The M VersaPro® (MVP) Dicer, by Urschel, provides a sanitary (IP69K) design and versatile cutting (VFD-equipped 5HP Crosscut) of proteins. Patented fluted crosscut. Deeper circular knife penetration. It outperforms the M6 by a resounding 33%.

Explore the MVP to improve your line.

FEBRUARY/MARCH 2024 • VOL. 84, ISSUE 1

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service

Tel: 416-510-5113 Fax: 416-510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

ASSOCIATE PUBLISHER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Barb Vowles bvowles @annexbusinessmedia.com 416-510-5103

AUDIENCE DEVELOPMENT MANAGER | Anita Madden amadden @annexbusinessmedia.com 416-510-5183

GROUP PUBLISHER/VP SALES | Martin McAnulty mmcanulty@annexbusinessmedia.com

PRESIDENT/COO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Subscription rates

Canada 1-year – $86.65 per

Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission @2024 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Tel: 416-442-5600 Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

A UN Environment Programme (UNEP) assessment report has found that emerging novel alternatives to animal products, such as meat and dairy, may help reduce the environmental footprint of the current global food system, especially in high- and middleincome countries. However, this is only possible if the countries use lowcarbon energy, as some food types like cultivated meat employ energyintensive manufacturing methods.

As we know, animal-based foods are an important source of protein, vitamins, minerals, and other macronutrients. However, research indicates high intake of red and processed meat increases the risk of obesity and non-communicable diseases. Per the “What’s cooking? An assessment of the potential impact of select novel alternatives to conventional animal products” report, global meat consumption is projected to increase by 50 per cent or more by 2050. This is concerning because “animal agriculture is estimated to contribute 14.5 to 20 per cent of global greenhouse gas emissions. Many strategies have been proposed to address the environmental impact of animal farming. The study mentions:

• small-scale, extensive or regenerative livestock farms;

• direct interventions to reduce emissions from animal agriculture (e.g. feed additives);

• promoting reduced meat consumption in favour of whole plant sources of

protein like beans and lentils; and

• discouraging consumption of animal products with taxes or other policy levers.

However, the report found these interventions to be limited, and not achieving the desired impacts at the scale or speed necessary. But one approach that seems to have received thumbs up from this report’s authors is novel alternatives, such as novel plant- based meats; cultivated meat from animal cells; and protein-rich products derived through rapid fermentation by micro-organisms.

“Novel ASF [animal source food] alternatives, if supported by appropriate regulatory regimes and governance instruments, can potentially play an important role in a shift towards food systems that are more sustainable, healthier, and less harmful to animals, with likely regional differences,” said the report.

The report was quite candid about the difficulty in forecasting growth of the novel meat alternatives industry due to the “inherent uncertainty of making predictions of uptake at this early stage of the industry’s development.” It stressed “significant technological advances are required for these foods to become available at wider scale and to compete with ASF on taste and price.” The report projects the industry’s overall

Nithya Caleb

portion of total meat consumption could be from four to 60 per cent by 2040.

“New food alternatives will offer a broader spectrum of consumer choices,” said Inger Andersen, executive director, UNEP. “Further, such alternatives can also lessen the pressures on agricultural lands and reduce emissions, thereby helping us address the triple planetary crisis—the crisis of climate change, the crisis of biodiversity and nature loss, the crisis of pollution and waste—as well as address the health and environmental consequences of the animal agriculture industry. More government support, as well as open and transparent research, can help unlock the potential of these new technologies for some countries.”

The report’s authors underscore the need for more research to determine the environmental life-cycle impacts of novel ASF alternatives and socioeconomic implications, as data on those issues is scarce as well as the health benefits of these foods because some plant-based products are ultra processed with high amounts of salt and saturated fats. They also suggested “governments could consider reducing and/or redistributing subsidies or other forms of support currently in place for industrial animal agriculture to ensure food prices reflect associated health and environmental costs.

Nithya Caleb ncaleb@annexbusinessmedia.com

Sucro Can Sourcing plans to build Canada’s largest sugar refinery at the Port of Hamilton, Ontario, on lands owned by HOPA Ports (Hamilton-Oshawa Port Authority). The new refinery, at an estimated investment of $135 million, is expected to have an annual refining capacity of 1 million metric tonnes. “The sugar markets in both Canada and the United States are experiencing steady, long term, sustainable growth, and Sucro is investing to supply these growing market demands,” said Jonathan Taylor, founder and CEO of Sucro Sourcing.

Sodexo Canada releases the results of its first ever Sustainable Food Barometer. This new research reveals the sustainable food habits and intentions of Canadians, as well as the current disparities between their aspirations and behaviours. The Barometer identifies the narratives and incentives needed to induce changes in eating habits and support consumers in making the shift toward more sustainable diets. The Barometer is based on a survey of more than 1,500 Canadians conducted by Leger in December 2023. Three key takeaways of the Sodexo Food Sustainability Barometer are that Canadians are well aware of the urgent need to change eating habits and have aspirations to do so; there’s a gap between intentions and actions; and individual benefits of sustainable food choices are more motivating than the collective benefits for society, but not exclusively.

The governments of Canada and Ontario are investing up to $8 million,

through the Sustainable Canadian Agricultural Partnership (Sustainable CAP), to create or increase processing efficiencies and enhance food safety in the province’s dairy processing sector. Eligible dairy businesses are invited to apply for funding through the Dairy Processing Modernization Initiative to acquire modern technologies that increase production efficiency and ensure food safety in their facilities. Cost-share support through this initiative can be used to help cover the purchase and installation of new or refurbished equipment and its associated costs, such as training.

The Dairy Processing Modernization Initiative is open to cow, goat, sheep and water buffalo milk processors. Each eligible applicant can receive up to $200,000 in cost-share support. Applications open on April 2, 2024, and will remain open until the initiative is fully subscribed. Eligible project costs can be incurred as of April 2, 2024.

Avena Foods appoints Wayne Arsenault as its new CEO, following the retirement of Gord Flaten. Arsenault set up his first company at age 16. By age 29, he was the youngest plant manager in the Coca-Cola Enterprises system, responsible for the Toronto plant. Arsenault then went on to become general manager at Molson Canadian, Vancouver, where he was awarded ‘best performing brewery’ for two consecutive years. Over the years he has held a number of leadership roles, including president and CEO of Calgary’s Big Rock Brewery, and vice-president, operations & human resources and vice-president alignment champion at Moosehead Breweries.

The Canadian Roundtable for Sustainable Beef (CRSB) released its second National Beef Sustainability Assessment and Strategy report. The assessment reflects three years of in-depth scientific analysis and highlights the Canadian beef sector’s progress between 2014 and 2021 on sustainability indicators like greenhouse gas emissions, biodiversity, carbon storage, people’s health and safety, animal care, and economic contributions. The report also identifies areas for continuous improvement. Key environmental improvements include a 15 per cent reduction in greenhouse gas (GHG) emissions to produce 1 kg of beef (boneless and consumed) since 2014.

This improvement is attributed to increased efficiencies of cattle growth, leading to a smaller overall carbon footprint as fewer resources (e.g. land, water, and feed) are required to produce the same volume of beef.

The report also shows that land used for beef cattle production is estimated to store 1.9 billion tonnes of soil organic carbon, storing nearly 40 per cent of the total soil carbon across Canada’s agricultural landscape. This is equivalent to annual CO2 emissions from over two billion cars (~58 cars for every Canadian). The report found that animal care continues to be a top priority for the Canadian beef industry. Surveillance data shows no risk of resistance from Category I antimicrobials (very high importance to human medicine) indicating that tools to treat sickness in beef cattle is not a risk to human health. Visit crsb. ca/benchmarks for more information on the CRSB’s National Beef Sustainability Assessment & Strategy.

Are you importing food or beverages into Canada?

You need a food safety licence

des aliments ou des boissons au Canada?

