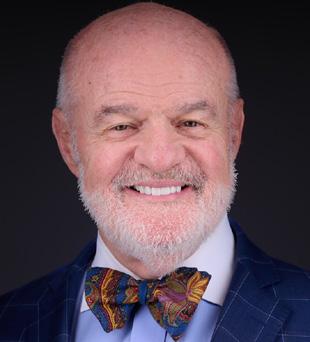

President Bryon Holz, CLU, ChFC, LUTCF, CASL, LACP

CEO Kevin Mayeux, CAE

Evelyn Gellar, LUTCF, RICP, CLTC, FSCP, CDFA

President-Elect

Tom Cothron, LUTCF

Mark Acre, LUTCF

Brian Haney, CLTC, CFS, CIS, CFBS, LACP, LUTCF, CAE

Secretary Doug Massey, CLU, ChFS, FSS

Treasurer Brock Jolly, CFP, CLU, ChFC, CLTC, CASL, RICP

Immediate Past President Lawrence

Elected and Sworn In at the 2023 National Leadership Conference

President Tom Cothron, LUTCF

President-Elect Doug Massey, CLU, ChFS, FSS

Secretary Christopher Gandy, LACP

Treasurer Brock Jolly, CFP, CLU, ChFC, CLTC, CASL, RICP

Immediate Past President Bryon Holz, CLU, ChFC, LUTCF, CASL, LACP

CEO Kevin Mayeux, CAE

Dennis Cuccinelli, LACP

Jesse Dogillo, CFP, CLU, ChFC, AEP

Ernest Guerriero,

Brian Haney, CLTC, CFS, CIS, CFBS, LACP, LUTCF, CAE

Carina Hatfield, LUTCF, CLCS, LACP

Stephen Kagawa, FSS, LUTCF

Barbara Pietrangelo, CFP, CLU, ChFC

Andrew Rinn

Bryon Holz, CLU, ChFC, LUTCF, CASL, LACP, led NAIFA through a historic year in the growth and evolution of the association. NAIFA reach agreements to merge with the Society of Financial Service Professionals (FSP) and add Life Happens as NAIFA’s public-outreach and consumer education wing. FSP and Life Happens retain their brand identities under the NAIFA umbrella, creating a stronger, more influential association.

Throughout his presidency, Holz emphasized the ability of individual NAIFA members to make a difference on behalf of NAIFA, their colleagues, and their clients. Drawing on an enduring theme in his writings, speeches, and discussions, he urged NAIFA members to remember their “first times”:

• Their first sale

• Their first NAIFA meeting

• Their first LILI class

• Their first IFAPAC contribution

• Their first grassroots event

• The first time they made a big difference in a client’s life

Holz spent much of the year on the road, visiting NAIFA chapters across the country. His enthusiasm for NAIFA, the insurance and financial services industry, and political advocacy was infectious as he urged NAIFA members to encourage their colleagues to become more engaged with their professional association and create their own “first times.”

Empowering financial professionals and consumers through world-class advocacy and education.

Founded in 1890, the National Association of Insurance and Financial Advisors is the preeminent association for financial service professionals in the United States of America. NAIFA members, in every Congressional district and every state house, subscribe to a strong Code of Ethics and represent a full spectrum of practice specialties to promote financial security for all Americans. Complimented by its professional development and consumer divisions, the Society of Financial Service Professionals and Life Happens, the association delivers value through advocacy, service, and education.

NAIFA has served the needs of insurance and financial services professionals and worked to protect consumers since 1890. Nearly all of the institutions serving the industry can trace their roots back to NAIFA.

1890

NAIFA was founded as the National Association of Life Underwriters.

32 NAIFA members founded the Million Dollar Round Table. 1947

NAIFA was among the founders of the Life Underwriter Training Councel, based on educational programs led by NAIFA local chapters, which in 1984 developed into the LUTCF designation.

1951

NAIFA created the General Agents and Managers Asociation (GAMA) as a conference for NAIFA.

1990

NAIFA created the Association of Health Insurance Agents (AHIA) as a conference of NAIFA.

1999

NAIFA changed its name from the National Association of LIfe Underwriters to the National Association of Insurance and Financial Advisors.

2024

NAIFA merged with the Society of FInancial Service Professionals 9FSP), retaining the FSP brand as an industry leader in professional development under the NAIFA umbrella.

NAIFA founded the Association of Life Agency Officers, a precursor to LIMRA.

NAIFA was instrumental in the founding of The American College and the Chartered Life Underwriter (CLU) designation.

NAIFA agreed to administer the John Newton Russell Memorial Award, which today is the industry’s highest individual honor.

NAIFA accepted theAssociation for Advanced Life Underwriting (AALU) as a conference of NAIFA

NAIFA was among the founders of the Life Insurance Foundation for Education, today known as Life Happens.

NAIFA added Life Happens as its consumer arm.

Helping my clients protect their assets and establish financial security, independence, and economic freedom for themselves and those they care about is a noble endeavor and deserves my promise to support high standards of integrity, trust, and professionalism throughout my career as an insurance and financial professional. With these principles as a foundation, I freely accept the following obligations:

To help maintain my clients’ confidences and protect their right to privacy.

To render timely and proper service to my clients and ultimately their beneficiaries.

To work diligently to satisfy the needs of my clients by acting in their best interest.

To continually enhance professionalism by developing my skills and increasing my knowledge through education.

To conduct all business dealings in a manner which would reflect favorably on NAIFA and my profession.

To cooperate with others whose services best promote the interests of my clients.

To present, accurately and honestly, all facts essential to my clients’ financial decisions.

To obey the letter and spirit of all laws and regulations which govern my profession.

To protect the financial interests of my clients, their financial products, and my profession through political advocacy.

