17 minute read

How to Open a Forex Account in Zimbabwe

Understanding Forex Trading

What is Forex Trading?

Forex trading, also known as foreign exchange trading, is the act of buying and selling currencies with the goal of making a profit from fluctuations in their values. Traders in the forex market speculate on currency pairs like USD/ZWL (US Dollar to Zimbabwean Dollar) and EUR/USD, anticipating movements in their values. The forex market operates 24 hours a day, five days a week, providing traders worldwide with a continuous trading platform.

Top 4 Best Forex Brokers in Zimbabwe

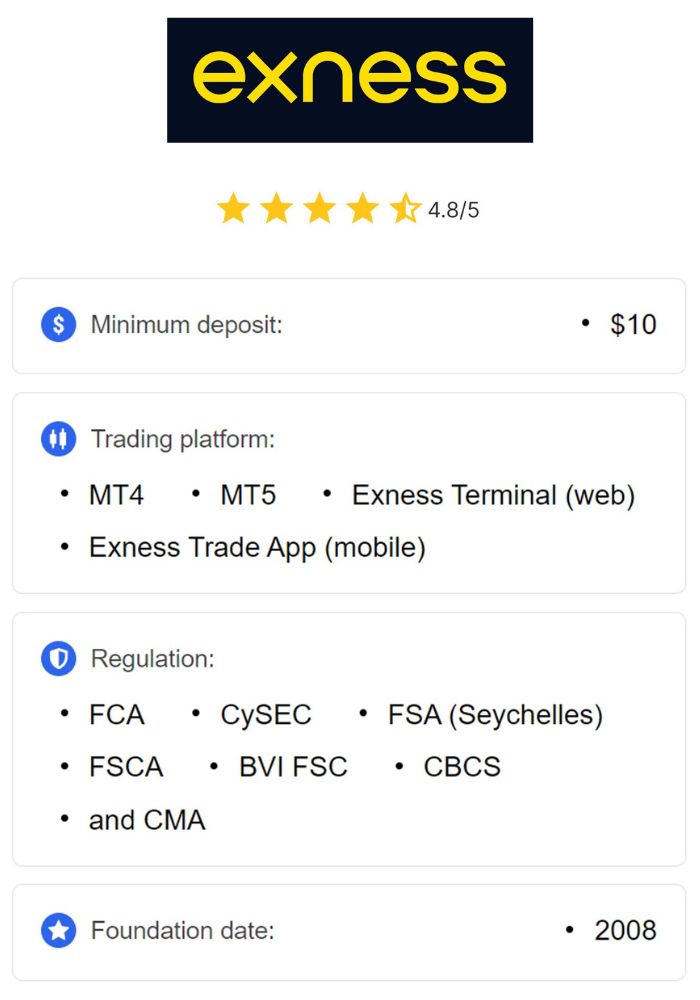

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

As the largest financial market globally, forex trading attracts both individual and institutional investors due to its high liquidity, flexibility, and opportunities for profit. In Zimbabwe, forex trading has gained popularity as a way for individuals to diversify income streams, particularly given the country’s currency challenges and economic shifts.

Key Terms in Forex Trading

Before diving into forex trading, it's essential to understand key terms frequently used in the industry:

Currency Pair: A currency pair is two currencies traded against each other. For example, in USD/ZWL, the US Dollar is the base currency, and the Zimbabwean Dollar is the quote currency.

Pip: A pip is the smallest price move in forex, typically equal to 0.0001 for most currency pairs.

Leverage: Leverage allows traders to control a larger position than their actual deposit. For instance, with 1:100 leverage, a trader can control $10,000 with just $100.

Spread: The spread is the difference between the bid (buy) and ask (sell) price, representing the cost of trading.

Margin: Margin is the amount required to open a leveraged position, acting as collateral for the trade.

The Regulatory Environment in Zimbabwe

Overview of Financial Regulations

In Zimbabwe, the financial regulatory environment is shaped by the Reserve Bank of Zimbabwe (RBZ) and other relevant authorities. Forex trading remains a regulated activity, requiring brokers to operate within guidelines set by the authorities. Zimbabwean traders need to be aware that engaging with locally unregulated brokers could expose them to potential risks, such as fraud or lack of recourse in disputes. While Zimbabwe does not impose direct restrictions on individuals trading forex through international platforms, it is essential to understand the associated regulations and select brokers that adhere to international standards.

Role of the Reserve Bank of Zimbabwe

The Reserve Bank of Zimbabwe (RBZ) is the central authority responsible for overseeing Zimbabwe's monetary policy and financial regulations. While the RBZ does not regulate international forex brokers directly, it plays a role in managing currency exchange rates, overseeing monetary policies, and guiding local financial practices. The RBZ’s policies affect the local forex market, and it is essential for Zimbabwean traders to stay updated on these regulations to understand how changes may impact their trading activities.

Choosing a Forex Broker

Types of Forex Brokers

Forex brokers are categorized based on their operating model, which impacts trade execution, spreads, and overall trading experience. The two main types of forex brokers are:

Market Makers: Market makers set their prices for currency pairs and profit from spreads. They often provide fixed spreads, making costs predictable. However, there may be a slight conflict of interest as they profit when traders lose.

ECN (Electronic Communication Network) Brokers: ECN brokers provide direct access to the interbank market, where traders interact with other participants. These brokers typically offer variable spreads and charge commissions per trade. ECN brokers are popular with experienced traders due to lower costs during high liquidity periods.

Factors to Consider When Selecting a Broker

When choosing a broker, Zimbabwean traders should consider the following factors:

Regulation: Opt for brokers regulated by respected authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Fees and Spreads: Look for competitive spreads and low fees to reduce trading costs.

Trading Platform: Select a broker offering a robust platform, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which provide essential trading tools and resources.

Customer Support: Ensure the broker offers responsive and knowledgeable support to assist with any issues.

Payment Options: Check for accessible funding and withdrawal options compatible with local banks or digital wallets.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Required Documentation for Account Opening

Identification Documents

When opening a forex account, brokers require specific identification documents to comply with Know Your Customer (KYC) regulations. These documents are essential to verify the trader’s identity and ensure that all participants adhere to legal requirements. Commonly accepted identification documents include:

National ID card: This is widely accepted and often preferred by brokers for Zimbabwean traders.

Passport: A valid passport can serve as an alternative form of identification.

Driver’s License: Some brokers also accept a driver’s license, as long as it is government-issued and includes a photograph.

Submitting clear, high-quality scans or photographs of these documents ensures a faster verification process, helping traders access their accounts and start trading without delays.

Proof of Address

In addition to identification, traders must provide proof of address. This is another critical step in the verification process to confirm the trader’s residency. Accepted documents include:

Utility Bills: Recent bills for electricity, water, or gas showing the trader’s address, typically issued within the last three months.

Bank Statements: Statements from a recognized bank with the trader’s address and recent transaction history.

Government-issued Letters: Official letters or documents from the government, such as tax forms or certificates, may also be accepted.

Proof of address ensures the broker complies with anti-money laundering (AML) regulations and maintains the security of trading activities. It’s essential that the address on these documents matches the address provided during registration.

Other Necessary Documents

In some cases, brokers may request additional documents to assess the trader’s financial background or trading experience. These could include:

Financial Background Information: Some brokers ask about the trader’s employment status, income level, and financial experience to recommend suitable trading conditions.

Proof of Income: Although less common, some brokers may request proof of income, such as pay slips or tax records, to verify the trader’s financial capacity.

Providing these documents may enhance the broker’s understanding of the trader’s profile, especially for advanced accounts or higher leverage options.

The Account Opening Process

Online vs. Offline Account Opening

Most forex brokers offer an online account opening process, which is quick and convenient. Traders simply need to visit the broker’s website, complete the registration form, upload documents, and submit the application for review. This process usually takes just a few minutes and allows traders to access their accounts from anywhere with an internet connection.

In contrast, some brokers may offer offline account opening, where traders can visit a local branch or office, if available, for assistance. However, this option is less common in Zimbabwe, as most brokers operate primarily online. The online method is the most efficient and widely used for Zimbabwean traders.

Filling Out the Application Form

The application form requires traders to provide basic personal information, such as:

Full Name: As it appears on the identification document.

Date of Birth: To ensure age compliance with legal trading requirements.

Contact Information: Email address, phone number, and residential address.

Financial Information: Some brokers may request details about trading experience or financial background.

Accuracy is crucial when filling out the application form, as discrepancies may delay the account approval process. Once the form is completed, traders can move on to uploading the required documents.

Verification Process

After submitting the application and necessary documents, the broker will review and verify the trader’s identity and address. Verification can take anywhere from a few hours to a few business days, depending on the broker and the completeness of the submitted documents.

Once the account is verified, traders will receive a confirmation email or notification, granting full access to their trading accounts. At this point, traders can fund their accounts, configure settings, and start trading.

Types of Forex Accounts

Standard Accounts

Standard accounts are the most common type of forex account, suitable for intermediate to experienced traders. These accounts generally offer access to a wide range of trading features, including competitive spreads, higher leverage options, and full trading capabilities across major, minor, and exotic currency pairs.

Standard accounts may require a higher minimum deposit than other account types but provide traders with comprehensive tools, resources, and favorable trading conditions. This type of account is ideal for Zimbabwean traders seeking greater flexibility and control over their trading activities.

Mini and Micro Accounts

Mini and micro accounts are designed for beginners or those with limited capital. Mini accounts typically allow trading in smaller lot sizes (10,000 units), while micro accounts allow even smaller lot sizes (1,000 units). These accounts have lower minimum deposit requirements, making them accessible to new traders who want to learn the forex market with reduced financial risk.

For Zimbabwean traders, mini and micro accounts provide an affordable way to start trading, practice strategies, and gain confidence without the need for a significant initial investment. Many brokers offer these accounts as an entry point for those looking to gradually build their trading skills.

Managed Accounts

Managed accounts are ideal for investors who prefer a more hands-off approach, allowing a professional account manager to trade on their behalf. In a managed account, the trader deposits funds, and an experienced manager makes trading decisions according to the investor’s objectives and risk tolerance.

Managed accounts are suitable for those who may not have the time or expertise to trade actively. Although these accounts usually require a higher minimum deposit and may involve management fees, they offer Zimbabwean investors the potential to benefit from forex trading without direct involvement.

Funding Your Forex Account

Accepted Payment Methods

Brokers provide various options for funding forex accounts, allowing Zimbabwean traders to choose the method that best suits their preferences. Common payment methods include:

Bank Transfers: Direct bank transfers are secure but may take several business days to process.

Credit and Debit Cards: Visa and MasterCard are popular, offering quick and convenient funding options.

E-Wallets: Digital wallets such as Skrill, Neteller, and PayPal are favored for their fast processing times.

Cryptocurrency: Some brokers accept cryptocurrency deposits, such as Bitcoin, which can offer enhanced privacy and speed.

Selecting the right payment method can reduce transaction fees and ensure faster processing times, enabling traders to start trading without delays.

Minimum Deposit Requirements

Minimum deposit requirements vary depending on the broker and the account type. Standard accounts often have higher minimum deposits, while mini and micro accounts require lower amounts, typically starting from as little as $10 or $50. It’s essential for Zimbabwean traders to review the minimum deposit requirements of their chosen broker to ensure they meet the account funding criteria.

Currency Conversion Fees

Since forex trading typically operates in major global currencies like USD, EUR, or GBP, Zimbabwean traders may incur currency conversion fees if they deposit in Zimbabwean dollars (ZWL). To avoid these fees, some brokers offer accounts in local currencies or provide fee-free currency conversion services. It’s important to understand these potential costs to minimize expenses and maximize trading funds.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Leverage and Margin

What is Leverage in Forex?

Leverage allows traders to control a larger position in the forex market with a smaller amount of capital. Essentially, leverage lets traders borrow funds from their broker to increase their trading power, enabling them to amplify potential profits. For example, a leverage ratio of 1:100 means that with $100 of their own capital, traders can control a position worth $10,000.

For Zimbabwean traders, leverage can be advantageous when used responsibly. However, it’s essential to remember that leverage also magnifies losses, making risk management crucial when trading with borrowed funds.

Risks Associated with High Leverage

While leverage can significantly boost profits, it also comes with heightened risks. High leverage exposes traders to larger losses, which can deplete account balances quickly if trades move against their positions. Overleveraging is a common mistake among new traders, leading to potential financial loss and account liquidation.

To manage the risks associated with high leverage, Zimbabwean traders should start with lower leverage ratios and gradually increase leverage as they gain experience. Setting stop-loss orders and carefully monitoring positions can further help in managing risks effectively, ensuring that leverage becomes a tool for growth rather than a source of excessive risk.

Trading Platforms and Tools

Popular Trading Platforms in Zimbabwe

Forex brokers offer a variety of trading platforms that provide the tools and resources needed to analyze the market and execute trades. The most commonly used platforms include:

MetaTrader 4 (MT4): Known for its user-friendly interface, MT4 offers essential trading tools, including advanced charting options, technical indicators, and Expert Advisors (EAs) for automated trading. It’s widely used by traders worldwide and is particularly popular in Zimbabwe due to its reliability.

MetaTrader 5 (MT5): MT5 builds on the features of MT4, adding more timeframes, an economic calendar, and access to additional asset classes like stocks and commodities. For traders seeking a multi-asset platform, MT5 provides enhanced flexibility.

cTrader: cTrader is favored for its intuitive interface and advanced charting tools, providing high-speed trade execution and customizable indicators. It’s a good option for Zimbabwean traders looking for an alternative to the MetaTrader suite.

Selecting the right platform depends on the trader’s individual needs, experience level, and preferences for specific tools.

Essential Trading Tools and Resources

To succeed in forex trading, Zimbabwean traders can benefit from using various tools and resources available on trading platforms:

Technical Indicators: Indicators like moving averages, Bollinger Bands, and the Relative Strength Index (RSI) help traders understand market trends and identify entry and exit points.

Economic Calendar: An economic calendar displays upcoming global events, such as interest rate announcements, inflation reports, and GDP releases, which can influence currency prices. Monitoring these events is essential for fundamental analysis.

Charting Tools: Platforms offer various chart types, including candlestick, line, and bar charts, along with drawing tools for trend lines and Fibonacci retracements, which help traders analyze price patterns and market movements.

Using these tools effectively helps Zimbabwean traders make informed decisions and improve their trading accuracy.

Risk Management Strategies

Importance of Risk Management

Risk management is critical in forex trading, as it helps traders protect their capital and minimize losses. By implementing a structured risk management plan, Zimbabwean traders can trade confidently, knowing that they have measures in place to safeguard against unexpected market movements. Without proper risk management, even successful trading strategies can lead to significant losses over time.

Effective risk management involves setting realistic goals, controlling position sizes, and using protective tools like stop-loss orders to limit potential losses.

Common Risk Management Techniques

Several risk management techniques can help traders control potential losses and maintain a balanced trading approach:

Stop-Loss Orders: A stop-loss order automatically closes a trade once it reaches a specified loss level, protecting traders from excessive losses.

Position Sizing: Determining the correct position size ensures traders don’t risk more than a small percentage of their account balance on a single trade.

Diversification: By trading multiple currency pairs or assets, traders can spread risk and reduce the impact of a poor-performing trade.

For Zimbabwean traders, these techniques are essential for creating a sustainable trading approach that minimizes losses while maximizing opportunities for profit.

Developing a Trading Strategy

Fundamental Analysis

Fundamental analysis involves examining economic, political, and social factors that impact currency values. For example, traders can analyze economic data like employment figures, inflation, and interest rates to predict currency price movements. By understanding the economic landscape, Zimbabwean traders can make informed decisions about major currency pairs that may be influenced by regional and global events.

Fundamental analysis is valuable for long-term trading strategies and helps traders anticipate market trends based on underlying economic conditions.

Technical Analysis

Technical analysis focuses on historical price data to predict future market movements. Traders use charts, indicators, and patterns to analyze trends and identify potential reversal points. Common tools used in technical analysis include moving averages, candlestick patterns, and oscillators like the MACD and RSI.

Technical analysis is particularly effective for short-term trades, allowing Zimbabwean traders to time their entries and exits accurately. Combining technical analysis with fundamental insights can provide a balanced approach for analyzing the market.

Combining Strategies for Success

Combining fundamental and technical analysis allows traders to benefit from both long-term economic trends and short-term price patterns. For example, a Zimbabwean trader might use fundamental analysis to identify strong currency pairs based on economic conditions, then apply technical analysis to determine the best entry and exit points. This dual approach enhances decision-making and provides a well-rounded view of the forex market.

Tax Implications for Forex Traders in Zimbabwe

Overview of Tax Obligations

Forex trading gains are typically subject to taxation, though tax policies for forex traders vary by country. In Zimbabwe, it is essential for traders to be aware of their tax obligations and maintain records of their trading activities to report any taxable income accurately. While Zimbabwean authorities may not impose specific taxes on individual forex traders, consulting with a tax professional is recommended to stay compliant with local tax laws.

Reporting Forex Income

Traders must accurately report their forex income, including profits and losses, to comply with tax regulations. Keeping detailed records of trades, such as transaction history and account statements, simplifies the process of calculating gains for tax purposes. For Zimbabwean traders, maintaining these records can help with transparent reporting and ensure smooth tax filing at the end of the financial year.

Common Challenges Faced by Forex Traders

Market Volatility

Forex markets are inherently volatile, with currency prices affected by economic events, political shifts, and global market sentiment. High volatility can present both opportunities and risks for traders. For Zimbabwean traders, understanding market volatility is essential for managing risk effectively and adapting strategies to suit market conditions.

Psychological Factors in Trading

Emotional trading is a common challenge, especially for new traders. Fear, greed, and impatience can lead to impulsive decisions and significant losses. Developing a disciplined approach and adhering to a trading plan helps traders overcome these psychological challenges and make rational, informed decisions. By maintaining emotional control, Zimbabwean traders can reduce the impact of trading psychology on their overall performance.

Staying Updated with Market Trends

Sources for Forex News

Keeping up with global news is essential for forex traders, as events worldwide can affect currency prices. Reliable sources for forex news include:

Financial News Websites: Platforms like Bloomberg, Reuters, and CNBC provide timely updates on economic events and market trends.

Economic Calendars: Economic calendars highlight upcoming releases, helping traders anticipate potential market movements.

Broker Updates: Many brokers offer market analysis, news articles, and daily insights to keep traders informed.

By staying updated, Zimbabwean traders can adapt their strategies to current events, improving their chances of success in the forex market.

Importance of Continuous Learning

The forex market is dynamic, and continuous learning is vital for staying competitive. Reading books, attending webinars, and taking online courses helps traders enhance their skills and stay informed about new strategies and techniques. Continuous learning empowers Zimbabwean traders to refine their trading approach, adapt to market changes, and build sustainable trading practices.

Conclusion

Opening a forex account in Zimbabwe is an accessible and structured process for traders who want to participate in the global currency market. From choosing a reliable broker and completing documentation requirements to funding the account and understanding leverage, each step is essential for creating a successful trading journey. Forex trading offers Zimbabwean traders the opportunity to diversify their income, leverage global market opportunities, and develop valuable financial skills.

By implementing risk management strategies, developing a trading plan, and staying informed about market trends, traders in Zimbabwe can maximize their potential for success in the forex market. While challenges like market volatility and emotional trading are part of the journey, a disciplined approach and continuous learning are keys to long-term growth and profitability. Whether you're new to forex trading or looking to refine your skills, this guide provides a comprehensive roadmap to navigating the forex market with confidence.

Read more: