How Africa can become new global supply chain force

The world never sleeps, neither do we. Indeed, we understand the needs of global economies and have upped our pace in the race against time to facilitate international trade.

Like clockwork we keep it moving; Importing, exporting, decongesting so that cargo moves in and out e iciently and timely to its final destination. Day and night we are open and ready for business.

Kenya Ports Authority; Growing Business, Enriching Lives.

Public debt in the sub-Saharan region has risen to levels not seen in decades, and now stands at a staggering 60% of gross domestic product (GDP) for the region after being at 30% a decade ago, according to an International Monetary Fund Africa department analysis.

Repaying this debt has also become much costlier.

The region’s ratio of interest payments to revenue, a key metric to assess debt servicing capacity and predict the risk of a fiscal crisis, has more than doubled since the early 2010s and is now close to four times the ratio in advanced economies.

A year ago, over half the low-income countries in sub-Saharan Africa were assessed by the IMF to be at high risk or already in debt distress.

These trends have sparked concerns of a looming debt crisis in the region that will curtail economic growth and employment and affect trading capability.

The IMF noted that most sub-Saharan African countries adopted fiscal policies focused excessively on short-term goals and were not guided by a clear medium-term strategy. This lack of anchoring has resulted in frequent breaches of fiscal rules and ever-increasing public debt levels.

“A more strategic approach to fiscal policy would be preferable by setting explicit debt targets that integrate key policy trade-offs between debt sustainability and development objectives, rather than focusing narrowly on short-term fiscal deficits,” the IMF said.

Furthermore, countries must prepare to undertake fiscal adjustments to bring debt back to a safer level, even if it is by two to three percent of GDP a year.

The Africa Logistics is a monthly publication and circulated to professionals in the logistics industry, members of relevant associations, government bodies and other personnel in the logistics and infrastructure industries as well as suppliers in Eastern Africa. The editor welcomes articles and photographs for consideration. Material may not be reproduced without prior permission from the publisher.

Making potentially painful decisions for the general and business public to reduce the debt also requires the government to actively reach out to all parties to outline its plans, the benefits, and where sacrifices might be needed so that more revenue can be raised internally. This might be revised corporate, individual or Value Added Tax tables, reducing or removing tax deductions or exemptions and other areas where the authorities might seek to increase revenues.

DISCLAIMER: The publisher does not accept responsibility for the accuracy or authenticity of advertisements or contributions contained in the journal. Views expressed by contributors are not necessarily those of the publisher.

© All rights reserved.

part

30

24

22

OPINION Air transport industry turns to digitalization to boost baggage management

The African logistics hub: Strategies for global connectivity

34

29

South Africa: Trade relations with China grow stronger Maersk unveils tech warehouse in Cameroon FlyNamibia bullish as it joins IATA

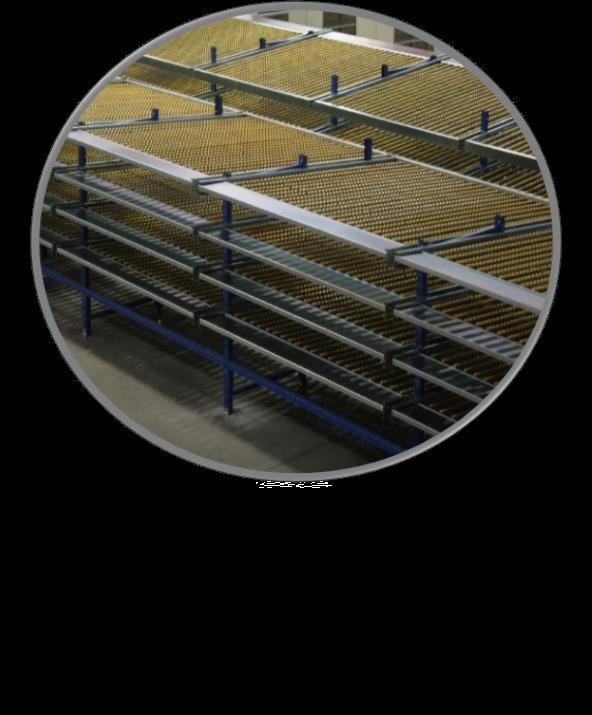

Acrow, a renowned provider of storage and material handling solutions, is set to revolutionize the operations at a Lusaka Cold Storage Facility in Zambia, boasting an installation that utilizes cutting-edge mobile racking system, Acrow aims to optimize storage capacity and enhance efficiency for this prominent cold room facility. The project entails the construction of a mobile racking system with 3000 pallet positions, complemented by an additional 2000 pallet positions of standard pallet racking with the end goal being to move these to a mobile racking system as well. This innovative solution promises to elevate the cold storage industry to new heights.

The implementation of such a mobile racking system signifies a significant advancement for the Lusaka Cold Storage. The 10-meter high mobile racking system is meticulously designed to maximize the available space by utilizing vertical storage capacity efficiently.

Highlighting Acrow’s care in durability as well as reliability when it comes to their storage solutions, each bay of their mobile racking system has been designed and manufactured so that it is capable of supporting up to 3 tons of weight per level, providing a secure and sturdy platform for palletized goods. The mobile racking system itself is rated at an impressive 18 tons per bay, ensuring the safe and efficient storage of heavy loads. This robust design guarantees the longevity and resilience required for the

demanding cold storage environment.

Arguably, one of the key advantages of the mobile racking system is its ability to enhance operational efficiency. The system is designed to allow for easy access to each pallet position, enabling swift and convenient retrieval of stored items. By eliminating the need for aisles between every row of racks, the mobile system significantly reduces the amount of space required for maneuvering, optimizing the cold room’s overall capacity.

Acrow understands the unique require-

ments of the cold storage industry, which is neither an easy nor a simple feat. The implementation of the mobile racking system in Lusaka not only demonstrates Acrow’s ability to provide customized solutions that address the specific challenges of preserving temperature-sensitive products, but also highlights their ability in meeting their Client’s specific requirements no matter where the location. With careful planning and expertise, Acrow has tailored the storage system to meet the stringent standards of the cold storage industry while optimizing the facility’s storage density.

The partnership between Acrow and the Lusaka Cold Storage facility marks a significant milestone in the evolution of cold room storage capabilities. By implementing an innovative mobile racking system alongside traditional pallet racking, Acrow has revolutionized the storage capacity and accessibility for the facility. The integration of robust design, strength, and tailored solutions underscores Acrow’s commitment to delivering efficient and innovative storage solutions across diverse industries. As Lusaka embraces this cutting-edge technology together with Acrow as their storage solution partners, it is set to achieve heightened operational efficiency, maximizing its storage capacity and overall productivity in the cold storage sector.

Sandra Moya, CEO of Acrow Storage Solutions, weighed in on the installation. “We have always been confident in our capabilities and expanding knowledge when it comes to the cold storage industry, and this project simply allows us to showcase our solutions to the greater African market.” While many companies have played it safe, sticking to easier tasks that are far less challenging, Acrow has risen above, engineering solutions and paving partnerships that can only set them on the path to future success.

“

“We have always been confident in our capabilities and expanding knowledge when it comes to the cold storage industry, and this project simply allows us to showcase our solutions to the greater African market.”Sandra Moya, CEO of Acrow Storage Solutions

Acold chain is a temperaturecontrolled supply chain that preserves agricultural products – fruits and vegetables, fish and meat, dairy and cut flowers – from the moment of harvest to the items’ arrival at stores and markets. Some of these markets are overseas. However, by the time a perishable product has reached a port or airport, the cold chain infrastructure available there is usually well-developed. It is on the farm itself and transportation links from farm to shipper where problems arise.

While it seems incredible that on average 50% of food produced in African countries

is wasted to rot, according to the UN Food and Agricultural Organisation (FAO), this is because most of Africa’s food is produced by 60% of the population who are smallholder farmers. It is these farmers who have managed to graduate from being subsistence farmers to growing a surplus that can be sold at market, who lack cold storage abilities and who require assistance. Heart-breaking stories about farmers’ crops rotting at delivery points because government trucks who were meant to collect harvests failed to show up are recurring. The most critical part of the cold chain is transportation:

the refrigerated railroad cars and trucks that move products from farms and warehouses to markets. Warehouse owners report that they enjoy nothing more than the sight of their refrigerated facilities standing empty. This is because that means the product has efficiently moved into and out of the warehouse from point of origin to market.

Further, in any African country, a cold chain can be disrupted by a faulty power supply. A reliable cold chain can only be achieved with the simultaneous improvement of a nation’s power grid. Electricity is expensive in Africa compared to the developed world, and faulty power grids require costly and polluting gas generators, which

add to costs and explain why the FAO reports that cold chain logistics in Sub-Saharan Africa are nine-times more expensive than anywhere else in the world.

Nations’ development plans depend on cold chain

Because African countries are committed by UN treaty to boost agricultural products, and national development plans target agriculture to meet the twin goals of sustainable food production and more employment, progress has been seen in the development of national cold chains, without which agricultural production cannot improve. The countries with Africa’s most advanced cold chains have instituted these in the successful private industry’s promotion of particular products.

For instance, the origin of Ethiopia’s, Kenya’s and Tanzania’s cold chains was their cut flower industries. Flowers are temperature controlled from their growth greenhouse to their arrival to buyers overseas (Kenya and Ethiopia are among the biggest cut flower exporters to the European Union). In

“

On average 50% of food produced in African countries is wasted to rot, according to the UN Food and Agricultural Organisation (FAO).”

recent years, flowers that once had to be air freighted abroad are now shipped by sea with the development of insulating cardboard wraps. Kenya now exports flowers to over 60 destinations. Similarly, Egypt is a major exporter of strawberries and other agricultural products to the Middle East and Europe because of an efficient cold chain built over the decades for this purpose. The same can be said of Morocco. South Africa’s advanced cold chain has made the country one of the world’s largest exporters of agricultural products. South Africa’s cold chain was originally developed to move citrus. The country’s citrus industry is huge and is growing every year. Thanks to a reliable cold chain, South Africa is now Africa’s largest producer of blueberries, which in recent years have also been successfully exported from high, cool growing areas in North Africa. In 1992, raspberries were first grown in Egypt, which had been impractical before a sophisticated cold chain was in place to allow air freight export.

Landlocked Rwanda is meeting its goal of local food production by improving its cold chain technology. The country is emerging as an exciting cheese producer, as government that values cheese as a value-added dairy product for export, is pursuing a dairy policy for farmers to produce 1.2 million tonnes of milk every year by 2024 – up 34% from 2021. Rwanda has introduced aquaculture farming to its Eastern region through public-private partnerships like Gishanda Fish Farm, which raises catfish and tilapia with organic feed from its own gardens. All operations are solar powered. Government’s dietary goal is to improve Rwandans protein intake – in part, by eating more fish.

The use of solar power is one way to ensure that the first link of the cold chain, which is at the point of a product’s origin, is achieved. Kenya is running a pilot project that tests the feasibility of distributing solarpowered cooler boxes to aid fishing communities. East Africa’s fishing and herding communities are thousands of years old but are adapting to export. Somaliland’s herd-

Head Office: +27 11 824 1527 info@acrow.co.za www.acrow.co.za

ers feed much of the Middle East, in particular Saudi Arabia, UAE, Oman and Yemen. For the entire Somalia federation, livestock (cattle and camels) is still the main export revenue earner and accounts for nearly two-thirds of the economy of the federation that includes Somaliland and Puntland. Growth in this sector has been tied to improvements in the cold chain, which has allowed for the growth of a slaughter and processing industry on the Horn of Africa itself. Ultimately, the thousands of live camels now being herded onto ships for export will be replaced with refrigerated processed meats and dairy products, earning more export revenue.

The healthcare of nations depends on an efficient cold chain that is required by medicines that must be refrigerated. The Covid pandemic has highlighted the crisis in cold storage for medicines in Africa.

A 2021 survey by the global health NGO PATH of thousands of clinics in the Central African Republic, Ghana, Kenya, Sudan, Zambia and Zimbabwe found that most did not have adequate refrigeration for liquid medicines like insulin and many antibiot-

ics. Limited capacity meant African clinics struggled to meet WHO guidelines to separately store vaccines and temperaturesensitive medicines. One reform that came out of the pandemic crisis was new WHO guidelines that seek to integrate the storage of vaccines and temperature-sensitive medicines. Solar-power generators are considered an essential component in the medicine cold chain infrastructure.

Because lack of vaccines is responsible for 1.5 million preventable deaths annually throughout the world, the cold chain is now recognised as an essential medical investment.

survey by

health NGO PATH

clinics

thousands

A 2021

the global

of

of

in the Central African Republic, Ghana, Kenya, Sudan, Zambia and Zimbabwe found that most did not have adequate refrigeration for liquid medicines like insulin and many antibiotics.

Targeting more visitors and trade with the Kingdom of Saudi Arabia, the Zanzibar government wants direct flights from the Kingdom of Saudi Arabia to boost trade and strengthen relations between Zanzibar and Saudi Arabia.

Zanzibar State Minister Mr. Haroun Ali Suleiman said that having a direct flight from Saudi Arabia to the island would attract more business travelers to fly between Saudi Arabia and Zanzibar hence providing quick flights to Muslim pilgrims from Zanzibar to the Holy City of Mecca in the Kingdom.

The Zanzibar Minister pointed out that most of the Tanzanian pilgrims going to Mecca are from Zanzibar, where this year a total of 2,500 pilgrims out of more than 3,000 who travelled to the Kingdom of Saudi Arabia, were from Zanzibar, necessitating a direct flight.

The Minister spoke during his welcoming comments to the Acting Saudi Arabian Ambassador to Tanzania, Mr. Fahad Al Harb, who paid him a courtesy visit the island.

Mr. Suleiman pointed out that a SAUDI Airline direct flight is much needed, especially during pilgrimages in order to ease transportation for people wishing to perform the holy journey.

