane to place.

“Depending on the location, we had to determine what cranes we would use, how far we had to reach out to install the pieces, and how far we had to manoeuvre around obstacles,” Woods said.

One particularly complicated part of track, the lift section, will direct riders upwards on a 47-degree angle, with the pitch 70 degrees in places. “These pieces are 144,000 pounds (65.3 tonnes) each and approximately 120 feet (36.6 metres) long and going up 207 feet (63.1 metres),” Woods said. “They’re flat on the ground and you’ve got to use 20-ton chainfalls and other heavy rigging to manipulate the pieces to get them situated and ready to install. And they’ve got a big drive motor at the bottom and all kinds of components. We put that up with the LTM1500 and a luffing jib.”

Another challenging task had cranes set up in an existing artificial pond into which the Yukon Striker will descend by means of a tunnel before re-emerging near a small mountain.

Because Wonderland remained open daily prior to Labour Day and on weekends until Halloween, crews had to drain the pond prior to setting up for a day or week’s worth of work.

YUKON STRIKER BY THE NUMBERS:

107 track elements weighing more than 1,213 metric tonnes combined 42 support columns weighing more than 363 metric tonnes combined Tallest column: 63 metres

* Three trains each have three cars with each carrying eight riders in a single row.

* Trains will run three minutes, 25 seconds apart, transporting up to 1,200 people an hour.

As the job winds down — final touches include using one of the smaller cranes to install the ride’s three 9.4tonne train-like cars — Woods said he looks forward to commissioning the coaster in March so it’s ready when the park re-opens in April.

“You might think a roller coaster can’t be too hard,” Woods said. “But, roller coasters aren’t flat. Every piece has to be rolled, twisted and rigged. A lot of times you could roll the pieces with the crane if you had a main line or an auxiliary line. But it took a lot of rigging, chainfalls and come-alongs to fine-tune them.”

Peter Switzer has seen this kind of crane work many

times given his role supervising construction at a theme park. Still, he said he’s impressed with how crew members handled the learning curve involved with erecting a complex coaster.

Switzer said a supervisor from Bolliger & Mabillard has been on-site throughout the project’s duration, providing guidance.

With Wonderland at capacity footprint-wise, Switzer knows adding new rides always presents a challenge. The park removed an older stand-up coaster back in 2014 to make room for the Striker.

“There’s multiple factors that go into a decision like that,” Switzer said, adding that a ride’s popularity and overall costs also influences a park’s roster.

However, space is clearly a factor. “It’s like building a ship in a bottle,” he said. “It’s not a traditional site by any means.”

To learn more about the Yukon Striker, visit: www.canadaswonderland.com/play/rides/yukon-striker. Photos courtesy of Canada’s Wonderland.

continued from cover

However, two 340-metric-tonne overhead cranes, supplied by Groupe LAR of Métabetchouan-Lac-à-la-Croix, Que. have done the heaviest lifting, working to help install the facility’s weighty powerhouse components.

The 84-metre-tall powerhouse includes four turbine/ generator units and, together with the spillway and dams, will form the nucleus of the generating facility, spanning the lower Churchill River at Muskrat Falls to create the reservoir and power the plant.

The Lower Churchill Project team sourced the two bridge cranes from Groupe LAR’s iCrane division, which designed, built and installed the cranes.

“Our main business is steel fabrication,” said Alexis Gauthier, a sales engineer with Groupe LAR.

The iCrane division custom-builds bridge and gantry cranes and other hoists for a range of hydroelectric infrastructure that also includes spillways and intake gates.

The two bridge cranes will have their work cut out for them at the project site. Working from rails attached to the columns inside the powerhouse structure, they will be used to help put the turbines and other powerhouse components into place. Then, in the years ahead, the cranes will assist with ongoing maintenance and periodic system overhauls.

Gauthier said the project required considerable planning and engineering, and placing the cranes underneath the ceiling proved particularly challenging.

“The room we had inside the powerhouse was quite tight,” Gauthier said, adding that the cranes’ components were brought into the powerhouse on the delivery truck via the Trans-Labrador Highway, a gravel road at the time, and assembled with help from a 350-tonne mobile crane and 90-tonne all-terrain crane working from inside. “Many hours of engineering were required because we had to plan exactly where the mobile crane would be located inside the powerhouse during the lifting, where the truck with the cranes would back up inside of the powerhouse, and how we would pick them up.”

A hole was left in the powerhouse roof so the larger mobile crane’s boom could extend beyond ceiling height. “That way we had enough lift-height capacity,” Gauthier explained.

The first crane was installed and commissioned in early 2017 and the second one followed this past summer.

Commissioning consisted of basic tests and fine tuning done immediately following their reassembly on-site to ensure basic functionality of electrical and computerized components.

With these initial tests completed, the cranes were ready for their load test. The project team determined the bridge cranes need to be able to hoist up to 650 tonnes, in tandem, and Groupe LAR engineers produced the needed calculations and drawings.

While load tests are routine, specified under the Canadian Standards Association, they’re normally done one crane at a time. This time, the project team decided to also test the cranes in tandem. “For us, to test the lifting beam was a first. It’s not common to test with the lifting beam,” Gauthier said.

To provide the needed performance assurance and meet safety standards, the project team looked to hoist a mandated minimum 125 per cent of the targeted 650 tonnes and settled on 812.5 tonnes.

Work crews connected their custom-made lifting beam to the tandem lifting beam of the two cranes and performed an initial test, at 100 per cent, using 34 concrete blocks for a total 650 tonnes. Continued on page 8.

Crews then disconnected the custom-made lifting beam from the concrete block assembly, added nine more blocks for a total of 43, and reconnected the custom-made beam for testing at 812.500 tonnes, representing 125 per cent planned capacity.

With lifting beam and hooks included, the weight increased to 830 tonnes, making the test even more rewarding. “According to the load cells on the cranes, 834.5 tonnes was lifted by the cranes, including the weight of the tandem lifting beam and the hook blocks, during this test,” Gauthier said.

With the load tests completed, the bridge cranes are now in the hands of the project team and contractors. Each crane includes a main hoist and an auxiliary one, with each main hoist capable of lifting 340 tonnes and the smaller ones able to lift up to 25 tonnes. The smaller hoists are meant for smaller, more routine jobs, to boost efficiency. “It’s to handle lighter loads and to move them faster,” Gauthier explained.

Gauthier wasn’t at liberty to disclose the cost of the bridge crane used at Muskrat Falls but said tandem bridge crane packages tend to cost roughly $12 million, including engineering and load test services and customer training.

“The load testing of the two cranes in tandem was a significant achievement,” said Scott O’Brien, the project manager for Muskrat Falls generation. “A fully operational powerhouse overhead crane system is a critical asset in the delivery and maintenance of the Lower Churchill Project’s turbine and generator sets.”

With first power expected this year and full power scheduled for 2020, Nalcor’s Muskrat Falls generation facility stands to be the second largest hydro plant in Atlantic Canada. The current facilities capital cost estimate for the generation and transmission components of the project is $10.1 billion, with financing and other costs bringing it to $12.7 billion.

Groupe LAR has supplied iCrane systems to a range of customers. Hydro-Québec purchased 300- and 325-tonne systems for its Romaine I and II hydroelectric projects a half decade ago. Groupe LAR also supplied bridge cranes to an aluminum smelter in Qatar. Founded in 1942 to service the timber and aluminum sectors, Groupe LAR switched gears and began serving hydroelectric customers in 1985. The company remains locally owned.

BY DOUG YOUNGER, OCCUPATIONAL SAFETY OFFICER

Regular inspections and maintenance of mobile cranes and boom trucks is essential to ensuring the safety of operators and workers who are working with and around this equipment.

Employers are responsible under the Occupational Health and Safety Regulation and Workers Compensation Act for ensuring the health and safety of all workers on their worksite. Mobile cranes and boom trucks have the potential for catastrophic equipment failure and serious injury or death. From 2009-18, there were 10 serious injuries related to mobile cranes and 12 serious injuries related to boom trucks, and one work-related death.

From 2009-18, there were 10 serious injuries related to mobile cranes and 12 serious injuries related to boom trucks, and one work-related death.

According to B.C.’s Occupational Health and Safety Regulation 14.71, owners and operators of mobile cranes or boom trucks must have all of the machine’s critical components annually inspected, in accordance with the manufacturer’s requirements and applicable standards, and certified as safe for use by a professional engineer.

“It’s imperative that the structural, mechanical, and control components are included in the annual inspection process,” says Doug Younger, occupational safety officer and member of WorkSafeBC’s provincial crane-inspection team. “If any part of the equipment is not inspected, it can put workers at unnecessary risk.”

In January 2018, WorkSafeBC launched its 2018–20 Crane Initiative, which conducts targeted safety inspections of worksites that use cranes or boom trucks. With officers based in the Lower Mainland, Central Interior, and Vancouver Island, the team inspects cranes and boom trucks all across B.C.

The Crane Initiative is one of 17 high risk strategies and industry initiatives designed to align prevention efforts with specific industries that present a high risk of serious injury to workers.

When the crane team visits a worksite, they look at the professional-engineer-certified annual inspection document, maintenance records, the operator’s certification, and — if it’s a boom truck — the stability documents.

“We’re also looking at where the machine is set up and how it’s being used,” Younger says.

Inadequate annual inspections are one of the most-frequent noncompliance issues with crane and boom trucks. While many employers have an annual inspection conducted on the machine’s structural components, not all employers are fulfilling the requirement for annual mechanical and control inspections.

The cost to do a structural, mechanical, and control inspection may be higher up front, but the cost of equipment failure can include injuries, loss of life, lost work-hours, equipment costs, and even administrative penalties or increased insurance premiums.

WorkSafeBC offers a Mobile Crane Inspection Checklist as a resource for employers. The checklist provides specific OHS references for each aspect of safe crane set-up and operation. There is also a crane lift-capacity analysis section, where description and load weights information can be added.

The checklist asks the following questions:

• Is the crane operator certified in British Columbia?

• Is the annual crane inspection current?

• Is the combination crane (boom truck) stability tested?

• Is the manufacturer’s manual in the crane or at the workplace?

• Is the daily crane pre-use inspection complete and documented?

• Can the crane be set up with the outriggers fully extended and set on cribbing?

• Is the lift planned with site-specific circumstances evaluated?

Information on safety devices, maintenance, inspection and repair is also included in the checklist.

Engineers and Geoscientists BC plans to develop professional practice guidelines for annual inspections of mobile equipment in B.C., with funding support from WorkSafeBC. The guidelines are expected to be completed by fall 2019.

For more information and resources, visit the Crane Initiative on worksafebc.com.

BY DANA FILEK-GIBSON

It’s steady – but not necessarily smooth – sailing for Canada’s roadbuilding and aggregate sectors in 2019.

As the new year gets underway, producers and contractors across the country are expecting similar conditions to last year, with steady growth and predictable investment in some regions – and volatility and funding challenges in others. Across the country, the distribution of federal infrastructure funding continues to see setbacks. A total of $180 billion has been set aside for infrastructure spending over 12 years, starting in 2016, including $10.1 billion dedicated to trade and transportation infrastructure. However, an August 2018 status report from the Parliamentary Budget Office found persistent delays in the spending of federal infrastructure dollars compared to the government’s original 2016 timeline.

Canada Infrastructure Bank, the Crown corporation established in 2017 to facilitate private investment in largescale infrastructure projects, has also been slow to invest its money. A $1.28-billion commitment to Montreal’s REM light rail transit system is the only funding to come out of the bank’s $35-billion coffers so far.

On a national level, housing starts are expected to decline gradually from a 10-year high in 2017 but will remain strong in many areas of the country, according to the Canadian Mortgage and Housing Corporation’s Fall 2018 Housing Market Outlook, as income and employment growth will continue to support new residential construction, as will new household formation.

B.C.

In British Columbia, the roadbuilding and aggregate industries expect to see the steady business of 2018 continue in the coming year. Housing starts have been strong across the province, though B.C. is expected to see a decrease in 2019, according to CMHC, as a record number of projects in Vancouver and Abbotsford-Mission are already underway.

Derek Holmes, president of the B.C. Stone, Sand and Gravel Association, is optimistic about the aggregate

industry’s prospects, citing major projects such as road improvements along Highway 1, the LNG Canada facility and the Site C Dam as highlights for the year ahead.

“2018 was a strong year for the industry in B.C. and we’re hopeful that 2019 will be as well, but the reality is that we’re looking at mixed economic indicators on home prices being down and housing and construction starts having increased at the same time.” said Holmes. “The trends showed that while home prices were down year over year, housing and construction starts were robust and increased modestly in the second half of 2018.”

But while the industry expects to stay busy in the coming year, Holmes also warned that government regulation could create roadblocks in future.

“The challenges facing us in 2019 lie with the regulatory regime and making sure industry and job growth is maintained through transparent policy implementation, cutting red tape, and tackling decision making bottlenecks by government at all levels,” he said.

Meanwhile, Kelly Scott, president of the B.C. Road Builders and Heavy Construction Association, believes provincial infrastructure spending will continue to provide opportunities for the roadbuilding industry in 2019, particularly on the Pattullo Bridge replacement project as well as a series of four-laning efforts along Highway 1 from Kamloops to the Alberta border.

“2019 looks very strong on the order board. Government has indicated they’ll be continuing to spend money on improving the infrastructure of British Columbia and the economy, which is good for us,” he said.

However, Scott is concerned about labour shortages in the coming year; as well as the province’s Community Benefits Agreement.

“The Community Benefits Agreement continues to be hanging over the industry as a concern – not so much the benefit agreement, per se, but the labour agreement that’s attached to it,” he said.

The CBA, announced last summer, promises to provide greater access to training and construction jobs for Indigenous people and women as well as workers living in close proximity to public infrastructure projects, however it also

requires workers and contractors involved in a CBA-affiliated project – such as the Pattullo Bridge replacement and the Highway 1 four-laning efforts – to join a union for the duration of that project.

While Scott says the roadbuilding industry has always supported efforts for greater inclusion and apprenticeship training, he takes issue with project labour provisions in the CBA, noting that the majority of B.C. construction workers are not affiliated with unions.

Slumping oil prices and uncertainty over provincial infrastructure spending mean the Prairies are likely to face some economic headwinds in the coming year, though it remains to be seen where those impacts will be felt the most.

“Anything that is a feeder to the oil industry has to plan for volatility,” said John Ashton, executive director of the Alberta Sand and Gravel Association, pointing specifically to areas in the north like Grande Prairie and Fort McMurray, where oil has a greater impact on the local economy.

Across Alberta, housing starts are expected to see “more balanced conditions” in the near future, according to CMHC, however infrastructure spending in the province remains a question. Alberta’s 2018 budget laid out a five-year, $5.6-billion funding plan for major road and bridge projects and work continues on efforts such as the Southwest Calgary Ring Road, however Ashton anticipates the provincial government will pull back on infrastructure spending in 2019.

“Depending on what the next budget looks like and who actually controls the next budget, there may be a serious discontinuation of infrastructure spending, especially on the road front,” he said. “That could be a very, very large decrease on demand… and that would definitely have an impact on the capital region and the Calgary areas.”

Still, Ashton cautions against making general predictions in the province.

“Aggregate demand is, by its nature, localized, and Alberta’s a very, very big place. Because of that, there’s really about six different economies happening in Alberta at any given time,” he explained.

• 81 V-CALC outrigger positions

• Real-time 360° charts

• Live capacity preview mode

• Outrigger position sensing

• Incorporated swing arrest

Meanwhile, the Saskatchewan roadbuilding and aggregate industries are “cautiously optimistic,” according to Shantel Lipp, president of the Saskatchewan Heavy Construction Association, who expects to see “a small reduction” in the amount of work put onto the market in 2019. Lipp also anticipates the carbon tax, which has not yet been levied in the province, could impact the amount of work the industry will be able to take on in the coming year as well as increase fuel costs for the heavy civil sector.

In Manitoba, the roadbuilding industry is facing another tough year after the provincial government slashed infrastructure funding in its 2018 budget, reducing spending by $152 million from the previous year for a total of $350 million in highway capital investments.

Additional infrastructure programs also took a hit, as the province downsized its Municipal Road and Bridge Program from $14 million in 2017 to $2.25 million in 2018.

“2018 was a very, very weak and poor year for industry in Manitoba as it relates to highways capital programs,” said Chris Lorenc, president of the Manitoba Heavy Construction Association, adding that he is “not at all confident that there will be any material change” in next year’s provincial budget. Still, there have been some bright spots. Lorenc credits the City of Winnipeg with “sustained, predictable and incremental investments” in municipal infrastructure, which he anticipates will continue in 2019.

In Ontario, a new provincial government and a handful of policy changes have the aggregate and roadbuilding industries optimistic about the coming year.

Andrew Hurd, director of policy and stakeholder relations at the Ontario Road Builders’ Association, is looking forward to the full implementation of 2017’s Con-

struction Lien Amendment Act, which he calls the “most important legislation to affect the provincial construction industry in decades.”

“Ontario’s Construction Lien Amendment Act, when fully implemented, will ensure that money flows quicker to contractors and workers, helping to keep companies competitive, bolster the economy and create jobs,” Hurd explained. “Our association continues to engage with the provincial transportation ministry regarding their transition to these new requirements, particularly on the incorporation of bonds into the ministry’s procurement practices.”

In terms of provincial infrastructure spending, concerns remain over the speed at which government-funded projects progress, however slower-than-expected timelines don’t seem to be impeding growth in Ontario’s aggregate and roadbuilding industries.

“My sense is that both the province and the federal government have moved more slowly than their stated budget commitments to the cause of new infrastructure spending,” said Norm Cheesman, executive director of the Ontario Stone, Sand and Gravel Association. “You would never know that, however, driving around the [Greater Toronto Area], for example, where new buildings are going up, and road repair and construction is now a year-round business.”

While he is optimistic about 2019, Cheesman notes there is still work to be done in bringing policymakers up to speed on issues related to the aggregate industry.

“I think the fact that we are now dealing with a government which is intent on making it easier to do business is contributing to a positive outlook on the part of the industry, but we have a big education job to do with both elected MPPs and officials in several ministries,” Cheesman explained. “It’s important for politicians to understand that these raw materials need to be available close to where they are needed for

construction so that projects are completed in the most economical and environmentally efficient way possible.”

Moving into the new year, Hurd says the ORBA is eager to learn more about Ontario’s infrastructure capital plans for 2019 and will also be keeping an eye on the effects of federal carbon pricing in the province. Hurd does not anticipate this will affect the asphalt industry directly but expects carbon pricing to impact fuel, energy and supply costs for the road building industry.

The roadbuilding and aggregate sectors are looking forward to another good year in Quebec, where the province announced a record $100.4-billion investment in its 2018-28 Quebec Infrastructure Plan, adding $9.3 billion to the previous year’s budget. CMHC also reports that strong population growth is expected to continue to spur housing starts, particularly in apartment buildings and other multi-unit housing.

