Legal constraints

SIMULATED POULTRY MAKERS SEEK FLEXIBILITY IN THE CREATION OF THESE PRODUCTS PG. 10

SIMULATED POULTRY MAKERS SEEK FLEXIBILITY IN THE CREATION OF THESE PRODUCTS PG. 10

Canada has the potential to become market leader PG. 14

“I’m Karsten Schellhas and I’m on Reiser’s team of Alternative Protein Specialists. I work with customers to develop all their alternative protein products from bacon to burgers to bologna. I can help you every step of the way. Let me show you how.”

Karsten: (604) 897-1026

Email: kschellhas@reiser.com Veggie Hotline: (905) 631-6611

Visit our Alternative Protein website

Reader Service

Print and digital subscription inquiries or changes, please contact Anita Madden, Audience Development Manager Tel: 416-510-5183 Fax: 416-510-6875

Email: amadden@annexbusinessmedia.com

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

MEDIA SALES MANAGER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Alice Chen achen@annexbusinessmedia.com 416-510-5217

VP/GROUP PUBLISHER | Diane Kleer dkleer@annexbusinessmedia.com

COO | Scott Jamieson sjamieson@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Publication

$159.95 All prices in CAD funds

Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission @2021 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

by the Government of

A recent research by Dalhousie University, Halifax, found “waning investment, aging facilities, large grocers’ fees and lack of government support are constraining domestic food and beverage manufacturing”.

The study used publicly available data to offer a snapshot of the sector’s health in 2010 and 2020, as well as to model outcomes in 2030 if the current trends hold steady. Visit https://www.dal.ca/ sites/agri-food.html to access the study.

According to the study, “weak investment conditions and labour shortages contributed to anemic growth” in domestic manufacturing from 2010 to 2020. During that time, only 20 new manufacturing facilities were opened in Canada whereas more than 4000 plants were constructed in the United States.

There is also a growing concern that the labour shortage is due to working conditions and unattractive wages. Women and minorities are also underrepresented in this sector.

There is a lack of greenfield investments in the industry, which is “stunting both innovation in food manufacturing and the upgrades of old facilities and old technology.”

The study authors also found limited federal support impacts the sector, though the pandemic has increased government interest in the food supply chain.

“Despite making essential food and other goods Canadians rely on every single day and despite supporting more jobs than any other manufacturing sector in Canada, the food and consumer goods sector has typically received little attention or support,” said Michael Graydon, CEO, Food, Health & Consumer Products Of Canada (FHCP), in a press release. “The government must urgently improve Canada’s investment environment and legislate to protect suppliers against unfair grocery fees.”

“Food and beverage manufacturing plays a key role in supporting farmers, and the rest of the supply chain. It needs to be broadly recognized through better, and more supportive policy. Canada has the potential to be a global force in innovation and food processing. As we have seen through the pandemic, domestic manufacturing is critical to Canadian security – food security included,” added Dr. Sylvain Charlebois, senior director, Agri-Food Analytics Lab at Dalhousie University.

Another factor negatively impacting the resilience of the food industry is the increase of food product prices.

The study found factory gate prices rose by 27 per cent. Also, machinery and equipment prices increased by 36.1 per cent over the past decade, and is expected to continue the upward climb.

The sliver of hope is that advances in transportation due to the entry

Nithya Caleb

of new players, such as Google and Amazon, may reduce costs.

Canada continues to be a “strong net-exporter of food products, and is a global leader in food and beverage product exports,” but manufacturing relocation away from Canada would affect this. The study also found that about 70 per cent of all processed food and beverage products sold in Canada come from domestic manufacturers.

The research discovered that food processing and manufacturing account for 37 per cent of food waste. When food waste ends up in the land fill, it produces emissions equivalent to putting 12 million cars on the road in Canada each year.

The study highlighted the fact that food and beverage manufacturing is Canada’s second largest manufacturing sector and top manufacturing employer. The sector’s GDP contribution in 2020 was $26.5 billion, about 13.5 per cent of Canada’s overall GDP. However, the growth is only marginal, as a decade ago, the sector’s contribution was 13.18 per cent.

As highlighted by the articles in this issue, plant-based food and beverages show a lot of promise. It could very well be Canada’s path to the top of the global food market.

Nithya Caleb ncaleb@annexbusinessmedia.com

Cargill plans to break ground on a new canola processing facility in Regina to support the growing global demand for canola products. The company expects to begin construction on the $350-million project early next year with plans to be operational by early 2024. The new facility is projected to have an annual production capacity of 1 million metric tonnes. This investment will generate approximately 1 million hours of employment throughout the construction phase. Upon completion, the company expects the facility will add approximately 50 full-time positions.

Arlene Dickinson launches Canada’s most extensive CPG business growth ecosystem

Arlene Dickinson launches a business growth ecosystem for consumer-packaged goods: Venturepark.

Venturepark will house Dickinson’s network of companies with a focus on supporting brands in the food and health CPG space. The new ecosystem offers capital, marketing, programming, innovation, commercialization and media amplification to the companies it serves. The new network includes Venture Play, Venturepark Labs, Venturepark Voice, District Ventures Capital and District Ventures Plus. Venturepark will serve clients across North America from its headquarters in Calgary, Alta. and offices in Toronto.

The launch of Venturepark follows a year of strategic shifts, high-profile hires, corporate acquisitions and numerous

investments through Dickinson’s venture capital fund, District Ventures Capital.

Molson Coors to quadruple production of hard seltzer

Molson Coors Beverage Company is increasing hard seltzer production capacity in its Canadian operations by 300 per cent. The expan sion is part of a $100-million investment in the company’s Canadian hard seltzer portfolio, and is mostly allocated for the Toronto brewery.

“Hard seltzers are fairly new in Canada, but Vizzy and Coors Seltzer have already proven to be hits,” said Frederic Landtmeters, president of Molson Coors in Canada. “Quadrupling our production capacity will allow us to make a lot more of our highly sought-after hard seltzers and better equip us to meet consumer demand well into the future.”

The company expects to be producing and co-packing Vizzy and Coors Seltzer, both malt-based and

> Scholle IPN , a supplier of flexible packaging solutions, partnered with Georgia-Pacific to develop, test and certify three patent-pending, bag-in-box package formats for liquids, according to Amazon’s ships-in-own-container (SIOC) certification process. The package range includes a dispensing tap design; a pour-out style solution; and a large-format dispensing tap design for large-volume use cases.

> Good natured Products, Inc., a North American leader in earth-friendly, plant-based products, introduces an innovative assortment of compostable microwavable-to-go containers as a viable alternative for businesses facing the impending single-use plastic ban in Canada. This is one of the first hot food packaging options in the Canadian market.

> TricorBraun Flex , launches Biotre 3.0, a fully compostable, plant-based packaging material. Biotre is a flexible packaging film made from renewable and compostable resources, such as wood and pulp. Available in a range of sizes, Biotre can reduce the amount of packaging in waste disposal because it breaks down naturally in a home composting environment. Biotre also preserves natural resources by reducing the use of fossil fuel and mineral resources.

spirit-based, in-house at the Toronto brewery as early as Winter 2022, and will continue to assess capabilities over time as product innovations and offerings come to surface.

