President - Lawrence Holzberg, LUTCF, LACP

President-Elect - Bryon Holz, CLU, ChFC, LUTCF, CASL, LACP

Secretary - Tom Cothron, LUTCF

Treasurer - Brock Jolly, CFP, CLU, ChFC, CLTC, CASL, RICP

Immediate Past President - Thomas Michel, LACP, CLTC

CEO - Kevin Mayeux, CAE

Mark Acre, LUTCF

George W "Wes" Booker II, LUTCF

Dennis Cuccinelli, LACP

Christopher Gandy, LACP

Aprilyn Chavez Geissler, LACP

Evelyn Gellar, LUTCF, RICP, CLTC, FSCP, CDFA

Winona Havir, CPCU, CLF, LUTCF, FSS, AIC, LACP

Jamie Hopkins, ESQ , MBA, CFP, LLM, CLU, ChFC, RICP

Douglas Massey, CLU, ChFC, FSS

Danny O'Connell, LACP

Vince Vitiello

Brian Wilson

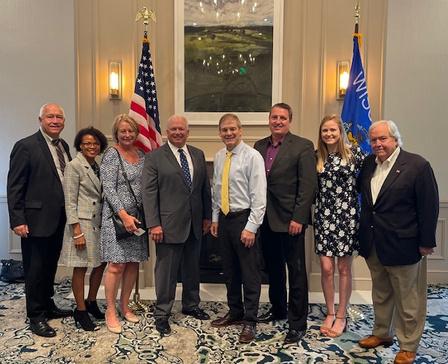

Elected and sworn in at the 2022 National Leadership Conference

President - Bryon Holz, CLU, ChFC, LUTCF, CASL, LACP

President-Elect - Tom Cothron, LUTCF

Secretary - Douglas Massey, CLU, ChFC, FSS,

Treasurer - Brock Jolly, CFP, CLU, ChFC, CLTC, CASL, RICP

Immediate Past President - Lawrence Holzberg, LUTCF, LACP

CEO - Kevin Mayeux, CAE

Mark Acre, LUTCF

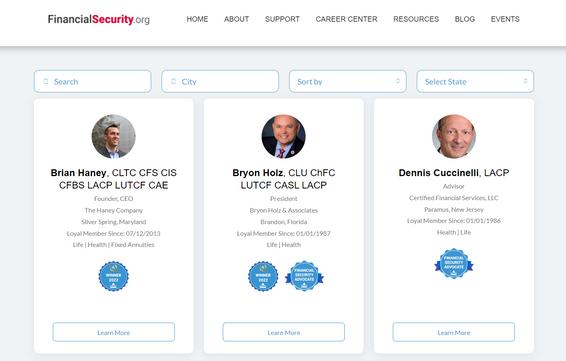

Dennis Cuccinelli, LACP

Christopher Gandy, LACP

Aprilyn Chavez Geissler, LACP

Evelyn Gellar, LUTCF, RICP, CLTC, FSCP, CDFA

Brian Haney, CLTC, CFS, CIS, CFBS, LACP, LUTCF, CAE

Carina Hatfield, LUTCF, CLCS, LACP

Winona Havir, CPCU, CLF, LUTCF, FSS, AIC, LACP

Danny O'Connell, LACP

As NAIFA President, Lawrence Holzberg, LUTCF, LACP, led NAIFA through Year Two of the NAIFA 2025 strategic plan During 2022, NAIFA made tangible progress toward reaching the plan's goals in the areas of membership growth, brand amplification, and improved membership experience

Among Holzberg's points of emphasis was urging NAIFA members to fully participate in their association by volunteering, recruiting new members, getting involved with grassroots, and contributing to IFAPAC He promoted the importance of One NAIFA: the national association and state and local chapters working together to promote members' success.

He emphasized accountability and challenged NAIFA leaders to spread their passion and commitment to NAIFA.

Despite any differences, he said during his Presidential Farewell Address at NAIFA's National Leadership Conference, "we all have a team we know and love called NAIFA "

Helping my clients protect their assets and establish financial security, independence, and economic freedom for themselves and those they care about is a noble endeavor and deserves my promise to support high standards of integrity, trust, and professionalism throughout my career as an insurance and financial professional With these principles as a foundation, I freely accept the following obligations:

To help maintain my clients’ confidences and protect their right to privacy.

To work diligently to satisfy the needs of my clients by acting in their best interest

To present, accurately and honestly, all facts essential to my clients’ financial decisions.

To render timely and proper service to my clients and ultimately their beneficiaries

To continually enhance professionalism by developing my skills and increasing my knowledge through education.

To obey the letter and spirit of all laws and regulations which govern my profession.

To conduct all business dealings in a manner which would reflect favorably on NAIFA and my profession.

To cooperate with others whose services best promote the interests of my clients.

To protect the financial interests of my clients, their financial products, and my profession through political advocacy

The NAIFA 2025 strategic plan sets our association’s course and establishes our goals over a five-year period. The year covered by this annual report, 2022, marks Year Two of the NAIFA 2025 plan. We created strong momentum over the course of the year and continued our progress, moving us significantly closer to achieving goals in the areas of Membership Growth, Brand Amplification, and Membership Experience Improvement.

Since NAIFA was restructured and reborn as a modern, nimble association in January 2019, more than 6,400 insurance and financial professionals have joined as first-time members. Our retention rate is up and attrition, due primarily to members retiring or leaving the industry, is well below the association industry average. We have built out and implemented a comprehensive marketing plan and sales process to put NAIFA’s membership proposition in front of more potential members and bring more insurance and financial professionals into the fold. Our 100% Agency and Financial Security Champion programs, combined with increasingly effective corporate outreach, are resulting in more group memberships.

Amplification of the NAIFA brand continues through our high-impact advocacy work, focus on providing a clear and consistent value proposition, championing of the next generation of financial professionals, and promotion of diversity, equity, and inclusion (DEI) in the industry. Our successful signature events – the Congressional Conference, Apex sales summit, and National Leadership Conference and Belong awards celebration – brought NAIFA members, prospective members, partners, and the media together to shine a trio of spotlights on the great work NAIFA is doing.

The expansion of our Advisor Today brand to include webinars and podcasts has put NAIFA’s content in front of more financial professionals and enhanced NAIFA’s reputation as an association of highly successful professionals and industry thought leaders.

We continued to promote our One NAIFA concept to improve the membership experience by better coordinating between our National home office, state and large local chapters, and affiliates. Overall, 2022 brought progress toward achieving each of our overarching NAIFA 2025 goals, and we look forward to continuing that momentum throughout 2023 and in the years to follow.

NAIFA reinforced our position in 2022 as the most influential advocacy association working on behalf of agents and advisors on Capitol Hill in Washington, D.C., and every state capital. On the federal level, we worked for and helped bring about the passage of SECURE 2 0 legislation soon after NAIFA members met with their lawmakers in Washington during NAIFA’s annual National Leadership Conference

The comprehensive retirement planning reform law had also been a topic of discussion when more than 500 financial professionals gathered in Washington and met with Representatives and Senators during the NAIFA Congressional Conference earlier in the year Despite election-year gridlock in Congress on many policy matters, NAIFA also realized several other legislative priorities, including passage of the SECURE Notarization Act giving consumers more flexibility to complete financial transactions remotely and the RILA Act reducing administrative burdens and other restrictions on registered index-linked annuities

On the interstate level, NAIFA continued to work with groups like the National Association of Insurance Commissioners (NAIC) and the National Conference of Insurance Legislators (NCOIL) on model laws and regulations and policy positions that benefit NAIFA members and consumers

NAIFA also saw advocacy success in numerous states, the highlight of which was the enactment by 11 states of rules or laws incorporating the NAIC model for annuity transactions This brought the total to 31 states by the end of 2022 that had implemented the NAIC model requiring financial professionals to act in consumers’ best interests

TheNAIFACentersof Excellencecontinuedproviding financialprofessionalswith resourcesand access to experts inspecific practiceareas. AdvisorToday, NAIFA’s flagshipmagazine,expanded its brandto offer webinars andpodcastsin 2022.In-personeventslike the NAIFA Live monthlymeeting (a hybridin-person/virtual gathering), NAIFA’sDEISymposium, Meetings on Main Street,AdvancedPractice CenterSymposia, the Apex sales conference, andNAIFAchapter events gave membersmanyopportunitiesfor face-to-face interaction.

With blogposts,a printmagazine, webinars, podcasts, andgatherings,NAIFA provided compelling resources for membersand the industrywherevertheywantedin and in theformattheypreferred.On the year,NAIFA saw morethan7,000webinar registrations andmore that 61,000podcastdownloads. We provided nearly 500 blog posts and three issuesofthe printmagazine.

NAIFA membersstandapartbybelonging to a professionalassociationthathighlightstheir success andshowstheyarecommitted toservingtheir clients’ bestinterests.NAIFA’sconsumer-facingFind-An-Advisor toolassurespotentialclients that NAIFAmembers are professionalagentsandadvisorswho abidebyNAIFA’s CodeofEthics.

NAIFA providesvolunteerand leadership opportunities aswell as nationalandchapter-level awardsthat distinguishthetopproducers in thecountry and those whoareworking toadvance theirindustry, the association,theircolleagues,and consumers. In 2022, morethan500agentsandadvisorsattended NAIFA’s annualNationalLeadershipConferenceand Belong event tocelebrateourleadersand awardrecipients.

NAIFA is the most influential advocacy association for financial professionals in the United States. NAIFA members come from every congressional district across the country and understand the financial goals and challenges of Main Street families and businesses. NAIFA members are a strong grassroots network delivering a unified message with individual stories and insights policymakers want to hear. NAIFA is the only association for insurance and financial professionals with an advocacy presence at the federal, interstate, and state levels, including in all 50 state capitals.

NAIFA’s access and influence extend through all three branches of the federal government: the Executive (SEC, DOL, OMB, IRS, and the office of the President), Legislative (one of the industry’s largest association PACs, largest Day on the Hill, and NAIFA members who are personal contacts with nearly all of the 535 members of Congress), and Judicial (success in federal lawsuits). NAIFA’s annual Congressional Conference often draws more than 1,000 financial professionals to Washington, D.C., to receive advocacy training and meet with lawmakers on Capitol Hill.

NAIFA is in the trenches, attending the meetings and conference calls of the National Association of Insurance Commissioners (NAIC) and National Council of Insurance Legislators (NCOIL) and helping draft model regulations and legislation used by insurance commissioners and state legislatures BEFORE the proposals even come up. NAIFA has had great success promoting states’ adoption of the NAIC consumer protection model on annuity transactions. NAIFA Trustee Christopher Gandy (Midwest Legacy Group/OneAmerica) gave a powerful presentation to the NAIC’s Special Committee on Race and Insurance.

NAIFA is the only association of insurance and financial advisors present at the state level across the country with a professional lobbyist, a political action committee, and a grassroots activation and training program. NAIFA’s 50 state Political Action Committees maximize our state-level influence and support friendly legislators and candidates. Legislative Days and state conferences create awareness, engagement, and presence in every statehouse. NAIFA members serve as key contacts for lawmakers and are often their friends, neighbors, insurance agents, or financial advisors. They provide testimony at hearings on proposed laws and regulations of concern to the industry.

NAIFA Members Are Politically Involved:

Each NAIFA state chapter has its own political action committee operating in addition to the federal PAC. Collectively known as IFAPAC, these PACs support candidates for seats in state legislatures and Congress who understand and advocate for the important work agents and advisors do on behalf of their clients. The PACs support candidates regardless of their party affiliations. In the words of 2023 NAIFA President Bryon Holz, whether we are Republicans, Democrats, or Independents, we are all members of the Financial Security Party.

IFAPAC supports candidates regardless of political party who understand and support the insurance and financial services industry.

NAIFA PACs operate on the federal level and in all 50 states.

IFAPAC allows NAIFA members to speak with a unified voice on behalf of their businesses, colleagues, clients, and communities.

Exclusion from federal income tax of the life insurance death benefit, dividends, and cash value

1913

Tax Reform Act - preserves inside build-up of life insurance and annuities

1986

The Tax Cuts and Jobs Act preserves tax incentives that encourage Main Street savers to contribute to retirement plans and does not make changes to non-qualified deferred compensation

2017

NAIFA convinces US Treasury not to pursue attempt to tax death benefits

1935 & Ongoing

Creation of IRAs which in turn led to 401Ks and HSAs

1974

COLI best practices adopted; tax-free charges against cash value to pay for LTC premiums; LTC Partnerships State High Risk Pool Funding

2006

NAIFA wins lawsuit to eliminate Department of Labor fiduciary rule that hurt retirement savers

2018

SECURE 2.0 retirement legislation signed into law soon after NAIFA visits Capitol Hill

2022

CARES Act passes the House and Senate less than a week after NAIFA visits Capitol Hill Work on the ProAct begins.

2019

NAIFA-MA President Josh O’Gara was invited to testify on behalf of NAIFA at a Department of Labor forum on DOL’s proposed rule that could reclassify many agents and advisors as employees rather than independent contractors. O’Gara urged DOL to exempt financial professionals. Later, in November, he testified before the Small Business Administration on the issue.

Congress included the Registered IndexLinked Annuity (RILA) Act in year-end wrapup legislation. The Act makes it easier for companies to provide investors with more options without reducing consumer protections.

The U.S. House of Representatives passed H.R. 3963, the SECURE Notarization Act. The bill authorizes a notary public to notarize electronic records related to interstate commerce remotely, subject to specified procedures.

SECURE 2 0 legislation was included in year-end funding legislation. The enactment of this legislation will simplify saving for retirement and incentivize employers to create and enroll employees in workplace retirement plans

Enacted Annuity Best Interest Model in 11 states: New Mexico, South Dakota, Maryland, Wisconsin, Minnesota, North Carolina, South Carolina, Colorado, Hawaii, Alaska, and Massachusetts

Rhode Island - Defeated bill that would have redefined "employee."

California - Enacted fraud training into ethics training for CE & licensure

Nevada - Amended insurance license exam passing score to align with 45 states.

Louisiana - Eliminated mandatory prelicensing in the state.

Stopped legislation to enact statesponsored retirement plans in 5 states: Arizona, Mississippi, Rhode Island, Kansas, and Missouri

New Mexico - Enacted a bill that allows many New Mexico retirees to receive their Social Security income under non-taxable status.

Kentucky - Exempted financial planners and insurance producers from being subject to a new sales tax on their services

Michigan - Enacted legislation making financial literacy a high school graduation requirement

Illinois - 13th State to allow CE Credit for Association Membership

Tennessee - Enacted revised background check rules for agent applicants with class E felonies.

Massachusetts - Gov Charlie Baker vetoed legislation that would have laid the groundwork for a singlepayer healthcare system.

California - Defeated legislation that would have established a singlepayer healthcare system

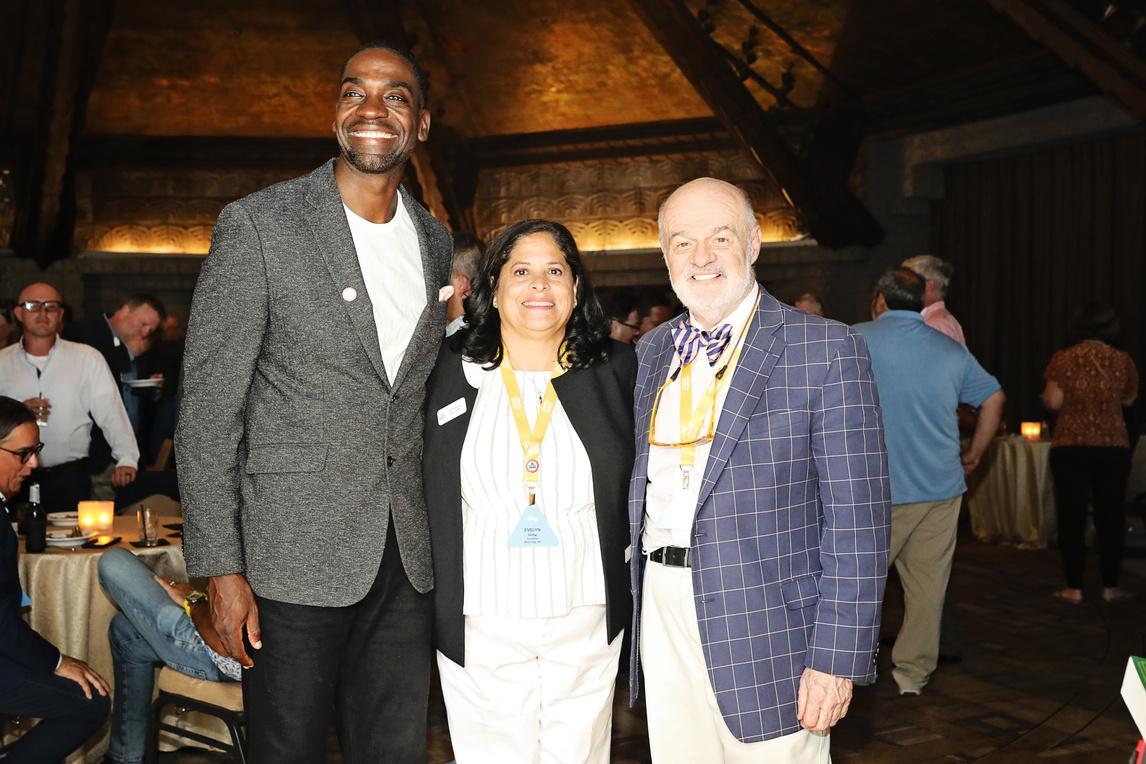

NAIFA Trustee Christopher Gandy, LACP, was featured in the "Diversity, Equity, and Inclusion in Producer Licensing" at the 2022 NAIC Insurance Summit.

NAIFA attended and participated in the 2022 Spring, Summer, and Fall NAIC National Meetings.

NAIFA attended and participated in the 2022 NCOIL Spring, Summer, and Fall meetings

Elected to the Board of NCOIL's Industry Education Council; served on the Interstate Insurance Product Regulation Commission's Industry Advisory Committee; and served on the National Insurance Producer Registry Board

July 21, 2022 - NAIFA and coalition partners submitted a letter on the NAIC's draft FAQs on the NAIC Suitability in Annuity Transactions Model Regulation

April 28, 2022 - NAIFA and ACLI letter on review of NAIC "Producer Licensing Handbook."

