Sweet tuberous growth

Albertan grower takes on a new crop | 10

Strawberry boom

Local demand and technological advancements allow for rapid growth | 20

UV x cannabis

Why UV radiation may not be the best choice for boosting THC or yields | 34

MAY 2022

Sweet tuberous growth

Albertan grower takes on a new crop | 10

Strawberry boom

Local demand and technological advancements allow for rapid growth | 20

UV x cannabis

Why UV radiation may not be the best choice for boosting THC or yields | 34

MAY 2022

The most highly valued plant features and key retail musts, revealed. By: Dr. Amy Bowen | 14

BY DR. FADI AL-DAOUD

KAITLIN PACKER

BY JOHN DIETZ

“Things are only impossible until they’re not.”

Admittedly, I am not yet a fan of this sci-fi series from which this quote spawned, but it’s a very apt way of summing up some of the main features in this issue.

This edition is all about new crops and new adventures, and the stories truly make for inspirational reads. You’ll learn about:

• Stephanie Lessner and her family, who are one of the first greenhouse growers to produce slips of a new, short-season sweet potato in the greenhouse for their own use, to supply commercial sweet potato growers, and for garden centres (pg. 10);

• Sunterra’s latest greenhouse build, their collaboration with Lethbridge College, and how they’re filling the demand for local strawberries in a very big way (pg. 20);

• Autoflowering cannabis and why it doesn’t have to play second fiddle to photoperiodic strains (pg. 18);

tests whether UV radiation can indeed boost cannabis THC and yields (pg. 34).

Thinking about succession plans and how to tackle them? Our cover story features the family team from John Slaman Greenhouses, who not only doubled their acreage, but are in the middle of a 10-year succession plan. Their family graciously invited us into both greenhouses – the older facility and the new – and what a sight to behold. The character and history of the older facility juxtaposed against the newer, shinier greenhouse – both were equally beautiful in their own way. Unfortunately, we weren’t able to fit in nearly as much photography as we would have liked, but keep an eye out for the online version with a dedicated URL where you’ll be able to access additional visual content.

For some very timely garden retail information, check out Dr. Amy Bowen’s feature on what plant consumers want. Their research delved into key factors that influence the consumer’s purchase decision, the most highly valued plant features, as well as key must-haves when shopping online or in-store at the garden centre (Pg. 14).

“Things are only impossible until they’re not.”

• How technology inspired by vertical farming, aquaponics and greenhouse are being used to grow beyond the usual crops, meeting the demand for plant protein, livestock feed, and medicine (pg. 36)

• Exotic crops grown under cover in other parts of the world, as highlighted in this month’s Inside View with Gary Jones (pg. 46)

What’s the difference between aquaponics, aeroponics and hydroponics? Dr. Mohyuddin Mirza gives an overview of different soilless systems (pg. 30).

For more new technology, lead author Victoria Rodriguez Morrison

And for those looking nervously at forecasts for this summer’s temperatures, check out the article on the effects of high temperature on tomato development by Dr. Fadi AlDaoud of OMAFRA and Dr. Xiuming Hao of AAFC. Can you decipher between green shoulder, sunscald and goldspot?

Last but not least, be sure to check out our latest webinars on greenhouse energy – geothermal, biomass and natural gas on greenhousecanada.com/webinars. As we head towards a net zero-carbon future, it’s time to think about your next steps. It’s an adventure.

The Ball Seed® Technical Support Team offers:

• Fast, accurate and practical solutions

• 24/7/365 availability by phone or online

• Experts with over 70 years’ combined industry experience

• Online solutions at ballseed.com/techsupport

Seek out answers about:

• Crop culture

• Clean environment protocols

• Plant physiology and pathology

• Biological pest control agents and more

Search our advanced digital and online tools:

• Podcasts

• Facebook groups

• Technical support videos

• Scheduling guides and culture info

Nominations are now open for Canada’s annual recognition awards.

For those under 40 years of age, the 40 awards recognize rising stars in the greenhouse sector. Nominees must work in greenhouse horticulture, related equipment and technology sectors, and/or allied trades, and be under 40 years of age by December 31, 2022.

The Grower of the Year award recognizes a greenhouse grower for their innovative thinking,

PHOTO CREDIT: PARKLAND

Not only has 2022 been proclaimed the Year of the Garden, it also marks the 100th anniversary of the Canadian Nursery Landscape Association.

“When we speak about gardens and gardening today, it’s not what it was 10 [or] 15 years ago. It’s changing,” says Michel Gauthier, executive director of the Canadian Garden Council.

According to Statistics Canada, sales in ornamental products for

the home and garden rose 9.5 per cent in 2020 compared to the previous year.

Canadian Garden Council is inviting gardeners to plant “red” to “honour frontline workers and to show their gardening pride.” Members of the public can also sign up their gardens as Celebration Gardens and to “Live the Garden Life.” Gardens will appear on a map of Canada, and gardeners

Lorne Metropolit, owner and operator of Yukon Gar dens, was presented with the 2022 Yukon Agriculture Award by the territorial government.

Metropolit was recognized for decades of work developing agriculture and building food security in the Yukon.

The operation began in 1985 as a show garden to demonstrate what could be grown in the northern climate. Over 40 years later, the family business has ex panded to grow greenhouse produce found in most of Whitehorse’s grocery stores. Over time, Yukon Gardens became the territory’s largest family-run greenhouse and garden centre operation.

Metropolit promoted northern agriculture nationally on CBC’s Canadian Gardener television show in the 80s. He has also delivered many gardening programs at the local correctional facility, communities and schools across the Yukon.

Source: Government of Yukon

MEET HAWTHORNE 360, our priority initiative designed to provide growers with an integrated suite of gardening solutions. From HVAC systems to irrigation and harvesting tools to lighting and nutrients - our family of top-tier brands (including brands where some products are manufactured in-house, such as Gavita), backed by an innovative R&D team, a strategic distribution network, and real-world cultivation experience, is here to support you.

Whether you’re a micro cultivator or a large-scale indoor or greenhouse grower, we are Canada’s go-to source for professional HPS & LED lighting and COA industry-standard nutrients. And our world-class tech services team is available every step of the way - from initial build-outs to final harvests to everything in between.

RESEARCH & DEVELOPMENT

Dedicated research facilities.

ICONIC BRANDS

Over 85 signature brands, plus exclusive & vendor brands.

TECH SERVICES

Troubleshooting for every part of your grow.

A target shipment time of within 24 - 48 hours.

ENERGY REBATES

1:1 support processing available rebates for licensed grows.

ADVOCACY & EQUITY

A focus on racial, social, and economic equity.

Peppers From Heaven are small, sweet peppers great for hanging baskets and 6” to 7” pots. The compact plants produce lots of fleshy fruit that mature from green to glossy colour (red, orange and yellow varieties are available). Plant three plants in one pot for a fuller look. burpeehomegardensbrand.com

Suncatcher is an industry breakthrough in the class of Helianthus. It provides retailers and gardeners with a hardy, perennial sunflower that continuously flowers from mid-summer through autumn across North America. This Zone 5, hardy North American native is also a pollinator magnet and matures on a tidy stature of 36” by 36” in the garden. For growers, it is best produced outdoors and makes an ideal partner for mums at retail.

kientzler.innovaplant.com

This new double impatiens series with beautiful rose-like blooms is highly resistant to Impatiens downy mildew. They make fabulous, durable hanging baskets for shade and lowlight gardens. Launching for spring 2023 in seven colours. Available exclusively through Ball Seed. ballfloraplant.com

Melon-coloured flowers with matching melon cones, at 5-5½” wide these are among the largest flowers in the collection.

‘Color Coded’ Echinacea are produced vegetatively from tissue culture, so all plants will be identical in colour and habit.

These varieties were selected for their excellent basal branching, flower performance, large flower size, and horizontally held petals. These are perfect pollinator magnets and, during late fall to winter, the seed heads will serve as food for birds. waltersgardens.com

Spreading intense colour, the award-winning Calliope geranium series continues to innovate with the industry’s first cascading interspecific geranium. Calliope Cascade has large, intensely coloured semi-double flowers that bloom all summer long, along with a vigorous spreading habit. Perfect for growing in highimpact premium hanging baskets, large pots, or landscape plantings. syngentaflowers-us.com

Named for the hands of a clock going around the center ring, TikTok varieties have a very playful pattern on more vigorous plants, perfect for baskets and combinations. New TikTok Orange features mediumsized flowers with a playful pattern of eye-catching center and novel yellow spokes. dummenorangena.com

A breeding breakthrough allows this all-new tradescantia to maintain heavy white variegation while still supporting vigorous growth. An excellent selection for monoculture in quarts through hanging baskets, as well an eye-popping combination item. Yearround sales are simple as a spring or foliage item. green-fuse.com

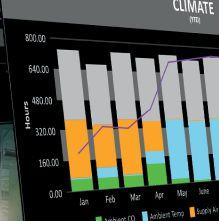

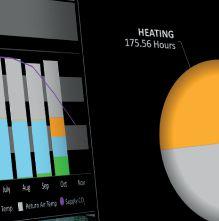

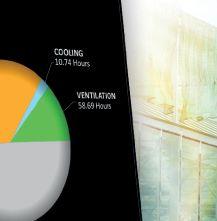

Growers know that when it comes to controlling and monitoring a production environment, a simple, flexible, sustainable control system is crucial. This is why you can depend on Reliable Controls. Our nationwide network of factory-certified Authorized Dealers will help you design, install, and commission a comprehensive control system paired with an intuitive, custom-tailored graphical interface. Take command of your precisely controlled environment. Generate tracking reports and analytics. Reduce your carbon footprint while improving productivity, quality, and serviceability.