Rritual teams up with NEXE to create compostable superfoods Rritual Superfoods partners with NEXE Technologies to develop and commercialize superfoods beverage products utilizing NEXE’s proprietary plantbased, compostable packaging.

“Rritual and NEXE can achieve a shared set of objectives, demonstrating best practices for plant-based, compostable packaging for an exclusive line of beverage products – something we see today as critical to our brand promise, but which in the future will be necessitated, as mass retail buyers we are working with have indicated,” said Rritual CEO, David Kerbel.

The Boston Beer Company is establishing a subsidiary to serve as a dedicated research and innovation hub in Canada focused on non-alcoholic cannabis beverages. Boston Beer is the manufacturer of alcohol brands, such as Samuel Adams and Truly Hard Seltzer.

It has hired industry veteran Paul Weaver to lead the research hub. This new subsidiary will enable the company to develop and pilot unique cannabis beverages while cannabis regulations continue to evolve around the world.

Real Treat’s Lemon Sablés with Herbes de Provence wins gold in the Cookies & Sweet Snacks category of the Specialty Food Association’s 2021 Sofi Awards. This is the first time a certified organic

cookie has won a Sofi Award. Further, Real Treat is the first Canadian brand to win a Sofi in this category since the inception of the award in 1972.

To win the highly competitive Sofi Award, Real Treat’s cookies were blind taste tested by a group of expert judges made up of seasoned food professionals including chefs, culinary instructors, recipe developers and specialty food buyers. Judges scored each submission on multiple qualities including flavour, appearance, texture, aroma and creativity.

Grain Discovery & Blindman Brewing launch first fully traceable beer

Grain Discovery and Blindman Brewing launch the first commercialized traceability system for beer, starting with their new May Long Double IPA. The companies have built an end-to-end digital system to trace Canadian grown malt barley through every stage of the value chain, from the field to a customer’s glass.

The May Long Double IPA will be the first beer from the Blindman product line to migrate to the Grain Discovery platform, providing a QR code for customers to scan, enter their lot number and view every step of the production process in detail.

> Clif Bar & Company has hired three CPG industry executives to helm the company’s next stage of growth and expansion. The new leaders are Shaunte Mears-Watkins, chief commercial officer, Roma McCaig , senior vice-president of impact and communications and Hari Avula , chief financial and strategy officer. Mears-Watkins will lead enterprise-wide growth initiatives including brand strategy, marketing, and sales. McCaig will oversee the company’s sustainability strategy and community initiatives as well as corporate, brand and employee communications. Avula will oversee enterprise business strategy and financial management.

> Danone Canada appoints Iannick Melançon as senior vice-president of sales. Melançon brings more than 20 years of CPG experience. He has been with Danone for 14 years in various sales leadership roles. He spent 10 of those 14 years in Europe including leading Danone’s global customer strategy and commercial leadership in the United Kingdom as well as the waters division in Spain. His expertise is expected to benefit Danone Canada in field sales operations, planning and account leadership.

> Further, Danone names Antoine de Saint-Affrique as CEO, effective September 15, 2021. The board of directors also decided to propose Antoine de Saint-Affrique as a new member to the board of Danone for appointment at the next annual shareholders’ meeting in April 2022. Saint-Affrique is the former CEO of global chocolate maker and cocoa processor Barry Callebaut.

> Modern Plant-Based Foods, a B.C.-based, award-winning, plant-based food manufacturer, hires chef Karen Barnaby as advisor and consultant to support product development and production scale-up of its meat alternatives and other plant-based products.

> AAK, a manufacturer of value-adding specialty vegetable fats and oils, appoints Dr. Jeffrey Fine as senior director, customer innovation, for United States and Canada. After serving as a consultant since October 2019, Dr. Fine will lead AAK’s customer innovation organization for the U.S. region.

> Food and Beverage Ontario welcomes Chris Conway as the organization’s new CEO. Conway is a proven expert in advocacy and government relations in both the manufacturing and education sectors. He has led three associations, most recently as CEO for Career Colleges Ontario and prior to that president of Concrete Ontario.

expands ultrasonic clamp-on

Endress+Hauser introduces the new Proline Prosonic Flow P 500 measuring system with built-in FlowDC functionality. Prosonic Flow P 500’s FlowDC function detects and automatically compensates for effects of disturbances on the measuring signal via calculation. This makes it possible, for example, to maintain a consistent, specified accuracy even with a significant reduction in inlet runs. Operators can install the Prosonic Flow P 500 wherever and whenever they want, independent of the pipeline design. Ultrasonic flowmeters have no moving parts. This non-intrusive measuring method with sensors mounted directly on the pipe enables safe measurement of corrosive, abrasive and toxic fluids, regardless of their properties. The new generation Prosonic Flow P 500 is suitable for monitoring and controlling processes employing a wide variety of fluids, such as chemicals, liquid hydrocarbons, solvents, acids, bases and water. www.ca.endress.com/en

Festo introduces the MS series of filtration products that lower the risk of particle contamination when compressed air comes into direct contact with food or packaging in the food zone. The MS series is designed for food and packaging-in-food-zone applications in the dairy, baking, produce, processed foods, pet foods, craft beer, cold food processing and beverage industries. www.festo.com/ca/en

Larry Martin

When markets move, funds tend to push them farther than they should. There is a bit of a lemming effect: buying corn, wheat or soybeans becomes ‘the thing to do,’ as a ‘hedge against inflation’.

We can observe this behaviour because funds are a separate reporting category. To illustrate, July corn futures rallied from $5.40 early April to $7.35 May 9. During most weeks during that period hedge funds increased their net long open interest (i.e. they bought contracts). A week or so before the top, funds actually reduced their net longs. In the final week, they again increased them, and then

For weeks, the question was “are these markets ever going to stop rallying?” Well, they did. USDA’s May report had more inventories than expected, triggering long liquidation by many of the so-called hedge funds. They are discovering margin calls! Oil is getting similar treatment, while the loon has been rising.

> Grains and oilseeds: USDA’s first forecast of 2021/22 carryover put corn inventories at 1.507 billion bu., and wheat at 774 million, compared to traders’ expectations of 1.334 and 730. Interestingly, USDA’s 2020/21 estimates were lower than expectations, as were both years for soybeans. 2022 is 15 months away and much can happen over that period. Stocks/use ratios are quite low, so I’m skeptical this report has any long-term meaning. It makes a good place to buy.

On the negative side, the US is seeding faster than expected, has good germination and experienced some moisture in the western corn belt and on second season Brazilian and Argentinian crops. However, there remains lots of time for “crop-killing” to happen. Expect more volatility.

> Corn: July corn peaked at $7.35 on May 7, then fell back to $6.58½ currently. This is near support at $6.42. If the market stays in this area for a few days, it is a buying opportunity. If it breaks through $6.42, the next level of support is $5.88.

> Wheat: July Chicago wheat peaked at $7.69½ on April 27, tested it again two weeks later, then faded to $6.79¼ currently. It is

they crashed after the peak, when price dropped to $6.35.

What went on here? Some funds got in early and rode the trend, realized that it was getting too high and took profits: if you bought 500 contracts at $5.40 and offset at $6.50, you made $2.75 million.

