SITE DESCRIPTION

2.1

Title details

Registered proprietors

Lot & Deposited Plan Parkes 88 Pty Ltd. Lot 1 DP1267012.

2.2 ‘ As If Complete ’ Assessment

• The potential realisation range in this report is subject to the improvements being completed in a proper and workmanlike manner and that upon completion, detailed reports with respect to the structure and service installations of the improvements would not reveal any defects or inadequacies requiring expenditure.

• That the development will be completed in accordance with the plans and specifications provided and on completion the development will fully comply with all statutory building regulations, Council’s development conditions, and each unit will have individual Strata Title and be completed in accordance with the fittings and finishes as detailed within this report.

• That the proposed units are sold on an ‘individual sale’ basis with an appropriate marketing campaign undertaken by an agent suitably experienced in the marketing of this type of property. It is also assumed that a reasonable selling period and costs would be allowed in line with market parameters.

• The views expressed are as at the report date only and are not an expression of a potential realisation range as at a future date.

2.3

Land description, dimensions and area

Land description

Identification

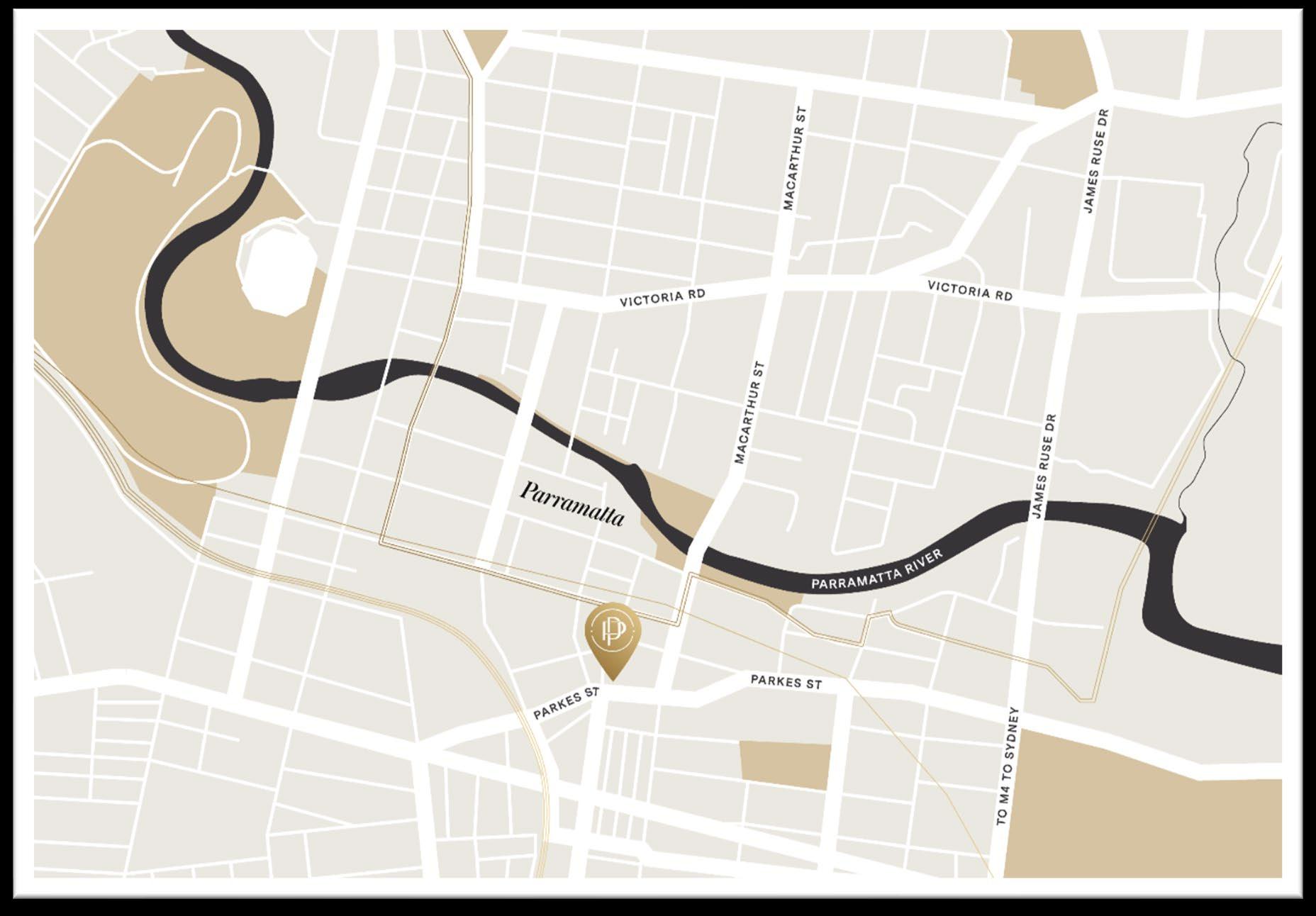

The land has been identified by reference to the street numbers, Certificates of Title, registered Deposited Plans, annexed Site Survey and our physical inspection and is situated on the northern side of Parkes Street, the eastern side of Wigram Street and the southern side of the storm water channel.

Shape and topography A consolidated irregular shaped mixed use redevelopment site which falls from south (Parkes Street frontage) to north (rear boundary).

Flood status

The site is subject to flood related development controls.

The flooding information noted has been obtained from Parramatta City Council. This information has been relied upon in my assessment of value and no responsibility is accepted for the accuracy of the flooding information provided. Should the information prove incorrect in any material respect, the matter should be referred to me for review of the valuation as we deem appropriate. Whilst we have physically identified the boundaries of the site on inspection and there do not appear to be any encroachments, we are not a qualified surveyor and no warranty can be given without the benefit of an identification survey.

Additionally, we assumed flood protection measures would have been implemented as a condition of the consent to obtain the final Occupation Certificate.

