A copy of passport

A copy of ePass/work permit

Employment Certificate Click here to complete a request form

Minimum deposit amount - this is set by the bank and varying according to account type

Before visiting the bank

Make sure you have collected the Employment Certificate at the office at Exchange 106 , Agoda International (Malaysia) Sdn Bhd

• Upon arrival, please register at the Lobby or Ground floor’s Low Zone Concierge to obtain a guest access card to Level 11.

• You can access the building via,

o MRT Tun Razak Exchange (TRX) station - exit through Gate/Pintu B, Jalan Tun Razak & go to Exchange 106 building (Ground floor)

o E-Hailing – set drop off point to Exchange 106 Lobby

Location

No. 42-2, Ground & 1st Floor, Jalan Sultan Ismail 50250 Kuala Lumpur

Operation Hours

Monday to Friday : 0930- 1600 hours

Saturday, Sunday and Public holidays : Closed

Getting There

• E-Hailing

• Train (MRT Bukit Bintang or Bukit Bintang Monorail)

TherearemultiplebanksavailableinKualaLumpurwithmanybranches aroundthecity.However,Maybankisrecommendedasitislocatednear ourofficeandofferseasyaccesstoATMsthroughoutthecity.*Different branchesmayhavedifferentrequirements.

• Effective October 2025, all foreign employees are required to contribute a minimum of 2%, employer will contribute 2%.

• Original application and supporting documents are to be submitted by employee at the nearest EPF office

• Click HERE to locate the nearest EPF office

Documents to be submitted to EPF office for registration (Expat)

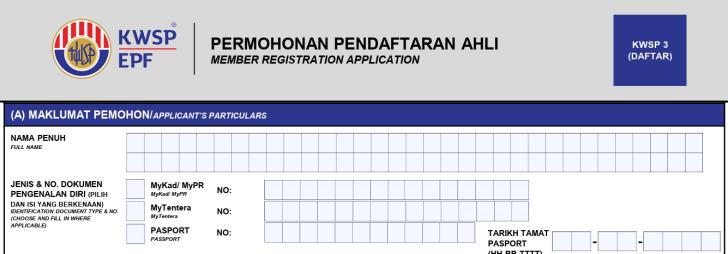

Filled KWSP-3 form

Filled KWSP-16B form

Original passport and ePass/work permit

“KWSP-16B” form requires a wet ink signature from the employer. You will receive the signed form along with your employment certificate.

If you lose the signed form, please print a new copy and get it signed at the office:

POC: Chin Shu Wen (shuwen.chin@agoda.com)

Location: TRX 11th Floor

Availability: Wednesdays and Thursdays every week

(Note:Pleaseemailandcheckforavailabilitybeforearrivingforsignature)

Click HERE to see the form filing guide and download the “KWSP-3” form

Employer's Name: Agoda International (Malaysia) SDN. BHD.

Employer's Address: Level 10 & 11, Menara Exchange 106, Lingkaran TRX, Tun Razak Exchange, 55188, Kuala Lumpur, W.P. Kuala Lumpur Malaysia

Employer's EPF Ref. No.: 016923125

Telephone No (Office): 0327881410

Q: For individuals who are not Malaysian but are currently working in Malaysia, which option should be selected in the form 'Non-Citizen' or 'Temporary Resident’?

A: Definition of Malaysian residential status

• WARGANEGARA (CITIZEN): For Malaysian citizens only

• BUKAN WARGANEGARA (NON-CITIZEN): For individuals who are not Malaysian citizens but are working in Malaysia, such as those with a work permit

• PENDUDUK TETAP (PERMANENT RESIDENT): For individuals who have been granted permanent residency in Malaysia

• PENDUDUK SEMENTARA (TEMPORARY RESIDENT): For individuals with temporary residency status, which is different from a work permit

Q: Is it acceptable to use the same address for 'Permanent Address' as the 'Correspondence Address,' especially if it reflects my current place of residence?

A: It is generally acceptable to use the same address for both the "Permanent Address" and "Correspondence Address" sections if you do not have a separate permanent address.

Q: I’m currently staying at temporary accommodation. Can I use that address for Section B?

A: Yes, you can use your temporary accommodation address. Please make sure to update it once you have access to i-Akaun.

Q: Which telephone number should be entered under the 'Office Telephone Number' section?

A: You may leave the office phone number field as blank if you prefer to be contacted exclusively on your mobile phone.

You can contact the EPF office directly by calling their customer service at 03-8922 6000 or visiting the nearest EPF branch. Provide your identification details, and the EPF staff can assist you in checking your registration status.

Once you have received your EPF number, please update Workday as soon as possible. Please refer to the GUIDE for your reference.

For any questions, contact PeopleHelpDesk@agoda.com

• A Malaysia Income Tax ID is required for monthly tax contribution and year-end filing/tax clearance. Click this link for Tax ID registration

Before filing the details

Prepare a copy of your passport (the page showing the full information)

A copy of ePass/work permit

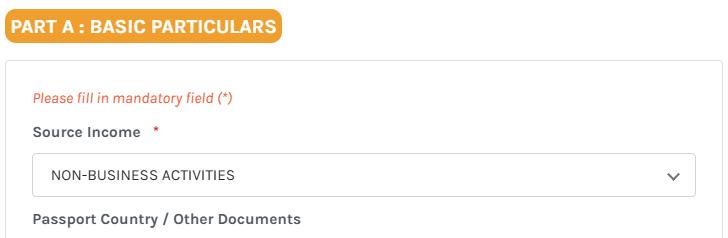

Step 1. Select preferred language (English or Bahasa Melayu)

Input reference number Passport country

Input your email Input phone no.

Step 2. Type of Taxpayer, choose “Individual”

If you are local, choose Identification Card Number

If you are expat, choose Passport Number / Other Documents

Step 3. (Part A) Fill in your personal details

Step 4. (Part C) Date of Joining

Step 5. Attach the supporting documents

• Prepare a copy of your passport (the first page only)

• ePass/employment pass

Income tax reference number will be released within 3 working days after completing online application.

To check your Application Status

❑ Use the application number that you receive via email when you initiate the application online

❑ Contact 03-8913-3800

❑ Contact LHDN customer care officer Link

❑ Visit the nearest LHDN branch Link

The tax reference number consists of maximum twelve or thirteen alphanumeric character with a combination of the Type of File Number (SG, OG, IG)and the Income Tax Number.

EXAMPLE: SG00087682020

EXAMPLE: C90005123021

Once you have received your Malaysia Tax ID, please update Workday as soon as possible. Please refer to the GUIDE for your reference.

For any questions, contact PeopleHelpDesk@agoda.com