Kevin Mayeux, CAE

NAIFA CEO

We will long remember 2023 as a momentous year for the National Association of Insurance and Financial Advisors and for our entire industry. NAIFA leaders began discussions with Life Happens early in 2023 to bring the preeminent public awareness and consumer outreach voice on the importance of insurance and financial services into the NAIFA fold. Soon after, NAIFA and the Society of Financial Services Professionals proposed a merger. Following historic votes by the NAIFA and FSP memberships and approval of both associations’ Trustees, these three iconic organizations became one, effective January 1, 2024.

The Life Happens and FSP brands, which have gained renown in the industry, will continue under the NAIFA umbrella. The union brings together NAIFA, the leading advocacy association of insurance and financial professionals, FSP, the industry leader in education and professional development, and Life Happens, the unbiased voice providing financial risk protection information to consumers. The union creates synergies that strengthen all three entities and make them more effective and efficient in their mission to empower financial professionals and consumers through worldclass advocacy and education.

The expanded organization retains all three brands under the NAIFA umbrella and leverages each one’s strengths to create a greater impact on the industry, financial service professionals, and consumers. The integrated organization aims to empower financial professionals and consumers through world-class advocacy and education.

FSP offers world-class professional development programs and products, including the renowned Journal of Financial Service Professionals, the annual FSP Institute, and a highly popular series of educational webinars. These dovetail nicely with NAIFA’s existing professional development offerings to bring an expanded slate of benefits to members. The addition of FSP expands NAIFA’s reach into a broader spectrum of financial professionals, including attorneys, CPAs, and other advisors who work collaboratively on advanced planning issues.

NAIFA was a founding member of the Life and Health Insurance Foundation for Education, now known as Life Happens, NAIFA has remained a key supporter. Life Happens, a non-profit organization, focuses on consumer education about the importance of life insurance and related products in a sound financial plan. It conducts three national awareness campaigns each year: its flagship Life Insurance Awareness Month in September, Insure Your Love in February, and Disability Insurance Awareness Month in May. Life Happens is now NAIFA’s consumer outreach arm.

While the merger of these three brands was top-ofmind for NAIFA for much of 2023, our association continued to provide great value and political advocacy excellence for our members and the greater community of insurance and financial professionals throughout 2023. We held tree successful signature events: the 10th annual Congressional Conference, the Apex East professional development conference, and the National Leadership Conference/Belong awards gala. Our advocacy wins included: the enactment of the NAIC best-interest model for annuity transactions in 11 state, bringing the total to 44 (and counting) by year-end; final Centers for

Medicare and Medicaid Services finalized rules governing practices involving advising/selling Medicare Advantage (MA) and Part D (prescription drug) plans that incorporated NAIFA-suggested changes; and testimony, written, comments, and a survey on the Department of Labor’s fiduciary-only rule for financial professionals that teed up a lawsuit NAIFA and allied have filed in 2024 to overturn the harmful regulation. NAIFA also continue providing exceptional value through our advocacy and professional development webinars, Advisor Today podcasts and blog posts, advocacy briefs and reports, state and local chapter programming, and much more.

While we look back on our successes of 2023, we know that the best of NAIFA is yet to come. Our expanded professional development and consumer outreach abilities – delivered through our FSP and Life Happens brands – promise to provide NAIFA with greater exposure and influence and NAIFA members with more opportunities to build professional success. We look forward in 2024 to beginning the process of building on our NAIFA 2025 strategic plan by formulating a new strategic plan to carry us upward and onward through the year 2030. We are putting together a number of the best strategic thinkers from among NAIFA membership, our professional staff, outside industry leaders, and association management consultants to ensure our new plan sets NAIFA on a course to continued success and maximizes our value to members and positive impact on the industry.

While 2023 built our excitement and gave us much to be proud of as an association, 2024 and beyond promise to see us fulfill our greatest potential. We look back with fond remembrance and ahead with enthusiastic anticipation.

NAIFA sets the standard for advocacy excellence in the insurance and financial services industry. There are NAIFA members who are constituents, voters, and employers in every U.S. Congressional district. The NAIFA network of grassroots advocates is second-tonone. NAIFA members share with policymakers the stories of their Main Street clients – the individuals, families, and businesses in their communities directly affected by the laws and regulations that either benefit or harm Americans’ financial security and prosperity. NAIFA is the only association for insurance and financial professionals with advocacy presence at the federal, interstate and state levels. NAIFA is the only one holding influence with lawmakers and regulators not only at the federal level but in every state capital.

NAIFA state chapters hold legislative days in state capitals that encourage NAIFA members to interact directly with lawmakers. Leaders and lobbyists testify before legislative and regulatory bodies on issues important to insurance and financial professionals and their clients. NAIFA members are regular participants in signing ceremonies with lawmakers and governors. NAIFA chapters support candidates for office with political action committees in every state. Important state issues in 2023

included laws and regulations promoting financial literacy education, senior financial protection, and the NAIC annuity best interest standard. NAIFA also worked to oppose state-sponsored retirement and long-term care programs in multiple states.

NAIFA has a working relationship with interstate groups like the National Association of Insurance Commissioners (NAIC), National Council of Insurance Legislators (NCOIL), and North American Securities Administrators Association (NASAA). NAIFA Government Relations team staff regularly attend their meetings and offer testimony, comments, and other input that help shape model laws and regulations frequently adopted by the states.

NAIFA leverages its influence on behalf of insurance and financial professionals and consumers with all three branches of the federal government: the Executive (SEC, DOL, OMB, IRS, and the Office of the President), Judicial (successful lawsuits filed in federal courts), and Legislative (relationships with members of Congress, influential Capitol Hill fly-ins, and one of the industry’s largest political action committees).

