The Airbus H140—introduced yesterday amid fanfare at Verticon—has more space and performance, along with two Safran Arrius 2ES engines.

The Airbus H140—introduced yesterday amid fanfare at Verticon—has more space and performance, along with two Safran Arrius 2ES engines.

By Charlotte Bailey

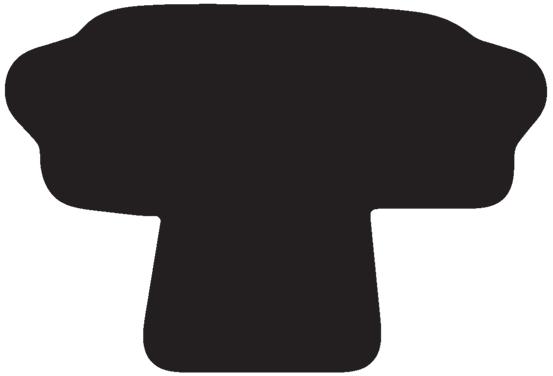

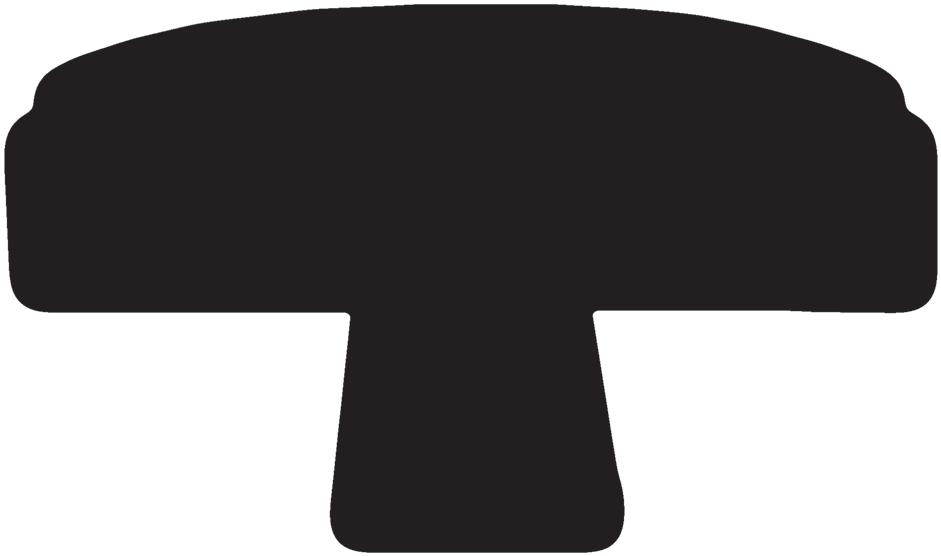

Airbus Helicopters has launched the H140 helicopter to bridge what it sees as a gap in its H135 and H145 light-twin family. Unveiling the new addition to its rotorcraft lineup yesterday at Verticon, the European manufacturer said the H140 will deliver more efficient mission flexibility when it enters service in 2028. Aeromedical operators Global Medical Response (GMR), ADAC Luftrettung, and ÖAMTC Flugrettung are the launch customers for the new helicopter. During separate signing ceremonies on the show’s opening day, GMR secured an agreement for 15 H140s, while ADAC and ÖAMTC inked

a joint agreement with Airbus for 10 H140s, three H135s, and one H145. Air Methods and STAT MedEvac also placed orders, the former for an unspecified number of H140s, 10 H125s, and 11 H135s, and the latter for three H140s. At press time, Air Methods booked firm orders for 12 and 24 options.

The H140 will be certified under EASA CS-27/FAA FAR 27 requirements, being at the top end of the “small rotorcraft” designation with a mtow of 6,985 pounds, which is 429 pounds more than the H125. Airbus said this will translate into elevated useful load. Specifications include a maximum speed of 155 knots.

A key factor behind the improved performance is the new Safran Arrius 2ES engine that will deliver

continues on page 22

Tried and TRU sim TRU’s Veris sim blends virtual reality with actual flight controls | 17

Bell 525 on final

The fly-by-wire, supermedium twin helicopter is finally nearing FAA certification | 8

By Curt Epstein

The world’s first firefighting-configured Sikorsky S-92A made its public debut at the rotorcraft manufacturer’s booth this week at Verticon. Developed by S-92 lessor Milestone Aviation in cooperation with operator VIH Helicopters, it marks the first utility-configured S-92 available to the commercial market. The program was launched last summer in British Columbia with the assistance of government wildfire management agencies.

According to the companies, this S-92A has the capacity to carry up to 19 passengers, internal/external cargo, or 5,000 liters (1,320 gallons) of water in the expandable bellymounted custom-built Helitak carbon fiber tank. The external tank weighs less than 700 pounds empty and is supplemental type certificated for the large-cabin helicopter. With its snorkel, it can fully fill from a body of water in just 48 seconds and can be removed from the helicopter in less than 30 minutes.

Other features include a lighter cabin interior, bubble window on the pilot side to enable more precise water drops and increased visibility when refilling, and exterior power gauge mounted just below this window for use during refilling.

VIH Aerospace is performing the reconfiguration in-house, a process that takes approximately four months. CEO Jen Norie noted it has received a lot of interest in the conversion, and VIH expects to have three converted S-92s operational by the third quarter.

“We’re seeing these wonderful aircraft coming off of the offshore service after 20 years still with lots of life left in them, and so that’s why we’re doing this program to reconfigure them,” said Norie, who sees this as a growing product line for the company. “There’s going to be more and more of them—it’s going to be the future of the business.”

There are currently more than 260 S-92s in service, and the airframe has a life-limit of 30,000 hours. z

On the opening day of Verticon, Bell announced a purchase agreement with aeromedical transport operator Air Methods for up to 27 helicopters. It consists of a firm order for 15 IFR-configured 407GXis with an option for an additional 12. The deal is in addition to Air Methods’ recent purchase agreement for a Bell 429.

Leonardo inked orders for a dozen helicopters on the opening day of Verticon 2025. The ships will be primarily used for o shore, search-and-rescue, or HEMs missions.

Petroleum Air Services (PAS), which flies helicopters for Egypt’s oil industry, signed for five AW169 light intermediate twin helicopters with skid undercarriages. According to Leonardo, the PAS deal will mark the skidded variant’s entrance into the energy market.

Deliveries to PAS are expected to begin in the third quarter of 2026. PAS, which already operates a fleet of six AW139 medium twins, was named an authorized service center for Leonardo last year.

UK-based Gama Aviation signed for five new helicopters in the light-intermediate category: two AW139s and three AW169s. Gama will use the AW139s for o shore transport missions, while the three AW169s will be employed for emergency medical services in the UK. Leonardo expects to begin these deliveries in 2027 or 2028.

Alaska’s North Slope Borough, the state’s northernmost borough, is looking to boost its emergency response capabilities with a pair of super-medium AW189s with full icing-protection systems. North Slope intends to use them for search-andrescue operations, as well as emergency medical evacuations. H.W.

By Matt Thurber

Skyryse, which is developing the SkyOS digitized aircraft operating system, is partnering with United Rotorcraft to support the maintenance of SkyOS modified helicopters and introduce SkyOS programs for Airbus H125 and H130 and Sikorsky Black Hawk helicopters. The first SkyOS helicopter— Skyryse One—is a single-control, fly-by-wire upgrade to the Robinson R66, enabling automatic takeoff and landing and fully envelopeprotected flight.

The Black Hawk SkyOS program is being done under contracts with the U.S. Army and ACE Aeronautics to integrate the system into that helicopter.

“Our collaboration with United Rotorcraft represents a significant step forward

in making aviation safer and more capable,” said Skyryse founder and CEO Mark Groden. “Adding United Rotorcraft to the team gives us additional scale to deploy SkyOS more quickly and e ffi ciently across multiple aircraft.”The two companies also see opportunities to expand the maintenance

United Rotorcraft will provide maintenance support for SkyOSmodified helciopters under a deal with Skyryse.

support agreement for other aircraft platforms.

“Safety shouldn’t be reserved for those who can afford it,” said United Rotorcraft president Larry Alexandre. “We see SkyOS as becoming an industry standard and are excited to be accelerating the speed of adoption across existing rotorcraft fleets.” z

PHI Aviation has begun o shore helicopter operations for Shell on Louisiana’s Gulf Coast with an Airbus H160, the company announced yesterday at Verticon. This represents the first H160 to conduct commercial o shore transportation missions, according to Airbus Helicopters, which partnered with PHI and Shell on a route-proving program for the helicopter model.

Commercial operations with PHI’s H160 o the Louisiana coast began on March 6 after 300 hours of route-proving flights. “This is the culmination of five-plus years of work and an even longer partnership between PHI, Shell, and Airbus,” said PHI Group CEO Scott McCarty.

“The extensive, first-of-its-kind route-proving program allowed our teams to work closely with Shell and Airbus to fully evaluate and optimize the H160’s capabilities, train personnel, and ensure certification and indoctrination into PHI’s operational and safety systems.”

PHI now employs 12 pilots with H160 type ratings, as well as 12 mechanics qualified to work on H160 airframes and powerplants. H.W.

For Emergency Medical Services operations, speed of response is critical. Thanks to the combination o advanced technolo ies and inherent fexibility, Leonardo’s product ran e uarantees a rapid and capable response. Spacious and readily reconf urable cabins, advanced avionics and all-weather capability, day and ni ht, ensure that medical personnel can always be there when it counts.

Visit us at VERTICON, Hall F, Stand 7750

By Matt Thurber

As Saudi Arabia-based The Helicopter Company (THC) and its Rotortrade subsidiary grow in the rotorcraft aftermarket, company officials are evaluating opportunities for further growth and new aircraft entering the market, including advanced air mobility (AAM) types.

In addition to its preowned rotorcraft sales and growth of its businesses, said THC CEO Arnaud Martinez, “We will keep focusing on opening and growing our EMS segments. In 2025 we’ll focus on developing and launching our [AAM] segments.”

Arnaud Martinez THC CEO

Philippe Lubrano Rotortrade CEO

As a portfolio member of the Saudi Public Investment Fund, he added, “We are tackling that AAM journey by watching closer what is happening in the eVTOL world. I don’t have any clear view of target dates by when we will have an eVTOL segment, but what I know for sure is we will have an eVTOL

segment. The when is still the question mark.”

When AAM aircraft get closer to certification and entry into service, THC will apply the rigorous process that it uses for new helicopters to evaluate the new machines. “We have a technical team with a clear technical assessment on what we hope to get from this new platform, because the topography in Saudi Arabia is very specific. We want to make sure that whatever they are saying, that they will deliver.”

Last year, THC and Rotortrade fleets flew more than 15,000 hours, according to Martinez. “One of the biggest achievements every year is to make sure that we always finish the year with zero accidents and zero major incidents, which is what we achieved.”

Rotortrade’s revenues climbed 20% year over year in 2024, according to founder and CEO Philippe Lubrano. Its MRO business is growing as well, and at the Verticon show this week Rotortrade announced the launch of its rotorcraft leasing business. These businesses will help Rotortrade capitalize on opportunities in the rotorcraft field, which are driven by a ramp-up in oil and gas exploration, helicopter renewal programs, geopolitical challenges facing many parts of the world, and demand for AAM aircraft.

“Our target is to reach $400 million of revenue by 2030 and hopefully $300 million by 2028,” Lubrano said. “So we want to focus on that to get more revenue and also more footprint to be as close as possible to my clients in [many] countries, including the United States.” z

The Vertical Flight Society (VFS) addressed the recent shakeups in the eVTOL arena on Monday afternoon at Verticon. Several high-profile players in the nascent market are either being sold at fire sale prices or forced to throw in the towel altogether.

According to Mike Hirshberg, the group’s director of strategy and former executive director, “The last several months has resulted in several companies now in insolvency.” He specifically noted Volocopter’s breaking announcement that a Chinese company has agreed to buy it for €10 million—an amount he described as essentially nothing—as it ran out of funding needed to cross the certification finish line after 15 years of development.

“There is a huge gap between designing aircraft, building aircraft, flying aircraft, and then getting to production.” Hirshberg added that there are still several potential OEM pushing for certification but cautioned, “Just because you have a good idea doesn’t necessarily mean you are going to be successful in the business.”

He explained what he describes as the Hirshberg Principle: “You need about a billion dollars, 10 years, and 1,000 engineers to field a new aircraft.” For eVTOLs, he said to add 50 percent to those totals. “New technology takes a long, long time and a lot of money.”

VFS maintains a registry of the world’s eVTOL aircraft designs, and as of this week it has listed nearly 1,100, which it describes as ranging from the silly to the serious.

Among them, it breaks down the designs—from more than 400 companies— in vectored thrust (387), lift and cruise (200), wingless multi-rotors (321), hoverbikes/flying devices (111), and eHelos and gyros (76). Of those, Hirshberg predicts maybe five will be certified over the next half-decade.. C.E.

By Hanneke Weitering

The Indonesian Army has accepted delivery of six Bell 412EP twin-engine helicopters upgraded with BasiX Pro avionics, Bell Textron announced yesterday at Verticon 2025.

Bell’s Basix Pro avionics retrofit kit replaces the helicopter’s original analog instruments with four Astronautics 6-by-8-inch highresolution Badger Pro+ smart displays.

It also comes with Garmin GTN 750 Xi and GTN 650 Xi GPS navigators, a Mid-Continent standby attitude module, and an optional upgrade of the Honeywell SPZ-7600 automatic flight control system to a four-axis configuration.

According to Bell, Basix Pro helps to reduce pilot workload and improve situational awareness.

“This avionics upgrade gives the Indonesian Army Aviation a modernized digital cockpit that enhances mission capabilities for their Bell 412EPs as they support critical national needs,”

said Chris Schaefer, v-p of customer solutions at Bell, which is a subsidiary of Textron.

“We are proud of the initial positive feedback regarding how these helicopters with the newly retrofitted systems are already enhancing Army operations in diverse terrain at high altitude and in rapidly changing weather conditions.”

Retrofits of the Indonesian Army’s six Bell 412EPs were completed by Black Diamond

The modernized Bell 412EPs for the Indonesian Army include Garmin GTN 750 Xi and GTN 650 Xi navigators and a Mid-Continent standby attitude indicator.

Heliaero, a Part 145 aircraft maintenance organization and Bell-authorized service center in South Jakarta, Indonesia.

“Our successful collaboration with Bell’s aftermarket teams allowed us to complete this important project for the Indonesian Army Aviation on an accelerated timeline,” said Black Diamond Heliaero president Karina Kasih. z

By Curt Epstein

Having had its predictions for certification of its 525 slide several times over the past few years, Bell is now taking a more circumspect approach. On Monday at Verticon, Mike Deslatte—who took over leadership of the 525 Relentless program in mid-2024 as its senior v-p—said the aircraft is still in the type certification process.

“In terms of a date for receipt for receiving type certification, we don’t fully control the timeline,” he said. “Obviously, we’ve got to progress through the final steps to the FAA, and so I’m not going to be very specific in terms of a forecast.”

He noted that the fly-by-wire, midsize twin helicopter, which launched in 2012 and first flew nearly a decade ago, has thus far completed more than 60 certification deliverables with the FAA, as well as many critical type inspection authorization flight tests. This means the finish line could finally be in sight.

“We only have a handful of tests left before we submit our final documents to the FAA,” Deslatte said. “There really isn’t a technical

issue that we’re working through. It is just the administrative timeline of trying to get through the remaining deliverables.”

The OEM currently has two aircraft engaged in cold weather testing in Alaska and icing testing in Michigan. “These tests will support cold-weather expansion of the 525, and full icing capability, both of which are anticipated to be introduced after the initial type cert of the aircraft,” said Deslatte.

Another factor in the 525’s certification could be out of the manufacturer’s hands in the form of budget cuts to the FAA’s apparatus. “What I can say about the 525 is that our local FAA representatives have been fairly stable,” Deslatte told the audience. “Now, obviously they’re going through some organizational change, but in terms of the partnership that we have with respect to getting the 525 to the finish line, we really don’t anticipate any direct impact.”

He added that the manufacturer has recently “reinvigorated” its dealings with EASA over concurrent certification for the 525 and noted that it will have better focus later this year on what additional requirements, if

any, it would need to secure European validation of the helicopter.

Following type certification, the company expects to engage in a 525 operational evaluation with Omni Helicopters Guyana, according to Danny Maldonado, Bell’s chief commercial officer responsible for the airframer’s global commercial sales and programs.

The aircraft will be flown initially by Bell pilots, with Omni crews slowly integrated. The program aims to accumulate 500 hours of simulated, real-world missions over six months.

“The market needs the aircraft, and we’ve been working with Bell for more than a year on the potential to do a full-scale kind of operational evaluation,” said Duncan Moore, group COO for Omni Helicopters International. “There’s a lot of interest in the product, and it just, in our view, needed someone to step forward and say, ‘Okay, let’s take it to work, let’s bridge the gap between the certification flying and the real world,’ so we have a consenting customer in the shape of Exxon in Guyana and a highly representative mission.”

On the military side, the company is focused on two procurement program competitions: the long-range assault aircraft for which it is touting its V-280 Valor tiltrotor, and what’s being referred to right now as the Flight School Next the competition for the next rotorcraft trainer for the U.S. Army. Bell is submitting a purpose-built military trainer variant of its 505.

When asked about how the recently announced U.S. tariffs could affect Bell’s business with some of its products manufactured in Canada, Maldonado said the company is monitoring “a very dynamic situation.” He does expect any tariffs to have some impact, but with other variables swirling, he wouldn’t make any assumptions.

The airframer celebrates its 90th anniversary this year, and at its Verticon booth this week it is showing a full slate of its products on display. This included a 525 in o ff shore transport configuration; a 505 recently delivered to the Peoria, Arizona police department; an aeromedical 407GXi from Global Medical Response, which recently signed for deliveries of 15 of the IFR-configured aircraft; a 429 from Quiktrip; and a Subaru Bell 412EPX in firefighting configuration from Kern County, California. z

By Curt Epstein

Air Rescue Systems (ARS) has launched ARS 2.0, an enhanced training program designed to equip helicopter rescue teams with the most up-to-date techniques, technology and mission critical skills.

Announced this week at Verticon, the Vita Inclinata subsidiary is debuting the program, which integrates real-world scenarios. Led by Mike Martin, ARS’s v-p of training, the expanded curriculum emphasizes high-stakes decision making and hands-on instruction featuring the company’s equipment and expertise.

The program is customizable, making it suitable for a wide range of customer experiences, from the established rescue team looking for advanced training to newcomers.

“We’re not just improving training, we’re revolutionizing how rescue systems prepare for real-world missions,” said ARS president Bob Cockell. “This program ensures that every helicopter crewmember, from pilots to hoist operators, is equipped with the skills and knowledge to execute rescues with greater precision, speed, and safety in their own aircraft.”

This year’s Verticon also marks the trade show debut of the company’s Air Reach Seat, which is being demonstrated at ARS’ booth. It is a work platform designed to improve safety, comfort, and efficiency for power linemen working from helicopters.

Built from stainless steel and aircraft aluminum, the seat eliminates the loss of circulation and fatigue normally associated with traditional harnesses while providing increased

maneuverability for linemen and stability for pilots.

The company is also demonstrating the Vita rescue hoist, which has a load stabilization system to prevent swing, spin, and rotation during lift operations. Additionally, it is showing the Pelican R.E.D., a rapid extraction device suitable for water, high-angle, and aerial hoist rescues.

“ARS and Vita Inclinata are committed to pushing the boundaries of what’s possible in helicopter rescue operations,” explained Matt Christiansen, Vita’s executive v-p of aerospace sales. “With ARS 2.0 and our lineup of advanced rescue solutions, we are delivering the training and technology needed to elevate mission success and improve safety across the industry.” z

By Curt Epstein

Enstrom Helicopter is unveiling two new trim levels—Elite and Signature—for its flagship 480B turbine-single helicopter this week at Verticon. Both versions include upgraded avionics with digital displays.

At the top of the line is the 480B Elite, which comes in a range of eye-catching paint schemes designed by famed airbrush artist Dean Loucks, featuring bold, clean patterns. Matching interior trims will be included to complement the exterior colors.

On the inside, the Elite will offer an all-glass instrument panel with the Garmin G500H TXi touchscreen display, GTN 750 touchscreen GPS navcom (or optional GTN 650), ADS-B

In/Out, Genesis three-axis autopilot, and air conditioning.

“This is the option for personal owners who want all the accoutrements,” said Charles Wade, the airframer’s s-v-p of product, sales, and customer excellence. “These are the pilots who enjoy the attention—whose desire is to show up in style wherever they travel, whether that be in their car, boat, coach, or airplane.”

Below that, the 480B Signature will include comparable avionics, but autopilot and air conditioning will be available as options.

The OEM noted its goal to provide helicopters to the customer’s exact specification

and added that the standard legacy 480B will still be available in its product lineup for those who are just looking for the base model or have a preference for analog instrument displays.

Wade, who has more than four decades of industry experience, recently joined the Michigan-based company, having served the past 24 years with Collins Aerospace, finishing as avionics market manager/director. “I was looking to join a small aerospace company, and I was familiar with the Enstrom brand,” said Wade. “I saw great potential to reinvigorate the market on a proven product.” z

Safran Helicopter Engines has launched its EngineLife Connect label to signify which airborne connectivity solutions are best compatible with its range of products and services. The manufacturer said the connectivity of present and future helicopters is “a mandatory link in the data value chain,” and views the collection of engine data as the raw material for digital services that will provide the opportunity for new operational performance improvements.

Several providers have already been awarded with the designation which signifies the data scope, downloading capabili-

ties, and worldwide certification coverage, related to Safran-powered helicopter fleets.

The initial group includes NSE Brite Saver,

Safran Electronics & Defense Helicom V2+, Outerlink IRIS System, and Airbus Helicopters/ Astronautics wACS (wireless Airborne Communications System).

“At Safran, we strongly believe that our OEM digital services have the potential to turn helicopter and engine data into a source of helicopter operation optimization,” said Albert Mathieu, executive v-p for support and services at the company’s helicopter engine division. “That is why we collaborate with the best players in the data market. EngineLife Connect will help operators make the most of their Safran EngineLife services.” C.E.

By Curt Epstein

Sikorsky has reached a milestone for its blown-wing tailsitter uncrewed air system (UAS), which the helicopter manufacturer is developing as the progenitor of a new family of VTOL aircraft. In test flights, the autonomous twin prop-rotor prototype was able to successfully transition from vertical lift to horizontal flight and back again.

According to Igor Cherepinsky, director of Sikorsky Innovations—the airframer’s rapid prototyping group—the UAS has transitioned dozens of times during testing. The wing-shaped, electric-battery-powered vehicle weighs 115 pounds, has a wingspan of 10 feet, and is controlled by the airframer’s Matrix flight autonomy system. The company believes the UAS can be scaled up as a cargo carrier.

“They’re products on their own, but they’re also helping us with the physics for a much larger aircraft,” said Cherepinsky during a preVerticon show press visit to the company’s Stratford, Connecticut headquarters. “We’re looking at a family of products that has a high degree of commonality when it comes to systems.”

Indeed, the shape of the autonomous UAS represents the wing of the planned follow-on

tilt-wing aircraft in the family. “For regional air mobility, we are in the process of building the hybrid electric demonstrator (HEX),” said Cherepinsky.

That will be a 9,000-pound UAS, which will use a single General Electric turbine spinning generators to develop electricity to power a pair of rotors mounted in the actuator-operated tilt wing. Cherepinsky believes hybrid power will be required, given the current development status of batteries. “No electric power source that we see in the near future could provide support for this vehicle,” he said.

Asked why Sikorsky favors the tilt-wing design over the tiltrotors pursued by other manufacturers, Cherepinsky replied, “We understand what happens in the hover with a tiltrotor where you are taking a vertical drag penalty. We believe tilting the wing, getting the wing out of the way in a hover buys you back a whole bunch of performance.”

The Lockheed Martin subsidiary is currently building the HEX’s power systems testbed. “That has all the dynamic components, all the drive train,” explained Cherepinsky,

adding Sikorsky plans to run that vehicle on the ground, as well as hover it. “We have the parts, we’re putting the vehicle together, we’ll have power on shortly, and then ground runs and first flight within 12 to 18 months is our current schedule.”

One of the other considerations for the HEX design is that the OEM wants to use it as a test case for next-generation manufacturing. “Part of the cost of the vehicle tends to be oldstyle manufacturing processes, forgings and castings,” said Cherepinsky.

Those types of components traditionally tend to have long lead times and are difficult and expensive to modify. “This aircraft doesn’t have any of that. We’re 3-D printing components including motor housings, gearbox housings, gears,” he added.

Sikorsky plans for the HEX to serve as a stepping-stone to an eventual scaled-up commercial hybrid-electric aircraft. “Last but not least is the actual product that we are studying as a regional mobility concept that is a nine- to 12-passenger machine, which has a 400+ mile range, that cruises comfortably in the high 200knots range, and that is a pretty compelling hovering machine,” Cherepinsky said.

It would feature the same drivetrain as HEX but with four rotors on the wing and a weight between 14,000 and 15,000 pounds. “These are not meant to be long-term hovering machines, that’s not the mission,” noted Cherepinsky. “The question is, how do I efficiently perform vertical takeoff, hover for tens of minutes at a time…get efficiently on wing and go far very fast, and do the same thing on the other end?”

For hovering applications, he believes the helicopter—Sikorsky’s primary product range—will continue to fill that role for the foreseeable future.

As part of plans for its eventual hybridelectric family, the rotorcraft manufacturer is also exploring what it describes as the E-76 concept, a hybrid-powered helicopter using one of its midsize S-76s as a starting point. “We’re not necessarily planning to convert S-76s into electric power, but we can use that platform as a study of what would happen if I took an S-76-class aircraft and added hybridization,” explained Cherepinsky. “We believe there are benefits there.” z

By Matt Thurber

Nearly 15 years after the R66 received FAA certification, Robinson Helicopter has unveiled significant upgrades to the turbine-single ship. Now called the R66 NxG, the latest version adds an integrated Garmin avionics suite with autopilot, impact-resistant windshield, and new interior material and exterior paint scheme options.

Two R66 NxG models are on display at Robinson’s Verticon exhibit in Dallas, and buyers will be able to choose from three trim levels: Riviera, Southwood, and Palo Verde.

All new R66 orders starting at Verticon will be for the NxG versions, according to Robinson president and CEO David Smith, with deliveries expected to begin in 2026.

A three-axis Garmin autopilot will be standard on the Riviera, a limited edition R66 NxG. The Riviera Midnight + Umber interior includes an Alcantara fabric headliner and midnight leather seat coverings.

Flooring is made of a light wood, a new feature for Robinson helicopters. Three new paint colors in a “bold color-block pattern” are available. The first Riviera R66, serial number 1500, is on display this week at Verticon.

Robinson’s new R66 NxG adds Garmin integrated avionics and autopilot, along with premium interior trim and exterior paint options.

The base-level R66 NxG trim is the Southwood edition, with Garmin G500H and 700P/700P TXi displays and two-axis autopilot, impact-resistant windshields, and LED landing lights. Stone or Graphite colors are the available interior choices.

Moving up to the Palo Verde version adds an optional Garmin 1060/700P TXi display and GTN 750 Xi navcom, synthetic vision, GDL 60 datalink, and the two-axis autopilot. Also included as standard with the Palo Verde are sun visors and ambient overhead lighting, with footwell lighting as an option. z

By Hanneke Weitering

Ascent Aerosystems, a subsidiary of Robinson Helicopter, unveiled its latest UAV yesterday at Verticon. Called Helius, it is the company’s first product in the sub-250-gram category.

The $4,500 drone uses artificial intelligence to avoid obstacles and track objects, which it detects using an electro-optical, ultra-lowlight sensor that can tilt, pan, and zoom. It can fly for 30 minutes at a max speed of 45 mph.

According to Massachusetts-based manufacturer, Helius is American-made and complies with the National Defense Authorization Act, making it a viable option for U.S. government agencies and contractors, including law enforcement and emergency response operations.

“Helius delivers unmatched capability in its class at a competitive price. It is the drone

we’ve wanted to make from the beginning; small enough to fit in your pocket but powerful enough to meet the rigorous demands of public safety, emergency response, and critical industrial missions,” said Ascent co-founder and CEO Peter Fuchs.

Ascent’s coaxial UAVs look much different than traditional quadcopter or multirotor designs, with a cylindrical airframe andcentrally mounted counter-rotating blades. Payloads can be mounted both on the top and bottom of the airframe.

“Bringing out coaxial propulsion technology to a sub-250-gram platform while maintaining the durability, performance, and reliability Ascent products are known for has been one of the most rewarding challenges we have undertaken,” Fuchs added.

Helius is available for pre-order, and with deliveries to begin in the fourth quarter. z

The sub-250-gram Helios drone is powerful enough to do law enforcement missions.

Here the whole ecosystem comes together to connect, share and shape the future of European Business Aviation. There’s nowhere better for exhibitors to go to market or for visitors to gain knowledge and experience new products or services. And don’t miss the plentiful opportunities to network with the community, hear insights from thought-leaders and reach new customers.

Tickets available at ebace.aero

By Curt Epstein

Global helicopter leasing firm Macquarie Rotorcraft Limited (MRL) was sold to SMFL LCI Helicopters (SMFLH), a joint venture formed in 2020 between Sumitomo Mitsui Finance & Leasing (SMFL) and LCI Investment. Terms of the purchase were not disclosed.

Established in 2013, MRL has a fleet of approximately 120 helicopters that operate in the offshore transport, aeromedical, searchand-rescue, and utility sectors. Under the new organization, which will be managed by Libra Group subsidiary LCI, the company expects that number will increase to more than 300 aircraft, including those in SMFLH’s fleet. SMFLH has focused on midsize twins such as the Leonardo AW139 and AW169, as well as the Airbus Helicopters H145.

LCI CEO Jaspal Jandu described two driver trends behind the purchase. The first is a recent Airbus Helicopters study that predicted demand for 16,000 new rotorcraft worldwide worth approximately $130 billion over the next two decades.

Under that assessment, Jandu notes that lessors will need access to equipment, finance, and experienced teams of people across multiple professional disciplines, which he believes will favor larger lessors with robust leasing platforms and a track record of operations and capital raising.

The second Jandu described as increasingly larger fleet requirements from SMFLH’s existing operators, particularly in the midsize-twin helicopter category. The acquisition of Macquarie will add six more helicopter types to the SMFLH’s fleet, along with 21 new customers

L-r:

Shinichiro Watanabe, SMFL senior managing exec officer, and LCI CEO Jaspal Jandu.

and 14 additional countries of operation.

“This agreement marks an exciting opportunity to create scale, value, and efficiency in a disciplined manner across the helicopter leasing sector,” Jandu told AIN.“Today’s helicopter operators and end users are demanding more creative capacity and finance options at the outset of any decision-making process. With the significant increase in scale this acquisition brings, we can offer more comprehensive, versatile, and efficient leasing solutions across the globe.” z

GE Aerospace is highlighting its hybrid-electric propulsion advances this week at Verticon. The company has teamed with Sikorsky to provide a CT7 turboshaft engine, electric motor/generator, and associated power electronics for the latter’s HEX (Hybrid-Electric eXperimental) VTOL demonstrator, the power train testbed of which is currently under construction.

The engine maker is also a partner with the U.S. Army on the Applied Research Collaborative Systematic Turboshaft Electrification Project, which focuses on the research, development, and testing of a megawatt (MW) class electrified powerplant. It also will further evaluate how hybrid-electric systems can enhance military rotorcraft.

A collaboration with NASA and Boeing, GE’s Electrified Powertrain Flight Demonstration Program centers on the development and testing of a MW-class hybrid-electric powertrain for commercial aviation. These systems can provide

improved fuel e ciency and performance compared to today’s commercial aircraft engines.

Also in partnership with NASA, the Turbofan Engine Power Extraction Demonstration will embed electric motor/generators in a high-bypass commercial turbofan to supplement power during di erent phases of operation. This creates a system that can work with or without

GE is providing its CT7 turboshaft engine for the hybrid-electric propulsion system in Sikorsky’s HEX (Hybrid-Electric eXperimental) VTOL demonstrator.

energy storage units such as batteries.

“At GE Aerospace, we think the future of flight is more electric. To that end, we’re pursuing a range of hybrid-electric programs that will demonstrate the integration of power electronics with gas turbines,” said Christine Andrews, GE Aerospace’s executive hybrid-electric systems leader. C.E.

By Matt Thurber

TRU Simulation is offering demos of its Veris VR (virtual reality) flight simulator this week at Verticon. The full-motion compact simulator replicates a Bell 505 and uses VR to provide a detailed view of the outside world.

This eliminates the need to attach an expensive and bulky visual system to the simulator while enabling realistic flight scenarios such as inclement weather and medevac scenes. Costing roughly 10 percent as much as a traditional full-flight simulator with a large visual system, the Veris’ footprint, including the six-degreesof-freedom motion base, is just 7.3 by 6.85 feet.

TRU sister company Bell was the launch customer for the Bell 505 Veris VR simulator. The training device is based at the Bell Training Academy in Fort Worth.

“The Veris VR simulator device is designed to meet the requirements for both EASA level 3 and FAA level 7 standards,” according to TRU Simulation general manager Jerry Messaris. Last year, TRU finished initial

EASA qualifications and the European regulator gave the go-ahead for TRU to move to final qualification.

This is now scheduled for later in 2025. “We’re also continuing to work with the FAA and plan to complete those qualification activities in 2025,” he added.

After these qualifications are done for the Bell 505 VR simulator, “we look forward to

The compact Veris simulator blends virtual reality with actual flight controls to provide realistic pilot training at a much lower cost than with a fullmotion device.

exploring other rotorcraft, as well as fixedwing design concepts,” Messaris told AIN “We’re also seeing great interest from the rotorcraft and fixed-wing community to support single-pilot training.”

In addition to Verticon, TRU has demonstrated the Veris simulator at last year’s Heli-Expo, NBAA-BACE, IITSEC, and AAAA. z

Rising demand for helicopters around the world has contributed to sustained growth at Pratt & Whitney Canada (P&WC) as the engine maker continues to grapple with supply-chain challenges stemming from the pandemic. The RTX business, which is celebrating its 100th anniversary this year, has been manufacturing helicopter propulsion systems for 60 years and has built around 20,000 helicopter engines that have amassed a combined total of 80 million flight hours.

Nico Chabee, v-p of marketing and sales for helicopters at P&WC, told AIN that shortages of pilots and mechanics, combined with lingering supply-chain woes, continue to constrain the industry as demand outpaces supply, creating hefty backlogs. “It’s a good problem to have,” he said. “Today we are growing at a pace where people would like us to grow even faster.”

Most recently, the company has been expanding its footprint in Asia. Last year P&WC expanded its Eagle Services Asia facility in Singapore and invested $20 million to expand its manufacturing presence there, with plans calling for a 10% increase in its Singapore-based workforce by 2026.

P&WC also continues to enjoy government support both in Canada and abroad, including from the U.S. Department of Defense. Chabee told AIN the company is not worried about any of its U.S. defense contracts being canceled as a result of federal government cuts.

“I don’t think it’s even a topic of discussion,” he said. While he declined to comment on the possible impacts of U.S. tari s on Canada, he noted that company leadership is “keeping a close eye on the evolving situation.”

While P&WC forges ahead with its global expansion, the company is also continually investing around $500 million per year in

innovations for its existing line of legacy engine models, as well as future products. For example, the company is studying advanced materials that could enable greater thermal e ciency in gas turbine engines to reduce fuel burn and emissions.

On the future front, P&WC is working with Airbus Helicopters’ PioneerLab team to build a hybrid-electric demonstrator aircraft based on the H145 helicopter, with first flights slated for 2027. That demonstrator will combine one of P&WC’s PW210S engines with a pair of Collins Aerospace 250-kW electric motors.

The company is also researching and experimenting with hydrogen propulsion turbine engines. It is preparing to demonstrate hydrogen combustion technology on a PW127XT turboprop engine for the Canadian government-backed Hydrogen Advanced Design Engine Study. H.W.

By Charles Alcock

The long-anticipated consolidation in the crowded, and some say over-hyped, advanced air mobility (AAM) sector appears to have gathered momentum since late last year. In the U.S., little has been heard from many of the players vying for attention over the first half of the 2020s, but the most visible signs have been the collapse in funding for former European eVTOL aircraft frontrunners Lilium and Volocopter.

Developers of eVTOL aircraft have made some inroads into the rotorcraft sector with operators such as Bristow, Air-Dynamic, Blade, Omni, and Helisul having signed provisional purchase agreements with several companies, including Eve Air Mobility and Beta Technologies.

Nonetheless, the only manufacturers with active programs exhibiting this week at Verticon are Joby Aviation, Bell Textron, and Boeing (through its Wisk Aero subsidiary). Part of the reason for industry group Helicopter Association International to rename itself Vertical Aviation International last year was a declared intention to include AAM companies in its fold.

The AAM enclave at the Dallas event this week would have included Airbus until the European aerospace group surprised the market in late January by pausing plans to bring its four-passenger CityAirbus NextGen eVTOL to market. It cited limitations in available battery technology as the main reason for the decision, indicating that it doesn’t rule out resurrecting the program at a later date.

Recent comments from Boeing’s new CEO, Kelly Ortberg, have prompted some doubts as to whether the group might walk away from its investment in the AAM sector as part of a wider rationalization that might see it jettison subsidiaries such as aviation software group Jeppesen and electronic flight bag app provider ForeFlight. Wisk Aero stands apart among Western eVTOL developers in remaining resolutely determined that air-taxi services will be viable only with completely autonomous, no-pilot-on-board operations—an approach that it acknowledges likely pushes type certification and entry into service into the next decade.

However, helicopter OEM Bell is actively involved in the development of the Nexus

eVTOL being advanced by the eAviation division of its Textron group parent. The first full-scale prototype for the four-passenger vehicle is under construction at Textron’s Glass House facility next to McConnell Air Force Base in Wichita, with Bell engineers contributing to the work, along with colleagues from the company’s Pipistrel and McCauley propeller subsidiaries.

From among the hundreds of eVTOL start-ups, California-based Joby Aviation is preparing to start flight-testing its four-passenger aircraft under the type inspection authorization issued by the FAA as it strives to meet its latest target for U.S. type certification by the end of this year. As funding for rival companies seems to be drying up, Joby is operating with healthy cash reserves estimated at almost $1 billion, following a further investment commitment of $500 million from its main backer, Toyota, in October.

Along with rivals such as Archer Aviation, Joby is actively pursuing opportunities to establish early eVTOL use cases in international markets, including the UAE, Japan, and Australia. Europe appears to be a tough nut to crack, with eVTOL manufacturers such as Lilium, Volocopter, and the UK’s Vertical Aerospace wading through protracted local type certification processes at high rates of cash burn.

In the U.S., frontrunners Joby and Archer have said little about where they now stand on their respective timelines to certify their eVTOL aircraft and launch the commercial operations so eagerly awaited by investors. The most significant and immediate question mark would seem to be over possible shifts in strategic priorities and resources at the FAA, which is among many U.S. agencies now facing scrutiny from Elon Musk’s Department of Government Efficiency.

All eyes are now on acting FAA Administrator Chris Rocheleau as to whether momentum in bringing U.S.-made eVTOLs to market will be maintained. Conceivably, more pressing concerns—such as safety and staffing issues raised by the January 29 crash of a CRJ-700 regional airliner and a U.S. Army Black Hawk helicopter at Washington Reagan National Airport—could result in this work falling down the list of the agency’s priorities. z

By Matt Thurber

The Los Angeles Police Department (LAPD) Air Support Division (ASD) is the first lawenforcement agency in the U.S. to install a Loft Dynamics virtual reality (VR) flight simulator. The device is being used to train its police pilots who fly Airbus AStar/H125 helicopters.

“It has been extremely difficult to incorporate mission-based scenarios into our training

program with the realism and frequency necessary for the training to be effective,” said LAPD chief pilot Kevin Gallagher. “The acquisition of the Loft Dynamics VR simulator and our partnership with their software engineers has solved that problem.

“The realism of the full-motion platform, combined with the ability to custom-build

highly specific police scenarios, is revolutionizing the way we train—whether it’s inadvertent IMC entry, low-altitude chases, or night vision operations. This technology ensures that in critical moments, our pilots are prepared to execute with precision and confidence—because in aviation, you don’t rise to the occasion, you fall to the level of your training.”

Gallagher and the LAPD instructor team are developing a structured, VR-centric training curriculum for the ASD pilots, in collaboration with Loft. Scenarios will include high-speed car chases and integration of virtual Tyler Special Operations Platforms used on the LAPD helicopters for SWAT operations.

Gallagher is also using the LofTWIN system to capture and share scenario- and maneuver-based lessons. Once captured, the student can see a virtual representation or avatar of Gallagher inside the cockpit giving verbal instructions. The student also feels force feedback on the controls to guide the proper control movement. Tracking features also enable measurement and benchmarking of student process against Gallagher’s expertise and objectives.

Meanwhile, Loft Dynamics has released its second Airbus VR simulator, the H145, which is now available for order. Boston Medflight has signed a letter of intent to add the H145 VR simulator to its training program and will install it at one of its four Massachusetts bases. z

Attaway director of operations at PHI Americas

Closter former CEO of Luxembourg Air Rescue

Thierry Couderc vice president of the European Helicopter Association

By Jessica Reed

In a departure from its traditional singlerecipient format, Vertical Aviation International (VAI) is recognizing four distinguished industry leaders with its 2025 Salute to Excellence Lifetime Achievement Award. The organization cited an exceptionally strong field of nominees and a desire to acknowledge more industry veterans as factors in expanding the program.

Recipients include Pat Attaway, director of operations at PHI Americas; René Closter, former CEO of Luxembourg Air Rescue; Thierry Couderc, vice president of the European Helicopter Association; and retired Indian Air Force Wing Commander B. S. Singh Deo. Sponsored by Bell, the awards are being presented during Verticon 2025.

Pat Attaway ’s 35-year career began as a U.S. Navy helicopter pilot before transitioning to commercial operations, where he played a key role in introducing the Sikorsky S-92 to commercial service. His leadership extended beyond PHI as chair of both the Helicopter Safety Advisory Conference and HeliO ff shore’s Operational E ff ectiveness Workstream, where he advocated for enhanced safety practices and ADS-B adoption in helicopter operations.

“René Closter receives a Lifetime Achievement Award for his commitment to aviation and rescue services that has had a profound impact on saving lives and advancing the capabilities of air rescue operations globally,” according to VAI. Under his leadership from 1995 to 2021, Luxembourg Air Rescue (LAR) expanded significantly, growing to operate a fleet of seven helicopters and five jets.

Closter, a helicopter pilot and paramedic himself, personally participated in more than 14,000 rescue missions. He pledged his home as initial collateral to establish LAR in 1988, and the organization went on to complete more than 70,000 missions during his tenure.

Thierry Couderc earned recognition for his work bridging French rotorcraft interests with broader European initiatives, particularly in navigating EASA’s regulatory framework. Beyond his vice presidency at the European Helicopter Association, he serves as executive director of the French helicopter association Union Francaise de l’Helicoptere and has been active in promoting safety and training advancements through various European committees. “Couderc is known for advocating inclusivity in aviation, notably supporting disabled pilots,” VAI stated.

B. S. Singh Deo’s career spans more than five decades and includes experience with 19 different aircraft types. After a distinguished

military career that earned him the Indian Air Force’s Vayu Sena Medal, he transitioned to civil aviation and made significant contributions at Bell Helicopter. His influence extends internationally through his work establishing training facilities and conducting safety seminars for the United Nations World Food Programme.

Singh Deo was recognized “for significantly shaping both military and civilian aviation sectors nationally and internationally.” He is now v-p of the Rotary Wing Society of India and a member of the Aeronautical Society of India.

“We are immensely proud to recognize this year’s Lifetime Achievement Award recipients, each of whom has made transformative contributions to the vertical aviation industry,” said VAI president and CEO James Viola. “By honoring multiple outstanding individuals this year, we not only celebrate their enduring impact and leadership but also reflect our commitment to adapting and responding to the evolving needs of our industry and its distinguished professionals.”

The expansion of VAI’s lifetime achievement recognition represents a recent effort to ensure that more rotorcraft industry leaders receive formal acknowledgment of their enormous contributions before concluding their careers.

around 7% more power for the same fuel burn at maximum continuous power than the current Arrius 2B2 Plus turboshaft. In the cockpit, the H140 will feature the same Helionix avionics suite as its siblings.

At a pre-show media briefing in Germany, Dirk Petry, Airbus v-p and head of the H135 program, said customer input, especially from Europe’s emergency medical support (EMS) sector, has been influential in defining the helicopter.

With Airbus Helicopters recently celebrating a record 2024 in terms of sales and profitability, including 445 gross orders last year, he said the time is right for the company to try to offer more value in the light-twin market segment.

“This is our new product in the range of light-twin helicopters, defined by a large cabin and the incorporation of the optimum innovations, performance, and economics in terms of an attractive acquisition price, but also in low operating costs,” Petry said. Airbus said the H140 will deliver an enlarged cabin while offering comparable direct maintenance costs to the H135 and similar costs to the larger H145.

Incorporating things learned from Airbus’ Bluecopter project and evolved T-tail elements— albeit in a different configuration, with the horizontal stabilizer mounted at the top of the tail—is expected to give the H140 increased lift in hover. The five-blade, 35-foot, 5-inch diameter rotor is similar to the H145’s while incorporating weight-saving benefits. Increased use of composites includes a larger-diameter Fenestron.

Externally, the aerodynamically-optimized front section of the airframe, complete with bird strike-resistant windshield, also features rear clamshell doors that are almost 10 inches higher than the H135’s. These, combined with a raised tail boom, facilitate easier rear stretcher loading—an operational consideration also evident in the almost four inches wider side cabin doors.

A cabin volume of 215 cu ft, excluding space for the pilot, offers 20% more room, unobstructed by center or door posts. Combined with a 4-foot, 2-inch flat ceiling and 15 inches wider than the H135, the additional real estate reflects requirements specified by EMS operators.

Following EASA certification and service entry in 2028, FAA validation, along with

commercial air transport use-case approvals, are expected to follow in 2029. Missions including offshore operations—benefitting from the larger rear window to the specifications of an escape hatch—are also expected. However, with the H135M remaining the most cost-effective value proposition for military training, Airbus is not planning to add an H140M version.

With the prototype H140 (registered as D-HEEY) having made its first flight in June 2023, around 55 hours have been logged so far. Volker Bau, chief test pilot for Airbus Helicopters Germany, said

that with harmonized controls, H135 pilots “will feel familiar and at home.” Already flying three times a week, D-HEEY has almost completed the entire flight envelope expansion phase, with a hot-and-high campaign to commence this summer followed by cold-weather analysis. A second prototype will follow this year and two more in 2026. At its helicopter final assembly line in Donauwörth, Airbus is enacting plans to expand output rates above the current total of 150 aircraft to work the H140 into the mix alongside the H135s and H145s. z

April 9 – 12, 2025

Friedrichshafen | Germany

Arm your top maintenance professionals with the technical and interpersonal skills that transform your operation into a safety-focused, highly e cient department.

Our coveted Master Technician certification improves safety, increases aircraft dispatch reliability, and lowers operational costs. Expertise can be earned in Airframe, Avionics, Cabin Systems, Composites, Engines, or Management.

FSI. Nothing short of excellence.

Email sales@flightsafety.com to secure a reservation.