Lynn Fantom

Ben Normand

Lynn Fantom

Ben Normand

VOLUME 16, ISSUE 7 | JANUARY/FEBRUARY 2025

Reader Service

Print and digital subscription inquiries or changes, please contact customer service

Angelita Potal

Tel: (416) 510-5113

Fax: (416) 510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Editor Jean Ko Din jkodin@annexbusinessmedia.com

Associate Editor Seyitan Moritiwon smoritiwon@annexbusinessmedia.com

Contributors Alan Cook, Charlie Culpepper, Lynn Fantom, Matt Jones, Ben Normand

Associate Publisher / Advertising Manager Jeremy Thain jthain@annexbusinessmedia.com +1-250-474-3982

Account Manager Morgen Balch mbalch@annexbusinessmedia.com +1-416-606-6964

Account Coordinator Catherine Giles cgiles@annexbusinessmedia.com

Media Designer Svetlana Avrutin savrutin@annexbusinessmedia.com

Audience Development Manager Urszula Grzyb ugrzyb@annexbusinessmedia.com 416-510-5180

Group Publisher Anne Beswick abeswick@annexbusinessmedia.com 416-410-5248

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

PUBLISHED BY ANNEX BUSINESS MEDIA 105 Donly Drive South, Simcoe, ON N3Y 4N5

Aquaculture North America is published six times a year by Annex Business Media. The authority for statements and claims made in Aquaculture North America is the responsibility of the contributors. Reference to named products or technologies does not imply endorsement by the publisher.

Subscription rates (six issues) Canada: $37.74+Tax

Within North America: $48.96 CAD

Outside North America: $63.24 CAD

To subscribe visit our website at www.aquaculturenorthamerica.com

Printed in Canada ISSN 1922-4117

Publications Mail Agreement #PM40065710

RETURN UNDELIVERABLE CANADIAN ADDRESSES TO 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Annex Privacy Officer Privacy@annexbusinessmedia.com Tel: 800-668-2374

The contents of Aquaculture North America are copyright ©2025 by Annex Business Media and may not be reproduced in whole or part without written consent. Annex Business Media disclaims any warranty as to the accuracy, completeness or currency of the contents of this publication and disclaims all liability in respect of the results of any action taken or not taken in reliance upon information in this publication.

Next Ad Deadline

The advertising deadline for the Mar/Apr issue is Jan. 28. Don’t miss the opportunity to be part of this publication. For more information, or to reserve space in the next issue, call our advertising department at +1.250.474.3982 jthain@annexbusinessmedia.com

Next Editorial Deadline

The editorial deadline for the Mar/Apr issue is Jan. 31. Contact Jean Ko Din at jkodin@annexbusinessmedia.com for details. Material should be submitted electronically with prior arrangement with the editor.

BY JEAN KO DIN

When I think about the frustration and uncertainty that we've been writing about in the past few months, I think about the role we play, as industry media, in continuing that conversation.

First and foremost, our priority is to provide useful and accurate information that could affect your daily work as an aquaculturist. That is the main priority and the main function of what we do. When news happens, we investigate it, we verify it, and then we present our findings to you, our readers. We are careful not to inject our own biases or interpretations of facts. We present them as they are and it is up to the reader to make their own decisions on them. We strive for a high standard of excellence because we take our reader's trust in us seriously.

But as I've gotten to know many of you in the industry in the last five years of working for this publication, you know what it's like to operate at that high standard of excellence. It honestly keeps the pressure up for our editorial team.

Looking back in the past year, we have seen a lot of bad news and more often, it brings up that common criticism that media only delivers the bad news. But I think this is all the more reason to help remind ourselves of why your work in aquaculture is so important. This is a bit like preaching to the choir, but sometimes, everyone needs to be reminded. And so, in the capacity of an editorial letter, I have the freedom to make my own comments and observations.

Aquaculture is the fastest-growing food production system in the world. More than eight billion people currently occupy this planet. The United Nations predicts that the population will reach the 10-billion mark in 2058. Because of this, the UN is looking to the aquaculture industry to help ensure longterm food security for us all. As fish farmers, you understand this reality very well. But if I may, I'd like to remind you how vital this industry's contribution is to society. In the

midst of our struggles with government regulators, or anti-aquaculture lobby groups, or with the changing climate, I imagine that it can feel extremely discouraging. Fish farming is hard work, even on its best day, but its core purpose is to feed the world.

As we enter into the new year, you start to think about how you're injecting a sense of purpose in your own lives and I'm hoping that this can help remind you of what makes you passionate about your work in the first place.

Aquaculture is well positioned to be a resource-efficient food production method for a changing environment. Sustainable farming techniques and technologies are cropping up all the time, and we need that innovation to continue. We need feed manufacturers to develop more nutrient-rich formulations that put less pressure on wild fish capture. We need more creative and agile health monitoring systems that will allow farmers to adapt to the changing pathogen landscapes in the oceans. We need more land-based technology efficiencies that could help ensure reliable production and reasonable operational costs.

The pursuit for more sustainability is a noble one, if not an extremely essential one. And we all know too well how it can sometimes be an uphill battle to explain the industry's ambitous plans for growth and progress. And if the industry is starting to fatigue with the challenges that it faces from multiple fronts, let the purpose of this industry be the thing that will continue to drive you forward. Because what else is the alternative?

In this new year, Aquaculture North America and its sister publications, Hatchery International and RAStech Magazine, will be taking a hard look at the content that we produce in these pages and online. We want to look internally to think about what stories or what information we can provide to aid your work both in your daily life and in the wider industry as well. We hope you stay engaged and share your thoughts at jkodin@ annexbusinessmedia.com. | ANA

Aquaculture North America’s Editorial Advisory Board: Ian Roberts | Sandra Shumway | Jason Mann | Jeanne Mcknight | Mykolas

| Jamie Baker

NOAA and Blue Ocean Mariculture use AI to monitor monk seal behaviour

NOAA Fisheries and Blue Ocean Mariculture are using technology to study Hawaiian monk seal interest in aquaculture net pens in Hawai'i.

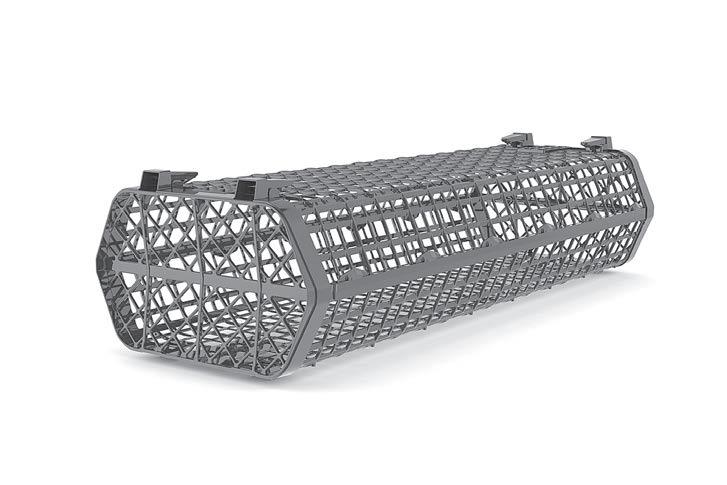

Blue Ocean Mariculture is the only commercial offshore finfish aquaculture facility in Hawai'i waters. It uses submersible net pens to raise Hawaiian kanpachi (almaco jack or kahala) in its natural environment. It is collaborating with NOAA Fisheries to evaluate observational methods and tools, such as remote cameras and artificial intelligence (AI), to study these seals’ behaviour around the pens.

“As managers of protected marine species, we need to understand their behaviours in order to best protect them,” said Tori Spence, aquaculture coordinator, NOAA

Fisheries Pacific Islands Regional Office. “Our project explores whether we could use a multi-faceted, technology-enabled monitoring approach to understand potential interactions between endangered Hawaiian monk seals and mariculture net pens.”

The team evaluated the effectiveness of using underwater video cameras to collect footage and using AI to analyze the data. They mounted four underwater cameras on different areas of the pens,

which collected over 700 videos for analysis.

NOAA Hollings scholar, Haley Durbin, created an algorithm to analyze the video data and identify Hawaiian monk seals. The team categorized and logged the seals’ behaviours based on the footage. They identified single monk seals in 103 of the clips and multiple monk seals in 42 of the clips.

“The video data has been really enlightening. It has reinforced the reliability of Blue Ocean’s staff

observations and given us a closer look at what’s happening underwater,” said Kristina Dauterman, resource management specialist at NOAA Fisheries Pacific Islands Regional Office.

They saw seals at the bottom of the pens looking for dead or dying fish. The seals would pull pieces of those fish through the netting to eat. To prevent this, Blue Ocean introduced a special collection cone inside the pen to catch dead fish. The goal is to keep the fish outside the reach of hungry monk seals or other predators until the offshore crew removes the fish.

“Having a better view, and understanding, of seal behaviour will help us and Blue Ocean recommend and implement the best possible measures to protect against potential impacts,” Dauterman added.