“We can prepare in advance effective strategies for the transportation of pilgrims and other citizens. This will to a greater extent help to minimize inconvenience to travelers from Tanzania to Mecca,” he said.

Zanzibar pilgrims flying to Saudi Arabia have to fly from Dar es Salaam, making them spend more time to book then board the flights, prompting Zanzibar authorities to seek direct flights between the island and Saudi Arabia. Direct flights between Saudi Arabia and Zanzibar will make it easier for travelers to end connecting multiple flights

through Qatar – Doha to Oman – Muscat and other places, he said. The request has already been submitted to the respective ministry of the Saudi Arabia government, while looking forward to a positive response.

SAUDIA, the Saudi national airline, began direct flights from Jeddah to Dar es Salaam’s Julius Nyerere International Airport in March of this year. Direct flights between Dar es Salaam and Jeddah will cut down the travelling time to about 4.40 hours from the previous 10 hours spent by travelers flying between Saudi Arabia and Tanzania through Addis Ababa and Doha.

Saudi Arabia’s rich heritage has been attracting travelers from Tanzania and rest of Africa, mostly pilgrims to the Kingdom’s holy sites in Mecca and Medina.

“SAUDIA’s direct route will provide a seamless experience for Hajj and Umrah guests from Tanzania,” the SAUDIA’s Chief Commercial Officer, Mr. Arved Nikolaus Von Zur Muhlen, said. “In alignment with the Kingdom’s Vision 2030 objective of increasing the number of visitors to Saudi Arabia, international expansion is vital to help

achieve that goal.”

Tanzania is the 14th African country in which SAUDIA is currently operating direct flights. The airline operates 4 flights per week between Julius Nyerere International Airport (JNIA) and King Abdulaziz International Airport on Tuesdays, Thursdays, Fridays, and Sundays.

Building good relations in tourism, Saudi Arabia and Tanzania are looking at biodiversity conservation and wildlife protection as areas of cooperation. Rich in history and religious antiquities, Saudi Arabia is now borrowing a leaf from Tanzania’s wildlife resources for the Kingdom’s future biodiversity conservation and tourism.

Rich in historical and religious antiquities, Saudi Arabia attracts pilgrims from Tanzania and Africa to visit the Kingdom’s preserved, religious, historical, and cultural heritage sites. Muslim pilgrims from Tanzania visit Saudi Arabia every year during Hajj caravans in Holy cities of Mecca and Medina.

The Saudi Commission for Tourism and Antiquities (SCTA) said earlier that inbound tourists to the Kingdom mostly take religious vacations.

Tanzania and other Eastern African states are rated high among African states sending their citizens to the Kingdom for the Hajj pilgrimage every year.

Saudi Arabia is currently promoting tourism as its priority and other key economic sector in combination with oil resources.

The Central Bank of Tanzania is planning to give tourist hotels in Zanzibar permits to conduct foreign currency transactions, said Mr. Emmanuel Tutuba, Governor of the Bank of Tanzania.

A survey conducted by various financial institutions has shown that tourist hotels in Zanzibar receive US dollars from visitors but use local currency to buy items in the local market.

Tourism is the leading sector for economic growth and the leading earner of foreign exchange in Zanzibar. The island’s government is striving to improve the business and investment environment to boost tourism and the blue economy using available marine resources.

Saudi Arabia’s rich heritage has been attracting travelers from Tanzania and rest of Africa, mostly pilgrims to the Kingdom’s holy sites in Mecca and Medina.

African economies can become major participants in global supply chains by harnessing their vast resources of materials needed by high-technology sectors and their own growing consumer markets, UNCTAD said in its Economic Development in Africa Report 2023 launched on 16 August in Nairobi.

Supply chains encompass the systems and resources needed to develop, produce and transport goods and services from suppliers to customers. “This is Africa’s moment to bolster its posi-

African economies should seize the opportunity to better integrate into technologyintensive global supply chains and boost prosperity, but this depends on their ability to harness key market and investment trends, the UN’s trade and development body UNCTAD says.

tion in global supply chains as diversification efforts continue. It’s also an opportunity for the continent to strengthen its emerging industries, foster economic growth and create jobs for millions of its people,” UNCTAD Secretary-General Rebeca Grynspan said. Africa’s abundance of critical minerals and metals, including aluminum, cobalt, copper, lithium and manganese, vital components in technology-intensive industries, positions the continent as an attractive destination for manufacturing, as recent upheavals caused by trade turbulence, geopolitical events and economic uncertainty compel manufactur-

ers to diversify their production locations.

Africa also offers advantages such as shorter and simpler access to primary inputs, a younger, technology-aware, and adaptable labour force and a burgeoning middle class, known for its growing demand for more sophisticated goods and services.

Strengthening African supply chains is key for the region’s growth

the report highlights that creating an environment conducive to technology-inten-

sive industries would help raise wages on the continent, currently set at a minimum of $220 per month, compared to an average of $668 in the Americas.Deeper integration into global supply chains would also diversify African economies, boosting their resilience to future shocks. Expanding energy supply chains into Africa is also an opportunity to accelerate climate action. The continent’s vast renewable energy potential, particularly in solar power, can help reduce production costs and decrease reliance on fossil fuel-based energy sources.

Africa needs more investment in renewable energy to help bridge the significant investment gap and tackle other obstacles to the manufacturing of solar panels on the continent. Currently, only about 2% of global investments in renewable energy go to Africa. The growth of investment in renewable energy, as shown by UNCTAD, could promote the manufacturing of solar panels on the continent.

As an example, in 2022, the Democratic Republic of the Congo was the largest producer of copper in Africa, at 1.8 million metric tons – and beyond exploration and extraction, the country is a potential destination for refining metal products for the electric vehicles industry.

Unlock Africa’s supply chain opportunities: Invest in infrastructure, technology and financing

Africa needs significant investment in infrastructure to bolster its position as a supply chain destination.

Seventeen African countries, including Angola, Botswana, Ghana and South Africa, have already implemented local content regulations to support the growth of local supply chains, foster technology transfer, create jobs and add value within their borders. Additionally, African countries should also secure better mining contracts and exploration licences for metals used in high-tech products and supply chains. This would strengthen domestic industries, enabling local firms to design, procure, manufacture and supply the necessary components. The adoption of innovative digital technologies is also critical to optimizing supply chain processes. Countries such as Kenya have

made notable progress in this realm, with rising rates of digital skills adoption in Africa.

UNCTAD urges governments to create sound policies, foster an enabling regulatory environment and scale up programmes to promote the widespread adoption of these technologies.

The UN trade and development body also reiterates its call for better financing solutions to offer African countries and businesses affordable capital and liquidity to invest in strengthening their supply chains.

More supply chain finance for small businesses

in 2022, the Democratic Republic of the Congo was the largest producer of copper in Africa, at 1.8 million metric tons – and beyond exploration and extraction, the country is a potential destination for refining metal products for the electric vehicles industry.

