BUILDING UP BIOCHAR

The biochar market in Canada is on its way to fast growth with the inauguration of Carbonity, the largest industrial biochar plant in Canada, and possibly, the largest in North America.

A “Buy Canadian” opportunity for Canada’s bioeconomy.

biggest biofuels plant under way Conver tus discusses construction of biofuel facility in York Region.

The WPAC 2025 Conference in Halifax featured sessions on bioheat opportunities, market and policy updates, and more.

What suppliers need for explosion protection design.

Volume 25 No. 4

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service

Ph: (416) 510-5113 Fax: (416) 510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400 Toronto, ON M2H 3R1

Editor - Andrew Snook

Ph: (416) 510-5239 ssobanski@annexbusinessmedia.com

Contributors - Gordon Murray, J.P. Antonacci, Joel E. Dulin and Ian Thomson

Group Publisher - Anne Beswick

Ph: (416) 510-5248 Mobile: 416-277-8428 abeswick@annexbusinessmedia.com

Account Coordinator - Shannon Drumm Ph: (416) 510-6762 sdrumm@annexbusinessmedia.com

National Sales Manager - Rebecca Lewis Ph: (519) 429-5196 rlewis@annexbusinessmedia.com

Quebec Sales - Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexbusinessmedia.com

Western Sales Manager - Tim Shaddick twshaddick@gmail.com Ph: (604) 264-1158 Fax: (604) 264-1367

Audience Development Manager - Layla Samel Ph: 416-510-5187 lsamel@annexbusinessmedia.com

Media Designer - Svetlana Avrutin

CEO - Scott Jamieson

Canadian Biomass is published four times a year: Winter, Spring, Summer and Fall. Published by Annex Business Media.

Publication Mail Agreement # 40065710

Printed in Canada ISSN 2290-3097

Subscription Rates: Canada - 1 Yr $58.14; 2 Yr $104.04

Single Copy - $9.00 (Canadian prices do not include applicable taxes) USA – 1 Yr $123.93 CDN; Foreign – 1 Yr $140.76 CDN

Annex Privacy Officer Privacy@annexbusinessmedia.com Tel: 800-668-2374

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above. No part of the editorial content of this publication may be reprinted without the publisher’s written permission. ©2025 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication. www.canadianbiomassmagazine.ca

Grain pain

The Halifax Grain Elevator needs to be protected and preserved

By Andrew Snook

This past September, I had the pleasure of attending the annual Wood Pellet Association of Canada Conference. In addition to fantastic educational sessions, I joined a tour that included the historic Halifax Grain Elevator in the Port of Halifax. The Halifax Grain Elevator was built in 1924 and is connected to Pier 26, Pier 28 and P&H Milling west of the Ocean Terminals. Pier 28 has six grain towers that have the capacity to deliver 50,000 bushels of grain per hour. It is the last ocean elevator in operation in Atlantic Canada.

The grain elevator was originally built to export wheat (it is still used to export grains and soy beans) and support the local flour mill, which currently produces 85 per cent of the commercial baking flour consumed in the four Atlantic provinces.

erations. To create additional revenue streams, the HPA has been expanding its container terminal operations, which includes the infilling of underutilized deep-water berths. The berths are being filled using materials from local construction operations, where contractors pay a tipping fee to have the HPA accept some of their construction waste.

In 1998, Halifax Grain Elevator Limited (HGEL) began using this infrastructure to store and ship wood pellets – first for MacTara in Upper Musquodoboit, N.S., and currently for Shaw Resources and Great Northern Timber. Today, wood pellets account for more than 100,000 tonnes of the operation’s in-and-out tonnes on an average year. Last year, wood pellets represented approximately 40 per cent of the 500,000 total in-and-out tonnes.

While this unique, historical piece of infrastructure is vital for agricultural and wood pellet operations across Atlantic Canada, the operation is under potential threat from container terminal expansion by the Halifax Port Authority (HPA), which leases the land for HGEL’s op-

Kimberly Batherson, president of HGEL, explained during the tour that the HPA is considering infilling berths currently being utilized in their operations to further expand the container terminals and increase revenues from tipping fees. She is in talks with the HPA to delay decisions to infill these berths, as the terminal is currently operating at 40-per-cent capacity. She explained that the HPA offered options for moving HGEL’s operations as part of its expansion, including a new ship loader and other upgraded infrastructure, but that it would be a very costly project to undertake, so Batherson is advocating strongly to hit the brakes on the infilling of the utilized deep-water berths.

Between the wood pellets and grains being shipped, the HGEL accounts for 10 per cent of the HPA’s total tonnage, so it does represent a significant amount of the port’s operations. The federal government and the HPA need to think long and hard about how it goes about the next phase of its container terminal expansion to ensure it doesn’t jeopardize the operations of Atlantic Canada’s wood pellet producers and local farming communities dependent on this infrastructure for their livelihoods.

QUEBEC GOVERNMENT ABANDONS

BILL 97

Rising tensions and repeated breakdowns in negotiations between stakeholders has resulted in the provincial government scrapping Bill 97 in its entirety, although some form of forestry reform is still a possibility.

The decision was made after Jean-François Simard was appointed as the province’s new minister of Natural Resources and Forests in last month’s cabinet shuffle.

“Today, Premier François Legault announced the end of Bill 97 in order to start fresh,” Ian Lafrenière, minister of First Nations and Inuit Relations, said last Thursday.

The proposed forestry bill was responsible for amassing an unprecedented coalition against it, from First Nations, environmental groups and labour unions to forestry associations.

According to Peter Graefe, a political science professor at McMaster University, this overwhelming opposition has made it difficult to discern what factors were ultimately responsible for the bill’s downfall.

“It’s hard to say which of the straws broke the camel’s back,” Graefe said.

From the moment Bill 97 was introduced to the National Assembly last spring, tensions between forestry workers and land defenders began to erupt across Northern Quebec.

Negotiations between the Coalition Avenir Québec (CAQ) and the Assembly of First Nations Quebec and Labrador (AFNQL) had already broken down twice by the time Bill 97 was withdrawn last week.

“From the very beginning, we have been consistent: Bill 97 did not respect the rights of First Nations, biodiversity, or even the long-term interests of workers,” the AFNQL said.

Simultaneously, the MAMO First Nation, an alliance of land defenders and hereditary chiefs from the Innu, Atikamekw and Abenaki nations, began conducting protest and barricade actions in an effort to pre-emptively resist this new legislation.

André Pikutelekan, a spokesperson for the MAMO First Nation, explained that the problems underlying these tensions have long existed prior to this particular piece of legislation.

“Tensions in the forest have existed for many years, often hidden beneath latent racism, barely disguised by some workers or forest users,” Pikutelekan said. “It is the only option they see in the face of their own powerlessness.”

To modernize Quebec’s forestry industry, Bill 97 proposed dividing Quebec’s forests into three equal zones for development, conservation, and multi-purpose use.

Although this version was unsuccessful, Lafrenière said the CAQ is still exploring other ways to approach forestry reform.

“We already have confirmation of the willingness of the AFNQL and the Atikamekw Nation Council to collaborate on reforming the forest regime—a reform that, in everyone’s view, must take place,” Lafrenière said. “I am confident that together, we will succeed.”

One lesson, Graefe noted, that the provincial government should take away from this situation is that consent will probably be central to any future successful attempts at forestry reform.

“Social license is often derided as the equivalent of DEI: a set of policies that have their day,” Graefe said. “But it’s still pretty crucial if you’re going to be investing billions of dollars in some sort of economic activity.”

Despite these recent developments, MAMO First Nation has vowed to continue its actions in the forests until the day these deeper issues are resolved.

“For decades, the environmental policies of successive governments have been leading the forest to its demise, all to enrich a few individuals and secure votes during elections,” Pikutelekan said. “We need more mature forests to support healthy biodiversity— for ourselves and, above all, for future generations.”

By Lucas-Matthew Marsh, Local Journalism Initiative Reporter, Iori: wase

DRAX ISSUES STATEMENT RESPONDING TO OFGEM ANNOUNCEMENT OF INDEPENDENT AUDITOR

Drax Group recently released a statement in response to Ofgem’s announcement of an independent auditor:

“We note that the appointment of an auditor into our historical biomass profiling data, agreed to at the time of the closure of the Ofgem investigation in August 2024, has been announced today. We fully support this independent external audit process, working with Forvis Mazars and Ofgem, to add further rigour and transparency to our profiling data reporting.

“We play a vital role in providing power when the sun doesn’t shine and wind doesn’t blow, so ensuring we are transparent

about the sustainability of our biomass is an essential part of how we work.

“Following the competitive tender process to appoint an auditor, we are looking forward to working with Forvis Mazars and building on our programme of continual improvement.”

The Ofgem investigation closure statement from August 2024 can be found at: https://www.ofgem.gov.uk/publications/ ofgem-decision-investigation-drax-power-limited.

Source: Drax Group.

CHAR TECH PROVIDES THOROLD FACILITY CONSTRUCTION UPDATE

CHAR Technologies Ltd. (CHAR Tech) recently offered an update on the construction progress of its Thorold Renewable Energy Facility in Thorold, Ont. The company stated that construction is proceeding on schedule for its commercial biocarbon production line by year-end, and that renewable natural gas (RNG) production should begin in 2026.

“The facility continues to progress on schedule thanks to the dedication of our construction and engineering partners. With the feedstock handling system nearing completion and preparations underway for kiln installation, we remain well positioned to complete the biocarbon production line before year-end to advance toward RNG production Phase 2 in 2026,” stated Andrew White, CEO of CHAR Tech.

The company stated that the major components of the feedstock handling system are now in place, with final installation of the outdoor conveyors scheduled in October 2025. The feedstock handling system will enable continuous movement of wood waste biomass through the facility.

Once the installation of the feedstock handling system is completed, CHAR Tech plans to transport the first of two commercial High Temperature Pyrolysis (HTP) kilns, currently located 40 kilometres from the facility, for installation and integration with the feedstock handling system. This will complete construction

of the commercial biocarbon production phase. The second kiln will be installed as part of the RNG production Phase 2 scheduled for 2026.

TSI BUILDS MACHINERY

Complete Dryer and Torrefaction systems including Heat Energy and Pollution Control equipment in one integrated solution for plants from 50,000 tons/year to 500,000 + tons/year.

A snapshot from CHAR Tech’s video of its feedstock handling installation. Image: CHAR Tech.

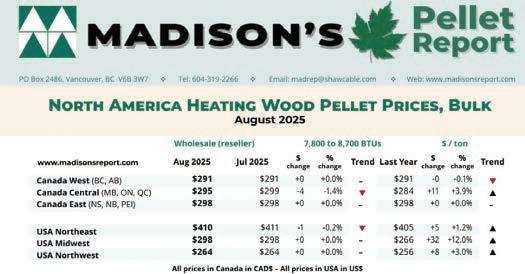

North America Heating Wood Pellet Market

Update for Q3 2025

By Earl Heath, editor for Madison’s Pellet Report

CRYPTO AND AI COMPUTING TO BE POWERED BY BIOMASS

Washington State-based modular waste-to-energy company Bioenergy Development Inc. recently unveiled a decentralized microgrid platform for AI computing and cryptocurrency mining powered by biomass. The system has been lab- and field-tested using wood residues and cattle manure as feedstock, and is capable of supplying approximately 1 GWh of net, dispatchable electricity. With government and public sentiment still hostile to nuclear power, this type of system is being heralded as an alternative source of local, scalable baseload power for many applications.

Representatives from the company claim the units solve grid constraints while cleaning up two of the most challenging waste streams in the industrial sector. Each factory-built, 40-ft. container converts biowaste into three value streams. Syngas is used to generate electricity and heat, biochar provides durable carbon sequestration and enhances soil performance, while biocarbon serves as a high-grade specialty carbon-replacement product.

The units can be rapidly deployed and commissioned in a matter of months rather than years, with the process apparently generating no waste from power production.

RECORD FUNDING PROVIDED FOR BIOMASS THERMAL PROJECTS IN U.S.

The USDA Forest Service recently announced a US$80 million funding package to spur investment in wood products manufacturing, expand active forest management, and accelerate energy innovation across U.S. timber-producing communities. At least $12 million of the funding is expected to go to more than 30 projects in 19 states that aim to use thermal biomass applications, as well as biomass-to-electricity projects.

Grants will be issued under three programs: the Wood Innovations Grant Program, the Community Wood Grant Program, and the Wood Products Infrastructure Assistance Program.

Under these frameworks, projects funded will include existing and proposed small wood pellet plants that produce biomass for domestic heating, large biomass thermal heating plants, and the expansion of firewood businesses, among others.

CALIFORNIA INVESTS IN BIOMASS

The California Department of Forestry and Fire Protection (CAL FIRE) recently announced plans to invest US$5 million in eight projects aimed at managing wildfire risk by training forestry work-

Madison’s Lumber Reporter.

ers and boosting regional biomass projects. The funding is part of CAL FIRE’s Business and Workforce Development Grant program, which supports innovative approaches to reducing wildfire risk while promoting economic growth and supporting communities in rural areas. Since launching in 2022, the program has disbursed more than US$100 million to over 100 projects across the state.

CAL FIRE’s wood products and bioenergy team notes that this funding will provide hands-on training to a new crop of forestry workers while also tackling the problem of fuel buildup in wildfire-prone areas across the state. Along with job programs for youth and entry-level forestry workers, the grants will also facilitate business expansion for companies to purchase equipment used in managing larger areas for wildfire risk reduction and forest restoration. A key component of the funding’s aim is to remove forest waste residues from high-risk fire regions and make use of that material in novel applications, including the production of biomass and even mass timber products.

AUSTRALIA LOOKS TO INVASIVE PLANTS FOR BIOMASS

Recent research out of the University of Queensland pointed to a potential source of biomass feedstock from invasive weeds from the outskirts of Brisbane. The University’s Queensland Alliance for Agriculture and Food Innovation discovered that out of 15 problematic weed species, two can be converted into high-quality biomass pellets. Those two species have a high enough lignin content to be competitive with wood-based biomass, making them a suitable source of durable, market-grade pellets. •

Source:

Madison’s North America Heating Wood Pellet Prices: August 2025

SPONSORS

GOLD

PLATINUM SPONSOR

IBelledune coal power plant conversion

A “Buy Canadian” opportunity for Canada’s bioeconomy

By Gordon Murray, Executive Director, Wood Pellet Association of Canada

n New Brunswick, NB Power’s plan to convert the Belledune coal-fired electric power station to black pellets presents an exciting opportunity for Canada. One that could strengthen the economics of the Canadian lumber sector, ensure better use of existing harvests and support rural communities across Atlantic Canada, while ensuring the power station complies with Canada’s 2030 coal phase-out regulation.

With the right federal support, all of Belledune’s fuel supply can come from within Canada — specifically, New Brunswick, Nova Scotia, Quebec and Ontario. This is “Buy Canadian” in practice: Canadian fibre turned into Canadian pellets for Canadian electricity.

THE OPPORTUNITY: BLACK PELLETS

Thermally treated pellets, often referred to as “black pellets,” are emerging as one of the most promising renewable fuels in Canada’s energy transition. They mimic coal in energy production, are compatible with existing coal infrastructure, easier to pulverize than white pellets and can be stored outdoors without degrading.

NB Power chose black pellets as the most viable and cost-effective solution for Belledune — able to provide reliable baseload power, reduce emissions, and make efficient use of the fibre resources available in Eastern Canada.

Many coal plants around the world have already switched to white pellets or blends. Belledune is the largest proposed conversion from coal to black pellets. It will demonstrate the next step: using black pellets at full scale — showcasing Canada’s ability to lead in advanced biomass technologies while supporting domestic wood pellet manufacturing. Once fully converted, Belledune will consume around 300,000 to 500,000 tonnes of black pellets per year.

However, black pellets are currently not produced at a commercial scale in Canada. Wood pellet manufacturers require financial support to convert facilities. If three Canadian facilities were converted, 600,000 tonnes of black pellets could be

This is “Buy Canadian” in practice: Canadian fibre turned into Canadian pellets for Canadian electricity.

and resilience.

CANADIAN WOOD PELLET SECTOR’S ROLE

The Canadian pellet sector is needed for Belledune to succeed. WPAC members bring access to fibre, existing facilities that can be modified to meet market needs, proven track records and technical expertise.

WPAC, our members, and NB Power are working closely together and are committed to strengthening our collaboration. We all understand that most of the capital investment must come upstream — by producers installing new thermal processing lines and steam-generation systems at their facilities, along with the necessary engineering, permitting and supply chain upgrades.

WPAC’s role is to help producers explore ways to reduce risk — by working with them to assess the business case, share knowledge on equipment and pro-

Photo courtesy of NB Power.

produced annually, providing Belledune’s needs with flexibility

cesses, and explore opportunities together. This includes helping producers evaluate options by coordinating information on equipment, providing education on the different thermal treatment processes, and facilitating site visits to facilities already using such technology — so producers can make well-informed decisions.

Building confidence, mobilizing investment and aligning supply chains will take time. NB Power’s patience and partnership will be essential as producers work through these steps. Together, we can ensure the conversion progresses in a way that is both reliable and sustainable.

GOVERNMENT OF CANADA SUPPORT IS REQUIRED

For Belledune to succeed, federal participation is essential. Currently, federal clean energy programs support utilities but not fuel producers. This gap must be addressed.

NB Power’s conversion requires relatively modest plant modifications and

has financial support from the federal government.

To convert to black pellet production, pellet facilities will need to invest about $30 million each in new thermal processing and steam-generation capacity to produce roughly 200,000 tonnes of black pellets per plant per year. Sites are not yet chosen, and investors must be convinced to commit.

The solution is a mix of loan guarantees, production credits, investment tax credits and direct grants or matching contributions from the Canadian government. These tools will enable Canadian producers to build the required capacity — without them, the project cannot move forward.

Without the right federal support, private capital alone will not be sufficient.

A MODEL FOR CANADA

The Belledune conversion will be a huge but achievable project. And it will mean

more than just decarbonizing one generating station. It will serve as a model project — a blueprint for other Canadian coalfired stations facing the 2030 phase-out. It will also demonstrate that Canada’s commitments under the coal phase-out regulation, the Clean Electricity Regulations and the Powering Past Coal Alliance are being put into practice.

Belledune is a national opportunity. It is good for Canada, good for New Brunswick, and good for the wood pellet sector. It will strengthen the forest industry, grow the bioeconomy, cut greenhouse gas emissions and deliver renewable energy at scale. Developing a Canadian black pellet industry to supply Belledune will lay the foundation for decarbonization in other sectors, including steel, cement and industrial boilers, while opening future domestic and export opportunities. Most importantly, it will show that Canada can, and will, turn its climate commitments into reality. •

RELIABLE HIGH PERFORMANCE PELLET FIBRE DRYING

Building up biochar

Carbonity plant starts up operations

By Andrew Snook

The biochar market in Canada is on its way to fast growth with the inauguration of Carbonity, the largest industrial biochar plant in Canada.

Located in Port-Cartier, Que., the plant has a starting production capacity of 10,000 tonnes of biochar annually. Those production levels are expected to triple to reach 30,000 tonnes annually in the next few years, making the facility the largest biochar producer in North America.

Carbonity (also known as “Carbonité” in Quebec), was created through a partnership between decarbonization solutions provider Airex Energy; Rémabec Group, a major player in Quebec’s forest products sector; and SUEZ, a global provider of circular solutions for water and waste management. It was also assisted through federal and provincial funding with the Government of Quebec supplying $16 million for the project and the Government of Canada supplying $10,5 million, including $7,5 million through the Investments in Forest Industry Transformation (IFIT) program and a $3-million repayable contribution under CED’s Regional Economic Growth through Innovation (REGI).

“We’ve been able to get great support from forestry departments, and on the innovation side, because we are developing new markets for residues,” explained Michel Gagnon, CEO of Airex Energy and Chairman of the Board of Directors of Carbonity. “We’ve been able also to get support from the provincial level through TechnoClimat, which is the energy transition fund in Quebec. Their goal is to enable industries to reduce their carbon footprint, either by metallurgical biochar, or with biofuel that we will generate as a byproduct.”

Once the plant is at full production capacity it is expected to sequester 75,000 tonnes of CO2 equivalent every year.

“The federal government is proud to have contributed to this flagship project for the development of a new subsidiary in Canada. Biochar is a key solution for carbon sequestration, in addition to its benefits for agriculture, the development of resilient cities, and supporting a diversified forestry industry,” stated Mélanie Joly, Minister of Industry and Minister responsible for Canada Economic Development for Quebec Regions.

CARBON CREDITS

The biochar production generates guaranteed and certified carbon credits, marketed by First Climate on the voluntary market.

The Carbonity plant has a starting annual production capacity of 10,000 tonnes of biochar. Photos courtesy of Carbonity.

Carbonity received a major boost for its carbon credits production in 2024 when Microsoft announced it would purchase 36,000 carbon credits from the company over its first three years of operation.

“The official opening of the Carbonité project is an important milestone for international climate protection through technical carbon removal solutions, as it demonstrates that biochar technology can be scaled up. We are delighted that our customers are showing such strong interest in Carbonité, supporting the continued development of carbon removal technology,” stated Olaf Bachert, president and CEO of First Climate in a previous release regarding the project.

Microsoft has targeted a negative carbon footprint by 2030 with a commitment to remove its direct and indirect carbon emissions from its operations by 2050. While it is good to have the additional revenue from carbon credit sales, the primary source of revenue is always expected to be the biochar products being generated.

“Although the main driver of this project is the biochar itself, the integration of carbon credits supports the business model,” Gagnon said.

The plant operates using Airex Energy’s patented DryFX and CarbonFX technologies. SUEZ’s role is to support the commercialization of the biochar in Europe by leveraging its expertise in organic waste recovery, soil amendment, and biofertilizer production, as the soil regeneration is one of the primary applications for biochar. The residuals required for the biochar production process are supplied by Rémabec Group’s forest products operations, which will supply about 58,000 tonnes of residuals annually.

“Today, we are continuing an exceptional adventure that is shaping the future of our forestry and affirming Quebec’s leadership in the development of bioproducts,” stated Réjean Paré, president and COO of the Rémabec Group during the plant’s inauguration this past May. “In partnership with Airex Energy and SUEZ, together we are taking on the challenge of building a new economy, focused on the future and committed to the environment. It is in

Port-Cartier, on the North Shore, that we are focusing on innovation and boldness to develop our residual forest resources in order to decarbonize our economy. This project is revitalizing a long-abandoned industrial site, offering it a promising and sustainable future. Thanks to solid partnerships, cutting-edge technologies, and a clear vision, we are positioning ourselves as a world-class player and diversifying our products and markets for a better future.”

Airex Energy and SUEZ are planning to develop enough production facilities around the globe over the next 10 years to generate 350,000 tonnes of biochar annually by 2035, which will total approximately 1 million tonnes of CDR (carbon dioxide removal).

“We are very pleased to contribute to this pioneering biochar production project in Canada. This negative emissions solution, identified by the IPCC, is effective in combating climate change and relevant to SUEZ’s waste recovery activities,” stated Yves Rannou, COO, Recycling & Recovery, SUEZ in the press release announcing the plant’s inauguration. “We are convinced that biochar will play a decisive role in the ecological transition of industrialists. This is why we aim to produce 350,000 tonnes of biochar per year by 2035, with Airex Énergie, to offer our customers committed to a carbon-neutrality trajectory innovative solutions for reducing their residual emissions.”

Gagnon says he expects most of the facilities to have similar production ca-

(L to R): Anne-Lise Méthot, Pierre Fitzgibbon, Michel Gagnon, Réjean Paré and Yves Rannou at the groundbreaking ceremony for the Carbonity plant in 2023.

(L to R): Patrick Girard, Michel Gagnon, Alain Thibault, Kateri Champagne Jourdain, Réjean Paré and Yves Rannou celebrate the Port-Cartier plant’s inauguration.

pacities to the Port-Cartier plant at about 30,000 tonnes with a few of the plants having larger capacities.

“We have projects under evaluation now and there are some locations where we can have about 50,000 tonnes of biochar instead of 30,000 tonnes,” he said.

VERSATILITY OF BIOCHAR

The production of biochar is recognized by the Intergovernmental Panel on Climate Change (IPCC) as an effective way to combat climate change due to its ability to sequester carbon on a long-term basis. The potential applications for biochar are impressive, as it can be used in soil regeneration for the agriculture sector; construction and urban development; and support the decarbonization of heavy industries.

When it comes to benefitting the agricultural sector, Gagnon says biochar has properties that allow it to absorb pollutants from water to help battle soil degradation by improving nutrient and

water retention, aeration, drainage, and microbial activity. These properties are also important for cities in aiding with soil remediation projects.

Airex Energy stated that when used as a soil amendment, biochar “enhances nutrient and water retention, aeration, drainage, and microbial activity. It regenerates soil, increases fertilizer efficiency, improves crop yields, and aids water drainage.”

“It also has some applications in some of the animal feeds,” Gagnon added. “Mixing a little bit of biochar with food can improve digestion.”

Carbonity has been contributing to research tests in Quebec to develop more detailed data on this application.

On the construction side, biochar can be added to concrete and asphalt mixes to improve the building materials’ performances while reducing their carbon footprints.

Biochar is also used as an absorbent by cities for recycling organic waste and combatting flooding.

“We have projects under evaluation now and there are some locations where we can have about 50,000 tonnes of biochar instead of 30,000 tonnes.”