An NCOIL "Resolution Supporting Independent Contractor Status for Insurance Agents and Other Licensed Financial Professionals" cites work and research done by NAIFA

2022 NAIC President Dean Cameron, Director of the Idaho Department of Insurance, is a past NAIFA member and former two-term President of NAIFA-ID

Grassroots advocacy reinforced by NAIFA's network of political action committees, at both the federal and state levels, is at the core of NAIFA's advocacy success. With members in all 435 U.S. congressional districts and chapters active in advocacy in every state, NAIFA has a broad reach and members are able to have meaningful relationships with state and federal lawmakers. These relationships coupled with our campaign support, help NAIFA support positive legislation and defeat bad bills that would negatively impact our members as well as their clients and communities.

NAIFA members have an unmatched impact as grassroots advocates because they have expertise and first-hand understanding of financial issues facing U.S. families and businesses. They represent the interests of their main street communities and support the election of state and federal lawmakers through IFAPAC. Their clients are the families, individuals, and business owners who are state and elected officials' constituents.

NAIFA's Congressional Conference

August Recess In-District Meetings

NAIFA's National Leadership Conference Day on the Hill

Town Halls and Local Events

Fundraisers

NAIFA's Financial Security Advocate Academy is a comprehensive grassroots training course. Participants learn to build relationships with lawmakers, influence important policy decisions, and be a part of the political process. Those who complete the course earn the Financial Security Advocate badge.

The NAIFA advocacy app provides NAIFA grassroots advocates with talking points, policy briefings, and other materials to help them be influential advocates and make the most of NAIFA's grassroots events.

NAIFA's 2022 Congressional Conference had more than 500 insurance and financial services professionals in attendance. They received advocacy briefings and grassroots training. The keynote speaker for Day 1 of the Congressional Conference was Senator Ben Sasse (R-NE), a member of the Senate Finance and Budget Committees. A Day 1 CEO panel, moderated by NAIFA CEO Kevin Mayeux, CAE, featured the leaders of top industry associations: Wayne Chopus, President and CEO of the Insured Retirement Institute, George Nichols, III, President and CEO of The American College, and Susan Neely, President and CEO of the American Council of Life Insurers.

Attendees from states across the country visited Capitol Hill on May 24 for meetings with more than 325 congressional offices, including lawmakers and senior staff. The day on the Hill is the highlight of Day 2 of NAIFA’s annual Congressional Conference.

NAIFA provides a variety of educational offerings that elevate agents and advisors to achieve professional success, maximize their performance, and best serve their clients and communities. Financial professionals are life-long learners, and NAIFA has programs and resources designed to benefit members in any practice specialty and at any stage of professional growth.

Meetings on Main Street NAIFA launched a new event series as a giveback to our industry featuring nationally-acclaimed speakers and industry leaders. The half-day program is a free event that NAIFA is providing to members and prospective members to help promote NAIFA's new programs and initiatives. 2022 events were held in Omaha, NE, and Lisle, IL.

More than 100 Meetings on Main Street Participants

52% Prospective NAIFA Members

Partner Webinars NAIFA partners provide thought leadership to our members through the five Centers of Excellence and Advisor Today. Partner webinars address timely and relevant topics in the insurance and financial services industry, and help NAIFA's members connect with industry leaders to help their businesses.

21 Partner Webinars

More than 2,500 Partner Webinar Participants

NAIFA Live NAIFA Live is a monthly opportunity for members to come together, and gain insight and advice on how to excel in the industry from the best in NAIFA Nation. Members can tune in online, or get together to network and host watch parties in-person. In 2022, NAIFA hosted nine NAIFA Live events, with more than 2,000 registrations over the course of the year.

9

NAIFA Live Meetings

More than 2,000 Participants

The Limited and Extended Care Planning Center (LECP) empowers professionals to network with solution and service providers to share best practices; directly access subject matter experts, research, training and resources; and provide thought leadership so we may continue to address the changing needs of the market.

The Advisory Council includes many of the leading experts on care solutions and funding and are available as resources to Center participants In 2022, they were Harlan Accola of Fairway Independent Mortgage, Chris Bruser, Patrick Cahill of Coventry, Robert Eaton of Milliman, Scott Hall of OneAmerica, Peter Herson of Coventry, Henrik Larsen of ARM, Jeff Levin of OneAmerica, Dan Mangus of Senior Marketing Specialists, Kevin Sypniewski of AGIS Network, Joseph Pulitano of LTC Agency Operations, Steve Cain of LTCI Partners, Tom Riekse, Jr., of LTCI Partners, Todd Rovak of Carefull, Christine McCullugh of LTC Solutions, and Cindy Harris of LifeSecure.

790 LECP Webinar Participants

36 LECP Blog Posts

The LECP offers a regularly updated blog, webinars, research materials, an industry and sponsor events calendar, a speakers bureau of industry leaders, and additional resources.

NAIFA and LECP thought leaders contribute each year to the Intercompany Long-Term Care Insurance Conference In 2022, NAIFA thought leaders including Trustee Chris Gandy; Past President Tom Michel; members Neil Himmelstein and Roger Sims; and professional staff Diane Boyle, Suzanne Carawan, and Carroll Golden presented sessions on modern marketing methods, publicly funded LTC programs, and LTC sales opportunities in the affluent market. NAIFA also hosted a networking reception for agents and advisors at the event.

This group within the Center explores important issues and enhances NAIFA advocacy positions and government relations efforts, engaging directly with state and federal policymakers. The group consists of industry experts, including LECP sponsors, insurers, NAIFA members, third-party administrators, distributors, and NAIFA's Government Relations Team In 2022, the group provided comments and testimony on state-run LTC programs, including the Washington Cares Act, and other issues and proposals impacting the care industry

The Business Performance Center (BPC) provides no-cost resources for agents and advisors driven to take their professional success to the next level. For advisors looking to become entrepreneurs and open their own practices, expand into new lines of business, or tap into new markets, the BPC offers valuable information, products, and networking opportunities.

The BPC Advisory Council Industry experts and thought leaders provide the BPC with guidance, knowledge, and content.

Members of the Advisory Council in 2022 were: Luke Acree of Reminder Media, Dan Finley of Advisor Solutions, Blake Gillies of Acacia Financial Group, Jason Himmelberger of Customers Bank, Tim Romig of Customers Bank, Lara Galloway of White Glove, Brian Wilson of MassMutual Midwest/WestPoint Financial Group, and Stephen Good of 1847 Financial.

