16 minute read

Exness Standard vs Pro Account Review - Pros and Cons

from Exness

by Exness Blog

In this comprehensive Exness Standard vs Pro Account Review, we will explore the various features, benefits, and unique aspects of both account types offered by Exness. As a leading online brokerage, Exness provides a range of trading solutions tailored to meet the needs of traders at different levels of experience. Understanding the differences between these two accounts can significantly influence your trading journey.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

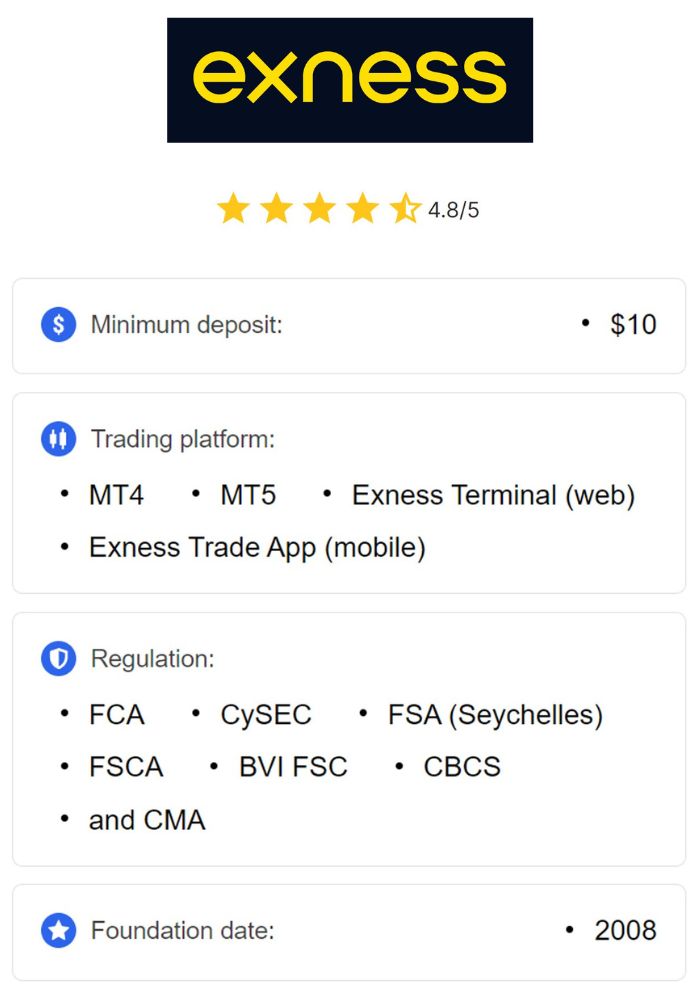

Exness is a globally recognized online brokerage firm that has gained traction for its user-friendly trading environment and competitive trading conditions. Founded in 2008, the broker has rapidly expanded its client base across various regions while maintaining a strong commitment to transparency and client satisfaction. In today’s review, we will delve into the core features of the Standard vs Pro accounts, helping you determine which option suits your trading style and objectives.

Overview of Exness as a Brokerage

Exness stands out in the crowded online brokerage landscape due to its extensive range of financial instruments, including Forex, precious metals, cryptocurrencies, and indices. With multiple licenses from reputable regulatory bodies such as CySEC and the British Virgin Islands FSC, Exness assures clients of its credibility and commitment to safety and compliance. This focus on operational transparency not only elevates client confidence but also helps Exness engage with a diverse clientele.

The broker aims to provide an intuitive trading experience, ensuring that traders of all skill levels can navigate the platform seamlessly. Whether you're a beginner looking to make your first trade or an experienced trader seeking to optimize your strategies, Exness caters to all.

Regulatory Compliance and Safety of Funds

One of the primary concerns for any trader is the safety of their funds. Exness addresses this through strict regulatory compliance and the implementation of robust security measures. Holding licenses from multiple jurisdictions means that Exness adheres to high standards related to operational transparency, financial security, and client protection.

Client funds are kept in segregated accounts, separate from the company's operational funds. This practice minimizes counterparty risk and protects customer deposits even during unfavorable market conditions. Additionally, Exness implements capital adequacy requirements and rigorous risk management practices, further enhancing the safety of client investments.

Understanding Account Types

As a potential trader, understanding the different account types available is crucial. Exness offers two primary account types: the Standard Account and the Pro Account. Each type is designed to cater to specific trading needs and styles, making it essential to comprehend their characteristics before making a decision.

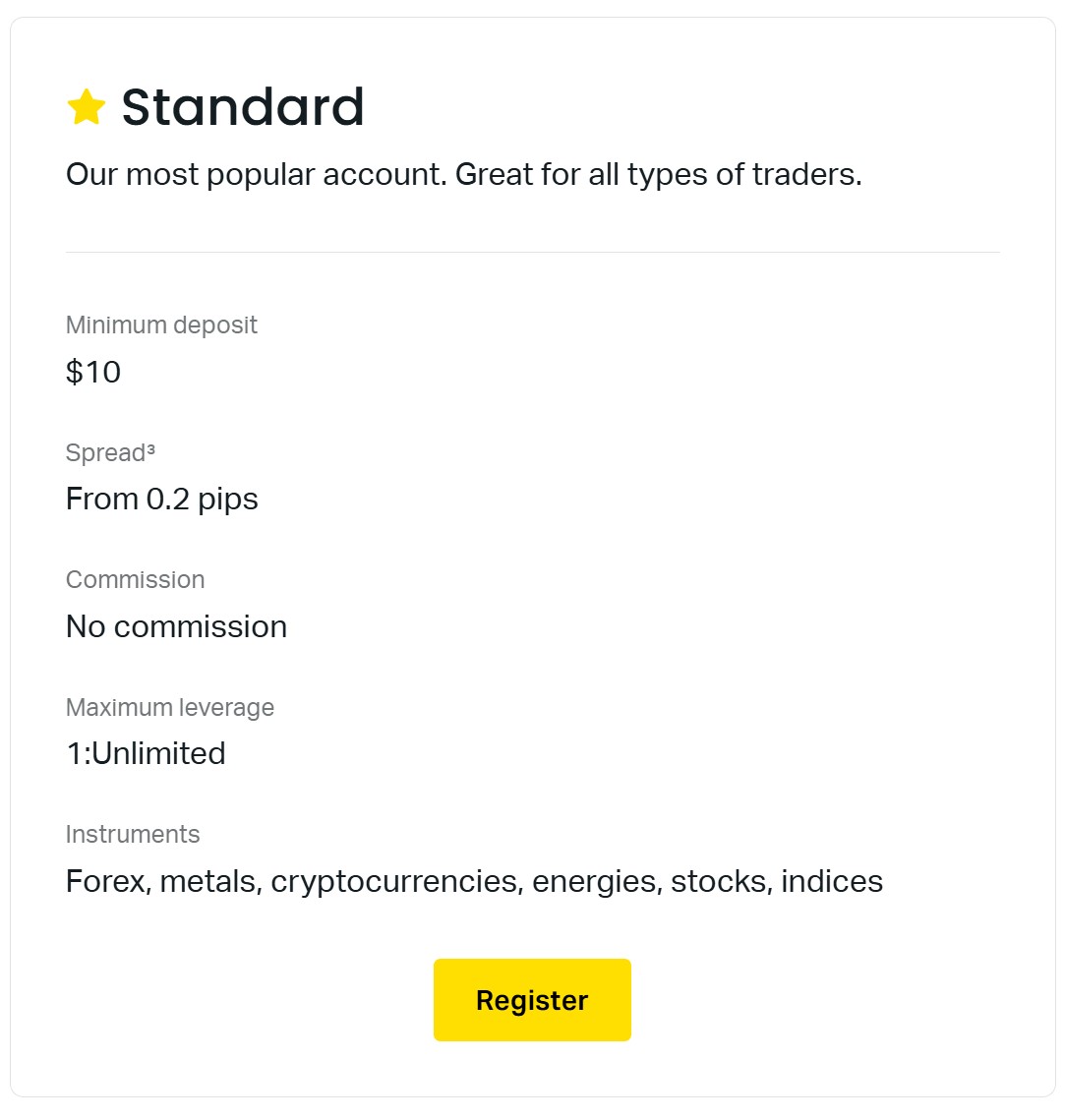

What is a Standard Account?

The Standard Account serves as an entry point for many traders, providing a straightforward and user-friendly trading experience. It is particularly well-suited for beginners who want to explore the world of Forex without being burdened by complex structures. Here, we’ll examine its key features in detail.