A bonus benefit of the biochar production process developed by Airex Energy is that it also generates biofuels, produced by excess energy in the form of steam or pyrolysis oil.

RESEARCH PARTNERSHIP

Earlier this year, Airex Energy announced a partnership with the research chair for Université Laval’s Faculty of Agricultural and Food Sciences for a research project related to cultivated organic soils. These soils are used almost exclusively for vegetable production and are vulnerable to rapid degradation.

The research project involves using biochar in cultivated organic soils to develop strategies for preserving soil fertility, enhancing sustainability practices and increasing carbon capture capabilities. Airex Energy will invest $100,000 over a four-year period and supply biochar from the Carbonity plant for the project.

“I am excited to take part in this groundbreaking initiative, which combines scientific expertise with Airex Energy’s industrial commitment. The application of biochar in cultivated organic soils represents a major breakthrough in restoring and conserving Quebec’s most fertile lands while providing a concrete response to climate change challenges. I firmly believe that this synergy between research and technological innovation will drive the development of practical, transferable strategies, strengthening soil health and the future of our agricultural sector,” stated Jacynthe Dessureault-Rompré, professor at the Faculty of Agricultural and Food Sciences at Université Laval and holder of the Research Chair on the Conservation of Cultivated Soils.

“We are proud to announce this partnership, which reflects our commitment to developing decarbonization solutions that address challenges in the agri-food sector. Biochar, with its unique potential, offers a promising solution to critical issues such as the degradation of black soils in Montérégie. We are honoured to collaborate with Université Laval to explore these innovative solutions and contribute to the preservation of our agricultural soils,” Gagnon said. •

Airex Energy and SUEZ are planning to develop enough production facilities around the globe over the next 10 years to generate 350,000 tonnes of biochar annually by 2035.

Ontario’s biggest biofuels plant underway

Convertus discusses construction of biofuel facility in York Region

By Andrew Snook

The Convertus Group is one step closer to building one of Ontario’s largest biofuel facilities.

The company recently announced that it received the approvals and permits to begin construction of its Convertus York Biofuel Facility within York Region.

“The team has been working through the required permitting for the site since 2023. Several provincial and municipal permits required for the site have been approved after extensive review by the various regulatory bodies involved. We worked with our engineering and construction partners to obtain the permits through collaborative design and consultation,” explained Arun Gudla, vice-president of strategic initiatives at Convertus Group.

Gudla added that the successful approvals process was the result of close collaboration with local and provincial authorities. The project is expected to be operational some time in 2027.

The Convertus York Biofuel Facility is designed to be the first biofuel plant in Canada to incorporate integrated CO2 liquefaction technology. The company stated that the facility will be able to process up to 200,000 tons of organic waste annually from the Regional Municipality of York and surrounding areas using advanced anaerobic technology. By reducing transportation of the organic waste to distant locations, the company estimates this will result in approximately 15,000 tonnes of CO2 emissions prevented annually. The waste materials will be converted into renewable natural gas (RNG) and nutrient-rich organic fertilizers.

The facility is expected to generate between 350,000 to 400,000 gigajoules (GJ) of RNG per year – enough to heat approximately 5,000 homes, according to The Convertus Group. The company stat-

ed that the RNG being produced at the facility will be of interest to multiple utility companies looking for cleaner and more sustainable energy sources.

“Additionally, the nutrient-rich fertilizer from the facility will be available to local farmers and can be land-applied to improve soil health and increase crop yields, helping boost local agriculture and close the loop for a more sustainable future,” Gudla said.

As one of Ontario’s largest organic waste-to-energy projects, the project received support from various levels of government.

“Convertus has received $5 million in government funding to develop the Convertus York Biofuel Facility. This investment includes $3 million from the Federal Economic Development Agency for Southern Ontario (FedDev Ontario) as part of a federal initiative for a greener economy and $2 million from Ontario’s Advanced Manufacturing Innovation Competitiveness (AMIC) stream,” Gudla said.

A community Q&A session was held as part of the planning process that included residents and stakeholders in York Region and the surrounding area.

“This provided an opportunity to ask questions and learn more about the project. No specific concerns were brought forward during the session,” Gudla said.

During its construction, the Convertus York Biofuel Facility is expected to generate more than 50 jobs for contractors, and once completed, will provide 15 longterm full-time operational jobs contributing to local economic development. •

Photos courtesy of Convertus Group.

Arun Gudla, vice-president of strategic initiatives at Convertus Group.

WPAC 2025 Conference discusses bioheat opportunities in Halifax

Bioheat was a hot topic of discussion during Day 1 of the Wood Pellet Association of Canada’s annual conference, which took place from Sept. 23 to 24 in Halifax.

Themed “Biomass for a Low-Carbon Future,” Day 1 of the conference offered attendees a variety of sessions covering safe biomass storage best practices; powering the net-negative transition; decarbonizing industry; bioheat opportunities for Canada; and more.

The “Bioheat Opportunities for Canada” panel discussion showcased projects and initiatives from Atlantic Canada, the Northwest Territories, Sweden and Austria.

The session featured panelists Jonathan Levesque, general manager of Biomass Solution Biomasse (BSB); Mark Heyck, executive director of the Arctic Energy Alliance; Jean Blair, director of planning and outreach at TorchLight Bioresources; Gustav Melin, Chaiman of World Thermal Services in Sweden; and

The “Bioheat Opportunities for Canada” panel discussion showcased projects and initiatives from Atlantic Canada, the Northwest Territories, Sweden and Austria.

Christiane Egger, deputy manager, OÖ Energiesparverband, Austria.

The panel was moderated by Reg Woods, general manager for Grand River Pellets Limited.

Local projects were the first to be presented with BSB’s Jonathan Levesque discussing a recent biomass boiler installation at Paroisse Notre-Dame-des-Prodiges, a multi-purpose facility and Catholic church in Kedgwick, N.B., which had switched over to wood pellets as its primary source of heat.

The church and its various facilities were being heated with firewood until the individual donating the wood passed away. With no one else in the community donating the firewood to feed the old firewood boiler, the church’s leaders needed to find an alternative source of heat and

Reg Woods, general manager for Grand River Pellets Limited, introduces panelists during the Bioheat Opportunities for Canada session.

decided to purchase three oil-fired boilers. At the time, oil was cheap. But once energy prices spiked, the church found itself in a poor position financially.

“That was a bad move because with 38,000 litres to keep those three buildings heated properly, they were pretty desperate in 2024,” Levesque told the crowd.

Fortunately, BSB was able to convince the church’s leadership to swap out the primary oil-fired boiler for a Herz Firematic 150kW biomass boiler fuelled with wood pellets.

