Date of Valuation: 11 June 2025

Date of Valuation: 11 June 2025

“Archibald”

108 Donnison Street, Gosford, NSW

Instructions

Instructing Party

Mann 88 Development Pty Ltd

Reliant Party Mann 88 Development Pty Ltd

Purpose

To provide an overview of the suburb of Gosford and the “Archibald” development, local market overview and sales evidence of residential apartments.

Address “Archibald” 108 Donnison Street, Gosford NSW

Description of Property

The subject property comprises 327 residential apartments over two towers forming part of a 27-storey mixed-use development over three levels of residential car parking.

Our brief is to consider the specific design, features and innovations that characterise the “Archibald” development, and in particular review and assess the value proposition(s) that may evolve from, or otherwise be attributed to, in particular, those identified elements that may not necessarily be regarded as typical in this market sector.

As part of this report, we have been requested to provide a current opinion of value ranges for the various apartment configurations within the development, together with relative references to support those opinions, in particular those characteristics that may contribute to value, not ordinarily found in the market sector being considered.

Based on the sales evidence outlined within this report, together with clearly identified value add initiatives not normally found in competing market evidence, we are of the view that current value ranges for the various apartment configurations as part of “Archibald” are as follows:

As outlined above, there is a vast range of values per apartment configuration type. This is primarily due to the individual attributes of each apartment type including internal size, internal configuration, aspect and view profile

This is a summary only and is not to be relied upon for any purpose. The valuation assessment for this property is subject to the assumptions, conditions and limitations as set out in the accompanying full valuation report.

