THE MYCELIUM REVOLUTION

Vemag Burger Former

n High-speed

n Gentle,

n Quick changeovers from

2022 • VOL. 82, I003

Reader Service Print and digital subscription inquiries or changes, please contact Anita Madden, Audience Development Manager Tel: 416-510-5183 Fax: 416-510-6875 Email: amadden@annexbusinessmedia.com Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

MEDIA SALES MANAGER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Alice Chen achen@annexbusinessmedia.com 416-510-5217

GROUP PUBLISHER/VP SALES | Martin McAnulty mmcanulty@annexbusinessmedia.com

COO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer

Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission @2022 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

Photos Meati, Warrior Spices, Jiminy’s

The upcycling phenomenon: Turning waste into food

In May, the Upcycled Food Association (UFA), the trade association for the upcycled industry, expanded its Upcycled Certified program into Canada. As part of the expansion, UFA is partnering with Anthesis Provision, the food sustainability experts within Anthesis Group and Circular Opportunity Innovation Launchpad, Guelph-Wellington’s circular business accelerator in Ontario, to expand the reach of the third-party verified Upcycled Certified Mark to Canadians.

The Upcycled Certified Program has already certified over 200 products and ingredients in the United States. It is projected to prevent over 820 million lb of food waste next year.

“We’re thrilled to see increased investment in the upcycled space by Canadian businesses and from all levels of the government. We are proud to expand the Upcycled Certified program to catalyze even more impact,” said Ben Gray MS, RD, co-founder and chief innovation officer at the Upcycled Food Association and co-chair of the Upcycled Certified Standards Committee.

As part of its Food Innovation series, Food in Canada held a webinar to explore the myriad of ways in which upcycling can mitigate food waste, create a circular food economy, and help Canada meets its sustainability goals. Over 100 participants heard from Jon Duschinsky, executive vicepresident, Anthesis Provision; Julie PoitrasSaulnier, CEO and co-founder, Loop Mission; and Shawn Leggett, president and founder, Ground-Up Eco Ventures.

Trend or transformation

“Upcycling is the new frontier of food waste,” began Duschinsky, who examined whether upcycling is a trend or a transformation. In 2019, Anthesis Provision, in partnership with the Walmart Foundation, conducted waste assessments in 50 food and beverage manufacturing facilities across Canada. The study found 11.4 million kgs of food waste was preventable.

Further, 60 per cent of Canadians want to see more upcycled products, and 95 per cent want to do their part in reducing food waste, which creates an opportunity for upcycling food.

Anthesis Provision found three major barriers to widespread adoption of upcycling, such as:

• the engineering and operational barriers of capturing the by-products in a way that is food safe and practical;

• product development; and

• go-to market challenges.

To help companies overcome these barriers, Anthesis Provision has launched the Repurpose Incubator.

The incubator can help food and beverage companies with byproducts to turn them into a revenue stream. Ingredient companies can reach out to the incubator for help identifying new upcycled ingredients. Duschinsky urged companies to seeks the incubator’s help. He ended his presentation by stating, “Upcycling is the next sustainable food movement.” I agree!

Nithya Caleb

Loop Mission

The next panelist, Poitras-Saulnier, strongly believes that. Her company, Loop Mission, is helping create a circular food economy by “repurposing the outcasts of the food industry.” They use imperfectly shaped fruits and vegetables, day-old bread, potato cutting, and upcycled oil that would otherwise be thrown out to create vegan dog treats, cold-pressed juices and smoothies, probiotic sodas, beers, gins and soaps. To date, Loop has rescued 8,035 tons of fruits and vegetables.

The trickle-down effect

Incorporated in 2018, Ground-up Ecoventures is also focused on creating a circular food economy and upcycling. It manufactures super flours and coffee oil. Leggett said it makes sense to upcycle because the “byproducts from many processes contain just as good or better nutrient value than the products made from them. It reduces the need to travel the globe for superfoods and minimizes the strain on the food system by utilizing everything grown to its maximum potential.” He also highlighted that “upcycling spent grain can help meet 24.5 per cent of the demand for flour.” With such convincing stats, it’s hard to dismiss upcycling as a fad. I would love to hear your thoughts on this topic.

Nithya Caleb ncaleb@annexbusinessmedia.com

Meet Canada’s first certified organic chocolate maker

Newly launched Wild Mountain Chocolate is Canada’s only organic bean-to-bar chocolate maker. Wild Mountain creates naturally dairy- and gluten-free and vegan chocolate from premium organic raw cacao beans that are sorted by hand, roasted, winnowed, stone-ground, conched and tempered onsite in Invermere, B.C.

News> file

Three

Farmers receives $6.2M investment from District Ventures and existing investors

District Ventures Capital announce the closing of a $6.2 million equity investment in Three Farmers Foods, a provider of whole roasted bean snacks. The round was led with $3 million from District Ventures and included $3.2 million from existing investors including Export Development Canada, Golden Opportunities Fund and PIC Investment Group.

The new investment will support Three Farmers’ continued growth in Canada with strategic marketing efforts, along with providing sales and business development support for the company’s US expansion efforts.

Above Food acquires Quinoa supplier NorQuin

Above Food Corp. acquires Northern Quinoa Production Corp. (NorQuin), a vertically integrated producer of quinoa. As one of North America’s largest suppliers of quinoa, the acquisition will add a scaled portfolio of specialty ingredients capabilities to the Above Food platform.

NorQuin has invested more than two decades of research to develop proprietary, higher yield, higher protein, non-GMO varietals of quinoa. Above Food plans to

integrate NorQuin’s genetic capabilities and grower programs into its disruptive agriculture business, providing significant scale to NorQuin’s existing grower infrastructure, while applying the team’s expertise in genetics and plant-breeding to a broader base of proteins.

Balzac’s Coffee Roasters partners with Acosta Canada

Balzac’s Coffee Roasters partners with Acosta Canada, a national broker to the retail channel. The partnership will be key to driving Balzac’s retail growth through Acosta’s extensive reach and customer solutions.

Balzac’s and Acosta will work together to bring forth strategically aligned joint business plans with retailers. By aligning with retailers’ goals, and then seeing those plans come to life at store level, Balzac’s aims to see shoppers convert into buyers, allowing them to savour the European-inspired brand in their own homes.

Bacardi appoints Jeff Branson as VP for Canada

Bacardi Canada, Inc., welcomes back long-time Bacardi leader Jeff Branson as vice-president and general manager for Canada. With 20 years of beverage industry experience, 16 of those at Bacardi, Branson returns to the company after two years of working at Southern Glazer’s Wine and Spirits (SGWS) as SVP of sales for the division dedicated to Bacardi portfolio in North America. The transition to SGWS and return to Bacardi are part of a program between the two partner companies to accelerate talent development growth

and create new leadership opportunities. Branson reports to Pete Carr, regional president of Bacardi North America, and will be based in Toronto.

