AVIATION INTERNATIONAL NEWS

ACCIDENTS: QUARTERLY BUSINESS AVIATION UPDATE

SUSTAINABILITY: PUTTING SOLAR POWER TO WORK

ASSOCIATIONS: BUNCE BIDS BYE AFTER GAMA SUCCESS

Special Report: What's new in safety

Epic Aircraft squeezes maximum performance from a thoroughly modern single-engine turboprop

Scan the QR code to see the mission

12 Airports , FBOs tap solar power in decarbonization plans

30 Special Report: U.S. runway incursions drive new safety push

8 Daher planning ‘more electric’ successor to EcoPulse

4 Bizav industry grapples with ramifications of tari s

6 Survey finds FBO fuel sales flat in 2024

10 Business jet accidents and fatalities rise globally in first quarter

16 Special Report: Notams, finally getting fixed?

24 Special Report: In face of barriers, SMS picks up steam 33 ACA grows in thriving charter market

Pilot Report: An epic Epic E1000 44 Pete Bunce: A reflection of 20 years

46 On the Ground | 48 MRO | 50 Accidents

Compliance | 54 People in Aviation On the cover: Epic Aircraft's E1000 GX

Correction: A chart in the April AIN monthly print edition inadvertently omitted Million Air at Houston Hobby in the top 10% of rated FBOs in North America, citing a di erent FBO in its place. Million Air did reach that mark with a rating of 4.67.

BY KERRY LYNCH

The business aviation community continues to try to absorb the ramifications of the White House’s rollout of global tariffs, but leaders are warning aircraft owners and operators to obtain expert or legal advice on the applicability before they conduct a transaction or upgrade their aircraft. They also warn that the tariffs are likely to have a broader economic impact, including on aircraft valuations.

President Donald Trump last month rolled out global tariffs, announcing a baseline of 10% worldwide and, initially, for imports from many countries, additional “reciprocal” tariffs that could become up to 50% higher. However, after days of market roils, Trump paused the additional reciprocal tariffs on most countries, except China, for 90 days.

The announcement did not change the tariffs already assigned for imports from Canada and Mexico, and the exemptions under the United States-Mexico-Canada Agreement (USMCA)—including aircraft and certain components—remained in place for those countries.

Speaking during an NBAA webinar, Jonathan Epstein, partner at Holland & Knight and member of the NBAA regulatory issues advisory group, noted that aviation has been

largely duty free since 1979 under the World Trade Organization’s agreement on trade and civil aircraft but said the tariffs are now less clear for aircraft and parts from countries outside of Canada and Mexico, as well as parts that do not qualify for the USMCA. Adding layers of complexity, there are numerous murky areas with the tariffs, such as accounting for the percentage of U.S. material in an import as well as assigning a tariff on a “transformed” aircraft or component, such as in completions.

KRISTIE GRECO JOHNSON

NBAA SENIOR V-P OF GOVERNMENT AFFAIRS

NBAA hosted the webinar to answer some of the numerous questions swirling around about what the tariffs mean for business aviation. NBAA senior v-p of government affairs Kristie Greco Johnson warned: “There are quite a few uncertainties that still exist,” and she encouraged operators to seek legal counsel for specific questions.

Greta Peisch, a partner at Wiley Law and former general counsel for the Office of the United States Trade Representative, explained that the White House has included provisions allowing them to modify the tariffs during negotiations with other countries—a process that has already begun. “It does seem as if this is a jumping-off point to have those conversations. Now, how fast those go, it’s a big question,” she said. z

Dassault Aviation is completing assembly of the first Falcon 10X at its Bordeaux-Mérignac facility in France. Service entry is planned for late 2027. At the same time, engineers are conducting airframe load and fatigue limit testing on a mechanical testbed to validate airframe life limits. Falcon 10X systems are being tested on multi-system test benches at Dassault’s Istres flight-test center. Tests will verify proper functioning of avionics, engine controls, flight controls, hydraulics, electrical distribution, braking, fire protection, and other aircraft systems. Tests of the flight deck and the digital flight control system are underway at Dassault’s Paris headquarters.

Universal Avionics introduced an AI-powered taxi assist solution to address safety challenges during aircraft ground operations at airports. Taxi Assist leverages speech-to-text technology designed for noisy environments to turn verbal ATC instructions into intuitive visual directions on flight deck displays. Features include verification of pilot readback against ATC confirmation, graphical displays with runway indicators and warnings on navigation maps, and logged clearance instructions with taxi status updates.

Ahead of its planned service entry later this year, construction on the first production Bombardier Global 8000 is nearing completion at the airframer’s final assembly center near Toronto. Meanwhile, the program’s Wichita-based test aircraft (the modified former Global 7500 FTV5) has been flying missions to Europe to showcase its performance under real-world operating conditions. The 8,000-nm aircraft will be able to link city pairs such as Dubai-Houston, Singapore-Los Angeles, and London-Perth.

BY CURT EPSTEIN

FBO fuel sales in 2024 were stable but stagnant, according to results from the Aviation Business Strategies Group’s (ABSG) annual survey, released on the eve of NBAA’s Schedulers & Dispatchers Conference in New Orleans.

While 7% of respondents to ABSG’s survey this year indicated that they saw fuel sales increase by more than 8%, 22% reported that their fuel sales remained static year over year, the highest response in this category in the survey’s history.

Overall, 58% of respondents either saw a reduction or no change in their fuel sales. ABSG principals John Enticknap and Ron Jackson noted the same totals in previous results comparing 2023 with 2022.

“After a robust recovery in fuel sales in 2021 following the pandemic, we’ve seen a gradual deterioration in fuel sales across most geographic markets,” said Enticknap. “The results of our recent survey would indicate that the industry has entered into a period of stagnation where the highs and lows seem to be evening out.”

When asked what they viewed as contributing factors, survey respondents pointed to larger, more fuel-efficient aircraft capable of tankering fuel; rising cost of aircraft ownership, which forces fringe customers out of

the market; and the increasing cost of hangar space to expand base customer revenue.

“In addition, several survey respondents indicated there has been a marked slowdown in Part 91 aircraft traffic, which has largely been the bread and butter of their business,” Jackson said. Data from Argus International backs up this hypothesis: Business flying declined for the second year in a row. In 2024, Part 135 activity was down 3.5%, while Part 91 decreased by 4.8%.

The survey also attempts to gauge respondents’ confidence in the economy, asking whether they believe it is headed in the right direction. This year, 43% indicated they were undecided about the direction, while 20% responded in the negative.

On the topic of hangar space, 52% said they would not add hangars, while 27% plan to build large box or community hangars; 8% said they would add more T-hangars; and 13% indicated they intend to add both.

Lastly, the ABSG asked participants to list their top five industry concerns. Responses included regulatory and compliance issues; training and turnover; the increasing cost of airport improvements; operating costs such as salary and insurance; and the reluctance of tenants to pay higher rents to support the return on investment for improvements. z

Aircraft owners can now block their personal information, including names and addresses, from public display on FAA websites. This change, mandated by Section 803 of the FAA Reauthorization Act of 2024, enables owners to submit privacy requests through the Civil Aviation Registry Electronic Services system. NBAA welcomed the move, citing security concerns for business aviation operators. Publicly available aircraft ownership data has raised broad industry concerns about passenger safety, corporate espionage, and unauthorized tracking.

In light of growing GPS jamming and spoofing reports, the U.S. Federal Communications Commission (FCC) is exploring commercial technologies that would provide an alternative source of position, navigation, and timing (PNT) data. “Although GPS is indispensable…it represents a single point of failure that can be vulnerable,” the agency said, outlining plans to accelerate e orts to “support new and complementary or alternative PNT solutions.” Potential technologies include low-earth-orbit satellite networks, the broadcast positioning system, enhanced long-range navigation (eLoran), and NextNav, a ground-based multilateration system.

Embraer Executive Jets started o 2025 on a high note with deliveries in the first quarter up 28% from the same period a year ago. The manufacturer handed over 23 aircraft in the first three months versus 18 in the first quarter of 2024. The mix consisted of two Phenom 100s and 12 of its larger sibling, the Phenom 300. Meanwhile, Embraer delivered three Praetor 500s and six Praetor 600s—two more midsize jets than it handed over a year ago.

A worldwide network, now with even more feld and airborne support teams near you.