Gisèle Bourque, executive director of the ACRGTQ (Association of Road Builders and Heavy Construction Quebec), attributed last year’s success to infrastructure projects like the new Champlain Bridge and the Turcot Interchange.

Amid a positive time for the industry, however, Bourque cautioned that labour shortages could become an issue in the near future and raised concerns about Quebec’s ability to provide steady funding for the maintenance of provincial and municipal road networks while tackling major infrastructure projects at the same time.

“The region’s infrastructure should not be neglected in favour of large cities,” she said.

Moving forward, Bourque anticipates business in the province will continue to grow, provided the roadbuilding industry focuses on three main efforts: “stable, predictable and recurring investments” in the province’s infrastructure, increased annual investment in Quebec’s highways and an early launch of tenders to allow the industry to complete more work before the winter season.

“On the one hand, this effort would allow the renewal of infrastructures before they are obsolete and, on the other hand, would allow public contractors and contractors to better plan the work… that they will have to execute,“ Bourque explained.

By and large, the East Coast is expected to hold steady in the coming year, with Nova Scotia, P.E.I. and Newfoundland and Labrador seeing sustained infrastructure investment from their respective provincial governments. Producers and contractors in New Brunswick, however, are in limbo as they await the coming year’s budget. Officials in the province recently tabled a $600.6-million capital budget for 2019-20, far less than the $865.6 million estimated by the previous government.

These latest capital estimates set aside $321.1 million for maintenance of transportation assets, however CBC reported following the budget’s release that New Brunswick will postpone work on several high-profile projects, including upgrades to Route 11.

For Tom McGinn, executive director of the N.B. Road Builders and Heavy Construction Association, these spending cuts spell uncertainty for the roadbuilding and aggregate sectors.

“We’re not quite sure what’s going to happen… everyone’s in a holding pattern,” said McGinn, adding that infrastructure work with local municipalities will likely remain steady.

“There’s lots of water and sewer work that needs to be done so that end of the industry is going to be OK, but it’s our highways and bridge work with the provincial government that we just don’t know.”

In terms of preparation, however, McGinn is pleased to see the provincial government compiling multi-year spending plans, as these long-term projections help the industry to see what lies ahead.

“Historically, New Brunswick has come out with a capital plan in December for the upcoming construction season, and they just go year by year,” McGinn explained. “We’ve been saying to government it would be nice to have a multi-year plan so businesses will know what’s coming not only next year (but) the next few years.”

B.C.

In B.C., the provincial government is set to continue its $5.3-billion investment in transportation infrastructure through 2020-21. Major projects like the four-laning of the Trans-Canada Highway between Kamloops and Alberta will move ahead in the coming year, as will plans for the replacement of the Pattullo Bridge, which is expected to reach completion in 2023.

Both projects will be handled by B.C. Infrastructure Benefits, the province’s newly formed Crown corporation responsible for executing the Community Benefits Agreement announced by the B.C. government last summer.

Alberta

Alberta’s 2018 budget laid out a five-year, $5.6-billion spending plan for major road and bridge work on projects such as the Highway 2-Peace River Bridge, the Grande Prairie-Highway 43X bypass and the Highway 15 bridge at Fort Saskatchewan. Construction on the Southwest Calgary Ring Road is also ongoing, and the road is expected to open to traffic in 2021.

Saskatchewan

Saskatchewan dedicated $2.7 billion to infrastructure spending in 2018-19, with $691 million going toward transportation infrastructure, such as rural highway

upgrades, passing lanes on Highways 6 and 39 and interchanges at Martensville and Warman.

Manitoba

Manitoba’s 2018 budget saw infrastructure spending reduced from $502 million to $350 million, while the province’s Municipal Road and Bridge Program was cut by more than 80 per cent. In its 2018 budget, however, the City of Winnipeg unveiled a six-year capital investment plan that aims to spend $2.2 billion on the city’s infrastructure over that period.

Ontario

Ontario’s 2018 budget commits $230 billion in infrastructure spending over 14 years, starting in 2014-15. This includes more than $106 billion set aside for new and upgraded transit and transportation infrastructure, $25 billion of which is designated highway spending.

Quebec

Quebec continues work on several major infrastructure projects, including a new public transit system in Quebec City and Montreal’s REM light rail system, while the province has announced a record $100.4-billion investment in its 2018-28 Quebec Infrastructure Plan, an increase of $9.3 billion from the previous year.

Nova Scotia

Nova Scotia announced in its 2019-20 Five-Year Highway Improvement Plan that the province will commit $300 million to major construction, asphalt and resurfacing, gravel roads and bridge replacement and rehabilitation, among other things, a $15-million increase compared to the previous year.

New Brunswick

The province’s road building industry is expecting work to be postponed on major projects such as upgrades to Route 11 following the tabling of New Brunswick’s smaller-thanexpected $600.6-million capital budget.

Newfoundland and Labrador continues to invest in a multi-year infrastructure plan first introduced in 2017. Spending for the 2018-19 fiscal year totalled $228.9 million in roads, bridges and marine infrastructure, while another $148.1 million in federal and provincial investment went to municipal infrastructure projects.

P.E.I.

P.E.I.’s capital budget estimates for 2019-20 allot $56 million in provincial spending on highway improvements and bridge replacements, including $5 million to replace six bridges. This remains relatively steady compared to last year’s budget, which set aside approximately $52.7 million for infrastructure projects.

In Nunavut, Transport Canada will invest more than $35 million for an expanded cargo warehouse at the Iqualuit airport as well as the replacement of airport terminals in several locations. Nunvaut’s 2019-20 capital estimates lists airport improvements in its budget as well as the air terminal buildings in Chesterfield Inlet and Naujaat.

The ongoing Mackenzie Valley Highway project, whose Inuvik-Tuktoyaktuk Highway was completed in 2017, will continue in the coming year with federal funding from the National Trade Corridors Fund, which sets aside as much as $400 million to develop transportation infrastructure in Yukon, Northwest Territories and Nunavut, including ports, airports, all-season roads and bridges. Moving forward, construction is planned for a bridge crossing the Great Bear River as well as an access road from Wrigley to Mount Gaudet.

Yukon

Yukon’s five-year capital plan, released in 2018, earmarks a total of $70 million in infrastructure spending for the territory in the coming year, with $5-million incremental increases over the following three years.

The Crane Rental Association of Canada will be presenting an outstanding slate of speakers at the 2019 annual conference in Charlottetown, P.E.I., thus helping its members navigate through changes. From the legalization of cannabis, the rise of the Millennials and the challenges faced by the oil and gas industry on Indigenous land, CRAC is looking at these impactful issues face on.

Don’t let David Coletto’s young appearance fool you, he earned a doctorate in 2010, he is an adjunct professor teaching courses on polling and public opinion, political marketing, research and public affairs. A talented and entertaining speaker, he is one of Canada’s leading experts on Millennials. David will share his finding and tools to guide employers in their recruitment and retention efforts.

Dan Demers is back by popular demand, top rated speaking in 2017, a year prior to legalization, Dan is returning with the latest information, research and tools to educate CRAC members on the new legal landscape, and Canadian workplace safety in the age of legal cannabis.

Jean Paul (J.P.) Gladu is currently the president and CEO of the Canadian Council for Aboriginal Business (CCAB) based in Toronto. Anishinaabe from Thunder Bay, J.P. is a member of Bingwi Neyaashi Anishinaabek located on the eastern shores of Lake Nipigon, Ont. JP brings a wealth of knowledge and expertise in business relationships between with Aboriginal businesses, and the participation of Indigenous peoples in the grow and development of business in general.

Several other speakers will share the stage at this year’s conference. Networking activities such as the annual golf event, discovery tour and evening programs will highlight several Maritimes entertainers and celeb-

rities. The Safety Awards for crane rental companies and the Longevity Awards for long-time association members will be presented at the CRAC Conference.

In preparation for the 21st anniversary celebrations, the Crane Rental Association of Canada (CRAC) is accepting applications for its annual Safety Awards. The criteria and application form can be found on the CRAC website. The Safety Awards are open to member crane rental companies and companies receiving the awards will be listed on the CRAC website and covered in partner publications.

Take advantage of the Early Bird Discount and sign-up for the Crane Rental Association of Canada’s 2019 Annual Conference taking place at the Delta Hotels Prince Edward in Charlottetown, P.E.I.

Three days of business and social events for all members and spouses of the association. The theme for the 2019 conference is “Navigating the changes!” and will feature speakers addressing topics of wide interest including the growing millennial workforce, the legalization of marijuana, and Indigenous rights and partnerships.

Spouses will be invited to attend some of these sessions as well as participate in the spousal program.

For membership information or to register for the conference, please visit www.crac-aclg.ca or email claire@crac-aclg.ca.

BY JUDY MELLOTT-GREEN

There is an old industry saying: “Don’t sweat the small stuff, it’ll all come about in the end”. That may have worked 10 or 20 years ago, but it wouldn’t fly in today’s industries. Manufacturing, assembly, production, construction and operations have radically changed over the past 10 years. Operating equipment now is very sophisticated with onboard computers, lots of bells and whistles, and some even come with robots.

What hasn’t changed are the workers in the shops, who operate all types of powered equipment to perform their job tasks. Many of these workers are skilled certified trades personnel that utilize all types of powered equipment to perform their job, such as welders, pipe fitters, electricians, etc.

The employer is responsible to ensure all workers have successfully completed the site orientation prior to entering the shops, as well as provide safety training programs applicable to the company equipment operations. Examples of this are forklifts, pallet jacks, telehandlers, overhead crane lifting equipment, etc.

Most industries across North America have made significant changes to applicable local occupational health and safety regulations and federal legislation. It is every employer’s responsibility to ensure the safe work practices in their shops comply to the most current published regulations and standards requirements.

In addition to meeting compliance to jurisdictional OH&S regulations and safety codes, the employer shall meet compliance of applicable equipment safety standards. CSA-B167 in Canada, and ASME B30 in the United States, have designed standards applicable to most types of lifting equipment. In event of an injury, accident or fatality, these standards will be utilized to ensure the equipment was inspected, maintained and operated in compliance to these standards. These records are the employer’s objective evidence of due diligence, that everything reasonably prac-

Manufacturing, assembly, production, construction and operations have radically changed over the past 10 years.

ticable was done to ensure worker safety on their jobsite. The employer is responsible for maintaining all records of maintenance, inspections, repair logbooks, including the operator daily logbook, that may be reviewed at any time. The equipment “Operator Daily Logbook” is the employer’s objective evidence of due diligence in the event of an injury accident or fatality, to ensure worker safety and that everything reasonably practicable has been done correctly. These equipment checks take place at the beginning

and end of every shift and are documented in the “Operator Daily Logbook”. This is very cost effective for the employer, as most deficiencies are noticed and reported to the supervisor on every shift. As an example, when a limit switch is not working or brake not holding, etc. Should these types of issues not be addressed, it could result in a very costly repair or a catastrophic accident.

Downtime alone for the repair could easily result in tens of thousands of dollars in lost production, costly repairs, or possibly loss of contract. The only way to reduce these incurred costs is to ensure all workers are properly trained and work continuously in accordance to the safety training received, for the powered equipment they operate.

Supervisors, HSE-personnel, foremen and lead-hands are recommended to attend and successfully complete the same safety courses all their workers attend, as they are responsible for observing/monitoring workers performing tasks, to ensure they are not putting themselves in jeopardy of having an accident.

The employer is responsible to ensure every worker is operating powered equipment correctly. These instructions are all in the manufacturer’s handbook, which is an excellent tool to utilize when seeking out safety training venders for the powered equipment in the shops.

Judy Mellott-Green has over 27 years experience working in the overhead crane industry and was the recipient of the 2016 CSA Award of Merit in recognition of exemplary goal-oriented leadership. As president of the All Canadian Training Institute Inc. (ACTi) in Edmonton, Alta., Judy continues to participate on provincial, national and international safety committees to assist in improving standards and workers safety for those who utilize this type of equipment.

BY ANDREW SNOOK

Terex Cranes’ Demag AC 300-6 all-terrain crane has arrived in Canada. Cropac, one of Terex Cranes’ biggest and most active dealers, officially sold the first-ever Demag AC 300-6 to come to Canada to Milton, Ont.-based Modern Crane, which took ownership of the crane this past January. Cropac president Bill Finkle says that the main application for this type of crane is the erection of tower cranes.

“This class of crane has been very popular in Eastern Canada,” Finkle says. “It’s going to change the way we put up tower cranes.”

