AMERICAN IN BRITAIN

Serving the American Community in the UK

Serving the American Community in the UK

Halkin Arcade, Belgravia, London, SW1X 8JT

I am sure that very few people know how many Indian restaurants London has, but I am sure it will surprise you, as it did me, that there are over 3,600, which shows how popular this cuisine is.

I obviously haven’t visited all of them, but I am certain that there are few, if any, that would hold a candle to Amaya. Amaya is under the same ownership as Chutney Mary’s and Veeraswamy, and has rightly held a Michelin star since 2006, focusing on Indian grills seasoned with subtle and flavoursome marinades.

The restaurant is close to Knightsbridge and its entrance gives you no idea of the joys awaiting you as it is understated. On entering, the first thing that strikes you is the size of the room that houses Amaya, but that is quickly followed by how comforting and stylish the décor is, with its warming blacks and reds along with swish lighting and wooden tables. Although the décor is stylish, the real star of the show (other than the food), is the open kitchen which fills the whole of the back wall with its hot charcoals and flames licking the food lovingly, all providing the chefs with the tools to weave their magic.

Amaya offers a tapas styled Indian experience, which is unusual for an Indian restaurant, therefore most dishes have two sizes, regular and small, allowing diners to mix and match and sample more delights from the extensive menu.

Our first choice from the menu was a Salad, the Minced Chicken Lettuce Parcel (£13.5), yes, you read it correctly, a salad at an Indian restaurant! This is clearly out of the ordinary, but Amaya is not an ordinary restaurant. It is innovative and pushes boundaries, which is why it has maintained

its Michelin star for 21 years now. Here a crisp and succulent lettuce enclosed the delicate chicken in a lightly spiced sauce which was delicious in its own right, but the addition of sweet hints from small slices of apple took it to another level.

Our next dish was the Tandoori Salmon from Norwegian Waters (£27). I thought our first dish was good, but this one raised the bar even higher! Many think that tandoori is a recipe, but like many of the world’s greatest dishes, it is actually a cooking method that has become synonymous with the food that is prepared. The first step in this process is to marinate and spice the salmon and then it is cooked over an intense fire in a tandoor (a clay oven). The tandoor creates an extremely hot and smoky environment which enhances the flavours from the marinade and spices by allowing them to seep into the meat or in this case the fish, creating intense flavours. Our generous piece of salmon was so light and flaky it almost melted in our mouths and is one of the best pieces of salmon I have tasted. Our second journey into the world of tandoor cooking was the Black Pepper Chicken Tikka (£15), which was so light and succulent I am considering buying a tandoor for myself! I am sure however, that I will never to be able to get close to creating such a dish, as the flavours come not only from the tandoor oven, but also from the spices and marinade used, and here the rich pepper marinade includes the legendary pepper from Wayanad estate from Kerala.

Going to a restaurant should be a wonderful experience, where you are served food you could not recreate at home, that looks amazing, in a stylish environment, and at Amaya they combine these just perfectly. Our next dish, Griddled Flaked Crab cake (£17) showcased this

perfectly. Most restaurants include fillers like potato in their crab cakes, but not at Amaya. Their cakes are 100% Crab meat sitting on a delicately flavoured mixture of ginger, lime and green chilli sauce, all served in a crab shell which stimulates your eyes as well as your taste buds.

After revisiting our favourite tandoor cooking, with a Tandoori Duck Leg (£28) which just fell off the bone and was served with a ridiculously smooth mash and the classic orange accompaniment, we opted for two vegetarian dishes, the Sweet Potato Chaat (£22) and the Punjabi Channa Chaat in a tart (£20). If vegetarian dishes would always taste like these, this confirmed meat eater could be converted! The sweet potato chaat is made from griddled Indian white sweet potatoes and these cubes of loveliness are covered with a delicately spiced sauce and are eaten with little wooden forks, but the Channa Chaat was an old friend from a previous visit and it didn’t disappoint. Chaat’s are a family of snacks typically served at roadsides, but it would be some roadside seller that would produce such subtle, but at the same time boisterous flavours, with a pastry so crisp, and even lightly spiced as well.

Our curry dish was the Spicy Malabar Prawn Curry (£38) accompanied with Rice (£7.5) and a Garlic, Green Olive and Cumin Naan (£8.5). The curry bursts with southern Indian flavours and the addition of coconut mellows the strength of the madras spice. The rice is fluffy and the Naan tastes as good as it smells, and believe me, it smells amazing!

For dessert, we selected the Chocolate Fondant, which finished off a perfect meal with a perfect dessert. The fondant was crazily light, and the pastry would illicit a Paul Hollywood handshake.

You rarely find restaurants where you run out of superlatives to describe the food, but with Amaya I think I have found it. The food, the service and the décor are on point, and after you visit I think you will run out too. www.amaya.biz

6 Electric Blvd, London, SW11 8AL

In our ever-growing health-conscious world, Japanese food has become even more popular as it is uber healthy and uses the freshest of ingredients, and one restaurant chain that has ridden this popularity wave expertly is Sticks ‘n’ Sushi. It has expanded rapidly and it now not only has a number of restaurants in and around London, it also has ones in Oxford and Cambridge. Each restaurant is uniquely decorated in the style of the area in which it is located and our visit to the Battersea restaurant showcased that perfectly.

The Battersea area has been rejuvenated by the redevelopment of the Power Station, and is now one of the up and coming areas to live in, and Sticks ‘n’ Sushi mirrors this with its modern, almost minimalistic style, with well-spaced out wooden tables on a hard floor, but this doesn’t mean the restaurant is cold or unwelcoming, indeed far from it, as the welcome from the staff is warm and friendly and the music contemporary, giving an overall classy vibrant vibe.

On arrival we were greeted with a warm towel to cleanse our hands, and we settled down to look through the wide selection of traditional sushi and yakitori sticks (the clue as always is in the name of the restaurant!). I always like to start with a bowl of Edamame (literally meaning stem beans in Japanese), not only because they are rich in vitamins and fibre, but it is because they taste great! Our edamame here could have been accompanied by either just salt or soy sauce, but we opted for the Spicy Miso and Sesame and the mixture of crunch and spice was a lovely start to the meal and went perfectly with our ice-cold Sapporo Beer.

After the edamame we decided to order the Tuna Tartare Bites (£12) and the Kani Ikura Temaki (£10.6). Fresh tuna cannot be beaten for taste or texture, and when combined with smooth avocado and

sesame yuzu is spectacular, and if you add crispy bread providing a contrasting texture it is even better. The Snow Crab in the Temaki had a rich almost sweet taste with a lobster-like creamy texture perched on sushi rice flavoured with sake all sitting on a crispy seaweed base, which gave joyous mouthfuls of contrasting flavours and textures, all combining perfectly.

Our next selections were the Ebi Bites (£9.9) and Karaage (£10.8). The Ebi Bites are crunchy tempura shrimp with an appearance similar to rice crispies! (a well-known UK cornflake) accompanied by chillis, and the Karaage were soft and tender chicken pieces surrounded by a light and crispy batter, totally moreish and accompanied by a ‘to die for’ wasabi mayo which had heat, but was not too overpowering.

Our next set of selections were from the Sushi Section and the choice is extensive, so we were grateful for the images the menu has so we could see what we were ordering. We selected the Crispy Ebi (£10.5) and the Pink Alaska (£10). Sushi is a firm favourite of mine as it is a combination of fresh ingredients packed with flavour all surrounded by light rice, and the crispy ebi again didn’t disappoint. The Pink Alaska Sushi was a combination of salmon, avocado, lumpfish roe and cream cheese, and was a new texture for me as I have not had cream cheese in sushi before, and I enjoyed the full-on creaminess, but it is an acquired taste.

Our final selection were the Yakitori Sticks, and we selected a wide range including Mackerel, Salmon, Black Cod and Goats Cheese wrapped in Bacon (£5.8 to £11.5), along with a bowl of rice with sauce (£3.9) and Fried Cauliflower with Black Truffle Goma (£6.5). Yakitori usually relates to chicken as its literal translation in Japanese is grilled bird, and there are chicken options available, but here the name refers to the way it is cooked, namely on a skewer over charcoals. This method brings out all the flavours of the skewer, and my personal favourite was the rich goats cheese wrapped in salty bacon. The rice was light and fluffy and topped with crunchy chilli and almonds with a chilli dip, and the fried cauliflower was crisp and smothered in an indulgent truffle sauce. A lovely end to our journey through the sticks and the sushi.