To learn more about this cost-effective, Canadian-made solution, please contact a Reliable Controls Authorized Dealer near you.

Canada: 647.982.7412 Western Canada: 403.561.4148

The gutsy spirit of free enterprise is still alive in southern Alberta. Last year, a cattle ranch sprouted a greenhouse to begin growing sweet potatoes and sweet potato slips.

BY JOHN DIETZ

Doing something different to diversify ranch income in semi-arid southeast Alberta could be challenging.

Stephanie Lessner, a young mom with ambition, energy, and little ones at home, took on the challenge full-time in 2021 and had a good year. Finding success will take two more years, at least, but she may be sprouting a sweet potato niche (or industry) for western Canada.

Lessner, along with her husband, parents, two brothers, and their spouses, lives on short-grass Prairie along the Red Deer River near the hamlet of Jenner. The four-family J G Larson Livestock ranch has about 1,000 cow-calf pairs, 9,000 acres of crops and pasture, and a pair of farm-owned

ABOVE

natural gas wells. It’s about 100 km to the nearest commercial greenhouse.

“We have been looking to diversify without increasing the land base or the farm operation for a few years,” Lessner says.

They had settled on building a small greenhouse heated with their natural gas in cold weather. Inside, they wanted a new-to-Alberta crop that would have good market potential.

Stephanie already had a management diploma from Lethbridge College. For the Fall semester, 2020, she signed on for a horticulture certificate course through Olds College “so we’d have a little information” about operating a greenhouse.

About that time, she learned that Vineland

Stephanie Lessner’s family farm started Alberta Sweet Potatoes, a new venture cultivating sweet potato slips of the new short-season variety, Radiance.

ABOVE

Canada’s first short-season sweet potato, Radiance, was launched in 2018 and matures three weeks earlier than the competition.

Research and Innovation Centre (Vineland) in Ontario was looking for entrepreneurs who would try greenhouse production of sweet potato slips.

“The thing that got us started was the slip production. They need to be propagated in a greenhouse but then they utilize the farmland as well,” she says.

Alberta already has a well-established commercial potato industry about 150 km south of Jenner. The industry has three processors. A processor could, in theory, shut down one production line for a few weeks to process sweet potatoes – if an industrial supply became available.

In February 2021, the family pitched in to build a simple 24x26-foot polycarbonate, half-circle, greenhouse on the ranch.

“We don’t need high technology. It does have high-pressure sodium lights,

a louvre, a fan, a little water pump, and a furnace. For water, we fill a 1,000-litre tote because our water is not very good here,” she says.

With a production manual in hand from Vineland and hotline connections to Vineland as well as the Alberta Greenhouse Growers Association consultant, Lessner began her efforts to launch a sweet potato industry for Alberta and British Columbia.

The production manual for best practices, Sweet Potato Slip Production in Canadian Greenhouses, rolled off the press in early 2020.

The publication culminated about eight years of research and development funded by the Ontario Ministry of Agriculture, Food and Rural Affairs, the University of Guelph and Agriculture and Agri-food Canada, and was led by Vineland research scientist and vegetable breeder Valerio Primomo.

It was about a new variety, and an idea intended to spawn a new horticultural industry in Canada.

Amanda Moen, Vineland’s business development advisor, explains how Vineland started developing a shortseason sweet potato for Canada’s climate in 2012. The crop was being ‘discovered’ as a healthy alternative food on a global basis. Sweet potato already was popular among new Asian immigrants, but Canada was importing at least 70 percent of what it consumed.

At the time, Canada had about 1,500 acres of sweet potato production in southern Ontario and Quebec plus a handful of growers in Nova Scotia’s Annapolis Valley, BC Lower Mainland, and on Vancouver Island. However, the Canadian crop would always be ‘sold out’ right after harvest.

Canada’s first short-season sweet potato, Radiance (VSP001), was launched in 2018. It is about three weeks earlier to maturity than the competition.

“This variety is going to open the door to increasing cultivation because it derisks production,” Moen says. The project aims to increase cultivation by building a network of producers.

“Access to quality slips coast to coast will make a big difference. With the combination of an early, high-yielding variety and availability of quality slips for it, we expect a huge increase in acreage.”

For the next step, Vineland needed

a network of one or two licensed slip producers in each region of Canada. Qualified slip producers need a simple greenhouse, equipment, and land for field multiplication.

Today, Canada has established a network of six slip producers with the ability to serve Canadian growers coastto-coast. Hope is in the air at Ontario’s Vineland Research and Innovation Centre. Their idea may be taking root.

For Lessner, their new venture began soon after the little greenhouse was ready. To grow slips, Canadian propagators use a greenhouse to bed seed potatoes or small in-vitro plantlets in potting soil and harvest the vines as they emerge.

Lessner and family laid seed potato down in the greenhouse on an inch of media or soil, and put another inch or two of soil on top, then added heat and water. By the end of March, roughly 6,000 Radiance sweet potato slips halffilled the little greenhouse.

“They like heat and moisture and grow very quickly. We were taking cuttings from the slips from late March through the middle of April,” she says.

The first 6,300 cuttings filled the other half of the greenhouse. They did a second cutting in May, sending those slips (about 9,000) by express shipping to buyers. At that stage, the sweet potato slips are unrooted vegetative cuttings. They are about 6 to 12 inches tall and ready for planting when delivered.

Meanwhile, in a nearby field, the Larson family built a specialized acre of raised, black mulch beds irrigated by drip lines. They ended up with nine rows of beds spaced at 36” between beds. Each bed had two rows of sweet potatoes on 12” spacing. Altogether, they planted 15,000 slips in the beds in mid-June.

The first field season turned out well, under the circumstances. Deer never jumped the fence and pests they expected didn’t arrive. The late planting was complemented by a long, open fall that enabled their first sweet potatoes to bulk up and mature. They harvested in mid-October.

Some tubers grew out farther than expected and were damaged by the digger before it was modified. Surprised livestock enjoyed the damaged sweet potatoes.

“We had a few more damaged than I wanted to see, but after being in grocery

stores this fall, I think everybody had a hard time with sweet potatoes. We had set a very high standard on how they had to appear, and in retrospect, we would have been able to market most of the culls,” she says.

In February 2022, the small greenhouse was already bedded with sweet potatoes to supply retail greenhouses and garden centres with slips early in their season. A second greenhouse, 4.5 times larger, was being erected for commercial growers wanting slips in 2022.

“This expansion allows us to serve more commercial growers and be open for orders from greenhouse and garden centres,” she says.

The balance of their first sweet potato crop was in temperature-controlled storage in a reefer trailer. In early March 2022, it was to be bedded in the expanded greenhouse space to start a second cycle in western Canada.

Down the road, if all goes well, Lessner will need upgrades to the greenhouse, processor support for the new industry, and a major investment in specialized storage similar to potato industry sheds.

Lessner points to a few challenges ahead.

For one, there is competition from American slip producers. “They grow the slips outside in fields for less than our greenhouse expense,” she says. But her low-cost shipping offsets that.

Second, weed control needs registered herbicides. Lessner has started working with chemical manufacturers and ag supply retailers to begin trials leading to registration. Happily, some are registered in eastern Canada.

On the positive side, she adds, there is every reason to see a good market outlook.

“I believe there’s a lot of demand. We had a lot of inquiries we couldn’t fill. We shipped some slips to Ontario, but most went to Alberta and British Columbia. We had inquiries from Saskatchewan and Manitoba as well. If there is enough heat, and if we don’t get an early frost, the sweet potato will grow very well here.”

Sweet potatoes are native to the tropics and are a member of the morning glory family. According to the FAO, with approximately 147,500 acres of sweet potatoes and 1,450,000 tons of production in 2019, the United States

ranked 9th in the world. The USDA records that, the same year, North Carolina planted 98,000 acres, followed by Mississippi (28,000 acres) and California (21,500 acres).

