Thrillers, fillers and spillers

GRAEME MURPHY

GRETA CHIU

GRAEME MURPHY

GRETA CHIU

Prior to working on this May issue, I didn’t realize just how big the cut flower industry was in Canada.

According to Statistics Canada, $1.1 billion worth of greenhouse ornamentals were produced in Canada in 2016, and cut flowers were responsible for 30% of it. Not a small slice of the pie.

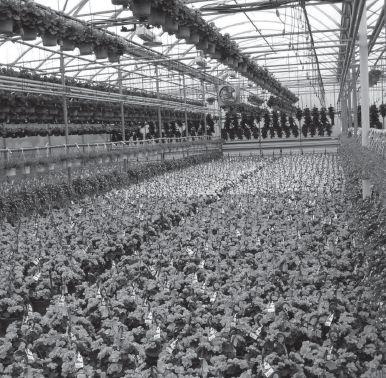

It’s one thing to look at numbers, but quite another to experience it. Visiting Rosa Flora’s open house a few weeks back, I witnessed what seemed like neverending rows of fresh gerbera, snapdragons, lisianthus and gerpoms – all standing perfectly, waiting for their moment at harvest.

Tabulating the results of the Grower Survey (p.g. 12), labour and energy were identified as key challenges for growers. But things really hit home after seeing Rosa Flora’s staff on the production floor and speaking with head grower Jay VanderHoeven.

Back in 2006, Rosa Flora installed a wind turbine that could generate up to 615 kW of electricity per hour, capable of providing electricity for

ornamental industry. Cut flowers will be hit hardest (pg. 16), but the authors also note the incredible adaptability and resilience that growers have shown. Just look the percentage of greenhouse operations currently using biocontrols (pg. 12). Ones that have yet to adopt biocontrols are in the minority.

Shipping year-round, many growers have cut-flower growing down to an art. But relatively new pests like echinothrips can still emerge, presenting new challenges. Luckily, there are some great biocontrol options available, such as ones discussed for cut gerbera, a crop that is revered by pests and biocontrols alike (pg. 32).

For both greenhouse floriculture and vegetable growers, investing in new equipment continues into 2018. How can we afford not to? With wage hikes and slimmer margins, paying for overtime is something most can’t afford. This is where automation comes in.

“Growing in Canadian climates can be hard on growers’ wallets.”

250 homes. But that same turbine powers just a tenth of their two million square-foot greenhouse facility. Growing in Canadian climates can be hard on growers’ wallets. And things aren’t about to get easier. With minimum wage hikes in multiple provinces and policy changes that seem to forget the hard work and long hours needed to make greenhouse horticulture thrive, one can’t help but feel that the industry is not well understood by the public, which in turn influences policy.

As you’ll also see in this issue, the PMRA is proposing changes to pesticide use patterns for the

Seeing food recalls from Health Canada almost every day, I thought it fitting to highlight new technology designed to improve food safety and traceability. Automated stickering of fresh produce (pg. 11) and blockchain technology (pg. 10) could help deter food-borne illnesses and facilitate fast recalls on unsafe products. Greenhouses and indoor farming facilities are ideal places for sensors, not just to track growing conditions, but to also allow feedback control of inputs such as supplemental lighting, helping to save on energy costs (pg. 20).

Whether we’re growing flowers or vegetables, we all come across similar challenges. It’s what we do in the face of them that matters.

GREENHOUSE CANADA is the only national business magazine published exclusively for the commercial greenhouse grower in Canada. May 2018 - Volume 38, No. 4 Editor GRETA CHIU, MSc. P.Ag gchiu@annexbusinessmedia.com 416.510.5163

National Advertising Manager NASHELLE BARSKY nbarsky@annexweb.com 905.431.8892

National Advertising Manager SARAH OTTO sotto@annexbusinessmedia.com 888.599.2228 ext 237

Account Coordinator MARY BURNIE mburnie@annexweb.com 519.429.5175 888.599.2228 ext. 234

Circulation Manager BARBARA ADELT badelt@annexbusinessmedia.com Media Designer BROOKE SHAW Group Publisher MARTIN MCANULTY mmcanulty@annexbusinessmedia.com COO TED MARKLE tmarkle@annexbusinessmedia.com

President & CEO MIKE FREDERICKS

Publication Mail Agreement #40065710 Printed in Canada ISSN 0712-4996

CIRCULATION email: blao@annexbusinessmedia.com Tel: 416-442-5600 ext 3552 Fax: 416-510-6875 (main) 416-442-2191

NatureFresh™ Farms has announced a new 32-acre greenhouse facility in Leamington, Ontario.

The new facility will include supplemental lighting using high-pressure sodium (HPS) lamps, similar to ones currently used in their Ohio facility, allowing them to grow tomatoes year-round.

“The first full growing season in our Ohio greenhouse has been very successful so far, so with the same technology that we use in Ohio being

implemented in our new Leamington greenhouse, we expect similar success,” says Matt Quiring, Executive Retail Sales Accounts Manager at NatureFresh Farms. “We should see higher production, greater efficiency in the growing process, and consistently high-quality products from our new Canadian greenhouse.”

A number of different varieties will be grown. Construction on the new facility will start this year, with production scheduled to begin in 2019.

The 23rd annual Grower Day is set for June 20th in Ontario. This year’s topic: the roots of successful propagation.

Using LEDs for propagation – Dr. Youbin Zheng (University of Guelph) provides guidance based on recent research results.

Dips for thrips –Dr. Rose Buitenhuis (Vineland Research and Innovation Centre) presents the latest research on options for

dips and best practices. Treating water for re-use – Dr. Jeanine West (Flowers Canada (Ontario) Inc.) looks at customizable, low maintenance and costeffective options.

Sanitation from the start – Amanda Tracey (OMAFRA) talks about gaining the upper hand on pests and diseases with proper sanitation technique.

Propagating for quality – Dr. Will Healy (Ball Horticultural

Company) shares tips on propagation conditions, PGR use and other techniques.

Beneficial microbes – Dr. Ishtiaq Rao (Crop Defenders) elaborates on the benefits of beneficial microbes for targeting prop house problems.

What’s next for automation – Pieter Kwakernaak (Hoogendoorn) and Jack Ford (AgriNomix) talk automation for climate control and the propagation process.

$74 million in cut flowers and flower buds were exported to the U.S. in 2017 (Statistics Canada)

6.9 MILLION

dozen cut roses and rose buds were imported from Columbia in 2017 (Statistics Canada)

The right set-up for cannabis – Bill MacDonald (Niagara College) walks us through the ideal set-up for cannabis. Co-hosted by our sister publication, Grow Opportunity

New for 2018: Top 10 Under 40 awards will be presented at Grower Day. Nominate a young leader and register at greenhousecanada.com/ grower-day.

306 MILLION CUT FLOWERS WERE PRODUCED BY CANADIAN GREENHOUSES IN 2016. FARM GATE VALUE WAS $140 M (Statistics Canada)

Selective granular herbicide for container grown ornamentals

Specticle G offers pre-emergent weed control in container-grown ornamentals, trees, and shrubs.

Luna Privilege Greenhouse contains fluopyram, a novel active ingredient in the SDHI class of chemistry that controls the following:

• Powdery Mildew and Botrytis in greenhouse cucumbers, tomatoes and peppers

• Early Blight in greenhouse tomato

• Botrytis in greenhouse lettuce

For more information, check out www.BayerES.ca/LunaPrivilege

This new selective herbicide offers season long control of important broadleaf weeds and grasses.

• Now registered in Canada

• Controls over 49 weeds including hard-to-controlweeds such as: Bittercress, Groundsel, crabgrass, and annual bluegrass

• Season long control

• Easy to apply granular

• Low use rate with excellent plant tolerance

For more information, check out www.BayerES.ca/Specticle

The foliage of Jelitto’s Heliopsis ‘Bleeding Hearts’ emerges almost entirely black before settling down to a dark purple. Excellent for cut flowers, the orange-red blooms contrast magnificently with the dark stems and leaves. ‘Bleeding Hearts’ is the first Heliopsis without a hint of yellow. Flowers start out scarlet before maturing to a bright orange-red, and then to lingering washed tones of bronze. jelitto.com

With oversized, truly double flowers, growerfriendly production, indoor/outdoor appeal and marketing support, I’Conia Portofino Yellow might just be one of the best yellow hybrid begonias available.

From Dümmen Orange, I’Conia features vibrant flowers, clean foliage, strong branching, excellent flower power, shade/ part-sun tolerance and unbeatable consumer preference. dummenorange.com

Phlox Gisele

Bred for reliable rooting, heat tolerance and large, attractive flower clusters, Gisele Phlox from Selecta One is a top performer across all areas. It has been trialed all over North America and has proven to perform in gardens – continuously producing colourful blooms. 25-30 cm tall x 36-46 cm wide. selectanorthamerica.com

This series of pansies from Syngenta offers reliable and programmable production with near day-neutral flowering. Efficient to produce with reliably fast crop times, Delta Speedy offers a tight bloom window even under short day conditions, delivering colour when you need it most. 10-15 cm tall x 15-20 cm wide. syngentaflowers-us.com

This Supertunia Charm Petunia from Proven Winners becomes completely covered in lavender pink flowers with a purple eye and veining from spring into fall without deadheading. This series is extremely well-branched and mounded, delivering a spectacular performance in upright containers, hanging baskets and in-ground plantings, where they make a good substitute for Calibrachoa. They thrive in heat and humidity, delivering a stellar season-long performance

from north to south. 15-30 cm tall x 46-61 cm spread. Part sun to sun. provenwinners.com

The excellent branching of Ball FloraPlant’s Lucky Red means less pinching and fewer PGRs used during production. Lucky stands up to heat, drought and other stressful conditions in

This series of snapdragons from Syngenta offers highly programmable production with reduced photoperiod sensitivity for consistent crop timing across all seasons. It’s bred for highdensity production in packs and small pots with a reliable, tight flowering window for bench run finish. Strong central leader combined with sturdy branching creates an easy-to-ship plant and a classic look at retail. 15-20 cm tall x 15-20 cm wide. syngentaflowers-us.com

the garden. The series works well in small pots, baskets and mixed combos attracting butterflies and other pollinators to its vibrant blooms. 30-41 cm tall x 30-36 cm wide. ballfloraplant.com

From seed to table, higher quality with better

A better-quality product for the consumer. An integrated, innovative greenhouse solution for you. That’s what Syngenta provides through quality genetics and new variety innovations. Your customers, and their dinner tables, deserve nothing less than the very best.

To learn more about varieties from Syngenta, contact Plant Products at 519-326-9037 or info@plantproducts.com

TIM HAMMERICH | FutureofAg.com

Last December, Long Island Iced Tea Corporation announced that they were looking into how they might utilize blockchain in their business practices. As part of this announcement, they changed their name to “Long Blockchain Corp”. Shares of the company rose 200 per cent following this news.

Clearly, the true value of the business did not go up 200 per cent by changing their name and “looking into” blockchain technology. Unfortunately, events like these have led many to believe the idea of blockchain is over-hyped.

Blockchain is the technology behind bitcoin and other cryptocurrencies. It uses cryptography to allow data to be stored on a distributed “ledger” of assets and transactions. It’s kept in multiple places, keeping data distributed throughout a network rather than in one central location to prevent hacking. It’s encrypted and cannot be tampered with. People known as “miners” compete to validate the transaction by solving a complex “math” problem incentivized by a token or cryptocurrency. Only verified transactions are recorded on the ledger.

This shared ledger works not just for currency transactions, but for all assets and transactions from the crop being grown to the final product being purchased at the grocery store. A record of agricultural products, data, and transactions can be shared across platforms in a way that could smooth out inefficiencies in supply chains, protect the integrity of the products, and offer more value to the consumer. It’s the universal source of truth that everyone in the supply chain can trust.

In practice, it might look like this:

Better feedback loops. Through a supply chain recorded on the blockchain, consumers get information on how their products were grown (location, growing practices, etc.) through network-connected sensors and devices known as IoT (internet of things). This speaks directly to the consumer’s growing desire for transparency. Those consumers can then provide feedback based on their more subjective preferences like taste, texture and freshness. This creates a feedback loop between grower and consumer that could before only be captured in a hyper-local transaction on a small scale. One cool startup doing interesting work in this space is ripe.io.

Greater accountability. Who is accountable

for product that does not meet standards in terms of quality, safety, and other specifications? There is not always a clear answer. When there are just two parties involved (a buyer and a seller), then it’s fairly straight forward. But what happens once you add in brokers, packers, shippers, warehousers, customs agents, third-party logistics providers, processors and others? The more participants in the mix, the more complicated the issue of accountability becomes. However, if all transactions are recorded on the blockchain, accountability can be tracked and the right parties held responsible. Walmart has been a leader in piloting blockchain technology to establish transparency, safety and ultimately accountability among their vendors.

Decreased transaction costs. One interesting application of blockchain technology is ‘smart contracts’. These are basically “if this then that” statements – clauses that are automatically carried out once certain conditions are met. One example could be, as soon as delivery of a product is verified, then everyone in the supply chain gets paid instantly. This is possible without blockchain, but very difficult to get all participants to put their complete faith in the agreement. With smart contracts, everyone can verify that the funds are available and that the terms of the contract are set so they will get paid for certain when delivery is received. This is just one example of the numerous applications for smart contracts in supply chains. AgriDigital has already commercialized a similar application that is being used in the Australian grain supply chains.

Similar to the early days of the internet, it’s still difficult to predict exactly how this technology will change the way we do business in the future. This technology will most likely operate in the background through network-connected devices, gathering data on all aspects of the growing and shipping process and storing it on the blockchain.

What we do know, is that these are all real problems that could be solved using blockchain technology, and these applications are likely to be around long after the hype has subsided.

Tim Hammerich is the host of the “Future of Agriculture” weekly podcast. He recently completed a 10-episode series on blockchain in agriculture. Learn more at www.FutureOfAg.com or through your preferred podcast distributor.

Paper

Product traceability is critical for food processors, and an Essex County company specializing in agricultural automation has been helping them sustainably improve for 27 years.

“Automation was almost non-existent in agriculture 30 years ago, but there was obviously a need for it,” says Joe Sleiman, founder and president of Ag-Tronic Control Systems, an automation

ABOVE

Automated labelling system and biodegradable paper stickers make this product both costsaving and more sustainable than plastic stickers.

technology company based near Windsor, Ontario.

“We started by looking at ways to help local produce growers improve efficiency, and do so in a more sustainable way. Now we have clients throughout Canada, the United States, and Mexico, and we’re in the process of expanding to South America, Europe and Australia,” he says.

Together with his wife Samia, Sleiman started Ag-Tronic Control Systems in 1991 to market and improve his own automation equipment. At the time, that included a height control system for tomato harvesters, tractor guidance equipment, and a plant watering system.

With these accomplishments, Sleiman was asked by local greenhouse growers to design a better cucumber grading system, and improve a labelling system for tray-packed tomatoes.

The market success of those tomatoes, though, created a new challenge: the mislabelling of produce once tomatoes were removed and repackaged. This caused losses at the retail level, prompting the same

growers to request a labelling system that could apply stickers directly to the tomato body instead of the packing box.

With the success of his new direct-label system, Sleiman created a sub-company called Accu-Label Inc. in 2001.

Under the Accu-Label brand, he developed both an automated label machine and biodegradable, paper stickers. Combined with a recyclable liner –the parchment on which the stickers sit – he started marketing his product as both cost-saving and more sustainable than those using plastic stickers.

“Our goal was to provide better performance with more sustainably,” he says. “Plastic stickers are already used, but no one wants to eat that. People also hate that they can’t be recycled.”

A number of additional technologies were also created, including a handheld unit for smaller packers, and a larger portable machine that lets food retailers put their own brand onto a product wherever and whenever they require.

A more user-friendly labelling machine was unveiled in 2008 that negated potential problems associated with the labeller’s liner removal system.

“We developed a system to print labels on-the-go, including bar and trace codes,” says Sleiman. “That means marketers can get both traceability and their own brand right on the produce in a safe, efficient way.”

More recently, Sleiman launched a camera attachment that automatically monitors labels after printing. This, he says, helps ensure each sticker is printed properly, and further improves product traceability.

“We’re providing this for free to everyone who has our Print & Apply™ brand label machines,” he says. “It’s part of our commitment to ensure our customers continue to have the latest and best fruit labelling technology.”

This feature was supplied by AgInnovation Ontario, an online publication of the Agri-Technology Commercialization Centre (ATCC). Its goal is to tell the story of agricultural innovation in Ontario. The ATCC, founded in 2008, is the centre in the Canadian agricultural sector that houses organizations dedicated to new company formation, market development, expansion of existing businesses, and attraction and retention of larger firms, making it easy for companies of all sizes to access resources and support. Learn more at www.agritechcentre.ca.

Sales and profit margins rose for most growers in 2017. Energy and labour are poised to take top spots once again as the most costly inputs for 2018.

BY GRETA CHIU

Comparing across last year’s survey results, 2017 may not have been as profitable, but a good year like 2016 can be hard to follow –especially with big changes afoot.

Who filled out the survey?

A fairly even mixture of growers in wholesale (35%), retail (24%) and vegetable (32%). Most responses came from Ontario (50%), followed by Alberta (13.8%) and British Columbia (12.1%).

Most operations continue to be under 50,000 sq. ft. (40%). But where the 2017 survey found an almost even distribution of operations from 50,000 to over one million sq. ft., this year’s responses saw a shift towards smaller operations under 350,000 sq. ft.

What’s being grown?

Top five for floriculture:

1. Ornamental bedding plants (52.7%)

2. Flowering potted plants (52.7%)

3. Perennials (43.2%)

4. Plugs and propagation material (30.0%)

5. Tropicals (25.0%)

Top five for vegetables:

1. Tomatoes (72.5%)

2. Peppers (70.0%)

3. Cucumbers (67.5%)

4. Herbs (67.5%)

5. Leafy greens (52.5%).

Notable mention: strawberries (37.5%)

Where’s it all going?

The majority are meant for:

• Wholesalers/distributors (39.7%)

• Farmers markets (37.9%)

• Supermarkets/grocery stores (31.0%)

• Own retail shops (31.0%)

Merchandisers/box stores and independent garden centres were at 22.4% each.

How were sales in 2017?

72% reached sales volumes of over $50,000. Compared to 2016, sales rose for 49% of surveyed growers by less than five per cent (21%), five to 10 per cent (14%) or more than 10 per cent (14%).

How does this compare when you factor in operating costs and inputs? 76% of growers made a profit, with 64% rounding out the year at a five per cent margin or higher.

Insect/disease pressure.

We looked at changes in insect and disease pressure, divided by season:

• Early (January to March)

• Spring (April to June)

• Summer (July to September)

• Fall (October to December)

More than half experienced no changes in insect pest pressure (51 to 63%) across the board, and some noted it was better than 2016 (23 to 38%).

Similarly for disease pressure, the majority saw no changes across the four seasons (53 to 64%). The rest were almost equally split between “better” or “worse” than 2016.

Trying something new.

About 21% use hydroponics, 17% use LED lighting and 14% hold organic certifications. Biocontrols continue to be popular, as 32% of surveyed growers increased their use in 2017 and 42% opted to stay at their 2016 use levels.

Which input costs rose the most in 2017?

With changes in labour laws and rise in minimum wages, labour came in first place with 37.5% of the votes. Heating was the runner-up at 25%.

But regardless of costs, helping hands

are always needed in the greenhouse. 50% of respondents expect the size of their labour force to remain the same for 2018, with 38% expecting to employ more. Only 24% hire off-shore workers –domestic labour was still in demand.

Looking ahead to 2018.

Unsurprisingly, there are no plans to reduce prices. Growers are either looking to maintain prices (25%), increase prices by less than five per cent (43%), or raise them by more than five per cent (32%).

Forecasts for sales volumes are somewhat positive, with only 7% of surveyed growers predicting lower sales in 2018. 54% look forward to higher sales volumes and 39% expect no change.

Plans to expand or invest in 2018?

Similar to previous years, the vast majority have no plans to expand their operations (72%). A few are looking to increase their operational area by less than 10,000 sq. ft. (19.3%).

Investing in new equipment is a different story, however. 73.7% are looking to spend anywhere from less than $1,000 to over $100,000 in 2018.

Top business threats in the next three to five years?

The biggest named threat by far was taxes/regulations (63.2%), which included permits, property and wage increases. Energy costs came in close second (59.6%), with labour shortages (including lack of skilled labour) and markets/prices tied for third (47.4%).

Thank you to all growers who completed the survey. Your help is very much appreciated.

Less than $50,000

31.6%

37.5% LABOUR

71.9%

63.2%

Changes to commonly used chemical products are poised to hit the cut flower industry hard.

BY CARY GATES AND DR. SARAH JANDRICIC

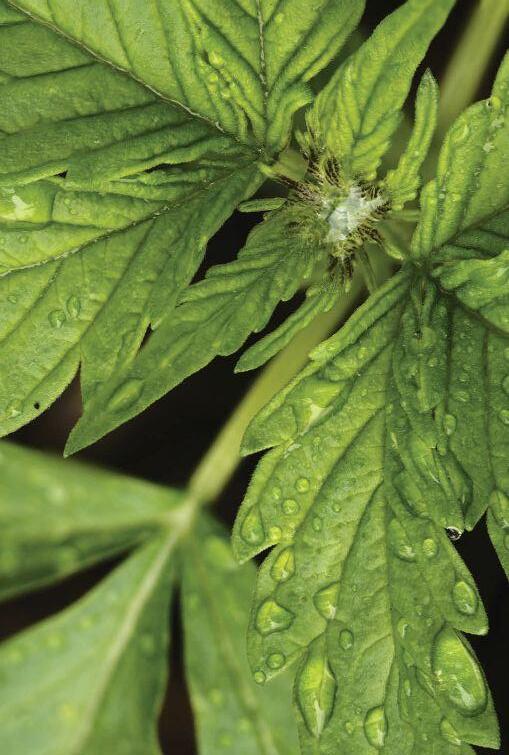

It seems there is never a dull moment in the greenhouse ornamental industry. From transitions to new crops, new export requirements to novel pest problems (I’m talking about YOU, mealybug!) the industry has seen a lot of change lately. And it’s not over yet.

Also on the horizon are significant changes to some commonly used chemical products. These include transformations to use patterns and outright de-registrations. Unfortunately, many of these changes are poised to hit the cut flower industry particularly hard.

The re-evaluation process: The Pest Management Regulatory Agency (PMRA),

ABOVE

the branch of Health Canada that regulates pesticides, is mandated to review registrations periodically – typically every 15 years. Their primary goal is to ensure that registered pesticides remain safe for the public and the environment.

The PMRA is also reviewing many pesticides registered before 1995 with greater focus on human and environmental safety. Additionally, Health Canada is conducting special reviews on products where unique concerns have been identified. Neonicotinoids (due to concerns relating to pollinators and watershed habitats) are a good example of this, but are not the only

Potential pesticide de-registrations could mean increased costs per bloom or significant crop losses for growers. Hand harvesting of flowers increases worker exposure to chemical residues, and weighs heavily in PMRA’s registration decisions.

FUNGICIDESPESTICIDE

Aliette (fosetyl-Al)(P07-33) Phosphonates

Systemic control of Pythium

Captan (captan) (M4) Multi-site contact activity Damping-off diseases

Daconil (chlorothalonil) (M5) Multi-site contact activity

Cancellation of outdoor cut flower and bulb dip uses

Botrytis, leaf spotsCancellation

Folpan (folpet) (M4) Multi-site contact activity Multiple diseasesCancellation

Rovral (iprodione)(2) Dicarboxamides

Botrytis,Rhizoctonia Cancellation

DDVP (dichlorvos)(1B) OrganophosphatesWestern flower thripsCancellation

Dyno-Mite (pyridaben) (21A) METI acaricides/ insecticides Spider mitesCancellation

Imidan (phosmet) (1B) OrganophosphatesAphids and mitesCancellation

Intercept (imidacloprid) (4A) NeonicotinoidsAphid control Cancellation

Orthene (acephate) (1B) Organophosphates Broad-spectrum control Cancellation

Sevin (carbaryl)1(A) CarbamatesBroad-spectrum controlCancellation

chemical class under special review.

Pesticides at risk: Products used in ornamentals with upcoming registration changes are listed in Table 1. Some changes will affect all ornamental crops; bolded items will affect cut flowers only. Most of the proposed changes for potted crops are limited to use-pattern adjustments, while cut flowers face outright product cancellations.

In any product review situation, Flowers Canada Growers (FCG) works closely with registrants and the PMRA to try and keep these products in some capacity – often by recommending use changes such as increased restricted entry intervals (REI’s) or fewer allowable applications. But such compromises aren’t always considered enough to offset potential risks from continued use of a chemical.

Why cut flowers are “targeted”: Due to greater safety risks associated with increased handling in cut flower crops, the PMRA understandably holds products in this crop sub-group to a higher safety standard.

Products registered for flowers

must demonstrate that they are safe for workers after application. When calculating risk, PMRA reviews “dislodgeable foliar residue” (DFR) data, to determine how much of the product could transfer to workers during regular activities. The PMRA also reviews “transfer coefficient” (TC) data. This outlines which worker activities present the highest risk of exposure – like handharvesting cut flowers.

In the absence of pesticide-specific data, generic risk “default” values are often used for DFR and TC limits in risk assessments. Many of the proposed product cancellations for cut flowers may be a direct result of using these harsher defaults, which may not accurately reflect worker exposure in greenhouses.

Grower response to pesticide cuts:

Some growers are quite pragmatic about many of these proposed de-registrations or use-pattern changes. Generally, growers seem comfortable with losing some of the older or “high risk” chemistries. Intercept (imidacloprid), for example, has been removed from regular production by many growers voluntarily. “We answer to the [retail] chains,” says one cut flower grower, “so we have been avoiding them [neonics] for some time. And they also don’t seem all that bio friendly”. Captan is another product few growers use anymore.

For other potential de-registrations, growers agree that limiting pesticide exposure to workers is important, but their complete loss may be hard to swallow. “DDVP was used - I felt - too

much when we grew mums” says the same grower. “But I also know that we like having it for emergency measures, when one needs to hit reset on a bio program.” Another grower of specialty cut flowers points out that Orthene, as a very broad-range insecticide, can be used to combat several major problems at once: “Instead of spraying or drenching several different chemicals a few days apart from each other, I can apply Orthene and be done with it”. This ultimately leads to fewer pesticide applications. Limiting applications per crop for certain products, rather than outright de-registrations, would seem to be a far better option for growers and the sustainability of the cut flower industry in Ontario.

Fungicide options seem to be the

losses that will hurt the cut flower industry most. This is partly because of the long-term nature of many cut flower crops (up to three years for cut gerbera). Plants are likely to pick up a variety of diseases over their life span, and simply roguing out infected plants may not make sense if they’re still producing stems, given the high initial investment.

As one grower put it, “our industry will be…history” without products like Daconil and Rovral to combat diseases like Botrytis cinerea (grey mold), where chemical rotation is key for long-term resistance management and control. Fewer multi-site fungicides (Class “M” products), to which resistance is unlikely to develop, will lead to increased losses in marketable stems from this disease. Loss of tools to adequately control Botrytis also has the potential to damage the reputation of Canadian growers and distributors since this disease is often a post-harvest problem.

Where we go from here: FCG and OMAFRA recognize the loss of these chemicals is significant for many farmers. Registering replacements is one way to combat potential losses. Currently, FCG is working on over 35 files for new registrations.

Securing funding to accurately determine pesticide risks to workers in greenhouses is another priority. We suspect the reality might be different than the defaults used in PMRA risk calculations for things like TC’s and DFR’s, but we need to prove it. This data may help mediate future cancellations and secure access to new tools.

In the face of the numerous proposed fungicide cancellations, improved water management is going to become increasingly important as a preventative disease control option. Current projects, like those from Drs. Ann Huber (Soil Resource Group) and Jeanine West (FCO) that focus on cost-effective, in-house water testing will help provide necessary tools to the industry. They can also provide guidance on the different water treatment options available to growers.

In terms of insect pest management, it may sound trite, but it really may be time to start investigating pesticide alternatives, like biological control, for your farm. Ontario has world-class experts that can assist you in developing insect pest management programs for your specific crop needs. Experts from OMAFRA, Vineland Research and Innovation Centre, the biocontrol industry, and private consulting companies all have years of experience in implementing biocontrol programs. You may even discover value-added benefits; employees enjoy working around crops treated with biocontrol agents, and bios can be an effective marketing tool with customers.

History has shown us that flower growers in Ontario are incredibly adaptable. Past challenges, such as insecticide resistance in pests like western flower thrips, have helped shape our industry, reducing our reliance on chemicals and making us world leaders in biological control. This new era of pesticide cancellations will no doubt present new challenges, but if anyone’s able to face them, we are.

Cary Gates is the pest management director at Flowers Canada Growers. You can reach him at Cary@fco.ca or 519836-5495 ext. 228. Dr. Sarah Jandricic has been the greenhouse floriculture IPM specialist for OMAFRA (Vineland station) for the last three years. She is in charge of IPM projects for insects and diseases, and runs the ONFloriculture blog. You can reach her at sarah.jandricic@ontario.ca or 905-562-4141 ext. 106.

Registered for use on cannabis raised indoors, KOPA insecticidal soap controls whiteflies, spider mites, aphids and other soft-bodied insect and mite pests on contact.

OMRI® CANADA Listed for organic production, KOPA can be used right up until the day of harvest. KOPA is lethal to pests, yet it is of low risk to workers and the environment.

KOPA. When clean product is your only marketable option.

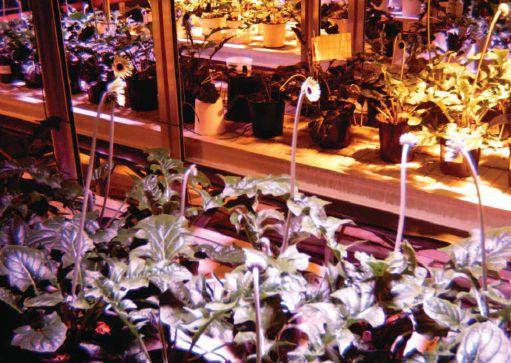

BY DAVE LLEWELLYN AND DR. YOUBIN ZHENG

Numerous articles have extolled the virtues of modern LED lighting technology for horticultural applications, particularly as a replacement for HPS in greenhouse environments. Various LED technologies have been proven to achieve comparable or better commodity-specific production metrics to HPS in many different greenhouse production scenarios. Horticultural LED systems have been touted as having greater energy efficiency, longer functional life and spectral tuning capabilities (i.e., light recipes) which may enable growers to steer the growth of their crops without chemical inputs.

Less heralded benefits for LEDs in greenhouses are derived from their potential for infinite dimming, which HPS cannot do. Note that some HPS do have rudimentary dimming to discreet levels, for example turning a 1000W to 600W or 400W; however these are not widely used in greenhouses. While not all LED systems on the

ABOVE

market have built-in dimming, this capability is fundamentally intrinsic to how LEDs convert electricity into light. Dimming capabilities offer the greenhouse grower two main advantages:

1) Energy savings by modifying supplemental light intensity, in real time, to fluctuating levels of natural light.

2) Modification of spectral recipes.

A major limitation of HPS technologies with respect to light control is that they are not instant on/ off devices. They usually require a few minutes to warm up to full power and also to cool down before the lamp can be turned on again. With this in mind, HPS users still have various control strategies for saving energy by limiting the use of supplemental lighting during periods when natural light is sufficient. A simple strategy uses a timer (usually part of the greenhouse control system) to limit

HPS users can still save energy by using various control strategies such as a timer and light sensor, turning on supplemental lights when natural light levels are lower or when electricity is cheaper.

lamp operation to only the ends of the photoperiod when natural light is habitually lower, or to times of day when electricity pricing is cheaper. More advanced strategies employ some type of light sensor, usually located outdoors, to control the duty cycle of the HPS lights based on user-defined algorithms of varying complexity. The two most common sensor types measure:

1) Photosynthetic photon flux density (PPFD), which is a count of all photons in the photosynthetically active radiation range (PAR: 400 to 700 nm) that falls on a surface in a given time (µmol·m-2·s-1).