Dishes arrive when ready so I would recommend you order a couple of dishes at a time, like we did, that way you ensure you can give each dish the time it deserves and enjoy it to the full.

Sticks ‘n’ Sushi has gone from strength to strength as it offers quality food at reasonable prices, and its staff are engaged and welcoming, and I am already looking forward to my next visit. www.sticksnsushi.com

8 Gillingham Street, London, SW1V 1HJ

One of the best signs that a restaurant is good is how long it has been in business, and Tozi Victoria has occupied its location at 8 Gillingham Street, a short walk from Victoria Station, for 13 years, and is still going strong if our visit was anything to go by, as when we arrived, early evening on a Thursday, the restaurant was already nearly full and providing my favourite sound of the low buzz of people enjoying themselves.

Its décor is a throwback to an older retro age with the high-ceilinged large room split into two levels, a retro parqueted floor and red velvet curtains, but there is nothing retro about the thinking at TOZI. The open kitchen dominates pretty much the whole length of one side of the restaurant and above the pass a 60s black and white film is showing on the wall, which gives you hints of why TOZI is not your usual restaurant and is special. This is even clearer when you get an Italian lesson when you go to the bathroom where there is a voice saying phrases in English that are then translated into Italian!

Dining out has to be an experience, and Head Chef, Maurilio Molteni, and his talented team, have created a menu that showcases perfectly his roots near Lake Como in the North West of Italy, and TOZI’s concept of ‘Cicchetti’ enables diners to experience more of the menu as the dishes are designed to share.

What better way to start a meal than a cocktail, and at TOZI there are a wide range of Italian themed options to choose from with a wide range of negroni’s and

signature selections, many with wonderful names, like La Dolce Vita or Penicillin at TOZI (no prescription needed!).

The menu is just packed with a wide range of selections and it is very difficult to choose what to order as everything sounds so good. Luckily, as they are sharing dishes, you should probably order 3-4 dishes per person, so you have scope to order more than you usually would.

Our first selection was the Calamari Fritti (£10.75). These are standard on most restaurants around the world, but at TOZI they were far from standard, and were slightly salty mouthfuls of delight with the meaty texture of the perfectly cooked calamari, the dusting of batter and the contrasting sharpness of the lemon combining perfectly.

It is hard to be able to explain how good the next dish we selected was, and it is no surprise that this is one of TOZI’s signature dishes and has been on the menu since it opened 13 years ago. The dish in question is the Buffalo Ricotta Ravioli with Black Truffle (£14.25/£23.5). When it arrives at your table you get a waft of that wonderful rich truffle smell, and that joy continues when you taste that earthy and musky truffle flavour along with the al dente pasta and the contrasting creamy ricotta. The sauce is so good I could not help but mop up the sauce with some bread, which in Italy is known as Scarpetta, (literal meaning ‘little shoe’ as the shoe, like the bread, picks up what’s on the ground).

TOZI’s cooking of pasta is just exceptional, so our next choice was the Maccheroni, Duck and Girolles Ragout and Smoked Ricotta (£13.5/£21.75), and again the ragout was so flavoursome that the

dish it was in was ‘scarpettaed’ fully (not sure if you can use it as a verb!), and the accompanying large tubes of pasta were again the perfect texture.

You can’t visit an Italian restaurant and not opt for a Parmigiana dish of some kind, and at TOZI our selection was an Aubergine dish (£13.25/£19.75). Aubergine, or eggplant as it is also known, is a very underrated vegetable, which is a mystery to me, as when roasted it becomes soft and creamy and is a perfect replacement for pasta, especially in this lasagne-like dish. The layers of aubergine were separated by the well-seasoned tomato and smoky cheese, but unlike the same dish elsewhere, here there wasn’t too much tomato which allowed the aubergine to shine rather than be overpowered.

Our final dish before dessert was the Slow Cooked Ox Cheeks, mashed potato and wild mushrooms, in a red wine jus (£14.74/£26.5). Ox cheeks are a culinary treasure, and when cooked slowly just burst with rich beefiness and just fall apart when in proximity to a knife, and when combined with a lovely smooth mash, meaty mushrooms and a punchy red wine jus, is one of my absolute favourites!

If Italy isn’t the home of ice cream (and it actually isn’t, China is), it really ought to be, as Italian ice cream and sorbets are just dreamy, and my final dish was a scoop of decadent chocolate and one of creamy coconut, a classic combination to end a classic meal.

TOZI has delighted diners for over a decade with its cicchetti concept and its tongue in cheek touches (think Italian lessons in the toilet!), and will continue to do so, as food this good will never go out of fashion. www.tozirestaurant.co.uk

Epsom Downs, Tattenham Crescent, Epsom, KT18 5NY

One of the most well-known institutions in the UK is the British Public House (colloquially the Pub), and they were so named to differentiate private houses from those houses that were open to the public to drink alcohol. The first Pubs were thought to be in Roman Britain, and over the years they have developed and evolved into the ones you see today. In the past Pubs were usually only for having a drink and maybe a sandwich, but over the last decade or so this food offering has expanded, via the ham egg and chips type meals, to fine dining, and the new Youngs offering at Tattenham Corner, Epsom, is a prime example of this new fine dining genre.

This Pub sits on a prime site just on Tattenham Corner, a famous sharp bend on the Epsom Race Course track, which is home to two of the five classic horse races run in England, namely The Oaks and The Derby. It was also on this bend on the course that on 4th June, 1913, Emily Davison made her way onto the track holding Suffragette flags and was hit and killed by King George’s horse, Anmer. It is also the start of the home strait at Epsom, so is steeped in horse racing tradition.

The views from the pub, the extensive gardens and also the balcony rooms (The Oaks and Paddock rooms) are stunning, and there is nothing better than after a brisk walk on the Downs, to relax with a drink or bite to eat marvelling at the amazing views. As good as this would be, The Tattenham Corner is also very much an evening venue as the menu not only has the traditional pub fare it has many surprises as well.

The venue has only very recently (January) opened after an almost total overhaul, and it is clear that no expense has been spared, as the décor is plush, whilst still keeping that Pub feel, and there is more than a passing regard to

sustainability as the designers have used reclaimed wood for the ceiling and recycled leathers for the settees.

The garden has been totally re-landscaped and has lots of stylish garden furniture for diners and drinkers to sit, and it even has an outside bar which not only serves drinks but also a limited food menu.

Inside, on the ground floor there are three distinct areas, the large well-lit Tudoresque Barn, with a central wood burner and a high vaulted beamed ceiling, a more cosy dimmer-lit, low ceilinged area at the front, providing those wonderful views over the Downs, and a connecting area between the two which is more akin to a local pub, with banquettes and tall round tables where you can drop in to have a drink or two.

The menu is full of surprises, not only for a pub, but also for a restaurant, with dishes like Shropshire Chicken Chasseur (£7.5) on the starters rather the mains where you would expect it. Intrigued, I just had to order this, and was rewarded richly with two crispy skinned chicken thighs on the bone sitting on a generous helping of smoky and earthy mushrooms, all in the warming chasseur sauce bursting with the flavours of mushrooms and shallots. My wife selected the Smoked Mackerel Pâté (£8), which was served with Kohlrabi slaw on sourdough. The mackerel had that punchy fishy taste enhanced by the addition of horseradish and the crunch from the Kohlrabi, and the sweetness from the apple was an able accompaniment.

For your mains there are many pub favourites to choose from, but far from being the usual fare they all have slight twists to elevate the flavours, so the batter on the Fish and Chips is flavoured with Cyder (the archaic way to spell cider) or the Sausages and Mash are premium flavoured with pork and fennel giving them much more taste, but we opted for two less ‘classic’ dishes. I opted for the Dingley Dell Braised Ham Hock Pie (£18) and my wife went for the Shropshire Chicken Kiev with Clotted Cream Mash (£16). Many places

buy in their pies, but here the pies are made daily on site and it certainly showed, as the pastry was slightly crunchy on the outside and slightly doughy inside, just how it should be, and the salty meaty denseness of the ham that filled the pie completely is just delicious. This is served with a wonderful beer and mustard jus with just enough mustard to bring out the ham flavour even more, and if that wasn’t enough, it was accompanied by a large portion of light and fluffy triple cooked chips. Chicken Kiev has its origins in Ukraine and Russia and is usually a plump chicken breast covered in breadcrumbs and filled with garlic butter, but it appears the Shropshire version of this classic dish has the garlic butter on the outside! It is a nice twist and the garlic butter is packed with flavour, but unfortunately being outside the chicken means that the sauce seeps into the chicken so you lose the crunch of the breadcrumbs. The clotted cream mash is so smooth, and any dish that uses cream is delicious and this mash is no exception.

I was really unsure that the government’s requirement for putting calories on meals on a menu was a good idea, but having seen some of the numbers on what would have been my choices I am now not so sure! I selected the Bread and Butter Pudding with Meringue and Custard (£6,) and my wife the Steamed Ginger and Walnut Cake with stout glaze and clotted cream (£6). You would think a dessert with stale/leftover bread would not taste that good, but don’t be fooled, as when added to custard these bits of bread become a thing of beauty, and with the addition of the meringue even more so. The Ginger and Walnut Cake was moist, and it is not surprising that it is a firm British favourite, as it is basically gingerbread that has been steamed!

The addition of Tattenham Corner to the Epsom dining scene is very welcome, as, as well as serving great food, it also provides sweeping views of the Downs in a stylish and comfortable environment. www.tattenhamcornerpub.co.uk

Ah, springtime! The temperatures are warming, the trees are budding, and the collective groan of US expats across the nation signals the approach of that most dreaded of seasons - tax season. That’s right, it’s that time of the year when you dig through documents, scratch your head over confusing forms, and muster all your courage to get your US tax return filed on time.

This period can be both critical and challenging, as taxpayers work to ensure accuracy, maximise eligible tax benefits, and avoid any potential penalties. This article will guide you through essential tips and best practices for efficiently managing your tax preparation, helping you meet the deadline with confidence and ease.

This may be one area that most of you are familiar with, but it’s always good to cover it just in case. The typical deadline for US taxes is April 15th, which is also technically the deadline to pay taxes (more on this later).

However, Americans living abroad on the regular deadline get an automatic extension to June 15th - June 16th this year since the 15th falls on a Sunday. If more time is needed to file your return by the June 16th date, you can file Form 4868 by that date to request an extension to October 15th. The October 15th date is also the de facto deadline for filing your FBAR report.

A Report of Foreign Bank and Financial Accounts (FBAR) is a filing separate from your tax return that is required when you own or have signature authority of accounts outside of the US, and the aggregate value of those accounts exceeds $10,000 at any point during the year. It’s critical to note that penalties for missing or filing an FBAR late can be severe.

A common misconception is that if each account is under $10,000, you’re not required to file. However, the key to remember is that it’s the combined total of all accounts that count toward that $10,000 threshold.

Also, FBAR reporting isn’t just for bank accounts, which is another area of confusion. Common accounts include:

• Bank accounts (checking, savings)

• Investment accounts

• Foreign retirement accounts (with some exceptions)

• Certain foreign insurance policies with cashout value.

Foreign retirement accounts can get tricky, as some may be exempt from FBAR filing under IRS guidelines, but there is ambiguity in this area, and it is suggested to take a conservative approach and report your retirement accounts if they have a vested value.

In addition to the FBAR, there may be another form you need to file with your tax return that reports mostly the same information. The difference is that the requirement to file Form 8938 is much higher than the $10,000 threshold of the FBAR. Generally, a single or married filing separate taxpayer must file Form 8938 with their tax return if the maximum values exceed $300,000 at any point of the year, or $200,000 at the end of the year.

Now, let’s look at some penalties that may affect you if returns are not filed by the deadline or if payments are made late

Now, let’s look at some penalties that may affect you if returns are not filed by the deadline or if payments are made late. Here are four of the main ones that most individual expats may encounter:

1. Interest charges – The IRS charges interest on any amounts due after the original deadline, April 15th. This is charged regardless of whether you are living abroad. The current interest rate is 7% and is compounded daily.

2. Failure to pay penalty – This is charged on any amounts not paid by the filing deadline, June 16th for expats. This

amount is assessed at 0.5% monthly until the tax is paid.

3. Failure to file penalty – This penalty is assessed at 5% each month the tax return is not late and maxes out at 25%.

4. International informational Return Penalties – These are penalties for forms that report information relating to certain international-based issues, such as businesses, trusts, and foreign account reporting. These penalties can be very steep, and many times start at $10,000, but they are only assessed if the form is filed late or incomplete.

To avoid extra charges, make sure to file your returns and make your payments on time. If you can’t meet the June expat deadline and need an extension, it’s a good idea to make an estimated tax payment if you think you’ll owe money. This helps you avoid, or at least minimise, interest and penalties.

So, what documents do you need to start gathering for your taxes. The first thing to remember is that US individual taxes are reported on the calendar year, rather than the UK April fiscal year. This can pose some challenges in getting the necessary information that you need to transpose the fiscal year income into the calendar year. If you are an employee, the easiest way to accomplish this is to use your payslips to get the information you need for the January – December reporting. Some other suggestions are keeping a log of routine payments and expenses for tracking income from a rental property and seeking monthly transaction details for your investment accounts.

Speaking of investments – there are a few nuances you should be aware of. The US taxes all investment income, including interest, dividends, capital gains, and net rental income. Furthermore, there aren’t tax-free allowances for smaller amounts of investment income like there are in the UK, which can cause an unexpected tax bill on your US return. To add to that, the popular Individual Savings Account (ISA) does not receive the same reciprocal

tax-free status on your US returns. Requiring you to report your investment income from these accounts, potentially causing another unexpected tax impact.

Employee share schemes are another complicated area. While both countries have their own versions of incentive employee compensation plans, they do not always operate the same. No matter the form of the share scheme, the tax treatment is typically the same.

If you are awarded stock incentives from your company without having to pay for them, those incentives are going to be taxed at two separate timeframes. First, once the incentive becomes vested (meaning you own it), you will report the value of those stocks upon vesting as compensation on your return. Then, when you later sell that stock, you will be taxed on the accretion of the value of the stock over what you reported as compensation when it vested.

This is not how all plans are taxed, and the UK does have more options for unique schemes than most other countries. Therefore, it is generally suggested that you get support if you have questions, as document tracking and proper reporting of stock plans can be tedious.

There is one other issue you need to be aware of when making investments. The following should not deter you from entering into these types of investments, but rather, you should be aware of the tax impacts so you can make a more informed decision.

A Passive Foreign Investment Company, or PFIC, is a complex taxing regime that affects some popular non-US pooled investment funds. This is not only a British problem, but common investments like mutual funds, ETFs, unit trusts, and index funds get caught up under the PFIC umbrella.

Before investing in these funds, you should be aware that the tax treatment from the US side can be quite punitive, although there are elections that can be made to help minimise your tax exposure. The best thing you can do is be aware and speak to your tax accountant and investment manager to see if these types of funds will result in the financial and tax incentives you anticipate.

The Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC) are two critical mechanisms aimed at alleviating the burden of double taxation on American expats. While both serve to mitigate tax liabilities, their applications and benefits vary significantly.

The FEIE allows qualified Americans to exclude a portion of their foreign earned income from US federal income taxation, with the exclusion limit set at $126,500 for the 2024 tax year. It’s imperative to note that the exclusion is restricted to earned income – such as wages, salaries, and professional fees from self-employment – and does not extend to unearned income, including interest, dividends, and other investment income.

and the Foreign

(FTC) are two critical mechanisms aimed at alleviating the burden of double taxation on American expats

Conversely, the FTC offers a credit for foreign taxes paid on income that is concurrently subject to US taxation. This provision is particularly advantageous for taxpayers with foreign income that doesn’t qualify for the FEIE or where the foreign tax burden exceeds the excludable amount under the FEIE. The credit can prove beneficial in high-tax jurisdictions, like the UK, effectively reducing US tax owed on a dollar-for-dollar basis. Unlike the FEIE, the FTC applies to a broad spectrum of income types, encompassing both earned and unearned income.