Modern Crane, a division of Pumpcrete Corporation, has additional offices in Niagara Falls, Kitchener, London, Oshawa and Concord, is highly active in the heavy lifting and concrete pumping sectors across Ontario, and employs approximately 300 people.

Finkle says the Demag AC 300-6 has a wide variety of impressive features, including increased capacity at the tip, and that these cranes are ideal for the Ontario market.

“Ontario has more tower cranes than anywhere else in North America,” Finkle says. “This has a big jump in capacity compared to what’s out in the field. We expect to sell more in the future.”

The six-axle all-terrain crane has a 300t (350 US ton) classification, features an 80-metre (262.5 ft.) main boom and is the first crane of its size in the Demag range equipped with a luffing jib. The 80-metre main boom is designed to perform jobs at heights up to 78 metres (255 ft.) or 74 metres (242 ft.) radius without rigging a jib. It is ideal for tower crane erection, with a class leading lifting capacity of 15 t (16.5 US ton) on fully telescoped 80-metre main boom, according to Terex Cranes.

Aaron Hanna, vice-president of sales at Modern Crane, says that the crane’s long main boom makes it a perfect fit for erecting tower cranes; adding that another one of the features that makes this crane a must-have is its ease of set up on jobsites where there are potentially impeding obstacles. The Demag AC 300-6 all terrain crane features a carrier length of 15.3 metres (50.1 ft.) and a width of 3 metres (9.8 ft), and is easy to position thanks to its active

all-wheel steering designed to provide excellent maneuverability in tight spaces.

Modern Crane owner, Mark Williams says that being the first to take ownership of a Demag AC 300-6 will give his company significant advantages in the heavy lifting marketplace.

“It gives us a leading edge being the first in the market with it. We’re always embracing the latest technologies,” he says. “This is the first variable plus outrigger. It allows us to set up in very tight spaces.”

Other features that drew Modern Crane to the AC 300-6 were Demag’s single engine concept with an

intelligent motor management system, which should reduce the company’s maintenance times and costs; the long-range fuel tank; its arsenal of safety cameras; and its tire pressure monitoring system. Williams says that the tire pressure monitoring system could pay big dividends.

“It allows the operator to deal with it before it becomes an issue,” he says.

The Demag AC 300-6 also helps significant Demag fleets maintain a lower stock of spare parts because it uses many interchangeable parts with the Demag 5-axle family of all terrain cranes. For more info on the Demag AC 300-6, visit www.cropac.com.

“That’s very difficult because much of the investment is going towards sustaining existing projects as opposed to new growth. The oil sands won’t see much of an investment at all,” Brennan says. “On the conventional side, the fact that we’ve seen two years in a row of decline is a pretty significant indicator as well. It had a little bit of a boost in 2017, but now that we’re seeing it decline again in 2019, we’re on a downward trend for both. It’s not going to be the best year for our sector.”

He adds that much of the future investment and growth in the oil and gas sector will be dependent on the outcomes of substantial decisions from the federal government, the governments of B.C. and Alberta, as well as other players.

Brennan says one of the decisions the CAPP is watching is how long Alberta’s curtailment program will last (announced in December 2018), and “how deep it will cut.”

“While it is a temporary reprieve for challenging prices, on a long-term basis it really doesn’t create any confidence from an incremental investment perspective – if you’re being curtailed, no one will invest any additional dollars,” Brennan says.

Alberta recently increased the limit on oil production from 3.56 million barrels per day in January to 3.63 million barrels in February and March – as the storage levels declined and market value of the province’s oil increased.

The CAPP is also watching the decisions on various pipelines developments currently in play or proposed.

“We’ll be looking very closely at some of the pipeline developments, and hopefully see some positive announcements at a minimum for decisions for Keystone (Keystone Pipeline) and for TMX (Trans Mountain Expansion Project),” Brennan says, adding that the association will be looking for good news related to the Enbridge line replacement project. “We’ll be looking for that project to complete construction hopefully by the end of the year. Those will be key signals for the confidence of the sector that we’ll be watching in 2019.”

Brennan adds that if the sector sees positive results coming from these projects that it could start to see a slowdown or stoppage in the declining investment trend.

“But until we see that information, I don’t think there’s going to be a heck of a lot of incremental development in Canada’s upstream sector this year,” he says.

The CAPP recently released its report, “Oil and natural gas priorities for a prosperous Alberta,” which discussed the association’s goals for 2020.

The main goals were:

• Ensure the rate of Alberta’s oil and natural gas supply doubles in growth and helps meet global demand, thereby displacing less responsible sources of supply;

• Double investment in Alberta;

• Growth in Alberta helps Canada become the fourthlargest oil producer, surpassing Iraq and China; and,

• Growth in Alberta helps Canada become the third-largest natural gas producer, surpassing Iran and Qatar.

To help advance these goals, the CAPP stated that action was required in the following areas:

• Market access;

• Regulatory competitiveness;

• Climate policy; and

• Fiscal and economic policy.

“One of the key objectives and the pieces we would like to emphasize for governments and Canadians is the recognition of Canadian oil and gas as the preferred fuel of choice to meet global energy needs domestically and internationally,” Brennan says. “We have a robust regulatory regime and one of the most stringent carbon-pricing regimes in the world from a producer country perspective, and we invest in continuous improvement.”

He adds that the CAPP would like to see Canadian oil and gas be used domestically to displace imports from countries with less robust social and regulatory environments; and globally, for Canadian oil and gas to meet future energy needs.

“We’re seeing an increased demand of emerging companies for affordable energy, and Canada should be the barrel of choice,” Brennan says. “We want Canadians and governments to embrace this and work towards getting there… I think the need for this stems for, what I would consider, a lack of focus and strategy to build the infrastructure needed to ensure Canadian oil and gas serves Canadian consumption needs. And that requires concerted effort from governments, provincially and federally, industry, and Canadians at large.

“Moving on from that it’s about getting the facts on the table, promoting and being champions of our industry and countering myths so that Canadians understand the value we bring to the table.”

One of the key components to meeting the CAPP’s goals is to improve the industry’s regulatory competitiveness. The CAPP would like to see average application timelines be reduced by 50 per cent through the use of “OneStop,” which is a consolidated approach to a approvals.

“The OneStop is a consolidated approach to approvals, so that industry can submit their applications and have a response in an efficient timeline on a broad array of approval conditions,” Brennan explains. “We call it a risk-based application approach. We have a lot of applications we have to bring forward - whether it’s for a well, a well pad, a facility, or an existing facility in the oil sands or anything along those lines – and some of these applications are more complex than others, and have more components than others, while others are quite straightforward.