Blue Ocean said it’s re-engineering the pen structure to accommodate smaller-size mesh

netting, which it plans to launch in the near future.

Spence said NOAA plans to support science and research so that the industry can keep developing and evolving in a way that’s sustainable and protective of marine species.

The National Oceanic and Atmospheric Administration (NOAA) is requesting public input on a draft programmatic environment impact statement supporting the identification of aquaculture opportunity areas in Gulf of Mexico federal waters.

On Nov. 22, a notice was published in the Federal Register announcing the availability of the Draft Programmatic Environmental Impact Statement (DPEIS) for the Identification of Aquaculture Opportunity Areas (AOA) in U.S. Federal Waters of the Gulf of Mexico for public review and comment.

The DPEIS is the result of a multiyear planning effort to identify areas that may be suitable for offshore aquaculture development in the Gulf. It assesses the impacts of identifying one or more AOAs in federal waters of the Gulf and the potential impacts associated with siting aquaculture operations in those locations.

Four Preferred AOA Alternatives are identified in the DPEIS, ranging in size from 500 to 2,000 acres. Three of them are located off the coast of Texas, and one off the coast of Louisiana.

The 90-day public comment period will conclude on Feb. 20, 2025. The public may review the DPEIS and provide NOAA Fisheries with comments which may be submitted electronically, by mail, or verbally at one of three upcoming virtual public meetings: Tuesday, Dec. 17, 2024

6:30 p.m.-8:30 p.m. CST 7:30 p.m.-9:30 p.m. EST

Wednesday, Jan. 15, 2025

3:30 p.m.-5:30 p.m. CST 4:30 p.m.-6:30 p.m. EST

Thursday, Feb. 13, 2025

6:30 p.m.-8:30 p.m. CST 7:30 p.m.-9:30 p.m. EST

MSX and Dermo confirmed in New Brunswick oysters

The Canadian Food Inspection Agency (CFIA) has confirmed the presence of MSX and Dermo, two oyster diseases, in Spence Cove, New Brunswick samples. This is the first confirmed case of MSX in New Brunswick, and the first confirmed case of Dermo in Canada.

MSX or multinucleate sphere unknown is caused by Haplosporidium nelsoni while Dermo also known as Perkinsosis, is caused by Perkinsus marinus. These diseases do not pose risks to human health or food safety.

Earlier in the year, the CFIA confirmed the first case of MSX in Prince Edward Island and is still determining how to deal with the disease.

CFIA and Fisheries and Oceans Canada (DFO) and the Province of New Brunswick are working with stakeholders to reduce the spread of these diseases and monitor the situation.

“These actions are part of the Government of Canada’s One Health approach to prepare for, detect, and manage animal diseases. In addition to existing robust protective measures and increased animal surveillance measures, the CFIA, DFO and the province continue to conduct tracing activities and testing of oysters to gain insight into the presence of MSX and Dermo in the area,” a press release from the CFIA states.

In the meantime, their response measures include: controlling movement to oysters in the Spence Cove area; investigating the potential source of the detection; monitoring mollusc health and notifying CFIA or the province of sick oysters, decreased growth rates and increased mortalities; and ensuring that information regarding detection and movement control information is available to producers.

A Stats Canada report has shown that the sales of Canadian aquaculture products and services in 2023 decreased by 4.7 percent compared with 2022 to C$1.3 billion, while product expenses declined by 3 percent.

In British Columbia, aquaculture sales in British Columbia were down 35.9 percent, while sales in the Atlantic provinces increased 68.8 percent.

Nationally, farmed finfish production fell to 107,144 tonnes in 2023, a 15.7 percent decline from 2022. While the average farmed finfish price rose 9.7 percent to $10.52 per kilogram. Over the same period, the total farmed finfish value decreased 7.5 percent to $1.1 billion.

Canadian farmed Atlantic salmon by quantity in 2023.

Production of shellfish in Prince Edward Island—Canada’s primary producer of farmed shellfish, accounting for 52.5 percent of the national total—decreased to 20,684 tonnes (-4.8 percent) compared with 2022. Farmed shellfish sales accounted for 9.7 percent of total sales of Canadian aquaculture products and services.

Mussel production in Prince Edward Island, the largest producer of mussels in Canada, declined 10.9 percent year over year, totalling 15,543 tonnes in 2023. British Columbia, the largest producer of oysters, produced 7,371 tonnes of oysters in 2023, 11.8 percent less than it did in 2022.

Canadian farmed shellfish production also declined in 2023, down 4.5 percent to 38,699 tonnes. Despite the decrease in production, farmed shellfish value edged up to C$126.5 million (+1.0 percent), as the average farmed shellfish price increased to $3.27 per kilogram (+5.7 percent).

Farmed finfish production in British Columbia declined 41.4 percent in 2023, compared to 2022 because many farms stopped operations along important migratory routes for wild salmon. As a result, British Columbia represented 47.9 percent of national finfish production for the first time since reporting began in 1991.

On the other hand, farmed finfish production in the Atlantic provinces increased 52.4 percent year over year, with New Brunswick leading at +137.5 percent and Newfoundland and Labrador following at +90.1 percent, as finfish production recovered from environmental and biological issues.

Export quantities for farmed Atlantic salmon—including fillets— decreased to 64,469 tonnes (-18.0 percent compared with 2022). The United States accounted for 98.6 percent of total exports of

Export quantities of mussels decreased to 11,296 tonnes in 2023, compared with 2022. But the price of exported mussels increased 11.8 percent, yielding a 0.3 percent increase in total export value of $49.3 million.

The Government of Prince Edward Island has developed a PEI Seafood Sector Climate Change Adaptation Strategy to help the province’s seafood industry adapt to climate change challenges.

The initiative, developed with industry leaders and the ICF consulting group, builds on a Seafood Sector Climate Risk and Opportunity Assessment. This assessment identified potential climate-related impacts on PEI’s aquaculture, commercial fishing, and processing sectors and provided targeted solutions.

Peter Warris, executive director of PEI Aquaculture Alliance, said the strategy will ensure the longterm sustainability and resilience of the province’s aquaculture industry despite the changing climate conditions.

“By proactively addressing potential risks and implementing adaptive strategies, we can help safeguard the future of the

aquaculture industry and the livelihoods of those who depend on it,” added Warris.

The strategy lists key actions to strengthen the seafood industry’s resilience, including climate readiness training, a climate impact monitoring program, and a seafood industry resilience program. It also recommends collaboration with researchers on innovative solutions and species-specific adaptation plans, continued support for broodstock programs, and promotion of diversification.

The commercial fishery and aquaculture industry is one of the province’s most valuable sectors, with an economic value of approximately C$850 million (US$607.9 million), employing 8,000 people yearly.

“Continued investments in climate change adaptation will help reduce risks and continue the conservation and economic viability of our ocean resources for generations to come. This strategy will be a key component in making that happen,” said Zack Bell, minister of fisheries, tourism, sport, and culture.

The provincial government plans to engage with key stakeholders in the coming months to explore and further develop options.

“As frontline stewards of our marine resources, we recognize the urgent need to address the challenges posed by climate change,” said Robert Jenkins, president of the Prince Edward Island Fishermen’s Association. “By working together on these critical issues, and with governments financially supporting these initiatives, we can build resilience against climate impacts and

continue to provide high-quality seafood for generations to come.”

Salmon producers in Canada have embraced the commitments made by the Canadian Aquaculture Industry Alliance (CAIA), as it is reported in its first sustainability report for the Canadian salmon farming sector.

CAIA noted that salmon farms achieved compliance with the Code of Practice for the Care and Handling of Farmed Salmonids, saw over 81 percent of fish survival rate in the ocean, and 70 percent of all sea lice treatments being non-medicinal in 2022.

“Canadians and the world want more Canadian-raised salmon, but they need to know it is of the highest quality and sustainability. Each company has its own sustainability systems and reporting, and all salmon farms are independently certified to global or Canadian standards,” said Tim Kennedy, president and CEO of CAIA.

The association is committing to using best management practices and technologies that support the well-being of farm-raised salmon. They also plan to pursue partnerships, measures, and initiatives that support wild salmon recovery, habitat restoration, and enhancement efforts.

The report outlines commitments in seven areas – fish health, climate change, sustainable feed, food security, food traceability, ocean health, and public reporting.

“Our goal is to be nothing less than the most sustainable animal product in the world, show why and how, and continually work towards further improvement. While we have made great progress in ensuring our operations perform at the highest level, there is always more to do,” Kennedy added.

CAIA intends to publish this report annually going forward and has a goal to be able to provide multi-year performance data for all actions and targets.

BY ALAN COOK

How the pursuit

Salmon farmers have a complicated relationship with aquaculture site licenses.

On the one hand, the processes of securing and maintaining an aquaculture license are onerous, expensive and slow. On the other hand, once a license is secured, it becomes an extremely valuable and useful asset and acts as an important barrier to competitors entering the industry.

