TIME FOR ACTION

IN THESE VOLATILE TIMES FOR OUR INDUSTRY, IT’S MORE CRITICAL THAN EVER TO HAVE OUR VOICES HEARD

It ’s your moment to shine. Enter your spirits to be tasted and reviewed by industry experts in the American Craft Spirits Competition. ACSA recognition can help you build your brand, increase product distribution and sales, gain media exposure, and earn the industry cred you’ve been looking for.

Advocacy, Access, and Attention

Why it’s critical now more than ever for craft distillers to raise their voices on market access, as well as regulatory and financial relief

BY JEFF CIOLETTI

Party At Our Place

From trivia nights to holiday bonanzas, small distilleries increasingly rely on tasting room events to drive foot traffic.

BY KATE BERNOT

An Iowa Instituion Turns 20

As Cedar Ridge celebrates its 20th anniversary, the distillery reflects on its history and successes over the years.

BY SYDNEY GERMAN

MEMBER SPOTLIGHTS

to Know ACSA Member Producers

Profiles on Leather & Oak Spirits and Rotten Little Bastard Distilling

Western N.C.: One Year After Helene

How Asheville-era distilleries are recovering in the wake of Hurricane Helene.

BY SYDNEY GERMAN

BY ROBIN ROBINSON

ON - PREMISE

52

The Sipping Scene

We spotlight some top cocktail destinations in Colorado and Pittsburgh.

54

Hospitality-Forward

Tales of the Cocktail panelists ponder what’s next in evolving bar trends.

BY JEFF CIOLETTI

PACKAGING

56

Telling a Craft Spirit’s Story, One Bottle at a Time

Packaging traceability is evolving from a must-have into a competitive advantage.

BY ANDREW KAPLAN

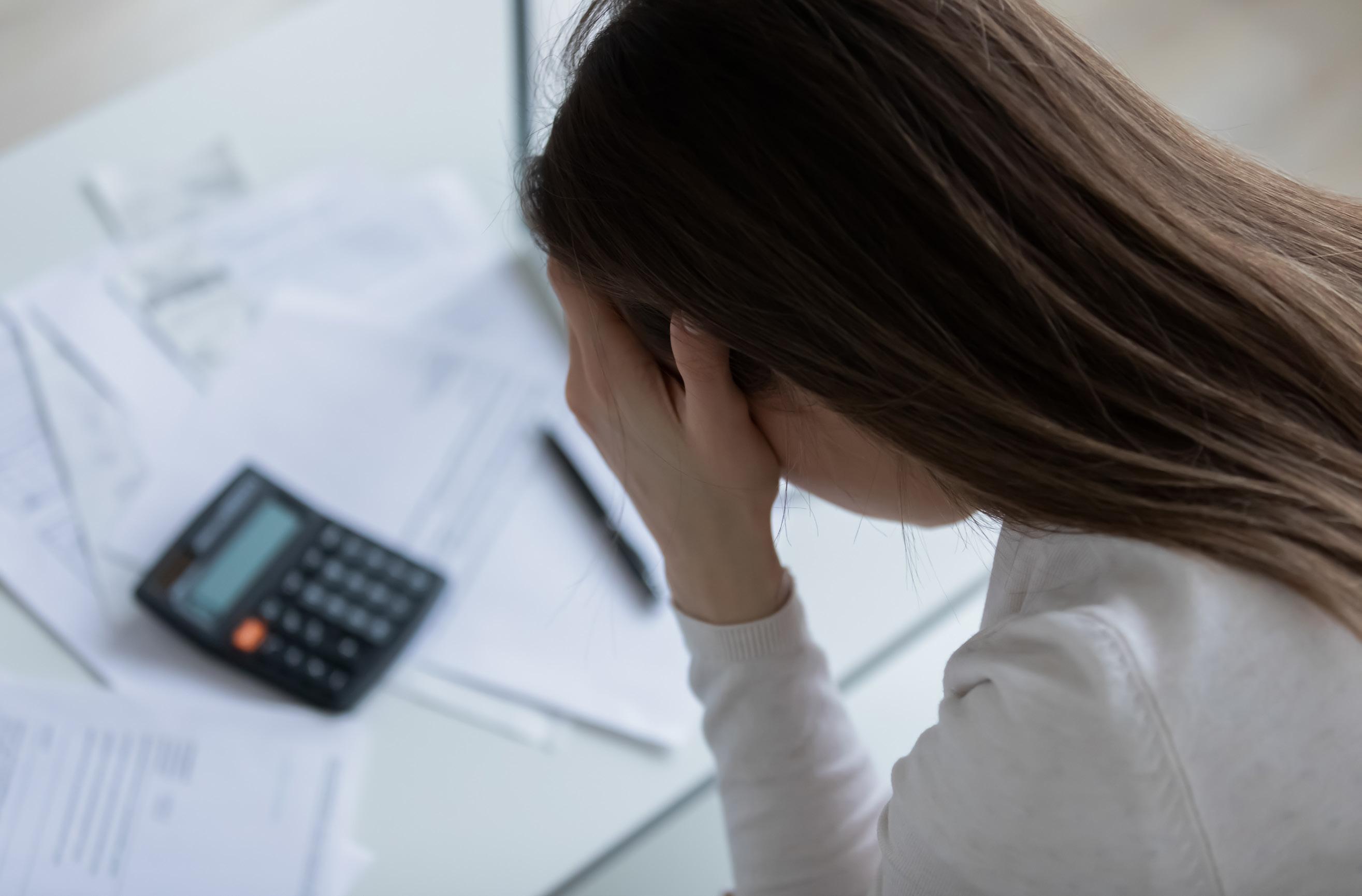

BUSINESS SENSE

60

Navigating Uncertain Waters

Insights on staying afloat in a difficult economic climate.

IN THE LAB

66

A Leap Into Brandy Blending

Flying Leap Vineyards and Distillery’s Mark Beres takes us inside his brandy blending process.

Five WatchOuts for Spirits Labels

The key regulatory requirements to keep an eye on when reviewing your labels

MAGGIE BOYD

Scenes from Heartland Whiskey

Competition Judging & Tales of the Cocktail 2025

CRAFT SPIRITS MAGAZINE

EDITOR-IN-CHIEF | Jeff Cioletti, jeff@americancraftspirits.org

ASSOCIATE EDITOR | Sydney German, sydney@americancraftspirits.org

ART DIRECTOR | Michelle Villas

ADVERTISING & SPONSORSHIP ASSOCIATE | Kristiane Weeks-Rogers, kristiane@americancraftspirits.org

CONTRIBUTORS | Lew Bryson, Maggie Boyd, Kate Bernot, Robin Robinson, Andrew Kaplan

AMERICAN CRAFT SPIRITS ASSOCIATION

CEO, AMERICAN CRAFT SPIRITS ASSOCIATION | Margie A.S. Lehrman, margie@americancraftspirits.org

COO, AMERICAN CRAFT SPIRITS ASSOCIATION | Emily Pennington, emily@americancraftspirits.org

EDUCATION MANAGER | Kirstin Brooks, kirstin@americancraftspirits.org

ADMINISTRATIVE ASSISTANT | Albab Melaku, albab@americancraftspirits.org

SENIOR MANAGER OF MEMBERSHIP & MARKETING | Jon Page, jon@americancraftspirits.orgi

DIRECTOR OF MEETINGS & EVENTS | Stephanie Sadri, stephanie@americancraftspirits.org

ACSA ADVISORS

STRATEGIC COMMUNICATIONS | Alexandra S. Clough, GATHER PR LEGAL | Ryan Malkin, Malkin Law, P.A.

PUBLIC POLICY | Jim Hyland, The Pennsylvania Avenue Group STATE POLICY | Michael Walker, The Walker Group, LLC

ACSA BOARD OF DIRECTORS, 2025-2026 PRESIDENT | Jordan Cotton, Cotton & Reed (DC) VICE PRESIDENT | Jaime Windon, Windon Distilling Co. (MD) SECRETARY/TREASURER | Tom Bard, The Bard Distillery (KY)

EAST

Jordan Cotton, Cotton & Reed (DC)

Greg Eidam, Sugarlands Distilling Co. (TN)

Becky Harris, Catoctin Creek Distilling Co. (VA)

Adam Polonski, Lost Lantern Whiskey (VT)

Colin Spoelman, Kings County Distillery (NY)

Jaime Windon, Windon Distilling Co. (MD)

EX OFFICIO

Jeff Kanof, Copperworks Distilling Co. (WA)

CENTRAL

& MOUNTAIN

Tom Bard, The Bard Distillery (KY)

Murphy Quint, Cedar Ridge Distillery (IA)

Mark Shilling, Maverick Distilling (TX)

Phil Steger, Brother Justus Whiskey Co. (MN)

Olivia Stewart, Oxbow Rum Distillery (LA)

Thomas Williams, Delta Dirt Distillery (AR)

ACSA PAST PRESIDENTS

2024-2025 | Kelly Woodcock, Westward Whiskey (OR) 2023-2024 | Gina Holman, J. Carver Distillery 2020-2023 | Becky Harris, Catoctin Creek Distilling Co. 2018-2020 | Chris Montana, Du Nord Craft Spirits 2017-2018 | Mark Shilling, Maverick Distilling 2016-2017 | Paul Hletko, FEW Spirits 2014-2016 | Tom Mooney, House Spirits

CRAFT SPIRITS MAGAZINE EDITORIAL BOARD

PACIFIC

Caitlin Bartlemay, Clear Creek Distillery (OR)

Orlando Lima, Bainbridge Organic Distillers (WA)

Alex Villicana, Re:Find Distillery (CA)

ACSA PAC

Jordan Cotton, Cotton & Reed (DC)

Lew Bryson, Alexandra S. Clough, Prof. Dawn Maskell, Adam Polonski, and Teri Quimby

For advertising inquiries, please contact Kristiane Weeks-Rogers, kristiane@americancraftspirits.org For editorial inquiries or to send a news release, contact news@americancraftspirits.org

P.O. Box 470, Oakton, VA 22124

© 2025 CRAFT SPIRITS magazine is a publication of the American Craft Spirits Association.