On April 12, the Centers for Medicare and Medicaid Services finalized rules governing practices involving advising/selling Medicare Advantage (MA) and Part D (prescription drug) plans. The rules cover practices applicable to plan sponsors, agents, brokers, and third-party marketing associations.

The House passed the NAIFA-supported Employer Reporting Improvement Act, which provides employers flexibility about what personal information they have to provide on behalf of their employees and their families.

On February 27, the House passed the NAIFAsupported SECURE Notarization Act of 2023 by a voice vote.

On January 30, the House passed a bill that would give financial services professionals better tools to deal with suspected financial exploitation and abuse of seniors.

NAIFA president, Bryon Holz, and his client, Chuck, brought authentic voices to the DOL proceeding concerning the proposed fiduciary rule and complemented the testimony of industry lobbyists.

On January 19, 2023, the president signed legislation that extends the National Flood Insurance Program’s authorization to March 8, 2024.

This new guidance, requested by NAIFA, provides a much-needed transition period for certain SECURE 2.0 changes to ensure that financial professionals and plan sponsors can get the proper systems in place and ensure that retirement savers understand how they will be impacted by the changes.

Producer

• Enacted the NAIC Annuity Best Interest Model in 11 States, including Tennessee, Illinois, Georgia, West Virginia, Wyoming, Washington, Florida, Oregon, Kansas, Oklahoma, and Utah.

• Tennessee - Defeated a bill that would give funeral directors the ability to obtain a decedent’s life insurance policy information.

• Stopped legislation to enact statesponsored retirement plans in Rhode Island, Mississippi, North Carolina, Kansas, Tennessee, and Washington.

• Washington, Alabama, and Tennessee eliminated insurance producer prelicensing mandates.

• Indiana - 15th State to allow CE credit for association membership.

• Texas - Enacted legislation allowing remote ink notary (RIN) within existing statutory Remote Online Notary (RON) framework.

• Arkansas and Tennessee enacted bills to allow employers to offer group family leave insurance.

• Texas and Florida now authorize agents who already transact life insurance policies to also offer family leave products.

• West Virginia, Idaho, Indiana, Alabama, Montana, Minnesota, Connecticut, and Wisconsin enacted legislation that will require high school students to complete a personal finance course to satisfy graduation requirements.

• The National Association of Insurance Commissioners (NAIC) issued a NAIFA-backed statement touting the NAIC’s best-interest model for annuity transactions and disagreeing with an administration statement favoring a DOL fiduciary-only rule.

• NAIFA’s Roger Moore was appointed to represent NAIFA on the Board of the National Insurance Producer Registry, an NAIC affiliate.

• NAIFA testified at the 2023 National Conference of Insurance Legislators (NCOIL) Summer Meeting, opposing U.S. DOL efforts to create a fiduciary-only standard for financial professionals.

• On July 21, NCOIL adopted a NAIFA-backed resolution to oppose any new fiduciary rule from the DOL.

• NAIFA’s Bianca Alonso Weiss was elected to serve on the NCOIL Industry Education Council Board.

• NAIFA opposed proposed changes to the North American Securities Administrators Association’s (NASAA’s) Model Rule on Dishonest and Unethical Business Practices of Broker-Dealers and Agents that would conflict with the SEC’s Regulation Best Interest and cause unintended harm to investors.

May 22-23, 2023

The 2023 Congressional Conference emphasized the importance of good NAIFA citizenship, which NAIFA members exhibit through their engagement in the areas of membership, grassroots, and IFAPAC. A Trifecta Committee panel consisting of NAIFA National President-Elect Tom Cothron, Grassroots Liaison Dennis Cuccinelli, IFAPAC Liaison Chris Gandy, National Membership Chair Carina Hatfield, National Grassroots Chair Josh O’Gara, and National IFAPAC Chair Barry Johnson discussed how NAIFA’s Triangle Team members are graduates of NAIFA’s Leadership in Life Institute (LILI), have earned their Financial Security Advocate badge, and contribute to IFAPAC. The panel discussion was moderated by NAIFA Secretary Doug Massey.

A second panel explored their “Passion for Politics and Public Service” as NAIFA members. The discussion by loyal NAIFA members Kris Alfheim, Demetrius Bryant, Vinny Dallo, and Rick Demko was moderated by NAIFA Past President Robert Miller.

Miller wrapped up the first day of Congressional Conference with a moving tribute to NAIFA Past

President Terry Headley, who himself held a deep passion for advocacy and IFAPAC.

Featured speakers on Day 1 of the event included:

• Susan Neely, President and CEO of the American Council of Life Insurers (ACLI)

• NAIFA President Bryon Holz

• NAIFA CEO Kevin Mayeux

• The Honorable Kevin Hern (R-OK)

• The Honorable Brad Schneider (D-IL), who is a former NAIFA member

Highlighting the Congressional Conference were grassroots meetings between financial professionals and lawmakers on Capitol Hill. More than 500 Congressional Conference attendees met with more than 300 congressional offices and spoke with lawmakers and senior staff about important financial security issues. They shared their clients’ stories to the important work they do on behalf of consumers and their communities.

NAIFA is the leading advocacy association of insurance and financial professionals in the United States with thousands of members participating and making a difference in high-impact events. Our grassroots run deep in Washington, D.C., and extend to every state capitol. In 2023, NAIFA held several Washington Fly-Ins in addition to the Congressional Conference:

• The Inaugural Women’s Financial Security Fly-In

• The World Financial Group Fly-In

• The National Leadership Conference

NAIFA chapters around the country held 42 state Legislative Days over the first half of 2023. These events help NAIFA members build relationships with lawmakers and regulators at the state level where many of the policies governing the products and services they provide are formed. NAIFA is

the only association for agents and advisors with strong advocacy influence in Washington, D.C., and all 50 states. NAIFA members also frequently testify at state-level hearings and committee meetings on policy proposals that impact their businesses and clients.

