AMERICAN IN BRITAIN

Serving the American Community in the UK

FEATURES INCLUDE:

American Expatriate Clubs’ News

Hotel Review

• Legal Matters

• Eating Out

• Moving

• Education

• Taxing Issues

Theatre • Travel • Wealth Management

ADVISORY PANEL

Serving the American Community in the UK

FEATURES INCLUDE:

American Expatriate Clubs’ News

Hotel Review

• Legal Matters

• Eating Out

• Moving

• Education

• Taxing Issues

Theatre • Travel • Wealth Management

ADVISORY PANEL

26-28 Bruton Place, London, W1J 6NG

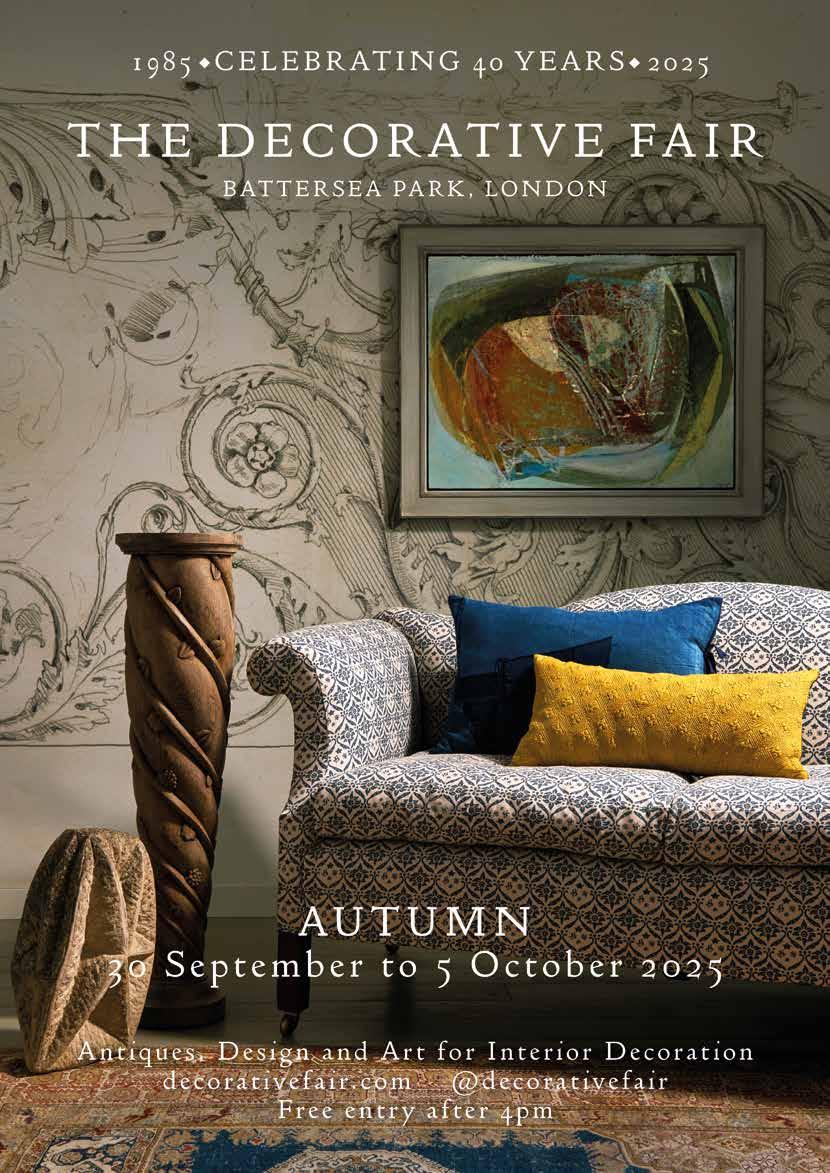

Bruton Street, in Mayfair, has a strong reputation for being a foodie haven, and just off this busy street is the more secluded Bruton Place, which is the home to the new venture from first time restauranteur Daria Grebenyuk and Head Chef Slawomir Sawicki. Although a first time venture, Chef Slawomir has developed his craft under a number of famous chefs, so my expectations were very high before I visited and I am pleased to say I wasn’t disappointed.

Silva means woodland or forest in Latin, and the restaurant’s décor has many hints back to this natural theme with its earthy tones. At the back of the room, a wall adorned with plaster relief moulded plants gives the interior a sophisticated and tranquil atmosphere. The seating is mainly curved banquettes around wooden tables and the dappled natural light floods into the restaurant from a skylight at the back. Additional light is provided on the tables from fixed lamps, with shades that project shapes reminiscent of the ghosts that chase Pac Man in the arcade game of the same name.

It is not just the décor that is stylish and sophisticated, the food is also. The menu takes its inspiration from the Mediterranean and selects the freshest of ingredients. Menus start at the beginning of the day with in-house baked pastries, a variety of egg based dishes along with indulgent salmon, and a rich and frothy coffee to set you up for the day. There are also many choices for lunch to delight diners all with the same attention to detail, however, we visited Silva for dinner and that menu has the widest choice.

As with most Mayfair restaurants Silva offers the almost mandatory raw fish

selection, and if you are struggling to select from Salmon, Yellowfish Tuna or Seabass, why not opt for a selection of all for £29. My wife didn’t have such a dilemma as she opted for the Salmon Tartare, Avocado, Puffed Rice and Ponzu (£17) and wasn’t disappointed by the ultra-fresh salmon, the creamy avocado and the subtle crunch of the puffed rice, all bathing in a delightful ponzu sauce, providing not only the salty earthiness of the soy content, but also the zesty citrus overtones that makes ponzu so popular.

Tempted as I was with these crudos, my starter was the Cornish Crab Raviolo with a Langoustine Sauce (£17). Crab flavour is delicate and is so often swamped when added to other ingredients, but at Silva the taste shines through. The pasta is cooked skilfully, but even though the crab was spectacular the true star of this dish is the Langoustine sauce. The sauce is so light and frothy it is almost cloud like, but although light, it is just bursts with flavour, and you do need to mop up every last drop with some freshly baked sourdough (£5.50).

For our main courses, my wife opted for the creamy Stracciatella, Caramelised Peach & Hazelnuts (£15) which although on the starters section was large enough for a main. Many may know stracciatella as an ice cream, but here we are talking about a fresh Italian cheese made from pulled mozzarella curds and cream. This cheese is the inside of the burrata, so if you have cut into a fresh burrata the gooey interior that oozes out is stracciatella. Burrata gets all the plaudits, but the real star is the stracciatella. The taste is buttery and mild, with a silky texture, which went perfectly with the fresh peaches and pears.

My main was the Steamed Halibut, Broccoli Purée, Samphire with a Sauce Vierge (£38). Halibut has a similar sweet taste of that of clams and crab and is

also one that absorbs flavour from its accompaniments, so takes on some of the classic taste of the tomato-based sauce vierge. Steaming the fish made the flesh melt in my mouth, and to accompany this I selected some Rosemary Roast Potatoes. These potatoes are just spectacular, as they are slow cooked and then deep fried, giving them a wonderful crunch that you just mustn’t miss!

The delights just kept coming with our desserts which were the Manuela’s Casque Cheesecake and the Strawberry, Vanilla, Fontainebleau Meringue (both £13). The Fontainebleau was packed with a combination of fresh cream, sweet meringue and succulent strawberries and the cheesecake was amazingly creamy and so light (apparently Basque cheesecakes don’t have the biscuit base).

Silva is a wonderful addition to the London food scene as it does things right from the moment you enter. The décor is stylish, the food excellent and the service second to none, and you will certainly leave with a big smile on your face. www.silvarestaurant.co.uk

7-9 Slingsby Place, London, WC2E 9AB

The original Oriole was located at Smithfield Market and was an award winning cocktail bar which had to close in 2022 due to the market’s redevelopment, and despite a three month pop up called Prelude by Oriole offering a taste of what was to come, its patrons have had to wait for Oriole’s second iteration which has now settled in the Yards, a series of interconnecting courtyards two minutes from Covent Garden tube station, bursting with an eclectic mix of trendy shops and household named restaurants.

The restaurant/bar and music venue is aptly named after the Oriole bird, as like the bird the restaurant is striking in colour, provides an eclectic mix of dishes (the oriole is migratory), and provides patrons with wonderful music (orioles are re-known for their melodious songs).

Having spent a hard day shopping or visiting the many London sights, where better to relax than first in a bar, followed by a relaxing meal in the same sophisticated venue, whilst listening to some live musicthat is the Oriole offering.

On the ground floor is the curiously named Bamboo Bar (as there isn’t a stick of bamboo in sight!), which tantalises the drinker with a number of classic and also innovative cocktails whilst you watch the world go by.

The Bamboo Bar is just the apéritif to the restaurant which is located in the basement. Here, there is bamboo in the form of woven bamboo ceiling panels along with

a signature tropical wall mural providing an intimate and stylish vibe. At the back of this room is the bar which is home to Oriole’s first in-house bar lab, a dedicated space for cocktail development using the most sophisticated equipment including an Ultrasonic Homogeniser (no I don’t know what this is either!), which enhances the flavour of the ingredients, ensuring some of the best cocktails in London.

The tables are spaced out and surround the stage where most nights a wide variety of music is played, including live jazz, cabaret and world music, and you can see who is playing by searching on the Oriole website. It is advisable to book your table in advance, as the venue is intimate, and you do want to ensure you have a good seat.

When we visited we were treated to a wonderful pianist, who we later found out was an American, who treated us to numerous timeless songs blending perfectly with the lush surroundings.

The menu starts with Bar Bites, and from that we selected the Padron Peppers (£7) and the Truffle Mash Croquettes (£8). Padron peppers are a staple favourite of tapas restaurants and are super flavoursome and a great start to any meal. The other favourite of tapas is the trusty croquette and they can have many fillings including fish and meat, but here the humble potato stood up as the filling and really delivered. The mash was smooth and creamy with just a hint of truffle giving that opulent flavour only truffle can, all encased in a crispy shell. Our next course was from the Small Plate selection, and here the selection was an eclectic mix from all around the world. Our selection was

the Seabass Ceviche (£14) and the Pork Katsu Sando (£15). The seabass ceviche is Peruvian- inspired, and the citrus tones complemented the fresh fish perfectly along with peppers and onions and a hint of mint. My pork dish originated from Japan and Korea. The Katsu Sando is a dish of comfort, with its crispy meat cutlet in Panko breadcrumbs sandwiched between soft white bread, all supported by the complex flavours of the kimchi which was spicy, tangy and slightly salty.

Our large plates were also a journey to another country’s cuisine, with the quintessentially English Lamb Rump, Jersey Spring Greens and Huacatay Black Olives (£26), and the Asia-inspired Trout Mi-Cuit with Galangal, Coconut Sauce and Peanut Sambal (£25). The lamb was slightly crispy on the outside and succulent on the inside with a hint of rosemary, all bathed in a rich deep sauce, with slightly crunchy spring greens, and the trout had a lovely crispy skin and a slightly raw inner flesh (Mi Cuit is French for half cooked). This was accompanied by the slightly sweet coconut sauce and the spicy and aromatic qualities of the galangal, which is commonly believed to aid digestion.

Desserts are restricted to a Gin Infused Strawberry Eton Mess (£10), a Chocolate & Hazelnut Delice with Tonka Ice Cream (£10), or a selection of Sorbets (£7), but whichever you choose you won’t be disappointed.

Eating great food is always a pleasure, but when you can do that in an intimate venue with classy live music it is even more enjoyable, and Oriole provides it all, and will go from strength to strength. www.oriolebar.com

By

Atul Kochhar

17-19 Maddox Street, London, W1S 2QH

Situated just off bustling Regent Street, Kanishka by Atul Kochar is a modern, Indian restaurant, run by charming, efficient staff, serving delicious Indian food with a modern twist, created by the award-winning and Michelin starred chef, Atul Kochar.

Atul was the first chef to be awarded a Michelin star for Indian cuisine, and it is under his expert tutelage that Kanishka shares with diners Atul’s expertise and his culinary delights. One thing you can guarantee from Atul Kochhar is the uniqueness of the dishes, and here he has taken the largely unexplored cuisine of the Seven Sisters region of India, along with influences from Nepal, China and Bangladesh, and combined them to produce spectacularly tasty dishes.

The restaurant’s décor is bright, modern and cosy, decorated with black and white stripes and aqua blue colours that surround stunning artworks by Zara Muse (Grove Gallery). They were launched last year in honour of International Women’s Day and really add an extra dimension to the décor.

Diners have either a number of Tasting Menus to choose from, with the highlight being the Kanishka Tasting Menu (£120) which consists of 7 courses, showcasing many of the dishes on the à la carte menu, On the night we dined here we chose from the à la carte menu itself, and the starter selection included dishes such as: Tandoori Ratan-tandoori prawns, chicken tikka and lamb chops, roasted pepper and sunflower chutney (£32), Scottish Mackerel, Andhra-

spiced torched mackerel, rillette, cucumber, heritage tomatoes, dill (£20), Tandoori Monkfish - monkfish, wild garlic, coconut and kale (£22), and the infamous Atul Chicken Tikka Pie (£20). Vegetarians are also well catered for, and can choose from Blue Cheese Paneer Tikka - home churned cottage cheese, blue stilton, quince murabba, pickled onions, Nadru Ki Chaat Lotus - stem kebab, raisins, amaranth seed, plum chutney and Malai Broccoli - grilled broccoli, marinated in nutmeg garam masala, served with cardamom parmesan fondue, all at £19.

We chose the Mackerel, that was beautifully spiced and quite light, and obviously, the must-have, Atul’s Chicken Tikka Pie, which I have to say I would go back for time and time again. The pie is a light and flaky puff pastry encasing a lightly spiced chicken tikka, served on a delicious berry sauce. One of my favourite Indian dishes to date.

As with the starters, the main dishes are full of unexpected ingredients for an Indian restaurant. Diners can choose dishes such as Venison and Lamb, but we chose the Butter Chicken (£29), the Kadhai Jhingstir-fried prawns with peppers, ginger, tomatoes and padron peppers (£35), and the Biryani (£32), along with a Roti (£5), a Paratha (£6) and Steamed Rice (£6). Butter chicken must have succulent chicken smothered in a rich and creamy sauce and here the tandoor-roasted chicken tikka is surrounded by a wonderfully indulgent sauce which was eagerly soaked up by the fluffy rice. The biryani had been cooked with a pastry lid, as it should, and this enhanced the flavour of the fragrant cumin rice and succulent oven baked lamb. The prawns were meaty, bathed in a spicy

tomato sauce and the paratha was light and flaky, and was perfect to mop up the rich butter chicken sauce.

Desserts are also creative and more stylish than most Indian restaurants, and are all priced at £14. We chose Baked Alaska and Mango Millie-feuille - mango custard, mango and basil sorbet, coulis, both of which were beautifully presented, light and fruity.

Kanishka has an extensive wine list to accompany the culinary delights all starting at £40, but for whisky lovers they also have over 50 to choose from with many rare single malts available from all over the world.

Kanishaka offers Indian food, but not as we used to know it, as this food is sophisticated and brimming with exciting and extravagant flavour combinations, and is a restaurant I look forward to returning to soon, (even if it is just to have the pie!). www.kanishkarestaurant.co.uk

Hippodrome Casino, Cranbourn Street, Leicester Square, London, WC2H 7JH

The Hippodrome Casino is in a great location, situated at one corner of Leicester Square, London’s capital of the cinema world, and offers readers not only the chance to have a flutter on the gambling tables, it also offers several restaurants and even a theatre, and on our visit we were there to review Chop Chop, a restaurant from the Four Seasons Restaurant Group, located in the basement of the Hippodrome Casino, and it is certainly a welcome addition to its other restaurants.

I suspect that Chop Chop’s décor will be a ‘marmite’ experience for diners, with some loving it and some not. As mentioned, the restaurant is housed in the basement of the Hippodrome so natural light lovers will be sorely disappointed, but the décor is a throwback to the 1960’s Hong Kong style with jade greens, cosy booths and lantern lights. The restaurant colours I suggest are a hint to actual green jade, a most admired gemstone by the Chinese as they consider it a symbol of the five virtues: modesty, courage, justice, wisdom and compassion. The Chinese history continues with a number of neon Koi carp strategically adorning the walls around the restaurant which are a reference to the Chinese waterfall legend which tells the tale of the gods helping one Koi carp make it up a waterfall to became a dragon.

The menu at Chop Chop is extensive and caters for both diners that just want a quick meal, before maybe returning to the casino, or those, like us, who are looking for a more leisurely meal. One thing I have learnt in my time eating out is to order dishes as you go rather than all at once. This then not only ensures that you don’t over order, it also enables you to space out the dishes so you have the time to enjoy each dish separately rather than getting everything all at once, and hot dishes will remain so.