2) Global radiation, which measures all incoming solar radiation that falls on a surface in a given time (W·m-2 or J·m-2·s-1, note: one watt (W, power) equals one joule (J, energy) per second)

Note that because the energy of photons depends on their wavelength (i.e., colour), it is not possible to directly convert between PPFD and radiation units when multiple light sources are combined. Using the two sensor types above, control algorithms usually depend on either threshold levels of natural light (instantaneous), accumulated light over time or a combination of both of these factors. With threshold control, a programmed value of ambient light triggers the HPS to turn on/off; usually accompanied by a 10 to 15 minute (or more) time delay to avoid rapid cycling on variable cloudy days. Accumulated light or light sum is usually measured over 24 hours and expressed as daily light integral (DLI, in mol·m-2·d-1 or kJ·m-2·d-1), but longer time periods are sometimes used that reflect a timeframe relevant to the crop’s production cycle. Supplemental lighting can then be provided (varying the length of time) at the end of the natural

photoperiod in order to make up the difference and achieve a specific accumulated light sum target. Some algorithms are predictive as well, utilizing both instantaneous PPFD and trends of average PPFD and DLI from previous days.

The dimming capabilities of adjustable LED technologies offer the potential for more advanced feedback control strategies of supplemental lighting. The two main control strategies are PPFD control and DLI control.

PPFD control adjusts the supplemental light intensity in

Cut gerbera plants under either threshold-controlled HPS (yellowish plots) or DLI-controlled LEDs (magenta plots).

real time in order to maintain a constant PPFD at crop level. Picture the supplemental lights getting progressively brighter and then dimming again as a cloud passes. The main benefits of this strategy are reduced energy usage when supplemental light is not needed and more uniform crop-level PPFD. This reduces stress and maintains optimum crop productivity by minimizing fluctuations in light intensity. These benefits are seen daily during dawn and dusk, as well as on days with highly variable natural light. LumiGrow’s smartPAR™ system can utilize their fixturemounted smartPAR Light Sensor Modules™ to monitor natural light just above the height of the fixtures (i.e., at gutter level), and then control the output intensity of their PRO325™ and PRO650™ lights in real time; effectively using the sun to manage the control for the supplemental light. LumiGrow has posted an excellent video on their website and on YouTube that very clearly demonstrates the capabilities of their lighting control system in a real-world setting.

DLI control enhances the PPFD-control concept by integrating additional input factors such as upper/lower PPFD thresholds, time-of-day electricity pricing, latitude and historical PPFD data into a predictive algorithm with the goal of attaining a target DLI as efficiently as possible. DLI-control strategies have similar potential to enhance crop productivity by lowering fluctuations in canopy-level PPFD, while simultaneously minimizing energy use and cost. Further, balancing the amount of photosynthetic light the crop receives during each day allows the grower to maintain stable production schedules. This is critical for some commodities such as microgreens, vine crops and cut flowers, where the markets demand consistent production yearround. We beta-tested a DLI-control system from Heliospectra by growing cut gerbera (variety Alliance) during the 2016-17 supplemental lighting season (pictured above).

The experiment benchmarked DLI-controlled LEDs against conventional threshold-controlled HPS. Both treatments had similar mean supplemental PPFD, light distribution and photoperiod. The DLI-control treatment used Heliospectra’s HelioCORE™ feedback-control system with an integrated canopy-level PPFD sensor, to manage their LX602G grow lights. It was programmed to target a canopy-level DLI of 7 mol·m-2·d-1 For the HPS treatment, an outdoor radiation sensor managed its

DLI-controlled LEDs reduced energy use by 15 per cent compared to threshold-controlled HPS in the experiment.

duty cycles using a threshold of 375 W·m-2. This was selected based on historical data measured in the same greenhouse to also target 7 mol·m-2·d-1 with an average daily runtime of about 8.75 hours. Each treatment was replicated in four separate plots all located within a single greenhouse section. For the whole trial, the overall mean canopy-level DLI were 7.8 and 7.1 mol·m-2·d-1 for HPS and LED treatments, respectively, with about 3.5 mol·m2·d-1 coming from ambient light.

There were no differences between treatments on the number of flowers initiated and harvested, or per cent marketability. Flowers under HPS developed about five per cent faster, but had seven per cent lower fresh mass and four per cent shorter stems than those under LEDs. There were no treatment effects on leaf area or leaf dry mass at the end of the trial, indicating that vegetative biomass was similar for both treatments. While the cut gerbera plants were similarly productive under both supplemental lighting treatments, the DLI-controlled LED treatment utilized about 15 per cent lower lighting capacity. Light intensity is fixed at a set level for HPS, but this varied between 0 and 100 per cent for the LEDs due to its DLI-control algorithm.

Lighting capacity is defined as the product of daily runtime and instantaneous intensity settings, similar to how DLI is calculated from logged PPFD data. Speaking in terms of lighting capacity allows us to generalize for any lighting technology, regardless of the manufacturer, without the need to consider the efficacy (i.e., conversion of J of electricity into µmol of photons of PAR) of a given lighting technology. In other words, for a given lighting technology, a 15 per cent reduction in lighting capacity equates to an equivalent reduction in energy use. While this was a beta-test of an early prototype, this trial clearly demonstrated the potential for intelligently-controlled LED systems which manage light output on an ongoing basis in real time, to maintain or even increase productivity while simultaneously reducing energy use.

LumiGrow’s smartPAR and Heliospectra’s HelioCORE dynamic lighting control systems are both recently-released products (i.e., within 2017) in their respective companies’ product lines.

Energy efficiency is a commonly-touted advantage that LED technologies have over HPS. However, these waters have

been made somewhat murky due to the lack of standards as to how energy efficiency is measured and reported. Efficacy is the concept that relates the output of electromagnetic radiation (i.e., “light”) to the input of electrical energy. For horticultural applications, we (usually) measure light output as photosynthetic photon flux (µmol·s-1) in the 400 to 700 nm range and electrical energy as power (W or J·s-1). Note that both of these units have time components which should cancel when made into a ratio. Therefore, the units for efficacy should be micromoles of photons per joule of energy (µmol·J-1). However, many ambiguities and mash-ups of these units exist in the industry; creating confusion. Some things to note when considering fixture efficacy:

1) Light of different wavelengths (i.e., colours) have differing amounts of energy. Shorter wavelengths (e.g., blue) fundamentally require more energy per photon to produce, although there are many other factors that determine the efficacy of a specific colour.

2) It is important to understand what specific wavelength ranges have been used to determine efficacy since HPS and some LED technologies produce wavelengths of light that lie outside of the photosynthetic spectrum (e.g., UV and far red). Therefore, the total photon flux can be substantially higher than the photosynthetic photon flux, which can be misleading.

3) For LEDs, there are various electrical components that make up the fixture including the individual diodes, drivers, control electronics, active thermal management (if present) etc. It is important that buyers confirm that efficacy is reported on a

“system” level and not just the individual diodes or the LED array.

4) Adjustable spectrum LED systems may be specified as having a ‘native’ efficacy for when the system is run at full power. The actual efficacy will depend on the spectral recipe used in a given production scenario, as each colour channel will have different efficacy values.

We are truly at the tip of the iceberg with our understanding of how light can be leveraged to improve production of various commodities, within both greenhouse and indoor production scenarios. We will be engaged in lighting research for years to come. We will keep you updated on our research projects as well as the development of LED technologies for horticulture applications from time to time. Stay tuned for part two of this article in the next issue of Greenhouse Canada, where we’ll explore the other advantage of LED dimming: adjustable spectra.

Dave Llewellyn (dllewell@uoguelph.ca) is a research associate in Dr. Zheng’s lab who has extensive experience working with lighting technologies in research and production environments. This lab has focused on lighting in high-value crops (e.g., cannabis, microgreens and ornamentals) for many years. Dr. Youbin Zheng (yzheng@ uoguelph.ca) is an associate professor at the University of Guelph.

Disclaimer: The purpose of this article is to provide objective information to the end users of greenhouse lighting technologies. Several horticultural LED manufacturers/vendors and their various technologies are mentioned throughout this article as exemplars. Specific brands or technologies cited should not be construed as either endorsement or criticism.

