16 minute read

Which Exness account is best?

from Exness

by Exness Blog

In the world of online trading, selecting the right brokerage account can significantly impact your trading journey. Among the various options available, many traders ask themselves: Which Exness account is best? This comprehensive guide aims to shed light on the different Exness account types, their features, and which one may be the ideal choice for you based on your trading objectives and strategies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Exness Accounts

Navigating through the world of online trading requires knowledge about different account types, especially when it comes to a reputable broker like Exness. The accounts offered by this broker are designed to cater to a variety of trader needs and preferences. Understanding these nuances is crucial for maximizing your trading potential.

Overview of Account Types

Exness provides a diverse selection of account types tailored for traders ranging from beginners to professionals. Each account type serves specific trading styles and financial goals, making it essential to comprehend each option fully before opening an account.

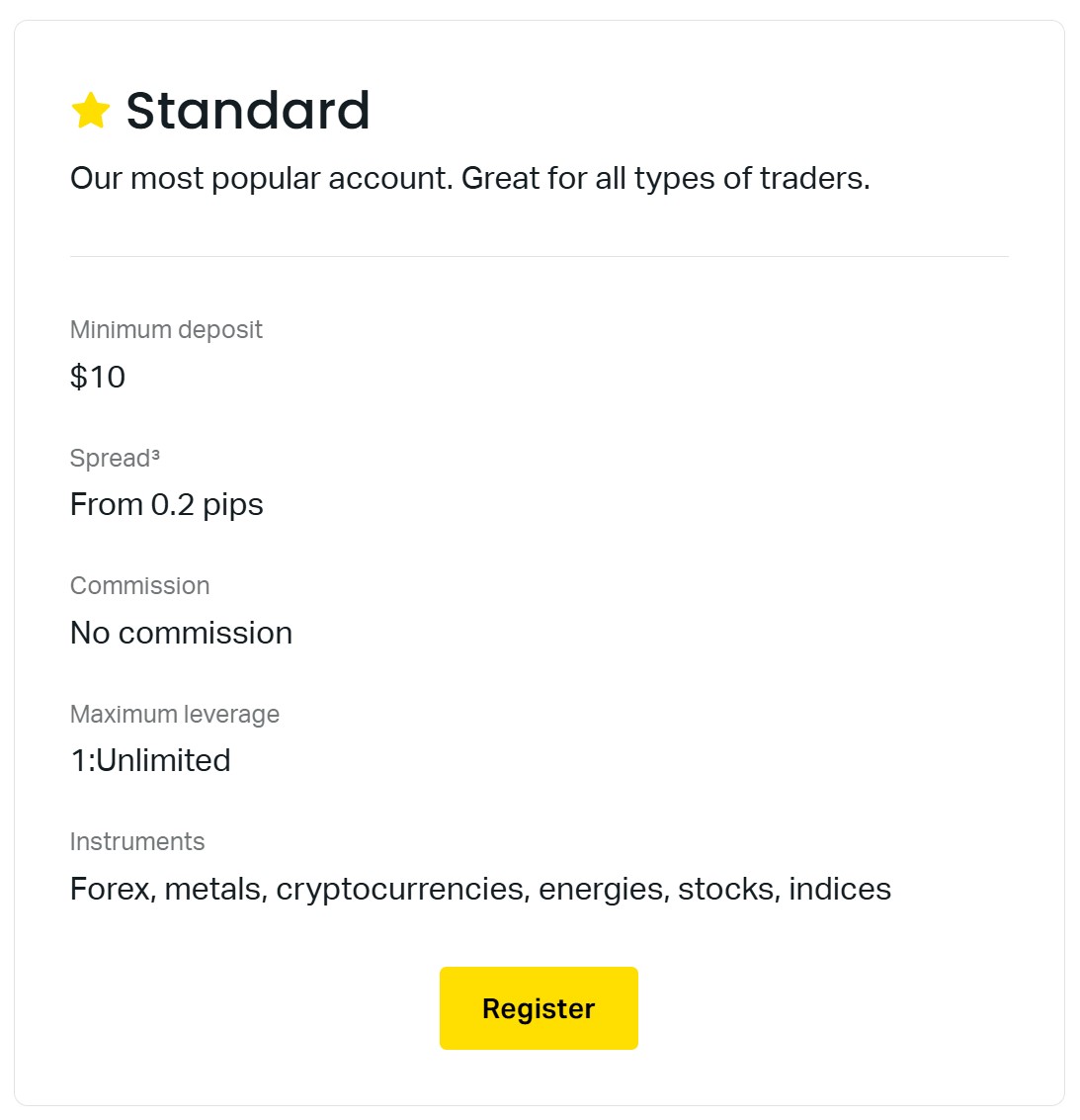

Standard Account: Often regarded as the quintessential account for novice traders, the Standard Account stands out due to its beginner-friendly features. It offers competitive spreads and no commissions, making it an appealing choice for those just starting out in trading.

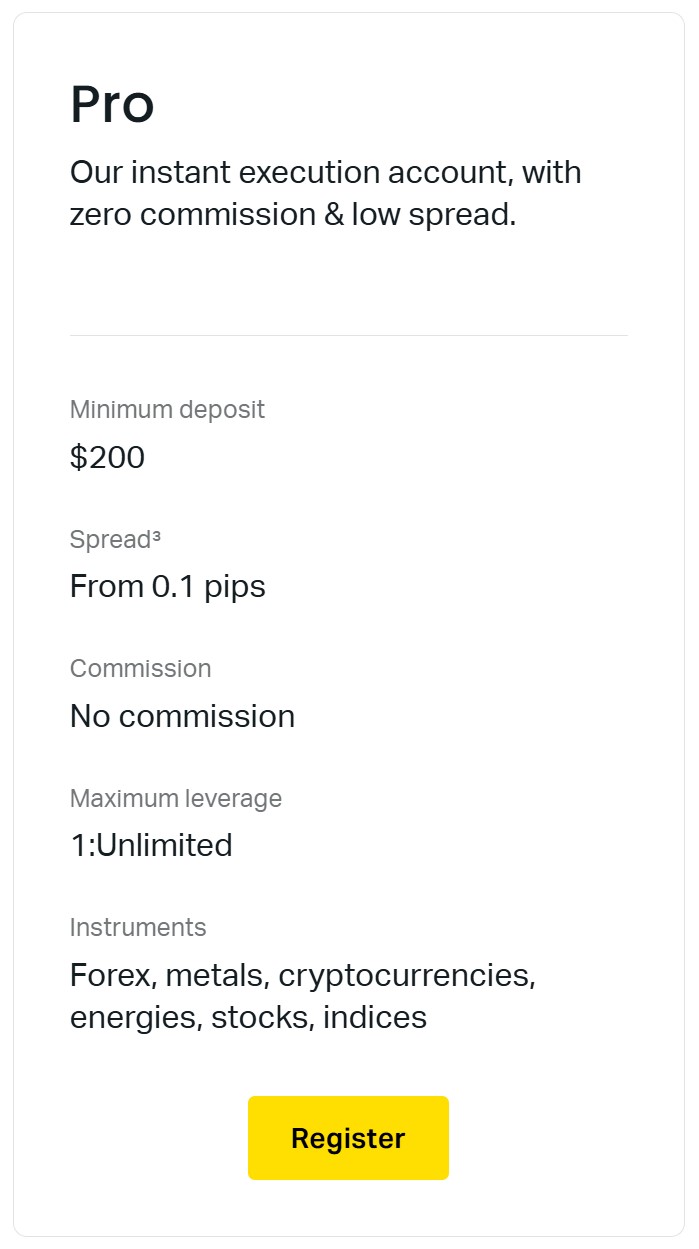

Pro Account: Designed for more experienced traders, the Pro Account enhances trading conditions and provides access to advanced tools that can significantly improve trading performance. With floating spreads and quick execution, this account caters to traders who require additional functionalities.

