Manager’s Note

At its meeting held on July 18-19, 2023 the Executive Council confirmed the appointment of Capt. Jon Erickson (Delta) as chair of the ALPA National R&I Committee. Capt. Erickson has served on the R&I Committee since 2020 and also serves on the Delta MEC R&I Committee. As chair of the Delta MEC Strategic Planning Committee, Erickson was one of the key players in the successful achievement of the Delta Market-Based Cash Balance Plan. We thank Capt. Ken Binder for the 12 years he served as chair of the committee. Capt Binder will continue to serve on the committee. In May, ALPA awarded Capt. Binder the first Andrew J. Hughes Presidential Citation for Outstanding Volunteerism for his extensive work and accomplishments for ALPA, including his dedication to improving the benefits of ALPA members.

In May, the national R&I Committee hosted ALPA’s second Financial Wellness Seminar in Westlake, Tex., which was attended by approximately 200 pilots and guests. In collaboration with Charles Schwab, the seminar was a full day of presentations from ALPA experts and Schwab financial consultants on a wide range of financial topics, such as saving, investing, planning for retirement, tax strategies, and estate planning. Building on the success of the first Financial Wellness Seminar in Phoenix last November, the program continues to receive positive feedback, and we hope to bring the program to pilots at other locations throughout the country in the future. We are tentatively planning another Financial Wellness Seminar this fall. Stay tuned for more on date and location.

CONTENTS Questions? Please click here or e-mail Celeste.Sweeney@alpa.org Comments? NOTE: Text in blue is a live link to referenced external PDF files. Click on the link to open the file. JULY 2023

Manager’s Note 1 Collective Bargaining Updates 2 Legislative & Legal Updates 5 Court Cases of Interest . . . . . . . . . . . . . . 11 Canadian Update 13 Membership Plans 15 R&I Fast Facts 15 Investing & Marketing Outlook 18 R&I Contacts . . . . . . . . . . . . . . . . . . . . . . 23

Collective Bargaining Updates

Amerijet International (CBA Effective June 26, 2023, amendable June 26, 2026)

PRE-ALPA AGREEMENT

INSURANCE

CBA Protected Plans and “Me Too” Clauses

The current plans for medical, dental AD&D, life insurance, and vision and provide a disability plan will continue per the status quo

Management shall make the union aware of each yearly plan adjustment applied uniformly to plan members

The same life insurance, personal accident, medical, dental, and vision insurance that is available to other company employees will be made available to pilots and their dependents . The pilot’s monetary contribution shall not be more than the contributions required of other employees

Management will provide pilots with the option to purchase longterm disability insurance and additional own occupation coverage

Insurance provided by the company will not exclude terrorism or acts of war if occurs during the scope of employment

Management has flexibility regarding plan design and thirdparty administrator, provided there is no reduction in quantifiable measures determined by both management and the Association or reduction in actuarial value in the plans as of the date of signing

Pilot Premiums Management shall make the union aware of each yearly plan adjustment applied uniformly to plan members

A pilot’s monetary contribution for monthly premiums will not exceed 30% of the total required contribution when aggregated across the medical, dental, and vision plans The pilot’s monetary contribution shall not be more than the contributions required of other employees

The pilot’s contribution to insurance premiums will be made through payroll deductions .

A pilot will be eligible to participate in the insurance plans after 60 days from their date of hire . The effective date of coverage will be the 1st of the month following when the elections are submitted .

A committee of Association and management members will meet semiannually to review and discuss issues related to insurance benefits . Management will share information regarding benefits, costs, claims and experience, and potential plan design changes as early as possible to allow for consultation and input before implementing changes

RETIREMENT

CBA Protection of Plan The company will continue to offer the current 401(k) plan

The Amerijet Airlines 401(k) Savings Plan will be offered to U S participants The company will offer a Puerto Rico 401(k) plan that provides pilots, whose primary residence is in Puerto Rico, with an equivalent benefit as the U S pilots, subject to applicable laws, regulations, and federal guidelines

The retirement plan will be amended as soon as administratively feasible after the date of signing to incorporate the provisions in Section 28 Otherwise, no changes that negatively impact the pilots will be made to the Retirement Plans Adoption Agreement document that was in effect on January 1, 2021, unless agreed to in writing by both parties Company Contributions The

The company will make 4% nonelective contributions to each pilot The nonelective contributions will increase to 6% on June 26, 2024, and 10% on June 26, 2025

R&I Update • 2 • July 2023

NEW AGREEMENT

No provision

Eligibility

Meetings and Information Sharing No provision

company will match 50% of the 4% contributed by the pilot, up to a maximum of 2%

PRE-ALPA AGREEMENT NEW AGREEMENT

Eligibility No provision in CBA

The plan allowed pilots to be eligible to participate after six months of service .

Pilots will begin receiving nonelective contributions on the first day of the pay period following 90 days of service

Pilots are automatically enrolled at a 5% pretax deferral after three months of service The deferral will increase by 1% annually until it reaches a maximum of 10% . Pilots will be provided with notice and the opportunity to opt out of automatic deferral and escalation

Pilots are allowed to make pretax, after-tax, and Roth deferral contributions up to the 402(g) and 415(c) limits The retirement plan will allow in-plan conversion of non-Roth contributions to Roth

Amounts that cannot be contributed to the pilot’s 401(k) plan account due to the limitations of IRC §415(c) and/or §401(a)(17) will be paid to the pilot in cash

In the event the company is required to regularly make cash payments to the pilots because of IRC §415(c) or §401(a)(17) limits, management will explore the creation of a market-based cash balance plan as long as it is not found to be administratively burdensome or have material cost associated with its creation or operation Timing

Company nonelective contributions will be made as soon as administratively feasible after the payroll date to which they are related If there is an unintended administrative delay, the company must follow the correction process and guidance from the IRS Vesting

The plan provided a six-year graded vesting structure:

1 year: 0%

2 years: 20%

3 years: 40%

4 years: 60%

5 years: 80%

6 years: 100%

Company contributions will be fully vested after four years of service:

Less than 1 year: 0%

1 year: 25%

2 years: 50%

3 years: 75%

4 years: 100%

The company will provide a brokerage option that includes online trading capability, as soon as administratively feasible after the date of signing The investment options in the brokerage sleeve will be registered under the Investment Company Act of 1940 and subject to applicable laws including ERISA regulations, case law, and federal guidance .

Pilots can direct up to 100% of their contributions, vested and non-vested 401(k) funds to be invested through the brokerage sleeve

Pilots will be responsible for any fees associated with the brokerage account, including transaction fees

R&I Update • 3 • July 2023

Enrollment No provision

Auto

provision

After-tax Contributions No

.

Excess Contributions No provision .

of Contributions No provision .

No provision in CBA

Schedule

No provision

Brokerage Option

Meetings and Information Sharing

PRE-ALPA AGREEMENT NEW AGREEMENT

Management shall make the union aware of each plan adjustment and apply them uniformly to the plan members

Management will meet with R&I chair or designee and other Association representatives upon request to discuss investment options, participation, statistics, expenses, and administrative concerns that are related to pilot participants Neither the Association nor the MEC representatives will act as fiduciaries with respect to the Amerijet Airlines 401(k) Savings Plan Management will provide the Association with reports required to be filed with the government, plan documents, annual reports, summary annual reports, summary plan descriptions, and summaries of material modification within 60 days of filing any such reports with the government

In the event the contribution amount by or on behalf of the pilots is reduced by law, regulation, or official guidance, the Association and management will meet as soon as administratively feasible to discuss

Bearskin-Perimeter (JCBA Effective June 20, 2023, expires June 19, 2028)

PERIMETER PRE-ALPA AGREEMENT

Pilot Premiums No provision in CBA

Previously, life insurance, short-term disability, and longterm disability premiums were pilot-paid while health and dental insurance premiums were company-paid . This arrangement resulted in an overall premiums split of 61% pilot-paid and 39% companypaid

Transitioning to PAG Plans

No provision in CBA

Sick Leave

Full-time pilots who have completed three months of pilot service are eligible for unlimited sick days

BEARSKIN PREVIOUS AGREEMENT

NEW JOINT AGREEMENT INSURANCE

The cost of the plan [incl life, STD, healthcare, dental] shared equally by the pilot and the company

The total cost of premiums for all mandatory benefits shall be split equally by the company and the pilots, except for the distinct benefits outlined below

Company-paid portion shall consist of: 75% of healthcare, 100% of basic AD&D, basic life, critical illness, dental, travel, and EFAP

Pilot-paid portion shall consist of: 25% of healthcare, 100% of short-term disability and long term disability

The company will maintain the following plans through GreatWest Life Assurance Company:

• Policy #57770 (Healthcare, Dental, STD)

• Policy #163780 (Life, Travel)

LEAVE

New-hire pilots shall receive 15 8 hours credited to their sick bank Annually, on a pilot’s anniversary date, their sick bank shall be credited with 17.2 credit hours . The sick bank cumulative maximum is 40 0 credit hours

Unused sick credits from a pilot’s sick leave bank may be used at the pilot’s discretion immediately prior to retirement .