Join us for a day of stimulating talks on young plants and propagation. Hear from researchers and industry leaders on the cutting edge, then connect with key suppliers and specialists during our networking breaks.

HOW TO USE LEDS FOR PROPAGATION

Speaker: Dr. Youbin Zheng University of Guelph

TREATING WATER FOR RE-USE: AN INNOVATIVE NEW TECHNOLOGY

Speaker: Dr. Jeanine West Flowers Canada (Ontario) Inc.

QUALITY GROWTH BEGINS AT THE START

Speaker: Dr. Will Healy Ball Horticultural Company

WHAT’S NEXT FOR AUTOMATION

Speakers: Pieter Kwakernaak Hoogendoorn (pictured), Jack Ford AgriNomix

START CLEAN: DIPS FOR THRIPS

Speaker: Dr. Rose Buitenhuis Vineland Research and Innovation Centre

A CLEAN START IS A HEAD START: GETTING AHEAD OF PESTS AND DISEASES

Speaker: Amanda Tracey, MSc. Ontario Ministry of Agriculture, Food and Rural Affairs

BENEFICIAL MICROBES FOR PROP HOUSE PROBLEMS

Speaker: Dr. Ishtiaq Rao Crop Defenders

AIMING HIGH: THE RIGHT SET-UP FOR CANNABIS

Speaker: Bill MacDonald, MSc. Niagara College Co-hosted by Grow Opportunity

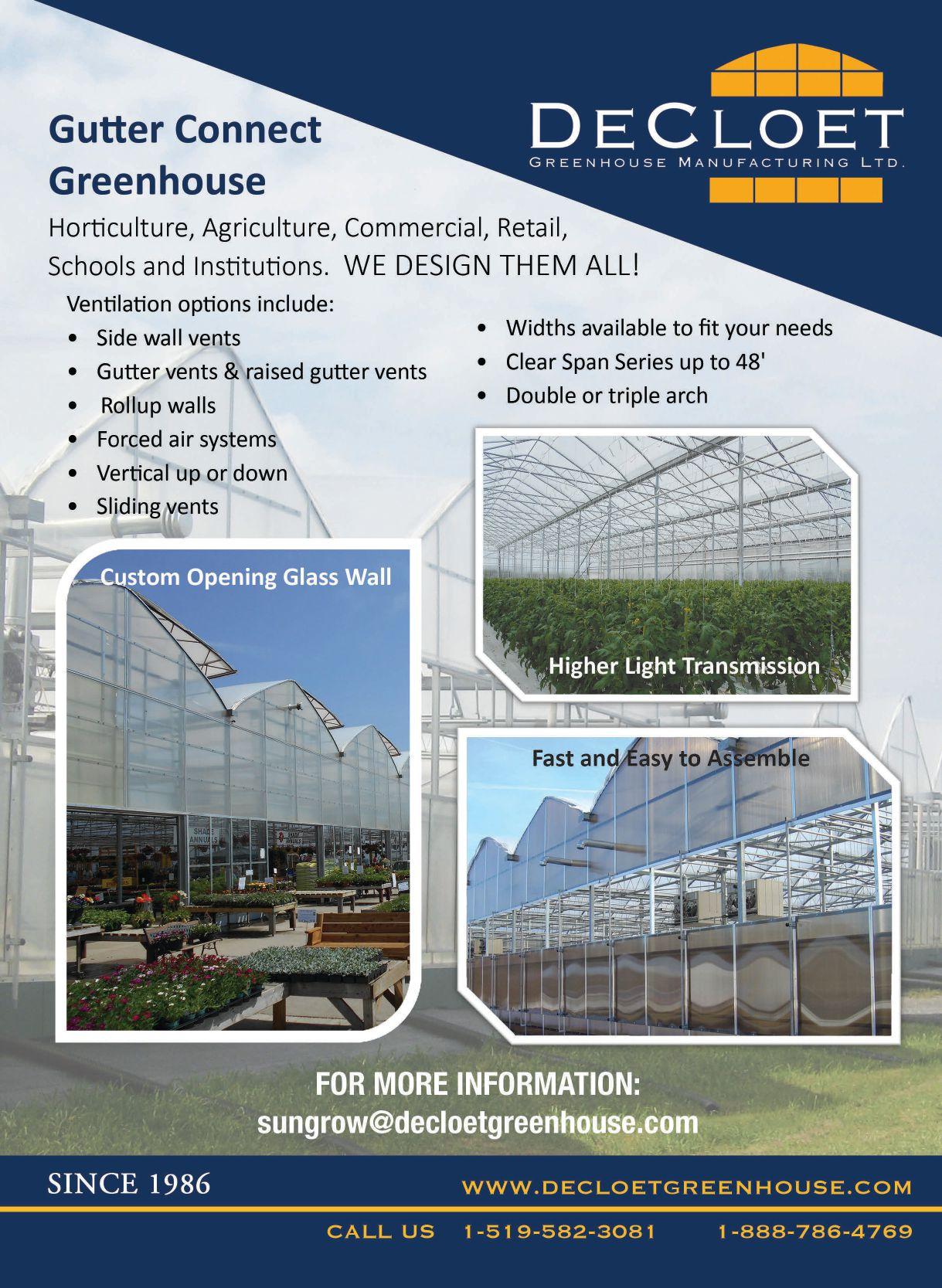

What makes consumers choose certain pre-mixed planters over others?

BY AMY JENKINS, DR. ALEXANDRA GRYGORCZYK, DR. AMY BOWEN AND RODGER TSCHANZ

BELOW

The pastels in this ‘Trixi Batting Eye’ combination give off a soft look.

Pre-made mixed planters have been gaining popularity over the past couple of years. But what makes an attractive mix? Researchers at the University of Guelph and Vineland Research and Innovation Centre saw an opportunity to gain a better understanding of consumer preferences for container plants. Volunteers attending a public outdoor event at the University of Guelph on June 2017 were asked to create their own planter by selecting three plants from among 21 common annual container plants. 312 attendees, most of them young women between the ages of 18 and 25, gave their feedback.

Among the plants presented to participants, a clear winner emerged, with 40 per cent of the participant-made planters containing a pink Hypoestes. Overall colour was the main driver for selection and pink plants tended to be selected the most while red plants tended to be selected the least. Examination of the plant genus in the most and least selected plants confirmed the importance of colour as no one genus was consistently in the top or bottom categories. For example, pink zinnias were among the most selected and red zinnias among the least.

Another way to categorize container plants is in terms of the role they play in the container: they can be categorized as “fillers”, “thrillers” or “spillers”. Fillers are plants mainly used as foliage backdrops, thrillers are plants with striking features and spillers are plants that trail over the side of the pot, adding dimension. The most popular combination in this study included two plants classified as thrillers and one filler. It is possible that consumers selected thrillers more

HUB International is a leading global insurance brokerage that provides risk management services and a broad array of property and casualty, life and health, voluntary benefits and personal lines insurance.

Since 1963 we have been providing high quality insurance protection to our clients from coast to coast.

Experienced, local service is available through our national network of offices.

For a quality product, local service and very competitive pricing give us a call today.

HUB International Ontario Limited

www.hubontario.com 800-463-4700 24 Seacliff Drive East. Unit 100 Leamington, ON N8HOC2

‘Confetti Garden Mountain’s Majesty’ shows great colour contrast, plus showy thrillers.

often simply because they are more eye-catching. Among the younger demographic, which buys plants less often, a “showy” option might also encourage purchase.

Preliminary findings from the current study point to two trends for this younger consumer group: the first being a preference for pink-themed containers and the second, a higher ratio of thrillers to other categories in a container.

A question remains, did participants choose those plants because they felt they blended well or because they genuinely liked the plants they selected? In order to answer this question a follow-up study was conducted at the Annual Plant Trials open house in Guelph, Ontario in August 2017. Feedback was collected from 97 volunteers, most of them aged 51 or above.

This time, volunteers were shown a subset of the same 21 annual plants from the previous study and asked to select their most and least preferred individual plants. The result? Despite the older demographic and different question format, the same plant, a pink Hypoestes, came out on top. Unlike the previous study, plants with red flowers and foliage also made an appearance among the top selected plants. The results suggest that consumers first select their favourite plant, in this case a pink Hypoestes, and then continue by adding plants that compliment their first selection.

