Brazil

Obstacles and opportunities in the world’s third-largest feed market

TRADE IMPACTS

HPAI reaches poultry in world’s biggest exporter; what now?

Pages 6 - 7

FEED PRODUCERS’ CONCERNS

Raw materials to sustainability

Pages 10 - 12

BRAZIL AS EXPORT DESTINATION

Proving product efficacy is key

Pages 14 - 16

Summer 2023 Issue

YOUR CONNECTION TO THE GLOBAL ANIMAL NUTRITION AND FEED INDUSTRY

Brazil: obstacles and opportunities

According to Alltech, Brazil, the world’s third-largest feed producer, Brazil, consumed nearly 82 million metric tonnes of feed in 2022. This represented a yearon-year increase of 0.87%, at a time when feed tonnage globally is believed to have contracted.

That feed supports the growth of animals that are consumed across the globe. Around 33% of the 14.5 million tonnes of poultry meat, 22% of the 5 million tonnes of pork meat, and 25.5% of the 9.71 million tonnes (cwe) of beef produced in 2022 was exported, according to industry associations ABPA and ABIEC. The country is the world’s largest exporter of chicken meat and beef.

Moreover, even in times when animal production industries elsewhere have struggled, Brazil’s has thrived. In recent months, exports of meat have picked up even greater momentum. The daily average of chicken shipments in April, for example, was the highest since the Brazilian Secretariat of Foreign Trade (Secex) began keeping records. According to CEPEA (the Center for Advanced Studies on Applied Economics, part of the University of São Paulo), between February and March, Brazil saw volumes exported to Japan, Mexico and China increase 78%, 50% and 48%. Bilateral agreements (such as that which saw Mexico suspend import tariffs on Brazilian chicken meat), the high costs of feed and power, and the impact of avian influenza on other major producers are thought to be a significant driver of that increase. Meanwhile, other meats, such as pork and beef, have also been setting or approaching records.

Because of all of these factors — the sheer size of the market, the positive

growth seen there when other markets were in decline, and the deep connections between Brazil and other regions of the world through its vast exports — the global animal nutrition industry should keep a close eye on Latin America’s largest country.

Of course, there are significant challenges in this market as well. For one thing, highly pathogenic avian influenza (HPAI) has at last reached the country, which has not yet had to face the disease. Although at the time of writing, the virus had primarily been seen in wild birds, its recent occurrence in a backyard flock is raising questions about the knock-on effects on global trade should the world’s largest poultry exporter lose its HPAI-free status.

Another major issue on the minds of multiple individuals we spoke to as we put together this issue was the concern that Brazilian infrastructure was proving increasingly inadequate to the task of keeping up with the titanic volumes of agricultural goods Brazil is dealing in. While many commentators have noted that simultaneous record-breaking harvests in both corn and soybeans might strain Brazil’s silo, processing, and transportation capacity, there are more than just export commodities at stake. The accessibility of ports and the quality of roads are an issue not only for those shipping things out of Brazil, but also for those bringing goods in or moving them between states.

“There is more complexity in logistics or in taxes than in other aspects,” one Brazilian feed additive importer told us. “Brazil is almost a continent [in itself].”

Summer 2023

Senior editor: Shannon Behary

Design and Layout: Julianne Abrams

Glenn Juszczak

Content contributors: Luís Vieira

Heather McGuire Doyle

Guillaume Milochau

Sam Weatherlake

Simon Duke

Perspectives manager: Elisabeth Mork-Eidem

Magazine promotion: Luke Bailey

House ad production: Jeanne Ferrer

Luke Bailey

Jo Goodwin

Magazine production: Melissa McChesney

To discuss advertising or Perspectives partnerships: Lisa Guiraud

lisa.guiraud@feedinfo.com

+33 6 37 46 86 47

Ben Cronin

ben.cronin@agribriefing.com

+44 7 780 47 47 63 Cover

2 | SUMMER 2023 www.feedinfo.com FROM THE EDITOR Welcome to the SUMMER 2023 edition of Feedinfo Review

graphic © Designsells

Shutterstock.com

Review (ISSN 1777-5566) is a Mintec (formerly AgriBriefing) publication. Copyright ©2023. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording, or any information storage or retrieval system without the express prior written consent of the publisher. The contents of Feedinfo Review are subject to reproduction in information storage and retrieval systems.

|

Feedinfo

Shannon Behary, editor, Feedinfo

Danisco Animal Nutrition & Health © 2022 by International Flavors & Fragrances Inc. IFF is a Registered Trademark. All Rights Reserved. The gold standard of feed phytases: • Superior performance driven by high activity at low pH: delivering greater cost savings to the poultry and swine feed industries • Improves sustainability: driving the science towards inorganic phosphate free diets • Market leading thermostability, even under harsh pelleting conditions • Value-added services to support you, including: diet & raw material analysis and feed formulation tools info.animalnutrition@iff.com | animalnutrition.iff.com THE BEST JUST GOT BETTER Axtra® PHY GOLD

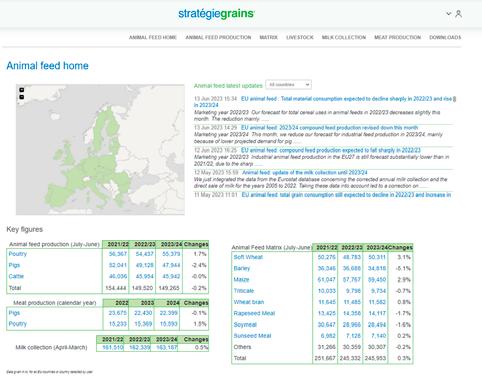

www.feedinfo.com 4 | SUMMER 2023 CONTENTS SUMMER

AB Agri 34 ABIEC 2 ABPA 2, 6 Adisseo France S.A.S ...................... 5, 30 Adare Biome 34 ADM 30 Ag-Commodities 8 Agolin 34 Agri-footprint............................................ 9 Alltech 2, 30, 34 American Feed Industry Association 14 Anhui Redpont 32 Avril 34 Axéréal 34 Barentz .................................................. 30 BASF ........................................... 11, 19 Benchmark Genetics 30 BioZyme 30 Bioiberica S.A.U. 25 Blonk Consultants .................................... 9 Bunge 34 Cargill 26, 34 CEPEA 2 China Pharmaceutical University 32 CJ Bio 32 Conab .................................................... 10 Daesang 32 Danisco Animal Nutrition & Health (IFF) .. 3 Darling Ingredients Inc 30 DCP Capital 34 Dechra Pharmaceuticals 34 DG SANTE .............................................. 30 dsm-firmenich ................... 13, 30, 34, 35 EQT 34 Eurostat 20 Evonik, Animal Nutrition Business Line 21 FAO 10, 12 FeedAccess ..................................... 20, 22 FEFAC 30 Fertinagro Biotech 32 Flylab Tech Co., Ltd ............................ 17 ForFarmers N.V 30 Fufeng ................................................... 32 Gira 6, 7 GlobalFeed 32 Global Feed LCA Institute 9 Haineng 35 Herbonis 34 IFCN AG ................................................. 34 Immersion Group 34 Innovad 34 International Feed Industry Federation 12 Leiber GmbH 7 MAPA (Ministry of Agriculture, Brazil) .. 6, 16 Meihua 32 National Milk Records plc 34 NHU 32 Nissui Corporation 34 No Bull Ag 26 Novozymes 30 Novus International ............................. 15 OCP Group 32 Orffa 30 Praxed 22 Prioskolie 32 QualiTech............................................... 34 Royal Agrifirm Group 30 Schothorst Feed Research 30 Seascape Restorations Australia 34 Secex (Secretariat of foreign trade) 32 Shandong Yinghe Bio 32 Shengda................................................. 35 Sindirações 10, 12 Stratégie Grains 28, 29 Swedencare 34 Symrise 34 Thai Union Feedmill ................................ 30 Urner Barry 7 U.S. Soybean Export Council (USSEC) ................................... 8, 9, 23 Vilomix 24, 25 Viterra 34 Wayne-Sanderson Farms 30 Yota Bio-engineering Co 32 HPAI IN BRAZIL Poultry tests positive. Are exports at risk? 6 INDUSTRY PERSPECTIVES

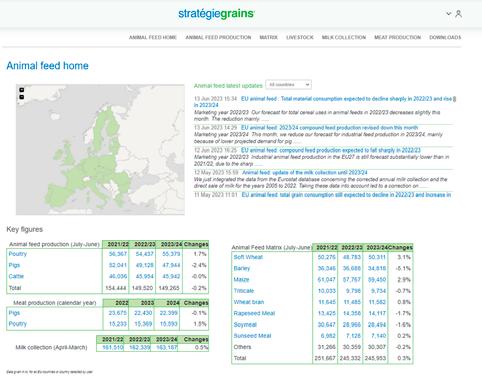

ingredient variability and supply chain risk with sustainable US soy, says USSEC 8 SINDIRAÇÕES INTERVIEW On the minds of Brazilian feed producers: from raw materials to sustainability concerns 10 AFIA INTERVIEW Brazilian opportunities abound for products that can prove their effectiveness 14 ANALYST’S CORNER Global feed additives use seen climbing while Europe struggles 18 INORGANIC FEED PHOSPHATES How low can phosphate levels drop in compound feed? 20 M&A IN SOUTH AMERICA Vitamix to Give Vilomix Foothold in South American Premix and Mineral Feeds Markets 24 AS SEEN ON FEEDINFO.COM US oilseed meal volumes set to take off, potentially changing feed formulations 26 STRATÉGIE GRAINS REPORTS Stratégie Grains forecasts 1.2% drop in EU-27 compound feed output for 2023 28 2023/24 wheat harvest outlooks ‘diminishing week by week’ 29 RECRUITMENT UPDATES 30 NEWS BITES Production 32 M&A 34 Global context 35

ARE CLICKABLE

2023

Minimise

COMPANIES APPEARING IN THIS ISSUE | BOLD ENTRIES

Surf the wav OH-METHIONINE IN LIQUID FORM RHODIMET www.adisseo.com I feedsolutions.adisseo.com Ge t feed cost savi ng s by switching to Liquid OH - Me thionine A WAVE OF BENEFITS VIDEO

Poultry tests positive. Are exports at risk?