2.4 Planning

Planning scheme

Parramatta Local Environmental Plan 2011

Zoning ‘B4 Mixed Use’.

The planning information noted has been obtained from NSW Planning Portal website. This information has been relied upon in my assessment of potential realisation and no responsibility is accepted for the accuracy of the planning information provided. Should the information prove incorrect in any significant respect, the matter should be referred to us for review of the Research Report as we deem appropriate.

2.5 Locality and surrounding development

• Harris Park is a predominantly residential suburb adjoining Parramatta, the second largest city in NSW. Parramatta is a major regional centre comprising a mix of commercial, retail and residential uses, located approximately 23 kilometres west of the Sydney CBD. The subject site is located on the south-eastern fringe of the Parramatta CBD and within the Parramatta Local Government Area.

• Local shopping and retail facilities are available on Wigram Street within the “Little India” restaurant precinct, additionally regional shopping facilities are available at Westfield Parramatta Shopping Centre approximately 600 metres west from the subject complex

• Parramatta railway station/bus interchange is located approximately 450 metres north-west from the subject complex whereas Harris Park railway station is located approximately 450 metres south-west from the subject complex.

• The subject complex is located approximately 1.5 kilometres north-east from the M4 Motorway/Parramatta Road and Woodville Road intersection which allows for access to the Sydney CBD and the metropolitan road network.

• Immediate surrounding development comprises a mix of low-medium rise commercial buildings at the fringe of the Parramatta CBD in addition to a mix of residential flat buildings/mixed use complexes of varying vintage, residential/mixed use development sites currently under construction along with older style residential dwellings and heritage commercial cottages more towards Harris Park.

Locality map with the subject complex indicated

2.6 Road system, access and exposure

• The subject complex has two street frontages, with the main street frontage being to Parkes Street to the south and Wigram Street to the west.

• Parkes Street is a main local road within the Parramatta CBD, providing a two way bitumen sealed roadway with formed kerb and guttering within the vicinity of the subject site and stretches from Church Street in the west to Hassall Street in the east and is subject to moderate to high volumes of vehicular traffic and moderate flows of pedestrian traffic throughout its various sections.

• Wigram Street is a two-way bitumen sealed roadway with formed kerb and guttering, which extends from its intersection with Hassall Street in the north, through to its cul-de-sac south of Bowden Street.

• No car parking is available within the vicinity of the subject complex along Parkes Street, although time restricted on-street metered parking is available along Wigram Street. The subject complex will provide on-site car parking within six (6) levels of basement car parking and above ground car parking on Levels 1-3 for a total of 236 vehicles.

• Formed footpaths run along both street frontages of the subject complex.

SALES EVIDENCE

Due to lack of recently built modern complexes in Harris Park, we have also included comparable sales transactions of recently built and modern complexes further afield. The recent transactions include re-sales and residual stock (which the Vendor can be the Developer) sold through local agents. The more noteworthy sales from our investigations are as follows:

Address

“180 George”, 180 George Street, PARRAMATTA

SP104773, SP105613, SP105371 & SP106306

Accommodation Sale date Sale

1 bed, 1 bath, 1 car 0 1/24 - 07/24 $ 555,000 - $745 ,000 ($ 685,000 avg) 61 – 63 (62 avg) $10,278 - $12,481 ($ 11,579 avg)

2 bed, 2 bath, 1 car 04/24 - 05/24 $ 855,000 – $1,260 ,000 ($ 959,800 avg) 78 – 92 (8 3 avg) $ 10,675 - $ 13,696 ($ 11,535 avg)

3 bed, 2 bath, 2 car 02/24 - 05/24 $1,335,000 - $1,560,000 ($1 ,387,480 avg) 103 – 119 (111 avg) $ 11,226 - $13,482 ($ 12,557 avg)

A circa 2023 built mixed use complex consisting of 1 x 59 storey and 1 x 67 storey lifted buildings comprising 522 home units, a 1,000 square metres supermarket and a 75-place childcare centre with its own lift and lobby over 5 levels basement car parking.

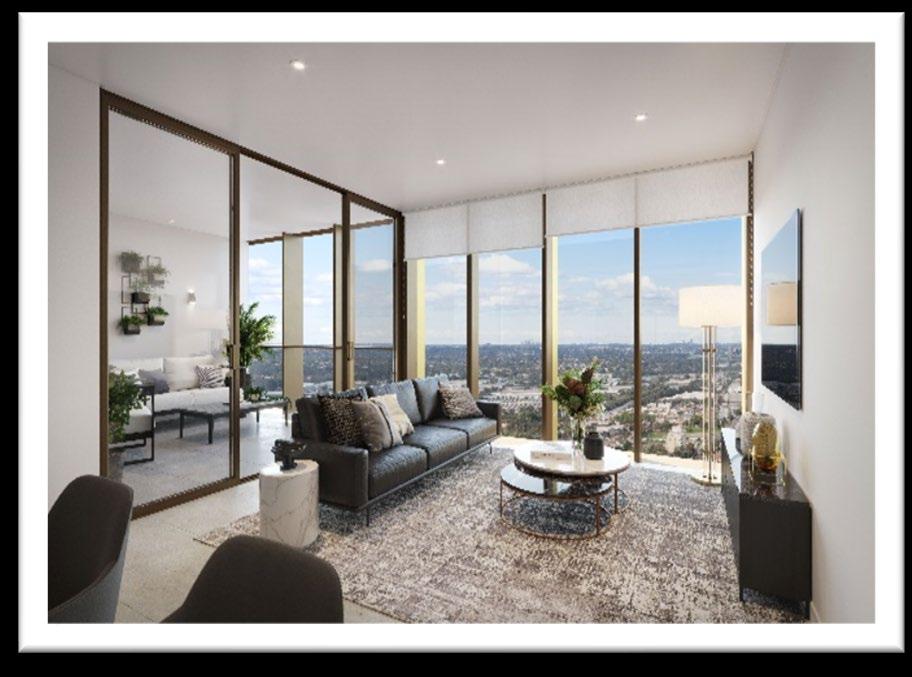

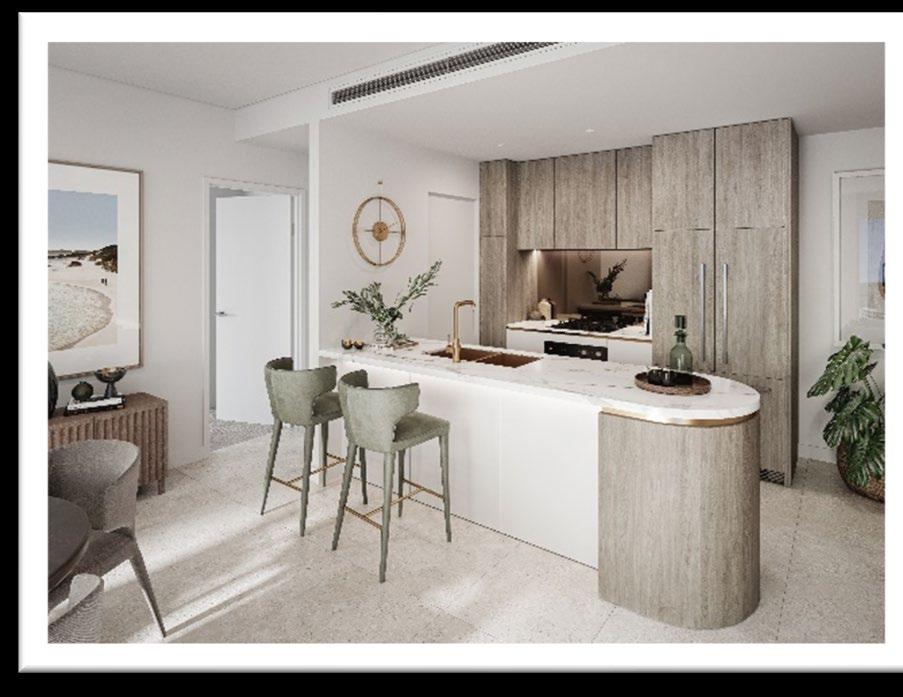

Finishes and fittings include built-in wardrobes, timber floors, full height windows, 40mm Caesarstone bench tops kitchen with stainless steel BOSCH appliances, gas cooktop, breakfast bench, integrated split system air-conditioning, LED downlights internal laundry, modern bathrooms with tiled flooring, frameless glass shower panes, wall mounted vanity, frameless mirror cabinet, balcony, security network, video intercom, CCTV cameras and secure basement car parking.

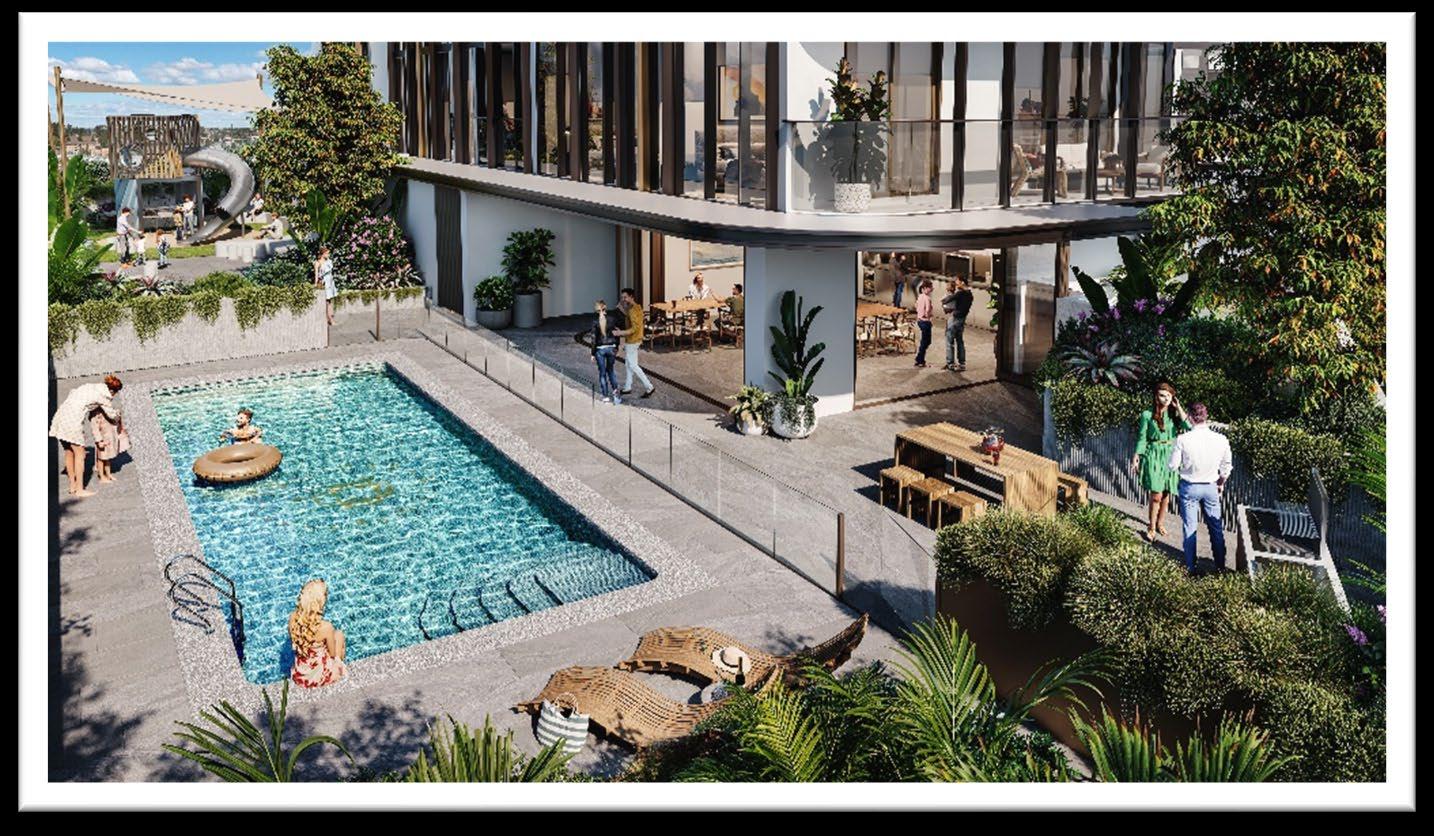

Communal areas include a 1,200 square metres of lush podium garden with a BBQ area, resort-style outdoor pool, fully equipped gymnasium and an indoor aquatic centre with a heated pool, spa and sauna.

Located within the Parramatta CBD adjoining the Parramatta River within close proximity to Parramatta ferry wharf and approximately 900 metres north-east from Parramatta railway station.

Considered an inferior complex in a comparable location compared to the subject complex.

Address

“The Lennox”, 12-14 Phillip Street, PARRAMATTA

SP102896

Accommodation Sale

1 bed, 1 bath, 1 car 01/24 – 07/24 $560,000 – $650,750 ($620,250 avg) 50 – 53 (52 avg)

$10,123 - $12,500 ($11,036 avg)

2 bed, 1 bath, 1 car 05/24 $820,000 72 $11,389

2 bed, 2 bath, 1 car 02/24 - 06/24 $830,133 - $1,000,000 ($901,031 avg) 78 – 87 (81 avg) $10,377 - $12,500 ($11,137 avg)

A circa 2021 built 47 storey lifted mixed use building comprising 414 home units (23 x studio units, 88 x one bedroom, 239 x two bedroom, 56 x three bedroom, 7 x four bedroom and 1 x five bedroom) within 39 levels along with a lower level retail/commercial component over 9 levels of basement car parking.

Features and finishes comprise a combined open plan kitchen lounge and dining, built-in wardrobes, kitchen with Miele appliances and stone bench tops, timber floorboards throughout the living areas with carpet to the bedrooms, bathroom with Parisi hardware and floor-to-ceiling tiles, LED downlights, internal laundry with dryer, balcony, alarm system and secure basement car parking.

Located adjoining the Parramatta River within the Parramatta CBD, approximately 700 metres north from Parramatta railway station and 750 metres west from Parramatta Ferry Wharf.

Considered a inferior complex in a superior location compared to the subject project.

Address

“West Village”, 88 Church Street, PARRAMATTA

SP95238

Accommodation Sale date Sale price Int. area

1 bed, 1 bath, 1 car 03/24 - 04/24 $680,000 - $690 ,000 ($ 685,000 avg) 5

$12,830 - $13,019 ($12,925 avg)

2 bed, 2 bath, 1 car 0 2/24 – 07/24 $ 800,0 00 - $865,000 ($ 839,583 avg) 74 - 81 (76 avg) $ 9,877 - $11,333 ($ 11,013 avg)

A circa 2020 built complex consisting of 1 x 6 and 1 x 39 storey mixed use towers containing 347 home units and 6 ground/podium level retail suites over 4 levels of basement car parking. Communal facilities include a rooftop lounge and view platform, as well as multiple podium level garden/green areas with BBQ and recreational areas such as a virtual-reality 18 hole golf course. The building, unit and basement entry are monitored with secure entry.

Finishes and fittings are typically of a high quality consisting of open plan living areas, with engineered timber floor boards, floor to ceiling windows and tiled balconies. Caesarstone benchtops and Miele appliances in the kitchen with mirror splash backs to all wet areas. Tiled balconies with floor to ceiling windows and sliding doors. Bedrooms are carpeted with tiling to en-suites if provided.

Located on the corner of Church Street and Great Western Highway approximately 450 metres south from Parramatta railway station and 250 metres south from Westfield Parramatta Shopping Centre. Considered a comparable complex in a comparable location compared to the subject project.

Address

“ Altitude by Meriton ”, 330 Church Street, PARRAMATTA

SP 96002

Accommodation Sale

1 bed, 1 bath, 1 car 06/24 $ 650,000 52 $ 12,500

2 bed, 2 bath, 1 car 04/24 $ 695,000 - $860,000 ($ 777,550 avg) 7 4 – 76 (75 avg) $ 9,392 - $11,316 ($ 10,354 avg)

A circa 2017 built complex consisting of 55 storey lifted residential flat buildings comprising 115 home units over 5 levels of basement car parking.

Finishes and fittings include modern kitchen with stone benchtop, engineered timber flooring throughout the living areas, wool carpet in the bedrooms, all bedrooms with built-in robes, en-suite to the master bedroom within the two bedroom units, ducted air-conditioning, and secure basement car parking.

Located adjoining the Parramatta River within the Parramatta CBD, approximately 800 metres north from Parramatta railway station and 650 metres west from Parramatta Ferry Wharf

Considered an inferior complex in a superior location compared to the subject project.

Address

“ The Pinnacle”, 46 Walker Street, RHODES

SP88557

1 bed, 1 bath, 1 car 02/24 – 03/24 $700,000 - $840,000 ($770,000 avg) 53 – 56 (55 avg) $12,500 - $15,849 ($14,175 avg)

2 bed, 2 bath, 1 car 01/24 – 05/24 $ 1,060,000 - $1,310,000 ($1,163,000 avg)

3 bed, 2 bath, 1 car 03/24

– 87 (80 avg) $ 13,230 - $16,582 ($14,482 avg)

A circa 2014 built 28 storey lifted residential flat building comprising 260 home units over 2 levels of basement car parking.

Finishes and fittings generally include modern kitchen with stone bench tops, carpet flooring in living area, modern bathroom, split system air conditioning and balconies. The east facing units offers Parramatta River, distant city skyline & harbour views.

Located approximately 300 metres north from Rhodes railway station.

Considered an inferior complex in a superior location compared to the subject project.

Address

“ Skyline”, 42 Walker Street, RHODES

SP91522

Accommodation

1 bed, 1 bath, 1 car 03/24 - 05/24 $ 525,000 - $835,000 ($ 748,750 avg) 50 – 57 (55 avg) $ 10,500 - $14,649 ($13,458 avg)

2 bed, 2 bath, 1 car 01/24 – 07/24 $850,000 - $1,100,000 ($999,000 avg) 66 – 108 (86 avg) $9,120 - $12,879 ($11,781 avg)

A circa 2015 built 28 storey lifted residential flat building comprising 225 home units over 2 levels of basement car parking.

Finishes and fittings generally include modern kitchen with stone bench tops, split system air conditioning, carpet flooring in living area, modern bathroom, study room, winter garden and balcony area. The east facing units offers Parramatta River, distant city skyline & harbour views Communal areas include a children’s playground area and BBQ facilities.

Located approximately 300 metres north from Rhodes railway station.

Considered an inferior complex in a superior location compared to the subject project.

Address

“ Sienna by the Bay”, 8A Mary Street, RHODES SP80000

2 bed, 2 bath, 1 car 03/24 - 05/24 $ 900,000 - $1,4 50,000 ($ 1,208,333 avg) 97 – 108 (102 avg) $ 8,824 - $14,948 ($ 11,931 avg )

3 bed, 2 bath, 2 car 02/24 - 04/24 $ 1,770,000 - $1,850,000 ($1,810,000 avg) 120 – 123 (122 avg) $14,750 - $15,041 ($14,895 avg)

A circa 2014 built 9 storey lifted waterfront residential flat building comprising 110 home units over a level of above ground car parking.

Finishes and fittings generally include modern kitchen with stone bench tops, split system air conditioning, timber floorboards throughout, modern bathroom and ensuite, winter garden and balcony. The east facing units offers Parramatta River views

Located approximately 350 metres west from Rhodes railway station.

Considered an inferior complex in a superior location compared to the subject project.

In referring to sales information as detailed within this report, we have relied on a range of external sources including publicly available information (newspapers, statements by public companies), subscription to information databases and information generally provided verbally by others such as estate agents, property managers, property valuers and consultants. In many instances, we have not had access to the original source material such as contracts of sale or signed leases. Although we have no reason to doubt the validity of the information provided to us, and we have relied on this information in good faith, we are unable to state with certainty that the information upon which we have relied is consistent with the contractual arrangements between the relevant parties.

Sales in the subject development

A summary of the average sale prices is provided below: Address

“ Paramount on Parkes” Subject Property

“180 George”, 180 George Street, PARRAMATTA

“The Lennox”, 12-14 Phillip Street, PARRAMATTA

“West Village”, 88 Church Street, PARRAMATTA

“Altitude by Meriton”, 330 Church Street, PARRAMATTA

“The Pinnacle”, 46 Walker Street, RHODES

“Skyline”, 42 Walker Street, RHODES

“Sienna by the Bay”, 8A Mary Street, RHODES

$641,500

$12,578/m2 (51m2) $883,925 $11,764/m2 (75m2) $1,222,250 $12,831/m2 (95m2)

$685,000 $11,579/m2 (62m2)

$620,250 $11,036/m2 (22m2)

$685,000 $12,925/m2 (53m2)

$650,000

$12,500/m2 (52m2)

$770,000 $14,175/m2 (55m2)

$748,750 $13,458/m2 (55m2)

$959,800 $11,535/m2 (83m2)

$820,000 $11,389/m2 (72m2)

$839,583 $11,013/m2 (76m2)

$777,550 $10,354/m2 (75m2)

$1,163,000 $14,482/m2 (80m2)

$999,000 $11,781/m2 (86m2)

$1,208,333 $11,931/m2 (102m2)

$1,387,480 $12,557/m2 (111m2)

$901,031 $11,137/m2 (81m2)

$1,710,000 $21,646/m2 (79m2)

$1,810,000 $14,895/m2 (122m2)