“There’s a lot of interest and the crop is in demand,” says Moen. “Lessner, for example, stands out because she is making high-quality slips accessible in a region that was unable to receive them in the past. If she can scale up to a million-plus slips a year over the next few years, it’s going to make a big impact in

sweet potato becoming a common root vegetable crop in western Canada.”

Based on what they know today, if the network scales up to planned capacity, it would be able to meet today’s sweet potato demand in Canada.

“We now have licensed producers in Alberta, Manitoba, Ontario, Quebec, and Prince Edward Island. And, we have a North Carolina farm that does field planting for slips. The people are in place, now they must scale up their stock and build their confidence,” Moen adds.

What do consumers look for at garden retail? This study reveals the true role of pricing, the most sought-after plant features, and key elements of the ideal shopping experience.

BY DR. AMY BOWEN

Independent garden centres (IGC) have seen a boom in business over the past several years. With consumers restricted in their activities and travel having been almost non-existent, many homeowners turned to gardening as a way to stay active and release stress.

Research studies completed during the pandemic found that one in five Canadians started a garden in 2020. They also found that gardening is attracting a new segment of younger consumers, and there is increased interest in buying online as garden centres offer more services such as delivery and curbside pickup.

In fact, 89 per cent of IGCs in Canada and the U.S. reported an increase in sales over the past two years. Statistics Canada reported $1.68 billion in the sale of plants and

ABOVE

flowers in 2020, marking a 10-year high.

The combined impact of increased sales and new customers provides a tremendous opportunity for keeping consumers engaged and to develop long-term home gardening habits.

With this in mind, researchers from the Consumer, Sensory & Market Insights team at Vineland Research and Innovation Centre as well as the Department of Marketing and Consumer Studies at the University of Guelph embarked on a multi-year research project to understand the path to purchasing for Canadian garden centre consumers.

The first part of the study, completed in the fall of 2020, aimed to

The study presented a number of ornamental plant types to surveyed consumers who indicated their most valued plant features.

Neudorff North America is an innovative leader in ecologically responsible pest solutions for nursery and greenhouse growers, farmers and turf professionals.

Our effective and affordable solutions for disease, insect pests, pest slugs and snails have limited impact on applicators, and the environment. They are an important part of integrated pest management programs.

Powerful disease protection for your greenhouse vegetable and ornamental crops with a fraction of the copper found in other copper fungicides.

Fast-acting insecticidal soap. Controls aphids, mites and whiteflies on ornamentals, herbs, spices, vegetables, including cannabis. Effective as a cutting dip to control whitefly nymphs.

A summer and dormant oil. Controls all life stages of insects and mites. Suppresses powdery mildew of greenhouse ornamentals, fruit, vegetables and cannabis grown indoors.

Fact acting. Controls moss, algae and liverworts in and around greenhouses.

A durable pelleted iron phosphate bait. Provides excellent protection of greenhouse crops from slugs and snails.

A durable, fast-acting pelleted spinosad bait that is active against a wide range of ants in greenhousegrown vegetables and ornamentals.

Inside and outside. Neudorff protects.

The path to purchase for garden centre shoppers.

(Quality & knowledge) PURCHASE COMPLETE

(Look & size)

(Key features: appearance, dimensions, & quality)

The combined impact of increased sales and new customers provides a tremendous opportunity to keep consumers engaged and develop long-term home gardening habits.

understand the role of pricing in nursery plant purchasing decisions and to explore the plant qualities and garden centre factors considered by consumers when purchasing a plant.

The qualitative study of 44 garden centre shoppers in southern Ontario, British Columbia and Saskatchewan found that consumers engaged in a multi-stage path to purchase. The first step is the planning stage where consumers identify the dimensions and the look of the plant they want to purchase. The second step is deciding where to make the purchase; higher commitment plants require more investment of time, and consumers carefully consider the location and knowledge of retail staff at various locations. The third step is going to the garden centre; consumers select their store, browse, consult staff and compile a short list of options with price generally being an afterthought. The final step is the purchase once they are confident in their selection.

Based on consumer feedback, 64 per cent of respondents said they shop exclusively at IGCs because they value the knowledgeable staff, quality and diverse selection. When making their selection, consumers indicated that their top features were plant dimensions (34 per cent), plant aesthetics such as colour and shape (32 per cent) and plant vitality or a healthy appearance (31 per cent). Only 7 per cent indicated price as the main consideration.

Further prodding on the issue

found that 68 per cent of shoppers either didn’t notice the price, or they made an assessment and found the price to be fair. Only 30 per cent of shoppers said they paid attention to pricing and made price comparisons. In addition to product cost being an afterthought, only 16 per cent of shoppers made an impulse purchase while at the IGC. This number is surprisingly low when compared to grocery stores where the impulse purchase rate is 80 per cent. It could mean that few garden centre customers make unplanned purchases, perhaps due to a lack of space or purpose in mind for the plant.

The second part of the study sought to understand which plant features consumers value most and would potentially pay a premium for. 678 participants from Canada and the U.S. completed an online questionnaire in the summer of 2021. All participants were over 18 years of age and had purchased one or more plants in the past 12 months. Three plant types were selected for consumer feedback: geranium to represent an annual flower, daylily to represent a perennial flower and hydrangea to represent a shrub/ tree. Participants were randomly divided into three groups and each group evaluated the features of one plant type. Preferred features and willingness to pay by plant types were as follows.

• Geranium: Consumers preferred and were willing to pay more for geraniums when displayed in pots with messaging indicating a moderate growth rate, full sun light requirements and attractiveness to butterflies and hummingbirds. They were more price-sensitive to pot sizes greater than four inches.

• Daylily: Consumers preferred and were willing to pay more for daylilies that were low maintenance, had large flowers and displayed buds and blooms. Canadian consumers also preferred and were willing to pay more for winter hardiness and blooms in the spring and summer. U.S. consumers were more pricesensitive to the one-gallon pot size,

whereas Canadian consumers were more price sensitive to one- and twogallon pot sizes.

• Hydrangea: Consumers preferred and were willing to pay more for hydrangeas as shrubs versus trees. They were also drawn to those identified as having low to medium pruning requirements, medium to long bloom times and bloom colour changes due to pH and season. Canadian consumers were more pricesensitive to smaller pot formats whereas U.S. consumers were more pricesensitive to the five-gallon pot size.

Overall, key features identified for each plant type can be used to engage with consumers, manage inventory and create plant displays and messaging based on preferred features.

The third part of the study explored the online versus in-store retail experience to understand shopping features most important to consumers. Qualitative interviews of 17 garden centre shoppers were completed at three IGCs in southern Ontario in August 2021. Shoppers were asked to share the most important aspects of their shopping experience.

For in-store shopping, 94 per cent of consumers said being able to see plants, along with access to garden centre customer service and consultation, were the most important features. The shopping process itself was also important, with 65 per cent of consumers stating that being able to walk around and compare plants was important to the in-store experience. Typically, consumers who enjoy an instore experience are actively looking for a variety of plant options, personalized advice, along with deals and promotions. The biggest challenge to in-store shopping, as stated by 24 per cent of surveyed consumers, was the difficulty in finding the items they were looking for and the lack of inventory.

As for the online shopping experience, 88 per cent of consumers said they cared most about being able to see actual plant photos with descriptions and care instructions, not just stock images. Similarly, this was the largest deterrent for 71 per cent of those who wanted to be able to see and inspect the plants to determine their size and quality. Other advantages of online purchasing included the convenience of shopping from home with 24-hour access, along with the ability

ABOVE

For each representative item, surveyed consumers identified key plant features that they preferred and were willing to pay more for.

to easily search for products (if they know the plants by name).

As an IGC, how can you apply this knowledge to your business? Here are a few recommendations:

1. Create an inviting culture. IGC consumers are, for the most part, true hobbyists. They choose to shop at your location because they appreciate the experience of being at the garden centre. They enjoy interacting with the staff and seek their advice and knowledge in making purchase decisions. Use this to your advantage and invest in your employees to provide the best in-store and online shopping experience. Your staff and customers can be advocates of your business and be the reason for both new and returning customers.

2. Encourage impulse buying. In general, impulse purchasing at garden centres is low. Why not have plant care information in close proximity to the plants? By creating a convenient one-stop shopping experience, consumers can purchase their plants and pick up pruning shears, gloves or plant fertilizers to increase their gardening success rate. This enhances their overall experience while increasing your sales.

3. Create zones to promote plant features valued by consumers. With so many new home gardeners taking up the hobby, why not set up areas in your garden centre to highlight plants with specific features, particularly ones valued by consumers? Try creating an area featuring cold-hardy plants for your region. Or how about including signage for plants that attract pollinators? Other options include creating areas to highlight low maintenance products, or setting up an expert area to challenge consumers’ green thumbs. The possibilities are endless.

This research was supported through the American Floral Endowment’s Floral Marketing Fund, as well as the Canadian Nursery Landscape Association, Landscape Ontario and Garden Centres Canada. Members of the research team included Dr. Amy Bowen, Dr. Alexandra Grygorczyk and Mithun Shrivastava of Vineland Research and Innovation Centre, as well as Dr. Juan Wang and MSc candidate Xuezhu (Nicole) Wang from the University of Guelph.

Amy Bowen, PhD, is the Director of Consumer, Sensory and Market Insights at Vineland Research and Innovation Centre. Contact her at amy.bowen@vinelandresearch.com.

BY BEN LIND

Environmental conditions in Canada follow a gradient of sorts from south to north. Along the southern border there is a pronounced milder, coastal influence where the successful planting and harvesting of most photoperiodic cannabis varietals is possible outdoors. As you move north into colder, harsher and more variable conditions, autoflowers become the ideal choice for outdoor.

Different from most commonly cultivated “photoperiod” types, autoflowers don’t rely on light cycles to determine flowering. They can also give you the added predictability of knowing you can harvest within 100 days or less from planting.

To craft the modern autoflower, crosses have been made using Cannabis ruderalis, which is hardy in cold, northern climates. The resulting strains can be grown in distinctly colder environments than what traditional varieties can tolerate.

The ruderalis subspecies carries adaptations that modern breeders have used to their advantage, yielding plants that have a variety of THC/CBD ratios and also the unique quality

ABOVE

of allowing for multiple harvests on a quick timescale. Modern autoflower varietals bred by reputable, skilled breeders retain all the important terpenes and cannabinoids you would expect in traditional photoperiod genetics. Bud structure and density on par with photoperiod varietals is now standard for today’s autos. You’ll have the whole colour spectrum, from deep purples to vibrant greens represented as well.

The autoflower seeds of today can also compete with photoperiod strains in the marketplace in a way that wasn’t possible not too long ago. A significant portion of the Canadian market has been THC-focused for some time. With today’s updated autos, it’s possible to get the THC numbers demanded by the high-THC segment of the market.

That being said, the magic of autoflowers really is that they are suitable for both indoor and outdoor growing. Modern varieties dispel the outdated notion that autos are not as good as photoperiod strains. Whether you choose outdoor, a greenhouse setup, or a controlled environmental

Modern autoflowering varieties don’t have to come second behind photoperiod strains when it comes to quality. They could potentially maximize overhead and space in the grow facility.

agriculture (CEA) approach, you could potentially maximize your profits and minimize your overhead by choosing autoflowers.

If you look at the harvest index, or measurement of crop yield, which is defined as the weight of harvested product as a percentage of the total plant weight of a crop, you’ll quickly see that autoflowers are considerably more efficient to grow. Photoperiod strains expend a lot of energy building massive stalks, whereas autos put all of their energy into growing the part of the plant that makes a profit. The harvest index becomes really important when you start calculating employee hours. Autos are much less time intensive in terms of leafing, pruning, harvesting and general greenhouse maintenance, leading to substantial cost savings. Being able to run multiple, consistent harvests in rapid succession gives growers the opportunity to scale up in a predictable way.

Due to the faster finishing times, autos require fewer nutrients than photoperiodic strains, which adds to the cost savings. Space is often at a premium. Starting with autoflower seeds allows you

ABOVE

Autoflowers could be a good option for both indoor and outdoor growing environments.

to eliminate the veg room and nursery team. You can dedicate your full square footage to flower production. Autos also come with the added benefit of being hardy. If you are growing outdoors or in a greenhouse and you have a surprising change in weather leading to quick fluctuations in temperature or humidity, there is less risk with autos. They are able to withstand more variability in environmental conditions when stressed. Some auto strains also offer enhanced pest and mold resistance, making them a potentially good choice for both experienced cultivators and those new to growing cannabis.

Commercial operations will want to keep a close eye on all plants, autoflowering or not, but smaller growers and hobby growers can just about set it and forget it with autos, making them convenient and fun to grow.

Ben Lind is chief science officer at Humboldt Seed Company, a specialist in cannabis breeding and strain development. For more, visit humboldtseedcompany.com.

Greenhouse fills the gap for tasty, local strawberries.

BY Kaitlin Packer

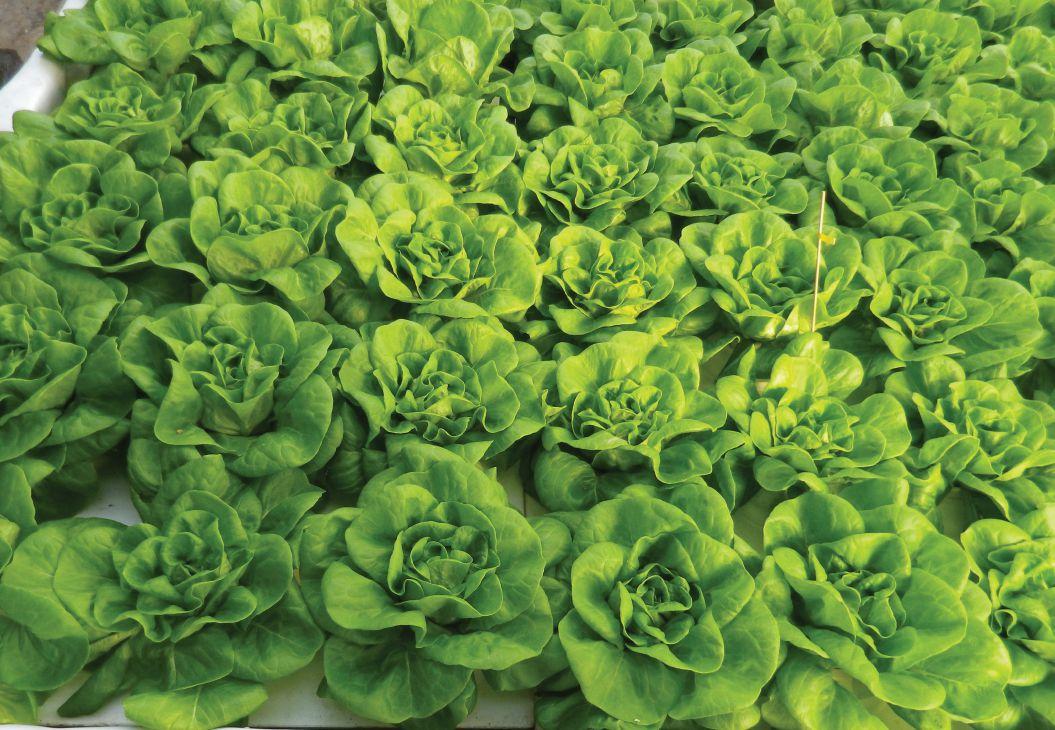

The lift gutter system at Sunterra allows for production at a greater plant density.

More and more Canadian greenhouse growers are recognizing the unique opportunity that lies with strawberry production. With two years of COVID-19 behind Canadians, the value for fresh, locally grown fruit and vegetables is evident now more than ever, and growing strawberries under glass helps ensure they’re in supply all year long.

Sunterra Greenhouse, located an hour northeast of Calgary in Acme, Alta., is a recently constructed 20-acre greenhouse facility for tomato and strawberry production with plans to expand to 70 acres. According to Amanda Hehr, president of Sunterra Greenhouse, they’re the third greenhouse in North America to implement the lift gutter system for strawberries. “It’s more expensive, but it allows for 10 rows per eightmetre bay rather seven to eight rows at most with conventional systems,” says Hehr. It means better use of the growing space and higher plant density, and their next expansion may almost be exclusively strawberries.

Starting with 2.5 acres of a novel Dutch variety, Sunterra planted their first crop in Nov 2021 and harvested their first batch of strawberries in Jan 2022. “There’s so much demand,” says Hehr, who estimates that Alberta imports 97 per cent of its strawberries. Since

Located in Acme, Alta. is Sunterra’s recently constructed 20-acre greenhouse facility for strawberries and tomatoes, with plans to expand to 70 acres.

They’ve been able to grow strawberries that are more flavourful and nutritious than imported ones. It helps that their product only takes 24 hours to reach store shelves, rather than seven to ten days after harvest.

imported berries often have less quality and flavour, that leaves more opportunity for local greenhouse strawberry production.

According to Megan Shapka, interim director for the Centre for Applied Research, Innovation & Entrepreneurship at Lethbridge College, the annual demand for strawberries totals 14 million kg in Alberta, and much of the supply is imported from Mexico and California. With their new facilities, Sunterra aims to produce about 200,000 kg of fresh strawberries per year.

“Sunterra Greenhouse has also been exclusively testing a Japanese

variety of strawberry known for its high quality, sweetness and texture,” shares Shapka, whose team has been working with Sunterra to optimize production. Once it’s available for commercial production, the Japanese variety could sell for a premium.

While most strawberry propagation occurs by collecting and rooting the runners from mother plants, the two varieties used by Sunterra were developed for cultivation from seed. As Shapka points out, this practice not only reduces the risk of disease transfer from mother plants, it also allows Sunterra to bring the varieties to Canada more easily than other plant material. “Growing strawberries from seed is a new technology and has not been adopted widely within the industry,” she says.

Sunterra’s greenhouse strawberries are currently sold exclusively through Sunterra Market grocery stores, an Alberta grocery chain and an extension of their corporate brand. “Our first focus, of course, will be to market to Albertans and then widen that distribution area as we bring in more acres,” says Hehr.

So far, they’ve been able to grow strawberries that are more flavourful and nutritious than imported ones. It helps that their product only takes 24 hours to reach store shelves, rather than seven to ten days after harvest. Compared to the average imported field-grown strawberry that is bred for distance, Sunterra’s are focused on sweetness, aroma, colour and speed to market. “We allow the fruit to ripen on the plant to obtain high brix levels,” says Hehr.

Funded by RDAR and the Canadian Agricultural Partnership, the latest collaborative research project between Sunterra and Lethbridge College officially began in Sept 2021 and will conclude in Dec of this year.

According to Megan Shapka, the project encompasses both strawberry and tomato trials and spans two locations: precommercial research studies at the Brooks Research facility where Sunterra has been conducting strawberry trials since 2019, as well as commercial validation at Sunterra’s in Acme, Alta. Research objectives for strawberries include evaluating varietal performance and growing media, optimizing planting densities and LED lighting, as well as controlling powdery mildew.

In Oct. 2020, the government of Alberta transferred management of the Brooks greenhouse to Lethbridge College.

“The Alberta greenhouse industry is the fourth largest in Canada,” shares Shapka. “The industry has experienced bourgeoning growth in recent years thanks to consistently low natural gas prices. This has led to a highly competitive environment as greenhouse growers in Alberta are forced to look for innovative technologies for lighting, computercontrolled climates, growing media, sensing technology and more efficient water and nutrient management systems.”

At the same time, the industry is under increasing pressure to reduce its environmental impact, leading the college to focus its resources on improving water, nutrient and energy efficiency of greenhouse operations.

With files from Lethbridge College

Amanda Hehr [left] says finding skilled labour has been one of their main challenges, particularly for the strawberry crop which requires more workers per acre.

In addition to the benefits to quality brought on by local production, Alberta’s cool, dry climate, large amounts of sunlight and lower natural gas and electricity costs also make it a logical choice for growing the fruit. “We have more sunny days than any other province in Canada,” Hehr says. A total of 333 days in their area, in fact.

“We have such cold winters here that it presents some risk,” she adds. Sunterra currently sustains a full winter crop and year-round production with supplemental LED lighting.

“I think we’re growing very efficiently,” she says. In addition to installing energy-saving LEDs, Sunterra recaptures CO2 from their boilers to feed their plants and recirculates their leachate.

Finding skilled labour in their remote location in Alberta is proving to be an even bigger hurdle. While tomatoes require under two workers per acre, strawberries average four per acre. “In strawberries, we really require skill in terms of crop work and harvest technique, so that’s taken us a while to build those competencies,” Hehr says.

Hoping to hire over 200 employees in the next three years, Hehr says they want to prioritize creating jobs for locals. “Value-add agri-food in this province is really growing and we want to be at the center of that,” she says.

Sunterra Greenhouse’s collaboration with Lethbridge College on research trials for strawberries shows that there’s lots to look forward to in the industry. Whether it’s evaluating plant density, comparing varieties or testing unique strawberries from Japan, research and development is a key priority for the greenhouse. “I think we’re always going to be looking at quality as a priority,” Hehr says. “We’re always searching for unique and high-flavour genetics.”

The search is underway for Greenhouse Canada’s Top 4 Under 40. Nominees must work in the greenhouse, horticulture or related equipment and technology sectors and be 39 years of age or under by Dec 31, 2022

Know someone who brings innovative thinking, hard work and dedication to their craft? Tell us! Nominate a supervisor, staff member or fellow grower to recognize their impact on the farm and on the Canadian greenhouse sector.

LEFT

Three generations of owners stand side-by-side at John Slaman Greenhouses. From left to right: Theo, Stephanie, Brian and John Slaman.

Succession can be a touchy subject for many farm families, but the Slamans have found a way to tackle the process, all while building a brand new greenhouse facility.

Retiring from the family farm isn’t the same as retiring from a company, says Stephanie Slaman. “In our case, there is a family home on the farm. Not to mention eight siblings that need to be considered. What does that look like when the transition occurs?”

Last year, she and her brother Theo become part-owners of John Slaman Greenhouses in Burford, Ont. They share the responsibility with their dad, Brian, who had been the sole proprietor for almost a decade prior. It’s part of a 10year transition process which began three years ago. Brian initiated the conversation with his partner Judi and eight children about his future plans and expectations. “This allowed the family and business considerations to be openly discussed in a transparent way, supporting individual and collective concerns,” says Stephanie. Once Theo and Stephanie received collective support from their siblings on taking active roles in the business’ ownership, the legalities moved forward.

“There’s still a lot of knowledge and guidance that Theo and I will rely heavily on my dad for,” Stephanie says. In fact, their grandfather and founder of the company, John Slaman, still actively visits the site every day. “My grandfather and I have fantastic conversations about all aspects of both our company and the industry,” she says.

Stephanie and Theo are the third generation to manage the cut flower operation. John Slaman built the first 18,000 sq. ft. in 1969 for chrysanthemums, which eventually grew to 63,000 sq. ft. In 1987, his sons, Brian and Mike succeeded the operation and built 37,000 sq. ft before expanding

by an additional 45,000 sq. ft. to accommodate their new crop, lisianthus. In 2012, Brian became the sole owner of the greenhouse operation. His children, Stephanie and Theo would join him as part-owners almost a decade later.

There weren’t many managementtrack opportunities for quite a long time, says Stephanie, who went on to pursue a professional career in economic development in B.C. But even on the other side of the country, she found herself drawn to the local flower auction and sometimes walking into a florist shop just to ask if she could stand inside their cooler. “It smelled so uniquely like home,” she says, reminiscing. “That’s where I figured out that this passion for the agriculture industry... isn’t ever going away.”

Meanwhile, Theo had chosen a career in construction, developing his professional skills in leading residential and commercial projects. Three years later, he returned to the greenhouse, working with the plants and learning the ropes before taking over management of their lisianthus crop in 2017.

When the family’s focus eventually shifted towards their business’ future, Brian, now in his early 60s, knew it was time for a discussion.

A partnership made sense. All three brought complementary skills to the table, forming a formidable team: Stephanie’s experience in administration and governmental relations, Theo’s skills in construction management and aptitude for operations, and Brian’s ability to manage staff, production and customer relations.

“We all talked about the goals of the company, future opportunities, the current needs and our personal aspirations within the company,” says Stephanie. And they were honest about it with each other.

Cut flower grower tackles both succession and expansion head on.

BY GRETA CHIU

Anticipating the new build, the Slaman team made significant retrofits to the older facility over the last few years.

“My partner and I packed up our life, then drove across the country in the dead of winter and in a pandemic,” she says of her trip back to Ontario with her spouse. Realizing that the operation would not be able to support three full-time management positions, Stephanie found full-time employment at the City of Guelph and instead, spends evenings and weekends on greenhouse tasks. “That’s part of the [succession] conversation, too. If my dad is still running the company full-time and my brother is on the ground at the greenhouse every day, how do you look at the succession plan in that context? How are we making space for those strategic conversations …that value [everybody’s] work?”

Theo emphasizes the importance of mutual understanding. “We understand what our different skillsets are, and we’re willing to reach out to each other for help,” he says. That’s been a critical part to their working relationship as they continue the succession process and plan for the future of the operation.

Stephanie agrees. “There were a lot of decisions that we made together, but for those that were made independently, it was important to know we had each others’ backs. It was essential to us that additional management did not complicate the efficient operations and that we all agreed on the strategic direction.”

The world has certainly thrown them a few curveballs, but by supporting each other every step of the way, the dynamic trio took it all in stride. Faced with COVID-induced supply chain issues as well as delays in local, bureaucratic processes, the team broke ground on the new greenhouse last July, then planted their first crop in February of this year. Although they missed some milestones, the team has been pushing for Mother’s Day, which is a key market holiday for both lisianthus and chrysanthemum.

“For the first generation on a farm, everything is new,” says Theo, recalling an article he had read. “It’s the third generation who typically needs to rebuild or create new infrastructure, as well as reach out to new customers as previous ones may be retiring or turning over.”

Anticipating a new build, the Slamans made significant and intentional retrofits to their original, older facility over the last few years. “We want to ensure that there’s no difference in our product lines [whether] it’s being grown in the most recently built zones of our greenhouse to the most historic areas,” says Stephanie. “There are three components that we agreed were driving our business –labour efficiencies, energy and water sustainability, and technology adoption/innovation.”

The original facility also produced its last lisianthus crop this year. It’s now dedicated to two types of chrysanthemum production.

ABOVE

In early 2022, Slaman’s planted their first crop of lisianthus in the new greenhouse.

The first is what Stephanie calls the commercial look, where a single large bloom sits at the very top of the stem. “For this one, we take off all of the little side buds and all of the energy from the plant is directed to the top.”

The second is the spray look where there are multiple blooms per stem. To achieve this, the team pinches off the top to encourage side buds to bloom in sync.

On average, it takes about 10 to 12 weeks to produce each chrysanthemum crop, allowing four to five rotations per year. They push for a bit more crop to meet periods of higher demand, such as Valentine’s Day or Mother’s Day. All in all, they plant and harvest continuously and steadily, year-round. “We may do an additional third [of the crop] and plan a lull behind it,” she says.

In this facility, almost every task is still done by hand, from the steaming of the soil to the harvest and sleeving of their cuts.

Growing different varietals of the same genetics, the team conducts their own selective breeding in-house to pick and choose their preferred attributes. Cuttings taken from the mother plants are stuck by hand, then spend two weeks in the propagation area before being transplanted into growing beds.

Walking through this greenhouse facility is like taking a trip through time. The growing zones become progressively taller, more automated, and differed in structural appearance.

Many retrofits had been done over the years, Theo points out. For one, they used to rely on a manual crank to close the windows, rushing back to the greenhouse whenever it rained. Now, they can control the ventilation through their Argus system and from their mobile phones, all while monitoring the other variables in the greenhouse.

“One of the other recent upgrades was the lighting,” Theo says. Previously, production simply depended on the sun. “There are enough lumens in the sunlight to grow. [The crops] just take longer or … have more variability. In the summer, we would use shade screens [to lower] the intensity of the sun. And in the winter we need to add artificial lighting.”

As the greenhouse acquired more lighting and automation, their electricity needs also rose. Five years ago, they decided to install a combined heat and power generator powered by natural gas which produces electricity for the farm. The waste heat, a byproduct of the process, is used to heat the greenhouse. It took about four years to pay off the investment, and the change reduced their electricity costs by 80 per cent.

There is a huge opportunity for Canadian-made greenhouse solutions in the climate controlled agriculture sector. “Even with the innovation and investment that is happening, we’re still behind European leaders in The Netherlands,” Brian shares. “This has always been the case, but we’re focused on the future opportunities

convert your entire facility from HPS to powerful, efficient LED in record time.

The new 150,000 sq. ft. facility has plenty of real estate left on each side to accommodate future expansions.

for our business and these investments have positioned the company well.”

Located just five minutes away is Slaman’s new 150,000 sq. ft. facility. The space is dedicated to lisianthus production, which takes about 12 to 14 weeks to complete. Although the area is roughly equal in size to their first greenhouse, the new facility was built for expansion and efficiency.

There were a number of key reasons that propelled them towards a new, separate site, despite the 45,000 sq. ft. of available room behind their original facility.

Lisianthus is very susceptible to fusarium, explains Theo. The crop also has a long taproot that pushes deep into the ground, making it imperative to steam sterilize deep into the soil. Unfortunately, the available lot behind the older facility had a tremendous amount of pitrun material underneath, which does not allow them to sterilize deep enough. “We knew we couldn’t expand there with lisianthus.”

Other reasons had to do with the existing infrastructure of their original facility, which would not have been able to sustain much more production. Plus, using up the available lot would have left them landlocked and unable to expand in the future.

“Now we’re on a farm with 150,000 sq. ft. of greenhouse and 40 acres of wide open field,” says Theo. There’s plenty of room to expand on each side, allowing them to add more houses or widen each one. It’s rife with opportunity.

But the biggest difference between the two greenhouses comes down to operational efficiency.

Where the older facility used raised benches that required manual adjustment, the new facility takes advantage of large area automation. The roof is about 30 per cent taller, which allows room for more efficient mechanized systems and contributes to a more stable growing environment. There is also about 30 per cent more lighting output along with sensors throughout, per square foot.

To tackle the issue of fusarium, they’ve installed underground suction lines that pull the steam further into the soil. “That helps to steam deeper, more thoroughly and in less time,” Theo says.

Currently, the new greenhouse is able to produce up to four times more product each week than their original farm.

Looking ahead, Theo says they’ve laid the foundations for a cost-effective expansion in the future, such as the 8,400 sq. ft. cooler and the 350-horsepower boiler. “It may have added roughly 20 per cent to our initial build costs to install additional (or larger) infrastructure,” Theo estimates. However, the costs

weren’t high enough to necessitate an immediate expansion just to recoup the costs, leaving them with some flexibility.

Although the Slamans continue to make upgrades to the older greenhouse, the new facility could also house chrysanthemums one day. “We still have a facility that is competitive right now,” says Theo, “but in 10 or 15 years? It may not be.”

A strong, growing market is what led Slaman’s to double their production space. “Floral consumers are more sophisticated and interested in knowing products are grown locally utilizing sustainable practices,” says Stephanie. “[We are] investing to meet this demand. It aligns with [our] company values of bringing premium quality floral products to market.”

People are starting to recognize lisianthus, but may not yet know it by name. “The consumer is still learning about [it]. We’ve seen it grow very strongly in Europe over the last 10 years,” she adds.

Currently, about 35 to 40 per cent of Slaman’s products go to the Dutch-style floral auctions – Ontario Flower Growers in Mississauga, Ont. and Marché Florale in Montreal, Que. The rest predominantly sell direct to floral wholesalers, distributors and retailers.

“You need to get more product out there for consumers to learn about it,” says Theo, but adds that it’s important not to produce too much. “Flowers are different, especially in Canada.” Recalling previous trips to The Netherlands, he’s seen cut flowers on the tables of fast food restaurants as well as visited cut flower growers with operations 10 times the size of theirs, all growing lisianthus. “In Canada, we don’t have the same cultural floral ties [as the Dutch] so the market is smaller.”

“On the way home, they’re picking up a fresh bouquet for the house,” adds Stephanie. “You’re not just getting it for a special holiday or birthday.” COVID-19 may have changed that for some Canadian consumers. “The wellness benefits of sending a bouquet to a friend or family member to brighten their day has become more apparent in conversations with friends. I know those in the industry are talking about it and looking to realize the opportunity this new consumer awareness brings.”

When asked about expanding to other cut flower crops, Theo says they have no immediate plans to do so, but it all depends on the market.

“We’re good at what we do and we’ve been doing it for a long time,” he says. “We are going to keep doing it until consumer trends change. It’s about what’s best for the crop, our customers and long-term success.”

A comparison across soilless systems – is one better than the other?

BY DR. MOHYUDDIN MIRZA

It was 1980 when I first had to learn about hydroponics, a word that literally means “water works.”

During that time, it became impossible to grow greenhouse vegetables in the soils of Alberta. Root knot nematode affected the production of cucumbers to such an extent that the economic viability of the industry was threatened. There were two commonly used methods to disinfect the soil: steaming and using chemicals like Basamid. Neither of them worked because the nematodes had “learned” to move away around the greenhouse poles or into nooks and corners before moving back to the plants and infecting them all over again.

Our team, located at what was then known as the Alberta Horticultural and Special Crops Research Centre in Brooks, Alta., started

researching different growing media and hydroponics methods to cultivate cucumbers, tomatoes and peppers. Between 1980 to 1984, we tested strawbales, peat pillow bags, sawdust and nutrient film techniques (NFT). We designed nutrient delivery methods, held several open houses for growers to view the trials, as well as prepared how-to manuals and publications. By 1984, almost all vegetable growers had switched to soilless cultivation techniques, and the industry bounced back to an economically viable position.

This was also the time when I became aware of the research work done by Dr. Allen Cooper on the nutrient film technique. A group of tomato growers in southern Alberta invested in NFT set-ups and successfully grew tomato crops. Unfortunately, there were many issues

ABOVE

A tomato crop grown in coir bags must still be well managed in order to produce great yields.

which emerged in NFT-grown tomatoes, such as the need for Pythium control and nutrient management in recirculating solutions. Cucumbers did grow very nicely for 100 days, but would then quit due to the development of massive root systems. The root mats were so thick that they started senescing and affecting the top growth of the plants. Pursuit of an NFT hydroponic system was abandoned.

After experimenting with different media, there was a transition period where commercial growers tried the different options. Many growers in Alberta switched over to rockwool, but coir started coming into the picture in the early 2000s and many started using this as the main growing medium instead. Lately, rockwool has been gaining ground again. Growers will keep on changing their growing media based on cost, ease of handling, disposal and other considerations.