BY CHAD TRAUTVETTER

Using insights from the EcoPulse hybrid-electric demonstrator, Daher Aircraft is taking a pragmatic approach to a “more electric” airplane it expects to launch in 2027, company CEO Nicolas Chabbert said at the Sun ‘n Fun Aerospace Expo.

EcoPulse, a TBM 960 fitted with six electric motors on the wing leading edges, “was not a commercial product—it truly was a demonstrator for motors and batteries,” he told AIN. “What we now envision [for a commercial product] is a more electric airplane, likely hybrid-electric and a derivative of one of our existing airplane models,” meaning the TBM 960 or Kodiak 100/900.

According to Chabbert, the company learned a great deal from the 20 EcoPulse flights. “We learned that we will have to revisit aerodynamics for electric aircraft, as well as make changes to the user interface,” he said, specifically citing the control yoke and power levers.

“We also need to clearly outline the desired benefits, as well as the storage, distribution, and use of electric power. Then there’s certification.”

He is also disappointed with the progress on battery technology. “We’re not even close to where they projected 10 years ago,” he said, explaining that energy density was expected to double by now but has increased only by about 10%.

“We tested a 360-kilogram battery on EcoPulse and didn’t get the performance that we were hoping, though we did find ways to make better use of the available power. For perspective, a 360-kilogram battery equals about 10 kilos [22 pounds; about 3.5 gallons] of jet-A.”

Chabbert said Daher polled customers about a more-electric airplane and the response was positive, with “no pushback.”

“Whatever we do in this space has to be as safe—or safer—than the products we have today,” he noted. “We’ll also have to go back to basics on aerodynamics. Aircraft are a compromise of weight, power, and flight qualities.

“The way we think of ‘more electric’ is more assisting,” Chabbert added. “We need to push technology. The end product has to be fully embraced by our customers.” z

Unither Bioélectronique test pilot Ric Webb lifted o in a Robinson R44 helicopter powered by a hydrogen fuel cell propulsion system at Roland-Désourdy Airport in Bromont, Québec, Canada, on March 27. A subsidiary of United Therapeutics, Unither is developing hydrogen-powered helicopters, including a hybrid-electric R66, that it plans to use to transport manufactured organs for transplants. The demonstrator R44 marked the first flight of a hydrogen-powered helicopter.

Victor Sierra Aviation Holdings has added The Av8 Group to its stable of aftermarket component manufacturing companies. Av8, which specializes in FAA parts manufacturer approval (PMA) development, overhauls and repairs business and regional airplane landing gear and electrical, mechanical, and hydraulic components. The companies under the Victor Sierra umbrella—including Aviation Products Systems, McFarlane Aviation, and Tempest Aero Group—serve more than 45,000 customers and o er more than 3,500 proprietary PMA parts.

Epic Aircraft launched the E1000 AX, an upgraded version of its E1000 GX, last month at the Sun ‘n Fun Aerospace Expo. The new variant o ers more than 25 new features, including Garmin Autothrottle and Autoland, and eight new paint schemes. Wellequipped price is $4.85 million—$100,000 more than the GX model it replaces—with certification and service entry expected in July. Other added features include automatic yaw damper, electronic brake hold, CoolView windows, Garmin PlaneSync, GRA 5500 radar altimeter, 3D SafeTaxi and Taxiway Routing, GWX 8000 weather radar, and True Blue lithium-ion battery.

BY GORDON GILBERT

Five fatal business jet accidents claimed 12 people in the first three months versus four accidents and 11 deaths in first-quarter 2024, according to preliminary data gathered by AIN. U.S.-registered business jets fared better, with two fatal accidents claiming two people in the quarter versus

three accidents and nine fatalities in the same period last year. But non-U.S.-registered business jets experienced a significant uptick in fatalities: 10 deaths in three accidents in the first quarter compared with two deaths in a single accident in the same timeframe last year.

Bombardier has begun construction on a Middle East aircraft service center at Al Bateen Executive Airport (OMAD) in Abu Dhabi, UAE. The 120,000-sq-ft facility is expected to open in the second half of next year. The facility was originally planned for Abu Dhabi International Airport (OMAA), but Bombardier determined that OMAD provided a more strategic location. The facility will have a 55,000-sq-ft hangar, along with a parts depot. It will o er a complete slate of aircraft services to support Learjets, Challengers, and Globals.

Aviation Personnel International (API) has launched API WorkWell, an organizational wellness program designed to address retention challenges in business aviation workplaces. It aims to evaluate workplace health, strengthen leadership, and improve team dynamics. The first phase of the program incorporates qualitative and quantitative assessments through team feedback. API analyzes this data to deliver a diagnostic report that identifies organizational strengths, improvement areas, and potential risk factors, then benchmarks them against industry peers. Phase two delivers a customized implementation plan with personalized coaching.

In the ongoing United States v. Hansen Helicopters case, the U.S. Attorney’s O ce for the District of Guam has entered into a global settlement agreement with four defendants associated with Pacific Spotters Corporation (PSC). The agreement included “disposition of aircraft and aircraft business operations…and…a provision of information/ cooperation.” A sentencing hearing for Hansen Helicopters and its CEO, John Walker— found guilty on 110 counts—is set for May 5.

BY CHARLES ALCOCK

As the aviation industry steps up efforts to decarbonize, solar power is increasingly among the steps being taken by FBOs, airports, aircraft operators, and maintenance providers to move the dial. Solar panels are being installed at multiple sites as part of a wider approach to decarbonizing operations that also include improving the energy efficiency of facilities and enabling aircraft operators to have access to sustainable aviation fuel.

Last year, specialist supplier Solivus installed solar panels on the hangar roofs at the London-area business aviation hub Farnborough Airport. These are now meeting around 25% of the facility’s power

needs, and the company has made similar installations in the west of England at Cotswold Airport, which is also used by private aircraft operators, as well as supporting Air BP with infrastructure projects.

At London Biggin Hill Airport, Bombardier last year made a significant investment to install 3,000 solar panels across its 250,000-sq-ft service center. The photovoltaic system can generate more than 1.133 kilowatt hours of power, providing for around one third of the facility’s electricity needs and reducing its annual carbon emissions by up to 252 metric tons.

On the other side of the Atlantic, Signature Aviation has installed solar power

provision at 13 of its FBOs at U.S. airports. The ground handling specialist has installations at five more sites at various stages of construction, including at its UK base at London Luton Airport.

The Luxaviation Group’s FBO at Lanseria International Airport in South Africa makes extensive use of solar power. Panels have been installed on its buildings and some of its ground support equipment.

On March 26, Luxaviation introduced what it said is the industry’s first real-time carbon calculator as part of its private aviation services app. This now features live emissions tracking, as well as instant

carbon offset purchases and options to select blends of sustainable aviation fuel through the Europe-based group’s Green Legacy platform.

UK-based Solivus handles all aspects of installing solar power infrastructure, also taking responsibility for commissioning the equipment (including connections to the power grid), operations, maintenance, and reporting monthly energy generation. The group says it is seeing increased demand from the aviation industry.

According to Solivus’ business development manager and environmental advisor, Charlie Armitage, around 40% of commercial buildings cannot support the weight of the required number of solar panels. The company has developed lighter panels that equate to a weight of about 3.5 kilograms per square meter, compared with typical installations of between 10 and 15 kilograms.

Panel construction uses silicone wafers around 2 millimeters thick that are encased in polymer, compared with the more usual 2 centimeters. Importantly in airport environments, they are designed to minimize glare and glint with a surface that is wrapped in plastic. Armitage explained that Solivus bonds the panels directly to the roof surface with no penetration, which he said is advantageous for expensive or critical infrastructure.

Even in the UK—a country not noted for its high levels of bright sunshine— Solivus believes there is potential for solar power to cover higher proportions of energy needs if more panels were installed on buildings.

The company has looked at groundmounted panels at airports but found that customers were reluctant to commit out of concern that this might compromise future expansion plans.

According to Armitage, the typical payback period for customers investing in its technology is five to seven years, with the equipment covered by a 25-year warranty.

In some countries (but not the UK since 2019), solar customers get paid for electricity they supply back to the grid.

For FBO group Signature, solar power is a key facet of its roadmap to achieving netzero carbon by 2050. There are two interim steps, starting with cutting 29% of Scope 1 and 2 emissions by the end of 2025 and then achieving a 50% reduction by 2030. Scope 1 covers energy used directly by the company for applications such as running ground support equipment, while Scope 2 covers energy that a company buys from utilities to run its facilities.