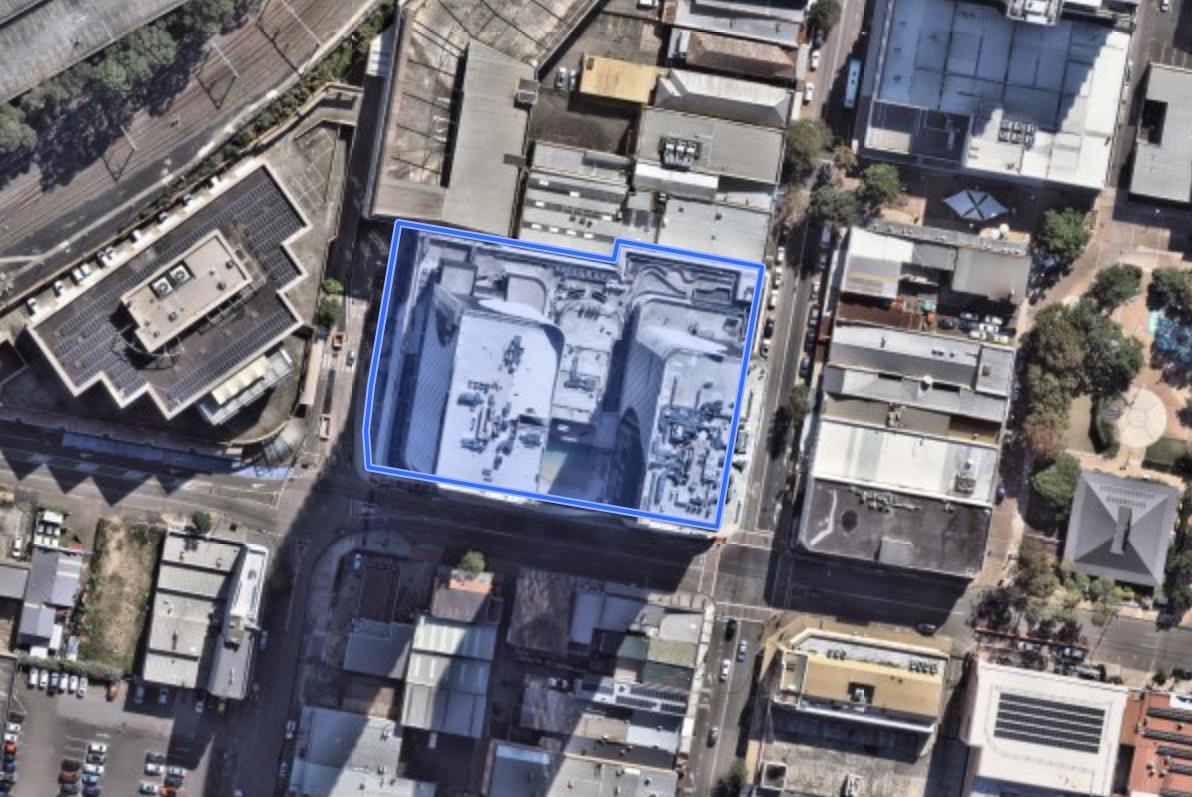

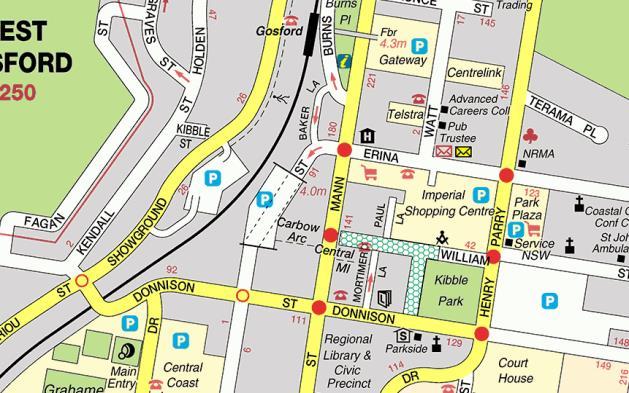

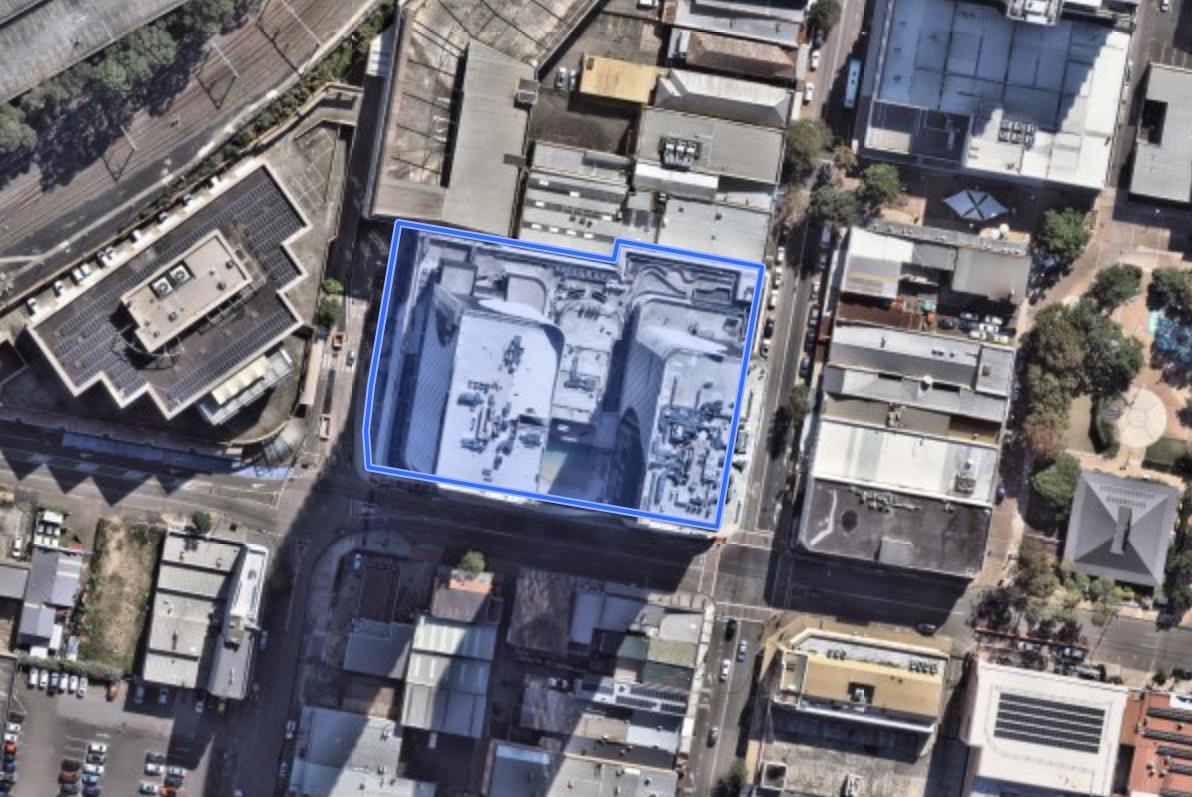

Source: UBD Source: Nearmaps

Situated

Main Roads

Access

• The subject property has frontages to Donnison Street, Baker Street and Mann Street.

• Approximately 45 radial kilometres north of the Sydney CBD.

• Located within proximity of Central Coast Highway and Pacific Highway.

• Vehicle access available via Baker Street.

In the general vicinity of the subject property comprises a mix of medium and high density residential development and commercial development.

Bus Stop Donnison Street after Mann Street.

Train Gosford Train Station is located within close proximity to the subject property.

Education

Primary and Secondary Schools

Located within proximity of Gosford Public School, Wyoming Public School, St Patrick’s Catholic Primary School, Gosford High School and St Joseph’s Catholic College.

Tertiary Located within proximity of The University of Newcastle – Gosford Precinct, Wakefield International College and TAFE Gosford.

Kibble Park

Industree Group Stadium

Leagues Club Park

Located within proximity of the subject to the east.

Located within proximity of the subject to the south-east.

Located within proximity of the subject to the south.

Shopping Centre Gosford Marketplace is located within proximity of the subject to the east.

Services

All usual urban services are connected or available to be connected to the individual subject apartments.

The subject property benefits from Development Consent (46256/2014) for the mixed use development, commercial/retail, supermarket, hotel and shop top housing development (JRPP).

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/MOD1) for the increased number of hotel rooms to 167, increase number of residential apartments to 342, increase number of car parking spaces to 507, reduce size of units & balconies, minor alterations to internal layout of commercial and retail areas addition of demolition to condition 2.1.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/MOD2) for the reduction in residential apartments and increase active street frontage and facade modifications and increase in landscaping.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/MOD3) for the amendment - stage developer contributions, release of construction certificates, correction of site boundaries and modifications to approved building.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/D) for modifications including an increase in residential units from 289 to 323, with the west tower housing 199 units and the east tower 124. Car parking is reduced from 910 to 708 spaces, allocated between commercial and residential use. Two lower basement levels have been removed

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/F) for modifications including removing a lower basement level with 22 car spaces, reducing total parking from 708 to 666 spaces, and improving circulation and service layouts. Parking levels will be slightly adjusted for flat slabs instead of split levels.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/G) for modifications including minor RL adjustments to improve buildability and align internal levels with the public domain, along with lift overruns as per specifications, slightly increasing maximum RLs. Changes also involve modifying the conference room roof and adding a balcony, internal layout improvements, amalgamating units on upper levels to reduce total units from 323 to 320, and a slight increase in car parking from 666 to 667 spaces.

Also, the subject property benefits from Development Consent (DA/1872/2023) for Subdivision - Stratum - 6 Lots.

Also, the subject property benefits from Development Consent (DA/1873/2023) for Subdivision - Strata - 320 Lots.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/H) for modifications including the reconfiguration of level 26 is reconfigured, increasing the total unit count to 327, while car parking is slightly reduced from 667 to 664 spaces.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/I) for minor facade changes for the ground floor portion of the eastern elevation.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/J) for the reallocation of residential parking spaces to valet parking spaces.

Also, the subject property benefits from Section 4.55 Modification Approval (DA/1872/2023/A) for Subdivision - Stratum - 6 Lots (Amended Application)

Also, the subject property benefits from Section 4.55 Modification Approval (DA/1873/2023/A) for Subdivision - Strata - 320 Lots (Amended Application)

Also, the subject property benefits from Section 4.55 Modification Approval (DA/1872/2023/B) for proposed stratum subdivision of an approved development into six Torrens title lots

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/K) for the modification of Condition 2.18 (d) of the consent to ensure compliance with the Central Coast Council Street Design Guidelines

Finally, Section 4.55 Modification Application (DA/1872/2023/C) has been submitted for Subdivision - Stratum - 6 Lots (Amended Application).

No. of Apartments 327.

No. of Levels 27.

Architect

Place Studio.

Plan Reference AR-DA-0000 – AR-DA-9052

Date of Plans

Multiple dates.

Endorsed Central Coast Council.

Structure Suspended concrete slab floors. Floors Reinforced concrete.

Roof Combination of cladding, rendered and painted concrete.

External Walls Combination of concrete, cladding, steel, glass, aluminium, brick and sandstone.

Internal Walls

Painted plasterboard.

Ceilings Painted plasterboard.

Floor Coverings Suspended concrete slab floors with a combination of timber, tile and carpet.

Pedestrian Access Via Donnison Street, Baker Street and Mann Street.

Vehicle Access Via Baker Street.

Lift 11 lifts across two towers available from the basement.

Car Parking Multiple levels of car parking (three attributed to residential).

We highlight that the level of finishes for the development has the potential to significantly impact the achievable sale prices. In undertaking our valuation and as part of our inspection, we note the development incorporates a good level of finishes.

We note the development provides for a suitable level of accommodation consistent with current market demands and provides a good level of utility. Our valuation assumes that the development has been completed in a good workmanlike manner in accordance with all relevant statutory requirements. We have provided further detail with regard to the level of finishes below:

Kitchen Specifications

Appliances

Fisher and Paykel four burner gas cook top.

Fisher and Paykel under bench oven.

Fisher and Paykel microwave.

Fisher and Paykel fully integrated dishwasher.

Fisher and Paykel Rangehood.

Benchtop Marble.

Floor Timber.

Splashback Glass.

Bathroom and Ensuite Specifications

Floor Timber.

Shower Frameless glass.

Toilet Suite Back to wall concealed cistern in each bathroom.

Living Room Specifications

Floor Timber.

Bedrooms Specifications

Floors Timber and carpet.

Laundry Specifications

Appliances Fisher and Paykel dryer.

We consider the finishes to be appropriate for the subject property’s market.

Marketing for the subject development commenced circa October 2022. We note that a total of 320 contracts relating to residential apartments have exchanged as at the date of valuation, equating to $247,195,198.

Currently pending construction completion and being marketed “off the plan” this development is situated on the frontages to Donnison Street, Baker Street and Mann Street.

The subject property benefits from Development Consent (46256/2014) for the mixed use development, commercial/retail, supermarket, hotel and shop top housing development (JRPP).

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/MOD1) for the increased number of hotel rooms to 167, increase number of residential apartments to 342, increase number of car parking spaces to 507, reduce size of units & balconies, minor alterations to internal layout of commercial and retail areas addition of demolition to condition 2.1.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/MOD2) for the reduction in residential apartments and increase active street frontage and facade modifications and increase in landscaping.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/MOD3) for the amendment - stage developer contributions, release of construction certificates, correction of site boundaries and modifications to approved building.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/D) for modifications including an increase in residential units from 289 to 323, with the west tower housing 199 units and the east tower 124. Car parking is reduced from 910 to 708 spaces, allocated between commercial and residential use. Two lower basement levels have been removed.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/F) for modifications including removing a lower basement level with 22 car spaces, reducing total parking from 708 to 666 spaces, and improving circulation and service layouts. Parking levels will be slightly adjusted for flat slabs instead of split levels.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/G) for modifications including minor RL adjustments to improve buildability and align internal levels with the public domain, along with lift overruns as per specifications, slightly increasing maximum RLs. Changes also involve modifying the conference room roof and adding a balcony, internal layout improvements, amalgamating units on upper levels to reduce total units from 323 to 320, and a slight increase in car parking from 666 to 667 spaces.

Also, the subject property benefits from Development Consent (DA/1872/2023) for SubdivisionStratum - 6 Lots.

Also, the subject property benefits from Development Consent (DA/1873/2023) for Subdivision - Strata - 320 Lots.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/H) for modifications including the reconfiguration of level 26 is reconfigured, increasing the total unit count to 327, while car parking is slightly reduced from 667 to 664 spaces.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/I) for minor facade changes for the ground floor portion of the eastern elevation.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/J) for the reallocation of residential parking spaces to valet parking spaces.

Also, the subject property benefits from Section 4.55 Modification Approval (DA/1872/2023/A) for Subdivision - Stratum - 6 Lots (Amended Application).

Also, the subject property benefits from Section 4.55 Modification Approval (DA/1873/2023/A) for Subdivision - Strata - 320 Lots (Amended Application).

Also, the subject property benefits from Section 4.55 Modification Approval (DA/1872/2023/B) for proposed stratum subdivision of an approved development into six Torrens title lots.

Also, the subject property benefits from Section 4.55 Modification Approval (46256/2014/K) for the modification of Condition 2.18 (d) of the consent to ensure compliance with the Central Coast Council Street Design Guidelines.

Finally, Section 4.55 Modification Application (DA/1872/2023/C) has been submitted for SubdivisionStratum - 6 Lots (Amended Application).

A summary of the sales achieved to date within the proposed development are outlined below:

“The Waterfront” 26-30 Mann Street, Gosford NSW

Currently under-construction and being marketed “off the plan” this development is situated on the western alignment of Mann Street with additional frontage to Baker Street, within Gosford.

The property benefits from State Significant Development Approval (SSD-23588910) for the construction of a 25-storey mixed-use building comprising of 136 apartments including 183 car parking spaces and associated works.

Also, the property benefits from State Significant Modification Approval Section 4.55 Modification Approval (SSD-23588910-Mod-1) for the number of design amendments internal and external to the approved plans. No change in building height or envelope. No change in number of car spaces. Minor decrease in Gross Floor Area.

Also, the property benefits from State Significant Modification Approval Section 4.55 Modification Approval (SSD-23588910-Mod-2) for the inclusion of a lightning protection device on the roof of the northern tower, minor internal layout amendment and correction of an error on the eastern elevation plan.

Lastly, the property benefits from State Significant Section 4.55 Modification Approval (SSD23588910-Mod-3) for amendments to internal layout and unit mix, reduction in number of apartments from 136 to 134, minor changes to retail GFA at ground floor and minor changes to landscaping on level 4.

A summary of the sales achieved within the proposed development from 2021 to 2025 is outlined below:

to the

Further to the sales above, a summary of the sales achieved in 2024 and 2025 within the proposed development are outlined below:

“La Riviera” 1 Shortland Street, Point Frederick NSW

Currently being marketed “off the plan” this development is situated on the southern alignment of Shortland Street, within Point Frederick.

We note that the property benefits from Development Consent (DA/48475/2015) which provides for the construction of a residential flat building (23 units) and demolition of existing dwelling.

Furthermore, the subject benefits from Section 4.55 Modification Approval (DA/48475/2015/A) which provides for the amendment increase number of units from 23 to 24 with a half storey addition to the upper most level & one additional carpark & increase amount of storage area in basement & a modest increase in GFA and FSR and a small increase in height of portion of a building.

Furthermore, the subject benefits from Section 4.55 Modification Approval (DA/48475/2015/C) which provides for the amendment of plans and modification to Conditions 2.6 and 2.12

Finally, the subject benefits from Section 4.55 Modification Approval (DA/48475/2015/E) which provides for the construction of a residential flat building (24 units) and demolition of existing dwelling (amended application).

We have been unable to obtain the individual sales details of each apartment however the marketing agent advised us of the following asking prices:

1

Smaller residential development located within proximity of the subject property in a superior location. Similar internal areas to the one-bedroom apartments, smaller internal areas to the two-bedroom apartments and larger internal areas to the three bedroom and four-bedroom apartments and a similar level of finishes to be provided. Consider the asking prices as being broadly indicative of those applicable to the subject onebedroom apartments and above those applicable to the subject two-bedroom, three bedroom and four-bedroom apartments.

62 Hills Street, North Gosford NSW

Forms a circa February 2024 completed residential development located on the western alignment of the Hills Street, within North Gosford.

Finishes to the apartments are of a good standard including stainless steel appliances, built in wardrobes, open plan living and dining together with internal laundry.

sales within the

may be summarised as follows:

Forms a circa June 2020 completed residential development located on the eastern alignment of Mann Street, within Gosford.

Finishes to the apartments are of a good standard including stainless steel appliances, built in wardrobes, open plan living and dining together with internal laundry.

Recent sales within the development may be summarised as follows:

Forms a circa 2020 completed residential development located on the western alignment of St George Street, within Gosford.

The development comprises of 60 residential apartments. Finishes to the apartments are of a good standard including stainless steel appliances, built in wardrobes, open plan living and dining together with internal laundry.

Recent sales within the development may be summarised as follows:

A summary of the recent sales achieved within the development is outlined below:

2 Wilhelmina Street, Gosford NSW

Forms a circa December 2018 completed residential development located on the northern alignment of the Wilhelmina Street with a secondary frontage to Batley Street, within Gosford.

Finishes to the apartments are of a good standard including stainless steel appliances, built in wardrobes, open plan living and dining together with internal laundry.

Recent sales within the development may be summarised as follows:

A summary of the recent sales achieved within the development is outlined below:

Smaller residential development located within proximity of the subject in a similar location. Similar internal areas with an inferior level of finishes. Consider the prices achieved as being below those applicable to the subject one and two bedroom apartments.

Forms a circa 2017 residential development situated on the western alignment of Hills Street, within North Gosford.

Finishes to the apartments are of a good standard including stainless steel appliances, built in wardrobes, open plan living and dining together with internal laundry.

Recent sales within the development may be summarised as follows:

A summary of the recent sales achieved within the development is outlined below:

Forms a circa May 2019 completed mixed-use development located on the western alignment of the Kendall Street, within Gosford.

Finishes to the apartments are of a good standard including stainless steel appliances, built in wardrobes, open plan living and dining together with internal laundry.

Recent sales within the development may be summarised as follows:

A summary of the recent sales achieved within the development is outlined below:

Forms a smaller mixed-use development located in a similar location. Larger internal areas to the subject apartments and an inferior level of finishes. Consider the prices achieved as being below those applicable to the subject one and two bedroom apartments.

Based on the sales evidence outlined above we are of the view that current value ranges for the various apartment configurations as part of “Archibald” are as follows:

As outlined above, there is a vast range of values per apartment configuration type. This is primarily due to the individual attributes of each apartment type including internal size, internal configuration, aspect and view profile.

We have adopted the above-mentioned ranges having regard to:

• Located approximately 45 kilometres from the Sydney CBD. Positioned within short distance to Gosford Railway Station and Bus Routes directly to the Sydney CBD along Donnison Street

• Within proximity of The University of Newcastle – Gosford Precinct, Wakefield International College and TAFE Gosford

• Within close proximity of Industree Group Stadium

• Gosford Marketplace is located within proximity of the subject to the east

• The project will incorporate a good level of finishes including Fisher and Paykel appliances.

• Sizes of both internal and external areas for each apartment configuration is typical in the local market.

• All of the apartments include secure basement parking.

Most advanced economies are expecting inflation to be under control over the next year with some central banks still cautious about easing interest rates. Inflation remains problematic in other parts of the world with some central banks raising rates to battle long term inflation. Global trading and economic uncertainties are forecast to remain high, with likely risk of disruption to global supply chains and oil price hikes. Australian’s economy will be impacted by these global headwinds over the short term, with the market remaining cautious as a result.

GDP December Qtr. 2024 $658.49b 1.3% Oxford Economics Australia are forecasting economic growth to continue growing at 2% over 2025 as the global economy faces uncertainty over potential US tariffs sparking a trade war.

CPI Inflation March Qtr. 2025 140.0 (CPI value) 1.4% The Consumer Price Index has increased by 0.8% over the last quarter to March 2025 compared to 2.34% increase in the December 2024 quarter. Inflation peaked in December 2022 but has dropped to within RBA’s margin.

Unemployment Rate March 2025 4.10% 0.2% By state: NSW (4.20 %), Vic (4.40%), Qld (3.90%), SA (4.00%), WA (3.60%), Tas (3.90%), NT (3.80%) and ACT (2.90%). The unemployment rate is expected to continue trending downward as inflation stabilise and interest rate drop.

Cash Rate May 2025 3.85% -50 bps The RBA has cut cash rate a further 25 basis point to 3.85% at its May meeting, following the 25 basis points cut in February 2025. While underlying inflation is moderating, the RBA still hold concerns with uncertain global economic condition and tight labour market.

Retail Turnover March 2025 $37,275.1m 3.08% Retail sales have been volatile over recent months. Retail turnover for the March 2025 year on year increased by 3.08%. National retail turnover is forecast to increase in 2025, with real household income and spending improving slightly post interest cut.

Wages growth has strengthened in response to the tight unemployment rate and inflation.

Sentiment has increased 12.0% over the past 12 months as the RBA rate cut lifts consumers spending and is expected to continue rising throughout 2025 as the RBA moderate their monetary policy. Business Conditions (Index - net balance)

Population^ September 2024

2 -71.4% Business conditions have been trending down over the year to date 2025, driven by low profitability. Further interest rate cut is expected to enhance business outlook despite global economic uncertainty looming in 2025.

1.80% Population growth drives stronger investment, spending, and general economic growth.

Dwellings Approved March 2025 25,361 5.78% Approvals have been showing monthly volatility and are up 5.78% year on year. Approval numbers are expected to volatile in the short term.

10 Year Government Bond (original) March Qtr. 2025 4.44% pa 32bp Bond yields are forecast to stabilize to a lower level over 2025.

Source: ABS, RBA, NAB, Westpac – Melbourne Institute, Oxford Economics Australia, and M3 Property. Seasonally adjusted, except where stated. *Deviation from average. ^estimated population from Oxford Economics Australia.

Growth in the domestic economy is expected to return to the regular growth level by late 2025, with headlining inflation already within the target range. However, the RBA’s battle with underlying inflation may yet come under pressure as the labour market remains tight, stimulating higher labour costs and inflation. The four major banks have agreed to pass on the most recent interest rate cut in full.

Source: ABS, M3 Property

Source: ABS, CoreLogic, SQM Research, M3 Property

Factor Comment Six Month Outlook

Dwelling Supply Housing Australia forecast net dwelling completions in NSW to total 22,800 for 2025 (compared to 24,500 in 2024) as new house and land sales as well as dwelling approvals materialise into supply completions.

Over the medium-term, dwelling completions are forecast to remain low in 2026 at 22,9800 dwelling completions, before increases from 2027. Over the longer term, completions are expected to increase to reach 28,100 completions by 2030. However, supply completions are likely to continue to be impacted by elevated construction costs, labour and materials shortages, and tightening credit conditions.

Dwelling Demand Approvals are likely to continue facing increased challenges due to decreasing dwelling prices, construction cost blow-outs and the prospect of lengthy project delays.

Median Unit Price Unit prices are expected to stabilise over 2025. Unit growth will benefit from worsening housing affordability as buyers look to purchase more affordable apartments or townhouses rather than houses. Prior to the interest rate cuts in February 2025, Oxford Economics Australia were forecasting units would experience a modest increase of 2.5% for FY2025. The recent interest rate cut is likely to provide a modest boost to the market, and we now expect there to be slightly higher growth than this forecast during 2025. Medium term Oxford is forecasting that unit prices will increase by 7.8% per annum in 2026 and 5.5% per annum in 2027.

Median House Price The Sydney market recovery slowed through the first half of 2024 and prices have seen a slight decline over the last three months. Prior to the interest rate cuts in February 2025, Oxford Economics Australia were forecasting a modest decline of -1.0% for FY2025. However, the recent interest rate cut is likely to provide a modest boost to the market, and we now expect there to be nominal growth during 2025. Medium term Oxford is forecasting that house prices will increase by 7% per annum in 2026 and 4.7% per annum in 2027.

Vacancy Levels The vacancy rate is expected to remain around current levels over the short-term. Increasing population growth and affordability constraints in the purchasermarket will continue to contribute to astrengthening in rental demand.