As part of its efforts to create a more sustainable coffee supply chain, Café William hires a sailboat to ship coffee from Colombia. The first cargo sailboat set sail from the port of Santa Marta in Colombia on December 18, bound for North America. During its 20-day voyage, the cargo sailboat carried 72,000 kilos of coffee beans on the wind, in a constant effort to run on clean energy. The decision to opt for environmentally friendly shipping is part of the company’s drive to reduce its carbon footprint and promote sustainable practices throughout its supply chain. For the Sherbrooke (Quebec) roaster, this new era in maritime coffee transport represents a historic moment in the industry. According to Café William’s projections, the company could see a reduction of around 1 tonne of shipping-related CO2 per container, thanks to the cargo sailboat. The company hopes to increase

its cargo sailboat shipping capacity to 100 per cent of the volume imported for Café William in the long term.

A new study led by researchers at Ocean Conservancy and the University of Toronto found microplastic particles in 88 per cent of protein food samples tested. The samples were drawn from 16 different protein types destined for U.S. consumers. Protein types included store-purchased breaded shrimp, minced pollock, fish sticks, white Gulf shrimp (headless/shellon), Key West pink shrimp (headless/ shell-on), Alaska Pollock fillets (skinless), chicken nuggets, top sirloin steaks, pork loin chops, chicken breasts, plant-based nuggets, plant-based fish sticks, plantbased ground beef, and tofu blocks. While scientists have long documented the presence of microplastics in the digestive tracts of commercial fish and

shellfish like salmon, halibut and oysters, there has been little research into whether these microplastics are entering the filets of the fish – the parts that are actually eaten by people; and little research into terrestrial protein sources like beef and chicken that make up a large part of the American diet. In this study, microplastics were found in all 16 protein types tested, suggesting humans are likely eating microplastics no matter the source of protein they choose. Further, there were no statistical differences in microplastic concentrations between land- and ocean-sourced proteins.

The study found evidence that food processing is a likely source of microplastic contamination, as highly processed protein products (e.g. fish sticks, chicken nuggets, tofu, and plant-based burgers, among others) contained significantly more microplastics per gram than minimally processed products (e.g. packaged wild Alaska pollock, raw chicken breast, and others). However, no statistical difference was found between high-processed products and fresh-caught products, suggesting food processing is not the only source of microplastic contamination and opening avenues for further research. Using survey data from a separate study by Ocean Conservancy and the University of Toronto (to be published in Frontiers in Marine Science), the authors estimate an American adult will consume, on average, 11,500 microplastics per year.

Antares Vision Group introduces a non-invasive, inline pressure measurement system for high-speed inspection for beverages in glass and plastic bottles. Applicable for all transparent and semi-transparent bottles, the company’s PCS700-IOT utilizes advanced laser spectroscopy technology to determine whether a container headspace has appropriate pressure levels.

Through a technique called Tunable Diode Laser Absorption Spectroscopy, the PCS700-IOT analyzes specific molecules in their gaseous state, particularly, their ability to absorb light at certain telltale wavelengths. The laser beam passes through the bottles in the product-free headspace. For carbonated beverages like seltzer, soda, and beer, this enables the measurement of CO2 levels and pressure concentration in order reveal whether a leak or micro-leak is occurring in the bottles. Leak-determining pressure inspection also can be performed on nitrogen-dosed products such as water and teas, as well as hot-filled beverages including various juices. For the wine sector, PCS 700-IoT enables the inline oxygen measurement to evaluate the efficiency of inertization process after bottle closing. www.antaresvisiongroup.com

ALWAYS INNOVATING ALWAYS EVOLVING ALWAYS FINDING

FCC is proud to offer financing and knowledge to people with one eye on today and another on tomorrow. People like you.

Dr. Amy Proulx

e can all agree the food industry needs to reduce its reliance on plastics, especially those that cannot be recycled, composted, or reused. In Canada, the food industry produces 35 per cent of all plastic waste, according to Environment and Climate Change Canada. The Canadian Comprehensive Zero Plastic Waste agenda has prioritized plastic reduction in the food retail industry.

The federal government’s plastic reduction agenda began with a ban on single-use plastics. Companies are required to reduce plastics, especially hard-to-recycle ones, and eliminate can and bottle ring carriers, checkout bags, cutlery, foodservice ware, stir sticks and straws. The Single Use Plastic Prohibition Regulation allowed a change to Canadian Environmental Protection Act’s (CEPA’s) Toxic Substances List and included Manufactured Plastics in it. However, the legislation was overturned by the Federal Court in November 2023.

The regulation and the repeal for the plastics ban hinged on the word, ‘toxicity’. The meaning of toxicity for food safety practitioners is different from how it is defined under CEPA. Food safety practitioners see a chemical hazard as something potentially injurious to human consumers. Under CEPA, the term, ‘toxicity,’ extends to chemicals and materials with the potential for enduring environmental harm.

Under section 64 in CEPA, the definition is, “a substance is toxic if it is entering or may enter the environment in a quantity or concentration or under conditions that (a) have or may have an immediate or long-term harmful effect

on the environment or its biological diversity; (b) constitute or may constitute a danger to the environment on which life depends; or (c) constitute or may constitute a danger in Canada to human life or health.”

In food safety, using CODEX Alimentarius’s glossary, the words, ‘toxin’ or ‘toxic,’ only emerge with relation to pesticides and veterinary chemicals. Hazards are “a biological, chemical or physical agent in, or condition of, food with the potential to cause an adverse health effect.” Toxins can be acute, causing short-term immediate impacts, or they can be long term and chronic where exposure is small.

Plastics approved for food contact use are not inherently toxic to human health and have had been evaluated by Health Canada for safe use. The issue is not plastic in its standard form. Microplastics are emerging as a major area of concern for human health, as well as a concern in environmental contamination. Researchers are investigating the potential toxicity and long-term effects of microplastics. The science in this field is relatively new. Environmental microplastics were only first described in the early 2000s. Pubmed’s academic literature database indicates very minor uses of the term, ‘microplastics,’ in research literature before 2011. However, the term was referenced in almost 4000 articles in 2023. The science on microplastics has not yet created any direct causal links to toxicity, but many strong theories are being investigated.

This reframing of risk assessment, where human health is aligned with environmental health and sustainability, will have major implications

for food safety management systems. Food safety practitioners who have followed its history can appreciate this potential movement. Threat assessment or TACCP came into force within the United States when terrorist threats to the food system and deliberate adulteration became a hazard. BRCGS has a standard for ethical trade and responsible sourcing. GFSI has developed a Sustainable Supply Chain Initiative to benchmark social compliance. It has set requirements such as no forced and prison labour, no child labour, freedom of association and rights to collective bargaining for workers, no discrimination and abuse, application of health and safety systems, application of building and fire safety codes, fair wages and employment practices, fair working hours, and ability to grieve working conditions. GFSI indicates they will have an environmental standard coming out in the near future. Encouraging or mandating food companies to consider environmental consequences as part of their quality management and supplier strategy is very likely in the future.

The food industry has an authentic need for plastics, and other lightweight barrier materials. Food safety and shelflife extension are intrinsically tied to plastics use. The successful environmental transition to this is better plastics materials and better use and repurposing of existing plastics. Fortunately, we are seeing investments in this area.

Dr. Amy Proulx is professor and academic program co-ordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont. She can be reached at aproulx@niagaracollege.ca.

On May 12, 2023, Health Canada published a cost recovery proposal for natural health products (NHPs). The dietary supplement industry’s response has been overwhelmingly critical of the proposal for a variety of reasons. In the meantime, many of our food clients have asked whether this proposal has any impact on the food industry, even if indirectly. The short answer is an overwhelming “yes”. The food industry should watch closely. If Health Canada successfully implements any or all of the elements of its proposal for NHPs, it is reasonable to expect that similar proposals by Health Canada may impact food companies in the future.

As background, cost recovery is “the practice of establishing and collecting user fees for regulatory activities,” as described by Health Canada. In the case of NHPs, the proposed fees have also been earmarked to pay for an oversight system that Health Canada does not yet have in place, and to recover costs of the review process itself. Therefore, while framed as a cost ‘recovery,’ Health Canada seemed to be proposing that industry pay for establishing an updated and far more expensive regulatory program. In response to Health Canada’s proposal, industry engaged in a grassroots campaign that highlighted inconsistencies with the purpose, and disproportionality of the quantum of fees. Upon receiving thousands of comments, Health Canada has indicated its intention to reopen its consultation with stakeholders. These developments are important for the food industry; it’s critical that food companies appreciate

By Lewis Retik and William Bjornsson

the potential consequences if Health Canada proceeds largely as proposed, as well as the importance of active industry participation in the consultation process.

The Canadian Food Inspection Agency (CFIA) imposes fees for certain services it provides to the food industry under the Safe Food for Canadians Regulations. Health Canada does not currently have a cost recovery framework for its activities related to foods, but it has the legal authority to impose cost recovery for services it provides the food industry, in a similar manner to those proposed for NHPs.

Certain foods and food ingredients require Health Canada approval, and thus could be subject to cost recovery in the future. Pre-market approvals by Health Canada’s Food Directorate are required for, among other things:

• supplemental food ingredients;

• novel foods and ingredients;

• food additives; and

• temporary marketing authorization letters.

Health Canada also provides industry with novelty opinions for foods, and letters of no objection for processing aids. Given the time and resources required to review the safety and acceptability of these sorts of products, it is not alarmist to fear that Health Canada could consider similar NHP-like cost recovery for food approvals and reviews and seek to both recover costs of providing approval services, and fund investments into regulatory programs not yet in place.

For finished food manufacturers, the impact of expanded cost recovery in the food industry may not be immediately

Cost recovery is likely to reduce ingredient innovation and availability, as it could disincentive companies from seeking Canadian approvals.

evident. However, fees for approval of certain ingredients are likely to be passed on to food manufacturers, in the form of increased ingredient costs. Further, cost recovery for supplemental food ingredients, novel ingredients and food additives is likely to reduce ingredient innovation and availability, as it could further disincentive companies from seeking Canadian approvals, which do not grant exclusivity in the Canadian marketplace. Therefore, companies may think twice before spending additional resources on approvals that may also benefit competitors.

Ultimately, while we don’t yet know the final form that Health Canada’s cost recovery for NHPs will take, it is certain to have a direct impact on the NHP and dietary supplement industry in Canada. If the broader food industry does not pay attention and remains silent, it could face many of the same challenges the dietary supplement industry is facing today.

Lewis Retik is a partner and William Bjornsson is an associate in the Ottawa office of Gowling WLG, specializing in food and drug regulatory law. Contact them at lewis.retik@gowlingwlg. com and william.bjornsson@gowlingwlg.com.

Julie Daigle

anada’s food and beverage industry is known for its high-quality products, its strong and reliable food safety system, and increasingly, for its innovative food technology solutions. One region that is thriving in these areas is Quebec, where entrepreneurial startups and creative innovators are working to solve some of the most persistent challenges facing food companies in Canada.

Quebec has a long history of excellence in food and beverage manufacturing. As the largest manufacturing sector in the province’s economy, the food industry generated $36.7 billion in manufacturing shipments in 2022, representing approx. 3000 food companies, and 75,000 jobs in the province. Quebec is the second-largest food processing province in Canada, primarily in meat processing ($7.8 billion), dairy processing ($7.4 billion), and beverages ($5.4 billion).

In recent years, Quebec’s food industry is focusing on foodtech-driven solutions, buoyed by provincial government initiatives. In 2020, the government announced $2.4 billion in funding to foster innovative, digital transformation, and the adoption of new technologies and processes such as automation, robotics, and artificial intelligence. As a result, Quebec is the number-one province for R&D investments in terms of per cent of GDP, drawing an additional $8 billion in venture capital financing for the food sector between 2017 and 2021. Montreal is recognized worldwide for its artificial intelligence ecosystem and its scientific community, which includes Mila, the Quebec Artificial Intelligence Institute, the largest concentrations of deep learning academic researchers globally with more

Purpose-driven companies are outperforming their competition by a factor of three to one

than 1200 researchers specializing in machine learning.

Saint-Hubert-based Foodarom Group (owned by Glanbia Nutritionals) has been an innovator of custom flavours since 2006. The company received funding through the Canadian Food Innovation Network’s (CFIN’s) Food Innovation Challenge in 2022 to develop a natural antimicrobial for eliminating multiresistant fungal contaminants found in concentrated fruit syrups and purées.

“We are targeting the problem of food waste, which is predominant in all modern industries in all modern countries,” explains Guillaume Brault, R&D scientist leader at Foodarom, noting that “[products with] very high sugar, cane syrup, jams, fruit syrups, have a lot of long-term stability problems with yeasts and moulds.”

Montreal’s Relocalize also received CFIN funding for its project to demonstrate the world’s first autonomous micro-factory for food and beverage. The project will “demonstrate the decarbonization, cost reduction and product improvement benefits of hyper-local food,” says Wayne McIntyre, co-founder and CEO of

Relocalize. McIntyre adds the company’s mission is “to make packaged food and beverage products better, greener, and more affordable.”

Another company tackling food waste and greenhouse gas emissions is Montrealbased Still Good Foods. It works with local food and beverage partners to upcycle ingredients that are by-products of the manufacturing process, are “still good” and nutritious, and transform them into flour, baking mixes, cookies, granola etc. Since launching in 2019, Still Good Foods has transformed more than 1.4 million lb of spent grain, and almost 450,000 lb of fruit, vegetables, and pulp.

According to TRACXN, which tracks startups globally, there are almost 50 foodtech startups in Montreal alone. Just outside the city in Saint-Brunode-Montarville is Meatleo, a foodtech developing cultivated beef through a proprietary precision fermentation process. Meatleo founder, president, and CEO Pierre Normandin writes on the company’s site, “Cultured meat and Meatleo could make a significant contribution to addressing a huge need to improve animal welfare, substantially reduce greenhouse gases and increase food security (from sourcing to reducing the risk of zoonotic diseases). An opportunity like I’ve rarely seen.”

Julie Daigle is regional innovation director for Quebec for the Canadian Food Innovation Network, a national organization stimulating innovation across the Canadian food sector. Contact her at julie@cfin-rcia.ca.

$100,000 UP TO cost-share funds for eligible Ontario Producers and Processors

Competitive • Resilient • Safe • Secure

The Agri-Tech Innovation Initiative (ATII) helps Ontario agri-food businesses expand production capacity and boost energy efficiency. Funding is available for technology and equipment that is innovative or advances productivity or reduces greenhouse gas emissions through energy cost savings.

Application intake opens February 15, 2024

Application intake deadline March 28, 2024 (at 11am EST)

— BY NITHYA CALEB —

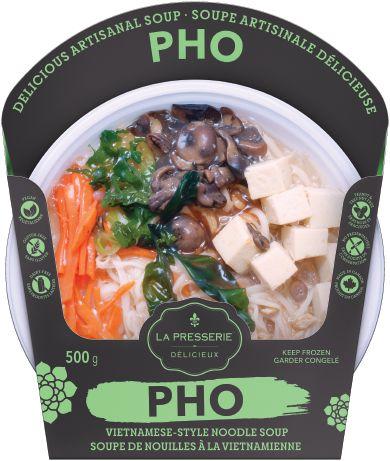

La Presserie’s founder, Adolph Zarovinsky, is no stranger to the food processing business. He founded and ran Tiffany Gate Foods, a manufacturer of fresh food products (e.g. salads), for several decades, before selling it in 2017 and taking cautious steps toward retirement. However, the retirement, if any, was short-lived. Very soon, the then 70-year-old’s mind was buzzing with product ideas. Thus was born La Presserie, a Toronto-based award-winning frozen F&B manufacturing start-up. I visited their 50,000-sf plant in Scarborough, which began operations in 2021.