NAIFA members held more than 135 In-District Meetings with federal lawmakers and senior staff during the recent Congressional recess. This is the second post-COVID year in a row that the number of meetings has reached triple digits. In addition, many NAIFA members also met with state officials over the summer.

All of these meetings solidify NAIFA as the leading grassroots voice for insurance and financial professionals and the consumers who rely on them for products, services, and advice. They helped NAIFA members create or nurture meaningful, influential relationships with people whose decisions affect the financial security of every American.

The meetings produced some immediate results:

• Representative Jeff Jackson of NC agreed to join the Financial Literacy and Wealth Creation Caucus.

• Representative Eric Burlison of MO agreed to join the Financial Literacy and Wealth Creation Caucus.

• Representative Jim McGovern of MA agreed to join the Financial Literacy and Wealth Creation Caucus.

• Representative Bob Good included the meeting with NAIFA-VA in his newsletter.

• Representative Ashley Hinson included the meeting with NAIFA-IA members in her newsletter.

NAIFA’s Financial Security Advocate Academy is a free benefit that helps members become the best grassroots political advocates they can be. The online, self-paced course covers the fundamentals of advocacy and graduates to advanced concepts. Those who complete the course learn to effectively communicate with lawmakers, build lasting relationships, serve as influential resources, and fully participate in the political process. NAIFA members who complete the six FSA modules receive the FSA badge from Credly.

The Insurance and Financial Advisors Political Action Committee (IFAPAC) allows contributors to combine their financial support for candidates who understand and support the insurance and financial services industry across all 50 states and at the federal level. In 2023, IFAPAC exceeded its contributions goal by raising $1.5 million from 3,000 contributors, a member participation rate of 17%.

The Society of Financial Service Professionals is the industry hallmark when it comes to education and professional development. The merger of NAIFA and FSP does nothing to diminish that and the FSP brand, under the NAIFA umbrella, continues to offer all the great products and resources it always has. Now, it adds existing NAIFA programs and makes all of these benefits available to a wider audience.

The Journal is celebrating its 75th year of publication and over that time has risen to the top as the standard of excellence in financial services publications. From its roots in insurance, pensions, and estate planning, the Journal has evolved into a vehicle for groundbreaking applied research on topics of concern to the holistic financial planner. It is a blind peer-reviewed journal with a competitive nature for publishing insightful articles of the highest level that enhance the ability of financial planners to serve their client base.

The Journal of Financial Service Professionals publishes insightful peer-reviewed articles and regular

columns by industry experts in all areas of financial planning, including retirement planning, estate planning, insurance, investments, tax, health care, ethics, and technology.

All NAIFA members now have access to the Journal of Financial Service Professionals via the Member Portal on NAIFA’s website.

The webinars are presented by industry subjectmatter experts and cover a broad range of topics of interest to insurance and financial service professionals. Educational levels range from earlycareer to advanced. The webinars are designed to give attendees actionable information and resources they can use for the benefit of their practices and clients. Many of the webinars offer the opportunity for attendees to earn continuing education credits.

Presentation materials and recordings are also provided to everyone who registers. The NAIFA-FSP Webinars are free to NAIFA members and available to non-members for a fee.

The FSP Institute is an annual event that draws some of the most successful financial service professionals from a broad range of practice specialties. It is a haven for productive networking and a unique environment that inspires collaboration.

We call it our premier educational event. We boast about the quality of the presentations and the expertise of the speakers. We brag about the attendees who haven’t missed this annual event in 5, 10, 15, 20, even 25 years.

But these not quite adequate words are an attempt to describe the indescribable experience of the FSP Institute.

The FSP Institute is truly something special on the landscape of professional development programming. It dates back to 1946 when it was first held at Arizona State University and today it still has all the flavor of a college classroom learning experience, including comprehensive discussions on complex topics and sophisticated planning concepts. Beyond that, and perhaps more importantly, the FSP Institute features the energy and camaraderie that comes from education in a group setting among talented individuals.

What we are trying to say is that the magic of the Institute comes from not just what participants learn from presenters – although that’s incredibly good stuff – but it’s what the speakers learn from the attendees; it’s the tips and tactics, ideas and strategies that are shared from attendee to attendee over breakfast, at lunch, and during the cocktail receptions. It’s a morning-to-night full immersion educational experience.

Members sometimes express concern that they aren’t ready for the “Institute experience”; that it might be too high-level for them. To this apprehension, we reply simply: if you are committed to FSP’s core values of relationships and education, and you strive to serve your clients with excellence, then you are 100 percent ready.

This year’s Institute was held in January in Jacksonville, FL, and it attracted financial professionals from around the country.

The Society of FSP is now the premier educational and professional development arm of NAIFA. Members benefit from access to the Journal of Financial Service Professionals and a robust slate of webinars and other resources. NAIFA members receive a special registration rate for the FSP Institute and may also take advantage of an expanded networking group as we welcome financial professionals from a broad range of practice specialties, including attorneys, CPAs, and others, into the NAIFA family.

NAIFA hosted its inaugural regional conference based on its national conference named Apex – Apex East – October 24 at its association headquarters building in Arlington, VA. Apex East is a regional spin-off of the Apex conference that was launched in August 2022 and will be held again in Arizona in September 2024.

Apex East brought together high-performing producers and their colleagues in the financial services industry, including professionals in the fields of estate planning law, accounting, financial technology, performance coaching, wellness, and others. The dynamic event was designed to help attendees boost production and their professional performance. It featured top-notch speakers and exhibitors and provided significant networking time to allow attendees to build professional connections.

Attendance was limited to the first 100 registrants to ensure a robust networking environment.