It hasn’t always been the case, but the global situation around site licenses has put a cap on growth and allowed salmon farmers to enjoy more than a decade of increasing prices and tremendous profitability. Previously, I looked at the impact on pricing of a short period of oversupply. What would the impact be on salmon farming companies if this barrier to entry disappears or is seriously diminished?

Given the state of play in most regions, site licenses are extremely valuable and occupy a large chunk of the asset value of a salmon farming company. Here is some information about a few companies from 2023 annual reports. (Figure 1)

You can see there is quite a range of values, perhaps reflective of the geographic distribution of sites in a company’s portfolio. Salmar production is highly concentrated in Norway whereas much of Grieg’s production is in Canada – the west coast sites would likely have very low values given the political uncertainty and the Newfoundland sites would have had a relatively low acquisition cost and are yet to produce a profit.

So, what are the benefits of having these artificially scarce assets on the balance sheet?

1. They increase the asset value of the business on the balance sheet and improve the creditworthiness of the company to investors and creditors.

2. They provide security against loans and improve access to operating funds. With a higher asset to debt ratio, they are likely instrumental in negotiating more attractive lending terms.

The enormous barrier to new license entrants has resulted in a situation where the worse things get, in terms of costs and production results, the more the prices increase to offset the cost.

3. Unlike most other asset classes, they have little downside risk (assuming the status quo is maintained) and do not trigger depreciation charges which would negatively impact earnings.

I’m going to run through my perspectives on the availability of licenses and potential for growth in key regions.

Norway – Norway conducts an annual auction for a relatively small number of new licenses every year and routinely issues developmental licenses for groups prepared to invest significant sums in technology development. Norway is miles ahead of most other regions in the clarity of their regulatory framework and support for growth of the industry. In the most recent auction, purchasing the equivalent of 4,000 metric tons of production capacity (just the license to produce) would have cost approximately US$120 million. Despite the enormous price, the auction was over-subscribed.

Chile – When I worked in Chile from 2007-2010, there were more than 1,000 approved licenses in existence with just over 320 actual operating farms. Many of the idle licenses, at that time, were in the hands of

speculators who were trying to make a living from applying for licenses and then selling them to farming companies. The situation has changed rather a lot, licenses are much harder to obtain, and regulations are quite strict. The barrier to growth should be more fairly assigned to challenging logistics rather than the ability to secure licenses.

Scotland – Very few new permits issued and generally permit decisions take many years and involve an agonizing level of bureaucracy. Very high regulatory burden and lots of vocal opposition.

Faroe Islands – A great place to farm fish but limited ability to secure new licenses using conventional technology. It is a well-managed and well-regulated region.

Iceland – One of the few growth regions in the salmon world but also a growing opposition and increasing regulation. A protest in Reykjavik earlier this year saw one percent of the population attend an anti-salmon farming protest.

Eastern Canada – New Brunswick, Nova Scotia, and Newfoundland are home to net pen farms. The situation is quite different in each. New Brunswick is generally supportive of the industry but the regions suitable for conventional net pen technology are fully

utilized. Nova Scotia is a province that dithered for many years on its views of aquaculture and remains highly bureaucratic and reluctant to issue new licenses. Cooke has enjoyed some success in the province but only after herculean effort. In Newfoundland, the process is politically fraught but generally, the province is prepared to issue new site licenses. The challenges in Newfoundland are brutal logistics, vast distances, and harsh winters.

Western Canada – What can I say? It’s a crap show in British Columbia. Canada’s federal government seems prepared to throw the industry and thousands of jobs under a bus to cling to a few parliamentary seats in the lower mainland of the province. Very few new licenses have been issued in recent memory and the government has refused to renew ~40 percent of existing licenses.

West Coast USA – Like what’s happening in B.C., certain Washington government actors are determined to eliminate an industry that has operated sustainably for more than 30 years. I was involved in attempting to permit a new farm in the state and found that no new licenses had been issued in 25 years and that no one working in government had a clue as to how to do it.

East Coast USA – Maine has a progressive aquaculture policy but the potential for new salmon licenses is quite limited. Between user conflicts with lobster fishers and waterfront owners, it is difficult to imagine any growth happening in the state.

Australia – Very hard to secure new site licenses and substantial pressure to move out of areas with challenging characteristics. Unless they can breed a warm-water tolerant breed of Atlantic salmon, the potential for growth, using conventional technology is very limited.

New Zealand – Getting new net pens issued in New Zealand is almost as bad as B.C. One of my former employers, NZ King Salmon, spent years and millions of dollars to secure new site licenses. The conditions attached to the consent, the ongoing scientific scrutiny, and the public consultations were taken to an absurd extreme. I am led to believe that a recent change in government shows promise in terms of more reasonable regulation, but I believe that is still to be proven. Don’t expect a lot of growth regardless.

The truly frustrating thing when considering the lack of global availability and costs of salmon farming licenses is that the scarcity is entirely artificial. I haven’t done the exercise in a while, but if you added up all the surface area occupied by salmon farms globally, they would occupy a vanishingly small percentage

of the surface area available.

If Canada and the USA chose to make coastal employment, food security, and carbon footprint national priorities, all the demand for farmed salmon in the USA and Canada could be met with domestically produced salmon. Doing so would occupy a small fraction of one percent of the surface area of coastal waters.

Given the situation described in salmon farming regions, a dramatic change which would trigger a massive drop in the value of licenses is unlikely. The industry is massively profitable, and the market fundamentals suggest it will continue to be so provided consumers continue to buy farmed salmon. Operationally, the profitability of the industry is rooted in the efficient conversion of salmon feed into edible salmon.

If someone were to crack the code on offshore salmon farming to open the vast potential of the high seas and do so in a cost-effective manner, the attractiveness of paying absurd sums in the Norwegian site auction would disappear, wouldn’t it?

It wouldn’t change the fact that existing sites are producing excellent fish at profitable cost levels, but it could significantly impact on the balance sheets of many companies. Those impacts could include:

1. Significant write -downs or impairments on license values. Those write-downs would be expensed to the income statement and negatively impact profitability in the short-term. Share price would take a hit – the stock market hates bad news. (Shares in Grieg Seafood dropped 10.8 percent in value following a negative earnings report).

2. If they were used as loan security, banking covenants would be impacted, and loan interest could get more expensive, loan amounts could be reduced.

3. If the fall in value of licenses is driven by the increased availability of producing regions and, presumably, an increase in production, the advantage of operating in a chronically under-supplied market could disappear and the high prices farmers have enjoyed for a long time could be eroded.

Keen observers of the salmon market have noted that in recent years, the enormous barrier to new entrants has resulted in a situation where the worse things get in terms of costs and production results, the more the prices increase to offset the cost. A doubling in production costs over the past 10 years has been offset by a larger increase in pricing. The prevalence of downgraded harvest fish (as much as 50 percent per some reports) in the winter of 2023-2024, presumably sold at a discount, was more than offset by stratospheric pricing for a diminished volume of premium fish.

These asset and market advantages go away if growth in the industry returns to a level which matches or exceeds the growth in demand. The kind of pricing we have seen in recent years – which forgives a lot of grave sins – could force a lot of farmers into the red. I can recall an online article from Document NY that details the impact on New York City taxi medallions (the license to operate a yellow cab in the city) of the arrival of rideshare programs like Uber and Lyft. In that example, the value of a taxi medallion dropped from US$1 million to just a few thousand in the span of a handful of years. Holders of medallions purchased at peak prices (when banks were more than happy to loan funds for the purchase) were on the hook for huge payments that were effectively worthless. Obviously, a very different situation for salmon farmers, but worth thinking about. | ANA

This opinion editorial is an excerpt of Alan Cook’s Understanding Fish Farming blog. https://www.alanwcook.com/blog

investigate “aquaculture readiness” of more marine

By Lynn Fantom

With seafood consumption increasing faster than population growth and climate change threatening supply, aquaculture is seeking more candidate species to bring to market successfully. But in a recent paper, researchers make clear that “aquaculture readiness” is no simple thing.

To aid that process, Lynne Falconer of the University of Stirling in Scotland and Elisabeth Ytteborg of Nofima in Norway introduced a new system of “Aquaculture Readiness Levels” in a paper called “Diversification of Marine Aquaculture in Norway under Climate Change,” published in the journal Aquaculture in December.

“National economies and local communities may be able to build

resilience and enhance adaptive capacity if there is a range of aquaculture activities rather than focusing solely on farming a single species,” they say. “However, decisions on diversification strategies and species selection must consider the biology of the new species alongside possible impacts from climate change at farm sites.”

The dominant species they are talking about is Atlantic salmon.

In Norway, the largest producer of salmon, last year’s harsh winter led to record fish mortality and, in the future, warmer waters will increase the threat of sea lice.

Such climate issues, along with factors like a halt on new licenses for net pens in Norway and government-mandated sea pen closures in British Columbia, are likely to affect what’s available at the fish market.

farming was not “aquaculture ready” and collapsed in Norway after a disease outbreak in the early 2000s. Knowledge has been retained, however, and methodical production is resuming.

PHOTO: LARS ÅKE ANDERSEN/NOFIMA

In the U.S., which imports between 70 and 85 percent of its seafood, salmon is now the second most popular choice.

Nonetheless, there is currently only one other marine finfish in Norway — rainbow trout — that can be successfully farmed and distributed commercially at scale, according to Falconer and Ytteborg.

So, what will it take to get more species in the aquaculture pipeline?

The pathway to success

Falconer and Ytteborg developed— and trademarked—the new system by adapting Technology Readiness Levels, used by both the European Commission (EC) and the National

Aeronautics and Space Administration (NASA) to assess the maturity of new technology and guide project management.

Redefining these stages for aquaculture, the process covers:

• Research - fundamental knowledge of biology and requirements of species under aquaculture, with testing of technology and husbandry;

• Dev elopment - trials to harvest size in production environment, standardization and refinement of protocols, upscaling;

• Commercialization - commercial success, products to market, production at large scale.

Nine specific Aquaculture Readiness Levels (ARL) are included in these stages. Going beyond the EC and NASA systems, the researchers added a tenth ARL called “Adaptation” to reflect the need for sufficient resources and knowledge to sustain production

of a species under climate change. It also sets the bar for responsible aquaculture production and reduced emissions, aligning with United Nations Sustainable Development Goal 13.

Overall, the Aquaculture Readiness Levels demonstrate “how difficult it

Decisions on diversification strategies and species selection must consider the biology of the new species alongside possible impacts from climate change at farm sites.

is to diversify species,” says Ytteborg, “This is the work that is needed if you really want to do it properly.”

Risks of leap-frogging levels

The initial ARL specifications in the Research stage call for an understanding of basic biology and evidence that

the species can be cultured. What happens when shortcuts are taken at this phase?

As an example, lumpfish became popular so quickly as a biological fighter of sea lice that broodstock were not in place before the industry grew. Producers used wild-caught lumpfish

The production of lumpfish to manage sea lice in salmon net pens became widespread before a viable breeding program was developed. Sourcing broodstock from the wild, which depleted natural populations, meant lumpfish were not “aquaculture ready.”

PHOTO: RAMA BANGERA/NOFIMA

to support commercialization, which seriously diminished the population on the Norwegian coastline.

“The wild stock of a species was exploited to commercialize it, and I think that’s a very bad thing,” says Ytteborg.

A problem also occurred with intensive Atlantic cod culture in Norway in the 2000s. “It was carried out hastily to cash in the demand for cod in the market even though there were many biological knowledge gaps that are required for a successful aquaculture venture,” according to a paper published by Velmurugu Puvanendran and colleagues in 2021.

The calamity that followed may also have been avoided if this fast-growing sector had adhered to the steps Falconer and Ytteborg describe for the Development phase: a species should be grown to harvest size in the production technology in the intended location and then at a commercially relevant scale at a small number of farms.

But that was not the case. Farms were sited throughout Norway, including southern areas with warmer

waters. Some scientists identify that as a likely factor in what happened next: Francisellosis outbreaks and large losses. “The market just crashed, almost all the companies went bankrupt, and production stopped,” says Ytteborg.

Still, it should be noted that Francisellosis was a new disease. “But if you are prepared for most of the things that you can foresee, then you can handle most of the things that you haven’t thought about,” Ytteborg adds.

Falconer and Ytteborg call the system “an idealized pathway to commercial farming of a species.” It offers different benefits for different users. An aquaculture company might tap it as a longterm planning tool. A governmental entity might study the ARL ratings of a range of species to assess potential vulnerabilities in its food system.

Cyr Couturier, an aquaculture scientist and marine biologist, at the

Fisheries and Marine Institute of Memorial University of Newfoundland, sees this new system as “part of the overall business risk management suite of tools.”

In emphasizing that research, development, and commercialization cycles take from 10 to 15 years, Couturier notes that “some of the risk is

shared with the public, with governments providing development funds.”

But, entrepreneurs may want to go to market more quickly. In those cases, showing a plan to potential private investors based on the Aquaculture Readiness Levels could help them evaluate both risks and opportunities.

Jim Duston, a professor of finfish aquaculture at Dalhousie University in Nova Scotia, says the Aquaculture Readiness Levels Falconer and Ytteborg designed are “well thought out.” They provide a solid core, which can be expanded with greater detail in a project management plan, for example.

Duston suggests building out tasks related to nutrition and genetics. For example, he would specify, “Brood stock have been successfully reared to maturity in captivity and produced viable F1 offspring.”

Elisabeth Ytteborg of Nofima collaborated with Lynne Falconer of the University of Sterling to devise an “aquaculture readiness” pathway to aid development of new species for farming, especially in the context of

As was the case with cod, he says in an email, “Disease issues might not appear for a few years,” adding “Extreme ruinous weather events may be at fiveyear intervals.” Duston also suggests more emphasis on market demand.

In fact, changes in consumer preference significantly affected suspended culture of mussels in

Development of aquaculture methods for new fish species has long been a research interest of Ken Cain. At the University of Idaho, where he is a distinguished professor, he and his team have investigated burbot as a candidate for freshwater aquaculture. With wild stocks in steep decline in North America, burbot could offer the market flaky white meat that is

Cain taps his experience with burbot to comment that a species

Optimize the return on your capital investment with a single screw extrusion system. Buy one system and cost-effectively deliver product to multiple market opportunities.

SINGLE SCREW EXTRUSION SYSTEM OPTIMIZES FLEXIBILITY AND

• One system capable of economy up to super premium fresh meat petfood

• Aquatic feeds that range from floating to sinking shrimp feed

• Capitalize on high margin petfood treat opportunities

• Significantly lower operating cost per ton versus competitive systems

An Extru-Tech Single Screw Extrusion System provides all the flexibility and production efficiencies at around half the cost of competitive extrusion systems with high operating costs.

may not fit a given ARL perfectly. With burbot, researchers mastered an understanding of nutritional requirements, reproduction, early-life culture and immunology to bring it to an ARL 6, he estimates. It can now be grown to harvest in production technology, with standardized protocols.

But whether production can occur “in a cost-effective time frame,” as ARL 6 specifies, won’t necessarily be known until it is scaled up. So, says Cain, it is important to approach this system with some flexibility.

Currently, at the NOAA Fisheries Northwest Fisheries Science Center in Washington State, Cain and his colleagues are experimenting with raising farmed sablefish. Also called black cod, it is valued on the seafood market for its buttery taste and is native to the Pacific Northwest and Alaska.

And here some Canadians have a first-mover competitive advantage, Cain notes. Since 2005, Golden Eagle Sablefish has been raising sablefish in

Research and development of the different life stages of an aquatic species is one indicator of its readiness for commercial farming.

PHOTO: JON-ARE BERG JACOBSEN/NOFIMA

net pens in British Columbia in partnership with the Kyuquot-Checleseht First Nations.

“There is a lot of value when an entrepreneur takes research results—when you’ve got a species you can reproduce, you can grow, you can feed, you can get through the different life stages—and just takes the risk and says, ‘Let’s jump into that and see where we go!’” he says.

Like the Canadians, the Washington State researchers were able to achieve commercialization status, raising sablefish to harvest size in marine net pens, which was the original mandate. However, with Washington State’s political opposition to open ocean

farming, the team is now examining the cost-effectiveness of land-based culture, as well as options in the live market and different fish sizes.

If aquaculture readiness requires production technology in the intended environment, then consideration must also be given to countryand state-specific regulations that govern those practices.

“In the U.S., where we have all the resources to develop aquaculture, there are many additional barriers outside of the science that prevent moving forward from research and development to commercialization,” says Cain. | ANA

BY BEN NORMAND

Ben Normand a fish farmer, writer, college instructor, and cheerleader for aquaculture. He has worked with various fin and shellfish species in New Zealand and Canada in production management, compliance, and communications. (ben.r.normand@gmail.com)

Shellfish farming is an important and tremendously productive part of the Canadian aquaculture industry. There are over 2,600 marine shellfish farms in Canada, with production averaging over $100 million per year. Most jobs in this sector are in rural, coastal and/or First Nations communities. Beyond the economic impacts, there is great cultural value in these operations. Places like P.E.I. have been major suppliers of shellfish to Canada and the world for many, many years – there is a historic and intergenerational pride to be found in the exercise of this production. But the industry is changing. The old seasonal and biological rhythms that defined production practices are changing with the climate, employment trends are shifting, and world markets are changing. Also, regulations are changing and must also continue to change. Most of these changes and their consequences can be seen as good or bad, depending on your perspective. Regardless of your perception, they absolutely warrant examination and awareness.

I spent considerable time working in and around the P.E.I. shellfish industry. So many production deadlines were based on old, reliable biological and seasonal rhythms. A good example was that you could stop spraying your mussel crop for the invasive and nightmarishly prolific tunicate Ciona after Labour Day. The thinking was that water temperatures had lowered enough that they had stopped or would soon stop spawning and growing. However, increasingly common warm autumns and winters meant crops would emerge in the spring covered in large tunicates, which can cause catastrophic crop loss.

In a changing climate, farmers need to be ready to use data and a flexible approach to adapt to the new rhythms.

The answer to this was to simply keep spraying until the water was cold enough to stop them from spawning and growing. Was it a pain to shift production rhythms to facilitate this? Absolutely. Did it pay dividends to stay on top of it until the data showed it was safe to stop? Also absolutely.

In a changing climate, farmers need to be ready to use data and a flexible approach to adapt to the new rhythms. Data will show us the path, we just need to walk down it.

Farm managers can tell you – it’s hard to find and retain good staff who want to do this work. It’s not that there is anything wrong with it, but it isn’t for everyone. The issue is that it seems to be less and less attractive over time. Young adults are increasingly aiming for less physical careers as they have for years been told that laborious jobs are somehow lesser. We’re witnessing a change in that messaging, but it will take time for that to equate to increased applicants.

To compensate, we are seeing shellfish farming wages increase, and the introduction of other perks such as benefits, RRSP matches, etc. Also, farmers across the country are

Shellfish farmers are a resilient bunch. Despite the challenges, they wil perservere.

increasingly turning to international labor solutions, such as helping international applicants become permanent residents while they work for the company.

I firmly believe that as we see a shift in the Canadian social understanding that aquaculture is agriculture, and a resultant broader acceptance of aquaculture practices, we will see greater legitimization of shellfish farming as a viable career option. This, coupled with farmers’ flexible approach to hiring, will keep their boats full and their long lines rolling.

People love Canadian shellfish. And thankfully, people outside of Canada in certain parts of the world have been liking it to an increasing degree. For example, according to Stats Can, in 2014 farmers exported only one tonne of mussels to Japan, but in 2022 they exported 51 tonnes of mussels to Japan.

If people are paying to have them shipped across the entire Pacific Ocean, we’re doing something right here.

We’re seeing a shift from smaller, homemade vessels and gear (such as cranes) to larger, engineered vessels and gear as a response to regulatory requirements as well as the pursuit of a reduction in liability as businesses grow. This is a good thing for the staff, for the companies and for productivity.

Similarly, we’re seeing an increased alignment with the salmon sector in terms of safety measures. We’re seeing more life jackets and hard hats than ever before. Soon, these crews will be indistinguishable from modern salmon farm crews from the perspective of an outsider, aside

from their being covered in mud! Again, this is a good thing for the staff, for the companies and for productivity.

We’re unfortunately also seeing a shift in unwarranted regulatory oversight increasing over time in certain parts of the country. For example, a zero-risk approach by regulators is a leading impediment to the efficient adoption of floating cage culture in British Columbia.

One of the biggest regulatory shifts is one that has yet to occur but must occur.

Canadian shellfish farming has enormous potential. Projections based on the UN FAO/OECD show that by 2030, Canadian shellfish production could reach almost 58,000 tonnes – a 36 percent increase over 2019 levels.

New site access is critical in pursuit of this potential, and one of the major constraints to new site access is the Canadian Shellfish Sanitation Program (CSSP), co-managed by CFIA, DFO and ECCC. A stagnant funding envelope (~C$15 million without inflationary increases) for twenty years is a leading barrier to economic development.

We need to see additional, permanent funding for the CSSP program to support greater capacity to classify new harvest areas along Canada’s vast coastlines, to efficiently re-open sites and to modernize the program. We saw a highly focused funding increase for two years in Budget 2024 (aimed exclusively at First Nations ceremonial and food purposes). This is a good initiative, but we need to see secured, long-term funding increases to facilitate these First Nations uses, as well as increased commercial farming uses indefinitely.

Yes, shellfish farming doesn’t look like it did 20 years ago. Shellfish farmers are a resilient bunch, though. Despite the changes, they will persevere. | ANA

For over 35 years oyster growers worldwide have trusted our S1000 Oyster Tray and S4000 nursery tray, to produce the highest quality half-shell oyster for today’s demanding consumers.

ENTERPRISES

S4000 nursery trays

S1000 oyster trays

Cleans, measures, sorts, counts and bags oysters fast and automatically.

ACCURATE - high production with minimal labour – average processing speed of 14,000 oysters per hour using only one operator.

Immune-compromised individuals would be most negatively impacted by a vibrio infection. Taking simple steps like using gloves when handling shellfish will protect workers from any exposure.

procedures

By Matt Jones

Vibrio is making headlines again.

The bacteria species continues to attract attention and with good reason. Infections and deaths related to the bacteria continue to rise, with 74 cases of the particularly troubling Vibrio vulnificus strain (and 13 related deaths) having been confirmed in Florida in 2024, up from 46 cases and 11 deaths in 2023.

There have also been a handful of deaths in New York and Connecticut in recent years. In the meantime, research efforts such as the paper “Climate Change Is Making Europe’s Shellfish Dangerous” published by Medscape have caused some fear regarding impacts on shellfish and potential interactions with consumers.

To be clear, these impacts are not directly connected to the

aquaculture industry or any specific sector within. Virtually all recent vibrio infections and deaths in North America have been attributed to exposures due to hurricanes. And while European regulators and producers may be struggling with managing vibrio in areas where the bacteria had historically been less of a presence, generally when proper handling procedures are followed (and the product is properly cooked) vibrio-related health impacts upon the aquaculture sector are minimal.

However, as the prevalence of vibrio (and other potentially harmful bacteria) increases alongside rising ocean temperatures, it seems likely that the potential for negative impacts on workers in the aquaculture industry will increase and will become more common.

Vibrio is a range of different bacteria which are typically found in warm marine waters. While many vibrio strains are actually benign, there are several prominent dangerous strains of vibrio, including Vibrio cholerae (as in cholera) and Vibrio parahaemolyticu s (a common cause of bacterial gastroenteritis in Asia). Vibrio vulnificus is generally seen as the most dangerous strain, particularly for immune-compromised individuals for whom an infection could lead to nightmarish conditions such as necrotizing fasciitis (flesh-eating bacteria) or septicemia (sepsis).

The University of Maryland’s Rita Colwell has been one of the eminent researchers into the topic of vibrio. In her view, the conditions that lead to the

proliferation of vibrio bacteria have gotten worse in recent years.

“The temperatures of the water in Miami have reached at least 90 degrees,” says Colwell. “The increased water temperature – severe in the case of Hurricane Ian, three or four hurricanes ago, which swept diagonally across Florida on the west side, stirred up sediment and with the heavy rain, salinity on the coastal waters was reduced. Conditions were ideal for Vibrio vulnificus and there were 10 deaths. We have been monitoring the increase of the sea surface temperature along the Atlantic coast and it’s been increasing detectably every 50 kilometers.”

One interesting factor, Colwell relates, is that contrary to climate-related migrations that have been seen (as temperatures

increase in more northern areas, the zones where certain wildlife and plant species are most commonly seen have shifted to the north as well) vibrio bacteria are not migrating to warmer areas. Rather, they are part of the natural flora of any area of the marine environment.

“But the conditions are switching to make it ideal for them to become abundant,” says Colwell. “We’ve been collecting samples after this latest hurricane and we’re in the process of analyzing those and keeping an eye on the news and hoping we don’t have any more deaths.”

As of 2024, Colwell notes, the U.S. Center For Disease Control now requires any vibrio infection to be reported. Academics like Colwell have also developed prediction models for vibrio which are based on using satellites to monitor water temperatures.

In terms of potential impacts on workers in the aquaculture industry, the most at risk are the same as the general population. Immune-compromised individuals would be most negatively impacted by a vibrio infection. In those cases, the most important thing to ensure is that if an immune-compromised worker has an open wound they take steps to avoid getting seawater into that wound.

This element of vibrio may not have been properly communicated in the past. Jeff Bishop, executive director of the Aquaculture Association of Nova Scotia, admitted that he was unaware of those types of potential direct impacts on humans and was mostly familiar with the potential for impacts on the product itself.

“Just colloquially, having been on farms and watching folks as they’re doing things, they are gloved,” says Bishop. “So the likelihood of that kind of interaction would absolutely be low. But that’s just based on what I’ve observed.”

As the prevalence of vibrio increases alongside rising ocean temperatures, it seems likely that the potential for negative impacts on aquaculture workers will increase.

In terms of specific standards and regulations to avoid vibrio impacts on the product itself, there are several steps outlined in the Canadian Food Inspection Agency’s Canadian Shellfish Sanitation Program (CSSP). Those include the use of temperature controls during transportation to avoid the growth of undesirable pathogens and recommend a ramping up of testing for strains such as Vibrio parahaemolyticus when water temperatures rise to 15 C or higher.

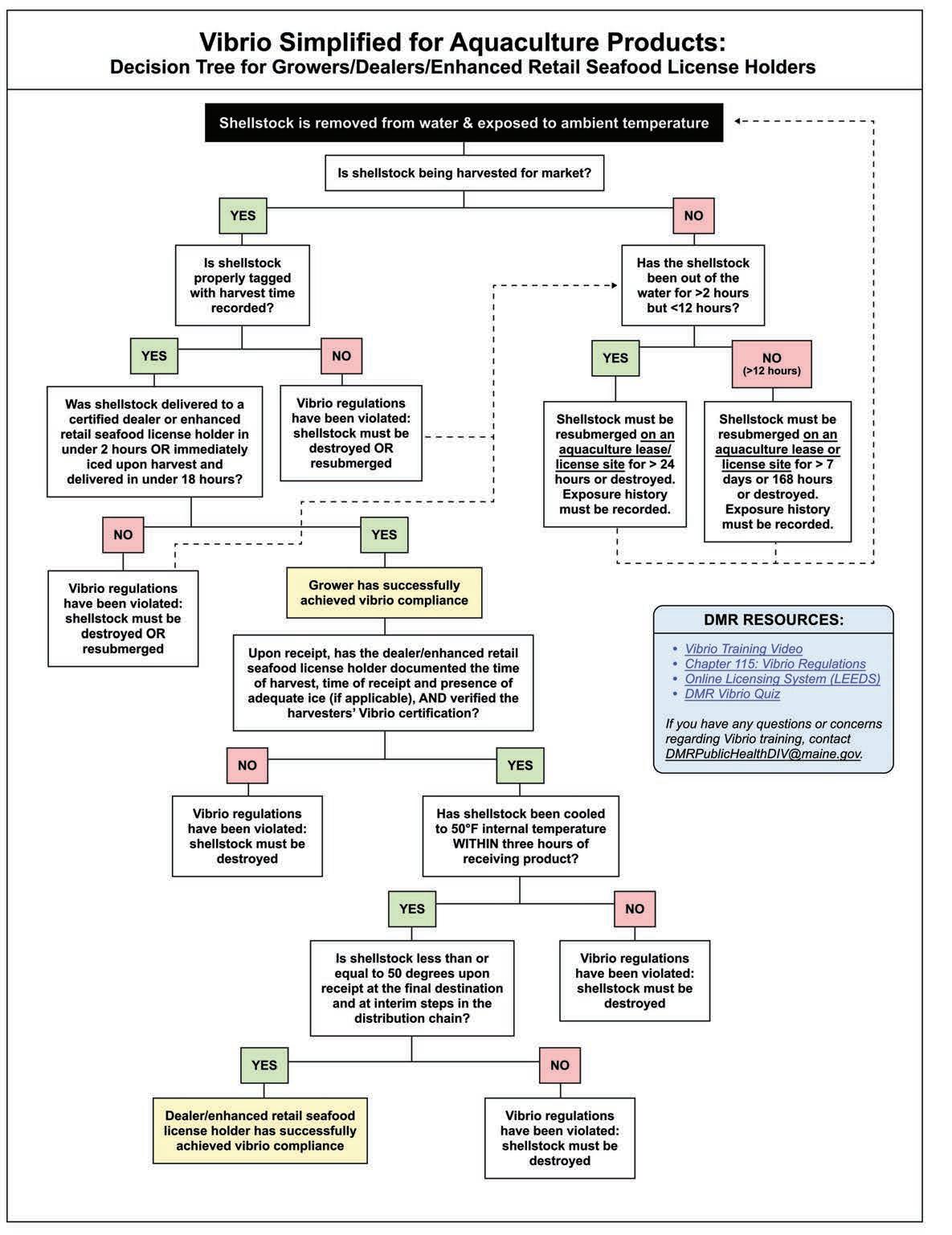

The East Coast Shellfish Growers Association website also has some valuable vibrio-related resources available, including a decision tree for growers, dealers and retail seafood licence holders to ensure that they are following proper handling and harvesting measures to minimize impacts.

Bishop has been more intimately involved in the discussion regarding the much more common impact on the products – MSX, the unknown disease impacting PEI oyster farms as of late. Bishop notes that the disease has appeared to move up and down the eastern coast of the United States for more than 50 years.

“But what’s fascinating to me about it is we don’t know how it moves, we don’t know what spreads it,” says Bishop. “Something that’s been impacting a fairly significant industry up and down the coast for so long and we still don’t have an understanding of how it moves.”

Some have theorized that MSX is also driven by warming ocean temperatures but the evidence is inconclusive thus far. As our understanding of that disease and our understanding of the proliferation of bacteria such as vibrio increases, new techniques and standards may evolve. At that time, small farms such as those that make up much of the Nova Scotia

aquaculture industry could play a key role as smaller businesses are generally more agile and can adjust their practices and operations far more quickly than larger more industrial approaches.

“I come from 15 years in the forest sector, so I can see the parallel lines of something like a small private woodlot owner and their forest holdings that they manage can pivot in a different way than a larger company could on certain things,” says Bishop.

“If you’re a privately owned business – one with three or four family members that sit around the table at night and make the decisions – it’s much easier to have that family meeting and say, ‘We’re going to go this way because we think this is the right way for us to go.’ As opposed to a larger company that may have a board of directors to answer to because of investors and all those kinds of things.” |

ANA

"WE TAKE CARE OF THE LITTLE GUYS"®

By Ben Normand

Acommon refrain among farmers who experience crop losses is, “I didn’t see it coming.” Every farmer wishes to make smart choices to maintain animal welfare and health, thus increasing productivity. However, to do this a shift in how they monitor, and measure health of livestock may be required.

The industry is witnessing a shift in how health is understood in their animals. Whereas historically it was understood as being the absence of disease and abnormal behavior, these more obvious manifestations are the results of minute shifts in several internal and external factors. Ecosystem and fish health are intertwined. Healthy fish and ecosystems are not just desirable for farmers because they represent a lack of disease, they also are in the “sweet spot” where maximum growth efficiency can be achieved.

Microbiome sequencing is a good example of a tool which is changing perceptions of ecosystem health, its impact on their animals, and how it shifts in response to external and operational inputs. But how can farmers get a better look at what is shifting inside of their animals?

Loch Duart has been farming the cool, clean waters of northwestern Scotland for over 20 years. According to its website, “fish

welfare is at the heart of everything we do which means our farms are designed around our salmon.” With this core focus in mind, they wanted to improve their health monitoring services to catch these shifts early, so they began collaborating with WellFish Tech.

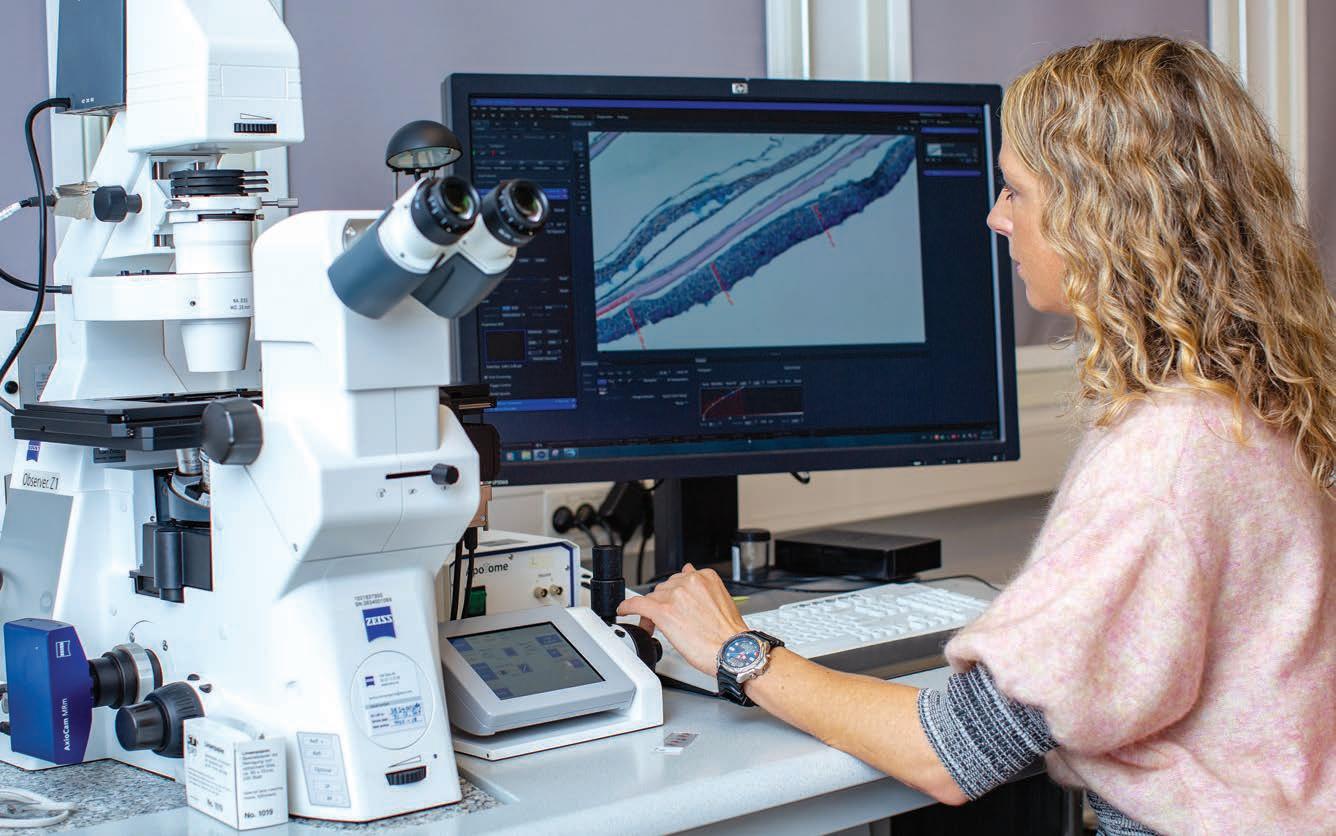

Founded in 2021 in Scotland, WellFish Tech uses non-lethal blood sampling to assess biomarkers to offer farmers real-time, rapid and accurate insights into the health status of fish as well as early warning signs of when fish are leaving a healthy state.