The Standard account typically offers variable spreads and does not involve any commissions, making it very convenient for new traders. The floating spreads are designed to adjust according to market volatility, ensuring that traders receive competitive pricing in varying market conditions.

This account type allows traders to take advantage of a maximum leverage of 1:2000, meaning they can control larger positions within the market with a relatively small amount of capital. This feature offers the potential for amplified profits, but it's also important to recognize the inherent risks associated with high leverage.

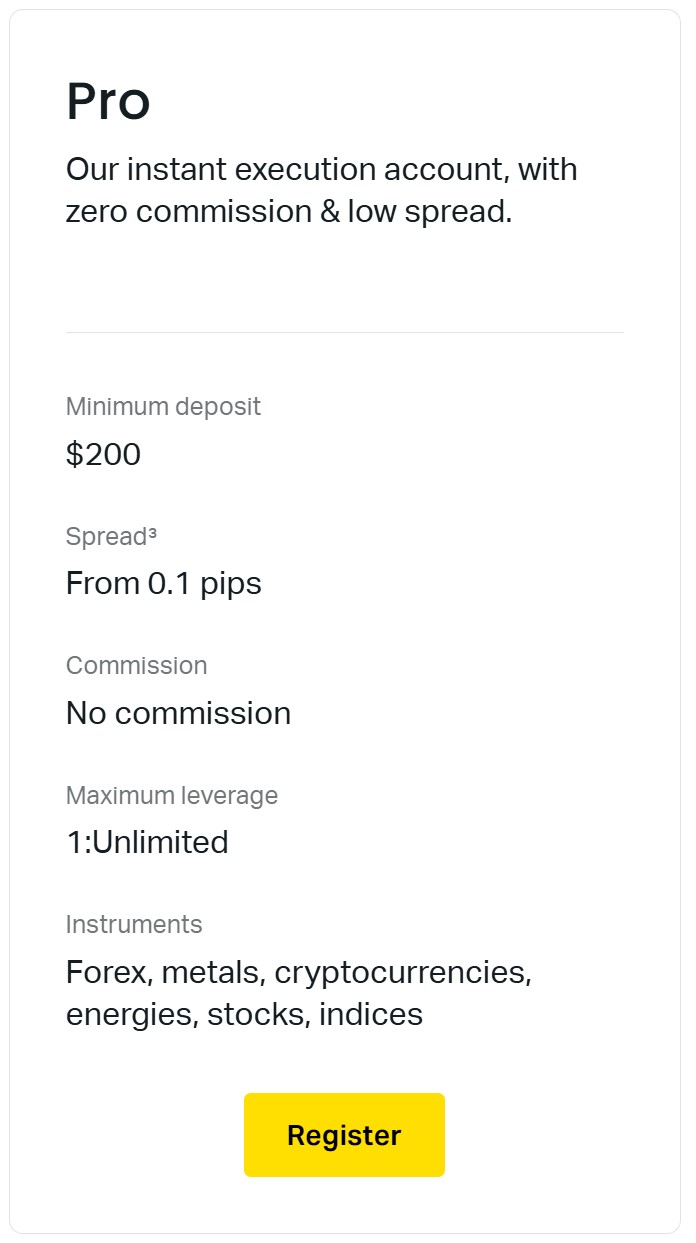

What is a Pro Account?

For experienced traders looking for tighter spreads and greater control over trading costs, the Pro Account presents an enhanced trading experience. This account type is aimed at active traders who prioritize reduced trading costs and potentially increased profitability.

The Pro account utilizes a raw spread structure, where the spreads represent the actual difference between bid and ask prices in the interbank market. Fixed commissions are applied per trade, allowing for transparent cost management—ideal for scalpers and high-frequency traders. Just like the Standard Account, the Pro Account also requires a minimum deposit of just $1, making it accessible for those seeking a more efficient trading setup.

Key Features of the Exness Standard Account

Understanding the key features of the Exness Standard Account is essential for traders considering this option. This account type may be particularly appealing for novices looking for simplicity in their trading.

Spreads and Commissions

The Exness Standard Account is characterized by floating spreads that fluctuate based on market conditions. While the spreads may widen during times of high volatility, Exness generally offers competitive spreads that reflect current market dynamics.

Importantly, no commissions are charged on trades executed in this account type, which adds to its convenience for those starting their trading journeys. By eliminating commission fees, traders can focus solely on the overall performance of their strategies without worrying about hidden costs.

Leverage Options

Leverage plays a pivotal role in trading, acting as a multiplier of your capital. For the Standard Account, Exness allows a maximum leverage of 1:2000. This means that for every dollar in your account, you can control up to $2000 in the market.

While the potential for amplified profits is attractive, it’s crucial for traders to understand the associated risks. Margin calls can occur if losses reach a defined level, prompting the broker to close positions to protect against further loss. Thus, effective risk management strategies should be employed to safeguard your investment.

Minimum Deposit Requirements

Another appealing aspect of the Standard Account is its low barrier to entry. With a minimum deposit requirement of just $1, aspiring traders can begin their trading endeavors with minimal financial commitment. This approach allows individuals with smaller capital bases to explore the Forex market, test strategies, and gain valuable experience without having to invest significant amounts upfront.

1️⃣ Open Exness Standard MT4 Account

2️⃣ Open Exness Standard MT5 Account

Trading Instruments Available

The Exness Standard Account provides access to a diverse range of trading instruments. Traders can engage in Forex trading by selecting currency pairs from major, minor, and exotic markets. Additionally, they can speculate on price movements of precious metals like gold and silver, trade energy contracts for commodities such as crude oil and natural gas, and gain exposure to leading global stock market indices.

Furthermore, the Standard Account enables trading in selected cryptocurrency pairs, allowing traders to capitalize on the dynamic digital asset market. This variety of instruments allows traders to diversify their portfolios and explore different trading opportunities.

Key Features of the Exness Pro Account

The Pro Account is tailored for seasoned traders who require advanced trading features and tools. Let's dive deeper into what makes this account an attractive option for active traders.

Spreads and Commissions

The most notable characteristic of the Exness Pro Account is its unique pricing model featuring raw spreads. These spreads represent the actual distances between bid and ask prices in the interbank market, generally resulting in tighter spreads than those found in the Standard Account.

However, fixed commissions are applied to each trade executed in the Pro Account. While this means that there are additional costs involved, it also allows traders to better control their trading expenses. For frequent traders, this enhanced cost management can lead to improved profitability over time as they manage their trades more effectively.

Leverage Options

Similar to the Standard Account, the Pro Account also provides maximum leverage of 1:2000. This consistency in leverage options is beneficial for traders who might switch between account types, allowing them to maintain similar trading strategies regardless of their chosen account.

However, the combination of tighter spreads and the potential for lower overall costs on the Pro Account can create favorable conditions for traders engaging in frequent trading activities, such as scalping. Effectively managing leverage alongside tight spreads can bolster profitability in the right trading environments.

3️⃣ Open Exness Pro MT4 Account

4️⃣ Open Exness Pro MT5 Account

Minimum Deposit Requirements

Like the Standard Account, the Pro Account also boasts a low minimum deposit requirement of just $1. This accessibility ensures that both new and experienced traders can open a Pro Account without facing exorbitant financial barriers. Consequently, this feature attracts a wide range of traders seeking a more sophisticated trading environment.

Trading Instruments Available

The array of trading instruments available on the Pro Account mirrors those of the Standard Account. Traders can explore Forex pairs, precious metals, energy contracts, global stock market indices, and select cryptocurrency pairs. This consistent offering ensures that traders do not sacrifice instrument variety when opting for the Pro Account.

Trading Platforms Offered by Exness

Choosing the right trading platform is fundamental to a trader's success. Exness offers various platforms catering to different preferences, including the popular MetaTrader platforms and its own proprietary solution.

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is one of the most widely used trading platforms globally, revered by traders for its user-friendly interface and comprehensive functionality. Exness offers MT4 on desktop, mobile, and web versions, ensuring traders can access their accounts from various devices.

MT4 is equipped with advanced charting capabilities, technical analysis tools, and automated trading through Expert Advisors (EAs). This versatility appeals to both novice and experienced traders looking to enhance their trading experience.

MetaTrader 5 (MT5)

MetaTrader 5 (MT5) represents a more advanced version of the MetaTrader platform, introducing additional functionalities to cater to sophisticated trading strategies. With improvements in technical analysis, order management, and backtesting capabilities, MT5 can be an excellent choice for traders focused on deep analysis and enhanced execution.

Exness provides both desktop and mobile solutions for MT5, ensuring flexibility for traders who thrive on using multiple devices to monitor their trades and assets.

Exness Proprietary Platform

Apart from the MetaTrader platforms, Exness also offers its own proprietary web-based trading platform. Designed to be user-friendly, this platform integrates charting tools, order management features, and real-time market information.

This proprietary solution can be particularly appealing for beginners who want a hassle-free experience without the complexities of advanced trading tools. The intuitive layout makes it easy for new traders to get started and navigate the functions effortlessly.

Comparing Spreads and Commissions

A critical part of evaluating the Standard vs Pro accounts lies in analyzing their respective spreads and commission structures. Understanding how these factors impact trading costs can help you make informed decisions.

Spread Differences between Standard vs Pro Accounts

The disparity in spread structures between the Standard vs Pro accounts is one of the most significant considerations for traders. The Standard Account operates on a variable spread basis, which fluctuates based on market liquidity and volatility. While these spreads can be competitive, they may widen during periods of high market activity.

Conversely, the Pro account features raw spreads that are generally much tighter. This variability can directly impact a trader's bottom line, especially for those executing frequent trades. A lower spread equates to lower trading costs, enabling traders to retain more of their profits.

Commission Structure Analysis

The commission structure is another pivotal factor to consider when comparing accounts. In the Standard Account, there are no commissions charged, simplifying the cost structure for novice traders. However, wider spreads can result in higher indirect costs.

On the other hand, the Pro Account employs fixed commissions based on trading volumes and instruments. While traders must account for these commissions, the narrower spreads can often lead to lower overall trading costs, ultimately benefiting seasoned traders who prioritize cost management.

Understanding Leverage in Trading

Leverage is a powerful tool in trading, and understanding how it applies to both the Standard vs Pro accounts is vital for effective risk management.

Leverage for Standard Account Users

For traders utilizing the Standard Account, maximum leverage of 1:2000 allows for substantial control over larger market positions. While this amplification can yield higher returns, it is equally important to recognize the risks it poses.

Risk management becomes paramount when using leveraged positions, as significant losses can occur quickly. Traders must develop robust strategies that encompass stop-loss orders, position sizing, and continuous monitoring of margin levels to avoid unwanted margin calls.

Leverage for Pro Account Users

Similarly, Pro Account users also benefit from a maximum leverage ratio of 1:2000. This consistency means that traders transitioning to the Pro account do not need to adjust their trading strategies concerning leverage.

The added advantage of the Pro Account comes from its tighter spreads. When combined with high leverage, traders can maximize profitability while minimizing the impact of trading costs. However, prudent risk management remains essential, whether you're a Standard or Pro account holder.

Account Management and Support Services

Excellent customer support is crucial to gaining confidence in any brokerage. The quality and availability of support services can enhance the overall trading experience, ensuring traders feel adequately supported in their endeavors.

Customer Support for Standard Account Holders

Exness provides dedicated customer support for all account holders, including those using the Standard Account. Traders can reach out to support through multiple channels, including live chat, email, and phone support.

The responsiveness and professionalism of the support staff can significantly impact a trader's experience. Many Standard Account traders have reported positive experiences, often highlighting the team's ability to resolve issues promptly and effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Customer Support for Pro Account Holders

Pro Account holders also enjoy the same level of customer support as Standard Account users. However, due to the more sophisticated nature of Pro trading, some traders may require specialized assistance. Exness's support team is trained to address a diverse range of inquiries and can provide insights tailored to advanced trading strategies.

Traders appreciate the commitment of Exness to ensure that all customers receive timely and relevant assistance, regardless of the account type they hold.

Withdrawal and Deposit Methods

Having flexible and efficient payment methods is essential for seamless trading. Exness recognizes the importance of this facet by offering various withdrawal and deposit options for both Standard vs Pro accounts.

Payment Methods for Standard Accounts

Exness supports a wide range of deposit methods for Standard Account holders, including bank transfers, credit/debit cards, and e-wallets. This variety allows traders to choose the most convenient option based on their preferences and geographical location.

Withdrawals are typically processed quickly, allowing traders to access their funds without unnecessary delays. The swift processing times contribute to an overall positive trading experience for Standard Account users, who often seek efficiency in managing their capital.

Payment Methods for Pro Accounts

Similarly, Pro Account holders can enjoy the same diverse payment options when depositing funds. However, given the potentially larger trading volumes, many Pro traders prefer using e-wallets for faster transactions.

Withdrawal processes remain efficient for Pro Account users, and the same commitment to promptness applies. This reliability in transaction handling can be instrumental for active traders who depend on quick access to their funds for reinvestment or other financial needs.

User Experience and Feedback

User reviews and feedback play a crucial role in assessing the practical implications of trading on Exness. Evaluating trader experiences from both the Standard vs Pro accounts can provide valuable insights to potential users.

Reviews from Standard Account Traders

Many Standard Account traders praise Exness for its user-friendly platform and ease of navigation. Beginners often find the lack of commissions appealing, allowing them to focus on learning the dynamics of trading without incurring additional costs.

Traders also highlight the effectiveness of customer support, noting quick response times and helpful resolutions to queries. Overall, the Standard Account appears to cater well to novice traders seeking a supportive environment to initiate their trading careers.

Reviews from Pro Account Traders

Pro Account traders, on the other hand, commonly express appreciation for the raw spreads and fixed commissions, which contribute to a more predictable trading cost structure. Experienced traders often emphasize the advantages of tighter spreads for their strategies, particularly for scalping and day trading.

Many Pro Account users value the advanced features found in the MetaTrader platforms and the availability of effective analytical tools to refine their trading strategies. The overall sentiment reflects satisfaction with the level of service provided, with traders feeling empowered to take charge of their trading outcomes.

Pros and Cons of Exness Standard Account

Evaluating the advantages and disadvantages of the Exness Standard Account can help traders determine if it aligns with their objectives.

Advantages of Using the Standard Account

One of the primary advantages of the Standard Account is its accessibility, with a low minimum deposit requirement of only $1. This invites aspiring traders to explore the financial markets without heavy initial investments.

The absence of commissions allows traders to execute trades without worrying about additional costs, while the floating spreads remain competitive. Overall, the user-friendly nature of the Standard Account provides an ideal foundation for beginners.

Disadvantages of Using the Standard Account

However, the Standard Account does have its drawbacks. The variable spreads can widen during periods of high volatility, which could negatively affect trading costs. In addition, the lack of commissions may not be suitable for experienced traders who prefer a more precise cost structure for their strategies.

Pros and Cons of Exness Pro Account

Examining the pros and cons of the Exness Pro Account is equally essential for potential traders contemplating this option.

Advantages of Using the Pro Account

The Pro Account offers several compelling advantages, particularly for experienced traders looking for tight spreads and fixed commissions. This pricing structure fosters better cost management and increases profitability, especially for high-frequency trading strategies.

The access to advanced tools and resources, including the latest features in MetaTrader platforms, enhances the overall trading experience. Additionally, the same low minimum deposit allows new traders to enter this sophisticated environment without excessive financial commitment.

Disadvantages of Using the Pro Account

Despite its benefits, the Pro Account may not suit all traders. The fixed commissions can add to overall trading costs, especially for those who do not engage in frequent trading. Furthermore, the tighter spreads may not appeal to beginners who are still learning the ropes and would benefit more from the simplicity of a no-commission structure.

Which Account is Right for You?

Ultimately, deciding between the Standard vs Pro accounts depends on individual trading goals, experience levels, and preferred trading strategies.

Considerations for Beginners

For novice traders stepping into the world of Forex, the Standard Account is likely the better option. Its user-friendly interface, absence of commissions, and low minimum deposit requirements create an inviting trading environment. New traders can focus on building their skills and understanding market mechanics without the pressure of managing commissions.

Considerations for Experienced Traders

Conversely, experienced traders who are comfortable navigating the complexities of trading may find the Pro Account more advantageous. The favorable pricing structure, advanced tools, and lower overall trading costs can lead to better profitability when implementing sophisticated strategies.

In summary, the choice between accounts hinges on your experience level and trading style.

Conclusion

In conclusion, the Exness Standard vs Pro Account Review illustrates the nuanced differences between these two account types. While the Standard Account provides a friendly and accessible entry point for novice traders, the Pro Account caters to the needs of experienced traders seeking tighter spreads and fixed commissions.

Both accounts come with their unique advantages and disadvantages, making it essential for you to assess your individual trading goals and risk tolerance before making a decision. By understanding these differences, you can embark on your trading journey with confidence and clarity, maximizing your potential for success in the dynamic world of online trading.

Read more: