14 minute read

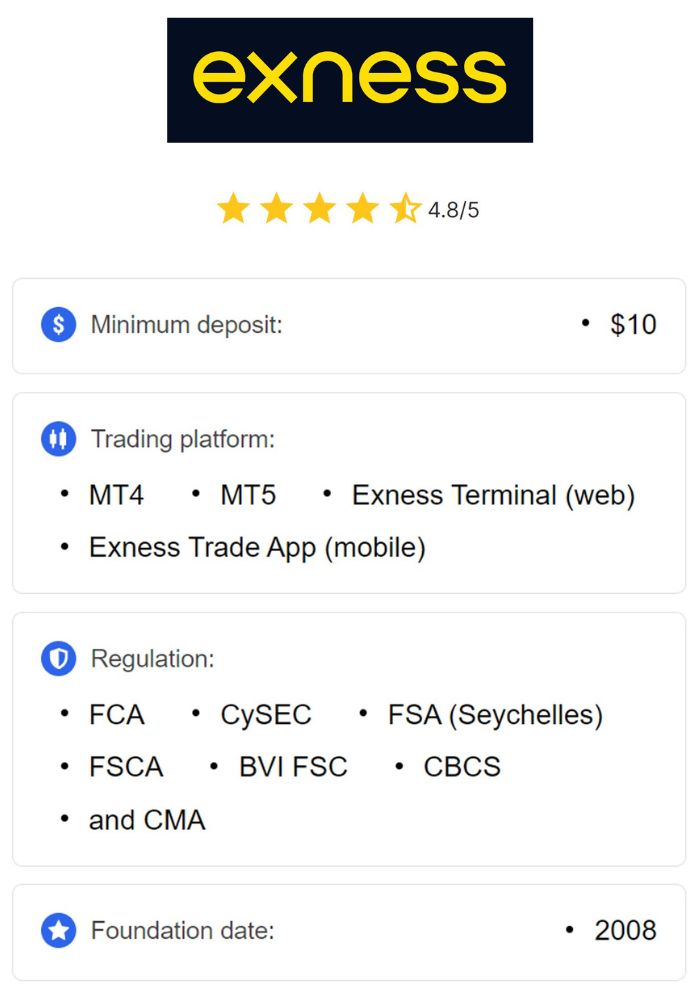

Is Exness legit or scam? Review Broker

from Exness

by Exness Blog

Introduction to Exness

Overview of the Brokerage

Exness is a prominent online brokerage firm that has been providing trading services since its inception in 2008. With its headquarters in Limassol, Cyprus, Exness has established a reputation as a reliable and innovative broker, catering to a diverse range of traders worldwide. The firm offers a wide array of financial instruments, including Forex, commodities, indices, and cryptocurrencies, making it an attractive choice for traders with various interests.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness is known for its user-friendly trading platform, competitive trading conditions, and commitment to transparency. The brokerage emphasizes the importance of customer satisfaction, offering localized support to meet the needs of its clients. With a strong focus on regulatory compliance, Exness ensures that traders can operate in a secure and trustworthy environment.

History and Development of Exness

Exness was founded by a group of financial experts who aimed to create a trading platform that prioritized customer needs. Since its establishment, the broker has experienced significant growth, expanding its services and enhancing its technology to keep pace with the evolving financial landscape.

Over the years, Exness has garnered numerous awards and recognition for its innovative trading solutions and customer service excellence. The company’s commitment to regulatory compliance and security has further solidified its position as a leading broker in the online trading space.

As of now, Exness serves clients in over 190 countries, providing them with access to advanced trading tools and resources. The broker continuously invests in technology and infrastructure to enhance the trading experience for its users.

Regulatory Status

Licensing Information

One of the key factors in determining the legitimacy of a brokerage is its regulatory status. Exness operates under the oversight of several regulatory authorities, ensuring compliance with stringent legal requirements.

The broker is licensed by:

Cyprus Securities and Exchange Commission (CySEC): This regulatory body supervises Exness's operations in the European Union, providing a level of consumer protection and ensuring that the firm adheres to European standards.

Financial Conduct Authority (FCA): Based in the United Kingdom, the FCA is one of the most respected regulatory bodies in the financial industry. Exness is authorized to operate in the UK under FCA regulations.