Having already made inroads in Scotland and Norway, WellFish Tech has invested in the North American market by developing a team, led by Mark Braceland, and establishing lab capacity on the continent.

WellFish Tech’s marketing materials explain biomarkers by saying, “Biomarkers encompass a vast range of blood borne proteins and electrolytes, all of which are in constant flux in response to changes in the animal’s physiological status and as such are indicators or markers of that status, hence biomarkers.”

They go on to explain that this departure from healthy status may be the result of various factors, “Changes to the levels of many

biomarkers can occur through natural processes such as feeding or life stage. However, inputs that constitute a challenge to the animal’s health, whether environment, nutritional imbalances or pathogens also produce swift upsets to biomarker profiles.”

Having this data can help farmers to mitigate stress and health issues early, as well as maximize efficiency by making informed operational decisions.

In terms of what biomarker sampling looks like on the ground for the customer, a WellFish Tech staff, such as Braceland, will consult with the farmer to get a clear picture of their production and health history.

Then, they will carefully guide the farmer through the entire sampling procedure to ensure they understand the process, provide all consumables and ensure they are adequately equipped to carry out the tests.

Sampling is quite simple by design, so the farmer can carry it out which expedites the entire process. First, the farmer anesthetizes the fish, then uses a provided vacuum syringe for easy blood draw. Then, the farmer centrifuges the sample, moves the serum to a provided container, freezes the sample and sends it to WellFish Tech.

Within 24 hours of sample receipt, WellFish Tech will provide the farmer with an analysis, which is presented in an easy-to-read format which includes the farmer’s data points visualized within a “normal” range as well as explanations for what those mean in a practical sense for their fish.

With every sample, WellFish Tech can further expand their database and provide increasingly granular results.

Brian Quinn, founder and CTO of WellFish Tech, says on their website that they have the “largest database of fish health in the world.” This database includes over 900,000 data points and this amount is growing each day. Also, the company is starting to collect data in other species beyond Atlantic Salmon, such as Catfish and shrimp.

That amount of data is, to say the least, enormous and analyzing it and providing useful information for farmers would be an equally enormous undertaking using classic methods. However, by using machine learning and analysis, the company aims to continue to expand not only their species offerings and the granularity of their results, but the scope of their data collection as well. By incorporating the ability to overlay other data sets and identify causal and correlative patterns, WellFish Tech aims to offer farmers predictive capability.

Predictive capability would help farmers operate more confidently because when one or more of the multitudes of possible variable conditions and operational inputs are present (e.g. feeding times, jellyfish presence, etc.), they can know the impact that these variables will have on fish health, as opposed to has had, and act accordingly to correct divergence from optimum health early.

Of their collaboration with Wellfish Tech, Loch Duart said, “Within a short period of using WellFish Tech, we have found that their data is providing extremely valuable insights, in one case giving us the reassurance that the fish were coping with a challenge that resulted in an adjusted feeding schedule that led to a gain in biomass. Without this insight we would not have been able to make that call.”

Similarly, Dave Cockerill, director of biology at Bakkafrost Scotland said, “Analysis provided by WellFish Tech is proving to be a valuable salmon health management tool by providing early warning

Data analysis is proving to be a valuable salmon health management tool by providing early warning and insights into which vital functions are affected and how fish may be supported.

and insights into which vital functions are affected and how fish may be supported, as well as measurements of prognosis, making a significant contribution to our fish health strategy and influencing management decisions.”

Lesley Clark, business development manager, said that they are working to develop tools for farmers to be able to input data in real-time about their operations, environmental conditions and behavior which will further enhance their predictive capability. Through innovation and the application of advanced technology, WellFish Tech is doing their part to make “I didn’t see it coming” a refrain of the past. |

ANA

Innovasea adds BiOceanOr’s AI oxygen forecasting for aquaculture solutions

Innovasea, an aquatic solutions company for aquaculture and fish tracking has partnered with BiOceanOr – a water quality forecasting company – to add oxygen forecasting to its environmental monitoring solution.

The system uses regional weather models, physical and biogeochemical oceanographic models and advanced AI-powered algorithms that ingest real-time data from Innovasea’s environmental sensors and open data. This allows for in-pen predictions of dissolved oxygen (DO) levels and can warn farmers of low DO events up to 48 hours before they occur.

Farmers can access the forecasts and set customizable thresholds in Realfish Pro – a cloud-based precision aquaculture platform that enables fish farmers to monitor, manage, and control key aspects of their farms. Low DO levels can be fatal. Prolonged periods of low oxygen can stress fish populations, lead to reduced appetites, slower growth, and a negative impact on overall health and welfare.

“Being able to predict low dissolved oxygen events empowers farmers to determine when to feed with confidence and helps them mitigate against environmental threats before they happen,” said Tim Stone, Innovasea vice president. “Through this partnership with BiOceanOr, our users will be able to plan feedings better, address changing water conditions, and take a more proactive approach to improve fish health and growth.”

According to an Innovasea press release, BiOceanOr’s algorithm was trained on over 200 million data points to date.

“Our predictions model is a result of our unique combined expertise in AI-powered analytics, marine biology, fish health and oceanography,” said Gaëtan Fabritius, chief business officer at BiOceanOr. “By integrating predictive services on top of Innovasea’s real-time sensors and operation-driven Realfish Pro platform, we can provide farmers with a more complete and actionable service to improve operations and drive sustainable practices.”

Raw Seafoods, a supplier in the seafood industry, has partnered with Trace Register, a seafood traceability solutions company, to implement Trace Register’s TR5 platform.

The seafood supplier said it is part of its commitment to full chain traceability, product quality, and regulatory compliance. TR5 provides a unified system for managing data across the supply chain, allowing information sharing.

“This strategic move enhances our ability to meet current and future market demands

while adhering to key regulations, including the U.S. Food and Drug Administration (FDA) Food Safety Modernization Act (FSMA) Section 204,” said Christopher Steel, director of food safety and regulatory for Raw Seafoods.

FDA’s FSMA 204 regulations require enhanced traceability for global seafood supply chain entities. The regulation, enacted in 2023, requires full compliance by Jan. 20, 2026. These requirements include:

• Identifying products included in the FDA’s FTL (food traceability list).

• Developing and maintaining a comprehensive food traceability plan.

• Applying a traceability lot code system for all relevant products.

• Maintaining records of key data elements (KDEs) for critical tracking events (CTEs).

• Providing traceability records to the FDA within 24 hours upon request.

“Our decision to integrate the TR5 platform underscores our passion-driven connection with seafood and our dedication to improving our processes,” said Tom Vasile, director of purchasing for Raw Seafoods.

The TR5 platform is said to offer monitoring and analysis capabilities that enhance compliance and product quality by verifying real-time data accuracy.

“Trace Register’s role is to meet our clients where they are. Raw Seafoods is a fantastic partner to work with, and we share their dedication to quality and excellence,” said Chris Bradford, senior vice president of sales for Trace Register. “We also have a mutual commitment to sustainability which gives purpose to our efforts.”

New toolkit to reduce environmental impact of aquaculture feed

Sustainable Fisheries Partnership (SFP) has launched a resource for companies to tackle the climate change, habitat, and biodiversity risks associated with aquaculture feed, Feed Solutions Toolkit.

The toolkit connects seafood companies with tools and resources to make commitments, assess the risks associated with their feed ingredients and implement improvements. It has over 80 tools, standards, initiatives, and platforms from different organizations, guidance and case studies on steps to improve feed sustainability.

A press release from SFP states that some suppliers and retailers have already set goals and targets to improve the sustainability of the feed used to produce their products or the ingredients it contains.

“We want all seafood companies to include aquaculture feed in their sustainability commitments and policies because feed poses significant environmental and climate challenges,” says Paul Bulcock, aquaculture information manager at SFP. “Addressing this issue, along with continued improvements in farm planning and management, will enhance aquaculture’s role as a low-carbon, environmentally sustainable, and socially responsible food source.”

SFP notes that aquaculture feed is a significant climate change and environmental hotspot, with risks such as land conversion, deforestation, overexploitation, pollution and more.

“It is estimated that aquaculture’s use of compound feed ingredients is responsible for up to 70 to 80 percent of its carbon impact and up to 90 percent of certain environmental impacts such as land and water use,” the press release states.

Since aquaculture accounts for more than half of the world’s seafood, by volume, it is important to meet the increasing global demand for seafood while offering a low-carbon alternative to other animal products.

SFP states that although multiple tools, standards, and improvement initiatives have already been developed to assist the seafood supply chain in meeting the challenge of feed sustainability, the Feed Solutions Toolkit is the first time these resources have been curated in one place.

Send your latest products or supplier news releases to the editor: jkodin@annexbuesinessmedia.com

need a grant or funding?

Customized for your fish farm, hatchery or research operation!

Customized for your fish farm, hatchery or research operation!

Customized for your fish farm, hatchery or research operation!

Customized for your fish farm, hatchery or research operation!

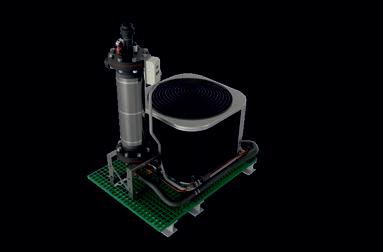

Our Commercial LSS Packages are custom engineered to meet your specific needs.

Our Commercial LSS Packages are custom engineered to meet your specific needs.

Our Commercial LSS Packages are custom engineered to meet your specific needs.

Our Commercial LSS Packages are custom engineered to meet your specific needs.

• Marine and Freshwater

• Marine and Freshwater

• Marine and Freshwater

• Mechanical filtration

• Marine and Freshwater

• De-gassing towers

• De-gassing towers

• Wide variety of flow rates

• Mechanical filtration

• Mechanical filtration

• Chemical filtration

• Chemical filtration

• Mechanical filtration

• Chemical filtration

• Ultraviolet disinfection

• Ultraviolet disinfection

• Wide variety of

• De-gassing towers • Wide variety of flow rates

• De-gassing towers

• Flow

• Flow control valves

• Wide variety of flow rates

• Chemical filtration

• Ultraviolet disinfection

• NEMA enclosed controls

• NEMA enclosed controls

• Protein skimmers

• Flow control valves

• Ultraviolet disinfection

• NEMA enclosed controls

• Bio-filter towers

• Bio-filter towers

• Bio-filter towers

• NEMA enclosed controls

• Bio-filter towers

• Protein skimmers

• Variable frequency-drive pumps

• Temperature management

• Variable frequency-drive pumps

• Temperature management

All our systems are pre-plumbed and fully water tested prior to shipping. Call us today at 206.937.0392 www.AquaticEnterprises.com

All our systems are pre-plumbed and fully water tested prior to shipping. Call us today at 206.937.0392 www.AquaticEnterprises.com

Researchers from the EU-funded ASTRAL project are releasing three production manuals for various marine species occurring in, or common to the Atlantic region.

The free manuals provide step-by-step guidance for species cultivation in three key Integrated Multi-Trophic Aquaculture (IMTA) system types: open-water IMTA, Land-Based Pump Ashore systems, and Biofloc systems. Aquaculture producers in Ireland, Scotland, South Africa, and Brazil tested the manuals.

“The details contained in these manuals demonstrate how the current monoculture aquaculture industry could diversify to IMTA to enable a more sustainable future for marine aquaculture,” said Pauline O’Donohoe, aquaculture researcher at the Marine Institute in Galway and co-author of the Open Water - IMTA Production Manual.

IMTA is a sustainable aquaculture practice that involves cultivating species from different trophic levels (positions in the food chain) within the same farming system, allowing one species’ waste and nutrients to be recaptured and converted into fertilizer and feed for the other aquaculture species.

The aim is to implement aquaculture systems for increased environmental sustainability and economic stability within holistic and circular economy approaches.

According to a press release from ASTRAL, the ASTRAL IMTA production systems showed an increase in circularity of up to 90 percent in terms of water recirculation. Bioremediation was improved to 90 percent, providing evidence for the potential role of IMTA in the circularity transition.

The newly released production manuals cover the cultivation of various marine species in each IMTA system in detail, addressing essential aspects such as welfare, health, and biosecurity.

“Together, these manuals serve as essential resources for cultivation in IMTA systems, demonstrating a more sustainable and diversified aquatic food system,” said Brett Macey, aquaculture specialist at the University of Cape Town and co-author of Land-Based Pump Ashore - IMTA Production Manual.

Deep Trekker, an underwater ROV technology company, and Underwater Contracting Ltd. (UCO), a provider of aquaculture solutions, are partnering to deliver technologies that address global aquaculture needs.

The collaboration aims to transform aquaculture farm inspections using specialized maintenance systems and ROV technology.

Deep Trekker said its ROV systems allow operators to manage daily tasks like net inspection, stock monitoring, and biofouling control. UCO’s Foover system shows video recordings of mortality recovery, while the NetFix system ensures ongoing net maintenance through inspections and automated patching. The companies will combine technologies for Deep Trekker ROVs, NetFix, and Foover.

UCO’s Foover system shows video recordings of mortality recovery, while its NetFix system ensures ongoing net maintenance through inspections and automated patching. The NetFix system is said to be a solution for repairing small holes in cage nets caused by predators or equipment snags.

The ROV-deployed system uses plastic patches secured with pegs, ensuring stock containment until permanent repairs are completed. The patches sit flush with the net, allowing for ongoing net washing and easy removal by dive teams when required. Deep Trekker said this method reduces the need for urgent dive interventions, saving time and costs.

“By combining UCO’s specialized maintenance systems with Deep Trekker’s ROV technology, fish farms will benefit from enhanced operational tools for monitoring, recovery, and maintenance,” a press release from Deep Trekker states.

Trace Register partners with Foa & Son to offer discounted seafood insurance

Trace Register, a seafood full-chain traceability company, has announced a collaboration with Foa & Son International Insurance Brokers, an insurance broker in the seafood industry, to provide seafood businesses with tools to safeguard their operations.

Together, they are offering Trace Register’s seafood customers access to product contamination & recall insurance at favourable terms.

Working with a provider that typically offers a 10 percent discount on insurance premiums for pre-crisis consultation services, instead 5 percent will now be used to cover Trace Register’s subscription costs. Companies receive this reimbursement by submitting their invoice to Foa & Son.

“This partnership demonstrates our ongoing efforts to support the seafood industry and lead with proactive, innovative risk management solutions,” said Peter Sollecito, senior vice president.

Trace Register’s TR5 seafood traceability system allows for integrating data from various sources into a unified system. The platform has real-time and continuous monitoring and analysis (CMCA) capabilities to enhance compliance and product quality by verifying data accuracy and driving corrective actions.

“It is a big win for our customers,” said Chris Bradford, senior vice president of sales at Trace Register: “This first-of-its-kind offering for the seafood industry reinforces our dedication to meet our customers where they are. It addresses the tight margins in the seafood industry while providing critical brand protection and operational savings.”

Cooke Inc., in New Brunswick, Canada, has announced the completion of its acquisition of Corporación Pesquera Inca SAC, (Copeinca) Peru.

This comes after the Nov. 7 announcement disclosing that Copeinca Canada Inc., a wholly-owned subsidiary of Cooke, had entered into a formal agreement with PF Cayman New Holdco Limited to buy all of the shares of Copeinca.

Copeinca was established in 1994 and is one of Peru's largest anchoveta processors and one of the largest anchoveta fishmeal and fish oil producers and exporters in the world. The Cooke family of companies operates global aquaculture and wild fishery divisions in 15 countries.

“We're excited to welcome Copeinca's dedicated employees to the Cooke family of companies,” said Glenn Cooke, CEO of Cooke. “Copeinca will be a major contributor in furthering Cooke's growth as a leader in strengthening global food security.”

Cooke says it’s further strengthening its growing marine ingredients business and diversifying its geographic and species portfolio. It entered the marine ingredients sector in 2017 after acquiring U.S.-based Omega Protein Corporation.

Mowi chooses Innovasea as preferred vendor for environmental monitoring

Innovasea has announced a renewed global framework agreement with Mowi, one of the world’s largest salmon farmers. The agreement makes Innovasea the preferred vendor for environmental monitoring equipment and software for all Mowi sites.

Mowi has already implemented Innovasea's environmental monitoring systems at multiple locations and will continue to add new sites as part of its ongoing Mowi 4.0 Smart Farming initiative.

“We are thrilled to build upon our successful partnership with Mowi as they continue to lead the industry in effective, data-driven techniques,” said Tim Stone, vice president at Innovasea. “As leaders in precision aquaculture, we are excited to help them leverage the information they’re collecting to deliver more efficient, sustainable practices.”

Innovasea's technology delivers real-time information on environmental factors, such as dissolved oxygen levels, salinity, and temperature, to a central cloud-based platform: Innovasea's Realfish Pro.