MAINSTREETUSA SPOTLIGHT: MESA,

Available at www.Adviso rToday.com

The Advisor Today Blog brings you the tools, ideas and techniques you need to build a successful practice. Fresh content is posted regularly, and we welcome your feedback and ideas in the comments section.

We look forward to hearing from you!

What is your number one tool for marketing to market to prospects and clients?

*Company website

*Podcasts

*Social media

*Answer this question at www.Adviso rToday.com

Join the conversation via Facebook, Twitter and LinkedIn. Simply log on to www.naifa.org and click on the social media icons.

NAIFA’s Advisor Today

Editor-in-Chief

Ayo Mseka amseka@naifa.org

703-770-8204

Circulation Manager

Tara Laptew tlaptew@naifa.org

703-770-8207

NAIFA

Kevin Mayeux, CAE CEO kmayeux@naifa.org

703-770-8101

Michael Gerber COO & General Counsel mgerber@naifa.org

703-770-8190

Diane Boyle SVP, Government Relations dboyle@naifa.org

703-770-8252

John Boyle VP, Professional Credentials jboyle@naifa.org

703-770-8267

Suzanne Carawan VP, Marketing & Communications scarawan@naifa.org

703-770-8402

Judi Carsrud

AVP, Government Relations

703-770-8155 jcarsrud@naifa.org

Jennifer Cassidy VP, Finance jcassidy@naifa.org

703-770-8125

Brian Steiner VP, Business Development & Strategic Partnerships bsteiner@naifa.org

703-770-8220

Gary Sanders Counsel and VP, Government Relations gsanders@naifa.org

703-770-8192

Michele Grassley Clarke VP, Member & Chapter Services mgc@naifa.org

703-770-8219

Alaina Faiello VP, Professional Development afaiello@naifa.org

703-770-8225

NAIFA OFFICERS

*President Cammie Scott, LUTCF, REBC, RHU, CLTC CK Harp & Associates Cammie@ckharp.com

*President-Elect Thomas O. Michel, LACP Michel Financial Group tmichel@michelfinancial.com

*Secretary Lawrence Holzberg, LACP Wealth Advisory Group, LLC Lawrence_holzberg@wagllc.com

*Treasurer

Brock Jolly, CFP, CLU, ChFC, CLTC. CFBS Veritas Financial LLC/MassMutual Financial Group jbjolly@financialguide.com

*Immediate Past President Jill Judd, LUTCF State Farm

Jill.judd.jyro@statefarm.com

NAIFA CEO

Kevin Mayeux, CAE kmayeux@naifa.org

Trustees

*Mark Acre

*Dennis Cuccinelli, LACP dennis@dcuccinelli.com

*Connie Golleher, CLTC, LUTCF connie@gollehergroup.com

*Stephen Good, LUTCF CLTC, CFBS stephengood@ohionational.com

*Todd Grantham, CFP, CLU, ChFC, MSFS toddgrantham@nm.com

*Win Havir, CPCU, CLF, LUTCF, FSS, AIC Winona.Havir@horacemann.com

*Bryon Holz, CLU, ChFC, LUTCF, LACP bryon@bryonholz.com

*Beth Jones, CIC bjones@dystewilliams.com

*Delvin Joyce delvinjoyce@prudential.com

*Ryan Pinney, LACP rpinney@pinneyinsurance.com

*Stephanie Rivas, MBA, CLU, ChFC, LUTCF stephanie.rivas@prudential.com

*Steve Saladino, LUTCF saladino@verizon.net

*John Wheeler, Jr., CFP, CLU, ChFC, CRPC, LUTCF obfsinc@aol.com

*Brian Wilson brianwilson@mutualofomaha.com

NAIFA SERVICE CORPORATION OFFICERS AND DIRECTORS

President

Kevin Mayeux, CAE

Secretary Cammie Scott

CK Harp & Associates

Treasurer

Brock Jolly, CFP, CLU, ChFC, CLT, CFBS

Veritas Financial LLC/MassMutual Financial Group

Directors

David Beaty

Susan Wier, CFP, ChFC, LUTCF

First American Trust

EDITORIAL ADVISORY COUNCIL

Laurie A. Adams, CFP, CLU, LUTCF

Country Insurance & Financial Services

Brian Ashe, CLU

Brian Ashe and Associates, Ltd.

Frank Bearden, Ph.D., CLU, ChFC

Frank C. Bearden, Ph.D., Consulting

Kevin Faherty, LUTCF

Faherty Insurance Services, Inc.

Greg Gagne, ChFC, LUTCF

Affinity Investment Group, LLC

Lisa Horowitz, CLU, ChFC

LifeCycles

Michael Lynch

Metlife

John Marshall Lee, CLU, CFP, RHU

People Insurance & Investments

John Nichols, MSM, CLU

Disability Resource Group Inc.

Ike Trotter, CLU, CASL, ChFC

Ike Trotter Agency, LLC

PUBLISHED BY

5950 Northwest 1st Place

Gainesville, FL 32607

Phone: 800-369-6220 Fax: 352-331-3525

Web: www.naylor.com

Publisher: Tamára Perry-Lunardo

Editor: Molly Schnepel

Project Manager: Michelle Hughes

Publication Director: Mark Ragland

Sales Representative: Lou Brandow

Marketing: Kiara Reynoso

Project Coordinator: Alyssa Woods

Layout: Deb Churchill

Published March 2020/NAI-S0220/5723

©2020 Naylor, LLC. All rights reserved.

NAIFA’s Advisor Today (ISSN 1529-823X) is published bi-monthly by the National Association of Insurance and Financial Advisors Service Corporation, 2901 Telestar Court, Falls Church, VA 22042-1205. Telephone: 703-770-8100. ©2020 National Association of Insurance and Financial Advisors Service Corporation. All rights reserved.

Subscriptions: The annual subscription rate for individual non-NAIFA members is $50; institutions, $60. The international subscription rate for non-NAIFA members is $100 per year.

Cover: ISTOCK.COM/Z_WEI

The latest NAIFA benefit is a website that educates consumers about the good that you do as a financial advisor — and where to find you.

By Ayo MsekaIn its never-ending quest to help raise your profile as a financial professional in the community, NAIFA recently launched a new consumer-facing site that will feature — you!

The new website, financialsecurity.org, replaces the former www.advisorsyoucantrust.org and will be expanded to provide consumers with information on mitigating financial risks, setting and achieving financial goals, planning for retirement and leaving a legacy for future generations.

The site will be a treasure trove of information about what NAIFA is, what it does, who its members are, the strict Code of Ethics they adhere to, and the qualities and qualifications that consumers should look for as they choose a financial advisor.

How will we do that? By featuring you!

We need your participation to create numerous videos, informational articles and short webinars in two areas. First, we need information on topics that enable consumers to increase their financial literacy, and second, segments targeted at students and career-changers about why they should consider a career in financial services.

The site also shines a spotlight on several NAIFA members who are dedicating countless hours of service to their clients and communities, and the exemplary qualities they possess as financial advisors.

Financialsecurity.org also contains a portal to help consumers connect with qualified, licensed professionals who can serve all of their insurance and financial services needs and who have committed to abiding by NAIFA’s high ethical standards.

All active members of NAIFA are automatically listed and we plan to continue to build out this directory this year to feature those who are recipients of NAIFA’s awards, including those who are recipients of the Four Under Forty Award, the National Quality Award, and more.

Visit financialsecurity.org today and see how NAIFA is working to make sure that consumers know that as a NAIFA member, you are committed to helping your clients meet their financial challenges and prosper, you help them create and achieve their financial goals, you establish long-term relations with them, and you serve as a great financial-literacy resource.

And while you are on the NAIFA website, don’t forget to review the other benefits you get just for being a NAIFA member. With a few clicks of your mouse, you can gain access to a plethora of resources that describe NAIFA’s advocacy wins and victories.

For example, NAIFA has recently released the new “Advocacy in Action” blog and the revised Advocacy Action Center to keep you more informed of the association’s federal, interstate and state work.

And if you haven’t yet seen our new Big Ideas webinar thought-leadership series, you can see upcoming and on-demand videos at bigideas.naifa.org.

Another important NAIFA benefit is what you are reading right now, Advisor Today. Pay careful attention to the ideas and strategies shared by the successful producers featured in this issue. They have worked well for them as they made their way to the top, and they may do the same for you.

If you have not renewed your NAIFA membership, now is also a good time to do so. Just visit www.naifa.org and renew your membership so that you can continue to reap all of the benefits you get for being a NAIFA member. Take full advantage of these benefits today and watch your practice grow!

NAIFA is in your state capital, and in every state capital, working on your behalf and that of your clients.

By Kevin Mayeux, CAESuccessful financial professionals stay busy. Between client calls and meetings, the day-to-day necessities of running a business, and carving out personal time to spend with friends and family, it’s easy to lose track of how government policies impact your career and clients.

When we do turn our attention to political matters, we often focus on the federal stage. Yet, state-level policies often have just as great an impact on financial professionals’ business success and client relationships.

Fortunately, NAIFA, since its founding 130 years ago, has recognized the importance of state-level advocacy. We are the only association representing producers with: a grassroots network extending through every statehouse and state regulatory agency, 50 separate state-level political action committees, professional advocacy staff in every state and a proven track record of success on state issues affecting financial professionals and their clients across the country.

I began 2020 with a trip to Boston, where I testified at a hearing before the Massachusetts Securities Division on some troubling aspects of the state’s proposed fiduciary rule for financial professionals. I spoke, along with colleagues from the American Council of Life Insurers (ACLI), the Insured Retirement Institute (IRI), the Financial Services Institute (FSI), and the Securities Industry and Financial Markers Association (SIFMA), about how the regulation will impact Massachusetts consumers and make it more difficult for Main Street investors to obtain products, services and guidance.

The hearing was a showcase of NAIFA’s state advocacy strength. More than two dozen members of NAIFAMassachusetts attended the hearing in support. NAIFA member Adam Sachs, CFP, CLU, ChFC, encouraged two of his clients to participate in the hearing, and they provided compelling and well-received testimony. The next day, Gov. Charlie Baker wrote a letter to Secretary of the Commonwealth Bill Galvin citing many of our concerns and asking him to delay action on the proposal.

Still, the issue is not settled. The regulation remains pending and is likely to be enacted. But NAIFA is exploring options to leverage all three branches of state government — executive, legislative, and judicial — to protect financial professionals and their clients. Stay tuned for updates.

You can feel confident that no matter what the challenge, together, we can take on anything.

Meanwhile, advocacy efforts in other states advance at a swift pace. A few examples from the early months of 2020 spotlight NAIFA’s state advocacy impact:

• NAIFA-New Jersey promoted two new laws, one empowering financial professionals to protect senior clients from financial exploitation, and the other waiving initial insurance licensing fees for military veterans. Efforts are also ongoing to oppose a fiduciary proposal in the state.

• NAIFA-Maine opposes a proposal that would create a state-run retirement plan to compete with private-sector offerings.

• NAIFA-Maryland held a reception in Annapolis fostering relationships between financial professionals, state lawmakers and regulators.

• NAIFA-Tennessee and NAIFA-South Dakota are advocating for measures to give producers continuing education credits for belonging to a professional association like NAIFA.

State advocacy begins even before legislators and regulators propose bills or rules. NAIFA participates proactively in National Association of Insurance Commissioners and National Council of Insurance Legislators committees, contributing expertise and helping to formulate model statutes and regulations that shape our industry. We

influence these models, which states often enact verbatim, from start to finish. We exert our influence to head off bad policies and encourage good ones before they become law.

A new, formal state-advocacy partnership between NAIFA and ACLI builds upon years of cooperation and highlights both groups’ understanding of how state laws and regulations impact our industry. The partnership initially concentrates on seven key states: California, Colorado, Florida, Illinois, Maryland, Massachusetts and New Jersey. As part of the effort, NAIFA has bolstered our state advocacy staff. We are already beginning to see results on issues ranging from fiduciary proposals and state-run retirement plans to senior investor protections and genetic testing and client security proposals.

Federal advocacy victories, such as NAIFA’s work to pass the SECURE Act and see the Department of Labor’s fiduciary rule vacated, often garner bigger headlines, but many more issues affecting the success and prosperity of producers and their clients occur in the states. That is why NAIFA’s unique state advocacy prowess is so important.

Financial professionals can rest assured that NAIFA is in your state capital, and every state capital, working on your behalf and that of your clients. You can feel confident that no matter what the challenge, together, we can take on anything.

Kevin Mayeux, CAE, is CEO of NAIFA. Contact him at kmayeux@naifa.org.

Kevin Mayeux, CAE, is CEO of NAIFA. Contact him at kmayeux@naifa.org.

The SEC proposal Best Interest will change the legal standard for ethical behavior for broker dealer registered reps when making recommendations to clients.

By Frank Bearden, Ph.D., CLU, ChFCEffective June 20, 2020, broker dealers and their registered representatives will have a duty to act in the best interest of a client, not placing their own interests above those of the client, per the SEC proposal Best Interest. The duty includes full and fair disclosure of an investment recommendation, including information about fees and costs (For FAQs on Regulation BI for Agents and Registered Representatives, visit http://naifa.org/ advocacy/federal-issues-positions/regulation-best-interest). This involves a change from the suitability standard to a best interest standard.

The SEC proposal Best Interest is pertinent for this column as it will change the legal standard for ethical behavior for broker dealer registered representatives when making recommendations to clients.

NAIFA supports the best standard of care provision, but had an issue with a part of the SEC’s initial proposal involving restrictions of the term “advisor.” The final regulation makes it clear that NAIFA and NAIFA members can continue to use the term “advisor” when referencing the organization and being a member.

We should remember, however, that the NAIFA Code of Ethics currently considers as one of the nine obligations: “To work diligently to satisfy the needs of my client by acting in their best interest.”

With that and the other obligations of the NAIFA Code of Ethics, broker dealer registered representatives within our membership already make their investment recommendations in a client’s best interest so that standard would not change.

In light of our Code of Ethics, we might consider this part of SEC Best Interest to be a step forward within the investment markets, which can enable clients to uniformly receive service in their best interests. We can also use this development as an encouragement to consider the level of service we provide to our clients.

We can use this development as an encouragement to consider the level of service we provide to our clients.

Among the questions we might consider within our client service area:

• When we form recommendations for insurance or investments of any type, does our first thought become our recommendation, or do we go further, seeking to nudge a B-level solution to A-level?

• When we have questions about recommendations, do we seek out the questions through NAIFA and other areas of information, including our respected peers? Or do we seek to implement the first recommendation that comes to mind?

• Do we practice largely in isolation, or do we engage in regular professional association with other financial advisors, accountants, and attorneys, seeking their wisdom to add to our own researched knowledge?

This exciting time of rejuvenation of our organization is an excellent time to invest in the quality of our practice, knowing that the results of such an investment will accrue to our clients, their families and their businesses. As the NAIFA Code of Ethics reminds each of us in the Preamble:

Helping my clients protect their assets and establish financial security, independence and economic freedom for themselves and those they care about is a noble endeavor and deserves my promise to support high standards of integrity, trust and professionalism throughout my career as an insurance and financial professional.

The best to all in this engagement!

Frank C. Bearden, Ph.D., CLU, ChFC, is with Frank C. Bearden, LLC. Contact him at fbearden@outlook.com or at 210-724-1958.Despite the fact that more than one in four 20-year-olds will become disabled before they retire according to the Social Security Administration, why aren’t more disability income (DI) insurance policies sold?

In conversations with advisors, I often hear these objections to DI sales:

• DI insurance is complicated.

• Prospects don’t believe they’ll become disabled.

Both of these objections usually stem from a lack of familiarity with how DI insurance works and what it covers. Instead of positioning DI on its own, I suggest you consider teaming with another product that can offer a complementary income protection goal.

Think of pairings a restaurant recommends for a great dining experience, for example a certain entree may be better with a particular wine. When clients have an appetite for protecting their income, consider showing them how DI pairs well with these products.

This business isn’t easy, but introducing DI is less difficult if you pair an unknown with a known.

Many term insurance clients believe there’s a chance death could occur prematurely; so, they need to replace income for loved ones or a business. When determining a face amount, most insurance advisors use an income calculator with the intent to replace income of the deceased so the survivors can pay bills and continue their lifestyle as close to what they’re accustomed to as possible.

In essence, a term life insurance sale is really an income replacement recommendation. But dying isn’t the only threat to their income. Disability may not allow them to work in the same capacity as before. Term insurance alone is not a comprehensive income replacement safety net. Combine term life with DI insurance and you have a more complete income replacement recommendation. It covers your client both in the event they suffer and survive a catastrophic sickness or injury or in case they don’t.

Many insurance advisors recommend permanent life insurance for its death benefit protection, while also illustrating and implementing a long-term plan for supplemental income at retirement — an income replacement recommendation. While the plan begins at issue, time must pass before the policy has built enough cash value where the policyholder can begin taking a supplemental income stream.

This typically means the client as the policyholder must maintain their ability to pay scheduled premiums. What if the client becomes too sick or hurt to work and can’t pay their premium or even cover their ongoing expenses? If their policy doesn’t have a waiver of premium for total disability rider, they may have to make hard choices. Will they need to take income from their permanent policy early to pay bills? How long will it last? The reality is that scrambling to protect their income today by taking money out of their policy can significantly affect their income expectations from the policy in future years.

Recommending DI can help policyholders continue to pay premiums and cover their expenses so that the plan can continue the way it was intended. The permanent insurance plan will help with income replacement when the policyholder retires. The DI will help with income replacement if they can no longer work prior to retirement. Permanent insurance, paired with DI, can provide a more holistic coverage against the risk of income loss.

People usually buy medical insurance because they believe they could suffer a sickness or injury and they want to make sure their health plan pays a significant portion of the medical bills to the hospital and care providers.

Recommending another product that also pays your client if they become too sick or hurt to work is a natural fit. Medical insurance alone is not a comprehensive health plan. Add DI and your clients will have a more robust coverage. Medical insurance makes sure the doctors and hospitals are paid in the event your client suffers a sickness or an injury. Similarly, DI insurance can make sure your client is paid if they are too sick or hurt to work.

This business isn’t easy, but introducing DI is less difficult if you pair an unknown (DI) with a known (the coverage you may already recommend). By striving to create a more complete income replacement package or health plan, you’ll likely find yourself more willing to sell DI insurance and your clients more willing to buy it.

Life insurance and disability income insurance products issued by The Ohio National Life Insurance Company and Ohio National Life Assurance Corporation. Issuers not licensed to conduct business in New York. Life insurance, disability income insurance, and medical insurance policies have exclusions, limitations, reductions of benefits, and terms under which the policies may be continued in force or discontinued. Contact the issuing company for additional information.

Dana Campion, RHU, is a regional sales director for disability income insurance with Ohio National Financial Services. He can be reached at dana_campion@ohionational.com, www.linkedin.com/in/dana-campion or 206.496.3403. For more information, please see www.ohionational.com.

Recommending DI can help policyholders continue to pay premiums and cover their expenses so that the plan can continue the way it was intended.

Persuading your clients and prospects to buy the disability income (DI) insurance they need is sometimes an uphill task — there is always something else that demands their time and money, and before long, the decision to buy is placed on the back burner.

But your clients and prospects do need DI insurance and it is up to you to convince them that now is the time to take action. To get you started on this important journey, we asked top producer Ari Fischman for some ideas to boost DI sales, and this is what he shared with us:

Use examples to empower clients. An unexpected life event could drive someone into a rut they can never get out of if they are not properly protected with policies like life, health, home or disability income insurance.

A foundation of affordable protection that can be further built upon is a critically important step in financial planning and should come before asset accumulation. Unfortunately, a key protection product like DI insurance is completely neglected by full-time workers nearly 40% of the time, according to Guardian’s research brief “The Role of Disability Insurance in Financial Wellness.”

Clients would likely be surprised to know that I’ve written more than eight times as many life insurance policies as I have disability policies in my career, but more clients have filed disability claims. Sharing tangible examples about the importance of protections like DI insurance helps clients recognize that many people who seem to be doing well health- and career-wise could be collecting disability benefits.

For instance, we leveraged DI insurance for a physician suffering from anxiety due to a hostile work environment, and a lawyer working at lessened capacity due to multiple back surgeries. Witnessing the impact on the families of the clients we protect is a rewarding experience that motivates me to provide the same level of

security to more consumers. Through real-life examples, clients learn that many claims are temporary to allow the insured to process their current traumas without experiencing a financial loss.

Targeting certain professions like physician residents or law firms and prospecting within a cohesive group can keep advisors’ sales pipelines flourishing.

Make use of an income-protection model. Driving home the importance of DI insurance by using an income protection model is another impactful method to use. Let’s take a 30-year-old accountant making $100,000 per year. If they work 30 years without any pay increase, their future earnings would be $3 million. If they had a DI insurance policy over that same period of time, they would have paid $120,000 in premiums if they never became disabled.

If they do suffer a disability, then that $120,000 would protect over $3 million of potential earnings. This accountant would be using about one year of earnings throughout their entire career to protect all of their income. Given that today’s 20-year-olds have a one-in-four chance of becoming disabled before retirement, according to the Social Security department, this perspective is valuable for clients to understand and makes protecting their income an easy decision.

While DI insurance is a basic foundational-planning component that is often neglected, many clients will be able to see the logic and necessity of protection with quantifiable or narrative examples.

Debunk common DI myths. DI insurance can be challenging to effectively present to clients due to the abundance of myths and misinformation that exist about it. While this fosters a lack of understanding of DI insurance and can make clients less receptive to purchasing a policy, it leads to a staggering opportunity for advisors to bridge the gap and grow their business.

Working to dispel financial myths that clients may have helps maintain open communication and sets the stage for advisors to present tailored solutions. Consumers often think DI insurance only protects them in situations of catastrophic, permanent harm that causes total disability. In reality, 90% of claims are from common illnesses such as musculoskeletal disorders, cancer, pregnancy and mental health conditions, reports the Council for Disability Awareness. Many policyholders can even make partial disability claims when they are still working in their occupation but are not as productive because of an ailment, illness or mental health problem.

The “Not-Me Mindset” is another myth that plagues consumers. Guardian reports over 40% of workers think there is less than a 1% chance they will become disabled from work. In reality one out of four of these people would greatly benefit from proper coverage. Many people think it will never happen to them until it’s too late to prepare and protect their income, but three in 10 households have experienced a disability leave in the past 10 years.

Clients may use the “I have coverage through work” reasoning when discussing disability with their advisor. While 50% of U.S. employers offer disability benefits, employees may not realize that their coverage is often inadequate particularly as their earnings increase. Employer-sponsored plans often have a cap and do not cover total compensation with bonuses and commissions. By dispelling this myth, clients can recognize the necessity of additional coverage to prevent an income gap in case of a disability.

Explore new marketplaces. If advisors have efficiently communicated the importance of DI insurance to their current clients in the individual marketplace, they can look to other sources to increase protection planning opportunities.

For instance, an advisor could pursue a multi-life discount for individuals from one employer, or enter the group marketplace to institute disability benefits and drive value for employers. Targeting certain professions like physician residents or law firms and prospecting within a cohesive group can keep advisors’ sales pipelines flourishing.

Through advisors’ dedicated efforts within multiple marketplaces, more consumers will be able to protect their income and prepare for the unexpected.

Ari Fischman, CFP, LUTCF, brings close to 20 years of experience in providing insurance, estate planning and financial solutions to successful business owners and executives. He is an 11-year member of MDRT, with four Top of the Table recognitions. He founded Fischman Insurance Group to help provide his clients with strategies for business succession, retirement and estate planning.

While you may not have considered discussing individual disability insurance (IDI) with younger clients in the past, there are numerous reasons it’s time to reconsider this group as a promising sales target. A common misconception is that IDI is only valuable for professionals who are further along in their careers.

However, younger professionals — especially those with an income-earning potential of $100,000 a year or more — should consider insuring their income with the valuable protection that an IDI policy provides.

Consider the following three points to start the conversation:

1. Young professionals have made substantial investments in their careers. Professionals beginning their careers in fields that require extensive schooling and advanced degrees, or who have a high potential for aboveaverage earnings over their lifetime, have already made a significant investment in their future by the time they reach their mid to late 20s. Many are likely carrying large student loan debts and don’t have much savings. For these individuals, protecting future income is important to ensure they can maintain their lifestyles and pay off loans in the event of a disability that leaves them unable to work for a period of time.

Disability can happen to anyone at any time, and it can financially devastate individuals and families if they are unable to work. It’s important to remind clients that no one plans to become disabled, but an individual entering the workforce today has a 25% chance of becoming disabled before retirement,1 according to the Social Security Administration. A wide range of causes can lead to disability, including injury and illness.

Many individuals may receive group long term disability insurance (LTD) through their employers, and it’s true that group LTD offers a solid income protection foundation. However, it often doesn’t provide the kind of

coverage that high-earning young professionals require. Workers’ compensation and Social Security can’t be relied upon to cover most disabilities. Workers’ compensation only covers time away from work if the disabling illness or injury was directly work-related, and Social Security doesn’t cover enough pre-disability income to maintain a high earner’s current lifestyle.

An IDI policy that covers disabilities for both the insured individual and other family members can be important.

2. Younger applicants are more likely to qualify for simplified underwriting rules. Younger applicants are more likely to qualify for simplified underwriting rules. This will remove steps in the process, such as lab test requirements and income documentation, and help you facilitate the sale with interested clients by streamlining the application process.

Most carriers require nothing from you or your client to initiate simplified underwriting, if the applicant meets the criteria. Consider this a valuable selling point for young professionals who value a streamlined approach to the underwriting and purchase of IDI.

3. IDI can provide young professionals with unique benefits. Young professionals and those who are early in their career should look for policy features and benefits that meet their needs today and can grow with them. The following are strong policy benefits that young professionals might look for in an income protection policy.

*Opportunities to increase coverage. Riders that increase monthly benefits to keep pace with salary increases are a must for professionals early in their career. Some increase riders provide annual benefit increases of a set percent a year for a set period of years. Others may allow the policyowner to increase coverage significantly to keep up with promotions or large increases in income.

*Strong definition of disability. Some professionals will want a definition of disability that provides specialty language. Or they may wish to continue to work if they become disabled in their current occupation. Own occupation riders can provide coverage for professionals who can no longer perform the substantial and material duties of their occupations due to illness or injury — but wish to work in another capacity.

Remind younger clients that career trajectories are long, and investing in a preemptive policy with an own occupation rider is a sound financial decision that accounts for the unexpected.

*Student loan riders. While the path to becoming a high-earning individual is rewarding, it requires a significant amount of upfront investment. Student loan costs for some professionals can range in the hundreds of thousands.

Becoming disabled can prevent potential high-earners from paying off student loans. Fortunately, should a client experience total disability, a student loan rider will cover some or all student loan payments, up to a maximum period. This policy feature is especially pertinent for young clients who have not built up the financial cushion needed to absorb student loan costs should disability occur.

As a financial advisor, you have a unique opportunity to help your younger clients safeguard their income with IDI.

*Provides time to care for loved ones. An IDI policy that covers disabilities to both the insured individual and other family members can be important. Look for a policy feature that provides a benefit if the policyowner must take time from work, and reduced pay, to care for a spouse, parent or child with a serious health condition.

By purchasing an IDI policy early, young professionals may enjoy benefits such as competitive pricing, easier underwriting and peace of mind. As these early-career professionals reach major life milestones, income protection becomes even more critical. Paying mortgages, developing a nest egg and managing the day-to-day expenses of early adulthood can be challenging if someone abruptly loses their source of income.

As a financial advisor, you have a unique opportunity to help your younger clients safeguard their income with IDI. Remind clients about the numerous investments they have already made in themselves: a good education, a sound career and smart financial decisions. They have already laid the groundwork for a prosperous and successful future; now, they must protect it.

1Social Security Administration, Benefits Planner: Disability, 2019 https://www.ssa.gov/planners/disability/index.html

Chris Coy, CLU, ChFC, L&H, is a regional director at The Standard. He works with producers and general agents to identify sales opportunities for fully underwritten and guaranteed standard issue individual disability insurance. Coy can be reached at chris.coy@standard.com.

Chris Coy, CLU, ChFC, L&H, is a regional director at The Standard. He works with producers and general agents to identify sales opportunities for fully underwritten and guaranteed standard issue individual disability insurance. Coy can be reached at chris.coy@standard.com.

With this victory under its belt, NAIFA stands ready to oppose state-run retirement plans.

By Judi Carsrud and Julie HarrisonNAIFA recently scored a major victory when Congress enacted the Setting Every Consumer Up for Retirement Enhancement (SECURE) Act. With some of the most significant changes to retirement savings rules, the act will make it easier for consumers to adequately save for retirement. NAIFA has been working with lawmakers for many years to address hurdles to saving for retirement and providing a guaranteed income for life.

Consisting of 29 provisions, the SECURE Act offers tax credits to employers starting plans, credits for employers who provide automatic-enrollment features in their plans, a safe harbor for employers choosing to provide annuities in the investment options, portability of annuities and expanded opportunities to finding a plan to meet employers’ needs.

A requirement that plan statements illustrate the amount of monthly income for life that might be expected from the account balance is a useful planning tool so that participants are able to adequately save to meet their income objectives during retirement.

There are a few non-retirement provisions in the legislation, including a “fix” to the Tax Cuts and Jobs Act tax law impacting Gold Star families that inadvertently increased the amount of taxes those families would pay, and expansion of allowable expenses from a Section 529 educational account.

The new law includes changes to required minimum distribution (RMD) rules, although not all are favorable. Under the new law, RMDs are not required until age 72 (up from age 70-1/2), which is easier to administer and recognizes the fact that because people are living longer, starting distributions later in life is beneficial for longterm financial security.

The new law also includes changes to Multiple Employer Plans (MEPs), creates Annuity Safe Harbor and Portability enhancements, increases tax credits for employers and modifies required minimum distributions for inherited IRAs. Visit www.naifa.org. for more information.

Although the SECURE act has been hailed as a major step in helping Americans better save and plan for their financial future, some states are seemingly unfazed by its power and several state lawmakers are moving forward with their own legislation to create state-run retirement plans for private-sector workers. This requires certain employers to auto-enroll their employees in these plans.

Bills exist in the following states:

*Virginia: Del. Hala Ayala (D) introduced legislation that would create a mandatory program that would allow employees of private employers to contribute to a defined contribution retirement plan.

*Maine : Sen. Eloise Vitello (D) introduced an Act to Promote Individual Retirement Savings through a PublicPrivate Partnership. NAIFA-ME had a large role in defeating a similar measure in the past but Democratic leadership in the Senate is making it a priority in 2020.

*Indiana: A new bill would require the Interim Study Committee on Pension Management Oversight to study the creation of a state-run retirement “Secure Choice” program for private employees who do not have access to a pension or retirement plan through their employers.

The association is educating legislators that removing the hurdles involved in adopting into a multiple employer plan will make it easier for businesses to provide retirement plans and lessen the need for state-run programs.

NAIFA stands ready to take its opposition to state-run retirement plans head on across the country. Policy experts at NAIFA-National are compiling statistics and data in opposition to state-run retirement plans, especially in light of the passage of the SECURE Act.

Together with state chapter advocates, NAIFA is educating legislators that removing the hurdles involved in adopting into a multiple employer plan will make it much easier for businesses to provide retirement plans to their employees and lessen the supposed “need” for state-run programs.

New grassroots technology and a new state legislator relationship tracking system located on NAIFA’s new Advocacy Action Center (www. naifa.org) will also support the challenge that NAIFA will bring against state-run retirement plan legislation.

Using its considerable influence and political prowess, NAIFA was instrumental in getting the SECURE Act introduced, co-sponsored, voted on by the tax-writing committees, passed on the House floor, included in last year’s spending legislation and signed into law on December 20, 2019.

We would like to thank the thousands of NAIFA members who reached out to their lawmakers via email and phone calls, wrote letters to the editors of local newspapers, and met in person in the District and on Capitol Hill in Washington DC. We could not have done it without you!

Judi Carsrud is assistant vice president in NAIFA’s Government Relations Department and Julie Harrison is the GR State Chapter Director at NAIFA.

Historically, globally diversified portfolios have generally outperformed their non-diversified counterparts.

By Aaron Hodari, CFP, CIMA2017 was a great year for U.S. stocks. Large caps returned nearly 22%, while small caps returned nearly 15%. Nobody complained about those returns.

But do you know which asset had an even better year? International stocks. Emerging market stocks; the MSCI Emerging Markets Index, returned a whopping 37.8% in 2017, while developed market international stocks — i.e., the MSCI EAFE Index — returned 25.6%. These were the two best-performing asset classes of the year.

This example may seem a little indulgent. After all, we are comparing big winners with bigger winners, and this was only one year. So, let’s do another.

From 2002-2007, the S&P 500 returned 6.1% annually. The MSCI EAFE Index, which measures the equity market performance of developed markets outside the U.S. and Canada (essentially the global equivalent to the S&P), returned 14.8% over that same period.

Both periods are completely arbitrary, but they underscore an important point about global diversification. While there is no one-size-fits-all approach for everyone, having some sort of international allocation is critical to maintaining optimal performance in most long-term portfolios. This is one of the core principles of asset allocation that I try to get across to my clients.

Because of globalization, it’s become increasingly difficult, perhaps impossible, to avoid having at least some sort of international exposure in your client’s investment portfolio today. Most U.S. large caps count international sales as a major revenue source. For example, international sales accounted for 59% of Apple’s revenue and 40% of Starbucks’ revenue in the June 2019 quarter.

But owning Apple or Starbucks and saying you’re globally diversified is inadequate. A true allocation to global assets means looking beyond U.S. companies. According to Vanguard, U.S. equities accounted for 55% of the global equity market as of September 2018, leaving the remaining 45% available for capital allocation. This is just one reason I reinforce international allocations to my clients.

Diversifying to global equities minimizes the likelihood that one market downturn will have an outsized effect on total portfolio performance. More importantly though, research has found that, historically, globally diversified portfolios have generally outperformed their non-diversified counterparts.

According to Charles Schwab, not only did a globally diversified portfolio outperform both the S&P 500 and a conservative 60/40 U.S. stock/bond blend from Jan. 1, 2001 to Sept 30, 2019, but it also held up better during both economic recessions during that time.

This happens because markets are cyclical. In the 1980’s, international stocks crushed the U.S. That was followed by a stark reversal in the 1990’s. This decade, the U.S. has dramatically outperformed the MSCI EAFE.

It may not seem like it, but the dominance of the U.S. over international stocks should eventually change, as it always has. Vanguard’s chief investment officer told CNBC last November that he expects international stocks to outperform their U.S. peers by 3-3.5% over the next 10 years, in part because of increased U.S. valuations.

Globally diversified portfolios are well-positioned to take advantage of growth over long-term time horizons — whichever market it comes from.

Volatility can eat away at returns over time; so, it’s important to keep it managed in long-term portfolios. One of the ways we accomplish that is with international diversification. A report from Vanguard found that having between a 40-50% allocation to international equities actually reduced volatility to below 15%.

“The benefit of global diversification can be shown by comparing the volatility of a global index with that of indexes focused on individual countries. While the United States had the lowest volatility of any individual country examined, its volatility was slightly higher than that of the global market index. Other countries examined had volatilities that were 15% to 100% greater than the global market index.”

The chart below shows this trend. From 1970-2018, a globally diversified portfolio had lower annualized volatility than any individual market.

Notes: Country returns are represented by MSCI country indexes; the global market return, including both developed and emerging markets, is represented by the MSCI All Country World Index. All data are from January 1, 1970, through September 30, 2018.

Having some sort of international allocation is critical to maintaining optimal performance in most long-term portfolios.CREDIT: VANGUARD, GLOBAL EQUITY INVESTING. SOURCES: VANGUARD, THOMSON REUTERS DATASTREAM, AND MSCI.

International investing comes with its own kind of unique risks. You expose yourself to, among other risks, currency volatility, political instability, and economic fluctuation. In addition, international markets can be less transparent and harder to navigate than those in the U.S. This is partly why managing global allocations is an area in which professionals can come in handy. Advisors with the ability to conduct research on foreign companies and rebalance portfolios based on market performances provide their clients with a unique edge.

Also, the importance of rebalancing portfolios, in particular, cannot be understated. Vanguard estimates that a hypothetical traditional 60/40 U.S. portfolio created in 2014 would now more closely resemble a 70/30 split given the outperformance of stocks over bonds.

According to the 2019 Credit Suisse Global Investment Returns Yearbook, the U.S. stock market accounted for 15% of the world’s total stock market in 1989. At the start of 2019, it was 53%. These disproportionate performances cause portfolio weightings to get distorted from where they started. An advisor who can see these shifts and rebalance accordingly keeps his client’s asset allocation and risk exposure where they should be.

The most common argument you’ll see against international diversification is that correlations between the U.S. and global markets are shrinking. While this is true, it doesn’t change my view that having a strategic allocation to global assets puts portfolios in the best position to achieve long-term growth.

Disclaimer: The views expressed in this article are those of the author and may not necessarily reflect those of Schechter or its affiliates. There is a risk of loss in trading and investing of any kind, and the diversification strategies described herein do not ensure a profit and do not always protect against losses in declining markets. The material herein is provided for informational purposes only and should not be construed as investment advice, a specific investment recommendation, a solicitation, or an offer to buy or sell securities Investment decisions should be made based on, among other things, an individual investor’s applicable objectives, risk tolerance, and financial circumstances and in consultation with his or her advisor(s). Past performance is no guarantee of future results.

Aaron Hodari, CFP, CIMA, is a managing director of Schechter, a boutique, third-generation wealth advisory and financial services firm located in Birmingham, MI. Schechter and its affiliates, Schechter Investment Advisors and Schechter Private Capital, provide our clients with institutional quality investment advisory services, access to alternative investments and specialized wealth management solutions, including advanced life insurance, income and estate tax planning, business succession and charitable planning.

Start by focusing on the six areas mentioned by these high-profile NAIFA members.

By Mark BriscoeDuring NAIFA’s Performance +Purpose Conference last year, NAIFA members Kathleen Owings, Taylor Sledge, and Corey Anderson offered attendees six key focus areas that have helped them succeed in the financialservices industry. Here are the six areas of focus:

Business Development . According to Anderson, a key to developing and growing his business has been simple persistency. For every yes he gets from a client or prospect, he receives six or seven no’s from others. Financial professionals who are not persistent in the face of rejection will never get to the yes. “No is not forever,” Anderson said. “You need to be pleasantly persistent.”

It is also important to delegate tasks to others. “So many advisors don’t want to delegate to their staffs,” Anderson added. “We’re all control freaks in this business.” Allowing associates to do the jobs they are the best qualified for frees you up to keep a balance to ensure you always have new appointments and opportunities for new business in the pipeline.

It’s also a good idea to leverage technology to work more efficiently and help build your practice. “Many appointments don’t need to be face-to-face,” Anderson said. “Phone appointments are often better for time management and provide clients with flexibility.”

Team Building. Financial professionals should build two teams: one for growth and another for support, Sledge said. Growing the business and bringing new clients are both vital, but so is performing the tasks that keep the practice running.

Different team members may serve in different roles, including:

• Relationship management

• Workflow

• Economics

• Administration

Sledge acknowledged that not everyone can hire staff, especially in young practices, but there are always resources available. Company connections, for example, can provide support. But spending money on good staff is

worthwhile. “A human being is never an expense,” Sledge said. “A human being is an investment. This is not gas money; this is your future. It’s about doing for your client what you’ve said you will do for them.”

Podcasts also help to build a personal brand and to reach consumers on devices that go with them wherever they go.

Professional Development . Owings said she is always testing herself, and constant challenges keep her moving forward. She believes that you should never become complacent just because you’ve achieved a high level of success.

Coaching has also been a big part of her professional development. In her career, coaches have kept her motivated and on track. She is also a firm believer in annual goal planning, constant monitoring of goals, and keeping objectives top of mind. If you don’t commit to ongoing professional development, it becomes “too easy to fall into the trap of just going through the motions,” she said.

Maintaining Balance. How do you keep a good balance in your life? For Anderson, one step is keeping a good calendar and using it to ensure that you don’t miss appointments. This calendar should not just include business engagements, but also personal and family ones. For him, family comes first, and it is just as important to keep his family and personal calendar appointments as it is to keep business appointments.

Everyone faces struggles that can threaten to throw them off balance. Anderson’s key to working through his struggles is to create goals and follow through on doing what is needed to achieve them.

Referrals and Marketing. Sledge noted that as long as human beings make decisions based on emotion, insurance and financial professionals will have career opportunities. Even as some parts of the insurance industry become more automated, many clients still need a personal touch. Producers can reach them by understanding the human condition and gearing their marketing activities to address clients’ specific needs.

Sledge offered the following marketing equation: shared experiences + constant communication = great relationships. Marketing today consists of being on social media and convincing others to speak well of you and your business.

Sledge presented what he calls “The Board Model,” which he uses to get influencers invested in helping him succeed. “I am treating you like a board member of my company. I share struggles and successes,” he said. “They become the greatest advocates for your business, and they will bring you more business than you need.”

Podcasts also help build a personal brand and reach consumers on devices that go with them wherever they go. To steer clear of compliance problems, Sledge develops personal branding that doesn’t talk about business, finance or products.

In his podcasts, he interviews entrepreneurs — asking them how they found success, how they struggled, and how they grew their business. He then broadcasts the interviews on social media. “The podcasts give people a reason to want to talk to me about business,” he said. “I’m giving them something they can use, not just something that serves my own business.”

Community Service. To get the most out of their community service endeavors, Owings said, insurance and financial professionals need to “go in” with a truly giving mindset. “Don’t take volunteer positions asking what you are going to get out of them for yourself,” she said. Instead, approaching the positions with a focus on service has given her better opportunities for “building relationships with professionals like me — like-minded professionals who are not asking what’s in it for them. You’ll be more relevant if you are passionate and not just looking for a return,” she added.

Mark Briscoe is Senior Director, Strategic Communications, at NAIFA. Contact him at mbriscoe@naifa.org

This presentation has enabled this advisor to become an excellent listener during a sales interview and to stay on track.

By Raymond Jones, ChFC

By Raymond Jones, ChFC

Through practicing and listening to sales training tapes, financial advisor Raymond Jones has developed an eight-step process, which he says is responsible for many of his large-value sales. In his book, Back Up the Truck, Jones outlines his Eight Step Presentation Process:

1. Get to know your prospects and make them feel comfortable. One of the most common mistakes we make is not breaking the ice or the initial tension that often exists when we meet someone for the first time. It is important to make people feel comfortable and to develop a friendly rapport with them. Talk with them about current events, their jobs or their families, he writes. Also, share your personal experiences to let them know that we are humans, too. Seating is important, as well. Never sit across from a desk or a table. You either move beside the prospect or ask him or her to sit beside you. “Remember that people will not do business with you if they do not like you or they feel uncomfortable,” Jones writes.

2. Sell yourself and your company. Jones has found out that the 2 most common objections that prospects have for not buying are they are not sold on his personal qualifications and they are not sold on his company. So, his presentation booklet has information about him and his company. He also emphasizes his business experience, his philosophy of the product, his educational background and the educational programs he has completed. This is because prospects generally want to know why they should do business with him and something about the company he represents.

3. Ask the magic question . This step has probably helped close more sales for him than anything else he has done in an interview. You need to find out what your prospect wants to avoid going off in the wrong direction. The best way to do this is simply by asking them the magic question. Here is an example: Jones asks the prospect: “Do you have any questions about your insurance or investments in general?” Then he keeps quiet. If you ask the question sincerely, your prospect will tell you what is on his or her mind. They might respond: “Well. I want to start a college fund for my children.”

If they do want to start a college fund, then deal with that concern first. “If the prospect wants a blue car, don’t try to sell him a red one,” Jones advises.

4. Get the pertinent facts. Based on what the prospect says in step 3, you should try to get the facts that pertain to their particular interests and needs. For instance, if they have been general in their answer, then you have to get the facts about their overall situation. But if they have been more specific, such as saying they want insurance on their spouse, then you should get the acts that pertain to this particular need.

5. Point out the problem through rational analysis. After obtaining the facts, take your prospect through the solutions you have for them and how their individual needs can be met by using these solutions. Go through this analysis carefully and show the prospect how their facts and situations relate to the problem. “Do not proceed any further until you get their agreement that there is a problem or a need,“ he writes. “No one will buy anything unless they feel they have a need. If you have done an effective job of showing the need and you have the prospect’s agreement to that need, then you can proceed.”

6. Present the solution. After you have illustrated the need, then present your solution. Try to present a solution that you would want if you were in their situation. If you don’t, then your prospect will begin to question your credibility.

7. Close or keep silent. After presenting your proposal, it is time for the decision. After going through the illustration and you feel that the prospect understands the solution, you should keep quiet. Jones offers the following example. He asks the prospect: “This product will provide the service and the solution you need, and the cost is $100 per month.” Then he does not say anything else.

On most occasions, the prospect will either say: “Yes. I feel that this is an adequate solution to my problem, or I can’t afford $100 per month.”

At this point, it is simply a matter of if they will purchase what he has proposed or if they will need some modification to the solution. Jones does not go into a long closing speech — he simply presents the solution and keeps quiet until he gets a reaction from the prospect.

Just as it was with the magic question in step 3, this is a time when you must give the prospect an opportunity to air their honest opinion. ”It is not always a yes or a no when it comes to closing a sale,” he writes. “It can be a yes, a maybe or a no. No matter what the response is, the result can be positive for the prospect and the salesperson. The prospect must be the first one to speak after you present your solution.”

8. Don’t forget to get referrals. If you have done a good job on the seven steps mentioned above, then your prospect will look at you as a professional and will be more willing to refer you to others. If you leave the interview without getting referrals, then you do not have anywhere to go even though you might have made the sale.

“And if you do not have any place to go, then you are basically out of the selling profession,” he writes. “Referrals provide an opportunity for your prospects to show you how grateful they are for the products and services you provide. Get the referrals and keep yourself in the selling profession.”

Raymond Jones, ChFC, is a financial advisor in Columbus, Ohio. He has over 40 years of experience in sales and sales management. As a Life Time Achievement Award recipient and an MDRT qualifier, Jones’ books and workshops have proven beneficial to individuals throughout the business community. Learn more at www.backupthetruck.biz .

If you lead the client discussion with ALL the benefits that life insurance can provide, in all likelihood, you will have a more compelling discussion than the one that results by just running “the numbers.”

By David Appel, CLU, ChFC, AEPA2012 study by the LIFE Foundation and LIMRA found that:

Survey respondents were asked to estimate the annual cost of a 20 year, $250,000, level-term life policy for a healthy 30-year-old consumer. The actual cost is roughly $150 per year, but Americans estimate the cost at $400. Younger adults, who are the most likely to qualify for preferred pricing, overestimate the cost by nearly seven times the actual cost!

Based on this cost misperception, it is no wonder that survey after survey concludes that individual life insurance ownership is at an all-time low. Potential buyers perceive the cost of term life insurance to be multiples of what it really is, which may be correlated to the lack of demand for the product.

According to the website Intelligent Economist, Price Elasticity of Demand (PED) is defined as “the responsiveness of quantity demanded to a change in price. The demand for a product can be elastic or inelastic, depending on the rate of change in the demand with respect to the change in the price.” Price elasticities are almost always negative, meaning that if the price goes up, the demand for the product goes down, absent any other differentiators.

This chart illustrates a price increase from $50 to $60 with a corresponding demand going down from 100 to 50. Given the same demand curve the opposite is also true, when the price goes down, the demand goes up.

It would follow that if the price of term life insurance goes down, one would think that consumers would buy more of it, but that has not occurred. Term insurance pricing wars between life insurance carriers have been going on for many years while ownership of insurance has been decreasing for years. What is the problem? Maybe it is the perception of price as discovered in the 2012 study mentioned above. When a consumer thinks that the price of a product is between 2.67 and 7 times the actual cost, what would that do to demand?

The prevailing attitude is that term life insurance is all about price and that there is not much that distinguishes one term product from another. The premium is paid for a pre-determined period (the term) and the insured is “covered” by a stipulated death benefit for a specified length of time according to the contract, so long as you pay the premium.

Generally speaking, the only real differentiator between term products in today›s market is possibly the conversion options offered by insurance carriers that price their products higher than those that have more limited conversion options. Another factor affecting price may be the carrier’s ratings, also known as counterparty risk. The more highly rated a company, the higher the premium may be, but we show no evidence of that being the case. There are many very highly rated carriers with very competitive term pricing.

For your clients who are considering purchasing something that goes beyond the product term period, conversion privileges would be important and might cause them to pay more for coverage. This is not complicated, but how often is this really part of the term sale process? For many advisors, the conversion conversation is critical planning advice. For others who are more transaction oriented or just “filling an order,” not so much.

Let’s also look at permanent insurance. Does price really matter? It depends on the product being considered. For guaranteed universal life (GUL), which is essentially permanent term insurance, it›s all about price when considering only the death benefit — ignoring for the moment any riders or other benefits such as long-term care or chronic illness. A lower price can enhance the rate of return of the “investment,” which means that the lower price paid for the same amount of death benefit results in a higher internal rate of return (IRR).

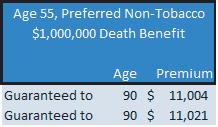

But is life insurance a good investment? The answer is: it depends. Essentially, it depends on when the client passes away. Let›s look at the pricing for one of the most competitive GUL products in the market for a

$1,000,000 death benefit on a preferred risk 55-year-old male. Many advisors request the cheapest premium because they fear that their competition may subsequently show the client a shorter guarantee period causing the loss of the case.

Which would you recommend to your client and how would you defend your recommendation? If you picked “Guaranteed to Age 100,” what happens if the client lives to age 101?

This brings us back to price elasticity. Is an 8.6% increase in premium from $11,189 to $12,151 really going to make the client NOT buy the needed coverage? Some financial planners may say invest the difference, which will enhance the return to the family. I would argue that they are absolutely correct. This means that if we take the difference in the premium between the “guaranteed to age 100” premium and the “guaranteed to age 120” premium, or $962, and invest it in a conservative, 3% after-tax return, by age 100, it will have accumulated to $95,619 — a 9.56% increase in wealth transferred to the beneficiaries. But what happens if the client lives to age 101? Will the $95,619 be enough to pay the premium at that age? I would think not.

What about current assumption universal life, such as an interest-based product or an index-based product? These products create a bit more complexity because they must be managed and monitored for performance.

This is the same product from the same carrier with the identical assumptions. The difference of $17 in premium, assuming 6% Index returns, is the difference between projected duration to age 101 (when it lapses) versus projected duration for life. What has been proven by running various design scenarios is that ink sticks to paper.

Index returns do not credit year over year 6% returns as the illustration projects. IUL fluctuates between a floor of 0% and a cap rate, let’s assume of 10%. The sequence of returns is what will dictate how this product will perform over time and a $17 difference in premium will not matter one way or the other. The only way to know how this product is going to perform is to monitor the performance and manage the premium flows based on re-projections of past performance. This needs to be communicated to the client at the time of sale and on an ongoing basis, not 10 or 20 years later when it is too late to make changes to the premium flow!

So, what premium should the client be shown? $11,004? $11,021? Something different altogether? It has already been established that consumers overestimate the cost of life insurance by multiples. In fact, consumers have no idea what premiums should be, and many would argue that neither do agents, brokerage agencies or even

the actuaries that designed these products. No one knows, but why? Because no one knows what interest rates will be going forward or what the Index linked performance will be in the future.

Regardless of the product, spread sheeting products based on price is not good practice. Clients make late payments; clients miss payments altogether and clients borrow funds from their cash values. Interest rates go up and down and markets go up and down as well. How can consumers possibly know what product is the best for them?

The best life insurance policy is the one that is in force the day the insured dies.

The best life insurance policy is the one that is in force the day the insured dies. In 2017, Prudential paid almost $5.8 billion in individual life claims and over $10 billion if their group life insurance claims are included. AXA Equitable paid approximately $2.1 billion in individual life claims, while Principal paid over $1 billion. This is what is important — this is what people buy and frankly, the difference of a few dollars of premium on a spreadsheet will not change that.

Consultative selling and ongoing policy reviews need to become more ingrained in how an advisor approaches his/her clients. Well-structured life insurance provides numerous benefits that must be a primary part of the conversation with your clients. If you are not discussing long-term care, chronic illness benefits and other available riders, the tax deferred growth of cash values, the tax favored access to cash values through withdrawals and loans and the tax-free benefits paid at death, then you are focusing on the wrong aspects of the sale.

If you lead the discussion with all the benefits that life insurance can provide, in all likelihood you will wind up having a more compelling discussion than the one which results by just running the numbers. Yes, price is important. But it cannot and should not be the focus of the conversation.

David E. Appel, CLU, ChFC, AEP, is the managing partner of Appel Insurance Advisors in Newton, MA. He can be reached at david@appeladvisors.com.

Carry your own personal code of conduct in your heart — it is easier to access that way.

By Scott BrennanIrecently read a restaurant review of French Laundry on its 25th anniversary. The company’s meticulous founder, Thomas Keller, operates a three-acre culinary garden across the street from his famous eatery in Napa Valley.

Visitors can sample strawberries right off the vine.

The review noted that when vines struggle, the roots dig deeper for resources and this strain produces a more interesting flavor, with a deeper complexity. The same is true for humans in general and for salespeople in particular because adversity is usually good for the soul.

But what is adversity? It means different things to different people. For one person, it might be as minor as missing a sale you spent hours pursuing. For another, it might be the heartbreaking death of a loved one. People grow when they struggle; so does their faith.

There is an element of courage in every call and in every sale that we make. For example, many years ago, I had the good fortune of taking an application for life insurance on the CEO of a Fortune 100 company. It was managed by the same company that oversaw a lot of professional tennis players and PGA tour players. Their posters were all over the walls both times I visited their offices. It was rather heady stuff for a young man attempting to write an important piece of business at that time in my career.

A few days before I was ready to deliver the policy the sports agent representing my client told me, in a rather matter of fact way over the telephone: “We are going to need 25 percent of this case if you want the business.”

There is no right way to do a wrong thing.

You could have knocked me over with a feather. I reminded this man that the state I live in, Indiana, and the state he worked in, Ohio, and the state where the application was dated and where the client lived in, Michigan, had anti-rebating statutes. He calmly responded: “We do not want a rebate; we just want a piece of the action.”

When I asked if he had a license to sell life insurance, he said he did not need one.

It took only a moment for me to respond that I would not be giving them anything, that I had earned the right to get the business, and that his request to be paid off was dirty. I did not get this case.

Did I want the business? Yes, of course. However, there was something bigger than a piece of business hanging in the balance. Always trust your gut. When you know something is not right and your instincts confirm it, then there is no right way to do a wrong thing.

Fast forward 25 years. A tough man who already owned a million dollars of life insurance with me needed more. However, he emphatically stated that the only way he would buy more coverage from me was if his lawyer in Manhattan approved of the idea. This seemed easy enough. His need for more life insurance was present and my client was doing very well for himself.

The next day, over the phone and after exchanging pleasantries with the lawyer, he asked a question I had not expected: “How do you feel about revenue sharing?”

“Revenue sharing?” I asked, hoping it was not what I was afraid it was going to be. “Yes,” he replied, “I am going to need a piece of your commission.”

I told him I would keep my commission and he could keep his hourly fee because at the end of the day, both of us would certainly earn them. Once again, although I did not write the business, I was better off in the long run.

Once you have a minimum standard of behavior set for yourself, the pressure is off. When you are asked to do anything that you should not do, the response is easy: “No, that is not going to happen.”

A friend of mine was being considered for a top job at one of the biggest life insurance companies in the country. Toward the end of the interview, they brought in a psychologist to visit with him.

At the end of their session, my friend asked the psychologist why she has spent so much time asking questions that dealt with his integrity. She calmly informed him that if he got the job and then decided to leave, it would not be because he did not like the job, it would be because someone asked him to do something that was unethical.

Someday, someone will ask you (perhaps more than once) to do something that is unethical. Do you want to simplify your life? Carry your own personal code of conduct in your heart. It is always easier to access that way.

D. Scott Brennan is a graduate of Indiana University. He is a past president of MDRT and The Forum 100. He is a longtime member of NAIFA and AALU and is the 75th recipient of the John Newtown Russell Memorial Award.With a revamped sales process and a sales coach, you will have more success with your cold prospects.

By John PojetaIf we don’t approach our sales process as a strategy for long-term growth, we’ll eventually stop growing. We see this every day among advisors: their businesses eventually reach the point where they spend so much time working on services that it’s hard for them to pull away and focus on sales.

In the early days of advising — and this is how I started as well — we have to hustle and scrape to build our book of business. If we start within an established firm or institution, we may be tasked with cold calling or with attending several networking events a week. Today, we are also sending emails and making LinkedIn connections.

For a new advisor, the ratio of sales to service skews heavily in favor of sales. As we close more business, we start to provide more service. That’s out of necessity, of course, because acquiring clients naturally means following through on delivering the promises we make.

Eventually, though, that ratio shifts to the point at which a veteran advisor is doing almost no sales whatsoever. The book of business is so big that the advisor can spend every business day working with the clients he or she already has. When sales meetings do come up, they are probably referrals, which are mostly “lay-ups” as far as sales are concerned.

The problem a service-focused advisor faces is the difficulty of again talking to cold prospects, which adds an additional dimension of frustration to any marketing initiative. Yes, you have new prospects in the door, but is it worth it if you can’t close them?

If you invest in finding new prospects, you should also invest in improving the sales process that you use to close those prospects.

If you take our advice and implement a growth plan that brings you a regular stream of new opportunities over a long-term timeline, you will have to address your sales process. Here’s why:

• Your sales skills, in general, may have dulled over the years. If you’re not actively meeting with cold prospects on a regular basis, you may lose some of the skills you acquired in your early days.

• New markets or new audiences may require a shift in the story you tell. If you’re meeting with different people than you’re used to, you’ll have to alter the script you’re used to using.

• Cold prospects do not have the built-in warmth and trust of a referral. For someone who hasn’t met with a cold prospect in a few years, this can be easy to forget.

• High-value prospects already have an advisor; so, your sales process needs to unseat the incumbent. What can you or your firm offer that no one else can?

Whether you end up working with an appointment-setting firm like the PT Services Group or not, you should consider investing in a sales coach if you want to grow. For our part, a sales coach is part of an appointmentsetting program. But the more important takeaway is that if you invest in finding new prospects, you should also invest in improving the sales process you use to close those prospects. Otherwise, you are going to be frustrated with the results, no matter how good your marketing plan.

With a revamped sales process and a sales coach by your side, you will see greater success with the cold prospects your marketing strategy brings in. With increased sales, your services will no longer kill your growth.

John Pojeta is vice president of business development at The PT Services Group. He researches new types of business and manages and initiates strategic, corporate-level relationships to expand exposure for The PT Services Group. Pojeta joined The PT Services Group in 2011. Before that, he owned and operated an Ameriprise Financial Services franchise for 16 years.