SAUL CHERNOS

What do marble-slab countertops in B.C., oil in Alberta, cars and trucks in Ontario, and shipbuilding in the Maritimes have in common?

They all strongly influenced markets for overhead cranes last year and stand to do the same in 2017. Business across Canada was mixed last year and maintaining a diverse business strategy helped save the day, industry reps say.

“Markets are quite quiet right now,” says Neil Humphry, who oversees sales at North Vancouver-based Canco Cranes & Equipment Ltd., which designs, manufactures, installs and service a wide variety of kinds of overhead cranes for a customer base spread across Canada and as far afield as Siberia, Indonesia, and Bermuda.

“Our manufacturing is down quite a bit, but our service is up,” Humphry says. “We make more money doing service and repairs than we do building cranes, so from that aspect it’s not all doom and gloom. It’s

Terex HC80 crawler among machines demonstrated during showcase event at Northern Lakes College

Alberta’s Northern Lakes College recently showcased several new pieces of lifting equipment — including an 80-tonne Terex crawler — at the college’s Slave Lake campus and headquarters.

The celebratory event, which took place Aug. 12, welcomed industry owners, crane operators, and the public to a barbecue, ribbon-cutting, and equipment demonstrations, said a news release from the college.

Bridge over lock on Ontario’s Trent-Severn Waterway completed ahead of schedule

The construction and installation of a bridge at Lock 18, part of the Trent-Severn Waterway system in Ontario, is now complete but there’s more work ahead, according to a spokesman with Parks Canada.

“The replacement of the swing bridge in the Village of Hastings is part of an unprecedented $3 billion investment by the federal government to support infrastructure work to heritage, visitor, waterway, and highway assets located within national historic sites, national parks, and national marine conservation areas across

Alberta’s advanced education ministry provided the “financial boost” needed to buy the equipment and expand the program, the release said.

As reported earlier in Crane & Hoist Canada, the college received $3.5 million in total from Alberta’s Apprenticeship & Industry Training system to buy the equipment. The system is a partnership between industry and the provincial government.

Editor - Keith Norbury • editor@craneandhoistcanada.com

Advertising Sales - Jeremy Thain • jeremy@capamara.com

free 1.877.936.2266 • Tel. 250.474.3982 • Fax. 250. 478.3979

Art Direction/Production - James S. Lewis • james@capamara.com

Publisher - Peter Chettleburgh • peter@capamara.com

Regular Contributors

Saul Chernos, Jeffrey Carter, Kevin Cunningham, Nelson Dewey, Matt Jones

Subscriptions - Deirdre Chettleburgh • deirdre@capamara.com Tel. +1.250.474.3935 • Fax +1.250.478.3979

www.craneandhoistcanada.com

Crane & Hoist Canada is published six times a year by Capamara Communications Inc.

Reference to named products or technologies does not imply endorsement by the publisher. A subscription to Crane & Hoist Canada (six issues) is $34 per year in Canada (including GST) and $36 (including HST). For subscriptions in the USA the price is $36 USD and $45 USD for overseas. Send cheque or VISA/Mastercard number to Subscription Department, Crane & Hoist Canada, 4623 William Head Road, Victoria, BC, Canada, V9C 3Y7. Fax orders to +1-250-478-3979. Or subscribe online at www.craneandhoistcanada.com

RETURN UNDELIVERABLE CANADIAN ADDRESSES TO: Crane & Hoist Canada, CIRCULATION DEPT. 4623 William Head Road, Victoria, BC V9C 3Y7

ISSN 1923-788X

Apair of gantry cranes capable of handling larger container ships arrived at New Brunswick’s Port Saint John in late October.

Next Advertising Deadline: Jan 27, 2017

Don’t miss the opportunity to be part of this exciting new industry publication. For more information, or to reserve space in the next issue, call Jeremy at our Advertising Department - Toll Free 1.877.936.2266. jeremy@capamara.com

Next Editorial Deadline: February 3, 2017 For writers’ guidelines and submission requirements get in touch with the Editor, Keith Norbury, at 250.383-5038. Email editor@craneandhoistcanada.com

The cranes arrived Oct. 29 aboard the ship Zhen Hua 14.

CBC reported that the cranes were recently refurbished in Charleston, S.C. They are about 10 metres taller than the cranes they’ll replace, which were second-hand when they went into service in 1971, CBC noted.

“The cranes represent private sector equipment investment on the part of DP World, the new terminal operator set to begin operations at Port Saint John in January,” said a news release from the port in advance of the arrival of the refurbished cranes.

A DP World official said by email that the cranes were built by Paceco España in 1998 and refurbished at the Columbus Street Terminal in Charleston.

The cranes are capable of working a 16-container-wide vessel with a capacity of 6,500 20-foot-equivalent units, a.k.a TEUs, noted a news release from DP World. That’s more than double the capacity of the average vessel currently serviced at the port.

The machines are expected to go into service at the port’s container terminal in January when DP World takes over the terminal’s operations.

The port announced a $205 million infrastructure project this July to upgrade its western terminals, primarily to nearly triple its container capacity, said Jim Quinn, the port’s president and CEO.

Cost of the $205 million project is split evenly among the port, and the provincial and federal governments. The port is also eyeing another $445 million in improvements to its western terminals.

The Southern Alberta Institute of Technology broke ground in early November on a new facility for its crane and hoist operator training programs.

“This new facility will dramatically enhance the learning environment for SAIT students and will include the best technology available, from crane simulators to a full crane maintenance shop, to labs designed specifically for ironworkers,” Dr. David Ross, SAIT’s president and CEO, said in a news item announcing the ground-breaking on the institution’s website. “By providing real-world experience, coupled with robust industry-specific academic programs, we will set our students up for success so our future crane operators and iron workers are job-ready and able to make a contribution to employers as soon as they graduate.”

Alberta Advanced Education is providing the facility with an operating grant of $5.35 million over five years.

The 30,000 square foot facility, scheduled to open in the fall of 2017, is being built on an eight-acre property in Calgary at 10490-72 St. SE, the news release noted. Centron, a Calgary-based construction firm and developer, is purpose-building the facility for SAIT. Its design resembles that of other SAIT satellite facilities such as the institution’s culinary campus in downtown Calgary.

The new facility will “house world-class applied learning labs” as well as “the largest array of crane simulators in North America,” the release said. It will also have a laydown yard equipped with mobile cranes and boom trucks as well as a “fully functioning” maintenance shop for cranes.

The facility’s classrooms, study spaces and meeting rooms are expected to accommodate “hundreds of future workers in apprenticeship programs.”

The ground-breaking came only a few weeks after SAIT celebrated its centennial on Oct. 16.

Below: SAIT’s

Plenty of construction cranes are visibly at work in Ontario’s Regional Municipality of Waterloo, but that isn’t translating into big growth in property assessments, says a recent news report.

The region’s budget for 2017 is projecting assessment growth of 0.7 per cent, about half of what was budgeted in 2016, the Waterloo Region Record reported.

“This trend just doesn’t make sense when you see the number of construction cranes, the number of homes being built,” the report quoted Coun. Tom Galloway.

According to the report, much of the construction activity in the region is from buildings being converted into office space. “Those projects generally won’t yield new assessment,” the report said.

A700-ton crane barge was brought in from Seattle in mid November to lift a sunken tug boat from waters near Bella Bella, B.C., over a month after the tug went aground on a reef.

The Nathan E. Stewart ran aground in Seaforth Channel Oct. 13 and spilled more than 100,000 litres of diesel fuel, oil and other lubricants, according to news reports. Thirty-four days later, the D.B. General crane barge plucked the stricken tug from deeper water where it had been dragged.

“We are relieved that the dirty tug is off the seafloor and on its way to being removed from Heiltsuk waters, but this is only the beginning for our community,” Marilyn Slett, chief councillor of the Heiltsuk Nation said in a news release. “After the outside world stops paying attention, the Heiltsuk people are left to clean up the mess.”

The chief said her people “have lost the most in this disaster” and that removal of the tug is just the beginning of their recovery efforts.

“We’re feeling very uncertain about our future as we face the hard work of assessing the short and long-term environmental, cultural and economic impacts on our community,” Slett said.

The Nathan E. Stewart, owned by Texas-based Kirby Corporation, was pushing an empty petroleum barge when it ran aground, according to news reports.

The D.B. General is owned by General Construction Company of Poulsbo, Wash., according to a data sheet on the Washington state government website. The barge’s Clyde 52 crane has a capacity of 700 tons at 70-foot radius over the stern and a 500-ton capacity at 70-foot

radius when fully revolving, the fact sheet notes.

General Construction is part of the Kiewit family of companies.

Ayla Brown, communications coordinator for the Heiltsuk Tribal Council, said by email that the tug was taken to a dry dock in Burrard Inlet for a Transport Canada investigation.

But for the Heiltsuk people, the story doesn’t end there. The chief, who was critical of the slow response to the sinking and subsequent spill, said governments have to make sure that her people are given priority when it comes to compensation.

“Our community members are asking what we are going to do now that our harvest areas have been affected by widespread oil contamination,” the chief said. “These traditional family harvesting areas have been used by our people for thousands of years — now we are faced with having to travel further south into more exposed and dangerous waters to find our traditional food.”

MATT JONES

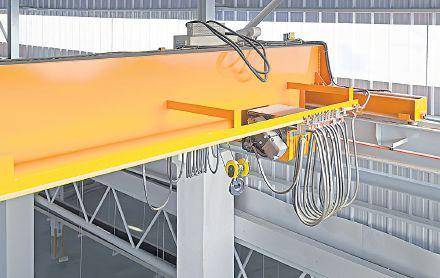

ew overhead cranes are key features of the recent expansion project of a New Brunswick heavy equipment attachment maker.

This spring, Craig Manufacturing completed a 25,000 square foot addition to its Hartland, N.B., manufacturing plant. The project included 19 additional welding bays serviced by a series of new overhead cranes.

“Following an investment we made in our sales team a couple of years ago to expand our sales coverage to include both Canada and the continental U.S., we’ve been experiencing a growth in demand for our product,” said company president Ben Craig. “As a result, we were able to justify the expansion of our Hartland facility.”

Craig said the expansion increased the size of the paint shop, and drying and assembly areas significantly. However, the highlight of the expansion was the installation of two 30-ton cranes that service the three heavy welding bays.

“We’re hoping to pursue large structural welding and attachments for the mining and heavy construction industry,” Craig said. “Obviously, very large attachments for quarries and mines and that sort of thing. We can do almost anything.”

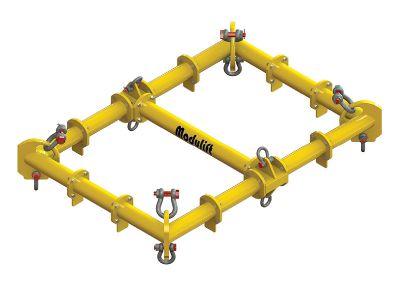

The two 30-ton capacity cranes were built by Street Crane Co. Ltd. and were supplied and installed by O’Brien Material Handling. The cranes travel on two 53-foot beams at a 102-inch gauge. Each crane has an 18-millimetre rope and weighs 2,297 kilograms.

A single controller can run the two cranes simultaneously at hoist speeds of 2.6 feet per minute and trolley speeds of 16 feet per minute. Having two cranes running on the same rails allows Craig operators to maneuver products in any fashion necessary for welding.

Craig manufactures custom attachments such as buckets, plows, and wings for excavators, backhoes, loaders and other heavy equipment, according to the company website.

The federal government’s Atlantic Canada Opportunities Agency contributed a repayable $500,000 grant toward the expansion with the New Brunswick government contributing an equal amount, the Government of Canada announced in March. The company contributed the remaining $2.5 million.

A year earlier, Craig found itself at the centre of a controversy when the New Brunswick government awarded a snowplow contract to a Quebec firm that had bid only $1,600 less on a $315,609 contract, according to news reports. Public backlash led to the contract being cancelled.

However, during the unveiling this spring of the expanded plant, Craig said the snowplow controversy was now in the past, the Woodstock Bugle-Observer reported.

“We were disappointed with that decision, but our relationship with the government is kind of like your brother or close family member,” the reported quoted Craig.

The work toward the plant expansion began when the oil and gas and commodity mining markets were stronger, Craig told Crane & Hoist Canada. While those markets have since weakened, the company will utilize the expanded plant for any other manufacturing opportunities that might arise.

“We obviously believe in the long-term and general business was very strong,” Craig said. “So we continued our

expansion in hopes of better days for commodities and oil and gas. We’ve got some great contract manufacturing opportunities that we’re working on that we’re very excited about.”

The family owned business started humbly as a machine repair shop and service station in 1946 and is now the largest privately owned attachment manufacturer in North America, notes a history on the company website.

Ken Kosik, who chairs the college’s trades program, said at the time that in addition to the Terex HC80, the new acquisitions included a three-axle Liebherr LTM1055, two Altec boom trucks, a Terex boom truck, and a Ferrari knuckle-boom machine.

“Each crane is unique in terms of its capacity and the range of work performed,” the release quoted Nelson Lutz, the college’s dean of trades and technology. “Students will receive hands on technical training on the very latest computerized crane and hoist equipment.”

The program is delivered “throughout the province” where demand is sufficient.

The college also showed off its new mobile training labs. Each of the 50-foot-long labs opens up to allow for 1,500 square feet of training area. The labs can be set up in eight to 10 stations for training in such trades as welding, electrical, and carpentry. The facilities “will provide pre-employment trades technical training to First Nation communities and dual credit in rural schools where accessing trades training is often not accessible,” the release noted.

Marlin Schmidt, Alberta’s minister of advanced education, said in the release that the mobile unit “provides a true hands-on approach to learning.” He even put his own hands on the controls of the HC80 during a photo op at the showcase event.

“Our students will benefit tremendously by these new mobile units and state of the art equipment,” said Ann Everatt, the college’s CEO and president. “We are excited to be able to better serve the students and communities in our region.”

For more information on the crane and hoist program or other apprenticeship programs at the college, visit www.northernlakescollege.ca. More information about Alberta Apprenticeship and Industry Training can be found at www.tradesecrets.alberta.ca.

Crane & Hoist Canada welcomes submissions of letters, guest columns, short notices, product announcements, press releases, and ideas for articles. Send them to editor@craneandhoistcanada.com.

Letters: Please limit your letters to 250 words. Include your full name, the city or town you live in, and a contact phone number. We do not publish anonymous letters or letters written under pseudonyms.

Guest columns: These can be up to 700 words. Please send a brief note of inquiry first, however, just in case space what you wish to write about has already received a lot of coverage in our pages. Include your full name, the city or town you live in, and a contact phone number.

Short notices: Tell us about individual promotions, appointments, awards, staff movements, plant openings, plant closures, expansions, and other milestones. These short items should be no longer than 100 words.

Product announcements: Are you a supplier to the industry? Has your company developed a new product or process? If possible, attach a photograph.

Press releases: These should have something to do with cranes and/or hoists in Canada. We might publish only part of a press release or use it as starting point for an article by one of our writers.

Story ideas: Maybe you have an idea you’d like us to explore for an article. A good rule of thumb is to limit your story idea to no more than 30 words. If it takes longer than that to describe it, then chances are we won’t be able to take it on.

All submissions are subject to editing and publication cannot be guaranteed. The deadline for our next issue of Crane & Hoist Canada is Feb. 3, 2016. Sooner is always better than later.

he election of Donald Trump as president of the United States has profound impacts for Canada’s economy. That’s because this country’s economic health depends heavily on trade.

Trump has sent some disturbing, albeit mixed, signals about raising trade barriers. Now, his main targets for trade sanctions are Mexico and China. And while he has threatened to tear up the North American Free Trade Agreement, Trump has indicated through his acolytes that he’s more or less OK with the state of Canada-U.S. trade. Then again, Trump himself is known to say one thing one minute and then tweet the opposite view the next day.

The thinking is that if Trump removes the U.S. from NAFTA that the existing U.S.-Canada free trade agreement would then hold sway. But neither that deal nor NAFTA specifically covers softwood lumber, which was subject to a separate bilateral treaty that has since lapsed. Fears abound that the Republican-controlled Congress, backed by a protectionist president, will succumb to the whims of the U.S. lumber lobby and again slap heavy tariffs on Canadian lumber.

A bigger worry is that scuttling NAFTA would harm Canada’s auto industry — a point enunciated by former Bank of Canada governor David Dodge following Trump’s election win, according to CBC News. That fear wouldn’t be realized as quickly as tariffs on lumber because of how heavily integrated manufacturing supply chains in Canada and the U.S. have become. But if Trump is serious about his goal of repatriating American manufacturing jobs, one easy target is those jobs north of the border.

The stark reality is that Canada’s economy depends far more heavily on trade than does the U.S. economy. In 2015, exports accounted for 31.5 per cent of Canada’s GDP, according to the World Bank. Meanwhile, about 78 per cent of Canada’s exports in 2015 were to the U.S.

For the U.S, however, exports accounted for 12.6 per cent of GDP in 2015, placing the U.S. among advanced economies with the lowest dependence on exports. Compare the U.S. with Germany, for example, where exports made up 46.9 per cent of GDP in 2015.

For the European Union, exports accounted 42.9 per cent of GDP, although much of that was among its member nations. But contrast that with exports in North America making up just 14.3 per

cent of GDP in 2015.

The U.S., for all of Trump’s bluster about bad trade deals, just isn’t as dependent on trade as most of its peers. Even U.S. imports accounted for only 15.5 per cent of the country’s GDP in 2015. That’s less than half of the 33.8 per cent that imports contributed to Canada’s GDP in 2015.

It’s a dilemma as old as Canada itself. With only a 10th of the U.S. population, Canada depends greatly on that huge U.S. market for its economic prosperity. That same huge market, however, makes the U.S. far less dependent on the rest of the world.

Yes, economists almost universally predict that erecting trade barriers, as Trump has proposed, would harm the U.S. economy. But they’ll do far more harm to those countries that trade with the U.S. The country most at risk of harm is Canada.

For that reason, the much-maligned Comprehensive Economic and Trade Agreement that Canada signed with the EU — and which was nearly scuttled by Belgium’s Wallonia region — is looking like a good idea. Sure, critics have blasted the deal over its dispute mechanism, which they worry gives too much power to corporations, and the intellectual property rights provisions, which critics says is a sop to the pharmaceutical industry. But, seriously, CTEA is a deal between two parties that share the best of liberal democratic conventions and which have similar living standards and rules of law. It’s not a mismatch between an advanced economy on the one side and a developing backwater on the other.

If CTEA shifts Canadian jobs to Europe or vice-versa it won’t be because of labour costs. But it might be because of innovation or the lack of it. That freer trade inspires innovation is one of its signature benefits that is lost amid the worries about job losses and the inequitable distribution of the gains from trade. (Of course, those beneficiaries include not only captains of industry but also hundreds of millions of people in India and China who have risen from abject poverty, as well as poor people in the west who can buy affordable clothing at Walmart.)

If Canada and liberal democracies in Europe cannot trade fairly, then maybe there is little hope for the world. But this deal might just spare Canada from the worst effects of trade policies that a U.S. led by an unpredictable President Trump might enact.

Nelson Dewey has been a prolific cartoonist for over 50 years. If his work looks familiar, maybe you read a lot of car comic books when you were younger.

In the 1960s, ’70s and ’80s, Dewey was a frequent contributor to those comics, particularly CARtoons. He also drew for Hot Rod Cartoons, CYCLEtoons, SURFtoons and SKItoons. In all, he produced nearly 2,000 pages in those publications.

He has also published cartoons in Cracked Magazine, Oui, Reader’s Digest and Motor Trend, as well as community newspapers and dozens of books. And he shared an Emmy Award in 1988 for his work on storyboards for the Arthur cartoon series on television.

To take a trip down memory lane and see samples of Dewey’s car cartoons, go to his website, www.nelsondewey.com.

The Ontario government is planning to reclassify certain cranes now considered to be road-building machines as commercial vehicles instead.

The reclassified vehicles, such as mobile cranes purpose-built for highway use as well as truck-mounted cranes, would then no longer receive exemptions that apply to road-building machines.

Such a machine, known by the acronym RBM, doesn’t require a licence plate nor does it pay provincial fuel tax on diesel, for example.

“Basically the goal of what we’re trying to achieve is distinguish between traditional types of RBMs, road-building machines, that require Highway Traffic Act exemptions to perform a function, and those built on a truck chassis able to operate at highway speeds and meet federal manufacturing requirements,” Robert Monster, a senior vehicle standards engineer with the Ontario Ministry of Transportation, said during a presentation at the annual conference of the Canadian Transportation Equipment Association this October in Vancouver.

He noted that the proposed regulatory changes won’t apply to mobile cranes that are strictly for offroad use. However, they will apply to mobile cranes, such a Terex crane shown in a slide in his presentation, that are designed for highway travel. Even though they are classified federally as commercial vehicles, “we will treat them and consider them a commercial motor vehicle,” Monster said.

He added that “there is really only a few” such purpose-built mobile cranes that would be captured by the rule change. “The biggest change is really those vehicles that are built on a truck chassis today and are being treated or claimed to be a road-building machine.”

A Nov. 18 ministry advisory to stakeholders said the proposed regulations are expected to come into force on July 1, 2017.

The ministry also plans to grandfather certain vehicles “that operate outside the HTA weight and dimensions limits, by way of a special vehicle permit.”

That concession would apply to street sweepers, sewer cleaners, and hydrovacs manufactured before Jan. 1, 2017. The note didn’t indicate that cranes might also be grandfathered.

Kenneth Williams, the president of the Crane Rental Association of Ontario, said by email that the association didn’t wish to comment on the proposed rule change at this time.

Forty years ago, the minimum hourly pay rate for crane operators in Brandon, Man., increased by 55 cents to $5.95 an hour.

So reported the Brandon Sun recently in its Looking Back feature. Other pay increases for trades, which went up as much as 11.5 per cent, included a 45 cent an hour hike, to $1.10 an hour, for backhoe operators, mechanics, and welders, the report said.

Canada,” Darryl Whitehead said.

“As part of this historic five-year investment, numerous bridges, dams, locks, buildings, and historic structures along the Trent-Severn Waterway and Rideau Canal will be repaired or replaced.”

The crossing in the Municipality of Trent Hills was completed ahead of schedule. On site was a 250-ton Grove crane brought in from the Oshawa location of All Canada Cranes & Aerials to place the beams, girders and decking, Whitehead said.

“While the lifts conducted during construction were completed without issue, the operator did have to operate within a somewhat challenging environment,” Whitehead said.” The lifting area was limited to a narrow strip with buildings housing local businesses on either side, as well as overhead power and telephone wires.”

“While the lifts conducted during construction were completed without issue, the operator did have to operate within a somewhat challenging environment. The lifting area was limited to a narrow strip with buildings housing local businesses on either side, as well as overhead power and telephone wires.”

~ Darryl Whitehead, Parks Canada

The relatively mild winter helped keep the work on track. Local residents were inconvenienced by a lengthy detour during the installation, which took just over a month.

“To help minimize these disruptions, the length of the closure was reduced by constructing the bridge off-site during the fall and winter months of 2015, rather than at the site itself. Parks Canada was also able to install a temporary pedestrian bridge which allowed accessible crossing at the site.”

The contractor for the project was Louis W. Bray Construction Limited of St. Andrews West, a rural community north of Cornwall. The design work was by

Associated Engineering, an Edmonton-based company with offices across Canada.

Managing the project was Public Services and Procurement Canada.

Components of the bridge were assembled in Montreal over a five-month period. It was opened to traffic nearly a month earlier than scheduled, on April 29.

The Trent-Severn Waterway meanders for 386-kilometres across south-central Ontario between Lake Ontario at Trenton and Georgian Bay at Port Severn. It was originally surveyed as a military route but was built as a commercial venture, the first lock being completed in 1933.

Today the waterway is operated by Parks Canada as a national historic site and is used for tourism and by recreational boaters. There are 45 locks, 39 swing bridges and 160 dams and water control structures along its length. Lake Simcoe, one of Ontario’s largest lakes, is part of the route.

According to Parks Canada, it’s been described as “one of the finest systems of navigation in the world.”

more consistent with these cycles where things go into the toilet for a year or two and then the economy starts to improve, capital projects start up again and all of a sudden we’re behind the eight ball.”

Canco kept busy through the 2008-09 recession but has felt the sting from slumping oil prices and reduced resource extraction. “Commodity prices are depressed, and that puts the mining people into belt-tightening mode,” Humphry says. “If equipment isn’t broken and doesn’t need to be replaced they’re going to repair it and keep it running until the economy improves.”

Norelco Industries Ltd., a Surrey B.C. maker of overhead bridge crane and runway systems, navigated tough times serving diverse geographical and vertical markets, says general manager Keith Ellis.

“Most of our work is local to the B.C. area, though we do some work in Alberta and the States, and we’ve had contracts in Mexico and overseas through consulting engineers who invite us to bid on projects.”

Ellis describes 2016 as “pretty bleak” until about May. “Things were pretty quiet, probably due to the whole economic downturn and the oil sands and everything like that. But our service department has been busy lately. Things have picked up quite a bit.”

What slowed activity in B.C. for Norelco, Ellis says, were potential customers holding off on planned construction projects. “We’d get purchase orders and then a few days later they’d ask us to hold off for a couple months until they saw what was happening.”

Still, with a hot residential market in the lower mainland, demand for marble and granite kitchen countertops and bathrooms kept product fabricators and distributors busy. “Marble and granite have been all the range in new condos,” Ellis says, citing demand for overhead cranes to handle five-ton slabs.

“We make more money doing service and repairs than we do building cranes, so from that aspect it’s not all doom and gloom.”

While Ellis anticipates a continued slow recovery, he has noticed overhead competitors from Alberta prospecting in his area. “We’ve had a niche market here with three or four local crane builders, but now that the oil sands have slowed down the crane builders from Edmonton have come here sniffing for work. We’ve found a lot of low-ball pricing — you lose out on a job and find that they basically came in and bought the job.”

~ Neil Humphry, sales manager, Canco Cranes & Equipment Ltd.

Indeed, Alberta was particularly hard-hit in 2016. Darren Lunt, president of Edmonton-based Weldco Companies, says low oil prices continue to pressure the economy. “There’s not a lot of activity in the resource sector in this province so we’re feeling it,” Lunt says.

Weldco doesn’t build overhead cranes but does use them in its operations, which are based in Alberta, B.C. and Ontario, and include steel fabrication, the manufacture of heavy equipment attachments and truckmounted cranes, and repair and refurbishment work.

“We’re fortunate we have a spread across Canada,” Lunt says. “Forestry is still fairly strong for us in B.C., but when

we get into mining and conventional oil and gas exploration it’s a tough market.”

Lunt says Alberta felt the effects of the recession in 2008-09 but things rebounded before oil prices plummeted a few years ago. “We’ve been struggling ever since,” he says. “We’re starting to see a number of players drop out. It’s starting to have that erosion effect on the market.”

Lunt says he expects the slowdown to continue through 2017 barring a significant event. “If a pipeline were to go ahead, that would be a major game-changer for us because a lot of our customers would go to work immediately to support that type of industry, and we would then of course support them.”

(Just before this went to press, the federal government announced approvals of Kinder Morgan’s controversial Trans-Mountain pipeline expansion project as well as the Enbridge Line 3 project. However, in the same announcement the feds killed the proposed Enbridge Northern Gateway pipeline.)

Auto sector boosts Ontario

Ontario, meanwhile, has remained fairly strong, largely due to robust automotive and manufacturing sectors. That’s good news for Givens Engineering Inc., which supplies overhead cranes and manipulators geared towards relatively lightweight lifting and is located in London, within easy striking distance of auto plants in Windsor, Oshawa, St. Catharines and Cambridge, as well as parts manufacturers.

While surrounded by a fairly strong automotive sector, Motivation maintains a diverse customer base, tapping into automotive, manufacturing, mining, rail and port facilities.

“We’re pretty well balanced,” operations vice-president Chuck Brimmer says, explaining that Motivation weathered the recession and current tough times in oil, gas and natural resources by maintaining a diversified portfolio and picking up market share from other sectors.

The strongest performing sector? “Manufacturing,” Brimmer says, adding that Motivation has managed well enough in mining circles thanks to an active dealer network in northern Ontario. “Over the last couple years mining has had a bit of a downturn, but it’s rebounding.”

While Motivation’s customer base is largely Canadian, the company also supplies U.S. and overseas markets. “The U.S. hasn’t had the same growth we’ve had in Canada but it’s been steady,” Brimmer says.

In Stoney Creek, Ont., Munck Cranes Inc. has maintained a diverse vertical and geographic market for its halfton to 250-ton capacity overhead cranes.

“The Prairies west to Alberta was weak this last year but B.C. has actually been pretty good, mostly with hydro projects, though Ontario and Quebec have been our strong provinces this year,” says North America sales manager Stephen Marczi. “We’ve seen quite a surge in business in the Windsor area this past year, with the automotive industry showing no signs of slowing down.”

Marczi adds that the Hamilton area, his company’s home base, is experiencing lots of tertiary business through industrial manufacturing.

Quebec, meanwhile, continues to present a viable market partly due to strong exports to the U.S. and considerable infrastructure investment. “We have a good foothold in Quebec and we’re looking for growth there,” Marczi says.

“Things were pretty quiet, probably due to the whole economic downturn and the oil sands and everything like that. But our service department has been busy lately. Things have picked up quite a bit.”

~ Keith Ellis, general manager, Norelco Industries Ltd.

Owner and president Ray Givens estimates the auto sector, including buses, trucks, and SUVs, accounts for 85 percent of his company’s business.

“Automotive has really got itself together,” Givens says. “People are buying vehicles faster than ever, and if it continues we’ll keep on expanding.”

The overhead cranes and manipulators Givens manufactures are largely geared to hoisting materials in the featherweight class — 200 pounds and under. “Any kind of an automobile part,” Givens explains. “Car seats and batteries are favourites, and sheet metal parts are the number-one thing we move.”

Givens says activity slowed considerably during the recession of 2008-09, with some auto parts suppliers turning to wind power and other industries for relief. But things have rebounded, and Givens predicts the trend continuing upwards.

“This year (2016) has been our record year, 2015 was the record before that, and I’m pretty confident 2017 will be another record. Surely at some point it will have to slow down, but as long as people are buying we’ll keep on expanding.”

A half-hour drive east, in Woodstock, Motivation Industrial Equipment Ltd. manufactures overheads designed to hoist up to 100 tons.

Still, recent election results south of the border leave room for caution. “We hope that the Trump government dust is going to settle, and if it does settle I think we’re going to see a faster kickstart to the U.S. economy. But right now everything seems to be on hold with very little movement. Everybody’s waiting for something to happen.”

Munck maintains operations in Buffalo, N.Y. and in Mexico, so Marczi isn’t overly worried about trade agreements. “I don’t think the new U.S. government under the Trump regime is going to play hardball with Canada,” he says. “I think it’s mostly southwards related.”

In the Maritimes, Halifax-based Atlantic Crane & Material Handling supplies overhead cranes and material handling equipment ranging from half-ton to 160-ton to customers in all four Maritime provinces.

CEO Mike Mikoda says fisheries have been strong across the board, as have steel fabricators, machine shops, warehousing and transportation-related repair shops, and a lot of this activity has helped keep concrete facilities busy. Regionally, Mikoda says, shipbuilding has remained active in Nova Scotia. Newfoundland’s offshore oil activities have been busy enough, though weakened iron ore prices have led to a slight slowdown in Labrador. While pulp and paper has been lukewarm in New Brunswick, Atlantic Crane has had some activity upgrading and changing out customer equipment. Mining has picked up somewhat in Nova Scotia, but not so much in New Brunswick, Mikoda says.

“The past couple of years have been average but, generally, our outlook here looks fairly bright,” Mikoda says, expressing optimism. “We’re noticing a bit of an increase in the housing business as far as sales go, and that’s always a good sign.”

and harassment can take many forms. Know what to look for.

• Verbal aggression or insults

• Harmful hazing or initiation practices

• Vandalizing personal belongings

• Spreading malicious rumours Help prevent workplace bullying and harassment. Find resources and view our video series at

The ultimate goal, Razavi and Wang said, is a zero-injury culture, and both acknowledge their research models don’t apply to mishaps such as workplace falls.

And while their research does apply to worksite collisions, there are multiple factors at play, including crane work. While Razavi and Wang did not look specifically at cranes, they said their models most certainly do apply to hoisting equipment.

“Crane load and swing have a high possibility of collision with existing infrastructure, equipment and people, for which the developed models in this study can be applied to prevent hazards,” Razavi said.

“That’s what we’re doing now,” Wang added, emphasizing the need for further exploration in terms of risk identification, assessment and management for hoisting-related hazards.

The two researchers said any success in enhancing safety also stands to improve the mobility and productivity of equipment and workers on-site.

However, at the end of the day, the challenge is ultimately making sure workers and equipment are all connected and communicating digitally and reliably.

“My slogan is stay connected, stay safe,” Razavi says. “All of these technologies are relying on people to somehow be connected to each other or to the other infrastructure elements. So, by letting the information flow in real-time, we can help protect them.”

The Canadian Standards Association has recently published a new version of its B167 standard for overhead cranes, gantry cranes, monorails, hoists, and jib cranes.

B167-16 — the 16 stands for 2016 — replaces the B167-08 version published in 2008.

Among the changes is that the new version has an “expanded scope to include manual hoists and similar equipment,” CSA project manager Jeffrey Kraegel said by email.

A technical committee recognized that potential hazards also apply to manual lifts, “and there is no other CSA standard dealing with this,” Kraegel said.

The technical committee also noticed a need for “higher-level involvement” in planning and safety, he noted.

“Safety measures are more likely to be understood, communicated, and followed if they are backed up by an organized management plan,” he said.

For that reason, the new version includes a clause on management responsibilities for planning, procedures, risk management, training, and documentation.

The latest version also makes fewer references to the International Organization for Standardization, a.k.a. ISO.

“Users said they wanted to see important requirements in B167 itself, rather than having to look to other documents,” Kraegel said. Exceptions were for topics outside the scope of the standard.

Users also requested clear descriptions about the types of inspections required and when and how they are to take place, he said. So the new version of B167 contains “updated updated targets and timing” for such things as function checks performed by operators.

Other changes include “revised and expanded qualification requirements for service technicians and crane inspectors” and “additional detail on documentation and logbooks.”

Until provinces and territories reference the standard in their safety regulations, B16716 is a voluntary standard, Kraegel said.

“It is hoped that the regulators will recognize the improvements in the new edition and update their references.”

In developing the new standard, the technical committee looked at other international standards, “but the final product had to take into account the specific situations encountered in this country, where we have more remote sites and extreme weather conditions,” he said.

The full 81-page B167-16 standard can be purchased through the CSA Group’s website for $120.

New editions for other crane safety standards are also in the works at the CSA. They include Z150 for mobile cranes, Z150.3 for articulating boom cranes, Z248 for tower cranes, and C22.2 No. 33 for the construction and testing of electric cranes and hoists.

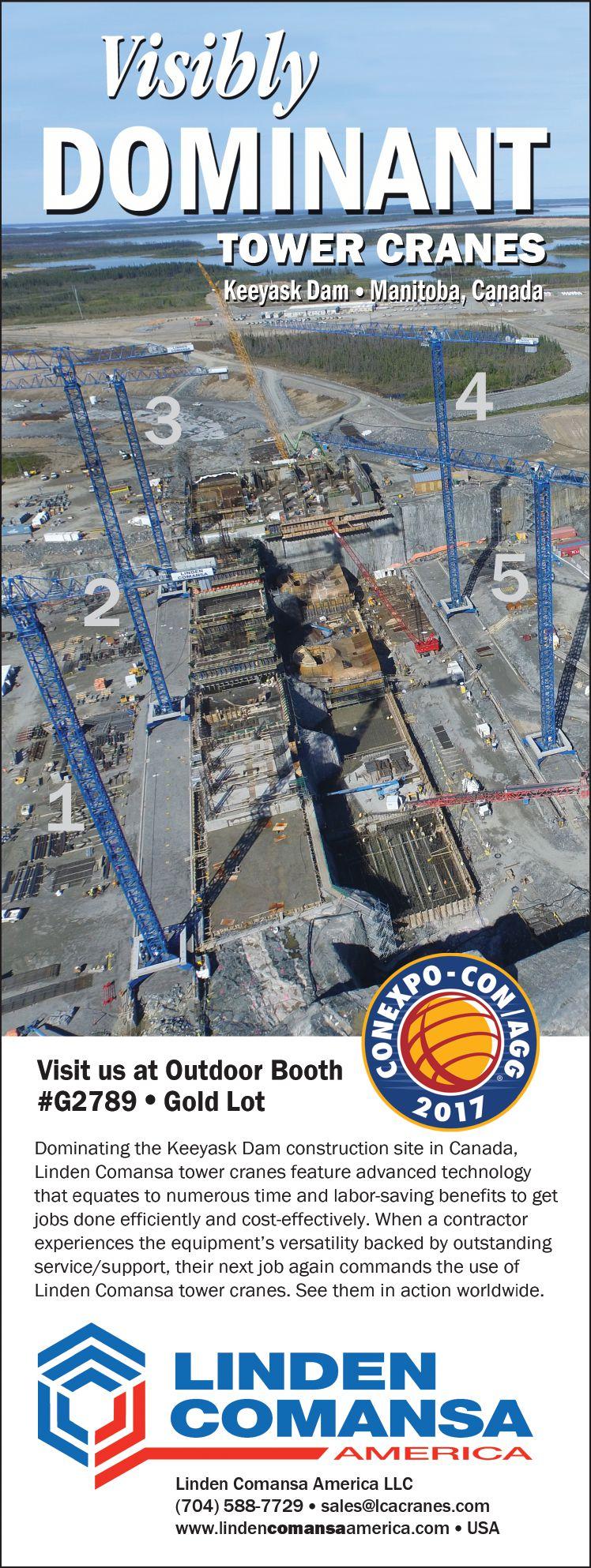

anadians are again expected to flock en masse to Las Vegas, Nevada this March for the enormous triennial heavy-equipment trade show, ConExpoCon/Agg.

A search of the ConExpo website lists 142 exhibitors from seven provinces — B.C., Alberta, Saskatchewan, Manitoba, Ontario, Quebec, and New Brunswick. Among them are several firms in cranerelated businesses, such as Cranesmart Systems (booth G72016) and WeldcoBeales Manufacturing (G73507), both of Edmonton. Alberta’s 14 exhibitors also include Ultra Seat Corporation (N10371) of Acheson, Alta. That company makes seats for heavy equipment, including cranes.

However, the ConExpo website search widget has its limitations. For example, a search of B.C. exhibitors did not find Penticton-based Brutus Truck Bodies, which is sharing space with Italian truckcrane manufacturer Next Hydraulics S.R.L. at booth G3125 in the Gold Lot.

However, a search did reveal 23 other B.C. exhibitors, including Crane & Hoist Canada magazine.

“We’re really looking forward to returning to ConExpo for the third time, and the second time as an exhibitor,” said Jeremy Thain, Crane & Hoist Canada’s advertising manager. “We invite all our readers attending the show to drop by our booth and pick up a complimentary issue. Crane & Hoist Canada will be exhibiting in the Gold Hall in the Gold Lot at booth G-73321. Just keep an eye out for the Canadian flags.”

Joining Thain at the Crane & Hoist Canada booth will be art director James Lewis, and editor Keith Norbury. They will each take shifts at the booth, where they expect to meet scores of Canadians as they did at the 2014 show when their booth was in the Gold Lot amid the towering booms of the crane displays. The Crane & Hoist Canada contingent will also visit as many other exhibitors as they can to shoot photos and take notes.

ConExpo 2017 takes place March 7-11 at the Las Vegas Convention Center. The show, co-located with the International Exposition for Power Transmission, features more than 2,500 exhibitors, 2.5 million

square feet of exhibition space, and more than 150 educational sessions.

At the 2014 event, attendance at ConExpo and IFPE totalled 129,364, reported the Association of Equipment Manufacturers, which produces the show. That was the second highest total ever, surpassed only by the 144,600 attendees in 2008, just before the financial crisis.

Of the 2014 attendees, 24 per cent came from outside the U.S., the AEM reported at the time. The association didn’t have an estimate for the number of Canadians attending, but judging by all the Canucks that the Crane & Hoist Canada trio encountered at the show, it fair to say that about 10 per cent of ConExpo 2014 visitors were from this side of the border.

Among them was Sheldon Baker, president and owner of Canadian Crane Rentals Ltd., which is based in Wingham, Ont. He said back then that he was impressed by the increased traffic flow compared to the 2011 show.

“I was here three years ago and optimism wasn’t as strong,” Baker said. “People weren’t quite as content.”

In 2014, the Alberta economy was

booming. However, since then oil prices have collapsed, taking the Alberta economy down with them. Many of the Canadian visitors to the ConExpo 2014 were from Wild Rose Country. It’ll be interesting to see how big the Alberta turnout is this time around — if only for a respite from the cold weather than can still chill the province in early March.

Ontario has the biggest contingent of Canadian exhibitors at 57. They include Bermingham Foundations Solutions Limited (S5159); Mechanics Hub (G71501); Palfinger North America Group (G4444); and the Operating Engineers Training Institute of Ontario (G72413).

Quebec is next with 28 exhibitors. Among them is Montreal-based CM Labs Simulations Inc., the maker of Vortex crane simulators, which again shares a booth with the OETIO.

Attending his first ConExpo will be David Clark, product marketing manager with CM Labs Simulations.

“ConExpo is a fantastic show,” Clark said in via email. “The scope of it alone makes it worth attending, and CM Labs will be there in full force. We can’t wait to exhibit with OETIO and showcase our newest training solutions for test drives.”

Other exhibitors from La Belle Province include Quebec City-based Rayco-Wylie Systems (G3878); St. Laurent-based Famic Technologies Inc., makers of Automation Studio engineering and design software (S82744); and Mount Royal-based UTV International, whose products include digger derricks (B8102).

Saskatchewan, with 11, Manitoba, with eight, and New Brunswick, with one, are the other provinces with exhibiting companies at ConExpo 2017. That single New Brunswick exhibitor is Craig Manufacturing Ltd., a Hartland, N.B., company that recently installed new overhead cranes as part of a 25,000 square foot addition — a project featured elsewhere in this issue.

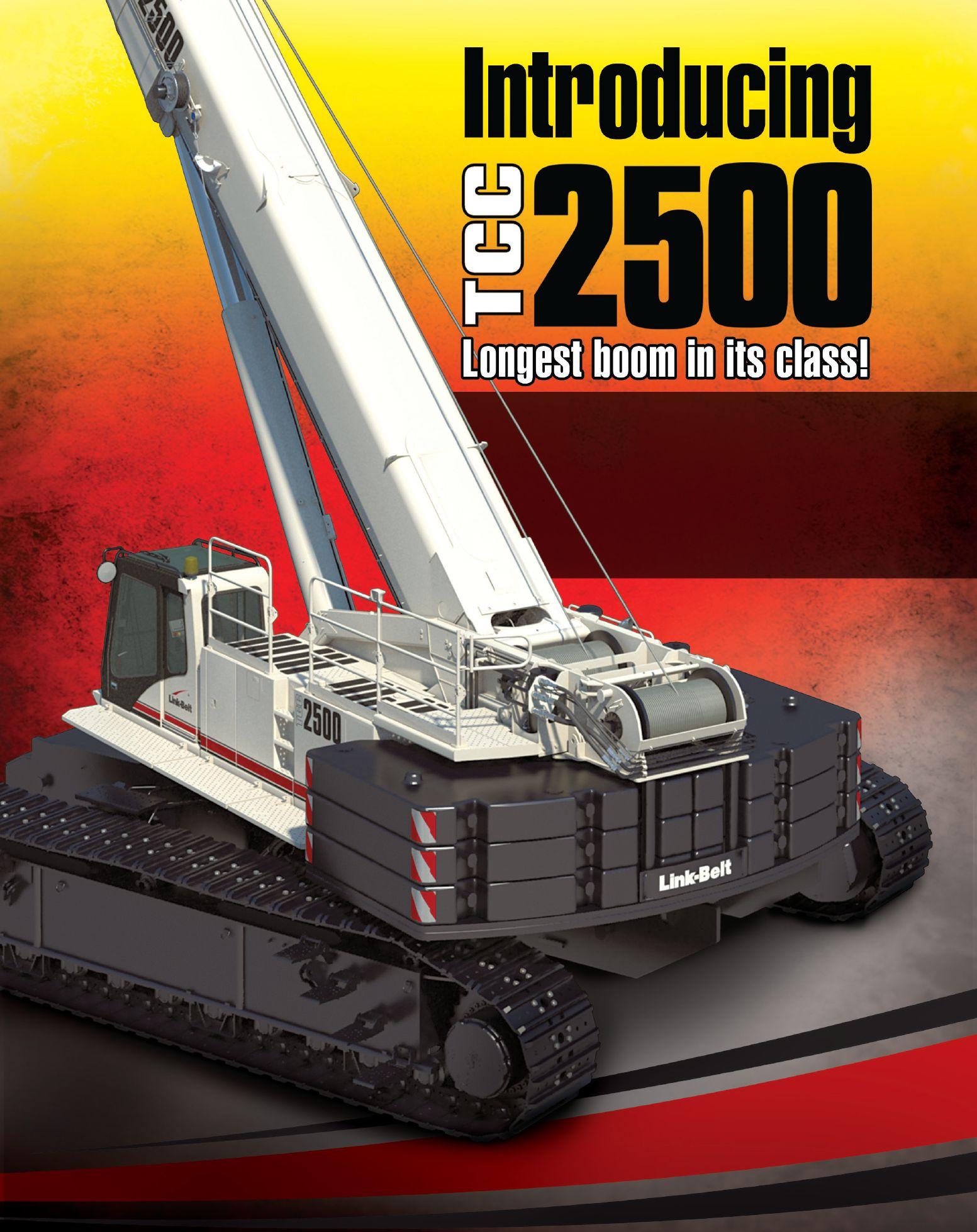

ConExpo has various product categories for cranes. They include all-terrain (54 exhibitors); gantry (24 exhibitors); lattice-boom crawler (39); hydraulic-boom cranes (59); roughterrain (41); and tower cranes (25). There are also 28 exhibitors categorized under hoist, 23 under wire rope, and eight for crane attachments.

Major crane manufacturers will again have an outsized and visible presence at ConExpo — particularly in the Gold and Silver lots. They include Terex, Manitowoc, Liebherr, Link-Belt, Tadano, Raimondi, Linden Comansa, Manitex International, Sany, Spydercrane, Shuttlelift, Maeda, Elliott, Altec, and Palfinger.

Other exhibitors related to cranes include Van Beest USA LLC, Miller Lifting Products, Harrington Hoists, WireCo WorldGroup, and Industrial Training International, which is headquartered in Woodland, Wash., and has a training centre in Nisku, Alta. For more information about ConExpo-Con/Agg, visit www.conexpoconagg.com.

Now dig this.

A “fully functional” 3D-printed construction excavator will be a feature display at the next ConExpo-Con/Agg trade show in Las Vegas.

The machine will be the first of its kind in the world “and the first large-scale use of steel in 3-D printing, known as additive manufacturing,” said a news release for the Association of Equipment Manufacturers, which organizes the triennial ConExpo at the Las Vegas Convention Center.

ConExpo and the co-located International Fluid Power Exposition, or IFPE, will jointly unveil the 3D printed excavator at the shows, which take place March 7-11, 2017.

“We’re thrilled to bring such a significant technological and first-of-its-kind achievement like the 3-D printed excavator to the show; it will be a platform to demonstrate how the latest innovations and applied technologies are changing the future of construction industry,” the news release quoted John Rozum, show director for IFPE, which is co-owned by AEM and the National Fluid Power Association.

Also collaborating on the project are the Center for Compact and Efficient Fluid Power, Oak Ridge National Laboratory, and the National Science Foundation.

“The group is working with research teams from Georgia Tech and The University of Minnesota to convert the current excavator design to one that is conducive to and takes full advantage of 3D manufacturing,” the release said. “Graduate engineering students at Georgia Tech will be creating a boom and bucket featuring integrated hydraulics with the goal of decreasing the weight, materials cost and maintenance, while students at the University of Minnesota are designing a hydraulic oil reservoir/heat exchanger and cooling system that reduces the size and weight and increase the efficiency of the machine.”

The collaborators are also holding a contest for undergraduate students of engineering from across the U.S. to design and print a functional and aesthetically pleasing humanmachine interface and futuristic cab for the excavator. The winning team will win $2,000 and a chance to see their design printed at the Oak Ridge National Laboratory in Tennessee.

magine synthetic fibres finer than hair but stronger than steel being used in offshore lifting applications and on mobile cranes.

Use of these fibres is already a reality, as outlined in a presentation at a crane and rigging conference in Edmonton.

One such miracle fibre is Dyneema, which is made from ultra high molecular weigh polyethylene, or UHMWPE.

However, it is just one of several highperformance fibres that are now commercially available, as noted in the presentation by Bill Fronzaglia, an applications and development engineer for DSM Dyneema, a division of the Dutch multinational conglomerate DSM.

Among those other high-performance brands are Spectra, Zylon, Vectran, and Kevlar. Like Dyneema, Spectra is high modulus poly ethylene, or HMPE, while Zylon is a poly-paraphenylene-2 6-benzobisoxazole aromatic fibre, Vectran is a liquid

6448 US Route 224 Ottawa, Ohio 45875

Phone: 419-523-5321

Email: sales@nelsontrailers.com www.nelsontrailers.com

crystal polymer, and Kevlar is a para-aramid aromatic fibre.

The various fibres have different properties. Many lifting products use aramid because of its resistance to high temperatures. Sparkeater slings from Slingmax, for example, are designed for use around welders, Fronzaglia noted.

Dyneema, however, has great fatigue performance, “which makes it a lot better suited for the use in hoisting and bending,” Fronzaglia said.

For example, an illustration on one of the slides in his presentation revealed that it takes 400 kilometres of Dyneema fibre for it to break under its own weight. That compares with 346 km for Zylon, 200 to 240 km for Vectran, and 25 km for steel.

For most of his talk, Fronzaglia focused on Dyneema and its properties and applications.

By weight Dyneema is 15 time stronger than steel, Fronzaglia said. To illustrate that, an image in his presentation showed a man with a thick rope of Dyneema fibres draped over his shoulders. Had the rope — about a foot in diameter — been made of steel, it would have crushed the man, Fronzaglia said.

An ingredient of technology

“So we don’t make chain, we don’t make rope, we don’t make vest protection, we don’t make any of that stuff,” said Fronzaglia, who joined DSM in 2006 and was previously director of engineering at New England Rope. “We make the ingredient that goes into it.”

DSM, which stands for Dutch State Mines, is a $10 billion euro company of about 24,000 employees globally. The Dyneema Group has about 700 employees — in the Netherlands, U.S., Brazil and Asia Pacific.

Among Dyneema’s applications are in cut-resistant gloves and the trademarked Cornermax sleeve from Slingmax, an example of which Fronzaglia held in his hand during the presentation. (He acknowledged the presence at the conference, organized by the publishers of Crane Hot Line, of representatives from Dyneema customers Slingmax and Wireco, a synthetic rope supplier.) Dyneema is also used in making cut-resistant hockey socks, motorcycle attire, and nets for fish farm pens.

“Polyester and nylon are pretty much the oldest synthetic fibres, and they work great,” said Fronzaglia, who began his presentation by referencing the “Plastics” quotation from the classic 1967 Dustin Hoffman movie, The Graduate. In fact for lifts under 15 tonnes, “a (polyester) web sling is going to be your solution just about every time,” he said.

Larger and more technical lifts require something stronger. A synthetic rope of the same diameter as a steel rope will have the same tensile strength and elongation at break, he said.

Many of the lifting solutions enabled by Dyneema are offshore related, he noted, because steel is too heavy for such locations. For offshore operations, lifting materials can also use much smaller “design factors” than required for lifts on land. (According to a recent article on www.rigger.com, design factor “is the ratio of the minimum breaking

strength to the permissible working load.”)

“Now maybe that sounds a little risky to the risk guys out there in the audience,” Fronzaglia said. “But when you look at the amount of tons extra that they have, and how slow this stuff moves, the dynamic forces are a little bit lower. So there’s a lot of logic in the way that they do this.”

Offshore lifts might have a design factor of 3-1 compared with 5-1 for a similar lift on land in North America or 7-1 in Europe, Fronzaglia said.

In another example, Fronzaglia noted that the synthetic rope that descended two miles deep from a traction winch on a rig 200 miles offshore had done more than 300 lifts without losing strength. Even so, the company replaced it with a new one because it was 50 per cent beyond its design life.

“Unofficially, Shell has said they’ve saved over $30 million in contracting installation vessels to come out and do this kind of work. So the savings can pay off big time,” Fronzaglia said.

The light weight of the synthetic rope also made it possible to support the crane on a cantilevered deck because steel wire rope would have weighed about 70 to 80 tonnes, he said.

For offshore uses, up to 3,000 metres of two and two-and-quarter inch rope has been spooled onto a drum winch, he said. That includes situations where it has been spooled up light and gone down heavy, “probably the worst case scenario.”

So far, all the offshore uses are single-fall applications, he said.

“There’s not really any blocks being used offshore on the synthetic winches — yet.”

Dig this application

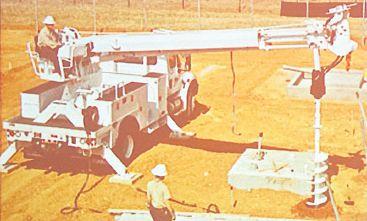

On dry land, synthetics have been replacing wire rope for nearly 30 years on digger derricks, Fronzaglia said.

While it’s debatable whether or not a digger derrick is a crane, Fronzaglia noted that it has a hoist and a rope for picking up utility poles and transformers.

“They move stuff around in the yard with it. It’s pretty loosely defined as a crane,” he said.

The driving force behind the switch to synthetic ropes on digger derricks is that they work in the presence of highly energized power lines.

“So they wanted something that was going to be a lot safer,” Fronzaglia said.

An initial strategy was to place the hoist at the boom tip with small winches that used polyester rope, he said. However that offset the centre of gravity. So to deal with that, the hoist would be moved to the turntable.

As digger derricks have gotten bigger and their booms longer, they still have had to meet code requirements that with a boom fully extended the hook could reach the ground and still have three wraps of rope on the drum, Fronzaglia explained.

“And the only way to do that would be to either make really big drums or to make smaller diameter rope,” he said.

Using synthetics, the latter has been achieved for a 130-foot digger derrick crane.

“I can tell you I don’t know of any failures or accidents other than when they use the end of the rope as a sling — they’ll just take a shackle and wrap the rope around a pole, shackle it in — and the other one is when they try to pull a pole without digging around it first,” Fronzaglia said.

A proposed engineering standard for wire rope for cranes will have separate chapters for steel and synthetic ropes, a member of the committee working on the standard told a crane and rigging conference in Edmonton last fall.

At the time, Bill Fronzaglia expected the new standard, called ASME B30.30, would be approved by a ballot at a subcommittee meeting in January. However, according to a June 2016 public schedule from the American Society of Mechanical Engineers, which develops the ASME standards, the B30.30 wire rope standard was still under development. And an agenda item from an ASME B30 standards committee meeting held in Houston in May 2016 noted that the ballot on the rope standards draft had been withdrawn. That was because of “the extent of the changes to the document” in evaluating comments.

The subcommittee planned a final review of a revised document after the May main committee meeting and anticipated “resubmitting a new first ballot shortly afterward.”

Deborah Wetzel, the society’s manager of media relations, confirmed by email in July that the B30.30 standard was still under development and had not just been approved by the B30 standards committee. Once that approval takes place, the public will have a chance to review the standard and submit comments during a public review process that will be announced on the ASME website at https://cstools.asme. org.

“Since our standards are developed under a consensus process, we are unable to predict when the committee will reach consensus on this new volume,” Wetzel said, adding that “a timeline for approval/publication is not available at this time.”

Of the 29 existing ASME B30 standards, “16 are incorporated into Canadian provincial and territorial regulations,” according to an August 2014 report of the Standards Council of Canada on hoisting and rigging regulations in Canada. However, none of the ASME B30 standards are incorporated into any federal Canadian regulations. As of August 2014, B.C. had incorporated 13 ASME B30 standards, the most of any Canadian jurisdiction. Yukon had incorporated 12, Nova Scotia, 10 Manitoba 6, and Newfoundland two. None of the other provinces or territories had incorporated any.

In Europe, the situation with synthetic rope is more complicated than in the U.S., Fronzaglia said. The European Union has a machinery directive that for a piece of equipment that doesn’t have a standard, a manufacturer can create a technical file and show evidence that it works and is safe, Fronzaglia said. That enables the manufacturer to place a CE mark on the product, such as on a high-performance sling.

However, the European Federation of Material Handling has met with major crane manufacturers to develop a standard “in a short period of time” that won’t be legally binding but will act as a guideline.

And the International Standards Organization in a meeting of Technical Committee 96’s subcommittee SC 3 redefined wire rope for cranes as applying to ropes “regardless of their material properties,” Fronzaglia said.

Basically that means the committee acknowledged the need to develop a synthetic crane rope standard, he added.

Before the end of November, Ritchie Bros. Auctioneers had already sold more than 61,000 pieces of equipment in Alberta in 2016.

That included more than 31,000 items sold at the company’s Edmonton site alone, said a news release from the global auctioneer, which is headquartered in Vancouver.

And that was before the company’s final Edmonton auction on Dec. 8 and 9 — after this edition’s deadline — when more than 4,000 items were to go on the block.

Featured items at that auction included the following cranes:

• a 2004 Demag AC160-1 160-ton 10x8x8 all-terrain crane;

two 2008 Tadano GT900XL 90-ton 8x4x4 hydraulic truck cranes; and

• a 2006 Tadano TR800XXL-4 80-ton 4x4x4 rough-terrain crane.

“We will be selling equipment and trucks for hundreds of Alberta companies — helping move idle or underutilized assets to people and companies who need it to work today or in the coming year,” the release quoted Ritchie senior vice-president Brian Glenn.

The auction included equipment from more than 550 owners, including complete dispersals for Dan Bailey Oilfield & Road Construction Ltd., Corvet Construction 1977 Ltd., and Site Safety Services Inc.

In the event of extreme weather, the items were to be sold by photo, the release said.

Anew 21,000 square foot facility in the Edmonton suburb of Leduc is expected to open up new opportunities for Tadano America Corporation to reach customers throughout Alberta and Canada.

The new facility, in the Leduc Business Park just minutes away from the Nisku Industrial Business Park, will provide complete service, repair and warranty work, stock parts for Tadano’s ATF model cranes, provide in-house training for customers, and service cranes by factory-trained technicians.

“We moved in about two months ago. We basically came from a one-bay strip mall where we couldn’t bring in machines, so having this new facility is all about opportunity and a chance to expand our business. Tadano saw the opportunity with this facility and decided to run with it,” explained Kyle Saunders, Canadian services manager with Tadano.

Tadano hosted an open house on Dec. 8 to give members of the industry, customers and others a first-hand look at the facility and to showcase what it will allow the company to do heading into the future.

“We basically came from a one-bay strip mall where we couldn’t bring in machines, so having this new facility is all about opportunity and a chance to expand our business.”

“We outgrew our old facility and with Tadano, they work on a multi-year plan versus a quarter-toquarter plan, so they looked at ‘what do we need’ and this one would last several years for us,” said Ingo Schiller, Tadano America’s executive vicepresident. “We have dealers in this area and they take care of our customers very well. We can take

~ Kyle Saunders, Canadian services manager, Tadano America Corporation

care of additional workflow from our customers and now be able to have the type of parts we have in Canada to ensure fast delivery for our customers.”

Ken Neil and Wayne Evans, who both have worked in the crane industry for more than 40 years, were two of many who attended the open house to check out the new facility and Tadano products on display.

“We deal with a lot of rigging, testing and worked with a lot of Tadano machines over the years. I love them all,” Neil said.

“They’re quiet, smooth and very userfriendly,” added Evans, who operates cranes for a living.

Tadano has served the Edmonton area for more than eight years and has built up a strong base of customers mainly in the oil industry, but also in construction and infrastructure industries. The company sells and services all-terrain and rough-terrain cranes as well as boom trucks.

Out of the Leduc and Edmonton branches, Tadano offers ATs from 70 to 200 tonnes and RTs from 35 to160 tonnes. The new facility also allows for in-house repairs by three qualified and highly trained technicians out of the Edmonton branch. Two of them come from the area and the other hails from Germany but lives in Alberta’s capital region.

“Basically everything we were doing before, but making it easier to do and more of it,” added Schiller, referring to how the new facility positions Tadano to continue the work done at the south-Edmonton facility while also giving more capacity to expand Tadano’s services across Western Canada and the rest of the country.

“We’re working to have a dominant market share with our rough-terrain machines, which are heavily involved in the oil industry,” Schiller said. “As for our all-terrain machines, the ones you see driving down the road, they’ll do a bunch of different jobs such as installations and that work continues. We can sell more of those in Western Canada and with the technicians to support this equipment, it increases our chances of selling more of these machines.”

The federal government’s recent announcement to spend $125 billion on infrastructure across Canada presents Tadano with another industry avenue to explore.

“We see there is a real opportunity as the infrastructure industry will use an awful lot of equipment which we provide for the oil industry,” Schiller said.

Tadano America is headquartered out of Houston, Texas, where it was established in 1993 and has a 46,000 square foot warehouse space for parts and storage. The company is a subsidiary of Tadano Ltd., which is headquartered in Japan.

Tadano America Corporation has hired Justin Andrews as the company’s regional business manager for Western Canada.

His career in the industry began in Brisbane, Australia where he worked as a rigger and crane operator for a small family-owned firm, said a news release from Tadano.

Later, after working as a parts interpreter for Tadano Oceania in Brisbane, Andrews was promoted to cranes sales at a new Tadano branch in Sydney.

“We are very pleased to have Justin on board to help us grow our presence in Western Canada,” the news released quoted Ken Butz, general manager of sales for Tadano America. “He has a proven track record for success that we expect will serve Tadano America well.”

Andrews said in the news release that he is looking forward to sharing his Tadano knowledge with his new customers. “Over time we plan to introduce Tadano products to more customers in Western Canada,” he added.

Established in Houston, Texas, in 1993, Tadano America Corporation has had a location in Edmonton for the last eight years and recently opened a new 21,000 square foot facility in nearby Leduc, Alta. Tadano America is a subsidiary of Tadano Ltd., which is headquartered in Takamatsu, Japan. For more information, visit www.tadano.com.

Don’t let your cellphone distract you while operating equipment — even off the road.

That’s the gist of a new joint safety alert from the Association of Equipment Manufacturers and the Mine Safety and Health Administration of the U.S. Department of Labor.

“Turn off your cellphone while operating off-road equipment” is the alert’s key message, according to a news release from the AEM.

The alert, which can be downloaded from the MSHA website, can be used in safety talks, handed out to miners and contractors, or posted on bulletin boards, the release said.

“We know in today’s connected world that it’s more important than ever to remind workers to focus on the job and be alert and aware and mindful of their environment and safety,” the news release quoted Mike Pankonin, AEM’s senior director of technical and safety services.

The MSHA alert notes that cellphones are involved in 6,000 automobile fatalities each year. The risks of automobile cellphone usage “can be translated into the operation of off-road equipment,” the alerts adds. For example, using a cellphone while operating mobile equipment can be up to six times riskier than operating that equipment while intoxicated. Texting a message can take an operator’s eyes off the task for five seconds — enough time for a vehicle travelling 55 miles an hour to cover the length of a football field.

“Cellphone usage on the job is a dangerous distraction and can lead to injury or death,” the news release quoted Joseph A. Main, U.S. assistant secretary of labor for mine safety and health. “Using a cellphone while operating mobile equipment takes your eyes off the road, your hands off the wheel, and your mind off your task.” For more information, visit www.msha.gov.

Some companies are using assets more carefully, such as employing smaller cranes, notes mining executive

SAUL CHERNOS

ranes are a common sight in the mining sector, relied upon to build basic infrastructure and mine facilities and, frequently, to assist with actual resource production.

CBut the 2008-09 recession and more recent dip in commodity prices have challenged an industry that has traditionally weathered rocky boom-bust cycles. While the oil patch has been particularly stressed of late, conventional metal mines have also been hit hard.

At Mines and Money Americas, a trade show held in Toronto in late September, there was considerable buzz around the economic prospects for exploration and extraction. These early-stage activities are almost uniformly undertaken by juniors and are a logical place to start when probing the financial health of the mining sector because they represent what’s coming down the pipe.

At Crown Mining, a Toronto-based junior exploration and development company with property in northwestern Ontario but focused on advancing California copper prospects and Nevada gold prospects to the production stage, president and CEO Stephen Dunn expressed cautious optimism.

Copper in demand but cash lacking

“The outlook for copper is fabulous because it’s critical to the world in terms of delivering electricity,” Dunn told Crane & Hoist Canada. “The demand for copper goes up every single year because demand for electricity goes up every single year. There isn’t enough copper out there right now to meet the need over the next five to 10 years.”

However, juniors like Crown Mining, which set the stage for actual mineral production, are running into a major bottleneck — maintaining adequate cash flow. “The seniors have money, but the juniors can’t get the funding to develop their projects,” Dunn said.

“The demand for copper goes up every single year because demand for electricity goes up every single year. There isn’t enough copper out there right now to meet the need over the next five to 10 years.”

~ Stephen Dunn, president and CEO, Crown Mining

He explained that banks are risk adverse and have stepped back, uncomfortable that it can take decades to complete engineering studies and get permits. This has left the juniors scrambling to get financing from investors who understand the business and its challenges and can anticipate eventual returns.

Kendra Johnston, corporate development manager with Vancouver-based Independence Gold, said investor confidence seems to be rebounding.

“The markets are starting to turn around again and the money’s starting to flow back in,” Johnston said. “It allows us a little bit more freedom to get out and do some of the things we’ve been thinking about and planning.”

Independence Gold has permitting sites in Yukon’s White Gold district, which extends from northern British Columbia into southwest Alaska, and Johnston said the territory did particularly well from 2010 to 2012 with more than 50 junior exploration companies getting in on a huge staking rush.

Despite a market downturn that began in 2013, Independence Gold has stayed the course and prospects are beginning to brighten, Johnston said. “We did the work we needed to do but conserved our cash as well and were responsible with it, and just in the last year things have started to come back.”

“There’s a lot of interest right now, with lithium in high demand for the electrification of the automobile and for other new energy sources. We think we have the right resource at the right time to offer a product to the market that the market really needs a lot more of going forward.”

~ Don Bubar, president and CEO, Avalon Advanced Materials

Exploration can be costly, especially in remote areas. “It’s people hours primarily, and in this jurisdiction it’s camp support, helicopter time and transportation,” Johnston said. “You have to get community engagement everywhere, and it takes time.”

Beware of geography

Commodity prices are the main economic driver, but Johnston said companies hoping to provide goods and services to mining companies also need to understand jurisdictions and geography.

“Our business is getting more and more difficult,” Johnston said. “The easy prospects and deposits have been found and we’re now looking deeper and more remote.”

In northwestern Ontario, Avalon Advanced Materials is at the feasibility stage for its Separation Rapids lithium project near Kenora, and president and CEO Don Bubar is looking to move into production.

“There’s a lot of interest right now, with lithium in high demand for the electrification of the automobile and for other new energy sources,” Bubar said. “We think we have the right resource at the right time to offer a product to the market that the market really needs a lot more of going forward.”

Avalon has other interests, however, including a pastproducing tin mine near Yarmouth, Nova Scotia. “It closed prematurely in the late 1990s due to a sudden collapse in price of tin,” Bubar said. “Most of the resource was left in the ground and there’s new demand. Prices have recovered and we’re looking to redevelop that site as a producer of tin plus other metals that are found with tin, including the rare metal indium which is used in indium tin oxide and in display screens and solar panels.”

While tin is subject to the whims of commodities markets, specialty compounds such as lithium and indium are used in high-tech goods such as electronics and batteries and tend to be negotiable.

“They’re more specially engineered chemical products you’re producing for end users, so they’re not really traditional commodities in that sense and are less volatile in terms of pricing,” Bubar said.

Mines add to crane workloads

If Avalon can advance its exploration properties into production, there would be varying infrastructure needs. In Nova Scotia, the infrastructure already exists, but Bubar said a mine there would use nearby port facilities and add to the workload of cranes hoisting shipping containers. The Separation Rapids project near Kenora, meanwhile, would be a new mine, so there would be some construction. Northwestern Ontario’s Ring of Fire was a particularly

hot topic at the conference. This mineral-rich region is considered to have billions of dollars worth of potential yet is almost completely lacking in infrastructure and remains subject to negotiations with First Nations.

Work cannot proceed until these issues are addressed, but proponents have been busy readying for the eventuality that they do get the green light. In a panel discussion, Alan Coutts, CEO of Toronto-based Noront Resources, said his company has continued exploratory drilling and feasibility work at its Eagle’s Nest deposit.

Coutts described the delays as a strategic blessing for Noront, which has bided its time by buying out two other major mining interests in the region, Cliffs Natural Resources and MacDonald Mines.

“It has allowed us to consolidate virtually the entire region,” Coutts said, touching on plans to eventually build mineral processing facilities.

Project success also depends on government commitments to roads, rail and hydroelectric infrastructure. “We’re working very closely with the provincial government and the local First Nations,” Coutts said. “It makes a lot of sense to bundle regional development on the back of the industrial development. This is a model that’s gaining popularity and traction throughout Canada.”

In northeastern Québec, NorthernShield Resources is actively looking for nickel, copper and platinum. “There’s some potentially large-scale deposits,” president and CEO Ian Bliss said in an interview.

Areas near Schefferville are served by a railway south to the St. Lawrence Seaway, but the Québec government is planning on pushing that railway further north towards Kuujjuaq with the purpose of developing and opening up mineral exploration, Bliss said.

While exploration and mine development remain challenging, it’s not exactly easy times for extraction either.

In an interview, David Frost, senior vice-president of process engineering for North America for Oakville, Ontario-based DRA Americas Global, said some companies are managing their assets carefully — for instance using smaller cranes rather than overhead cranes if efficiency and savings can be realized.

“Some might use boom cranes to carry out maintenance on equipment such as tanks, agitators and flotation cells,” Frost said.

Financial analysts also expressed cautious optimism. Don Coxe of Coxe Advisors said precious metals are faring well, in part due to the economic slowdown. “Our view is that we’re going to have a recession,” Coxe said. “It will probably not be a deep recession, but we may come out of it and not know we’re out of it because of this zero- and negative-interest-rate environment.”

The result for mining, Coxe said, is that precious metals such as gold and silver are ironically among the few industries that don’t benefit from high interest rates. “If you own a bar of gold or silver coins in the past you gave up interest to own them, but now with zero or negative interest rates … it’s no surprise that the two best performing assets this year have been gold and silver,” Coxe said. “And if we have a recession they will once again be the best.”