AUTUMNAL UPDATES

I guess I started an unofficial tradition last year with my fall preview Editor’s Note. I wasn’t intending to do the same thing again in this issue, but there’s just some big stuff happening in the next couple of months that just couldn’t be ignored.

Expanded E-Book

The e-book we released in 2023, The ACSA Guide to Starting and Operating a Distillery, has been an invaluable primer for anyone getting into the industry, as well as craft spirits producers that have been in operation for a few years. It’s also been an effective educational tool for distillery management to share with their entire staff to bring them up to speed on all facets of the craft spirits business. We’ve always viewed it as a living document, one that would be updated periodically to reflect the evolving nature of our industry.

We’re pleased to announce that in early October, we’ll be releasing a freshly updated edition that will include 20% more content, all written and peer-reviewed by industry experts.

The updated edition includes four new chapters, encompassing spirits sales best practices, bottle selection, packaging design, and the largest new section, RTDs.

If you already own the original e-book, we’ll be offering a special, limited-time discount on the price of the new chapters. Expect an email in the coming days with further details.

For those who haven’t yet purchased the e-book, you’ll be able to pre-order it, and the contents will be delivered electronically. We’ll be raising the price slightly from the original 2023 price, given the new, expanded content. ACSA members will still be able to purchase it at a significantly lower rate than non-members.

I’d like to thank the authors of the new sections, Benjamin Carr (Thoroughbred Spirits) Jon O’Connor (Long Road Distillers), Robin Robinson (Robin Robinson, LLC and author of “The Complete Whiskey Course”), and the Glass Packaging Institute. And thank you to all of our peer reviewers.

Mark Your Calendars

I’d also like to note some other upcoming events and initiatives. The call for submissions is still open for the 2026 American Craft Spirits Competition. Be sure to enter by October 20, 2025. Judging will take place at Cotton & Reed in Washington, D.C. in November, and awards will be presented at the 2026 ACSA Convention & Expo in Sacramento, California, April 17-18.

We’ll also be opening the call for submissions for the 2026 Craft Spirits Packaging Awards later this year, and we’ll be presenting those awards at the Sacramento convention as well.

But before that, you’ll want to head to Chicago for ACSA’s third annual American Craft Spirits Festival at Binny’s Beverage Depot on October 29.

Stay Connected

There’s so much more I want to talk about that we can’t quite announce just yet. But stay in touch, keep reading CRAFT SPIRITS magazine, Craft Spirits Weekly, and the Monthly Mash. Also, listen to some all-new upcoming episodes of the Craft Spirits Podcast for further updates. Please don’t hesitate to drop me a line at jeff@americancraftspirits.org for any questions, story ideas, or to discuss anything we can do to improve CRAFT SPIRITS magazine and its associated media properties. ■

Jeff Cioletti Editor-in-Chief

Thank You , Sponsors !

The American Craft Spirits Association would like to thank all of our annual sponsors and our key supporters of education. We are grateful for all of your support throughout the year. Interested in becoming a sponsor? Visit americancraftspirits.org/sponsors or contact membership@americancraftspirits.org.

Cask Strength Sponsors

Single Barrel Sponsors

Lew Bryson has been writing about beer and spirits full-time since 1995. He was the managing editor of Whisky Advocate from 1996 through 2015, where he also wrote the American Spirits column, and reviewed whiskeys. He has also written for the Daily Beast and American Whiskey. He is the author of “Tasting Whiskey,” “Whiskey Master Class,” and the forthcoming “American Whiskey Master Class.”

Michelle Villas is an art director with more than 25 years experience in publication design. After spending her career in New York, where she was the art director for Beverage World, and California, she now calls New Mexico home. She is the creative director on a range of lifestyle publications for The Golden State Company and also serves as the art director for BeachLife magazine.

Maggie Boyd is a Senior Compliance Specialist at Malkin Law PA. She has over a decade of experience in the alcohol beverage industry.

Robin Robinson is the author of “The Complete Whiskey Course: A Comprehensive Tasting School in Ten Lessons”. As a sales and marketing consultant, he acts as a “brand sherpa” to emerging spirit brands, from narrative creation to marketing/sales strategies. He teaches sales classes for spirit brands, is a Route-to-Market instructor at Moonshine University, and prior to covid, ran the longest-running whiskey class in the US at Astor Center in NYC for 11 years.

Kate Bernot is a reporter covering beer, food, and spirits. She regularly contributes to Sightlines and Craft Beer & Brewing; her work has appeared in The New York Times, The Washington Post, Imbibe, and elsewhere. She is a BJCP-certified beer judge and a past director of the North American Guild of Beer Writers. She lives in Missoula, Montana.

Andrew Kaplan is a freelance writer based in New York City. He was managing editor of Beverage World magazine for 17 years and has worked for a variety of other food and beverage-related publications, and also newspapers. Follow him on Twitter @andrewkap.

Quench your thirst for knowledge in ACSA’s Craft Spirits Classroom. For more information or to register, visit our website at americancraftspirits.org/education/webinars.

Wyoming Whiskey, has unveiled National Parks: Acadia Edition, a special-edition bourbon that it created in partnership with Friends of Acadia. The bourbon supports the organization’s continued stewardship of the natural beauty, ecological vitality and rich cultural resources of Acadia National Park in Maine. It’s the first time the distillery’s National Parks series has expanded outside its home state.

Barrell Craft Spirits has introduced Barrell Decade, a carefully crafted blend of whiskeys distilled each year from 1995 to 2005 showcasing secondary maturation in Spanish brandy and Hungarian oak casks. The new expression is the latest offering in the company’s Black Label Series.

Garrison Brothers in Hye, Texas, has released its rarest, oldest and most coveted expression, Garrison Brothers Laguna Madre Texas Straight Bourbon Whiskey for 2025. Bottled at 101 proof and cherry mahogany in color, the 2025 Laguna Madre shares tasting notes of vanilla bean, hazelnut, saltwater taffy, and milk chocolate.

Maverick Distilling has announced the release of its Samuel Maverick Four Grain Texas Straight Bourbon Whiskey Bottled at 106 proof and non-chill filtered, the Samuel Maverick Four Grain Texas Straight Bourbon begins with deep caramel and cola notes before opening into layers of spicy vanilla.

Luxury brand Wolves, in collaboration with Willett Family Estate, has announced its latest limited-edition release of the 10-year Rye Whiskey. This exclusive blend of straight rye whiskies highlights both brands’ commitment to quality, technique and flavor, while paying tribute to their respective homes of Kentucky and California.

Minden Mill Distilling has announced the nationwide release of its Single Estate Nevada Straight Rye Whiskey—a 94-proof, flavorful expression that aims to take American rye in a new direction with a focus on balance over spice.

Brother Justus Whiskey Company has announced the limited release of the newest and third expression of its annual Founder’s Reserve Whiskey series, made from 100% American malted barley. Brother Justus Founder’s Reserve 3 is bottled at cask strength and is composed of specially reserved whiskey.

High West Distillery has released High West Bottled in Bond Bourbon Crafted 4,000ft above sea level at the High West Distillery in Wanship, UT, this 100-proof expression was aged 4 years and 5 months in a federally bonded warehouse.

Kōloa Rum, the craft rum distiller from Kaua‘i, has unveiled the newest addition to its portfolio: Kōloa Kaua’i SingleBatch Aged Rum. Bottled at 92 proof, this rum glows with deep amber hues in the glass. Expect aromas of fragrant sugarcane with hints of mellow oak, orange peel, and subtle nuttiness.

Frey Ranch Distillery announced the launch of Frey Ranch Five Grain Single Barrel Bourbon. A rarity in the whiskey world, this is the first-ever release from Frey Ranch that includes all five of the grains—corn, wheat, barley, rye, and the special addition of oat.

Sauvage Distillery of Charlotteville, New York has launched Upstate Brandy Maple. This small-batch spirit blends two-yearaged apple brandy with pure, maple syrup sourced locally within Schoharie County, the same county where the distillery is located.

Wigle Whiskey is kicking off the fall whiskey season with the release of its newest spirit: Cherry Whiskey, a nod to the country’s Colonial history. Long before the United States was fully formed, a cordial known as Cherry Bounce was a staple of festive gatherings and a favorite of George Washington. This Colonial-era drink was traditionally made by steeping tart cherries, sugar, and spices such as cinnamon, cloves, and nutmeg in brandy for several weeks or months. Enjoyed as both a sipping cordial and cocktail ingredient, Cherry Bounce became a fixture of early American social life.

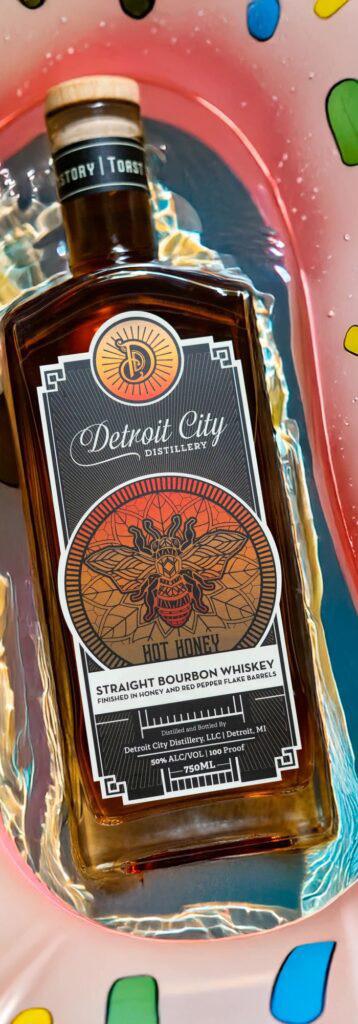

Detroit City Distillery says it has unleashed something new and slightly “dangerous” in the form of Hot Honey Bourbon, made with local honey from local community apiary Bees in the D. Detroit City took its house bourbon, infused it with the honey, and then finished it off with a proprietary blend of chili heat. The result? A balanced spirit that starts mellow, then finishes with a fire.

New Riff Distilling has announced the return of its second annual Headliner release. The 2025 limited edition features four whiskeys, including two from the first batches distilled 11 years ago. This year’s edition is bottled without chill filtration at 111 proof.

Sugarlands Distilling Company is once again teaming with NASCAR legend Richard Petty, to launch Petty Punch Moonshine. This vibrant, fruit-forward shine pays homage to “The King” and his legendary career. Petty Punch checks in at 50 proof (25% alcohol/volume).

In an effort to help local Franklin County residents in the flood recovery process, J. Mattingly 1845 Distillery has created a limited-edition bourbon called “Frankfort Rising.” It is a five-yearold, 112 proof bourbon finished with oak staves.

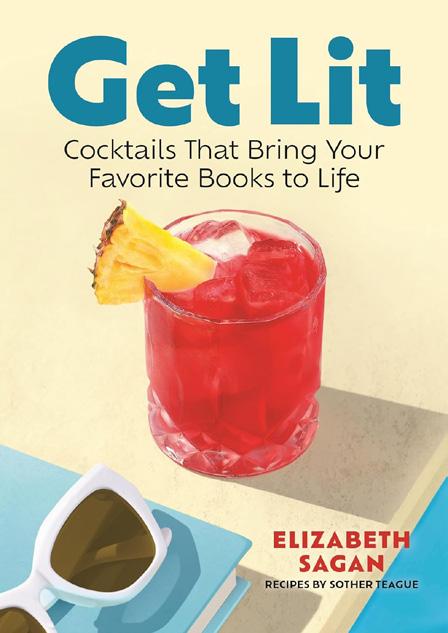

Get Lit: Cocktails That Bring Your Favorite Books to Life

Author: Elizabeth Sagan

Publisher: Media Lab Books

Release Date: September 9

Each page of this intoxicating title unveils a creative fusion of popular literature with mixology mastery, offering a selection of drink recipes inspired by beloved books from a variety of genres. Within the pages of Get Lit, readers will uncover cocktails meticulously crafted to capture the essence of characters, settings, and themes in popular literature.

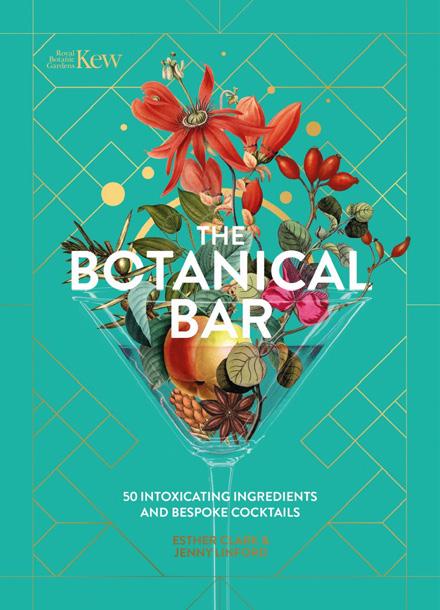

The Botanical Bar: 50 Intoxicating Ingredients and Bespoke Cocktails

Authors: Jenny Linford and Ester Clark

Publisher: Headline Publishing Group

Release Date: September 4

An intoxicating collection of 50 fragrant, floral, fruity, and herbal ingredients and 50 bespoke cocktail recipes, The Botanical Bar explores the stories and science behind the elements of favorite drinks. A unique blend of photography and the Royal Botanic Gardens’ signature botanical illustration creates a gorgeous package that will appeal across plant and drink audiences.

Author

Spotlight: Noah Rothbaum, The Whiskey Bible:

A Complete Guide to the World’s

Greatest Spirit

Author Noah Rothbaum has spent 25 years researching, reporting on, and tasting whiskeys from around the world. He brings an obsessive’s passion to the topic, offering up a country-by-country examination of the prominent distillers, whiskey cultures, and information on hundreds of whiskeys from the well-known labels to the small batch craft up-and-comers.

CRAFT SPIRITS magazine: What inspired you to begin this quest?

Noah Rothbaum: In 2000, Workman published the groundbreaking “Wine Bible” by Karen MacNeil. Then, 15 years later, they added “The Beer Bible” by Jeff Alworth. At the beginning of 2020, Workman decided that they wanted to add a Whiskey Bible to the series and reached out to me to see if I wanted to write it. Thanks to my previous book, The Art of American Whiskey, which came out in 2015, my love for and expertise in whiskey were no secret.

The book covers a lot of ground. How did you decide the format of the text, and what information would receive attention? The book is more than 600 pages long, so I tried to include as much information as I possibly could. And I thought a lot about the format of the book and how different people might use it. Ultimately, breaking out the history and production information from the

brand profiles worked the best. I hope the readers will agree.

During your travels, what experiences were unexpected while learning about whiskey and immersing yourself in the process?

You can read about a distillery, study photos of it, and even talk to the distiller, but until you actually go to the place where the whiskey is made, it’s very hard to truly understand it. And when you go to a distillery, like Leopold Bros. in Denver, you often learn about steps in the whiskey-making process that are generally glossed over but are incredibly important, like that fermentation is not just about producing alcohol but also building flavor compounds.

What do you hope that readers take away from The Whiskey Bible?

I hope that my book is approachable to all adults, whether they’re connoisseurs or have tasted whiskey for the first time. What always impressed me about “The Wine Bible” was that as my own wine knowledge grew, the book also seemed to somehow grow, and I discovered sections that I suddenly was interested in. I hope that readers will find that the same phenomenon happens with “The Whiskey Bible “and that the book will be a trusted resource as their love of and appreciation for whiskey grows.

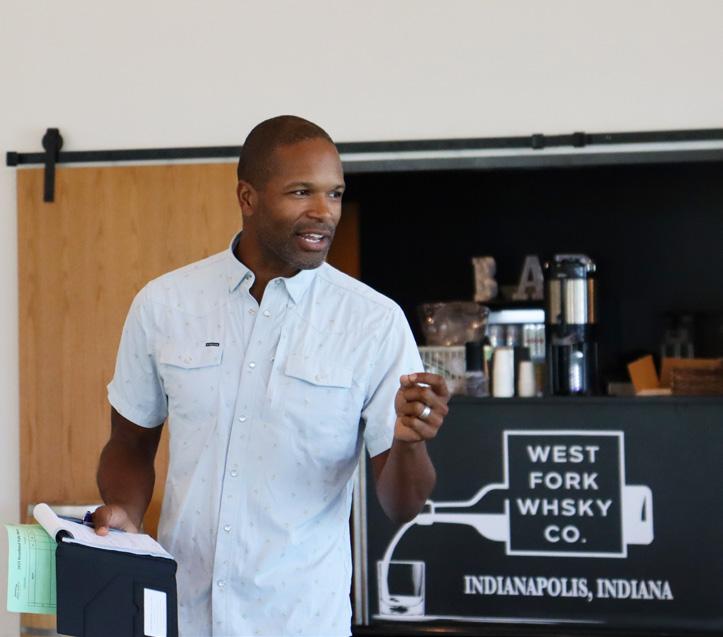

ACSA ANNOUNCES 2025 HEARTLAND WHISKEY COMPETITION AWARDS

In late August, the American Craft Spirits Association (ACSA), with support from state corn marketing associations, announced the top awards and medalists in the 2025 Heartland Whiskey Competition. The competition was open to craft whiskeys from all 50 states that incorporate corn in their mash bill (the mix of grains used to make whiskey).

In this fifth, biennial blind-judging event, whiskeys from “Heartland” states competed for Best of Show, Best of State, and three FarmerDistiller awards, in addition to traditional whiskey categories (e.g., Rye, Bourbon, etc.).

The competition was generously sponsored by state corn marketing associations with judging taking place in mid-July. ACSA facilitated the judging process and its former Board President Chris Montana, owner of Du Nord Social Spirits in Minnesota, served as Judging Director—a role he has held for all five Heartland competitions. Judges were selected from the spirits industry by ACSA based on their expertise in craft whiskey.

Starlight Distillery in Borden, Indiana, claimed the prestigious Top Farmer-Distiller award, determined by the highest average score across three judged spirits from a single qualifying distillery.

The Farmer-Distiller: Best Bourbon resulted in a numerical tie when Queen’s Reserve, a product of Wood Hat Spirits in Florence, Missouri, scored identically to Bloody Butcher Bourbon, which is produced by Pathfinder Farm Distillery in Boonsboro, Maryland. Both will receive trophies.

Farmer-Distiller: Beyond Bourbon goes to Tobacco Barn Distillery in Hollywood, Maryland, for its Maryland Bourbon Cream. To qualify as a farmer-distiller, participants must both own a distillery and operate a working farm. The 22 recipients of the Heartland Whiskey Competition Best in State trophies were announced by their respective state corn associations and are now listed on the ACSA website and Heartland Whiskey Competition website, along with all medalists from the competition.

Best of Show was awarded to 1845 Distilling Co. of Lowry Crossing, Texas, for its Texian No. 01 Texas Straight Whiskey, which also earned the top score in the Straight Whiskey category.

The 2025 Heartland Whiskey Competition category recipients are as follows:

Bourbon

Hugh Hamer Rum Finished

West Fork Whiskey Co.

Blended Whiskey

Burton James Uniquely American Whiskey —

Five Tool Player

B.H. James Distillers

Bottled in Bond (tie)

Single Barrel Bourbon #29

10,000 Drops Craft Distillers

Bottled in Bond (tie)

West Fork Whiskey Wheated Bottled in Bond

West Fork Whiskey Co.

Corn Whiskey

Rockfish Whiskey

Weldon Mills Distillery

Flavored

Caramel Apple Weldon Orchards

Weldon Mills Distillery

Four Grain

Preemption Texas Straight Four Grain

Bourbon Whiskey

1845 Distilling Co.

Light Whiskey

75-25 Reserve

Star Union Spirits

Read to Drink (RTD)

Maryland Bourbon Cream

Tobacco Barn Distillery

Rye Whiskey

Loup River Straight Rye Whiskey

Loup River Distilling

Straight

Texian No. 01 Texas Straight Whiskey

1845 Distilling Co.

“Several factors contribute to what is today a more challenging period for craft distillers which are often small, family-run businesses. Our member-distillers are grateful for the sup-

port of the state corn associations through five cycles of this important competition,” says Margie A.S. Lehrman, CEO of ACSA. “We greatly appreciate their continued support and the fact they supply our members with the best corn product in the world.

”The 2025 competition saw significant growth in the number of participating states and expansion of the farmer-distiller awards, which increased overall participation by farmer-distillers. Only 20 whiskeys were awarded a gold medal, while 91 received silver, and 23 bronze.

“It is important to recognize that craft distillers have sustained their businesses through trying times and continue to improve an already excellent product,” said ICMC board member Paul Hodgen, a farmer from Roachdale, Indiana. “Corn growers throughout the Heartland, through their participating state corn associations, support these entrepreneurs, many of whom are working farmers and all of whom are our customers.”

Scoring and Medal Criteria

The scoring of whiskeys, with judges handselected from the North American spirits community, was based on a 100-point system with 10 main categories of consideration: Appearance (10 points), Aroma Intensity (10 points), Aroma Complexity (10 points), Palate Concentration (10 points), Palate Complexity (10 points), Body (10 points), Alcohol (10 points), Texture (10 points), Finish (10 points), and Pour for a Peer (10 points).

Whiskeys were then assigned a medal based on the average score determined by the following benchmarks: 70-79 = Bronze; 80-89 = Silver; 90-100 = Gold. Best-in-State was awarded to the whiskey with the top score among all judged whiskeys from that State.

Best Farmer-Distiller was awarded to the top average score across three spirits among all judged whiskeys submitted by Farmer-Distillers. The top-scoring whiskeys were judged a final time in consideration of the Best-inShow distinction.

BOURDON SPIRITS COMPANY ANNOUNCES ACQUISITION OF COPPER & KINGS

Bourdon Spirits Company, a family-owned spirits company based in Louisville, has announced its acquisition of Copper & Kings American Brandy Company from Constellation Brands.

Key deal highlights:

• Spirits production will continue at the brand’s Louisville distillery, a standout destination on the Kentucky Bourbon Trail that reinforces Copper & Kings’ position in the heart of bourbon country.

• Expansion plans include enhancing the visitor experience and growing national distribution—while preserving the brand’s creative identity and commitment to quality.

Vision for growth: “We plan to build on Copper & Kings’ legacy by honoring its roots and continuing to do things our own way, just as the brand always has,” says Rob Bourdon, founder of Bourdon Spirits Company.

“We’re honored to welcome Copper & Kings into our family and lead its next chapter right here in Louisville,” Bourdon continues. “This is a brand that respects tradition while creating with a distinct, Americanmade spirit.”

GARRISON BROTHERS APPOINTS

SOUTHERN GLAZER’S WINE & SPIRITS FOR NATIONAL DISTRIBUTION

Garrison Brothers Distillery, Texas’ first legal bourbon distillery, has appointed industry leader Southern Glazer’s Wine & Spirits for national distribution. This new national distribution agreement positions Garrison Brothers’ premium corn-to-cork Texas straight bourbon whiskey for substantial growth in the market.

“From the incredible turn-key process with Southern Glazer’s transition team to the excitement and their notable expertise, this great partnership sets up Garrison Brothers for years of continued success. The entire team at Garrison Brothers is proud to be working with Southern Glazer’s and can’t wait for even more Americans to discover our award-winning Texas Bourbon on the shelves and being served in their favorite restaurants and bars,” shares Drew Pennington, Vice President of Sales, Garrison Brothers.

Garrison Brothers Distillery, located in Hye, Texas, in the beautiful Hill Country, is the first legal bourbon distillery in Texas history, and the first distillery outside of Kentucky to produce authentic, handcrafted, corn-to-cork bourbon whiskey—and only bourbon whiskey. Founded in 2006 by Dan and Nancy Garrison, Garrison Brothers bourbon first entered the market in 2010.

www.lallemanddistilling.com distilledspirits@lallemand.com @Company/Lallemand-Biofuels-&-Distilled-Spirits LallemandDistilling

WHISKEY DEL BAC ANNOUNCES PARTNERSHIP WITH ACTION WINE AND SPIRITS

Whiskey Del Bac has announced a new distribution partnership with Action Wine & Spirits in Arizona.

“Whiskey Del Bac was born from a profound love of the Sonoran Desert,” says Whiskey Del Bac CEO Paul Winandy. “Action only distributes in Arizona, aligning closely with the ‘buy local’ commitment of Whiskey Del Bac and our loyal fans. We are excited to launch this new partnership.”

Action Wine & Spirits is an independent, locally owned and operated wholesaler based in Phoenix. Servicing businesses throughout the state of Arizona. “It’s a value of ours to support local business,” says Ryan Shepherd, Action Wine & Spirits operating partner.”

MIRACLE AND SIPPIN’ SANTA BARS ANNOUNCE VENUE LINEUP FOR 2025 HOLIDAY SEASON

Holiday cheer is on the menu once again as the beloved, pioneering Christmas pop-up bars, Miracle and Sippin’ Santa, kick off the 2025 season, bringing their spirited charm and signature style to bars worldwide. Known for transforming cocktail hot spots into immersive holiday-themed destinations, this year’s pop-ups will debut a dazzling selection of new holiday drinks, returning favorites, exclusive limited-edition glassware, and, for the first time, a curated selection of zero-proof cocktails. It’s the ultimate holiday tradition to sip, see, and celebrate.

An annual celebration that began over a decade ago, over 200 Miracle and Sippin’ Santa locations—both new and coming back—will once again spread merry mayhem across the globe. Starting from early to mid-November, doors will open for guests to step into a wonderful world of over-the-top décor, spirited cocktails, and the kind of magic only these original holiday pop-ups can deliver.

The 2025 Miracle and Sippin’ Santa Partner Bars can be found at www.sippinsantapopup.com/locations2025

VIRGINIA DISTILLERY CO. COMPLETES NATIONAL BREAKTHRU ALIGNMENT

Virginia Distillery Company (VDC) announces the launch of its award-winning portfolio with Breakthru Minnesota. This milestone completes a multi-year expansion, aligning the distillery with Breakthru Beverage Group across all 16 of its U.S. markets.

The partnership began in Virginia—VDC’s home state and largest market—before expanding throughout the Mid-Atlantic and into South Carolina and Illinois. In 2024, the footprint extended westward with California, Nevada, Arizona, and Colorado coming on board. The momentum continued in 2025 with the addition of Florida, one of the country’s largest spirits markets, followed by Missouri, Wisconsin, and now Minnesota.

“Completing this alignment with Breakthru positions us for long-term growth across major regions in the country,” said Gareth Moore, CEO of Virginia Distillery Company. “We’ve built this partnership step-by-step over several years, and we’re entering the first fully recognized year for American Single Malt with unprecedented reach. We’re excited for what

this means for the category and our portfolio in the years to come.”

“Breakthru has been proud to partner with Virginia Distillery Company as they’ve expanded their award-winning American Single Malt whiskies into new markets,” said Drew Levinson, Vice President, Business Development, Emerging Craft Brands at Breakthru Beverage Group. “Their commitment to quality, innovation, and category leadership mirrors our own values, and completing this national alignment ensures we can collectively maximize the growing momentum for American Single Malt across the country.”

Virginia Distillery Company’s portfolio includes Courage & Conviction, its flagship American Single Malt whisky; the Virginia Distillery Co. American Single Malt range; and limited-time offerings such as the VDC Brewer’s Coalition,

which partners with renowned breweries, like Goose Island Beer Co. and Boulevard Brewing Co., to finish single malt whisky in barrel-aged beer barrels.

Clean, consistent, and ready to scale with your brand.

The Clear Choice For Grain Neutral Spirits

Clean, consistent, and ready to scale with your brand.

Exceptionally-clean base – Distilled 7x through 600 feet of distillation.

Reliable – Consistent quality, every batch.

Cost-efficient – Reduce production costs.

Flexible formats – Shipping in drum, tote, tanker or rail.

Scalable supply – From pilot runs to nationwide roll outs.

THE TARIFF TIGHTROPE

BY LEW BRYSON

An off-hand remark I made about brewers and tariffs recently became my most popular skeet to date on BlueSky.

“My advice to brewers: if you’re eating the tariffs, stop. Pass that cost right on through. It’s the only way to get people to oppose them.”

So let’s think about what you can’t, can, and should do about the recent wave of new or increased tariffs. Should you pass that cost along? Should we want consumers to oppose the tariffs?

What you can’t do about the tariffs is simple: you cannot ignore them. Like them or not, new or increased tariffs are a reality in the world of international trade that affects all of us, producers and consumers alike.

The effects of the tariffs are far-reaching and complex. There are the blunt force effects that are obvious. Anything made in China is now either more expensive or about to become so. Anything made in Brazil; same. Some cars and trucks will be more expensive, depending on where they’re actually made, or where their components are made. But the effects go beyond that.

Foreign companies are not buying as much from Americans. That might be because their own countries have imposed retaliatory tariffs, making American products more expensive. Or it might be consumer revenge. We’re all aware of how Canadian state retailers and Canadian consumers have dropped American products in general, and American-made spirits in particular. Spirits, widely perceived as a luxury (especially by non-drinkers), are usually high on the list for retaliation.

Even if you weren’t selling any products outside the U.S. at all, you are still likely affected by the tariffs. While one of the main stated goals of the tariffs is to make American-made products more attractive to American consumers, it’s not always easy to produce things that are 100% American-made.

Packaging, for instance, has increasingly been coming from outside the U.S., either because U.S. manufacturers closed, or because

of irresistibly lower prices. The grain or grapes or various botanicals you use to make your spirits may be coming from outside the U.S., again, either because of lower prices or simply availability. Promotional merchandise, production machinery (plus parts and specialized maintenance), your POS terminals may all be coming from overseas, and those increases trickle down and get added to your MSRP.

Or are they? Companies have been encouraged to swallow these cost increases and not pass them on to the consumer. The reasoning is that by doing so, while your costs may go up and your profits get slimmer, your prices will be much more attractive to consumers than foreign products that have tariffs levied on them directly, and you’ll gain loyal customers.

Only…that probably won’t work for you. For one thing, if you’re making a largely Americanmade product already, like bourbon, or corn whiskey, you don’t have foreign competition, just other American producers that have the same cost inputs as you.

What’s worse is that you’d be making yourself a commodity, competing on price rather than quality, or unique characteristics. If you’re any kind of craft producer, and you’re competing on price, you’ve already admitted that your product is no different from any other.

Specialty producers from Ferrari to your local coffee roaster get this. Their products are worth the price, and so are yours! If you don’t raise your prices to cover the added costs tariffs represent, you’re now effectively selling your product at a discount. Don’t go there.

Still, be honest: spirits sales are slowing. You know it, I know it. How can you possibly raise prices in the teeth of a segment-wide slowdown? The temptation to hold the line is huge.

Again, we’ve already talked about this. Your path through this is to be honest, transparent. Open up your books to some extent; show folks just how much more the tariffs add to your costs, and show them how

Like them or not, new or increased tariffs are a reality in the world of international trade that affects all of us, producers and consumers alike.

you’ve increased your prices to reflect that, and nothing more.

Also, in my opinion, this is a time when you want to take that increase as a straight passthrough, without markup. You should strongly encourage your wholesalers and retailers to do the same. That way, you’re not expressing an opinion about the tariffs, right or wrong; you’re simply dealing with them, being like everyone else.

That’s what you should do about the tariffs: treat them like any other new development. Meet them head on. Look at every way they’re going to affect your business, your products, and plan to handle that the best, most honest way you can. Adapt to any further changes.

If customers understand that the reason why your prices increased is the same thing that’s hitting all of us, they’ll be more likely to stick with you. We’re all in this together. ■

Lew Bryson has been writing about beer and spirits full-time since 1995. He is the author of “Tasting Whiskey” and “Whiskey Master Class.”

CRAFT SPIRITS CAUCUS DEBUTS DURING ACSA’S LEGISLATIVE FLY-IN

As the craft spirits community navigates the most challenging economic environment in its history, nearly 40 independent distillers and industry allies ascended Capitol Hill in early September to unveil the newly created Craft Spirits Caucus and garner bi-partisan support for legislative priorities that will broaden market access and provide regulatory relief at a time when our small-business producers need it most.

The bi-partisan Craft Spirits Caucus officially launched through U.S. Reps. Hillary Scholten (D-MI) and Jeff Hurd (R-CO), just in time for the American Craft Spirits Association’s (ACSA) Legislative Fly-In in Washington, D.C.

The Caucus will educate Members about the issues with the greatest impact on the craft spirits industry, including:

• Expanding fair market access for craft distillers here at home and abroad.

• Ensuring federal regulations are necessary and recognize the burdens they may place on small distillers.

• Improving shipping options for craft distillers in the U.S.

• Recognizing the value of craft spirits manufacturers in urban and rural areas throughout the U.S.

• Promoting tourism and hospitality.

• Championing bipartisan, commonsense legislation to advance and protect our craft distilling industry.

“We’re thrilled that the Craft Spirits Caucus has launched with Rep. Hurd and Rep. Scholten leading the charge,” says ACSA CEO Margie A.S. Lehrman. “With a new spotlight

shining on our value-added agriculture innovations, we are confident that our craft distillers operating in all 50 states will be well represented as we seek to educate and pass legislation important for our small business manufacturers.”

In addition to encouraging members of Congress to join the Craft Spirits Caucus, the top agenda items at ACSA’s Legislative Fly-In included:

• Gaining Congressional Support for the Supporting Independent Producers of Spirits (SIPS) Act, which would provide regulatory relief for the craft spirits industry.

• Enhancing market access by allowing spirits to be shipped through the US Postal Service (USPS) through co-sponsorship of the United States Postal Service Shipping Equity Act (HR 3011; Senate Bill Pending)

• Ensuring TTB has adequate resources and ability to reduce reporting burdens for craft distillers

• Urging support for a tax credit for craft distillers that utilize American agriculture Attendees also had the opportunity to meet with top leadership at the U.S. Alcohol Tobacco Tax and Trade Bureau (TTB).

TTB administrator Mary Ryan assured craft spirits producers, “We are on your team.”

The agency acknowledged that it’s working with a significantly reduced headcount, but says it remains committed to modernizing its processes and ensuring consistency in its approval protocols and feedback it provides to producers. TTB officials also assured attendees that their rulemaking processes involve rigorous discussions on how rules impact the

industry, and particularly its small producers.

During their Hill visits, craft spirits producers urged lawmakers to join as co-sponsors.

Other guest speakers included Michelle Korsmo, president and CEO of the National Restaurant Association; John Bodnovich, executive director of American Beverage Licensees; and David Jankowski, director of the Agricultural Affairs Office of the U.S. Trade Representative.

ACSA also presented longtime industry ally Senator Ron Wyden (D-OR), who was the driving force behind the Craft Beverage Modernization & Tax Reform Act, and Rep. Dan Newhouse (R-WA), sponsor of the USPS Shipping Equity Act, with the Craft Spirits Champion Award.

SIPS Act

The SIPS Act seeks to ensure that craft spirits producers are regulated as small businesses and not in a one-size-fits-all manner. Such an approach often penalizes small businesses for minor clerical oversights and burdens small, independent producers with meeting the same regulatory requirements as billion-dollar, multinational conglomerates. Simplifying tax and compliance reporting for small distillers is one particular area where a change would make sense.

SIPS would authorize, but not require TTB to develop rules and regulations specific to small distillers producing under 100,000 proof gallons per year. The Act also would create a new small business advocate position within TTB to help coordinate the needs of small spirits producers.

Additionally, SIPS would establish an adequate cure period for craft distillers to change their ownership or control structure to reduce the risk of paying higher excise taxes. And, it would allow for larger container formats for low-ABV RTDs, creating more flexibility, for instance, to fill keg-like vessels for draft RTD dispensing.

USPS Shipping Equity Act

Current law prohibits the US Postal Service from delivering beverage alcohol products, while private carriers like FedEx and UPS are allowed to do so. Distillers in rural areas are especially impacted by this, as the nearest UPS or FedEx shipping sites are often located great distances from them. They’re usually a lot closer to their local post offices and being able to use USPS to ship products would alleviate the logistical and financial burdens placed on alcohol producers to travel to their nearest private carrier locations.

Adequate Resources for TTB

Because TTB creates the necessary distillery permits and approves all formulas and labels, it’s critical that Congress votes to adequately fund the agency—especially at a time when there are budget shortfalls, looming threats of government shutdowns, and dramatic staffing cuts at TTB. ACSA members are calling for funding of roughly $157.8 million or more to enable TTB to perform its necessary services.

Tax Credit for Distillers Using American Agriculture

This would be the federal equivalent of a Michigan law that provides an incentive for craft distillers to use state-grown grains and other agricultural products. The U.S. version would offer a similar tax incentive for craft spirits producers (under 100,000 proof gallons) to use U.S.-based agriculture in their spirits.

On the evening prior to the Capitol Hill visits, the event officially kicked off with an ACSA PAC Reception at Cotton & Reed in Washington, D.C.’s Union Market district.

At the Fly-In’s conclusion, members of Congress and their staff joined ACSA and the Kentucky Distillers’ Association for a reception at the House of Representatives’ Rayburn office building. U.S. Reps. Andy Barr (R-KY) and Morgan McGarvey (D-KY) of the House Bourbon Caucus joined attendees in sampling an array of spirits from American craft spirits producers and toasting to the future of the industry.

ACSA SUBMITS COMMENTS TO TTB ON PROPOSED RULES FOR ALCOHOL FACTS STATEMENTS AND MAJOR FOOD ALLERGEN LABELING

In August, ACSA submitted comments to the U.S. Alcohol and Tobacco Tax and Trade Bureau (TTB) on proposed rules for alcohol facts and major food allergen labeling.

In response to Alcohol Facts Statement in the Labeling of Wine, Distilled Spirits, and Malt Beverages (Notice No. 237), ACSA urged exemptions for small distilleries, warning the costs would outweigh consumer benefit. Alternatives suggested included a simple calorie statement, QR codes, or adding details to the government warning.

In response to Major Food Allergen Labeling for Wines, Distilled Spirits, and Malt Beverages (Notice No. 238), ACSA expressed support for mandatory disclosures, recommending clear “Contains: [allergen]” language, consolidation of all ingredient statements, and a five-year compliance period.

AMERICAN CRAFT SPIRITS FESTIVAL RETURNS TO CHICAGO THIS FALL

The American Craft Spirits Festival is set for October 29, 2025, at Binny’s Beverage Depot in Chicago. The festival is a prime opportunity to showcase up to three of your spirits to both consumers and the trade, including distributors, restaurant operators, and more.

Registration is now open to ACSA members and non-members. However, space is limited, so we recommend registering as soon as possible, and you must be logged in to register.

SAVE THE DATE FOR THE 2026 AMERICAN CRAFT SPIRITS CONVENTION & EXPO

Mark your calendars! The 2026 American Craft Spirits Convention & Expo will take place April 17–18, 2026 in Sacramento, California.

Stay tuned—registration and full details will be announced soon.

ENTRIES NOW OPEN FOR THE 2026 AMERICAN CRAFT SPIRITS COMPETITION

We are thrilled to announce that entries are now being accepted for the 2026 American Craft Spirits Competition, but don’t delay: the entry deadline is Oct. 20.

This is the premier competition created for the craft distilling community, and it’s your chance to see how your spirits stack up in a blind-tasting judged by industry experts. We’re looking for American whiskeys, vodkas, rums, gins, brandies, RTDs, and other specialty spirits that could take home a medal. Whether you’re nationally distributed or just launching your first product, we encourage you to enter by Oct. 20.

Advocacy, Access, and Attention

Why it’s critical now more than ever for craft distillers to raise their voices on market access, as well as regulatory and financial relief.

BY JEFF CIOLETTI

Public policy can be a complicated, noisy affair. If you’re a small business, even more so. More often than not, the most effective approach to ensuring that an industry’s collective voice is heard above all of the racket is simplicity.

“When it comes to ACSA’s policy priorities, I’ve often said it is important to focus on communicating our goals in a more effective, concise manner,” says Michael Walker of the Walker Group, ACSA’s state public policy advisor. “We’ve got a very extensive agenda with a long list of action items. There could be 50 different agenda elements, but more often than not they fit into three broad, but accessible, buckets: improving craft spirits producers’ market access, reducing their regulations and lessening their tax burden. Those are the three overarching themes that continue to come up in our conversations with ACSA members.”

Half a decade ago, it was arguably easier to craft that elevator pitch, since the predominant, most unifying issue of the day was lowering the federal excise tax (FET). After achieving a temporary reduction that kicked in at the beginning of 2018, and a one-year extension that took effect on January 1, 2020, the reduction to $2.70 from $13.50 per proof gallon on the first 100,000 gallons was finally made permanent at the end of 2020. That $10.80-per-proof-gallon savings was as immediate and tangible a result as one could hope for in public policy.

Many of the industry’s current legislative and regulatory priorities are, individually, far more nuanced, yet essential pieces of a much larger puzzle. Even direct-to-consumer shipping, a very unifying goal—for small producers—with very concrete results, isn’t really a single issue; it’s 50 different issues, all with their own unique challenges and idiosyncrasies.

But all of the granular details of the wide range of individual policies that are identified as ACSA priorities would easily fit within one of Walker’s easily definable “buckets.”

Market Access

If we’re prioritizing priorities, the deepest and, perhaps, most consequential of those buckets is market access.

“Direct-to-consumer shipping is probably the big one,” says Walker. “Limited self-distribution, going right to retailers, is another. Then, tying it in at the local level, it’s liberalization of tasting room sales. There are some states like Texas that only allow certain amounts [to be sold] out of their tasting room.”

On the DtC front, the state-by-state nature of the issue may lead many to question what, if anything, can actually be done at the federal level to advance the cause. But the answer is fairly straightforward. Federal lawmakers and regulators are typically quite influential in their home states. They can use that influence to help convince state officials to act.

“I think this is an area that can show some of the interconnectedness between the federal and state-level efforts that ACSA is undertaking,” argues Jordan Cotton, co-founder and CEO of Cotton & Reed in Washington, D.C. and current president of ACSA’s Board of Directors.

Cotton points out that, for instance, ACSA has been working for years to expand the organization’s relationship with the Federal Trade Commission (FTC).

“That has been eased a little bit by our relationships with some of our allies on the Hill who have been allies of ours in legislative fights and whom we’ve contributed to through the ACSA PAC,” Cotton explains. “Some of those members have written letters on our behalf, helping us get meetings with FTC commissioners.”

Cotton, ACSA CEO Margie A.S. Lehrman, and the association’s public policy adviser Jim Hyland recently sat down with the FTC chair and asked the agency to use its voice and the advocacy filings that it typically sends to state legislators, weighing in on state legislative issues.

“FTC [is] obviously influential in their regulatory power, in their decision-making power over mergers, but they’re also respected in a lot of state legislatures as an expert voice on issues that affect every sector of the economy,” Cotton notes. “And they’ve weighed in on alcohol legislation at the state level in the past.”

Notably, the agency helped the wine industry a great deal two decades ago when it authored a report detailing why more states should allow direct shipping of wine and how that would help consumers and small wineries.

“That wasn’t a silver bullet, but it was a big help in expanding those rights for wineries and that’s the cornerstone for that industry, depending on whom you ask,” Cotton says. “So we do expect our efforts at expanding that FTC relationship to help us in our stateby-state battles.”

The various state laws that govern what distillers can and can’t do in their tasting rooms are as much a complicated patchwork as the ones related to DtC.

“It’s all about small business. Every word out of my mouth is small business these days.”

- Becky Harris, Catoctin Creek

Distilling

For instance, two years ago, Texas increased the number of bottles a single consumer can buy in a distillery tasting room to four—double the two-bottle limit the state had set a decade prior. It was certainly progress, but four bottles in the space of an entire month—purchased, not consumed, of course—is still a very low number. California is another state with a bottle limit, though not nearly as restrictive as the one in Texas. Consumers in the Golden State can buy up to 2.25 liters of spirits for off-site consumption per day, from producers carrying a Type 74 craft distillery license (reserved for those producing no more than 150,000 gallons per year and not affiliated with a wholesaler). Colorado’s limit is similar to that of California. Both states require that consumers visiting

the distillery must take an instructional tour before they can purchase any bottles within that 2.25-liter limit.

“We’ve got states where you can still only buy one bottle a day,” notes Becky Harris, co-founder, president, and master distiller at Catoctin Creek Distilling in Purcellville, Virginia. “The biggest thing is that all of these laws are hamstringing people from doing what they need to do to make their businesses grow and succeed.”

Another key initiative that would fall under the market-access umbrella would be the bipartisan United States Postal Service (USPS) Shipping Equity Act (HR 3011), sponsored by U.S. Representatives Dan Newhouse (R-WA) and Suhas Subramanyam (D-VA).

If craft spirits producers want to ship their spirits—where legal, of course—they’re restricted to using private carriers like UPS and FedEx, as USPS is not allowed to ship any alcoholic beverages.

On the surface, people might not perceive that as a big deal. But that’s likely due to the fact that they take the presence of those shippers for granted because they seem ubiquitous in their immediate vicinity. However, for those who operate distilleries in more rural areas, those carriers are much harder to come by. Some distillers have complained that they’ve had to drive upwards of an hour to get to a UPS or FedEx location, when there’s a post office within walking distance.

“The Postal Service just has such a broader reach because they’re required to be everywhere, as opposed to where it just makes financial sense,” Cotton says. “There’s something like 10 times as many USPS locations as there are UPS and FedEx locations combined.

So that can make a big difference for rural distillers who are able to do some DtC business, depending on their state laws.”

A recent report by ShipMatrix notes that USPS delivered the largest number of packages in the country, while also handling a significant portion of “last mile” delivery for common carriers.

The USPS Shipping Equity Act would direct the Postal Service to establish rules so that only those 21 and older and authorized agents can receive shipments. The legislation would not pre-empt any existing state shipping laws and does not allow shipping into any jurisdictions that don’t already legally allow it. It also grants U.S. District Courts jurisdiction over any claims made by state, local, or Tribal governments over violations regarding the sale, mailing, and transportation of beverage alcohol.

And the advantages aren’t just for rural producers. “It could help out other producers just by providing a little more price competition, since it’s not just [the choice between] UPS and FedEx,” Cotton points out. “I think it should make things a bit smoother for anyone who has to ship distilled spirits, not necessarily for DtC business, but samples to journalists, or to competitions, or to labs.”

USPS, Cotton adds, is adept at disseminating its policies in a uniform manner, whereas private carrier locations may be owned and managed by franchisees whose staff may not be as well-versed in company-wide protocols.

“We’ve all had those experiences when you’ve gone into [a common carrier’s] store and that individual employee or location isn’t familiar with the rules and says, ‘no, we’re not actually allowed to ship that for you,”

Cotton continues. “And you’ve got to tell them that [the package] is actually olive oil or something.”

There’s also a financial advantage for USPS itself, as alcohol shipping would provide an additional revenue stream for the perennially cash-strapped agency.

With the vast market-access spectrum running from initiatives like the USPS Shipping Equity Act on one side to legalizing DtC spirits shipping in all, or at least most, U.S. states on the other end, the key to achieving those goals is harnessing the energy that ultimately made FET relief permanent—even though we’re already five years removed from that landmark legislation.

Not only did operating distillers get to see their excise tax bill drop by nearly $11 per proof gallon on their first 100,000 gallons, a sizable number of new distilleries have opened since then that never existed in a world where they had to pay $13.50 per proof gallon.

“I would suggest to everyone that next time you calculate the excise tax you’re paying, instead of $2.70 per proof gallon—just for this exercise—multiply it by $13.50,” says Harris, who’s also an ACSA Board member, chair of the Government Affairs committee & past president. “Those of us who’ve been here more than five years know what it’s like, for a lot of years, to pay that amount. “

Craft spirits producers have to be just as focused on market access, Harris says, as they were on cutting the FET.

“When times are hard, people tend to look inward,” notes Harris. “I would encourage people to take just 2 to 3% of your attention and turn it to ‘What can I do to move this cause forward?’”

It still falls on the craft spirits community to do the real work.

“For the person saying ‘Why would I care, I’m just trying to keep the lights on,’ ‘You want brighter lights on,’ is what I would say to them.”

- Michael Walker, The Walker Group

ACSA Policy Advisors Michael Walker (The Walker Group) and Jim Hyland (The Pennsylvania Avenue Group)

Jordan Cotton (Cotton & Reed) and Rep. Dan Newhouse (R-WA)

Scenes from ACSA’s Congressional Reception in September

Tax Relief

Just because the craft spirits industry was able to check off the most consequential excise tax cut in its existence from its to-do list, it doesn’t mean the book is closed on further relief.

One of the newer initiatives that producers were advocating for at September’s ACSA Legislative Fly-In was a potential tax credit for craft distillers that use American agriculture. It’s modeled after a Michigan law that provides a similar incentive to some distillers that use raw materials grown in that state.

ACSA is calling for a federal credit that would be available only to those producers whose annual volume is less than 100,000 proof gallons.

There’s also an opportunity to get more states to follow Michigan’s lead and adopt such an incentive for the agriculture grown within their borders.

“I had a conversation with a distiller in Iowa where I said, ‘Have you thought about this?’ because they use a lot of Iowa corn,” Walker recalls. “And they said that would be a brilliant idea.

Regulatory Relief and the SIPS Act

The “less than 100,000-proof gallons” aspect of the nascent effort to get a federal agricultural tax credit is key because it makes clear that it’d be an incentive for small, craft producers only and not something that large, multinational spirits conglomerates can take advantage of.

Such a small-business focus is core to the craft spirits industry’s major regulatory relief effort, the Supporting Independent Producers of Spirits (SIPS) Act. The SIPS Act essentially

would ensure that craft spirits producers are regulated as small businesses, and not in a manner identical to the way multi-billiondollar companies are regulated.

One area in particular where it would make a significant difference is in compliance reporting. Right now, the U.S. Alcohol & Tobacco Tax & Trade Bureau (TTB) requires all distilleries, regardless of size, to file the same volume of paperwork.

“The SIPS Act is telling [regulators] that big distilleries and small distilleries are different, that you need to regulate them differently so businesses like mine can save money on our record keeping, on our reporting,” explains Harris. “It helps our bottom line, because I don’t need to be spending the money that I’m currently spending to keep track of things.”

She expanded on that further in meetings with Congressional staff at September’s ACSA Legislative Fly-In.

“Right now, just so you know, I fill out the same monthly reports that all of the Diageo plants in Kentucky fill out,” she told legislative officials. “I have to keep the exact same records that Diageo keeps, Buffalo Trace, all those guys—it’s crazy … Buffalo Trace, they’ve got compliance departments, they can do that. Honestly, with the amount of tax that they’re paying, it makes sense that they should have to prove that they’re paying their taxes right. But when you’re looking at someone who’s paying the tiniest fraction of a percent of that, why are we wasting money on this kind of thing?”

Harris noted that Catoctin Creek has to pay $700 a month for compliance software that keeps up with all of TTB’s requirements— a lot of money for a distiller of Catoctin

Creek’s size.

The SIPS Act would authorize, but not require, TTB to develop rules and regulations for distillers producing below that same 100,000-proof-gallon threshold.

It would also create a new small business advocate position within TTB to help coordinate the needs of small distillers, as well as provide an adequate cure period for craft distillers to change their ownership or control structure to reduce the risk of paying higher excise taxes. Additionally, it would allow larger format container sizes for low-ABV, spiritsbased RTDs, which would enable producers to sell more RTDs to bars for draft dispensing.

“It would, for example, introduce the ability to sell spirits-based beverages in a five-gallon size—which would be a Corny Keg—so, your standard-format for kegged cocktails,” Cotton says. “It’d be a five-gallon standard of fill for spirits-based beverages below a certain alcohol content. So, you can’t fill five gallons of Everclear, but you can do a kegged margarita or whatever.”

That would be a benefit that would be visible fairly immediately if the SIPS Act were to pass.

“Over the long run, we would want to see that [distillery] size-based approach to regulations trickle down through everything that TTB looks at,” Cotton adds.

For that to happen, Harris recommends that one concept should always be on the tip of every craft spirits producer’s tongue.

“It’s all about small business,” she says. “Every word out of my mouth is small business these days.”

Craft Spirits Caucus

The good news for the industry is that there likely will be more lawmakers interested in listening when those words come out of the craft spirits community’s mouth, thanks to the formation in September of the bi-partisan Craft Spirits Caucus, through U.S. Representatives Hillary Scholten (DMI) and Jeff Hurd (R-CO). The Caucus will be instrumental in educating members of Congress about the issues that impact craft spirits producers the most, including all of the legislative and regulatory priorities discussed up to this point.

“[The Craft Spirits Caucus] is our brandspanking-new little baby and we’ve got to start telling people that it exists so they know,” says Harris. “It wasn’t easy to actually get people to recognize the need for it until the past year or so because the Bourbon Caucus already exists … But it’s not the same

thing … The thing about craft spirits is we have different needs and need to have a different set of people focusing on us.”

And, adds Cotton, it shouldn’t be too hard to get members of Congress excited about the Caucus. “A lot of them are part of much more boring-sounding caucus, something like the ‘CPA Certification Agency Test Caucus.’ Their eyes light up when you say you’re going to get to talk about booze for work … We’re going to have that group of people to go to who have some baseline familiarity with our issues and interests, hearing from us and helping us out.”

Messaging and Action

But even with some receptive ears on the Hill, it still falls on the craft spirits community to do the real work. Especially during these increasingly challenging economic times for our small business community, it’s more critical than ever for craft spirits producers to have their voices heard and engage, not only

lawmakers, but their peers in distilling.

It may, however, prove difficult to rally craft spirits producers around advocacy when most of their energy is focused on just keeping their business from closing

“For the person saying, ‘Why would I care, I’m just trying to keep the lights on,’ ’You want brighter lights on,’ is what I would say to them,” says Walker. “People are like, ‘hey, I’m just trying to survive, I don’t have time for this.’…Anything that you can give is helpful. That might not be financial, it might be making sure that we keep those lines of communication open with you all…ACSA is making sure that we keep your doors open.”

But it’s those challenges that keeps Cotton motivated to fight for the industry’s future. Cotton & Reed faces the same headwinds that producers nationwide confront and that continues to strengthen Cotton’s resolve, both as a small business and as an officer on ACSA’s Board. “We all need to focus on what’s right in front of our faces and,

oftentimes for small businesses, financial questions are going to take precedence,” Cotton notes. “But we also struggle under the weight of these restrictive regulations that, in a lot of cases, do not make sense, applied uniformly to small and large distilleries. The cost of our time, which is extremely limited, is a serious one.”

Still, he acknowledges that it’s not always as easy to communicate market access and regulatory reform as it is something like a monumental federal excise tax break.

“It’s not as clearly black and white as, ‘you paid $20,000 in excise tax last year, now you’ll pay $3,000,’” Cotton explains. “Yes, we want to reduce our costs, and tax burden and regulatory burden, but we also want to grow our opportunities and grow our revenue. And FET did not address that where our market access issues can. You’re not trying to protect your piece of the pie, you’re trying to grow your pie.” ■

Party At Our Place

From trivia nights to holiday bonanzas, small distilleries increasingly rely on tasting room events to drive foot traffic.

BY KATE BERNOT

Paul Grey didn’t open his distillery in order to host Taylor Swift-themed trivia. Yet events like music trivia, comedy nights, and particularly the distillery’s signature themed pop-up months have become critical to keeping the business’ doors open. Since 2021, Grey Matter Distillery in Jacksonville, Florida has hosted four Christmas-themed pop-ups, along with several other themed months and countless one-off events. The tab for holiday decorations alone runs to about $15,000 annually, and Grey doubles his staffing during the month of December.

“This is not why I got into distilling. It wasn’t my dream to have a themed bar,” Grey says. “But the reality is, I have two kids and I have employees and a business I want to keep alive. So I have to focus on the things that bring in revenue and people to the space.”

Grey Matter’s commitment to elaborate themed events—spearheaded by Grey’s wife, Alison—is on a level all its own. The latest incarnation was Enchanted Forest, featuring Disney princess trivia, a spiked tea party, a “deepwoods disco” night, a full forest-themed cocktail menu, and floor-to-ceililng neonmeets-woodland decor that looks like it was borrowed from Burning Man. The investment in time and resources pays off: Grey says themed months’ sales are double or triple that of months without a themed pop-up, and

December sales surpass those entirely.

“The way the industry is going, you’ve got to think outside the box and be willing to do what it takes to keep your distillery afloat,” Grey says. “This is my specialty not because I want to do it, but because I had to.”

Grey isn’t alone in feeling the pressure. While the Kentucky Bourbon Trail set attendance records last year with 2.7 million visitors, many smaller distilleries are struggling with declining foot traffic and check totals in the years post-covid. Some of this is due to Americans’ increasing preference for staying home. With the rise of remote arrangements and streaming entertainment, Americans are spending more time at home than at any other point in history. In 2023, we spent on average more than 90 additional minutes at home than we did in 2003, according to the U.S. Census Bureau’s Time Use Survey. And according to the National Restaurant Association, about 75 percent of all restaurant traffic today is off-premises, which means three out of four orders are to-go rather than for dine-in. (That’s up from 61 percent precovid.) None of that is good news for distilleries that depend on in-person visits.

“We definitely need these events for our lounge/tasting room—we have food there as well—to turn any type of profit at all. It would be a money loser otherwise,” says Dave Schleef, president and co-founder of 503 Distilling in Portland, Oregon.

This is not to say people aren’t willing to go out; they just need a good reason to. With the rise of better-quality ready-to-drink cocktails that people can enjoy at home, a delicious cocktail menu alone often isn’t enough to entice them into a tasting room. Often, that’s activities. According to Nielsen IQ, 29% of Millennials and Gen Z have visited “experiential bars”—think TopGolf, Barcade, or shuffleboard bars—in the past three months.

It’s why, beginning in November 2022, 503 Distilling’s new tasting room manager began programming events in earnest. Today, the distillery hosts Wednesday happy hours, Thursday trivia, biannual parties for its club members, monthly open mic nights, monthly drag bingo, every-other-month cocktail classes, an annual holiday market, and more. The tasting room can double its revenue on trivia or bingo nights compared to days without those events.

But not all events are feasible for all distilleries. End of Day Distillery in Wilmington, North Carolina began hosting private events at its tasting room in 2020, but a few years later pulled back from hosting weddings and other large-scale buyouts. Operations coordinator Ali Clark says the logistics, staffing, and liability of such events became too much of a strain for the small business and its four bartenders. Today, End of Days hosts smaller private events,

as well as in-house programming such as live music, tours, cocktail classes, art shows, visiting chef pop-ups, and TV show viewing parties. Revenue from a busy tasting room has helped End of Days fund its ultimate goal: distribution expansion.

“Keep your eye on the goal, whatever that is. Our particular goal is brand awareness and eventually more distribution sales,” Clark says. “The goal is for [events] guests to take that brand awareness back to wherever they’re from and tell their friends.”

Distilleries can also band together to increase visitation and share the eventsprogramming load. As tourism numbers level off from their post-covid peaks, the Tennessee Whiskey Trail has increased the number of decentralized events to encourage visits to individual tasting rooms. Last year, more than 20 distilleries participated in trail events like the holiday Carols & Barrels, a dog-friendly “pawsport” program, and local pet adoption and pet supply drives. Tennessee Whiskey Trail executive director Charity Toombs says such events not only appeal to tourists but help introduce local distilleries to neighbors who might not otherwise stop in.

“You’re engaging audiences that maybe wouldn’t have come into a distillery to see it more as a community meeting place,” Toombs says. “Distilleries really serve as conduits of tourism as well as community goodwill. This programming checked a lot of boxes for us.”

Toombs encourages a try-something-new approach to distillery events, always keeping customers’ preferences front of mind. When consumer research indicated that summer visitors were planning to stay closer to home, opt for more affordable transportation, and shorten their trips, the Trail launched the Tennessee Road Trip Bingo Card. The card encouraged people to visit Tennessee landmarks (such as the Dolly Parton statue in Sevierville), blend those with distillery experiences (like live music or a selfie with distillery staff), then submit photos of those experiences to earn a prize pack. The response was positive. Toombs emphasizes that members take their guests’ demographics into account, reaching beyond the typical distillery events to welcome new visitors.

“We’re going to try some new things. Some of it is going to stick and some of it is going to flop, but I need us to have the grace to try some new things so we can continue to engage new audiences,” she says. “Year over year, we’ve introduced new experiences … that have proven to be successful.” ■

An Iowa Institution Turns 20

As Cedar Ridge celebrates its 20th anniversary, the distillery reflects on its history and successes over the years.

By Sydney German

Understanding that the resources of Iowa were underutilized in the local craft spirits industry, Jeff and Laurie Quint took it upon themselves to begin Cedar Ridge Distillery 20 years ago. They started the business while working fulltime jobs and spending endless hours lobbying the state to allow them to sell their product directly to their consumers. Yet, despite hardship and hurdles, the Quints transformed their micro-distillery into one of the most beloved craft distilleries in the country.

Initially, notes master distiller and director operations, Murphy Quint—Jeff and Laurie’s son—the business was a winery that stood apart by having a distillery on site. The winery was the primary operation on the land that Jeff and Laurie purchased and began growing in 2003. In 2005, when they received their license, the distillery was much smaller, with a selection of premium Clearheart Vodka and other clear spirits to allow for simple cash flow. But their intentions were always to create Iowa’s first bourbon since Prohibition.

“Most distilled spirits are made from corn,

and Iowa is the number one corn-producing state in the country,” says Jeff Quint. “Iowa produces more corn than all but three countries in the world. Yet, before Cedar Ridge, we Iowans were importing 100% of the $350 million worth of spirits we consumed annually. Cedar Ridge set about to change that, and it became obvious to us…and Murphy was adamant about this that we needed to be a player in the bourbon space.”

The Quints realized that the resources flourishing in Iowa provided them with exactly what they needed to be successful in producing premium brown spirits. However, unlike wine and clear spirits, brown spirits take a lot more planning and intention.

As explained by Jeff, “if you’re in the vodka business, you can cash flow day one, but what we have going on right here…we have a crew working 24 hours a day making whiskey that we’re going to sell in 2029 or 2030. That’s a different business.” Furthermore, “growing that business is a far more complicated process than growing, say, a vodka business. I think it’s more of a generational business

because it takes a generation of effort before you feel like you’re on solid ground.”

With this in mind, Cedar Ridge stayed committed to its goals and released its first barrel-aged spirit in 2010, 5 years after starting the distillery. Jeff and Murphy recall that, on the day of release, people lined up out the door, ready and willing to support the venture. Aside from their commitment to the challenge of dark spirits, the Quints attribute a lot of their success to their community. Once regulations in Iowa changed to allow the distillery to sell directly to consumers, it changed the game for Cedar Ridge.

Cedar Ridge played a critical role in the efforts to change the ruling, which enabled the business to expand. The distillery started with one building in Swisher, Iowa, and has since built nearly 15, which made it possible to create multiple gathering spaces for the community.

“We had a winery, a distillery, vineyards, an event center, a kitchen, live music. So this became the place for locals to congregate,” Jeff says. “And what those locals would do is

they›d bring their out-of-town friends here. And we›ve slowly started building a fan base, a customer base, a following.”

Apart from weekly events attended by locals, Cedar Ridge also hosted weddings and other larger events that not only brought in additional revenue but people from all over the county. Noting the increasing numbers in attendance, the company also built a visitor center that offered facility tours paired with samplings and discounts in the gift shop. It encouraged people to spend additional time at the distillery, and gave them with an educational experience on how the spirits are produced and merchandise to share with their friends.

As the awareness of the distillery has grown, so have its collaborations with other brands. In August 2019, Cedar Ridge partnered with the band Slipknot to create the Slipknot No. 9 Iowa Whiskey, a blend of 3-4-year-old straight rye and straight bourbon mashed, fermented, distilled, and aged on site. Initially, the band had reached out to the team at Cedar Ridge to express interest in creating a whiskey because they wanted to create a spirit with fellow Iowans that channeled the passion they had for their global following.

The thing about Iowans,” Murphy explains, “[is] we have a tendency to stick together and to support one another.”

Through a very hands-on approach from both the distillery and the band, the team made a product that everyone was involved in and had a lot of fun creating. At the time of its release, the whiskey brought attention to Cedar Ridge and increased sales as the band toured. Although sales slowed down during covid, it has continued to be a popular product for the distillery.

Like many craft distilleries across the country, Cedar Ridge has experienced many of the struggles and unknowns of the craft spirits industry, like covid, legal limitations, and frustrations with distribution. Yet, despite it being a crowded market, Murphy states “the willingness of other craft distillers to collaborate or to bounce ideas off one another to just generally be helpful to each other along the way. I think it’s one of the most incredible things about this industry, and I think that stuff goes a really really long way, and it’s certainly contributed to our success.”

With that in mind, the distillery has had a lot to celebrate over its two decades in operation. But Cedar Ridge also continues to look toward the future, planning and crafting spirits for those in Iowa and around the world to enjoy over the next 20 years. ■

“We needed to be a player in the bourbon space.“