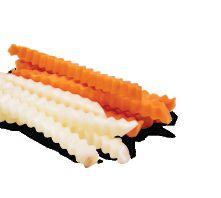

Successful food processors rely on Urschel for optimal, precision cutting solutions to improve production.

The Urschel global network of sales and support has expanded. Urschel Canada is now open in Ontario with full coverage throughout Canada.

Contact Urschel Canada to learn more: 647-910-5017 | canada@urschel.com

FEBRUARY/MARCH 2025 • VOL. 85, ISSUE 1

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service

Tel: 416-510-5113 Fax: 416-510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

ASSOCIATE ED ITOR | Ojasvini Parashar oparashar@annexbusinessmedia.com 416-510-5206

ASSOCIATE PUBLISHER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Barb Vowles bvowles @annexbusinessmedia.com 416-510-5103

AUDIENCE DEVELOPMENT MANAGER | Anita Madden amadden @annexbusinessmedia.com 416-510-5183

GROUP PUBLISHER/VP SALES | Martin McAnulty mmcanulty@annexbusinessmedia.com

CEO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Subscription rates

Canada 1-year – $86.65 per year

Canada 2-year – $127.45

Single Issue – $15.00

United States/Foreign – $163.15 All prices in CAD funds

Food in Canada is published 6 times per year by Annex Business Media. Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer

Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission @2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

Pensive has been the mood of the mind since U.S. President Donald Trump threatened to impose tariffs on Canada. I’m aware that by the time you get this magazine, Trump may have gone ahead. Hopefully that’s not the case. Even if that happened, I believe this crisis offers us an opportunity to breakdown long-held barriers to interprovincial trade, thereby softening the impact of a trade war with the U.S.

During an interview with CBC News in late January, Internal Trade Minister Anita Anand said removing existing barriers “could lower prices by up to 15 per cent, boost productivity by up to seven per cent and add up to $200 billion to the domestic economy.”

In fact, a study by the International Monetary Fund determined, “Complete liberalization of internal trade in goods can increase GDP per capita by about four per cent and reallocate employment towards provinces that experience large productivity gains from trade.”

Our industry has been vocal about the negative impact of these trade barriers that prevent, for example, the sale of B.C. or Nova Scotia wine in Ontario. Food safety regulations vary across the country. Plus, provinces have separate marketing boards for dairy and poultry, limiting the Canadian market for certain agricultural products.

As the Canadian Federation of Independent Business (CFIB) reported, “These barriers hinder the free flow

of goods, services, and labour across provinces and territories, posing significant challenges to businesses wanting to grow and expand within the country. Half of Canadian businesses report that navigating the regulatory requirements across different Canadian jurisdictions deters them from entering new domestic markets,” which is sad.

Our governments recognized these issues and signed the Canadian Free Trade Agreement (CFTA) in 2017. According to the Canadian Chamber of Commerce, “While CFTA provides some progressive relief measures on specific areas such as procurement, much of the 300-page document is dedicated to exemptions, creating opt-out measures on many key files that continue to pose significant issues at the sub-national level.”

CFTA “preserved the ability of federal, provincial, and territorial governments to adopt and apply their own laws and regulations related to economic activities to achieve public policy objectives including the protection of public health, social services, public safety, consumer protection, the promotion of cultural diversity and workers’ rights,” per the Growing Imperative to Create a More Integrated Internal Economy in Canada report by Steven Globerman of the Fraser Institute. CFIB recommends that Canada reviews and reduces the scope of exceptions with CFTA to make it more

Nithya Caleb

effective; allow interprovincial trade of alcohol and other types of food products; simplify procedures as well as streamline processes for recognizing professional qualifications and certifications across provinces and territories.

Another interprovincial trade agreement is the New West Partnership Trade Agreement (NWPTA) between British Columbia, Alberta, Saskatchewan and Manitoba. It recognized standards, lowered thresholds for public sector procurement and opened energy markets. Ontario and Quebec also have a trade agreement.

In a study on “the Impact of Internal Trade Liberalizations on Plant Productivity and Markups,” Daniel Teeter, a PhD candidate at Queen’s University, found NWPTA “raised the average plant’s productivity by 1.97 per cent across all post-treatment years.”

NWPTA seems to offer a framework that’s more conducive to trade and could be used as a model to modify CFTA. Ideally, when one province or territory approves a trade item, it must be deemed to automatically satisfy the requirements of another province or territory. This type of ‘mutual recognition’ would strengthen CFTA, reduce regulatory burden on companies, improve productivity and overall trade in Canada.

Nithya Caleb ncaleb@annexbusinessmedia.com

Olymel reveals a new look, which was created in collaboration with creative agency LG2. According to a media statement, the rebranding’s main objective is to “highlight the quality of Olymel products, while making the brand more visible, contemporary and attractive.” Olymel anchored the new identity around its iconic red and blue colours, while simplifying the logo to reinforce its visual impact.

Joriki Beverages shuts operations

Toronto-based Joriki Beverages, which had processed plant-based milk linked to the 2024 listeria outbreak, permanently closes all four of its plants—two in Ontario, one in B.C. and one in Pennsylvania owned by a subsidiary. It also files for creditor protection. According to the Canadian Food Inspection Agency, a production line at the company’s Pickering, Ont., plant that was used by Danone Canada, was the source of the listeria outbreak that caused three deaths between August 2023 and July 2024.

requirement reduced salmonella in chicken

A recent study by Public Health Agency of Canada found a Canadian Food Inspection Agency (CFIA) requirement for frozen breaded chicken products (FBCP) reduced human salmonellosis incidence rate by 23 per cent. In 2018, a CFIA notice required companies to implement control measures at the manufacturing/processing level to reduce salmonella in FBCP to below a detectable amount from April 1, 2019. The study found that FBCP salmonella prevalence decreased from 28 to 2.9 per cent after the requirement was implemented.

code of conduct adjudicator appointed

The board heading Canada’s grocery code of conduct hires Karen Proud, former president and CEO of Fertilizer Canada, as adjudicator to oversee the code’s implementation. Proud has held executive roles at Food, Health and Consumer Products of Canada and the

Retail Council of Canada. The code is intended to be operational by June.

Premium Brands acquires three specialty food companies

Premium Brands acquires NSP Quality Meats (NSP), Casa Di Bertacchi (Casa), and Italia Salami (Italia). NSP is a cooked protein and deli meats manufacturer with plants in Oklahoma, Texas and Missouri. New Jersey-based Casa manufactures branded and private label cooked protein products. Ontario-based Italia produces dry cured Italian salami.

Nova Scotia testing centre gets $400k to expand capacity

The federal government grants $411,434 to the Acadia Laboratory for Agri-Food and Beverage (ALAB), an analytical lab providing research and analytical services to the wine, craft beverage and food industries in Nova Scotia. This investment will support the purchase of specialized testing equipment, expanding ALAB’s capacity for ISO-accredited analytical testing. The contribution will also support a marketing plan and

digitization upgrades to streamline the process for ordering lab tests.

Baxter’s Bakery modernizes Ontario plant

Baxter’s Bakery is investing $3,491,269 to create 54 new jobs in Cobourg, Ont., with $466,569 in supportive funding from the Ontario government. The business will purchase new manufacturing and packaging equipment, which will be installed at their wholesale baked goods manufacturing facility in Cobourg, according to a news release from the Ontario government. The new equipment is expected to increase production capacity, support research and development as well as further use of automation.

ABB updates its Baldor-Reliance Food Safe stainless steel motor product portfolio with a streamlined three-lead electrical connection design. This new motor solution is engineered to enhance reliability and improve workplace safety. The optimized three-lead design reduces installation time and simplifies the setup process. The Baldor-Reliance Food Safe stainless steel enclosure features smooth surfaces and a self-draining design. Additional features, such as welded feet, a polished 360-degree rotatable conduit box and external drains, enhance sanitation efficiency. This motor line is available in C-Face foot-mounted and footless designs. go.abb/motion

Dr. Amy Proulx

e should have learned our Listeria lessons, but the recall of plant-based beverages in late summer 2024 shows there is still much to be done to improve regulatory compliance. Last summer, a major Listeria recall occurred at the Joriki Beverages plant in Toronto. The infection had caused more than 20 illnesses and three deaths. As with any food safety incident, root cause analysis is helping systematically map where errors occurred. Much of the current attention is focused on Canadian Food Inspection Agency’s (CFIA’s) establishment-based risk assessment (ERA) model for food establishments. This model, in its conceptual state, is quite useful. Rate the food safety risk within the company and then base the frequency and intensity of inspection based on the risk profile. This is a way to gain efficiency for tax-funded services.

In the ERA model, which was developed through consultation with food safety specialists across the country, a list of 173 factors were profiled and ranked by importance. These factors were then grouped into three categories: Inherent Risk Factors, Mitigation Factors, and Compliance Factors.

Inherent Risk Factors include commodity, type of products, volume, type of activities conducted at the establishment, direct distribution to vulnerable populations, and processing steps. These inherent risk factors were then ranked by the health impact or disability adjusted life year (DALY) attributable to the commodity and product.

One issue that’s related to Inherent

Risk Factors is the sorting of commodities apart from traditional ones like meat, seafood, dairy, eggs, honey, maple syrup, and processed fruits and vegetables into one large category of ‘Manufactured Foods’.

Manufactured foods run the gamut for risk profiling and are hard to quantify because of the vast range of products and process innovation that can occur within this category. Interestingly, they were ranked low for risk, despite the huge range of potential risk profiles in this category.

Continuous improvement should be part of every company’s food safety management program.

Plant-based beverages were classed as Manufactured Foods, as identified in an investigation by the Globe and Mail, thereby giving a lower risk rating than comparable commodities like dairy. However, the intrinsic properties of the beverage, including a pH close to neutral, a high level of fermentable substrate within the product, no water activity control, and lack of antimicrobial additives suggests this product is prime for pathogen survival and microbial outgrowth. Bacterial growth is highly likely if there is a failure in the pasteurization and aseptic filling process, or packaging contamination. Based on the Listeria Policy categorization, plant-

based beverages would typically be rated as Category 1—highest risk product for the lack of intrinsic properties protecting the product.

In my work, I coach many companies on food safety and quality management and will frequently ask about their knowledge of inherent risk in their products. Do they know the water activity, pH, titratable acidity, Brix, and other various factors that define the risk basis of their products? When working with small businesses, which make up the bulk of our Canadian food manufacturing, the answer is quite often no. These companies do not have the sophistication of quality control programs to track, either at the specification level or lot level, the properties of the product that make it high or low risk.

Mitigating Factors include applying additional processes and process controls, application of microbial sampling plans, evidence of food safety certifications and third-party audits, employment of qualified quality control personnel, and evidence of supplier verification schemes. All of these add robustness, but again, the presence of these programs, and the quality of performance of each of these elements within the ERA model is all based on single points in time.

Compliance Factors include information derived from CFIA activities and actions. This includes inspection results and impact assessment, history of enforcement actions, history of recalls and food safety confirmed complaints. With many establishments inspected

under the Safe Food for Canadians licensing requirements, the frequency of inspection was already very low, making the quantity of these compliance factors consequentially low.

The ERA model and each establishment’s risk profile is predominantly based on self-reported data. Most of the rating criteria are not determined by audit or verification from an external body such as CFIA. Whenever organizations self-select their data and response, there’s always a bias to respond in a way that places the organization in the least risk possible category. It’s tempting to offer what you think is the easiest answer rather than reflect on worst-case scenarios. Secondly, if a company is doing product innovation, is a new risk catego-

rization prompted by the system? Continuous improvement should be part of every company’s food safety management program. It is not clear how frequently establishments re-register within ERA to reflect updates and changes within their risk profile.

Based on an investigation from the Globe and Mail, it appears that 1443 out of approximately 8000 establishments did not answer the survey at all, thereby receiving low risk ranking without any verification from inspection.

The use of mathematical models, artificial intelligence, and algorithm-based decision-making is only as good as the data we feed. When data is missing, not correctly verified, or is not addressing the entire scope of the system, it will

not reflect reality. In today’s technology-driven world, we become more and more reliant on it for answers. Meanwhile onsite observation, expert common sense and scientific consensus is still the prevailing way of assessing risk.

A full-scale audit of the ERA model will be performed in winter 2025. The entire sector is looking forward to understanding what went wrong. There is great anticipation for major improvements to bring trust back to this high impact food safety model.

Dr. Amy Proulx is professor and academic program co-ordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont. She can be reached via email at aproulx@niagaracollege.ca.

Laura Gomez

t’s time to use modernization of the Food and Drug Regulations (FDR) and Safe Food for Canadians Regulations (SFCR) to embrace opportunities for international alignment.

At the end of December 2024, amendments to FDR were published. These changes to the food regulatory framework aim to modernize compositional standards, microbiological criteria and methods of analysis for foods as well as complete the modernization of the food additive regulatory regime.

The stated goal of these regulatory amendments was to provide a more responsive and adaptable regulatory framework. Using incorporation by reference, the Canadian Food Inspection Agency (CFIA) aims to “update the standards more efficiently to support growth and innovation…”. The impetus being several reviews, including a 2018 Treasury Board review and another specific to agri-food and aquaculture sectors in 2019. These reviews identified regulatory practices and requirements that hindered economic growth and innovation in the agri-food sector.

Much has changed in the past five years, and modernization efforts must continue to keep pace. Ensuring Canada’s food regulatory framework is agile is increasingly important as e-commerce continues to change the way Canadians access food products. Modernization also presents an opportunity to address regulatory irritants and promote alignment that will improve Canadian companies’ ability to export foods as well as decrease the regulatory burden and associated added costs for imported food. For years regulatory cost benefit analysis has been making errone-

ous assumptions that additional cost of regulatory burden and red tape would not affect consumers—while increased regulatory burden (including successive labelling requirements) is not the only reason for increases to the price of food in Canada, the cumulative costs are not insignificant.

As an example of an area that could benefit from modernization is Canada’s regulatory regime for food additives and processing aids. In December 2024, Health Canada announced it will discontinue offering letters of no objection (LONOs) for premarket review of food processing aids (and incidental additives). While there is no regulatory requirement to obtain a LONO from Health Canada for food processing aids, these LONOs provided a measure of certainty for suppliers and the supply chain as the Canadian regulations and policies as implemented by Health Canada differ from those of Canada’s major trading partners (e.g. U.S.A.) and the Codex Alimentarius Commission. The certainty provided by a LONO was helpful to industry given that Health Canada’s policy on processing aids is subject to interpretation and assessed by Health Canada on a case-by-case basis. Accordingly, having a LONO from Health Canada provided a

measure of certainty that Health Canada did not object to a supplier’s interpretation.

At a webinar in December 2024, Health Canada explained that the rationale for discontinuing this service with respect to processing aids was budgetary concerns (LONOs are not cost recovered). With the certainty of LONOs no longer available, Health Canada committed that in the coming months it would update its Policy

to “better assist industry in self-determining whether a substance is a food additive or food processing aid in a given context of use”.

While improved guidance is helpful, the burden and risk has been shifted entirely to industry now that the relative certainty of a LONO is not available. Perhaps it is time for industry to address the root cause and propose a plan to pursue improved alignment with CODEX and the U.S. with respect to processing aids and food additives. Surely alignment with respect to substances that are used in trace amounts, and in foods consumed safely around the world, is a reasonable goal for regulatory co-operation.

Industry is key to leveraging modernization. Industry’s input on regulatory irritants and opportunities for alignment is key to ensuring that the government can use these efforts to improve Canada’s regulatory framework. In 2025, the stars might be aligned as modernization is on the regulatory agenda for CFIA and Health Canada and the spring is likely to usher in a different government with new opportunities for engagement.

Laura Gomez is a lawyer in Ottawa’s GowlingWLG food law group. She can be reached at laura.gomez@gowlingwlg.com.

Unlock possibilities with Dairy-Lo ®, Lactalis Canada‘s unique fat replacer made from 100% Canadian dairy. Dairy-Lo ® has proven to be an excellent tool to reduce the overall fat content in classic recipes while delivering desired functionalities of fat such as mouthfeel, creaminess, opacity but also water binding and texture.

Dairy-Lo ® can be used in a wide range of applications: A Low-Fat Dairy Solution with a Creamy Mouthfeel! An Innovative Tool to Provide Great Taste without the Need of the Upcoming Front of Package Labelling

Premier Canadian Dairy Ingredients Manufacturer:

Butter | Cream Cheese | Cheese | Fluid & Evaporated | Functional Proteins Milk Powders | Milk Replacers | Whey Powders | Whey Replacers lactalisingredients.ca | Email: ingredientsinfo@ca.lactalis.com

Alex Barlow

ustainable food packaging is nothing new. Compostable and biodegradable alternatives to conventional plastic packaging have existed for several decades, but high production costs and limited scalability are perennial challenges. Biodegradable materials like polylactic acid (PLA) and starch-based bioplastics often lacked the strength or barrier properties required for food safety and shelf-life, making them impractical for many food packaging applications. Compounding the challenge was the lack of recycling or composting infrastructure capable of handling these materials. In Canada, new policies and regulatory targets seek to accelerate the transition from plastic food packaging.

Plastic packaging thoroughly transformed our food system in the mid-20th century. The stuff became ubiquitous for a reason: it’s lightweight, durable, inexpensive, and flexible. It also helps reduce food loss and waste, meets stringent food safety standards, and integrates easily into established manufacturing operations.

Unfortunately, we have never scaled robust plastic recycling infrastructure, making plastic a profoundly damaging source of pollution, which is why we urgently need alternatives that compete with the utility of petroleum-based plastics. That is the problem Canadian innovators like Copol International are dedicated to solving. The North Sydney, N.S.-based company has partnered with the Verschuren Centre to develop multifunctional biopolymer food packaging applications. This includes a compostable cast polypropylene film, which will one day replace flexible plastic wrap while preserving its

key benefits—lightweight, durable, safe for food, and cheap—in a way that earlier generations of bio-based materials could not. Other engineering breakthroughs are pushing the boundaries of what’s possible from biodegradable materials. For instance, Waterloo’s Nfinite Nanotech is creating nano-coatings to improve the utility of compostable packaging.

Creating better materials is only half of the sustainable packaging equation. What happens at the end of their functional life is equally important, which was a key challenge for early generations of sustainable packaging products. Composting and recycling facilities were ill-equipped to handle the influx of biopolymers that require highly specific conditions to process effectively. In most of the country, composting facilities were simply non-existent until quite recently, and even today many do not accept certified biodegradable materials. As a result, compostable packaging materials ended up in landfills, almost entirely negating the potential environmental benefits. Fortunately, advances in biotechnology are making it easier to process bioplastics

appropriately. For example, Ottawa’s Food Cycle Science is developing enzyme-based technologies that can be added to commercial composting units to accelerate the breakdown of bioplastics.

Elsewhere, some innovators are demonstrating how we can move away from single-use food packaging entirely. In 2024, the Circular Innovation Council launched a reusable food container pilot in partnership with Vancouver-based Reusables and major grocers like Metro, Sobeys, and Walmart Canada in Ottawa. The program leverages Reusables’ smart return system to offer select products in reusable containers. The company’s sleek, IoT-enabled return bins, located at retailer and other neighbourhood locations, make container returns convenient and trackable.

Despite incredible progress made by these innovators and many others across Canada, a food system free of single-use plastics is still almost impossible to imagine. Without it, our modern food system would cease to function. So, although a transition away from plastic packaging is an environmental and public health necessity, it remains a challenging task, and success is far from guaranteed. However, transformational change happens almost imperceptibly. It occurs as the right mix of regulatory alignment, consumer education, industry support, and technological innovation begin to coalesce.

Alex Barlow is vice president, programs, for the Canadian Food Innovation Network (CFIN), which funds foodtech projects Visit CFIN at www.cfin-rcia.ca to become a member for free.

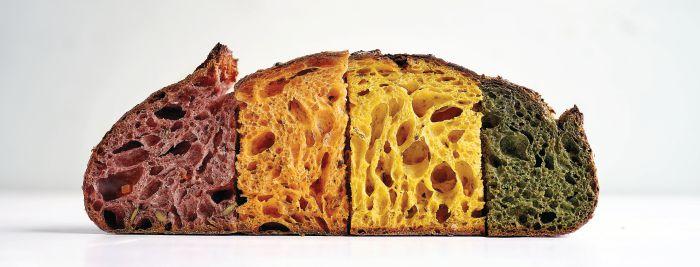

From hyper-crunch to next-gen naturality, learn what consumers want — BY JACK KAZMIERSKI —

Tate & Lyle’s latest report on Trends in Mouthfeel offers insights into what consumers desire the most.

As the report said, “getting mouthfeel right in food formulation is crucial in unlocking taste, which is the primary reason people choose certain foods and drinks.” So, it’s valuable for companies to understand mouthfeel trends so that they can deliver the textures and sensations consumers want.

When it comes to baked goods, Marina Di Migueli, global marketing director, texturants and proteins at Tate & Lyle, said that mouthfeel is no longer just an enhancement; it’s at the heart of taste transformation and is critical for the success of brands.

“In particular, ‘next-gen naturality’ is an important trend, as consumers are increasingly looking for baked goods that incorporate wholesome, natural ingredients,” she added. “This includes innovations with seeds, wholegrain flours and fibres, which enhance both the nutritional value and textural appeal of products.”

Another standout trend, according to Di Migueli, is ‘hyper-crunch,’ especially in the snacking category.

“Consumers are seeking more intense, satisfying textures, and the amplified crunch or snap of products can create a dynamic sensory experience,” she explained.

Additionally, air as the next ‘magic ingredient’ presents a novel opportunity for baked goods manufacturers.

“Inspired by the light, airy textures of chiffon and pandan cakes in eastern markets, incorporating air into baked goods offers consumers a new sensory experience, while supporting portion control and satiety,” said Di Migueli.

‘Mouthfeel mimicry’ is particularly relevant for reformulations.

“As bakery companies innovate healthier or more affordable versions of their products, replicating the texture and mouthfeel of traditional baked goods ensures consumer satisfaction while meeting demands for clean-label, sustainable or cost-effective solutions,” added Di Migueli, “especially when some ingredients have become too expensive. For example, cocoa for fillings, butter and oils.”

Each of these trends represents an opportunity for companies to innovate and

Mouthfeel is no longer just an enhancement when it comes to baked goods. It is critical for the success of food products.

differentiate their offerings in a way that resonates with evolving consumer expectations.

Jane Dummer, president of Jane Dummer Consulting, said consumer demand for a variety of sensory experiences that enhance snacks and meals is driving texture trends.

“When it comes to baked goods and bread, often we see inclusion of nuts and seeds to add a simple texture change,” she said. “Over the past five years, I have witnessed more texture variations with dehydrated fruit, innovative cream fillings and the use of flour blends to boost the sensory experience through texture.”

Dummer explained how the right texture combinations can boost sales.

“I’m seeing interesting multi-layers of texture in [a single] baked good,” she said. “It can include smooth, crunchy, crumble, soft, crispy and flaky textures all in one bite.”

She offers an example. Christophe Bonzon, pastry chef and owner of B.C.-based Chez Christophe, came up with creative combinations with laminated dough and the croissant cube. “Specifically, the Bubble Tea Cube version,” she recalled. “It consists of a creamy filling, an insert of liquid tea and boba pearls on top, along with the flaky croissant layers. When this version was first introduced, they sold over 1,500 units in two days.”

Consumers seek multiple textures in a single baked good these days.

According to Dummer, ‘crunch’ seems to be the ‘texture of the moment.’

“From crispy grains and granola to sprouted and fermented nuts to roasted chickpeas and mushroom chips—consumers are increasingly reaching for these items to enhance meals and add texture to breakfast, lunch and dinner,” she added. “This trending texture can also be seen in beverages and desserts like crème brûlée espresso martinis or pistachio-topped pastries.”

Julie Istead, VP, R&D, at Puratos Canada, notes that texture is the new taste.

According to Puratos’ research, about one-third of consumers, globally, think that crispy or crunchy along with creamy textures make a food indulgent.

“I think it’s important for companies to remember that texture is as important as taste,” Istead said. “And I think it’s great to have more than one texture in a food prod-

uct. For example, sourdough bread has a really crispy crust and a soft interior, and it’s that eating experience of crunching through the crust into a nice pillowy crumb that makes it so enticing.”

The best way to take advantage of emerging trends, Istead explained, is to pay attention to consumer demand.

“Food companies should keep an eye out for trends that are popping up on social media, in grocery stores and in foodservice restaurants,” she added. “Just don’t forget that texture is as important as taste.”

Tate & Lyle’s Marina Di Migueli agreed: “Companies can embrace textural innovation by creating products with unique sensory attributes, such as hyper-crunchy or airy profiles, to surprise and delight consumers. At the same time, they should aim to balance indulgence with health-focused reformulations, ensuring that new formulations retain the preferred taste and mouthfeel of existing products.”

Di Migueli recommended brainstorming novel baked goods that align with emerging consumer preferences.

“For example,” she said, “consider how a traditional product might need to evolve to incorporate an airy texture or a clean-label ingredient.”

By aligning product development with these trends, companies can drive innovation, enhance customer satisfaction, and stay competitive in a rapidly evolving market.

— BY NITHYA CALEB —

I’m thrilled to share that we’re celebrating Food in Canada’s 85th anniversary this year. In 1941, when the world was in the thick of World War II, Food in Canada came into being, chronicling the incredible innovation that was happening in the processing world then and now. Every month in 2025, we’ll be paying homage to this storied magazine as well as to the largest manufacturing industry in Canada through contests, polls, articles, infographics, etc.

We begin in 2010, as it, in some ways, marks a pivotal moment in our industry, which was beginning to rebuild trust after the 2008 listeria crisis as well as a recession. It seems like a good starting point given the recent economic downturn and another major listeria-related recall of plant-based milks in 2024. History is a great teacher and I’m hoping the years between 2010 and 2024 will offer us valuable lessons to navigate the ongoing economic challenges.

Kraft Foods acquired U.K.-based chocolate maker Cadbury in 2010. This set the stage for Kraft Foods to split into two companies in 2012. Its snack food division including Cadbury was spun off into a separate company called Mondelez International and the grocery business with brands like Kraft, Maxwell House and Oscar Mayer continued to be known as Kraft Foods. The story, however, continues for Kraft. In 2015, it merged with Heinz to create Kraft Heinz, the third-largest food and beverage company in North America and the fifth-largest food and beverage company in the world at that time.

Closer to home, in 2010 French multinational company Yoplait acquired Liberté. In 2011, General Mills bought a 50 per cent

stake in Yoplait. But, in 2024, it sold its North American yogurt business for approx. US$2.1 billion. As a result, French dairy co-operative Sodiaal was able to resume operations in Canada by acquiring the Canadian yogurt business of General Mills. This followed Sodiaal’s acquisition of Yoplait’s operations in Europe and the global ownership of both the brands in 2021.

When Ultima Foods lost its Yoplait manufacturing license, it decided to launch its own yogurt brand in 2012—Iögo, which is now regarded as one of Canada’s leading dairy brands.

In 2013, Sofina Foods bought Janes Foods. In 2014, Maple Leaf Foods sold Canada Bread to Grupo Bimbo for $1.83 billion. The sale wasn’t the end of Maple Leaf Foods’ association with Canada Bread. In 2023, Canada Bread was fined $50 million by the Ontario Superior Court after pleading guilty for its role in a criminal price-fixing arrangement that raised the wholesale price of fresh commercial bread. Canada Bread admitted that it arranged with its competitor, Weston Foods (Canada), to increase prices for various bagged and sliced bread products, such as sandwich bread, hot dog buns and rolls. The price-fixing resulted in two price increases, one in 2007 and another in 2011. In December 2024, Grupo Bimbo sued Maple Leaf Foods and some senior officers and company directors for alleged fraudulent and negligent misrepresentation during the Canada Bread sale process. Maple Leaf has also filed a defamation lawsuit against Bimbo. These cases are still in court.

In 2014, McCain sold its Canadian pizza business to Dr. Oetker. In 2023, the Kellogg Company split its North American cereal business into two independent companies—Kellanova and WK Kellogg Co. Kellanova (with brands like Pringles, Cheez-It, Pop-Tarts, Kellogg’s Rice Krispies Treats, MorningStar Farms, Incogmeato, Gardenburger, Nutri-Grain, Rxbar and Eggo) was subsequently sold to Mars in 2024 for approx. US$35.9 billion. WK Kellogg Co. is the home of Kellogg’s, Frosted Flakes, Froot Loops, Mini-Wheats, Special K, Raisin Bran, Rice Krispies, Corn Flakes, Kashi and Bear Naked.

In 2010, companies were keen on regaining market share especially in exports, which fell by nearly 40 per cent during the 200809 recession. In the 2010s and subsequent years, Canada signed several trade agreements including the Canada-Europe Trade Agreement (CETA) with the European Union in 2017, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Canada-United States-Mexico Agreement (CUSMA) in 2018. Canada currently exports over a third (34 per cent) of its food and beverage production, with 90 per cent of these exports going to countries in our top three free trade agreement markets. CUSMA dominates with 82 per cent of our exports, followed by CPTPP at six per cent and CETA at two per cent. Of course, there have been bumps in the road. For instance, Canadian

meat products lost access to Guatemala in 2013 due to new inspection requirements. After years of negotiations, Guatemala allowed exports of Canadian beef, pork and poultry meat products in 2024. Similarly, B.C.’s fresh cherries regained access to South Korean markets in 2022 after seven years, and Japan reopened its doors to Canadian processed beef after two decades in 2023. Japan had placed restrictions on Canadian beef in 2003 after a case of bovine spongiform encephalopathy was discovered in Alberta.

Another big concern in 2010 was food safety and regaining consumer trust. In 2008, a listeria outbreak linked to readyto-eat meats produced at a Maple Leaf Foods plant in Ontario resulted in the death of 23 people across Canada. This outbreak forced Health Canada, the Canadian Food Inspection Agency (CFIA), and Public Health Agency of Canada to implement stricter measures to prevent foodborne illness. The steps taken since then by government authorities and companies have ensured food and beverages produced in Canada are the safest in the world. However, in 2024, another listeria-related outbreak has shown there are still systemic flaws in our food safety programs. Plantbased milks produced at Joriki Beverages’ Pickering, Ont., plant, was the source of a listeria outbreak that led to three deaths between August 2023 and July 2024. The company has since then shut down operations and filed for creditor protection. A CFIA investigation found Joriki was not adhering to Health Canada’s policies on listeria prevention such as conducting environmental swabbing and finished-product testing for listeria.

In 2010, Canada’s federal, provincial and territorial ministers agreed to reduce the average sodium intake of Canadians by

Frozen foods started becoming popular in the 2010s due to economic conditions.

In the 2010s, the Buy Local movement started getting traction.

The demand for functional foods, clean labels, and natural ingredients began in the 2010s and is still relevant today.

Kale turned from a simple vegetable into a superfood in the 2000s. Other foods that became trends include sriracha, avocado, bone broths, pumpkin spice, cauliflower rice/crust, non-alcoholic beverages, sourdough/fermented foods, matcha etc. The list goes on and on…

In 2010s, Greek and other regionspecific yogurts became popular. The demand for hi-protein foods propelled yogurt into a staple dish for Canadians.

In 2010, it was decided to reduce the average sodium intake of Canadians by a third, from 3400 mg to 2300 mg per day by the end of 2016.

In 2016, Beyond Meat launched Beyond Burger, the world’s first plant-based burger.

Food delivery apps like Flashfood, Too Good to Go, Uber Eats, Skip the Dishes began in the 2010s and changed the way we order food. Further, meal kit companies like Hello Fresh helped bring gourmet-style food into our homes.

* Editor’s note: This list is by no means a complete compilation of the trends we’ve witnessed in the last 15 years. I’m sure we’ve missed many innovations, but it wasn’t intentional.

a third, from 3400 mg to 2300 mg per day by the end of 2016. This spurred product reformulations as well as the law-salt movement, which has since expanded into low-sugar, low-fat, low-carb etc.

On November 30, 2012, Health Canada’s Food Directorate modified the List of Permitted Sweeteners to enable the use of steviol glycosides as a sweetener in certain food categories. This was the first sugar alternative to enter the Canadian market.

Enhanced labelling regulations for food allergens came into force on August 4, 2012.

In 2012, Canada began to consolidate federal food laws to simplify the regulatory landscape. The idea was to combine five laws into just two regulations—the Safe Food for Canadians Act applies to imported foods or those prepared for interprovincial or international trade and the Food and Drugs Act deals with all food sold in Canada. This attempt at modernizing our food laws is ongoing.

In 2018, Canada legalized the sale of cannabis. On October 17, 2019, the sale of edible cannabis, cannabis extracts, and cannabis topicals was permitted with a limit of 10 mg of THC per container. Companies have found this limit debilitating, and the cannabis edible market hasn’t grown as forecast.

In 2024, the grocery code of conduct cleared all hurdles with support pledges from all the major retailers. The voluntary code is meant to level the playing field for suppliers and smaller retailers by providing guidelines for fair negotiations. It’s expected to be in place by June.

We began hearing about staff shortages in the food and beverage manufacturing industry as early as 2015. Companies began to rely on temporary foreign workers to fill the gap, which has only been growing. According to Food Processing Skills Canada, we need to recruit 142,000 new people between 2023 and 2030.

There’s no way to sugarcoat the devastating impact of the pandemic and avian influenza on our industry. Several food and beverage manufacturing plants, especially those involved in meat processing, had to cease operations for weeks due to COVID-19 outbreaks in their workforce.

Poultry farms across Canada had to engage in mass culling to stem the spread of avian influenza. It’ll take farms years to recover their losses despite getting government support.

I’m sure I’ve missed highlighting many industry milestones, but the error isn’t intentional. Given the breadth of our industry, it’s impossible to report on all the happenings. Nevertheless, I’d like to be reminded of the landmark events that I missed reporting here, so please feel free to email me at ncaleb@annexbusinessmedia.com with your 2010-2024 F&B processing-related memories.

cold-pressed

In a world where sustainability is no longer a niche concept but a necessity, Loop Mission rescues fruits and veggies that would have been otherwise thrown out for aesthetic reasons like shape and size and turns them into beverages. Founded by David Côté and Julie Poitras, this Quebec-based company has upcycled more than 36 million lb of fruits and vegetables.

The inspiration

Before co-founding Loop Mission, Côté was involved in a chain of vegan restaurants and co-founded the kombucha brand Rise. He had a firsthand view of the staggering amount of food waste in the industry.

“Having restaurants, you see a lot of food waste. One day, I received a call from Fred at Courchesne Larose telling me that he was throwing away 20 tons of fruits and vegetables in his produce warehouse as distributors [tend to] keep a little extra for their customers. Julie and I visited the warehouse, and we couldn’t believe they were throwing away tons of good fruits and vegetables every single day. The produce was still good, only a victim of speculation,” said Côté.

Poitras sold her house, and Côté sold his restaurants to start working on Loop Mission full-time. The name ‘Loop’

embodies the company’s core philosophy: creating a circular system within the food industry where nothing is wasted.

“We started with a co-packer making the juice and built a facility inside the produce warehouse where the produce was being rejected. Slowly, we grew and opened our factory in Boisbriand, Qué., where we started receiving food waste from all around,” he said.

Other than local produce warehouses, Loop Mission also works with grocery chains like Sobeys, Metro, and Loblaws on their overstock products.

Loop Mission’s product line features coldpressed juices, wellness shots, probiotic sodas, protein smoothies, lemonades, and iced teas. Loop Mission also crafts beers made from day-old bread, repurposes

potato scraps from Yum Yum Chips and recycles cooking oils from a restaurant chain to produce soaps. Further, it uses leftover pulp and grains to create energy bites.

While the concept of upcycling may seem straightforward, Côté said that Loop Mission’s success lies in effectively navigating the logistical and operational complexities of the business.

Côté said that 95 per cent of all the produce they use in their products are upcycled. Loop Mission diverts approximately 140 tons of produce from landfills each week, which is important since food loss and waste account for eight to 10 per cent of annual global greenhouse gas emissions.

When it comes to sourcing, Loop Mission collects produce from a 750-km radius around their facility in Boisbriand. The com-

pany also works with farmers in Egypt, Brazil, Texas, and Florida by buying produce that is unfit for grocery shelves or value-added manufacturing due to imperfections or extra processing needs at a lower price.

The sorting process at the company involves manually unpacking and sorting through produce. Côté explained that it is an intensive procedure because a significant amount of manual work is required. Other companies lack the profitability margin to pay employees for tasks like separating packaged products to send them to compost, which is why most of the produce and bread end up in landfills.

Loop Mission is not working in isolation. The company has partnered with other businesses, such as Matéina to include organic yerba maté in their ‘Brain Fuel’ wellness shot, Vega for their plant-based protein and Davids Tea for creating an exclusive flavour of sparkling iced tea.

These partnerships exhibit the potential of upcycling to create financial value and offer

a win-win scenario where companies “make millions of dollars” by utilizing ingredients they used to discard.

The company also collaborates with other food manufacturers through the Loop Synergies program. Loop Synergies is a branch of Loop Mission focused on transforming rejected produce into usable ingredients for the food industry. This program aims to reduce food waste by making upcycled ingredients readily available to other businesses. Last year, Loop Mission received a $1.5 million grant from the federal government’s Food Waste Reduction Challenge program to expand its capacity and provide bulk ingredients.

“The grant is not for Loop Mission itself. It’s for making bulk ingredients to sell to other manufacturing companies that want to be part of the movement but don’t know where to start. We use the strength and the volume of other food manufacturers to make the movement bigger and have a bigger impact,” Côté said.

Technology and expansion

Currently, Loop Mission’s 40,000-sf facility produces approx. 3,000 bottles daily. The company is investing in automation and robotics to enhance efficiency. A major investment was in an HPP (high-pressure processing) machine to create their juices.

“HPP is the biggest buy that we did as a company in terms of value and size. It’s a 78-ton machine. It helps us take a juice that has three days [shelf life], and make it 100 days shallow without pasteurization,” Côté said.

Another key piece of equipment for Loop Mission is a bottling machine for wellness shots, which has reduced production costs by 25 per cent.

The company’s commitment to sustainability extends to packaging. Loop Mission conducted life-cycle assessments on all packaging options and found that PET is the best packaging option in terms of greenhouse gas emissions, provided it is recycled.

The company also incorporates a portion of post-consumer recycled resin (PCR) into their plastic to lower its environmental impact. The bottle caps are made from HDPE. However, Côté recognizes that the labels aren’t eco-friendly. He said the company is working on a solution for a ‘wash away label’ that will be compatible with recycling processes.

Loop Mission’s primary goal is ‘eradicating food waste globally.’

“Our main goal was to educate, and it still is to educate the industry because 80 per cent of food waste comes from the industry. We want to show that there’s financial value in our way. Our partners, who started working with us eight years ago, make millions of dollars. We give them money for buying the produce that

they used to send to landfills. Our goal is to help the industry realize that they have gold in their garbage and that people are ready to pay for it if they sort it well,” Côté said.

Loop Mission is an example of how a company can be both profitable and environmentally responsible. They are committed to their mission of eradicating food waste and educating the industry about the value of what they discard, believing that ‘everything has value’. Through their innovation, dedication, and practical approach to the circular economy, Loop Mission is not just reducing waste, but also creating a more sustainable future for all.

BY MARK JUHASZ

It may seem self-evident for industry observers that during COVID-19 (and in the nearly five years from when the pandemic began) brands had to be agile to meet grocery retailers’ need for adjustments in product offerings. For a historical context, the grocery market was disrupted in 2020 due to COVID-19 and related lockdowns. In 2021, we had to face supply-chain issues. In 2022, inflationary pressures beset the industry and since 2023, Canadians have been struggling with high costs of living. Through all these challenges, food brands, as a standard, are expected to provide their retail partners products in formats and configurations that will sell on grocery shelves.

Many Canadians have a recessionary mindset, which is influencing their purchase decisions. In 2024, according to NielsenIQ, ‘increasing food prices’ was the number one concern for Canadians. Further, fluctuations in many agricultural commodities have fuelled the need for brands to think critically about product portfolios. Specifically in 2024, frozen seafood, snacking fruits and nuts, crackers, apples and frozen vegetables retained strong consumer demand, while ingredients such as cocoa beans (up 122 per cent in 2024), coffee, beef, wheat, soybeans, and sugar increased in cost.

A major tool to help navigate the current market is price pack architecture (PPA), but further context is useful. Strategic PPA

thinking is fuelled by the realities facing grocery retailers, and in turn, CPG brands. In an inflationary time, retailers are under pressure to ‘rationalize’ their stocked items, and the number of SKUs on offer to consumers. Obviously, products need to have traction and sell. Brands need to be attuned to what formats, sizes, and products motivate consumers. If a brand is not able to configure their offerings, for example, to a larger volume, more convenient package, or a healthier ingredient list, retailers may remove those SKUs or discontinue a brand. Hence the importance of nimble, responsive product formats for a variety of consumer channels. NielsenIQ data from August 2024 also found that Canadians are placing less food item units in their grocery baskets, driven in their desire for lower prices, promotions, conve-

nience and discounts.

Grocery retail is also investing in private labels. Additionally, they’re under greater scrutiny for profitability, enhanced shopper experience and maintaining their own supply chains. Retailer SKU rationalization allows merchants to assess the profitability of their stocked and displayed items, using metrics such as inventory and storage costs, supplier fees, and sales data to further assess which items are (dis)continued or retained with adjustments. Further SKU analysis for retailers can include:

• are there any additional storage demands of certain products (i.e. refrigeration, handling safety);

• is there volatility in consumer demand for these products; and

• are there any unique stocking-picking-display requirements?

These factors allow grocery retailers to be adaptive in their inventory management to offer customers products that are most in demand, and to create shelf space for products that their unique clientele will purchase.

These realities underline the urgency for food brands to continually reconsider their PPA, which as a strategy, helps adjust portfolios in terms of packaging sizes, formats, features, or internal characteristics. PPA is a method to help ensure products are meeting consumer needs and preferences and inducing purchase, especially important for fast-moving consumer goods such as perishable foods and beverages. PPA also helps brands to react to macro changes such as inflation or the evolving costs of food commodities.

Additionally, market research and retailer feedback help ease the guess work of PPA by knowing how consumer budgets, occasions, and preferences impact purchase decisions for different segments of buyers. Decisions are made differently whether a family is stocking up on an item, buying for immediate consumption, or making a purchase while on vacation. Food brands need to ask:

• how willing will consumers be to pay for existing product features (e.g. pure cocoa powder);

• will consumers pay a higher premium for those same ingredients in an individual pack;

• what quantity of items or format should be in our discount offering; and

• how does our portfolio compete with competitors, private label, and is there any risk of cannibalizing existing offerings?

Retailer feedback is essential in this regard. NielsenIQ noted in 2024 that nearly half of Canadians are planning ahead before they go shopping to manage spending. This makes it much more imperative to offer products that meet consumer needs.

Many Canadians are trying new brands based on more competitive price points compared to familiar brands and switching retailers to further reduce shopping expenses. An effective PPA strategy requires a good understanding of customer willingness to pay for products, what the attributes of those products entail, and how it relates to package size, format, and price per unit.

PPA gives brands increased confidence in which SKUs to (dis)continue, and whether there might be an opportunity for new product development or alterations to existing offerings that improve margins. For example, cleaning company Clorox’s Pine-Sol brand created a smaller container with a more concentrated solution to get the same number of uses out of a unit but with less plastic. The result translated into a better consumer experience.

Food brands can utilize PPA to help on a variety of merchandising fronts: for price consistency related to those of their competitors and the private label offerings of retailers; and for product offering that meets consumer needs in different channels, and for different occasions.

Now more than ever, food brands should be carefully considering their PPA strategy as a discipline in product-market-retailer fit, and co-ordinating with their partners, both internal to the organization, and externally. For retailers’ part, they will arguably prefer to carry products that sell well, with consistent turnover. Food brands that offer well performing SKUs and adjust to market signals will strengthen their relationships with retailers and have better shelf ‘security’. As the cost of living remains high, the offer of fit-fordemand, well-designed products that also work with company margins will make business sense.

PPA gives brands increased confidence in which SKUs to (dis) continue, and whether there might be an opportunity for new product development or alterations to existing offerings.

In 2024, according to NielsenIQ, ‘increasing food prices’ was the number one concern for Canadians.

Strategies to handle risks posed by global warming — BY

VAISHNAVI DANDEKAR —

In the face of climate change, food safety is emerging as a critical concern. Shifting environmental patterns are introducing new challenges to the food supply chain, demanding an urgent response from both industry and regulatory bodies. To delve deeper into these complexities, I spoke to Amy Proulx, a professor and academic program co-ordinator of Culinary Innovation and Food Technology at Niagara College, and Meghan Griffin, food recall specialist at the Canadian Food Inspection Agency (CFIA).

“Climate change provides a compelling lens through which to examine food safety, with numerous systemic dynamics influencing how companies, organizations, and value chains tackle food safety challenges,” says Proulx.

She emphasizes the interplay between shifting weather patterns and the prevalence of foodborne pathogens. These pathogens thrive in changing environmental conditions, and their distribution patterns are being altered by climate change, which can result in more frequent outbreaks.

“The changing weather patterns are already having a drastic impact on food safety and contamination risks,” Proulx notes. “For example, changes in rainfall can lead to flooding, which disrupts irrigation systems and exposes food products to contaminated water sources.”

These shifts can weaken preventive control measures that companies use to man-

Climate change is causing frequent weather disruptions, which can provide more favourable breeding grounds for foodborne pathogens like e.coli and listeria.

age risks in their production processes, ultimately compromising the safety of food.

The relationship between climate change and pathogen spread is well documented. In Canada, the Public Health Agency of Canada and CFIA track these dynamics through various surveillance programs, including the National Microbiological Monitoring Program. Between 2017 and 2022, results indicated that up to 99.7 per cent of domestic and imported food products tested were compliant with food safety standards. However, the growing frequency of climate-related disruptions is challenging this com-

pliance, requiring enhanced vigilance and adaptation strategies.

The Canadian food supply chain is increasingly vulnerable to climate-induced disruptions.

“In western Canada, wildfires can cause road closures, delaying product deliveries and extending transit times, which affects the shelf life and safety of food items,” Proulx adds.

CFIA plays a critical role in monitoring these disruptions.

“Our agency works closely with industry partners to address food safety risks related to transportation delays, including those caused by climate events like wildfires and floods,” explains Griffin.

The challenge lies not only in managing the immediate effects of such disruptions, but also in ensuring that food remains safe for consumption after being delayed in transit.

To combat these risks, significant investment in food safety infrastructure is essential. However, Proulx points out food companies often view food safety programs as a cost rather than essential.

This trend is especially concerning during periods of economic stress, when companies under financial strain might deprioritize food safety measures.

This phenomenon is problematic because a reactive approach to food safety can result in severe consequences for public health. Therefore, Proulx advocates for a more proactive stance, where food safety is integrated into the organizational culture as an essential part of the food production process, rather than a regulatory burden.

Despite these challenges, there are promising innovations in food safety technology.

“There have been many advancements in rapid analysis and pathogen detection, including innovations in lower-level pathogen detection,” Proulx explains.

These innovations can help identify contamination before it becomes widespread, allowing for a more targeted and efficient response. AI is also playing an important

role in enhancing food safety protocols.

Blockchain technology has also emerged as a potential tool for enhancing traceability.

“While blockchain offers significant promise in tracking the journey of food products, the initial investment required can be prohibitive for small companies,” Proulx admits.

However, there are scalable solutions, such as GS1, that allow smaller companies to adopt blockchain-like traceability features without the high upfront costs.

The role of public awareness in food safety cannot be overstated, according to Griffin.

She emphasizes that increased awareness, such as through media coverage, often triggers individuals to check their homes for recalled products, thus preventing further exposure to unsafe food. Further, Griffin stresses that food safety is a collective responsibility.

Looking ahead, both Proulx and Griffin agree continuous innovation and vigilance will be required to navigate the increasing challenges posed by climate change.

“The future of food safety will likely see greater integration of AI and machine learning, which will help predict and mitigate foodborne illness outbreaks before they occur,” says Proulx.

These technologies will enhance the ability to forecast food safety risks and facilitate more rapid, precise responses. Griffin also emphasizes the importance of continuous improvement in food safety systems.

“Food safety is not a one-time achieve-

ment but a continuous process. We need to constantly adapt, looking for new ways to improve safety and efficiency,” she says.

This ongoing commitment to innovation, collaboration, and public awareness will be vital in maintaining Canada’s food safety standards in an era of climate uncertainty.

Canada’s food safety standards, administered by Health Canada and enforced by CFIA, are regularly updated based on emerging scientific data.

“When new risks emerge, standards are reviewed and revised to ensure they reflect the latest scientific evidence,” says Griffin.

This adaptive approach ensures that the food safety system remains resilient in the face of new challenges, including those posed by climate change. In line with these updates, CFIA has been exploring the integration of predictive tools to assess climate change risks and vulnerabilities.

“We are working with the Public Health Agency of Canada to conduct integrated risk assessments, focusing on emerging zoonotic threats and public health priorities,” says Griffin. These efforts aim to strengthen Canada’s ability to address future food safety challenges proactively.

As climate change impacts Canada’s food system, the collaboration between regulatory bodies, the industry, and public will be essential in maintaining food safety standards. Through the use of innovative technologies, increased investment in infrastructure, and proactive risk management strategies, Canada can navigate the evolving food safety landscape. As both Proulx and Griffin assert, the road ahead will require continuous effort and adaptation, ensuring a safe and sustainable food supply for all Canadians.

Leading the product development and production launch of some of Canada’s most popular foods, I’ve learned there is always an opportunity to save on costs. Here some strategies on how you can find and save on costs that hide in plain sight—in the products we manufacture and the processes that we inherit.

Creating a focus

It is so important to dedicate attention to cost saving by delegating an individual, team, or department to it. Create a strategic focus for cost savings with clear goals and targets, continual communication and a spotlight on achievements. Otherwise, it’s too easy for everyday tasks to sideline a business’ cost-saving work. Remember: Energy flows where focus goes, so make sure that what you want to get done is someone’s priority.

The magic of observing

The second element to saving costs is to know what’s really happening. When you believe nothing of what you hear and only half of what you see, there is so much you will discover.

Get out of your office and head to the plant floor. Observe everything that is happening within a 3-m radius. Stay there for a while and get to know the processes. Ask why we do it this way or that way. Then begin to count, measure, and inquire.

Repeat this step and see if anything has changed. Are processes consistent day to day or hour to hour? Determine what is generating a waste of time, materials, and throughput.

In 2015, I visited the restaurant that I ultimately purchased. Java Jack’s Restaurant & Gallery in early August was at the peak of the tourism season in Newfoundland’s Gros Morne National Park. At 10:30 a.m., the place was abuzz. The 15-seat cafe was full. I sat down to watch all the action. First, I just observed. Then I started to count: how many people, what they ordered, how long it took to get their order, who left, how the staff were interacting and more. I spent two hours at the restaurant. Together with the restaurant’s financials and my observations, I ambitiously projected doubling revenue within two years in my business plan.

There are three main places to find cost savings:

Reduce costs by minimizing defects caused by excessive movement and handling on the processing line.

It’s reasonable to expect payment within 30 days rather than 60 or 90 days. Finished goods inventory, especially items requiring special handling or having a

in fixed and variable costs such as consumables, utilities, inventory and terms; in product ingredients and underperforming SKUs; and in the efficiency of your production line.

Look at how common areas such as kitchens, lunchrooms, and washrooms are maintained and supplied. Consumables like soaps and towels can be metered. Order only what you need when you need it and no more. Smart thermostats and motion-sensor lights can change how the space is lit. Adjusting thermostats by one or two degrees can save on utility costs. For weekends and evenings, energy expenses decrease when computers, machinery, and vending machines are turned off. This list can go on and on.

Keeping inventories low and ordering only what you need is essential. Your inventory of finished goods and supplies significantly impacts the cash you have to reinvest in the business. If you have a unique ingredient requiring a larger purchase for minimal use, your money becomes tied up, and its use is uncertain. Ordering more for a better deal ties up more immediate cash in hopes of using or selling something later.

You want your money actively working for you. Can you shorten the period before customers pay you? It’s reasonable to expect payment within 30 days rather than 60 or 90 days. Finished goods inventory, especially items requiring special handling or having a limited shelf life, should be invoiced within 30 days. Likewise, on-hand supplies and materials, such as packaging, labels, and ingredients, should be converted into

finished goods within 30 days. Payment terms should be negotiated for payment within 30 days, and suppliers should not be paid sooner than 30 days. If you are not paid on day 30, pursue the payment vigorously. Of course, you may be dealing with a savvy businessperson who has also adopted the same strategy and delays payments for as long as possible!

As a career food scientist and Red Seal chef, I can vouch that most recipes are over-formulated, adding band-aids to solve problems that are caused by the process. Even my grandmother’s recipe for date squares contains flour in the crumb and sugar in the date puree. Over-formulation and over-processing are often based on unscientific trial and error with no real understanding of what is causing certain results.

Make sure you know the purpose of every ingredient in your products. Find out if all the ingredients are necessary or if a less expensive alternative would suffice and understand the science behind how a different cooking process can create the same results more cost-effectively.

Years ago, we manufactured a cooked chicken product that contained icing sugar. The sugar helped make the chicken meat golden brown. That same effect could be achieved more readily with a different cooking method. We changed how the product was cooked and removed the icing sugar, resulting in an even better, sugar-free chicken product that sold well. With this one change, we reduced a unique ingredient, inventory spend, cost of goods, and labour costs.

Keep inventories low and order only the essentials. This will ensure you have cash to reinvest in the business.

Every SKU you produce should fit with your existing product lines and make sense with your values and mission.

When you’re running a small business, every product must be a moneymaker for you. If you’re creating any product as a loss-leader item, stop. Identify and address unprofitable products, whether due to low sales, high costs, or sentimental attachment. Consider how you can make a SKU more profitable by increasing price, reducing costs or changing the product. Or be bold and discontinue the product.

Every SKU you produce should fit with your existing product lines and make sense with your values and mission. If you’re considering adding a new product, ask yourself if that product will add or take away focus from your business and what you stand for.

It’s expensive to develop and launch new products. Before you do, ask yourself if you’ve tapped into all possible markets and if customers are happy with your existing product.

When I’m on the processing floor, I always check the garbage to see what is being wasted. Then I examine where and how much garbage is generated and put a dollar value to it.

Garbage costs you money in lost opportunity yield, finished goods, manpower, and the cost of disposing it. The key is determining what is causing the defects that become waste. In my experience, diverting or converting what is going in the garbage will save costs and make money.

Costs rack up at each process step—before, during, and after the process. Creating a culture of on-time starts and finishes promotes efficiency. Many other industries measure how often they start and finish on time so the food industry should adopt this philosophy without reservation.

Consider what the travel time is for a component of your product to get from one place to another. How many transfers occur, creating opportunities for a defect to occur or for part of the product to be wasted. A shorter travel time will speed up the process. Fewer and more gentle transfers will reduce defects and increase yield. Every time a supply or product changes hands, time is spent and there’s a chance for the item to be damaged, adulterated or otherwise wasted.

I observed a chicken nugget production where the breading was brought into the facility and carefully poured into the production machines. The nuggets were punched out of a former and flew down the production line amidst acrobatic transfers losing some breading and batter along the way. The breaded nuggets were packed into boxes beside the garbage bin that filled with globs of breading and coating shovelled off the floor.

Create a set production schedule detailing how much output is expected. In this way, staff and supplies can be allocated correctly (no more or no less than you need) so materials are ready for the production line and people are kept busy.

Finding cost savings is about challenging yourself to think and see things differently. Costs are hidden all around you, even in the obvious places. Challenge why things are done the way they are, understand the role of each ingredient, and explore alternatives or ways to optimize. Your portfolio needs regular review, with a focus on eliminating unnecessary, unprofitable products. Before adding anything new, ensure it serves a real purpose.

Reduce waste by minimizing defects caused by excessive movement and handling. Create an environment where timely starts and finishes are expected. Set targets and demand on-time delivery of supplies to their destination. With a little focus and observation, you can significantly improve your bottom line.

Andreas Duess

n the food sector, Canada exports over 80 per cent of its wheat and pulses in raw form, and imports billions of dollars in value-added products like pasta. While these resources have positioned Canada as a global trade powerhouse and driven our economic growth, this dependence comes with risks. When world markets fluctuate, our producers take the hit.

After exporting these raw commodities, we then see other nations add value through innovation. Our grains become Italian-branded pasta, our beef turns into premium cuts in Japanese restaurants, our legumes turn into healthy premium snacks in Germany. This value chain bypasses Canada, leaving our industries with missed opportunities. These products are then sold back to Canadians at a premium.

To quote Frank Hart, interim CEO of Protein Industries Canada, “Continued reliance on our commodities trade alone is becoming increasingly challenging... However, by domestically converting Canada’s crops into new, high value ingredients and food products to be sold in international markets, Canada can improve its productivity, grow its national GDP and amplify its position as a global leader and an essential player in addressing the world’s growing demand for healthy food.”

On the surface, any tariffs by U.S. will add fuel to this fire*. But what if we’d work to turn the situation around? What if today’s trade barriers could become tomorrow’s breakthrough? A sticky situation like tariffs by our largest trading partner can be the catalyst to shift Canada’s reliance away

By prioritizing investment in agri-food and beverage innovation, we can transform our commodities into high-value products that are less sensitive to tariffs and trade disruptions.

from fluctuating commodity markets toward a future where value-added, highly innovative branded products dominate both domestic and international markets. For example, Canada is one of the world’s largest producers of pulses like lentils and peas. By investing in domestic processing and branding, Canada could lead the global market in plant-based food innovations.

Other nations offer valuable lessons in navigating this transition. For instance, New Zealand has shifted from commodity reliance to value-added products.

Once focused on exporting raw milk, New Zealand’s dairy industry now produces globally recognized brands like Anchor and Fonterra’s Anlene.

Similarly, Ireland has leveraged its beef and dairy production to create premium, branded products marketed worldwide for their quality and sustainability. These nations have not only boosted their economies, but also strengthened their global reputations as hubs of innovation and quality.

Canada has the resources, talent, and infrastructure to do the same. By prioritizing investment in agri-food and beverage

innovation, we can transform our commodities into high-value products.

To capitalize on this opportunity, Canada must take bold, co-ordinated steps.

Invest in infrastructure: Establish more processing facilities to transform raw commodities into finished products. This could range from advanced milling operations for grains to facilities that produce plantbased proteins, gourmet meat products, or functional beverages.

Encourage R&D: Government and private sector partnerships can fund R&D to develop innovative products that cater to global trends.

Support branding and marketing: Help Canadian businesses build strong, globally recognized brands that emphasize the quality, sustainability, and innovation behind their products.

Enhance trade diversification: Reduce dependency on the U.S. market by expanding trade relationships with Europe, Asia, and the Middle East. Agreements like CETA and CPTPP offer Canadian businesses access to high-potential markets hungry for premium products.

Leverage technology: Embrace AI and data analytics to better understand consumer preferences and optimize product development. Digital tools can also improve supply chain efficiency and reduce costs.

The agri-food and beverage sector in Canada stands at a crossroads. The choice is clear: adapt and innovate or risk falling behind. We can continue to rely on the sale of raw commodities or we can seize the moment to innovate, transform, and lead.

*When this column was written, tariffs weren’t imposed by the U.S.

Andreas Duess, CEO of 6 Seeds, is on a mission to help the food sector thrive in a world transformed by AI and shifting consumer behaviours. His email ID is andreas@6seedsconsulting.com.

Join us for this dynamic digital event, where we’ll gather manufacturing leaders and changemakers to share insights, inspire action and explore the transformative potential of inclusion and innovation in our industry.

This can’t-miss event will feature some of the most influential leaders in Canadian manufacturing. Panel discussions and on-demand sessions will explore how to foster a diverse and inclusive workforce, actions companies can take to attract new talent to the industry and advance employees to leadership positions, and more!

Discover the many amazing ways in which California Raisins can enhance and add value to baking formulations.

You can reduce your product’s added sugars and artificial sweeteners when you use this natural source of sweetness.

California Raisins have a low water activity; they’re the perfect fit in low-moisture snacks, cereals, bars and confections.

The plump, soft “chew” of California Raisins does wonders for mimicking fat’s richness. Put raisins to work in low-fat baked goods, cookies and cakes.

The natural sugars in California Raisin juice concentrate, paste and whole, chopped raisins help bind wet and dry ingredients.

California Raisins contain naturally occurring organic acids like tartaric, propionic and glutamic acids, which inhibit mold growth and act as natural preservatives.

Because California Raisins hold water and build natural viscosity, they help maintain a soft, appealing texture without the need for texturizers or preservatives.

California Raisins contain 2.2% tartaric acid—a natural flavor enhancer. They’re also packed with Maillard reaction precursors, so when roasted, baked or processed at high temperatures, they make everything taste richer.