Next, the participants were shown commercial pre-mixed planters and asked to select their most preferred and least preferred mix. Here, more than any one colour, contrast was found to drive preference for pre-mixed planters. Contrast can be achieved by a large difference between the colours and textures of a planter. Texture, in the context of this study, was defined as the degree to which plants have distinctly different shapes and architecture. Texture and colour contrast can be enhanced by the vibrancy of each colour, the number of “thrillers” per planter, and creating patches of single colours within the planter as opposed to plants of different colours intermingled throughout. Mixed planters with a high degree of contrast were found to be the most preferred, while mixed

planters with the least amount of contrast were the least preferred. The mixed colour planter, which was the most preferred, had distinct areas of vibrant red, yellow and purple flowers, while the least preferred planter had muted yellow and white flowers which were intermingled throughout. The top performing planters also had a higher ratio of larger flowers that could be considered “thrillers” to smaller flowers which could be considered “fillers”. It is interesting to note that red flowers were present in the most preferred planter.

Although the general trend favoured high contrast planters, there was one exception. One of the most preferred planters had very little contrast in terms of both texture and colour. The planter in question consisted of pastel yellow, orange and pink flowers, all of the same variety. This very low amount of contrast gave the planter what many consumers described as a “soft” look. To investigate whether an interaction between colour and texture exists, a follow-up study is planned for the summer of 2018. The basis of this study will be to determine whether high colour contrast planters must also have a high level of texture contrast to be acceptable to consumers, as well as whether planters with low colour contrast can be equally as acceptable as long as they have a low level of texture contrast.

Based on the results of the current study it’s recommended that pre-mixed planters contain a high level of contrast in colour and texture. Contrast is enhanced by:

• Vibrantly coloured foliage and flowers

• Distinct areas of different colour within a planter

• High proportion of “thrillers” per planter

This research was funded in part by the OMAFRA-University of Guelph Partnership Program.

Amy Jenkins, MSc. is a research technician, Dr. Alexandra Grygorczyk is a research scientist and Dr. Amy Bowen is the research director of Consumer Insights at Vineland Research and Innovation Centre. Rodger Tschanz is the ornamental trial garden manager at the University of Guelph.

9TH ED.

World standard on plant propagation and horticulture for over 50 years!

Hartmann and Kester’s Plant Propagation remains the field’s most complete and up-to-date guide to the principles and practices of plant propagation. Using colour figures throughout, the text pairs chapters on horticultural science with commercial techniques for plant propagation.

The extensively updated Ninth Edition integrates the latest breakthroughs and innovations, including advances in plant hormone biology and the molecular basis of plant growth. It includes a vast new range of colour photos taken at commercial producers and research labs around the world.

GH_BookAd_May18_EJS.indd 1

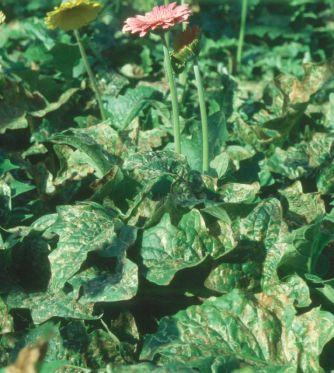

Cut gerbera’s many qualities make it an ideal crop for biocontrol. The problem? Insects, mites and diseases love this crop too.

Biological control in greenhouse ornamental crops has become more mainstream in the past 10 years and one of the crops that has led the way has been cut gerbera. Gerbera grown for cut flowers has many qualities that make it the poster child for biocontrol in ornamentals:

• Perennial crop – it remains in the greenhouse for two to three years (longer for some varieties). This allows plenty of opportunity and time for biocontrol populations to establish

BY GRAEME MURPHY

• Great environment – the dense canopy provides an ideal environment for natural enemies

• Bridging canopy – and the

ABOVE

overlapping foliage between adjacent plants allows biocontrol agents such as predatory mites a perfect pathway to move along the length of each bed

• Greater tolerance for pests –Cut gerbera are one of the few ornamental plants where none of the foliage is sold, so there is some tolerance for low levels of foliar pests (within reason), as long as the flowers are not directly (or indirectly as a result of reduced photosynthesis) affected

So - if it’s that easy…..

The problem is that pests (insects, mites and diseases) love gerbera. Here is a quick rundown of the major pest problems:

We’re naming the next crop of industry leaders. Know one?

The search is underway for Canada’s top 10 industry leaders under 40. From commercial growers and wholesalers, to manufacturers and allied trades, we’re recognizing the best and the brightest in greenhouse horticulture.

Winners will be revealed at Grower Day and featured in Greenhouse Canada.

Nominees must work in the greenhouse, horticulture or related equipment and technology industries and be under 40 on December 31, 2018.

We’re looking for a strong work ethic, leadership and initiative, a lifelong learner and/or an active member of the industry.

NOMINATIONS CLOSE MAY 9, 2018

Visit greenhousecanada.com/top-10-under-40 for nominations

Brought to you by

· Breeding · Seed Technology

USA Office: 125 Chenoweth Ln. · Louisville, KY 40207 Phone (502) 895-0807 · Fax (502) 895-3934 · maryv@jelitto.com

German Headquarters: P.O. Box 1264 · D-29685 Schwarmstedt Fax 01149-5071-9829-27 · www.jelitto.com · info@jelitto.com

In Ontario, greenhouse whitefly (GWF) is the most common species, although I have occasionally seen small infestations of Bemisia. The life cycle of GWF is fairly long compared to other pests like mites or thrips, but the perennial nature of the crop allows plenty of time for populations to build up. It is mainly a foliar pest and can result in significant loss of production.

Chemical control can be problematic due to resistance. Some newer pesticides may give control, but the bigger issue is the impact they can have on biocontrol of other pests, for which there are no effective pesticide options (e.g. leafminer, thrips).

There is an excellent suite of biocontrol agents (BCAs) available for control of greenhouse whitefly. These include the parasitic wasps, Encarsia and Eretmocerus, the ladybeetle Delphastus, and predatory mites such as Amblyseius swirskii and Amblydromalus limonicus Delphastus in particular can produce spectacular results in reducing a large population when it gets established. Biocontrol can be excellent in the spring, summer and early fall, but in late fall and winter, the ability of the BCAs to keep up with the development of the whitefly is greatly reduced and growers often have to play catch up in the spring.

There is some potential for products like fresh Encarsia which is active at lower temperatures than stored product, and A. limonicus which is also active at cool temperatures, to maintain control of the whitefly during the winter months.

In some ways, leafminer is similar to whitefly in that it is primarily a foliar pest capable of massive population build up. Production can be severely impacted because of reductions in photosynthesis as a result of the leaf mining (Figure 2).

In Canada, there are only three pesticides registered for control of leafminer and all show high levels of resistance. There are some newer pesticides that show potential for control, but are not yet registered.

Biological control is the preferred control strategy for most growers. The parasitic wasp Diglyphus, is the most effective BCA, and my favourite BCA to work with. It establishes easily, and even with a hand lens, the immature wasps can be easily seen inside the mines. Many growers bring in low levels of Diglyphus on a regular basis as a preventative measure, even if leafminers are not present in the greenhouse. However, they are very sensitive to pesticides and control is often disrupted if growers have to spray for other pests. Even some fungicides can compromise biocontrol with Diglyphus

Spider mites are not in the same category as the two previous pests, but they can be devastating on almost any crop if left uncontrolled, and the same is true of gerbera. There can be varietal differences in susceptibility to mites and the heavy webbing that mites can produce can quickly render flowers unsaleable (Figure 1).

There are some excellent biocontrol options available for mites, including the specialist predatory mite Phytoseiulus persimilis, the generalist predatory mites Amblyseius fallacis and Amblyseius californicus, the predatory midge Feltiella and the ladybeetle Stethorus. Because mites have such a short life cycle and can build up damaging populations very quickly, it is important to keep a close eye on the most sensitive varieties and respond quickly if evidence of mites is seen. The generalist predatory mites mentioned above can be applied preventatively even in the absence of spider mites.

Aphids fall into a similar category to spider mites. Populations can build up very quickly and the insects can

infest foliage and flowers (Figure 3). Their presence on flowers is the most significant problem with this pest. Green peach aphid is the most common species of concern, but occasionally foxglove aphid can also be a problem.