At all times, the company will maintain a program that, at a minimum, consists of the benefits which are presently contained in the Perimeter Benefits Plans #50739 and #178033 Including: Healthcare, Life, AD&D, Critical Illness, Dental, Travel, EFAP, STD, LTD)

Effective January 1 of each year, all pilots shall be provided with 10 days of sick leave A pilot will carry-over unused sick leave days from the previous year, for future use, up to a maximum of 20 days .

A pilot who has completed 10 years of service shall be paid out, at their current hourly rate of pay, the balance of days in their sick leave bank at 4 3 credits per day, upon retirement or departure from the company .

R&I Update • 4 • July 2023

PERIMETER PRE-ALPA AGREEMENT BEARSKIN PREVIOUS AGREEMENT

RETIREMENT

All pilots shall be eligible to enroll in the company’s DCP, administered by Great-West Life Assurance Company, after twenty-four (24) months of continuous service with the Company . Company match based on Years of service:

• Less than 2 years: No contribution

• 2-10 years: 3% matching contribution

• Greater than 10 years: 4% matching contribution

Calm Air (CBA effective May 1, 2023, expires April 30, 2028)

NEW JOINT AGREEMENT

The company shall maintain the Perimeter Aviation Group Retirement Plan

Pilots shall be eligible to contribute to the RRSP plan immediately

The company matches RRSP contributions to a DPSP based on years of service All pilot and company contributions are immediately vested The company matching contribution schedule is as follows:

• Less than 1 year: No contribution

• 1-3 years: 3% matching contribution

• 3-5 years: 4% matching contribution

• 5-10 years: 5% matching contribution

• Greater than 10 years: 6% matching contribution

Legislative & Legal Updates

IRS Issues Proposed Regulations Intended to Simplify the Use of Forfeitures

On February 27, 2023, the Internal Revenue Service (IRS) published proposed regulations regarding the permissible uses of forfeitures in tax-qualified defined benefit and defined contribution plans, as well as a deadline for the use of forfeitures in defined contribution plans. Generally, forfeitures arise when a participant leaves an employer before completing the required service for full vesting under the terms of the plan. Forfeited amounts generally can be used by the plan sponsor to pay reasonable plan administrative expenses, and if permitted in a defined contribution plan, they can reduce future employer contributions or be reallocated among other eligible plan participants. Forfeitures in a defined benefit pension plan cannot be used to increase the benefits of other participants.

R&I Update • 5 • July 2023

Personal Leave No provision in CBA No provision in CBA Five days of paid personal leave shall be annually credited to each pilot on January 1

Company Matching Contributions No provision in CBA

PREVIOUS AGREEMENT NEW AGREEMENT LEAVE Statutory Holidays 10 days annually (0 .83 days credited per month) 12 days annually (1 .00 days credited per month) Personal Emergency Days 3 unpaid days annually 3 paid days, 2 unpaid days annually* Bereavement Leave 3 paid days, 2 unpaid days annually 3 paid days, 7 unpaid days annually* * Legislative requirement

The proposed regulations are intended to alleviate the confusion created by guidance contained in an informal 2010 newsletter issued by the IRS. The 2010 guidance contained language indicating that forfeitures cannot be carried over to any subsequent year, however, the guidance also contained language indicating that forfeitures could be used by the end of the following year in “appropriate situations,” without defining “appropriate situations.”

If finalized, the proposed regulations would become effective for plan years beginning on or after January 1, 2024, but may be relied on by plan sponsors immediately. In addition, the proposed regulations provide transition relief for defined contribution plans with accrued forfeiture suspense accounts by allowing a plan to treat forfeitures incurred during any plan year that begins before January 1, 2024, as having been incurred in the first plan year that begins on or after January 1, 2024.

The IRS has warned that failure to use plan forfeitures in accordance with the plan’s terms and the proposed regulations would constitute an operational failure requiring correction under the IRS’s Employee Plans Compliance Resolution System (EPCRS) to maintain the plan’s qualified status.

It is worth noting that the Proposed Regulations do not address situations where a plan sponsor cannot use the full amount of a forfeiture suspense account because it exceeds both the amount of plan expenses and would cause excess annual additions under Internal Revenue Code Section 415.

Defined Contribution Plans

For defined contribution plans, the proposed regulations simplify administration and alleviate administrative burdens by specifically stating the following permissible uses of plan forfeitures and the time by which forfeitures may be used:

y Forfeitures must be used no later than 12 months after the close of the plan year in which the forfeitures are incurred;

y Forfeitures must be used for one or more of the following purposes: (i) to pay plan administrative expenses, (ii) to reduce employer contributions under the plan, or (iii) to increase benefits in other participants’ accounts in accordance with plan terms. Under the law, forfeitures cannot revert to the employer.

Defined Benefit Plans

For defined benefit plans, the proposed regulations eliminate a provision in the 1963 forfeiture regulations that directed plan sponsors to use forfeitures as soon as possible to reduce employer contributions. This provision conflicted with rules regarding minimum funding and the use of reasonable actuarial assumptions to determine the effect of expected forfeitures on plan liabilities. Under the proposed regulations, defined benefit pension plan must provide that forfeitures may not be applied to increase the benefits of any other participants, but the effect of the forfeitures may be anticipated in determining the costs of the plan for minimum funding purposes.

Key Takeaways:

y The proposed regulations serve as a reminder that forfeitures must be used promptly and failure to do so may jeopardize a plan’s taxqualified status.

y The proposed regulations help with the administration of defined contribution plans by clarifying the use of forfeitures, clarifying the timing for use of forfeitures, and providing a transition period for compliance.

y Plans may need to be amended to comply with the proposed regulations’ use of forfeitures. The IRS cautioned that plans that provide for use of forfeitures only to pay administrative expenses may need to be amended to permit forfeitures to be used for other purposes to avoid a qualification failure that may result if the forfeiture amount exceeds the administrative expenses payable by the plan in a year.

R&I Update • 6 • July 2023

IRS Reiterates that Unsubstantiated FSA Claims Will Be Added to Gross Income and Subject to Taxation

On March 29, 2023, the Internal Revenue Service (IRS) Office of Chief Counsel issued a memorandum providing guidance on claims substantiation for medical expenses and dependent care expenses from flexible spending accounts (FSAs). FSAs for dependent care assistance and adoption assistance must follow the substantiation procedures applicable to health FSAs. While Chief Counsel Advice memoranda are not binding and cannot be relied upon by taxpayers, they offer insight into the IRS’s pattern of thinking and how the IRS has evaluated specific issues in the past.

Health FSAs are employer-established cafeteria plans, permitting employees to set aside pretax dollars to pay for qualified medical expenses. Internal Revenue Code §213(d) defines medical care and provides examples of several types of medical care expenses that qualify for reimbursement under an FSA. IRS Publication 502 provides practical guidance regarding qualified medical expenses. Employees contribute to their FSA by electing an amount to be voluntarily withheld from the employee’s pay each pay period. Employers may also contribute to an employee’s FSA, if permitted by the plan. In 2023, the health FSA contribution limit is $3,050. Dependent care FSA contributions may not exceed $5,000 per household.