Strategically, the decision to utilise the FEIE, the FTC, or a combination of both requires careful consideration of individual circumstances, including the nature and amount of foreign income and the comparative tax rates of the host country. There are several situations where the FTC is more favourable. One example that is more beneficial is when you have a dependent

child you can claim on your US tax return, since you can be eligible for a refundable child tax credit. This benefit is not allowed when you claim the FEIE. Alternatively, if your earned income is under the exclusion limit and you have investment income that is not taxed in the UK, you may benefit from claiming the FEIE since you can then use your standard deduction amount to offset your investment income.

These are just a couple of examples; you will want to consider your individual situation to determine which is better for you. One very important aspect to point out is that if you claim the FEIE, you will want to continue to claim that benefit unless you know for sure the FTC is going to benefit you more in the near future. The reason is that once you make a switch from the FEIE to the FTC, you lose your ability to claim the FEIE for another 5 years.

There are a lot of items to consider when getting ready to file your US taxes. This article touches on some of the more important and pressing topics to consider when starting that process. While there are other topics of consideration not discussed in this article (i.e. owning a Pvt Ltd, retirement taxes), if you review the points discussed in this article you will have a jump start in getting that return filed and out of the way.

Eric Scali is a manager with H&R Block Expat Tax Services. He has worked with H&R Block for 14 years, entirely focusing on international tax and expat-related business. Currently, he remotely manages a large tax team, manages H&R Block Expat’s DIY programme, and manages new business relationships. H&R Block Expat Tax provides US tax preparation services virtually to US citizens who live abroad. Whether you would like to work with one of your international tax advisors or do your own return online, we are here for you. For more information or to get started check us out at hrblock.com/expats or contact us at expattax@hrblock.com.

For American entrepreneurs in the UK, choosing the right business structure is as crucial as understanding the intricacies of driving on the left side of the road. It requires careful navigation and attention to detail. While both countries share a common language, their business structures can feel worlds apart. This article will provide an overview of the common options available, from UK sole traderships to US corporations, and flag common differences in how they are viewed in their non-native jurisdiction.

Before diving into specific structures, consider these fundamental factors that will influence your choice:

• Risk tolerance and desired level of personal asset protection

• Anticipated business scale and growth trajectory

• Resources available for tax compliance and reporting

• Long-term goals, including potential investment or sale

• Tax efficiency in both jurisdictions.

The UK-US Business Structure Matrix Understanding how each structure interacts with both tax systems is crucial: (See table below).

UK Sole Trader: The Direct Path Forward Like taking the helm of your own ship, operating as a sole trader puts you in direct control of your business journey, offering simplicity but requiring careful personal management of risks and responsibilities.

• Ease of Setup: Registering with HMRC is quick and inexpensive

• Direct Earnings: After taxes, income flows straight to you

• Simplicity: Minimal administrative burden.

• Unlimited Liability: Personal assets are at risk if the business incurs debts

• UK Tax and NI Contributions:

o As a sole trader, you pay UK income tax on

your business profits, and these rates can climb to 40% (higher rate) or 45% (additional rate) depending on your earnings

o In addition to income tax, you’re required to pay two types of National Insurance Contributions (NICs):

• Class 2 NICs: A flat weekly rate for profits over £12,570

• Class 4 NICs: 6% on profits between £12,570 and £50,270, and 2% on profits above £50,270

o You are personally responsible for all tax liabilities, which may become burdensome as your business grows.

• US Tax Implications:

o The IRS requires sole traders to pay an additional 15.3% self-employment tax on net earnings. This tax covers Social Security and Medicare contributions, which would typically be withheld if you were employed in the US. This requirement may still apply, even if you’re living abroad

o The US-UK Totalisation Agreement may help alleviate the effects of double taxation if you are covered by National Insurance contributions in the UK, but navigating these rules can be complex, making professional guidance essential.

Sole Trader

UK Limited Company

US LLC

US S-Corp

US C-Corp

Income tax & NICs payable by sole trader at their marginal tax rate

Company pays Corporation tax, owners pay income tax on salary and dividends taken

Individual owner taxed on distributions.

LLC may be subject to UK Corporation tax if breaching UK corporate residency rules

Individual owner taxed on distributions.

S-Corp may be subject to UK Corporation tax if breaching UK corporate residency rules

Individual owner taxed on salary and dividends

C-Corp may be subject to UK Corporation tax if breaching UK corporate residency rules

Income tax & self-employment surcharge payable at sole trader’s marginal tax rate

CFC anti-avoidance rules, ‘GILTI’

Pass-through to owners, unless C-Corp election is made

Pass-through to owners

Company pays corporation tax, owners pay income tax on salary and dividends taken

A Robust Foundation, but Brace for IRS Scrutiny

A UK Limited Company represents building a well-structured foundation - requiring initial investment but providing long-term stability and protection.

• Limited Liability: Your personal assets are protected, as the company is a separate legal entity

• Tax Efficiency:

o A limited company pays UK corporation tax on its profits at gradual rates from 19 – 25% based on your level of profit

o By taking income from the company as salary or dividends, you can more effectively manage your personal tax liability. Owners often draw a combination of the two to optimize their personal income tax exposure:

• Salary: Paid through PAYE (Pay As You Earn) and taxes collected at income tax rates (20%, 40%, of 45% depending on income brackets)

• Dividends: Taxed at comparatively lower rates (8.75%, 33.75%, or 39.35% depending on income brackets) and not subject to NICs, making this strategy more tax-efficient for higher earners

• Credibility: Clients, partners, and investors often view limited companies as more professional and stable than sole traders, especially in B2B sectors.

Clients, partners, and investors often view limited companies as more professional and stable than sole traders, especially in B2B sectors

• US Tax Complexity:

o A UK Limited Company may be classified as a Controlled Foreign Corporation (CFC) if US expats owns more than 50% of the company. This triggers IRS reporting requirements, including Form 5471, which requires detailed disclosures about the company’s finances as part of the US owners’ annual US tax filings

o Additionally, anti-avoidance measures apply to the profits of Controlled Foreign Corporations (CFCs) under the Global Intangible Low-Taxed Income (GILTI) rules. These rules treat the CFC as distributing annual profits to their US owners, and tax the owners at the highest US personal tax rate (currently 37%) even if no cash is actually distributed. This creates a ‘dry’ US tax charge

o There are options available to potentially ease the burden of the GILTI rules. However, successfully navigating these rules, and exploring potential mitigation strategies, requires tax advice and ongoing planning to avoid the punitive taxation.

• Ongoing Costs:

o Limited companies incur ongoing costs for accountants, legal compliance, and filing annual reports with Companies House and HMRC. Budgeting for these expenses is essential

o Equally, US owners may need to factor in the compliance costs of their personal US tax returns as well.

US LLC: Straightforward at Home, Complicated Abroad

The LLC structure provides flexibility and efficiency for US domestic use but requires careful consideration of its crossborder tax implications.

• Limited Liability: Protects personal assets from business liabilities

• Flexible Taxation:

o By default, LLCs are taxed as passthrough entities domestically (income is reported on the owner’s personal tax return), Creating one layer of tax

o The option to elect taxation as a C-Corp provides added flexibility for brining on new shareholders or for scaling a growing business. However, the timing of the election can have tax implications, making professional advice and planning essential

• Simplicity: LLCs have fewer compliance obligations than corporations, with no shareholder limits or complex ownership restrictions.

• UK Taxation: HMRC does not treat LLCs as pass-through entities. UK-resident owners of LLCs are typically subject to personal UK tax on LLC distributions, without any relief for US income taxes already paid on the relevant profits. Furthermore, if the LLC breaches UK corporate residency rules, its profits may be liable to UK corporation tax as well.

A Domestic Solution with Overseas Headaches

The S-Corporation structure is designed for tax efficiency in the US, but its benefits diminish once the owners relocate to the UK.

• Pass-Through Taxation: profit share is reported on the owner’s personal tax return, retaining one layer of US tax

• Limited Liability: Protects personal assets from business obligations

• Salary-Dividend Split: S-Corp owners must take a reasonable salary, so there is some flexibility to choose the optimal profit extraction method to manage their own income tax liability and exposure to payroll taxes.

CHALLENGES

• Eligibility Restrictions: S-Corps are limited to 100 shareholders, all of whom must be US residents or citizens

• Incompatibility with HMRC: HMRC views S-Corporations to be similar to LLCs and so does not recognise their flowthrough tax treatment, which can result in

double taxation for UK-resident owners

• Reporting Requirements: Owners may need to navigate dual reporting to HMRC and the IRS, including payroll filings for salaries, if operating the business from the UK.

The C Corporation provides a robust framework for international operations, like establishing a multinational headquarters

The Global Framework

The C Corporation provides a robust framework for international operations, like establishing a multinational headquarters.

• Global Scalability: Well-suited for businesses with international aspirations, multiple shareholders, or significant growth potential

• Limited Liability: Personal assets are entirely separate from business liabilities

• Corporate Tax Rate: Profits are taxed at a flat 21% rate in the US (as of 2025).

• Double Taxation: Profits are taxed at the corporate level, and dividends are taxed again at the shareholder level

• UK Tax Implications:

o Dividends paid to a UK resident shareholder are likely taxable in the UK at individual dividend tax rates

o UK corporation tax may apply if the company breaches UK corporate residency rules

o However, with tax treatment aligned across jurisdictions, it may be possible to claim tax credits in one country for taxes paid to the other. Again, you should seek professional advice on this before taking the plunge

• Administrative Burden: There are potentially complex compliance and reporting obligations, which may extend to both jurisdictions depending on the specific circumstances.

Selecting the optimal business structure as a US expat in the UK requires careful consideration of multiple factors, from tax efficiency to operational flexibility. While sole traders enjoy simplicity and UK Limited Companies offer protection with tax advantages, US entities add layers of complexity to cross-border operations. Success lies in matching your chosen structure with your business goals while ensuring efficient navigation of both tax systems.

Success lies in matching your chosen structure with your business goals while ensuring efficient navigation of both tax systems

MASECO Private Wealth is aware of the issues that Americans in the UK have to navigate. We can connect you with our trusted network of dual-qualified US/UK tax and legal professionals to help you on your journey. Working collaboratively with these specialists, we can then assist with your broader financial planning needs, including tax-efficient investment strategies for your business assets and personal wealth. This coordinated approach ensures all aspects of your financial life are aligned and optimised for both jurisdictions.

Information about tax and legal matters and potential benefits are based on our understanding of current tax law and practice and may be subject to change. The levels and bases of, and reliefs from, taxation is subject to change. The tax treatment depends on the individual circumstances of each client and may be subject to change in the future. MASECO does not provide tax and/or legal advice.

MASECO LLP (trading as MASECO Private Wealth and MASECO Institutional) is established as a limited liability partnership under the laws of England and Wales (Companies House No. OC337650) and has its registered office at The Kodak Building, 11 Keeley Street, London, WC2B 4BA.

MASECO LLP is authorised and regulated by the Financial Conduct Authority for the conduct of investment business in the UK and is registered with the US Securities and Exchange Commission as a Registered Investment Advisor.

Further information please contact: Ben Lightfoot Email: Ben.lightfoot@masecopw.com

If you don’t already receive these newsletters or invitations, please email helen@theamericanhour.com and put Newsletter Request in the subject. Don’t miss out on news, advice and invitations to events that are free to attend.

Written by Communications at MASECO

MASECO Private Wealth is pleased to announce the return of the LondonSports Charity Softball Tournament on 4th July 2025. In keeping with the spirit of American Independence Day, this fitting celebration will bring together teams from various firms in the US/UK community for a day of friendly competition and community engagement, all in the American style of sportsmanship and camaraderie, while supporting youth sports.

The tournament will feature competitive softball matches, fostering teamwork and raising funds for LondonSports. Spectators can enjoy an exciting day of sport, food, and refreshments. Invitations to our professional network, celebrating this special occasion, will be sent later this month with further details to follow.

We’re grateful for the generous support of our sponsors, with more expected to come on board!

• Jaffe & Co (Headline Sponsor)

• Blick Rothenberg

• Buzzacott

• EY

• Frontier US Tax Services

• Mishcon de Reya LLP

• Tax Advisory Partnership

• USTAXFS

LondonSports, the UK’s largest youth baseball and softball organisation, has been providing young people with opportunities to engage in sport since 1986. Over the years, the organisation has registered more than 15,000 children to play baseball and softball, collectively throwing over a million pitches. Spanning 130 different schools and 20 nationalities, LondonSports offers a unique and inclusive sporting environment.

Each game day, LondonSports sets up 15 fields of play, making it one of the largest youth sports leagues in the UK. Annually, the organisation fields 36 teams across 9 divisions, hosting over 250 games. LondonSports welcomes boys and girls aged 5-18, regardless of prior experience, fostering participation in a dynamic, supportive community. The club’s commitment to skill development, teamwork, and sportsmanship ensures that players build self-confidence and resilience.

As the largest feeder organisation for Team GB’s youth baseball and softball programmes, LondonSports plays a critical role in the development of players who go on to represent Great Britain internationally.

LondonSports is launching a new women’s softball league at Wormwood Scrubs, running every Saturday from Easter until June. Open to all skill levels, the league aims to promote community and active lifestyles. For more information and to register, visit: www.londonsports.com/womenssoftball

The partnership between MASECO Private Wealth and LondonSports ensures the tournament raises vital funds while promoting teamwork and community engagement. We are delighted to be hosting this tournament for the 7th year in support of LondonSports and look forward to continuing this collaboration in the future.

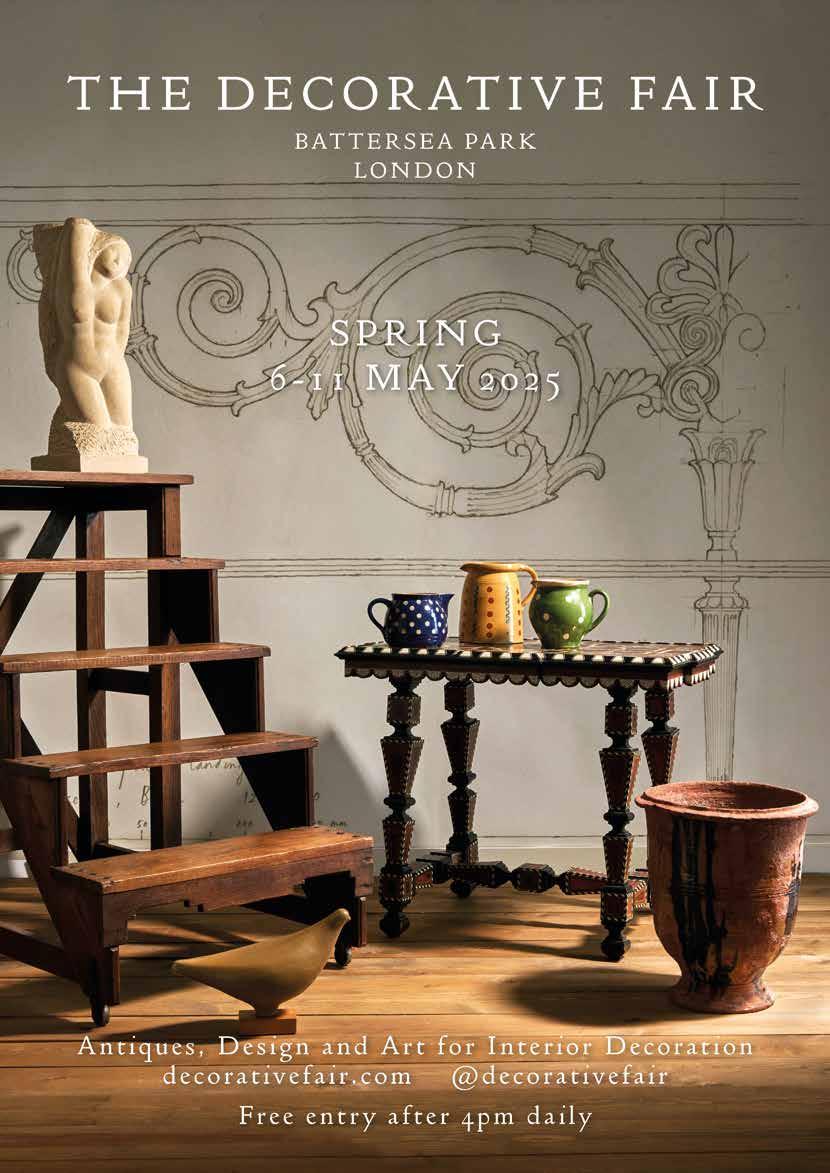

Spring in London is a magical time, when the city comes to life after the long, cold winter months. As the days grow longer and the temperatures rise, the parks and streets of London are filled with colour, energy, and an unmistakable sense of renewal.

In early spring, the city’s famous gardens and green spaces start to blossom. Places like Hyde Park, Regent’s Park, and Kew Gardens become a vibrant display of flowers, from the delicate crocuses and daffodils to the lush cherry blossoms and magnolias. People flock to these spots to enjoy the warmer weather for a leisurely stroll, a picnic, or simply to soak up the beauty of nature.

A hidden gem of London during this period is the London Wetland Centre in Barnes. This oasis of marshland, open fields and animal enclosures offers something genuinely different for those warmer days.

Whilst the weather in spring can be a bit unpredictable, with occasional showers and cool days, it’s the perfect time to experience London without the crowds of summer. Visitors and locals alike can enjoy outdoor activities, from boat rides along the Thames to cycling along the city’s many scenic paths.

Cultural life also thrives in spring. London’s theatres, museums, and galleries see a burst of activity with new exhibitions and performances. The city hosts a variety of spring festivals, including the wellknown London Fashion Week, and various food, art, and music events that celebrate the season’s energy.

Moreover, London’s outdoor markets come alive in spring, with fresh seasonal produce and handmade goods. Borough Market, for example, offers a delightful selection of spring vegetables, cheeses, and baked goods, while Columbia Road Flower Market turns into a vibrant spectacle of plants and flowers.

Overall, spring in London is a time of transformation, when the city feels renewed and full of possibilities. The combination of mild weather, blooming flowers, and exciting cultural events makes it one of the best times to experience the vibrant spirit of the city.

If you, or anyone you know, are considering a move to London then why not give it a try for a few weeks via a short-medium term tenancy on an apartment? Residential Land offer a wide variety of apartments across the city with tenancy agreements ranging from 3 months to 3 years.

Each apartment is interior designed and finished to a high standard, and many come with outside space allowing you to bring the outdoors in. All are managed and let by our experienced Building Managers, we offer an unrivalled rental service for both short- and long-term tenancies.

Contact our team today to find out more about all our available properties and to book a viewing.

lettings@residentialland.com www.residentialland.com 020 7408 5155

By Tim Baros

Step back into the 90s with the totally fabulous new musical ‘Clueless’.

Based on the 1995 movie of the same name, which starred Reese Witherspoon, (and Jane Austin’s classic book ‘Emma’), the hotly anticipated ‘Clueless, the Musical’ is full of colour, charm, humour, great music (by both KT Turnstall and Glenn Slater), great performances, fantastic clothes, very good direction, and choreography (Rachel Kavanagh and Lizzi Gee respectively). It also includes a simply wonderful lead actressEmma Flynn - who nails it!

Flynn seamlessly and effortlessly sings, acts and flows throughout the show - and she is in almost every scene as Cher Horowitz,

the beautiful and popular high school teenager at Beverly Hills High School, who wants to do good deeds all the time, including matching people up, but who doesn’t realise that her love match is closer than what she thinks!

Through so many catchy and fingersnapping songs, including ‘Perfect’ and ‘She’s All That and a Bag of Chips’, Cher befriends a new girl in town and tries to match her up with a classmate, then successfully matches up two teachers at her school, and when she thinks she’s found the right guy for herself, he turns out to be gay!

Chyna-Rose Frederick and Romona LewisMalley are good as Cher’s best friends, while Keelan McCauley makes the girls in

the audience swoon as Cher’s step-brother, and who has a fantastic number in the song ‘Human Barbies’.

This musical re-imagines everything that came from the movie, but gives it an extra twist by being live and in real-time, 30 years after the movie (and 210 years after the book was published). It successfully brings it back to life for a new generation.

This show will remind the audience goer of their time in high school, with the good times and the bad times.

‘Clueless, the Musical’ is a very, very good time!

Clueless, the Musical plays at The Trafalgar Theatre until September 27th, 2025.

www.trafalgartheatre.com/shows/ clueless-the-musical

Guernsey is the second largest island in the Channel Islands, and although a Crown dependency of the British Crown, is actually much closer to France. It is the largest island in the Bailiwick of Guernsey which includes five other inhabited islands – Alderney, Herm, Jethou, Lihou and Sark, and although it is a dependency it uses the Pound as its currency, but it has its own parliament and sets Its own laws and taxes.

Although Guernsey is nearer to France, it is easily reached from the UK either by air or sea with flights that go from many cities, and there are ferries from Poole and Portsmouth.

Guernsey has had a varied history and has been home to the Romans, the Normans and even pirates who lured passing ships on to the rocks around the island, and more recently the Nazi’s during the Second World War.

There are still things to see from all of the earlier occupations, but much has been modified by the Nazi’s when they landed on the island on 30th June, 1940, and then fortified the island as they expected retaliation by the Allies for the occupation. 2025 is a special year for Guernsey, as on the 9th May it will be 80 years since Guernsey

was liberated from Nazi occupation, and a full programme of events and entertainment for all ages is planned, with a strong focus on the St Peter Port seafront. In recognition of this year’s milestone anniversary, the day will see the return of traditional events, alongside new events and activities and all of these can be viewed at www.liberationday.gg

Visiting for liberation day will be a very special experience, but a visit to Guernsey throughout the whole year is also special as there is so much to see. I have a few suggestions of well-known and lesserknown places/tours to take.

I know this isn’t strictly a place, but it is rightly the first on the list, as to get the best of your trip to Guernsey and to truly get a feel for all of what Guernsey has to offer, what better a way than to hire an experienced local guide who will take you to all that Guernsey has to offer and provide colour to every sight. On our visit our guide for our 4 hour tour around the island was Amanda Johns from Tours of Guernsey

(www.toursofguernsey.com). Amanda was born on the island, and was not only extremely knowledgeable about all aspects of Guernsey, her passion for everything to do with Guernsey shone through, and as well as providing amazing tours she is actively involved in the restoration of WWII fortifications, and a volunteer at The German Occupation Museum.

On our tour with Amanda, she took us to The Little Chapel, a beautiful, tiny chapel that is mainly the work of one-man, Brother Deodat, who wanted to build a grotto like that at Lourdes in France. He started work in March 1914, and finished it a few months later, and it was adorned with the very same statue of ‘Our Lady of Lourdes’ that stands there today. He built the Little Chapel above this grotto, 9 feet long by 6 feet wide, but this first chapel had to be destroyed when a visiting Bishop could not get through the narrow door so refused to let it be used for Holy mass!

The second chapel that he built is adorned with bright pebbles, shells and pieces of colourful, broken china, which were donated

by the locals and Wedgewood themselves, making it striking to look at, and it remains as striking to this day as luckily it survived the occupation.

Our next stop on our tour with Amanda was to the German Occupation Museum, that is owned and operated by Richard Heaume and is his labour of love.

This museum is one of the most fascinating museums I have ever visited, and there is so much to see here that to look closely at everything you would need a whole day!

The museum leads the visitor along telling the story of the occupation from the invasion right up to liberation day using models, real life vehicles as well as videos. As Richard has collected more memorabilia, which he started doing as a child, he had to build more extensions to house them, and when you visit, he will probably be the one who will collect your money. This is a must visit as it provides a real feel of how Guernsey was impacted by the occupation covering all aspects of life including rationing, children and families being evacuated, and the resistance to the occupation. It is absolutely fascinating and has ignited my interest in Second World War history. www.germanoccupationmuseum.co.uk

Yes, you read it correctly, a tour based around seaweed!

You may think this would not be for you, but suspend your judgement, as this is actually fascinating.

Guernsey has some of the highest tidal ranges in the world, and when the sea

retreats it leaves a hidden world of seaweeds in the rock pools. We were led out on to the rocks by Ben, the owner and founder of the company, whose passion for seaweed and all the natural benefits it can offer shone through, and we were educated all about the various types of seaweeds and even given a chance to taste some. As well as being interesting, it took me back to my childhood, when I used to mess around in rockpools.

The seaweeds somewhat surprisingly tasted quite good, and the 1 ½ hr tour just flew by. You also don’t have to have wellingtons, but you do need decent walking shoes. You also learn all the things that seaweed can be used for, and some are quite surprising, and at the end you can also buy a few of these products. We bought some moisturiser made from seaweed and no we don’t now smell of the sea!

This is a great fun tour that all the family will enjoy, as long as elder relatives are physically able to walk across the rocks to the sea. www.eventbrite.co.uk/o/bentustin-77533994203

Hauteville House was the home of Victor Hugo during his exile from 1856 to 1870, and even when that exile ended, he returned to Guernsey a few times in later years.

The house was the place where he wrote many of his greatest masterpieces including Les Miserables, from his private floor in the attic overlooking the sea. The house is open from April to September and the rooms look just like they did when Hugo lived there, but are small, so the number of visitors are restricted, so advanced booking is essential.

www.museums.gov.gg/hauteville

Herm is a small island with no cars, no crowds, some stunning beaches and plenty of nature trails. It can be reached from Guernsey by ferry, and is the perfect place to just get away from the hustle and bustle of life and truly get back to nature.

Sark is another of the islands making up the Bailiwick of Guernsey, and again is reachable by ferry from Guernsey. It too has no cars, but as it is larger than Herm and uses horse drawn carts as transport. This is a walker’s paradise, and the wildlife and flowers, not to mention the beautiful beaches, make it a great place to spend a day.

This pass, which lasts 12 months, enables the purchaser to visit Castle Cornet, Fort Grey, the German Naval signals HQ and the Guernsey Museum at Candie, and if you plan to visit all these sights (which you should!) it is great value.

Castle Cornet has guarded St Peter Port Harbour for over 800 years, Fort Grey is a small Martello tower built on a tidal islet and the Guernsey Museum has extensive information about all the previous visitors to the island, as well as a large collection of art.

My wife’s favourite piece of art was The Tree of Life, where the artist has painted minute animals and birds in great detail, and you have to see it to believe it. It is incredible. www.museums.gov.gg/DiscoveryPass

If you plan to stay in Guernsey what better way to enjoy all of the history Guernsey has by staying somewhere which has an extensive history of its own, whilst also being one of the best hotels on the Island.

The Old Government House Hotel and Spa (OGH) is a luxury hotel located right in the heart of St Peter Port, and is part of the renown Red Carnation Hotel Group. It occupies the old residence of the Lieutenant Governor of Guernsey up until 1842, when it was leased out and turned into a hotel, which by 1895, had been extended to 100 bedrooms.

During the occupation, The Old Government House Hotel and Spa was taken over and used to give the German officers a place for relaxation, and the hotel has a room dedicated to this period of its history where you can see pictures and letters from the period which is fascinating.

Despite having been extended and developed over the years, the OGH has retained its period features and charm, and there are times when you can imagine you are back in the olden times whilst having a cup of tea on the private lawn with the great and good of Guernsey society.

The grand entrance with its lovely façade is lined with red carpet providing the guest with a sense of what is to come even before you enter. and that is enhanced by the warmth of the welcome from the staff.

On our arrival we were whisked through the formalities and taken on a tour of the hotel, and then we were quickly on our way to our room.

As mentioned, the OGH has accumulated the nearby properties over the years, and so the journey to our room would have been eventful if we hadn’t been guided, as we had to wend our way up and down a number of stairways to find it.

We were staying in the Herm Suite, and it is perfectly named as the views we had from our lofty perch over the harbour to Herm were spectacular. To maximise these views there is a large covered balcony with loungers and large windows that can be lowered if you want to enjoy the sun. Our suite also had a four-poster bed with an incredibly comfortable mattress, and crisp sheets which cocooned us at the end of the day and gave us the best night’s sleep we have had for a while (although that could have also been because of the clean fresh air we had been breathing?). Every room in the hotel is extremely well appointed, and has everything you would expect from a 5-star hotel, with robes, luxury toiletries and large fluffy towels, along with a turn down service every night that ensures everything is replenished or new for the next day.

You would think that in the heart of St Peter Port (5-minute walk to the shops) there wouldn’t be much outside space, but the Governor clearly knew how to live well, as the OGH has a delightful garden. which

is a sun trap, where you can sit and relax or eat, as well as a good-sized swimming pool which is open from April to September. As well as the pool, there is also a wellappointed gym and two indoor jacuzzis, a steam room and a sauna.

Having enjoyed all the wonders that Guernsey offers, guests of the OGH can relax after a busy day in its Spa, either enjoying a relaxing treatment or just sitting in the sauna or steam room, or as we did, relaxing in one of the large Jacuzzi’s, washing away the stresses of the day and building up a good appetite!

To satisfy that appetite, OGH offers two different restaurants, The Brasserie or The Curry Room. The Brasserie is in a light and airy conservatory overlooking the gardens and serves seasonal local ingredients, and the Curry Room offers delicately spiced curries in a more intimate room.

Guernsey is a wonderful place to visit as it has it all, wonderful beaches, lots of history, incredible walks and a varied wildlife all on this small island, and combined with the wonderful Old Government House Hotel and Spa to stay in, is a trip you must make.

We must say a very big thank you to all the staff at the hotel, who made our trip so special, including the Duty Manger Kris, and our driver for the three days, Andrew.

For further information on The Old Government House Hotel & Spa, please visit: www.theoghhotel.com

When I was young, I always wondered why, when we were in Kent, there was a castle called Leeds Castle, as Leeds I was sure was a town way up North. There are many different beliefs as to why it was so named, but to me the most plausible is the Castle was named after its first owner Led, Leed or Ledian, who was the Chief Minister of the King of Kent, but, whatever the truth, Leeds Castle has developed over the years to an action packed and fun filled day out for all the family.

The first mention of Leeds Castle is in the Domesday Survey in 1086, when the first stone Castle was built in 1119 on the two islands in the middle of the River Len, and its first encounter with royalty was in 1139, when it was embroiled into the dispute between King Stephen and Matilda the daughter of Henry I.

Fast forwarding over 100 years, the Castle continued to be developed and amended, and became the home of Queen Eleanor of Castille, wife of Edward I, and after that the Castle was owned by a number of other Queens until King Henry VIII transformed what was a fortified stronghold into one of his magnificent royal palaces.

We fast forward again, many hundreds of years, to the last individual owner of the now house, Lady Baillie, who bought it in 1925, when she was looking for a country retreat in Kent. During the 1930s, Leeds Castle became one of the great country houses of England, and its lavish hospitality attracted the great and the good of the age, including Errol Flynn, Charlie Chaplin and Daphne De Maurier. But in 1974, Lady Baillie died, and left the house to the newly formed Leeds Castle Foundation who still own it today.

This Foundation has developed the site as a family day out and has re-created the actual Castle back to its heyday so that visitors are transported back to the 1930s and experience exactly what those illustrious guests would have experienced during a visit, with a faithful recreation of how the Upper Class lived at that time, as well as the servants who waited on them.

Sometimes tours around old houses can be dry, but not here, as there are free headsets to provide colour to the tour, and there are many things to engage the children and keep their interest, which allows parents to enjoy the house without interruption!

After the tour, you may be forgiven for thinking that that is it, but far from it, as Leeds Castle is set in 500 acres of wonderful Kent countryside and there is so much more to enjoy.

Because of its extensive grounds there are many trails and walks for visitors to enjoy, but that is not the half of it, as Leeds Castle also has a number of other attractions to keep the kids (and those young at heart!) amused for hours.

I am not sure if the maze at Leeds Castle has the same age to it as that at one of Henry VIII’s other palaces, Hampton Court, but I can tell you from experience that it is as difficult! If there was a leaderboard for the time it took to get to the centre tower of the maze and then down into the grotto, suffice to say I would not be troubling it! Despite this I was not going to be beaten by the maze, so I did eventually complete it, along with my 2 year old Godson, his parents and my wife. We had initially split into a girls team and a boys team, but after both teams had got nowhere near the centre, we decided to become one team and try and crack it together!

Next to the maze is what is called ‘The Beach’ which is a vast, partially covered sand pit where our little godson Bill, spent ages running around and making sandcastles, even though it was the start of March.

Having exhausted his interest in sandcastle building, our next port of call was the Squires Courtyard Playground, where he climbed turrets, swung on swings and plunged down small slides whilst we relaxed watching from the sidelines. For children over 6 there is a Knights Stronghold Playground with lots of structures, play equipment and a number of slides of varying steepness to keep even the most demanding children occupied.

For those competitive families, or those who just enjoy the joy of the game, there is also an adventure golf course packed with fun themed holes that will test even the ardent golfer, but there is an extra charge for this.

As well as all these activities the things to do at Leeds Castle keep coming, as after allowing your children to let off steam on the playgrounds etc., you can visit the bird of prey centre where you can marvel at these majestic and regal birds. There are owls, falcons and eagles to learn about, and there is even a falconry display every day, where you can get up close and personal with these majestic birds.

There are many attractions that claim to cater for the whole family but few actually deliver on that promise, but at Leeds Castle there is truly something for all the family and will entertain them for the whole day.

Visitors are able to bring their own food and drink, but if you don’t fancy bringing your own refreshments, it is nice to see somewhere providing a wide range of tasty options at very reasonable prices.

Please note that once you have bought an admission ticket to Leeds Castle, you can revisit anytime within the next 12 months. Now that is value!

Leeds Castle, Maidstone, Kent, ME17 1PL

Telephone: 01622 765400

Website: www.leeds-castle.com

The

Guide will contain content covering:

The Guide has been published for over 20 years, and has had over 1.5 million views over the past year on our digital issues.

Please visit our website www.expatsguidetotheuk.com which is the digital platform for the Guide.

Please share the website with colleagues or friends relocating to the UK.

With a Celebrant, your wedding ceremony becomes a truly personal experience, crafted to reflect your unique love story as a couple. There are no restrictions; your ceremony can take place anywhere, at any time, and in any way that feels right for you, giving you complete freedom to celebrate your love in the most meaningful way.

Here are a few points to consider when planning a Celebrant-led wedding:

Popular wedding venues get booked up years in advance, especially during peak wedding season, so it’s normally the first thing on a couple’s to do list. Find your dream wedding location and book your venue.

If you want a legal ceremony at your venue, you’ll need to book a licensed venue. But if you’re having your Celebrant-led ceremony separate from the legal signing, it then opens up a multitude of different options to you.

Independent Celebrants can create and conduct beautiful ceremonies, but couples must still attend a registered office or have a Registrar attend a licenced building to make their marriage legally binding. Whilst this might sound like a pain, it actually gives you complete freedom to choose whatever venue you like; If you love a stately home, but want an outdoor wedding, have a wander around the grounds and pick somewhere with great views, or perhaps with the house as a backdrop.

One of the best things about planning a Wedding Ceremony with a UK Wedding Celebrant is that there are no restrictions

when it comes to location, so long as you have permission from the land or venue owner.

Wedding Celebrants will work outside at any time of the year.

Did you know that Registrars are restricted by guidelines that state that once the temperature drops below 16 degrees, they will automatically move the ceremony inside, but Celebrant-led weddings can be officiated anywhere, at any temperature, so pick a venue that suits you as a couple and one you truly love!

Once you have found your dream location for your day, the next thing should be to research and book your officiant, and if that is to be a Wedding Celebrant, then you will need to check their availability, and of course, have a consultation in order to confirm if they are the right fit for you and your wedding.

The benefit of choosing a Celebrant over a Registrar is that you can actually choose who conducts your wedding and build a relationship with them before your big day. Having a say in your ceremony content, format, and flow is a huge benefit and can mean the difference between a choice of three pre-set government scripts and a truly personal and unique one!

Independent Celebrants, like the couples they celebrate, are completely unique with their own styles and approaches. They can craft unique ceremonies with meaningful rituals like handfasting, sand ceremonies, or other unique elements and sprinkle them with their own personality, so it’s worth taking the time to find a Celebrant who feels like a good fit.

Unlike Registrars, who might have several ceremonies on the same day, Independent Celebrants usually only conduct one wedding a day, so you can choose a ceremony time that suits you both, rather than accepting whatever is left.

You will now need to register your intent to marry. This must be done in all cases, whether you choose a Registrar or

Celebrant, as it enables the registration service to prepare your legal documentation and record the details of your marriage.

Depending on where you are in the UK, the rules are slightly different, but wherever you are in the UK, Registrars are busy, and popular times might be hard to come by, so make sure you give plenty of notice – ideally at least 10-12 weeks.

In England and Wales you must give at least 29 days notice and legally marry within 12 months of giving notice, and you must register your legal intent to marry (give notice) in the district where you currently reside, as in local Registry Office to your home address.

Scotland also requires at least 29 days notice (ideally 10-12 weeks) but it works differently. Couples are required to fill in M10 forms that must be placed with the Registrar in the district in which the venue (for the legal wedding) is. The place of marriage is recorded on the form.

Northern Ireland requires couples to give notice at least 28 days prior to the marriage. Couples should contact the Registrar of the council district in which the legal ceremony will be registered.

If you opt for a Celebrant-led ceremony and just want to complete the legal bit at a registry office,

you can request a simple ‘statutory’ service to complete your paperwork and declarations. Most couples do the legal documents at the registry office, close to their wedding day, usually the day before or day after. You are free to choose when this takes place, so book your legal signing when it suits you.

When you attend your legal service, remember that you can save your vows and ring exchanges, along with all other personal details, for your Celebrant-led ceremony. Doing this when you sign your papers is not a legal requirement. Just inform the registry office that you would like to do this.

You will be required to take two witnesses and choose one from each of the following legal statements:

Declaratory Words

“I do solemnly declare that I know not of any lawful impediment why I, AB, may not be joined in matrimony to CD”.

or “I declare that I know of no legal reason why I, AB, may not be joined in marriage to CD”. Or by replying “I am” to the question “Are you AB free lawfully to marry CD?”.

Contractual Vows

“I call upon these persons here present to witness that I, AB, do take thee, CD, to be my lawful wedded wife (or husband)”.

or “I AB take you CD to be my wedded wife (or husband)”.

or “I AB take thee CD to be my wedded wife (or husband)”.

I am a professionally trained Celebrant and a member of the Fellowship of Professional Celebrants.

As a Celebrant, I am dedicated to crafting heartfelt ceremonies that honour life’s most significant occasions especially weddings. I create meaningful ceremonies with warmth, compassion, care and a personal touch.

I will work with you to create a wedding ceremony that shares your love story with your friends and family. The wedding ceremony will be a reflection of you as a couple, your passions, your joys and your unique love story journey.

Together, we will design a wedding ceremony that is personal, genuine, and as unique as your love story. Whether you’re overflowing with ideas or need a bit of guidance, I really take the time to get to know you as a couple and listen to your dreams and visions. Then, I transform them into an amazing, tailor-made, unforgettable ceremony that perfectly represents your romantic journey.

I am passionate in making your wedding ceremony as personal and memorable as the rest of your big day. After all, a wedding is more than just a single day, it marks the beginning of a beautiful new chapter in your lives, making it all the more important to get it just right.

For further information, please contact me, Joanne Brown at: joannebrown.celebrant@gmail.com

The current (2024) Standard UK Fees Notice of Marriage are £42 per person (or £57 if you are subject to immigration control) which are payable to the registration service in which both parties live. You will also need to book the Statutory Ceremony which is £56 (+£12.50) per copy of your marriage certificate, and provide proof of your current immigration status (visa).

You are then free to hold your ceremony wherever and whenever you like!

Now that your venue is booked, your Celebrant secured and your intent to marry logged at the registration service, you can set about planning your big day with gusto, and without restrictions!

The same process applies for destination weddings too. If you are wanting to have your ceremony abroad, why not separate the legal signing and avoid all the red tape at your wedding destination. Upon your arrival abroad you will often have to complete documentation and visit several government offices and associations in order to satisfy their requirements. It’s a lot simpler this way!

For further information on Celebrant-Led Weddings, please contact: joannebrown.celebrant@gmail.com

Although many today would be forgiven for not knowing where Lavenham is, or what it is famous for, Lavenham was, many centuries ago, very well known as a prosperous village, and in the medieval period it was among the twenty wealthiest settlements in England. This wealth was based around the wool trade, and led to Lavenham having a Guildhall, a little hall, a church, and countless half-timbered medieval cottages housing the wealthy wool merchants and buyers.

One of these quaint timbered buildings houses The Swan Hotel, which is perfectly situated right in the heart of this picturesque village, with its market square and small boutique shops, and it was even used as the birth place of Harry Potter at Godric’s Hollow in the film Harry Potter and

the Deathly Hallows (although sadly for them none of the cast actually came to film here and were superimposed instead!).