However, if you were one of the late entrants and bought 500 at $7.10, before it reversed to $6.35, you accumulated $1.875 million in margin calls, giving you incentive to sell and drive prices down. This behaviour adds to volatility, but it also gives serious sellers and buyers great opportunities.

Market Trends is prepared by Dr. Larry Martin (dlm@xplornet.com or 519-841-1698), who offers a course on managing risk with futures and options. For more information, visit agrifoodtraining.com.

approaching that significant $6.72 level mentioned last month. If it can’t get through there, it is a great place to do some purchasing. If it does break through, the next level of support is $6.15.

> Soy oil: The oilseed complex was led up by soy and palm oil due to strong post-pandemic demand and tight supplies of oilseeds. July bean oil peaked at $.70 and only dropped back to $.6708. We suggested to cover above $.48. If you did with paper, we would hold. The oilseed market is by far the tightest with the most potential to rise. If futures can’t get through $.70, then take profits, but be covered above $.70.

> Sugar: Sugar is a bull and bear conflict. Brazil and Thailand both expect major shortfalls because of dry weather, but India has a bumper crop. Recent reduction in crude oil prices make Brazilian use of sugar in ethanol less attractive, so more may go to refineries. The big question is how strong will post-pandemic demand be?

July peaked at $.1825 on May 12 before falling back to the current $.1695, which is major technical support. We would protect at this level, unless the market can close twice below $.1675.

> Natural gas: Predicted hot temperatures in parts of the US and strong export demand pulled natural gas prices up, but domestic demand has lagged and inventories are down. July natural gas futures peaked at $3.20 on May 17, then fell back to $3.02 currently. We suggested covering at $2.45 and holding to just under $3.00. With the current

chart, we would take profit if it moves down, but be covered above $3,12.

> Crude oil: July Brent crude trended upward in April and May, with prices testing the $70 level again in May. Chinese demand seems to be “temporarily curtailed” and uncertainty is rampant because the market is waiting for negotiations on the Iran nuclear treaty. That, and questions about post-pandemic demand, the general selloff by “hedge” funds set the market back to the current $66.60.

We suggested buying paper around $60 and selling just under $70. If buyers did that, you should be out now. Cover against a breakout above $70.

> Canadian dollar: Strong commodity prices and the Bank of Canada’s warning that inflation may lead to higher interest rates led to a higher loon. The June contract reached $.83 on May 18 before declining with the drop in commodity prices.

A part of the loon’s performance is relative weakness in the U.S. currency, which seems to be spurred partly by confidence in the economy and partly because of the preference for gold over the USD as an inflation hedge.

Interestingly, the rise is despite the Bank of Canada warning the currency is overvalued. As always, our preference is to hold C$ Puts as insurance against a falling loon, buying Puts two or three strikes out of the money and rolling them 1½ to two months before contract maturity. That would mean $.82 or $.815 Puts on the December currently.

Ron Wasik

recently received a few inquiries from aspiring processors planning to market fully cooked foods. The inquiries brought to mind the many variables one has to consider in preparing fully cooked dishes.

Size and shape: It takes longer to heat a larger and thicker product than light and uniform one.

Variability: The more variability of size, shape and composition within a batch or product, the greater the challenge to establish the safest and best conditions to fully cook the food.

Most foods are not homogeneous throughout like hot dogs. Natural products usually vary in makeup from one end to the other, and this will impact the rate of heat penetration.

Coatings: Coatings affect the rate at which change takes place within a product during heating, cooling and dehydration. The coating’s composition and the uniformity of the coating on the product must be taken into consideration.

Marinade quantity: Introducing a marinade into a product adds to the product’s mass and slows the rate of heating and cooling. Certain ingredients like phosphates, if present at high levels, inhibit denaturing of blood in bone-in poultry pieces. As a result, meat will appear uncooked even when the pieces have been heated to an internal temperature of 100 C or more. The process of marinating also adds to the microbial load inside and on the surface of a product. The older the marinade, the higher the bacterial load. Other things to consider are the pH and ionic strength of the marinade, which can affect food safety as well as quality. Quality of the raw materials: As a rule-of-

thumb, if it’s “garbage in,” then it’s “garbage out,” which means poor quality raw materials end up producing lower quality and, potentially, unsafe products. An often-overlooked factor is the age of raw food. Older raw foods have higher microbial loads and very different chemistries from their fresh counterparts. This affects both quality and food safety.

Processors have to consider how mitigation measures affect the product’s quality.

Mode of cooking: Products can be heated by convection, conduction and radiation. In convection, products are cooked using forced-air ovens employing either dry or humidified air to transfer the heat energy to the product and to take away excess moisture. Conduction cooking transfers thermal energy to the product by making direct contact with either the product or its container. Radiation introduces heat energy via electromagnetic means. All of these cooking methods need to be managed carefully to produce consistently safe, high quality products.

Belt loading: The upside of squeezing more product on the oven belt is that it increases throughput, but the downside is

that the rate of heating and the uniformity of heat penetration are reduced. Heating control: Both the quality and food safety of the product are affected by the rate at which energy is delivered to the product. Better controls result in safer, higher quality products.

Processors not only have to assess food safety risks and how best to mitigate them, but also consider how all the variables and mitigation measures affect the product’s quality, shelf life and the bottom line. It’s a balancing act.

Dr. R.J. (Ron) Wasik, PhD, MBA, CFS, is president of RJW Consulting Canada. Contact him at rwasik@ rjwconsultingcanada.com.

It is undeniable that one of the largest developments in food in recent years has been the proliferation of plant-based products. Whether it is ice-cream alternatives made with coconut or milk alternatives created with cashews, nearly every animal product has a substitute that does not contain animal-derived ingredients. From a consumer perspective, this means there are potentially more options on the grocery shelf. However, from the perspective of companies developing and selling meat alternatives, the situation in Canada is challenging. Recently proposed guidelines for these products may, in reality, result in more constraints.

At present, the federal Food and Drug Regulations (FDR) has compositional requirements for simulated meat and poultry products. These products only have the appearance of meat or poultry and not the actual meat or poultry. Under FDR, most simulated meat and all simulated poultry products must contain a minimum amount of protein and fat and be fortified with vitamins and minerals. All of these products must meet their corresponding compositional requirements to be sold in Canada.

These regulations have historically posed a number of challenges for the industry. For example, the minimum protein requirements in Canada are higher than other countries. Fortification is also not mandatory in other countries producing and selling simulated meat and poultry products, most notably in the United States, Canada’s largest trading partner. Brand owners are obligated to reformulate their products to Canada’s standards in order to sell them here. This often results

Lewis Retik and Victoria Asikis

in products that may not meet the same texture or taste profile as the non-Canadian versions. Alternatively, brand owners do not even attempt reformulating to sell their products in Canada. Companies wishing to sell alternative meat products in Canada have advocated for years to change the mandatory compositional requirements to allow for more flexibility in the development and formulation of these products.

In the fall of 2020, the Canadian Food Inspection Agency (CFIA) released proposed guidelines for simulated meat and simulated poultry products. The guidelines better delineated the difference between a product that is in the shape of meat or poultry products but may not be attempting to simulate the same taste and/or texture from products that are intentionally trying to simulate meat or poultry. This was helpful in providing industry additional clarity as to when it did not need to consider the fortification or macro nutrient requirements of the

simulated meat or poultry provisions in FDR.