Featured presenters at Apex East included:

• Lynne Franklin, a leadership communications expert, author of Getting Others to Do What You Want, and a top TEDx Talk presenter whose presentation on how to be a mind reader had 4 million views. At Apex East, she will present “Be the Most Persuasive Person in the Room: Build Rapport & Connection.”

• Max Major, The Mind Hacker, is a worldrenowned mentalist and expert in influence and body language. He has performed and enlightened audiences at corporate events around the world.

• Shailini George, Professor at Suffolk University Law School and a well-being advocate, will present “The Cure for the Distracted Mind.”

NAIFA’s Leadership in Life Institute (LILI) has started celebrating its 25th anniversary early with exciting new developments. Furthering its mission of growing leaders for NAIFA while providing transformative growth to LILI students, LILI has enhanced the curriculum.

For 2024 NAIFA has added content within the topic of Covey’s Habit 4: Think Win-Win addressing the abundance mindset. This added content will also feature more from Viktor Frankl, author of Man’s Search for Meaning and the founder of Logotherapy or the therapy of meaning.

Also new in 2024, LILI has added a postgraduate class that will occur three months following graduation. This 90-minute class will provide an opportunity for graduates to reflect on their LILI experiences in light of the passage of time. It will also be a forum to discuss the fulfillment of the graduates’ service commitment to NAIFA and their progress on two new homework assignments, nominating a student for LILI and recruiting a new NAIFA member.

For more information on hosting LILI in 2024 please contact Brendan Bernat at bbernat@naifa.org. To enroll in LILI visit: https://tdc.naifa.org/lili

NAIFA Live is the hybrid, in-person-plus-virtual, monthly meeting for all NAIFA members that features a top speaker. networking, and camaraderie. NAIFA Live takes it to a new level by eliminating geographic limitations and ensuring everyone hears a top speaker each month. Members may attend in person, virtually as individuals, or via watch parties organized by agencies and firms or NAIFA chapters. Hundreds of members participate in real-time, and hundreds more watch on-demand. NAIFA Live speakers in 2023 included:

• LILI has graduated more than 3,000 NAIFA members.

• 70% of LILI graduates report a measurable growth in their books of business during the year following graduation.

• More than 95% of LILI graduates have completed or are completing their twoyear association service pledge.

• 12 of NAIFA’s past 15 National Presidents are LILI graduates.

• NAIFA’s 2024 President and two NAIFA officers in line to be our 2025 and 2026 Presidents are LILI graduates.

• In recent years, more than 65% of NAIFA State Chapter Presidents have been LILI graduates.

NAIFA

Completed LILI in 2023

• Joey Davenport: “Practice Growth & Success”

• Tom Henske: “Too Many Clients – A Nice Problem”

• Ryan Barradas, Julian Movsesian, Dan Munroe, and Howard Sharfman: “Super-Producers Share Their Secrets of Success”

• Deirdre Van Nest: “Get to the Yes! How to Increase Trust, Connection, and Likeability in Three Minutes or Less”

8 NAIFA Live Events in 2023 2,400+ Participants

Since 1984, NAIFA’s LUTCF designation has been among the most recognized and valued professional designations in the financial services industry. Over the past 40 years, more than 70,000 insurance and financial advisors have earned the LUTCF designation.

During 2023, NAIFA was in the process of completely revising the LUTCF program to better suit modern students and satisfy the needs of today’s professionals. The new LUTCF consists of a series of online, self-paced, educational modules. Each module can be accessed via a student’s personal computer and contains both audio and video elements.

The LUTCF is especially relevant to younger advisors who are determined to thrive during their first five years in the business. While the curriculum provides a broad base of industry and product knowledge, a core focus is the fact finding, prospecting, sales, and closing skills that are essential to a successful career in the industry.

Each LUTCF module includes instruction in a specific topic area, such as Whole Life Insurance, Annuities, and Estate Planning Products. These modules are housed within three Courses required to complete the LUTCF designation:

• Course 1: Advising Process, Risk Management, and Life Insurance

• Course 2: Investment and Protection Products

• Course 3: Wealth Management, Retirement Planning, and Estate Planning

Each of the three courses contains a comprehensive quiz students must successfully complete. In addition, each student must achieve a passing score on the final exam before the LUTCF designation is conferred.

To ensure that LUTCF students understand and apply the course content, they complete a student learner guide in conjunction with each of the educational modules. Fieldwork guides include course-related questions to be discussed with the students’ mentors. Students are encouraged to choose mentors who they know within the profession. However, NAIFA will provide a NAIFA member mentor who has earned the LUTCF as necessary. Learn

The NAIFA Centers of Excellence provide financial professionals with resources and access to experts in specific practice areas, including Limited and Extended Care, Business Performance, and Talent Development. In 2023, the Centers provided insurance and financial professionals resources via blog posts, webinars, and connections with leaders in specialized fields.

2,485

1,748

Thank you to the NAIFA Limited and Extended Care Sponsors

NAIFA’s Talent Development Center is focused on packaging professional development programs and tools to ensure that NAIFA members are the best. These include the Young Advisors Team, Leadership in Life Institute, Future Leaders program, and the LUTCF designation. The TDC also houses all materials within the Center that can be used to grow the next generation of financial professionals and ensure that our advisors reflect the diversity and inclusivity of MainStreet USA.

1,514 Blog Subscribers

2,038 Monthly Page Views

1,110 Monthly Website Visitors

Thank you to the NAIFA Talent Development Center sponsors

More than 175 insurance and financial professionals attended NAIFA’s REPRESENT Diversity Symposium on May 22, 2023. Participants shared insights and experiences focused on recruiting more diverse talent into the insurance and financial services industry and creating strategies to reach underserved populations.