To purchase or receive reimbursement for qualified medical expenses from pretax FSA dollars, an employee must substantiate each claim by providing the FSA administrator with information from an independent third-party (e.g., care provider, insurance company, or pharmacy) describing the service or product, the date of the service or sale, and the amount of the expense. Automatic substantiation of claims is also permitted. Automatic substantiation refers to a method of substantiation that allows payment of a recurring medical expense incurred at certain providers that match the amount, the medical care provider, and the time period of previously approved expenses to be automatically substantiated. As part of the substantiation process, the employee must also provide a written statement that the expense has not been paid or reimbursed under any other health plan coverage. Substantiated qualified medical and dependent care expenses, during the period of coverage, are excluded from the employee’s gross income. The chief counsel’s memorandum reiterates these well-established requirements and reinforces Prop. Reg. § 1.125–6(b)(2), which requires that “all claims for reimbursement must be substantiated.” The memorandum also advises that payments and reimbursements issued through the following types of plans will be included in an employee’s gross income because the method of payment or reimbursement “does not ensure that every claim be substantiated.”

y Plans permitting employees to self-certify expenses without any third-party documentation.

y Plans substantiating a random sample of debit card claims via third-party information.

y Plans that do not require substantiation of debit card payments or reimbursements below a specified dollar amount.

y Plans that do not require substantiation from specific providers or hospital systems.

y Plans that permit reimbursement of dependent care expenses, based on the estimated cost prior to service, with no requirement for substantiation after the expenses have been incurred. The memorandum explains that if a cafeteria plan does not require an independent third party to fully substantiate reimbursements for medical expenses or dependent care assistance expenses, then the plan fails to operate in accordance with the substantiation requirements of Prop. Reg. § 1.125–6(b) and is not a cafeteria plan within the meaning of the Internal Revenue Code. Therefore, the amount of any benefits

R&I Update • 7 • July 2023

that any employee elects under the cafeteria plan must be included in the employee’s gross income and is considered wages for Federal Insurance Contributions Act (FICA) and Federal Unemployment Tax Act (FUTA) purposes subject to withholding. In addition, an employer must include reimbursements of dependent care expenses in an employee’s gross income if any expenses of any employee under a dependent care assistance program are not substantiated after the expense has been incurred.

Key Takeaways:

y Yes, it is necessary to provide third-party substantiation (or auto-substantiate) every claim, regardless of the amount or frequency of the claims.

y Failure to substantiate FSA claims will result in the claim or reimbursement amount being added to the employee’s gross income and subject to FICA and FUTA taxes.

y The information provided in the memorandum is not new. Perhaps, the IRS is educating its auditors of the longstanding substantiation requirements that could be applied in an IRS audit of an employer’s Section 125 cafeteria plan, health FSA, or dependent-care FSA.

y R&I Committees should review FSA plan substantiation procedures to ensure they are free of impermissible practices.

Leaders in Retirement Community Request Delay in Implementation of Secure 2.0 Catch-Up Feature

On June 29, 2023, a letter signed by more than 200 corporations, employer organizations, law firms, and plan recordkeepers in the retirement community urged Congress to delay implementation of a feature of the Secure Act 2.0 that requires catch-up contributions be made on a Roth basis for high earners beginning in 2024. While Congress had previously indicated in a letter to the Secretary of Treasury and the commissioner of the Internal Revenue Service on May 23, 2023, that it planned to make corrective amendments to Secure Act 2.0, it has not indicated a timetable for doing so. The retirement community urged Congress to enact transitional relief as soon as possible, or many 401(k) participants will lose their ability to make any catch-up contributions for 2024.

The letter noted that while some 401(k) plans will be able to implement the new catch-up feature, a vast number of employers and plans are not able to comply with the new rule effective for 2024. Secure Act 2.0 requires that employees who earned over $145,000 in the preceding year from their current employer must make their catch-up contributions on a Roth basis. The letter noted that systems do not currently exist to comply with this requirement and such systems cannot be built to coordinate with payroll systems in 2023. Systems need to be built to integrate the new rule with how payroll deductions for catch-up contributions are processed and then forwarded to recordkeepers. The letter indicated that for many employers the only way to comply with the new law will be to eliminate all catch-up contributions for 2024. The letter noted that this unintentional result of the legislation can be avoided by Congress enacting a two-year delay, or alternatively for the Treasury Department and the IRS to provide the necessary transitional relief.

The letter contained 235 signers, including Alight Solutions, Charles Schwab, Fidelity Investments, Empower, Delta Airlines, The Vanguard Group, Southwest Airlines, UPS, Mercer, and WTW.

It is important that MEC R&I Committees initiate discussions with their airlines on whether the airline and the 401(k) recordkeeper can implement this new feature, and if not, how they will comply with the new law. The ALPA R&I team will keep committees informed of legislative and/or regulatory developments.

R&I Update • 8 • July 2023

DOL Suggests 8 Tips for Protecting Your Retirement Savings Online

On June 26, 2023, the Department of Labor published a blog suggesting ways that individuals can protect their retirement savings to reduce the risk of online fraud or loss.

y Regularly monitor an online account. Regularly checking retirement accounts reduces the risk of fraudulent access and allows for quick identification of suspicious activity.

y Use strong and unique account passwords. Avoid using dictionary words and reusing or repeating passwords when creating an online account. Instead use letters, numbers, special characters, and 14 or more characters.

y Use multifactor authentication. While two-step verification may seem like a hassle, it is a very effective way to prevent an unauthorized person from accessing an account.

y Keep account and personal information up to date. Contact information should be updated whenever it changes and provide multiple communications options.

y Avoid using free wi-fi. Use of public wi-fi networks should be avoided when checking retirement accounts. These networks can be accessed by criminals.

y Be alert to phishing scams. Phishing scams target passwords, account numbers, and sensitive information.

y Install antivirus software and keep your apps and software up to date. Outdated software and apps are a security risk.

y Report identity theft and cybersecurity incidents to the FBI or the Department of Homeland Security through the FBI or CISA.

For employment-based retirement accounts, plan fiduciaries have a responsibility to take steps to protect the plan against cybersecurity risks. This includes ensuring that recordkeepers and other service providers responsible for plan-related IT systems and data appropriately safeguard participant information.

New American Academy of Actuary’s Issue Brief on Pension Risk Transfer

In July 2023. the American Academy of Actuaries released Buy-Out Group Annuity Purchase Primer: Pension Plan Sponsor’s Role and Considerations, a white paper primer discussing the various methods of pension risk transfer transactions utilized by plan sponsors. The primer describes the following three types of transactions but focuses on buy-out annuity contract transactions.

y Buy-in transaction: The insurer provides a commitment to fund future benefit payments to plan participants. Buy-ins are often used as an investment management strategy for the plan sponsor or to lock in pricing for a future buy-out. The liability and assets remain on the plan sponsor’s balance sheet. The plan sponsor continues to pay Pension Benefit Guaranty Corporation (PBGC) premiums as the sponsor retains default risk. The insurer provides funding to the plan sponsor for benefit payments until either all obligations have been satisfied, a buy-out conversion occurs, or the plan sponsor revokes the contract.

y Buy-out transaction: The insurer provides an irrevocable commitment to directly make all future benefit payments to the plan participants included in the transaction through an annuity contract. The benefit obligation associated with participants included in the transaction is transferred from the

R&I Update • 9 • July 2023

plan sponsor to the insurer. As the insurer is responsible for the future pension payments, the PBGC guaranty protections end, and state guaranty protections begin. There is a discussion of PBGC and State guarantees in the document.

y Lump Sum Payments: Lump sums, on the other hand, transfer pension risk from the plan sponsor directly to the participant. A lump sum is a one-time payment equal to the present value of the expected payments due to the participant under the plan. No additional benefits are payable to the participant, any spouse, or beneficiary in the future. Once a lump sum payment is made to participant, there are no further guarantees (PBGC or otherwise).

Access the full issue brief.

Group Health Plan Limits for 2024

The inflation-adjusted limits applicable to group health plans and health savings accounts (HSAs) have been announced for 2024. The following are the HSA contribution limits and HSA qualifying high deductible health plan (HDHP) cost-sharing limits for 2023 and 2024. In general, contributions to HSAs are permitted only if an individual is covered by an HDHP and no other health plan that is not an HDHP.

Note that the HDHP maximum out-of-pocket is different from and lower than, the out-of-pocket limit that applies to all group health plans not grandfathered under the Affordable Care Act (ACA OOP limit). The inflation-adjusted ACA OOP limit applies to all in-network out-of-pocket expenses including deductibles, coinsurance, copayments, and any other cost-sharing for covered services, except premiums. The maximum out-of-pocket limit for an individual covered under an HDHP cannot exceed the ACA OOP limit, even if the HDHP does not otherwise have an embedded individual out-of-pocket limit. The inflation-adjusted ACA OOP limits for 2023 and 2024 are shown below.

R&I Update • 10 • July 2023

2023 2024 HSA Contribution Limit Individual HDHP Coverage $3,850 $4,150 Family HDHP Coverage $7,750 $8,300 Catch-up Contribution (age 55+) $1,000 $1,000 HSA Minimum Deductible Individual Coverage $1,500 $1,600 Family Coverage $3,000 $3,200 HDHP Maximum Out-of-Pocket (In-network, including deductible and all other cost-sharing

premiums) Individual Coverage $7,500 $8,050 Family Coverage $15,000 $16,100

except

2023 2024 Maximum ACA Out-of-Pocket Limit (In-network, including deductible and all other cost-sharing except premiums) Individual Coverage $9,100 $9,450 Family Coverage $18,200 $18,900

Court Cases of Interest

Court Rejects Health Plan’s Denial of Residential Treatment Coverage Due to Failure to Address Treating Provider’s Opinion

The District Court for the District of Utah ordered a health plan to reconsider a coverage denial for residential treatment due to the plan’s failure to “engage with and address” the opinion of the treating health care provider, D.B. v. United Healthcare Insurance Co.

The plaintiff’s son suffered from mental health issues and met with a psychologist who conducted an assessment involving nine separate testing sessions over a period of 28 days. At the conclusion of the assessment, the psychologist made several diagnoses and recommended long-term residential treatment. Shortly thereafter, the plaintiff’s son commenced two years of treatment at Triumph Youth Services, a residential treatment facility that provides in-patient treatment for adolescents with mental health and substance abuse issues.

During the two-year treatment period, the plaintiff was covered by two different health plans, one administered by Blue Cross Blue Shield of Illinois (BCBS) and one administered by United Healthcare (UHC). The UHC plan used United Behavioral Health (UBH) to administer its mental health coverage. Both BCBS and UBH denied coverage for the residential treatment at Triumph. The plaintiff did not pursue an internal appeal of the BCBS denial. However, he appealed the UBH denial, and his appeal was denied based on a purported lack of medical necessity. He subsequently filed a claim for benefits under ERISA in federal court. During the internal claims and appeal process with UBH, the plaintiff submitted a “specialty psychological evaluation” prepared by his son’s treating psychologist, together with additional medical records. However, UBH did not address any of the medical evidence in its denial letter. The court held that this failure to “engage with and address” the medical evidence, particularly the treating provider’s specialty psychological evaluation, was arbitrary and capricious. The court emphasized that “a plan administrator cannot shut its eyes to readily available information that could confirm a beneficiary's entitlement to benefits.” Accordingly, the court sent the case back to UBH to fully consider all of the medical evidence. This case demonstrates the importance of medical documentation when contesting a denial of benefits under a plan. Pilots who are subject to health or disability benefit denials should make sure to submit supportive documentation, including documentation from their treating medical provider as part of any appeal.

Are Pilots on Military Leave Due the Same Wages and Benefits Afforded to Pilots on Non-Military Leave?

On June 8, 2023, the United States Court of Appeals for the Eleventh Circuit (Eleventh Circuit) in Myrick v. City of Hoover, Alabama ruled that an employer violated the Uniformed Services Employment and Reemployment Rights Act (USERRA) by not providing employees on military leave the same benefits it provided to similarly situated employees on a comparable non-military leave.

USERRA entitles employees on military leave to the same rights and benefits, not determined by seniority, provided to similarly situated employees on non-military leave. USERRA considers factors such as status and pay when determining if two employees are similarly situated. To determine comparability, courts must compare the duration of the leave, the purpose of the leave, and the employees’ ability to choose when to take the leave.

In Hoover, the Eleventh Circuit affirmed the United States District Court for the Northern District of Alabama’s (District Court) ruling for summary judgment (ruling in favor of one party against another without a full trial) in favor of four City of Hoover police officers who were military reservists and summoned to active duty but did not receive wages, accrue leave, or receive holiday pay unlike police officers on administrative leave.

R&I Update • 11 • July 2023

Here, the City of Hoover placed employees in one of two categories: paid status or unpaid status. Employees on the City’s payroll or using paid leave were on paid status and were able to accrue different types of leave and convert that leave to compensation and receive 8 hours of pay for 12 paid holidays per year. Employees on unpaid status could not accrue leave and did not receive holiday pay. Also, the City of Hoover provided 168 hours of annual paid military leave to employees absent for military service. During these hours, military employees remained on paid status, accrued leave, and received holiday pay. After the 168 hours, military employees were placed on unpaid status. Employees on administrative leave beyond 168 hours remained on paid status, accrued leave, and received holiday pay without restriction. During their periods of service, each of the four officers exhausted their 168 hours of paid status, did not accrue leave, and did not receive holiday pay while employees on administrative leave did. The four military reservists filed suit under USERRA. The four officers and the City of Hoover filed for summary judgment. The District Court ruled in favor of the officers’ motion. The City of Hoover appealed.

The Eleventh Circuit relied upon the DOL’s interpretation of status and pay to mean an employee’s position and salary prior to their leave status as opposed to while on leave. Based on this interpretation, the Eleventh Circuit found that the four military reservists held similar positions and earned similar salaries to officers on administrative leave; thus, the two groups of employees were similarly situated.

As part of the Eleventh Circuit’s comparability analysis, the Eleventh Circuit agreed that employees are placed on both military leave and administrative leave to serve a similar purpose—compliance with the law. The City of Hoover provides military leave to comply with USERRA, and employees are placed on administrative leave to comply with the notice and hearing requirements of the Due Process Clause. Additionally, both forms of leave are intended to shield employees from undue hardship.

With respect to an employee’s ability to choose when to take the leave, the Eleventh Circuit concluded that employees on military leave have no more ability to choose when to go on military leave than other employees can determine when they will be investigated and placed on administrative leave.

To compare duration, the Eleventh Circuit grouped military leave and administrative leave into two categories based on length: short-term leave and long-term leave. The court placed military leave for training and administrative leave for brief events like jury duty in the short-term leave category. The court found that the average duration for short-term military leave was about 37 days, while the average duration for short-term administrative leave was about 13 days. The Eleventh Circuit placed military leave for deployment and administrative leave for investigative purposes in the long-term category. The court found that the average duration for both forms of long-term leave was about 16 months. The Eleventh Circuit concluded that had the reservists been placed on administrative leave and not military leave, they would have accrued leave and received holiday pay for each period of service, including those shorter than 16 months. Thus, the Eleventh Circuit found that military leave and administrative leave were comparable and affirmed the District Court’s ruling in favor of the officers.

Key Takeaways

y USERRA requires employers to provide the same rights and benefits to pilots on military leave that they provide to similarly situated pilots on comparable forms of non-military leave.

y Most pilots hold either one of two positions and enjoy the same salary, with respect to their position, based on the terms of the collective bargaining agreement. Therefore, most military pilots are highly likely to be considered similarly situated to other pilots on non-military leaves.

y A comparability determination requires a facts and circumstances analysis that is individual to each pilot’s situation. Thus, determining whether a pilot on military leave is due wages or certain benefits obtained by a pilot on a non-military leave requires the employer to compare the duration of the leave, purpose of the leave, and pilots’ ability to choose when to take the leave of both sets of pilots.

R&I Update • 12 • July 2023

Canadian Update

Understanding Bill C-228: The Pension Protection Act

The Pension Protection Act, or Bill C-228 colloquially known as the Pension Super-Priority Bill, received royal assent on April 27, 2023. The passing of this law marks a significant milestone in Canadian pension protection legislation.

Efforts to establish stronger pension protection laws in Canada have been ongoing for several years, often to no avail, until now. Previous attempts have sought to address the challenges faced by workers when their employer-sponsored pension plans encounter financial difficulties. The passage of Bill C-228 represents a crucial step toward enhancing pension security for such employees across the country.

Sarnia-Lambton MP Marilyn Gladu, who introduced the private member’s bill in February 2022, describes the purpose behind the bill: “Pension funds will be solvent, in general, and when there is a bankruptcy, large creditors are way more likely to be able to survive one company’s going bankrupt than an individual who has paid into their pension and is counting on it for their retirement.”

Governmental interjection is welcomed by many, following in the wake of historic bankruptcies that left many pensioners pension-less. Traditionally coined as the ‘Cadillac of retirement plans’, defined benefit pension plans felt much more secure prior to the collapse of Nortel (2009) and Sears (2017), whose insolvencies left hardworking employees with just a fraction of their expected retirement funds.

Canada's current pension protection laws vary by jurisdiction, leading to disparities in the level of protection provided. The introduction of the Pension Protection Act addresses these inconsistencies and aims to establish a more unified and comprehensive framework to safeguard pension payouts.