Unit Rents Rental growth is likely to continue over the coming year, being driven by a forecast continued tightening of the vacancy rate. Oxford Economics Australia are forecasting two-bedroom unit rents to increase by 4.0% in 2025.

House Rents House rents are forecast to continue growing, albeit at a more modest pace than the last few years, being driven by the tight vacancy rate and rising affordability constraints in the owner occupier market. According to Oxford Economics Australia, median rents for three-bedroom houses are expected to increase by 3.9% in 2025.

Source: ABS, CoreLogic, SQM and M3 Property.

The Central Coast Council is a Local Government Area situated north of Sydney covering the former Gosford and Wyong Local Government Areas. The current Local Government Area covers part or all of the suburbs of Alison, Avoca Beach, Bar Point, Bateau Bay, Bensville, Berkeley Vale, Blackwall, Blue Bay, Blue Haven, Booker Bay, Bouddi, Box Head, Budgewoi, Budgewoi Peninsula, Buff Point, Bushells Ridge, Calga, Canton Beach, Cedar Brush Creek, Central Mangrove, Chain Valley Bay, Charmhaven, Cheero Point, Chittaway Bay, Chittaway Point, Cogra Bay, Colongra, Copacabana, Crangan Bay, Daleys Point, Davistown, Dooralong, Doyalson, Doyalson North, Durren Durren, East Gosford, Empire Bay, Erina, Erina Heights, Ettalong Beach, Forresters Beach, Fountaindale, Frazer Park, Freemans, Glenning Valley, Glenworth Valley, Gorokan, Gosford, Green Point, Greengrove, Gunderman, Gwandalan, Halekulani, Halloran, Hamlyn Terrace, Hardys Bay, Holgate, Horsfield Bay, Jilliby, Kangy Angy, Kanwal, Kariong, Kiar, Killarney Vale, Killcare, Killcare Heights, Kincumber, Kincumber South, Kingfisher Shores, Koolewong, Kulnura, Lake Haven, Lake Munmorah, Lemon Tree, Lisarow, Little Jilliby, Little Wobby, Long Jetty, Lower Mangrove, MacMasters Beach, Magenta, Mangrove Creek, Mangrove Mountain, Mannering Park, Mardi, Marlow, Matcham, Moonee, Mooney Mooney, Mooney Mooney Creek, Mount Elliot, Mount White, Narara, Niagara Park, Norah Head, Noraville, North Avoca, North Gosford, Ourimbah, Palm Grove, Palmdale, Patonga, Pearl Beach, Peats Ridge, Phegans Bay, Picketts Valley, Point Clare, Point Frederick, Point Wolstoncroft, Pretty Beach, Ravensdale, Rocky Point, San Remo, Saratoga, Shelly Beach, Somersby, Spencer, Springfield, St Huberts Island, Summerland Point, Tacoma, Tacoma South, Tascott, Ten Mile Hollow, Terrigal, The Entrance, The Entrance North, Toowoon Bay, Toukley, Tuggerah, Tuggerawong, Tumbi Umbi, Umina Beach, Upper Mangrove, Wadalba, Wagstaffe, Wallarah, Wamberal, Warnervale, Watanobbi, Wendoree Park, West Gosford, Wisemans Ferry, Wondabyne, Woongarrah, Woy Woy, Woy Woy Bay, Wybung, Wyoming, Wyong, Wyong Creek, Wyongah, Yarramalong and Yattalunga.

• The Central Coast LGA median unit price was at $675,000 recording a 2.3% increase for the 12 months to March 2025.

• The suburb of Gosford median unit price was at $568,000 recording a 9.4% increase for the 12 months to March 2025.

Central Coast LGA and Gosford

Source: Domain Group – Pricefinder.

• Vacancy across the Central Coast residential market has decreased to 0.8% over the 12 months to April 2025.

• Vacancy is below the National Vacancy of 1.4%.

• The vacancy rate is below the equilibrium vacancy rate of 3.0% where supply equals demand.

Residential Vacancy Rate

Sydney National Central Coast

Source: SQM Research, M3 Property