“If we can use the OneStop on a risk-based approach where something that is straightforward and routine and is a sub-component of a broader project, that should be approved quite quickly and not require some separate process, compared to others that might need a little more consolidated focus. The OneStop is trying to integrate the approvals within the regulators of Alberta and then also within other Ministries – such as Environment, Energy, and Indigenous Relations – in a way that we get those approvals, and one: the conditions are identified early; and two: the approvals come out in a consolidated way so there’s good information

sharing across agencies; so they’re able to make their decisions in a consistent and expedited way.”

In the CAPP report, it states that industry is committed to being a constructive partner in addressing climate change, but its ability to contribute is compromised by a lack of access to markets and capital. The CAPP stated that industry would support climate policy that “ensures flexibility, encourages innovation, doesn’t impede investor confidence, and allows for the growth of greenhouse gas (GHG) emissions-efficient operations.”

“The idea here is there are multiple pathways to compliance,” Brennan explains. “There are all kinds of innovative ways that companies are looking at reducing GHG footprint and intensity, whether its through innovations in the reservoir – what’s called solvent injection in the reservoir – or how they’re approaching the way they structure their facility from boiler efficiencies, and those types of things.

“But this is really about encouraging government to create the incentives for companies to innovate as they see fit – they can explore based on their situation. There is another issue based on the geology of the facilities – of the oil itself – that can have a differing impact on the GHG intensity. Each facility is a little bit different, so finding a way to encourage these facilities to reduce their emission intensity through innovation, and still be able to compete and grow, is really what it’s about.”

Since U.S. President Donald Trump took office and created more aggressive tax policies to attract investment in various sectors across the U.S., Canada’s oil and gas sector has felt an impact from an investment perspective.

“The competition with international jurisdiction for capital is fierce right now, in particular into the United States,” Brennan says. “The administration in the U.S. has undertaken a number of efforts to draw investment, and investors are paying attention. So while they’re reducing their taxes, that immediate deductibility is a major lever for project economic comparisons with other jurisdictions, because the speed with which you can recover your capital drives the return timelines for your projects.”

Brennan says that U.S. tax policy combined with the country’s focus on de-regulating its industry, and a climate policy that is, “much more consistent from a competitiveness perspective,” generate favourable comparable economics, confidence from the investment community and momentum.

“So a lot of the capital has been drawn to the south, and has been sort of sucked out of Canada,” he says. “What we’re asking for is for federal and provincial governments to create a tax framework that allows us to compete.”

Brennan argues that a carbon tax pricing system that is uncompetitive will only result in lost investment for the industry and “carbon leakage.”

“Imposing a carbon tax in our industry, when it’s not imposed in other jurisdictions, effectively means you’re moving that investment to those other jurisdictions and it will have no affect on pollution production. So they need to design these programs in a way that doesn’t hinder our competitiveness in competition for capital but does help move the needle on emissions reduction.”

Could 2019 be a year that helps turnaround Canada’s oil and gas sector? Brennan certainly thinks so.

“2019 is going to be a pivotal year for Canada’s oil and gas sector,” he says, adding that the CAPP will be keeping a close watch on the resolution of key pieces of legislation, such as Bill C69 and Bill C48. “From market access perspective, there are some major pipeline decisions we are watching quite closely that will dictate the fortunes and the confidence on the oil sands side of things, and in particular, the Government of Alberta’s curtailment plans. And then provincially, the extent to which, whichever government wins the election embraces the competitiveness challenges of our industry and influence reforms will be very pivotal. These pieces combined have the potential to drive investment confidence near the end of the year and move us into a prosperous 2020, or continue to really challenge investor confidence and really drive us further into a negative investment cycle. That’s really what’s at play here. This is definitely a big year for us.”

Global Rigging & Transport is a world renowned International Heavy-Lift, Heavy-Transport company. Our company provides engineering, technical supervision and equipment to project sites all over the world.

We have an impeccable track record for completing projects within budget and on schedule without compromising quality workmanship.

We approach each project with the same strategy, focusing on safety and efficiency from the start.

So whether you are writing a proposal or in need of emergency response, GRT has the people and equipment ready to help.

Contact us today info@globalrigging.com • +604 513 8468 www.globalrigging.com

BY HOWARD ELMER

Trucks, currently, have never been more important to a manufacturer’s bottom line. Not only because they are selling in ever increasing numbers but because there just doesn’t appear to be a price ceiling. Customers keep loading up new pickups with luxuries that only a few years ago were found only in sedans. It’s this hunger for constantly increasing content that pushes prices up as these upmarket extras quickly add up; and of course this is where builders earn the most money.

Ford knows this full well. They currently offer nine distinct trim packages and an extensive list of options. So, each year in this pickup war Chevrolet responds to Ford’s increasing number of trim levels with their own increase in luxury, accessories, special editions and personalization. This is the current state of the heated pickup market and it shows no sign of cooling down.

For 2019 that’s why we not only have an all-new generation of Silverado (the fourth since 1999) but also, simply put, more of everything. The new Silverado now offers eight trim levels, six different engine and transmission combinations – and for the first time – a new Duramax 3.0L turbo-diesel. These trim packages not only offer groups of conveniences but they also cover the very necessary work truck (WT) market right up to the opulent High Country. Yet within each trim level customers still have ample options when it comes to custom building the truck they need. Cabs, box lengths, powertrains, gearing and sundry equipment –Chevy does not believe in one-size-fits-all.

Chevrolet has now been building trucks for 100 years - for this generation of Silverado, Chevy is mining its history and adding elements from previous generations of trucks. The notable one is the “Chevrolet” name stamped on the tailgate that harks back to 50’s and 60’s. The centre grille mounted bowtie is also iconic; however the new look is anything but rounded as the designs of previous trucks. This new body is square, tall and slab-sided, offering a powerful profile. Sitting on up to 33-inch tires just amplifies that impression.

Though this next-gen Silverado is larger than its predecessor (1.2-inches wider, 1.5-inches taller, 1.7-inches longer, with 3.9-inches added to the wheelbase) it is lighter by some 450 lb. A mixed materials approach to construction is the reason for this. Strategic use of aluminum and more hi-strength steel have lowered the weight; yet the frame is actually 10 per cent more rigid than the outgoing model.