Implications of the Law

The Pension Protection Act brings numerous positive impacts and benefits for Canadian workers and retirees. The key implications are:

1. Enhanced Protection.

The Act ensures greater security for plan members by establishing stronger fiduciary duties for plan administrators, imposing stricter reporting requirements, and strengthening the oversight of pension funds. This helps prevent mismanagement and enhances the accountability of pension plan administrators.

2. Super-Priority Status.

One of the significant provisions of the Act is granting pension deficits super priority in bankruptcy and insolvency proceedings. This prioritizes pension obligations over other creditors, significantly improving the chances of recovering pension benefits for plan members. The Globe and Mail reports that this provision received widespread support, providing the fire necessary to get the legislation passed through the Senate after a history of failed attempts.

3. Improved Governance.

The Pension Protection Act promotes better governance practices within pension plans. It emphasizes the establishment of a pension advisory committee to enhance plan member representation and

R&I Update • 13 • July 2023

influence in decision-making processes. This allows plan members to have a voice in shaping the management of their pension plans and ensures greater transparency and accountability.

4. Transparent Communication.

The legislation emphasizes the importance of clear and timely communication between pension plan administrators and plan members. It mandates the provision of accurate and up-to-date information regarding pension benefits, enabling plan members to make informed decisions about their retirement planning.

The Act will serve as direct protection for many Canadian pilots who continue to accrue years of service within their grandfathered defined benefit pension plans. Moreover, pilot groups seeking to implement new retirement savings vehicles may reconsider the value and safety provided by the defined benefit structure. Although the design flexibility and lower costs of a defined contribution plan has made them popular in recent decades, the protection against longevity risk offered by defined benefit plans is still a significant advantage. Pilot groups seeking to support their members with retirement readiness may view the defined benefit structure as a guiding hand toward future financial stability.

The Act provides for a four-year transition period before the amendments to the Bankruptcy and Insolvency Act (BIA) and the Companies’ Creditors Arrangement Act (CCAA) will apply to the existing defined benefit pension plans. However, any defined benefit plans established following the date of royal assent will be immediately subject to the act’s full suite of provisions.

Despite the act’s well-meaning intentions, some industry stakeholders have raised their concerns about the potential for unintended negative consequences. Sponsors of defined benefit pension plans may worry the super-priority provision can lead to increased costs and liabilities, potentially straining their financial resources. The risk profile of lenders to sponsors of defined benefit pension plans may be impacted; their credit now less of a priority than pension benefit payout obligations in bankruptcy or insolvency. Gavin Benjamin of LifeWorks’ pension and benefits solutions business explains, “While the goal of [Bill C-228] is to protect the pensions of members and retirees in the event of a company’s insolvency, it could have adverse consequences for certain companies that sponsor DB pension plans.” Such critiques of the act emphasize the importance of striking a balance between protecting plan members' interests and the feasibility of sponsoring a plan. It can be argued that while safeguarding pension benefits is crucial, it should be done in a manner that considers the long-term sustainability of pension plans and the economic viability of employers. Such views are backed by the Association of Canadian Pension Management and the Pension Investment Association of Canada.

On the positive end of the varied spectrum of sentiments about the act, plan members who rely on their pension plans for financial security in retirement support the act. It is viewed as a crucial measure to safeguard retirement savings. Increased protection and enhanced transparency in pension plan management provides plan members with a greater sense of security. Bea Bruske, president of the Canadian Labour Congress, affirms, “We are glad to finally see workers being prioritized over banks and CEOs in bankruptcies situations.”

While stakeholders may hold differing opinions on the act, it is essential to recognize the positive impact it brings, such as improved protection, enhanced governance, and increased transparency. By prioritizing pension deficits in insolvency proceedings, the Act significantly improves the chances of Canadian pilots receiving their rightful benefits.

As the Pension Protection Act is implemented and its implications unfold, ongoing dialogue and collaboration throughout the industry will be crucial. Future developments may include refinements to balance the interests of all parties involved, ensuring both the long-term sustainability of pension plans and the financial security of Canadian workers.

R&I Update • 14 • July 2023

Membership Plans

Critical Illness Special Open Enrollment in Canada

Extending a warm ALPA welcome to ACA pilots, ALPA is offering a special open enrollment window for all Canadian ALPA members to join the Critical Illness program underwritten by Industrial Alliance Insurance and Financial Services Inc. Until July 30, 2023, members and their spouse can purchase up to $50,000 of Critical Illness Insurance with no medical questions. Acceptance is guaranteed. Members may also purchase $10,000 for their children. Take advantage of this special opportunity online.

ALPA Dental Plan Changes Coming

Changes to the ALPA voluntary dental program are forthcoming, be on the lookout for announcements this fall .

Critical Illness Insurance provides a tax-free, lump-sum payment if the individual is diagnosed with one of the 25 covered conditions, including cancer, heart attack, and stroke. Participants receive payment whether they are able to work after receiving their diagnosis, regardless if a full recovery occurs. The payment can be used to cover medical expenses, income loss, or however the participant determines. Plus, with the new “multiple event coverage” benefit, participants can make claims for the diagnosis of multiple unrelated covered conditions.

This offer is special because it can be difficult to qualify for Critical Illness Insurance. Normally, extensive medical information for the individual and their familial medical history is required to complete the application process. Acceptance by the insurance underwriter will then be dependent on the applicant’s personal health and the medical history of their natural parents and siblings. With this special offer, Canadian ALPA members can immediately qualify for up to $50,000 in coverage, regardless of their medical history.

Please note, members that are currently enrolled in the $50,000 of guaranteed-acceptance Critical Illness Insurance under this plan may not apply for more under this offer. However, members with $25,000 of guaranteed-acceptance Critical Illness Insurance may increase their coverage up to an additional $25,000 during the special open enrollment window.

R&I Fast Facts

Financial Preparedness Concerns Mount

The 2023 MetLife Employee Benefits Trend Survey reveals a growing concern over financial and retirement preparedness. Personal saving rates have decreased significantly from 2022.

y Over half (55%) of respondents indicated they are living paycheck to paycheck (an increase from 43% in 2022).

y Previously, 61% of survey participants felt in control of their finances; that has decreased to 55% in 2023. These general financial feelings translate into saving for retirement.

y The number of employees who are considered on track for meeting their retirement savings goals decreased by 7% (from 37% in 2022 to 30% in 2023).

R&I Update • 15 • July 2023

y Over 42% of employees are behind their savings goals; an increase of 5% from 37% in 2023.

y Half of Americans have less than $50,000 saved in defined contribution plans. Similarly, in a survey conducted by Nationwide on Economic Impact 52% of survey respondents are not only concerned about their ability to save for retirement, but also the value of their 401(k) accounts depreciating. “Friends and family” was listed as the number one avenue to seek out financial advice. Financial advisors were only used by 30% of employees. Cost was the number one reason people chose to not use a financial planner. As a reminder, ALPA members have access to complimentary initial financial planning services with Charles Schwab along with a myriad of other discounts.

2022 Health Survey Findings

Mercer published its 2022 National Survey of Employer-Sponsored Health Plans, revealing an average 3.2% increase in employer-sponsored health plans. This was lower than projected, and only half the general inflation rate. However, concern remains for significant increases in the years to come.

y Mercer found the average total benefit cost per participant was roughly $15,000 in 2022.

y Although the medical plans only experienced on average a 3.2% increase, spending on specialty drugs increased by 10%.

y Looking forward, the average inflation rate for 2023 is projected to be 5.4%, with 45% of employers absorbing the cost as the labor market tightens and competition for top candidates increases.

y The rate of healthcare inflation is expected to increase in the foreseeable future due to higher wages, and supply costs in the healthcare sector along with high claims from delayed care. Likewise, the 2023 HSA Bank Wealth Index Report was released in June. The findings support Mercer’s survey in that employers are expanding benefit offerings to stave off attrition. HSA Bank found that Gen Z (61%) and Millennials (51%) are likely to leave an employer if a competitor offers better benefit options. Additionally, as mental health concerns have grown over the past few years, more employers are providing mental health benefits. Coverage has increased by 4% from 2022 to 2023, with 27% of health plans now covering mental health. The HSA Bank Wealth Index Report provides insights into retirement as well; 44% of the participants said inflation impacted their retirement savings. Additionally, younger generations (Gen Z and Millennials) are more concerned about healthcare costs in retirement and are currently more likely to heavily weigh the premium costs when determining which healthcare plan to select.

July 2023

Long-Haul COVID-19 and Disability Claims

March marked the third anniversary of COVID-19. Although the National Emergency and Public Health Emergency ended in May, we will continue to experience the effects of COVID-19 in the years to come. According to a recent Employee Benefit Plan Review article, the Social Security Administration (SSA) is tracking disability claims related to COVID-19.

As of January 2023, over 44,000 disability claims mentioned COVID-19. It’s estimated that 16 million Americans experience long-haul COVID-19. The long-lasting effects of long-haul COVID-19 are still greatly unknown. The symptoms can be vague and difficult to medically address or document. People can experience fatigue, difficulty concentrating, shortness of breath, dizziness, heart palpitations, chest pain, joint pain, cough, depression or anxiety, fever, and loss of smell. Even if a person is experiencing longhaul COVID-19 they still must meet the SSA definition of disability to receive SSDI, which is the inability to engage in substantial gainful activity due to an illness or injury that is likely to result in death or has lasted for over 12 continuous months. As the SSA grapples with how to handle long-haul COVID-19, it is expected that long-term disability insurers to experience similar issues.

Estimated $1.65 Trillion in Forgotten 401(k) Accounts

In a recent Capitalize Report, forgotten 401(k) assets were estimated at $1.65 trillion which is a 23% increase from 2021 ($1.35 trillion). Forgotten 401(k) accounts occur when employees terminate their employment and do not rollover their 401(k) accounts to their new employer’s plan or to an IRA. Roughly 29.2 million accounts and 25% of all 401(k) assets are considered to be in forgotten 401(k) accounts. The average balance of these accounts is $56,616 and it can potentially result in hundreds of thousands of dollars in lost 401(k) contributions either from never remembering the account or leaving it poorly invested with high administration fees.

R&I Update • 17 • July 2023

SCFR Investing & Markets Outlook

In this publication, the Schwab Center for Financial Research provides its point of view on timely issues of importance to investors as they make decisions about their portfolios. The perspectives in this report are current as of July 1, 2023.

This report covers six key areas:

M Macro Outlook

U S Equities

U S Fixed Income

International Equities

International Fixed Income

Washington

SCHWAB CENTER FOR FINANCIAL RESEARCH 2 For institutional use only – not for further distribution

MACRO OUTLOOK

Rolling recession may shift to services

• Services the last leg of global growth is starting to slow. Manufacturing, trade, and some housing markets have been in recession, while services has been resilient. The drop in service Purchasing Manager Indices (PMIs) in June is a noticeable change that may indicate the rolling recession is starting to filter through to the services economy.

• Global inflation appears to have peaked, but core inflation has remained sticky. If global inflation and economic growth decline less than anticipated, central banks may have to keep rates higher for longer and postpone the start of rate cuts.

• Inflation metrics are diverging. Headline inflation metrics have continued to ease, but price-growth indices contain divergences. The Federal Reserve’s preferred gauge of underlying price growth the core services ex-housing component of the personal consumption expenditures (PCE) deflator increased by 4.5% through May. That annual increase is roughly in line with the average over the past six months (which shows little improvement) and is too fast for the Fed’s comfort.

• Economic momentum strengthened in Q1. First-quarter U.S. gross domestic product (GDP) growth was revised higher from 1.3% (quarter-over-quarter annualized) to 2%, driven by trade and services consumption. Residential investment was still negative, but the decline was less severe relative to the prior quarter; business investment was positive, but momentum waned.

3 For institutional use only – not for further distribution

U.S. EQUITIES

Breadth widened out in June

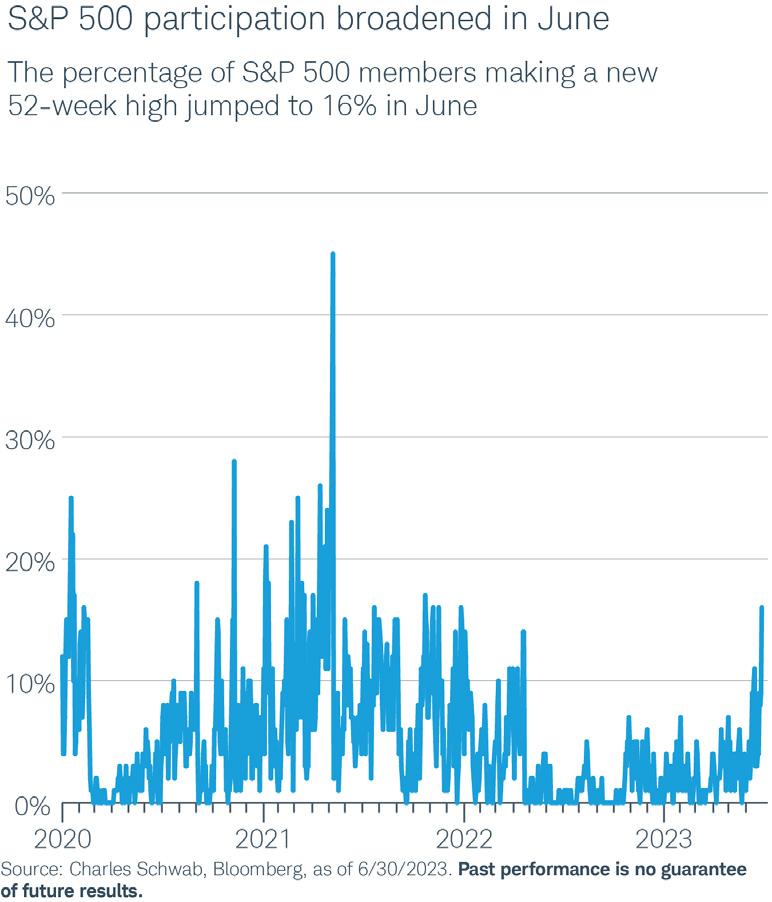

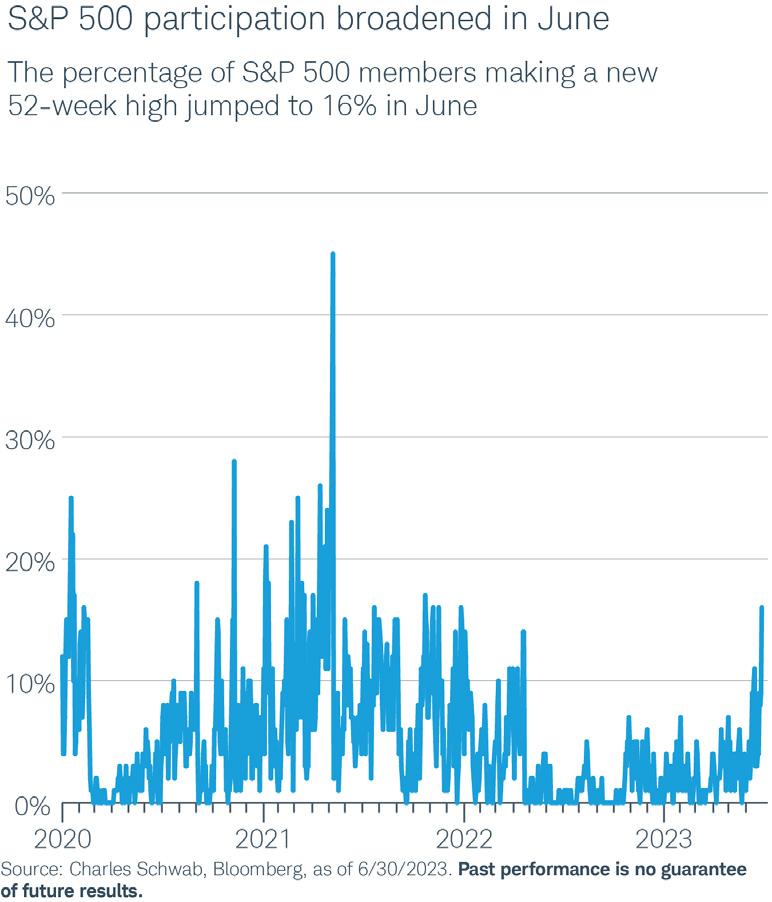

• Some promising signs for breadth (if sustained). The narrow nature of the stock rally started to fade in June and expanded to more participation from segments of the market (cyclicals and small caps, among others) that have been ignored for most of the year. A continued broadening out in breadth statistics such as the percentage of stocks making a new 52week high and trading above their 200-day moving average would bode well for the market this year.

• New highs are starting to confirm the market’s relative high

Through the end of June, 16% of members in the S&P 500® made a new 52-week high the highest share since the end of 2021. While that threshold has been crossed several times throughout history, it’s a particularly important milestone after a bear market in 2022 and the fact that the broader S&P 500 index made a new 52-week high earlier in the summer.

• Earnings headwinds haven’t faded. First-quarter earnings were down slightly but not as much as analysts had initially estimated. Expectations for a rebound by the end of the year still look too optimistic, especially given the expectation of tighter credit conditions and restrictive monetary policy.

• Focus on quality. We suggest investors focus on high-quality segments of the market those that have strong profit margins, maintain positive earnings revisions, and have high interest coverage ratios.

4 For institutional use only – not for further distribution

R&I Update • 19 • July 2023

Charles Schwab

Charles Schwab

U.S. FIXED INCOME

The Fed suggests more tightening is likely

• The markets are pricing in one more rate hike, while the median Federal Reserve projection suggests that there may be two more rate hikes. The gap between the peak rate implied by the dot plot and market expectations has narrowed but hasn’t closed.

• Inflation still appears sticky. The Fed’s preferred inflation indicator the core personal consumption expenditures (PCE) price index, which excludes volatile food and energy prices is off its highs but at 4.6% remains elevated. With an inflation target of 2%, the Fed would like to see that downward trend resume.

• Investors should gradually extend duration. We still suggest investors lock in the relatively high yields that intermediate-term bonds currently offer rather than face reinvestment risk when the Fed cuts rates down the road. The Fed seems intent on bringing down inflation even if that means slowing down the economy; if the economy does in fact, slow, Treasury yields of all maturities should decline.

• Focus on quality. High-quality bond yields remain near their highest levels in years. Rather than moving down in credit quality to earn even higher yields, we suggest investors favor U.S. Treasuries and investment-grade corporate or municipal bonds. There may be better opportunities to take risk down the road.

INTERNATIONAL EQUITIES

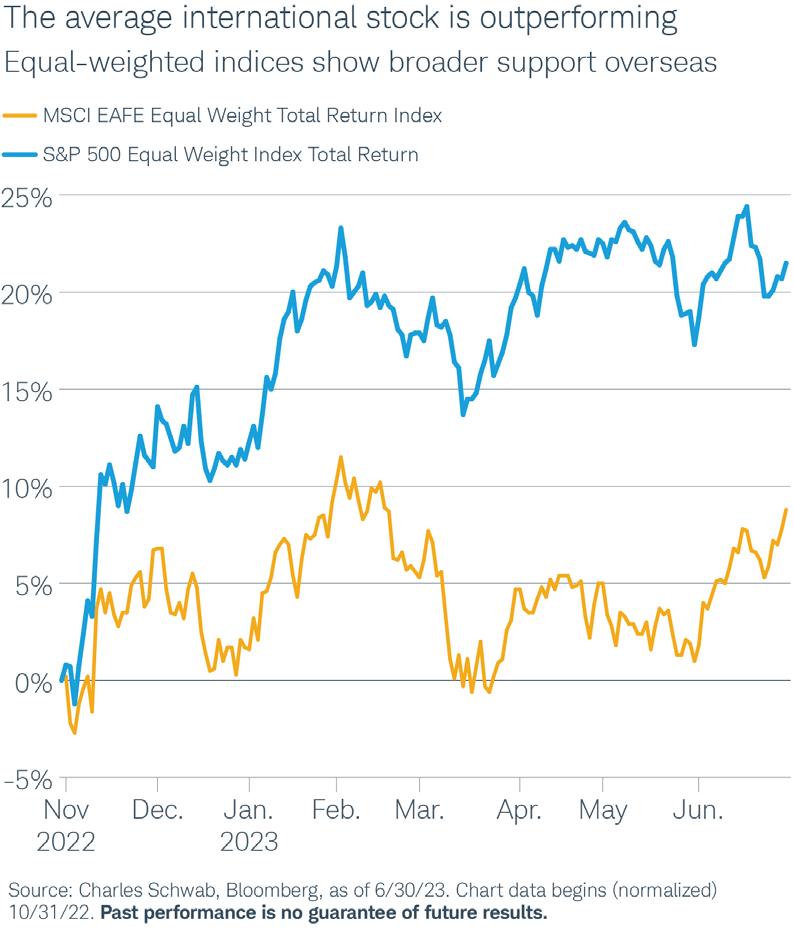

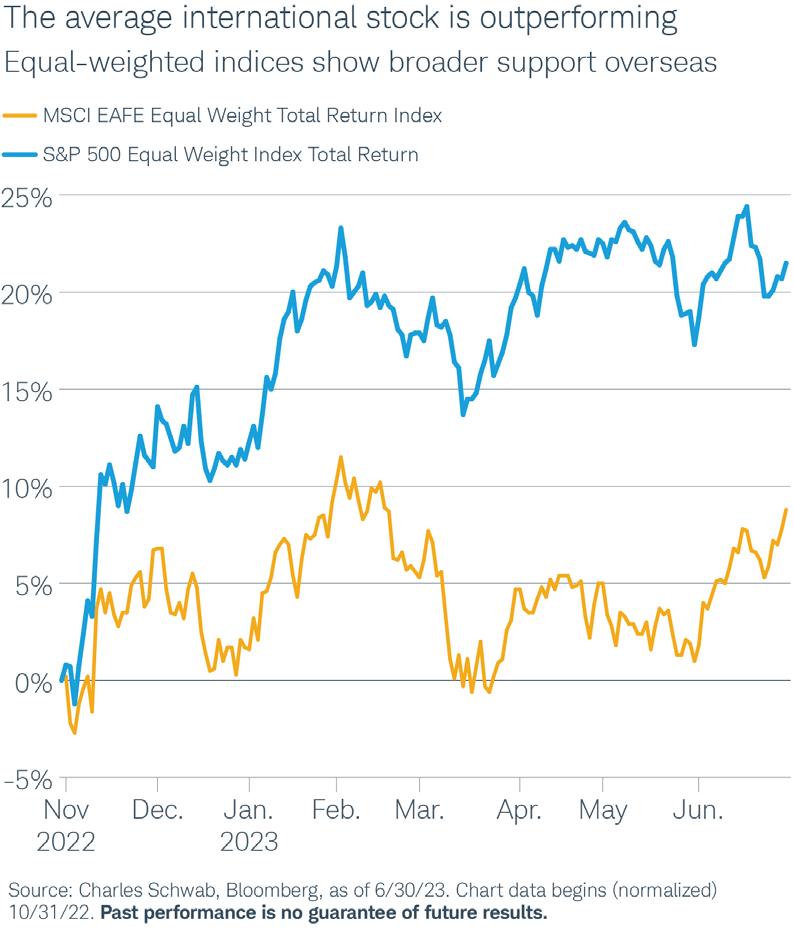

Some international stocks are outperforming; Japan may still be attractive

• International stocks remain an important component of a diversified portfolio. Currently, the average international stock is outpacing the average U.S. stock comparing broadbased indices on an equal-weighted basis. Using equalweighted indexes gives a better view of how the average stock is doing. In general, the more stocks that are helping to push the overall market higher, the more support the market has.

• Japanese stocks may still be attractively valued, despite returning double that of the S&P 500 this year in local currency. Japanese companies have $2.5 trillion in cash, depressing valuations. The catalyst for change is the Tokyo Stock Exchange asking companies to provide plans to boost price-to-book (P/B) ratios above 1.0, which has encouraged an increase in stock buybacks and has attracted foreign investors’ interest and activist funds.

• China’s recovery has been sluggish, but the government is shifting into an active support mode. We believe the longer growth remains disappointing, the greater the chance of more aggressive stimulus. Consumer confidence will take time to improve and may need more property-market support and incentives to induce consumers to buy big-ticket items.

6 For institutional use only

not for further distribution

R&I Update • 20 • July 2023

Charles Schwab

5 For institutional use only – not for further distribution Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read the Risk Disclosure Statement for Futures and

Charles Schwab

Options prior to trading futures products.

–

INTERNATIONAL FIXED INCOME

Most global bond yields remain elevated

• Developed market global bond yields are at the top end of their recent trading range. Like the Fed, many other global central banks continue to hike rates. The average yield of the Bloomberg Global Aggregate ex-USD Bond Index continues to trade in a tight range after surging from the recent lows, but closed June near its recent highs.

• U.S. bonds still offer a yield advantage over global bonds, but that gap has shrunk lately. The U.S. Agg offers a yield of roughly 180 basis points more than the Global Agg, but that’s down from the high of almost 240 basis points from last fall. Despite the lower relative yields, global bonds can offer diversification benefits in a fixed income portfolio.

• “De-dollarization” concerns seem overblown. While the dollar is down more than 9% from last September, it’s still near its 10-year high versus currencies of countries with which the U.S. trades. It also remains the primary currency used for trade and financial transactions in the global economy.

• Tighter financial conditions pose a risk to emerging-market (EM) bonds. The average yield of the Bloomberg Emerging Market USD Aggregate Bond Index is over 7%, but much of that is due to higher U.S. Treasury yields. Given global growth concerns, we suggest a cautious stance toward EM bonds, as spreads may rise.

For institutional use only – not for

WASHINGTON

Congress working through several key legislative issues

• July is typically a month where Congress is in the weeds of crafting legislation. The month is key time for developing the bills that will dominate the fall. This month, keep an eye on:

• Government-funding battle. Congress needs to approve the 12 appropriations bills that fund all government programs for the next fiscal year by October 1. House Republicans are reducing funding below the targets agreed to in the debt ceiling debate, setting up a battle with the Senate–and a possible government shutdown in the fall.

• ESG issues. The House Financial Services Committee has planned a half dozen hearings on ESG topics in July and plans to consider legislation to put some restrictions on ESG investing, though any bills the House passes will face a tough road in the Senate.

• Tougher banking rules. The Senate may vote this month on a bill to increase penalties on executives of failed banks. We also may see a proposal from the Federal Reserve to toughen stress tests and increase capital requirements for mid-size and large banks.

• Fed nominee confirmations. The Senate is expected to move forward with confirming World Bank economist Adriana Kugler to the open seat at the Fed, as well as confirm current governor, Phillip Jefferson, as vice chair. 8

For institutional use only – not for further distribution

R&I Update • 21 • July 2023

Charles Schwab

7

Past performance is no guarantee of future results

further distribution

Charles Schwab

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Supporting documentation for any claims or statistical information is available upon request.

The policy analysis provided by the Charles Schwab & Co., Inc., does not constitute and should not be interpreted as an endorsement of any political party.

Past performance is no guarantee of future results.

Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. For more information on indexes please see schwab.com/indexdefinitions

Performance may be affected by risks associated with non-diversification, including investments in specific countries or sectors. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts (REITs), fixed income, small capitalization securities and commodities. Each individual investor should consider these risks carefully before investing in a particular security or strategy.

Investing involves risk including loss of principal.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed-income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Lower rated securities are subject to greater credit risk, default risk, and liquidity risk.

Tax-exempt bonds are not necessarily a suitable investment for all persons. Information related to a security's tax-exempt status (federal and in-state) is obtained from third-parties and Schwab does not guarantee its accuracy. Tax-exempt income may be subject to the Alternative Minimum Tax (AMT). Capital appreciation from bond funds and discounted bonds may be subject to state or local taxes. Capital gains are not exempt from federal income tax.

International investments are subject to additional risks such as currency fluctuation, geopolitical risk and the potential for illiquid markets. Investing in emerging markets may accentuate these risks.

This material is for institutional investor use only. This material may not be forwarded or made available, in part or in whole, to any party that is not an institutional investor.

Currencies are speculative, very volatile and are not suitable for all investors.

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

Schwab does not recommend the use of technical analysis as a sole means of investment research.

Diversification and asset allocation strategies do not ensure a profit and cannot protect against losses in a declining market.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Important Disclosures

Environmental, social and governance (ESG) strategies implemented by mutual funds, exchange-traded funds (ETFs), and separately managed accounts are currently subject to inconsistent industry definitions and standards for the measurement and evaluation of ESG factors; therefore, such factors may differ significantly across strategies. As a result, it may be difficult to compare ESG investment products. Further, some issuers may present their investment products as employing an ESG strategy, but may overstate or inconsistently apply ESG factors. An investment product's ESG strategy may significantly influence its performance. Because securities may be included or excluded based on ESG factors rather than other investment methodologies, the product's performance may differ (either higher or lower) from the overall market or comparable products that do not have ESG strategies. Environmental ("E") factors can include climate change, pollution, waste, and how an issuer protects and/or conserves natural resources. Social ("S") factors can include how an issuer manages its relationships with individuals, such as its employees, shareholders, and customers as well as its community. Governance ("G") factors can include how an issuer operates, such as its leadership composition, pay and incentive structures, internal controls, and the rights of equity and debt holders. Carefully review an investment product's prospectus or disclosure brochure to learn more about how it incorporates ESG factors into its investment strategy.

For institutional use only – not for further distribution

Charles Schwab 9

Schwab Retirement Plan Services, Inc. and Charles Schwab & Co., Inc. are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. Brokerage products and services are offered by Charles Schwab & Co., Inc. (“Schwab”, Member SIPC, www.sipc.org). Schwab Retirement Plan Services, Inc. is not a fiduciary to retirement plans or participants and only provides recordkeeping and related services.

The information provided here is for general informational purposes only and is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner or investment manager.

Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

©2023 Charles Schwab & Co., Inc. (“Schwab”). Member SIPC. All rights reserved

0723-3BLT

For institutional use only – not for further distribution

Charles Schwab

R&I Update • 22 • July 2023

10

R&I Contacts

REPRESENTATION DEPARTMENT—R&I TEAM MEC-BASED STAFF

NAME

NATIONAL

MEMBER INSURANCE STAFF

NATIONAL R&I COMMITTEE

Capt Jon Erickson (DAL), Chairman Jon.Erickson@alpa.org

Capt Ken Binder (FDX) Kenneth.Binder@alpa.org

Capt Steve Gower (WJA) Steve.Gower @alpa.org

Capt Fred Greene (UAL) Fred.Greene@alpa.org

Capt Jeffrey Hicks (FFT) Jeffrey.Hicks@alpa.org

Capt . Travis Wheat (SPA) Travis.Wheat@alpa.org

R&I Update • 23 • July 2023

NAME/JOB TITLE TELEPHONE ASPEN E-MAIL Phil Borgman, Benefits Specialist (ALA MEC) 206-241-3138 1946 Phil.Borgman@alpa.org Dianne Myers, Associate Benefits & Contract Specialist (ALA MEC) 206-241-3138 1949 Dianne.Myers@alpa.org Sontia Green, Benefits Specialist (DAL MEC) 404-763-5193 5193 Sontia.Green@alpa.org Louis Parks, Associate Benefits Specialist (DAL MEC) 404-763-4932 4932 Louis.Parks@alpa.org Ann Giannini, Benefits Specialist (FDX MEC) 901-842-2207 2207 Ann.Giannini@alpa.org Brandy Hough, Sr Benefits Specialist (FDX MEC) 901-842-2208 2208 Brandy.Hough@alpa.org Stacey Stewart, Assistant Benefits Specialist (FDX MEC) 901-257-2024 2020 Stacey.Stewart@alpa.org Christal Oliver, Benefits Specialist (JBU MEC) 703-689-4261 4261 Christal.Oliver@alpa.org Lisa Kwilas, Benefits Specialist (UAL MEC) 847-292-1723 1723 Lisa.Kwilas@alpa.org

STAFF Danika Borda, Benefits Specialist (Canada) 613-265-7970 Danika.Borda@alpa.org Kevin Burton, Benefits Attorney 703-689-4117 4117 Kevin.Burton@alpa.org Angela Greene, Sr Benefits Attorney 703-689-4124 4124 Angela.Greene@alpa.org Jack Parrack, Sr Enrolled Actuary 703-689-4379 4379 Jack.Parrack@alpa.org Catherine Powers, Assistant Director, Representation 703-689-4126 4126 Catherine.Powers@alpa.org Celeste Sweeney, Benefits Specialist (U S ) 703-689-4224 4224 Celeste.Sweeney@alpa.org Michael Swierczek, Investment Portfolio Advisor 703-689-4137 4137 Michael.Swierczek@alpa.org Anngi Tipton, Administrative Specialist 703-689-4114 4114 Anngi.Tipton@alpa.org Dan White, Supervising Benefits Attorney 703-689-4118 4118 Dan.White@alpa.org

NAME/JOB TITLE TELEPHONE ASPEN E-MAIL Navea Harris, Supervisor 703-689-4156 4156 Navea.Harris@alpa.org Mike Barreto, Sr . Insurance Analyst 703-689-4330 4330 Mike.Barreto@alpa.org Patricia Morse, Insurance Clerk 703-689-4152 4152 Patricia.Morse@alpa.org Typhani Short, VEBA Administrative Assistant 703-689-4193 4193 Typhani.Short@alpa.org

E-MAIL