Heather Frost, the group’s director of environmental and sustainability programs, explained to AIN that installing solar infrastructure at locations where it is appropriate is one of three main aspects of its “green power” strategy. It also purchases renewable energy where it is available from local utility companies—for example, in Colorado—and purchases credits for renewable energy, but only when it is solaror wind-generated.

Other green power initiatives at Signature include improving water-use efficiency at FBOs through measures such as improving the efficiency of heating and

air conditioning, installing insulation in buildings, and replacing windows. The company has also been electrifying its fleet of ground vehicles and increasing its use of carbon credits and offsets. In 2022, it achieved operational Scope 1 and 2 neutrality for greenhouse gas emissions across its global network.

According to Frost, the availability of solar power at the first 13 FBOs where Signature has made the investment has stabilized now. At all of these sites, it is now selling power back to the grid.

“I am proud to work for a company that is focused on taking action toward internal and external climate goals and that looks at how our achievements in this area impact airports and communities,” Frost commented. “Sustainability is viewed as a journey at Signature, and it is embedded in decision-making across the company. Collaboration within Signature and with industry leaders, regulatory agencies, and professional organizations is essential as we continue to make transformative changes and collectively work to decarbonize aviation.”

In recognition of its pioneering commitment to renewable energy, Signature received the prestigious Green Power Leadership Award from the U.S. Environmental Protection Agency in 2024. z

A proven predictive analytics system that forecasts the service you need—before you need it.

BY MATT THURBER

Notams should be limited to information that is important for safety, but that isn’t always the case.

Note: AIN is using “notam” as a word (not as the FAA uses it, as a contraction) per the International Civil Aviation Organization (ICAO) definition: “A notice distributed by means of telecommunication containing information concerning the establishment, condition, or change in any aeronautical facility, service, procedure, or hazard, the timely knowledge of which is essential to personnel concerned with flight operations.”

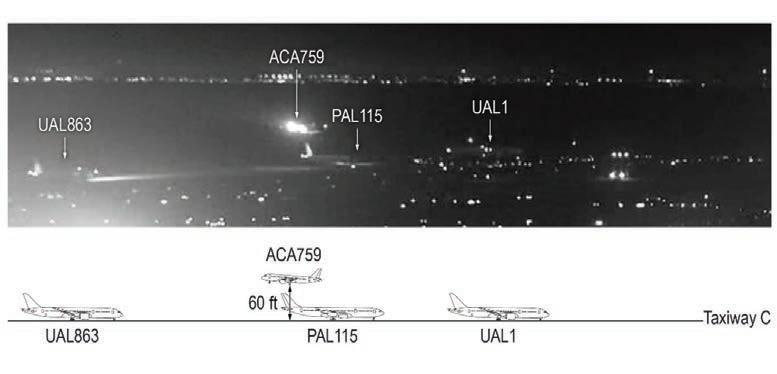

On the night of July 7, 2017, the flight crew of Air Canada Flight 759, flying an Airbus A320, lined up with San Francisco International Airport’s Taxiway C instead

of Runway 28R after being cleared to land. Four airliners were waiting on Taxiway C for takeoff, and the A320 kept descending toward them until it reached 100 feet agl and flew over the first airplane, then started a go-around. At its lowest point, the A320 reached 60 feet agl and was an estimated 10 to 20 feet above the second airplane in line before climbing away.

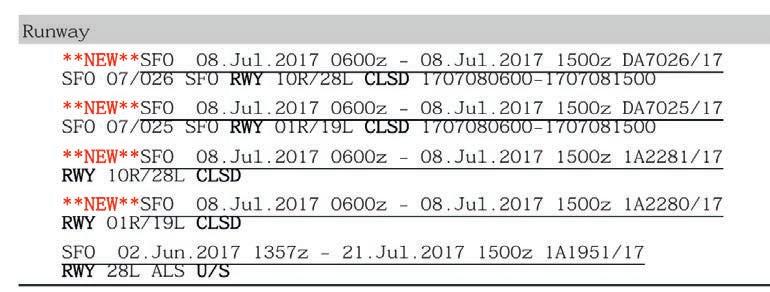

There was a notam for the closed parallel runway—28L. It was in the pilots’ flight release package and included in the airport’s ATIS flight information broadcast, which pilots must review prior to

arrival. The closed runway notam was on page eight of a 27-page briefing package in a section titled “Runway” and came after 14 clearly less urgent notams. Six of these were for OBST CRANE, none of which intruded into the flight path for Runway 28R. Two were for taxilane closures, three for taxiway closures, and one for taxiway CL LGT U/S, which means “centerline lights unserviceable” in notam-speak.

After all of these less urgent notams, the Runway section listed five notams that looked like the image on the next page.

Small items can end up causing big problems. Foreign Object Debris (FOD) of manmade and natural origins poses ingestion risk to engines and can hazard other aircraft systems if overlooked or allowed to be where it does not belong. It’s everyone’s job to stay watchful and be proactive. Make sure consumables and equipment are stowed and taken care of after maintenance. Then keep an eye out for other potential debris. No detail is too small to ignore when it comes to safety. If you see something, stow something.

Guard against FOD damage impacting your aircraft and organization. Mount this poster where it can serve as a visual reminder to stay vigilant for loose or unneeded items. Need more? Download free copies at usaig.com.

Thank you and safe flying!

Find out more about our coverage, our Performance Vector safety initiative or Performance Vector PLUS good-experience returns program. Contact us and we’ll connect you with an aviation insurance broker in your area.

John Brogan President and CEO, USAIG

Before you leave a hangar or parked aircraft, be on the lookout. Stray items you brought in such as tools, consumables or trash, as well as any introduced by other means, become Foreign Object Debris (FOD) hazards if left where they don’t belong. Your eyes and vigilance defend against costly aircraft damage and accidents.

Ensure consumables like rags, safety wire, and other items are removed after work.

Observe strict tool control and account for personal markers, penlights, multi-tools, etc. Avoid unneeded items in maintenance areas; discard packing and trash away from aircraft.

Check tarmac and fence lines often for manmade or natural debris that could become airborne.

Even though the critical runway closure notams came after a set of useless notams, the importance of the closed runways was highlighted by the word NEW in red. Otherwise, there was no ranking of these critical notams that might have signaled to the pilots that there was something important that needed their attention.

In follow-up interviews about the incident, the first officer stated that he could not recall reviewing the specific notam that addressed the runway closure. “The captain stated that he saw the runway closure information, but his actions (as the pilot flying) in aligning the airplane with Taxiway C instead of Runway 28R demonstrated that he did not recall that information when it was needed,” according to the NTSB report.

According to the NTSB, “Features of the notam text emphasized the closure information, such as the use of bold font for the words ‘RWY’ and ‘CLSD’ and a ‘**NEW**’ designation in red font with asterisks before the notam text, as shown in figure 10.98. However, this level of emphasis was not effective in prompting the flight crewmembers to review and/or retain this information, especially given the notam’s location (toward the middle of the release), which was not optimal for information recall. A phenomenon known as ‘serial position effect’ describes the tendency to recall the first and last items in a series better than the middle items (Colman 2006).”

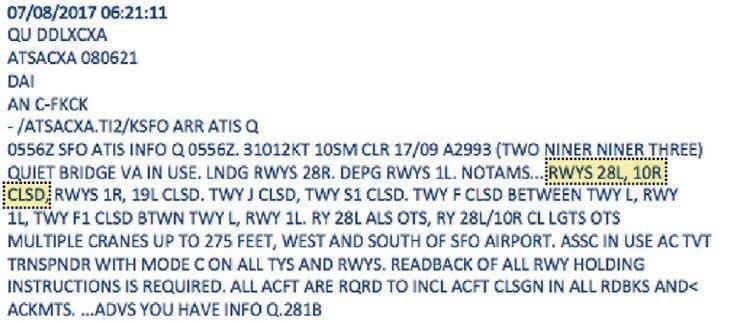

On the right is how ATIS Quebec looked as received via the aircraft’s onboard aircraft communications, addressing, and reporting system (ACARS). In other words, the pilots didn’t listen to information Quebec on the KSFO ATIS radio frequency but read it as an ACARS transmission. (The yellow section highlighting the runway closure is from the NTSB report, not the way it looked to the pilots.)

The report continued: “The ACARS message providing ATIS information Quebec, as displayed in the cockpit, was 14

These notams were on page eight of a 27-page briefing package for the Air Canada flight.

continuous lines with all text capitalized in the same font. As shown in figure 11, the Notam indicating the Runway 28L closure appeared at the end of line 8 and the beginning of line 9. The uniform presentation of the ATIS information could have contributed to the flight crew’s oversight of the runway closure information.”

During a hearing on the incident, thenNTSB chairman Robert Sumwalt singled out what he called the “messed up” notam system.

Sumwalt claimed that the “crew didn’t comprehend the notams” and, as an example of the confusing notams pilots are faced with, read this complex entry from that same Air Canada flight’s briefing package, just one of the many for Toronto Pearson International Airport: “**72**YYZ 06.Jul.2017 1400z–31.Jul.2017 2200z 1Y1247/17 TWY AK, TWY R BTN TWY B AND TWY AT, TWY B BTN TWY B1 AND TWY R NOT AUTH TO ACFT WITH

“Why is this even on there?” he asked. “That’s what notams are: they’re a bunch of garbage that no one pays any attention to,” adding that they’re often written in a language that only computer programmers would understand.

Sumwalt also relayed a recent experience he had flying the jumpseat into North Carolina’s Charlotte Douglas International Airport, saying, “There were pages and pages and pages of notams, including one for birds in the vicinity of the airport… When are there not birds in the vicinity of an airport?”

The NTSB issued six safety recommendations to the FAA after the Air Canada incident, one of which—A-18-024—was to develop a “more effective presentation of flight operations information to optimize pilot review and retention of relevant information.” So far, that recommendation’s status remains “Open—acceptable

The ACARS-delivered ATIS Quebec, with the closed runway information (NTSB highlight).

response.” This means that the FAA has indicated it would, but has yet to comply with the recommendation, eight years after the near-collision and seven years after the NTSB recommendation.

In fact, notams are not supposed to be used for information that might be considered normal—for example, birds in the vicinity of an airport. Such a notam provides no useful information because birds move around, and there is no way to assess the level of risk involved, other than the normal watch for potential hazards such as birds.

According to an FAA presentation for airport managers, “A notam is a notice containing information essential to personnel concerned with flight operations but not known far enough in advance to be publicized by other means. Notams concern the establishment, condition, or change of any component (facility, service, procedure, or hazard) in the NAS [National Airspace System]. They must state the abnormal status of a component of the NAS—not the normal status.”

There is plenty of guidance for those responsible for creating notams. The foundational instructions come from the ICAO, which sets standards for member states to implement. ICAO’s guidance still advises the use of contractions and capital letters, which are leftovers from the days of teletype machines when bandwidth was extremely limited.

For reasons that aren’t entirely clear, ICAO and the world’s aviation authorities have continued with this protocol. The FAA requires that “Contractions and abbreviations designated for ICAO usage as specified in FAA Order JO 7340.2, Contractions, and ICAO Document 8400, ICAO Abbreviations and Codes, must be used in the notam system. When an ICAO usage contraction is not available, plain text is required, except for the list of differences in Appendix C.”

ICAO’s documentation lists common terms and their coding information and

“uniform abbreviated phraseology” to help those who submit notams. However, this isn’t a perfectly clear process, and there is room for confusion.

For example, the contraction “act” can mean two things in ICAO-speak: when used by itself, it means “activated,” but when preceded by the word “volcanic,” it means “activity.” To add inconsistency, the word “deactivated” is not abbreviated to something like “deact” but is spelled out in full. A word like “canceled” is contracted to “cnl,” which is hardly intuitive. Yet “prohibited to” is spelled out instead of contracted to something like “phbto.” Runway centerline lights are “rcll” while other mentions of lights use the contraction “lgt” like “twy cl lgt” for taxiway centerline lights.

The FAA seems to think that this is a good idea. From the notam presentation: “Notams have a unique language characterized by the use of specialized contractions. Contractions are imperative to the notam structure because they make communication more efficient and allow computer systems to parse important words.” It is not clear how the inconsistent use of contractions makes it easier to parse important words.

Notams are so important—even though many are not considered essential for

aviation safety—that the FAA paused domestic airline departures for an hour and a half when the U.S. notam system shut down on Jan. 10, 2023. The problem was due to a contractor who “unintentionally deleted files while working to correct synchronization between the live primary database and a backup database,” according to the FAA, which added, “The FAA made the necessary repairs to the system and has taken steps to make the notam system more resilient.” Yet since then, the FAA had to inject delays into the system on Feb. 1, 2025, due to another outage, this time reportedly a hardware issue, and again on March 22.

Thousands of new notams are generated each day, and tens of thousands are in various databases. Efforts to make the notam system work better frequently mention starting with those who write the notams, claiming that the system’s problems originate with poorly coded Notams or ones that simply shouldn’t have been submitted in the first place.

ICAO points out on its NOTAMeter website that simply removing old and obsolete notams would instantly reduce the number of notams in the database by 20%. NOTAMeter is a tool to analyze the age of notams submitted by the 193 ICAO member states. Unfortunately, the NOTAMeter tool is

not current. The last date for which data was published is July 1, 2023, and at the time, it said there were 34,733 notams in the world. A list shows how many old notams exist for each state, with some of the highest numbers from countries in Africa. Yet even the U.S. and France have a significant number of old notams, 13% and 13.3%, respectively.

ICAO has launched a notam improvement project, with the following goals intended to help civil aviation authorities and data originators: using ICAO’s NOTAMeter to analyze a state’s notams, identify old notams and cancel or replace them, or simply update aeronautical information products; delete non-compliant notams; come up with procedures to prevent inputting of non-compliant notams; and examine training and competency of notam personnel.

Notably, the above attempts to address the problem from the notam submission angle. Some in the industry thought there might be a better way.

In February 2023, after the U.S. ground stops due to the Notam system failure, OpsGroup convened a team to answer the question, “What do pilots want” from notams. In May, OpsGroup brought together 300 people for a “Notam Sprint,” a five-day effort to “Design a prototype system to post-process notams, tag them, summarize them, and then sort/filter into a newly designed briefing package.”

One of the team’s earliest realizations was that it would be impossible to fix the problem from the bottom up just by brute-forcing the correct submission of notams and by trying to get notam submitters to do a better job. The real challenge— and the resulting epiphany—was figuring out how to make more effective use of the existing notam system.

This addresses a fundamental truth about the slow notam improvement efforts by CAAs: anyone is free to do with notams

what they will. CAAs can create their own improved notam systems, building off the existing database. Electronic flight bag app developers can build notam transcription and organization features into their apps, putting the important notams at the top of the list, highlighting them, and turning them into readable plain English, even using uppercase and lowercase letters that are proven to be far easier to read than all caps. ForeFlight, for example, does this with notams that are tied to specific airports.

An airline or flight operation can even use software tools that OpsGroup helped develop to run their own notam improvement programs. A key result of the Notam Sprint was the creation of a categorization system that puts important notams at the forefront and delegates nearly useless ones (“dark notams,” as OpsGroups calls them) into an appendix.

“It doesn’t solve it at the back end (the notam office),” OpsGroup explained, “but it doesn’t need to, anymore. Until this year, we were all convinced that the only way to fix notams was to change the way notams are issued by notam officers, perhaps adding a tag to each one so we could organize them better. But AI has launched a cannonball of change into the aeronautical information sphere. Notams are just the start of the change we can expect to see.”

For the Notam Sprint testing, the team created an application programming interface that demonstrated the benefits of its approach, and airlines and aircraft operators could build on that if they wished. More work needs to be done, according to OpsGroup founder Mark Zee, but the Notam Sprint team’s efforts at least point the way to a solution.

The FAA did respond to the NTSB’s recommendations following the San Francisco near-collision and said, “We will continue to share our progress towards notam

modernization with our aviation industry stakeholders through periodic briefings.” The agency gave three private briefings to then-NTSB vice chairman Bruce Landsberg on Aug. 19, 2019, Dec. 19, 2019, and Nov. 12, 2020. On Dec. 13, 2022, the FAA briefed the industry-led Aeronautical Services Reform Coalition. Finally, the FAA promised to provide updates online, but the link it provided is now dead.

LANDSBERG FORMER VICE-CHAIRMAN, NTSB

AIN contacted Landsberg to ask about the results of those briefings, and basically, nothing happened. “I have been doing battle in this little corner for a quarter of a century,” he said, “and I feel like Charlie Brown and Lucy and the football [a cartoon where Lucy endlessly promises to let Charlie kick the football then lifts it at the last second so he misses] saying, ‘We’re going to fix it; this time we really mean it.’”

Landsberg flies his airplane frequently from Georgia to north of Washington, D.C., and complained of seeing notams in his preflight briefing that “have nothing to do with the flight. On my flights north, I routinely get something like laser lights at Disney World because it’s part of Jacksonville Center [airspace].

“I was almost certain that after the incident in San Francisco [this would be fixed]. Had the Air Canada airplane actually landed on the taxiway, it probably would have been a bigger accident than Tenerife,” where two Boeing 747s collided on the ground as one was taking off in foggy

conditions. While he wasn’t on the board when the Air Canada incident occurred, the fact that the NTSB did a major investigation on an incident in which no one was injured and no damage occurred was significant. “They missed the tail [of one of the airplanes on the taxiway] by something less than 20 feet,” he said.

“I thought after that [incident], the notam business and whole system would start to make sense because we were within 20 feet of having a humongous fireball.”

Over the years, Landsberg has seen congressional mandates and industry working groups try to tackle the notam problem. “And then nothing happens,” he said.

How notams are disseminated and organized is a fundamental problem, Landsberg said. He likes to quote former FAA associate administrator for aviation safety Nick Sabatini, who said about notams: “If everything’s important, nothing’s important. You can’t have everything hair- onfire top priority because it gets lost in the clutter.”

As for notams’ contractions and allcapitals presentation, he added, “There are hundreds of contractions; some are obvious, and some are obscure. I like to remind my friends at the FAA that the teletype is not coming back.”

Fundamentally, he explained, “We get so bogged down in the process, we forget what this is all about: coming up with something to let pilots know about operationally pertinent items. If it’s an unlit something or other, if we’re day VFR, we don’t need to know it’s missing a couple of lights. We can parse these at a pretty basic level and probably eliminate 70% of the garbage.”

There has been progress on responding to the Notam Improvement Act of 2023. The industry task force formed to address the act’s mandate just released the results of

With AvfuelZero, we guide your path to sustainability—assessing emissions, setting targets, creating a reduction plan and delivering clear reports.

Let our ESG experts simplify your journey to net zero so you can stay focused on the flight.

its work, although the report was finalized on January 3.

The task force found: “The current management of notams faces challenges, including a high volume of notices that can obscure crucial information, complex formatting that may lead to misunderstandings, and the potential for critical data to be buried within lengthy messages.” The report includes 41 “actionable recommendations.”

The task force included FAA and industry people as well as subject matter experts (SMEs). Industry members came from associations, airlines, other companies, and academia.

In the 50-page report, the recommendations did address issues raised by the OpsGroup Notam Sprint team. There were five primary focus areas addressed by workgroups covering: notam processes, standardization, human factors, FAA-industry engagement, and system resiliency, stability, and security.

Some of the notable recommendations include:

— The FAA should develop protocols that allow for third-party prioritization, sorting, and filtering of aeronautical information and attaching critical flags, enabling users to focus on essential data first.

— The FAA should, following the sunsetting of the U.S. notam system, begin transitioning tower light notam data out of the notam system and into its own digital aeronautical data application.

— The FAA should expand the provision of geospatial data to smaller airports previously not surveyed to provide pilots with graphical displays of notams containing location-specific information.

— The FAA should ensure that notams are designed according to human factors principles to increase the ability to process, comprehend, and retain the information.

— Users, including pilots who receive notams via a company-issued flight packet, should be able to customize and search notam information based on their individual needs, and the system should allow for this customization through an intuitive interface.

— The FAA should create a centralized, publicly available portal containing all relevant aeronautical information.

— The FAA should ensure that the notam system is designed with open architecture to allow for the adaptation of new and emerging technologies.

— [Notams should] use plain English instead of contractions/abbreviations. There is much more to the report. However, there is no assurance that its recommendations will be implemented. The task force believes that its work, if completed, will satisfy the NTSB’s recommendations in A-18-024. The task force also urged that “A dedicated FAA/industry working group should be established within 180 days of the sunsetting of this Task Force to ensure continued collaboration and improvement of notams. This body…should collaborate as the FAA initiates work to ensure that all notams contain actionable information, defined as operationally significant information that pilots and flight planners can assimilate easily, quickly, and accurately.” z

BY KERRY LYNCH

A year after the FAA released its final rule mandating charters, air tours, and manufacturers to adopt safety management systems (SMS), industry leaders are starting to see interest pick up from affected operations, in part as they lay the groundwork to come into compliance. But, in addition to a drive for compliance, they also began seeing an uptick for an unexpected reason—the people in the back of the aircraft.

The agency on April 26, 2024, mandated SMS for Part 135, air tour operators, and manufacturers (those with a type and production certificate), establishing a deadline of May 28, 2027, for compliance. That is the date when operators must submit their declaration of compliance, meaning they have SMS fully implemented.

Some companies have been spurred into action because of the mandate. Justin Raymond, director of operations in the Americas for Web Manuals, said his company has seen “a significant rise” in business aviation operators and manufacturers looking

JUSTIN RAYMOND DIRECTOR OF OPS IN THE AMERICAS, WEB MANUALS

for SMS support. He cited the FAA’s final ruling as largely driving this trend.

But also, one of the ripple effects from the high-profile accidents that have brought a spotlight on aviation safety this year is that passengers have started to question the safety standards of their operations, noted Bryan Burns, president and CEO of the Air Charter Safety Foundation. As such, ACSF, which administers an SMS program for its members, has seen inquiries increase in that area.

“What we’ve discovered in the last couple of months with the activity surrounding recent accidents,” said Burns, “is that passengers that are in the back of these corporate aircraft are asking pilots: ‘Hey, what’s this about SMS? Hey, what am I

hearing about ASAP [aviation safety action programs], data monitoring, and the term ‘just culture?’”

He likened the scenario to two decades ago when industry audits began to take root. Passengers saw that companies were advertising that they had met the high standards and began to ask whether their operator was also participating in that: “‘Are we doing this? Are we mitigating and managing our risks?’”

This comes as media coverage has particularly intensified since the January 29 midair collision between a PSA Airlines CRJ700 and U.S. Army Black Hawk near Ronald Reagan Washington National Airport. That was followed within weeks by fatal accidents in Philadelphia and Scottsdale, Arizona. “Whether it’s an incident or an accident, fatal or nonfatal, it’s on the news every day, somewhere, someplace,” Burns added. “And that has triggered just a lot of questions.”

For manufacturers, the mandate has been an imperative. SMS has received substantial attention on Capitol Hill, particularly in the aftermath of the Boeing Max crashes. The mandate was something manufacturers pushed for as they faced other proposals that could have substantially altered the certification process.

However, most manufacturers have long been on board, regardless, noted Walter Desrosier, GAMA’s v-p of engineering and maintenance, noting that the International Civil Aviation Organization has had standards in place for years.

While many have pieces of an SMS, Desrosier said that does not mean the manufacturers are in compliance with the final rule as written. They are assessing the requirements to see where it might differ from where they are, conducting a “gap analysis,” he said.

The FAA also said it is seeing the number of operators proactively implementing SMS continue to climb.

However, the mandate and the deadline are raising numerous questions. Chiefly, will an already strained staff at the FAA be able to keep up with the requirements that were extended to 2,500 more operators? And, how will a small operator—particularly those with a single aircraft, few staff, and few resources—comply?

BRYAN

BURNS PRESIDENT AND CEO, ACSF

Whether it’s an incident or an accident, fatal or nonfatal, it’s on the news every day, somewhere, someplace...

The benefits of SMS have been well documented and endorsed by many industry associations, which have long advocated for the programs and key elements of SMS, such as just culture and data analysis.

Web Manuals’ Raymond noted that in addition to the simple mandate, companies are coming on board because there is “an industry-wide recognition that proactive safety management is essential in reducing operational risks. Many operators are realizing that traditional, manual processes are no longer suitable in the industry’s evolving landscape.”

He also sees a broader industry shift toward data-driven safety reporting and just culture, key elements of SMS.

Desrosier pointed out that many of the elements of SMS are not new to manufacturers, and the reasons behind the FAA and ICAO mandates are the “very same reason that we as manufacturers have been looking at this all along.” In fact, the manufacturers played a role in helping to design the global standards.

About one-third of ACSF’s members have either incorporated or at least started the process of adopting an SMS, Burns noted. But these operations are the ones that are taking the time and investing in a safety organization, likely more predisposed to SMS programs.

Even so, Burns was encouraged by the inquiries the association has been receiving, including the helicopter operators that have reached out through its partnership with Vertical Aviation International.

This is critical given the vast number of operations that need to adopt the program in just two years, including getting it in working order and ready for submission of the declaration of compliance, Burns said.

“What you don’t want to do is wait and then submit some kind of document or manual without having potentially demonstrated between now and May of 2027 that you’ve got a program in place and it’s measurable, it’s quantifiable, and it’s working. Don’t wait until a few months before the deadline and think you’re going to put something together that’s going to be effective,” he said.

GAMA’s Desrosier agreed. Noting there are two years left for compliance, “It’s going to take all of that to effectively and successfully implement [SMS]. We encourage a process where the companies bring in the culture, they bring in the processes, and they bring in the non-punitive

From the moment you arrive, there’s a difference you can feel—and this year, the industry felt it too. In the 2025 AIN FBO Survey, ten Sheltair locations ranked in the top 20%, with seven teammates honored for going Above & Beyond. Whether you’re arriving for a quick turn or seeking a longterm base, our award-winning service and premium facilities are built to support every mission.

Discover more at sheltairaviation.com.

reporting, which all takes time. You don’t just turn that on overnight.”

However, numerous barriers still stand between getting operators on board, but primarily time and resources, Burns said. “Having internal staffing to dedicate to getting through this process is the num ber-one issue.”

Doug Carr, NBAA senior v-p of safety, secu rity, sustainability, and international affairs, agreed, saying this is particularly true as the industry grapples with how to get the smallest operators on board. Carr noted that aware ness is not an issue—most operators have heard of SMS and are aware of the mandate.

But learning how to implement SMS and how it can apply to a one-aircraft oper ation or a small staff where there aren’t resources is an issue.

Burns agreed. “We find ourselves in this constant education process.” He noted that that’s why ACSF developed a scaled-down version of its Industry Audit Standard— IAS Lite—because the original wasn’t accessible for small operators. It also rolled out an SMS platform to facilitate this for small operators.

“Our whole focus was around making it simple, customizable, and a key to a lot of this—low cost,” adding that this was created with the entry level in mind “because they lack time and resources.”

Web Manuals has been working toward that goal as well, said Raymond. “Unlike larger operators that have dedicated compliance departments, smaller operators often have limited resources and personnel managing multiple regulatory requirements. This can increase the complexity of SMS implementation,” he said, noting that his company is working with all sizes of operators.

“Web Manuals’ goal is to make SMS management as straightforward as possible. An effective SMS should scale over time as the operation grows, building on existing processes.”

With an eye on concerns around implementation, the National Air Transportation Association (NATA) is planning a series of forums to help prepare Part 135 and air tour operators, as well as provide better insight to the FAA on their struggles in meeting the requirements. The association is looking at potential locations and timing that would best fit operator schedules, as well as other events where it could reach the larger community.

These forums come on the heels of the 135 SMS Roundup event the association held earlier this year, focusing on topics such as building safety culture and employee engagement, as well as using technology and learning about case studies.

Importantly, the sessions fostered a dialogue between the FAA and operators on areas that were unclear or concerning, said Jenny Ann Urban, v-p of regulatory affairs for NATA. The overarching theme was to help operators understand the need to be prepared for the May 2027 deadline for the submission of their declaration of compliance.

“You need to design and implement your SMS before submitting your declaration of compliance because once that’s submitted, even if you’ve submitted ahead of the deadline, you’ve entered into a regulatory environment where they can come and inspect you,” Urban said.

Also important at the forum was to include representatives from larger operators that have already adopted past voluntary SMS programs or submitted their declarations of compliance. They were on hand not only to share best practices with smaller operators but also to learn from each other, Urban noted. A key theme emerging among them was that safety is not a competition, but rather it’s better for the industry as a whole when everyone is incorporating best practices and sharing information.

As far as the FAA officials there, they had an opportunity to hear questions on how the SMS programs will be reviewed and inspected, as well as concerns that different inspectors may have different

15 - 17, 2025

“The AIN CALS event has been a refreshing experience for leaders within the corporate aviation community and the vendors that support their businesses. 100% engagement for 2.5 days. Truly a working event that leaves us all a bit tired but very enthused!”

– 2024 CALS FLIGHT DEPARTMENT ATTENDEE

“The AIN CALS event provides excellent opportunities for high level interaction between vendors and clients. The one-on-one time and small group sessions are very valuable settings.”

– 2024 CALS SPONSOR

expectations. A key message impressed by operators was the importance of inspectors being trained and understanding the rules. Particularly important was that inspectors evaluate for compliance but do not dictate how to get there.

Among the questions was whether the FAA could keep up with the mandate alongside industry. Regulators are hoping—and starting to see—that many will seek approval for their declaration in advance. But there is a prevailing concern about a rush right at the deadline.

FAA officials indicated that they were paying attention to these and other concerns and were using that information as they train and educate their workforce to oversee the SMS process.

“People get a little overwhelmed with SMS, but if you already have management systems in place, you don’t have to reinvent the wheel. You can utilize that,” Urban said, stressing that SMS will be different for every operator.

Every operator has different risks and different safety analyses. This is why it is important to have the regulators understand the industry and make sure SMS is scalable, she said. Operators need to understand what fits and works for them.

But all of this points back to how the FAA will manage this. Carr noted that the FAA has indicated it may fold SMS into its regulatory inspections of the carriers.

The FAA told AIN it is now in the “final process” of publishing guidance on SMS maturity and how its employees will be instructed to

conduct performance-based oversight.

The agency further noted it has added briefings for its workforce to prepare them for oversight of SMS and developed enhanced oversight tools to help inspectors evaluate and document the effectiveness of an SMS program. In addition, the agency pointed to an array of other efforts such as videos, a frequently asked questions document, and FAA Safety Team (FAASTeam) briefings.

“We have recognized that there is still some confusion regarding development and implementation of SMS, so the FAA has leveraged our partnership with industry to champion SMS,” the agency said, including participating in a number of industry events “to dispel the mystery around SMS for those service providers who are new to the conversation.” z

BY AMY WILDER

A series of recent runway incursions and near-collisions has reignited urgent discussions about surface safety at U.S. airports, with regulators, industry groups, and manufacturers calling for new technologies and procedures to address what the NTSB has called a critical risk.

According to FAA data, the number of reported U.S. runway incursions—defined as the incorrect presence of an aircraft, vehicle, or person on the protected area of a surface designated for landing and takeoff—has hovered around 1,700 annually for the past three years. In 2024, the agency recorded 1,758 incursions, nearly matching 2023’s total of 1,760 and continuing an upward trend from a pandemic-era dip in 2020 and 2021. The totals also are similar to the tally 2019 but are double of those recorded 25 years ago.

Although most incidents fall under Category C or D (ample time/distance to avoid a collision or no immediate safety impact), a growing number of high-profile Category A and B events—where a collision was narrowly avoided or risked— have captured national attention. These include close calls at New York John F. Kennedy (KJFK), Texas’ Austin-Bergstrom (KAUS), and Ronald Reagan Washington National Airport (KDCA).

Each day, U.S. air traffic controllers handle approximately 45,000 flights—more than 16 million a year. With the steady rebound of travel post-pandemic, flight volumes are back to pre-2020 levels. Busy commercial hubs such as in Atlanta (KATL), Los Angeles (KLAX), Dallas-Fort Worth (KDFW),

Denver (KDEN), and Chicago (KORD) see the highest volumes, but not all incursions happen at the busiest airports.

FAA data shows that pilot deviations are the primary source of incursions, accounting for roughly two-thirds of events. The remaining are split between air traffic controller operational errors and vehicle or pedestrian deviations.

As defined by the FAA, runway incursions are categorized by severity:

— Category A: Serious incident; collision narrowly avoided.

— Category B: Significant potential for collision.

— Category C: Sufficient time/distance to avoid collision.

— Category D: No immediate safety consequences.

(Surface incidents, distinct from runway

A runway incursion at New York’s John F. Kennedy International Airport (Universal Avionics graphical depiction, left) raised significant concern, as did the incursion below at Chicago’s Midway Airport where a Southwest Airlines Boeing 737 crew initiated a go-around when a corporate jet taxied across the active runway.

incursions, involve unauthorized movement on the airfield that affects safety but does not occur in the designated runway protection area.)

Over the past 25 years, the U.S. has seen fluctuations in runway incursions, reflecting both challenges and advancements in aviation safety.

In 2002, there were 987 reported runway incursions. By 2024, this number had risen to 1,757 (this number could still change as final reports are issued and causes assigned for incidents and accidents currently under investigation).

It’s important to note that while the total number of incursions has increased, the

most serious incidents—those classified as Categories A and B—have shown a decrease over the past two decades. For instance, in 2022, there were 18 serious runway incursions, down from a high of 32 in 2007.

Several high-profile incidents have underscored the importance of runway safety. In June 1999, American Airlines Flight 1420 overran the runway upon landing in Little Rock, Arkansas, resulting in 11 fatalities. More recently, in February 2025, a Southwest Airlines flight at Chicago’s Midway Airport had to abruptly ascend to avoid a smaller jet crossing its runway.

Among the most serious recent events was a February 2023 incursion in Austin

involving a FedEx Boeing 767 on approach and a Southwest 737. Poor visibility prevented air traffic control from seeing the aircraft on the runway, and the FedEx crew initiated a missed approach just in time to avoid collision. The incident reignited calls for better surface detection systems in towers and alerting systems in cockpits.

NTSB board member Michael Graham, speaking at the 2024 Bombardier Safety Standdown, emphasized the importance of procedural discipline and surface awareness. He cited incidents at JFK and Austin as examples of what he called “clear opportunities for cockpit-based runway alerting systems.”

“Since 2000, we’ve been asking for

surface detection in towers and alerting systems in the cockpit,” said Graham. “We now have technology that can help, and it’s time to implement it widely.”

In 2024, the FAA released its National Runway Safety Plan 2024–2026, outlining riskbased strategies to reduce surface events. The plan emphasizes collaboration with airport operators, pilots, and manufacturers and aligns with the agency’s safety risk management principles.

In March 2025, the agency convened a General and Business Aviation Safety Call to Action to address runway incursions and other safety issues.

Immediate outcomes included increased outreach on phraseology, operations around Class B airspace, and reminders for pilots to use checklists and verify notams. The FAA also committed to analyzing mixed IFR/VFR airspace encounters and expanding tracking technologies in control towers.

At the same time, the U.S. DOT Office of Inspector General released an audit critical of the FAA’s fragmented data-sharing processes, calling for better integration across systems and follow-through on initiatives like the “Technology Sprint.”

The FAA has allocated more than $200 million to runway incursion mitigation programs. This includes deploying new surveillance tools, including:

— Surface Awareness Initiative (SAI): This o ff ers real-time situational awareness to controllers. It is now operational at airports, including Indianapolis and Austin, with more expected by the end of 2025.

— uAvionix FlightLine: Displays aircraft and vehicle movements via ADS-B signals on detailed airport maps.

— Collins Aerospace STARS ARV: Alerts controllers when an aircraft lines up on the wrong surface or approaches a closed runway.

In the cockpit, manufacturers such as Garmin, Honeywell, and Collins Aerospace are introducing enhanced surface alert systems.

Garmin’s SafeTaxi overlays hold-short lines and hotspot indicators on georeferenced airport diagrams. Honeywell’s Surf-A and Surf-IA systems, using GPS and ADS-B, issue real-time aural and visual alerts of potential conflicts during takeoff or taxi.

AMANDA FERRARO CEO, AVIATION SAFETY SOLUTIONS

It’s not about blame. It’s about asking, ‘How do we ensure this never happens again?’

These systems offer pilots improved situational awareness and, according to NTSB investigators, could prevent accidents by alerting crews seconds earlier than ATC in some cases.

The NTSB has issued more than a dozen safety recommendations to the FAA in 2024 alone, calling for:

— Cockpit-based verbal callouts before crossing runways.

— Better SOPs for managing distractions during taxi.

— Flight deck alerting systems for surface hazards.

— Expanded deployment of surface surveillance systems.

Notably, safety recommendations A-24-4 through A-24-6 call for FAA collaboration with OEMs to develop and mandate cockpit-based surface alerting technologies in both new and existing aircraft.

The FAA has concurred with all recommendations but has yet to implement many of them.

Beyond technology, safety experts emphasize procedural rigor and clear communication. At last year’s Bombardier Safety Standdown, Aviation Safety Solutions CEO Amanda Ferraro presented a case study where a lack of internal documentation led to FAA scrutiny and potential violations. “It’s not about blame. It’s about asking, ‘How do we ensure this never happens again?’” she said.

General Aviation Joint Safety Committee (GAJSC) member Jens Hennig echoed that point, praising the FAA’s “From the Flight Deck” video series as a vital resource for pilots unfamiliar with complex airport layouts. “There’s nothing like seeing it visually before you go,” he said.

GAJSC studies found that most wrong-surface events stem from distraction, inexperience, and expectation bias. “It’s not just pilot error—it’s an opportunity to improve planning, training, and awareness,” the group noted.

Efforts to reduce runway incursions are accelerating across the industry. But, with nearly 1,700 incursions annually and a steady stream of close calls, the consensus among regulators, manufacturers, and operators is clear: more must be done.

As the NTSB’s Graham emphasized, “The potential is always there. Vigilance, procedures, and technology together are our best defense.”

BY KERRY LYNCH

The Air Charter Association (ACA) has seen a near doubling of its membership since it rebranded from the Baltic Air Charter Association during its 70th anniversary in 2019. This steady growth since the global pandemic is demonstrating the key role that charter is playing in Europe, according to ACA CEO Glenn Hogben.

Founded as the Airbrokers’ Association in 1949 by members of the Baltic Mercantile and Shipping Exchange, the organization is picking up members at a rate of between six and seven a month and is poised to reach 500 this year.

This, Hogben said, “could be seen as an endorsement and testament of the health of the industry.” More evidence, he added: “We continue to see high levels of engagement across all of our industry events,” and its Air Charter Expo sets yearly new attendance levels.

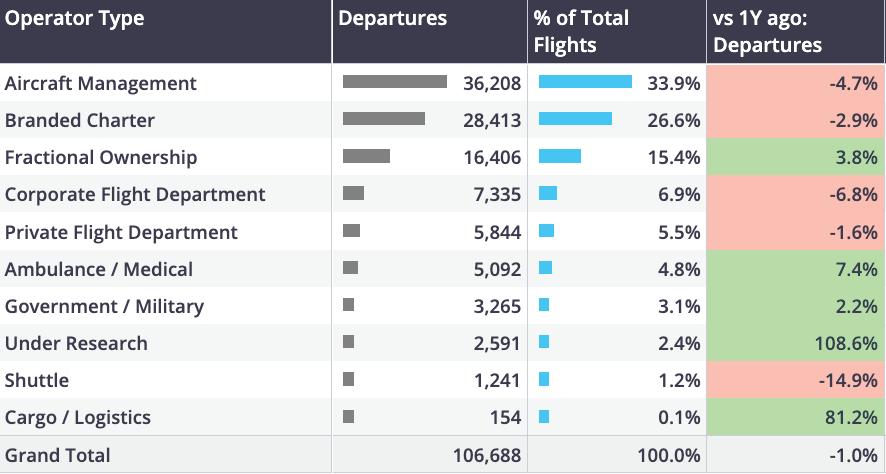

Branded charter operations have ebbed in Europe in recent months but are still stronger than in pre-pandemic 2019. For the first quarter, according to data provider WingX, charter operations dipped by 2.9% but showed improvements in countries such as France, Spain, and Greece. Importantly, though, Hogben noted that as of September 2024, scheduled airline departures were still 14% below 2019 levels, while business jet and turboprop departures were up 10% at the same time.

“The continued demand for air charter demonstrates the key role it provides in connectivity, business growth, and critical services,” he said, citing several factors for this, including a greater number of charter operations provided into smaller regional airports not served by airlines. In addition, he noted that scheduled service is still reduced from pre-pandemic levels, and air carriers are struggling with on-time performance.