The report says African small and medium-sized enterprises need more supply chain finance, which bridges the payment time gap between buyers and sellers, improves access to working capital and reduces financial strain.

According to the report, the value of the African supply chain finance market rose by 40% between 2021 and 2022, reaching $41 billion. But this is not enough.

The continent can mobilize more funds by removing barriers to supply chain finance, including regulatory challenges, high-risk perception, and insufficient credit information.

UNCTAD also underlines the need for debt relief to offer African countries fiscal space to invest in strengthening their supply chains, as on average they pay four times more for borrowing than the United States and eight times more than European economies.

The adoption of innovative digital technologies is also critical to optimizing supply chain processes. Countries such as Kenya have made notable progress in this realm, with rising rates of digital skills adoption in Africa

Shanghai Automotive Industrial Corporation (SAIC), one of the world’s top five electric vehicle (EV) manufacturers, has appointed a South African dealer and distributor to market and sell its commercial EVs. The newly formed green mobility business, to be called MAXUS Electric Vehicles, is among the country’s first distributors to focus exclusively on the EV market. MAXUS Electric Vehicles will offer urban logistics fleets access to EVs that help them to reduce total cost of ownership and make significant progress towards their net-zero goals. Early customers in South Africa such as Woolworths and DSV, working with MAXUS’ leasing partner Everlectric, have already zoomed past 1 000,000km while saving over 220,000kg of harmful carbon emissions.

Proof of concepts with MAXUS vehicles show that each EV on the road saves more than a tonne of carbon emissions each month. Operating costs are attractive compared to ICE vehicles, at around 40 c/km to run a MAXUS EV compared to around R2/km for a combustion engine. The low maintenance nature of EVs helps to improve asset utilisation, delivering further efficiencies. “With environmental and sustainability concerns rising up the corporate agenda and the growing operational efficiencies of EVs, there is a compelling business case for decarbonising

urban logistics fleets,“ said Ndia Magadagela, CEO at MAXUS Electric Vehicles. “We are excited to partner with a leading EV manufacturer to offer South African companies access to commercial EVs that enable them to simultaneously reduce CO2 emissions and harvest cost savings.”

MAXUS will initially focus on the Gauteng market, with the opening of one of South Africa’s first all-electric vehicle dealerships, showrooms and service centres in Menlyn, Pretoria. Launches will follow in Cape Town, Durban and other metropolitan areas. Financing is available from major commercial banks. MAXUS Electric Vehicles will initially offer three commercial EV models to the South African market:

The MAXUS eDeliver 3 Panel Van features a comfortable cab, a range of up to 244-344 km and a payload of up to 945 kg. This vehicle has been extensively tested and validated in South Africa over the past 24 months with MAXUS’ leasing partner, Everlectric. The MAXUS eDeliver 3 Chassis Cab is a two-seat, single chassis variant that allows customers to load a range of commercial bodies onto the long wheel base chassis. These include drop side load bins, space saver cargo canopies, refriger-

ation and temperature controlled bodies. It can be ordered for delivery later this year.

The MAXUS T90EV, which can be ordered for delivery in late 2023, will be the first electric double cab bakkie to be available in South Africa. With 354 km of range, the vehicle provides an alternative to urban 4X2 commercial combustion double cabs in industries like mining, private security, aviation, and farming. MAXUS vehicles have sufficient range for commercial operations and can be charged overnight, with solar panels or when there’s no load shedding. They can be charged on most existing DC Fast Charger networks in South Africa. The local dealership and its partners have also created a grid-tied charging infrastructure with solar micro-grids to support customers.

“It is testimony to the efficiency of commercial EVs that they outshine traditional internal combustion engine fleets in terms of operational costs—despite the ad valorem taxes added to EV imports in South Africa,” said Magadagela. “Lower duties could help to encourage faster adoption of commercial EVs and

shape a cleaner energy future. “We urge government, commercial fleets, financing companies, and other stakeholders to join hands to accelerate adoption of EVs in South Africa. Fast-tracking the migration to EVs will not only help us to pave the way for a more sustainable future and meet Net Zero goals – it will also ensure our global competitiveness as the world decarbonises vehicle fleets.”

MAXUS will initially focus on the Gauteng market, with the opening of one of South Africa’s first all-electric vehicle dealerships, showrooms and service centres in Menlyn, Pretoria.

Boeing projects that intra-African passenger traffic will more than quadruple in the next twenty years, placing the continent’s growth among the highest globally. To support this, 1,025 new airplanes will be needed over the next two decades.

Overall African air traffic growth is forecast at 7.4%, the third highest among global regions and above the global average growth of 6.1%. Boeing included the data as part of its 2023 Commercial Market Outlook (CMO), the company’s long-term assessment of global demand for commercial airplanes and services.

“African carriers are well-positioned to

support intra-regional traffic growth and capture market share by offering services that efficiently connect passengers and enable commerce within the continent,” said Randy Heisey, Boeing managing director of Commercial Marketing for Middle East and Africa. “We forecast an increase in the average aircraft size and seats per aircraft for the African fleet, as single aisles, like the Boeing 737 MAX, will be the most in demand for the continent.”

African aviation traffic has recovered at a strong pace in 2023 led by pent-up demand and economic growth driven by higher global commodity prices. African airline flights are currently 8% above pre-pandemic levels. Africa’s above global average,

long-term annual economic growth of 3.4%, combined with increasing rates of urbanization and a growing middle-class population, will continue to drive Africa’s long-term traffic demand, according to Boeing. Economic and growth Initiatives such as the African Continental Free Trade Area and Single African Air Transport Market are expected to further stimulate trade and intra-regional connectivity.

The 2023 Africa CMO also includes these projections through 2042:

With Europe remaining the most prominent origin/destination for travelers to and from Africa, airlines in the region will grow their fleets by 4.5% per year to accommo-

date passenger traffic growth.

Single aisle jets are expected to account for more than 70% of commercial deliveries, with 730 new planes mainly supporting domestic and intra-regional demand. In addition, African carriers are estimated to need 275 new widebodies, including passenger and cargo models, to support long-haul routes and air freight growth.

Approximately 90% of African jet deliveries are expected to serve fleet growth with more fuel-efficient models such as the 737 MAX, 777X and 787 Dreamliner, with nearly one in five deliveries replacing older airplanes.

Estimated demand for aviation personnel will rise to 69,000 new professionals, including 21,000 pilots, 22,000 technicians and 26,000 cabin crew members.

Commercial services opportunities such as supply chain, manufacturing, repair and overhaul are valued at $105 billion.

African aviation traffic has recovered at a strong pace in 2023 led by pent-up demand and economic growth driven by higher global commodity prices.

Airlines and airports are facing a surge in baggage mishandling rates amidst the growing number of passengers, with the number of mishandled bags almost doubling from 2021 to 2022 to 7.6 bags per thousand passengers, according to SITA’s 2023 Baggage IT Insights report released today.

The shortage of skilled staff, resumption of international travel, and congestion at airports has made it challenging to manage bags and ensure their smooth handling at airports – particularly during peak travel periods. The overall increase in mishandling is forcing the industry to focus on digitalization and automation, with technology investments that deliver greater automation and self-service being a top priority.

Delayed bags accounted for 80% of all mishandled bags in 2022, lost and stolen bags increased to 7%, and damaged and pilfered bags decreased to 13%.

The surge in the mishandling rate comes after more than a decade of reduction in mishandled baggage. Significant process improvements helped the mishandling rate per thousand passengers fall by 59.7% between 2007 and 2021. However, given the pressure of staff shortages on operations post-COVID, the 2022 mishandling rate of 7.6 bags per thousand passengers represents a 75% increase from 2021.

Transfer bags have historically accounted for the majority of mishandled bags. This

was no different in 2022, with a one-percentage point increase from 2021, pushing the proportion of bags delayed at transfer to 42%.

This increase is attributed to the resurgence of international and long-haul travel, leading to loading errors and greater transfer mishandling rates. The failure to load bags accounted for 18% of all mishandled bags in 2022, representing a 3% decrease from the previous year. Loading errors more than doubled compared to the previous year, accounting for 9% of all delayed bags in 2022, stemming from operational strains on baggage systems.

David Lavorel, CEO, SITA said: “After a decade where the mishandling rate more than halved between 2007 and 2021, it

is disheartening to see this rate climbing again. As an industry, we need to work hard to ensure passengers are once again confident to check in their bags. We at SITA are working directly with airlines and airports to help solve key pain points in the baggage journey through smart automation, tracking, and digital platforms.”

Investing in real-time baggage status information has become a key priority for airlines, with 57% of airlines providing their staff with mobile access to real-time baggage status information. This figure is expected to increase significantly to 84% by 2025, and 67% of airlines plan to offer realtime baggage status information directly to passengers, marking a substantial improvement from 25% today.

SITA has developed the WorldTracer Auto Reflight system in direct response to the high mishandling rates observed at transfer. This solution automatically identifies bags what are not likely to make their planned connecting flight and rebooks them on the next possible flight using the existing bag tag – all while keeping the passenger informed.

SITA estimates that automation of reflight operations could save the industry up to $30 million per year. Lufthansa and SITA’s recent partnership using the technology aims to digitalize the manual reflight process, and the results of their Proof of Concept suggest that they can automatically reflight as much as 70% of Lufthansa’s mishandled bags at Munich Airport.

A.P. Moller – Maersk (Maersk), the global integrated logistics company, has opened its doors to a brand-new and technology-driven Warehousing & Distribution (W&D) facility in Douala, Cameroon. Situated within the Douala Port Zone, Maersk’s new facility is the ideal site for cargo moving in and out of one of the most important ports in the country along the West African coast, one that also serves as a gateway to several markets within Central Africa.

With the rapid expansion of the middleclass population in the region, there is a growing demand for goods, especially in

the FMCG sector. The Port of Douala plays a crucial role in meeting this demand, as it handles over 70% of imports into Cameroon, serving both the nation’s population and its landlocked neighbours within the Central African Economic and Monetary Community. The conversations with our customers have revealed a gap between the demand and supply for modern Warehouse & Distribution (W&D) facilities that can provide the additional capacity needed in this market. As a response, we have decided to invest in a technology-driven Warehouse Management System (WMS) facility. This strategic move not only bridges the demand-supply gap, but also offers our customers a cost-

The Port of Douala plays a crucial role in meeting this demand, as it handles over 70% of imports into Cameroon, serving both the nation’s population and its landlocked neighbours within the Central African Economic and Monetary Community.

effective and efficient solution. We are expanding our logistics footprint in Southern West Africa and will scale up as per the customers’ demands. Maersk’s new W&D facility in Douala will be spread over 16,000 sq. m., including more than 12,000 sq. m. covered space that provides more than 8,000

pallet positions. The facility will provide for dry warehousing and distribution with a focus on deconsolidation and fulfilment. Being a bonded facility, it will also provide for the storage of cargo in the customs clearance process. Maersk will also arrange value-added services at this facility, such as palletisation, packing and kitting.

The state-of-the-art facility with modern WMS will provide customers with accurate and real-time visibility of their inventory. Full traceability using lot, batch, and serial numbering will ensure efficient movement of goods. Ultimately, the optimised operations using technology will aid in reducing waste and inventory errors and provide an improved experience to customers.

Maersk has a clear goal of being Net Zero by 2040, and every new investment being made has deep considerations in terms of the decarbonisation of logistics. The new facility by Maersk in Douala is no exception. 100% internal lighting will be done using low-consumption LED lights, and all external lighting will be powered by solar energy. All forklifts required in the W&D operations will be battery-operated and charged using solar energy. At the beginning of operations, 15% of the site’s electricity requirements will be fulfilled by solar panels installed at the site itself, with a plan to scale up in the coming years.

Maersk’s customers will get several benefits by utilising this facility for bonded as well as non-bonded storage and distribution. Bundled with ocean transportation, customs clearances, intermodal transportation and other services, Maersk will provide truly integrated logistics solutions to its customers. Such a solution also adds greater control over supply chains and offers higher resilience. With everything put together, customers will get cost advantages, too, as all their logistics requirements get fulfilled under the same roof.

Southern West Africa encompasses the following countries: Angola, Cameroon, Central African Republic, Chad, Republic of Congo, Democratic Republic of Congo, Gabon, Equatorial Guinee and Sao Tome and Principe.

Arican leaders, calling for urgent action by developed countries to reduce carbon emissions, have proposed a new financing mechanism to restructure Africa’s crippling debt and unlock climate funding.

In a call to action, African leaders attending the inaugural Africa Climate Summit held in Nairobi, Kenya, stressed the importance of decarbonizing the global economy for equality and shared prosperity.

They called for investment to promote the sustainable use of Africa’s natural assets for the continent’s transition to low carbon development and contribution to global decarbonization.

“We call for a comprehensive and systemic response to the incipient debt crisis outside default frameworks to create the fiscal space that all developing countries need to finance development and climate action,” African leaders said in the Nairobi Declaration on Climate Change and Call to Action, adopted at the conclusion of the Africa Climate Summit.

The Africa Climate Summit (ACS) brought together global leaders, intergovernmental organizations, Regional Economic Communities, United Nations agencies, private sector, civil society organizations, indigenous peoples, local communities, farmer organizations, children, youth, women and academia to discuss Africa’s climate change challenges and formulate sustainable solutions.

The leaders expressed concern that many African countries face disproportionate burdens and risks from climate changerelated, unpredictable weather events and patterns.

The impacts have included prolonged droughts, devastating floods, wild and forest fires, which cause massive humanitarian crisis with detrimental impacts on economies, health, education, peace and security, among other risks, the leaders said, acknowledging that climate change is the single greatest challenge facing humanity and the single biggest threat to all life on earth.

Underlining that Africa was not historically responsible for global warming, but bore the brunt of its effect, impacting lives, livelihoods, and economies, the leaders emphasized that the continent possessed the potential and the ambition to be a vital

component of the global solution to climate change.

“We note that multilateral finance reform is necessary but not sufficient to provide the scale of climate financing the world needs to achieve 45 per cent emission reduction required to meet the Paris 2030 agreements, without which keeping global warming to 1.5% will be in serious jeopardy,” the Declaration said, noting that, “Additionally, that the scale of financing required to unlock Africa’s climate positive growth is beyond the borrowing capacity of national balance sheets.”

The African leaders further called for the acceleration of on-going initiatives to reform the multilateral financial system and global financial architecture including the Bridgetown Initiative, the Accra-Marrakech Agenda, the UN Secretary General’s SDG Stimulus Proposal and the Paris Summit for a New Global Financing Pact.

“We urge world leaders to rally behind the proposal for a [global] carbon taxation regime including a carbon tax on fossil fuel trade, maritime transport and aviation, that may also be augmented by a global financial transaction tax (FTT)) to provide dedicated affordable and accessible finance for climate positive investments at scale and ring fencing of these resources and decision making from geopolitical and national interests,” the leaders urged.

The Summit proposed a new financing architecture responsive to Africa’s needs including debt restructuring and relief and the development of a new Global Climate Finance Charter through the United Nations General Assembly and the COP processes by 2025.

“We call for collective global action to mobilize the necessary capital for both development and climate action, echoing the statement of the Paris Summit for a

New Global Financing Pact that no country should ever have to choose between development aspirations and climate action,” they said.

They emphasized the need for concrete action and speed on proposals to reform the multilateral financial system currently under discussion specifically to build resilience to climate shocks and better deployment of the Special Drawing Rights liquidity mechanism.

The Nairobi Declaration was adopted to be the basis for Africa’s common position in the global climate change process to COP 28 and beyond.

It was also noted that the Africa Climate Summit should be established as a biennial event convened by African Union and hosted by AU Member States, “to set the continent’s new vision taking into consideration emerging global climate and development issues”.

FlyNamibia’s is now a member of International Air Transport Association (IATA), a move that the airline terms as “significant milestone.”

It not only marks an extraordinary achievement for FlyNamibia but also signifies a promising future for the airline industry in Namibia and beyond.

IATA, with its mission to represent, lead, and serve the global airline industry, stands as the collective voice of approximately 300 airlines hailing from more than 120 countries worldwide.

The core vision that propels IATA’s actions is the determination to collaboratively shape the future growth of an aviation sector that is both safe and secure, while ensuring sustainability. Through this endeavour, IATA endeavours to create an air transport industry that not only connects nations but also enriches our global community.

FlyNamibia’s membership in IATA opens up a world of opportunities for the airline, its employees, and, most importantly, its valued customers. By aligning with IATA’s principles and collaborating with a global network of industry leaders, FlyNamibia is poised to elevate its operations, offer enhanced services, and contribute to the growth and sustainability of air travel in Namibia.

“This momentous occasion is a testament to FlyNamibia’s dedication to excellence, safety, and customer satisfaction. As we embark on this new chapter, we anticipate the myriad benefits that IATA membership

will bring to the airline, its passengers, and the aviation industry as a whole.”

In order to be accepted an airline must pass the IATA Operational Safety Audit (IOSA).

IOSA is the globally-benchmarked safety quality standard for assessing airlines. It is a mandatory IATA membership eligibility requirement. Member airlines are required to undergo IOSA audits biennially to retain their membership.

IATA members benefit from access to the association’s financial clearing house and its billings settlements and distribution systems, which smooth the process of collecting and disbursing revenues and settling bills for some infrastructure services such as air traffic control and overflight permits.

FlyNamibia is owned by Westair (60%) and South Africa-based Airlink (40%).

High quality tyre products and innovative digital solutions combine to support fleets manage the impact of fuel costs on their operations

Johannesburg, South Africa, 21 September 2023 – According to the latest midmonth fuel price data from the Central Energy Fund (CEF), South Africans should brace for another substantial increase in fuel prices in October, with petrol expected to rise by up to R1.22 a litre, while the increase in diesel prices is set hit R2.03 per litre.

According to Brandon Meyer, Director of Commercial Business at Goodyear South Africa: “Fuel and tyres are amongst the biggest cost factors for trucking and logistics companies, and there is a direct correlation between the condition of truck tyres and fuel efficiency.

“But conducting a tyre check on a 26-wheeler truck and trailer is a time-consuming exercise. Digital solutions, such as Goodyear’s TireOptix solution, can support logistics companies save time and money, as they offer the ability to get real-time updates on the condition of each tyre on all the

vehicles in a fleet,” says Meyer.

Underinflated tyres, for instance, increases rolling resistance, which can increase fuel consumption by up to 20%. This will mean that the engine on a truck running on underinflated tyres will have to work harder and use more fuel for its journey to overcome the extra friction with the road caused by the underinflated tyres.

The correct tyre pressure for a truck can be determined based on the load per axle. Checking regularly that all the tyres are properly inflated can help to reduce running costs.

Adopting a regular tyre maintenance regimen is important for ensuring maximum fuel efficiency. Inspecting the tyre treads and side walls can help you spot signs of wear, as well as imbedded objects, that cause a loss of pressure.

Such maintenance can prolong the lifespan of the tyres, and improve the tyre’s cost per kilometre (CPK) and the return on investment (ROI) of the vehicle. This is especially important for transporters as tyres make up a significant portion of running costs.

Africa has long been an important region, known for its diverse landscapes and rich cultural heritage. Situated as a crossroads between the East and the West, it has held geographic and cultural significance throughout history.

However, in our modern world of globalization, Africa’s true potential as a central hub for global logistics and trade is only just beginning to be fully recognized. This emerging concept of Africa as a powerful logistics center not only highlights its strategic location, but also underscores its ambitions for economic growth.

As the world becomes more interconnected, with the seamless flow of goods, services, and ideas across borders, a fascinating narrative is unfolding around Africa’s unique role in linking global supply chains.

Africa’s logistics scene is changing fast. Even though it faced many issues in the past, like poor infrastructure and political problems, things are now improving. Big investments have been made in transport, ports, and railways. Strong economic plans and global partnerships have made it easier

to do business. There’s also a big push for new technology, digital tools, and a variety of sources that help learn how to record a video to document various aspects of logistics operations and other essential points, making trade smoother. Plus, Africa has a young and skilled workforce, which is great for business. There are still some challenges, but overall, Africa’s logistics is growing and becoming a key player in global trade.

Central to Africa’s growth in logistics is the development of ports and infrastructural landmarks. With the likes of the Djibouti Port and the ambitious Lamu Port in Kenya,

Africa is no longer just catering to its immediate neighborhood. These establishments are facilitating intercontinental trade routes, connecting the East with the West.

Have you ever pondered how efficient port management can influence global connectivity? Much like how a proficient airport facilitates seamless passenger travel, an efficient port acts as a catalyst for trade growth.

Technology plays a vital role in shaping the logistics landscape. By incorporating state-of-the-art digital solutions, such as

blockchain for supply chain management and AI-powered tracking systems, Africa continues to stay at the forefront of innovation. It’s truly remarkable how the appropriate digital tools can revolutionize an entire continent’s logistical narrative in this technology-driven era.

To position Africa as a prime logistics hub, a blend of infrastructural, technological, and policy-driven strategies is essential. Let’s delve into the pivotal strategies:

Development Ports and Harbors: Investing in modern, efficient ports is crucial for maritime trade.

Enhancing port capacities and automation can drastically reduce cargo dwell times.

Railways and Roads: Developing and maintaining an extensive network of railways and highways ensures efficient cargo movement inland.

Airports: With the rise of air freight, especially for perishable goods, a network of world-class airports can put Africa on the global air cargo map.

Investment in Technology

Digital Platforms: Deploying platforms for real-time cargo tracking, customs clearance, and port operations can significantly streamline logistics.

Automation and Robotics: Modern ports and warehouses equipped with automation can expedite cargo handling and reduce operational costs.

Sustainability Tech: Investing in technologies that promote sustainable logistics, like eco-friendly warehousing and green transportation modes, aligns with global ecoconscious trends.

Seamless Borders: Collaborative policies to simplify cross-border trade and transport can ease the flow of goods between African countries.

Trade Blocs: Strengthening regional trade agreements, such as the African Continental Free Trade Area (AfCFTA), can spur intra-Africa trade.

Policy Reforms and Facilitation

Regulatory Streamlining: Simplifying customs procedures and reducing bureaucratic hurdles can significantly expedite cargo movement.

Foreign Direct Investment (FDI): Creating a conducive environment for FDI can bring in the needed capital and expertise to boost logistics infrastructure.

Skilled Workforce: Investing in training programs tailored to logistics and supply chain management ensures a skilled workforce ready to take on the challenges of modern logistics.

Industry-Academia Collaboration: Partnerships between logistics companies and educational institutions can foster innovation and research in the sector.

In synthesizing these strategies, Africa can not only bolster its logistics infrastruc-

ture but also position itself as a pivotal player in the global supply chain ecosystem.

While Africa is brimming with potential to establish itself as a dominant player in global logistics, it’s essential to recognize the challenges that can influence this trajectory. Addressing these issues head-on is pivotal for sustainable growth.

Diverse Political Landscape: Africa’s mosaic of nations comes with diverse political systems, agendas, and stability levels. This diversity can sometimes lead to policy inconsistencies, affecting seamless logistics operations across countries.

Financial Constraints: Securing adequate funding for vast infrastructure projects is often a hurdle. While international investors show interest, the conditions attached can

By incorporating state-of-the-art digital solutions, such as blockchain for supply chain management and AIpowered tracking systems, Africa continues to stay at the forefront of innovation.

sometimes hamper the pace and direction of development.

Infrastructure Gaps: While some regions have seen rapid infrastructural development, others lag. This disparity affects the holistic growth of a connected logistics network.

Technical Limitations: While technology promises a revolution in logistics, the lack of robust digital infrastructure, especially in remote areas, can slow down its adoption.

Bureaucratic Hurdles: Inefficient and often cumbersome bureaucratic processes can delay projects, increase operational costs, and deter foreign investments.

Skills Gap: The logistics domain requires specialized skills, and there’s a pressing need to bridge the gap between industry requirements and available expertise.

External Competition: Established global logistics hubs in other parts of the world present stiff competition. Positioning Africa favorably against these hubs requires strategic efforts and differentiation.

Environmental Concerns: Logistics projects, especially infrastructure developments, can impact the environment. Balanc-

ing growth with sustainability is a challenge that can’t be overlooked.

By understanding and strategizing around these challenges, Africa can pave a clear path towards establishing a resilient and globally-competitive logistics hub.

Reflecting on Africa’s evolving logistics landscape, it’s imperative to consider the underlying questions: How can Africa maintain this accelerated growth? What strategies will fortify its stance as a linchpin in global connectivity?

The future, while promising, demands continuous effort in innovation, collaboration, and resilience. As Africa scripts its success saga, the global business community should observe keenly. The message is clear: Africa isn’t just a burgeoning logistics hub; it’s the next big epicenter of global opportunities. And for visionaries, the time is ripe to embrace and collaborate with this dynamic continent.

Trade between China and South Africa is set to grow further after several announcements on trade were made at the BRICS summit, held in South Africa in August 2023.

At the summit, the countries agreed to narrow the trade deficit by increasing access to Chinese markets for South African products.

In this regard, China has recently begun importing South African beef after a block on the product (due to foot and mouth disease) was lifted. The two countries also agreed to allow avocados to be exported from South Africa to China.

China also announced at the summit that it would donate energy equip-

ment worth around ZAR 167 million (USD 8.97 million) and a grant valued at around ZAR 500 million (USD 26.9 million) to South Africa to assist with its energy crisis, although no deadlines were given.

In August, the countries jointly announced that Chinese companies had signed twenty deals to buy products worth around ZAR 41 billion (USD 2.2 billion) from major South African companies. The Minister of Trade, Industry and Competition in South Africa, Ebrahim Patel, said at the signing ceremony that the deals would assist South Africa in creating jobs and growing the economy.

It was also noted at the signing that two-way trade between China and

South Africa amounted to USD 47 billion in 2022 and that both countries were committed to strengthening the relationship.

China Minister of Commerce Wang Wentao noted at the summit that there was a prospect of even greater growth in trade, not only with South Africa but with other African countries

Across Africa, China is increasingly importing agricultural products and manufacturing goods on the continent, in addition to its strong focus on oil, critical minerals and metals. African imports from China mainly focus on manufactured goods such as electronics, clothing, appliances and technology.

Recent data from the Chinese Ministry revealed that over the last two decades, China’s trade with Africa as a whole has risen 20-fold, showing that China is one of Africa’s biggest bilateral trading partners. To balance the trade gap, China pledged in 2021 to import USD 300 billion of African products by 2025. The country has also increased the number of products that can be exported to China tariff-free.

A recent report by Economist Corporate Network, supported by Baker McKenzie and Silk Road Associates, BRI Beyond 2020 (Economist report), showed how these

strengthening trade links are, in part, a result of favourable financial incentives offered to African jurisdictions by China. According to the Economist report, 33 of the poorest jurisdictions in Africa export 97% of their exports to China with no tariffs or customs duties.

This report noted that bilateral trade was still heavily centred on China’s import of Africa’s natural resources. However, in recent years, China has increased its imports of manufacturing products from more diversified economies, such as South Africa. At an official session of the Joint Economic and Trade Committee held at the 2023 BRICS summit, Minister Patel said the aim was for South Africa to export more manufactured and value-added products to China.

A Baker McKenzie report with Oxford Economics, AfCFTA: A Three Trillion Dollar Opportunity (AfCFTA report), revealed that over three-quarters of African exports to the rest of the world were still heavily focused on natural resources, but that on the import side, manufactured goods accounted for more than half the total volume of imports into African jurisdictions. Africa’s most important suppliers of manufactured goods were listed as Europe (35%) China (16%) and the rest of Asia, including India (14%).

The Economist report pointed out that political and policy commitments between China and Africa have strengthened and expanded in scope in recent years. Since its launch in 2000, the Forum on ChinaAfrica Trade Cooperation (FOCAC) has focused on forming closer relationships between China and Africa.

At FOCAC’s last conference, held at the end of 2021, China announced that it would move away from state-backed projects in Africa, partly due to the impact of

Over the last two decades, China’s trade with Africa as a whole has risen 20-fold

COVID-19. Instead, the focus would be on increasing reciprocal China-Africa trade, incentivising private firm investments from China into Africa and strengthening cooperation between the two regions.

At China’s Foreign Ministry Spokesperson Wang Wenbin’s regular press conference in August 2023 it was noted that Chinese companies were growing in confidence in the African market, with 3000 Chinese enterprises, of which more than 70% are private, currently invested in Africa.

It was also noted that the progress of the African Continental Free Trade Area (AFCFTA) meant that Chinese investors would find more op-

portunities to invest in the African market. Successful panAfrican trade under AfCFTA will connect the region’s wealthier and poorer nations, promote the growth of value chains and lay the foundations for increased international trade in the process.

As Africa reduces its overdependence on natural resources and increases its manufacturing capacity, it must also ensure it develops other industries in a sustainable way.

To this end, the Economist report outlined how China and Africa have agreed to work together on improving Africa’s capacity for green, low-carbon, and sustainable development, and to roll out more than

there is a prospect of greater growth in trade, not only with South Africa but with other African countries

50 projects on clean energy, wildlife protection, environment-friendly agriculture, and low-carbon development.

The trade in sustainable goods and services is also expected to reap benefits for the African continent in future years.

A joint statement issues by the two countries in August 2023 acknowledged “the need to defend, promote and strengthen the multilateral response to Climate Change and undertake to work together for a successful outcome of the 28th Conference of the Parties of the United Nations Framework Convention on Climate Change (UNFCCC COP28) in the United Arab Emirates in December 2023.”

Virusha Subban is a Partner Specialising in Customs & Trade, and Head of Tax, at Baker McKenzie, JohannesburgTe will depend on the regulatory environment, which in most countries does not yet allow largescale deployment

Recent data from the Chinese Ministry revealed that over the last two decades, China’s trade with Africa as a whole has risen 20-fold

LOCATED AS CLOSE AS POSSIBLE TO OUR CLIENTS

SNF Mining Markets

21 MAUNUFACTURING FACILITIES

Plaquemine

Iron Ore

Coal and Fly ash

Ferrous and non Ferrous metals

Industrial minerals: Titanium, Phosphate & Potash

In keeping with its global expansion strategy, SGL strengthens its presence on the African continent by inaugurating a new office in Port Elizabeth.

Adding to its existing locations in Johannesburg, Durban, and Cape Town, new and existing customers will gain access to SGL’s extensive global network while benefitting from expert local knowhow and capabilities.

Just last month, the company opened its first office in Kenya. Already present in Togo, Benin, Mali, Côte d’Ivoire, and Senegal, SGL provides customers with its tailormade and comprehensive logistics solutions across the vast continent.

As one of the largest multi-cargo, deepwater ports in South Africa, Port Elizabeth offers connectivity to global maritime import and export routes. Along with the effective, well-developed rail and road infrastructure, the new location provides customers with efficient supply chain management through extended and easy access to the rest of South Africa and the entire continent’s logistics network.

Lars Syberg, CEO EMEA ex. Nordics expands on why opening a new office on the Eastern Cape is a logical next step in the company’s expansion strategy:

“We already offer a warehousing and distribution solution in Port Elizabeth for one of our key customers, so extending our capabilities and local expertise

through an office is only natural. Furthermore, the port includes the Coega Industrial Development Zone, a world-class infrastructure and logistics business hub, enabling us to offer our comprehensive supply chain solutions to our customers, including warehousing and distribution. Our global flexibility builds on our local presence; it’s what enables us to uncomplicate our customers’ world whenever, wherever.”

Port Elizabeth’s strategic maritime location and robust infrastructure make it a key entry and exit point to South Africa for various goods.

Jerome James, Managing Director of South Africa, finishes:

“Within the automotive industry, Port Elizabeth is often called the ‘Detroit of South Africa,’ as it’s home to a significant number of major car manufacturers and parts suppliers with operations in and around the city. Similarly, the port is a vital part of the pharmaceutical supply chain of the country and continent. Two industries that are a part of our strategy in South Africa and suit our capabilities very well.”

So that your business can bene t and grow sustainably adding value through audit assurance remains our focus. Our audit design, execution and close-out aims to accurately assess compliance risks, objectively evaluating your control systems and procedures. Our audit team draws on 25 years of industrial experience. Our collaborated industrial knowledge, specialised levels of insight and strict compliance to audit principles enables us to execute best in class audit programmes and or stand alone audit reports.

We recognize the complexity of environmental compliance and respond by staying abreast with legislative changes and interpretations. We benchmark and interact with our clients and our network of legal specialist and provide a unique range of compliance and environmental technical audit solutions. We endeavour to improve time and cost e ciencies and have considered physical constraints such as site accessibility, travel distances and other unforeseen events such as the national state of emergency.

In response that we have deployed ISO 9001 aligned, tailormade audit protocols to suit the varying demand of our clients which include:

• Site based – integrated audit protocols (meetings, interviews, checklists, feedback)

• Remote based - intensi ed and interactive desktop reviews

• Remote based - Online opening meeting, interviews and close out meetings

• Remote based - Secure online documented evidence submission platforms

• Semi remote based - Drone ( y by) and live streaming camera site visits,

• Semi remote based - After-hours auditing to limit exposure.

Our Audit reports link to clear interpretable documented evidence, strong visualization and an alignment with existing document controls on site.

ENVASS has been able to present as much as 50% year-on-year audit programme cost savings to our clients through tailored protocols and audit integration.

Ask our highly capable team of auditors for a suggestion or a quote on any of the following:

• Water Use Licence’s compliance and or technical audits

• Waste Management Licence’s compliance and or technical audits.

• Environmental Management Programme Performance Assessment.

• National Norms and Standards compliance audits and review.

• Atmospheric Emission Licence’s. compliance and or technical audits

• Biodiversity Management Plan implementation audits and reviews.

• Mine Closure Audits based on GNR 1147.

• Internal ISO 14001 Systems and GAP Audits.

• NEMA Environmental Authorisation listed activities audits and reviews.

• Regulation 34 Audits and Recommendation for EMP amendment.

• Compliance Due Diligence & Gap Assessments.

• Occupational Health and Safety Audits.

Any of the above to be packaged into a Tailor made audit programme, cost e ectively suitable for you!

The Africa Logistics

SNF Mining Markets

Iron Ore

Coal and Fly ash

Ferrous and non Ferrous metals

Industrial minerals: Titanium, Phosphate & Potash