That said, our first selection were the Minced Pork & Prawn Dumplings (£10) and the Prawn & Chive Dumplings (£10), both providing a generous 6 pieces of each. Pork and prawn is a classic combination and when expertly combined with the right seasoning create a tasty, meaty mouthful. The prawn and chive dumplings were equally moreish, stimulating not only our taste buds but also our eyes with their vibrant green colour. Both were steamed perfectly to give that lovely sticky texture.

Our next course involved Char Siu BBQ Chicken Buns (£10) and some Salt & Pepper Prawns (£12.80). I like to think of myself as a devotee of salt and pepper prawns, and these at Chop Chop are right up there with the best, with the batter light and crispy, and the prawns firm and almost meaty. Added to that are salt, fiery chilli, and a touch of soy saucewonderful. The buns were again steamed to perfection giving that perfectly sticky texture and their slightly sweet flavour surrounded the equally sweet succulent BBQ’d chicken. My only gripe was there weren’t more of them!

There is something about Chinese duck pancakes which is special, and the Four Seasons restaurant group are renown for their duck, drawing devotees from around the world. The ducks are sourced from Ireland where they are reared totally organically making the meat all the more tender. Crispy skin, laced with sweet savoury glaze, gives way to meat that is tender and flavoursome without being greasy, and the way the waiter almost lovingly shreds the portion at your table tells you all you need to know about how seriously they take their reputation for providing one of the best roast duck dishes. The pancakes are plentiful, and the plum sauce rich and deep in texture, and if you want to enhance it just a little more try

adding a little bit of chilli as it gives that extra zing.

The mains here at Chop Chop are varied and you can select a number of signature meats, including that wonderful duck again, or a mixture of two or three with rice for a very reasonable £16 - £20. Fish lovers are also well catered for, with Lobster, Seabass and Prawns to choose from, but we opted for the Sweet and Sour Prawns (£17.80), the Stewed Beef Brisket in Chu Hou sauce (£17.80), and a portion of the Singapore Noodles with Pork and Prawn (£14.80).

As with the other dishes the portion sizes are generous and the tastes classic. The sweet and sour prawns were coated in the sweet sticky sauce accompanied with pineapple onion and peppers, and the Chu Hou sauce enhanced the deep flavours of the braised beef helping it shine through. Chu Hou sauce was invented during the Qing Dynasty (the last Chinese dynasty spanning from 1636 to 1912), as at that time beef wasn’t popular, so this special sauce enhanced the beef flavour. The noodles were perfect to mop up both rich sauces.

Desserts include a number of ice cream lollys with exotic flavours including Pandan & Coconut and Green Mango & Lemon (£2.50 to £3.50) as well as a Choux Bun filled with Vanilla Custard (£5) and a Yuzu Cheesecake (£7).

Prices at Chop Chop are very reasonable and the portion sizes generous. The food is excellent, so even if you are a natural light lover, overcome your trepidation and take a trip to Chop Chop, as you may just be surprised!

One final note is because the restaurant is situated in a casino you do have to be 18 to visit, and you also need to bring photo identification to show that. www.hippodromecasino.com/chopchop

Starting September 30, 2025, the US federal government will stop issuing paper cheques for most federal payments, including IRS tax refund cheques, in accordance with Executive Orders issued on March 25, 2025. In addition, the Executive Order directs that payments to the US Treasury - including tax payments - be processed electronically as soon as practicable and in accordance with applicable law. The move aims to improve efficiency, reduce administrative costs, and combat fraud - particularly theft and loss of cheques sent through the mail. According to Treasury data, maintaining paper-based payment systems cost taxpayers over $657 million in 2024 alone.

The Treasury has indicated that limited exceptions may apply; however, as of this writing, no formal process or eligibility criteria have been announced. Potential exceptions could include individuals without access to banking or electronic payment systems, emergency situations, national security concerns, or other cases as determined by the Secretary of the Treasury.

Because there is currently no clear guidance on how to request an exception and the effective date is quickly approaching, it is possible that the Treasury will announce a formal process or offer temporary relief soon. However, until such guidance is provided, we recommend not assuming eligibility for an exception or that relief will be granted. Taxpayers are encouraged to monitor the US Treasury’s website for updates.

Any individual expecting an IRS refund or any other federal payment should make alternative arrangements before the September 30 deadline.

A recent Treasury press release offered guidance for Americans who still receive paper cheques for Social Security, Veterans benefits, or other federal payments:

• Enroll in direct deposit by contacting the federal agency that issues your payment or by calling the Electronic Payment Solution Center (800-967-6857)

• If you don’t currently have a US bank account to receive payments like IRS refunds, consider opening one that accepts direct deposits. Digital-only banks and low-fee credit unions are also good options

• You can also sign up for a Direct Express® Debit Mastercard®, a Treasurysponsored debit card that allows you to receive benefit payments electronically. Individuals without a bank account can enroll by calling the Electronic Payment Solution Center (mentioned above) or by contacting you’re paying agency directly.

When President Trump signed the Omnibus Tax Simplification and Fairness for Americans Abroad Act - commonly referred to as The One Big Beautiful Bill (OBBBA) - into law on July 4, 2025, it marked a major overhaul of US federal tax policy. From sweeping tax cuts to changes in reporting thresholds and reductions in healthcare spending, the bill carries far-reaching implications.

While much of the legislation is aimed at stimulating domestic economic activity, OBBBA includes several provisions that directly or indirectly affect individual US taxpayers - including those residing abroad. One of the most notable aspects of the bill is that it permanently extends several key provisions from the 2017 Tax Cuts and Jobs Act (TCJA). While not all these changes will be relevant to Americans paying UK taxes, here are a few highlights worth noting:

The individual tax rates introduced by the 2017 Tax Cuts and Jobs Act (TCJA) - ranging from 10% to 37% - were originally set to expire after 2025. Under OBBBA, these rates are now permanent.

The increased standard deduction remains in place for the 2025 tax year:

• $14,600 for single filers

• $29,200 for married couples filing jointly. Personal exemptions continue to be suspended.

• Miscellaneous itemised deductions remain disallowed

• The deduction for unreimbursed employee expenses continues to be unavailable to most taxpayers.

The Child Tax Credit, previously set to revert to $1,000 after 2025, has been increased to $2,200 per qualifying child starting in 2025. Beginning in 2026, the credit will be adjusted annually for inflation.

Families supporting dependents who don’t qualify for the Child Tax Credit - such as elderly parents or adult relatives - can continue to claim the $500 credit, now permanently available.

Additional

Qualified taxpayers aged 65 and older may reduce their taxable income by an additional $6,000, in addition to the standard or itemised deduction.

Starting in 2026, taxpayers who take the standard deduction can still benefit from charitable contributions:

• Up to $1,000 for individuals

• Up to $2,000 for married couples filing jointly. This reinstates and expands a previously temporary provision.

Effective 2025, a qualified taxpayer paid through US payroll may qualify for a dollarfor-dollar deduction for overtime (OT) pay covered by the Fair Labor Standards Act through 2028. Employers must designate overtime wages on the taxpayer’s Form W-2 (special rule for 2025 will allow employers to approximate OT). The deduction is capped at $12,500 for individuals and $25,000 for joint filers. The deduction is phased out for higher-income taxpayers. It is important to note that this deduction is not available for individuals who file separately from their spouse, which could impact taxpayers living abroad who are married to non-US spouses and choose not to file jointly.

Beginning in 2026, the federal estate and gift tax exemption increases to $15 million per person, indexed for inflation. This replaces the 2024 threshold of $13.61 million and is now permanent, offering opportunities for long-term estate planning.

Citizenship-Based Taxation Remains Intact

For many Americans living abroad, one of the most anticipated reforms was a shift to residence-based taxation (RBT). In late 2024, Representative Darin LaHood introduced the Residence-Based Taxation for Americans Abroad Act (H.R. 10468), proposing a move away from the longstanding citizenship-based system.

This bill gained attention and support from advocacy groups and tax professionals, raising hopes that it might be included in the broader reform package.

During the US presidential campaign, there was also public discussion around “fairness for Americans abroad” and “ending double taxation,” which many interpreted as signals that RBT might be on the table. However, OBBBA does not include any provision to modify the current system, likely because implementing RBT would require a major overhaul of IRS systems, enforcement mechanisms, and international coordination, and OBBBA focused primarily on domestic economic stimulation, tax cuts, and deregulation.

As a result, Americans residing in the UK are still required to file US tax returns and report their worldwide income annually, even if they also file and pay taxes in the UK. This includes compliance with:

• Foreign Bank Account Reporting (FBAR)

• Foreign Account Tax Compliance Act (FATCA). Fortunately, key provisions remain in place to help avoid double taxation:

• Foreign Earned Income Exclusion (FEIE)

• Foreign Tax Credit (FTC)

• US-UK Income Tax Treaty (2001), as amended by the 2003 Protocol. These provisions continue to offer meaningful relief for most taxpayers, but the underlying system of citizenship-based taxation remains unchanged.

Effective 2026

The One Big Beautiful Bill introduces a new 1% excise tax on certain remittance transfers beginning in 2026.

The new 1% remittance tax (effective Jan 1, 2026) applies only to non-US citizensincluding green card holders, visa holders, and others sending cash-funded remittances from the US to recipients living abroad.

The sender is responsible for the tax, which specifically targets transfers made using physical instruments, such as:

• Money orders

• Cashier’s checks

• Similar non-bank methods.

Transfers made through standard banking channels - including bank wire transfers, debit or credit card payments, and electronic transfers conducted by institutions regulated under the Bank Secrecy Act (BSA), such as US banks and credit unions - are exempt from this tax.

The 1% remittance tax will not necessarily impact US citizens living in the UK, as Americans abroad will likely be sending money through standard banking or electronic channels. However, green card holders are not exempt and may be subject to the tax regardless of where they reside.

If you’re a US citizen planning a trip to the US, it’s important to be aware of the new 1% remittance tax. While the tax does not apply to US citizens, you may be more likely to use non-bank instruments such as money orders or cashier’s checks during your time in the US. Since remittance service providers are responsible for collecting the tax at the point of transfer, they may not be able to easily verify a sender’s citizenship and might apply the tax by default. Using electronic or bank-based transfers will help you avoid any issues.

Estate Planning Opportunity

With the federal estate tax exemption now permanently set at $15 million per individual, Americans with UK assets or dual-tax exposure should consider reviewing their estate plans. This may include updating wills, trusts, or gifting strategies to reflect the new threshold and ensure cross-border alignment.

Retirement Account Rules Unchanged

OBBBA does not introduce any changes to retirement account rules.

• Contribution limits and tax treatment for Roth IRAs and traditional IRAs remain unchanged

• The treatment of foreign pension plans, including UK-based schemes such as SIPPs, also remains the same

• Existing IRS reporting requirements for foreign pensions continue to apply.

Compliance and Reporting Reminders

Despite calls for simplification, OBBBA does not reduce the reporting burden for Americans abroad. The following forms and requirements remain in effect:

• Form 1040 – Annual federal income tax return

• Form 8938 – FATCA reporting for specified foreign financial assets over threshold

• FBAR (FinCEN Form 114) – For foreign bank accounts exceeding $10,000 aggregate

• Form 1116 – To claim the Foreign Tax Credit

• Form 2555 – If claiming the Foreign Earned Income Exclusion.

It’s important to be aware that not meeting these requirements may lead to penalties, even if no US tax is ultimately due. To stay on track, it’s a good idea to review your filing status each year and consider speaking with a tax advisor familiar with cross-border matters.

For Americans living in the UK, the One Big Beautiful Bill offers more continuity than disruption - but with a few notable changes that deserve attention and Tax Payments.

• Digital Only Refunds and Tax Payments: As of September 30, 2025, the IRS will no longer issue paper refund cheques or other federal payments. All disbursements will be electronic - via direct deposit or prepaid debit cards. For Americans in the UK without a US bank account, now is the time to set up a digital payment method to avoid delays in accessing funds

• No New Relief for Expats: The bill does not introduce any new exemptions or simplifications for Americans abroad. Annual filing requirements and citizenshipbased taxation remain unchanged

• Remittance Tax Alert: Starting in 2026, a new 1% tax will apply to certain cash-based transfers initiated within the US While most electronic and bank transfers are exempt, this change is a nudge for expats to modernize any lingering non-bank financial habits.

While the landscape hasn’t shifted dramatically, these updates underscore the importance of staying informed and prepared. Keeping accurate records and working with a qualified cross-border tax advisor remain essential strategies for staying compliant and making the most of available provisions.

RoseMarie Guaglieri is a Tax Manager with H&R Block Expat Tax. In her 30+ year career, she has developed deep expertise in working with thousands of expatriates. RoseMarie has lived and worked in the United Kingdom, Japan, and Switzerland, gaining a unique perspective on the intricacies of cross-border taxation. At Block, she manages a team of expat tax advisors and focuses on new business development. H&R Block Expat Tax provides US tax preparation services virtually to US citizens who live abroad. Whether you prefer to work with one of our international tax advisors or do your own return online, we are here for you. For more information or to get started, visit us at www. hrblock.com/ expattaxpreparation/ or contact us at expattax@ hrblock.com.

In 2025, the US dollar (USD) has faced one of its steepest declines in decades, depreciating approximately 11% against major currencies like the British pound (GBP) and the Euro (EUR) in the first half of the year, its largest drop since 1973(1). This depreciation marks the end of a 15-year bull cycle for the dollar, driven by a convergence of factors including slowing US growth, rising inflationary pressures from tariffs, and increasing global investor anxiety.

The Federal Reserve’s anticipated rate cuts from a range of 5.25%-5.5% down to potentially 2.5% by 2026, have narrowed the interest rate differential between the US and other economies, weakening the dollar’s appeal. Meanwhile, foreign investors have begun hedging their exposure to US assets, signalling a shift in sentiment that could further pressure the greenback.

For many US taxpayers living in the UK, recent currency movements have raised concerns. There are compelling reasons why they hold USD-denominated investments, since the US offers access to one of the largest and most tax-efficient investment universes, and it enables the construction of globally diversified portfolios. However, while their investments may span global markets, the currency denomination is often in US dollars, whereas their living expenses and retirement goals are typically tied to the British pound. This mismatch between asset and liability currencies introduces foreign exchange (FX) risk, which, if left unmanaged, can erode wealth and disrupt long-term financial planning.

Fortunately, FX risk can be managed effectively. The key lies in understanding where the risks lie and how to anticipate and mitigate them. Let’s explore three core strategies to help investors navigate this complex terrain.

Investing in globally diversified fixed income funds can offer a range of advantages, including access to varied interest rate environments, reduced country-specific risk, and broader exposure to global credit markets. These funds are particularly appealing to long-term investors seeking consistent income and capital preservation through different market cycles.

However, for US taxpayers residing in the UK, investing tax-efficiently in fund structures requires careful consideration. To avoid punitive taxation under the Passive Foreign Investment Company (PFIC) regime, eligible funds will almost certainly need to be both domiciled in the US and denominated in USD. This constraint limits the ability to invest in fund structures denominated in other currencies, such as GBP. As a result, alternative investment solutions may need to be explored.

This approach helps eliminate the risk that currency fluctuations could increase the cost of those liabilities

This is especially true for those with nearterm expenses (expected within the next 12 months) and it may be prudent to instead focus on holding GBP-denominated fixed income assets or utilise high-yield GBP savings accounts. This approach helps eliminate the risk that currency fluctuations could increase the cost of those liabilities. For example, if you’re planning to:

• Pay a large UK tax bill

• Purchase a property in the UK

• Fund school fees or other major living expenses …then holding those funds in USD could expose you to FX risk. A further depreciation of the dollar would mean you’d need more USD to meet the same GBP obligation. To mitigate this, consider:

• Tranching investments out of the market over time: If you’re planning to convert USD to GBP for a known expense, doing so

gradually, rather than all at once, can help smooth out FX fluctuations and reduce timing risk

• GBP-denominated corporate bonds: These can offer attractive yields while matching your liability currency

• UK gilts: Backed by the UK government, they provide security and predictability

• High-yield GBP savings accounts: These offer liquidity and competitive interest rates, ideal for short-term needs. By aligning the currency of your assets with your known liabilities, you reduce uncertainty and protect your purchasing power. This strategy doesn’t mean abandoning global diversification, it simply means being tactical about how and where you hold assets based on your financial timeline.

Equities, real estate, and commodities are the core asset classes that can help drive fundamental growth within long-term savings. For many US investors living in the UK, the most efficient way to access these real assets is often through US-based funds with UK reporting status. These vehicles offer tax efficiency, regulatory clarity, and access to the broadest range of global investment opportunities.

It’s important to remember that diversification is critical to the success of any long-term investment strategy. A globally diversified portfolio helps reduce reliance on any single market or currency, smoothing returns over time and increasing resilience to localised shocks.

However, in times of pound weakness, it’s not uncommon for investors to hesitate before converting GBP into USD. On the surface, the cost of exchange can feel like a barrier. But this hesitation can lead to missed opportunities, especially when the long-term benefits of global diversification outweigh short-term currency concerns.

If your wealth manager has set up efficient foreign exchange banking services, the actual transaction costs of converting currency should be trivial. With institutional-grade FX platforms, spreads can be minimal, and conversions can be timed or trailed to reduce exposure to sudden market moves.

Another common oversight is focusing too much on the currency of the fund rather than the currency exposure of the underlying assets. For example, converting GBP to USD to invest in a US-domiciled fund that holds European or Emerging Market equities doesn’t mean you’re only exposed to USD. Your real exposure lies in the currencies of the underlying investments.

When it comes to equities, FX fluctuations can enhance or detract from returns in the short-term. Some fund managers use hedging strategies to protect against this volatility, but academic research shows that currency hedging is generally ineffective over the long-term for equity investments. Equity returns are primarily driven by company performance and economic growth, not currency movements. So, rather than letting exchange rate costs dictate your investment decisions, consider:

• The true geographic and currency exposure of the underlying assets

• Whether the fund manager uses currency hedging, and if so, how

• The long-term benefits of diversification, even if short-term FX movements seem unfavourable

• The efficiency of your FX banking setup, which can significantly reduce the cost of currency conversion.

By understanding where the real currency risk lies, and where it doesn’t, you can make more informed, confident investment decisions that support your long-term goals.

Cash holdings are often overlooked in FX risk discussions, but they play a crucial role in financial planning. If you’re living in the UK and spending in GBP, holding large amounts of USD cash can expose you to unnecessary volatility. Consider the following:

• Short-term liquidity needs: These should be held in GBP to avoid FX risk

• Emergency funds: If you’re living in the UK, it makes sense to keep your emergency cash in GBP

• Investment cash: If you’re planning to invest in USD-denominated assets, holding cash in USD may be appropriate. The key is to segment your cash holdings based on their purpose and time horizon. For example, you might hold GBP for day-to-day expenses and USD for future investments, but ensure that each pool of cash is aligned with its intended use.

Global diversification remains one of the most powerful tools for long-term savers. By spreading investments across geographies and asset classes, investors can reduce

risk and enhance returns. However, with diversification comes currency exposure.

Understanding where FX risk lies, whether in your cash holdings, your investment vehicles, or your future liabilities, is essential. Misunderstanding these risks can lead to poor decisions, such as overhedging, under-diversifying, or failing to plan for currency mismatches.

For US taxpayers living in the UK, the challenge is balancing the tax efficiency and investment breadth of USD assets with the reality of GBP-denominated living costs. It’s a delicate dance, but one that can be mastered with thoughtful planning and a clear understanding of currency dynamics.

It’s a delicate dance, but one that can be mastered with thoughtful planning and a clear understanding of currency dynamics

The depreciation of the USD in 2025 has served as a wake-up call for many investors. While it’s tempting to react emotionally to currency movements, the smarter approach is to build a strategy that anticipates and manages FX risk.

By aligning investments with liabilities, understanding the true currency exposure of your portfolio, and managing cash holdings wisely, you can protect your wealth and stay on track toward your financial goals.

Currency risk is real, but with the right tools and mindset, it doesn’t have to be a threat. In fact, it can be an opportunity to refine your strategy and build a more resilient financial future.

References 1. Devaluation of the U.S. Dollar 2025

Morgan Stanley

The Legal Stuff

This document may not be forwarded, copied or distributed without our prior

written consent. This document has been prepared by MASECO LLP for information purposes only and does not constitute investment, tax or any other type of advice and should not be construed as such. The information contained herein is subject to copyright with all rights reserved.

The views expressed herein do not necessarily reflect the views of MASECO as a whole or any part thereof. All investments involve risk and may lose value. The value of your investment can go down depending upon market conditions and you may not get back the original amount invested. Your capital is always at risk. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The levels and bases of, and reliefs from, taxation is subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

MASECO LLP (trading as MASECO Private Wealth and MASECO Institutional) is established as a limited liability partnership under the laws of England and Wales (Companies House No. OC337650) and has its registered office at The Kodak Building, 11 Keeley Street, London, WC2B 4BA. For your protection and for training purposes, calls are usually recorded.

MASECO LLP is authorised and regulated by the Financial Conduct Authority for the conduct of investment business in the UK and is registered with the US Securities and Exchange Commission as a Registered Investment Advisor.

Dan Keeley Manager at MASECO Private Wealth Contact: daniel.keeley@masecopw.com

For many successful US businesses, setting up a UK branch is a natural next step: whether to establish a European presence, better serve international clients, or expand global reach.

But one common (and absolutely critical) question often arises during the expansion process:

Can we bring over key team members from the US (or elsewhere) to help establish our UK operations?

The short answer is, yes. However, despite common misconceptions, the process isn’t as simple as the proposed new hire packing their suitcase, booking a flight to Heathrow, and starting work for the UK entity the next day.

In this article, Lydia StephensonSlater, Senior Associate and Immigration Solicitor at Russell-Cooke LLP, explores what American companies need to know when expanding into the UK and relocating talent or hiring non-UK nationals, and why immigration planning should be an integral part of business’ UK expansion strategies from day one. Typically, that begins with securing a Skilled Worker sponsor licence.

A Skilled Worker sponsor licence is formal permission from the UK Home Office that allows a UK entity to employ non-UK nationals, specifically under the Skilled Worker immigration route.

This route enables UK employers to sponsor overseas talent for qualifying skilled job roles, provided certain criteria are met, such as minimum salary and skill thresholds. Crucially, companies must hold a valid sponsor licence before they are able to assign Certificates of Sponsorship (CoS) to workers or support their visa applications.

For American companies, this licence is often an important recruitment resource and a key to relocating trusted skilled staff to get UK operations off the ground.

In order for the Home Office to grant a sponsor licence application, it must be satisfied that a UK entity meets specific requirements. Amongst other considerations,

the Home Office will typically expect to see evidence that the business:

• Is genuinely active and trading in the UK

• Has robust HR and compliance systems in place

• Can meet its sponsorship duties and obligations

• Is sponsoring roles that meet the Skilled Worker salary and skill requirements. Companies will also need to appoint Key Personnel within the UK entity to manage the licence using the Sponsor Management System (SMS), and a range of corporate documents must be submitted as part of the application.

This application is not just a form-filling exercise, attention to detail and providing the correct prescriptive documents is critical. Even minor errors in the application can lead to Home Office processing delays or outright refusals, so thorough preparation is key.

Securing a sponsor licence is just the beginning, maintaining it comes with ongoing compliance responsibilities

Securing a sponsor licence is just the beginning, maintaining it comes with ongoing compliance responsibilities.

Once it has been granted a sponsor licence, a UK business is expected to:

• Monitor and track its sponsored workers’ visa status and attendance

• Maintain robust right-to-work checks

• Report specific changes to the Home Office (e.g., role changes, resignations, company structure updates)

• Keep accurate personnel records and policies

• Cooperate with Home Office requests for information or audits.

Non-compliance can result in suspension or revocation of a sponsor licence, potentially affecting sponsored workers’ visas (and their dependants’) and the stability of the company’s UK operations.

Depending on the company’s stage of expansion, other immigration routes, including under the Global Business Mobility (GBM) umbrella might be appropriate. These include:

• Expansion Worker visa – for sending senior staff to establish a new UK presence

• Senior or Specialist Worker visa – for transferring experienced employees between linked corporate entities. These routes can suit specific scenarios, but often come with visa time limits and fewer long-term benefits compared to the Skilled Worker route.

Once a UK branch is up and running, the Skilled Worker route is typically the most viable long-term solution for hiring and relocating non-UK talent.

However, every company is different, so understanding the options and seeking tailored UK immigration advice early on is essential to understand all options and avoid issues down the line.

For employees relocating from the US, the ability to bring family is often a major concern, and rightly so.

The good news? The Skilled Worker route allows dependant spouses, long-term partners, and children under 18 to join or accompany the main visa holder. In most cases:

• Spouses and partners can work in the UK (with some limited exceptions)

• Children can access UK education

• Dependants’ visa durations match the main applicant’s.

However, dependants must meet their own eligibility criteria, and applications should be carefully prepared. Early planning is essential to avoid delays, especially when it comes to school enrolment and ensuring family life is not disrupted.

A Skilled Worker sponsor licence application typically takes up to 8 weeks to be processed by the Home Office. A faster, 10-working-day priority service is available, but with limited capacity and eligibility restrictions.

It is also important not to discount the additional time required to process workers’ visa applications after the UK entity’s sponsor licence is approved. In time-sensitive business launches, delays in securing sponsored workers’ immigration permission can impact everything from leadership presence to project delivery timelines.

Incorporating immigration planning into your company’s wider UK expansion strategy is not just wise; it is essential to staying on track.

Relocating to the UK is rarely a onesize-fits-all exercise. But with the right legal assistance, you can avoid common mistakes, remain compliant, and focus on what matters the most: building your UK business with confidence.

Russell-Cooke’s Immigration team, led by Ed Wanambwa, advises businesses and private clients on the full spectrum of UK immigration matters.

Whether you are a business owner leading a company expansion or are part of a wider project team, Ed, Lydia and the team are here to guide you clearly and confidently through the UK’s complex immigration landscape. From identifying the most appropriate visa route for your senior executive hire, to securing your Skilled Worker sponsor licence and ensuring long-term sponsor compliance, the Immigration team at Russell-Cooke can assist in making every step of your UK immigration journey as smooth and efficient as possible.

Ed Wanambwa

Partner

+44(0)20 8394 6445

Ed.Wanambwa@russell-cooke.co.uk

Lydia Stephenson-Slater

Senior associate

+44(0)20 8394 6357

Lydia.Stephenson-Slater@russell-cooke. co.uk

We are delighted to invite you to our free

for Americans who are living in the UK on Monday 22nd September 2025 at The Royal Automobile Club, a private members club, on Pall Mall, London

This event will take place from 12pm - 3.30pm and offers you the opportunity to network with other Americans living here, along with an hour’s useful advice on all aspects of financial management for Americans living in the UK. Complimentary tea, coffee and pastries will be served from 12pm, there will be a free prize draw, and you can enjoy a glass of wine after the presentations whilst networking with the exhibitors and fellow Americans.

We will be running a Free Prize Draw, where you can win prizes kindly donated by the sponsors of the event. This event is only for Americans living in the UK, and is FREE TO ATTEND, so to register for this event, please email helen@theamericanhour.com with the name/s of those who would like to attend.

We look forward to hopefully seeing you there!

WITH THANKS TO OUR SPONSORS:

The UK has 15 National Parks, and what might surprise you is that one of the largest is also one of the least well known, that being The South Downs, which covers a surprising 1,624km squared across the south of England, from Winchester in the West to Eastbourne in the East. There are a large number of very different things to do within the park, including the South Downs Walk and visiting a number of picturesque towns and villages, and nestling in the heart of the Downs is the lovely town of Midhurst.

Midhurst was on the ancient trade route from London to Portsmouth and so is brimming with history, as well as many boutique shops to browse in, and it also has one of the oldest coach inn’s in the country, which is now the Spread Eagle Hotel & Spa.

The Spread Eagle is brimming with character and centuries of history, dating

back to the 15th century, and the hotel has welcomed everyone from Elizabethan travellers to modern-day guests, and offers a timeless charm that’s rare to find. The creaking floorboards, open log fires, and oak-beamed ceilings transport you to another era - without sacrificing comfort. The most famous visitor was Elizabeth I, who stayed at the inn circa 1591, and the best of the Spread Eagle’s Suites is named the Queen’s Suite, as it was from there that one of the most famous women in English history watched from the window whilst the townsfolk celebrated her visit below in the town square. The Queen’s Suite is also believed to be the only room that has a wig room where the Elizabethan gentry stored their wigs whilst staying. It is now used as a dressing room for the modern-day guests to dry their hair and do their make-up, but make

sure you duck before entering the room, as it is a low door, showcasing how much shorter people were at that time.

Every corner of the hotel whispers stories of the people who have passed through over the centuries, and other historical figures who have stayed at The Spead Eagle include Guy Fawkes and Oliver Cromwell.

The rooms retain much of the original charm, while still offering the comfort and amenities you’d expect from a high-end boutique hotel. A number feature four-poster beds and antique furnishings, making a stay here feel like stepping into a different time, so you can not only view history, you can live it.

Alongside all this history the Spread Eagle also provides its guests with a surprisingly large spa. It is a serene and well-equipped facility, featuring a heated indoor pool beneath a Scandinavian-style wooden roof which is

almost church like, along with a sauna, steam room, and treatment rooms, and offers the perfect opportunity to unwind after exploring the charming town of Midhurst or the nearby South Downs National Park.

Guests not only like luxurious and relaxing rooms, they also like to dine well, and the Spread Eagle caters well for this. The food is unapologetically British (with the occasional modern twist), and the menu champions seasonal, locally sourced ingredients with many options for vegetarians, all at a very reasonable price. My starter was one of those twists being a well spiced Lamb Kofta flavoured with just enough mint, whilst my wife’s Smoked Salmon is a British favourite. I continued the lamb theme with Lamb Shoulder on a bed of Risotto and British Asparagus and my wife chose the Trout. The lamb and trout were perfectly cooked and bursting with flavour, the asparagus was slightly crunchy, and the risotto was smooth. There was a large selection of desserts, and all of these did not disappoint either, with the Dark Chocolate Mousse being the star, elevated by some slightly tart cherries. We paired our meal with a bottle of English wine from one of the nearby estates, a great local touch that rounded off the evening nicely.

Even the dining room has its little nuggets of history, and here it houses six amazing Flemish stain glass windows (the other

seven are in the Victoria and Albert Museum in London), that date back to 1612, and are well worth looking for.

The Spread Eagle is so much more than just a hotel, as it is so welcoming you feel that you are returning home when you step through the door. They even have a Christmas tradition which emphasises that, as people can come and make a Christmas pudding under the watchful eye of the Spread Eagle Chef, and then that pudding can either be taken away on the day or it can be hung up in the dining room on the ceiling in front of the impressive fire place where tradition means that those people will always be welcomed back when they return.

In summary, The Spread Eagle Hotel & Spa offers much more than just a place to stayit’s a destination in its own right. Whether you’re a history enthusiast, a food lover, or simply looking for a tranquil getaway in the English countryside, it delivers on every front. With its rich heritage, excellent cuisine, and welcoming ambiance, it’s a place you’ll want to return to again and again.

Spread Eagle Hotel & Spa

South Street, Midhurst, West Sussex, GU29 9NH Telephone: 01730 816911 www.hshotels.co.uk/spread-eagle

The American Theatre of London was founded by husband-and-wife team Aaron Vodovoz and Annelise Bianchini with a simple but urgent vision: to bring authentic American theatre to British stages.

The idea came from a shared observation. While American plays are frequently staged in the UK, they are often mounted without American voices in the room. Rarely were these productions directed, produced, or performed by Americans themselves. “We felt something was missing”, Aaron explains. “American theatre has a rhythm, a cultural nuance, a voice that can only truly be captured by artists who’ve lived it. We wanted to create a home in London for those voices”. That impulse has since grown into a mission. Today, the American Theatre of London is dedicated to producing plays with a majority of American (and Canadian) creatives, celebrating both emerging writers and iconic works from the US. The company offers London audiences a chance to encounter American theatre with its full authenticity intact, while also giving American artists abroad a platform to tell stories in their own voices.

At the heart of the American Theatre of London’s current work is the development of Steinberg V. Steinberg, written by Annelise Bianchini.

Set in 1980s New York, the night after Rosh Hashanah, two estranged sisters stage a mock trial for their dying mother to confront a long-buried family secret. As the night unfolds, what begins as a battle for justice becomes a reckoning with the past - and each other. It’s is a gripping, psychologically charged play about family, trauma, silence, women’s rights, and the impossible mess of healing. It asks: when the truth is unbearable, how do we carry it?

Steinberg V. Steinberg is not only about trauma but about the bonds of family, the complexities of accountability, and the haunting presence of what cannot easily be named. That haunting takes shape in the figure of the Dybbuk, drawn from Jewish folklore, who moves through the play as both spirit and force, propelling the sisters forward in their reckoning.

To bring this element to life, the company has partnered with Talk to the Hand Puppets, whose credits include Star Wars, The Dark Crystal: Age of Resistance, and Mary Poppins Returns, who are developing the Dybbuk’s on-stage presence.

The development of Steinberg V. Steinberg has been made possible through support from Arts Council England. From the outset, Aaron and Annelise knew they wanted to build the play with sensitivity and authenticity, especially given its themes of abuse and generational trauma.

To that end, the company has worked in collaboration with Solace Women’s Aid and the National Association for People Abused in Childhood (NAPAC), who are running workshops with the cast and creative team. These sessions ensure that the play’s development is informed by lived experience and grounded in a thoughtful, responsible process.

From the outset, Aaron and Annelise knew they wanted to build the play with sensitivity and authenticity, especially given its themes of abuse and generational trauma

Composer and sound designer Pierre Flasse is also attached, developing a sonic world that will both underscore the Dybbuk’s presence and expand the play’s emotional resonance.

Guiding the creative team is director Scott Le Crass, whose credits include the Broadway World and Off West End Award-

nominated Rose with Maureen Lipman at the Arts Theatre in the West End. Scott’s involvement began even before the official R&D stage, helping shape the readings and creative direction.

Actor Grace Wallis, a California-born performer with experience at the Orange Tree Theatre, Williamstown Theatre Festival, and American Shakespeare Centre, joins the cast.

Christopher Adams-Cohen (they/them), a Jewish-American playwright and dramaturg, contributes dramaturgical expertise, with experience supporting new writing at the RSC, JW3, and Soho Theatre.

The current R&D period will culminate in a series of readings that will help clarify the play’s creative vision. The company’s hope is that this stage will lead to further development, either in partnership with theatres or with the support of independent producers and investors who share their passion for the story.

As Aaron puts it: “Our goal is to show the full potential of the piece. We want audiences and theatres to see not just the play, but the larger vision of how it can live on stage”.

The American Theatre of London is more than just another addition to London’s vibrant theatre scene. It is a cultural bridge, creating space for authentic American voices in the UK while bringing British audiences into closer contact with American stories told as they were meant to be heard.

For Americans living in London, it offers a home - a place where their accents, their histories, and their cultural nuances are not just represented but celebrated. For British audiences, it is a chance to encounter the richness of American theatre in its truest form.

With Steinberg V. Steinberg, the company is demonstrating what that mission looks like in practice: ambitious, challenging, rooted in authenticity, and unafraid to grapple with the most difficult human questions.

There are two public readings at JW3 on 21 September 2025 2pm & 6pm. Tickets can be found here: www.jw3.org.uk/ whats-on/steinberg-v-steinberg

Edinburgh Fringe may be over for 2025, but exceptional theatre and bold productions are still being showcased across London and the UK. Here are some highlights of some events coming in October, from rejuvenated anniversary productions, cartoonish action scenes, adaptations of beloved literature and much more, there is truly something for everyone this October!

Do let us know if there are any particular productions or artists that you might like this more info on, or might like to chat with. If you would also like to attend any of the shows to review please do let us know!

27 Sep – Sun 2 Nov

A Unicorn Theatre and Chichester Festival Theatre production, Join little superstar piglets Bar, Bee and Q as they set off into the big wide world to build their three little houses out of hay, sticks and bricks... but can they get the better of the huffing, puffing (and a bit misunderstood) Big Bad Wolf? Full of catchy songs, humour and fun, this ‘very curly musical tail’ will leave audiences squealing with glee and howling with laughter.

5th Sept - 11th Oct

Following a critically acclaimed Off-Broadway run, Seagull: True Story is transferring to London to Marylebone Theatre. Inspired by Alexander Molochnikov experiences as a Russian director forced to flee his country after speaking out against the 2022 invasion of Ukraine, this provocative reimagining of Chekhov’s classic explores the heartbreaking struggle of displacement, love and the power of creative freedom in the face of oppression.

16th Oct - 8th Nov

The 5-star hit and high-energy original romcom comes to London following its critically acclaimed award award-winning Edinburgh Festival Fringe run. Created by the awardwinning creative duo behind 42 Balloons, the pop musical reimagines the climate crisis as a tempestuous relationship between Earth and Humanity. Leading the production are acclaimed West-End stars Danielle Steers (SIX The Musical, The Cher Show) and Tobias Turley (winner - ITV’s Mamma Mia! I Have A Dream).

Dates TBC

A Unicorn Theatre and Birmingham Rep production. Back by popular demand following a sold out 2023 run, this vibrant retelling of classic West African and Caribbean folk tales follows Anansi, the cleverest spider in the kingdom, known for his wit, charm and mischief. But sometimes, being too clever comes at a cost. Brought to life by Unicorn Associate Director Robin Belfield, these tales spin a web of fun for all ages.

1st – 18th Oct

Winner of the Highly Commended Prize at Soho Theatre’s Tony Craze Awards 2020, The Soon Life is a bold, bitingly funny and deeply human play, making its debut performance at the Southwark Playhouse Borough. Set during lockdown in a London flat, the play unfolds in real-time to

explore the messy intersections of motherhood, relationships and identity in an authentic and unapologetic presentation of childbirth.

1st – 25th Oct

The groundbreaking play from writer Joe Penhall (The Road, 2009; Mindhunter, 2017), returns for a 25th anniversary performance at Greenwich Theatre, with Penhall revisiting his original script by repositioning the character of Bruce from a young White British man to a young South Asian woman. Starring John Michie (Taggart, ITV; Holby City, BBC; Coronation Street, ITV), Rhianne Barreto (The Outlaws, BBC; Honour, ITV; No Escape, Paramount+), and Matthew Morrison (EastEnders, BBC; Boy Meets Boy, Cosmic Productions), the plot follows a young, enigmatic Black patient named Christopher who claims to be the son of an African dictator and the two psychiatrists responsible for his treatment.

from 4 Oct

In line with Black History Month 2025, the Old Royal Naval College presents a powerful new film installation by Sweet Patootee Arts. Reframing war narratives through British Caribbean lenses, the piece blends performance, 3D sound design, archival montage and calypso and colonial anthems. A poetic Caribbean comedy-melodrama, CORNWALLIS CLOTH explores loyalty, freedom and emerging post-colonial identity with a striking satirical edge.

23rd Oct – 16th Nov

Based on the ninth and final story of the globally loved Moomin books, by Finnish author Tove Jansson, Moominvalley in November is a new musical following six strangers including Snuffkin, who arrive in a quiet Moominvalley, right as the Moomins are inexplicably absent from their home. Previously shortlisted for the Mercury Musical Developments BEAM 2025 showcase, this production is the first time the show will be fully realised on stage.

Suitable for ages 12 +

The smash hit tour from Trevor Payne and Prestige Productions are embarking across the UK this year for their 40th consecutive

tour, warming up for their ruby anniversary this Autumn. That’ll Be The Day will grace stages again with its time-tested formula integrated with exciting new material. Filled with hits that will throw you back to the 50s and 80s, the show is also packed with sketches, adverts and more, making it an unforgettable night for all!

17th Sept - 18th Oct

The Place London 4th Oct, 7:30pm

Taking inspiration from classic and contemporary action movies to create highoctane and sometimes ridiculous fight scenes, Stuntman presents an intensely physical, funny, and tender experience that puts the audience front and centre of cartoonish fights. This explosive production investigates the emotional and physical impact that action-hero role models can have on men and boys. Touching upon personal experiences of performers David Banks (Fox) and Sadiq Ali, Stuntman delves into the violence, rage and gentleness prevailing in today’s masculinity. With dates across the UK the show will have a limited run at HMP YOI Polmont, Scotland’s largest Young Offenders Institution which primarily houses young males between the ages 18-21.

11th Oct - 29th Nov 2025

Marking 50 years since the Grunwick Strike (1976–1978), Townsend Productions remounts their acclaimed We Are the Lions, Mr Manager! for a UK tour. This powerful production retells the story of Jayaben Desai and the Grunwick Strike Committee, whose fight against exploitation became a national movement for dignity and rights. Blending drama, humour, and live music, the play captures both the fierce resistance and extraordinary solidarity of the time, while resonating strongly with today’s political and social climate.

Sep 2025 - May 2026

Blackeyed Theatre presents the world premiere of Sherlock Holmes: The Hunt for Moriarty, a thrilling new spy adventure by Nick Lane, based on the work of Sir Arthur Conan

Doyle. Interweaving several of Holmes’ most celebrated short stories into a single narrative, the production sees the great detective and Dr. Watson drawn into a desperate race against time as a shadowy figure threatens to destabilise the British Empire. With powerful performances, live music, and a gripping design, this brand-new staging offers audiences an atmospheric encounter with Holmes’ most feared adversary.

Tonbridge, 24th - 25th October & BEAM, Hertford, 28th-29th October

Multi-award winning puppetry company Smoking Apples present their latest heartwarming production Three across the South of England this Autumn. Inviting audiences into the lives of three neighbours as generations of family members gather round cups of tea to share experiences, understand generational moral views and uncover their pasts. Three movingly delves into the personal struggles of each family to capture the importance of sharing wisdom and the knowledge we acquire through age.

The first major London revival of Mel Brooks’ hilarious musical THE PRODUCERS is now playing the Garrick Theatre following a smash-hit ★★★★★ sold-out run at the Menier Chocolate Factory.

Based on the classic cult film, the original Broadway production won a record twelve Tony Awards. Teeming with Mel Brooks’ signature humour, The Producers takes no prisoners as it proudly proclaims itself an “equal opportunity offender!”. Down-on-his-luck Broadway producer Max Bialystock schemes with timid accountant Leo Bloom to create the biggest flop in theatre history - only to have it backfire spectacularly, and with thunderous applause.

Tony Award-winning director Patrick Marber and critically acclaimed principals Andy Nyman, Marc Antolin, Trevor Ashley, Raj Ghatak, Harry Morrison and Joanna Woodward all return triumphantly for the West End production.

Special ticket and meal package for just £99!

To celebrate Mel Brooks turning 99 years old, The Producers has teamed up with Brasserie Max to offer a fabulous night out. Brasserie Max is the calm amongst the buzz and bustle of Seven Dials, an elegant restaurant serving brasserie classics alongside more modern, European dishes.

For £99 you can enjoy a two-course meal, including a glass of sparkling wine, plus a Band A ticket to see the show. This package is valid for Monday to Thursday performances until 12 February 2026, subject to availability. Full t&c’s apply.

For more information, and to book your package, visit The Producers’ page at www.nimaxtheatres.com

Having supported families and professionals moving to the UK for many years, we’ve learned that while every move is unique, the same key steps can help keep you on track. Here’s a simple framework to guide your planning and some pitfalls to watch out for along the way.

Before diving into logistics, it helps to sit down and ask what really matters most to you and your family. For some, it’s proximity to good schools or green space. For others, it might be an easy commute, vibrant city life, or a quieter village setting. Being clear on these priorities early on makes every other decision easier, from which city or region to focus on to what kind of property you’ll look for.

It’s tempting to scroll through property sites straight away, but the truth is that choosing the right area is just as important as the house itself. The UK offers a wide range of lifestyles, from London’s fast-paced buzz to Oxfordshire’s leafy market towns or England’s dramatic countryside. Do your homework: look at school ratings, transport links, crime statistics, and local amenities. Many expats make the mistake of picking a house they like online, only to discover that the neighbourhood doesn’t match their needs.

One of the trickiest parts of relocating and moving is knowing when to start the property search. The UK rental market moves at lightning speed - most properties are snapped up within days

As a rule of thumb, 8-10 weeks before your move is the sweet spot for active searching, but this is often easier said than done, especially if you are overseas. Time zones, estate agents who don’t always respond quickly, and misleading online photos can make the process overwhelming.

The UK rental system may differ from what you’re used to in the US. Most landlords require proof of income, references, and a security deposit (usually five weeks’ rent). Tenancies are often set up on a six- or twelvemonth basis, and competition can be fierce in popular areas.

The UK rental market is also in the middle of change. The government’s new Renters Reform Bill, expected to come into effect in late 2025, will bring in significant updates. Among the biggest shifts is the move away from fixed six- or twelve-month tenancies

towards more flexible agreements. The details are still being finalised, but once the Bill becomes law, it will be important for anyone renting in the UK to understand how these changes affect them.

It pays to have your paperwork ready, bank statements, employment contracts, and visa details, so you can move quickly if the right property comes along.

If you’re moving with children, schooling is likely to be high on your list. The UK has a mix of state, independent, and international schools, each with different admissions processes and timelines. The catch? Many schools prioritise local families, so having a confirmed address is often key before you can secure a place. Another reason why timing your property search well is so important.

Things like setting up utilities, registering with a GP, and opening a UK bank account are part of the process and can feel daunting if you’re navigating them alone.

Relocating to the UK from the US is a big adventure, as is moving from home to home once you are here, but it doesn’t need to be overwhelming. With the right planning and the right support, you can avoid the common pitfalls and focus on the exciting opportunities ahead.

Whether you’re just starting to explore the idea or already counting down the weeks, taking it step by step will keep you on track and although you can do all of the above steps every country has its own nuances and to avoid all of the pit falls using an experienced relocation specialist is advisable.

Mark Palmer and the Forbury Services team have guided countless families and professionals through this journey, ensuring their move to the UK is smooth, stress-free, and successful.

Mark has supported hundreds of families relocating to the UK and holds over 100 five-star Google reviews. Check out what others are saying here.

You can reach Mark directly at mark@ forburyservicesltd.co.uk or visit the website www.forburyservicesltd.co.uk for more information.

The UK’s private school sector - often called independent schools - is world-renowned for academic excellence, rich traditions, and diverse opportunities. But for families new to the system, the structure, terminology, and admissions process can feel overwhelming. This guide is designed to demystify the journey and help you choose the right school for your child.

• Nursery (ages 6 months – 4 years): Nurseries such as Parsons Green Nursery in Fulham or Wetherby Pembridge Minors welcome children from as young as six months or two years old. Many offer flexible half and full-day sessions, with structured activities in Maths, Phonics, and English to prepare children for the next stage. Increasingly, parents choose a full-time nursery from age three to ensure readiness for school

• Pre-Prep (ages 4 – 7/8): Schools like Wetherby School, Notting Hill and Wetherby School Kensington provide Reception through Year 3. They combine strong academics with pastoral care and extracurricular activities, preparing children for entry into leading prep schools at ages 7+ or 8+

• Prep (ages 4/7 – 11/13): Prep schools such as Pembridge Hall, Fulham Prep School, or St Anthony’s School for Boys offer a rigorous, well-rounded education. With small class sizes, excellent co-curricular programmes, and a focus on

confidence, manners, and independence, they prepare children for competitive senior school entry at 11+ or 13+

• Senior (ages 11/13 – 18): Senior schools are where students take GCSEs, A-Levels, or the International Baccalaureate. Admissions can be highly competitive, with assessments such as the 11+ (English, Maths, reasoning, and interview) or the 13+ Common Entrance (Maths, English, Science, and often languages and humanities).

There is no single “best” school - only the right fit for your child. Always consider:

• Day vs. boarding (weekly, flexi, or full)

• Size of school (small & nurturing vs. large & diverse)

• Single-sex vs. co-educational

• Academic selectivity (highly selective vs. non-selective)

• School ethos (traditional vs. modern). When visiting, don’t just be swayed by the beautiful grounds - focus on the teaching, relationships between staff and pupils, and how the school supports children across all ability levels. Talk to teachers and students, ask about staff retention, and look at leavers’ destinations - not just where students go to university, but what they go on to study. Most importantly, trust your instincts. Parents often talk themselves out of the right choice by over-listening to others.

• Register early - spaces fill quickly

• Visit in person - see the school on a regular day, not just at an open day

• Prepare for entrance exams and interviews - encourage your child to be authentic and enthusiastic

• Submit strong applications - with reports, references, and documents complete by deadlines.

If you’re standing in the middle of a school, wondering, “Is this the right one for my child?” - you’re not alone. We’re here to guide you through every step.

Contact us at ukadmissions@inspirededu. com to learn more about Inspired schools in London and beyond. Whether you need advice on admissions, finding the right fit, or understanding the process, we’re here to support you.

Mark Snell - Education Director, Inspired Education UK.

Mark has worked in education for 30 years. Prior to joining Inspired as UK Education Director in September 2023, Mark was Headmaster of Wetherby School Notting Hill for 15 years, and Deputy Head for 2. With extensive experience in all aspects of academic, pastoral and co-curricular provision, Mark was also Executive Headmaster of Wetherby School Kensington from September 2022 until April 2023. Mark also brings to governance his experience as Head of Mathematics at King’s College Junior School, Wimbledon for 5 years and Head of House, at Westminster Under School and Eaton House the Manor.

Paris needs no introduction. For centuries, it has seduced travellers with its grand boulevards, sparkling monuments, and legendary museums. Millions come each year to stand in awe before the Eiffel Tower, wander the Louvre, or marvel at the Gothic splendour of Notre-Dame.