Soilless cultivation by hydroponics is the most commonly used technique world wide. That includes cultivation in sand, peat moss, rice hulls, gravel and other locally available growing media. The use of coir has expanded significantly now. There are also variations of the hydroponic system, such as floating Styrofoam panels with plants, nutrient film techniques, deep flow channels and other similar techniques.

Nutrients are delivered via a drip irrigation through injectors, and leached water is drained to waste or recycled. Note that hydroponics is just another method of production and when it first came out, the benefits were often compared to production in soil. The touted benefits of using hydroponics, like less water use, lower disease pressure, and better quality crop – all should be understood in proper context and with relevant comparisons. I recall how growers in Alberta took four years to successfully switch over from soil to

in a model aquaponics system with 15 tilapia. In this system, the fish were reared directly in the tank and the water was oxygenated.

ABOVE

An A-frame set-up of an aeroponics system used to produce greenhouse lettuce. The nozzles actively fertigate the crop.

hydroponic systems, and only after they had gained a thorough understanding of nutrient delivery and crop management from open house demonstrations and technical manuals.

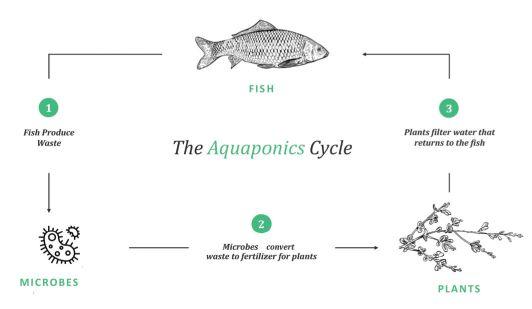

I had the pleasure of working with Dr. Nick Savidov when he was researching aquaponics systems at the Crop Diversification Centre South in Brooks, Alta. and thus learned about growing fish and plants together.

tanks, and the waste they produce is biofiltered and run through the root zone of the plants. The plants absorb the nutrients they need, the water is returned to the fish tank, and this cycle continues.

This system can keep recirculating such that very little additional nutrients are needed. One may have to add a few nutrients based on the crop’s needs and performance. Fish feed is regularly added as well.

Research shows that, once the microbial population within the aquaponics system has fully developed to change fish waste into plant food, this method can substantially increase crop productivity. Greater crop productivity combined with the additional revenue from fish sales can improve the economics of greenhouse investments in colder climates as well as the financial resilience of greenhouse operators. However, many growers do not want the added burden of marketing fish.

It is my observation that the nutrients involved in aquaponics are far lower than what we supply in hydroponics systems. Because of this, plants have to produce massive root systems to absorb smaller amounts of these nutrients.

Under the Safe Food for Canadians Regulations, aquaponically cultivated products can now be legally labelled as organic if they are certified by an approved certifying body in accordance with the organic aquaculture standard. According to the CFIA, producers are encouraged to provide voluntary information about which standard the product was certified under.

Simply stated, this system incorporates fish reared in water

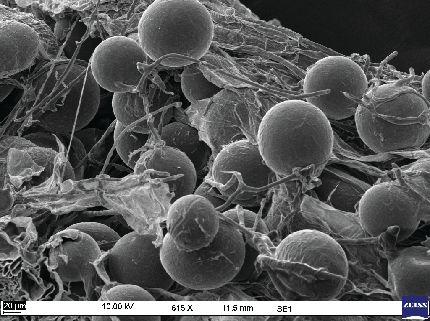

Aeroponics is a type of hydroponic system where water with dissolved nutrients is sprayed at the base of the plants. Proponents claim that the benefit lies in the availability of oxygen right at the root level. The picture shown above is of an A-frame set-up. One can see a massive plumbing system of nozzles used to fertigate the crop. Here, the aeroponically produced lettuce was comparable in yield and quality to those produced in a floating hydroponic system.

Here, I have given a historical perspective on the development of hydroponic systems in Alberta. The primary reason behind this change was that production in soil became impossible due to disease pressure. Soilless cultivation provided producers with an alternative at the time. Even in other parts of the world, one can see where the use of hydroponic systems have allowed for cultivation where it is not possible to do so in soil.

The bottom line is that hydroponic systems have developed bench mark yield data and any new systems now have to achieve comparable or higher yields. On an annual basis for example, regular Long English cucumbers yield over 200 pieces/m2, mini cucumbers yield over 70 kg/m2, tomatoes over 60 kg/m2, and peppers over 30 kg/m2. For leafy vegetables like lettuce, the bench mark yields are around 50 kg/m2 per year.

In the end, be sure to choose a system that best suits your needs, draws from the expertise available to manage the production system, as well as satisfies the market’s demands. There has been a growing focus on sustainability, zero carbon foot print and, of course, cost and benefits.

Mohyuddin Mirza, PhD, is an industry consultant in Alberta. He can be reached at drmirzaconsultants@gmail.com

Lavender

Essai

Prides Corner Farms Lebanon, CT

BY VICTORIA RODRIGUEZ MORRISON, DAVE LLEWELLYN AND DR. YOUBIN ZHENG

Light” is conventionally defined as electromagnetic radiation that is visible to humans, ranging from 380 to 750 nm. Plants, however, can detect a wider range of radiation between wavelengths of 280 to 800 nm. Within this range is the photosynthetically active radiation waveband (PAR) which runs from 400 to 700 nm.

Relative to PAR, ultraviolet (UV) radiation has shorter wavelengths and is divided into three sub-ranges: UVA (315 to 400 nm), UVB (280 to 315 nm), and UVC (100 to 280 nm). Only UVA and UVB are present in sunlight and at photon flux ratios of about UVB(1):UVA(100):PAR(2000). Even though the quantity of UVB in sunlight is low compared to PAR, its higherenergy photons are disproportionately effective in evoking plant responses.

Comparable to how human skin produces melanin with sun exposure resulting in a suntan, it has been theorized that UV radiation can induce increases in tetrahydrocannabinol (THC) in cannabis flowers, where it may act as a UV-absorbing sunscreen. Several older studies are frequently cited to support this theory however, their cultivars had THC concentrations approximately ten times lower than those of modern drug-type cultivars used, both medicinally and recreationally. Our lab sought to answer the question of whether this promising THC-enhancement technique could work in modern, indoor cannabis production systems.

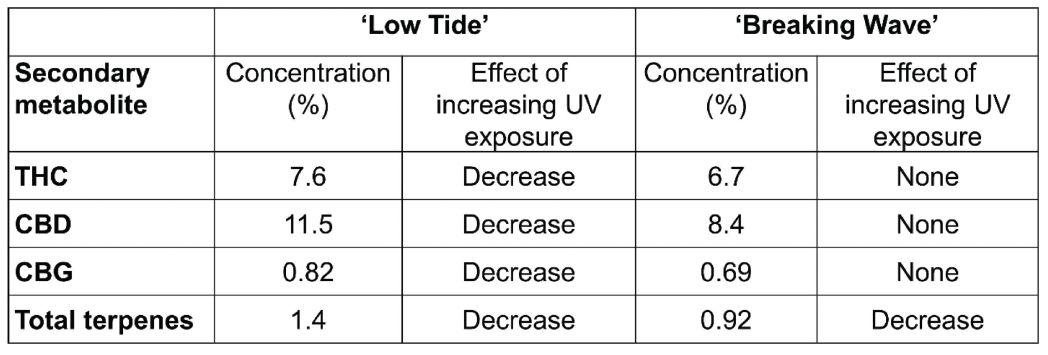

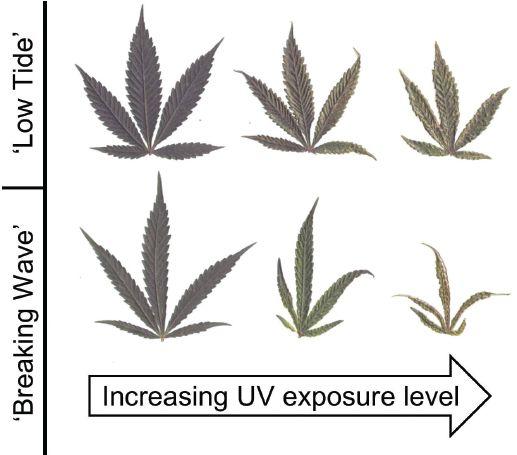

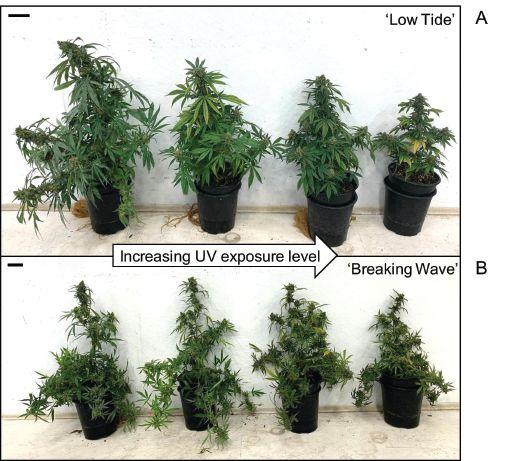

Our experiment exposed two modern cannabis cultivars, ‘Low Tide’ and ‘Breaking Wave,’ to uniform PAR (400 μmol∙m-2∙s-1) over a 12-hour photoperiod and UVB photon flux densities ranging from 0.01 to 0.8 μmol∙m-2∙s-1 (from LEDs with a peak wavelength of 287 nm) for the last 3.5 hours of the daily PAR photoperiod over the entire 60-day flowering cycle.