We all know that the cargo box on the truck is what makes it a pickup – a feature that’s been the same from day one. It’s also the feature which changes the least generation to generation; but not this time. Chevy has spent time and money on the business end of this new Silverado firstly by increasing the cargo volume to best-in-class.

By widening the inner box walls to mimic the outer body panels they have increased the available space by as much as 20 per cent. This space also boasts 12 fixed tie-down points with a sheer force of 500 lb. each (twice the previous rating). There are also nine moveable tiedowns. To see what you‘re doing in the box it has task lighting and a 120V power outlet in the sidewall. Getting in and out of the box is also easier now with even larger cut-outs in the CornerStep bumper and large stake-hole handholds.

Below it all is the rolled steel bed floor which is now using an even higher grade of highstrength steel. Silverado also offers four versions of its tailgate. A standard, manual unsprung gate; a manual gate with lift-assist; a power locking version and even a power up and down gate with automatic release. Each of these is lockable. Making use of this additional space in the new bed are available storage bins that fit over the wheel wells which still leave the floor clear. Multiple Powertrains are another feature that gives customers necessary choices and Chevy

has some veterans and also some very new mechanicals in its 2019 lineup. I’ve already mentioned the coming diesel; however that isn’t till late in the year and details are being kept under wraps till then.

Gas engines include updated versions of the 5.3L and 6.2L V8s along with a all new 2.7L turbo engine that is now the base engine on the high-volume Silverado LT and RST. It offers 22 per cent more torque and greater fuel efficiency that the 4.3L V6. However, this V6 and the 5.3L V8 will still have the chief options on the entry-level and WT models. An exciting development in fuel efficiency for this new gen is a technology called Dynamic Fuel Management. Unlike the current Active Fuel Management (which runs as either an 8-cylinder or 4-cylinder), the new DFM can fire on as few as two cylinders.

Studies have shown that under normal usage a DFM-equipped engine was running on less than eight cylinders 60 per cent of the time. This translates to a nine per cent improvement in fuel efficiency over the old AFM system.

The stretched body on the new Silverado translates to more room inside the cab – starting with three added inches of rear-seat legroom for a total of 43.4-inches; which almost equals the 44.5 inches available to the front seat driver and passenger. The other benefit of more space is storage and Silverado has built new features into the second row starting with two 10L bins integrated into the seat backs. Under the rear seat there is a moulded, compartmentalized, 24L storage tray. In the front, by going with a traditional gear shift lever, the entire centre console/armrest is a massive storage space organized into several transforming spaces that will accommodate pretty much anything your daily life requires – along with all the electrical inputs and outlets necessary to run them. The interior itself is better seen, then described. However, it is, without a doubt, the best interior Chevy has ever put forward. For transmissions there are three versions. Each is coupled to the appropriate engine, as needed. At the lower end (power and price-wise) is the automatic six-speed. The new base 2.7L

turbo pushes power through an eight-speed gearbox; it also is the main choice for the 5.3L V8. The new ten-speed is found on the 6.2L V8 and will power the coming 3.0L turbo-diesel.

Most truck owners know, and certainly sense, that each generation of 1500-series pickup is becoming more and more towing capable. This is regardless of brand. They tow more weight, handle larger trailers and, thankfully, the builders are adding the tech and safety features needed to handle these larger loads safely. It’s actually funny that many of us still refer to this size of truck as “half-tons” – we left that territory long ago.

The new numbers for the 2019 Silverado are 12,200 lb. - towing (max), up 400 lb. over 2018. New maximum payload has increase 340 lb. to a hefty 2,500 lb. Now to handle these new weights Chevy has added some very welcome and slick towing technologies. First, up to four cameras offer different views while hitching. This includes hitch guidance lines on the centre display and a choice of views. After the driver has lined up the hitch and shifted to park the parking brake sets automatically – avoiding that slight roll that wrecks the alignment. An optional feature is a trailer tire temp and pressure monitor. An industry first, this system allows the driver to keep an eye on the trailer tires. A new trailer light check system runs the lights in sequence as you watch. This feature can be activated from inside the truck or via a MYChevrolet Trailering App on your Smartphone.

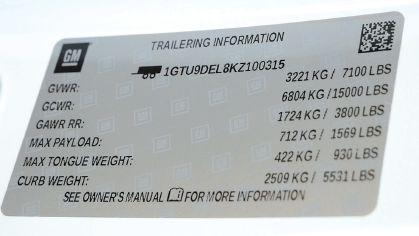

Who doesn’t worry about their weight? But, I’m not talking about that nagging 10 pounds you’d like to drop. No, I’m talking about the weight problem you have with your tow vehicle. You know the one where you “think” you know what the truck will tow. And, frankly, manufacturers have never made getting an exact number easy. Between the boasting in commercials and obscure, difficult to find information on websites and in the owner’s manual - is it any wonder that most owners really aren’t sure what their truck will tow.

But there is a new initiative – from General Motors – that is rather exciting in its simplicity. A door jam sticker that gives a truck owner the exact weight limits for that truck. And by “that truck” I do mean the exact truck (as it’s built with its unique combination of cab/box/powertrain/gearing/tires and options) as defined by the VIN number on the sticker. The numbers on this sticker are not generalizations or round-abouts – these numbers are exact and belong to that truck individually – like a birthmark. Also, the General has included max tongue weight, which is brilliant. Good for you, GM.

AS TO WHAT MEANS WHAT; HERE IS A QUICK REFRESHER.

GVWR – Gross vehicle weight rating

The GVWR refers to the maximum weight a vehicle is designed to carry including the net weight of the vehicle with accessories, plus the weight of passengers, fuel, and cargo.

GCWR – Gross combined weight rating

A vehicle’s GCWR is a specific weight determined by the manufacturer to be the maximum weight of a loaded tow vehicle and its attached loaded trailer.

GAWR – Gross axle weight rating

The gross axle weight rating (GAWR) is the maximum distributed weight that may be supported by an axle of a road vehicle. Typically, GAWR is followed by either the letters FR or RR, which indicate front or rear axles respectively.

SUBMITTED BY ASSOCIATION OF EQUIPMENT MANUFACTURERS

1.

INTELLIGENT MANUFACTURING: The concept of intelligent manufacturing is always changing. But in the simplest sense, it can be defined as a largescale integration of cutting-edge artificial intelligence and advanced manufacturing technology and processes. Ultimately, intelligent manufacturing serves to help companies optimize organizational systems, improve product quality, increase the efficient allocation of resources and positively impact customer service.