However, brand owners were hoping Health Canada would adopt a more flexible approach to the formulation of simulated meat and poultry products. In this regard, there is no proposal to amend the regulatory requirements, and therefore, at least for now, the law has not changed.

This poses a unique challenge going forward. For brand owners who were hoping the law would evolve with changing consumer demand and global manufacturing trends of these foods, the guidelines were disappointing, as they did not address the longstanding issues facing industry. These companies are hoping Canada’s legislation will progress to strike a reasonable balance between the need for these products to meet certain compositional requirements and allowing broader availability of these products in Canada. At this point, it is unclear whether companies will choose to formulate for the Canadian market or continue to limit products sold in this market.

The public comment period on the guidelines closed in early December 2020, and any potential revisions to the proposals are yet to be disclosed by CFIA. For now, when it comes to simulated meat and poultry products in Canada, one thing is for sure: the more things change, the more they stay the same.

Lewis Retik is a partner in the Ottawa offices of Gowling WLG. He is leader of the food and beverage group and co-leader of the cannabis group. He can be reached at lewis.retik@ gowlingwlg.com.

Victoria Asikis is an associate in the Ottawa offices of Gowling WLG, focusing on food and product regulatory law. She can be reached at victoria.asikis@gowlingwlg.com.

Birgit Blain

When surveying food stores, I often see packaging graphic designs that miss the mark. It is important to understand packaging is more than a pretty face. As the primary communication vehicle for brands at the point of purchase, it must convey key information and have visual impact. Do you assume any graphic designer has the knowhow to design a food package? Here’s why that is not the case.

Food package graphic design demands expertise. Graphic design is a profession with many disciplines and food packaging is one area that demands special expertise. Numerous factors unique to packaging put graphic designers to the test.

Regulations

Health Canada regulations dictate mandatory information, placement and formatting for food labels. A designer with knowledge of the requirements for presentation of information can prevent costly mistakes. A regulatory specialist should still be consulted to ensure packaging is compliant with regulations.

Real estate on packaging is very limited, yet marketers love to cram in as much information as possible. Regulatory requirements and Canada’s bilingual labelling further complicate the process.

The challenge is to fit in a plethora of text and graphic elements, and clearly present dual language information while creating a legible, impactful package that doesn’t look cluttered. Experienced package designers have the talent and skills to manipulate numerous visual elements and fonts to

accommodate an inordinate amount of information without overcrowding.

Graphic designers typically work in two dimensions, but packaging has a third dimension that must be designed around.

Brands have no control over instore merchandising, shelf placement and number of facings. Food retailers use various merchandising strategies in planograms that impact how brands present on shelf.

An inexperienced designer may assume brands are blocked within the set. More commonly a product range is split up and merchandised according to category, segment, flavour or size, and with prime eye-level slots are typically allocated to store brands and multinationals, other brands can end up on the top or bottom shelf.

Deciphering a category set can be mind boggling for shoppers. How do you differentiate multiple skus in a way that consumers will grasp quickly? Making it easy for them to find the brand and flavour they want in a sea of competitors will capture sales.

Packaging requires a variety of substrates and printing processes, each with their own tolerances. Depending on colour specifications, printing processes, equipment, press speed, inks, coatings, laminations and other variables it can lead to undesirable results. This includes poor resolution, inaccurate colour reproduction and registration, inadequate legibility and an inferior end product. Colour selection can drive up the cost of packaging. A designer who knows how to work with colour and printing systems can specify colours to keep packaging costs in line.

Brand owners don’t always hire the right pro for the job.

Stores use a variety of fixtures— shelving, wire racks, pegboard, bins, bunkers and coolers with glass doors—that affect how products are displayed. Shelf dimensions and spacing, and lighting also play a part in product visibility.

It’s important to understand instore merchandising and how a product stacks up on shelf. Effective package design takes these variables into consideration.

Understanding the limitations of print processes and building artwork accordingly, within dieline limitations and printer specifications, can help to mitigate quality issues and manage costs. Brand owners don’t always hire the right pro for the job. Perhaps it’s to save money or because they don’t understand the complexities of the work. Hiring an experienced package designer can optimize the quality of packaging and save rework, time and money. In short, it’s a good spend.

As CPG food consultants, Birgit Blain and her team transform food into retail-ready products. Her experience includes 17 years with Loblaw Brands and President’s Choice. Contact her at birgit@BBandAssoc.com.

Gary Gnirss

here is something new about making food rules in Canada.

In February 2021, Health Canada started formal consultations with the Canadian Food Inspection Agency (CFIA) on a proposed joint policy statement on food labelling co-ordination. This stems from the 2019 Agri-food and Aquaculture Sectoral Regulatory Review Roadmap, where the strain of multiple food labelling modernization rules highlighted the advantage of co-ordinating efforts.

Our U.S. neighbours have been exercising uniform compliance dates for about 20 years. The implementation date for new food labelling amendments is always January 1 of every second even year. However, labelling changes that are deemed a priority for safety and health purposes can be rolled out outside the two-year period.

The Canadian approach, as being discussed, would be similar. Health Canada would likely reserve the right to expedite the implementation of label changes that are deemed a priority for health and safety purposes. An example of this was the swift rulemaking and implementation related to restricting the alcohol level in “flavoured purified alcohol” beverages (2019).

Uniform co-ordinated compliance dates are a good move. With the 2019 consolidation of many federal food label regulations in Canada, when the Safe Food for Canadians Act and its regulations (SFCA, SFCR) came into force, the co-ordination between this act and the Federal Food and Drugs Act and its subordinate regulations (FDA, FDR) became simpler.

Food labelling in Canada is governed by both federal and provincial rules. While federal rules predominate food labelling, they are not universally paramount to

provincial regulations. FDA and SFCA are the two titan pieces of legislation governing foods. Food labelling is governed by both FDR and SFCR FDR is the principal legislation governing nutrition, ingredient, allergen, gluten source and sulphite labelling. SFCR governs net content labelling for consumer prepackaged food and as well non-consumer prepackaged food for certain commodity types. Both govern label elements like common name, dealer name and address, and country of origin. The scope of country-of-origin labelling varies. For example, country of origin under FDR covers certain alcoholic beverages whereas SFCR has a broader scope. Even with SFCR, country-of-origin rules vary depending on whether a food is prepackaged or consumer prepackaged, and, of course, the commodity type. Both FDA and SFCR address label and advertising misrepresentations.

Lots of organizations are involved with food labelling in Canada. The key players are Health Canada, Food Directorate and CFIA. The latter is a creation under Agriculture-Agri Food Canada, but on the food side, it is jointly overseen by both. However, CFIA operates as an independent agency and is responsible for enforcing the provisions of FDR and SFCR. It is also responsible for administrative aspects of food labelling, such as matters related to trade and commerce, food standards and their identity, grades, standard container sizes, etc. Health Canada administers FDR in respect to issues related to health and safety matters, such as allergen, gluten and sulphite labelling as well as nutrition labelling. Therefore, when faced with labelling amendments, CFIA’s sandbox could spill over to that of Health Canada’s, and viceversa. Hence, co-ordinated effort is essential

if amendments are to be implemented in the most efficient way possible.

Nutrition and ingredient labelling is administered by Health Canada, governed by FDR and enforced by CFIA. When regulations under FDR are subject to the Statutory Instruments Act and Regulations, final amendments must be registered by the Privy Council Office of Canada. The amended FDR rules related to the new ingredient and nutrition labelling regulations were registered on December 2, 2016. The implementation date is not a fixed one. It can be set to any date, like the date of publication in Canada Gazette II or any date thereafter. In this case, the new rules became law on registration but were set to come into force on December 14, 2016. A five-year transition period was provided based on the coming-into-force date. The end of that transition period is technically still December 14, 2021. However, CFIA has extended that date until December 14, 2022, and under certain circumstances, no longer than December 14, 2023, because of COVID-19. The lack of a uniform compliance could complicate matters. Just image how difficult it would be if one had to keep track of multiple food labelling amendments that have their own individual compliance dates.

Fortunately, there is a proposal to set a universal compliance date, effective January 1, 2026, and then every two years after that. A fixed date will allow Health Canada, CFIA and the industry to better plan for changes.

Gary Gnirss is a partner and president of Legal Suites Inc., specializing in regulatory software and services. Contact him at president@legalsuites.com.

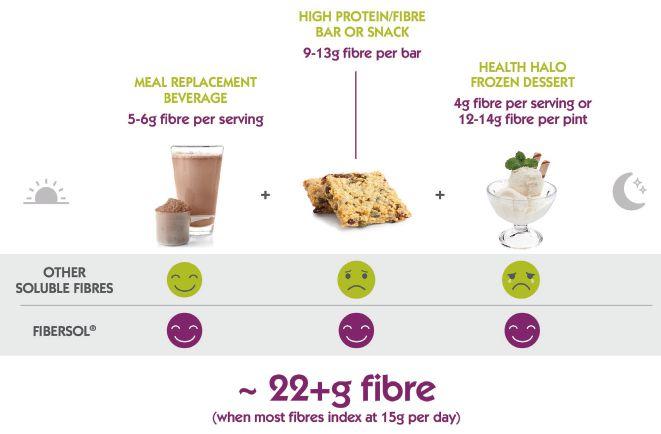

Nearly 2/3 of consumers are adding fibre in their diet1 because they believe it is important,2 yet +95% fall short of the recommended intake of 28g per day.3

65% of consumers associate fiber with boosting their immune system.4 Yet, if a product causes gastrointestinal discomfort—for any reason— nearly 70% of consumers will not buy it again.1

Better-for-you foods and beverages may cause discomfort that consumers blame on diet choices or health conditions5 when actually, the soluble fibre source may be at fault.

A well-tolerated fibre can make a world of difference.

Well-Tolerated Fibersol®

Fibersol®’s soluble prebiotic dietary fibre ingredients bring positive nutrition to a variety of food, beverage and dietary supplement applications—without discomfort.

Fibersol® and Digestive Tolerance

Fibersol® resists digestion in the stomach and small intestine and is slowly fermented by the flora in the large intestine. With less rapid off-gassing than other soluble fibres such as inulin or oligofructose, Fibersol® helps minimize bloating or gastric discomfort.6

Fibersol® delivers desired benefits and is well tolerated vs. other soluble fibres—even when consumed in a variety of products throughout the day.

With products containing less-tolerable soluble fibre ingredients, consumers may feel discomfort as they nourish and snack throughout the day.

Fibersol® is well tolerated at up to 68 grams per day7 for positive nutrition and indulgence—without any gastrointestinal discomfort—from morning to night.

At 4-8g daily, Fibersol® is shown to:

• Help support or maintain intestinal regularity

• Help relieve occasional constipation

• Support gut health

• Improve stool consistency*

Fibersol® prebiotic fibre helps today’s wellness-minded consumers maintain intestinal regularity and a healthy digestive system, comfortably. *selected studies

Areas to focus on to capture 10 per cent of the world’s plant-based food market

— BY TREENA HEIN —

Arecent study by global research firm

Ernst & Young (E&Y) found the global market for plant-based food, feed and ingredients is expected to surpass $250 billion by 2035. It also determined that growth in the plant-based market will be driven by demand for meat and dairy alternatives.

“It’s an ambitious goal, but we believe Canada can capture 10 per cent [of the market], creating an additional $25 billion in annual sales. It’s a goal that’s needed to help strengthen Canada’s economy and make us a global leader in the plant-based race,” says Bill Greuel, CEO of supercluster funding agency Protein Industries Canada (PIC). PIC had commissioned the study.

To achieve this ambitious goal, Greuel identifies three broad must-dos. One of them is innovation, including initiatives to get more value from processing methods. This will take more investment, but Greuel notes that this “doesn’t just rest with the government, which has invested $153 million already.”

Private investment will increase, in his view, as integration throughout the plant-based value chain grows. This means crop breeding companies (that develop varieties with more protein, less fibre, or different protein profiles, for example) need to be closely connected with crop protein processing technology developers, and in turn, ingredient and end-product makers. PIC has already started projects in this vein.

PIC’s overall focus in creating a robust plant-based innovation ecosystem has been to ensure small start-ups, medium-sized firms and large companies work together. “The multinationals

already have broad reach and years of business experience and are always searching for new sources of innovation,” Greuel explains. “We need all sizes of company to work together. Every PIC application for funding must have at least one SME.”

An example is the PIC project announced in mid-2020 with large firm AGT Food and Ingredients and start-up Ulivit. They are working together in Regina on processing pea, lentil and faba bean protein concentrates into high-moisture meat analogue and tempeh.

For Canada to capture 10 per cent of the world plant-based food market, it will need to scale up in terms of both crop and ingredient production. The E&Y report found that more than 65 million metric

tonnes (mmt) of crops will be required globally by 2035 to meet plant-based food product demand. To capture one-tenth of that market, Canada will need 8 mmt of applicable crops (pulses, canola, hemp, beans), says Greuel.

It’s a plus that Canadian crop farmers are quick to adopt new varieties or add new crops into their rotations, such as yellow peas and lupin. However, to spur interest in growing the major plant-based product crops, PIC is supporting the creation of a high-tech grain traceability and marketing platform. In mid-April, this project moved into the second phase. Winnipeg-based Farmers Edge, an agritech company, is providing crop growers with field-level analysis; Grain management company OPIsystems is helping to better dry, condition and store grains; and Edmonton-based TrustBix is building a blockchain system to improve traceability. Crops aside, processing capacity must also increase. “We need more investment now,” says Greuel. “We need plants to be built here, and while it makes sense from a raw materials’ perspective to build plants on the Prairies, the competitiveness of Canada’s business environment is not what it could be. Our tax rates, incentives to build and so on aren’t, or aren’t perceived, as being as good as some other jurisdictions. Our regulatory environment must also be improved in terms of consistency and the ability to keep pace with change.”

While Lovingly Made has scaled up nicely during the pandemic, it and other plant-based ingredient makers need greater volumes of raw materials. Sutton is hopeful this will happen in the next two years.

For its part, Ahmad Yehya, CEO of Nabati Foods Global in Edmonton (Nabati makes plant-based ‘meats’ and ‘cheesecakes’) has seen a spike in demand, with three-month waitlists for its products, as of mid-April, and the recent completion of an oversubscribed $7.7-million financing round. “We are investing part of that capital in a brand-new manufacturing facility [that is] seven times larger than our current pilot plant,” says Yehya.

Lindsay Sutton, sales manager at Lovingly Made Ingredients (Calgary, Alta.) agrees. “Canada is a massive grower of pulses and grains. But, at this point we still ship the majority of these products outside our borders to be refined or fractionated into starches, proteins and fibres, only to be shipped back and used here. Investment into fractionation is cost-in-

Greuel is optimistic about Canada’s ability to be a major player in the plantbased food business. “Canada has a strong global reputation for food safety, and the E&Y report cites this as one of our key competitive advantages,” he says. “Companies are also interested in doing business here because of our strong reputation as a sustainable source for commodities and ingredients. We have so many advantages and I believe we can reach one in 10.”

To conclude, if Canada continues R&D in processing methods and product development, increases both its protein crop growing and processing capacity by supporting farmers to get top value and attracts more international investment, it is possible to capture 10 per cent of the global plant-based food market.

Cher Mereweather

Soft power, or the power of influence refers to the “ability to attract and co-opt, rather than coerce...to shape the preferences of others through appeal and attraction”. It creates win-wins. While soft power gets things done in a way that makes people feel good them, hard power results in feelings of resentment and mistrust.

Unfortunately, soft power is mostly absent from the food industry. Coercion and strong-arming—the tenets of hard power—are the daily reality in this industry. From farmers to retail, we exert pressure on other parts of the supply chain to get what we want. We flex our muscles rather than our brains.

I see the impact of this hard power approach every day. Producers and manufacturers are distrustful of retailers. Farmers are wary of processors. Food service and retail are uneasy around distributors and manufacturers.

Over the course of my over 20-year career in food, I’ve not been afraid to call out what I see as failings. I also don’t hesitate to champion organizations that use the power of influence to create better outcomes for all. I would like to highlight two of them in this column.

The first is the Canadian Agri-food Sustainability Initiative (CASI). This group of leaders from across the food system have been working for four years to harmonize the way companies share their data and report their sustainability performance. Food and beverage companies spend an inordinate amount of time completing reporting processes

is powerful, disruptive and will make a real difference across the food system.

Soft power is mostly absent from the food industry. From farmers to retail, we exert pressure on other parts of the supply chain to get what we want. We flex our muscles rather than our brains.

that vary from one supplier, distributor, region or retailer to another. Getting useful data from two or three levels down in the supply chain can be a headache. Further, the quality of the data is often dubious.

CASI is seeking to create a single reporting system for everyone to use. Of course, soft power has to be at the heart of this project. No amount of coercion will get farmers, processors, manufacturers, distributors, retailers and food service representatives to openly share their needs, challenges and best practices. This is only possible by influencing through “appeal and attraction”. The solution that is being developed (yes, I’ve had a sneak peek)

As I mentioned above, retailers are not averse to using hard power to get what they want from their supply chain. However, when it comes to sustainability, it is clear soft power has an increasingly important role to play.

Both Sobeys and Loblaws have or are running programs to engage their suppliers in developing their own sustainability and circularity plans to ensure food waste, water, energy and greenhouse gases emissions are tackled upstream in the supply chain itself, and before the products arrive on the shelf.

Coercion wouldn’t work here. By influencing suppliers with a win-win that helps them promote efficiency, cost reduction and brand elevation, both retailers are demonstrating that it is possible to do good and make money— everyone can agree that would be a positive outcome.

In conclusion, I would like to invite all of you to reflect on how the soft power of influence is your best ally in creating a more sustainable food system in this country.

Cher

Mereweather, CEO of Provision Coalition, Inc., is a food industry sustainability expert based in Canada.

— BY MARK JUHASZ —

In today’s busy beverages sector, consumers desire convenience, nutrition, taste and, increasingly, a clear conscience. Dairy milk beverages, and a plethora of ‘milk’ alternatives have become a highly contested category.

The updated Canada Food Guide, and a July 2019 Statistics Canada study, encourages Canadians to drink water regularly, consume vegetables and fruits more than juice, and to consume up to half a litre of either one or two per cent milk daily or soy milk (the only milk alternate mentioned). The guide also limits fruit-flavoured drinks, soft drinks, sport/ energy drinks and sweetened drinks.

Milk and milk alternates face the many niche markets where consumers make choices. Factors such as nutritional density, gut health, reduced toxicity (from pesticides), animal welfare (in relation to dairy milk), environmental impact, and digestibility serve different demographics. The buying power of a new generation is pushing beverage companies to advance food science and product attributes to meet greater expectations. A January 2017 study by Deloitte, entitled Global Dairy Sector Trends and Opportunities, highlights macroeconomics trends such as urbanization, rising incomes and movement toward greater consumer protein intake. Consumers seek ‘clean labels’, for products to ‘go green’, to be ‘natural’ or ‘free from’, and 55 per cent of respondents are willing to pay 10 per cent more for it, while 23 per cent will pay 10 to 20 per cent more.

A recent piece by FoodBev Media in March 2020 adds that 35 per cent of U.K. adults are skipping a meal in favour of a snack, and global dairy snacking is expected to grow. However, younger consumers are drawn toward dairy alternatives, so brands will need to re-think flavours, functional-nutritional profiles, and include plant-based and lactose-free options. In March 2019, McKinsey & Co contributed to the dairy vs. milk alternative debate by examining the potential areas of growth. According to their study, a new generation of digitally savvy consumers are avoiding ‘big food’, and up to 82 per cent ‘must know’ or ‘would like to know’ more about product ingredients, while 70 per cent want sourcing information practices. Consumers are weary of awkward ingredients, artificial flavours, colours, GMOs, or high levels of sweeteners or sodium. McKinsey added that tailoring value propositions to niche consumer segments is a challenge due to omnichannel proliferation and media fragmentation.

Amidst the significant rise of milk alternatives, cow’s milk has some strong elements going for it. It is a complete, nutritionally dense food known to benefit muscle mass, bone density and satiety. Dairy milk components, such as casein and whey protein, serve well established markets. It also addresses the growing demand for digestive health with fermented beverages, and can be marketed as a local product, especially when it comes from largely grass-fed sources, as is the case of organic Canadian milk.

Specific to gut health, a March 2020 FoodBev Media report noted the specific opportunities for kefir, a fermented dairy product, which is packed with strong health attributes, supports digestion, and has a lower lactose profile. In the Journal of Functional Foods, Garcia-Burgos and a team of Spanish researchers in 2020 highlighted the special characteristics of fermented dairy products as a functional food with antioxidant properties and does not need to be fortified like milk alternatives.

In their 2019 Plant Milk report, ProVeg, a plantbased advocacy group, claim that 75 per cent of the world’s population is lactose intolerant, and a growing generation of people are turning toward plant-based beverages as a personal preference. By 2018, plantbased milk sales had risen nine per cent in the U.S.A., while sales of traditional cow’s milk sales had declined by six per cent. Further, plant milks accounted for 15 per cent of total milk sales. Research and Markets, a data agency, projects non-dairy milks to reach $38B USD in sales by 2024.

A trend toward milk alternatives is clearly evident. In 2016, dairy giant Danone purchased Alpro, a milk alternative company, and Finnish dairy producer Valio launched a plant-based line of non-dairy milks and yogurts. More than 50 per cent of U.S. and E.U. consumers, 69 per cent in Asia-Pacific and 71 per cent in Latin America drink plant-based milks. In the U.S., almond milk accounts for 64 per cent of market share, with soy milk at 13 per cent, and coconut milk at 12 per cent. In Sweden, oat milk occupies 66 per cent of plant-based milks.

In a January 2020 article in the Guardian, Annette McGivney wrote, “All milk alternatives are better for the planet than dairy.” She cited a 2018 University of Oxford study that found producing a glass of dairy

milk results in three times the amount of greenhouse gas emissions than a plant-based alternative. While the scientific merit of this study is up for debate, the environmental footprint of industrialized dairy production has been scrutinized for decades. McGivney’s article also sheds light on the impact of milk alternatives. For example, coconuts grown for a rising global market have “led to deforestation and place pressure on rainforests”. Closer to Canada, the California almond industry claims it takes 130 pints of water to produce a single glass of almond milk.

Advances in food science and rapid consumer responsiveness in both animal and plant-based milks is leading to a positive future. For example, lactose-free, grass-fed and organic dairy milk that are certified for animal welfare is now available. According to the research agency, Reports and Data, the global probiotics market in 2020 was $14.7B USD, and it serves the demand for ready-to-drink functional beverages addressing gut health disorders. Probiotics are well established with brands such as Yakult, Danone, Nestle, Lifeway, Nextfoods, Fonterra, Chobani and Bio-K.

Even though dairy milks will continue to innovate and evolve, scholars such as Erica Pontonio and Carlo Rizzello claim there is “a growing prevalence of allergenicity toward cow’s milk, lactose intolerance, and hypercholesterolemia” in a 2021 article for the academic journal Foods. These statements and growing consumer awareness are leading advances in food science, emulsification, fortification, and cost-efficient operations. Beverage brands in dairy, and plant-based alternatives, alike must remain aware of the possibilities.

Data agency Research and Markets projects non-dairy milks to reach $38B USD in sales by 2024.

In response to consumer demands, the dairy industry is now offering lactosefree, grass-fed and organic dairy milk that are certified for animal welfare.

Jupiter and Food 4 Pets Canada announce new partnership

Jupiter, a company specializing in the manufacturing of dry food for dogs and cats, is partnering with Food 4 Pets Canada, which focuses on manufacturing wet food for dogs and cats for the Canadian, American and European markets.

The partnership will capitalize on enhanced product lines and provide Food 4 Pets Canada with new growth opportunities, including an expansion of its production plant. The synergy and the sharing of complementary expertise between the two Quebec companies will also give this manufacturing group the opportunity to stand out in the pet food industry and foresee future expansions.

“This partnership will enable Jupiter and us to offer our respective customers a combination of wet and dry food, practically under one roof. This alliance will also give us a preferential position in the North American market,” said Dominique Martin, president, Food 4 Pets Canada.

“By pooling their respective strengths, our two companies will give rise to a major manufacturing group in the pet food industry. This will enable us to better serve our many customers,” added Jean-Philippe Désilets, founding partner of Jupiter.

Royal Canin North America along with the Village of Lewisburg in Preble County is building a new, $390-million factory in Lewisburg, Ohio, to meet increasing demand for its premium pet nutritional products.

The 450,000-sf Lewisburg loca-

tion will join Royal Canin’s five other manufacturing sites across the United States and Canada. The factory will manufacture both Royal Canin and Eukanuba health and nutrition with both dog and cat food product lines. The new facility will pursue a Leadership in Energy and Environmental Design (LEED) Silver certification.

“We are excited to expand our presence in the Lewisburg area and continue to partner with the State of Ohio to invest in U.S. manufacturing and the local community,” said Roland Hooley, vice-president of value chain operations for Royal Canin North America. “This expansion fuels the local economy and allows us to further invest in communities like Lewisburg where we are proud to call home.”

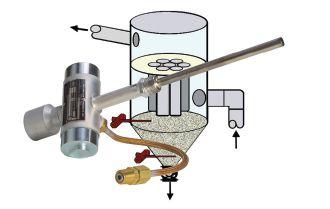

The Dynatrol DJ Level Switch handles either high or low point level detection of bulk solids. The detector operates on applications, such as baghouses, cyclone separators or above airlocks. Maintain consistent results with dry pet food and other dry ingredients, feed blending, grain storage, pellet mills and mineral additives.

Dynatrol DJ Level Detectors require no adjustments and have no moving parts. There are no gaskets or seals to deteriorate. They withstand dusty environments and work well in vessels

equipped with vibrators. Installation is also simple. The level switch mounts through a ¾-in. half-coupling at the point of desired level detection. Specialized units are available for temperatures in excess of 500 F Approved for Class III services, as well as for Class I, Groups C & D; Class II, Groups E, F & G; and Class III.

Open Farm commits to reducing its carbon footprint by 2030 Open Farm is embarking on a journey to reduce the brand’s carbon footprint by 2030. Starting with a commitment to offset emissions from the company’s direct operations and manufacturing, Open Farm will set and work toward ambitious science-based targets to reduce their greenhouse gas (GHG) emissions.

“At Open Farm, we have always set out to pioneer better standards and practices in our industry, and this aggressive carbon reduction plan is a crucial next phase of that leadership journey,” said Isaac Langleben, CEO,Open Farm.

To establish the company’s climate strategy, Open Farm has measured its emissions and is pledging to reduce its Scope 1 and Scope 2 emissions by 42 per cent over the next decade, in line with the 1.5-C goals of the Paris Agreement on Climate Change.

As a first plan of action toward offsetting carbon emissions, Open Farm has chosen to support three high impact programs that provide verified carbon offsets. These offset programs contribute to the preservation of important ecosystems in the agricultural and forestry sectors and have co-benefits that reflect Open Farm’s mission, such as the preservation of biodiversity and the protection of endangered species.

General Mills acquires Tyson Foods’ pet treats business

Tyson Foods, Inc., sold its pet treats business to General Mills, Inc., for approximately $1.2 billion. The sale includes the Nudges, True Chews and Top Chews brands, as well as a production facility in Independence, Iowa. Tyson Foods will continue to provide meat ingredients for the pet treats business after General Mills assumes ownership.

“We’re proud of the tremendous success of this business and the diligent work by our team to meet growing demand for high quality pet treats,” said Noelle O’Mara, group president of Prepared Foods for Tyson Foods. “We believe the time is right to transition these great brands to an established pet foods business where they will complement their existing portfolio.”

Tyson Foods’ pet treats business and the approximately 300 team members involved in it will become part of General Mills after the sale is completed.

> Acana introduces healthy grains dry dog food, high-protein biscuits and freeze-dried food . Champion Petfoods has incorporated healthy grains including sorghum, millet and oats in the healthy grains food. Created in small batches and packed in easy-to-serve portable pouches, the freeze-dried food comes in morsels and patties. It can be served as a full meal or meal topper. The high-protein biscuits are crafted with five simple ingredients, including nutrient-rich liver.

> Cargill launches the Chompery, a new brand of butcher-quality dog treats. The treats are all natural, single-ingredient and both sourced and produced in the U.S. The Chompery bones, ribs, windpipes and can be used at multiple occasions and purposes, including long-lasting entertainment, rewards and training.

> Petcurean , a producer of premium quality pet food brands, is announcing a global brand refresh of its Now Fresh recipes for cats and dogs. As part of the refresh, Now Fresh recipes have undergone minor changes that do not affect nutritional performance or palatability, allowing most pets currently eating Now Fresh to easily switch to the updated recipes. The Now Fresh kibble packaging has also been updated to better communicate how the recipes are uniquely positioned in the market.

Nuna is the first cat food in North America to be made with insect protein

— BY MARK CARDWELL —

Montreal pet supply scion Rolf Hagen Jr. says he’s satisfied with the modest retail sales posted by his family-owned firm’s new Nuna line of cat food, the first in North America to be made with insect protein.

However, as president and CEO of the Hagen Group, the world’s largest private multinational maker and distributor of pet products, he is electrified by the market potential of the novel product.

“It’s a small niche, but sales are building each month,” said Hagen, son of company founder and Canadian pet industry pioneer Rolf Hagen Sr.

The two-flavour Nuna line is part of the Hagen Group’s Catit brand. Made from a mix of insect, yeast and meat protein—chicken or fish—the dry kibble went on sale both online and at retail locations across Canada in January, 2021. It is also available in the U.S., but only via the Catit.com website.

The line is also now being launched through Hagen’s extensive network of pet retail companies in Europe and the United Kingdom. A container was also shipped to Korea in April, the start of what Hagen hopes will be a lucrative foray into the Asian market, where Catit is already a top brand, thanks to its many lines of quality cat products including wet food, interactive toys, drinking fountains and furniture.

“Our partners in China are very excited,” said Hagen. “The cat market in China is looking for high-end products like this and we’re already one of the top brands there, as well as in Japan. They believe there is a niche for a very educated and quality product like ours.”

Developed over the past few years at Hagen’s 270,000-sf facility in the west-end Montreal neighbourhood of Saint-Laurent, the Nuna line uses the floured larvae of black soldier flies, the same animal protein alternative being used by Nestlé’s Purina to make their new Beyond Protein dry dog food line in Europe. Catit also uses the same ingredient to make Bug Bites fish food under its Fluval brand.

According to Hagen food scientist Grégoire Guot, the project’s goal was to use the nutrient-rich larvae as an eco-friendly

Guot said the challenge facing Hagen was to find a balanced formula that was both nutritious and tasty to cats.

“People think cats are finicky but they’re not that difficult,” he said. “They just like to eat what they know, and there is a genetic aspect to it: cats tend to love what their mothers ate.”

Guot said it took a year of taste testing by different panel of cats (both internally using pets of Hagen employees and externally employing professional cat tasting panels in Ontario) to find the right blend of protein and flavours for the new Nuna line.

“We tested a few different recipes,” Guot said about the panels, which typically involve 40 cats that are kept for two days in a common area with free access to automatic feeders. The amounts of food they eat and their reactions and behaviours are recorded for statistical analysis to help measure acceptability, palatability and digestibility.

Once the two Nuna recipes were approved, focus switched to production. Unlike airtight wet cat food lines like Catit’s Divine Shreds and Fish or Chicken Dinner, which are

substitute for the more resource-intensive meat from farmraised animals that are found in traditional cat food.

“Insects are still considered animals so making a vegan food was never the plan, but cats can’t survive on insects alone either,” said Guot.

All felines, he noted, from the world’s 500 million house cats to the remaining 3900 tigers in the wild, are obligate carnivores, meaning they rely on meat to survive because their bodies can’t digest plants properly.

cooked in sealed cans or pouches to protect them from oxidation and contaminants, dry food kibble like Catit’s Gold Fern, which is 95 per cent meat and green-lipped mussel, need to be created out of ingredients that can provide 12 to 18 months of shelf life.

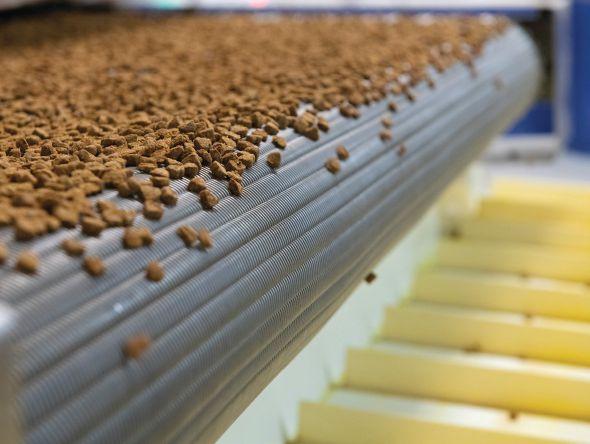

Supplied by various American and Canadian insect producers, including Maple Ridge, B.C.’s Enterra Feed and some small Quebec firms, Hagen began processing whole black soldier fly larvae by first running them through a mechanical press to extract the oil, which is then treated to remove impurities and stabilized using a natural antioxidant blend.

“The larvae are essentially peanuts,” said Benoît Choquette, an agronomist who has worked 23 years for Hagen, where he is in-charge of laboratory work and regulatory affairs. “They are high in calcium and protein and there are trace vitamins and minerals and some amino acids. However, we need to supplement it with protein from yeast (an ingredient used for decades in the pet food industry) and meat protein (chicken or fish) to complement the nutrition profile.”

After going through a Hammer mill, the insect meal and additives are reduced to a flour mix that is conveyed to a computer-controlled, twin-screw extruder and cooked at low temperatures (to prevent nutrient degradation) to form dry, pellet-size kibbles.

After extrusion, the preservative-free kibbles are sent to a single pass dryer (to add shelf life), sifted and enrobed in flavours. Once cooled, they are bagged in recyclable packaging—a first for Hagen—on one of the company’s eight fully and semi-automatic packaging lines.

The project’s goal was to use the nutrient-rich larvae as an eco-friendly substitute for the more resource-intensive meat from farm-raised animals.

Though it is only a small addition to the Hagen Group’s 25-strong list of brand name pet products for aquatic species, birds, cats, dogs, reptiles and small animals, Rolf Hagen Jr. says the sustainability mindset behind the innovative Nuna line is now driving R&D in a company that was founded as a small seed brokerage in Montreal in 1955 by his late father, a young German immigrant who left his war-ravaged homeland for a new life in Canada.

“There are many benefits from using black soldier fly larvae, but they cost eight times more than soybean so they will remain a premium category product in terms of protein pricing,” said Hagen.

The Hagen Group, he added, “is not a prototypical pet food. We have an eclectic array of equipment (and) use a batch system of production that allows us to create targeted speciality runs.”

Still, Hagen is confident the insect pet food market will continue to grow, and he is ready to ramp up the Nuna line to large-scale production if and when demand warrants it.

“We birthed it (and) if it is successful commercially the goal would be to produce it in a traditional pet food factory,” he said. “We have partnerships with pet food makers that would make it happen.”