We found that there were no commercially beneficial effects from any level of UVB radiation (at least, when supplied as described above) on cannabis morphology, yield, and secondary metabolite composition. In fact, the results were counterproductive.

The UV treatments induced older leaves to curl and many to die, while newer leaves became undersized and misshapen (Fig. 1) and had reduced photosynthetic capacity. Increasing UV also reduced both vegetative and generative biomass (i.e., yield) in both cultivars (Figs 2 & 3).

Apical buds located closest to the UV source exhibited the greatest reductions in size and appearance. These buds are often considered the highest quality tissues due to their larger size and (potentially) higher cannabinoid concentrations compared to other flowers on the plant. As a result, the negative impact of increasing UV exposure on the value of the crop was disproportionately high.

ABOVE

Table 1. Increasing UV exposure resulted in reduced cannabinoid concentrations (calculated as a percentage by weight of the dry flower) in ‘Low Tide’ but had no effects in ‘Breaking Wave’, whereas total terpene potency was reduced in both cultivars.

ABOVE

Figure 1. Leaves that developed under increasing UV exposure were smaller and misshapen. Reductions in leaf area limit the capacity for light capture and the plants’ ability to convert PAR into biomass.

There was no commercially beneficial impact on secondary metabolite concentrations (Table 1). Compounds measured included THC, cannabidiol (CBD), their precursor cannabigerol (CBG), as well as other terpenes.

Similar to how excessive UV exposure accelerates skin aging, we noticed that symptoms of plant tissue deterioration, such as leaf senescence, accelerated with increasing UV exposure. Further, while stigma browning is often used by cannabis cultivators to determine inflorescence maturity level, this was not possible in our trials because premature stigma colouration

ABOVE

Figure 3. Apical buds (closest to the UV source) exhibited the largest reductions in size and appearance. (The scale bar in the upper left corner of each image represents 2 cm).

ABOVE

Figure 2. Both cultivars exhibited trends of decreasing vegetative and inflorescence biomass with increasing UV exposure level. (The scale bar in the upper left corner of each image represents 5 cm).

was prevalent under higher UV exposure levels.

Overall, there were dosage-dependent, UV-induced depreciations in cannabis plant health. Further, there was no level of UV exposure (as supplied in this study) that enhanced inflorescence yield or the composition of secondary metabolites measured. Therefore, the results of this experiment do not support the theory that UV can be used as a production tool to increase floral THC concentrations in modern cannabis cultivars.

However, before completely invalidating UV’s potential for increasing cannabinoid potency in cannabis, further research must be done to investigate alternate methods of UV application. The present study used short-wavelength UV radiation, composed primarily of highly energetic wavelengths that are largely absent in the solar spectrum. Further, UV exposures occurred daily during the entire 60-day flowering stage. It is still possible that longer wavelengths and/or shorter exposure periods may have beneficial effects. For example, exposing plants to UV after the cessation of vegetative development (normally about 5 weeks after switching to the 12-h photoperiod) could potentially mitigate leaf malformations that impede yield accumulation.

This article is the first of a two-part series that summarizes the results of experiments that were conducted as part of Victoria’s M.Sc. study at the University of Guelph, School of Environmental Sciences. More detailed results of this study have been published in the open-source scientific journal Frontiers in Plant Science. This manuscript is available to anyone using the following weblink: https://doi.org/10.3389/fpls.2021.725078

Victoria Rodriguez Morrison is a plant performance researcher at Canopy Growth and a former graduate student at the University of Guelph. Dave Llewellyn is a research associate, and Youbin Zheng, PhD, is a professor at the University of Guelph.

Indoor farming technology opens doors to cultivating plant protein, livestock feed, medicine and more.

BY TREENA HEIN

The possibilities offered by controlled environment agriculture (CEA) are many.

With the promise of high quality, high yields, and high efficiency, other non-traditional applications are looking towards this technology. When optimized, the precise environmental control and automation offered could help address issues driven by sustainability and human health.

Continuously pushing the envelope, here are a few new and unique Canadian businesses using CEA technology to do more. They run the gambit from plant-based protein and livestock feed to human health products.

PONTUS PROTEIN

Pontus is a Vancouver-based company about to begin production of a highly nutritious crop called

ABOVE

water lentils in an organic, aquaponics setting.

Water lentils, commonly known as duckweed, are tiny plants found in nature which typically float atop of bodies of fresh water. They grow extremely quickly and contain 42 per cent protein along with Omega-3 fatty acids, antioxidants, calcium, iron, fibre, carbohydrates, and an array of micronutrients.

The company plans to automatically harvest, dry and grind the lentils into the firm’s flagship product, Pontus Protein Powder, which has an astonishing 11g of protein in every 25g of product.

Beginning in spring 2022, the company plans to produce five species of water lentils at their first 20,570 ft2 facility and on-site food science lab in Surrey B.C. Annual production of the protein powder is estimated to reach 9.6 tonnes.

As with any aquaponics system, fish waste

Based in B.C., Pontus Protein is harnessing aquaponics technology to produce two protein-rich products: water lentils and rainbow trout.

ABOVE

In aquaponics systems, microbes convert the fish waste into fertilizer which is used by the plants.

will be metabolized by aerobic bacteria in the water into base nutrients which are then used to fertilize the plants.

The accompanying rainbow trout will also be sold and is projected to reach 10.5 tonnes per year.

Pontus plans to operate the two production systems separately for lentils and trout using its proprietary closed-loop growing system known as CEVAS (Closed Environmental Vertical Aquaponics System). The system is said to feature state-of-the-art analytics, machine learning and artificial intelligence to optimize the growth of the water lentils. 95 per cent of the water is re-

Employers are responsible for the safety of their workers. Educate new and young workers to identify hazards and minimize risks.

Contact@AgSafeBC | 1-877-533-1789 | AgSafeBC.ca

ABOVE

Pontus Protein’s first facility measures over 20,000 sq. ft. and includes an on-site food science lab.

circulated, and CO2 is captured and reused.

Water lentils are ready for harvest every 24 hours within the CEVAS system. Because there was no known technology available for harvesting the crop, Pontus developed the Harvesting Automated Robotic Vehicle (HARV) in partnership with Calgary-based Automation Experts.

This ‘vertical rack’ robotic system enables a robot to operate along a system of vertical and horizontal rails to complete automated tasks. These rail systems, like ones found in large warehouses all over the world, maintain the health of the crop and harvests daily, minimizing chances of contamination, as well as enabling highly efficient production.

“HARV moves between our stacked beds, detecting mature lentils ready for harvest and harvesting them into a strainer basket,” explains Pontus Protein’s chief technology officer, Steve McArthur. “When it detects that its basket is full, HARV goes down and empties it. Its low profile allows for nine levels of vertical farming in our current facility, but the level number could be increased in future facilities. We developed HARV to fit our vertical farming system, which goes against the traditional way of trying to design vertical farming beds to enable some type of efficient harvest.”

The company’s protein product will first be marketed to consumers as an ingredient for smoothies, cooking, and baking, as well as to other companies as a nutraceutical food ingredient with potential health benefits and disease prevention properties. In the future, powdered and/or raw water lentils will be used in the company’s own beverages and protein bars.

For now, the potential market for trout consists of high-end restaurants, but processing into canned product could be a possibility in the future.

In late 2021, Pontus entered into a consulting agreement with Sting Organics, a B.C.-based company planning to farm stinging nettles, another highly nutritious crop with nutraceutical properties. Pontus will conduct feasibility tests on the production of the crop in its bio-secure, aquaponic and automated vertical farm system. The project also includes food product development and planning for market launch.

HydroGreen is a unique, fully automated indoor growing system where wheat or barley seed is continually sprouted and harvested every six days to produce nutritious livestock feed. The division

HydroGreen systems offer automated seeding, watering and harvesting of livestock feed, stacked vertically.

is based in South Dakota and owned by CubicFarm Systems of Langley, B.C.