Unless there is a fundamental shift away from current pre-construction tendering models, we may see the same deficiencies in reporting reductions in embodied carbon and other Greenhouse Gas Emissions, with governments being unable to provide reports with independently verifiable data.

A Bill of Quantities (BoQ) prepared by quantity surveying professionals provides a common basis for tenderers by being based on the nationally recognised Australian and New Zealand Standard Method of Measurement of Building Works. A BoQ breaks down the contract works in a formal structured manner into the detailed scope of

works to be tendered and reflect accurately the work required by the contract drawings and specifications. They also provide a check of the contract works before tender and a continuation of the cost planning process as well as defining a financial structure for the administration of the contract. A BoQ offer positive means of eliminating and preventing waste thereby increasing industrial efficiency and economy.

Benefits that result from the use of a contracted BoQ include:

■ clients save money due to lower tender prices on projects where a guaranteed BoQ is used

■ tenderers compete on an equal basis of quality and quantity resulting in more competitive tendering

■ tenderers make fewer errors in tendering and ensure that all works are priced

■ tendering costs and risks for contractors and sub-contractors are reduced

■ the number of sub-contract prices received by contractors is increased and the range of those prices reduced

■ assessment of tenders received is simplified by the structured format

■ tendering time is reduced, particularly on larger projects

■ tenderers can spend more time on buildability, programme and approaches to problem areas

■ providing a quality control review, during preparation, to identify inaccuracies and inconsistencies in drawings and specifications before going to tender

■ assisting in reducing disputes during construction

■ calculation of progress claims is straightforward and reliable

■ prices for variation works are reduced by the use of BoQ rates

■ data from a BoQ is available for accurate calculation of depreciable items for taxation purposes

■ providing an absolute basis for the calculation of consultant's fees

■ providing a readily available basis for asset management of a completed building, cost-in-use studies, maintenance schedules, general insurance, and insurance replacement costs

■ improving standards of accountability, probity, equity, and overall efficiency in the tendering process

■ enabling the measurement and quantification of embodied carbon and other greenhouse gas emissions.

In comparison, a BoQ that is provided for information only is viewed by many contractors as presenting additional risk. A BoQ issued for information purposes only is less useful as a tender document and necessitates a greater need for each tenderer to obtain prices based on the specifications and drawings. This results in increased tender prices compared to a guaranteed BoQ.

By acting as the funnel through which all project information is channelled and by processing the documentation the quantity surveyor preparing a BoQ is in the unique position of being able to view the contract documentation in a detached manner, unfettered by any preconceptions or vested interest.

DULARI GUNASEKARA MAIQS, CQS Quantity Surveyor, WT

DULARI GUNASEKARA MAIQS, CQS Quantity Surveyor, WT

Working as a quantity surveyor on the refurbishment works of the Australian Parliament House was a profound privilege that left a lasting inspiration on me. The structural design, architectural style, history, and view from the rooftop align with the old parliament house, internal water pond, and boomerang shape of the buildings and finishes were captivating, and I was honoured to have contributed to some renovation works.

Australian Parliament House is one of the great places in Australia, situated in the Australian Capital Territory State. The Parliament House covers a vast area of 7.5 hectares, total floor area of 240,000 square metres, spread across four levels, including one below ground level.

The building’s 81-metre-high flag mast, a significant national symbol, adds to its both functional and architectural.

The Parliament House uplifts public access and involvement while responding to the Australian climate, landscape, vegetation, and light quality. The architectural firm Mitchell/Giurgola & Thorp’s vision of a Parliament House that symbolically rose out of the landscape won the design competition and has become an iconic landmark of the nation.

Among the building’s most impressive elements are the Marble Foyer, adorned with marble columns, and the Great Hall. Visitors to the Parliament House can also appreciate its seamless integration into Walter Burley Griffin’s original design for Canberra from the roof of the building.

The Parliament House’s architectural design and landscaping of the project inspire the nation’s commitment to democracy and public engagement. It was a privilege for me to work in a cost management role giving value for money in its refurbishment works.

I have been spoilt with many choices picking a project that has been inspiring. However, the project that inspired me the most was my recent involvement being the cost manager for Queensland Health Capital Division for their Capital Expansion Programme involving twelve hospital projects. The role I undertook was slightly different from other cost management as I acted as the client-side cost manager, working across the whole program on their behalf.

I prepared Managing Contractors’ tenders including setting up returnable schedules and providing liquidated damages calculations with the pricequality method tool to assist with tender evaluation. I reviewed and provided tender recommendations for

contractors and key consultants on the programme level rather than on specific projects.

Post-tender period, I was privileged enough to fly to Brisbane and sit in the commercial meetings with Queensland Health Capital Division executives and MDs from the contractor’s side as a cover for our client’s Commercial Lead. It was a great experience to take part in these meetings where billion-dollar projects were negotiated, even this early in my career and interstate where I had not worked before. The contracts for the twelve hospital projects were successfully awarded within the approved program budget. The complexity of such a significant public procurement process as well as its successful outcomes has inspired me.

I enjoyed helping the client to eliminate commercial risks during what was a significant procurement process.

I am grateful that Genus Advisory selected me for this project in which I gained valuable insight and inspired me with experience being a client-side cost manager.

The Randselva Bridge project in Norway stands as an exceptional source of inspiration. This 634-meter cantilever concrete bridge had been constructed entirely through the use of BIM models with not a single drawing being produced, marking a ground breaking approach to digital advancement. Whilst BIM adoption varies globally, BIM mandates are becoming more common, and as quantity surveyors (QSs) we should be aware of the imminent possibility of BIM becoming mandated in Australia and New Zealand.

Traditionally, BIM models often lack QSspecific considerations and inputs, this poses many challenges for the QS and render the BIM models less useful. The Randselva Bridge project underscores the immense benefits achievable with full BIM utilisation. By embracing paperless design and construction, this project reaps numerous advantages.

The integration of object modelling and clash detection ensures a buildable design. A comprehensive 3D model enhances on-site and off-site work comprehension. Reinforcement details, meticulously coordinated with pour phases (over two hundred), streamline bar bending list extraction, reducing errors, and saving time.

The project excels in 4D (time) and 5D (cost) planning, facilitating flexibility through parametric design and enabling swift revisions.

Furthermore, cross-border collaboration thrives with the universality of BIM model information.

As QS professionals, active involvement in shaping modelling standards like ISO19650 is pivotal for ensuring models’ cost applicability. With the trend of fewer drawings, our readiness for this transformative shift lies in our ability to collaborate with designers to establish BIM protocols. Enhancing QS engagement with the design process and our ability to focus on keeping our projects on budget.

The appeal of digital transformation within the industry is multifaceted. Beyond the obvious technological advancements, it also addresses the pressing issue of industry workers’ sustainability and wellbeing. Amidst increasing pressure on fees, costs and deliverables mixed in with shrinking timelines, the industry’s mental health crisis looms large. The construction sector presents distressing mental health statistics globally, with construction workers being at heightened risk.

In closing, the Randselva Bridge’s pioneering use of BIM underscores its transformative potential. Yet, the project is more than technological innovation; it’s a testament to the industry’s ability to address profound challenges.

By engaging in digital initiatives and reshaping our approach, we stand a chance to make construction not only more innovative but also more humane. After all, without a resilient workforce, there can be no monumental projects.

The memory of my initial venture into the realm of the construction world is the design and build of a power plant which remains etched in my mind as an unparalleled source of inspiration. This project holds a significance akin to the enduring memory of a first love, marking my inaugural strides into the professional domain.

Fresh out of university, I exuded unwavering self-assurance, convinced of my encompassing understanding. However, the harsh realities of the practical world quickly humbled me, serving as a catalyst for my determination and growth.

Undaunted by challenges, I embarked on this expedition with sheer determination. Armed with nothing more than a simple hand sketch and a complete lack of knowledge about power plants, I confronted the intricate task of crafting a feasibility study within a tight timeframe. Through uncountable days of relentless effort, the team transformed the rudimentary sketch into an all-encompassing plan, navigating uncharted waters and mastering unfamiliar concepts.

The triumphant culmination of the project, from inception to realisation, stands as my most rewarding achievement. The transformation of abstract numbers and theories into tangible reality illustrated the enchantment of transmuting aspirations into solid accomplishments. This experience illuminated the resilience of perseverance, the importance of embracing humility, and the profound fulfilment of materialising the dreams of others.

In essence, the power plant endeavours in Western Sahara remain an unwavering fount of inspiration — a testament to the transformative potency of dedicated commitment and the profound influence that the realisation of ideals can wield over individuals and communities.

VAN WRIGHT

I am currently working on the refurbishment of The Church of Jesus Christ of Latter-day Saints Temple, in Apia, Samoa. This building is considered the House of the Lord here on earth, and so it is one of the iconic buildings on the island, and an honour for me to work on this building, as I am a member of the Faith. I have worked on numerous of the Church’s Chapels and meeting houses here in Samoa, but this is the first time I have been given the opportunity to work as a quantity surveyor on a Temple. My goal when I first started off with my career, was to one-day work on one of the Church’s Temples, and now I have in Samoa, where I was born and raised.

The project has a lot of constraints, one being our program, as we have only a three-month window, to carry out the renovations required before it re-opens.

To date, the weather has been great to us, and we have passed mid-way through our programme and have reached one of our major milestones. All in all, I am grateful to the Church for entrusting me as one of their representatives to oversee this project.

I came from a dysfunctional family where my grandparents, parents and seven of my siblings lived in the same house. We had one cold water tap in the house and a bucket at the end of the garden for our toilet. Our father was neither fatherly nor a good husband. It was not a happy place, although the children stuck together and supported each other and Mum.

I started to rebel, and I joined a group of “friends” who were steering me into petty crime.

At age fifteen, I had no idea what my future would hold work-wise. I met regularly with an older cousin who was a quantity surveyor with a major construction company. He would talk to me and explain what a great career it could be. I set my target to become a quantity surveyor.

At age sixteen, I achieved passes in five ‘O’ level exams. I worked part-time at a fish and chip shop on the weekends. My father spoke with the owners, encouraging them to employ me fulltime at GBP12 per week. I declined their offer as I wanted a career. There was one position for a cadet advertised in our region, which I applied for and was accepted, with a salary of GBP4 per week. My father kicked me out of the house, and I never went back.

At sixteen I was on the street, not knowing which way to turn — petty crime or career? Looking back, I’m glad I chose a career. I became very successful, and it saved me from taking the wrong road at such an early age.

It was hard to live on low wages, but I survived — and even received a GBP1 raise due to my situation. I concentrated on working hard and taking on as many roles as possible in the office, to teach myself with help from other staff.

Six years later, I responded to an advertisement by Rider Hunt seeking a quantity surveyor for their Sydney office. I was accepted and in June 1971 arrived in Sydney.

In 1976, I transferred to the Rider Hunt Townsville office, which covered a huge area from central Queensland to the Gulf and out to the Northern Territory. In 1983, I was offered a partnership in the Townsville office, which also included shares in the whole group.

This decision meant that I had to get a qualification. I took the AIQS “Direct Final”, passed all exams on my first attempt, and was awarded a certificate and prize for achieving the highest student standard in the examinations.

As a Director of Rider Hunt, I considered how to retain new graduates who were often poached once their qualifications were obtained by giving them a career path that showed what they could achieve within the company. Rider Hunt had offices in many locations to be able to allow transfers within the company but initially, this idea was not accepted by all Directors.

Other overseas opportunities presented themselves to help with my agenda. Once Papua New Guinea (PNG) opened, I met many travellers from the Pacific region who came as far south as PNG but not into Australia which led me to Guam. New clients I met on the island of Guam had no idea what cost planning was but embraced the technique when we showed them how to cost manage their design and construction. In Guam, I met consultants who suggested I take a trip to Hawaii.

I met with one of the biggest developers who had not heard of quantity surveying, and it became apparent to me that there was little cost planning going on in the American system at the time. I met with a small local cost engineer consultancy firm which Rider Hunt purchased, and we established ourselves in Hawaii. Hawaii led to mainland USA where Rider Hunt had two small offices.

Hawaii then led me to the Philippines. There were quantity surveying companies operating there and in the 1990s there was a lot of work. After researching the industry, we purchased into a small local company and expanded from fifteen staff to onehundred-and-fifty staff within a year. Today, Rider Hunt has nine offices there.

I would like to add that the President of the USA group came from Rider Hunt Sunshine Coast and one Vice President came from the Townsville office.

One other Townsville staff member went from Townsville to the Rider Hunt USA group and then became a manager of Gardiner & Theobald’s New York office. I am very proud of the achievements of these men and pleased to know that I helped them to progress their careers.

Rider Hunt had two offices in USA in the 1990s, now there are twenty-one in that region.

I started Costplan Services in 2006, now trading as part of the Costplan Group. I have been instrumental in generating and overseeing other offices in the group in Papua New Guinea, Ashford (UK) and Cambridge (UK). These offices working collaboratively, have taken on projects in Iceland, Norway, Holland, Sierra Leone, Cape Verde, Nigeria and several Pacific Islands.

Costplan Group has grown to a company with now over thirty employees worldwide. Our focus is on developing local offices in all regions, investing in training and developing future leaders.

As the saying goes, “The world is your oyster”.

Quantity surveyor education provides a solid base for your career in an industry that covers every form of infrastructure and construction. The education is so broad that it does not govern you to just being a quantity surveyor. Other opportunities can be with entities such as developers, banks, financial institutions, and legal firms.

You can expand your skills into areas such as project management, programming, or education.

You can work in almost every corner of the globe. It’s up to you.

Our industry is lacking in skills in some areas and needs our emerging quantity surveyors to develop their skills at each level. Take your time, learn properly, and don’t undervalue experience, and you will be a more well-rounded quantity surveyor with the potential to be a future leader.

From my point of view, it is a great profession, in which I have been active since 1964 and still enjoy the challenges it brings, from helping staff tackle project tasks, analysing construction methods, or just meeting new clients to discuss projects. I have clients that have stayed loyal for over thirty years. Keep learning, don’t be afraid of hard work and taking on something new. The skills your education has given you will come to the fore and get you through.

Keep learning, don’t be afraid of hard work and taking on something new.

In this global insight piece, Brian Coyle and Carl Lobato MAIQS discuss the key benefits and how Early Contractor Involvement (ECI) delivers value in construction projects.

The Australian construction market is particularly challenging for general contractors and subcontractors at present. Inflation in material costs, labour shortages and rising interest rates have created a difficult situation for many companies, particularly those locked in fixed-price contracts and legacy projects won prior to or during the COVID-19 pandemic.

According to the Australian Securities and Investments Commission, 2,117 companies went into administration during the financial year 2022–231, with the construction industry accounting for more than a quarter of corporate insolvencies.

This situation has ramifications throughout the construction industry and significant implications at a project level. With the traditional competitive design-bid-build procurement model, which is still prevalent in the Australian market, clients may find that there are fewer firms prepared to tender, due to the associated risks as referenced. This leaves developers in a tough position, with limited options for negotiation.

It is particularly problematic in the booming data centre sector, where they are racing to meet exponentially growing demand. In line with this, it has resulted in an increasing number of our clients with large, complex projects in industries such as data centres and life sciences to consider alternative procurement strategies, such as early contractor involvement (ECI).

With an ECI strategy, the general contractor is engaged prior to the design phase, at the same time as the design consultants. Their engagement will be based on the provision of professional services support during the design phase, followed by managing the project during the onsite/construction phase.

During the design phase, their level of design responsibility and input can vary depending on the needs of the client, but the critical element is that they will be involved in the development of the scheme from an early stage and will therefore be able to inform aspects such as constructability, design optioneering, safety-in-design, cost assessments, and consideration of alternative materials.

This offers numerous other benefits including:

• advice and support on council requirements and approval processes

• placement of early orders of materials and equipment

• greater certainty of the general contractor’s management team and resources

• greater certainty on the selection of prime subcontractors

• in-depth knowledge of the project among the on-site team, due to earlier involvement in the lifecycle of the project.

One of the most significant advantages of ECI is the ability to maximise the general contractor’s expertise to fasttrack the programme. With this key partner already engaged, the drawings for the civil and early works packages can be prioritised, and construction can begin while the rest of the design is still underway.

This strategy does require a highly cohesive team approach on the part of the stakeholders, but when managed correctly it can provide real programme benefits. It is particularly relevant on major data centre and life sciences projects, where speed to market is always a high priority.

From a pricing perspective, ECI delivers the benefits that are often assumed to derive from traditional competitive procurement.

In an ideal world, the design-bid-build model would involve several general contractors competing against each other to offer the lowest price. In reality, and especially in the current market, there are only a certain number of firms able to undertake larger, more complex projects, and even fewer that are willing

to engage in a tender process in which price and margins are the only or main consideration.

Crucially, this applies to specialist trade contractors too. The subcontractor pool in Australia is still quite shallow, particularly for large complex projects in the data centre and life sciences spaces, so many of the same firms will be bidding to each general contractor. This often results in a situation where the only significant differentiator in a tender submission will be the general contractor’s preliminaries, margin, and project allowances.

In contrast, ECI is a much more attractive prospect for general contractors. When the prize is earlier, longer involvement in a project (for example, a three-year programme of work instead of two), they are more likely to put their best foot forward to secure the work.

With a longer lead time and greater insight into the pipeline of work, the general contractor is better able to guarantee the desired management team. This is also an effective way to lock in prime subcontractors too, a key advantage when both labour and subcontractors are in short supply.

If run correctly, the ECI tender process and associated workings can safeguard against future issues with

the successful general contractor, both from a budgetary and technical perspective.

An ECI tender should involve a rigorous review process, in which competition is based on a broader range of criteria, weighted appropriately, including the experience of the proposed team, the firm’s track record on similar projects, their safety record, programme and proposed completion date, value engineering initiatives, project approach, and more.

Price is obviously still a very important element too. Bidding companies submit their proposed preliminaries, resource loader, margin, and hourly rates. Combined with an independent estimate for the subcontractor or trade portion of the works, based on the level of design available, this can be compiled into a forecast for the overall project cost to provide the developer with a greater level of certainty.

As the design progresses, the winning general contractor can also be required to provide periodic cost plans as part of their ECI scope, independent of the continuous involvement of a cost manager or quantity surveyor. Moving forward, ECI is expected to account for a growing proportion of tenders as clients choose this approach to improve project outcomes. When conditions are challenging, it’s essential to take a clear-eyed view and to be realistic about the strategies that will deliver the desired result — and in the current market, the certainty that ECI can provide is perhaps one of the most valuable commodities of all.

If run correctly, the ECI tender process and associated workings can safeguard against future issues...

The Whakakāinga Aurecon Office Fitout in New Zealand stands out as an exceptional example of successful construction project delivery within specified delivery and budgetary constraints while embracing a vibrant Māori culture.

Whakakāinga Aurecon Office Fitout is 3,121m2 of new office space at 110 Carlton Gore Road, Newmarket, Auckland, New Zealand. Mansons TCLM completed the new development base build, and Aurecon was responsible for the interior fit-out of the space. The project was a finalist in the NZIOB Building People Awards held in August 2023.

The entire project management team incorporated diversity, collaboration, guardianship, health and wellbeing, mentorship, courage, boldness, leadership, and future-focused thinking to achieve a truly outstanding project that was successfully finished on time. The project team nominated included Caleb Kennedy and Chris Harrison (Savoury Construction — main contractor), Faith Chimhundu, NZIQS Graduate (BBD NZ — quantity surveyors), Patricia Balbas (TSA Management — project managers) and Arron O’Hagan (Warren and Mahoney — design team).

Savory Construction worked with consultants throughout the project to impute and track what the carbon consumption would be using a carbon fitout calculator. They then offset the carbon tonnage using certified offset credits through Toitu Envirocare.

The use of natural timbers in the project design was a significant aspect of incorporating New Zealand cultural elements.

The design team worked extensively with Whakakāinga Aurecon and Ngāti Whātua to tell the story of the curious traveller and its link to the local environment.

Pine and macrocarpa timbers were extensively utilised in various elements of the fitout, including flooring and a large amount of joinery. An impressive staircase beats as the heart of the office and adds warmth and richness.

The procurement, coordination and installation of the beautifully designed timber staircase took a high level of detail and precision to execute.

Kennedy and Harrison recognised the need for expert guidance in incorporating Māori culture into the construction project. They collaborated closely with Māori cultural consultants and local iwi (tribe) Ngāti Whātua who provided invaluable insights, cultural expertise, and guidance throughout the project’s lifecycle. The result is a fitout that tells the story of The Curious Traveller and its links to the local environment and ensured the project’s authenticity and respect for Māori customs and protocols.

The Savory Construction team also worked in close partnership with designers Warren & Mahoney to integrate Māori design principles and aesthetics into the construction project. Their collaborative efforts resulted in a seamless fusion of contemporary architecture and Māori design elements, creating a visually stunning and culturally significant outcome.

Whakakāinga means to make a home, and the team has gone above and beyond to create an environment that fosters a sense of belonging and pride for both the local community and visitors.

This collaboration enabled the project to incorporate sustainable practices aligned with Māori principles of kaitiakitanga (guardianship) and fostered the integration of traditional knowledge regarding the use of materials, energy efficiency, and environmental stewardship.

Another notable aspect of this project is the team’s exceptional collaboration with consultants and the base build contractor, Mansons TCLM.

Understanding that successful projects rely on effective teamwork and synergy, the project team demonstrated exceptional leadership and coordination skills, resulting in a harmonious and efficient working environment.

Throughout the project, the team consistently fostered an atmosphere of open communication and mutual respect. By valuing the expertise and input of all stakeholders, they created a collaborative platform where ideas were freely shared and synergies explored. This inclusive approach enhanced the overall project outcomes and facilitated a sense of ownership and pride among all team members.

The team’s commitment to transparent decision-making, fostering strong relationships, building trust among team members and efficient problemsolving further solidified their collaborative efforts. By prioritising clear communication channels, regular meetings, and constructive feedback loops, they were able to navigate challenges effectively and maintain positive project momentum.

The project management team firmly believes in the power of diversity and actively promotes inclusivity in their work and behaviour.

Their commitment to diversity is reflected in their decision-making processes, where they prioritised considering a wide range of viewpoints. They actively encouraged participation from team members with diverse backgrounds and experiences, creating opportunities for personal and professional growth. By embracing diversity, they have elevated the quality of the project and enriched the overall team dynamics.

This article was based on Savory Construction’s entry into the NZIOB awards 2023.

TRANSACTION COSTS

Construction projects involve transaction costs (TCs) both during the pre and post-contract phases. If these costs are not managed appropriately, they can lead to project cost overruns.

The purpose of this study is to explore the mitigation strategies for reducing transaction costs in the Australian construction industry. Qualitative data was collected by conducting semistructured interviews with professionals who have been working as contract administrators, project managers, quantity surveyors and construction managers. The data was then analysed using thematic and content analysis techniques. The research identified various strategies such as recruitment of qualified experts, building trust and relationships, and the use of digital technologies such as BIM, drones, and point cloud.

One of the success factors for construction projects is to complete them within budget. However, various researchers in Australia and other countries frequently reported project cost overruns. Terrill et al. identified that up to 52% of construction projects experience cost overruns.1 Similarly, Love et al. found that an average of 12.22% of projects had experienced cost overruns.2 The most prevalent causes of cost overruns as identified by previous researchers were design

changes, increases in the prices of construction materials, labour shortages, variations in scope, and force majeure.3 However, most of these causes are related to production costs.

Thus, this research is conducted to fill the aforesaid knowledge gap.

According to Li et al., construction project cost includes not just the production costs, but also transaction costs (TCs) such as the cost of bidding, acquiring information, processing claims, contract administration and dispute resolution.4 Also, Guo et al. explored TCs and classified them into pre-contractual and post-contractual.5

Pre-contractual TCs are costs incurred before signing the contract such as costs related to information gathering, communication, tender documentation, bidding, feasibility studies, environmental impact assessments, and negotiations.6

Post-contractual TCs are costs incurred on activities such as set-up and running, enforcement, decision-making, and dispute resolution after signing the contract. However, mitigation strategies for reducing transaction costs in the context of Australia were not thoroughly investigated.

The data analysis yielded many strategies that may be used to minimise TCs. According to the findings, most experts strongly advised employing an experienced project team since technical competency and experience can minimise a significant amount of unnecessary TCs incurred during project transactions. The interviewees agreed that the most important element of a project is the project scope and contract.

As a result, having a well-defined scope, good documentation, and readily available information would reduce most TCs. Following that, most participants suggested strategies such as maintaining uniform procedures and policies, as well as allocating sufficient resources within the organisation. Furthermore, it was suggested to implement transparent pricing techniques and competitive bidding procedures.

Maintaining a positive relationship between the contractor and the client, and developing trust with the consultant or contractor, was also suggested as a passive approach to reducing TCs. A summary of the strategies is presented in Table 1.

1 Terril, M., Coates, B. & Danks, L. 2016, ‘Cost overruns in Australian transport infrastructure projects’, Proceedings of the Australasian Transport Research Forum, vol. 16, Melbourne, Australia, p. 18.

2 Love, P.E., Wang, X., Sing, C.P. & Tiong, R.L. 2013, Determining the probability of project cost overruns, Journal of Construction Engineering Management, vol. 139, no. 3, pp. 321–330.

3 Abidin, N.Z. & Azizi, N.Z.M. 2020, Soft cost elements (SCE): Exploring management components of project costs in green building projects, Environmental Impact Assessment Review, vol. 87, pp. 106545.

4 Li, H., Arditi, D. & Wang, Z. 2013, Factors That Affect Transaction Costs in Construction Projects, Journal of Construction Engineering and Management, vol. 139, no. 1, pp. 60–68.

5 Guo, L., Li, G., Li, P. & Zhang, C. 2016, Transaction Costs in construction projects under uncertainty, Kybernetes, vol. 45, no. 6, pp. 868–883.

6 Rajeh, M., Tookey, J.E. & Rotimi, J.O.B. 2015, Estimating TCs in the New Zealand construction procurement, Engineering, Construction and Architectural Management, vol. 22, no. 2, pp. 242–267.

Indirect costs, unforeseen costs, or costs related to the transactions between project parties are often overlooked.

Technical Competency

• Recruiting a qualified and expert project team

• Recruiting a project team who are diligent in decision making

• Recruiting employees who are competent in using new software and platforms

• Implementing a proper methodology before negotiating with clients.

Scope and Contract

• Allowing appropriate time to go through contract documentation

• Incorporating more time to plan and research

• Having information readily available to use

• Maintaining clear and proper documentation and records

• Trying to maximise the detailing of the project.

Organisational Aspect

• Having a proper organisation structure with a key point of communication

• Establishing standards procedures and templates

• Installing efficient software/systems for compliance works

• Implementing digital technologies such as BIM, drones and point cloud

• Focus on procuring sufficient resources to cater to project needs.

Bidding Behaviour

• Encouraging a more transparent bidding procedure

• Advising on more competitive bidding than bidding low

• Advising on an apple-to-apple bidding procedure

• Conducting a advanced feasibility study before factoring.

Trust and Relationships

• Entrusting the selected builder from the beginning

• Use a single and double-pointed contractor base

• Making good relationships with all parties with mutual trust.

Client’s Behaviour

• Recruiting a consultant/superintendent if having less experience and knowledge in construction projects

• Following a timely payment system

• Having sufficient capital/funds in hand before entering a project

• Indulge more time to decide the requirements and scope of the project

• Taking decisions diligently and on time.

Procurement Aspect

• Installing efficient software/systems for procurement

• Involving more collaborative procurement methods which increase early contractor involvement

• Following selection criteria or a matrix to find the best-suited procurement method.

Contractor’s Behaviour

• Increasing transparency during variations and claims

• Following a more diligent approach with clients

• Implementing more flexibility in project works.

Leadership and Management

Proper Planning

Risk Allocation

• Maintaining a strong leadership

• Agreeing on a proper conflicts management process

• Implementing a swift, smooth, and an efficient communication system

• Planning on a sustainable vendor management procedure.

• Proposing to add an extra percentage to cover up TCs at the planning stage

• Incorporating more time to plan and research

• Applying a proper feasibility.

• Identifying project risks from an early stage

• Implementing a fair risk allocation process.

The mitigation strategies for reducing TCs in construction projects were explored in this study. This was investigated by conducting semistructured interviews with professionals in the Australian construction sector. Several mitigation strategies for minimising TCs were identified and presented in tabular format. These include recruitment of qualified experts, building trust and relationships, and the use of advanced software or digital technologies such as BIM, drones and point cloud.

Moreover, it was revealed that the mitigation strategies are interrelated; therefore, one strategy alone may not mitigate the effect of TCs on total project cost. This research has both theoretical and practical implications.

The findings of the study are an important addition to the body of literature on TCs From the practice point of view, stakeholders involved in the construction of building projects can adopt the strategies identified in this research to minimise transaction costs or avoid unnecessary TCs in their projects.

This will eventually aid them to reduce project cost overruns. Although this study met its aim and objectives, it has some limitations. The data collection for the study was limited only to the opinions of professionals who work for main contractors and cost consultants. Consequently, the views of the owners and other stakeholders were not considered. Moreover, the focus of this research was on TCs associated with building projects.

Therefore, it is suggested that future studies can explore the views of other stakeholders such as owners, material suppliers, and subcontractors on TCs in infrastructure projects.

The construction industry plays a crucial role in supporting Singapore’s economy and its growth. However, from the onset of 2020, this industry was crippled by the impact of COVID-19. From labour crunch to supply chain disruptions, the industry struggled to keep up with the rapid changes caused by COVID-19, resulting in lengthy delays on projects and new developments being put on hold or scrapped.

Information gathered through published articles shows that COVID-19 disrupted major supply chains, transportation (logistic), labour supply, and other related issues around the globe.

These changes have led to a shortage of imported construction materials and foreign labour in local manufacturing and construction, resulting in delays in new developments.

This paper aims to explore the impacts of construction materials shortage in Singapore’s construction industry caused by the COVID-19 pandemic.

A COVID-19 Temporary Measure Act 2020 (COTMA) was introduced by the Building Construction Authority (BCA) to the construction industry in June 2020 which relieved contract parties through the extension of the project timeline, co-sharing of qualifying cost and foreign manpower cost.

With the aid of COTMA and the improvement of the COVID-19 situation around the world, the supply chain of construction materials is gradually recovering.

However, contractual parties in a construction project still need to find ways to manage the project’s budget as material costs continue to fluctuate.

Planning with Building Information Modelling (BIM) and Design for Manufacturing and Assembly (DfMA) can be adopted to mitigate material cost increases.

The road to recovery for the industry remains a long and difficult one. Industry players need to put continuous effort into adapting to the new obstacles and challenges to ensure resilience.

Since 2019, the global pandemic COVID-19 has greatly disrupted the world economy, affecting many industries including the construction industry. Many construction projects face disruptions to their project timeline due to supply chain disruption, increasing costs and uncertainty in the global economy.

Today, as the world slowly recovers from the effects of the pandemic, the construction industry is still plagued with challenges caused by rising construction costs.

Project costs may be directly affected by (but not limited to) the increased building material costs and delays caused by the current logistical situation, which affects the project timeline and the requirement of implementing Extension of Time and Liquidated Damages.

This paper will focus on the construction industry in Singapore, studying the recent TPI trends and construction material price fluctuations for concrete and steel.

Additionally, this paper will focus on studying how to more effectively manage or optimise construction materials to minimise the overall project costs by the following ideas:

1. Planning with Building Information Modelling (BIM)

2. Design for Manufacturing and Assembly (DfMA).

COVID-19 has affected many industries, from which the construction industry was not exempt, as the construction industry can be greatly influenced by the economic cycles.

One of the reasons why the construction industry was affected is due to increases in prices of building materials.¹

With a focus on the impact of COVID-19 on Singapore’s Construction Industry, it can be observed that Singapore’s Gross Domestic Product decreased from 3.7 (2019) to 2.7 (2020)2 and the construction industry’s contribution to the Singaporean GDP has greatly reduced from S$18.09B to S$11.5B which has an approximate 57.3% (Figure 1).

According to Zhu, it was reported that the high cost of building materials would continue for the rest of 2022 and as the Linesight director quoted, the construction costs may only stabilise in 2023.4

A method of quantifying the effects of COVID-19 towards the construction industry would be through the study of the Tender Price Index (TPI).

TPI evaluate the changes in tender prices with consideration to most of the components. This typically includes the cost of producing the output of construction activities.5 TPI also helps clients and tenderers evaluate how the building tender prices are changing. Additionally, it is important to note that TPI can help the industry determine the level of individual tenders, time adjustments, pricing, cost planning, predicting cost trends and general comparisons.6

1 GEP 2020, ‘ The Impact of COVID-19 on Building Materials’ , GEP, accessed 18 July 2023, <https://www.gep.com/blog/strategy/the-impact-ofcovid-19-on-building-materials>.

2 New Zealand High Commissioner in Singapore 2021, Singapore’s Construction Industry August 2021, New Zealand Foreign Affairs & Trade, <https://www.mfat.govt.nz/assets/Trade-General/Trade-Market-reports/Singapores-Construction-Industry-August-2021.pdf>.

3 Taylor, P. 2022, ‘Teradata Corporation’s global annual revenue from 2010 to 2021’, Statista, accessed 18 July 2023, <https://www.statista.com/ statistics/545622/worldwide-teradata-annual-revenue/>.

4 Zhu, M. 2022, ‘High material prices to remain a drag on Singapore construction this year: report’, Business Times, 14 February, <https://www. businesstimes.com.sg/companies-markets/energy-commodities/high-material-prices-remain-drag-singapore-construction-year>.

5 Goh, B.H. 2005, ‘The dynamic effects of the Asian financial crisis on construction demand and tender price levels in Singapore’, Building and Environment, vol. 40, no. 2, pp. 267–276.

6 Ernest , K., Adjei-Kumi, T. & Badu, E. 2016, ‘A Conceptual Framework Towards the Development of Tender Price Index’, The 40th Australasian Universities Building Education Association (AUBEA), v. 40.

Material availability

Labour productivity

Liu et al. 2007

Elhag, Boussabaine and Ballal 2005; Shash 1993

Level of profit Park and Chapin 1992

Project financing

Han and Diekmann 2001

Cost of manpower Shash 1993

Location and control of site Akintoye 2000

Zonal rates

Category of contractor

Management ability

Contract type

Method of tender selection and degree of competition

Government policy

Project definition/size

Type of development

Construction plan

Zou 2007

Shen et al. 2004

Hatush and Skitmore 1997

Drew and Skitmore 1997

Oo, Drew and Lo 2008

Shen et al. 2004

Drew and Skitmore 1992

Fu, Drew and Lo 2003

Watt, Kayis and Willey 2009

According to Table 1, there are indications of several factors which will affect the tender price index.

It can be observed that TPI is affected by many factors apart from material costs. Macegroup recognises that the recent TPIs had significant changes due to the increase in material prices and labour costs.8

Furthermore, the Ukraine–Russia War also negatively influences the TPI in the construction sectors as energy prices soar leading to an increase in the cost of material fabrication.9

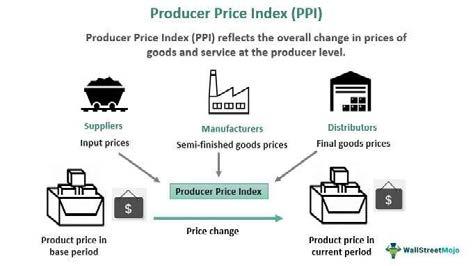

A method by which specific material price fluctuations can be observed would be through their producer price index, which will be investigated in the next section.

This study will further focus on two major construction material (construction and steel) prices and their fluctuations between the years 2019 and 2021, but excluding 2022 which has been further affected by international conflicts.10 11 12

Figure 2 shows a general introduction to PPI. We will observe building materials and supplies PPI from October 2019 to December 2021, before focusing on the fluctuation in prices for steel and through the Producer Price Index for concrete.

7 Ernest , K., Adjei-Kumi, T. & Badu, E. 2016, ‘A Conceptual Framework Towards the Development of Tender Price Index’, The 40th Australasian Universities Building Education Association (AUBEA), v. 40.

8 J 2022, ‘The Russia–Ukraine Conflict’s Effect on Singapore’s Construction Sectors’, Renotalk, accessed 18 July 2023, <https://www.renotalk. com/article/russia-ukraine-effect-singapore-construction-sectors>.

9 Wallstreetmojo Editorial Team 2022, Producer Price Index, Wallstreetmojo, accessed 18 July 2023, <https://www.wallstreetmojo.com/ producer-price-index/>.

10 Zion, L. 2022, ‘Popular mistakes used in construction’, Construction Resources Blog, 26 March, accessed 18 July 2023, <https:// constructionresourcesblog.com/popular-materials-used-in-construction/>.

11 Kumar, E .M. 2022, ‘Materials used in construction — list of 72 basic items’, Pro Civil Engineer, accessed 15 August 2022, <https:// procivilengineer.com/materials-used-in-construction/>.

12 Krishna, V. 2020, ‘14 Important building materials used in construction’, Civil Read, 29 February, accessed 15 August 2022, <https://civilread. com/building-materials/>.

The PPI can be used to measure the rate of changes in product costs sold by producers over a period (see Figure 2). Refer to Figure 3 for information regarding the fluctuation of PPI for Building Materials and Supplies.

In October 2019 (pre-pandemic impact), the PPI for Building Materials and Supplies was only 152.400. In December 2021, it was shown that the PPI had increased to 199.890.

In two years, the PPI has increased by approximately 31.16%.

13 U.S. Bureau of Labor Statistics 2022, Producer Price Index by Industry: Building Material and Supplies Dealers, retrieved from FRED, Federal Reserve Bank of St. Louis, accessed 18 July 2023, <https://fred.stlouisfed.org/series/PCU44414441>.

14 Investing.com 2023, Steel Rebar Futures Historical Data, accessed 18 July 2023, <https://www.investing.com/commodities/steel-rebarhistorical-data>.

According to Figure 4, the price for Steel Rebar in October 2019 was USD 440.57 and USD 697.81 in December 2021. Based on this information, it can be observed that there was an increase of approximately 58.39% in price.

According to Figure 5, in October 2019 (pre-pandemic impact), the PPI for Building Materials and Supplies was only 136.300.

In December 2021, it was shown that the PPI had increased to 161.966. In two years, the PPI had increased by approximately 19%.

BIM is a collaborative process that allows all parties of a construction team to be able to plan, design and construct a building or structure based on one platform.15 16

Information stored within BIM is actionable which can be useful in improving accuracy, expressing design intent and most importantly (within the context of cost management), reducing change orders and field coordination problems.

BIM can be used to track progress accurately and monitor the financial performance of the project.18 19 Estimated costs are more accurate and allow better planning in the management of orders and supply chains.

15 Lorek, S. 2022, ‘What is BIM (Building Information Modeling)?’, Trimble.com, accessed 18 July 2023, <https://constructible.trimble.com/ construction-industry/what-is-bim-building-information-modeling>.

16 The Architecture Designs 2021, ‘The benefits of and barriers to BIM adoption: A detailed study’, TAD, 24 May, accessed 20 July 2022, <https://thearchitecturedesigns.com/benefits-of-and-barriers-to-bim-adoption>.

17 U.S. Bureau of Labor Statistics 2022, Producer Price Index by Industry: Concrete Contractors, Nonresidential Building Work, retrieved from FRED, Federal Reserve Bank of St. Louis, accessed 18 July 2023, <https://fred.stlouisfed.org/series/PCU23811X23811X>.

18 Moura, B. n.d., ‘7 Reasons to use BIM on your future construction projects’, Hexagon, accessed 26 July 2022, <https://aliresources.hexagon. com/articles-blogs/7-reasons-to-use-bim-on-your-future-construction-projects>.

19 Ireland, R. 2020, ‘BIM and existing buildings’, RICS Built Environment Journal, 10 December, accessed 18 July 2022, <https://ww3.rics.org/uk/ en/journals/built-environment-journal/bim-and-existing-buildings.html>.

Refer to Tables 2–4 for the savings that BIM can provide in project duration and concurrent project costs.

DfMA is a construction methodology that aims to increase construction productivity by taking a holistic approach to a project focusing on prefabricating components.20 This method is adopted to lower costs, making assembly easier, reducing labour requirements, improving workmanship and reducing construction periods.21 22 23

The Singaporean government has recently encouraged the adoption of this methodology in 2020, with the focus of achieving a 70% adoption rate in the Built Environment by 2025.24 The Singapore government has invested S$120 million into Singapore’s Public Sector Construction Productivity Fund (PSCPF) to promote DfMA techniques. Thereafter, it was confirmed in 2021 that the Singaporean Built Environment has been steadily adopting this methodology, keeping on track to achieve the goal of 70% in 2025. Among the technologies that are in line with DfMA are the following:

a. Advanced Precast Concrete System

b. Mass Engineered Timber

c. Prefabricated Prefinished Volumetric Construction

d. Prefabricated Bathroom Units

e. Prefabricated Mechanical Electrical and Plumbing (MEP) System

f. Structural Steel.

20 BuildTech Asia 2021, ‘Singapore Government makes a big push towards DfMA’, BTA, 7 April, accessed 18 July 2023, <https://buildtechasia. com/singapore-government-makes-a-big-push-towards-dfma/>.

21 Building and Construction Authority Singapore n.d., Design for Manufacturing and Assembly (DfMA), accessed 18 July 2023, <https://www1. bca.gov.sg/buildsg/productivity/design-for-manufacturing-and-assembly-dfma>.

22 Guan, T.S. 2021, ‘How DfMA changes the building game’, RSP, 1 July, accessed 18 July 2023, <https://rsp.sg/perspective/how-dfmachanges-the-building-game/>.

23 Leong, G. 2020, ‘Parliament: construction sector to digitalise building processes to boost productivity’, The Straits Times, 4 March, accessed 18 July 2023, <https://www.straitstimes.com/politics/parliament-construction-sector-to-digitalise-building-processes-to-boost-productivity>.

This circular is issued by the Singapore Institute of Surveyors and Valuers (SISV) to members of the Construction Industry Joint Committee as a service to disseminate general tender price trend.

Currently, no information has been published that directly discusses the savings DfMA can provide in the Singaporean Construction Industry.

Figure 6 is an extract of TPI Compilation by the Singapore Institute of Surveyors and Valuers, exclusive of unpredictable costs such as the following from each firm/group. The considerations taken to compile this data are as follows:

BCA: Excludes piling, substructure works, external works and mechanical and electrical services. For building works which include public residential, private non-landed residential and commercial office.

HDB: Includes building works, piling, external works and mechanical and electrical services. It is compiled based on the tender prices received for HDB’s construction works.

The index reflects the price movements in construction materials, equipment, manpower and elements of competition, risk and profit allowance by contractors.

The index excludes project-specific design features and provisions to achieve a like-to-like comparison across different quarters and reflects the movement of tender prices due to external factors.

2008200920102011201220132014201520162017201820192020202120221Q232Q23 BCAAllBuildings119.9101.3100.099.799.8104.6106.8104.098.096.798.699.9102.8117.1130.7135.8136.2 HDB124.2107.2100.093.092.097.899.896.085.883.286.990.997.9111.1126.0133.2134.3 AECOM119.8107.0100.0100.5101.8110.2112.5110.6105.5102.3103.5102.5106.1117.0124.5124.4124.4 RLB123.2100.2100.0103.1105.7110.5112.0110.2105.3101.5103.3103.2110.5121.6134.2141.6142.4 AIS124.096.6100.0102.0102.0108.1108.1104.3101.298.799.7100.2103.2121.6131.5134.1134.1

BCAnewTPIserieswithbaseyear2010=100isimplementedwitheffectfromthefirstquarterof2015.TofacilitatecomparisonofTPIchangesovertime,thehistoricalTPIdataserieswerelinkedtothe 2010-based TPI data series at the new reference period (year 2010).

With effect from 28 November 2022, "Arcadis Singapore Pte Ltd" has changed its name to "Asia Infrastructure Solutions Singapore Pte. Ltd.".

The tender price indices are based on yearly average, with the exception for AIS whose TPI from Year 2009 onwards is based on 4th Quarter index.

BCA:

HDB:

24 Sweet, R. 2020, ‘Singapore to spend $139m promoting modular and digital construction’, Global Construction Review, 6 March, accessed 18 July 2023, <https://www.globalconstructionreview.com/singapore-spend-139m-promoting-modular-and-digital/>.

Excludespiling,substructureworks,externalworksandmechanicalandelectricalservices.Forbuildingworkswhichincludepublicresidential,privatenon-landedresidentialand commercial office.

Includesbuildingworks,piling,externalworksandmechanicalandelectricalservices.ItiscompiledbasedonthetenderpricesreceivedforHDB’sconstructionworks.Theindex reflectsthepricemovementsinconstructionmaterials,equipment,manpowerandelementsofcompetition,riskandprofitallowancebycontractors.Theindexexcludesproject specific design features and provisions in order to achieve a like-to-like comparison across different quarters and reflects movement of tender prices due to external factors.

25 Sholeh, M.N., Fauziyah, S. & Khasani, R.R. 2020, ‘Effect of Building Information Modeling (BIM) on reduced construction time-costs: a case study’, E3S Web of Conferences, vol. 202, no. 3.

AECOM Residential Private NonLanded:

RLB:

AIS:

26 Singapore Institute of Surveyors and Valuers 2023, Singapore Construction Tender Price Index 2023 — Q2, SISV, accessed 30 August, <https://www.sisv.org.sg/admin/efinder/files/SISV%20TPI_2Q2023.pdf>.

Excludes piling, substructure works and external works. It is based on private sector projects handled by the company.

ConsultingandProjectManagement(Singapore)Pte.Ltd.("AECOM"),RiderLevettBucknallLLP("RLB")andAsiaInfrastructureSolutionsSingaporePteLtd("AIS").WhileSISV,BCA,HDB,AECOM,RLBandAIShave endeavoured to ensure the accuracy of the information and materials in this circular (the “Materials”), it does not warrant its accuracy, adequacy, completeness or reasonableness and expressly disclaims liability for any errors in, oromissionstherefrom.SISV,BCA,HDB,AECOM,RLBandAISshallnotbeliableforanydamage,lossorexpensewhatsoeverarisingoutoforinconnectionwiththeuseorrelianceontheMaterials.TheMaterialsare providedforgeneralinformationonly.Professionaladviceshouldbeobtainedforyourparticularfactualsituationbeforemakinganydecision.TheMaterialsmaynot,inanymedium,bereproduced,published,adapted,alteredor otherwise used in whole or in part in any manner without the prior written consent of SISV, BCA, HDB, AECOM, RLB and AIS.

AECOM Residential Private NonLanded: Excludes any price for piling and mechanical and electrical services. This TPI commenced in 2007 and reflected the movement of main contract prices in tenders on selected AECOM residential projects for the respective period.

Rider Levett Bucknall: Excludes piling and mechanical and electrical services. It is compiled based on tender returns on projects handled by the company.

Arcadis: Excludes piling, substructure works and external works. It is based on private-sector projects handled by the company.

Based on Table 4, it can be observed that there was an increase in average TPI of 19% from 2019 to 2021 and 7% from 2021 to Q1 2022.

However, it is important to note that the increase from 2021 to 2022 may not be indicative of the effects solely caused by the pandemic as the Ukraine War has also affected construction material costs.

...The use of BIM can shorten the project duration by approximately S$2 million in savings...Table 5: Cost distribution of a construction project

As discussed before, TPI cannot reflect completely the increase in construction material costs as it considers other items indicated in Table 1.

Therefore, key materials such as concrete and steel need to be further investigated in the next section.

Based on a S$100 million project, the costs in Table 7 are indicative of the average fluctuation of average concrete and steel prices from Oct–Dec 2019 to Dec 2021.

In both building materials, it can be observed that there was a slight decrease in material prices during the peak of the pandemic in 2020 — when most of the world had entered a lockdown. However, it can be seen in 2021, there was a sharp increase in prices over a short period.

It was indicative that there has been a price increase of approximately 10% for concrete and 54.23% for steel in the past two years from pre-pandemic prices.

Based on the information found, the price increase for concrete (18.83%) is higher than RLB’s findings (10%). However, steel rebar information was found to be 58.39% which is close to RLB’s findings of 54.23%.

Applying the above findings to a case study of a standard construction project, with the assumption that the project value is S$100 million.

Based on the findings, there were price increases on the following components from 2019 to 2021.

Table 6 outlines the price increases of the various elements and their impact on the case study.

Based on the case study, the percentage increase of 17.6% is consistent with the TPI increase of an average of 19% from 2019 to 2021 as shown in the findings in section Singapore TPI.

The difference of 1.4% could be attributed to other factors such as the ordinary inflation of other building materials not studied in the example above.

In conclusion, it is rather unlikely that the material prices have reached their peak, nor will they stabilise or drop for at least another two to three years. Not forgetting that the world is facing more uncertainty today than ever before; we are not only dealing with the ongoing effects of the pandemic but there are international conflicts that continue to shake the globe.

It can be demonstrated from Figure 6: Construction Tender Price Index Compilation that there is a rise of 7% even for a short period from 2021 to Q1 2022.

Notwithstanding that there is a continual increase in construction material prices, it would be very injudicious to cease all construction activities until the prices have been stabilised, as this would be detrimental to the GDP for all countries and the global economies will be disrupted further.

Given the above, it is sensible to explore some potential ways to help in cost savings and expedite construction progress. BIM can be a possible

measure to help in cost savings of around 2–5%, yet construction progress can be accelerated.

DfMA can be another method to help expedite construction activities so that the project can start to generate income as soon as the construction is completed.

According to the case study, the use of BIM can shorten the project duration by approximately 20%, which translates to approximately S$2 million in savings in preliminary costs. The use of DfMA can also shorten the project duration by about 10% which can result in savings of approximately S$1 million.

Although the world is struggling with inflation and material fluctuation, the demand for properties, i.e., residential and office, is still growing as people are looking for such spaces to accommodate the needs of working from home which businesses are exploring reducing office spaces in the CBD area to make ways for more foreign investors but to create hubs elsewhere to better connect with employees.

Prefabricated Prefinished Volumetric Construction (PPVC) can be another possible method, which has proven to be a success in countries or regions such as Singapore and Hong Kong Special Administrative Region where they can rely on places nearby, i.e., Malaysia and Mainland China to fabricate materials offsite and ship to the endpoints. With that, the labour cost can be reduced and can help achieve cost savings of 3–5% for the overall construction costs.

...It israther unlikely that the material prices have reached their

peak...

Project: BHP Adelaide

Team: Rider Levett Bucknall

Client: BHP

Sector: Commercial

Location: Adelaide, Australia

The brief for BHP Adelaide was crystal clear: create a bold, welcoming and connected new home for a proud and professional organisation.

Spread over eight storeys at Charter Hall’s 20-storey tower at 10 Franklin Street, BHP Adelaide echoes the distinctive landscapes of the company’s mining sites.

The earth-red colour scheme and natural materials pay homage to BHP’s heritage. With light, airy spaces and a range of work settings, it is a place that encourages people to breathe and do their best work.

Designed by Woods Bagot and delivered by Built, BHP Adelaide has garnered accolades and admiration around the world. In 2020, it was named the world’s best workplace by the Leesman Index, which benchmarks workplace experience and enjoyment. In 2023, BHP Adelaide took home the Property Council of Australia’s prestigious State Development of the Year Award.

RLB’s deep experience in the Adelaide market and our independent thinking proved a winning combination for the state’s largest company. RLB provided cost management services throughout the project from inception to occupation. With the help of our in-house cost benchmarking dataverse, RLB developed detailed cost plans that informed the project team’s decisionmaking process.

RLB Managing Director, John Drillis FAIQS, CQS says every element of BHP Adelaide was carefully designed to spark collaboration and connection, and a multi-disciplinary team looked at the cost implications from every angle.

“The result is a flexible and futurefocused environment that allows BHP’s people to adapt their space to each task today, and their work and ambitions tomorrow, as technology and thinking evolve,” John says.

“BHP Adelaide combines spectacular amenities, state-ofthe-art technology and inspiring aesthetics. A commitment to collaboration and creative thinking supported the delivery of an exceptional, future-fit workplace that will help BHP attract and retain top talent, innovate and unearth new value.”

— John Drillis FAIQS, CQS, Managing Director, RLBThe copper-clad steel staircase, made with materials taken from BHP’s Olympic Dam mine 560 kilometres north of Adelaide, runs through the building’s spine to foster connection and facilitate the ‘social bump’.

The exposed ceilings — with their earthy-brown tones — turn the mechanical services into a feature, celebrating BHP’s industrial heritage and eliminating unnecessary materials.

10,000M2 OF SPACE

8 STOREYS

1,500 EMPLOYEES

A commitment to collaboration and creative thinking supported the delivery of an exceptional future-fit workplace...

The best workplaces offer a range of settings to suit each person’s mood, task and preferred work style. At BHP Adelaide, appealing open-plan floors are flooded with natural light, while a series of soundproof booths offer privacy. Each floor is fitted with 100%

sit-to-stand workstations that can be raised or lowered electronically, moving to the right height each time a new staff member sits down. A large terrace, overflowing with greenery and with expansive views of the city, offers fresh air and fresh perspectives.

On level three, the Integrated Remote Operating Centre allows staff to control Olympic Dam’s machinery and systems remotely. This centre is sealed off from the rest of the office; a viewing gallery gives school groups a rare insight into the 24/7 operations.

The best workplaces offer a range of settings to suit each person’s mood, task and preferred work style.

Home to more than 1,500 people, the workplace experience is set from the moment BHP’s employees walk through the door. The foyer, with a design inspired by an airline lounge, features 60 workplaces and seating areas, as well as a 4.5-metre-high digital screen. Beyond the lobby, twometre-high dividers turn communal desks into oases of calm; the level five

library is another place of quiet respite that supports research and reflection. Rooms for contemplation, prayer, wellness and fitness were carefully considered and costed. Other rooms offer space for employees’ children to chill out after school, while a games room with table tennis and e-sports offers another relaxation zone.

BHP is a fitout that is future-ready — a welcoming place that connects a diverse workforce, fosters well-being and belonging, and signals a new chapter for an organisation with a long and storied history.

This feature was written and all images provided by Rider Levett Bucknall.

The World Health Organisation defines burnout as a syndrome resulting from chronic workplace stress that has not been properly managed. It is characterised by three key dimensions:

1. feelings of energy depletion or exhaustion;

2. increased mental distance from one’s job or negative feelings towards it; and,

3. reduced professional efficacy. Burnout is a state of complete mental, physical, and emotional exhaustion. Those experiencing burnout may struggle to engage in activities that once brought them joy and meaning. They may also lose interest in things that once mattered to them and feel a growing sense of hopelessness. Recognising the signs of burnout is critical to taking action to manage and prevent it.

Physical symptoms of burnout include headaches, stomach or intestinal issues, fatigue, frequent illness, high blood pressure, and changes in appetite or sleep. Emotional symptoms of burnout include feelings of helplessness, cynicism, self-doubt, anger and frustration, decreased satisfaction, detachment, and loss of motivation. Behavioural signs of burnout include difficulty concentrating, reduced performance in everyday tasks, reluctance to get out of bed, withdrawal or isolation, procrastination, outbursts, and loss of interest or pleasure.

It is crucial to be honest with yourself and recognise the symptoms as soon as possible. Identify your stressors and pay attention to what causes you the most stress and cultivate the ability to self-reflect. Attend to your own needs and reduce or eliminate unnecessary stressors.

Effective time management helps reduce stress and increases productivity. Prioritise tasks, delegate work where possible, and learn to say no to non-essential commitments. This will reduce workload and prevent burnout.

Take care of your mental health and wellbeing by practising mindfulness and self-care. This can include activities like meditation, deep breathing exercises or journalling. These activities help to reduce stress, increase awareness and improve overall health.

Nervous system regulation is crucial to managing stress and heavy emotions. By building a strong nervous system and recognising our responses to stress, we increase our resilience to cope with anything that life brings to our doorstep.

Physical activity reduces levels of the body’s stress hormones, such as adrenaline and cortisol. It also stimulates the production of endorphins, chemicals in the brain that are the body’s natural painkillers and mood elevators.

If your needs are consistently unmet or your rights are violated, you are likely to experience burnout. It is imperative to establish healthy boundaries and be aware of when enough is enough. Boundaries are limits that we set to communicate how we want to be treated and what we’re willing to do.

They are critical because they protect us from being mistreated. At work, boundaries are a way to assert our needs and rights. These include a need for fair compensation, time off, and to be given credit for our work. They also include our right to work in safe conditions, to be treated with respect, and paid for time worked.

If you are feeling overwhelmed, seek support from a trusted friend, family member or professional. Talking about your feelings and experiences can be a significant relief and help you to find new ways to manage stress.

Finally, reach out to your employer/ manager. By doing so, you are allowing them to appropriately support you; ultimately, they can only help with issues they know about. Creating a positive work environment can also help prevent burnout. Encourage open communication, provide opportunities for personal and professional growth, and foster a supportive and inclusive culture.

In conclusion, it is vital for individuals and organisations to be proactive in preventing burnout. By recognising the symptoms early, reducing stressors and practising self-care and stress management techniques, you can prevent burnout and improve overall health and wellbeing.

This article was written by EAP Assist, www.eapassist.com.au

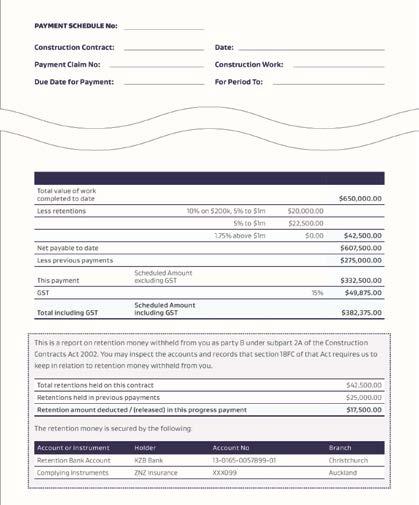

A significant amendment to the Construction Contracts Act 2002 (CCA) firmly establishes the trust status of retention money withheld on commercial construction contracts. The Construction Contracts (Retention Money) Amendment Act 2023 passed twenty years after the CCA came into force and five years after an abortive retention regime was established in 2017, and means that retention money withheld under new commercial contracts from 5 October 2023 is automatically held on trust.

The CCA came into force on 1 April 2003 and transformed payment practices in the construction industry. It cherry-picked elements of recent overseas legislation, particularly the Housing Grants, Construction and Regeneration Act 1996 (UK) and the Security of Payment Act NSW 1999. It aimed to improve cash flow by outlawing pay when paid clauses, and establishing statutory processes that cannot be contracted out for payment claim/payment schedule, fast-track adjudication and enforcement applicable to all construction contracts. It had restricted application to residential contracts, and retentions were not addressed.

An Amendment Act that eventually came into effect in 2015 removed the restrictions on residential contracts and tidied up aspects of the adjudication process. The failure of Mainzeal Construction during the passage of that legislation prompted a late amendment to address retentions (the 2017 regime).

The 2017 regime, subpart 2A of the CCA, applies to new commercial construction contracts from 31 March 2017 and remains in force. It requires a party (referred to as “Party A”) holding money (retention money) from a party performing the work (“Party B”) as surety for the performance by Party B of its contract obligations to set that money aside as trust money.

Party A may “commingle” the retentions with other money, and Party A must keep proper accounting records and make them available to Party B available upon request. Certain “prohibited provisions” outlaw contractual terms such as those making the payment of retentions conditional on anything other than the completion of Party B’s contractual obligations.

The Court interpreted the 2017 regime as creating an obligation on the contractor to hold retention monies on trust rather than, as Parliament had seemingly intended, deeming retention money to be held in trust.1 The Government undertook to address the shortcomings.

The Amendment Act significantly expands the 2017 regime, and automatically applies to every new commercial construction contract from 5 October 2023.2 Its key features include (added features of the 2023 regime are in italics):

• Retentions automatically become trust property when money is withheld from amounts otherwise payable as surety for the performance of a Party B’s obligations, and Party A becomes trustee.

• Retentions can only be withheld where a contract provides, but money withheld as surety for performance of contract obligations other than in accordance with the contract is also deemed retention money

When Ebert Construction failed in October 2018 the subcontractor retention money set aside was Ebert’s only significant asset and was significantly less than the required amount. The receivers applied to the court to establish their authority to disburse the retentions, how to be paid for that work, and how to address the shortfall.

• Party A must keep proper accounting records of the retentions.

• Retentions must be kept in a separate bank account(s), identified as “retention money trust account” and the bank must be informed of the nature of that account. The interest earned on that money belongs to Party A.

The Amendment Act significantly expands the 2017 regime, and automatically applies... From 5 October 2023.

• Instead of holding retentions in a bank account, Party A may arrange a “complying instrument” through a bank or insurer, and Party A must comply with reporting obligations.

• Party A must give detailed reports to each Party B on their retentions as soon as possible after each transaction, and at least quarterly. The required details include the retention transactions and amounts

withheld for each contract, together with the bank account name and number, and a statement that the payee may inspect the payer’s accounts and records.

It may be possible to include transaction reports in payment schedules (see sample retention money transaction report), but separate quarterly reports will be required.

• Party A may only use retention money for the purposes set out in the contract, after giving ten working days detailed written notice.

• Party B is entitled to interest on the late release of retentions at the rate in the contract, or where there is no rate at a rate specified in future regulations.

• Prohibited provisions include terms that:

• make payment of retentions, or the due date for payment, conditional on anything other than the performance by Party B of its contract obligations; or

• seek to recover Party A’s costs in administering the retention trust.

• Where Party A becomes insolvent the retention money is protected for Party B; the receiver or liquidator becomes trustee for distributing retentions to Party Bs, and fees are payable from the retention bank account

• Offences and severe fines apply to directors of organisations for each offence where they fail to keep retentions in a separate account (up to $200k), fail to keep proper accounting records ($50k), fail to provide quarterly reports to payees ($50k), or make false or misleading statements ($50k); and the chief executive of Ministry of Business Innovation and Employment (MBIE) is empowered to take enforcement action.