816 BPC Webinar Participants

50 BPC Blog Posts

"The Top 3 Financial Products to Weather This Financial Storm," featuring Harlan Accola of Fairway Independent Mortgage and Caleb Guilliams of BetterWealth.

"How to Grow Your Life Insurance Business by Adopting eCommerce Practices," featuring John Boothman, of iLife Technologies.

"Data Diving: Understanding and Maximizing Your Most Important Asset," featuring Gary Weber of AccuPoint Solutions.

"Benefits Marketplace Webinar with Chalice Connect," featuring Maria Petroni of Oasis/Paychex and Whitney Kendrick of Chalice Connect

"Compliance & Home Equity Conversion

Mortgages," featuring Harlan Accola of Fairway Independent Mortgage and Jamie Hopkins of Wealth Solutions

"How to Turn Clients into Raving Fans," featuring Luke Acree of ReminderMedia.

"Home Equity and Roth Conversions," featuring Harlan Accola of Fairway Independent Mortgage and Jim Silbernagel of RealWealth.

NAIFA is pleased to announce the launch of our newest Center, the Employee and Executive Benefits Center (EBC). The EBC will be loaded with tools and resources to help NAIFA members beat the competition. Today’s smaller benefit firms need to be able to pull things off the shelf to work better and see more people. The EBC will gather information in real-time to help you navigate the marketplace, create efficiencies, and offer information about the latest trends while you are busy growing your business. We will look for ideas that are scalable, benefit delivery, and touchpoints that make you efficient and user-friendly.

Today’s environment is all about benefits and that includes executive benefits. This Center looks at how executive benefits play into retirement security, preparing to sell a business or to buy one, and much more!

Contact our Executive Director of the EBC, Carroll Golden, at cgolden@naifa.org to become a contributor to the EBC or if you are interested in sponsorship opportunities.

The EBC is committed to providing compelling content as an essential resource for members to grow and expand their business in the workplace space. The Center provides insights into emerging trends in insurance, investments, and workplace business practices. As an EBC sponsor, you will be recognized as a provider of essential thought leadership content focused on current issues, product innovation, and legislation. An Advisory Council composed of industry experts along with guidance from NAIFA members oversees the ongoing development of the Center.

The EBC Advisory Council Industry experts and thought leaders provide the EBC with guidance, knowledge, and content. Members of the Advisory Council for 2023 are: Patrick Garrabrant of PrimeGroup Insurance, Cindy Harris of LifeSecure, NAIFA Trustee and Board Liaison Danny O'Connell, LACP, George Royal of HUB International Limited, Jamie Sarno of Aetna, Jennifer Simoni of Aetna, Kevin Sypniewski of AGIS Network

The Society of Financial Service Professionals and NAIFA created a Center of Excellence that offers content, events, and direct access to experts to provide thought leadership in advanced markets topics and concepts. The Advanced Practice Center (APC) is supported by the two organizations and company sponsors to ensure that agents and advisors have the most up-to-date information and access to leading experts for complex cases

The APC has an Advisory Council and Content Council that contribute to the functioning of the Center The Advisory Council: Kathleen Bilderback of Affinity Law Group, Andrew Rinn of Sammons Financial Group, Ernest Guerriero, Michele Collins of MassMutual, Doug Massey of Doug Massey Financial Services, Keith Gillies of United Wealth Advisors, and Tom Michel of Michel Financial Group. The Content Council: Andrew Rinn, Stacey McMahan of Pacific Life, Ronald Lee of Mutual of Omaha, John Snider of John Hancock, David Junker of OneAmerica, Brandon Buckingham of Prudential, Valerie Grombchevsky of AIG, Bill Crane of Global Atlantic, and Larry Reeves of Southern Farm Bureau

1,045 APC Event Participants

The series brought together top thought leaders in advanced planning and provides you with new approaches to common challenges. Whether advisors' practices focus on advanced markets or they were looking for new connections with whom to partner on complex cases, this half-day program offered insights, connections, and resources to help them grow your businesses

In 2022, APC Symposia were hosted in Phoenix in June and in Philadelphia in September

APC Webinars

"Is Behavioral Insurance the Future of Life Insurance?" featuring Matthew Gibson and John Snider II of John Hancock.

"Opportunities Abound! Planning for Business Owners Using Life Insurance," featuring Stacey McMahan of Pacific Life.

"Designing Insurance Solutions to Address Clients’ Macroeconomic Concerns," featuring John Snider II of John Hancock.

NAIFA's Talent Development Center (TDC) is focused on packaging professional development programs and tools to ensure that NAIFA members are their best. We also house all materials within the Center that can be used to grow the next generation of financial professionals and ensure that our advisors reflect the diversity and inclusivity of MainStreet USA.

DEI is an important component of the NAIFA 2025 strategic plan and promotes the goal of providing opportunities for financial security to all Americans NAIFA's DEI Council supports NAIFA's annual DEI Symposium that features top thought leaders on DEI in insurance and financial services.

Young Advisors Team

NAIFA's YAT program consists of advisors under the age of 40 or in their first five years in the business. The YAT program offers webinars, networking opportunities, and other resources for young advisors The YATs also assist with NAIFA's Future Leaders program designed to encourage students to consider careers in insurance and financial services.

682

TDC Webinar Participants

31

TDC Blog Posts

110

DEI Symposium Attendees

NAIFA's Apex Sales Summit: A Race to the Top

NAIFA's 2022 Apex event, held August 17-18 at the fabulous Arizona Biltmore, brought together top agents and advisors from around the country and those aspiring to join them. The pure-play professional-development meeting was a "race to the top," with leading professionals and thought leaders sharing production, sales, and marketing ideas.

Participated in Apex

NAIFA's Leadership in Life Institute (LILI) is a six-month program for NAIFA members committed to intellectual and professional growth through deep introspection and discussion with peers. LILI's intense curriculum creates a unique learning environment that encourages participants to bring out the best in themselves and apply what is learned across every aspect of their lives.

LILI has been a NAIFA program for over a decade but is continuously evolving to meet the needs of NAIFA and its members. Graduates agree to a two-year NAIFA volunteer leadership commitment, and many continue in leadership positions long after their commitments end. LILI fills what would otherwise be a leadership void within the association, helps create leaders in the profession who move the industry forward, and promotes members' personal success.

LILI participants explore principles of leadership in a group setting guided by experienced moderators. Unlike other leadership courses, LILI is not an off-the-shelf commercially available program. It is created, reviewed, and continuously updated by NAIFA-member volunteers who have been through the LILI curriculum, understand the association and industry they are a part of, and are highly motivated and dedicated to LILI's and NAIFA's success.

LILI consists of six sessions:

The Impact of LILI

LILI has graduated more than 3,000 NAIFA members.

70% of LILI graduates report a measurable growth in their books of business during the year following graduation. Of eight current NAIFA members who ran for state legislatures or U.S. Congress during the 2022 election year, six are LILI graduates.

More than 95% of LILI graduates have completed or are completing their two-year association service pledge.

12 of NAIFA's past 15 National Presidents are LILI graduates.

Two NAIFA officers in line to be our 2024 and 2025 Presidents are both LILI graduates.

In recent years, more than 65% of NAIFA State Chapter Presidents have been LILI graduates.

In 2022 LILI won a Power of Associations Gold Award from the American Society of Association Executives (ASAE).

The NAIFA Foundation for Financial Security aims to grow the number of qualified and ethical insurance and financial advisors serving the U S public By increasing the pool of practicing advisors, the Foundation will advance financial literacy and promote financial security among all Americans with an emphasis on traditionally underserved populations.

The need for professional financial assistance is great at a time when the ranks of qualified, ethical financial professionals are shrinking. The NAIFA Foundation for Financial Security promotes and supports the recruitment of the next generation of advisors to serve diverse and under-served Main Street communities across the United States.

The Foundation awards Diversity Scholarships to current or recently graduated college students who are members of under-represented populations in the industry. A scholarship for honorably discharged U.S. military veterans is also in the works.

The NAIFA Foundation is working to change some of the grim statistics about financial literacy.

66% of American adults cannot pass a basic financial literacy quiz.

More than 40% lack retirement accounts.

Fewer than 50% have emergency savings.

Fewer than 30% have financial plans in place.

Fewer than 20% use the continuing services of financial professionals.

Source: FINRA's National Financial Capability Study

MembershipinNAIFAshowsthataproduceriscommittedtohisorherprofessionalsuccess.The pledgetoabidebyNAIFA'sCodeofEthicsmeansthattheyworkintheirclients'bestinterests.

NAIFAmembersarepassionate aboutachievingpeakperformanceandservingtheinterestsoftheir clientsandcommunitiestothe bestoftheirabilities.NumerousNAIFAprogramshighlightthegreat workourmembersandtheircompaniesaredoing.

ConsumerAwareness

NAIFA’sconsumer-facingwebsite,financialsecurity.org,featuresaFind-an-Advisortoolthatallows NAIFAmemberstopresentthemselvestopotentialclientsdifferentiatedbytheirpractice specialtiesandgeographiclocations. NAIFA’sCodeofEthicsisasetofprinciplesthatresonates withconsumersandthatallNAIFAmembersagreetoabideby.Asakeypoint,itincludesthe requirementthatNAIFAmembersactintheirclients’bestinterests.

VolunteerandLeadershipOpportunities

NAIFAencouragesvolunteerismamongmembersandanoverwhelmingnumberofmembersserve asleadersintheindustry,theirassociation,otherorganizationsandcharities,andtheir communities.NAIFAoffersmanyopportunitiesformemberstodistinguishthemselvesby

Servinginnationalorchapterleadershiproles

AuthoringarticlesforNAIFApublications

AppearingonNAIFAwebinarsorpodcasts

SpeakingatNAIFAevents

SpeakingonbehalfofNAIFAinfrontofotherorganizations,legislators,orregulators

NAIFA's annual awards differentiate the best of the best among NAIFA members. They recognize and honor NAIFA members doing great work in the profession, within our association, and in their communities. Many NAIFA chapters offer awards to exemplary NAIFA members at the state and local levels. We celebrate NAIFA's national leaders and award recipients at the annual National Leadership Conference and Belong event.

NAIFA Awards

NAIFA Quality Awards, the hallmark for outstanding client care, recognize the top NAIFA producers in multiple practice specialties based on production, client service, and adherence to NAIFA’s high ethical standards.

The Terry Headley Lifetime Defender Award honors a NAIFA member who shows exemplary service to their profession, colleagues, clients, and community through political advocacy and contributions to NAIFA’s IFAPAC.

The Young Advisor Team Leader of the Year is a NAIFA member under the age of 40 who has shown extraordinary commitment to serving NAIFA and the insurance and financial services industry in leadership positions.

The NAIFA Diversity Champion is a NAIFA member recognized for exceptional efforts to promote the full and equal participation of diverse people in the insurance and financial services industry and to work with underserved communities.

Advisor Today Magazine’s 4 Under 40 Awards, sponsored by NAIFA’s flagship publication, recognize advisors who have achieved professional excellence and shown outstanding commitment to serving their clients, colleagues, and communities.

Presented by NAIFA's Advisor Today magazine, the 4 Under 40 Awards recognize highly motivated, well-rounded NAIFA members under the age of 40 who have achieved extraordinary professional success relatively early in their insurance and financial services careers.

The 2022 Advisor Today 4 Under 40 are: Scott Blake, MBA, of Blake Wealth Partners (Northwestern Mutual) in Columbus, OH, loyal member since 2018; Eric Bottolfsen, MBA, of GoldBook Financial (MassMutual) in Scottsdale, AZ, loyal member since 2017; Matthew Daley, MBA, FSCP, LACP, LUTCF, of the Daley Agency (American National) in Miller Place, NY, loyal member since 2018; and Brett Moore, CFP, of RBM Wealth Management Group (LPL Financial) in Newnan, GA, loyal member since 2015.

The NAIFA Young Advisor Team (YAT) Leader of the Year Award recognizes a NAIFA member who early in their career has made extraordinary contributions to NAIFA's success.

Jeff Chernoff, M.S., LUTCF, LACP, Vice President of Insurance and Trust in Tampa, FL, and loyal member since 2011, is the 2022 NAIFA YAT Leader of the Year. He is the 2023 President of NAIFA-FL and Past President of NAIFA-Tampa Bay. As NAIFA-FL's IFAPAC Chair, he helped grow the chapter’s political action committee in both dollars raised and number of contributors.

NAIFA created the Diversity Champion Award to recognize exceptional efforts to promote the full and equal participation of diverse people within the insurance and financial services profession.

The 2022 NAIFA Diversity Champion is Christopher Gandy, LACP, Founder of Midwest Legacy Group (OneAmerica) in Lisle, IL, loyal member since 2003. A renowned thought leader in the industry, he has been a featured speaker at events including the Intercompany Long-Term Care Insurance Conference and the NAIC Insurance Summit.

The Terry Headley Lifetime Defender Award recognizes a current NAIFA member who shows exemplary service to their profession, colleagues, and clients through their political advocacy and contributions to IFAPAC. It is named for past NAIFA President Terry Headley, LUTCF, LIC, FSS, who has exhibited a long, distinguished record of service to NAIFA and IFAPAC.

Robert A. Miller, M.S., M.A., Partner at MillerPomerantz Insurance and Financial Services in New York City, loyal member since 1983, is the recipient of the 2022 Terry Headley Lifetime Defender Award. A NAIFA Past President, he is recognized, along with award namesake Terry Headley, as an IFAPAC Co-Commander-in-Chief based on his lifetime contributions to NAIFA’s political action committee.

The John Newton Russell Memorial Award is the highest honor accorded by the insurance industry to a living individual who has rendered outstanding services to the institution of life insurance. The selection committee consists of representatives of the nine leading organizations in the life insurance and financial services industry. NAIFA serves as the award's custodian and the NAIFA President and the Selection Committee Chair present the award at NAIFA's annual Belong awards celebration.

The 2022 recipient of the 81st annual John Newton Russell Memorial Award is Harry P. Hoopis, CLU, ChFC, Chief Executive Officer of the Hoopis Performance Network and a renowned entrepreneur, leader, and speaker, a loyal member since 1978. Over his 40-year career, Hoopis built one of the largest and most successful financial services firms in the world in Chicago. He has been honored with Northwestern Mutual’s prestigious Dennis Tamcsin Career Achievement Award, was awarded the Master Agency Award every year since its inception, received the Robert Templin Award for his many contributions to management development, and is the recipient of NAIFA-Chicago’s Leadership in Life Award.

NAIFA's National Leadership Conference & Belong Gala Celebration

NAIFA's annual National Leadership Conference and Belong Awards Gala celebration highlights the best of the best among NAIFA members: Our volunteer leaders and awards recipients. The 2022 event at the Omni Shoreham Hotel in Washington, D.C., featured the election and swearing in of NAIFA's 2023 national leaders and awards presentations.

More than 500 NAIFA Leaders and Members

Attended the 2022 NLC & Belong Gala

Advisor Today is NAIFA's flagship publication, the Lifestyle Magazine for Today's Modern Advisor. The magazine publishes a print issue three times annually mailed exclusively to NAIFA members with additional blog articles posted on the Advisor Today online platform. In 2022, the Advisor Today brand expanded to include podcasts and webinars. Advisor Today brings financial professionals exciting content, where they want it, when they want it, and in the format they choose.

Advisor Today Webinars featured presentations by top thought leaders in the insurance and financial services business, including Dave Resseguie of the Resseguie Group, Coach and Author Simon Reilly, and Luke Acree of ReminderMedia.

6 AT Webinars in 2022

783 Registered Participants

Advisor Today blog posts feature profiles of successful NAIFA members, NAIFA and industry updates, and regular columns by industry veterans.

252 AT Blog Posts in 2022

77,852 Weekly email subscribers

Advisor Today Podcasts are hosted by NAIFA Trustee and top OneAmerica Producer Chris Gandy and NAIFA VP of Marketing & Communications Suzanne Carawan. Interviews highlight and provide insights from some of the top professionals in the business.

15 AT Podcasts in 2022

61,598 Downloads

10,740 followers | 10,714 page views | 5,294 unique viewers | 516 custom button clicks | 778 comments |

1,719 reposts | 12,563 reactions

1,119 subscribers | 182 videos published | 190,200 views | 5,300 hours of watch time

13,800+ followers | 443 Tweets | 671,3000+ Tweet impressions | 690 mentions

1,115 followers | 791 posts

6,700+ followers | 989 posts

NAIFA is a trusted source and subject of interest for influential media outlets. The association appeared in more than 225 stories in more than 88 media outlets in 2022, including Barron's, Broker World, Financial Advisor, Forbes, InsuranceNewsNet, InvestmentNews, and Politico

47 Press Releases Issued

26 Press Releases Distributed Through PRWeb

NAIFA is the big tent association for insurance and financial professionals. Our members have dedicated their professional lives to providing American families and businesses with products, services, and advice that promote financial security and help their Main Street clients create and achieve their financial goals.

Membership in NAIFA shows commitment to professional success and dedication to serving the best interests of clients.

NAIFA's 100% Agency and Financial Security Champion programs allow practices to fully support NAIFA membership while promoting and elevating their brands. Participating firms and agencies are listed on NAIFA's consumer site, financialsecurity.org, and receive additional publicity and program discounts.

Profile articles on NAIFA's Advisor Today blog highlight the great work 100% Agencies and Financial Security Champions do and provide opportunities to spotlight their individual agents and advisors. The programs also create a culture of excellence and provide agents and advisors with programming designed to increase their production. Being a 100% Agency or Financial Security Champion is a win for participating practices, a win for advisors, and a win for NAIFA.

NAIFA works with the leading companies in insurance and financial services to promote the role of agents and advisors, bolster the industry, and advance financial security opportunities for all Americans. For more information on becoming a NAIFA corporate partner, contact NAIFA Vice President of Growth & Revenue Karla Kirk at kkirk@naifa.org.

NAIFA partners with a diverse group of organizations to provide additional benefits to our members. Members are able to access these partners through the member portal to get discounts, special rates, and participate in programs that were designed for NAIFA. Explore the Partners tab in the member portal to see all of our offerings.

AARP BANKSAFE: After 60 minutes of training, NAIFA members are eligible to receive the receive the BankSafe seal of verification. This is at no cost to NAIFA members.

ADVISOR SOLUTIONS: Led by coach Daniel Finley, NAIFA members have access to coaching packages and archived materials that address common challenges in financial services.

WEBCE: NAIFA and WebCE have partnered to offer NAIFA members discounts on a wide variety of courses--from prelicensing to continuing education credits. *Includes AML & cybersecurity!

LIFE HAPPENS: Life Happens Pro helps NAIFA members spend less time planning communications and more time helping clients and prospects who need your expertise. NAIFA members get a Life Happens Pro subscription for 20% off.

REAL WEALTH MARKETING: With a core mission to Educate, Inspire, and Motivate Americans to make smart decisions with their money, Real Wealth® is built for busy advisors who want to maintain strong personal relationships with their clients and prospects. Complimentary basic membership is a available for NAIFA Members.

REMINDERMEDIA: The creation of digital and marketing services including personalized magazines that can be used to promote your practice. NAIFA members receive a significant discount on the program.

WHITE GLOVE: Providing introductions, not just leads. White Glove is Marketing Done For Advisors that focuses on virtual and in-person events with no risk and no upfront costs for the advisor.

CALSURANCE: NAIFA endorsed options for your E&O needs. The NAIFA plan offers coverage for individual agents, agencies and firms, and registered investment advisors.

KELSEY: NAIFA members now have access to quality dental, health and disability insurance with our partnership.

TASC: Key benefits of the Universal Benefit Account for your clients include: integrated benefit account options, mobile, configurability to create custom plans.

TOTAL HIPAA COMPLIANCE: Total HIPAA Compliance prepares health insurance agents, HR professionals, Privacy and Security Officers, healthcare professionals and subcontractors of Business Associates to meet federally mandated HIPAA compliance regulations. NAIFA Members are eligible for 10% off all products.

TravNow: With the TravNow Membership Card, NAIFA members receive guaranteed lower pricing than other travel websites on travel with a guaranteed price match or 10% back to you. Get $500 in travel credits with your NAIFA membership.

Chalice Network: Access exclusive savings on Fortune 500 group health insurance, back-office services, technology products, travel, and more at this pre-vetted and pre-negotiated online marketplace.

NAIFA and the American Council of Life Insurers (ACLI) share a long history of working together on advocacy efforts impacting the industry and Main Street consumers. NAIFA and ACLI collaborated on a lawsuit that prevented the implementation of an ill-conceived Department of Labor fiduciary regulation. Currently, NAIFA and ACLI are the driving force behind an effort that has resulted in 31 states (through the end of 2022) adopting the NAIC model on annuity transactions that enhances consumer protections by requiring agents to work in clients' best interests.

NAIFA shares goals with additional organizations within the industry and has signed partnership agreements to represent their members, along with NAIFA's, on Capitol Hill and in state capitals. NAIFA's partnerships with the Latin American Association of Insurance Agencies (LAAIA), National African American Insurance Association (NAAIA), the Society of Financial Service Professionals (FSP), and Women in Insurance and Financial Services (WIFS) demonstrate to policymakers that our associations are of one mind on issues that impact our members, their clients, and their communities. Working with these groups broadens the diversity of NAIFA's advocacy and leverages NAIFA's strong influence on behalf of these associations.

NAIFA participates in numerous coalitions and alliances in pursuit of advocacy success on behalf of NAIFA members, their clients and communities. These include:

American Savings Education Council

(Choose to Save)

America Saves

Coalition for Equity in Wholesaling

CEO Action for Diversity & Inclusion

Coalition for Medicare Choices

Diversity in Government Relations

Coalition

Help Protect Our Families Campaign

Joint Trades Group

Since NAIFA's rebirth in 2019 as a modern, nimble association with revised bylaws, state and local chapters have undergone a metamorphosis focused on a renewed commitment to providing a Quality Member Experience.

NAIFA members, wherever they live in the United States, benefit from the national home office, state and local chapters, and affiliates working together as One NAIFA.

The reborn NAIFA places an emphasis on accountability. By the end of 2022, 98.5% of chapters were in full compliance with their chapter operating agreements, up from 50.6% at the end of 2021 and 33.3% at initial analysis.

Chapters are arranged into six state and four local "cohorts," which serve as peer groups for volunteer-to-volunteer leadership collaboration. All of the cohorts received strategic-planning training from the renowned association management firm Raybourn Group International.

80

NAIFA Chapters: 51 State & Territorial Chapters + 29 Local Chapters

22

Chapters Managed by NAIFA Association Management Services

100%

Of Chapter Cohorts Received StrategicPlanning Training From Raybourn Group International

98.5%

Of Chapters Are in Full Compliance With Their Operating Agreements

47

State Chapters Implemented Comprehensive Affiliate Programs

NAIFA's Chapter Coaching Program is a comprehensive service provided to all NAIFA chapters. NAIFA's Chapter Services Team and Member and Chapter Services Department provide guidance, resources, and support to chapter leaders and executives. Under the program, each chapter completes an annual report and receives an annual Chapter Health Rating and Chapter Action Plan.

NAIFA also offers full-service chapter management under NAIFA Association Management Services. Last year, 19 state and territorial chapters and three local chapters opted to take advantage of the service.

NAIFA provides educational resources for consumers via blog posts, webinars, and financial empowerment tools on our FinancialSecurity.org consumer-facing site. Content comes from the Financial Security Alliance (security.naifa.org/financial-security-alliance) and other partners. These resources provide information designed to increase financial literacy and encourage students and those transitioning in their careers to consider the insurance and financial services profession.

The greatest asset NAIFA offers consumers is access to our membership. Using the Find-An-Advisor tool on FinancialSecurity.org, they can connect with dedicated, ethical advisors providing services in specified practice areas in their communities. NAIFA's search tool also powers advisor search tools on the websites of NAIFA partners Life Happens and the Alliance for Lifetime Income.

NAIFA's Future Leaders Program is a free series of informational and educational webinars for U.S. college and university students considering careers in insurance and financial services. The sessions feature highly successful NAIFA members discussing what it takes to make it in the profession, career options within insurance and financial services, and how young agents and advisors can maximize their professional success.

"Understanding the Industry," with Delvin Joyce, CLU, ChFC, RICP. "Finding Your Best Fit," with Evelyn Gellar, LUTCF, RICP, CLTC, FSCP, CDFA.

"Choosing Your Own Adventure: Career Options in the Industry" with Cheryl Canzanella, LUTCF, CLU, ChSNC, Mimie Yoon-Lee, Derek Scheetz, and John D. Richardson, RICP, LACP.

"Tools for Success: Becoming the 1%" with Christopher Gandy, LACP.

35 Future Leaders Participants in 2022 from 175

Participating Colleges and Universities