Presenters at the event included:

• OneAmerica President of Individual Life and Financial Services (ILFS) Dennis Martin

• Diversity in Government Relations Coalition (DGR) Co-Founder Cicely Tomlinson and New York Life Vice President of Office of Governmental Affairs Whytne Brooks

• Society for Human Resource Management (SHRM) Chief Knowledge Officer Alexander Alonso

• An expert panel of NAAIA Executive Director & COO Omari Jahi Aarons; Aurelius Consulting Group, Inc., Co-Founder & CEO Amir Ali; and C&F Bank Assistant Vice President Pierre Greene, MBA, moderated by NAIFA Trustee Christopher Gandy, LACP.

• Sara Hart Weir, MS, Executive Director of the Kansas Developmental Disabilities Council and a Senior Advisor at ABLE today

• Rachel Pearson, Founder of Engage and President and CEO of The Complete Agency

• A panel of NAIFA Diversity Champion award winners: Christopher Gandy, Stephen Kagawa, Aprilyn ChavezGeissler, Brian Haney, and Evelyn Gellar

• Marques Ogden, an executive coach, corporate trainer, and former NFL player

Membership in NAIFA shows that financial professionals are committed to their professional success. The pledge to abide by NAIFA’s Code of Ethics means that they work in their clients’ best interests. NAIFA members are passionate about achieving peak performance and serving the interests of their clients and communities to the best of their abilities. Numerous NAIFA programs highlight the great work our members and their companies are doing.

NAIFA’s consumer-facing website, financialsecurity. org, features a Find-an-Advisor tool that allows NAIFA members to present themselves to potential clients differentiated by their practice specialties and geographic locations. NAIFA’s Code of Ethics is a set of principles that resonates with consumers and that all NAIFA members agree to abide by. As a key point, it includes the requirement that NAIFA members act in their clients’ best interests.

NAIFA encourages volunteerism among members and an overwhelming number of members serve as leaders in the industry, their association, other organizations and charities, and their communities. NAIFA offers many opportunities for members to distinguish themselves by:

• Serving in national or chapter leadership roles

• Authoring articles for NAIFA publications

• Appearing on NAIFA webinars or podcasts

• Speaking at NAIFA events

• Speaking on behalf of NAIFA in front of other organizations, legislators, or regulators

NAIFA’s annual awards differentiate the best of the best among NAIFA members. They recognize and honor NAIFA members doing great work in the profession, within our association, and in their communities. Many NAIFA chapters offer awards to exemplary NAIFA members at the state and local levels. We celebrate NAIFA’s national leaders and award recipients at the annual National Leadership Conference and Belong event.

NAIFA Quality Awards, the hallmark for outstanding client care, recognize the top NAIFA producers in multiple practice specialties based on production, client service, and adherence to NAIFA’s high ethical standards. In addition to the NQAs, NAIFA presented national individual awards in 2023.

The John Newton Russell Memorial Award is the highest honor accorded by the insurance industry to a living individual who has rendered outstanding services to the institution of life insurance. The selection committee consists of representatives of the leading organizations in the life insurance and financial services industry. NAIFA serves as the award’s custodian.

Joseph W. Jordan, inspirational speaker, behavioral finance expert, best-selling author, and one of the founders of the Insured Retirement Institute (IRI), is the recipient of the 82nd annual John Newton Russell Memorial Award.

Jordan entered the insurance business in 1974 and later became the Vice President of Insurance Sales at PaineWebber before moving to MetLife. Until 2012, he was Senior Vice President – Retail Product Development at MetLife, where he started their fee-based financial planning program and behavioral finance department.

Over the past 11 years, Jordan has become one of the most sought-after speakers in the insurance and financial services industry. He has been the keynote speaker at numerous events, including MDRT Experience, the LIMRA Distribution Conference, The American College Knowledge Summit, the Asian Pacific Life Conference, and numerous NAIFA events. He has spoken in far-ranging locations spanning the globe, including Mexico, Canada, Brazil, the U.K., Italy, Poland, Hungary, Romania, Greece, India, Thailand, the Philippines, Singapore, Malaysia, China, Korea, Japan, and Australia.

John Davidson

The Terry Headley Lifetime Defender Award honors a NAIFA member who shows exemplary service to their profession, colleagues, clients, and community through political advocacy and contributions to NAIFA’s IFAPAC.

NAIFA is proud to announce that John A. Davidson, LUTCF, FSS, President and CEO of Davidson Insurance & Financial Services, Inc., in Moorpark, CA, is the 2023 recipient of NAIFA’s Terry Headley Lifetime Defender Award.

Davidson, a loyal member since 1982, was NAIFA’s National President in 2006-2007. He had previously served on NAIFA’s National Board of Trustees beginning in 2001 and as NAIFA-California’s President in 1999-2000. He was also President of NAIFA-San Fernando Valley from 1988-1989.

In 2010 he was a candidate for U.S. Congress in California’s 23rd Congressional District and finished second in the Primary.

He is a founding member of the NAIFA Congressional Council and regularly participates in NAIFA advocacy events, including the annual Congressional Conference, summer In-District meetings, and California State Legislative Days. Members of Congress Davidson has met with include Tom McClintock (CA-4), Mike Garcia (CA-27), Kevin McCarthy (CA-23), Zach Nunn (IA-3), Ralph Norman (SC-5), Kevin Hern (OK-1), Julia Brownley (CA-26), and Senator Kyrsten Sinema (AZ). He is a Platinum-level contributor to NAIFA’s political action committee, IFAPAC. He has completed NAIFA’s grassroots training course and holds the Financial Security Advocate badge.

The Young Advisor Team Leader of the Year is a NAIFA member under the age of 40 who has shown extraordinary commitment to serving NAIFA and the insurance and financial services industry in leadership positions.

Joseph Schreck, CPFA, President at the Piedmont Group in Atlanta, GA, is the NAIFA Young Advisor Team Leader of the Year for 2023. Schreck, a loyal member since 2016, is the 2023 President of NAIFA’s Georgia state chapter and a graduate of NAIFA’s Leadership in Life Institute (LILI) program. He was a former President of NAIFA-Atlanta and has been named one of the “Top Advisors Under 40 of Atlanta” for three years in a row. He is politically involved, advocating on behalf of his business, colleagues, and clients in meetings with lawmakers at NAIFA’s Congressional Conference and Georgia state Legislative Days.

Winona Havir

The NAIFA Diversity Champion is a NAIFA member recognized for exceptional efforts to promote the full and equal participation of diverse people in the insurance and financial services industry and to work with underserved communities.

Winona Havir, CPCU, CLF, LUTCF, FSS, LACP, AIC, Executive Vice President, Business Development for Educators Insurance Resources Services, Inc. (The Horace Mann Companies), in Saint Paul, MN, has been recognized as the NAIFA Diversity Champion for 2023.

Havir, a loyal NAIFA member since 1997, serves on NAIFA’s Board of Trustees and is a Trustee Liaison to NAIFA’s Diversity Council. She is a Past President and charter member of the Greater Twin Cities chapter of Women in Insurance and Financial Services (WIFS). She has been a panelist and speaker at NAIFA Diversity Symposia and is recognized as an advocate for diversity within the insurance and financial services industry. Her article, “Everyone Has a Money Story” published in California Broker magazine, relates the story of her immigrant father’s financial challenges and promotes the financial empowerment of Americans from diverse communities.

Advisor Today Magazine’s 4 Under 40 Awards, sponsored by NAIFA’s flagship publication, recognize advisors who have achieved professional excellence and shown outstanding commitment to serving their clients, colleagues, and communities.

The 2023 4 Under 40 awards are Matthew Cloutier, CRC, RFC, of Golden Wealth Solutions (Osaic) in Littleton, CO, loyal member since 2022; Jennifer Lewis of Wise Medicare Insurance Solutions (United Healthcare) in Rolla, MO, loyal member since 2022; Joseph Spinelli, CLU, FICF, LUTCF, of the Jim Spinelli Agency (Knights of Columbus) in Tallahassee, FL, loyal member since 2009; and Mike Paffhausen, of the Paffhausen Insurance Agency (State Farm) in Butte, MT, loyal member since 2015.

Advisor Today is NAIFA’s flagship publication, the Lifestyle Magazine for Today’s Modern Advisor. In 2023, Advisor Today published three print issues mailed exclusively to NAIFA members. The Advisor Today blog provides a steady stream of articles posted on the Advisor Today online platform. The Advisor Today brand also includes podcasts and webinars. Advisor Today brings financial professionals exciting content, where they want it, when they want it, and in the format they choose.

Advisor Today Webinars featured presentations by top thought leaders in the insurance and financial services business, including:

• Schyler Adams, Director of Advanced Strategies & Planning Platforms at Allianz

• Toby Kominek, Sr. National Sales Manager, LifeSecure Insurance Company

• A panel including Bryan Albert of Eagle Life, Ellen Donovan of Allianz, and Rona Guymon of Nationwide Financial

Advisor Today Podcasts are hosted by NAIFA Trustee and top OneAmerica Producer Chris Gandy and NAIFA VP of Membership Suzanne Carawan. Interviews highlight and provide insights from some of the top professionals in the business. Advisor Today podcasts are available on all major podcast platforms, including Spotify, Apple Podcasts, Google Podcasts, Amazon Music, iHeart Radio, and Stitcher. Among the podcast guests in 2023 were:

• Joe Templin, Co-founder and CEO of The Intro Machine

• Ken Leibow, Founder and Chief Executive Officer of InsurTech Express

• Marques Ogden, former NFL player and executive coach

83,891 Blog Subscribers

8,100

24 Years – Average Number of Years in Business

• Lara Galloway, SVP of Channel Management at White Glove

• Joe Jordan, speaker, author, and financial services industry legend

• Harry Hoopis, entrepreneur and founder of the Hoopis Performance Network

• Lynne Franklin, persuasion expert, leadership communication consultant, coach, author, and TEDx speaker

50,363

NAIFA is a trusted source and subject of interest for influential media outlets. The association appeared in more than 225 stories in more than 88 media outlets in 2022, including Barron’s, Broker

World, CNBC, Financial Advisor, Forbes, The Hill, InsuranceNewsNet, InvestmentNews, and Politico.

• 45 Press Releases Issued

• 35 Press Releases Distributed Through PRWeb

Our new National President Tom Cothron is putting the association’s focus fully on membership this year. With the expanded NAIFA Family that now includes Life Happens and the Society of Financial Service Professionals, our association has grown by nearly 2,000 members. The incoming members bring a huge amount of energy and opportunity in terms of new subject matter experts, new individuals with whom to network, and new potential volunteer leaders who can continue to drive our vision of One NAIFA forward. While the expansion will welcome new people into existing chapters, we are also likely to see the formation of new chapters and the expansion of affiliate programs. NAIFA is perfectly poised to now offer programming virtually across all geographic lines, as well as at the local level through in-person NAIFA Live watch parties, networking events, and meetings.

The flexibility that we now have as an association to welcome in new members from a multitude of disciplines and have the ability to connect people at the local, state, and national levels creates an incredible opportunity for networking and expanding your circles of influence. Gone are the days when an individual defined their membership by the local to which they belonged; today’s member understands that they can attend a local mixer, go to their statehouse, meet people across the country through NAIFA Live or Member-to-Member programs, and then see them in-person each May on Capitol Hill. The opportunity to build your network on a national level through the NAIFA platform is a powerful value proposition that only our association offers—and we want everyone to know it!

This year, we are focusing on improving and expanding our membership programs. First, we want to acknowledge that we are first and foremost, a word-of-mouth network and the members that

get the most out of NAIFA and grow the most personally and professionally come from referrals. This year, we are making it even easier for everyone to refer a member and get the credit due for your endorsement of NAIFA. We will recognize our Top Recruiters each month and continue to award a quarterly and annual Hard Hat award to those members that are doing the hard work of keeping our association strong. The quarterly and annual Hard Hat awards are also now available for grassroots and IFAPAC activity so that we can showcase the three pillars that keep NAIFA a formidable force at the state and federal levels. You can easily refer a candidate to membership by going to belong.naifa.org/refer

Following joining, we want to make sure that new members are welcome and learn both the history of NAIFA as well as get a sense of all that NAIFA has to offer so that the individual can begin to build out their personal plan for how to utilize their membership for professional growth. We hold orientation sessions every Monday at 3 pm eastern to review all that is new at NAIFA. Anyone in NAIFA Nation is invited to attend so consider it an open invitation to refresh yourself on our expanded benefit portfolio and brush up on new program offerings.

New this year are several Member-to-Member (M2M) Programs that we have instituted due to popular demand and at the advice of our external Industry Leadership Board that made it clear that NAIFA can fill a needed void by offering peer-to-peer training and networking that carrier companies do not. Several of the programs have existed in years past and are being re-instituted and revitalized to allow more members to meet each other, and take

on high-profile leadership roles in the association. The new M2M programs are all completely without cost to you and the members that run them have freely given their time, talent, and treasure for the good of the association. New programs include:

The YAT program has been overhauled to be better than ever for 2024. We took an award-winning program called the Advisor Ambassador Program and brought it back into the fold to offer as a jump start career accelerator for new advisors. The 4-week virtual program is entirely run by YAT leaders speaking to other YATs on topics deemed critical for making it in financial services: time management, prospecting, building your brand/ circles of influence, and tips and techniques for achieving peak performance that lasts through a personal coaching session featuring long-time member Joe Templin, who is part of our Coaches Circle and former National 4 Under 40 winner.

The program will run monthly, starting in February, and is a great outsourcing tool for managers with young professionals, as well as independent young professionals. The topics are broad enough to be applicable to professionals in all fields and we welcome in new attorneys and accountants as well into the program. Graduates of the program will receive a digital badge and certificate, as well as national recognition through our Advisor Today platform that has over 80,000 subscribers and within our Members News AIdriven member newsletter.

In addition to the 4-week accelerator program, the YAT program will also feature a new YATonly blog, feature a book group, and encourage YATs to form study groups. YATs can also take part in MentorLoop- a mentor-mentee matching program that pairs up seasoned members who have

volunteered to be a mentor with mentees. The opt-in program also does not carry a fee and is open to all members. Learn more at members.naifa.org/mentor

Another M2M program that we are reintroducing is our personal coaching program with Coaches Circle and long-time member, Dan Finley of Advisor Solutions. The program will run twice a month on Thursdays and is open to all active members regardless of where you are in your career journey. Spots are limited, but you can sign up for as many sessions as you want throughout the year. We only ask that if you take a spot, you show up so that another member doesn’t miss out on receiving toplevel coaching from one of our best. Dan focuses on a specific topic each session and covers everything from “Mastering Personality-Based Selling” to “Beyond the Production Plateau”. To see the full list of topics and sign up for a session, go to members. naifa.org/coaches-circle-daniel-finley.

Introduced in 2023, our Triangle Team recognizes our top members who are active in membership, grassroots, and IFAPAC. This exceptional group is recognized by name within the Members portal, received a special pin and certificate, and extra benefits at key signature events. This year, Triangle Team members also will receive two Peak Performance virtual workshops by loyal member, best-selling author and speaker, Frank Maselli. The two virtual workshops will focus on providing this illustrious group with extra tools and techniques to establish trust faster that leads to the creation of more long-term relationships with clients. Frank is a master at using seminar and public speaking strategies to establish credibility and walk away with appointments that have higher closing ratios than his colleagues. Learn techniques for how he has mastered the art of public speaking to drive top-line growth.

NAIFA is the big tent association for insurance and financial professionals. We provide an association home for professionals who serve a broad array of the American public’s financial services needs. We have grown with the times, joining with the Society of Financial Service Professionals to expand our membership base and secure our position as an industry leader in education and professional development. NAIFA has brought on Life Happens, the leading source of highly impactful consumer information in the industry, to bolster our public

outreach, promote the essential work done by our members, and educate the public on the vital products and services NAIFA members provide.

NAIFA members have dedicated their professional lives to providing American families and businesses with products, services, and advice that promote financial security and help their Main Street clients create and achieve their financial goals.

Membership in NAIFA shows commitment to professional success and dedication to serving the best interests of clients. NAIFA Members Serve the Financial Needs of Main Street.

25 Chapters Received their Certified Leadership Board Certificate

84

NAIFA Chapters: 53 State & Territorial Chapters + 31 Local Chapters

23

Chapters Managed by NAIFA Association Management Services

50 State Chapters Implemented Comprehensive Affiliate Programs Resulting in 226 Affiliates

78 of 79 FSP Component Entities have Successfully Merged into the NAIFA Family

100% of Chapters are in Full Compliance with their Chapter Operating Agreements

33

Chapters Received a Chapter Excellence Award – 6 Platinum, 6 Gold, 15 Silver and 6 Bronze

25 Chapters Received their Certified Leadership Board Certificate

NAIFA works with the leading companies in the insurance and financial services industry to promote the role of financial professionals and advance financial opportunities for all Americans. We thank the partners who help us complete our mission. To learn more about becoming a Corporate Partner, please contact NAIFA at infor@naifa.org.

NAIFA partners with many other associations in industry coalitions to promote the interests of financial professionals and consumers. In addition, we are proud to be the voice of the producer, at state and federal levels, for the following associations: