11 minute read

Is forex trading legal in Philippines? A Comprehensive Guide

from Exness

by Exness Blog

Introduction to Forex Trading

Definition of Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of global currencies. This decentralized market operates through a network of banks, brokers, and financial institutions, allowing participants to speculate on currency price movements. For example, a trader might buy the EUR/USD pair if they believe the euro will strengthen against the dollar. The forex market is the largest financial market in the world, with over $6 trillion traded daily. This high liquidity, combined with 24-hour accessibility, makes forex trading attractive to retail traders, businesses, and governments worldwide. In the Philippines, forex trading offers opportunities for investors but is subject to specific legal regulations.

Top 4 Best Forex Brokers in Philippines

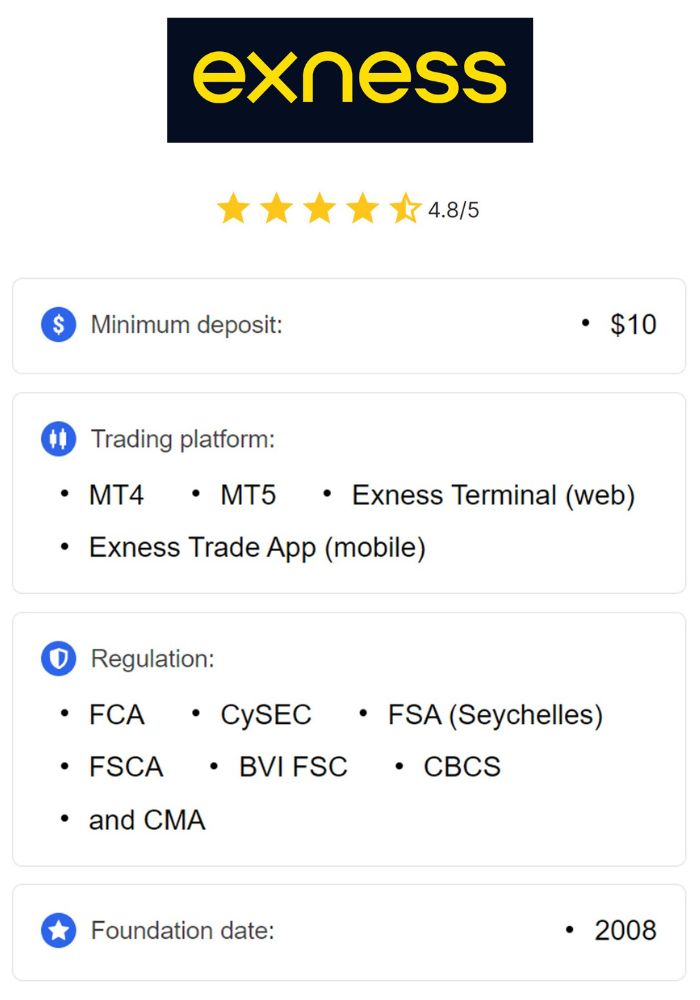

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Importance of Understanding Legality

Understanding the legality of forex trading is crucial for Filipino traders, as engaging in unregulated or unauthorized trading can lead to financial loss and legal consequences. Forex trading in the Philippines is legal; however, it is closely monitored by regulatory bodies, and only licensed brokers are permitted to operate. Knowledge of local regulations helps traders make informed decisions, ensuring they trade within the bounds of the law and avoid unauthorized brokers. This awareness not only promotes safe trading practices but also enhances investor protection, helping traders safeguard their investments.

Overview of Financial Regulations in the Philippines

Role of the Bangko Sentral ng Pilipinas (BSP)

The Bangko Sentral ng Pilipinas (BSP), as the central bank of the Philippines, plays a fundamental role in regulating the nation’s monetary policy and financial markets. While the BSP does not directly oversee retail forex trading, it establishes the guidelines that govern currency exchanges and international transactions, ensuring stability and transparency in the market. The BSP enforces policies that prevent excessive risk in currency-related activities and works to combat illegal trading and money laundering. Through its regulatory framework, the BSP sets standards for authorized financial institutions, creating a controlled environment for currency trading and ensuring that forex activities align with the country’s economic objectives.

Securities and Exchange Commission (SEC) Regulations

The Securities and Exchange Commission (SEC) of the Philippines is the primary body responsible for regulating investment and securities markets, including forex brokers. The SEC mandates that all brokers offering forex trading services to Filipinos must be registered and licensed, adhering to transparency, client protection, and financial reporting standards. The SEC regularly issues advisories warning the public about unlicensed forex brokers and platforms, helping traders avoid scams and fraudulent activities. By monitoring licensed brokers and penalizing those who violate regulations, the SEC works to ensure that the forex market operates fairly and securely in the Philippines.

Legal Framework for Forex Trading

Current Laws Governing Currency Trading

The legal framework for forex trading in the Philippines is shaped by several key laws, including the Anti-Money Laundering Act and the Foreign Exchange Liberalization Act. These laws mandate transparency in currency transactions, requiring banks and financial institutions to report large forex trades and verify client identities. The liberalization of foreign exchange controls allows Filipinos to engage in forex trading, but it emphasizes the importance of dealing with licensed brokers. This framework is designed to prevent illegal activities, ensure market stability, and create a secure environment for investors.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Compliance with Local Regulations

Compliance with local regulations is essential for both forex brokers and traders in the Philippines. Licensed brokers must adhere to strict guidelines on capital requirements, transparency, and customer fund protection. They are also required to segregate client funds from operational accounts to safeguard traders’ assets. For traders, compliance involves using only SEC-registered brokers and adhering to tax obligations. Non-compliance can result in penalties for brokers, and traders who engage with unauthorized brokers risk financial loss and limited legal recourse. Thus, regulatory compliance supports a stable, fair, and protected trading environment.

Registration and Licensing Requirements

Brokers Operating Legally in the Philippines

Forex brokers operating legally in the Philippines must be registered with the SEC and meet specific licensing requirements. These brokers undergo rigorous evaluation, ensuring they have sufficient capital, transparent reporting practices, and systems to protect client funds. Licensed brokers must also comply with anti-money laundering laws, submitting regular reports to the BSP. The licensing process ensures that brokers are financially stable, trustworthy, and capable of providing quality service to Filipino traders. By choosing a licensed broker, traders can avoid potential fraud and gain access to reliable trading platforms that meet regulatory standards.

Importance of Choosing Registered Brokers

Selecting a registered broker is a crucial step for forex traders in the Philippines. Registered brokers are monitored by the SEC and are required to adhere to strict financial and operational guidelines, which reduce the risk of fraud and provide traders with legal protection. Unregistered brokers often operate outside Philippine jurisdiction, offering high leverage and promising unrealistic returns, but with no regulatory oversight. Engaging with registered brokers not only ensures compliance with Philippine law but also offers greater transparency, access to dispute resolution mechanisms, and the security of knowing that the broker operates within established legal frameworks.

Risks Associated with Forex Trading

Regulatory Risks

Regulatory risks are inherent in forex trading, particularly when traders engage with unlicensed or offshore brokers. The SEC frequently updates its list of unlicensed entities, warning the public against unauthorized brokers and fraudulent schemes. Traders who work with unregistered brokers expose themselves to risks such as lack of legal recourse and increased chances of financial loss. Regulatory risks also include potential changes in forex laws, which could impact trading conditions. Staying updated on local regulations and adhering to compliance requirements can help traders manage regulatory risks and ensure they operate within a protected environment.

Financial Risks for Traders

Forex trading is highly speculative, and the financial risks involved are significant. Market volatility can lead to sudden price changes, resulting in gains or losses in a matter of seconds. Leveraged trading, while allowing traders to control larger positions, amplifies both profit potential and losses. Filipino traders must be aware of the risks associated with high leverage and currency fluctuations and are encouraged to use tools like stop-loss orders to manage potential losses. Understanding and preparing for these financial risks is crucial for sustainable trading, as it helps traders protect their capital and make informed decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tax Implications of Forex Trading

Income Tax on Trading Profits

In the Philippines, forex trading profits are generally subject to income tax, similar to other forms of investment income. Traders are required to report their earnings as part of their annual income tax filings with the Bureau of Internal Revenue (BIR). The tax rate for forex trading profits depends on the trader’s overall income and tax bracket. Additionally, professional traders who engage in frequent transactions may be subject to different tax treatments. By understanding their tax obligations, forex traders can avoid legal issues and ensure compliance with Philippine tax laws.

Reporting Requirements for Traders

Forex traders in the Philippines must maintain accurate records of all transactions and report their earnings to the BIR. This includes documenting profits, losses, and transaction details to ensure transparency. Licensed brokers provide statements and account summaries that facilitate the reporting process, helping traders calculate their taxable income accurately. Failure to report forex earnings can result in penalties and tax audits, so traders are advised to stay organized and consult tax professionals if needed to fulfill their reporting obligations.

Consumer Protection Measures

Role of the BSP in Protecting Investors

The BSP plays an active role in protecting Filipino forex traders by setting guidelines for safe currency trading and monitoring the activities of financial institutions involved in the forex market. Although the BSP does not directly regulate retail forex trading, it collaborates with the SEC to monitor the market and ensure compliance with anti-money laundering regulations. The BSP also provides resources and information for consumers, helping them make informed decisions and avoid scams. This oversight promotes a safe trading environment and upholds the integrity of the Philippine financial system.

Importance of Due Diligence

Due diligence is essential for forex traders in the Philippines, as it helps them avoid high-risk brokers and fraudulent schemes. Conducting due diligence involves verifying a broker’s SEC registration, reviewing customer feedback, and understanding the broker’s reputation in the industry. Traders should also educate themselves about forex trading and the potential risks involved. By practicing due diligence, traders can protect themselves from unlicensed brokers, minimize financial risks, and make better-informed investment decisions.

Popularity of Forex Trading in the Philippines

Growth Trends in the Forex Market

Forex trading has become increasingly popular in the Philippines, driven by rising internet access, mobile trading platforms, and financial literacy programs. Many Filipinos see forex trading as an opportunity to diversify their income, and the growing number of licensed brokers has made it easier for individuals to participate. Social media and online communities have also contributed to the rise in popularity, as traders share strategies, market insights, and trading experiences. The growth of forex trading in the Philippines reflects a broader trend of digital investment and financial engagement.

Factors Contributing to Its Popularity

Several factors have contributed to the popularity of forex trading in the Philippines. The 24-hour accessibility of the forex market, the potential for significant returns, and the convenience of mobile trading apps attract a diverse range of traders. Additionally, the Philippine tax structure, which is favorable for individual investors, encourages participation in forex. The availability of free educational resources and online platforms has also lowered the entry barrier, making forex trading an appealing option for younger investors seeking new income streams.

Comparison with Other Investment Forms

Forex vs. Stock Market

Forex and stock trading differ in market structure, accessibility, and volatility. The forex market operates 24/7, providing flexibility that the Philippine Stock Exchange, with its limited trading hours, does not offer. Forex trading is generally more volatile than stock trading, making it suitable for risk-tolerant investors. Additionally, forex trading involves currency pairs, while stock trading involves shares of individual companies. Filipino traders interested in short-term gains may prefer forex, while those seeking long-term growth may find the stock market more stable.

Forex vs. Cryptocurrency Trading

Cryptocurrency trading has gained popularity in the Philippines, offering an alternative investment option alongside forex. Both forex and cryptocurrency markets are known for high volatility, but cryptocurrencies are decentralized and lack the regulatory oversight present in forex. Filipino traders interested in crypto must consider the higher risks of price manipulation and lack of consumer protection. Forex trading, with its established regulatory framework and risk management tools, appeals to those who prefer a more structured trading environment.

Educational Resources for Aspiring Forex Traders

Courses and Training Programs

Various institutions in the Philippines offer courses on forex trading, providing insights into technical analysis, market trends, and trading psychology. Licensed brokers often conduct seminars and webinars, offering beginners a chance to learn from industry professionals. These training programs help traders understand the complexities of forex, build a foundation of knowledge, and develop the skills needed for successful trading. Additionally, some brokers provide demo accounts, enabling beginners to practice trading in a risk-free environment.

Online Platforms for Learning

Online platforms like Investopedia, Coursera, and trading-focused forums offer valuable resources for Filipino traders. These platforms provide comprehensive tutorials, e-books, webinars, and courses on topics ranging from basic forex concepts to advanced trading strategies. Engaging in these online communities allows Filipino traders to expand their knowledge, stay updated on global economic trends, and interact with other traders, creating a supportive learning environment.

Common Myths about Forex Trading Legality

Misconceptions about Regulation

A common myth is that forex trading is unregulated in the Philippines. In reality, the BSP and SEC regulate forex transactions and oversee licensed brokers to protect traders. These regulatory bodies monitor brokers’ activities, enforce compliance with financial laws, and ensure transparency in the market. Understanding the role of these regulators helps traders distinguish between legitimate and unauthorized trading activities, promoting safe trading practices.

Debunking Myths Surrounding Taxes

Another misconception is that forex trading profits are tax-free in the Philippines. In fact, forex trading earnings are generally subject to income tax, and traders must report these profits as part of their taxable income. While certain accounts may fall below the taxable threshold, traders are advised to be aware of their tax obligations to avoid penalties. By understanding the tax requirements, traders can ensure compliance and prevent future issues with the BIR.

Conclusion on the Legality of Forex Trading in the Philippines

Forex trading in the Philippines is legal, provided traders engage with licensed brokers and comply with local regulations. The BSP and SEC oversee the market, creating a structured and safe environment for investors. Filipino traders are encouraged to conduct due diligence, understand their tax obligations, and select reputable brokers to avoid financial and regulatory risks. With growing popularity, favorable tax policies, and ample educational resources, the Philippines offers a promising environment for responsible forex trading. Traders can participate in the forex market confidently, knowing they are supported by a robust regulatory framework and the tools needed for success.

Read more: