Tom Cothron Gets Back to Basics

6

NAIFA

7

The

6

NAIFA

7

The

As the world celebrated the start of 2024, the NAIFA nation also celebrated its union with the Society of Financial Service Professionals. This completed its three-way merger including Life Happens, building on our brand as the oldest, largest, and preeminent association for insurance and financial services professionals.

While the merger was complete with the strike of the clock, much remains to be done to integrate the organizations and fully realize the promise of this great opportunity. Most notably, the integration of FSP’s 79 chapters and communities into NAIFA has been the focus of our newto-NAIFA and veteran FSP staffer Brian Horn, who serves as VP of Operations and Integration, as well as VP of Member and Chapter Services Corey Mathews and the Chapter Services Team, under the direction of the NAIFA/FSP Integration Committee, chaired by FSP legacy leader and new

NAIFA’S ADVISOR TODAY

Kevin Mayeux, CAE, NAIFA CEO kmayeux@naifa.org

703-770-8101

Michael Gerber COO & General Counsel mgerber@naifa.org

703-770-8190

Erni Davis CFO edavis@naifa.org

703-770-8125

David Maola EVP, Society of FSP dmaola@societyoffsp.org

610-526-2551

Diane Boyle SVP, Government Relations dboyle@naifa.org

703-770-8252

Brian Steiner Executive Director, Life Happens bsteiner@naifa.org

703-770-8220

Suzanne Carawan VP, Membership scarawan@naifa.org 703-770-8402

Charmell Davis VP, Member Advancement cdavis@naifa.org

703-770-8225

Brian Horn VP, Operations & Integration bhorn@societyoffsp.org

610-526-2519

NAIFA Trustee Andrew Rinn. They are connecting with leaders and staff of both the former FSP chapters and the impacted NAIFA chapters to tailor integration plans to best serve the expanded membership.

At the time of this writing, the team has successfully integrated or mapped out the timeline for integration of 62 of the former FSP components, which amounts to a stunning 78% of the group. Initial hopes were to reach the halfway point by Congressional Conference, putting the effort well ahead of schedule. The group attributes its brisk progress to the time spent speaking with, and more importantly, listening to the impacted parties’ needs and concerns, positioning us to craft tailored solutions ensuring a quality member experience.

Another exciting element of this effort is the anticipated chartering of a dozen or more of the FSP chapters as new

Corey Matthews, CAE VP, Member & Chapter Services cmatthews@naifa.org 703-770-8404

Phu Ngo VP, Technology pngo@naifa.org 703-770-8130

Sheila Owens VP, Marketing & Communications sowens@naifa.org 703-770-8226

NAIFA NATIONAL LEADERSHIP

President Tom Cothron, LUTCF Southern Farm Bureau Life Insurance Company tomcothron@gmail.com

President-Elect

Douglas B. Massey, CLU, ChFC, FSS Doug Massey Financial Services doug@dougmassey.com

Secretary

Christopher L. Gandy, LACP Midwest Legacy Group cgandy@midwestlegacyllc.com

Treasurer Brock Jolly, CFP, CLU, ChFC, CLTC, CASL, CFBS Veritas Financial LLC bjolly@vfwealth.com

Immediate Past President Bryon Holz, CLU, ChFC, LUTCF, CASL, LACP Bryon Holz & Associates bryon@bryonholz.com

NAIFA CEO Kevin Mayeux, CAE kmayeux@naifa.org

Board of Trustees

Dennis P. Cuccinelli, LACP dennis@dcuccinelli.com

Jesse Dogillo, CFP, CLU, ChFC, AEP jesse@bayadvisers.com

Ernest Guerriero ernie_guerriero@cplanning.com

Brian J. Haney, CLTC, CFS, CIS, CFBS, LACP, CAE bhaney@thehaneycompany.com

Carina Hatfield, LUTCF, CLCS, LACP chatfield@weignerinsurance.com

Stephen Kagawa, FSS, LUTCF skagawa@pacificbridge.net

Barbara Pietrangelo, CFP, CLU, ChFC barbara.pietrangelo@prudential. com

Andrew Rinn arinn@sfgmembers.com

NAIFA local chapters. This will empower those groups to continue to offer the same great networking and education for which they have been renowned, while providing additional members and financial resources to support their efforts. These opportunities and the combined benefits of these organizations will ensure that each member of the expanded enterprise will have access to all of the benefits at nearly half the cost of what it was to belong to both.

We look forward to continuing to work with the remaining entities and all of our chapters to map out the remaining integration plans and continue to raise the bar and maximize our members’ experience.

Questions about the NAIFA-FSP chapter integration should be directed to Brian Horn (bhorn@societyoffsp.org) and Corey Mathews (cmathews@naifa.org).

ADVISOR TODAY EDITORIAL WORKING GROUP

Ike Trotter, CLU, RICP, ChFC Working Group Lead

Laurie Adams, CFP®, CLU, LUTCF, LACP

Brian Ashe, CLU, LACP

Frank Bearden, MSM, PhD, CLU, ChFC

Scott Brennan

Fred Joyner

ADVISOR TODAY STAFF

Sheila Owens NAIFA VP, Marketing & Communications

Mark Briscoe

NAIFA Sr. Director and Editor

PUBLISHED BY

The National Association of Insurance and Financial Advisors 1000 Wilson Blvd. Arlington, VA 22209

Phone: 877-866-2432

Email: info@naifa.org

www.naifa.org at.naifa.org

LAYOUT AND PRINTING BY

4024 Alexandra Drive Waterloo, IA 50702

Phone: 319-233-3731

Email: info@strategic-imaging.com

www.strategic-imaging.com

Business Development Manager: Mike Reyhons

Customer Relations Manager: Jackie Corkery

Layout and Design: Tessa McKenna

Cover Photo provided by NAIFA.

NAIFA’s Advisor Today is published twice annually by the National Association of Insurance and Financial Advisors.

©2024 National Association of Insurance and Financial Advisors. All rights reserved.

PRESIDENTS’ PERSPECTIVE

Without a doubt, what I love the most is being in a position to help others thrive. The trust that my clients place in me has translated into relationships that span decades of their lives, offering me the privilege of walking together with them, a witness to their personal journeys. Like many of you, I have received both the happy calls of “my daughter is getting married!” and the sad calls letting me know the passing of a loved one. This type of trust is sacrosanct in our profession, and perhaps we don’t talk about it enough. Too many people falsely believe that financial services is all about numbers, more about creating wealth for yourself than serving others. Financial advising gives me a perfect platform to be my best self—a servant to my clients who is personally fulfilled while providing financial peace to individuals, business owners, and families.

I often say that you start out in this business then you cross a bridge to where this business is in you. This was exactly my experience considering the real purpose of our business and greater meaning to all of those phone calls I made and appointments I set at the start of my career. Now, decades later, I can say that the business is so embedded within my heart that I know I chose wisely in my career. What I love about our business is that we can positively transform lives. We have the ability to set a path for an individual and to provide the support to follow the plan. Many times our clients don’t have a clear vision of what they want in life and we can help them not just obtain clarity, but make it a reality. Often our clients give us the credit, but we know it was their tenacity to making and sticking to a sound plan—we were just the lucky coach to help them achieve their potential. Having the opportunity to serve in this coaching capacity to others is, to me, one of the things that I love about the work that I’ve chosen to do with my life.

I help clients make financial decisions that make a difference in their quality of life. What I love most is being able to see the real effects of those financial decisions play out in real life. It never fails to amaze me that small choices can have huge effects long-term and to be able to positively affect outcomes makes this a career that has been totally fulfilling. I am not sure that I’ve ever made anyone rich, but I am sure that I’ve prevented many from becoming poor. I have been in this business for almost 40 years and had the opportunity to deliver millions of dollars to beneficiaries, but the one that means the most to me was a small life insurance policy check I delivered which I know for a fact allowed a family to have their electricity turned back on and put food on their table. I love being able to celebrate the wins with my clients. I make calls to my clients when their retirement accounts hit 100K, 250K, 500K, or a million dollars to congratulate them on their achievement. I love creating plans where everyone wins.

CEO CORNER

ach February, we celebrate NAIFA Love Month to show our appreciation for our great association, the volunteer leaders who make it run, and the NAIFA members who serve the financial security needs of American families across the country. This year, with NAIFA’s addition of the Society of Financial Service Professionals and Life Happens, we’ve had more to celebrate than ever.

FSP brings a host of new members to the NAIFA family, including professionals who serve the financial needs of their clients in a wide range of disciplines.

These include attorneys, CPAs, investment advisors, actuaries, and others. It also brings its industry-renowned educational and professional development programs (see page 7).

Life Happens has long been recognized as the leading consumer-education organization in insurance and financial services. The developer and top promoter of Insure Your Love Month (February), Disability Insurance Awareness Month (May), and Life Insurance Awareness Month (September), Life Happens is a natural fit as NAIFA’s consumer-education

arm. We love everything that Life Happens brings to NAIFA, including the extraordinary Life Lessons Scholarship and poignant Real Life Stories program.

Together, NAIFA, FSP, and Life Happens are spreading the love for our industry, NAIFA members, and the American families and businesses they serve like never before.

All eyes have been on the U.S. Department of Labor in recent months and a pair of regulations that could impact the ability of many financial professionals to serve American consumers.

DOL’s revived fiduciary-only proposal reprises many of the concepts in a rule a federal appeals court shot down in 2018 after NAIFA filed a lawsuit along with our partner at the American Council of Life Insurers. The rule would endanger the ability of clients who prefer a commissions-based business model to get financial guidance how and from whom they choose.

NAIFA 2023 President Bryon Holz, along with his long-time client Chuck Ross, provided compelling testimony at a DOL hearing about how the proposed rule would have prevented them from working together had it been in place when they first met. By adding to financial professionals’ costs and forcing many to charge fees and require minimum balances rather than accept commissions, the proposal would price many lower- and middle-income investors out of the ability to receive financial services and assistance.

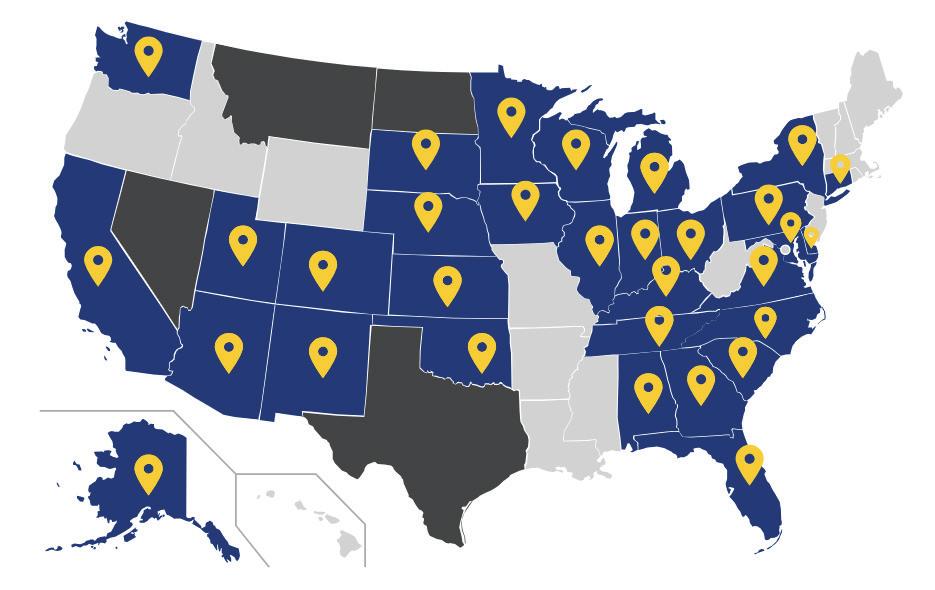

NAIFA members have responded by sending thousands of letters and emails to the DOL and members of Congress discussing the impact the rule will have. More than 250 attendees of NAIFA’s National Leadership Conference had in-person meetings with more than 200 Congressional offices on Capitol Hill in December. The fiduciary-only proposal will also be a key issue at NAIFA’s Congressional Conference in May.

Meanwhile, the DOL issued its final rule on worker classification, which changes the status of some independent contractors to employees under federal labor law.

NAIFA was at the forefront of working to shape the DOL rule in the proposal. In the end, the final rule, while not perfect, does incorporate some of NAIFA’s suggestions. In fact, the rule directly references NAIFA’s comments twice and acknowledges the guidance NAIFA offered.

While the final rule does not provide an exemption for insurance and financial professionals, the changes appear to have blunted its impact. Many carrier companies and the DOL have said that under their interpretations of the rule the status of financial professionals should not change.

NAIFA works with interstate groups like the NAIC, NCOIL, and NASAA to shape policy at the federal and state levels. Most recently, NAIFA Policy Director Roger Moore testified at the NAIC’s Fall Meeting on the harm the DOL’s fiduciary-only proposal would cause. The NAIC previously issued a statement opposing comments by the White House in support of the DOL’s fiduciary-only proposal.

Also at the meeting, Moore was named to represent NAIFA on the National Producer Registry Board of Directors and the Interstate Insurance Product Regulation Commission’s Industry Advisory Committee.

The first quarter of 2024 brings state chapter Legislative Days around the country. These events keep NAIFA members abreast of the state-level issues affecting their businesses and clients. They provide opportunities for NAIFA members to meet with their state-level lawmakers and regulators. NAIFA is the only association for insurance and financial professionals with a highly influential advocacy presence in every state capital. Learn more at advocacy.naifa.org/ statelegislativedays.

NAIFA has revised the Advocacy Action Center to better serve grassroots advocates. The updated Center features sections on:

• Grassroots – Learn how to get politically involved on behalf of your business and clients.

• Advocacy Issues – Learn about critical legislation and regulations in your state and at the federal level.

• IFAPAC – Learn how NAIFA’s political action committee gives us a seat at the table for important policy discussions.

• NAIFA’s Advocacy in Action –Learn how your fellow NAIFA members are making a difference and check out our photo gallery.

The Advocacy Action Center also provides Action Alerts and sections where you can log your relationships with lawmakers and grassroots interactions. Visit advocacy.naifa.org/ center

The Society of Financial Service Professionals is the industry hallmark when it comes to education and professional development. The merger of NAIFA and FSP does nothing to diminish that, and the FSP brand, under the NAIFA umbrella, continues to offer all the great products and resources it always has. Now, it adds existing NAIFA programs and makes all of these benefits available to a wider audience.

The Journal is celebrating its 75th year of publication and over that time has risen to the top as the standard of excellence in financial services publications. From its roots in insurance, pensions, and estate planning, the Journal has evolved into a vehicle for groundbreaking applied research on topics of concern to the holistic financial planner.

It is a blind peer-reviewed journal with a competitive nature for publishing insightful articles of the highest level that enhance the ability of financial planners to serve their client base.

The Journal of Financial Service Professionals publishes insightful peer-reviewed articles and regular columns by industry experts in all areas of financial planning, including retirement planning, estate planning, insurance, investments, tax, health care, ethics, and technology.

Featured articles and columns in the January 2024 issue include:

• “Financial Literacy and Estate Planning in American Households,” by Juan E. Gallardo, PhD, and Oscar Solis, PhD.

• “After You Are Gone: Using Letters of Intent to Coordinate the Roles of Guardians and Trustees,” by Lewis B. Hershey, PhD, MA.

• “Accounting & Taxation: Review of the Federal Tax Real Property Rental Rules”

• “Advice for the Young Planner: Helping Clients Uncover Their True Cash Flow”

• “Entrepreneurship: Navigating the Business Plan”

All NAIFA members now have access to the Journal of Financial Service Professionals via the Member Portal on NAIFA’s website.

The FSP Institute is an annual event that draws some of the most successful financial service professionals from a broad range of practice specialties. It is a haven for productive networking and a unique environment that inspires collaborative learning.

We call it our premier educational event. We boast about the quality of the presentations and the expertise of the speakers. We brag about the attendees who haven’t missed this annual event in 5, 10, 15, 20, even 25 years.

But these not quite adequate words are an attempt to describe the indescribable experience of the FSP Institute.

The FSP Institute is truly something special on the landscape of professional development programming. It dates back to 1946 when it was first held at Arizona State University and today it still has all the flavor of a college classroom learning experience, including comprehensive discussions on complex topics and sophisticated planning concepts. Beyond that, and perhaps more importantly, the FSP Institute features the energy and camaraderie that comes from education in a group setting among talented individuals.

What we are trying to say is that the magic of the Institute comes from not just what participants learn from presenters –although that’s incredibly good stuff – but it’s what the speakers learn from the attendees; it’s the tips and tactics, ideas and strategies that are shared from attendee to attendee over breakfast, at lunch, and during the cocktail receptions. It’s a morning-to-night full immersion educational experience.

Members sometimes express concern that they aren’t ready for the “Institute experience”; that it might be too high-level for them. To this apprehension, we reply simply: if you are committed to FSP’s core values of relationships and education, and you strive to serve your clients with excellence, then you are 100% ready.

This year’s Institute was held in January in Jacksonville, Florida, and it attracted financial professionals from around the country.

The Society of FSP is now the premier educational and professional development arm of NAIFA. Members benefit from access to the Journal of Financial Service Professionals and a

robust slate of webinars and other resources. NAIFA members receive a special registration rate for the FSP Institute and may also take advantage of an expanded networking group as we welcome financial professionals from a broad range of practice specialties, including attorneys, CPAs, and others, into the NAIFA family.

Of course, NAIFA members continue to have access to all of the great benefits and professional development resources NAIFA has offered for years, including the NAIFA Live monthly meetings, the Leadership in Life Institute, the NAIFA Centers for Excellence, the LUTCF designation program, chapter-level programming, and more.

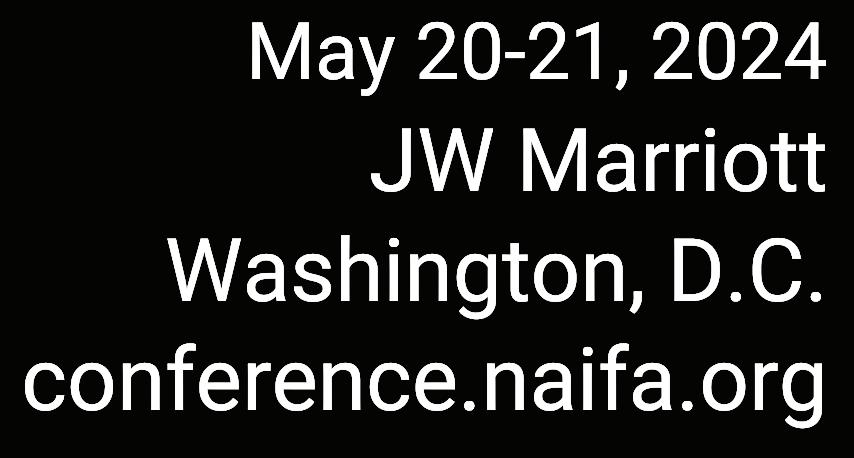

The FSP Institute, a premier educational event for financial service professionals, took place January 28-31 in Jacksonville, Florida. The highlight of the opening reception was the presentation of the 2023 Kenneth Black Award to Kevin E. Baldwin, CLU, ChFC, CAP.

The FSP Institute will provide content for an educational track at NAIFA’s Apex event, September 19-21 at the Arizona Biltmore in Phoenix. Learn more at apex.naifa.org/2024.

Joseph Schreck, CPFA, NAIFA’s 2023 Young Advisor Team (YAT) Leader of the Year, began his financial services career in 2009 when he was fresh out of college with a degree in Business Administration and Economics from the University of Wisconsin-Stevens Point. His first mentor brought him into the business and guided him through some common early-career struggles that frustrate many young advisors.

“I was too immature for the business and I probably didn’t have the greatest work ethic,” Schreck said. “I didn’t know what I was doing, but [my mentor] always spent time with me. He always helped me by explaining things and helped me learn the why before the how, which helped me create a vision for myself.”

With that meaningful guidance, Schreck found his footing and his career took off. He soon pursued an opportunity to move into a management position where he continued his professional growth.

“I failed a ton and learned a ton and eventually found some success,” he said. “I did a lot of recruiting, developing, coaching, and ran that office for a few years and did well.”

The next opportunity led him away from his hometown of Milwaukee. “I packed up my Honda Accord with pretty much everything I had and moved to Atlanta.” For the past eight years he has been with the Piedmont Group, a MassMutual financial planning firm in Atlanta, where he now serves in senior leadership as President.

As a recruiter, Schreck says there are five important traits he looks for in financial professionals:

• Honesty and integrity: “People are trusting you with pretty much everything they have, honesty and integrity are at the top of the list.”

• Willingness to work hard: “I always tell people that you can be really talented in this business and find great success or you can be not as talented and have an incredible work ethic and find great success.”

• Coachability with a growth mindset: #You have to be open to new ideas and be willing to learn. You just don’t know where the next client could come from.”

• A desire to help people: “That’s our job, helping people. When hiring, we need to make sure we’re doing the right job of bringing the right people, good people, into the industry.”

• An entrepreneurial flair: “You’re in business for yourself but not by yourself. The great thing about this industry is there’s so much support.”

Not only has Schreck grown as a leader in his professional life and firm, but he also served as President of NAIFA-Atlanta and the 2023 President of NAIFAGeorgia. He is a graduate of NAIFA’s Leadership in Life Institute (LILI). As state President, Schreck led the successful merger of NAIFA-Atlanta into NAIFAGeorgia, a move that strengthened the association and provided more resources and a better value proposition for members. Prior to the merger, as President of NAIFA-Atlanta Schreck was instrumental in growing NAIFAAtlanta into NAIFA’s largest local chapter based on membership.

One final piece of advice Schreck gives young insurance and financial professionals as well as his more established colleagues is to be actively involved NAIFA members.

“You’re helping the industry and you’re moving the needle, but if you get involved with NAIFA your career does well,” he said. “You get to know some influential people in the community you work in and the people that are successful in the industry, so it’s a great opportunity from a business standpoint. So if you’re looking to grow your practice, getting involved with NAIFA is a good way. It not only helps the association but it helps your business.”

Advisor Today’s 4 Under 40 Awards recognize highly motivated, well-rounded NAIFA members under the age of 40 who balance their work and home lives and are successful at helping their clients secure sound financial futures. They exhibit extraordinary professional success relatively early in their insurance and financial services careers.

Matthew Cloutier, CRC, RFC

Cloutier, 38, is the OwnerOperator of Golden Wealth Solutions (Adviser Group) in Littleton, Colorado, a financial planning firm focused on the business planning, succession, legacy, and retirement needs of clients. Golden Wealth provides visionary guidance to clients by implementing insurance products seamlessly with investment solutions. Cloutier has most recently moved and assisted with the transition of over $50 million in AUM, changing platforms from an insurancebased broker-dealer to an independent model.

Cloutier mentors younger advisors within NAIFA and the Adviser Group to help them focus on career growth. He also accompanies them to NAIFA state Legislative Days to get them involved with advocacy on behalf of their businesses and clients. He has worked with his own mentors to create a “pitch book” for retiring advisors giving them a low-resistance path to exiting the business and handing off their clients to a firm that cares.

Jennifer Lewis

Lewis, 38, is a successful agent with an independent insurance agency in Rolla, Missouri. In that small community, she enrolled over 200 Medicare beneficiaries in her first 18 months. She is an active member of the local chamber of commerce and serves on the Board of the Phelps Connections for Seniors, a local organization that helps seniors. She is a member of the ABLE commission which also helps seniors.

Lewis works with numerous “dual-eligible” clients in the Rola community. This clientele needs more help in understanding their Medicare and Medicaid benefits and she takes all the time that they may need. “I have never seen someone be so patient and

so caring in all of my career,” said Jeremy Tyler, Owner of Wise Medicare Insurance Options. “You can see the mother in her come out when helping our clients.”

Joseph Spinelli, CLU, FICF, LUTCF

Spinelli, 36, is an Advisor for Knights of Columbus Insurance in Tallahassee, Florida. In his first year as an advisor, at age 21, he was named the International Knights of Columbus Rookie of the Year and is a 14-time member of the Supreme Knights Club. Spinelli is also a 13-year qualifier for the Million Dollar Round Table. He is the youngest advisor in the Knights of Columbus to qualify for Lifetime MDRT membership.

Spinelli is a two-time winner of NAIFA-Florida’s 40 Under 40 award and was named Florida and National FIC of the Year in 2015. He is a mentor to newer agents across the country and has been featured as a presenter on panels at Knights of Columbus conferences.

Mike Paffhausen

Paffhausen, 37, began his insurance career in 2014 after working for six years as a civil engineer. He opened a State Farm agency in Butte, Montana, and follows in the footsteps of his father who has been with State Farm for nearly 40 years. Paffhausen is a five-time Honor Club Qualifier with State Farm, as well as a two-time Ambassador Club, and one-time Chairman’s Circle qualifier.

Paffhausen is a Past President of NAIFA-Montana. During his term, he focused on providing educational opportunities for NAIFA members in the state and promoting financial literacy through the chapter. He has also strongly promoted NAIFA membership, including leading a program aimed at recruiting Montana State Farm agents into NAIFA. He led a NAIFA-Montana effort to require Montana high school students to complete a personal finance course prior to graduation. NAIFA-Montana’s advocacy work resulted in a 2023 law that creates a financial literacy course requirement.

Winona Havir, CPCU, CLF, LUTCF, FSS, LACP, AIC, knows what it’s like to grow up without the financial security many of us take for granted. Her father, who

President

President

immigrated to the United States from China as a child, often repeated the phrase, “We don’t have any money” and the family at times struggled to put food on the table. But despite their precarious financial situation, Havir’s father was able to protect the family by purchasing an Occidental Life policy. Eventually, her father’s forethought would allow Havir to pay for her education and embark on a successful career as a financial professional.

Havir’s upbringing informs her relationship with money to this day and inspires her to give back to her community and help others gain financial literacy. NAIFA is pleased to honor Havir with the 2023 NAIFA Diversity Champion award, which she received in December at the annual Belong awards celebration.

Havir is recognized as a strong advocate for women and diverse populations in the financial services profession. Havir served on NAIFA’s Board of Trustees and was the Trustee Liaison to NAIFA’s Diversity Council. She is a Past President and charter member of the Greater Twin Cities chapter of Women in Insurance and Financial Services (WIFS). She has been a panelist and speaker at NAIFA Diversity Symposia and is recognized as an advocate for diversity within the insurance and financial services industry.

As Executive Vice President of Business Development for Educators Insurance Resources Services Inc. representing The Horace Mann Companies in Minneapolis, Minnesota, Havir has achieved professional success.

“I remember that as a young woman in our profession it was so difficult when there were many around me who I could not relate to, let alone trust,” she wrote in a column for California Broker magazine. “I was fortunate that I crossed paths with a financial professional who took a chance and believed in a young girl from East L.A. who didn’t look or act like any of his other agents. This has become another important part of my money story. Women and those from diverse communities need opportunities in our industry. They need mentors and the support of great associations like NAIFA and WIFS.”

Increasing the ranks of women and people from diverse communities among financial services professionals

also increases opportunities for traditionally underserved markets to receive needed financial guidance. Women are disproportionately impacted by financial hardships, Havir says, and they often relate better to women financial professionals. Havir is a vocal proponent of and active participant in efforts to support and mentor diverse financial professionals and provide financial literacy education to Americans of all communities.

NAIFA created the Diversity Champion Award to recognize exceptional efforts to promote the full and equal participation of diverse people within the insurance and financial services profession. Through her deeds as a volunteer and a professional, Win Havir is truly a deserving Diversity Champion.

NAIFA is now accepting nominations and applications for its 2024 awards to be presented at the 2024 Belong celebration at the Arizona Biltmore in September. Awards include:

• NAIFA Quality Award

• YAT Leader of the Year

• NAIFA Diversity Champion

• Advisor Today’s 4 Under 40

• Kenneth Black Award

• Terry Headley Lifetime Defender Award

• The John Newton Russell Memorial Award

Visit NAIFA’s Talent Development Center at tdc.naifa.org and select Awards.

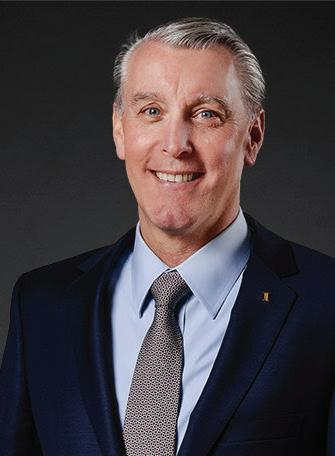

Tom Cothron, LUTCF, FSCP, was only three years old when his grandfather died suddenly at age 54. He was certainly much too young at the time to understand how that sad occurrence affected the rest of his family and particularly his own father. But the impact was long-lasting and made worse because Cothron’s grandfather had no life insurance. That one event’s lingering repercussions eventually spurred in NAIFA’s 2024 National President a great appreciation, in fact an enduring passion, for life insurance and financial services.

“Growing up, I remember many times hearing my dad talk about how humiliating it was having to go to the bank and borrow the money to bury his father,” Cothron said. “Later in life I recognized how hard it was for my grandmother to make ends meet, watching her work as a waitress in the local café and doing odd jobs for others to make extra money.”

Cothron’s father repeatedly emphasized with young Tom the importance of life insurance and protecting the financial security of those he loved. It was a message Cothron took to heart. Not only did Cothron resolve to protect his own future family, but when he was barely beyond his teenage years he began a journey that ultimately led to his life’s work: Providing for the financial security of others.

A few days after Cothron’s 20th birthday, a family friend hired him to work in a local life insurance agency. He was good at it. He found the work highly rewarding, despite the challenges all young agents face. Bringing with him his memory of his grandfather and the wisdom of his father, he has been in the insurance business ever since.

“I’ve never looked back,” he said. “I didn’t have enough sense to realize a 20-year-old kid had little chance of making it, but I had a real life story to tell.”

With perseverance and hard work, as well as the support of others in the profession, Cothron has more than just made it. He has thrived, built a highly successful practice,

provided for his family, become a leader in his field, and helped countless friends, neighbors, and complete strangers achieve financial success.

His journey in the insurance business began with that first opportunity in 1979. He joined Farm Bureau in his hometown, Palatka, Florida, in 1984. Cothron was named Agency Manager in the Hernando/Citrus County agency in May of 1986. In December of 1991 he became Agency Manager in Marion County, Florida, where he remains. He has been awarded Agency Manager of the Year and Team Player awards on multiple occasions. Naturally, NAIFA is also a big part of his story.

“I remember my first NAIFA meeting in 1981. The guest speaker was Art Guinn, the local New York Life agent,” Cothron said. “His subject was ethical sales and always doing what was right for the client. He talked about our association and the great things it has done and talked about the LUTC courses available that would help us better serve our clients. I recognized the need to belong to the association that was out there working on my behalf.”

Cothron has served as a two-time NAIFA local chapter President and the 2008-2009 President of NAIFA-Florida. He then served on NAIFA’s National Board of Trustees, 2011-2015. He is a former moderator of training courses for the Life Underwriter Training Council Fellow (LUTCF), one of the most sought-after designations in the insurance and financial services industry.

As a graduate of NAIFA’s Leadership in Life Institute (LILI), recipient of the Financial Security Advocate (FSA) badge, and regular IFAPAC contributor, Cothron earned recognition as an inaugural member of NAIFA’s Triangle Team. He has a strong history of political involvement, regularly attending NAIFA’s Congressional Conference and NAIFA-Florida state legislative days. He is a trusted voice who educates lawmakers on issues important to NAIFA and his clients.

It was Cothron’s close friend, Vinny Mazzurco, who suggested in 2011 that he take his leadership skills to the national stage by running for a position on NAIFA’s national Board of Trustees. Mazzurco managed the successful campaign, and just a few days after Cothron was elected as a NAIFA Trustee he crossed paths with his friend in the airport as they were heading home. Cothron expressed thanks to Mazzurco for his efforts and they discussed getting together back at home to debrief about the campaign.

“Only God knew those were they last words we would ever share,” Cothron stated. Seven days later, Mazzurco was tragically killed in an automobile accident. That same day his son, Jules, had received an acceptance letter from the college he hoped to attend. Once again, when he visited Vinnie’s wife SueAnn and the grieving family, Cothron saw in a very personal, firsthand way, the vital importance of life insurance.

“I was standing only a few feet from SueAnn when I witnessed something I’ll never forget,” Cothron said. “With letter in hand, Jules suddenly looked at his mother and asked, ‘Mom, what about college?’ Without hesitation, SueAnn lifted her head, looked him in the eye and said these seven words: ‘It’s okay, Dad took care of it.’ In seven words she summed up what we do.”

Cothron served as an effective NAIFA Trustee and when his term expired he remained an active, loyal NAIFA member at the state level. Then, once again, in 2021 he received a call from a friend who said, “We need you.” This friend urged Cothron to run for NAIFA Secretary. The association Governance Committee put his name forward

and he was selected, placing him in line to be this year’s National President.

“I’m forever grateful that they thought I was worthy of this role,” he said. “I’m very humbled.” During his term in office, Cothron hopes to lead NAIFA “back to basics.” As the NAIFA family expands with the additions of the Society of Financial Service Professionals and Life Happens, the association’s mission is straight forward: NAIFA is “Empowering financial professionals and consumers through world-class advocacy and education.”

It’s a simple directive, but one that has guided NAIFA since its founding 134 years ago. Using unmatched political influence to advocate for sound policies at the federal and state levels and providing professionals with the support and education they need to succeed and best serve their clients are NAIFA’s core reasons for existing. They make the association essential to the industry, American consumers, and the U.S. economy.

The industry faces challenges, from the need to grow the ranks of dedicated and ethical financial professionals to the complexity of serving the needs of an ever-expanding base of consumers. NAIFA also faces its own challenges, from continuing to strengthen its national, state, and local chapter structure to confronting advocacy threats like the Department of Labor’s fiduciary-only proposal. Throughout NAIFA’s 134-year history, the association has risen to the occasion and never lost sight of its core mission. NAIFA is focused on getting the basics right under President Cothron for the year to come and many to follow.

Just as NAIFA needs Tom Cothron, the insurance and financial services industry – as well as the 90 million American families it serves – needs NAIFA. And like Cothron, NAIFA is answering the call.

Our new National President Tom Cothron is putting the association’s focus fully on membership this year. With the expanded NAIFA Family that now includes Life Happens and the Society of Financial Service Professionals, our association has grown by nearly 2,000 members. The incoming members bring a huge amount of energy and opportunity in terms of new subject matter experts, new individuals with whom to network, and new potential volunteer leaders who can continue to drive our vision of One NAIFA forward. While the expansion will welcome new people into existing chapters, we are also likely to see the formation of new chapters and the expansion of affiliate programs. NAIFA is perfectly poised to now offer programming virtually across all geographic lines, as well as at the local level through in-person NAIFA Live watch parties, networking events, and meetings.

The flexibility that we now have as an association to welcome in new members from a multitude of disciplines and have the ability to connect people at the local, state, and national levels creates an incredible opportunity for networking and expanding your circles of influence. Gone are the days when an individual defined their membership by the local to which they belonged; today’s member understands that they can attend a local mixer, go to their statehouse, meet people across the country through NAIFA Live or Member-to-Member programs, and then see them in-person each May on Capitol Hill. The opportunity to build your network on a national level through the NAIFA platform is a powerful value proposition that only our association offers—and we want everyone to know it!

This year, we are focusing on improving and expanding our membership programs. First, we want to acknowledge that we are first and foremost, a word-of-mouth network and the members that get the most out of NAIFA and grow the most personally and professionally come from referrals. This year, we are making it even easier for everyone to refer a member and get the credit due for your endorsement of NAIFA. We will recognize our Top Recruiters each month and continue to award a quarterly and annual Hard Hat award to those members that are doing the hard work of keeping our association strong. The quarterly and annual Hard Hat awards are also now available for grassroots and IFAPAC activity so that we can showcase the three pillars that keep NAIFA a formidable

force at the state and federal levels. You can easily refer a candidate to membership by going to belong.naifa.org/ refer.

We want to make sure that new members are welcome, learn the history of NAIFA, and get a sense of all that NAIFA has to offer so that the individual can begin to build out their personal plan for how to utilize their membership for professional growth. We hold orientation sessions every Monday at 3 pm eastern to review all that is new at NAIFA. Anyone in NAIFA Nation is invited to attend, so consider it an open invitation to refresh yourself on our expanded benefit portfolio and brush up on new program offerings.

New this year are several Member-to-Member (M2M) Programs that we have instituted due to popular demand and at the advice of our external Industry Leadership Board that made it clear that NAIFA can fill a needed void by offering peer-to-peer training and networking that carrier companies do not. Several of the programs have existed in years past and are being re-instituted and revitalized to allow more members to meet each other, and take on highprofile leadership roles in the association. The new M2M programs are all completely without cost to you and the members that run them have freely given their time, talent, and treasure for the good of the association. The programs include:

The YAT program has been overhauled to be better than ever for 2024. We took an award-winning program called the Advisor Ambassador Program and brought it back into the fold to offer as a jump start career accelerator for new advisors. The 4-week virtual program is entirely run by YAT leaders speaking to other YATs on topics deemed critical for making it in financial services: time management, prospecting, building your brand/circles of influence, and tips and techniques for achieving peak performance that lasts through a personal coaching session featuring

long-time member Joe Templin, who is part of our Coaches Circle and former National 4 Under 40 winner.

The program will run monthly, starting in February, and is a great outsourcing tool for managers with young professionals, as well as independent young professionals. The topics are broad enough to be applicable to professionals in all fields and we welcome new attorneys and accountants as well into the program. Graduates of the program will receive a digital badge and certificate, as well as national recognition through our Advisor Today platform that has over 80,000 subscribers and within our Members News AI-driven member newsletter.

In addition to the 4-week accelerator program, the YAT program will also feature a new YAT-only blog, feature a book group, and encourage YATs to form study groups. YATs can also take part in MentorLoop, a mentor-mentee matching program that pairs up seasoned members who have volunteered to be a mentor with mentees. The optin program also does not carry a fee and is open to all members. Learn more at members.naifa.org/mentor.

Another M2M program that we are reintroducing is our personal coaching program with Coaches Circle and long-time member, Dan Finley of Advisor Solutions. The program will run twice a month on Thursdays and is open to all active members regardless of where you are in your career journey. Spots are limited, but you can sign up for as

many sessions as you want throughout the year. We only ask that if you take a spot, you show up so that another member doesn’t miss out on receiving top-level coaching from one of our best. Dan focuses on a specific topic each session and covers everything from “Mastering PersonalityBased Selling” to “Beyond the Production Plateau”. To see the full list of topics and sign up for a session, go to members.naifa.org/coaches-circle-daniel-finley.

Introduced in 2023, our Triangle Team recognizes our top members who are active in membership, grassroots, and IFAPAC. This exceptional group is recognized by name within the Members portal. They receive a special pin and certificate and extra benefits at key signature events. This year, Triangle Team members also will receive two Peak Performance virtual workshops by loyal member, bestselling author and speaker, Frank Maselli. The two virtual workshops will focus on providing this illustrious group with extra tools and techniques to establish trust faster that leads to the creation of more long-term relationships with clients. Frank is a master at using seminars and public speaking strategies to establish credibility and walk away with appointments that have higher closing ratios than his colleagues. Learn techniques for how he has mastered the art of public speaking to drive top-line growth.

NAIFA’s Leadership in Life Institute (LILI) has started celebrating its 25th anniversary early with exciting new developments. Furthering its mission of growing leaders for NAIFA while providing transformative growth to LILI students, LILI has enhanced the curriculum.

For 2024 NAIFA has added content within the topic of Covey’s Habit 4: Think Win-Win addressing the abundance mindset. This added content will also feature more from Viktor Frankl, author of Man’s Search for Meaning and the founder of Logotherapy or the therapy of meaning.

Also new in 2024, LILI has added a postgraduate class that will occur three months

following graduation. This 90-minute class will provide an opportunity for graduates to reflect on their LILI experiences in light of the passage of time. It will also be a forum to discuss the fulfillment of the graduates’ service commitment to NAIFA and their progress on two new homework assignments: nominating a LILI student and recruiting NAIFA members.

State chapters are already planning their 2024 LILI classes. Now is the opportunity to build your leadership bench with leaders who are trained in conflict resolution, problem solving, and as Covey writes staying out of the “thick of thin things.”

For more information on hosting LILI in 2024 please contact Brendan Bernat at bbernat@naifa.org. To enroll in LILI visit: https://tdc.naifa.org/lili

Fact: People will not buy what they don’t understand. This is especially true with financial products like life, disability, and long-term care insurance, as well as annuities.

That’s why the nonprofit Life Happens exists: to bridge that gap with education. It’s also why, as of 2024, Life Happens is now part of NAIFA. We are here to help you educate your clients and prospects so they buy the coverage they need—from you.

Here are three ways to put it to work:

1. Be a trusted source of information. To do that, you need to be where people are spending their time: on social media. Did you know that the majority of Millennials and Gen Z use social media for financial information, according to the 2023 Insurance Barometer Study by Life Happens and LIMRA. If you aren’t on social media, you’re missing the chance to be their go-to source of information.

But we know that finding new, engaging social content can be hard. The solution? Your NAIFA membership. Through the member portal, you can access Life Happens social media graphics and calendars, which you can use as-is, or modify to fit your marketing needs. Use these engaging posts to educate your followers, so that when they are in the market for insurance, you are top of mind.

2. Have them do their own math. No one likes to be told what to do, or how much life insurance to buy. So, send prospects to the free Life Insurance Needs Calculator (lifehappens.org/howmuch) to easily come up with “their own number.” That makes the next step in the life insurance conversation so much easier because they came up with a working idea of how much they need.

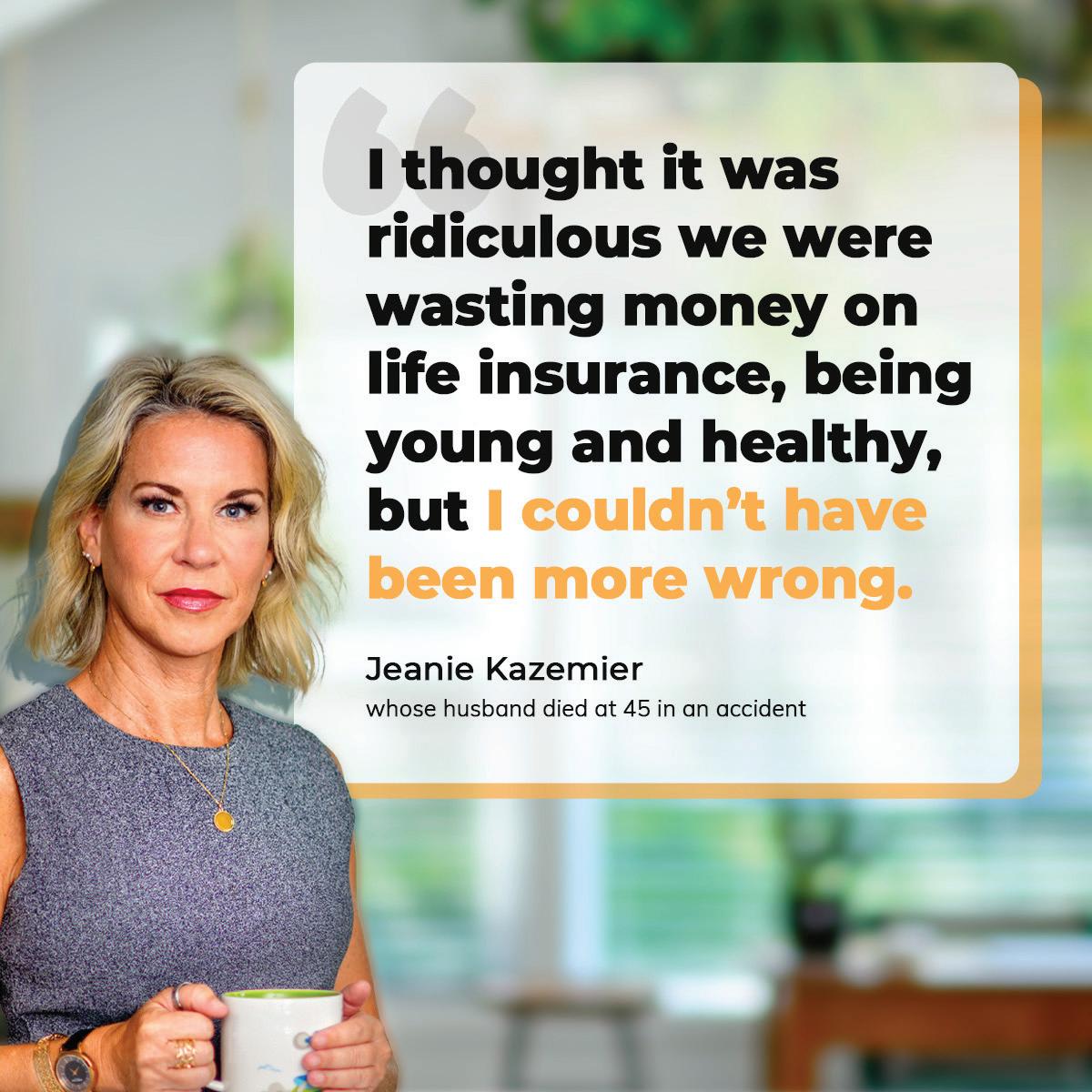

3. Reinforce the “why” of insurance with emotional storytelling. Life Happens has been telling Real Life Stories for more than 25 years. Why? Because they work. These are real stories of people, families and small businesses that have benefited from insurance planning when “life happened.”

Take Jeanie Kazemier. She and her husband, Tom, had an idyllic life with their two children, until he was struck and killed by a drunk driver while snowmobiling. The only reason Jeanie was able to keep living in the house they built and pay the bills is that Tom had planned ahead with life insurance. The irony is that Jeanie admits she was “not a fan” of life insurance when Tom bought it. Watch the story and then share it with your clients and prospects here: lifehappens.org/kazemier.

It’s very hard to say no to life insurance after watching a moving story like this. The Life Happens site also has disability, long-term care, and annuities stories you can share. And if you’d like to submit your own client story to be turned into a video, go to lifehappens.org/reallife to submit your application.

Be sure to take advantage of all your NAIFA membership has to offer and let us know what works for you.

February is I Love NAIFA month! Show your love for NAIFA by taking a photo of yourself with the graphic on the page and posting it to your social media channels. Remember to use the hashtag #NAIFAproud

Scott

Scott

Blake, MBA Columbus, OH Loyal Member Since2018

The Triangle Team is a select group of people to align with because it’s multi-generational, multi-practice, and has no geographic boundaries. Rather than setting limits, it brings the financial services industry together as one group of like-minded professionals who all believe in NAIFA. What’s special about the Triangle Team is that everyone is eligible to qualify. This is the place for people who want to really engage with NAIFA, advocate for our clients and industry, and get the most out of their membership.

Christopher Carothers, LUTCF Las Vegas, NV Loyal Member Since 1994

The qualifications of the Triangle Team are based on the core principles of our association. Membership, by encouraging our peers to join so they too have a voice. Grassroots, by having direct connections with our legislators, bringing the message to them from those we serve. IFAPAC, our contributions to support those at the State or Federal level to continue the fight for all Americans with a bipartisan voice. NAIFA members are the voice of our industry and the clients we serve. When we come together as One NAIFA, we are stronger together. As the tagline says, Together We Can Take On Anything. I am #NAIFAproud to be a Triangle Team member.

John Davidson, LUTCF, FSS Moorpark, CA Loyal Member Since 1982

NAIFA’s Triangle Team brings our members together to recognize and reward what we truly stand for, Membership, Grassroots, and IFAPAC. These essential elements were the foundation on which NAIFA was built in 1890 and have withstood the test of time and still remain strong today. Triangle team members exemplify good NAIFA citizenship. These are the leaders we can look to for mentorship, training, and association stewardship. As a member of the Triangle Team, I have the opportunity to align with like-minded individuals who understand that to get the most out of your NAIFA membership, you have to be involved. If you are not a member of the Triangle Team, join me, get engaged, and start working towards your Triangle Team qualifications. It will make all the difference in your career.

Peg Fraser North Liberty, IA Loyal Member Since 2013

NAIFA Triangle Team Members are known as the most engaged group of NAIFA members. To me, that’s such an honor. To be put next to industry legends and past presidents and be considered their peers. It means so much to wear my Triangle Team pin as a symbol of my engagement and loyalty to our mission.

Rith Nou Wakefield, MA Loyal Member Since 2017

To me, being a part of the Triangle Team is a great way to get access to NAIFA’s leaders. When I participated in Triangle Team events, it was really very inclusive but it was also beautiful to be able to have access to everyone in one place. I was able to gain a better understanding of my role in NAIFA and it inspired me to want to be part of something bigger.

Kathleen Owings, LACP Colorado Spring, CO Loyal Member Since 2011

Membership on the Triangle Team allows you to connect and build relationships with people from across the country. It is great to see so many of our members involved with the Triangle Team and supporting NAIFA at the grassroots level. We are one NAIFA and the Triangle Team is another way to reward and recognize the competitive spirit in each one of us to be our personal best. Being a part of the Triangle Team allows me to be surrounded by other members who are striving for their personal best as well.

“This is the place for people who want to really engage with NAIFA, advocate for our clients and industry, and get the most out of their membership.”

NAIFA’s Financial Security Academy is a free benefit that helps members become the best grassroots political advocates they can be. The online, self-paced course will take you from the fundamentals of advocacy and step you through an at-your-own-pace series to allow you to graduate to advanced concepts and develop skills that you can put into action with confidence. The entire course should take less than 2 hours to complete.

This year, NAIFA is offering Financial Security Academy webinars that allow members to complete the training in a single sitting. Remaining Academy webinars for 2024 will be April 24, July 24, and October 8

Learn more and enroll by logging into the NAIFA Member Portal and clicking Advocate>Grassroots.

NAIFA is the only association of insurance and financial professionals with strong advocacy influence in every state capital. State chapter legislative days are important to NAIFA’s overarching grassroots strategy and give NAIFA members opportunities to connect with lawmakers whose decisions impact the industry and consumers. Learn about your state’s Legislative Day at advocacy.naifa. org/statelegislativedays.

The annual National Leadership Conference and Belong awards celebration highlight all that is great about NAIFA. National and chapter leaders came together in Washington, D.C., to learn from each other and experts in association management. They networked and shared ideas on how together we give NAIFA members the best possible membership experience.

In the evening, attendees elected and installed our 2024 NAIFA Leaders, including President Tom Cothron, President-Elect Doug Massey, and Secretary Chris Gandy. The gala Belong event celebrated NAIFA award recipients. The following day, NAIFA’s advocacy prowess was on display. More than 250 NAIFA members went to Capitol Hill and met with more than 200 Congressional offices. These meetings build strong relationships that solidify NAIFA’s grassroots relationships and

educate lawmakers on important issues, like the DOL’s worker classification rule and fiduciary-only proposal.

For NLC and Belong videos and more photos, visit belong. naifa.org/nlc-archives-2023

NAIFA’s political action committee, IFAPAC, is vital to the association’s advocacy success. Not only does IFAPAC support candidates who understand the importance of the work financial service professionals do, but it also it amplifies NAIFA’s voice on Capitol Hill and in every state capital. Contributions by NAIFA members make IFAPAC successful, and NAIFA is proud to honor contributors who have shown extraordinary commitment and generosity.

NAIFA Past Presidents Terry Headley and Robert Miller have long been recognized as IFAPAC co-Commanders in Chief based on their lifetime contributions to IFAPAC. Now, IFAPAC is proud to honor Robert M. Roach, CLU, ChFC, of Columbus, Ohio, and R. Jan Pinney, CLU, ChFC, CPCU, of Roseville, California, as Joint Chiefs of Staff. Over the course of their careers, each has contributed more than $100,000 to IFAPAC.

Bob Roach has been a loyal NAIFA member since 1970 and is a past president of NAIFA-Ohio and past member of NAIFA’s national Board of Trustees. He has served as a member of the IFAPAC Subcommittee and Candidate Selection Group. He is the 2021 recipient of the Terry Headley Lifetime Defender Award from NAIFA.

Jan Pinney has been a loyal NAIFA member since 1971. He is a Past President of NAIFA-California and is a member of the Life Happens Council. In 2011, Pinney received the Distinguished Service Award from NAIFA California.

Strong political action committees at the state and federal levels show that NAIFA members are committed to being a part of the political process. IFAPAC is one of the largest political action committees in the insurance and financial services industry, but we need the help of NAIFA members like you to ensure it is as impactful as possible. Roach and Pinney set a powerful example for all NAIFA members.

To become an IFAPAC contributor or increase your support, log in at www.naifa.org/ifapac

Contributions to IFAPAC are voluntary and are used to contribute to campaigns of candidates for elected office. Your contributions will be divided between your state chapter’s IFAPAC and IFAPAC National if you have directed NAIFA to do so. You have the right to refuse to contribute without reprisal. The amount contributed will not benefit or disadvantage you in any way. Corporate contributions to IFAPAC’s political fund are prohibited. Contributions to IFAPAC are not deductible for federal income tax purposes. For NAIFA-Massachusetts members, the division of funds will be 60%/40% up to the state limit of $500 per calendar year. For NAIFA-New York members, a contribution on an LLC account will be retained 100% by the IFAPAC administrative fund due to state campaign finance rules.

NAIFA's Triangle Team recognizes highly engaged members who are committed to promoting NAIFA's success Being a good NAIFA citizen means being a full participant in three key areas: Membership, Grassroots, and IFAPAC To qualify, NAIFA members complete a requirement under each category

Triangle Team members receive special recognition throughout the year and at key signature events, and are eligible to participate in special virtual programming focused on peak performance

Not on the list? Learn more at members naifa org/triangle-team

Triangle Team Members Still Needed In: New Hampshire, West Virginia & Wyoming!

Alabama

Sallie Bryant

Booker Joseph

Greg Turner

Alaska

Lanet Spence

Arizona

Diana Brettrager

Barry Cook

David Ford

Lars Hansen

Tracy Jones

Michael Klein

Michael Sandoval

Barry McBride

Kenny Ziegler

Arkansas

George "Wes" Booker

Scott Dorminy

Brenda Doty

Jeffrey Hill

Robert Waddell

Howard Woodall

California

Elizabeth Angeles

Heather Bregman

Marc Bregman

Louis Brownstone

Peter Buechler

Richard Coffin

Roberto Corral

John Davidson

Jason Foster

Pamela Fugitt-Hetrick

Stephen Kagawa

Gilbert Mares

Michael Mares

Thomas Michel

Colorado

Robert Avery

Kate Cihon

Brent Jones

Randy Kilgore

Kathleen Owings

Donald Pacheco

Richard Seymour

Delaware

Joshua Shaver

C. Neil Stalter

Florida

Cheryl Canzanella

Joseph Chalom

Jeffrey Chernoff

Tom Cothron

Craig Duncan

Tiffany Drewes

Alberto Espinosa

Carroll Golden

Florida con’t.

Timothy Holladay

Bryon Holz

Lawrence Holzberg

Katherine Jones

Kelli Keith

Maureen Kirschhofer

Corey Mathews

Kevin Mayeux

Connie Mosley

Denwood Parrish

Keith Paynter

Mike Peters

Glenn Ritchie

Robert Rosenthal

David Russell

Kenneth Russell

Steven Saladino

Teresa Seefeldt

Melissa Snively

Michael Staeb

Toni Stanaland

Grace Staten

Shelita Stuart

Cal Thompson

Mark Tiralosi

Chad Vergason

Darian Ward

Bobby Whitley

Robert Wolford

Georgia

Fred Glass

William “Trey” Kelly

Joseph Schreck

Hawaii

Dustin Deniz

Idaho

Derek Baltimore

Deborah Dale

EmmaLee Robinson

Guy Stubbs

Illinois

Laurie Adams

Robert Burd

Dennis Dean

Sara Decatoire

Randy Ems

David Frolicstein

Christopher Gandy

Allan Hamilton

Art Hayes

Jeff Keicher

Rodrigo Menendez

John Nichols

Santiago Rodriguez

Camille Tan

Gabriela Reyna

Carl Zeidler

Indiana

Christopher Barnthouse

Gregory Boyer

Joe Cerda

D. Brent Dilts

Daniel Stallings

Iowa

Craig Adamson

Martin Berger

Emily Cabbage

Barry Delp

Brenda Eckard

Margaret Fraser

Joby Frey

Michael Gaeta

Mike Grandgeorge

Joshua Herbst

Clint Hinderaker

Brent Hinerichsen

Kristopher Hopkins

Ann Hudson

Barry Johnson

Dane Johnston

Nicole Kestel

Randy Kruse

Roger McCullough

Michael Nash

Jessica Nikkel

John Raley

Michael Rozum

Anthony Schau

Lynn Schreder

Neil Wilkinson

Kansas

Scott Colby

Donal Bratcher

Garry Burry

Catherine Carlson

John Kiebler

Charles Price

George Ridings

Brian Wilson

Louisiana

Keith Gillies

Maine

Lisa Laliberte

Maryland

Dan Altmire

Paul Dougherty

Brian Haney

Scott Iodice

Vijay Khetarpal

Stephanie Sheridan

Massachusetts

Daryl Grabowski

Benjamin Harding

Bradford Kadelski

Rith Nou

Joshua O'Gara

Raydania Pena

Adam Sachs

Jennifer Shepley

Michigan

Scott Embree

Jacob Rose

Luke Russell

Robert Smith

Mark Staat

Lawrence Stack

Minnesota

Corey Anderson

Gary Havir

Winona Havir

Julie Phillips

Judy Ringler

Mountain

Beth Snyder-Jones

Mississippi

Demetrius Bryant

Priscilla King

Montyne King Clay

Lee Owen

Missouri

Mark Acre

Eddie Anderson

Jennifer Hodges

Zachary Huels

Amy Kern

Julie Kudrna

Carl Maus

Craig Wright

Montana

Dan Rust

Nebraska

Brad Brodersen

Heather Chacon

Dusty Cook

Michael Cooper

Lori Gartner

Todd Gaswick

Maureen Vinton

Paula Harris

Lisa Hatterman

Jack Hawk

Michael Herring

Brian Holen

R. Douglas Hoops

Tanya Patzner

Angela Pavelka

Dave Skutnik

Preston Speece

Michael Struebing

Maureen Vinton

Dustin Will

Nevada

Christopher Carothers

New Jersey

Dennis Cuccinelli

Daniel Irizarry

Irene Stolte

New Mexico

Aprilyn Chavez-Geissler

Edward Dunn

Lynda Turner

Shane Westhoelter

Randall Wimsatt

New York

Vincent Dallo

Evelyn Gellar

Robert Miller

Thomas Palmeri

Joe Templin

North Carolina

Elisha Aharon

Thomas Austell

Brian Cooper

Glenn Deal

Kevin Joiner

Andrew Jones

John Mazza

Roger Sims

Alexander Smith

Janice Stevens

Shanna Strickland

North Dakota

Kim Albert

Steve Bergee

Tim Deitemeyer

Lyle Kraft

Stacy Norton

Todd Schweitzer

Paul Siebert

James Simons

Jacob Thrailkill

Gregg Webster

Jessica Westgard Larson

Ohio

Scott Blake

Suzanne Carawan

Tracy Cartwright

Elie Harriett

Michael Lundy

William Kecskemety

Robert Roach

Oklahoma

Shelly Burroughs

John Carroll

Brian Easlon

Richard Porter

Chad Tredway

Oregon

Kym Housley

Pennsylvania

Matthew Echelmeier

Jan Hartman

Carina Hatfield

Randall Kaufmann

Patricia May

Bronwyn Martin

Louis Pettinato

Christine Pikutis-Musuneggi

Pennsylvania con’t.

J. Drew Shumski

Paul Szkotak

B. Douglas Trainer

Paul Valerio

Michele Vitale

Brian Worrell

Rhode Island

Mark Male

Gene Nadeau

John Peacock

South Carolina

Blake Amick

MaryAnne Cannady

Casey Chambers

Johnny Craven

Aubrey Fitzloff

David Grookett

Kenneth Head

Michael Head

Henry Leslie

David Lloyd

Bruce Pope

Betty Roberson

Brad Tapscott

Stacie Wallice

South Dakota

Blaine Anderson

Terry Anderson

Andrew Bartling

Timothy Dardis

Douglas Leighton

Dennis Rowley

Calvin Sievers

Jeff Tveit

Tennessee

Sandra Bailey

Matthew Benson

Blake Finney

Scott Flowers

Cory Jacobs

Adam Milam

Mark Miller

John D. Richardson

Rebecca Schulter

Chase Sinquefield

Bruce Snider

Texas

Lilia Arandela

Bailey Baker

Charles Booth

Lane Boozer

Thomas Currey

Erni Davis

Richard Demko

Karen Easterling

Ted Erck

Hollie Gandy-Donohue

Andra Grava

Alyson Guest

Michele Guzman

Texas con’t.

Joseph Kerr

Lance Kroesch

Douglas Massey

Rodney Mogen

Danny O'Connell

Joseph Orr

Chane Reagan

Timothy Roels

John Ruckel

Ray Soto

Jason Talley

Karen True

Joey Ussery

Wes Wessel

John W. Wheeler, Jr.

Tallie Young

Jan Zenner

Utah

Joseph Bradley

Scott Johnson

Timothy Johnson

Dori Phillips

Bart Spencer

Vermont

Clinton Wood

Virginia

Diane Boyle

Jay Denny

Rose Goheen

Brock Jolly

N. Paul Martin

Marie Mercer

Petula Moy

Iris Nance

Steven Overly

Elizabeth Pate

Scott Pettyjohn

Charles Webb

Tim Westerman

John Woleben

Washington

Chris Bor

Monica Ewing

Jeffery Johnston

Randy Kimm

Richard Miller

Wisconsin

Kristin Alfheim

Richard Balch

Brendon DeRouin

Michael Immel

Heather Lindsley

Juli McNeely

Mark Miller

Patrick Mongin

Michael Smith

Kenneth Specht

Elwood Syverson

Daniel Ward

No matter where the day takes you, State Farm® is here to protect you and help you save. For auto insurance needs and more, call an agent or go online today at statefarm.com®.