Zero Account: Tailored specifically for scalpers and high-frequency traders, the Zero Account features incredibly tight spreads while imposing a small commission per lot. This account is suited for those looking to capitalize on minor price movements.

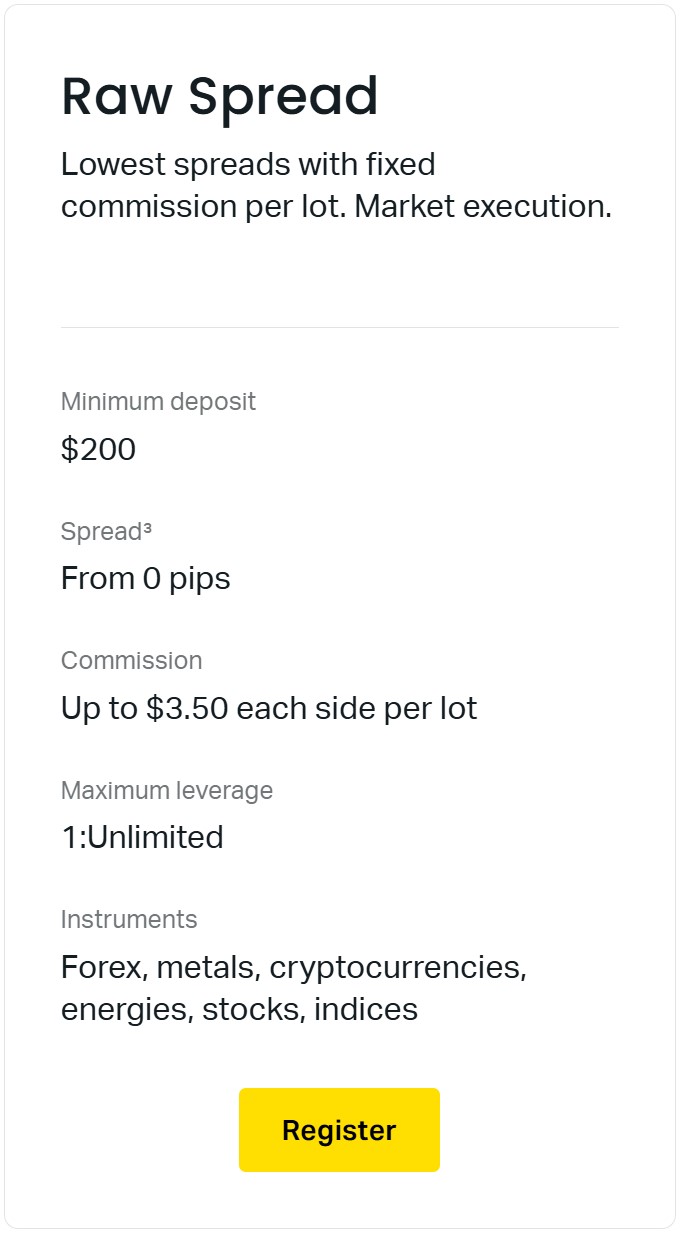

Raw Spread Account (ECN): For traders seeking maximum speed and transparency, the Raw Spread Account offers direct market access with the lowest possible spreads. It’s perfect for advanced traders wanting the peace of mind that comes with understanding their true cost of trading.

Each account type uniquely addresses various trader profiles, ensuring that every trader can find a suitable match based on their individual needs and strategies.

Importance of Choosing the Right Account

Selecting the appropriate Exness account is not merely a preference; it’s a pivotal decision that directly influences your trading experience and outcomes. The account type you choose can affect various aspects such as trading costs, access to features, and even your overall profitability.

Trading Costs: Different accounts come with varying spread structures and commission fees. A deeper understanding of how these costs impact your trading can lead to more informed decisions, ultimately affecting your bottom line.

Trading Conditions: Some accounts provide better trading conditions, such as faster execution speeds and advanced tools. These factors can make a significant difference, particularly in volatile market conditions.

Leverage: The maximum leverage available across account types varies, influencing your risk exposure and trading strategy. Knowing how to leverage your position responsibly can enhance your trading effectiveness.

Suitability for Trading Strategies: Not all accounts are created equal when it comes to accommodating specific trading styles. Finding an account that aligns with your chosen trading method—whether it's day trading, swing trading, or long-term investing—can significantly enhance your efficiency.

Ultimately, the importance of choosing the right account cannot be overstated. It sets the stage for your trading journey and has lasting implications on your success.

Exness Account Types Explained

Having established the foundational understanding of Exness accounts, let’s delve into the specifics of each type. By comprehensively examining their features, we can better assess which Exness account is best for you.

Standard Account Features

The Standard Account is designed for beginners who are just beginning their trading journey. Its user-friendly features make it an attractive option for new traders venturing into the world of forex.

Competitive Fixed Spreads: One of the standout features of the Standard Account is its competitive fixed spreads. This means you can expect consistent and predictable trading costs, enabling easier budgeting for your trades.

No Commission: Unlike some other account types, the Standard Account does not impose any commissions on trades. This simplicity helps beginners focus on learning how to trade without being bogged down by complicated fee structures.

Suitable for Beginners: The Standard Account serves as an excellent entry point for those new to trading. Its straightforward features allow novice traders to familiarize themselves with trading concepts without feeling overwhelmed.

Wide Range of Trading Instruments: In addition to forex, the Standard Account enables traders to explore various instruments, including commodities, indices, and cryptocurrencies. This versatility allows new traders to experiment with different assets and develop their skills across multiple markets.

1️⃣ Open Exness Standard MT4 Account

2️⃣ Open Exness Standard MT5 Account

When considering which Exness account is best, the Standard Account emerges as an ideal choice for those who are just starting and seek a simplified trading experience.

Pro Account Benefits

For more experienced traders, the Pro Account offers a suite of advanced tools and improved trading conditions that can elevate trading performance.

Floating Spreads: Unlike the Standard Account, the Pro Account features floating spreads. This means that spreads can vary based on market conditions, often resulting in tighter spreads during times of market volatility.

Advanced Tools and Features: Traders using the Pro Account gain access to an array of advanced trading tools, including VPS hosting and copy-trading features. These functionalities empower traders to execute their strategies with greater precision.

Faster Order Execution: Optimized for speed, the Pro Account ensures quicker order execution, a crucial factor in trading where timing can make all the difference. Faster execution leads to fewer losses caused by slippage.

Improved Trading Conditions: The Pro Account is designed to enhance the trading experience for proactive traders who require superior control over their trades. The combination of advanced features and optimal trading conditions makes it a strong candidate for serious traders.

If you're looking for an account that prioritizes enhanced control and sophisticated functionalities, the Pro Account might just be what you need.

Zero Account Characteristics

As the name suggests, the Zero Account caters to scalpers and high-frequency traders who thrive on tiny price movements and rapid execution.

Ultra-tight Floating Spreads: The Zero Account offers incredibly tight spreads, minimizing trading costs for those looking to capitalize on minute fluctuations in the market.

Small Commission per Lot: Though the account charges a small commission for each lot traded, the benefits of reduced spreads often outweigh this cost—especially for active traders.

Fast Order Execution: The Zero Account is optimized for speed, enabling traders to enter and exit positions rapidly. This feature is particularly advantageous for scalping strategies that rely on quick decisions.

Ideal for Scalpers & High-Frequency Traders: The unique characteristics of the Zero Account align perfectly with the needs of scalpers, allowing them to make numerous trades throughout the day with minimal expense.

1️⃣ Open Exness Zero MT4 Account

2️⃣ Open Exness Zero MT5 Account

When deciding on which Exness account is best, consider the Zero Account if your trading strategy hinges on executing a high volume of trades within short timeframes.

Raw Spread Account

Known as the ECN account, the Raw Spread Account offers unparalleled transparency and direct access to the interbank market.

Direct Market Access: This account type provides direct access to liquidity providers, including banks and institutional investors. This direct connection enhances the reliability of trade execution.

Lowest Possible Spreads: The Raw Spread Account is characterized by the raw, un-marked-up spreads available on the interbank market. This feature is critical for traders looking for the most cost-effective trading environment.

Variable Commission: Like the Zero Account, the Raw Spread Account charges a variable commission per lot traded. While this may seem like an added cost, the benefit of lower spreads often compensates for it.

Increased Transparency: This account offers a clearer view of the market and pricing, providing traders with valuable insights into their trading costs and market dynamics.

✅ Open Exness Raw Spread MT4 Account

✅ Open Exness Raw Spread MT5 Account

If you’re an advanced trader who values the lowest possible spreads and requires fast execution, the Raw Spread Account is likely tailored to meet your needs.

Factors to Consider When Choosing an Exness Account

Before making a decision about which Exness account is best for you, it’s vital to consider several factors that will affect your trading experience.

Trading Style and Preferences

Your trading style is fundamentally influential in determining the type of Exness account you should open.

Scalpers & High-Frequency Traders: If you tend to make a large number of trades within a short period, the Zero Account is the ideal option. Its ultra-tight spreads and fast execution are perfect for strategies that rely on precise timing.

Swing Traders & Day Traders: For those who hold positions for a few days or trade actively throughout the day, the Pro or Zero account can provide beneficial conditions. Both accounts enable tighter spreads and enhanced features for strategic trading.

Long-Term Investors: If you prefer a more leisurely approach focused on long-term investments, the Standard Account can suffice. The simplicity and ease of use make it suitable for traders who do not require complex trading tools.

Beginners: New traders often find comfort in the Standard Account due to its uncomplicated nature. As you grow and adapt your trading strategies, you may consider transitioning to other account types.

Minimum Deposit Requirements

Each Exness account type comes with a minimum deposit requirement.

Evaluating these requirements against your available capital is essential for prudent financial planning. You want to ensure that you can meet the initial deposit without stretching your finances too thinly.

Understanding the deposit expectations for each account will help you manage your budget effectively while still allowing room for future growth.

Spreads and Commissions

Understanding the structure of spreads and commissions in each account could save you considerable expenses over time.

Fixed vs. Floating Spreads: The Standard Account typically features fixed spreads, providing predictability in trading costs. Conversely, the Pro, Zero, and Raw Spread Accounts offer floating spreads, which can change based on market conditions.

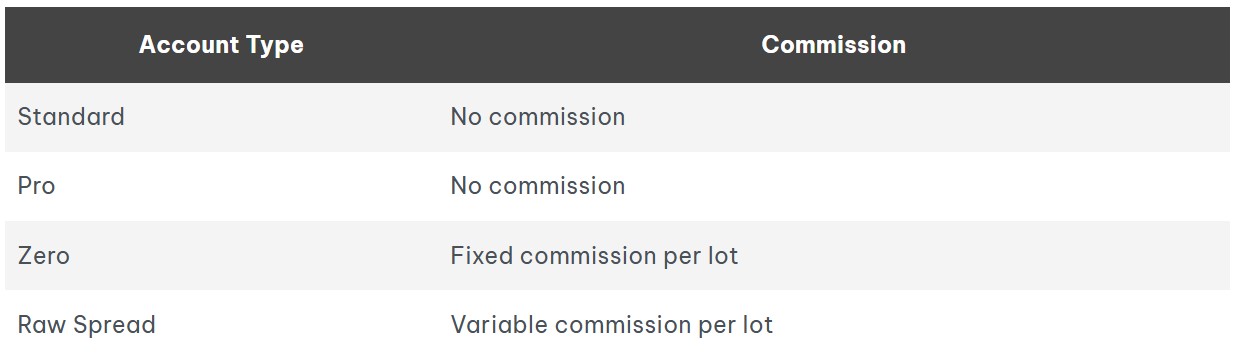

Commission Fees: While some accounts charge no commissions (like the Standard and Pro Accounts), others impose a small fee per lot traded, especially in the Zero and Raw Spread Accounts. It's imperative to weigh these costs against the anticipated trading frequency to determine the most cost-effective option.

By paying attention to spreads and commissions, you can gain valuable insights into your total trading costs, helping you choose an account that suits your budget and trading style.

Leverage Options Available

Leverage plays a crucial role in forex trading, as it allows you to control larger positions with a smaller amount of capital.

All Exness account types offer substantial leverage levels, which can influence your risk exposure considerably.

Listening to the market and managing leverage responsibly is necessary for preserving your capital while maximizing trading opportunities. Before diving in, take some time to understand how leveraging your positions can fit into your broader trading strategy.

Comparing Different Exness Accounts

To help clarify the distinctions between the various Exness accounts, let's compare them across key features.

Spread Analysis for Each Account Type

The spread structure is one of the most critical factors that affect your trading costs. Here’s a comparative analysis:

Spreads can fluctuate based on market volatility; therefore, knowing the typical spreads helps you estimate potential costs accurately.

Commission Structures Review

The commission structure can vary widely across account types:

Understanding these commission structures is vital for assessing your overall trading expenses.

Leverage Comparison Across Accounts

Leverage options available in each account type can have a profound impact on your trading capacity:

Different leverage levels can accommodate various risk profiles, allowing traders to select an account that aligns with their risk appetite.

Account-Specific Trading Instruments

While most account types offer access to a broad spectrum of instruments, certain accounts might specialize in specific assets. You can usually find this information on the broker's website, which details the instruments available under each account type.

Advantages of the Standard Account

The Standard Account is an attractive option for many traders, especially those new to the scene. Let’s explore the advantages it offers.

User-Friendliness for Beginners

One of the primary advantages of the Standard Account is its user-friendliness.

The straightforward interface and simple features make it easy for novice traders to navigate without feeling overwhelmed. Beginners can slowly acclimate to trading mechanics, gaining confidence and competence over time.

This account serves as an excellent launching pad for those eager to learn the ropes of forex trading, allowing them to build a solid foundation.

Competitive Spreads and No Commission

Another notable advantage of the Standard Account is its competitive spreads coupled with the absence of commission fees.

The fixed spreads lend predictability to trading costs, which can be immensely helpful for newcomers trying to budget their expenses. Without the worry of hidden fees, traders can focus more on honing their skills and developing effective trading strategies.

Ideal for Low-Risk Traders

The Standard Account is particularly well-suited for traders with a low-risk tolerance.

The competitive spreads, combined with the lack of additional fees, make this account an excellent choice for those looking to minimize their trading risks. New traders can gradually increase their exposure as they become more comfortable with the market dynamics.

Overall, the Standard Account presents a balanced package that appeals to a wide range of traders, especially those who are just embarking on their trading journey.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Advantages of the Pro Account

With its advanced features and optimized conditions, the Pro Account brings several advantages to the table.

Enhanced Trading Conditions

The Pro Account offers a suite of enhanced trading conditions that can significantly benefit experienced traders.

With floating spreads that can tighten during volatile market conditions, traders are afforded greater flexibility and reduced costs during crucial trading moments. The ability to respond quickly to market changes can be a game-changer for active traders.

Access to Advanced Trading Tools

Another compelling reason to consider the Pro Account is the access to advanced trading tools.

Tools like VPS hosting and copy-trading features give traders an edge in a highly competitive market. The ability to automate trading strategies or replicate successful trades from experienced traders can elevate your trading performance.

These advanced functionalities create a more dynamic trading environment that appeals to traders who prioritize efficiency and adaptability.

Suitable for Experienced Traders

As the name indicates, the Pro Account is tailored specifically for experienced traders.

The combination of improved trading conditions, advanced tools, and faster execution makes it a natural choice for those who have already honed their skills in the market. If you’re looking to take your trading to the next level, the Pro Account can help facilitate your growth and success.

Advantages of the Zero Account

Tailored for scalpers and high-frequency traders, the Zero Account provides unique benefits that cater specifically to these trading styles.

Tight Spreads with Minimal Costs

The most significant advantage of the Zero Account is its ultra-tight spreads.

The reduced spreads minimize trading costs, empowering traders to capitalize on small price movements and execute multiple trades without incurring excessive fees. This structure is particularly advantageous for scalpers who thrive on rapid trades.

Ideal for Scalpers and High-Frequency Traders

The characteristics of the Zero Account align exceptionally well with the needs of scalpers and high-frequency traders.

Its design optimally supports trading strategies focused on extracting profits from minute price changes. The fast execution times further bolster this suitability, allowing traders to enter and exit positions quickly.

Flexibility in Trading Strategies

With the features it offers, the Zero Account provides considerable flexibility in terms of trading strategies.

Traders are not confined to a single approach; instead, they can adapt their methods based on market conditions and personal preferences. This adaptability is crucial in the ever-evolving landscape of forex trading.

If you lean towards scalping or high-frequency trading, the Zero Account may be the best choice for enabling your strategies effectively.

Advantages of the ECN Account

The Raw Spread Account, also known as the ECN account, provides distinct advantages that cater to advanced traders seeking a transparent and efficient trading environment.

Direct Market Access

One of the standout benefits of the ECN account is the direct market access it offers.

This account connects traders directly with liquidity providers, allowing for more reliable trade execution. The direct nature of this access fosters greater confidence among traders who value efficiency and trustworthiness.

Lower Latency for Faster Execution

The Raw Spread Account minimizes latency, which translates into faster execution times.

Reduced latency is vital for trading, especially in fast-moving markets where every second counts. Quick execution ensures that traders can enter and exit the market at the desired prices, mitigating the risks associated with slippage.

Greater Transparency in Pricing

Transparency is another key advantage of the ECN account.

With access to raw spreads and clear commissions, traders can see exactly what they are paying for each trade, eliminating any ambiguity regarding costs. This insight is especially valuable for advanced traders who want to fine-tune their strategies based on accurate information.

If you prioritize transparency, speed, and efficiency, the Raw Spread Account is a compelling option that accommodates your advanced trading needs.

Evaluating Your Trading Goals

Once you’ve considered the advantages of each account type, it’s important to evaluate your trading goals thoroughly.

Risk Appetite Assessment

Understanding your risk appetite is paramount when selecting an account.

Are you comfortable taking on higher levels of risk in pursuit of potentially greater rewards, or do you prefer a more conservative approach? Reflecting on your risk tolerance will help narrow down your choices and reveal which Exness account best suits your trading personality.

Trading Frequency Considerations

Your trading frequency also plays a critical role in determining the right account type.

If you plan to engage in frequent trading activities, the Zero or Raw Spread Accounts may prove most beneficial due to their favorable conditions for active traders. Conversely, if your approach involves longer-term holding periods, the Standard or Pro Accounts may align better with your strategy.

Investment Horizon and Strategy

Your investment horizon and strategy will provide insight into the account type best suited for your needs.

Are you looking for a long-term investment opportunity, or do you prefer shorter-term trades? Clarifying your strategy will help you identify potential accounts that support your goals effectively.

Conclusion: Making an Informed Choice on Exness Accounts

Choosing the right Exness account is a fundamental step in enhancing your trading journey. By understanding the unique features and advantages of each account type, you can evaluate them against your trading goals, style, and preferences.

Consider factors like spreads, commissions, available leverage, and your risk tolerance to determine which Exness account is best suited for you.

Whether you’re a beginner, experienced trader, scalper, or someone pursuing transparency in their trading environment, Exness offers a range of accounts to meet your needs. Take the time to assess your trading habits and aspirations, and you’ll be well-equipped to make an informed decision that aligns with your individual trading journey.

Read more: