Renewable energy

Powering Ireland’s energy revolution

BnM’s Brendan Kelly

Energy Minister Darragh O’Brien TD discusses the acceleration of Ireland’s energy transition

UCC’s Paul Deane on the conundrum of reducing energy demand while rolling out data centres

Northern Economy Minister Caoimhe Archibald MLA on achieving a just and prosperous net zero future

Time for delivery…

Ireland’s ambition to decarbonise its energy supply hinges on the rapid expansion of renewable electricity generation, which remains a formidable challenge. Ireland has made considerable progress, with nearly 5GW of onshore renewable electricity capacity installed to date and the ability to accommodate 75 per cent system non-synchronous penetration (SNSP). However, efforts to increase installed capacity have been hindered, primarily due to a planning system that struggles to keep pace with the required changes.

This slowdown in development means that onshore infrastructure projects will continue into the 2030s, and the Government’s target of 5GW of operational offshore wind capacity by 2030 appears increasingly unlikely, as does the 2GW of green hydrogen production designed to arise from this.

An unintended consequence has been a shift towards addressing the grid solutions necessary to bridge the geographical gap between generation and demand and to manage the anticipated abundance of intermittent renewables.

Recognising that grid capacity limitations threaten the viability of future renewable projects, discussions are now focusing on long-duration storage, co-location hubs, planning system improvements, and private wires.

Our round table discussion hosted by Accenture underscores the growing attention being given to infrastructure resilience in the aftermath of Storm Éowyn. Meanwhile, our cover story with BnM’s Brendan Kelly examines the role of one of Ireland’s most significant energy players in powering the State’s energy revolution.

This edition also features commentary from Minister for Climate, Energy And The Environment Darragh O’Brien TD, alongside the North’s Minister for the Economy, Caoimhe Archibald MLA, reflecting the importance of delivery on an all-island basis.

Other highlights in this 15th edition of Energy Ireland’s Renewable Energy Magazine include expert analysis on the future of offshore wind, geothermal, biomethane, storage, and solar; each of which have a critical role to play in ensuring Ireland’s renewable energy targets can move from aspiration to delivery.

Joshua Murray

DAERA’s Jonathan McFerran on how the North’s agriculture industry is safeguarding its future while meeting climate

Deane on the conundrum of reducing energy demand while rolling out data

University of Cambridge lecturer Tony Roulstone discusses the role of

Friends of the Earth CEO Oisín Coghlan: Crunch

On the cusp of an energy revolution

Minister for Climate, Energy and the Environment Darragh O’Brien TD discusses the acceleration of Ireland’s energy transition, emphasising the need for enhanced grid investment, delivery of offshore wind projects, and all-island collaboration to achieve renewable energy targets.

Minister O’Brien, appointed in January 2025, highlights the scale of Ireland’s energy ambitions and the centrality of energy policy to government priorities.

“The three key priorities for this government are energy, housing, and water,” he explains, stressing that delivery, rather than policy formation alone, is the ultimate measure of success.

As part of the ongoing revised National Development Plan, the Government is rolling out its largest-ever infrastructure investment programme, encompassing €102.4 billion in departmental capital expenditure for 2026-2030, supplemented by €10 billion in equity funding to fast-track high-impact projects in energy, water, and transport.

In energy specifically, a €3.5 billion is to be allocated to EirGrid and ESB Networks – €2 billion and €1.5 billion respectively – aiming to modernise the electricity grid, enable onshore and offshore transmission growth, and reinforcing system resilience. This investment is foundational to accelerating grid development, strengthening interconnection capacity, and scaling up large-scale renewable energy deployment.

Legislative foundations for energy transition

The Minister outlines significant progress in establishing a legislative framework to enable faster energy project delivery.

“We have done well regarding onshore, and now we need to deliver offshore. That means starting construction, getting tangible progress that people can see.”

Minister Darragh O’Brien TD

“The Planning and Development Act 2024 will commence this year and will shape the planning environment from the start of next year,” O’Brien states.

Alongside this, the Marine Planning and Development Management Act and the creation of MARA (Maritime Area Regulatory Authority) as a single consenting body represent significant steps towards streamlining the development of offshore renewable energy.

These reforms, he says, are designed to ensure “an environment that supports accelerated delivery” of energy projects across the State.

Ireland’s renewable journey

Reflecting on Ireland’s progress, O’Brien outlined that in 2005, only 7 per cent of electricity came from renewable sources. By 2024, this had risen to 40 per cent, largely due to the success of onshore wind development. Solar energy has also grown significantly: from just 0.06 per cent in 2018 to up to 14 per cent on peak days, averaging 3 per cent to 4 per cent.

“This is real progress,” he says. “But our targets are even more ambitious: 80 per cent of electricity from renewables by 2030. That will be a challenge, but it is one we will meet.”

The Minister confirmed that a further renewables auction will take place this year, attracting “substantial interest” from wind and solar developers.

Offshore wind

While Ireland has delivered significant gains onshore, O’Brien describes offshore wind as the country’s “untapped resource” and a critical enabler of long-term energy security and decarbonisation.

“There are a number of projects progressing through planning, but we need to get construction started and turbines in the water before the end of this decade,” he says. “That is the priority.”

Recent requests for further information from An Coimisiún Pleanála on some ORESS 1 projects have caused delays, but O’Brien stresses that the Government is committed to overcoming barriers to ensure offshore wind moves from ambition to reality.

Building a resilient energy grid

Central to unlocking renewable potential is a modern, expanded, and resilient grid. O’Brien identifies grid investment as his “particular focus”, highlighting the upcoming Price Review Six (PR6) regulatory period as pivotal.

“PR6 will see multiples of the investment we had in PR5,” he says, adding that this will include major upgrades for EirGrid and ESB Networks to ensure that both onshore and offshore renewable energy can be integrated efficiently.

A strong grid is also essential for security of supply, which O’Brien described as a key driver behind government investment. “Nothing in this

country happens without a sustainable and expanded energy supply. It is critical for our economy, housing growth, and population growth.”

Interconnection and allisland collaboration

Ireland’s interconnection ambitions are focused on completing with the Greenlink Interconnector between Ireland and Great Britain, and the Celtic Interconnector, the first direct electricity link to continental Europe, both under development.

“These projects will allow us to import and, crucially, export energy in the future,” O’Brien explains.

The Minister also underscores the strategic importance of the North-South Interconnector, fully consented in both jurisdictions but yet to begin

construction. “This is a project that has been talked about for a long time, and we need to proceed. It is critical to reducing energy costs and improving grid resilience on the island.”

O’Brien expresses a desire to accelerate delivery, aiming to bring the project completion date forward from 2031 to “the end of this decade, if at all possible”.

Security

Beyond climate considerations, the Minister framed energy policy as fundamental to Ireland’s economic and social development. He points to Ireland’s population growth – 50 per cent since 1990 – and a sixfold increase in GDP over the same period.

“Our job is to expand capacity, not restrict ambition,” O’Brien says, addressing concerns over competing demands on the energy system. He emphasises that Ireland’s energy transition will support, rather than constrain, economic growth, housing delivery, and industrial development.

The Government is also working to phase out fossil fuels, with coal set to exit the energy mix by the end of this month. “We are reducing our dependence on fossil fuels while building the infrastructure to ensure energy security for decades to come,” he says.

Implementation

O’Brien acknowledges the challenges of meeting 2030 climate targets and confirms that Ireland will engage closely with EU partners on compliance and flexibility measures.

However, his broad message is one of optimism and urgency. “We are on the cusp of an energy revolution,” he says. “We have done well regarding onshore, and now we need to deliver offshore. That means starting construction, getting tangible progress that people can see.”

The Minister stressed that implementation will require close collaboration with industry. “I have said to the energy sector that I want you in the room. We have done some things very well, others less so, but we are committed to working together.”

O’Brien concludes by reaffirming the Government’s commitment to work with all stakeholders to deliver on Ireland’s energy transition.

“Our sole focus is to realise the potential of renewable energy for the good of our country, for climate action, and for economic and social growth,” he says. “Nothing can be done without sustainable energy. Over the next five years, I will work every day to achieve this.”

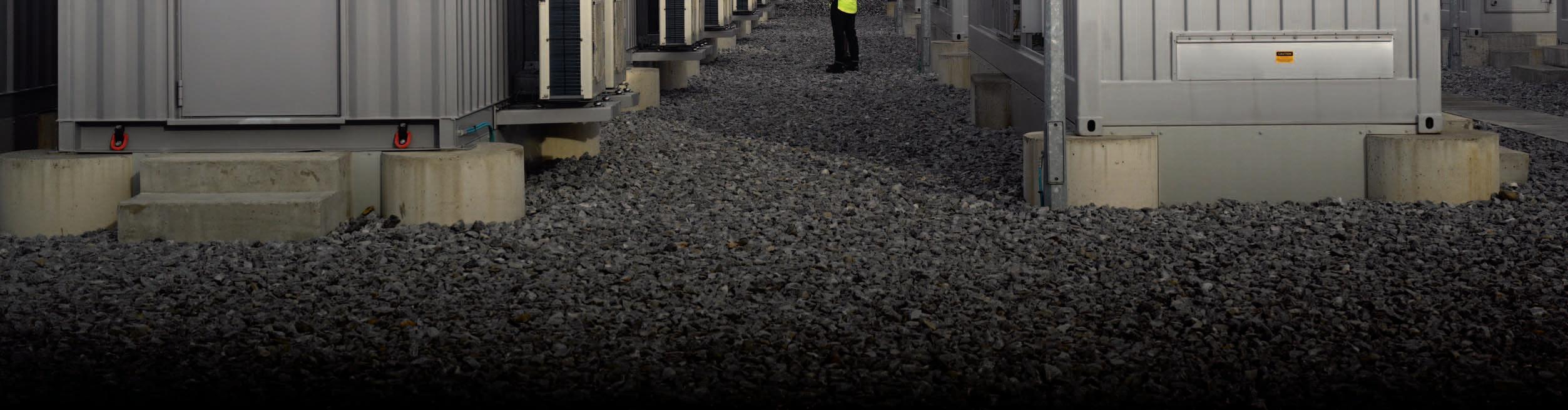

Powering Ireland’s energy revolution BnM’s Brendan Kelly

Brendan Kelly, Head of Commercial at BnM, talks to Owen McQuade about the company’s renewable energy projects, totalling 1GW delivered to date, and its plans for a further 5GW, including energy parks to deliver on the State’s decarbonisation, energy security, and industrial development ambitions.

BnM, the trading name for Bord na Móna PLC, has supported the energy security of the State for over 90 years. Its transformation has been significant over the last decade, transitioning from one of the most carbon intensive companies in the State, responsible for around 10 million tonnes of CO2 in the early 2000s, to a renewable energy company with close to zero CO2 emissions.

“We have shifted our focus entirely to renewable energy and renewable energy infrastructure. We are accelerating the delivery of energy infrastructure to support the energy security of the State in the form of renewables, generation, and supporting grid expansion,” explains Kelly.

“The company has undergone a remarkable transformation over the last five to ten years. Our assets have just surpassed 1GW of generation under management, which translates into 2 TWh of low carbon electricity. That is 15-20 per cent of low carbon electricity production in Ireland. The company also has a significant pipeline of development projects totalling 5GW of a mixed portfolio of technologies,” says Kelly.

Opportunity

Kelly observes that we are in the middle of the fourth industrial revolution, which is being driven by three megatrends: decarbonisation, electrification, and artificial intelligence (AI). “AI promises to change how the economy functions over the next 10 to 20 years; how we go about our lives and run our businesses on a daily basis. The levels of investment in AI by the technology giants is staggering with up to $500 billion this year [2025] alone; that is equivalent to the total GDP of countries like Denmark or South Africa.”

BnM also sees itself as a major player in supporting the State’s industrial policy. “Ireland is well positioned in that the biggest tech companies in the world are located here and we were early adopters in accommodating data centre growth in the 2010s. Ireland has a strong position to capitalise on the next phase of growth in this important sector of the world economy and BnM is supporting that.”

Electrification of the economy has accelerated the electrification of homes and businesses over the last five years, as Ireland looks to achieve its targets of 945,000 EVs and 600,000 heat pumps by 2030.

“This is having a huge impact on Ireland’s energy security as we wean ourselves off fossil fuels, instead generating indigenous renewable electricity. Consider a typical country town the size of Tullamore or Newbridge. If all homes and businesses in these towns install an EV changing point and a heat pump, that will have a huge impact on total and peak electricity demand. To enable that, we need to build more indigenous energy to ensure it is carbon free, and we need to build out the grid significantly.”

BnM has been a significant player in the drive to decarbonise the Irish electricity system. It is active across the renewable electricity sector with a pipeline consisting of 2.5GW of onshore wind, 0.5GW of solar, 1GW of ‘Flextech’, which is a combination of energy storage, flexible grid technologies and gas-fired generation. Included in this portfolio are a number of ‘mega projects’ such as a 700MW Derrygreenagh power plant in County Offaly, one of the largest power plants in the planning system, and the Ballydermot wind farm which will be the largest standalone wind farm in the country at over 300MW. Delivery of these and the associated grid infrastructure will have a massive impact on the wider system and the wider regional economies.

In addition to enhancing energy security, this will facilitate new industrial demand to connect to the system. It is also developing 1GW of offshore wind energy in a joint venture with offshore wind developer Ocean Winds, which is itself a joint venture between Portugal’s EDP Renewables and French energy company Engie.

Challenges

BnM’s transition mirrors the State’s ambition to deliver a carbon neutral electricity system. “It is relatively simple when broken down into its four constituent parts: build generation capacity; balance and back up all the various forms of intermittent generation; enhance and expand electricity infrastructure across the island; and grow the underlying electricity demand base, through electrification and industrial demand growth,” explains Kelly.

“Securing the generation, grid capacity, and demand that we need, hinges on the delivery of grid infrastructure. BnM does not want to sit on the sidelines when it comes to the delivery of grid infrastructure, and we want to play a big role in that.”

In this respect, BnM owns almost 700km of narrow-gauge railway track interconnecting large portions of the midlands that were previously used to transport peat to the power stations and briquetting factories.

At one stage, BnM was the largest private rail operator in Europe. That infrastructure is no longer in use and leaves up to 80m wide corridors across the Midlands. As a state-owned commercial entity, BnM wants to play a role in facilitating infrastructure development in those corridors and is working with EirGrid and other state agencies to do so. In turn, Kelly asserts that this will unlock the next wave of industrial development.

“Achieving our ambitions begins and ends with electricity infrastructure delivery. Ireland has not delivered this infrastructure at the required level over 4

the last decade. We adopted a fantastic model for delivery in the 2010s in counties Cork and Kerry, when EirGrid successfully delivered four 220kV cluster substations and hubs. Windfarms were able to interpret the locational signals and connect into the grid, helping us meet our 2020 targets. A similar model is now needed to help renewable energy connections and to connect demand side customers.”

Regulation

On regulation, Kelly says that there are “some green shoots in terms of enabling the delivery of new infrastructure, not least the latest announcement of €14 billion grid investment programme in PR6. Speed is essential to deliver the infrastructure needed and we think that a lot of this can be done within the existing regulatory constructs”.

Private wires will help accelerate the decarbonisation of industrial plants. For example, a cement manufacturing plant could build and connect to a solar farm adjacent to its site. It will also catalyse the development of green hydrogen production in Ireland, again areas BnM are active in with a pilot project under commercial development at Mountlucas Wind farm.

BnM’s landbank sits in the middle of the island with the 400kV and 220KV high voltage infrastructure already

overhead. “We do not need to build long lengths of infrastructure, we already have strategic infrastructure in the right place to attract generation demand. That is central to our ‘energy park’ concept. In 2024, we announced a partnership with AWS in which it would become the first tenant on one of these energy parks. The concept is very simple; tap into the high voltage infrastructure that crosses our land and connect large-scale renewable energy generation and large-scale demand, thereby ensuring a sustainable industrial development model.

“The challenge for renewable electricity generation delivery comes down to the capacity of the grid. Dispatch down has increased 30 per cent year-on-year over the last few years. That is a challenge around the certainty of the output from your projects which in turn impacts on the financing of those projects. The TSO [transmission system operator] can do some things relatively quickly to unlock more capacity. Relaxation of planning and operational policies or introducing smart technologies such as dynamic line rating or power flow controllers will get more capacity out of existing lines.”

On firm generation, Ireland has struggled over the past few years to meet growing demand. “It is very difficult through existing capacity mechanisms to drop a pin and say this is how much generation capacity we

need in 2030. We should therefore look at a five- to 10-year window and determine how much firm generation capacity we need over that period and then let the projects come in and deliver certainty. In addition, our capacity planning should also go handin-hand with our industrial policy. If we are trying to attract semiconductor plants or new data centres, then we need to grow firm generation capacity to cover periods when the intermittent renewables are not available. They will run more and more infrequently, but are absolutely needed for security of supply.”

Supply chain challenges

Discussing the global race for transformers, switchgear, and turbines, Kelly comments on the challenge of securing supply of critical items for future investment. “Both the Dutch and German TSOs have locked up order books for HVDC [High Voltage Direct Current] equipment from critical suppliers for a period of time. That is what other countries are doing and we need to look at securing long-lead time items that are critical to Ireland’s energy transition. It is anticipatory investment, but you never look back and say ‘I over-built that transmission line’ or ‘that transformer was too large’. It is our job as developers and investors to max out that infrastructure.”

Social license

On the challenges of the planning system Kelly says that things have improved over the last 12 to 18 months as more projects are now coming through the system. However, judicial reviews are still a challenge and, he argues, should be dealt with more quickly as they lead to projects being delayed for considerable periods of time, which only has a knock on impact on time and cost.

“Social license is critically important,” he acknowledges, adding: “It is important to give back to communities when investing in energy infrastructure. BnM has long been an advocate of community benefit schemes investing €1.4 million in the last year alone. When Mountlucas Wind Farm was built in 2014 the wind farm site was made accessible for walking and a weekly Park Run. Schools are regular visitors to the Mountlucas visitor centre and BnM, in conjunction with ESB, invested €3 million in its visitor centre at Oweninny wind farm in County Mayo.

We are also working with Fáilte Ireland on ‘Project Connect’, building over 60km of cycle trails and walkways on our land across the Midlands. This active travel infrastructure will link up with existing greenways and blueways and again demonstrates our commitment to creating a better environment for communities.”

Kelly regards BnM’s remit first and foremost as delivering on the country's Energy Security and Decarbonisation mandates. “Offaly is one of the largest counties producing renewable energy and now is acting as a magnet for large scale Foreign Direct Investment (FDI). If we can work to attract industrial demand to the county or Midlands more broadly, it will transform the region and have a huge knock on benefit for nearby communities.”

Looking to the future

Kelly believes it is realistic to target a net zero carbon electricity system in Ireland by 2040. EirGrid is currently developing its net zero network plan, detailing the investment required to 2040.

Over the last 18 months, BnM has invested €500 million into a range of technologies: the 105MW Derrinlough wind farm; the 108MW Timahoe North solar farm, a joint venture with ESB; Cloncreen 75 MWh battery storage; and the complete refurbishment of its Edenderry campus with refurbished biomass boiler and refurbished peaking plant to run on clean fuel. BnM’s recent investments reflect the future profile of what is needed for the island: a comprehensive mix of wind energy; solar energy; energy storage and firm generation capacity.

BnM’s Head of Commercial charts the immediate trajectory as being defined by a consolidation of what is already being implemented. “We need to double Ireland’s onshore wind energy capacity. Solar has been the big success globally and in Ireland it continues to grow with 1.5GW now installed amid a proliferation of rooftop solar. We will need long duration storage. BnM commissioned a threehour battery in Cloncreen Wind Farm in 2024. It is operating fantastically and has provided huge learning for us. We will likely need longer duration storage in future and all that needs backing up with gas fired generation.”

“It sometimes feels that things are moving slowly but when you look back over the last 30 years Ireland has made tremendous strides from being heavily fossil fuel dependent to now having a clear pathway to net zero.”

Looking to 2040 and beyond, Kelly is optimistic that Ireland can deliver on its 2040 energy ambitions but adds a caveat that this is contingent on how quickly grid infrastructure can be expanded. “That will be the number one challenge of our generation, how can we develop infrastructure and how can we do it quickly. It is required not just to accommodate renewables and new industry, but it is needed to deliver new houses and public infrastructure, as well as enhance the State’s economic competitiveness.

“In 1990, our GDP was €50 billion, the population of the State was three million, and electricity demand was 3GW, with 11 million tonnes of CO2 emitted. Today, GDP is 10-times that, with twice the population and twice the electricity demand, but emissions are half what they were in 1990. It sometimes feels that things are moving slowly, but when you look back over the last 30 years Ireland has made tremendous strides towards net zero energy,” he concludes.

Profile: Brendan Kelly, Head of Commercial, BnM

Having completed a degree and masters in electrical engineering from UCD, Brendan Kelly joined EirGrid in 2010 and worked in several roles across operations and planning. He then moved to smart grid startup company Smart Wires Inc. where he worked with several TSOs across Europe before moving to Vancouver to head up the company’s efforts with Canadian utilities. On returning to Ireland during the Covid-19 pandemic, he joined BnM and worked on several renewable energy projects as commercial manger before being promoted to the Executive Board in 2025 as Head of Commercial with responsibility for planning and development, investments, new technology and strategic grid investment and regulation and policy.

Family-focused with two young kids, Kelly has a keen interest in sport being a veteran marathon and half marathon runner and, as a former GAA county player, supports his native Westmeath.

Minister Caoimhe Archibald MLA: Driving the energy transition

The North’s Minister for the Economy Caoimhe Archibald MLA, outlines her priorities for delivering the energy transition, highlighting investment in skills, infrastructure, and renewables as key to achieving a just and prosperous net zero future.

Minister Archibald describes the transformation of Northern Ireland’s energy system as both “a moral necessity and a legal requirement under the Climate Change Act”, but one that also presents “an opportunity for a more prosperous and a fairer economy”.

The Minister acknowledges the shared challenges facing both jurisdictions on the island, but emphasises that the transition can unlock economic growth if delivered collaboratively.

“When [the strategy] was launched back in 2021, we were still recovering from the Covid pandemic. In 2022 Russia invaded Ukraine, and energy costs spiralled, triggering a costof-living and a cost of doing business crisis that has been hugely difficult for households and businesses, but it underlines the importance of Ireland becoming self-sufficient in renewable energy,” Archibald says.

Northern Ireland is now approaching the halfway point of its 10-year Energy Strategy: Path to Net Zero Energy. This long-term framework, the Minister says, aims to create “a more secure, affordable, and sustainable energy system”, while also helping to deliver her four economic priorities: creating more good jobs, addressing regional imbalance, increasing productivity, and decarbonisation.

“By working together across this island, with communities, businesses, and government, we can ensure that this transition delivers a secure, affordable, and decarbonised energy system, protecting consumers today and building prosperity for tomorrow.”

Caoimhe Archibald MLA, Minister for the Economy

Action plan for 2025

As part of the strategy, the Department for the Economy (DfE) publishes annual action plans. “My plan for 2025 identifies 19 crossgovernment actions which will move us towards delivery of our 2030 targets, which includes the commitment to deliver at least 80 per cent of our electricity consumption from a diverse mix of renewable sources,” she explains.

Among those actions was the publication of the Green Skills Action Plan earlier in 2025. “This is crucial, because if we are to deliver the transition and realise the economic opportunities that it presents, then we need to equip our people with the right skills,” the Minister says. The plan was co-designed with industry, and Archibald’s officials engaged with counterparts in Dublin to explore how training initiatives can maximise all-island opportunities.

Grid and interconnection

Archibald is clear that deployment of renewables “must be matched by investment in infrastructure, and work is ongoing to ensure our grid and energy systems accommodate greater levels of clean electricity”.

Delivery of the North-South Interconnector, she says, will be “critical in delivering allisland security of supply with efficient operation of the network and more renewable generation on the island”.

Building on the Utility Regulator’s approval of NIE Networks’ record RP7 Business Plan, Archibald asserts that investment in transmission and distribution will underpin the system’s capacity to integrate renewables at scale. Addressing high levels of dispatch down also remains a priority, with the Department working with SONI and the Utility Regulator to ensure that more renewable electricity can reach consumers at lower cost.

Smart meters and consumer empowerment

Later in 2025, DfE is scheduled to announce a smart meters design plan. Archibald says: “The rollout of smart meters will empower consumers to take control of their own energy usage while enabling a data-driven electricity grid ready to support the delivery of greater levels of renewables.”

Smart meters will also support real-time system balancing, reducing the need for costly grid reinforcements and lowering carbon emissions, while giving households greater transparency over consumption and costs.

The consultation for the plan closed in January 2025, and is scheduled for final publication later in 2025.

Bridging the renewable divide: Lessons from Ireland’s coal-free leap

As the global climate crisis intensifies, the race to decarbonise energy systems has become a defining challenge for governments, writes Neasa Quigley, Senior Partner, Carson McDowell.

In July 2025, the Republic of Ireland marked a historic milestone: its first coal-free month of electricity generation. This achievement – driven by strategic investment and policy alignment – stands in stark contrast to Northern Ireland’s stagnating renewable energy sector, highlighting a growing divergence on the island.

Ireland’s transition away from coal was not accidental. The closure of Moneypoint, the country’s last coal-

fired power station, was a deliberate move backed by robust infrastructure planning and a clear policy trajectory. In the same month, renewables supplied 32 per cent of Ireland’s electricity, with wind contributing 24 per cent and solar reaching a record 798MW. While gas remains dominant at 51 per cent, the momentum toward a cleaner mix is undeniable.

Meanwhile, Northern Ireland is at a crossroads. Progress has plateaued

despite achieving a higher renewable share of 45.8 per cent over the past year. Grid constraints, underinvestment, and policy inertia have led to increased curtailment of renewable output. The region’s draft Climate Action Plan 20232027, currently under consultation, outlines ambitious goals including net zero emissions by 2050. Yet without urgent and decisive action, these targets risk becoming aspirational rather than achievable.

The contrast between the two jurisdictions offers a compelling lesson: ambition must be matched by execution. Ireland’s success stems from coordinated efforts across government, industry, and regulators. Northern Ireland must now follow suit –accelerating grid upgrades, incentivising solar and long duration energy storage, and streamlining planning processes.

This is not merely a technical challenge; it is a leadership imperative. Climate action is a shared responsibility, and the island’s energy future will be stronger if both sides move in tandem. Collaboration on cross-border grid integration, shared innovation, and policy harmonisation could unlock new potential and resilience.

As Northern Ireland finalises its Climate Action Plan, the opportunity is clear: to reignite momentum, embrace bold reforms, and learn from Ireland’s coalfree breakthrough. The path to net zero is not linear, but with vision and commitment, it can be shared.

Carson McDowell’s energy and renewables team comprises specialist renewable energy solicitors who are widely regarded as leaders in their field. The team’s extensive involvement in significant and regionally important energy projects positions Carson McDowell as one of the most active and experienced law firms within the energy sector in Northern Ireland.

If you have any queries relating to any of the matters mentioned in this article or for more information on how Carson McDowell can assist your business, please contact Neasa Quigley, Senior Partner and Head of the energy and renewables team.

E: neasa.quigley@carsonmcdowell.com W: carson-mcdowell.com

New National Energy Demand Strategy sets direction for smarter energy use in Ireland

In Ireland’s transition towards net zero by 2050, Ireland’s first National Energy Demand Strategy (NEDS) is helping to clear the way for more renewables to be successfully integrated to system, writes CRU Chairperson Jim Gannon.

The NEDS, which was developed to meet both the specific ambition set out in the Climate Action Plan and to support wider decarbonisation and security of supply objectives, aims to enhance Ireland’s energy demand flexibility, helping to deliver a more sustainable, cost-effective and secure

energy system. The strategy enables customers to adopt more flexible energy consumption patterns.

The NEDS was published by the CRU and encourages all energy users to use electricity more flexibly, particularly during periods of high renewable energy availability.

This shift will reduce carbon emissions, lower system costs, and enhance energy security, particularly by encouraging demand during periods of high renewable generation, when prices and emissions are lower.

The strategy promotes a coordinated approach across public bodies and sectors, including energy, enterprise, environment, planning, and regulation.

The NEDS strategy is structured around these three key areas of focus:

• Smart services: Encouraging domestic and small business customers to use energy more flexibly.

• Demand flexibility and response: Enabling large energy users (LEUs) and storage providers to respond to system needs.

• New demand connections: Creating new connection policy pathways for large energy users such as data centres.

53 actions in support of Ireland’s climate targets

The NEDS outlines 53 key actions aimed at enhancing Ireland’s energy demand flexibility in support of climate targets. Key actions include increasing uptake of time-of-use and dynamic

tariffs, enabling smart EV charging and energy sharing, reforming electricity network tariffs, and procuring longduration energy storage.

These efforts are crucial for enabling households and small businesses to contribute to renewable energy generation.

Implementation and Progress

Since its publication in 2024, the NEDS has transitioned into the implementation phase, with a focus on incentivising flexibility through policies, market and standards, and enabling technologies. NEDS action owners have developed supporting plans and aligned them with broader organisational strategies. The CRU has submitted a Workforce Plan to government departments outlining staffing needs to support the future work of the CRU including Ireland’s transition to a low-carbon economy.

The CRU has published two biannual updates to date. These updates summarise progress, priorities, policy developments, and next steps with the objective of providing transparency and accountability as the strategy evolves.

Collaborative approach to delivery

This NEDS outlines a co-ordinated approach across relevant public bodies and relevant entities working to increase demand flexibility and requires that actions be taken across a broad spectrum of sectors including energy, enterprise, environmental, spatial and planning policy, and regulatory policy. To support these actions, further work and decisions are required across government departments, local authorities, enterprise development agencies, and other public bodies. Delivering the NEDS requires collaboration across multiple actors including government departments (DCEE, DETE), state agencies such as the SEAI and EPA, the CRU, system operators (ESBN, EirGrid, GNI), energy suppliers, and many others.

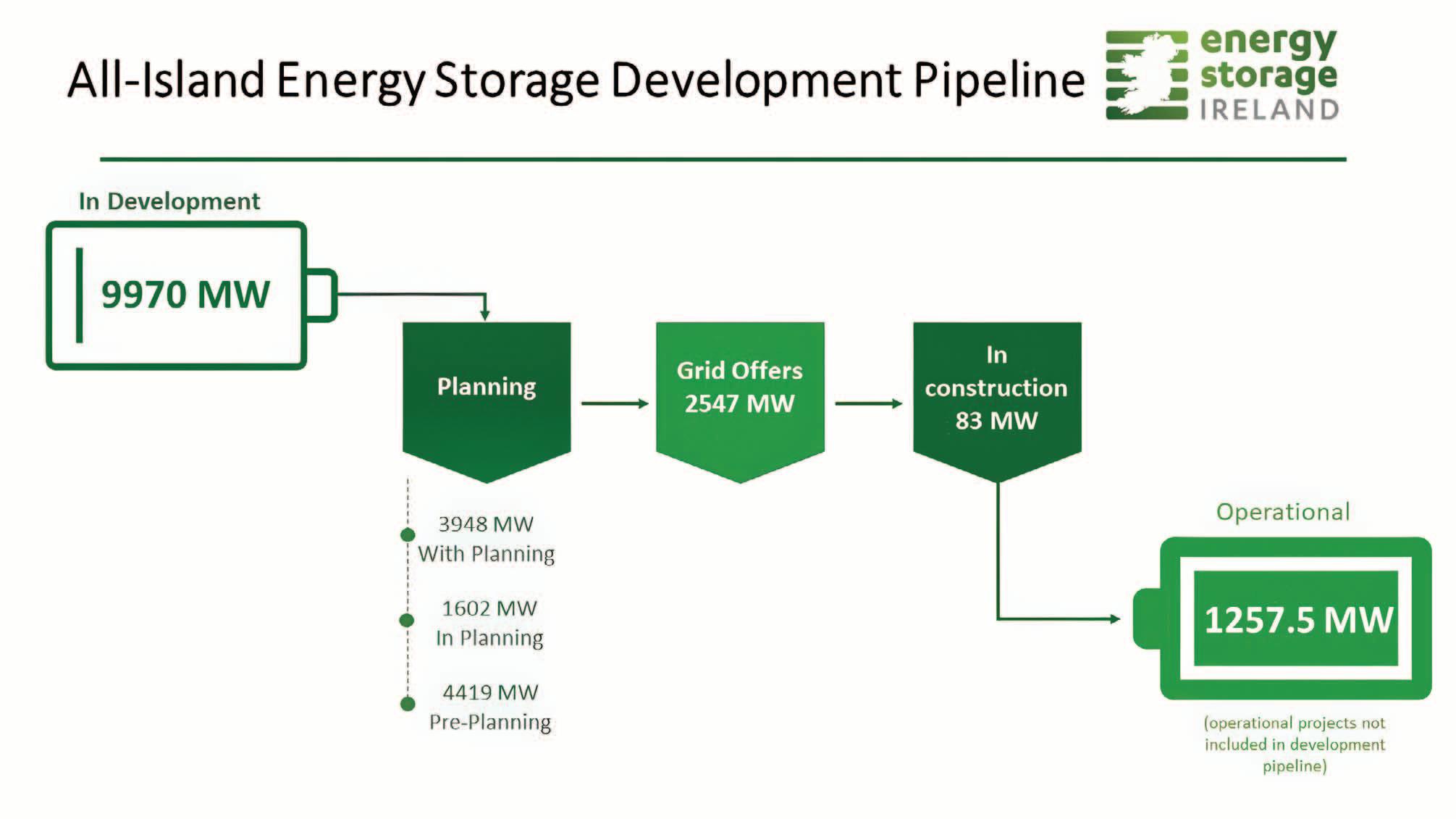

Focus on long-duration energy storage

In 2023, EirGrid and SONI (Northern Ireland’s TSO) conducted a Call for Evidence on market options for long duration energy storage (LDES). This initiative assessed the need for LDES, investment barriers, and potential revenue streams.

The outcomes, published in March 2024, directly informed the Department of

“The NEDS represents a transformative step in Ireland’s energy journey. By advancing demand flexibility across sectors and customer groups, it supports decarbonisation, enhances energy security, and reduces system costs.”

Climate, Energy and the Environment’s (DCEE) Electricity Storage Policy Framework (ESPF).

The ESPF defines long-duration storage as solutions capable of generating for more than four hours. Key actions include:

• Action 6: Initial procurement of 500 MW of LDES, with contracts expected by 2028.

• Action 10: Establishing a route to market for 2030-2040 LDES needs by the end of 2028.

An EirGrid consultation on the LDES procurement mechanism is expected in September 2025, seeking stakeholder input on the proposed procurement mechanism to attract investment in approximately in 500MW of ≥4-hour LDES technologies. The CRU will review EirGrid’s recommendations following the consultation process and oversee delivery of the procurement mechanism.

Behavioural insights driving demand flexibility

To promote smart energy services and demand flexibility, SEAI’s Behavioural Economics Unit have undertaken research to develop key recommendations. Traditional approaches often rely on financial incentives (e.g., time-of-use tariffs), but these alone may not be sufficient to drive behaviour change.

SEAI’s research programme over the past two years has included the following items:

• Online Experiment (2024): Studied factors influencing engagement and intentions related to demand flexibility and smart energy services with a sample of 1,500 participants

• Literature Review: Developed a taxonomy of behaviours relevant to demand flexibility and roadmaps for behaviour change.

• Time-of-Use Analysis (2023): Used data from the Behavioural Energy and Travel Tracker (BETT) to examine electricity usage timing in Irish homes.

• Field Experiment (2024): Tested an intervention telling people about the environmental benefits of reducing peak consumption with an option to pre-commit to specific actions, looking at how this affected their activity during the evening peak in the next survey wave compared with a control group.

The research showed that while financial incentives can play a useful role, they are at times neither necessary nor sufficient to induce behaviour change.

Advancing a resilient energy future

The NEDS represents a transformative step in Ireland’s energy journey. By advancing demand flexibility across sectors and customer groups, it supports decarbonisation, enhances energy security, and reduces system costs. Through coordinated action and innovative policy, Ireland is laying the groundwork for a resilient, low-carbon energy future.

Chairperson: Commissioner Jim Gannon

Jim Gannon has been a member of the Commission for Regulation of Utilities (CRU) since October 2019 and was appointed Chairperson in February 2023. Gannon previously served as the CEO of the Sustainable Energy Authority of Ireland, and before that role worked for 15 years in the private sector within the engineering and energy industry. Gannon is a graduate of NUI Galway, the University of Wales Aberystwyth and he holds an MBA from the UCD Smurfit School of Business.

Rolling out alternative fuels

The

development and deployment of alternative fuels in Ireland is occurring within the context of several overlapping regulatory obligations, policy frameworks, and working group outputs.

Ireland is legally required to meet targets set out under the Alternative Fuels Infrastructure Regulation (AFIR), in effect since 13 April 2024. Article 14 of this regulation obliges EU member states to prepare and submit a national policy framework (NPF) outlining measures for the development of the alternative fuels market and related infrastructure. The updated Irish NPF is required to be submitted to the European Commission by 31 December 2025.

The Alternative Fuels for Transport Working Group was established in 2023 to assist in coordinating crossdepartmental and inter-agency work related to transport decarbonisation via alternative fuels. The Working Group delivered its first report to the Minister for Transport in

March 2025, fulfilling Action TR/24/3 under Climate Action Plan 2024

Regulatory context and policy alignment

The AFIR sets binding targets for infrastructure development in EU member states. These targets include deployment of electric recharging infrastructure for lightand heavy-duty vehicles, hydrogen refuelling infrastructure, onshore electricity supply (OPS) in ports, and electricity supply to stationary aircraft. The Irish response to this regulation includes a revised NPF that builds on and replaces the existing 2017-2030 framework.

The Working Group has engaged in public consultations and submitted a draft of the updated NPF to the European Commission in December 2024, in line with Article 14. The NPF draft prioritises electrification and hydrogen infrastructure but notes the potential for inclusion of biomethane, advanced biofuels, and renewable synthetic fuels in the final version, pending further assessment and consultation.

Electric vehicle charging

AFIR requires Ireland to deploy sufficient charging infrastructure corresponding to the national electric vehicle (EV) fleet size. To meet Climate Action Plan targets for EVs by 2030, it is estimated that 712,395kW of public charging capacity will be required. The National EV Charging Infrastructure Strategy 2022-2025 provides the baseline planning document for delivering this capacity.

For heavy-duty vehicles (HDVs), a separate public charging network on the TEN-T core network is planned, with spacing every 3km. This will be implemented via a dedicated HDV charging scheme administered by Transport Infrastructure Ireland (TII), to be developed in 2025.

Hydrogen refuelling

AFIR requires a minimum of five hydrogen refuelling stations in Ireland by 2030. These are planned to be located in Dublin, Cork, Limerick, Galway, with one additional TEN-T corridor site. Progress toward this requirement must be demonstrable by 2027. The Department of Transport has indicated that inclusion of hydrogen is necessary to meet both light and heavy-duty transport decarbonisation requirements.

Renewable transport fuels

The Renewable Transport Fuel Obligation (RTFO), implemented under Part 5A of the National Oil Reserves Agency Act 2007, mandates a rising share of renewable transport fuels in the road fuel mix. The RTFO rate is scheduled to reach 25 per cent in 2025, with a sub-target of 1.5 per cent for advanced biofuels. Consultations are underway for the 2025-2027 revision of the Renewable Transport Fuel Policy.

Two working groups support RTFO implementation:

1. Biofuels Sustainability Working Group: Conducted vulnerability assessments regarding fraud risks, including analysis of feedstock traceability, union database

functionality, and EU regulatory compliance. Outputs aim to inform legal and administrative adjustments.

2. RES-T Working Group: Supports modelling and research aligned with RED II targets for 2030. Ongoing work includes assessment of supply-demand dynamics for advanced biofuels and RFNBOs, including phases of modelling by Byrne Ó Cléirigh Ltd.

Future work will assess B30 blending feasibility, potential extension of RTFO to Non-Road Mobile Machinery (NRMM), and alignment of RTFO with the Renewable Heating Obligation (RHO) due in 2026.

Road freight decarbonisation

Road freight is predominantly diesel-fuelled and presents significant decarbonisation challenges. EU emission standards for HDVs require 45 per cent reduction by 2030, 65 per cent by 2035, and 90 per cent by 2040.

ZEVI has initiated fleet audit schemes and infrastructure support programmes. The DRIFTHDV study, submitted in 2024, highlights cost-related adoption barriers and recommends operational expenditure-based incentives.

Next steps

The Alternative Fuels Working Group recommends continuation of its current remit through 2025, with updates to its terms of reference. Key priorities include:

• finalising the NPF in consultation with stakeholders and the European Commission;

• completing sector-specific studies in maritime and road freight;

• developing a hierarchy for renewable fuel use across sectors; and

• supporting integration of CAP26 corrective actions.

A year-end report to the Minister is expected to be sent at the beginning of 2026, along with monitoring of aligned actions.

Speaking in the Dáil in February 2025, Minister for Transport Darragh O’Brien TD said: “Regarding alternative fuels and biomethane in particular, and alternative energy sources, I see [biomethane] as having a particular fit in that regard.” However, O’Brien said he would “not commit to a figure” on capital expenditure on biomethane as an alternative fuel “because further discussions need to take place”.

Infrastructure resilience

Accenture hosted experts from across the energy sector for a round table discussion on infrastructure resilience.

What does ‘resilience’ mean from your or your organisation’s perspective in terms of energy infrastructure?

Catherine O’Brien

Resilience, long taken for granted, has become a national focus in light of more frequent and intense weather events and cyber-attacks. Utilities face an unprecedented challenge to improve resilience and deliver on energy transition goals while facing growing demand, skills shortages and the need to reinvent digital approaches; and all in compressed time-frame. Resilience presents a pivotal socioeconomic opportunity, and harnessing it demands a coordinated enterprise-wide approach to

strengthening commercial, people, operational, sustainability and technology capabilities. Accenture’s research shows that more resilient organisations achieve higher financial performance. This is vital to generate capital for infrastructure reinvestment, and even more important for the reputation of semi-state organisations in a local and international context.

Louise O’Flanagan

As the electricity grid rapidly evolves to meet the needs of our growing economy and society, we need have a secure and resilient grid. It needs to be able to withstand the impact of threats, such as storms, and reliable enough so that there is minimal downtime. The grid is becoming increasingly complex as we integrate more renewables, energy storage, and introduce

sophisticated digital systems and operational changes. We’re working with Government and stakeholders to progress and deliver essential infrastructure projects to ensure the grid is resilient and connect renewables.

Mike Cahill

Ireland’s gas network is one of its most strategically important and relied-upon national assets. Every year, our network transports almost a third of the national primary energy requirement. The gas network is dependable and flexible, delivering 100 per cent availability during recent weather events such as Storm Éowyn. A core priority for us is to safely maintain and develop our network, to assure reliable delivery of energy, keep pace with growth in demand and enhance resilience. We continue to enhance cyber and physical security defences to protect against ever-increasingly sophisticated threats. The gas network is at the heart of the Irish energy system and is a flexible and responsive backup to intermittent renewable energy sources like wind and solar.

Brian Brady

Network resilience begins with the customer and what you are seeking to achieve for them. It is about how to reduce the impact of an abnormal event and the pace of recovery from it, minimising the effect on homes, farms and businesses. We have been planning and delivering grid infrastructure resilience for years but the predicted scale of events is growing and our Price Review Six (PR6) plans, submitted in November 2024, includes for a doubling of investment in infrastructure resilience. Infrastructure resilience is a continuous multiyear process, influenced by both climate mitigation and climate adaptation which are two sides of the same coin.

Justin Moran

A stable, reliable grid directly correlates with economic resilience. Electricity prices in the EU are two to three times higher than the US or China. Within the EU, Irish electricity prices are amongst some of the highest. We are seeing what was a very successful free market-based economy facing tariffs and rising supply chain pressures, making us acutely vulnerable. We must make the energy system reliable, resilient, and affordable for customers. The Draghi report from September 2024 finds that Europe has become uncompetitive. However, a significant degree of the solution is in our hands. If we can deliver and build more renewable energy infrastructure, we can make the grid more resilient, and in turn, achieve economic resilience.

How are resilience risks evolving and how is your organisation/industry responding?

Justin Moran

Supply chain resilience is one of the most acute risks facing Ireland; ensuring that the complicated parts we need to build windfarms are in steady supply at an affordable price. There is a serious challenge in Europe about the viability of European wind part manufacturing as a competitive industry, further complicated by the potential cybersecurity risks associated with importing Chinese manufactured material. If policymakers want to take these challenges on, they make need to accept higher prices than would be the case with importing supply chain components from outside Europe.

Round table participants

Brian Brady

Brian Brady is Head of Network Resilience and Climate Adaptation for ESB Networks. With over 25 years’ experience in the energy sector, 15 of which are at a senior level, Brady has diverse management experience in the areas of operations, infrastructure, contracting, project delivery, strategic, and organisation transformation. He currently sits on the ESB Networks Senior Management Team and is responsible for the development of its extensive electricity network, ensuring its 160,000 km of overhead lines and 800 high voltage substations, provide a resilient and reliable electricity supply to 2.5 million customers in Ireland. Brady holds a mechanical engineering degree from University of Limerick, as well as Advanced Management qualifications from the IESE Business School.

Mike Cahill

Mike Cahill is an experienced leader with over two decades of experience in gas network operations, asset management, and capital delivery. As the Head of Network Operations at Gas Networks Ireland, he leads a team of people who ensure the safe, reliable, and efficient operation of the networks, meeting the country’s evolving energy needs as it works to decarbonise the gas network, support the economy, and provide essential energy resilience. Previously, Cahill served as the Head of Portfolio Office, his career also includes strategic, operational and transformation roles, leading out on the development of policy, and enabling the decarbonisation of GNI’s own operations and the gas network.

Justin Moran

Justin Moran is the Director of External Affairs with Wind Energy Ireland. Prior to this he spent three years as the head of advocacy and communications with Age Action, Ireland’s leading advocacy organisation for older people, after having worked with EirGrid, the national transmission system operator, on the Grid Link Project. He has also previously worked in communications and public affairs roles with Amnesty International Ireland and Sinn Féin. He has a Degree in Journalism and a Master’s Degree in International Relations from Dublin City University.

Catherine O’Brien

Catherine O’Brien is a Managing Director in Accenture’s Resources practice where she leads a wide variety of energy transition engagements for utility and energy clients. Prior to joining Accenture, she held a variety of roles in the electricity industry including in renewable energy and grid infrastructure development, energy trading, industrial energy services, and corporate strategy. O’Brien is a Chartered Engineer and Executive MBA graduate from UCD Smurfit School. She is appointed Fellow of the Institute of Engineers in Ireland for her work in the energy transition field. She is Fellow at the World Economic Forum where she leads initiatives including the global Transitioning Industrial Clusters programme. She has also been appointed to the Institute of International and European Affairs (IIEA) Climate and Energy working group in Ireland.

Louise O’Flanagan

Louise O’Flanagan serves as Head of Engineering and Asset Management at EirGrid, bringing over 20 years of expertise in infrastructure delivery. She has played a pivotal role in the development and evolution of Ireland’s national electricity grid, with particular focus on enhancing grid resilience and integrating renewable energy sources. Since joining EirGrid in 2011, O’Flanagan has led key initiatives to connect renewable energy projects to the grid and advance interconnection efforts. Her academic background includes a Bachelor’s Degree in Civil Engineering and a Master’s Degree in Engineering Science, both from University College Dublin (UCD). She is a Chartered Engineer, and was appointed as a Fellow of Engineers Ireland, reflecting her significant contributions to the engineering profession.

“Innovation and harnessing advances in digital technology is critical to ensuring resilience.”

Catherine O’Brien

Catherine O’Brien

There is limited visibility and transparency through end-end supply chains, meaning there are significant risks to delivery of energy transition and resilience goals as Justin mentioned. Accenture’s research shows that only 50 per cent of organisations have visibility of more than half of their tier one supply chain, and only 20 per cent of organisations have visibility of more than half of their tier two. Risk and complexity increase through the tiers. To de-risk and develop agile, robust supply chains, real time data insight, advanced scenario modelling and decision support tools harnessing Generative AI capabilities will be fundamental.

Brian Brady

The supply chain is also fundamental for us at ESB Networks. Consider the two timeframes of medium term and short term. The first is with PR6, where we have developed and adapted our supply chain strategy to give us the volume of material needed to meet both decarbonisation and network growth challenges while having a depth in our supply chain across multi providers over the medium term. The second factor, as we saw with Storm Éowyn, relates to strategic spares

ensuring that we do not run out of material during such emergency restoration works. Having a resilient supply chain is critical for when you have high peaks in a very short period of time. Key to this for us is about diversifying our supply sources and diversity in use of materials.

Louise O’Flanagan

Because of the challenges around supply chains, trade-offs often have to occur around cost and lead time. However, there are also challenges around long-term support available

from that supply chain. For example, when you look at assets going onto the transmission system, we are looking at a lifetime of around 50 years and the consideration needs to be given to how these assets will be supported into the future. We have to look at the market and also how the skillset to support these needs will be supported within Europe. There is also a challenge with transport; if we are transporting material from outside Europe, we have to account for geopolitical risk in some parts of the world, and having a diversification of sources for each part of your supply chain is a strong means of mitigating this risk.

Mike Cahill

Building capacity and capability in our supply chains is a key focus for us. Delivery of gas related infrastructure projects in Ireland is dependent on a relatively narrow supply base who have the necessary record of accomplishment and skill set to deliver our requirements. We are addressing this through extensive market engagement, seeking to expand relationships with UK and European suppliers. Five years ago, malicious damage to our sub-sea pipelines was considered improbable, however, with the growing unease in geopolitics, we have invested to became members of a Pipeline Repair and Subsea Intervention group which guarantees equipment availability times as well as specialist resources should we need to respond to an incident involving our sub-sea assets.

“Resilience is about risk management and risk assessment.” Louise O’Flanagan

What lessons have past disruptions taught us, and how can recovery be improved?

Mike Cahill

Disruptions have shown that having robust contingency plans in place is crucial for minimising impact and ensuring a swift recovery. We test our Natural Gas Emergency Plan (NGEP) annually through participation in the National Emergency Coordinator (NEC) emergency exercise in the UK and their comparator in Northern Ireland. The gas network is dependable and flexible, that said, there are always opportunities to improve. Investment is core to infrastructure resilience and for Price Control Six (PC6), we need to ensure allowances are sufficient to support the investment required, however, these financial requirements need to be balanced with keeping energy affordable for gas consumers.

Louise O’Flanagan

The transmission system held up fairly well during the events of Storm Éowyn, and I think that is important because extreme weather events will continue, they will become more severe, and they will become more frequent. This is because of its size and strength, as well as significant reinforcements made over the last few years and ongoing maintenance works. If we can optimise maintenance practice, have reliable supply chains which allow component parts to be replaced quickly, and manage things like vegetation, these hold the keys to ensuring resilience into the future. Improved interconnection with the UK via Greenlink, which is now operational, and with France via the Celtic Interconnector which is being constructed at present, will also allow us to improve our resilience. Weather phenomena which may be taking place in Ireland may not apply in France in the same way.

Justin Moran

The two big disruptions this country has faced over the last decade have been Brexit and the Covid-19 pandemic. They are the only two examples I can think of where the Government acted as one and had all parts of it moving in the same direction and where every aspect of government was working towards the same goal. We are trying to transform how the Irish energy system works and how it is delivered. That requires the input of many government departments, so I think that drawing on lessons from previous national priorities and

“The gas network is dependable and flexible, that said, there are always opportunities to improve.”

Mike Cahill

emergencies, we have shown that if government treats something with priority, then all the component parts of government can move in the same direction with a focus on what our national priority is.

Brian Brady

At ESB Networks, we are in the space of the ‘three Cs’: collaborate, communicate, and coordinate. Ireland is very well-connected even though we sit on the edge of western Europe. We collaborate closely with our European colleagues, sharing best practice in the resilience space, indeed we lead the eDSO working group on resilience. At home, coordination is going well in Ireland with the structures the Government is putting in place such as the National Adaptation Framework, the work of the National Climate Change Risk Assessment and Sectorial Adaptation Plans. These point to the level of cross agency collaboration and coordination and how we respond. During disruptive events, the National Emergency Co-ordination group (NECG) structures work very well and we saw that with a whole-of-government response to Storm Éowyn. In terms of learnings, we have seen how resilience is for all assets and not just infrastructure. In Éowyn we saw how forestry owners were affected by the storm with around 24,000 hectares of forest stock windblown and suffered with €500 million of investment at risk. We must ensure that we improve the resilience of all assets for extreme weather events.

Catherine O’Brien

Globally we have seen an increase in hybrid attacks. Offshore infrastructure such as wind farms and subsea cables is increasingly targeted by hybrid attacks; a growing concern for Ireland as an island with one of the largest sea areas in Europe. Cybercriminals are also using climate events and natural disasters as opportunities to exploit heightened vulnerabilities. During the wildfires in California, phishing attacks posing as relief donations were widespread along with attacks on utilities already strained by the wildfires. Holistic threat modelling and a portfolio planning approach to resilience at organisation and national level is critical to prepare for hybrid attacks.

Looking to the future, is there an opportunity to enhance the resilience of national critical infrastructure?

Brian Brady

In short, yes. The predictions are that future storms will become more extreme. Storm Éowyn certainly has set the new frame of reference for the scale and severity of a climate change wind 4

“Infrastructure resilience is a continuous multiyear process, influenced by both climate mitigation and climate adaptation.” Brian Brady

event. Éowyn has had double the impact of any previous event such as Darragh, Darwin, or Ophelia. All aspects of our critical infrastructure resilience –water, wastewater, communications, electricity, et cetera – were well-tested during Storm Éowyn. The lessons from that for all critical infrastructure are still being worked through. We work closely with all critical infrastructure providers and we continue to support them with their risk assessment enabling them prioritise their installation of back-up generation at key sites.

Louise O’Flanagan

Our costs are approved and overseen in five-year periods through the CRU’s Price Review process. As part of this process, we submitted a plan for the PR6 period of 2026-2030 against a backdrop of objectives laid down by Government and the CRU. PR6 represents a timely opportunity to invest in Ireland’s future as we work to support and facilitate the timely delivering of an unprecedented amount of new infrastructure. We have over 370 projects that we want to deliver over the next number of years which will

enhance the grid, it will enhance existing infrastructure by both replacing older assets on the grid and building new infrastructure. All of this supports the ambition of a more resilient grid.

Catherine O’Brien

Innovation and harnessing advances in digital technology is critical to enhancing resilience. As complexity grows and disruptions intensify, investing in asset intelligence, advanced scenario analysis, decision support and automated response tools leveraging generative AI is fundamental.

Accenture’s research finds that rapid AI adoption has dramatically accelerated the speed, scale and sophistication of cyber threats, far outpacing current enterprise cyber defences. Deploying generative AI can scale security capabilities, strengthen cyber defences and detect threats earlier. Upskilling the workforce to adopt these tools will be critical to balancing the demands of day-to-day operations, long term resilience and energy transition goals.

Accenture has launched LearnVantage to help our clients to quickly identify technology driven skills gaps and to provide industry-specific training at speed and scale.

Mike Cahill

In line with Action 17 of the Energy Security in Ireland report, Gas Networks Ireland has been tasked with evaluating delivery mechanisms for a state-led Strategic Gas Emergency Reserve (SGER). This initiative is a critical transitional measure to safeguard Ireland’s energy resilience as the country accelerates its transition to

large-scale renewable energy. We are also members of the EU Horizon funded project VIGIMARE which we believe has the potential to greatly improve our resilience against malicious damage to our sub-sea pipelines, which are being used as a demonstration case for the technology. In a BAU context, the ‘five Rs’ of reliability, resistance, redundancy, recovery, and redundancy are the corner stones of resilience, which is the frame of reference for our capital and operational work programs.

Justin Moran

Every project that we have earmarked will have to go through the planning system. The Draghi report finds that Ireland has the slowest planning system in the European Union for the delivery of wind farms. This also applies with solar. The Department of Housing has introduced a new statutory instrument to speed up the delivery of the Renewable Energy Directive III, which will hopefully be useful. This will also massively increase the workload on An Coimisiún Pleanála and the National Parks and Wildlife Service which are already under-resourced. The CRU is also not well-resourced enough to do its existing role, and yet it is about to be responsible for private wires legislation. State agencies involved in the energy transition and beyond are under-resourced; they do not have the resources to bring in AI and the other opportunities which could increase our advantages. Part of the solution to this from a Wind Energy Ireland perspective is the introduction of a state climate recruitment fund where we invest in the basic needs that each organisation can play in the energy transition. Through this, we can recruit the people with the skills and expertise that will allow us to expedite delivery and enhance resilience.

What approach should we adopt to monitor and anticipate future disruption risks and how do we know we are on the right track?

Brian Brady

When we emphasise resilience, there is a risk that climate adaptation will become the sole focus and climate mitigation will take second place. When we consider the devastation of Storm Éowyn, caused by our current greenhouse gas (GHG) emissions, we need to ask ourselves the question how devastating will future storms be with higher GHG emissions? What investment in infrastructure resilience

“A stable, reliable grid directly correlates with economic resilience.” Justin Moran

will be required to combat such weather events in the future? The more effectively we deliver on climate action plans now, the better we offset climate adaptation and the less investment we need in further resilience infrastructure. It is crucial that we address the origin of the problem and not just the symptoms. The delivery of climate action plans will be the measure of our progress in this regard.

Mike Cahill

Consider the creation of a central coordinating authority for critical infrastructure, modelled on the EU’s Projects of Common Interest (PCI) framework to align planning, environmental, and regulatory processes. This authority could enforce statutory timelines, apply a programme management approach, and ensure accountability across agencies in the delivery of infrastructure core to our energy resilience. Neither can we afford to reinvent the wheel and must improve our ability to leverage what has been successfully done in France, Italy, Denmark, and other EU countries for example in supporting biomethane production. Denmark is currently meeting over 40 per cent of its gas demand from biomethane.

Louise O’Flanagan

Resilience is about risk management and risk assessment. There are different approaches to both across organisations, so it is important that they are harmonised. This is to avoid a situation where you develop a solution which may not yield what you need it

to. It is also difficult to determine if we are on track as risks are evolving. Therefore, it is useful to regularly simulate cyber-attacks and extreme weather events as scenario planning keeps everybody focussed.

Justin Moran

We must determine how we will inform Irish customers and businesses about the fact that resilience is partly in their control. This relates to the decisions they make regarding where they live, how they live, and the energy systems they use. They can be a part of this process which must be bottom up as well as top down where individual consumers can be supported, educated, and empowered to make decisions to make the energy system more resilient.

Catherine O’Brien

It is crucial that we adopt a portfolio approach to infrastructure resilience underpinned by a shared understanding of risk tolerance, investment priorities and outcomes across government, utilities, industry, and society. Engagement is key and we must ensure citizens understand the system value of resilience and the investment required. International benchmarking and the implementation of industry standards and regulations is critical to measure progress.

Navigating the EU’s energy transition

Speaking to Energy Ireland, Katja Yafimava, Senior Research Fellow at the Oxford Institute for Energy Studies, offers a deep dive into the European Union’s decarbonised gas and hydrogen package.

“The future EU gas system will look very different,” Yafimava says. “There will be much less natural gas to transport as the system decarbonises.”

With the adoption of the Recast Gas Directive and Regulation, the EU is laying the groundwork for an energy system increasingly defined by decarbonised gases and pure hydrogen. “Existing gas networks will face a massive challenge, transitioning to accommodate more low-carbon gases, and some will inevitably need to be repurposed or decommissioned,” Yafimava states.

Building hydrogen networks

Central to the legislation is the vision of a dual system: one network transporting lower-carbon gases such as biomethane, and another dedicated to high-purity ‘green’ hydrogen. However, as Yafimava notes: “The topology of the future hydrogen networks is very uncertain. There is a big uncertainty about both supply and demand.”

Yafimava further stresses the risks of investing in infrastructure prematurely: “You do not want to build infrastructure and then find there is neither supply nor demand at either end of the pipeline.”

Regulation will play a critical role in managing this uncertainty. Flexibility, Yafimava emphasises, is paramount: “The regulation must be sufficiently flexible to allow small-scale, no-regret networks to start and to scale up if needed.”

The EU’s current hydrogen infrastructure is minuscule by comparison to the gas network, with just 2,000 kilometres of hydrogen pipelines confined largely to industrial clusters. “It is a huge difference in scale,” she said, warning that ambitions for a European hydrogen backbone, largely championed by transmission system operators (TSOs), may not materialise at the projected size. “Most of the proposed hydrogen backbone relies on repurposing existing gas pipelines because it is less expensive,” she adds, “but whether that will happen at the projected scale remains to be seen”.

Yafimava also points out the pragmatic steps being taken: “The first PCI [project of common interest] list for hydrogen and electrolysis projects confirms that hydrogen infrastructure will initially build on existing industrial clusters, predominantly in western Europe.”

Despite the legislative ambition, she cautions that “there is no hydrogen market in Europe as such”. Legislators, she explains, face a “tabula rasa” when drafting rules for hydrogen, opting to largely “cut and paste” natural gas market models, including unbundling provisions and regulated thirdparty access. Whether this will prove too rigid for a nascent market remains an open question: “It is valid to ask whether such regulation might stifle market development.”

Nevertheless, Yafimava acknowledges that flexibility has been integrated into the framework. “There is a transition period until 2033 for regulated access to hydrogen infrastructure,” she says, a compromise reached after initial proposals for immediate implementation faced resistance. Furthermore, the framework allows “all sorts of exemptions and derogations for both existing and new hydrogen networks”, offering critical breathing space for market evolution.

Phasing out LNG

On natural gas, Yafimava says the EU’s energy package was “hijacked” by the energy crisis of 2022. Emergency measures such as storage mandates, tariff discounts for LNG imports, and a now-expired wholesale price cap were introduced. However, she says: “The fundamental

provisions governing the natural gas market have been preserved. There are no groundbreaking changes.”

A key focus going forward, she argues, must be on coordinating the development and repurposing of networks. “The legislation requires national network development plans to identify infrastructure that can be decommissioned or repurposed,” Yafimava explains. However, she highlights a troubling inconsistency: “There is currently a huge gap between national plans and the EU TenYear Network Development Plan, particularly regarding low-carbon gas infrastructure.”

Implementation will determine the success of the framework. “It is critical to ensure that the natural gas phase-out and hydrogen phase-in are done in a coordinated manner without jeopardising security of supply,” she warns. Gas will remain important during the transition: “Although the role of gas is fading, it is still crucial for security, especially on low-wind, low-sun days.”

Further regulatory evolution is inevitable. Yafimava outlines several pressing challenges: the fate of emergency measures inherited from the crisis, increased tariff uncertainty due to regulators’ discretionary powers on discounts, and the urgent need to update capacity allocation rules to reflect changing gas flow patterns. “Flexibility and efficient provision of capacity will be crucial,” she says.

On LNG, Yafimava outlines a growing need for reform: “Given the increased role of imported LNG, changes are needed to allow more flexible secondary capacity trading and avoid hoarding.”

Path forward

In conclusion, while the decarbonised gas and hydrogen package sets the stage for a transformed European energy system, much depends on the details of implementation. “The package is not the end of the journey,” Yafimava reflects.

“A roadmap will be necessary to ensure consistent and efficient implementation, particularly for financing the move from natural gas to hydrogen infrastructure.” She reiterates that if rigidity hampers market development, “flexibility could and must be added as needed”.

The role of smart charging and V2G

The energy system in Ireland is undergoing a fundamental transformation driven by decarbonisation, writes David Cashman, EY Ireland Business Consulting Partner.

On the supply side, the shift is already well underway; renewable sources now account for an average of 39 per cent of electricity generation. On the demand side, the electrification of heating and transport remains a central priority. In 2025, electric vehicles (EVs) and heat pumps contribute just 4 per cent to total demand, but this is expected to rise significantly to 18 per cent by 2034, driving a projected 45 per cent increase in overall demand relative to 2023 .

The need for flexibility

Meeting this surge in demand while managing renewable variability presents a dual challenge. As dispatchable

sources are replaced by intermittent wind and solar, system flexibility becomes critical. Ireland’s Climate Action Plan (CAP) 2024 set an ambitious target of between 20 per cent and 30 per cent flexibility by 2030 to support the renewable transition.

The potential for EV flexibility

Transport electrification is not only reshaping demand, it also holds untapped potential for system flexibility. With approximately 148,000 EVs on Irish roads, and CAP targets calling for 845,000 private and 82,000 commercial EVs by 2030, the scale of this

transformation is significant. Research published this year by EY and Eurelectric has explored how EVs can provide grid balancing solutions, accelerate renewable energy adoption as well as reduce the total cost of ownership for consumers.

Unlocking EV flexibility

The technologies enabling this flexibility fall under two main categories –unidirectional smart charging and bidirectional vehicle-to-grid (V2G).

Unidirectional (V1G): Smart charging optimises the time of charging through smart algorithms, moving it away from peaks to lower demand periods overnight – and times of high renewable generation in its most optimised state. Customers benefit from lower prices via time-of-use (ToU) tariffs that reward offpeak usage. As ToU tariffs become more dynamic to network conditions, savings from optimised smart charging has the potential to grow.

Bidirectional: Bidirectional charging goes further, enabling V2G and vehicle-to-home (V2H) capabilities. V2G technology transforms EVs from passive consumers of energy into decentralised energy storage units and active participants in the grid by facilitating the flow of power between the vehicle and the grid. V2H capabilities provide network resilience, acting as on-site back-up generation to customers in the event of outages, and enable the optimisation of self-generation when integrated with microgeneration such as rooftop solar PV.

Benefits of unidirectional and bidirectional technologies

V1G and V2G present a clear win-win scenario for both system operators and customers. Here are some interesting findings from The EY-Eurelectric report outlines some interesting findings.

For system operators, V1G and V2G can contribute to peak demand shaving, reduction in renewable curtailment, and deferral/avoidance of network reinforcement. EY estimates that by 2030, the total EV battery capacity in Europe could be sufficient to power 30 million homes each year. Furthermore, by 2040, V2G technology could enable these batteries to store and reinject 10 per cent of Europe’s power.