There are a number of BCAs available for aphid control including Aphidius wasps (different species depending on the species of aphid), the predatory midge Aphidoletes (it diapauses in the winter so it is only effective from early spring until fall), and lacewings.

There is also a compatible pesticide Beleaf (flonicamid) which is reasonably safe on most BCAs and can be an effective ‘get out of jail’ card if required.

Western flower thrips (WFT) is an interesting pest in gerbera. In potted plant production, they can be devastating, but less so in gerbera grown for cut flowers, probably because the flowers are sold fairly tight before there is a large quantity of pollen

MilStop is a foliar fungicide for the control and suppression of powdery mildews. It kills powdery mildew on contact and provides 1 to 2 weeks of residual protection.

Approved for organic production, it fully dissolves in water, has no residue, and dries quick and clean. MilStop has a 4-hour REI.

Now approved for greenhouse and field strawberries.

showing. WFT love pollen and in potted production, the first flower is often quite mature and showing significant pollen before the plant is shipped. However, there are still some situations in cut gerbera where thrips are a major problem, especially where there is a large population build up outside that can move into the greenhouse and cause significant damage.

The other thrips species of concern is Echinothrips, which has become more important as a pest in the last five to 10

years. It is a foliar pest and is not usually found in the flowers, but it can develop into large populations.

There are some very effective biocontrol options for WFT, especially the predatory mites such A. swirskii and N. cucumeris. The gerbera canopy provides an ideal environment for these mites to establish and spread from plant to plant. There are fewer options for Echinothrips. The above predators are not effective, but the mite A. limonicus shows some potential, although it is quite

expensive. The predatory bug Dicyphus also has the potential to be an effective predator of Echinothrips, although there is not much research or field experience with these products. Microbial pesticides such as BotaniGard or Met 52 can also provide some control. Traditional pesticides will control Echinothrips, but can interfere with biocontrol of other pests.

One of the most destructive pests and difficult to control in cut gerbera is mealybugs. Fortunately, we don’t often see them as a pest, but when it does happen, it is critical to get control of them as soon as possible. Saying it like that makes it sound easy, but that is far from the case. Very few pesticides work well and if they do, they will probably cause major problems with the rest of the biocontrol program. Mineral oil is reasonably effective but may damage the flowers (and the rest of the plant), especially with repeated applications. Beleaf may provide some control, but it is unlikely to reduce the populations to acceptable levels.

That’s the power of SunPatiens. These amazing, lowmaintenance performers provide more color for less work, which means nonstop color in almost any garden or landscape. Resistant to downy mildew, they are the original and best alternative to traditional impatiens. When you want unstoppable three-season color, think SunPatiens.

To order, contact your preferred supplier

In a potted crop, my recommendation is usually to throw out any infested pots that are found. That’s not as easy with a two to three year crop grown for cut flowers. However, if found early, drastic measures such as this may be the most effective (and economic) option.

The most readily available biocontrol agent for mealybugs is the ladybeetle Cryptolaemus but that can be difficult to establish. One Ontario grower with a severe problem eventually gained control with this natural enemy by introducing larval beetles (rather than adults) into infested areas. It was a long slow process, but it showed that it can be done.

Caterpillars are not often a problem and not usually as severe as shown in Figure 4 which was caused by cutworms.

Fortunately, there are several compatible pesticides including products such as DiPel and Confirm which are very effective and won’t interfere with other biocontrol systems in the greenhouse.

Pests should not just be thought of as insects and mites. Diseases such as

CLASSIFIED RATES: Minimum order $75.00 or 84¢ per word, word ads must be pre-paid. CLASSIFIED DISPLAYS: $72.00 per column inch, or $5.14 per agate line. GENERAL INFORMATION: Payment must accompany order. Copy required by the 1st of the month preceding publication. All advertising copy subject to the approval of the publisher. Send order and remittance to: Classified Dept., Greenhouse Canada, P.O. Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5

powdery mildew (Figure 5) can be just as devastating and can have a major impact on other parts of the biocontrol program, especially during the shoulder seasons of spring and fall.

Excessive use of fungicides can affect plant growth and products such as sulphur can have a negative effect on many of the biocontrol agents. There is a certain level of tolerance with many of the BCAs to sulphur but if applied too frequently or for too many hours during the night, it can be damaging.

Environmental controls should be considered as a first line of defence to keep night-time humidity levels down and reduce large humidity fluctuations between day and night.

Phytophthora, Pythium and Fusarium can all be problematic, especially in recirculating systems. Water treatment of return water in such systems is essential, because if disease becomes established it can be very difficult to get rid of.

Fungicides may help, but for pathogens like Fusarium, even fungicides provide limited control and can compromise biocontrol programs.

Graeme Murphy is the IPM specialist at bioLogical control solutions. He can be reached at graeme.murphy307@gmail.com.

GARY JONES | Gary.Jones@kpu.ca

It’s survey time of year again. It’s always interesting to hear the views and thoughts of those in the industry. ‘Inside View’ of February last year looked at the scope of such a survey: what is the geographic scope (provincial, national, global), how do we now define the production systems in ‘greenhouse’ (conventional greenhouse, controlled environment agriculture, rooftop protected structures, micro-green production), and what are watershed moments the industry is experiencing?

Production horticulture seems to be changing at an ever increasing pace. Who was it who said that ‘the only thing that is constant is change’? I’m not even sure that that statement is true anymore, as change seems to happen faster all the time, not remain constant. Certainly feels like things have moved on a lot in just the past 12 months.

So, I got to thinking. Surveys always come from someone, a business, an organization, and ask the respondent questions. I suppose that’s the definition of a survey. But what if the survey simply asked the audience what their questions would be? Which made me wonder what questions I would like to ask. I came up with a few.

Looking back, what do you think was the single biggest technology change that moved our industry forward? The switch to hydroponics. Climate control computers. Heat dump tanks and on-site

“...why do you love being a greenhouse grower?”

CO2 generation. Screens, new glazing materials, LEDs?

Along similar lines, what do you think will be the next big technology advance for greenhouse production? Robotics perhaps, or automated pest scouting and management. Drones. ‘Green’ energy sufficient to take a large-scale greenhouse ‘off-grid’.

What do you think will be the challenging issues for the industry over the next five years? Today, five years is a long time away, and much can change in that timeframe. That said, some of our issues have been around for decades and show no signs of change –finding enough new growers for example.

Why/how did you get involved in the greenhouse industry? Of course, there will be many who continued in the family business. But if we learn what brought newcomers into the industry, we might find valuable information as to how to

attract more new entrants to be the future of the greenhouse sector.

Given the dramatic and sudden impact on our industry of the legalization of recreational marijuana, what do you envisage as other crops achieving the same influence? Maybe there are other ‘watershed crops’ waiting in the wings. What do you think they may be? A new food crop perhaps, or nutraceutical, or algae for food even? Maybe this will be affected by climate change, with new climatic zones presenting new crop possibilities. Or salt-tolerant crops/varieties? Or changes in attitudes to GMO’s or new advances there. Talking of GMO’s…

What is your attitude to GMO’s in our sector, in particular with respect to food crops? Perhaps now is the time for obligatory labelling of GMO crops in foods.

If you had a magic wand, what would be the one thing you’d like to change about the greenhouse industry in general? Government policy perhaps. International trade barriers. Bureaucracy, paperwork. Hours. Energy costs. Public perception. Prices. Pests or diseases that keep battling away at your profits.

For anyone starting in the industry, what’s your one piece of advice to help them succeed? Work hard? Enjoy what you do. Learn something new every day?

What keeps you doing what you do – why do you love being a greenhouse grower? If nothing else, most growers exhibit a passion for what they do like few other business sectors. They are also some of the most skilled business managers, required to be masters of multiple practical trades while at the same time learning academic details about such disciplines as crop nutrition, entomology and plant pathology. Oh. And trying to make a profit to stay in business.

Anyway. Those are a few of my questions. What would be the questions you’d like to ask of industry colleagues? Maybe we should have you send them in to Greenhouse Canada?

Gary Jones is co-chair of Horticulture at Kwantlen Polytechnic University in Langley, British Columbia. He sits on several industry committees and welcomes comments at Gary.Jones@kpu.ca.