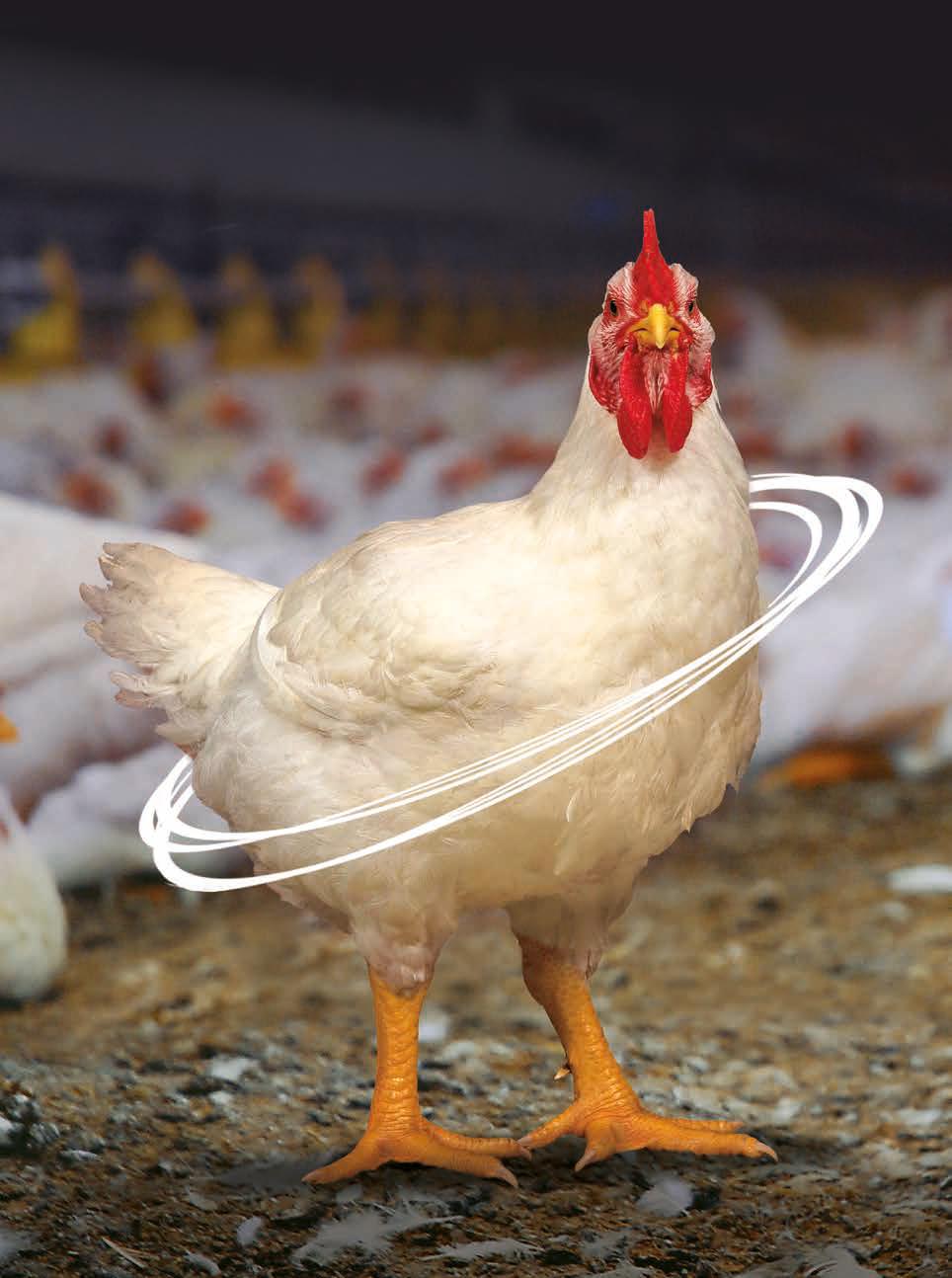

Brazil leads the world in poultry meat exports. The 4.8 million tonnes it shipped abroad in 2022 represented around a third of the total poultry meat volumes exported globally.

One of several factors behind this rise to the top was the fact that, unlike competitors in Europe, North America, or Southeast Asia, Brazil was in a neighborhood free of highly pathogenic avian influenza (HPAI). HPAI is a disease which can severely damage poultry exports — not only because the infection and culling used to control the virus reduce bird numbers, but also because some importers will reject poultry meat from countries or zones known to have HPAI on sanitary grounds.

ARRIVAL IN SOUTH AMERICA’S LARGEST PRODUCERS

Unfortunately, that disease-free status appears to be changing. In the last quarter of 2022, H5N1 HPAI was detected in South America for the first time. As wild birds spread it throughout the continent, it also reached the poultry population in some countries — for example, Argentina, South America’s second-largest producer, suspended exports of poultry and by-products entirely between the end of February and late March after detecting HPAI in a commercially-farmed bird. Resuming those exports meant certifying that particular regions remained free of HPAI, and achieving recognition from trade partners of that new regional-level disease-free designation.

And then, this quarter, HPAI reached Brazil. From mid-May to late June, a few dozen wild birds tested positive for HPAI in seven states. Then, on 27 June, Brazilian authorities confirmed the detection of a first case of HPAI in a farmed bird in Serra, in the state of Espírito Santo. The farm where the outbreak was confirmed belongs to a smallholder raising several types of birds.

Brazil’s Ministry of Agriculture (MAPA) stressed that the case is isolated, and that Brazilian commercial poultry production

In an interview with CNN, Brazil’s Minister of Agriculture, Carlos Fávaro, reaffirmed that there was no risk of the country facing trade barriers in the short-term and that the government has taken all sanitary measures necessary to eradicate the virus on small farms.

In an official statement, the Brazilian Association of Animal Protein (ABPA) recalled that the outbreak of HPAI on a subsistence farm does not provoke any change to the country’s “free of avian flu” status as per the World Organisation of Animal Health (WOAH).

“This is a backyard case,” the statement reads.

REGIONALISATION

As of the time of publication, it remains unclear how the situation will develop — most notably, whether the disease will make it into commercial flocks, and how Brazil’s international trade partners will react if it does.

Japan, for example, suspended purchases of poultry from the state of Espírito Santo immediately after the case in domestic birds was confirmed. Rupert Claxton of Gira, a consultancy, called Japan’s move “interesting”, observing “firstly, [a backyard outbreak] shouldn’t lead to a ban, and secondly, Japan doesn’t normally acknowledge regions!” Japan, it should be noted, is not an unimportant market for Brazil; it was the third largest destination for Brazilian poultry in 2022, and is the world’s largest importer.

In a presentation in April 2023, Dr. Sula Alves, Technical Director of ABPA, observed that MAPA had been negotiating protocols to minimize restrictions and limit the commercial impact of an HPAI outbreak. He mentioned China (1st largest export destination for Brazilian poultry), Japan (3rd largest), South Africa (5th), and several others as countries with whom negotiations were ongoing.

However, given the high geographic concentration of Brazilian poultry production, regionalisation may not be terribly effective in keeping exports flowing. According to the most recent annual report by ABPA, 78% of poultry exported from Brazil is produced in just three southern states: Paraná, Santa Catarina, and Rio

www.feedinfo.com HPAI IN BRAZIL

THIS IS A BACKYARD CASE. BRAZILIAN ASSOCIATION OF ANIMAL POULTRY (ABPA)

6 | SUMMER 2023

© Augustine Bin Jumat | Shutterstock.com

78% OF BRAZIL’S POULTRY EXPORTS ARE PRODUCED IN JUST 3 STATES.

Grande do Sul. In order for those states to continue to export, they would need to keep their commercial operations free of HPAI — and all three of the states have had wild birds test positive for the HPAI virus along their coastlines.

WHERE WOULD THE EXTRA VOLUMES GO?

Because of this uncertainty, all eyes are watching Brazil. Speaking in the final days of June, Dylan Hughes, a poultry analyst for Urner Barry, observed: “it is a little too early to truly tell if/how the positive HPAI case in Brazil could impact the poultry landscape... We’re specifically monitoring how China responds to this development. This trade destination, which represents one of the largest importers of poultry by volume, has historically taken a stringent approach to disease outbreaks. If we do happen to see HPAI-related restrictions on Brazil production destined for China, this could potentially allow U.S. exporters to fill in the missing gaps.

“On the other hand, Brazil relies heavily on export trade volume. If there was a bottleneck in movement headed into China, this

could prompt Brazil to rely more heavily on alternative destinations to offload their production, thus making for a more competitive marketing landscape for U.S. exporters.”

GIRA, for its part, observes that in the first five months of 2023, exported volumes grew by 11%. “Some countries dependant on imports from Brazil are anticipating their purchases in case HPAI enters the commercial sector,” stated Laurène Bajard of Gira.

Amid a backdrop of weak domestic demand and record-high Brazilian production volumes,“[HPAI-related export restrictions] would increase domestic availability and crash prices,” she said.

Meanwhile, in the days following the announcement of HPAI in a domesticated bird, one UK-based meat trader observed that there was a “shedload” of Brazilian chicken fillets on the water heading towards Europe and the UK.

“Now we’re being offered product that’s nearly 40% cheaper this week compared to where it was maybe 3-4 weeks ago.

“[Brazilian exporters] are panicking,” he believed.

By Shannon Behary, senior editor With contributions by Luís Vieira, analyst

By Shannon Behary, senior editor With contributions by Luís Vieira, analyst

With a high level of technology, uncompromising quality standards and an unceasing innovative spirit, Leiber turns a brewery byproduct into healthy and sustainable products for animal nutrition.

Leiber Brewers‘ Yeast products are designed to: stabilize the gastrointestinal tract | provide dietetic and prebiotic mechanisms | adsorb and inactivate harmful bacteria and mycotoxins | strengthen specific and nonspecific immune response

For further information just get in touch with us!

www.feedinfo.com SUMMER 2023 | 7 HPAI IN BRAZIL

Eff ective.

Leiber GmbH | Hafenstraße 24 | 49565 Bramsche Germany | info@leibergmbh.de | leibergmbh.de

180423_Leiber Anzeige_Feedinfo Review_210 mm x 139 mm.indd 1 18.04.23 13:44

Leiber Brewers‘ Yeast –Sustainable. Innovative.

We have been upcycling at world-market level since 1954 and keeping the environment and climate in mind.

Since1954

© Geet Theerawat Shutterstock.com

Minimise ingredient variability and supply chain risk with sustainable US soy, says USSEC

Soy is everywhere in animal nutrition. As an oilseed and a legume, it is an extremely versatile ingredient for food, feed, and energy: soybean meal is, of course, a staple in monogastric diets, whole soybeans can be fed to cattle, and soy-derived ingredients are even increasingly used in fish and shrimp diets as a sustainable alternative to marine-sourced feed.

However, all soy is not created equal — at least not according to the US Soybean Export Council (USSEC). Instead, argues Tom D’Alfonso, director for animal nutrition and aquaculture at USSEC, those interested in maximising the nutritional value for their animals, minimising the carbon footprint of their consumption, and avoiding potential supply-chain disruptions caused by logistical chokepoints should pay careful attention to the origins of the soy products they purchase. In today’s Perspectives piece, D’Alfonso presents the evidence for these claims, making the case that this economical and nutrient-dense ingredient can and should remain an important part of sustainable feed formulations.

[Feedinfo] Soybean meal quality is a function of several different factors, including whole soybean quality, soybean processing indicators, digestible amino acids, and energy content. Can you explain how US soy performs on these metrics?

[Tom D’Alfonso] The value of soybean meal in the diet is determined by its amino acid (AA) profile and the digestibility of those amino acids. U.S. soybean meal has better AA digestibility for swine and poultry compared to products sourced from Argentina and Brazil. Higher amino acid digestibility translates into superior animal performance, less nitrogen wasted, and reduced diet costs. The energy content must be considered when assessing the total intrinsic nutritional value of the soybean meal in swine and poultry diets. Compared to other soybean meal origins analyzed, the U.S. has a higher Net Energy (NE) and Apparent Metabolizable Energy, nitrogen corrected (AMEn) values than Brazil and Argentina. NE and AMEn are the most common energy measures for swine and poultry diets, respectively. Sucrose

also contributes to higher energy levels. Sucrose levels in U.S. soybean meal have been consistently higher than Brazil, and comparable to the Argentinian meal. The higher level of energy and sucrose gives an advantage to U.S. soybean meal, which contributes to reducing diet costs, increasing animal performance and sustainability.

[Feedinfo] How does US soy measure up in terms of the consistency of its amino acid content? Are there other relevant characteristics in which US soy is more consistent than soy from other origins? And why is consistency important for feed formulators?

[Tom D’Alfonso] One of my favorite sayings is “There is no quality without consistency” and this is where U.S. soy really excels. For the meal to be consistent, every upstream practice demands world-class quality control. Our growing and harvesting conditions for the beans are the most advanced and sustainable in the world by a large factor, hands-down. When crushers receive consistent US soybeans, they are better able to control their process and produce more consistent soybean meal. This is a big factor in keeping the nutrients, such as amino acids and calories, digestible and metabolizable. Nutritionists can formulate feed with more confidence in the nutrient composition. Feed millers also like the consistency of the meal in terms of particle size distribution, flowability, and consistent pellet quality.

[Feedinfo] Tell me more about the studies which identified this difference between the quality and consistency of soy of different origins. How were samples deemed representative of a whole country’s supply selected? Who ran the tests? When did they take place? Was this a one-time study or part of an ongoing monitoring program?

[Tom D’Alfonso] Quality measurements are collected, analyzed, and shared on an ongoing basis. Protein, amino acid, and energy data are obtained from Evonik and summarized based on international trading specifications. Additional U.S. data are sourced from the USDA FGIS public database. Brazilian and Argentinian data are collected from different surveyors and summarized by Ag-Commodities (Tap Top Ventures, Ltd.) Since 2017 we have seen that total damage of Brazilian-origin beans is approximately 5 times that of US soy.

www.feedinfo.com 8 | SUMMER 2023 INDUSTRY PERSPECTIVES | Sponsored

Tom D’Alfonso

[Feedinfo] USSEC claims that the carbon footprint of U.S. soybeans is significantly lower than those of other origins, at 0.4 kilograms CO2 per kg of U.S. soybeans vs. 5.6 kilograms for soybeans from Argentina and 5.7 kilograms for soybeans from Brazil. What accounts for this difference? And what more can you share about the methodology for this assessment?

[Tom D’Alfonso] More often than not, the dialogue about the sustainability of soy speaks in generalities and doesn’t account for differences by origin. To demonstrate the U.S. soy advantage, we worked with Blonk Consultants using the Agri-footprint database to compare the carbon footprint of U.S. soybeans to other sourcing countries of soy. In the specific case you’re mentioning, this compares whole soybeans shipped to Europe. This calculation includes the cultivation, the transportation (both within the country of production and transportation from the point of export to destination), and land use change. The largest difference between the values is attributed to land use change, with it accounting for only 4% of the U.S. carbon footprint, but 94% of Argentina’s and 91% of Brazil’s. These calculations evaluate land use change over the last twenty years, which is the industry standard. It is important to look at the environmental impact of soybean production and there are several third-party sources that allow users to make these comparisons, including Agri-footprint and The Global Feed LCA Institute

Sponsored | INDUSTRY PERSPECTIVES

crops, precision agriculture, and participation in programs offered by the U.S. Department of Agriculture (USDA) Natural Resources Conservation Service. This is reflected in U.S. soybean farmers’ commitment to achieve specific sustainability goals by 2025 (with year 2000 as the benchmark):

• Reduce land use impact by 10%

• Reduce soil erosion by 25%

• Increase energy use efficiency by 10%

• Reduce total GHG emissions by 10%

[Feedinfo] Finally, USSEC claims that the reliability of US infrastructure is another competitive advantage for US-origin soy. Can you elaborate?

[Tom D’Alfonso] One of the cardinal rules in supply chains is to avoid putting all your eggs in one basket. The U.S. soybean industry benefits from being able to access multiple supply chain options. Soybeans grown in the U.S. are ultimately exported from the Mississippi Gulf, the Pacific Northwest, the Atlantic Coast, the Texas Gulf, the Great Lakes, and via railroad to border countries. As a result, when challenges materialize in one of our supply chain options, they may cause inconvenience, but the industry is able to remain resilient by redirecting to other transportation options.

[Feedinfo]

Beyond land-use change, US soy producers are proactively working to improve the sustainability of their production practices. Can you give any more information about this work, including examples of the kinds of practices that can help bring about improvements such as better resource efficiency or lower emissions?

[Tom D’Alfonso] U.S. soybean farmers have long prioritized sustainability and continuously strive to improve their farming practices. As predominantly family-owned operations (97% of farms), U.S. soybean farmers are committed to leaving the land in better condition for future generations. This can be seen in the adoption of practices like no-till and conservation tillage, cover

While many opportunities exist to invest more thoroughly into our transportation system, the U.S. still enjoys infrastructure that allows soybeans to be transported more cost effectively and reliably than our competitors. We continue to benefit from the investments in locks and dams, freight rail, roads and bridges, and ports that consistently allow U.S. soybeans to reach our valued customers more predictably and economically. One of the secrets to the U.S. soybean supply chain is the utilization of barge and rail transportation — the modes of transportation designed to transport high volume commodities long distances in an economical manner. The cargo capacity of barge and rail far exceeds trucking, which is still disproportionately utilized by many of our international competitors.

www.feedinfo.com SUMMER 2023 | 9

Published in association with USSEC 0 1 2 3 4 5 6 2017-04-25 2018-09-07 2020-01-20 2021-06-03 2022-10-16 2024-02-28

Running Monthly Average of Soybean Total Damage Brazil USA

Carbon Footprint (including LUC) of Whole Soybeans Imported into Europe

On the minds of Brazilian feed producers: from raw materials to sustainability concerns

From the volatility of corn and soybean prices and availability, to the concern that the country’s infrastructure and logistics will not hold up to the strain of ever-larger harvests, and the growing pressure to address the carbon footprint of animal production, the Brazilian feed industry is facing several serious short-term and long-term challenges. Today, in a Feedinfo Review exclusive, Ariovaldo Zani, president of Sindirações (the National Union of the Animal Feed Industry) shares his insight into how each of these are experienced by the animal nutrition value chain.

FLUCTUATING AG COMMODITY PRICES

Ariovaldo Zani explains that the state of the feed industry is deeply connected with the supply and prices of the commodity raw materials used in feed.

“When agriculture goes well, of course, grain prices go down, favouring livestock production. We have been suffering for the last two years with the prohibitive levels of corn and soybean meal prices. There was only relief starting a month and a half ago,” says Zani.

Indeed, over the last two years, the corn and soybean crops in the Americas have fluctuated, but in 2022/23, Brazil has a projected soybean harvest of 154.8 million tonnes, which is 23.3% greater than last year, according to Conab (a state company focused on the food supply, one of whose missions is the production of agricultural data). On the other hand, Argentina has suffered with a historical drought that would put its total production at 23.9 million tonnes — the lowest in 24 years per

USDA figures. The US, in the meantime, saw its soybean crop size decline 4% in the last marketing year, coming in at roughly 116 million metric tonnes in 2022/23 (a rebound is estimated for the 2023/24 marketing year).

For corn, Brazil expects to harvest 125.5 million tonnes this year, according to Conab estimates. Coarse grain production in Argentina will also be reduced due to drought, and the US harvested 9% less corn in CY2022 — a total of 348 million tonnes.

DEMAND PRESSURE, GRAIN EXPORTS, AND PROTEIN IMPORTS

Meanwhile, the number of animals in Brazil hungry for that grain just keeps growing. The OECD-FAO Agricultural Outlook 2020-2029 forecasts that Brazilian swine production will have risen 13% by 2029 compared to its average level from 2017-2019, faster than the 9% growth predicted at a global level, and also predicts Brazil’s poultry meat production will have risen 9% by 2029 against the same benchmark.

Of course, it is not just production-side factors that can pressure feed ingredients prices. Zani points out that the growing demand both from the export market and from the energy sector is increasingly being felt in terms of higher grains prices.

“Corn is the most important crop for feed. It used to be that corn was not exported, [but] now over 50 million tonnes are exported, and yet we have corn-based ethanol in the country,” adds Zani.

Moreover, in addition to the high prices for feed ingredients in

Continued on page 12

Brazilian animal feed production forecasts through 2029

10 | SUMMER 2023 SINDIRAÇÕES INTERVIEW www.feedinfo.com

50 55 60 65 70 75 80 85 90 95 100 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 M i l l i o n s t o n n e s

Data Source: Sindirações. © JoeBamz | Pixabay.com

The science of sustainable feed that succeeds Natuphos® E Natugrain® TS Natupulse® TS Enzymes to fully utilize the potential of your feed animal-nutrition.basf.com Pioneering Expertise BASF Enzymes More than 30 YEARS

ARIOVALDO ZANI

Continued from page 10

recent times, Zani explains that Brazilian animal production is also suffering from cheaper imports from neighbouring markets, which are undercutting prices.

“Argentina is a lot more competitive due to a devalued currency exchange rate,” he observes. “We are [net] importers of milk, and import prices are not compensating the costs.”

CROP BOTTLENECKS

On the other hand, even when local crop production is plentiful, challenges can occur in Brazil. This is because, as has been seen multiple times in recent years, Brazilian infrastructure is straining under the weight of harvests which just keep growing, thanks to the expanding frontiers of agricultural production as well as ever higher yields.

Traditionally, Brazilian grain has been exported through the three southern ports of Santos, Paranaguá, and Rio Grande. For some soybean-producing regions such as the state of Mato Grosso, this means trucking their beans over 1,000 miles. Therefore, more northern terminals such as Barcarena, Itacotiara, and Santarem have seen some private investments enabling exports, and access to them has been made easier after the BR-163 road that connects Mato Grosso to these ports was paved.

Even with these investments, Zani and others believe there is a risk that Brazil’s ports will not be capable of keeping up with the massive crop volumes this year, given that the first four months of the year have already shattered records.

“Lack of storage is another problem. Nearly 33% of all this grain cannot be stored due to lack of grain bins. The government is even offering more credit to buy silos. The whole infrastructure will be tested”.

Moreover, even if exports are being made easier, cross-country travel remains quite tricky. This matters for the feed industry, because the places where the feed ingredients are produced and where the animals are raised are not necessarily the same; most of the corn and soybeans are produced in the country’s centre-west, which consumes only 13 million tonnes of feed, while the south consumes 39 million tonnes. A pending railway project would connect both regions, but it is still under review by environmental agencies.

CARBON FOOTPRINT AND OTHER ENVIRONMENTAL IMPACTS

Even amid the acute concerns of getting feed ingredients moved around and animals fed, the industry also has its eyes on longer-term challenges, such as climate change. Indeed, as the president of Sindirações confirmed, there are opportunities for animal nutrition and production to play an important role in halting

these threats.

For example, to paraphrase from a 2016 study that was sponsored by Sindirações alongside the International Feed Industry Federation and the feed industry associations of Europe, the US, and Japan, feed additives such as amino acids and phytase can enable a reduction in the nutrient input into livestock production systems without compromising the productivity of the animals. Thus they can reduce the total amount of feed needed — and spare the greenhouse gas emissions required to make that extra feed.

Feed consumption estimates, 2022

“This means less use of land, less diesel, and fertilizers,” summarized Zani.

Moreover, a more targeted use of feed additives can also mitigate the production of undesirable emissions, including nitrogen and phosphorus discharge, or methane emission from cattle, he notes.

In addition, Zani mentions that Brazil has reached some of the goals of a lower carbon footprint that were previously committed to at the Cop 15 climate conference in Denmark in 2009. “We have complied with the goals of recovering degraded pastures and more feedlots.”

Meanwhile, the agricultural sector is also pushing back against the perception that Brazilian soy and feed production is so terrible for the environment. The president of Sindirações cited a recognition by the Food and Agriculture Organization of the United Nations (FAO) that the carbon footprint of Brazilian agriculture had previously been overestimated, through a failure to take into account regionally important variations in agricultural practices, including the large and growing areas of the country submitted to double-cropping (usually with soy and corn).

According to Zani, this work is connected with an initiative to develop more accurate and higher quality data about land use in Brazil for the purposes of evaluating carbon footprints.

“I cannot deny that carbon emissions are very important, and that animal production and agriculture have a very important impact on the emissions, but these [re-evaluations] are very important facts to be highlighted, too” says Zani.

On the question of antibiotics reduction, the president of Sindirações said that the matter was above all being driven by the European Union, which the Brazilian industry is watching closely. “The use of antibiotics to improve animal performance has already been minimised, and the only use is now for animal health where relevant.”

By Luís Vieira, analyst Edited by Shannon Behary, senior editor

www.feedinfo.com 12 | SUMMER 2023

WE HAVE BEEN SUFFERING FOR THE LAST TWO YEARS WITH THE PROHIBITIVE LEVEL OF CORN AND SOYBEAN MEAL PRICES.

SINDIRAÇÕES INTERVIEW

North 2.3 million tonnes Northeast 6.1 million tonnes Center-west 13.0 million tonnes Southeast 20.4 million tonnes South 39.0 million tonnes © shooarts / Shutterstock.com

Protect your flock with confidence

Reducing the risk of health and nutritional challenges at every life stage is essential for successful poultry production. With our comprehensive range of solutions at the heart of healthy development and welfare, we at DSM help you address the challenges you face to protect your flocks with confidence.

If not us, who? If not now, when? WE MAKE IT POSSIBLE

Follow us on: www.dsm.com/anh

Brazilian opportunities abound for products that can prove their effectiveness

Brazil imported a record $334.6 million worth of animal feed and pet food in 2022, a 3% growth in value from 2020. Indeed, imports have been steadily increasing over the past 10 years, a function of the country’s increasing animal production demands.

Amid this backdrop of growth, the American Feed Industry Association (AFIA) recently conducted a market assessment in Brazil, interviewing 52 professional importers, distributors, livestock producers, feed manufacturers, and associations, in order to better understand the opportunities and expectations of the Brazilian animal nutrition industry.

“Brazil is an economic leader in Latin America and is well respected in international arenas. Its growing livestock, poultry, and aquaculture sectors make it suitable for niche markets, like feed additives and U.S. feed ingredients,” Gina Tumbarello, AFIA’s Senior Director of Global Strategies, Policy, and Trade, told Feedinfo in a discussion about the results of that market assessment.

A GROWING, BUT HIGHLY CONTESTED, MARKET

Naturally, this is all underpinned by the impressive expansion in the country’s livestock production.

Brazil is the second-largest producer and the world’s largest exporter of chicken meat.

The USDA Foreign Agricultural Service’s office in Brazil (FAS) forecasts the country’s export volume for 2023 at 5 million metric tons, a 6% increase year-over-year.

Production is estimated at 14.85 million metric tons in 2023, a historical record and a 3% increase yearover-year. This is thanks to both improved domestic consumption and strong global demand. China is Brazil’s top export market and accounts for 34% of Brazil’s total production.

Vitamins,mineralsAminoacids,analogsAnionicsalts Acidfiers BuffersAntioxidantsSweeteners/flavors Probiotics Prebiotics Enzymes(andfungalextracts)PhytogenicextractsMethyl-donors

Meanwhile, Brazil’s beef production, traditionally organized around large-scale cattle grazing on natural grasslands, is now beginning to evolve towards more feed-dependent models as well, Tumbarello claimed.

“While pasture-based systems have historically been dominant, the country has seen some increases in feedlot operations in recent years, especially in regions closer to urban centers and where there is a greater demand for grain-fed beef.” FAS estimates Brazil’s cattle production will expand 1% in 2023, producing 48.2 million head. On the other hand, the swine sector is predicted to reduce stocks in 2023 on account of unfavourable weather and increased production costs, especially feed costs.

The upshot of all of this is an increase, in volume terms, in total demand for feed products.

“Overall, in Brazil, the animal protein industries are growing, demand for animal protein is growing, demand for Brazilian protein exports are growing,” she observed.

“Brazil’s feed additive and premix market is more mature than in other emerging markets and is highly competitive among key players including the United States, China, the European Union and other parts of South America,” Tumbarello explained.

The opportunity is, in fact, already being seized by many producers from around the world who have established themselves and their reputation on the ground.

“According to trade interviews conducted for our market assessment, we found that many Brazilian industry members believe their needs are being met by local supplies, yet they are often buying from multinational corporations, which are purchasing imported ingredients and additives,” Tumbarello

Continued on page 16

www.feedinfo.com

AFIA INTERVIEW

14 | SUMMER 2023 © RF Studios | Pexels.com

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Non -Medicated Additives

% of Brazilian survey respondents who have bought, sold, or used non-medical additives by category

WE KNOW WHAT YOU’RE MADE OF.

Every

to

to

on NOVUS

nutrition

that

advanced

in scientific research,

day, the world asks poultry producers to do more. More growth. More efficiency. And every day, you’ve just got more to do. More challenges

overcome. More products that promise

do more… but don’t. That’s why you can rely

for intelligent

solutions

are made of more. NOVUS delivers

technology, rooted

designed to help your birds reach their full potential. Together, we can show the world that you’re made of more.

NOVUSINT.COM/MADE-OF-MORE INFO@NOVUSINT.COM • 1-800-568-0088 ® is a trademark of Novus International, Inc., and is registered in the United States and other countries. TM Made of More is a trademark of Novus International, Inc. ©2023 Novus International, Inc. All rights reserved.

AFIA INTERVIEW

Continued from page 14

reported. “Trade members lack awareness of their current usage of imported ingredients and additives.”

Most of Brazil’s feed additive and premix imports fall under the tariff code 230990, she notes. The EU is the largest trade partner in this category, followed by China, the United States, the Netherlands, Germany and France.

Not only is the EU the largest exporter of these products to Brazil, but its exports also now represent 44.3% of what Brazil imports, up from 34.9% in 2016. China’s market share has grown slightly since 2017, from 22.8% to 28.5% in 2022, although its market share in 2016 was up to 31%. The U.S. holds 11.5% of the market, but over the past decade has faced increased competition from the EU and China.

“This is an incredible opportunity for U.S. producers of feed additives and premixes, which complement and enhance diets and give producers and manufacturers options when the pricing is tight and quality product is a requirement,” she believed.

DEMONSTRATIONS OF EFFECTIVENESS BUILD CONFIDENCE

In order to break into the Brazilian market, therefore, it is critical for animal nutrition companies to differentiate their products’ quality, and most importantly, prove their worth under local conditions.

“When promoting feed ingredients in Brazil, building trust with the livestock and feed community is key, and part of that is demonstrating through validated data the efficacy of the products in question,” Tumbarello said.

“For example, it was remarkable how often the interviewees brought up the importance of ‘providing testing data’ and of obtaining samples so that local manufacturers and their customers could run their own field tests to ensure product quality and prove product claims were accurate. They also raised questions about competitor countries making claims about certain ingredients

without verifiable data to substantiate the claims.”

“The U.S. industry is seen as leading in quality and innovation but must develop trust among the Brazilian industry by providing data to support their products’ efficacy claims,” Tumbarello concluded.

PRODUCTION EFFICIENCIES, HEALTH AND ENVIRONMENT TOP OF MIND

The concerns that emerged from dozens of interviews with farmers and feed manufacturers were similar to those facing producers everywhere: how to improve the bottom line through more costefficient animal growth, greater nutrient absorption and feed conversion; how to ensure animals remained healthy and the food chain safe; and how to improve the environmental impacts of animal production, for example through mitigating the waste products resulting from their operations.

“As corn and soybean meal prices continue to rise and put pressure on the animal feed industry, feed additives and ingredients play a critical role in relieving financial pressure and instability while ensuring a nutritious and complete animal diet,” she observed.

Moreover, the imperative to find alternatives to antimicrobials in animal production is another opportunity for innovators in animal nutrition and health to shine.

Specific Goals

Specific goals for feed additives sold or employed in Brazil

In the Brazilian context, this has been a priority since at least 2019, when the Secretary of Agricultural Defense (SDA), part of the Brazilian agriculture ministry (MAPA), implemented restrictions on using antibiotic growth promoters, requiring those used solely for growth promotion to be classed as veterinary prescription drugs. The SDA aims to ensure that antibiotics are only administered to animals under the supervision of veterinarians for therapeutic purposes, such as treating diseases or preventing infections, and their use is now strictly regulated.

“There are U.S. feed additives that can provide viable alternatives to antibiotics, which, when added to animal feed, can improve growth, performance, and/ or livestock efficiency,” Tumbarello said.

By Heather McGuire Doyle, senior analyst

www.feedinfo.com 16 | SUMMER 2023

0 10 20 30 40 50 60

EnhanceHealthMeetNutrient RequirementsIncreaseDigestibilityEnhance/ImproveEfficiencyMaintainFeedQualityManageFeedIntake Impact/Improvethe GastrointestinalTractModifyDigestion/IngestionMitigateMycotoxinsControlParasitesEnhanceProductsManageWasteProducts Feed preparations 53% Enzymes 25% Amino acids 20% Active yeasts 1% Minerals 1%

Feed preparations Enzymes Amino acids Active yeasts Minerals

Share of Imports from the U.S. by Category Volume 2022

Improving our food system one fly at a time

About Us

Flylab is an agritech company built with an experienced team that has years of proven track in the insect industry. We harness the bioconversion power of the Black Soldier Fly Larvae (BSFL) to recycle agricultural waste into food for animals and plants. We want to disrupt the use of very unsustainable protein ingredients such as fish meal and soybean meal and eplace it with a more sustainable, more natural and more nutritious protein: FLMeal. We are the future of sustainable animal feed.

Our Products

We're ready to serve powerful ingredients that will contribute to a better world

•FLMeal is a free flowing defatted Black Soldier Fly Larvae meal. Characterized by: Highly digestible amino acids. Rich in antimicrobial peptides, high palatability, low environmental footprint.

• FLDried larvae are high in protein, lipids, calcium, minerals and free from preservatives or additives. Great source of amino acids and lauric acid for a boosted animal health and immune system.

•FLOil is a sustainable source of energy for animals. Inclusion in feeds improves animal's health.

VDO

Flylab Tech Co.,Ltd Tax ID : 0505564018228 +66(0)52 000 597 hi@flylabfeed.com flylabfeed.com Flylab 182 Moo. 8, Outer Ring Road, Tha Wang Tan, Saraphi, Chiang Mai, 50140 Thailand

www.flylabfeed.com

FLMeal FLOil FLDried FLFrass

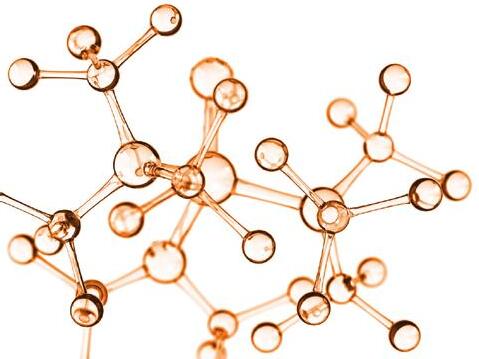

Global feed additives use seen climbing while Europe struggles

Last year, the various factors pummelling poultry and swine producers — from animal diseases to sky-high input costs to depressed Chinese consumption — resulted in a sizeable drop in demand for many feed additives at a global level. While a few of those factors have receded — energy costs, or the zero-COVID policy in China, for example — others, such as stricter environmental or animal welfare regulations eating at margins, the continued pressure of highly pathogenic avian influenza (HPAI) or African Swine Fever (ASF), or the ongoing inflationary environment, continue to weigh on the sector.

Where, precisely, does that leave feed additive demand in 2023? Fresh off the latest round of updates to Feedinfo’s Supply & Demand Pro service, Principal Analyst Sam Weatherlake walks us through the most recent estimates for global and Chinese consumption of various vitamins and amino acids, and also shares what the market is saying about the potential for recovery in Europe, an area which has seen a starker decline than most over the last few years.

AMINO ACIDS

to fall each year until 2025 as new capacity comes online but will then rise rapidly to meet increasing global demand.

For global lysine HCl consumption, we project an increase of 2.6%, down from the previous forecast of plus 3.6%.

Chinese consumption growth of 3% is forecast for 2023 for both lysine HCl and lysine sulphate. Close to 400,000 tonnes/ year of lysine HCl equivalent capacity is set to come online in mid-2023 to early 2024. Lysine HCl exports are projected to resume their upward trend in 2023-24, even as the growing pork and poultry sectors drive up domestic consumption. Lysine sulphate exports are forecast to continue rising rapidly as more volumes become available.

East Asia Methionine - Supply & Demand

Feedinfo anticipates an increase of 2.1% in global threonine consumption this year, revised down from the previous forecast of plus 3.2%.

Feedinfo projects an increase of 3.2% in global methionine consumption in 2023, revised down from the previous forecast of plus 3.7%.

Meanwhile in China, consumption growth of 3.5% is forecast for 2023 following the relaxation of stringent COVID-19 restrictions. It is also perhaps worth noting that the country became a net exporter for the first time in 2022. Operating rates are projected

Chinese consumption growth of 2.5% is forecast for 2023. Exports are projected to be lower over the next few years due to weaker global demand and increased capacity in other regions. As a result, production volumes are set to fall in 2023-24 despite plans for a large new plant to start up in mid-2023.

Finally, Feedinfo projects an increase of 3.7% in global tryptophan consumption, which is modest by the standards of the past decade. This reflects the expected stabilisation of the Chinese pig herd, the lack of spare capacity at CJ’s Indonesian plant, and Chinese producers’ struggle to remain cost competitive.

Chinese consumption growth of 5% is forecast for 2023. The

18 | SUMMER 2023 www.feedinfo.com ANALYST’S CORNER

52 57 62 67 72 77 82 87200 400 600 800 1000 1200 1400 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Operating Rate (%) '000 tonnes

Capacity Production Consumption Operating Rate

Sam Weatherlake

country was a modest net exporter until 2021, when it became a net importer. China developed a large deficit in 2022, although this is projected to stay close to 10,000 tonnes per year as the country’s growing demand is met mostly by domestic supply.

VITAMINS

Feedinfo’s Supply & Demand Pro has also revised its global consumption estimates for 2022. Nearly all of these revisions indicate that the drop in global feed additive consumption 2022 was less than previously thought — indeed, in methionine’s case, we now believe there was very slight growth. The only exception where consumption was calculated lower than previously estimated for 2022 was vitamin B2.

Feedinfo projects an increase of 5.6% in global vitamin A consumption in 2023 (calculated on a vitamin A 1000 basis), revised down from the previous forecast of plus 8.5%.

Chinese consumption growth of 5% is forecast for 2023. The forecast assumes that operating rates at BASF’s Ludwigshafen site will rise progressively as the site’s long-running technical problems are resolved and new capacity is utilised from mid-2023. Chinese production and exports are projected to decline throughout the forecast period as BASF accounts for a greater share of global consumption.

The market dynamics for vitamin A have diverged from other products in recent years owing to a series of incidents that have reduced BASF’s output at Ludwigshafen going as far back as October 2017. The cumulative effect of these developments is that consumers have not returned to the inclusion rates that were standard before the price spike of 2017-18. Feedinfo’s forecast also assumes that vitamin A 1000 inclusion rates will begin to rise towards historical levels as global availability improves.

For vitamin E consumption, we now anticipate an increase of 3.1%, revised down sharply from the previous forecast of plus 6%.

Chinese consumption growth of 5% is forecast for 2023. Export volumes dipped in 2022 owing to weaker overseas demand but are expected to recover this year. In the longer term, exports are forecast to rise in line with increasing global consumption.

Finally, Feedinfo projects an increase of 3.1% in global vitamin B2 80% consumption in 2023, revised down from the previous forecast of plus 4.2%.

Chinese consumption growth of 6% is forecast for 2023. While the forecast assumes that China’s excess capacity will be used to meet rising global and domestic demand, the country’s exports are set to fluctuate over the next few years as it faces competition in overseas markets.

VIEWS FROM THE EUROPEAN MARKET

In Europe, the fall in compound feed production in 2022 was matched by decreases in feed additives consumption, although the impact varied by product and region. Feedinfo’s most recent estimates reckon that use of amino acids and vitamin E in Europe declined by 5-6%, while vitamin B2 dropped 7.6% and vitamin A fell 10.7%.

Premixers were hit particularly hard as farm managers who manufacture their own feed cut back on high-cost inputs, adjusting their formulations to reduce feed additive inclusion rates. In some cases, these trends have continued into 2023, with one premixer saying it expected to produce 10-15% less volume this year compared to 2021.

One trader said the picture was even bleaker than it had been at the end of 2022, with compound feed manufacturers and premixers facing severe insecurity and pig farmers in northwest Europe struggling to maintain viability in the face of costly investments needed to meet new regulatory standards. The source projected that feed additives consumption could fall by 5-6% in 2023. Another trader was anticipating a recovery in the French poultry industry this year but said that pork production would likely fall by 3-5% in Germany, Belgium, and the Netherlands. Spain also faced losing some market share, it suggested.

A reseller said that amino acids demand fell sharply in 2022 and had not yet stabilised, although the pace of decline had slowed. Many pig farmers ceased operating last year due to poor profitability, it explained, and while moderating costs meant that the situation was likely to stabilise, it did not expect the sector to recover to previous production levels given weaker domestic demand and uncompetitive exports. However, the source anticipated that poultry production would pick up as HPAI increasingly came under control.

A vitamins producer confirmed that it had seen a “high singledigit decrease” in European consumption for 2022, with western Europe down by 10-15%. The source said it was expecting to see a recovery in 2023 but H1 was proving to be slow and it was hoping for a stronger H2. While it did not anticipate that European vitamins demand would be structurally lower overall, the producer said it was expecting to see a redistribution from western Europe to other parts of the continent.

A feed additives producer said that demand was returning “slowly but surely”, with the poultry industry being “back on track” but the pork sector continuing to decline. The source said it was seeing slightly higher demand for 2023 compared to last year and expected this trend to continue into the second half of the year. “This is valid for all animal species except pork. Pork will need to time to recover, if possible to recover at all, as regulations make it almost impossible to run a profitable business”, the producer noted.

By Sam Weatherlake, Principal Analyst

For more detailed analysis of global capacity, production, and consumption of feed-grade amino acids and vitamins, ask your Feedinfo account manager about access to Supply & Demand Pro

SUMMER 2023 | 19 www.feedinfo.com ANALYST’S CORNER

© StudioMolekuul | Shutterstock.com

INORGANIC FEED PHOSPHATES

How low can phosphate levels drop in compound feed?

Feed phosphate consumption in compound feed production has declined by 58% in France over the last 20 years. This article examines that trend and explores the question of just how low usage can go.

The French Ministry of Agriculture has provided comprehensive national statistics, offering a detailed view of French feed production over the past 20 years. These statistics include information on raw materials used in producing compound feed, mineral feed, and milk replacers collected in 2003, 2006, 2009, 2012, 2015, and 2020. The 2020 data was published in late 2022.

Upon initial examination, the most striking observation is the considerable decrease in phosphate usage between 2008 and 2009. Despite growing total compound feed production, there was already a trend of reduced consumption of minerals and feed phosphates from 2003 to 2006. From 2003 to 2020, feed phosphate usage in compound feed declined by 5% per year, while minerals consumption decreased by 1.8% against a backdrop of a 0.1% reduction in compound feed production. Minerals consumption is decreasing more rapidly than compound feed production, therefore. However, minerals consumption has remained relatively stable since 2012, averaging 564,000 tonnes per year in compound feed.

minerals consumption. Phosphates ranked second until 2015, but in 2020 salt took this position, relegating phosphates to the thirdmost-essential mineral in compound feed.

Data from the past 20 years shows a 58% reduction in feed phosphate consumption in compound feed. The question now is: how low can it go?

HIGH PRICES AND IMPROVEMENTS IN PHYTASE TECHNOLOGY DRIVE CONSUMPTION DOWNWARD

Feed producers are currently grappling with challenging market conditions. The 2022 price increase in inorganic feed phosphate (IFP), sparked by Russia’s invasion of Ukraine, has forced feed producers to reconsider phosphate usage, just as they did during the commodity supply crisis of 2007/2008. Based on market feedback collected by Feedinfo as well as Eurostat’s trade statistics for phosphates in 2021, 2022, and early 2023, we believe that feed phosphate consumption is decreasing in Europe.

It is worth noting that French compound feed production declined by 7% from 20.6 million tonnes to 19.2 million tonnes in 2022, according to the latest FEFAC publication. This decline is alarming, as French compound feed production had remained relatively stable since 2006, with an average annual output of 20.7 million tonnes.

Feed phosphates are the only mineral category experiencing a decline; consumption of other minerals has remained stable or experienced a slight increase. The primary mineral ingredient in compound feed is calcium carbonate, accounting for 71% of

Utilising the French statistics from 2003 to 2020, we have estimated feed phosphate consumption for 2021 and 2022, and forecast figures for 2023. To achieve this, we collaborated with Edouard Bault, CEO and founder of FeedAccess, to estimate the impact of new-generation phytase on monogastric compound feed in Europe and the reintroduction of processed animal proteins (PAP) in Europe.

Over the next decade, meat consumption in Europe is projected to remain steady, with a slight increase in European feed production driven by growing demand for the

Continued on page 22

Inorganic feed phosphates consumption in compound feed in France vs MCP prices (source: Agreste 2003-2020; Eurostat 2003-2022); index 100=2003. IFP consumption for 2021 and 2022 is estimated (source: Praxed).

www.feedinfo.com 20 | SUMMER 2023

Evolution of compound feed, minerals and phosphates production in France (source: Agreste)

120 100 80 60 40 20 0 2003 2006 2009 2012 2015 2020 Phosphates in compound feed Minerals in compound feed Compound feed production 450 400 350 300 250 200 150 100 50 120 100 80 60 40 20 IFP in compound feed, Index 100=2--3 IFP Consumption MCP CFR PRICE MCP price in France, Index 100=2003 20032004200520062007200820092010201120122013201420152016201720182019202020212003

Trust in science. Trust 65.

We can guarantee that 65 units of MetAMINO® will achieve comparable performance* to 100 units of Methionine-Hydroxy-Analogue-Free-Acid. Other than MHA-FA, dry crystalline MetAMINO® is directly digestible and 100 % bioefficacious. It enables superior meat yield and feed conversion while offering easier handling and dosing. In this way, the global demand for milk, eggs, meat and fish can be met.

Sciencing the global food challenge. evonik.com/metamino

* For references and the proposition of the guarantee, please contact us or visit our website.

* For references and the proposition of the guarantee, please contact us or visit our website.

Discover the new MetAMINO® ATLAS

INORGANIC FEED PHOSPHATES

end-product in developing countries unable to meet these needs, according to forecasts from the OECD and FAO. This trend could lead to a minor increase in IFP usage.

However, the introduction of next-generation phytases is expected to cause a decline in IFP usage. The impact of phytase on available phosphorus depends on the feed’s composition, with a lowerimpact scenario being more likely as the transition to new-generation phytase takes time.

There is also another potential substitute which might change the dynamic. The European ban on adding animal meal to animal feed was partly repealed from July 2021, allowing meat and bone meal to be used under specific conditions. This could enhance Europe’s self-reliance in protein for animal feed and decrease the need for IFP, as these ingredients provide digestible phosphorus. However, processed pig protein is only permitted in poultry feed, while processed poultry protein is exclusively allowed in pig feed, which introduces complexities for the industry when it comes to avoiding contamination risks. Additionally, prevailing labelling standards typically prohibit the use of meat and bone meals, and it is likely that consumers would reject the introduction of such raw materials in animal feed. This suggests that the impact of using processed animal protein will essentially be negligible.

WILL WE SEE ANOTHER DRAMATIC DECLINE?

In light of these changing market conditions, the question is: will the consumption of feed phosphates in compound feed decrease as much as it did in 2009? According to French statistics, the inclusion rate of feed phosphate in compound feed declined from 0.53% to 0.37% between 2006 and 2009. In 2020, this fell further to 0.29%. In our estimates for 2021 and 2022, we account for the reduction in feed production and assume a slight decrease in IFP incorporation in feed. If we see a repetition of historical trends, does this imply that consumption will decrease again by approximately 30%? Is this feasible?

According to research by FeedAccess, the impact of new-generation phytase, depending on the scenario, ranges from -3% to -25%. The critical determinant is the speed at which the industry capitalises on the optimal effect of phytase in feed. Another consideration is that, similar to feed phosphates,

the performance of phytases varies between producers.

In a high-impact scenario, with a 25-30% reduction in consumption, it would mean formulating feed without phosphates for broilers, as suggested by phytase producers in several publications.

Of course, even if that high-impact scenario proves correct, the use of feed phosphates is not exclusive to compound feed production for monogastrics. Phosphates are also fed to ruminants, mainly supplied through mineral feed. Currently, there is no alternative to feed phosphates to meet the phosphorus needs of highly productive dairy cows or beef cattle.

The use of phosphates in animal feed is, therefore, not over. Still, it will undoubtedly become more and more marginal in compound feed in markets where higher use of phytase makes economic sense: specifically, regions with access to alternative feed raw material containing a higher level of phytate.

In conclusion, the French Ministry of Agriculture’s comprehensive national statistics offer valuable insights into the evolution of feed phosphate usage in compound feed production over the past two decades. The data reveals a considerable decrease in feed phosphate consumption.

Extrapolating these trends, the impact of the 2022 price increase for IFP on phosphate usage is a topic of interest for feed producers (particularly alongside the decline in French compound feed production, which is itself a concerning development).

While the use of processed animal protein may increase Europe’s self-reliance on protein for animal feed, prevailing labelling standards and consumer preferences are likely to limit its adoption.

The impact of next-generation phytases on feed phosphate consumption is yet to be determined, and the key determinant is the speed at which the industry capitalises on the optimal effect of phytase in feed. Nevertheless, the French statistics suggest that further reductions in feed phosphate consumption are feasible, and it remains to be seen how low it can go.

Guillaume Milochau is Economic Intelligence Consultant for agricultural commodities, chemicals, and energy for Praxed, and provides periodic insight on the phosphate and urea industries for Feedinfo. All views are his own.

22 | SUMMER 2023 www.feedinfo.com

Continued from page 20

DATA FROM THE PAST 20 YEARS SHOWS A 58% REDUCTION IN FEED PHOSPHATE CONSUMPTION IN COMPOUND FEED. GUILLAUME MILOCHAU

Guillaume Milochau

Advance

your sustainability and transparency with U.S. Soy Sustainability Assurance Protocol (SSAP) certificates.

Did you know that U.S. Soy has the lowest carbon footprint versus soy of other origins? Plus, SSAP certificates give you internationally-recognized verification. Backed by over 20,000 U.S. Department of Agriculture annual farm audits. Recognized by the European Feed Manufacturers Federation, Global Seafood Alliance, and many other respected third-party organizations. SSAP certificates are clear, verifiable proof of (y)our commitment to sustainability and transparency.

Discover how to increase your transparency. solutions.ussoy.org/ sustainability

SUMMER 2023 | 23

Vitamix to Give Vilomix Foothold in South American Premix and Mineral Feeds Markets

In late March, Denmark’s Vilomix acquired a 75% shareholding in Vitamix Nutrição Animal, a Brazilian premix and minerals company.

Founded in 1998, Vitamix is headquartered in Nova Itaberaba in the state of Santa Catarina. The company employs 100 people in Brazil and Paraguay (about 65-70 in Brazil; 35 in Paraguay) and recorded sales of approximately DKK 130 million (approximately $18.7 million) in 2022.

Vitamix operates two factories: one in Brazil and another in Naranjal, Paraguay, which opened in 2021. In total, both factories have five production lines for mineral feeds, premixes, and concentrates. Their overall maximum capacity for mineral feeds, premixes, and concentrates is estimated at 40,000 tonnes/year.

Commenting on the tie-up, Enio Feiber Sônego, one of the company’s founders, was quick to highlight the technological synergies for animal nutrition and production with Vilomix in the picture. Enio Feiber Sônego will stay in the business and retains a 25% share.

Peter Iversen, CEO of Vilomix, also commented on the synergies in late March: “We see clear synergies between Vitamix and Vilomix, and together we have great potential in the sales of feed additives and customised premix solutions. At the same time, we believe that our strength and expertise in genetics in Denmark can help strengthen Vitamix’s position in both Brazil and Paraguay.”

Discussing the rationale of the deal in a recent interview with Feedinfo, Iversen explained that the Vitamix and South American opportunity wasn’t necessarily on his company’s radar this time last year.

“Prior to this acquisition, we also had a focus on Russia, which was our biggest export market. But due to the situation in Ukraine,

we decided not to go in that direction. We also thought about going to China and [were] looking in that direction. However, also due to the geopolitical situation, we decided to put that on hold,” Iversen said.

“Our primary focus until February last year was looking towards the East, but for now this is not an option for us, and we are not that much interested anymore in looking at that direction,” he added.

Iversen said the Vitamix opportunity arose last summer, in JuneJuly 2022, with the first visits to Vitamix in September.

When the Vitamix opportunity came up, it was “perfect timing and a really good possibility to get a foothold in South America,” Iversen commented.

Also, on Vitamix’s side, two of the three owners were looking to retire. Vilomix agreed to buy their shares, totalling 75%. And as mentioned, Enio Feiber Sônego stayed on with a 25% share.

Discussing the immediate synergies, Iversen said these are, for now, mainly in upstream processes.

“We have already started sourcing raw materials for our factories in Brazil and Paraguay. Essentially, we are selling raw materials directly to them in mixed containers, which should hopefully give them an advantage on the prices of raw materials,” he commented.

“Furthermore, we are also looking into helping and assisting them on the knowhow, feed recipes, and feed optimisation, primarily focusing on pigs and poultry. And then in a second step, we will look at dairy diets.”

Moving forward, developing the business in Brazil and Paraguay will be the main priority, but Iversen argued that the company

24 | SUMMER 2023 www.feedinfo.com M&A IN SOUTH AMERICA

Photos Courtesy of Vilomix

will have a look at export possibilities too. He also mentioned that opportunities to enlarge the product portfolio (e.g., piglet feed) will be studied.

From a production standpoint, Iversen pointed out that both of Vitamix’s factories are already well-run and optimally organised.

“We will try to push more volumes through the existing factories using the resources we have,” he said.

For the Vilomix CEO, near-term investments will be more geared towards getting additional people on board to grow the commercial presence in Brazil and Paraguay.

“We will have a serious look into expanding our sales capacity, investing in further resources to push sales forward. We are looking to hire additional people, for sure,” he said.

The longer-term prospects of investing in South America are also favourable for premixes and mineral feeds demand, according to Iversen.

“I see, especially right now, both Brazil and Paraguay increasing animal production. We can also see from the export statistics in

South America that these markets are growing and will be growing also in the future,” he said.

“When it comes to beef, swine, and poultry production, we also expect that these markets will keep growing in the coming years.”

Asked whether the animal disease challenges in the region, such as the spread of avian influenza in South America cast a shadow on his outlook, Iversen said outbreaks in commercial flocks are bound to happen and large poultry integrators will be affected. However, biosecurity measures are strong, and he doesn’t envisage large integrators being significantly impacted.

“Whether it is mad cow, African swine fever, or bird flu, I cannot see any possibilities to avoid [trade disruption from animal health threats]. But I think for the long haul, they [Brazilian meat and livestock producers] will keep on pushing their production and their exports forward. I’m pretty sure about that,” Iversen said.

By Simon Duke, editor-in-chief

By Simon Duke, editor-in-chief

SUMMER 2023 | 25 www.feedinfo.com M&A IN SOUTH AMERICA

BIO_Palbio50_Anunci_139x210mm_2_AFT.pdf 1 30/6/23 12:42

Pictured: Executives from both the Danish and South American side, including Peter Iversen, CEO of Vilomix and Enio Feiber Sônego, CEO of Vitamix.

US oilseed meal volumes set to take off, potentially changing feed formulations

When you crush oilseeds, you end up, broadly speaking, with two main products: oilseed meal used for livestock feed, and vegetable oil used for various purposes.

According to Susan David, agricultural market commentator and Managing Director of No Bull Ag, in the US market at least, the meals have generally been the priority for crushers, because of the US’s sizeable livestock industry, whereas vegetable oils were a significantly less valuable product.

However, the growth of North American demand for renewable diesel, made from vegetable oil, is turning this dynamic on its head. In this interview, David discusses the explosive increase projected for the US’s crush capacity and the implications for animal nutrition.

HUNDREDS OF MILLIONS OF BUSHELS MORE CRUSH

By her account, across the US, no less than 19 projects to either build new crush plants or expand existing capacity have been announced between here and 2026. If all are brought to fruition — something she is deeply skeptical will happen — this would add nearly 700 million bushels of crush capacity to a nation that’s crushing around 2.2 billion bushels today.

Of course, there is likely to be a vast difference between what has been announced and what will actually be added. Some of those projects may fail to secure adequate funding, she believes, while others will be cancelled when the company behind them changes strategy. For example, just recently Cargill announced that it would be pausing its plan to build a soybean processing plant in Missouri because of what it refers to as “shifting market dynamics”; David points out that Cargill’s acquisition of another soy processor had given it capacity in the area where it had been planning to build.

“That is the main reason Cargill would have scrapped the new build. Both locations are on rivers for exporting meal, and they are within a few hundred miles of one another. Crushing margins have collapsed from their highs, and construction costs are much higher than when many of these projects were first announced.”

More realistically, David estimates that we’re looking at something more in the order of 500 million bushels of additional crush capacity built. This could produce a respectable 10-11 million short tons of additional oilseed meal per year. By comparison, the USDA’s National Agricultural Statistics Service had the country’s production of cakes and meal from crops like soy, canola, and cottonseed at roughly 50 million short tons last year.

THE GAP BETWEEN PROMISES AND REALITY

There are a few more caveats. For one thing, she warns that estimating the crush utilisation rate can be a precarious exercise, and full year crush estimates have already been pulled back a couple times this year.

“When dealing with extreme temperatures or a lack of available soybeans — we’ve had really tight carry-outs here in the US the past few years, in the summer, especially — if you’re a plant that doesn’t have ownership already, you’re probably going to see some pretty seriously reduced crush rates in the summer, because there just aren’t beans available.

“And margins as they are right now — they’ve somewhat fallen apart. So you’re not paying up for bushels because the margins aren’t there. It doesn’t make any sense. We’ll probably start to see more downtimes.”

In other words, it’s not just whether the additional capacity is ultimately built, but also how extensively all capacity is used, which will determine how much additional meal is available to the livestock sector.

Soybean Crush Capacity Expansion

“Even though we, in theory, have all of this additional capacity coming online, the way things work on paper and the way things work in real life are two very different situations.”

Still, even though at this point, only one of the numerous projected capacity increases has come online (and even though teething issues in first few months of operations meant that it has only barely begun operating at full capacity), the additional capacity is making itself felt. David says, “That single plant is the reason why the monthly USDA NASS

26 | SUMMER 2023 www.feedinfo.com AS SEEN ON FEEDINFO.COM

U.S.

Announced I New Facilities and/or Expansions 700 Million Bushels Added Annual Crush Capacity by 2026* *As of March 2023, North Platte, NE site proposed, not confirmed Scoular Goodland soy & canola Not all facilities will come online due to lack of funding and/or changes in market dynamics i.e., Cargill Caruthersville MO given their recent purchases of Owenboro | Assumes 94% run rate, 355 days a year. Operational Under Construction/Announced

oilseed crush this spring have toppled records.”

Beyond that one project which has already come online, she doesn’t believe any other expansions are set to shake things up for a little while longer. “We’ve got a lull here before we see anything else pop up. Most of these expansions will not come online until the next marketing year — probably the 2024-25 marketing year. So we have a way to go before we really see a lot of this up and running.”

But regardless of when it happens, “as new plants and capacity expansions continue to come online, we will see [crush] records continue to fall,” she asserts.

IMPACTS OF ADDITIONAL MEAL

The meal produced by this additional crush capacity is almost surely going to reach both domestic and international markets.

“In general these plants are going in places where we have a lot of soybean production, but [where] it’s kind of a desert as far as demand goes,” she explains.

Biomass-Based Diesel Production Million Gallons*

describes as having the same chemical composition as fossil diesel, allowing it to be fully compatible with existing diesel engines, as opposed to biodiesel (fatty acid methyl ester), which has a different chemical composition to fossil diesel and thus can only be blended into fuel in limited amounts.

That characteristic makes renewable diesel an extremely important part of the puzzle for governments looking to reduce the carbon intensity of their transportation sector. In the US, the state of California (the biggest vehicle market in the US) is leading the way in this with their low-carbon fuel standard.

For example, additional crush capacity in the Dakotas might send the oil-derived renewable diesel into the Californian market, and then ship meal by rail and out of ports in the Pacific Northwest. Meanwhile, plants in Kansas might be anticipating sending meal by rail to Mexico.

“We’re set up to have more meal exports,” she believes. “Sure, we’re probably going to see more meal demand domestically because of cheaper prices. But we should see the US naturally become a larger exporter.”

Meanwhile, more abundant oilseed meal is likely to affect demand for synthetic amino acids among US feed formulators. This is not only because it will become cheaper, but also because it will potentially become available in more places, according to David.

“Say you’re in the middle of Nebraska, and you’ve got corn all over the place and close by, but maybe the nearest crush facility to buy meal is two hours away. So then a lot of times, you’ll rely more heavily upon synthetic amino acids for those logistical reasons.

But that will probably change with this [crush expansion].”

DRIVEN BY DEMAND FOR RENEWABLE FUEL