“They were paying $60,000 a year for oil, compared to $25,000 for pellets,” Levesque said, explaining that it is estimated that the new system will consume about 80 tonnes of wood pellets annually.

To pay for the installation of the new boiler system, the church performed fundraising activities within the community and took advantage of the NB Power Energy Efficiency Program, which covered 25 per cent of the cost off the installation since they were heating with oil fuel.

NORTHERN OPPORTUNITIES

Mark Heyck of the Arctic Energy Alliance presented next, discussing the adoption of biomass throughout the N.W.T., which has become a champion of biomass use for space heating. The Arctic Energy Alliance is a non-profit that was created in the late 90s by the Government of Northwest Territories as an entity to deliver programs around energy efficiency and renewable energy technologies.

“The idea at the time was to create a non-profit that could be a little more flexible as a public-facing service delivery agency,” Heyck explained. “We’ve grown considerably over the years. We have our headquarters in Yellowknife, but we also have five regional offices through the Northwest Territories, and that allows us to make sure that our programs and services are being equitably delivered to all 33 communities in the Northwest Territories.”

Heyck said that the percentage of houses and buildings on space heating in the territory fuelled by biomass is probably the highest in Canada.

“So, how did we get there? One of our benefits of being a small jurisdiction, population wise, is that as a territory, despite our vast geography, we’re 43,000 people spread over 1.1 million square kilometres in 33 communities. So, it’s a really small community,” he said. “Whether it’s between decision makers at the political level, people in government, people working in the private sector, it’s not hard to connect with each other, strike up conversations and move initiatives forward.”

Bioheat was first introduced to the N.W.T. by Bruce Elliott, an immigrant from New Zealand who owned and operated a company in the early 2000s called Fiberglass North.

“Bruce had a large facility with large main doors that were constantly opening and closing throughout the winter, and Bruce was trying to figure out what he could do about his high heating costs. He was using heating oil at the time to heat his

facility. So, Bruce started to learn about wood pellets and brought the concept of wood pellets and using them for bioheat spacing,” Heyck explained.

Elliott was so confident in the technology that he started up another company called Arctic Green Energy and installed the first wood pellet boiler in the N.W.T. at the territory’s main correctional facility in the mid-2000s.

“Bruce was so confident that he approached the Government of Northwest Territories and said, ‘I will invest and cover all the capital costs of this installation, and you sign a long-term key sales agreement with me, and I will sell you that heat. That was how the first large-scale biomass wood pellet boiler came to be in the Northwest Territories,” Heyck recalled.

Not long after the first biomass boiler was installed, government and residents took notice of wood pellets as a low-cost option for space heating. Within a couple

Combustible Dust Specialists

of years, the City of Yellowknife opted to install a wood pellet boiler at a cluster of recreational facilities including a community arena, a swimming pool and a curling space. In this case, the city chose to purchase the boiler from Elliott’s company and pay for the installation so it could realize the savings themselves instead of paying his company for the heat.

In 2006, the City of Yellowknife adopted its first community energy plan that identified biomass as the primary option for space heating and recommended that the city explore the possibility of converting all of its facilities to biomass with wood pellets as the primary choice of bioheat fuel.

Shortly after the community energy plan was released, the territory’s largest private landlord at the time started installing boilers in all of their apartment buildings.

“It grew from that point and really began to spread around the territory,” Heyck said, crediting the Government of N.W.T. for its support of biomass use for building up the sector in the marketplace.

“Coming up on 20 years now, they’ve put a very strong emphasis on wood pellet biomass space heating for all facilities they are responsible for managing throughout the Northwest Territories – schools, health centres, rec centers… we’ve seen wood pellet boilers being deployed basically in every corner of the Northwest Territories. So, that’s been really positive to see,” Heyck said.

The overwhelming majority of wood pellets supplied to the N.W.T. come from northern Alberta. Heyck was happy to note that the use of bioheat technologies in the N.W.T. have been viewed as an apolitical technology.

“When we’re talking about green energy, there can be some tensions between different people on different ends of the political spectrum, as you know,” he said. “I’m very pleased to say that biomass is an apolitical technology. If you’re an environmentalist, you love the low carbon aspects of it. If you’re a fiscal conservative, you love the low cost of it, and so, we all happily came together to promote the technology and make sure that we were deploying it as much as possible across the N.W.T.”

A GROWING FUEL SOURCE

TorchLight Bioresources’ Jean Blair offered attendees a look at the Canadian Bioheat Database, an interactive bioheat dashboard showing nearly 700 biomass systems in place across the country approaching a total of 500 MW of thermal and a demand of over 250,000 residents.

“Installations are everywhere other than Nunavut,” Blair said, adding that there has been an increase of smaller boilers being installed with fairly good growth in a number of different biomass systems.

The largest growth regions for the adoption of biomass systems were in N.W.T.; southeastern Quebec; New Brunswick; and P.E.I.

Blair noted that much of the development was in clusters in various regions

across the provinces driven by provincial policies, procurement programs, and a lack of affordable heating alternatives such as natural gas.

“Federal support has been important as well, particularly in rural communities and in the agricultural sector, and then also just the availability of the regional technology suppliers and regional champions to move these projects forward and to provide technical,” Blair explained.

OVERSEAS SUCCESS

Gustav Melin discussed Sweden’s bioheat success with attendees. More than 96 per cent of the energy that the forest industry uses is renewable and the vast majority of that is bioenergy. District heating comprises 70 per cent of their energy from bioenergy, which largely displaced heating oil technologies. The push for biomass technologies in the country were driven by high carbon taxes and investment support.

Christiane Egger discussed how the use of biomass for heating experienced successful growth in Upper Austria. Residents in the region primarily use wood pellets for home heating that are delivered via tanker trucks by commercial suppliers to feed fully automated biomass boiler systems.

Wood chips are commonly used mostly for larger buildings, and cord wood is used in semi-automated systems for heating farms. These systems are often built as co-ops within farming communities where local farmers and forest owners provide the wood, which is chipped by chipping service providers.

“Bioenergy covers more than a third, nowadays, of our total heat demands in the domestic sector. And of that, I think about 10 per cent are from district heating, and most of these are small-scale bioenergy district heating networks,” Egger explained.

She said the successful growth of the forestry-fuelled bioenergy sector in Austria was largely due to a combination of financial incentives, regulatory instruments and legislation. She added that ensuring people are educated on the benefits of bioenergy systems is vital for successful adoption of these technologies.

“Change doesn’t start in your wallet; it

BSB general manager Jonathan Levesque.

Mark Heyck of the Arctic Energy Alliance.

starts in your brain. And if you’re not aware that this energy exists, and that it’s a good solution, nothing whatsoever is going to happen. No matter how good the technology is, it will not change anything.”

MARKET AND POLICY UPDATES

The WPAC Conference also offered attendees updates on market and policy updates for the wood pellet sector.

The panel discussion, “Market and Policy Update: Navigating Regulatory Change,” was moderated by Vaughan Bassett, president of WPAC and senior-vice president of biomass sales and logistics at Drax. The panelists included FutureMetrics president William Strauss; Fiona Matthews, bioenergy director at Hawkins Wright; Marta Imarisio, senior reporter at Argus Biomass; and Pierre-Jonathan Teasdale, director of Trade and International Affairs Division, Canadian Forest Service (CFS).

Pierre-Jonathan Teasdale kicked off the session explaining the role of the CFS and discussing the policy environment for biomass, specifically wood pellets, as it relates to the role of the federal government. The CFS is the international and domestic voice for the forest sector in Canada and provides advice, expertise and policy support from its office in Ottawa and six regional offices across the country.

“For us, the forest sector is a key pillar of the Canadian economy, supporting good jobs, supplying low-carbon products, and the biomass and wood pellets sector is certainly part of that,” Teasdale

told the crowd.

The CFS supports the forest sector through grants and contributions through a range of programs. Currently, it has five competitiveness programs delivering a range of support to the forest sector in the areas of innovation, market diversification and Indigenous engagement. The CFS is also helping the industry prepare for meeting the EU requirements for its Regulation on Deforestation-free Products (EUDR), which were delayed by one year this past September.

“We provided some support to WPAC, for example, to develop a pilot traceability platform. I think that the sector is well ready to meet the EUDR requirements, which is good news,” Teasdale said. “Internationally, we are also supporting Canadian participation in ISO standards for solid biofuels exports. This includes standards for testing wood pellets, as well as for their safe storage.”

ysis, it conducts yearly surveys on the sector, collecting information and data on wood pellet mills, bioheat used in commercial and institutional settings, and the industrial use of wood for energy. The CFS is in the process of collecting 2024 data and should be able to release this information in a webinar this November, as well as publish it on the CFS website.

Internationally, one trend that the CFS has identified in recent years is the need for wood pellets to be sourced from legal and sustainable sources, which creates a pressure of transparency and traceability, Teasdale told the crowd.

ELEVATE YOUR PRODUCTION LINE WITH ON-LINE MOISTURE MEASUREMENT

To help CFS provide support and anal-

ELEVATE THE PRODUCTION LINE WITH AUTOMATED MOISTURE MEASUREMENT

Engineered to deliver unparalleled accuracy and reliability: continuous near-infrared moisture analysis enhances product quality and consistency, plant efficiency, lowers energy costs, and reduces waste.

MoistTech’s Non-Contact Moisture Measurement Technology is Designed for Seamless Integration into Existing Production Line

“Although Canada is recognized as a leader in sustainable forest management, it still creates uncertainty for producers and could lead to increased costs to export in those markets,” he said. “Given that EU is the third [largest] market in importance for the wood pellet sector, this is a top priority for us.”

The CFS is working with the provinc-

Drax’s Vaughan Bassett moderated the panel session on market and policy updates.

es, territories, and industry associations, such as WPAC, while engaging with European officials to talk about Canada’s strong, sustainable forest management practices, legal framework, and low risk of deforestation.

“We continue to monitor and report on the state of Canada’s risk, which provides reassurances to most markets that Canada is still a great trading partner,” Teasdale said,

Teasdale also touched on the recently announced $500 million in funding for the forest products sector, which will focus on innovation, diversification, and targeted support for Indigenous-led forestry biomass development.

“As part of that, our team will launch a diversification program that targets offshore markets. There will definitely be support provided to the pellets industry on that [ie. the pellet sector will be among the sectors eligible to apply for support], and we’re actively working on measures to be announced promptly in the new year,” he said.

CARBON TRANSITION

FutureMetrics president Bill Strauss discussed the need to transition out of a carbon-based energy economy, and the role that wood pellets and biomass can play.

“Now, for many, many, many years in a row, we’ve hit new records for carbon dioxide concentrations the atmosphere…

the Earth is not able to manage this kind of rapid increase in carbon dioxide emissions,” he said.

Strauss said that a strategic plan is needed to combat the rising carbon emissions and reducing reliance on fossil fuels. He showed the U.K.’s energy mix as an example that can be emulated by other countries, which generates a significant amount of power generation from the Drax Power Station and Lynemouth Power Station, both fuelled by biomass (wood pellets), as well as wind, solar and nuclear energy.

Strauss added that the impact of climate change is affecting the insurance industry and that he is optimistic that this will help push policy goals forward related to the adoption of more alternative energy sources, reducing the use of fossil fuels.

“This means the cost of doing business is going up. And even the most conservative businesspeople who think climate change is a hoax, they’ll get the message when their pocketbook is being invaded by climate change issues, and I think this is going to cause change,” he said.

TRENDS, TRADE AND POLICY

Hawkins Wright’s Fiona Matthews discussed global demand trends, trade flows and policy environments during the panel session.

After challenging years in 2022 and

2023, the wood pellet sector rebounded in 2024 with the market experiencing a nine per cent year-on-year increase reaching 49 million tonnes. This was despite a slowdown in the Asian market.

“The key factor driving that annual growth in 2024 was a return to normal historic levels of generation from converted power stations in the U.K., and we saw actually a huge jump of 3 million tonnes additional demand emerge in the U.K. last year,” she said. “We expect to see a similar increase this year, with the U.K. likely to return to its previous peak around 9 million tonnes in 2025.”

Matthews then offered the crowd a look at trade flows presenting some key data on major wood pellet importers and exporters, shown as a 12-month moving total. Using the latest available data that was available up to June 2025, she discussed the trends taking place so far this year. The U.K. market was up 18 per cent from the previous 12-month period, while the Japanese market was up 29 per cent year over year, due to new feedin-tariff supported power plants coming online. However, there was a 10-per-cent reduction in wood pellet imports into the Netherlands over the previous 12-month period.

In terms of major supply regions, Matthews said there has been huge growth in Vietnamese exports.

WPAC Conference attendees got the opportunity to tour one of Shaw Resources’ wood pellet plants.

“Vietnamese pellet producers are very successfully building out their capacity, increasing their production rates to serve the demand in Japan and Korea,” she said.

The U.S. wood pellet market experienced an increase in exports of two per cent, year over year, while Canada also experienced an increase in exports of five per cent over the past 12-month period, overcoming some feedstock availability challenges that had previously supressed outputs.

However, there is some uncertainty facing the wood pellet market. Looking forward, Matthews stated that her company is forecasting a reduction of over 4 to 5 million tonnes of wood pellet demand in the European market, largely fuelled by changing energy policies in the U.K. and the Netherlands.

Matthews also discussed the potential impact of the EU’s Renewable Energy Directive, also known as RED III.

“Some of the key requirements of RED III are The Cascading Principle, which now has been implemented at member state level, and also a ban on the use of industrial grade roundwood. But both of these aspects are being implemented with some variations across different member states, and the consequences of this is that there will be variations in different end user requirements across the European

market, depending on how those individual member states implement those rules,” Matthews explains. “There could be a consequence in terms of feedstock sourcing for pellet producers selling into these different countries and countries.”’

Matthews also touched on the impact of the delayed implementation of the EUDR. She said that her company has seen some signs of the expected deadline driving some increased stock levels in the European market.

“Actors were definitely taking this seriously and there’s been a lot of investment through the supply chain, managing the data collection and due diligence requirements,” she said.

SPOT PRICES AND FREIGHT RATES

Marta Imarisio, senior reporter at Argus Biomass, presented on the wood pellet market with a focus on the upcoming heating season. Imarisio said that spot prices had been rising so far this year, ahead of the 2025-26 heating season until the end of August, but that things have changed slightly in September.

During the 2024-25 heating season, some end users were stocking up ahead of the EUDR implementation, which ended up being delayed by one year, and now, by an additional year. The market was also supported by strong biomass use across northwestern Europe this past winter. So far this year, Argus has not seen the same wood pellet stockpiling taking place by end users in the bioheat space.

Freight rates have been creeping up in the past two quarters of 2025. Imarisio stated that the increasing rates are being driven up by U.S. fees on Chinese-owned vessels, which will take effect on October 14, 2025.

Chinese vessels are starting to move towards the Pacific Ocean to avoid incurring the charges, while non-Chinese-owned vessels are remaining in the Atlantic Ocean due to strong demand, Imarisio explained.

“We’ve been seeing, since Q2, high demand for vessels with charter rates creeping up compared to earlier in the year, and that is still the case. These price increases are applying mostly to larger size vessels, so supermaxes and ultramaxes, which are the larger sizes that are usually used for wood pellets,” she said. •

Attendees toured the Halifax Grain Elevator.

Fixing the big stuff

YWhat suppliers need for explosion protection design

By Diane Cave

ou’ve sorted through your DHA (dust hazard assessment), you’re knocking out the easy stuff like a champ, now it’s time to embark on your first larger project. These projects are the ones requiring large amounts of capital, downtime and planning. Where do you start, and who do you talk to if you want to make sure everything goes a smoothly as possible?

First, we need to figure out the objective of the project.

What exactly is it that you’re trying to fix is going to shape how you go about fixing it.

Any company embarking on a path to fixing DHA deficiencies should have a coherent Management of Change process in place before starting. This process should make sure all the right people are involved from engineering to environmental, production as well as health and safety folks.

Now that we’ve chosen what we’re going to fix and involved all the right people internally it’s time to figure out how to get the most out of downtime.

Typically, it makes sense to upgrade all the items that are deficient with a vessel. You might as well fix it all and then more or less be done with it. Let’s look at some best practices when working with a supplier.

Since big upgrades to most vessels outlined in a DHA is usually explosion protection, we’ll focus there. The installation of explosion protection can be very challenging and require a lot of footwork. What information is a supplier of explosion protection looking for and why?

A lot of equipment suppliers will have standard templated sheets they give you to fill out, but sometimes the information can be convoluted and hard to understand. Let’s break down the information that is key for making the right decisions for explosion protection.

No matter what type of explosion protection (vents, chemical, etc.) you plan on installing, the Kst and Pmax of your material are the first thing you need. Kst and Pmax values are determined through lab testing and are specific to your dust.

The Kst, or the dust deflagration index, is a measure of the relative severity of a dust explosion compared to other dusts. It essentially tells you how combustible dust is. The higher the Kst value the more combustible a dust.

The only time you don’t have to worry is if your Kst is zero, and your dust isn’t combustible.

Pmax is the maximum pressure that can be generated during a dust explosion in a confined space, by your dust.

“No matter what type of explosion protection (vents, chemical, etc.) you plan on installing, the Kst and Pmax of your material are the first thing you need.”

It’s a crucial parameter for assessing the severity of a dust explosion and understanding the potential for damage in enclosed environments. The higher these two values the larger or more explosion protection you require.

The final number in the magic trio is the Pred (reduced pressure) of the vessel. This value tells you how much pressure your vessel can withstand.

There are two ways to find the Pred of your vessel. You can contact the equipment supplier to get the vessel’s Pred or complete a finite element analysis (FEA) on the vessel. Either way, you’ll need this number for your explosion protection supplier.

Once you’ve got these three values, the project engineer will be able to determine if reinforcing the vessel is necessary to accommodate the explosion protection.

Other helpful values include operating pressure and temperature. Knowing the standard operating pressures helps ensure that the installed explosion protection system will not be falsely deployed under standard operating conditions. Operating temperatures are very important to prevent malfunction of equipment due to freezing of equipment.

Last, is the geometry and orientation of the vessel. The geometry (round vs. square) or location of inlets can all affect the location, size and quantity of the explosion protection required.

This is the main information that the explosion protection equipment suppliers will be looking for. By knowing what you need, involving the right people and understanding the DHA report, you and your supplier can make sure you’re getting the most bang for your buck. •

LOWER FUEL COSTS

Optimizes the boiler lead/ lag operation by continually monitoring the rate of change in steam pressure which allows multiple boilers to work together efficiently to achieve system set points.

REDUCE EMISSIONS

Reduce greenhouse gas emissions by maintaining proper air-to-fuel ratios.

MAXIMIZES BOILER ROOM EFFICIENCY INCREASES PRODUCTIVITY REDUCES OPERATING COSTS

High Efficiency Integrated Control Systems for all Hurst Product Lines

Offering integration and scalability, the new, high efficiency Integrated Control Systems from Hurst Boiler for boiler room monitoring and communications provide advanced supervisory boiler controls for all new and legacy Hurst products. FireMaster, BoilerMaster & BioMaster may also be configured to work with any existing boiler - no matter the manufacturer.