Financial Services Commission (FSC) in the British Virgin Islands: This license allows Exness to provide services in certain jurisdictions, adding to its credibility.

The multiple licenses obtained by Exness demonstrate the broker’s commitment to maintaining high standards of compliance and transparency.

Regulatory Bodies Involved

Exness is overseen by several regulatory bodies that play crucial roles in maintaining the integrity of financial markets. These regulatory authorities include:

CySEC: Responsible for protecting investors and ensuring the smooth operation of financial markets in Cyprus and the EU.

FCA: Ensures that firms operate in a manner that promotes fair competition and protects consumers' interests in the UK.

FSC: Regulates financial services in the British Virgin Islands, providing oversight for companies operating in that jurisdiction.

The involvement of these regulatory bodies signifies that Exness is held to high standards, contributing to a safer trading environment for clients.

Compliance with International Standards

Exness adheres to international standards and best practices in the financial industry. The broker is committed to transparency, ethical trading practices, and providing clients with accurate information about their trading conditions.

Additionally, Exness regularly undergoes audits and assessments by regulatory authorities to ensure compliance with applicable laws and regulations. This dedication to regulatory compliance enhances the broker’s credibility and reassures traders that their funds and personal information are secure.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Platforms Offered

MetaTrader 4 Features

Exness provides access to the widely popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading capabilities. Key features of MT4 include:

Advanced Charting Tools: Traders can access various chart types, indicators, and graphical objects for in-depth technical analysis.

Automated Trading: MT4 supports Expert Advisors (EAs), allowing traders to automate their trading strategies and execute trades without manual intervention.

Multi-Device Compatibility: The platform is available on desktop, web, and mobile devices, ensuring that traders can access their accounts anytime, anywhere.

MT4 is favored by traders for its reliability and extensive functionalities, making it a top choice for Forex trading.

MetaTrader 5 Features

Exness also offers MetaTrader 5 (MT5), the successor to MT4, which includes additional features and enhancements. MT5 is designed to cater to traders interested in a broader range of financial instruments. Key features of MT5 include:

More Timeframes: MT5 offers more timeframes for analysis, providing traders with greater flexibility in their technical studies.

Integrated Economic Calendar: The platform includes a built-in economic calendar, allowing traders to stay updated on important economic events that may impact the markets.

Enhanced Order Types: MT5 supports additional order types, including buy stop limit and sell stop limit orders, enhancing traders’ capabilities.

By offering both MT4 and MT5, Exness ensures that traders can choose the platform that best suits their trading style and preferences.

Mobile Trading Capabilities

In addition to desktop platforms, Exness provides a mobile trading app compatible with both iOS and Android devices. The app offers many features, including:

Real-Time Quotes and Charts: Users can access live market data, charts, and price movements directly from their mobile devices.

Order Management: Traders can execute trades, set stop-loss and take-profit orders, and monitor their accounts on the go.

Market Analysis Tools: The app provides access to various technical indicators and tools, enabling traders to conduct analyses while mobile.

The mobile trading capabilities of Exness empower traders to stay connected and make informed decisions regardless of their location.

Account Types

Standard Accounts

Exness offers Standard accounts, which are ideal for beginner traders. These accounts feature competitive spreads, no commission, and a low minimum deposit requirement. Standard accounts provide access to a wide range of financial instruments, making them an excellent choice for new traders looking to gain experience in the markets.

Professional Accounts

For more experienced traders, Exness provides Professional accounts. These accounts typically offer tighter spreads and faster execution speeds, catering to traders who require better trading conditions. Professional accounts may involve commission fees based on trading volume, making them suitable for high-frequency traders.

Islamic Accounts

Exness also offers Islamic accounts that comply with Sharia law. These accounts are swap-free, meaning that traders do not incur interest on overnight positions, making them suitable for Muslim traders. Islamic accounts can be opened as Standard or Professional accounts, allowing traders to choose the account type that best fits their trading style.

The variety of account types available at Exness ensures that traders of all experience levels can find an account that meets their needs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Instruments Available

Forex Pairs

Exness provides access to a wide range of Forex trading options, allowing traders to access various currency pairs, including:

Major Pairs: EUR/USD, GBP/USD, and USD/JPY are among the most traded pairs, providing high liquidity and tight spreads.

Minor and Exotic Pairs: Exness also offers a selection of minor pairs and exotic currency pairs, providing additional trading opportunities for experienced traders.

This extensive range of Forex options enables traders to implement different strategies based on market conditions.

Commodity Trading

In addition to Forex, Exness offers commodities trading, allowing traders to speculate on popular commodities such as gold, silver, and oil. Commodity trading provides opportunities to capitalize on price movements driven by global economic factors and market sentiment.

Traders can diversify their portfolios by including commodities alongside Forex instruments, allowing for a broader range of trading strategies.

Indices and Cryptocurrencies

Exness also provides access to trading indices and cryptocurrencies, catering to the growing interest in these markets. Traders can speculate on major global stock indices, such as the S&P 500 and FTSE 100, as well as popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

The diverse range of trading instruments offered by Exness enables clients to build well-rounded portfolios and explore different market opportunities.

Spreads and Commissions

Comparison of Spreads Across Account Types

Exness offers competitive spreads on its various account types. Spreads can vary depending on market conditions and account type:

Standard Account: Spreads typically start around 0.3 pips, making this account type cost-effective for beginners.

Professional Account: Pro accounts may offer spreads as low as 0.0 pips, providing better trading conditions for experienced traders.

Understanding the differences in spreads across account types is crucial for traders when calculating potential costs and profits.

Additional Fees and Charges

While Exness does not charge deposit fees, some withdrawal methods may incur fees. It is essential for traders to review the fee structure associated with their chosen payment methods to avoid unexpected costs.

Traders should also be aware of any additional fees related to trading activities, such as overnight financing fees, particularly for positions held overnight.

Deposit and Withdrawal Methods

Accepted Payment Methods

Exness provides a wide range of payment methods for deposits and withdrawals, ensuring that traders can easily manage their funds. Common payment options include:

Bank Transfers: Traders can use local and international bank transfers for funding their accounts.

E-Wallets: Exness supports popular e-wallet services such as Skrill, Neteller, and WebMoney for quick and secure transactions.

Credit/Debit Cards: Users can deposit and withdraw using major credit and debit cards.

Cryptocurrency: Exness also allows transactions using cryptocurrencies, catering to the growing demand for digital payments.

These payment options provide flexibility for traders when managing their accounts.

Processing Times for Transactions

Exness is known for its fast processing times for deposits and withdrawals. Most deposit methods are processed instantly, allowing traders to access their funds quickly. Withdrawal times vary depending on the payment method:

E-Wallets: Withdrawals to e-wallets are typically processed within 24 hours.

Bank Transfers: Withdrawal requests via bank transfers may take longer, usually ranging from 1 to 3 business days.

Credit/Debit Cards: Withdrawals to credit/debit cards can take up to 3 business days to process.

Understanding the processing times for different payment methods can help traders plan their withdrawals and ensure timely access to their funds.

Minimum Deposit Requirements

Exness has a low minimum deposit requirement, making it accessible for new traders. The minimum deposit varies based on the account type chosen, typically starting as low as $1 for Standard accounts.

This low barrier to entry encourages new traders to start their trading journey with Exness without significant financial commitment.

Customer Support Services

Availability and Accessibility

Exness is committed to providing excellent customer support to its clients. The broker offers several support channels, including:

Live Chat: Instant support via live chat on the Exness website allows traders to get quick answers to their inquiries.

Email Support: For more detailed inquiries, traders can contact Exness via email, ensuring that complex issues receive thorough attention.

Phone Support: Exness also provides phone support, allowing traders to communicate directly with customer service representatives.

These multiple support channels ensure that traders can get the help they need promptly.

Multiple Language Support

Exness understands the importance of catering to a diverse client base and provides customer support in multiple languages. This multilingual support ensures that traders from various regions can communicate effectively and receive assistance in their preferred language.

Contact Methods and Responsiveness

The quality of customer service at Exness is generally regarded as high. Clients often report positive experiences with the support team, noting their responsiveness and helpfulness. The broker’s commitment to providing excellent customer service contributes to a positive overall trading experience.

Traders can expect knowledgeable representatives who can address their questions and concerns effectively. This level of support is particularly valuable for new traders who may need additional guidance.

Trading Education and Resources

Educational Materials Provided

Exness is dedicated to providing traders with comprehensive educational resources. Key learning materials include:

Guides and Articles: A wide range of informative articles covering trading strategies, market analysis, and risk management techniques.

Webinars: Regularly scheduled webinars hosted by experienced traders, allowing clients to learn and ask questions in real-time.

Tutorials: Step-by-step tutorials designed to help traders navigate the platform and utilize its features effectively.

These educational resources empower traders to enhance their skills and make informed decisions in the market.

Webinars and Online Courses

Exness offers a variety of online courses and webinars that cater to traders of all experience levels. These educational programs provide insights into various aspects of trading, including technical and fundamental analysis, risk management, and trading psychology.

Traders can participate in these sessions to gain valuable knowledge and interact with experienced professionals in the industry.

Market Analysis Tools

Exness provides valuable market analysis tools to help traders stay informed about market trends and developments. Key features include:

Market Reports: Regular market reports and analysis are available to help traders understand current market conditions and potential trading opportunities.

Economic Calendar: Exness offers an economic calendar that lists important economic events and data releases that may impact the markets, allowing traders to plan their strategies accordingly.

By providing these resources, Exness helps traders make informed decisions based on up-to-date market information.

User Reviews and Testimonials

Positive Feedback from Traders

User reviews regarding Exness are generally positive, with many traders praising the broker for its competitive trading conditions, user-friendly platforms, and responsive customer support. Clients often highlight the following aspects:

Competitive Spreads: Traders appreciate the low spreads offered by Exness, which help reduce overall trading costs.

Ease of Use: Many users find the trading platform intuitive and easy to navigate, allowing them to execute trades quickly and efficiently.

Excellent Customer Support: Positive feedback regarding the customer service team’s responsiveness and helpfulness is a common theme among reviews.

Common Complaints and Criticism

While the majority of feedback is favorable, some common complaints have been noted by users:

Withdrawal Delays: A few traders have reported delays in the processing of withdrawals, particularly during peak periods.

Learning Curve for New Traders: Some new users have expressed difficulty in navigating the platform initially, though many have reported that they quickly adapted after familiarization.

On balance, the positive feedback from users far outweighs the negative, reinforcing Exness’s reputation as a reliable broker.

Overall Reputation in the Trading Community

Exness has built a solid reputation in the trading community, known for its commitment to transparency, customer satisfaction, and regulatory compliance. The broker has garnered numerous awards and recognition for its innovative trading solutions and services, further solidifying its standing in the industry.

Security Measures

Data Protection Protocols

Exness prioritizes the security of its clients' data and implements robust data protection policies. The broker uses advanced encryption technology to protect sensitive information and ensure secure transactions.

Additionally, Exness adheres to strict data protection regulations, safeguarding client information and maintaining confidentiality. Regular audits and assessments are conducted to ensure that security measures are up to date and effective.

Fund Security Policies

Exness ensures the safety of client funds by keeping them in segregated accounts with reputable banks. This practice guarantees that client funds are separate from the broker's operational funds, providing an added layer of security.

Moreover, Exness is committed to maintaining high levels of financial security and transparency, enhancing its reputation as a trustworthy broker.

Risk Management Practices

Exness employs various risk management practices to protect both the broker and its clients. These practices include:

Margin Call and Stop-Out Levels: Exness has defined margin call and stop-out levels to manage risk exposure effectively. Traders are alerted when their account balance falls below a certain level, helping them avoid significant losses.

Negative Balance Protection: Exness offers negative balance protection, ensuring that clients cannot lose more than their deposited funds, providing peace of mind during volatile market conditions.

These risk management practices contribute to a safer trading environment and reinforce Exness's commitment to protecting its clients.

Conclusion

In conclusion, Exness is a legitimate and reputable online brokerage that offers a wide range of trading services and features. With its strong regulatory status, competitive trading conditions, and commitment to customer support, Exness provides a secure and reliable trading environment for both novice and experienced traders.

While some minor drawbacks exist, the overall positive feedback from users, along with the broker’s dedication to transparency and compliance, reinforces its legitimacy in the trading community. Traders seeking a reliable and user-friendly platform can confidently consider Exness as their trading broker.

As with any trading activity, it is essential for traders to conduct their research, understand the risks involved, and continuously educate themselves to succeed in the dynamic world of Forex and CFD trading.

Read more:

How to Open a Forex Account in Sri Lanka