Certification for upcycled ingredients and products arrives in Canada

The Upcycled Food Association (UFA), the trade association for the upcycled industry, expands its Upcycled Certified program into Canada.

As part of the expansion, UFA is partnering with Anthesis Provision, the food sustainability experts within Anthesis Group, and COIL (Circular Opportunity Innovation Launchpad), Guelph-Wellington’s circular business accelerator in Ontario, to expand the reach of the third-party verified Upcycled Certified Mark to Canadian consumers, raising awareness and providing confidence that the food, beverage, cosmetic, companion pet food, home care, and cleaning products they buy include upcycled ingredients.

Federal government invests in digital food innovation hub

The federal government is investing up to $1.9 million to help the Canadian Food Innovation Network (CFIN) develop a digital food innovation hub, which will enhance connectivity among players in Canada’s food innovation ecosystem. This project aims to bring together the many individual components of Canada’s vast food ecosystem into an interactive online community.

The digital food innovation hub will be available around the clock for businesses to access one-on-one mentorship as well as knowledge, research, and innovation resources. This tool will help identify and match entrepreneurs with technical expertise and partnerships to spur growth.

How do you know if someone is skilled for a food safety job?

Amy Proulx

Late spring is a great time for academicians because our newly graduated students are eagerly joining the workforce. Company leaders know this is the time to look for new talent. They reach out to professors like me for reference checks.

Without fail, every year I get the same message from companies, “How do I know this recent graduate is ready for a job in food safety and HACCP work?”

In the early 2000s, when I was in university, HACCP-based management systems were just being initiated. It was not uncommon back then for a student with a master’s degree in food science to have never taken a course in food safety management. They would take a short course, and suddenly be in charge of food safety in a company.

Competency development

Short courses are important, but they’re not perfect models for competency development. They are very important for knowledge transfer. Being competent and having a mastery of a skill takes time, repetition, progression of complexity, mentorship, feedback and evaluation. That said, I strongly encourage people to take as many short courses as they can afford.

Short courses rely on people to apply the newly learned skills in the workplace for the element of time and repetition to take place. These programs also rely on continuing mentorship for feedback and on-the-job evaluation. Mentorships may not be available in small companies with a lean staff.

There’s also an academic route for food safety training. Many post-secondary schools now include HACCP training courses in their food science curriculum.

We’re also seeing more schools with postgrad and micro-credential programs. These are good moves. Students now pick up skills and context, albeit under a different timeframe. The challenge here is that many employers view academic credentials as a lesser form of training than a short course even if the former’s program length is longer than the latter.

Often, I get calls employers who aren’t sure about hiring a student applicant because they lack a certificate from a specific food safetyrelated organization. These types of calls raises a lot of questions about competency development. Some short courses only give a letter of participation, as competency evaluation was not a part of the program. So, how do you know when someone is competent in food safety?

Section 75 of SFCR states people “must have the competencies and qualifications that are necessary to carry out their duties.”

In section 2.1.1.5 of the SQF Code 9 Food Manufacturing, the primary and substitute SQF practitioner shall (paraphrased) be employed onsite, have responsibilities within establishment’s RACI framework for the SQF system, have completed a HACCP course, be competent to implement and maintain the HACCP plan and have an understanding of the SQF code for implementation and maintenance.

In BRC’s Code 8 Clause 2.1.1 (paraphrased), the HACCP food safety plan shall be developed and managed by a multi-disciplinary team including quality assurance, technical management, production operations, engineering and other relevant functions. The team leader

shall have an in-depth knowledge of HACCP principles and be able to demonstrate competence, experience and training. If local regulations require specific training, this must be in place. The team members shall have specific knowledge of HACCP and relevant knowledge of products, processes and associated hazards. In the event of the site not having the appropriate in-house knowledge, external expertise may be used, but dayto-day management of the food safety system shall be company responsibility.

All HACCP-based food safety systems require a team-based approach. The team delivers decision-making, scientific evaluation and accountability for the program, with senior management of the company taking final responsibility.

If you’re an employer looking for a worker with HACCP skills, ask for certificates, but also ask for student work portfolio or example assignments that would demonstrate competency. Also make sure to design behaviourbased interviews that allow a new graduate to demonstrate competency.

Competency comes from a team adopting a continuous improvement stance. All members of the team must continue to learn and upskill, as well as provide constant feedback and constructive improvements on the HACCP system.

Good luck to our food studies graduates, the class of 2022! We’re cheering for you!

Proulx is professor and academic program co-ordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont. She can be reached at aproulx@niagaracollege.ca.

Impact of supply chain disruptions on food labelling

Victoria Asikis

Global events can cause long lasting disruptions in the supply of ingredients to food manufacturers. This was especially pertinent in March 2020 when the pandemic began, as manufacturers who may not have experienced shortages in the provision of goods in the past were suddenly faced with the prospect of not having access to certain ingredients.

For food manufacturers, disruptions in the supply chain pose unique challenges, in particular, as it relates to food labelling. A fundamental requirement for food labels is an accurate ingredients statement. Yet, accuracy in an ingredients statement is predicated on the assumption the manufacturers making food products will have access to the ingredients they need, and that are declared on a label in an ingredients statement. If a food does not contain an ingredient that is declared in an ingredients statement, or contains an ingredient in less of a proportion than the order in which it is declared, the product is technically mislabelled under the law.

In November 2021, due to ongoing supply chain disruptions and the concomitant impact on ingredients statement labelling, the Canadian Food Inspection Agency (CFIA) released a notice to industry attempting to clarify the existing provisions in the Food and Drug Regulations (FDR) for permitted flexibilities in a list of ingredients. Through the notice, CFIA allowed for flexibilities in an ingredients statement in situations when a substitution cannot be planned for, resulting in the need to substitute ingredients for “short periods of time” without being required to change an ingredients statement on a product label (provided the risk of doing so is low). The notice also suggested

regulated parties were required to have a plan to demonstrate how ingredient shortages would be resolved, or how product labels/formulas would, over time, be brought into compliance.

Manufacturers are now looking for clarity on CFIA’s current position as related to labelling flexibilities for substitutions, omissions and variations in ingredients and the corresponding impact on an ingredients statement.

The issue is that supply chain disruptions have stretched beyond only those posed by the pandemic as recent global events have caused other ingredient shortages, most notably in the availability of canola oil. While CFIA maintains that vis-à-vis the notice to industry they attempted to clarify the existing labelling flexibilities under FDR, what resulted instead appears to be a two-tiered approach to supply chain disruptions and associated permitted labelling flexibilities for an ingredients statement: on the one hand, unplanned supply chain disruptions that result in short-term substitutions of ingredients where a label need not be revised, and on the other hand, plannedfor supply chain disruptions that result in long-term substitutions, variations or omissions of ingredients that necessitate label revisions. As a result, it is ambiguous

under which circumstances these labelling flexibilities apply, how a long-term versus short-term supply chain issue is quantified, what CFIA considers a “natural or economic” supply chain disruption to be such that an ingredient may need to be substituted, omitted or varied, and how these matters affect food labels, in particular an ingredients statement.

It is also unclear if manufacturers are obligated to inform CFIA when a supply chain issue has resulted in the need to take advantage of existing labelling flexibilities. Communications with the regulator seem to suggest manufacturers must contact their regional CFIA offices to seek clarity on these matters and discuss solutions for how labelling flexibilities will be resolved once supply chain issues are solved. However, this is not necessarily a productive approach to resolving the issue, as it could open the potential for even more ambiguity due a lack of consensus between regional offices.

Manufacturers are now looking for clarity on CFIA’s current position as related to labelling flexibilities for substitutions, omissions and variations in ingredients and the corresponding impact on an ingredients statement, similar to recent policies implemented by the United States Food and Drug Administration. Further, clarity is needed in how the provisions of FDR and CFIA’s own guidance are to be interpreted, particularly considering that it is becoming increasingly unclear when certain supply chain disruptions will be fully resolved.

Victoria Asikis is an associate in the Ottawa offices of Gowling WLG, specializing in food and drug regulatory law. Contact her at victoria.asikis@gowlingwlg.com.

Eaglestone Equipment offers a constant turn conveyor

Eaglestone Equipment, a custom manufacturer of industrial food processing equipment, launches the 1150 Fabric Constant Turn Conveyor. This conveyor is suitable for cookie and bar production, as it maintains product orientation while small diameter discharge rollers allow for tight transfers. www.eaglestone.net

Readco develops a sealed continuous processor

Continuous processors from Readco Kurimoto feature a sealed design that safeguards the materials and products in process from contamination due to exposure to the plant environment. The Readco continuous processors automatically mix, encapsulate, crystallize and/or chemically react multiple powdered, liquid and/or viscous ingredients in a single step. The design directs the materials onto twin shafts, co-rotating screws set within the closed barrel to create the material interactions needed to achieve a uniform, homogeneous product. www.readco.com

Dynatrol introduces level detectors

Dynatrol DJ Level Detectors are suitable for high point level detection in dusty environments as well as on vessels, storage bins or hoppers equipped with vibrators. One can obtain accurate level measurements for pet food industry bulk solids materials ranging from low-density flakes and powders to pellets and heavy granular materials.

Dynatrol point level detectors are approved for Class I, Group C & D; Class II, Groups E, F & G; and Class III Services. www.dynatrolusa.com

www.urschel.com

Rely on U rs c hel , The Global Leader in Food Cu t tin g Techno l og y, to del i ver opti m a l f ruit and vegetabl e cut t ing s olut i ons. Del i cate appl i cat i ons, li ke frui t d i c i ng , requi re gen t le, e f fec t i ve cu t ting to gene rate a h i gher ra t e of des i red cu t s and p rolonged s helf-life H i gh volume Sanita r y design. Ba c ked by U r s che l sales and suppo r t , p roces s or s achi eve s uc c ess f u l ope ration s th roughout p roduct i on run s

For sales and service in Canada contact: Chisholm Machinery Solutions info@chisholmmachinery.com | 905-356-1119

Is packaging redesign a sound investment?

Birgit Blain

Are you planning a packaging redesign? Changing the graphic identity may be a worthwhile investment or costly blunder. Before taking the plunge, here are some insights to determine whether it’s a sound strategy.

Why redesign?

It is often the marketing department’s go-to tactic to improve sales. However, “nine out of 10 redesigns fail to deliver a meaningful sales lift in market”, according to NielsenIQ.1 This signals the need for a strong business case.

Packaging redesign coincides with rebranding, a strategy used to address a variety of issues like changes in customer needs, trends and the competitive market, which call for a shift in brand positioning.

Launching a brand into a new market sometimes requires a packaging rethink to align the positioning with differing consumer and market attributes.

Following corporate mergers, several disparate brands may end up under one umbrella. The brand hierarchy must be defined, followed by an alignment of the graphic identities.

As brands evolve, their appearance and message relevance may become outdated. A packaging makeover can update brand positioning and breathe new life into an aging brand.

New product launches over a brand’s lifetime may result in a fragmented portfolio with a mishmash of designs. A redesign is an opportunity to consolidate the product offering and create a portfolio with a cohesive look.

Before making a decision

Packaging is usually redesigned to solve a problem. Identifying the problem and

conducting a root cause analysis will help to determine the best course of action. If flagging sales are attributed to poor product quality, uncompetitive pricing, distribution issues or insufficient marketing, a redesign will not solve the problem.

A cost-benefit analysis is another worthwhile exercise. Be sure to connect the silos by involving all business units in the process.

If flagging sales are attributed to poor product quality, uncompetitive pricing, distribution issues or insufficient marketing, a redesign will not solve the problem.

Review the packaging format to ensure it meets all requirements beyond protecting product integrity. Factor in sustainability, which is a growing concern among supply chain partners and consumers.

Redesigns are expensive. In addition to the cost of graphic design and packaging production, disposal and write-offs of old packaging must be considered. Then there’s the expense of marketing programs to raise awareness, prevent sales erosion and generate incremental sales.

Consider brand equity

I have seen brands introduce radically redesigned packaging. Brand recognition is of crucial importance to capture sales. Shoppers identify brands through unique visual elements, such as colours, logos,

stylized fonts, shapes and images. It’s essential to maintain key characteristics through which the brand is recognized, thereby preserving brand equity.

Is a radical change required or will a simpler revision achieve objectives? A moderate brand refresh is an opportunity to revitalize a stale, outdated look and adjust messaging to better resonate with the target customer.

Watchouts

Redesigns that are not on the mark may require further revisions. The additional expense can be avoided by testing design concepts with target customers.

Transitioning all skus to a new design simultaneously ensures a cohesive look on shelf and reduces shopper confusion. However, it can result in substantial write-offs. New packaging rollouts require careful planning to prevent out of stocks and reduce old packaging and finished goods inventories.

Brand owners may assume redesigns are a quick fix. They consume a lot of time, resources and money. Plus, there are no guarantees they will improve sales and achieve objectives. Whether to initiate a packaging redesign is a critical strategic decision that requires a solid plan to protect the brand and bottom line.

Note

1 Visit https://nielseniq.com/us/en/newscenter/2020/2020-global-nielsen-basesdesign-impact-awards.

As a CPG food consultant, Birgit Blain transforms food into retail-ready products. Her experience includes 17 years with Loblaw Brands and President’s Choice. Contact her at birgit@bbandassoc.com or learn more at www. bbandassoc.com.

YOUR BRAND, WITH BENEFITS:

Consumers Appreciate the Benefits of Fibre

Nearly 2/3 of consumers are adding fibre in their diet1 because they believe it is important,2 yet most Canadians are only getting about half of the recommended intake of 25g per day for women and 38g per day for men.3

The Relationship Between Digestion and Tolerance

65% of consumers associate fiber with boosting their immune system.4 Yet, if a product causes gastrointestinal discomfort—for any reason—nearly 70% of consumers will not buy it again.1

Less Discomfort, More Positive Nutrition

Fibersol®’s soluble prebiotic dietary fibre ingredients bring positive nutrition to a variety of food, beverage and dietary supplement applications—with less discomfort.

1. ADM Outside VoiceSM Fibre Consumer Study, 2019.

Better-for-you foods and beverages may cause discomfort that consumers blame on diet choices or health conditions8 when actually, the soluble fibre source may be at fault.

Why Fibersol® is Better Tolerated

Fibersol ® resists digestion in the stomach and small intestine and is slowly fermented by the flora in the large intestine. With less rapid off-gassing than other soluble fibres such as inulin or oligofructose, Fibersol® results in less bloating or gastric discomfort.5

How Does Fibersol® Stack Up to Other Fibres?

Fibersol® delivers desired benefits and is well tolerated vs. other soluble fibres—even when consumed in a variety of products throughout the day.

The Power of Comfort, All Day Long

With products containing less-tolerable soluble fibre ingredients, consumers may feel discomfort as they nourish and snack throughout the day.

Fibersol® is well tolerated at up to 68 grams per day6 for positive nutrition and indulgence—with minimal gastrointestinal discomfort—from morning to night.

Science You Can Trust

Fibersol® is shown to:

• Help support or maintain intestinal regularity

• Help relieve occasional constipation

• Support gut health

• Help improve stool consistency*

Fibersol® prebiotic fibre helps today’s well ness-minded consumers maintain intestinal regularity and a healthy digestive system, comfortably.

*selected studies

2. A. Bonnema; et al. “Gastrointestinal Tolerance of Chicory Inulin Products.” 2010. Journal of the American Dietetic Association. June 2010; 110(6): 865-868.

3. Health Canada. Fibre. Accessed May 20, 2022.

4. FMCG GURUS: “How Has COVID-19 Changed Consumer Behaviour.” March 2021.

5. EA Flickinger; et al. “Glucose-Based Oligosaccharides Exhibit Different In Vitro Fermentation Patterns and Affect In Vivo Apparent Nutrient Digestibility and Microbial Populations in Dogs.” 2000. J. Nutr. 130:1267-1273.

6. Yuka Kishimoto; et al. “The Maximum Single Dose of Resistant Maltodextrin That Does Not Cause Diarrhea in Humans.” 2013. J Nutr Sci Vitaminol (Tokyo). 59(4):352-7. PMID: 24064737 DOI: 10.3177/jnsv.59.352.

7. As codified by FDA.

8. ADM Outside VoiceSM Stomach Discomfort Social Listening, December 2020.

into mushrooms and mycelia A MEATY LOOK

Consumer demand for taste, value, and clean labels is driving an innovation race in alternative protein formulation

— BY MARK JUHASZ —

We might be entering what can be called a fungi, mushroom, and mycelium revolution as this wondrous family of natural foods gain a critical mass of awareness, generated through major promotion, such as with the Netflix documentary, Fabulous Fungi.

Mushrooms in particular, the fruiting part of the larger fungi living organism, continue to have positive sales. The global mushroom market is estimated to reach USD116 billion in sales by the end of the decade with a 10 per cent annual growth rate. Mushrooms Canada adds that there are over 100 mushroom farms across the country, producing approximately 300 million lb annually. Just over half of these farms are in Ontario, with about 40 per cent in B.C., and the rest across the country. Most mushrooms are sold fresh, while some are canned or pickled. There are estimates of over 150,000 types of mushrooms globally, and the most popular varieties in Canada include white button, brown crimini and portobello, with more exotic types such as shitake, oyster, enoki, and morels gaining favour and availability in specialty markets. Shogun Maitake, London, Ont., offer maitake mushrooms, a high-quality premium variety. According to the company, the health benefits of maitake mushroom include lower blood sugar, a boosted immune system, healthy heart, and weight loss.

The additional benefit of mushroom farming in Canada is that the crop can be grown year-round, in controlled environment settings, and lending itself to the diversity of cuisines in multicultural Canada. Ontario-based Mycionics is a leader in providing automation robotics to the Canadian mushroom industry with an advanced technology for monitoring and harvesting the crops.

DEMAND FOR HEALTHY FOODS

Part of the rising popularity of mushrooms and the related world of mycelium is in

Mushrooms and mycelia can help address growing consumer demand for healthy, sustainable, animal-free proteins.

Photo

meeting a growing consumer and societal demand for healthy and sustainable foods. There are concerns about health problems associated with ultra-processed foods that contain artificial and synthetic chemicals, additives, preservatives and colourings. Mushrooms as food and mycelium as a food innovation application can provide a creative alternative in the world of food processing today. Consumer demand for convenient, nutrient dense, satiating protein remains strong.

At the end of 2021, there was some surprise with lower-than-expected sales of plant-based food offerings from high profile companies like Beyond Meat and Maple Leaf Foods. Consumer demand for taste, value, and understandable ingredients is driving an innovation race in alternative protein formulation and product creation. Mycelium applications might be one of the answers to this challenge. Mycelium could come to be seen as the ingredient in the development of sustainable foods, whether for protein, or as natural ingredient substitute. Investors and celebrities are taking notice and contributing resources, such as actor Robert Downey Jr’s Footprint Coalition Ventures, or actor Natalie Portman’s investment in Francebased La Vie, a bacon alternative.

MYCELIUM

Mycelium is the living infrastructure of fungi underneath the fruiting mushrooms most familiar to people, and not all fungi produce mushrooms. Mycelium science is realizing the vast potential of this material as a pliable food source, and in applications for packaging. Mycelia are now being grown in controlled environments and offer potential for upcycling food/ ingredients. Mycologists (scientists working in the field of fungi-mushrooms-mycelia) are at the frontier of fermentation research to bring these innovations to market. Mycelium can provide an important contribution to the development of alternative proteins with taste neutrality;

Mycelium could come to be seen as the ingredient in the development of sustainable foods, whether for protein, or as natural ingredient substitute.

Meati has launched classic and crispy cutlets made with mycelium fibres.

a texture that can be ‘meat-like’ and satiating; and the capacity to be moulded into different shapes for meat analogs. Mycelium also have essential amino acids, fibre, vitamins, and nutrients.

Another advantage of mycelium is the ability to support the scaling of alternative proteins via fermentation. It is currently more cost effective than new developments and iterations of cell, cultured proteins. There is an innovation race in the mycelium category with unique products and processes that are gathering the attention, and funding, of investors and legacy food corporations. Winning mycelium companies have unique selling propositions, such as fast-growing mycelium strains, processing models, or ingredients for in-demand food categories like burger patties. Mycelium-focused companies are providing biomass for alternative meats in the form of mycoprotein. These functional ingredients can help, for example, to reduce bitterness, sugar, or fat content in finished products.

LEADING PLAYERS

Colorado-based mycelium fermentation company MycoTechnology secured over $85 million in advanced series financing earlier this year. With investors coming from a combination of venture capital, food corporations (Tyson Foods and Maple Leaf Foods), and government (Oman Investment

Authority), the company intends to use their fermentation application to provide a range of ingredients that help to reduce sugar, is a sustainable protein, and support immune function. One of their products, FermentIQ, is made from pea and rice protein fermented with shitake mushroom mycelium, and is said to improve the nutrition, functionality, and taste of plant-based protein foods.

US-based Meati has garnered attention recently in its partnership with celebrity chef, David Chang. The company brews mycelium in fermentation tanks using a strain that has high nutritional content and rapid growth. Meati’s technology can arrange mycelium fibres to grow and form whole cut meat textures. Since Meati’s product is from mycelium, it avoids some of the allergens associated with soy and wheat-based foods.

In Sweden, Mycorena is becoming a leader as a fermented ingredients producer for the alternative protein market, led in part with their Promyc product. The company, and its innovation and development centre, is serving as a catalyst for the Nordic region to scale mycelium innovations and IP, while offering production at the first mycoprotein-specific facility of its kind in northern Europe. Additional mycelium-focused companies in the EU include Mushlabs and Keen 4 Greens from Germany, and Bosque Foods and Libre Foods from Spain.

Mushrooms can be grown year-round in Canada in controlled environment settings.

The global mushroom market is estimated to reach USD116 billion in sales by the end of the decade with a 10 per cent annual growth rate.

Photos © Maciej, vitals / Adobe Stock

Paul Shapiro, co-owner of California-based Better Meat Co. has added, “Mushrooms are way meatier than plants and that is why in Asian cuisine, mushrooms have been used for centuries as a meat substitute. However, mushrooms are not that high in protein, so [Better Meat Co.] use mycoprotein or mycelium, the root-like structure underneath the mushroom that is high in protein.”

Better Meat Co. is building a fermentation plant to produce thousands of pounds of their IP protected mycoprotein, Rhiza.

In Canada, Ontario-based Whitecrest Mushrooms has partnered with Atlast Food Co., (itself an offshoot of mycelium innovator, Ecovative Design) to create My Forest Foods, and begin ramping up their bacon alternative, MyBacon, which uses mycelium.

Whitecrest president Murray Good said at that time, “After more than a decade of experience growing and producing the highest quality gourmet mushrooms, we’re excited to leverage our expertise in the new market of alternative proteins.”

Mycelium can help create a ‘meat-like’ texture for alt-meat products. It also has the capacity to be molded into different shapes.

FROM NO-KNEAD TO SOURDOUGH

With From No-Knead to Sourdough, author Victoria Redhed Miller blends her own journey toward self-reliance with her fascination for traditional homesteading skills and love of good food. From making simple yeast breads, to learning how to bake a wide variety of sourdough-based breads, the author’s curiosity and fearlessness come together to share with readers a simpler approach to the pleasures of bread-baking.

A giant leap into the unknown

Cher Mereweather

It increasingly feels like we have taken a giant leap into the unknown. Energy costs are rising so steeply that provincial governments are taking the unprecedented step of reducing fuel taxes to preserve buying power at the pump. Russia and Ukraine together produce nearly 30 per cent of global wheat and 12 per cent of global calories. With all sea routes out of Ukraine blocked and trains only able to transport a small percentage of the harvest, Ukrainian farmers are only half-joking when they say the West needs to send them armoured tractors. Plus, there simply isn’t enough space in this column to address the spiking fertilizer prices, the highest inflation rates in a generation or even the messy global supply chains.

Everything has changed. The question is, what are we going to do about it? You’ll not be surprised to hear me say that we need to create a more sustainable and circular food system. Where to start, though? When the pressure is on and you need to act now, here are the five things you should be focusing on.

1. People

You need them now more than ever, and they are struggling. The percentage of adults reporting mental health challenges nearly quadrupled during the pandemic, and that was before the cost of living started to spike. Review your benefits to make sure you are really putting wellbeing at the heart of your employment strategy. Think about stock options for staff so they feel they are investing with you for the future. Make commitments to your communities and to the environment that show you care about more than just getting product out the door and your bottom line.

2. Food loss + waste prevention

When every single input to your production process (e.g. labour, raw materials, energy and water) costs more, then every pound of food or beverage wasted has a bigger impact on your bottom line. Food waste prevention has a 14:1 return on investment. Start with an assessment and figure out what you can prevent, then look at the by-products you are sending out to animal feed, compost or landfill and see if you can upcycle them.

a solid understanding of your baseline (e.g. how much carbon emissions your business is responsible for). Then do an assessment to figure out your energy, water and waste per unit of production and identify ways to reduce them (carbon emissions are embedded in all your utilities and food that is wasted). Finally, make a commitment to reduce your carbon emissions. Control what is within your four walls first, and monitor, measure and track reduction performance to show you are making a difference.

5. Advocacy

Focus on how your business responds to climate change and you’ll find a sustainable path through the rest of the chaos.

3. Value chains

The pandemic kick-started the repatriation of value chains, but a lot more needs to be done. With higher fuel prices and shipping costs, start by revisiting the economic case for a more local value chain. In parallel, build a redundancy model on critical items you need for production because we are heading for even greater disruptions as the impact of fertilizer shortages unfold.

4. Understand your climate impact

Earlier this year, Loblaws and the federal government published their net zero commitments. This is a game-changer for the food and beverage industry. There is urgency now for companies to understand their climate impact and the carbon risk facing their business. Start by getting

Look beyond your own value chains at industry associations and advocacy networks to see if they are actively engaging in a positive way around climate change. The latest report from the International Panel on Climate Change clearly draws the link between private sector advocacy and failure of policymakers to pass the required legislation to accelerate climate mitigation. Look to see if your membership dues are actively supporting climate action or whether they are hindering it and make your voice count.

Margins in our industry have never been tighter, but this is not the time to cut your investments in people and business. Invest in paying your talent well and looking after them, first. Then invest in carbon reduction, automation and productivity.

At the start of the year, the question most food and beverage companies were asking was how to make net zero affordable. The world has changed since then. Today the question is how to get to net zero faster so that food and beverage products can remain affordable.

We have taken a giant leap into the unknown. But there is one constant through all this – climate change. Focus on how your business responds to that and you’ll find a sustainable path through the rest of the chaos.

Cher Mereweather, CEO of Anthesis Provision, is a Canadian-based food industry sustainability expert.

Untapped flavours from First Nations

— BY MARK CARDWELL

Daniel Picard has spent much of his adult life travelling the world in search of meaning as an Indigenous man in Canada. Now the budding food entrepreneur is using the knowledge he acquired in his travels to bring a unique taste of First Nations cuisine to the world.

“Our products are made from traditional recipes using local ingredients like plants, herbs and maple sugar and other contemporary foods,” said Picard, founder and president of Les Épices du Guerrier, or Warrior Spices. “Our mission is to offer high-quality Native culinary products that are distinct from anything else on the market.”

Located in Wendake, a small urban Huron-Wendat reserve in north-end Quebec City where Picard was born and raised, Les Épices du Geurrier makes more than a dozen original spice blends.

One of those products is Les Épices du Guerrier’s Traditional Blend. Made with a dozen ingredients that include maple sugar, sea salt, dune pepper and balsam fir, it is the company’s original spice and its No. 1 bestseller.

“I invented it,” said Picard. “It’s got a sweet, peppery taste that combines the flavours of hand-picked herbs and spices from the boreal forest with maple sugar. You can use it on any foods in place of salt and pepper. You can even use it on ice cream.”

Other top-selling blends include the Tomahawk, which incorporates small amounts of ghost pepper, and Boreal Bacon Pepper, which features smoked bacon and green

alder pepper that is harvested by hand by Indigenous pickers on the ancestral lands of several of Quebec’s 11 First Nations communities, which number nearly 150,000 people or two per cent of Quebec’s population.

For Picard, the growing popularity of his company’s niche products in a global spices market that is worth an estimated $100 billion is both a source of pride and a high-water mark in a life that has come full circle.

Picard had a troubled youth and left home at age 15 with dreams of becoming a pilot. Instead, he ended up studying psychotherapy at college and working until his late 20s in recreational and social services for troubled youth in various First Nations communities across Quebec.

In an effort to document and showcase the more positive aspects of First Nations

culture and traditions, Picard successfully developed and sold a reality show called ‘La Route des Premières Nations.’

From 2004 until 2009, Picard travelled more than 300,000 km around Quebec and filmed 150 episodes that were aired on cable and network TV stations, including APTN.

“I learned a lot of traditional recipes from elders that used mixes of herbs and spices and other foods from the boreal forest,” said Picard. “First Nations people and Innu have used hundreds of plants for thousands of years for everything from medicinal purposes to flavouring the different meats and fish they ate and as substitutes for vegetables. The variety of uses is astounding [and] many are absolutely delicious for cooking.”

In 2016, when Picard was helping raise money for a youth centre in Wendake he

Warrior Spices use ingredients handpicked by Indigenous communities across Quebec

—

Quebec-based Warrior Spices sells spice blends that are unique to Indigenous cuisine.

Photos courtesy Warrior Spices

first hit on the notion of making an Indigenous spice.

Together with Patrice Dion, a friend, fellow inveterate traveller and partner in a few small business ventures, Picard made a large batch of spice (using many of the ingredients that would later be found in their Traditional Blend) and packed it into 500 small, hollowed-out wood logs.

“We used logs instead of jars or pouches because logs have spiritual meaning in aboriginal culture, and they look nice,” explained Picard.

The duo took the logs to one of Quebec’s biggest annual outdoor events—the Festival Western de Saint-Tite, which is held in early September—and sold out in hours.

After donating all their proceeds to the youth centre, Picard and Dion dove into what they saw as a promising business venture.

By early 2017, they were making their single spice at Picard’s place and selling it in 100-g quantities in logs for $24.95 apiece at more than 100 stores of all stripes.

“We sold 10,000 logs the first year,” said Picard. “Everyone was calling us. We couldn’t keep with demand.”

After an appearance on Radio-Canada’s version of Dragon’s Den, which netted them two offers that never panned out, the two rented a small plant in the Charlesbourg neighbourhood of Quebec City, bought a couple of packaging machines, and started making and producing a wider variety of spices and coffee blends for sale in stores and online.

They also began creating and training teams of mostly First Nations pickers who go into the forest in search of the ingredients they needed to make their products.

“Our name, Warrior Spices, is for our pickers,” said Picard. “They go into the woods and get down on all fours in all conditions—black flies, bears, snow, rain and cold—to find and pick the plants we need. They are real warriors.”

Once harvested, the materials are dried, crushed and mixed by hand, either in Que-

bec City or by First Nations partners like Aqua Nature, which has pickers of its own.

“Everything’s done by hand except for the packaging,” said Dion, the company’s vice-president operations.

Packaging for online sales, he added, is done in Quebec City, while most retail packaging is now being completed by an Innu partner.

After moving last year to a new plant in Wendake (in the back of a seasonal ice cream counter called Boréal that also sells Warrior Spice products), the company has continued to expand its product line.

In addition to its three top sellers, Warrior Spices produces a spice for each of Quebec’s 11 First Nations communities. Additionally, it manufactures sauces, gift sets and blended coffees (“a fun sideline for us,” said Dion). It also still makes and sells its original logs for $28.

“They have some very original and interesting products, and Daniel is a very good salesperson,” said Jean Soulard, one of Quebec’s most famous celebrity chefs and author of more than a dozen books on cooking. “Their (Boreal Bacon Pepper) in particular is a very interesting item that really stands out.”

For Soulard, who cooked in some of France’s top restaurants before coming to Canada 30 years ago to take over as head chef at the Chateau Frontenac in Quebec City, there is both strong and growing demand for local, artisanal foods and ingredients like Warrior Spice products.

“We’re not just talking about for tourists, but for Mr. and Mrs. Everybody,” Soulard told Food in Canada. “People are learning to appreciate things they didn’t have access

to 30 years ago or turned their noses up at, like forest foods and even seaweed. It takes time, but we’re getting there.”

Since less than 10 per cent of the entire spice market is sold to consumers, with 90 per cent of sales going to restaurants and packaged food manufacturers, Laura Shumow, executive director of the American Spice Trade Association, said specialty local spice products like Warrior’s brands represent “a small fraction of a market that is already a fraction of the total spice market.”

Most common spices, added Shumow, are also grown in tropical countries outside North America. However, she believes the uniqueness of local ingredients, together with the increase in home cooking during the pandemic, have led to an uptick in consumer sales of locally made spices and seasoning blends.

“As more people had more time at home and were eating out much less often, consumers became more interested in learning new recipes and experimenting with seasonings,” said Shumow. “Additionally, the pandemic sparked more interest in health-promoting properties of foods and seasonings, with a special focus on any potential immunity effects, but also a general interest in healthful properties of ingredients.”

For Picard and Dion, the focus now is on building their company’s capacity by training more pickers and mixers and tapping into new markets, including other Canadian provinces and the United States.

“We’ve done some food shows and tastings in the US that were super successful,” said Picard. “We’re happy with how things are going and there are many interesting avenues for us to explore.”

Patrice Dion and Daniel Picard

Photo © Gorilla / Adobe Stock

Vemag Extruders, Formers and Depositors

Holac Dicers and Slicers

Seydelmann Grinders, Mixers

Reiser Form/Fill/Seal

Vemag Sausage and Meat Stick Linkers and Portioners

DJM VacForm Multi-lane Formers

Barks&bites

Tuffy’s Treat Company acquires Finley’s Barkery

Tuffy’s Treat Company purchases premium pet brand, Finley’s Barkery. Finley’s was launched in 2010 by Kyle and Angie Gallus, two former special education teachers who saw an opportunity to serve a greater purpose through pets. Since 2016, Finley’s has created more than 9,000 hours of paid employment opportunities for people with disabilities through its ambassador initiative and donated over USD120,000 to people and pets in need.

“At KLN Family Brands, it’s part of our vision to better the world by caring for others,” said Charlie Nelson, CEO of KLN Family Brands, the parent of Tuffy’s Treat Company.”

“We have long admired the work that Angie and Kyle have done in utilizing the Finley’s brand as a vehicle to provide paid employment opportunities for people with disabilities. Their mission-based entrepreneurial spirit closely aligns with our values that the opportunity to bring the Finley’s brand under the KLN umbrella was a natural fit,” he added.

Finley’s and Tuffy’s Treat Company have enjoyed a strong contract manufacturing partnership that will be bolstered by this acquisition.

Additionally, the Finley’s brand will benefit from Tuffy’s organizational infrastructure and expansive channels of distribution.

Both Kyle and Angie Gallus will remain with the Finley’s brand as employees of Tuffy’s Treat Company. Kyle will serve as vice-president of Finley’s brand development while Angie will take on the role of vice-president of Finley’s mission advancement.

Mondi showcases sustainable packaging at Interzoo

Mondi displayed its full packaging portfolio at leading pet food trade fair, Interzoo, in Germany to demonstrate how innovative flexible solutions can help the industry become more sustainable.

RetortPouch Recyclable is suitable for wet pet food. A new high barrier pouch, it can replace complex multi-layer and unrecyclable packaging, offering a solution that can withstand high temperatures, protect the product, and provide excellent shelf life while reducing food waste.

Mondi’s FlexiBag Recyclable is a reclosable high barrier packaging solution that confines smells, protects the product and is recyclable.

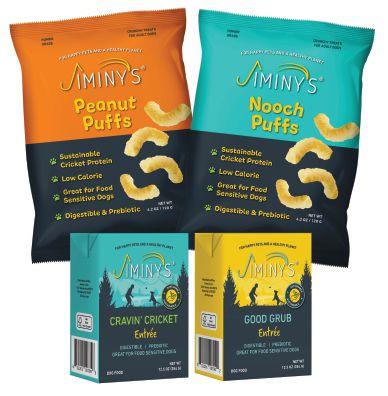

Jiminy’s launches new human-grade treats

Jiminy’s, a producer of insect-based protein dog food, unveils four new products. This includes two wet food options: Cravin’ Cricket and Good Grub Entrée along with their newest treat innovations, Nooch and Peanut Puffs.

“At Jiminy’s, we continue to innovate with truly differentiated products,” said

founder and CEO Anne Carlson. “For example, our new Peanut Puffs are not only made with a novel and sustainable protein source (crickets!), but they’re also a new and exciting treat form. These puffs are less than two calories, contain 22 per cent protein, and are so fun to eat! They’re crunchy but then melt in the mouth. Our new Peanut Puffs are so light that they float. Our friends at the Canine Rehabilitation Institute are using these treats to entice dogs to walk in the water treadmill, less cleanup and a great incentive for the pups! Finally, the Peanut Puffs are human-grade, so you can share them with your fur buddy.”

Dr. Marty Pets unveils refreshed brand designs

Dr. Marty Pets’ new brand esthetic aims to reflect the mission at the core of their company, ‘being champions of change.’

The new visual identity for Dr. Marty Pets includes a modernized logo, website, and packaging for the company’s products.

“At Dr. Marty Pets, we’re changing the way pet parents think about pet food,” said Dr. Marty Goldstein, DVM and founder of Dr. Marty Pets. “We’re committed to bringing education and awareness to pet parents on what a healthy diet is and not. For decades, the massive pet food and old-school kibble industry has been known for bringing sub-par products with unhealthy, even dangerous ingredients. Responsible pet parents are more aware than ever of the constant pet food recalls, and looking for a trustworthy, healthy option. Our pets should be fed real food. Our hope is that this updated brand appeals to even more pet parents looking for the healthy pet products we offer.”

‘ASPIRING’ CHANGE

A young company in Ontario is on the cusp of changing the pet food landscape with insect protein — BY TREENA HEIN —

Canadians may not typically associate crickets with pet food, but once they think about how insects are a natural food source for cats and dogs and understand their many health and sustainability benefits, the association swiftly becomes favourable. That’s what companies like Aspire are betting on, anyway. Of course, Aspire’s plans are backed up by years of intensive research into the nutritional value of crickets for pets (and humans), quality assurance and much more.

Companies like Aspire have found that products with insects are attractive to consumers—especially Millennials, for themselves and their ‘furkids’—because they’re very sustainable. A recent report from Future Market Insights predicts the growing demand for sustainable and organic pet food will propel global sales of insect-based pet food to USD17.29 billion by 2030.1

The sustainability of insect farming is many-faceted. Insects convert feed into growth at a rate that’s light years ahead of even the best performers of all other livestock types (fish and chickens). Further, in the production of insects like black soldier flies (BSF), food waste is already being used as feed source. BC-based Enterra is currently building a new plant near Calgary, Alta., where it will use food waste to grow BSF to further meet market demand in the pet food, poultry feed and

wild bird feed sectors here and in Europe. With some insects such as crickets, the waste (known as frass) makes outstanding fertilizer, providing a sort of circularity to insect farming, as well as adding another revenue stream for companies like Aspire.

It’s no wonder then that the use of crickets and other insects in pet food and in human food products is growing in Canada and beyond. As many of us already know, in some regions of the planet, insects have always been a staple in human diet.

Company beginnings

All this was realized by a group of young and ambitious McGill University MBA students who founded Aspire in 2013: Mohammed Ashour (now Aspire CEO), Shobhita Soor, Gabriel Mott, Jesse Pearlstein, and Zev Thompson. Their quest to produce a high-quality protein with low environmental footprint would win them the Hult Prize that year.

Between then and now, however— Aspire is now headquartered where its new plant is located in London, Ont. — the firm has travelled the world.

In 2014, Aspire started a palm weevil larva pilot facility in Ghana with KNUST University, the first-of-its-kind in Africa (and now a spin-off called Legendary Foods Africa, where Soor is CEO). That same year, Aspire began conducting R&D in Mexico while launching a pilot cricket production facility in Austin, Texas. By 2017, Aspire had built a

Aspire’s London, Ont., plant is the world’s largest, fully automated cricket production and processing facility.

The house cricket thrives in low light and has an attractive nutritional profile.

second pilot plant in Austin, which is also an R&D facility.

“There’s a strong open-mindedness with regards to food products in that city and it was—and still is—a very good business environment ‘match’ for us,” explains Ashour. “There, over five years, we did an enormous amount of R&D, refining systems and trialling technologies to achieve the right environmental conditions for the high quality and high yields we wanted, while remaining cost effective.”

At the same time, Aspire leaders were talking with pet food firms, and as early as 2017 they already had orders for volumes that would justify building a large plant.

“An investor encouraged us to look at southwestern Ontario,” says Ashour. “There were a growing number of funding opportunities from the federal government, which are an important consideration for any company, new or old. We visited several cities and London came out ahead. It offered us proximity to customers and feedstock suppliers and was also very attractive in terms of talent recruitment, company growth and local government support.”

Farming crickets

At the end of March 2022, the cutting-edge 150,000 sf plant was finished, with construction supported by $10 million from Sustainable Development Technologies Canada. Aspire also received $16.8 million from the feds (the NGEN Supercluster) to work with partners on automation of cricket processing. As the plant moves to full capacity by the end of 2022, it will produce 20,000 metric tonnes of product a year in whole crickets for the pet food market and frass. (Whole crickets provide pet food makers with maximum flexibility in their production processes.)

The London plant will be the world’s largest, fully automated cricket production and processing facility, leveraging all kinds of Industry 4.0 technologies such as robotics and artificial intelligence.

As Anne Waddell (Aspire’s director of

CRICKETS AT ASPIRE

Species: Acheta domesticus (the ‘house cricket’).

Calm in large groups, thrives in low-light and has an attractive nutritional profile.

Life cycle: Crickets are grown from egg to adult. Each female lays about 100 eggs, which hatch into ‘pinheads’ that are placed in ‘totes’ and undergo eight molts over about 30 days.

Feed: Aspire crickets are fed a modified chicken feed formula, mainly ground soybeans and corn. This provides consistency in insect performance and ensures high quality.

Cultivation: Vertical indoor farming. Totes are placed in an automated storage/ retrieval system with their environment kept consistent and optimal through automated sensors.

Harvest: Achieved through freezing the crickets.

government affairs) explains, the creation of the plant is backed by Aspire’s own R&D investments of over $20 million. “No company in the world has assembled a body of research on crickets that comes close,” she says. “We have 176 independent inventions and have acquired 11 patents.”

Products

The first target market for Aspire’s London-grown crickets is premium pet food, with protein that’s competitively priced compared to other complete proteins, and pound for pound, less fat and calories.

“While animal-based proteins are highly nutritious, ‘pet parents’ are increasingly concerned about sustainability and animal welfare,” explains Dr. Jenn MacLean, Aspire’s vice-president for research and innovation. “Plant-based proteins are sustainable and ethical but raise concerns about adequate nutrition for carnivorous pets.”

Eventually, Aspire will also target the human food market. “Crickets are not a novel food in North America,” Waddell explains. “The edible insect protein market is now growing at a rapid pace. Aspire cricket protein powder, made in Austin, goes into snacks and other products made by Hoppy Planet Foods and other companies.”

Strong interest in Aspire’s high-protein cricket powder has grown, says Ashour, because it’s odourless and tasteless. But he explains, “food-makers have been waiting for large volumes. I believe that within 10 years in Canada, we’ll see enormous production growth in this industry, with maturation on the regulatory side and entire research departments being created focused on

Aspire uses cutting-edge technology to harvest crickets that can be used in pet foods.

food and feed uses for crickets and other insects. We’re planning several large plants in the next decade, in North America, the Middle East/North Africa region and Asia, and we’re only one company.”

Although much insect research has already been done by Aspire and others, there is much more to be discovered. “We’ve learned a lot,” says Ashour, “but there’s so much more to research in terms of the dietary needs of insects, their nutritional content, feed trials in dogs and cats to measure health benefits, the list goes on. The story of crickets so far has been one of high levels of protein and Vitamin B12, but preliminary research suggests there are digestive and immune benefits with consuming crickets as well. There are exciting times ahead and right now we are helping to establish the first ‘Canada Research Chair’ in insects for food and feed at Laval University, and a research program at Western University.”

Setting aside food and feed for a moment, Ashour notes other important possibilities of insect farming. “This is very exciting for me personally, to plan for the use of our insect production system to someday manufacture other valuable raw materials at scale,” he says. “There are 3 million insect species. We can’t begin to measure the potential for producing raw materials for pharmaceuticals, textiles, cosmetics products, surgical materials, inks and dyes, the sky is the limit. But it all requires a successful model for large-scale production, which we have already successfully created.”

Note

1 Visit https://www.futuremarketinsights.com/ reports/insect-based-pet-food-market.