First-quarter 2025 charter operations dropped by 2.9% but remain stronger than in prepandemic 2019, although new tax schemes are threatening the European charter industry.

However, despite the underpinnings of a stronger market in the region, it faces challenges, chiefly illegal charter. ACA has engaged in a strong battle against such activity. Hogben noted this is not new; the organization has been educating the public and government for more than 70 years—nearly its entire existence.

“One of the most important tools available to mitigate against illegal charter flights is awareness. We must ensure that the general public is aware of the dangers posed by operating outside of the legal standards.”

To that end, it rebranded its Fly Legal Day campaign this year with a new look and slogan to boost engagement.

It also has implemented a threepronged approach to encourage legal operations: “Use it,” advising the use of accredited ACA air charter brokers or operators; “Check it,” encouraging people to review things such as operator licenses, air operator certificate, certificate of airworthiness, insurance, and pilot qualifications; and “Report it,” warning that if a flight sounds too good to be true and is significantly cheaper than other options, then it can be reported to the ACA, where it can be verified.

“There is limited data available on the occurrence of illegal charter flights; therefore, it is impossible to quantify the exact number of illegal charters that may occur or how often,” Hogben said. But the association takes submissions to its illegal charter reporting mechanism seriously and shares that information with the relevant authorities.

Other issues, such as airport access, also continue to pose threats to the industry. “Night restrictions at many airports and capacity restrictions at busier times are making it increasingly difficult for business air charter flights to land as close to the destination as possible,” he said. This detracts from one of the key benefits of the market. However, Hogben did say that there have been some positive signs on that

WingX’s Europe data shows that while first quarter year-over-year charter departures are down, fractional-share and air ambulance numbers have climbed, and especially cargo/logistics.

Greece captured the strongest growth in first-quarter charter compared with a year ago, followed by Spain and Switzerland. Germany saw the steepest decline, down 9.1%.

front with the approval of airport expansion projects.

Hogben further expressed concern about regulations and taxation based on misperceptions that could harm the industry either through restrictions or “hugely inflated” taxation.

“This is a short-sighted reaction to a sadly misunderstood sector,” he said. “Business aviation and the air charter sector provide a huge range of critical services to countries

across Europe and around the world…The industry is, above all, an important driver of international trade in goods and services, without which many countries’ GDP and domestic growth would be significantly reduced. Many outside the industry have the misguided view that business aviation is purely a luxury transport method for the rich and famous. This is far from the truth, with the majority of business aviation flights supporting business activities.”

He cited a survey of business aviation users finding that 84% of their operations involved business activity. Another survey found that the average travel time savings in business aircraft versus scheduled airlines was 127 minutes.

“The value of air charter and business aviation industries is hugely underestimated, and recent policies to impose grossly inflated individual passenger tax not only negatively impacts on reducing the critical services and growth of the country’s economy but also encourages minimum passengers to travel on the aircraft, directly countering sustainability efforts to maximize passengers onboard aircraft.”

Sustainability remains an urgent issue for the industry, he added. An ACA survey of 75 air charter professionals at a recent young professionals event pointed to sustainability as the single most important factor affecting the industry in 2025, Hogben said. “The majority of our 440 member companies have an emissions offsetting scheme in place,” he noted, and the majority support an “opt-out” policy under which offsetting is included in the charter quotation, and it is up to the client to opt out. “Some of our members have also gone even further and offset all charter flights by 200% or more, demonstrating real commitment in our sector,” he added, with many companies employing full-time sustainability officers.

Another key initiative underway at ACA is its Broker Qualification program. This stemmed from its individual Broker Training days, involving a one-day high-level overview of some of the regulatory and legal aspects of being a charter broker. ACA members believed that training would encourage best practices and higher standards in the transactions between brokers and operators, ultimately benefiting the end users. That has since evolved into a three-level professional qualification covering financial, legal, and regulatory topics, as well as

GLENN HOGBEN CEO, THE AIR CHARTER ASSOCIATION

service and operational considerations. In 2024, ACA launched an online version of the qualification program to increase access to the training resources.

Since the launch of the qualification in 2021, more than 250 delegates from more than 25 different countries have attended, he noted. “The feedback has been incredibly positive.”

ACA is also working to attract the next generation of young professionals, including

launching an internship program for 18- to 25-year-olds to provide insight into various career paths. The three-month internship program includes classroom training, work experience through placement at a member company, participation in a research project, and an invitation to the Air Charter Excellence Awards event. Interns could work with an operator, charter broker, FBO, flight support company, or an array of other industry service providers.

Its NextGen Group now has 10 members that have participated in 24 “engagements” last year at schools, universities, and colleges, Hogben said. z

BY MATT THURBER

Just before this issue was published, Epic Aircraft unveiled its newest model, the E1000 AX with some significant improvements. These include Garmin’s autothrottle, Autoland, automatic yaw damper, GDL 60 PlaneSync for database updates, and GWX 8000 StormOptix weather radar; Lee Aerospace CoolView windows, True Blue Power lithium-ion batteries, and Starlink airborne connectivity. Pilatus also upgraded the PC-12 with the Pro model, now Garmin-equipped and with Autoland. The following was written before these announcements were made.

When prospective buyers consider high-performance single-engine turboprops, they might at first think about Daher’s TBM 960, the Pilatus PC-12 NGX, Piper M700 Fury, or Textron Aviation Beechcraft Denali, which isn’t yet available but is set to be certified and enter service next year. There is another airplane they should consider, however—one that outperforms all of the others in many aspects, is the only one with an all-composite airframe, and is relatively easy to fly. That airplane is the Epic E1000 GX, manufactured in Bend, Oregon.

Having started as an amateur-built experimental airplane, the E1000 GX took a different road to entering the certified market. The original Bend factory helped buyers assemble their airplanes while meeting FAA requirements for the owner- builder’s participation in manufacturing the airplane. There weren’t many built this way, but one such buyer-builder was Doug King, who still owns his kit-built Epic and now runs the company that makes the FAA-certified E1000 GX.

When Epic started on the certification program for the E1000 almost a decade ago, the goal then was to produce one airplane per month, King recalled. In 2024, the build time was down to only nine days with work underway to whittle that down to just seven days. Now, the company is building more than two airplanes per month.

An E1000 GX airframe consists of 587 composite parts, each of which has to be made to tight tolerances. All of the materials such as carbon fiber, fiberglass, and resin that make up the composite airframe must be constantly tested. Unlike aluminum, which is manufactured to a established standard that is not hard to replicate, composite materials are not so simple. A misalignment of fibers, too much or little resin, improper storage, or resin deterioration can compromise the end product.

Thus, regular testing is necessary, and Epic has its own composites testing lab with sophisticated equipment that assures the quality of every process. Testing is ongoing because there are so many variables involved, and this explains some of the high expenses involved in composites manufacturing.

The parts begin as Toray bidirectional carbon fiber stored in freezers that is then thawed indoors to prevent condensation. A roll of fiber is placed on a cutting table, where it is sliced into various shapes by a CNC cutting machine that maximizes the use of material. Some parts are made of fiberglass, where a non-conductive surface is needed.

The carbon fiber outward-facing material is bonded onto the first layer placed onto a mold, which is copper mesh infused with resin to provide lightning strike protection. Other materials are added in certain areas, whether it’s more layers of carbon fiber to strengthen a part, honeycomb core to give shape and stiffness, tapes to make joints, or fiberglass inserts to add material to areas where hardware

attaches. All of this material layup must be done precisely for consistency and to meet structural design requirements, and laser alignment is the way everything is positioned.

Each part, once built up on its mold, is fitted with thermocouples that help gather data—another important step in composites construction—when the vacuumbagged parts are cured in an oven.

Epic has developed its own software for managing the manufacturing process, aided by King’s background in software development. Each part carries detailed instructions and drawings with the layup schedule, trim and drill instructions, and dimensions to be checked during the quality control process. The instructions live in the computer system but are also duplicated in a paper package that travels with the part in case of computer failure.

Inspections are a continual part of the manufacturing process, not just done at the end. “It’s always layup-inspect, layup-inspect,” King said. A team of inspectors roams the manufacturing floor and checks the parts at each necessary stage,

paving the way for assembly technicians to continue adding layers and preparing the parts for the oven treatment.