La Presserie specializes in premium plant-based food and beverage products, such as cold-pressed frozen juice and cocktail mixers, prepared foods, salad dressings, and soups, made using a proprietary flash-freeze technology. The company has won several awards, such as the 2021 Local Innovation Award from Sobeys for their dressings; a 2022 SIAL Innovation Award for cold-pressed vinaigrettes; a 2023 Best Condiment Award from Grocery Innovations Canada for plant-based miso dip cups; and a 2023 SIAL Innovation Award for their cold-pressed cocktail mixers.

Zarovinsky was motivated to start La Presserie because of an innate curiosity about plant-based foods as well as a desire to do something different from what he achieved at Tiffany Gate Foods. Since he grew up in a family that ate a lot of fruits, vegetables, and grains, and meat consumption was limited to special occasions, Zarovinsky had an appreciation for these ‘gifts’ of nature. Zarovinsky was also aware that the plant-based movement has a bad reputation in Canada.

“People think plant-based food is not tasty or good and limiting,” he said. Zarovinsky wanted to experiment with plant-based foods and see how far he can go with things that are underutilized in that sector without compromising on taste.

On several occasions during our interview, Zarovinsky stressed that his only goal is to offer consumers delicious food, as evident by the company’s tag line of “délicieux” (delicious in French). Everything else about the product—be it health

claims, vegan, or plant-based—is incidental.

“When a product is declared to be plant-based or vegan, people automatically assume the food to be of a certain type. I don’t like that,” he said, as there’s a huge pool of consumers who simply want great tasting food regardless of labels.

After having decided on the type of product to make, which initially was cold-pressed juices, the biggest challenge, for La Presserie, was shelf life.

“Our previous company was designed to do chilled food with short shelf lives. This brought about logistical challenges. We did not know until late afternoon what we’re going to make tomorrow because the shelf life was literally days. We couldn’t make it in advance. Trying to use very short shelf-life raw materials to produce very short shelf-life finished goods was a logistical nightmare. When I started this company, I decided we cannot do this. We’re going to do frozen,” he explained.

Before the COVID-19 pandemic, prepared frozen foods were perceived as quick-fix meals. One didn’t expect freezer foods to taste good or be healthy; it was a convenient way to satiate hunger.

In Zarovinsky’s opinion, frozen foods also “destroyed family dinners,” as people ate at their convenience. In many traditions, food is a way of socializing. It’s a family affair, as described by Zarovinsky. People come together to cook, share, argue as well as enjoy each other’s company. With quick-fix frozen meals, there was no longer a need for families to eat or prep meals together, he added.

“Further, frozen food is cooked at least three times. First, it has to be cooked, then frozen, which is a form of cooking, and the third time you cook it when you heat it. Now, who wants to eat food that’s been cooked three times. We looked at all this and we decided we’re going to do it differently,” he explained.

At La Presserie, the coldpressed juices and smoothies from fruits and vegetables are flash-frozen immediately to avoid deterioration. They don’t add any chemicals nor take out anything from the juices.

“When temperatures are raised, the very volatile components that create flavour, aroma, taste, and freshness in juices, enzymes, and vitamins don’t survive,” he explained. Hence, the juices are frozen immediately. The company has also been able to extract juices out of hard raw materials like spinach and ginger.

While the pandemic complicated things for young companies like La Presserie, the timing couldn’t have been better to launch a frozen product. Eager to avoid infections, consumers bought frozen foods to limit store visits.

La Presserie’s beverages are sold in small 213-ml bottles that are an easy addition to lunch boxes.

Once the technology and process were perfected with juices, La Presserie introduced a line of cold-pressed and creamy salad dressings and dips at SIAL Canada in 2022. The vinaigrette-based dressings are made using cold-pressed juices and fresh herbs; they’re sold frozen. The creamy dressings, on the other hand, are sold refrigerated, as they have plant-based mayonnaise and the starch in the creamy dressings is cooked.

Once again, Zarovinsky stressed that while these “dressings are low-calorie, we don’t advertise them as such. People can review the nutritional facts table and determine for themselves.”

He added, “We do not make any health claims because I don’t believe we can prove it scientifically. There’s nothing negative about fruits and vegetables. They can’t hurt you. To say that you have to eat it because it’s healthy is counterproductive. Most of the time healthy food doesn’t taste good. What we’re saying is, our food is delicious and happens to be healthy. We want to serve consumer’s needs. The most important thing about our food is that it’s delicious. Surprisingly, when we got into this business of plant-based, cold-pressed foods, everybody in that business was touting the ‘healthy’ aspects of their products. I believe that people come back to the same food because they like the taste… Delicious is what we aim for. We want them to fall in love with what they eat, and make sure that it is safe for them to eat and is enjoyable. If that happens, I did my job.”

La Presserie’s strength is product development. Within three

years, the company has launched seven product lines. Besides juices and smoothies, salad dressings and dips, the company introduced premium frozen cold-pressed cocktail mixers in 2022. These mixers are made with raw, cold-pressed fruits, vegetables, and herbs.

In fall 2023, La Presserie entered the frozen prepared food category with a line of four Asian soups. The packaging of these meal-sized soups is unique. Unlike many frozen foods, the skin-film packaging allows you to see the actual product. I got to taste the Tom Yum Thai-style Lemongrass Soup during my plant visit. It was earthy and fresh, an unlikely (one might say) description of a frozen food product. To ensure the food isn’t overcooked by the time it reaches our dinner tables, most of the vegetables in the soup are packed raw. They get steam-cooked in the microwave for the first time when you heat it. Zarovinsky added that each broth was specifically designed for the product with respect to the country of origin.

“Pasta is custom-made because it must behave in a specific way; it has to survive freezing and reheating. A lot of food engineering and design has gone into” these soups, he explained.

For years, frozen food has been considered not as good as fresh produce. Nothing could be further from the truth. If done properly, frozen food can be as fresh as new produce. Plus, it can reduce waste. It takes a lot of skill to create frozen food, though, as not every food or ingredient can be frozen. With meticulous work, diligent R&D, and laser-eyed focus on serving delicious foods, La Presserie is redefining the frozen food aisle with its premium, hi-quality products.

A deep dive into the challenges and opportunities in redefining packaging for a sustainable future — BY KAREN BARR —

Plastic has been critical in moving food safely across the supply chain from manufacturing to handling, transportation, storage, grocery shelves, and consumers. It increases product shelf life, prevents food from spoilage and waste, and reduces the spread of food-related diseases.

According to the Government of Canada’s website, Canadians throw away over 3 million tonnes of plastic waste every year,

while only nine per cent is recycled. How can manufacturers balance food safety concerns with the government mandate for phasing out plastic food packaging?

In a statement, Food and Beverage Canada (FBC) said, “While we align with the government’s objectives in plastic waste reduction, we have reservations about the potential unintended consequences stemming from the current approach.”

“We all agree that we should be cut -

ting back on the use of plastics,” says Kristina Farrell, CEO, FBC. “There are plastic alternatives for some packaged goods and not others. There are no alternatives for plastic film to safely package meats. The current plastic packaging, which includes transparent multilayer packaging, enables consumers to inspect products for things such as quality and cut. The material itself has low gas permeability, which promotes extended

MARCH 6, 2024

https://www.automationmag.com/virtual-events/women-in-manufacturing-2024/

shelf life. Right now there is no viable alternative to this packaging material. Additionally, the blood and tissue often remaining on the packaging after its disposal would still make it unrecyclable, regardless of whether the material itself was more environmentally friendly.”

“There are multiple ways to address plastic packaging without eradicating it completely. We need to take a systemized approach,” says Martin Gooch, CEO of Value Chain Management International. “We’ve taken decades to be right where we are, and it’s been allowed to evolve. Things have changed since the 1950s and 60s when produce was sold loose. It was available only seasonally. You only could buy strawberries in summer. Salads didn’t come in a convenience bag. Families

There are multiple ways to address plastic packaging without eradicating it completely. We need to take a systemized approach

– Martin Gooch

shopped more than once a week, so shelf life was less of an issue. Today, there are no standardized specifications when it comes to plastic packaging. It’s the system that needs to be changed.”

Plastic has been considered a low-value product, and to create perceived value, more complexity has been added to plas-

tic packaging than necessary. This has had repercussions. Gooch gives an example by saying, “PET [polyethylene terephthalate] is a recyclable plastic. Let’s say you produce a PET water bottle. Once a PVC [polyvinylidene chloride] cap is placed on top, it limits its recyclability.”

One solution Gooch points to is the standardization of plastic polymers. “This could mean using fewer polymers or making multi-layer laminates out of the same polymers. Up to this point, there has been

no incentive for this to be done. I am fully in support of reducing plastics; it just has to be achieved in a well-thought-out way.”

The Canada Plastics Pact (CPP) is tackling plastic pollution with plastic-related solutions. “There isn’t one solution but a portfolio of solutions. Packaging for food is a challenge. It requires technical solutions that maintain product integrity, shelf life, and product food safety. Brands use packaging to communicate their consumer proposition,” says Cher Mereweather, managing director, CPP. “One really important element is what happens to the plastic after we are done with it. Today, we are focused on the big challenges that companies cannot achieve on their own.”

Mereweather points to the Golden Design Rules. These rules for plastic packaging were developed by Consumer Goods Forum’s Coalition for Action on Plastic Waste, for which Galen Weston is the co-chair, along with Alexis Perakis-Valat, president, Consumer Products Division, L’Oreal.

The nine Golden Design Rules were established to facilitate less plastic packaging, while also using more plastic packag-

ing that is easier to recycle by 2025. This includes increasing the value of PET recycling; PET thermoformed trays and other PET thermoformed, as well as flexible consumer packaging, such as the packaging for frozen produce, and rigid HDPE (high-density polyethylene) and PP (polypropylene) used for products such as laundry soap and dairy tubs.

Another rule involves the removal of problematic elements such as PVC or PVDC (polyvinylidene dichloride), which can disrupt recycling in some types of packaging. The plastic film used in vegetables and meat trays are usually manufactured from PVC or PVDC. Other elements under this umbrella include undetectable carbon black, EPS (expanded polystyrene), PS (polystyrene), PETG (polyethylene terephthalate glycol), and oxo-degradable plastics.

Reducing plastic waste involves rules governing the elimination of excess packaging headspace, with a stipulation of a 30 per cent maximum guideline, the reduction of overwraps, and reduced virgin plastic use in B2B plastic packaging. Finally, to guide consumers, there is a packaging rule to include recycling or reuse instruc-

tions on all consumer plastic packaging.

Omnia Packaging, the Canadian-based industrial plant owned by Italy’s Gruppo Sunino, operates two production divisions. One is for plastic, producing only 100 per cent recyclable packaging, and the other is for paper.

“We are different because our plastic food packaging is made with PP,” explains Monica Viazzo, who represents Omnia Packaging, in business development and marketing. “This is the purest polymer and the most recyclable one. We use 27 per cent less plastic in each tub we produce. This still guarantees the same shelf life for food. Additionally, we only use mould labelling using a monolayer of PP. This creates a clean, fully recyclable container.”

The research and development team at Omnia Packaging continues to develop moulds to support various packaging solutions that food and beverage manufacturers require, such as for ready-made meals, soups, sauces, dips, and cheese.

Solutions abound for keeping foods safe while reducing and recycling plastic. It will be interesting to see how food and beverage manufacturers as well as governments tackle the plastic problem.

In a competitive market, the meat company’s focus on diversification and innovation has ensured growth — BY

MARK CARDWELL

—

In December 2023, Canabec started selling a new line of pate in tubes, which is not just another novel retail product from the innovative Quebec-based game meat maker, but the realization of a family’s food business dream. It was Canabec’s ‘national coming out’ party through Loblaws and Costco.

“My dad had a vision that’s reflected in our company name,” said Alexandre Therrien, owner, president, and CEO of Canabec. “He saw a Quebec company that supplies Canada with game meats. It’s been a long time coming but we’re finally there.”

From the first few carcasses of red deer that his father and company founder Laurier Therrien initially imported from New Zealand in 1987, Canabec today processes around 15,000 kg a week of mostly game meat at its plant in an industrial park in Saint-Augustin-de-Desmaures, a village just west of Quebec City.

Over the years, the company has developed a range of specialty meat products for high-end restaurant chefs across Quebec and, increasingly, for everyday consumers across Canada. Those products range from fresh and frozen pre-cut meats and precooked meals to confits, terrines, and deli. In addition to conventional meat and poultry protein, Canabec uses meat from a dozen exotic farm and game animals to make its products. Those species range from mostly Canadian-supplied duck, goose, rabbit, bison, elk, wild boar, guinea fowl and ostrich to imported kan-

garoo from Australia.

Canabec has also developed several retail products over the past 15 years that are carried by all major food store chains and specialty meat shops across Quebec. Its two best-selling items are raw Chinese fondue meats and pre-cooked confit duck legs, which are sold two to a box.

“I’m very happy and super excited by how things are working out for us these days,” said Therrien. “We’ve worked hard to develop new products and to diversify our offering. It’s helped us stand out in what is a very competitive but growing meat protein niche market.”

That market didn’t exist when Therrien’s father first imagined the culinary and commercial possibilities of wild game.

Born and raised in the asbestos mining town of Thetford Mines, a 90-minute drive south of Quebec City, Laurier trained and worked as a chef in Montreal and Europe in the 1970s. He struck out on his own in 1978 when he and wife, Chantale Miclette, opened La Tanière, a gourmet restaurant that served haute cuisine dishes made with wild game deer, elk and seal on a remote rural road in CapRouge, a 5-minute drive from Canabec’s current location.

“Dad ran the kitchen, mom handled the front,” said Therrien, who was only one when his La Tanière opened. Both he and his younger brother Frédéric worked in the business growing up, helping in the kitchen, bussing tables and doing whatever their parents needed. The same thing happened when their father created Canabec and started importing red deer carcasses from New Zealand. Initially, the business was run out of a small addition at

Alexandre Therrien.

the back of the restaurant with a C1 meat cutting certification where meat was prepared, packaged, and shipped to high-end eateries and speciality meat shops. As demand grew, Laurier moved Canabec into a 5000-sf facility in the Quebec City neighbourhood of Saint-Émile.

“Dad’s goal was to make more value-added products and cuts for his customers,” said Therrien. “The added space allowed him to diversify our game offering and expand our product lines.”

Game additions included quail, pheasant, and caribou from Northern Quebec. Canabec also developed several high-end deli products like terrines, mousses, and duck rillettes. It also began selling fresh cuts of red deer, bison, caribou and wild boar.

“Dad developed the market in Quebec City first,” said Therrien. “Then he went all across the province by adding a sales rep and a delivery truck.”

With business booming, Laurier sold La Tanière in 2001 to focus on Canabec. The following year, however, Laurier suffered a heart attack at the age 50 and had to wind down his business

23_011340_Food_In_CN_FEB_MAR_CN Mod: January 18, 2024 1:27 PM Print: 01/25/24 4:15:00 PM page 1 v7

activities. Therrien stepped up and took on more responsibilities at Canabec. At that time, the business focused on foodservice. Slowly, Canabec started to manufacture products for the grocery sector, which is challenging for game meat. They’re more expensive than other meats.

“Price point is the key,” said Therrien. “That’s why we decided to diversify by adding cheaper protein like pork to some of our products.”

The company’s first grocery store product was sliced terrine. It went on sale in Quebec Sobeys stores in 2008. A few years later Canabec launched its first line of thinly sliced game meat for Chinese fondue or Chinese hot pot, a popular French-Canadian meal.

“I saw it as an opportunity and a way to make game meat more accessible to consumers,” said Therrien. “We developed some techniques that allowed us to thinly slice frozen game meats at –2 C. Any colder than that it flakes. Game meat is very lean. It

Game meat is very lean. It has to be processed quickly to retain its original colour, texture and taste.

– Alexandre Therrien

has to be processed quickly to retain its original colour, texture and taste.”

Canabec’s Chinese fondue meats proved to be a hit with Quebec consumers. “It’s been one of our biggest successes,” said Therrien. In 2017, he moved the company to the 50,000-sf plant it now calls home.

The new plant carries many new machines and features that Therrien says have allowed the company and its 82 employees to make productivity gains in everything from processing, logistics and distribution to butchering, cuts and on-site cooking. New and automated equipment include three thermo former vacuum packaging machines, several cooking ovens, steam cooking equipment, kettles as well as vapour tumblers to thaw frozen meat. Other key pieces include a meat grinder, a boxing machine, and a package labeller.

In 2020, Canabec acquired the federal meat processing license, which brought about big changes at the company.

“It’s created a different culture,” said Therrien. “Before that we were more focused on taste profiles and customer service, notably on developing complex recipes and products to please our restaurant chef clients. We were not thinking like a food manufacturing company. We had to simplify, rationalize and streamline the process to make things less complicated and reach higher volumes. Now, security is the No. 1 issue in our manufacturing process. We needed to rethink our recipes and ingredients and processes in order to be compliant and to control or eliminate allergens like pistachios in duck confit.”

He said the company’s bestselling item in recent years has been Confit Duck Legs which, like guinea fowl, are cooked in duck fat in sealed bags and sold two to a box. Retail products now account for 75 per cent of company sales.

“Every meat has a different reaction to heat and different cooking times; it takes time and experience to get it just right,” said Therrien. “Our competitive advantage comes from our knowledge and experience with game meats and the vacuum cooking process. We plan to continue focusing on the retail side of the business. But we also do some private label. I’d like to increase that business by 15 to 20 per cent in the next two or three years.”

Lane Keeping Assist won’t save us from climate change.

carbon neutral is the ultimate safety feature.

The time is now to invest in Canadian food and beverage companies — BY JANE DUMMER —

Consumer trends such as sustainability, health and quality convenience are increasing demand for new, innovative products in the food and beverage sector. Taking an innovative idea to a scalable business involves focus, time, and money. What are the options when it comes to the financial part of the equation?

First up, Canadian financial institutions and banks. However, they can be risk adverse especially for early stage food and beverage companies. Another option is to access government funding. There are a variety of government funding programs available for Canadian food and beverage start-ups. A few mentions are the AgriInnovate program, Canadian Food Innovation Network, Natural Products Canada, Protein Industries Canada, and the National Research Council of Canada Industrial Research Assistance Program for small and medium-sized businesses.

Plus, there are numerous accelerator and incubator programs across the country. Mike McNeil, vice president, Venturepark Labs, emphasizes the importance of supporting Canadian entrepreneurs. “For too long, we’ve relied on shipping our raw ingredients outside our borders and repurchasing those products after they are commercialized. We must support entrepreneurs here in Canada by opening doors for them and building a large community to guide them on their journey,” he says. What about venture capitalists and private investors? Is there an investing landscape for these food and beverage innovators to access? Omid McDonald, founder, Dairy Distillery, explains, “The money is out there. I raised money for my previous software companies, and I did not find raising money for a food and beverage company any more difficult. I found it was easier to get bank financing when I focused on the hard assets needed for a food and beverage business. There are

many government support programs and venture capitalists (VCs) focused on food and beverages. I was fortunate to connect with AgCapital Canada that invests in promising Canadian agritech companies. In 2023, we pitched our story on CBC’s Dragons’ Den and attracted the attention of Manjit Minhas. We’re in discussions with Manjit’s team and have already started doing business together. Don’t be shy to tell your story. Investors are looking for both great financial returns and a good story to tell their friends.”

Wallace Wong (The SixPackChef), co-founder, Spatula, describes, “My experience with investors and funding opportunities in Canada is that the community is small, concentrated, and exciting. It reminds me a lot of the restaurant industry; everyone is in the loop with things, and everyone is trying to improve and push the community. For example, one thing I’ve noticed is that people are always looking for opportunities. Canada is

home to so many talented and incredible founders but even more so, hustlers! I look at this as an amazing aspect because it shows excitement, growth, diversity, and activity. My co-founder Ian Weng does a great job in continuously staying part of the community, driving conversations and being in tune with the VC environment.”

Ian Weng, CEO, Spatula, highlights, “In 2023, the Spatula team slayed the Dragons on CBC’s Dragons’ Den, receiving investment offers from all five Dragons. Our innovative flash-frozen meal kits wowed the Dragons. After receiving escalating bids, our team ultimately accepted a $500,000 (for 10 per cent equity) deal with our dream Dragon, Arlene Dickinson. One of the goals of this investment is to expand across Canada and into large box grocery retailers.”

At the beginning, it takes dedication, hard work, and a continuous daily effort to

raise funds for a new business. This can be difficult when you need to be working in the business simultaneously. Some food and beverage start-ups are finding success accessing investment outside of Canada. Jake Karls, co-founder, Mid-Day Squares, describes his experience, as Canadian banks and VCs were being on the risk adverse side when it came to investing in homegrown innovative, scalable food and beverage companies.

“Canada has incubators, government programs with process and tools, however, we found a definite risk adverse mindset and very little in the way of funding for early stage food and beverage companies. Mid-Day Squares was rejected many times as too risky, too early with the common phrase ‘wait until you are profitable’. Currently 80 per cent of our funding is coming from outside of Canada and 20 per cent of funding is coming from Canadian VCs and angel operators,” he shares.

How can Canadian investments for

food and beverage companies be encouraged and increased? Karls recommends, “A shift in mind-set to take a risk and invest in early stage companies. More private entrepreneurs need to reinvest and take a risk on start-ups; to raise awareness and celebrate successful entrepreneurs in Canada. One of our goals is to encourage a culture of entrepreneurism in Canada in the CPG space. And eventually, we will reinvest in Canadian early stage food and beverage companies.”

McDonald suggests, “I have met a lot of people who want to support their local food and beverage start-up but are not aware of the tax advantages of investing in them. A guide explaining the investor tax advantage would be helpful. Also, I found a lack of networking events in food and beverage sector compared to high-tech. Networking events that connect investors with directly to companies seeking funds. These events could be held alongside local experiences such as fairs and festivals to attract potential investment.”

Wong explains, “One opportunity for Canadian food and beverage companies accessing local funding and investors is to recognize the foreign recognition of the ‘Canadian brand – Made in Canada’ is still on the uprise and strong. As a result, the demand for Canadian products, especially items that are consumable, are on the rise. The ability to not only create a domestic product for Canadian consumers, but also to be able to market to foreign demographics will help in growth and in parallel show exciting promise and value to potential investors.”

The time is now to encourage a Canadian culture of food and beverage entrepreneurs and foster a community of investors for those entrepreneurs meeting the evolving trends and needs of consumers domestically and internationally.

The LW2120 radar level sensor measures levels of liquid media up to 10 metres precisely and without blind areas. The 80 GHz frequency used ensures stable and precise measurement results, even in the presence of steam or condensate in the tank

Non-contact level measurement

Level measurement with millimetre precision up to 10 metres.

Non-contact measuring principle, therefore no problems from deposits or wear.

Direct measurement or through non-metallic walls.

Remote sensor parameter setting and level monitoring via connection to the IT system

Let’s make automation smart and simple!

Seal meat producers navigate the challenges and celebrate the benefits of a wild game meat

— BY JACK KAZMIERSKI —

Seal meat is as Canadian as beavers, moose, and maple syrup. Long consumed by some Indigenous populations, all seal products (including meat) fell out of fashion in the 1970s and 1980s when images of the annual seal hunt started popping up on television screens and in newspapers. By 1987, the harvesting of harp seal pups and hooded seal pups became illegal in Canada.

Today, many organizations are trying to change the way Canadians think of seal meat. For one, Canadian Seal Products (vendors of seal oil, meat, and fur), is promoting the industry with the help of a digital and social media campaign entitled, “Good for you. Good for the environment,” that encourages Canadians to consider the benefits of seal products.

One of the goals of this campaign is to put seal meat back on the menu here in Canada. Currently, seal meat is only available in some parts of the country, and few consumers know how to cook it or turn it into a meal.

“This is a very dark meat,” explains Romy Vaugeois, program manager at Canadian Seal Products. “When people see it for the first time in a grocery store, and they’ve never tried it, it’s hard for them to want to buy it.”

The solution, Vaugeois explains, is to promote seal meat with restaurant owners, because consumers are more likely to want to

try something new when dining out. “Seal meat is more readily available in restaurants in Quebec, where it has been served for many years, often as an appetizer, so people can try it,” she adds. “It’s especially popular with restaurants that like to work with local ingredients.”

Seal meat is also available in some fish markets, but only seasonally. “A number of distributors are already established in Quebec,” Vaugeois explains, “so restaurants can call distributors directly to place their orders.”

According to Vaugeois, seal meat is currently being produced by five Canadian companies, all located in Newfoundland or Quebec. These include Ár n-oileán Resources, Boucherie Côte-à-côte (only sell within Quebec), Carino Processing, Mi’kmaq Commercial Fisheries,

and Reconseal Inuksiuti (Indigenous owned, they provide seal meat mostly to Inuit communities in Ottawa and Montreal).

Although seal meat is available in a growing number of restaurants and retailers within Quebec, it’s more difficult to find in other provinces. The best way to purchase seal meat as a distributor in regions other than Quebec is to contact one of the manufacturers listed above.

Seal meat is available as either a loin or a flipper. “The loin is much easier to cook,” Vaugeois says. “It’s like wild game meat, and it has a slight iodine taste, so you don’t want

to overcook it.” The flipper, on the other hand, is a tough muscle, and Vaugeois recommends using it in stews and soups where it can be cooked for longer periods of time. Seal meat is also available in processed forms, including seal burger patties, sausages, pepperettes, smoked flipper and more.

The loin is offered in two versions, adult and veal. According to Vaugeois, who says she has eaten lots of seal meat, the veal tastes a lot like beef. “You would barely be able to tell the difference, if it’s processed properly,” she says. The adult loin, on the other hand, because it’s a bit older, tends to be more gamey, and Vaugeois compares the taste to moose.

Preparing seal meat for sale is complex

and requires expertise and know-how. “The meat has to be placed in seawater for more than 24 hours for the blood to drain,” she explains. “You also have to remove the fat because it will oxidize and give you a fishy taste.”

Fortunately, seal meat producers are more than happy to process the meat properly and remove all the fat before shipping the various cuts to their customers.

Once delivered, the loin can be prepared the same way one would cook filet mignon, Vaugeois explains. “You can also turn it into ground meat, put it in your traditional spaghetti recipe, or make burgers or sausages,” she adds. “It’s similar to preparing other types of meat.”

Historically, seal meat wasn’t always consumed cooked. “The Inuit eat it raw,” Vaugeois says. “They also put it in soups, and they have their own recipes.”

Prior to the 1987 ban on harvesting seal pups, seal meat was big business. It’s still worth millions of dollars annually today, Vaugeois explains, but mostly because of the value of the fur, and the seal oil, which is a great source of Omega-3 oils.

The actual edible part of the animal (loin and flippers) is only a small fraction of the total weight of each seal. “The meat only represents about five or six per cent of the total weight of the animal,” Vaugeois explains. “Most of the weight is the fat and the fur.”

Retail cost for the loin (veal or adult) is between $70 and $80/ kg, and Vaugeois says that it’s very lean meat with very little fat and no bones. The flippers are much more affordable, and retail for about $40/kg.

While organizations like Canadian Seal Products are eager to boost sales of seal products, some communities simply couldn’t live without it. “For many who live in the north,” Vaugeois explains, “it’s a matter of food security. In Nunavut, Labrador, and other northern countries like Greenland, importing proteins like pork and poultry is much less sustainable, and much more expensive than seal meat.”

In Canada’s north, she adds, where store-bought meat is costly, a single seal can provide the equivalent of $200 worth of meat, or more, to a family, while providing a much higher nutritional value.

A study conducted in 2012 estimates that there were over 40,000 seals harvested per year in Nunavut, and that the replacement food value of seal meat was worth approximately $5 million. At the time, seal skin products were worth an additional $1 million to the arts and crafts sector of the Nunavut economy.

Packed with minerals and vitamins, low in fat and high in healthy Omega-3 oils, seal meat is Canada’s superfood, according to Vaugeois. “It’s also the only wild game meat that can be legally sold throughout Canada,” she adds.

When you consider the health benefits of seal meat, as well as the benefits to local economies in northern parts of Canada, it’s clear that this is an important industry and that there’s potential for growth.

Even so, seal meat producers have an uphill battle as they endeavour to change popular opinion. “We are still dealing with pushback,” Vaugeois admits, “but we see great improvement from a decade ago. Due to all the propaganda from animal activists and all the trade restrictions and misinformation arising from this propaganda, it will take us several years to rebuild the seal industry.”

There is no need to reinvent the wheel when it comes creating baked goods with few ingredients — BY MONICA FERGUSON —

The process of baking is one of the oldest cooking methods.

Since 2600 BCE the Egyptians were making bread by methods similar in principle to those of today. The 2023 Statista Consumer Insights survey found that a majority (58 per cent) of Canadians are actively trying to eat healthy, with 30 per cent of the survey respondents opting to avoid artificial flavours and preservatives. As the demand for simpler, healthier options continues to grow, food manufacturers baking with fewer ingredients are poised to benefit from consumer preferences.

“Formulations for baked goods can be complex. When the goal is to make a baked good with fewer ingredient, it’s important to understand how the ingredients work together and the process necessary to achieve the product’s desired taste, texture, and colour,” said Jane Dummer, registered dietitian, consultant and a Bakers Journal columnist.

The ultimate goal when producing a baked good with limited ingredients is being able to maintain the taste and texture that consumers crave.

“Taste and texture are critically important for bakery products for acceptance by consumers who are looking for healthier products but are not inclined to give up their desire for ‘healthy indulgence.’ Thus, formulators need to make sure that the solutions they provide to improve nutritional profiles meet customer expectations,” said Kyle Krause, Beneo regional product

As the demand for simpler, healthier options grow, food manufacturers baking with fewer ingredients are poised to benefit from these consumer preferences.

manager, functional fibres and carbohydrates, North America.

It is not uncommon to flip over a packaged good to review the ingredients and find a handful of unpronounceable ingredients listed. Often, these long words are shelf stabilizers, texturizers and preservatives used to maintain the product so consumers can enjoy a tasty and safe treat. Given consumers are opting for healthy food without preservatives, it’s valuable to dig into how to manufacture delicious baked goods with limited ingredients.

“Simple and few ingredients could deliver a flavourful, nutritious product with opti-

mal texture,” said Katie Thomas, corporate communications manager, Mondelez Canada. “We always start with our consumers and a back-to-basics approach where you think about how to achieve your goal using the fewest ingredients, like you would in your own kitchen.”

Thomas explained that the process of creating a recipe with fewer ingredients boils down to simple ingredients and augmenting recipes to ultimately deliver one that fulfils consumer expectations.

“When developing products with limited ingredients, bake profile can be used to decrease the amount of shelf stabilizers needed,” said Thomas.

Bake profile, also known as thermal profiling, is a baking process for optimization and control. A thermal profile helps ensure food safety and regulatory compliance. It also helps improve product texture, quality, and shelf life by monitoring aspects like yeast kill, bake out zone, product temperature arrival and colour development.

When working with fewer ingredients, it is easier to correct a misstep, thanks to the simple nature of the baked good.

“If a bakery is creating a baked good from scratch, the positive thing about fewer ingredients is that if one ingredient is improperly scaled and added at the wrong time, it is easier to problem solve that formulation compared to a formulation with

many ingredients,” said Dummer. “Simplified blends and mixes of dry ingredients can ease the on-site labour and risk of errors, as bakeries reduce the total ingredients in their products and create new ones.”

A popular growing-alternative is direct-toconsumer dry mixes made for baking at home. Companies such as Second Spring Foods in Seaforth, Ont., create options like organic banana bread mix with no additives, artificial flavours, or preservatives.

“It’s a question of using ingredients that have a long and natural shelf stable life to start with,” said Julie Barbeau Capruciu ND, president of Délices Sublimes, a small business that produces dry mixes of muffins, cookies, brownies, cake, and energy balls that are naturally sweetened.

Capruciu is a naturopath by training and passionate about nutritious food. When she was pregnant with her third child, she developed pregnancy diabetes. She then decided to sweeten snacks for her and her family by adding fruit and vegetable purees in addition to using organic whole grains, naturally rich in protein and fibre.

“I am trying to promote real food with basic ingredients that people all know,” said Capruciu.

For vegan options, breads are relatively straightforward to create using only plantbased ingredients, however, baked goods are often reliant on eggs and dairy ingredients like butter, and this can be more complex, explained Dummer.

“There have been helpful advancements with pulse ingredients over the past five years. For example, the industry has seen positive developments in egg replacers available. As a result, improved ingredients and ingredient technology can remove the trial-and-error testing for the

processor. Gluten-free ingredients have seen improvements as well. Specifically, when it comes to gluten-free flour options available (for example, sorghum) and flour mixes and how these flours and mixes work with fewer ingredients to achieve the anticipated textures and tastes, while boosting the nutrition in gluten-free bread or baked goods,” said Dummer.

Beneo offers a prebiotic chicory root fibre, oligofructose, which is a soluble fibre and can be incorporated into a variety of baked goods. It can increase fibre content while allowing manufacturers to reduce the sugar or fat content of their products.

“Thanks to the technical properties of chicory root fibre, producers can develop products without compromising on taste and texture. This soluble fibre can stabilize water into a creamy structure, mimicking fat, important for fillings,” said Krause. “Additionally, the humectant properties of oligofructose allow for moisture retention in baked goods like muffins and cakes while also delivering sugar-like flavour and mouthfeel.”

Chicory root fibre also allows for easy processing without changing production processes. At only 2 kcal/g chicory root fibre enables food manufacturers to produce reduced-calorie and fibre-enriched versions of traditionally indulgent baked goods and snacks such as cereal bars, baked goods, and fillings.

Ultimately, if the goal is to produce a baked good with fewer ingredients and maintain a flavourful profile—the standard is, use simple and quality ingredients. When unusual flours and ingredients enter the mix, it can be counterintuitive as some flours require a much more rigorous processing cycle. While crafting baked goods with limited ingredients requires a thoughtful approach that balances flavour, texture, and nutritional aspects, there is no need to reinvent the wheel.

It has come to my attention that there are still a number of those in today’s baking industry who remain uninformed about the many benefits of California Raisins to the craft. As Dean of the California Raisin Academy, I feel a great responsibility to right this egregious wrong!

Even today, many see California Raisins simply as ‘an ingredient’ when, in truth, they are far more! Used whole or processed into a paste, they can become a delightful substitute for refined sugar. They are an excellent binder that adds a desirable texture to everything from cookies to cakes to more savoury dishes. And they hold up well under a variety of temperatures. Dinner or dessert, California Raisins deliver delight!

At a time when the baking industry has been hit hard by inflation, California Raisins remain steady in their reasonable cost-to-portion ratio. Their shelf-stable nature only adds to their affordability as they can be stored for longer and used later. Unlike other foods, their wrinkles don’t mean they’ve gone bad!

Yes, here is another ingredient that dispels the myth that plant-based foods sacrifice flavour or texture. Instead, California Raisins enhance recipes with their naturally-sun dried, no fat, no cholesterol sweetness, texture and mouth-feel!

In closing, I say that, although their origins can be traced back to 2000 BC, California Raisins have shown they transcend time. Let us then free ourselves of the shackles of traditional baking and explore the vast, inspired world opened by California Raisins!

Dictated but not read,

RayZin

Ray Zin, Dean California Raisin Academy

Birgit Blain

oo often food processors and brand owners are chained to their desks firefighting and buried in day-to-day tasks. Scheduling time to leave the confines of the plant and office to visit stores provides a much-needed perspective. Store surveys yield a wealth of insights to translate into sales. Taking photographs, provided retailers don’t object, is an easy way to keep a record for further analysis. For brands with limited human resources, services are provided by thirdparty sales and store support agencies. However, they view the category through a sales, distribution, and merchandising lens. Therefore, it’s important for brands to visit stores regularly.

Conducting store surveys prior to retailer category reviews affords the opportunity to share insights that can influence customer decisions.

Since category sets are dynamic, regular store surveys capture a live snapshot of the landscape. Assess whether the category is well developed by evaluating brand assortment, sku count, sizes, flavours, pricing, and private label presence. Identifying underdeveloped categories and gaps in the retailer’s portfolio can open doors for a compelling offering.

Getting a handle on the competition is critical for brand success. Compare the points of parity and points of difference with your product offering, packaging, positioning, placement, pricing, and promotions.

Store surveys yield a wealth of insights to translate into sales.

Suss out whether there are opportunities to supply the retailer with store brand items. How prominent is private label and what percentage of the category does it currently represent? Does the program cover all the tiers: value, national brand equivalent, premium and gourmet?

How well does your brand’s design stand out on shelf adjacent to competitors? Are flavours clearly differentiated to make it easy for shoppers? Is the container size appropriate for shelf spacing, or are oversized products relegated to the top or bottom shelf? Also scan other areas of the store for packaging innovations.

Evaluate the pricing landscape to determine if your products are in line, over or under priced. Review promotional activity, noting the depth, duration and frequency of discounts and what types of offers are most common in the category.

Examine how the category is merchandised. Check where your brand is positioned in the planogram and if it’s easy for shoppers to find. Are brands blocked or split into segments? If retail-ready packaging is commonplace, consider offering it too.

Cues picked up in store can flag a potential quality problem.

Out-of-stocks are sales killers. Check on-shelf product availability and ensure there are no missing shelf labels.

Every retailer operates and merchandises their stores differently, so it’s important to visit every banner. It enables brand owners to gain insights about brand positioning, target customer, product offering, the role of store brands, merchandising, pricing, marketing, etc.

Being in store opens up the possibility of observing and engaging with shoppers to gain insights into their decision-making process.

It’s also important to look outside your category, examining other store departments like fresh, frozen, and centre store. Doing so can unlock potential by spotting gaps in the offering and opportunities for new listings, crossmerchandising and cross-promotions. It is highly beneficial to cast a critical eye over your own brand and product portfolio. Store surveys allow you to do just that. Observations reveal useful information to apply to product life cycle management, sku rationalization, new product development, packaging design, branding, and marketing initiatives. Ultimately, store surveys enable brand owners to capitalize on new opportunities and resolve issues that threaten listings, thereby contributing to sales growth.

As a CPG food consultant, Birgit Blain helps clients think strategically to build a sustainable brand. Her experience includes 17 years with Loblaw Brands and President’s Choice. Contact her at birgit@bbandassoc.com.

CANADA’S ONLY BUSINESS-TO-BUSINESS BAKING EVENT

Join Canada’s baking industry professionals from bakeries (artisan, retail, wholesale, commercial, in-store, pizzerias), grocery and foodservice outlets at Canada’s ONLY Business-to-Business Baking Event!

MAY 5 - 6, 2024 I TORONTO CONGRESS CENTRE

• Connect with suppliers and learn about the latest ingredients, bakery equipment and services for the baking industry!