2025 CAYMAN

Our motivation over the past two decades has been to create interiors with a sense of character that is not only beautiful but livable for our clients. As Cayman’s Design Exemplar, our highly skilled creatives bring years of expertise and unparalleled value to our projects.

Acorn Media mailing address: PO Box 31403

Grand Cayman KY1-1206 Cayman Islands

Acorn Media physical address: 209 Alissta Towers

North Sound Road, George Town

Tel: (345) 946 3200 Fax: (345) 946 2830

Email: info@acorn.ky www.caymanresident.com

Welcome to the 22nd annual issue of Cayman Resident! It has been a joy working with our wonderful team at Acorn Media who check, research and update every piece of information contained in these pages and across our website each year, ensuring that we bring you the most up-to-date information. And we’re always adding new information that we think you — our valued readers — will find useful and interesting.

Thank you also to the many industry experts who have, once again, shared their wealth of knowledge and expertise so that we can in turn share that with you. The Cayman Islands are flourishing and much has changed in a year; the myriad of which is reflected in the following 480 pages, and on the Cayman Resident website (www.caymanresident.com).

Each year it is so interesting for us to delve into every aspect of what has been happening across our islands, from the prospering financial services industry, which has been superbly managed by highly educated members of our government and the private sector, to the booming construction industry that has been building new hotels, homes and schools, plus there are new restaurants and food festivals that we look forward to going to.

We really do talk about everything that is happening in the Cayman Islands and we answer questions that you might not have even thought to ask! Cayman is a wonderful place to live and work, where ‘Caymankind’ is a real thing, and our Community Life chapter reflects this with the dozens of social and service clubs, and charitable organisations that continue to help those in need and genuinely want to give back to our community. Long may this side of Cayman continue to blossom!

We hope you have a wonderful year ahead and we would like to wish you, your family and the whole Cayman community a very happy, prosperous and blessed 2025.

Editor

Joanna Boxall

Sales

Charles Grover

Deborah Roberts

Design/Production

Julian Dalton

Michelle Pankhurst

Researchers/Copy

Editors

Emily Richardson

Rosita Ritch

James Sedgley

Jessica Wright

Proofreaders

Lindsay Japal

Peta Adams

Contributors

Christine Ballantyne-Drewe

Monique Bhuller

Hilary Brooks

Michelle Butler

Shana Chin

Louise Desrosiers

JS de Jager

Lucy Frew

Nick Joseph

Ian Mason

Menelik Miller

The CUC team

Phillip Paschalides

Fleur Peck

Louise Reed

Claudia Subiotto

Darren Trickett

Benjamin Twidle

Jeanette Verhoeven

Joanne Zeigler

Photography

Cathy Church

Julie Corsetti

Rebecca Davidson

John Doak Architecture

Chuck Gloman

Cayman Islands National Archive

Daria Keenan

Jennifer Marshall

John Molyneux

Marc Montocchio

Courtney Platt

Lisa Reid

Jonathan Sparrow

Kathleen Spencer

Design Studio

Bryan Winter

Monika Wotkiewicz

To create the Cayman Resident magazine and website every year takes a team of dedicated staff and the willing participation of industry experts. We owe our heartfelt thanks to:

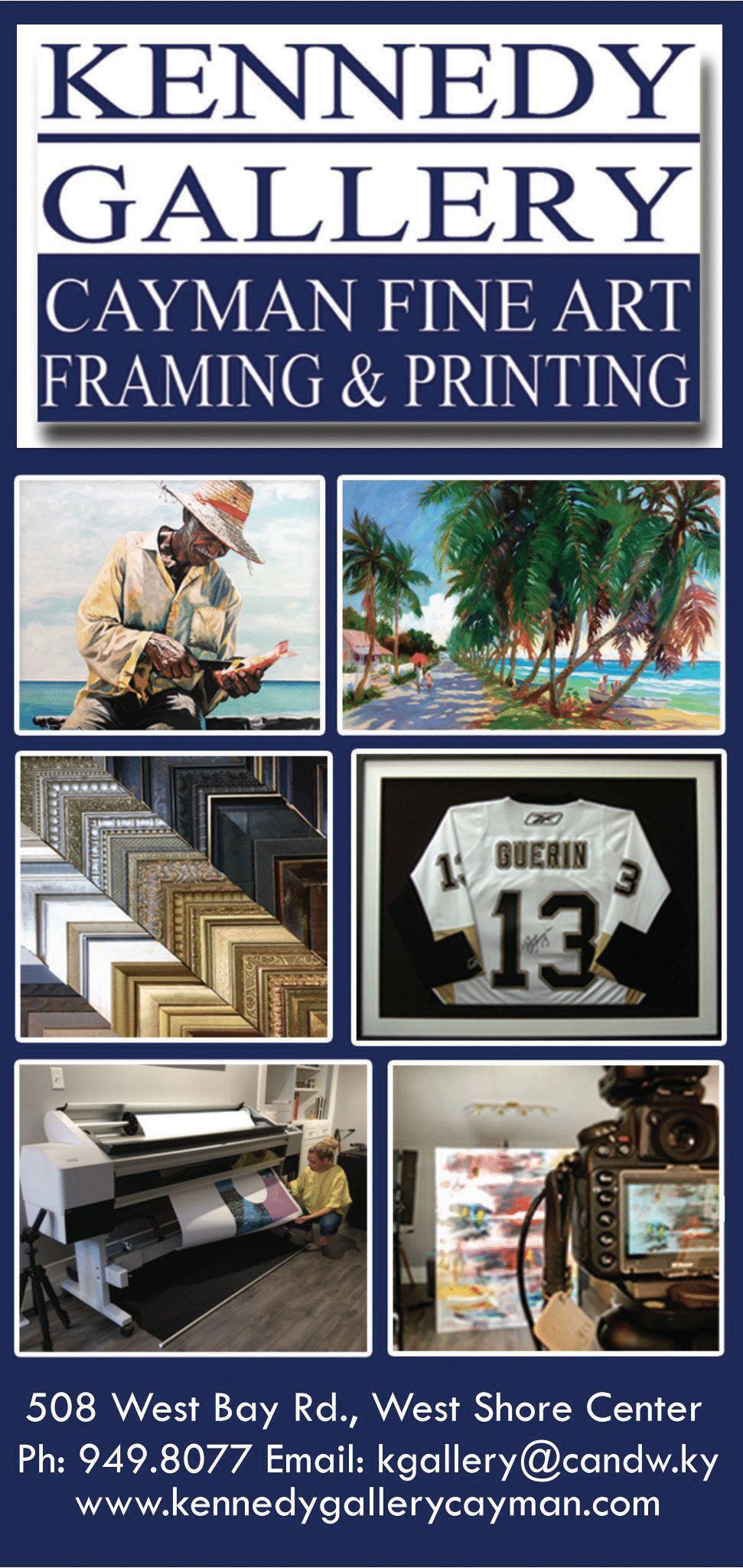

Michelle Butler from Design Studio who completely updated our Home Improvements chapter giving it a fresh and inspiring new perspective and direction.

Louise Reed and her team at the CML Group who shared their wisdom on the current state of the jobs market in Cayman, and advised on specific areas such as IT, accounting and legal services.

Claudia Subiotto from RE/MAX who wrote the ‘Overview of the Cayman Property Market’, updated us on all the new developments, plus advised on the status of buying a house in Cayman. Fleur Peck from Blue Point Consultants who shared her very detailed market report on what is happening in the world of property in Cayman.

Jeanette Verhoeven from Bogle Insurance Brokers who helped us update the insurance information across the Health, Settling In and Transportation chapters. She knows everything about insurance!

Louise Desrosiers from Travers Thorp Alberga who is the author of the Family Matters chapter

Nick Joseph from Reside Cayman again shared his expertise on Cayman’s immigration laws.

Menelik Miller at Appleby who helped us update all our insurance legislation.

JS de Jager from Cayman Management who updated the Independent Directors information.

Hilary Brooks from HSM who reviewed our endof-life medical laws, as well as the information we have on Wills and probate.

Also, special thanks to the team at Walkers (Cayman) LLP who again helped us update large sections of our financial services information: Christine Ballantyne-Drewe who helped us update the investment funds, fund administration and investment business information in various chapters.

Monique Bhullar helped us update the Trusts section of the Cayman – A Global Financial Centre chapter.

Lucy Frew updated the sections on Jurisdiction of Choice, Banking in the Cayman Islands, Beneficial Ownership and Legislation to Meet Client Needs.

Ian Mason who updated the information we have on FinTech and Cryptocurrencies.

Philip Paschalides who reviewed and updated the information we have on single family offices and families relocating to Cayman.

Benjamin Twidle helped us review and update our information on Taxation in the Cayman – A Global Financial Centre chapter.

Joanne Ziegler helped us review and update the Structured Finance section, as well as the information on CLOs.

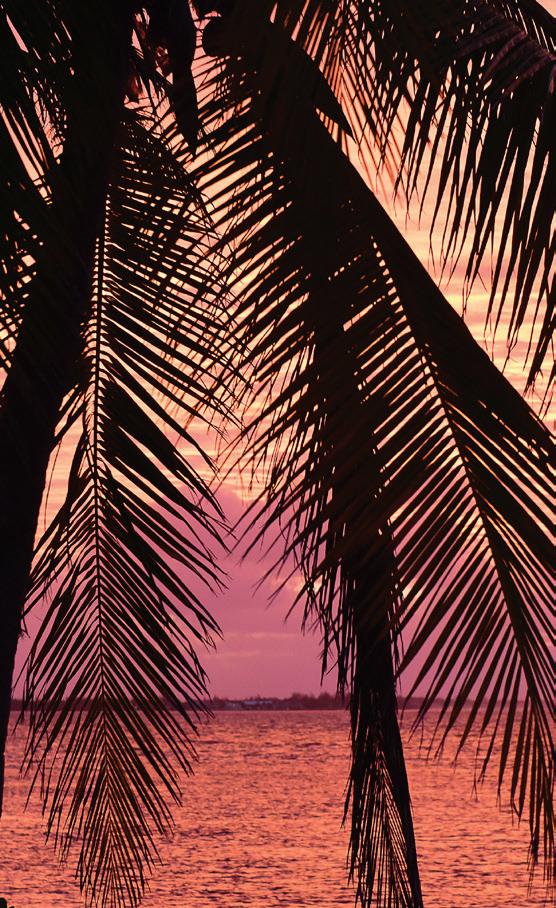

Our Cayman Resident 2025 cover photographs were taken by Julie Corsetti. We would like to thank Monyque Brooks for agreeing to be featured on the front cover, and to Julie Corsetti who took this beautiful photo of our 2025 cover model.

Special thanks to the photographers!

Last but not least we would like to thank the Islands’ wonderful photographers who have given us so many of their beautiful photographs to use in this issue. We need a wide variety of photos, from a cross-section of life in these Islands, and it is a huge task each year.

On a final note, we always welcome contributions, suggestions or photos to make this magazine even more informative and visually appealing each year. If you are a budding photographer and would like to get some of your photos published, then send us your best. As you can see, we publish a wide variety of images so don’t be shy! Contact Acorn Media on (345) 946 3200 or email: joanna@acorn.ky.

At Kirk Market, we go the extra mile to bring you fresh, local produce, trusted grocery brands, and authentic European products, all in one place.

Visit our Cheese & Charcuterie Department for an exceptional selection of European products, or explore our Meat & Seafood Department, which features Certified Angus Beef® PRIME cuts and the freshest seafood on the island.

If you're looking for a delicious meal on the go, our Salad Bar, Mediterranean Bar, and Hot Bar offer an incredible selection of local and international dishes, prepared fresh every day by our talented chefs.

Shop at Kirk Market, and experience a world

Sticks & Stones Home Collection has been providing the Cayman Islands with unique & eclectic home furnishings and design for over two decades. We are the exclusive supplier of Rowe & Robin Bruce upholstered furniture. Our showroom located on The Grand Pavilion Courtyard showcases a wide selection of our offerings that may always be custom-tailored to your home.

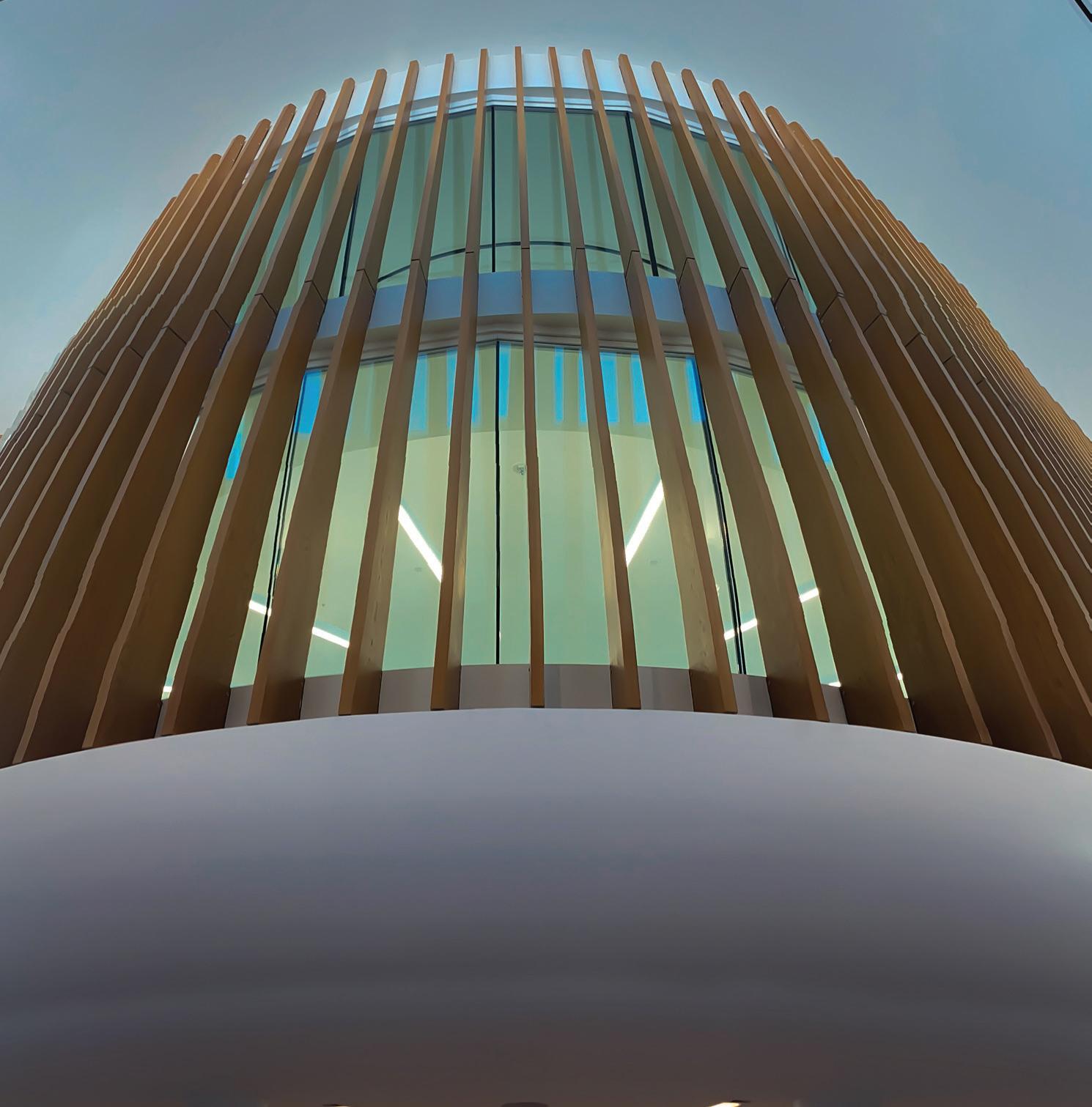

AT DART, we’re committed to creating a prosperous future, not just for our company and our people, but for the entire Cayman Islands.

For over 30 years, we’ve been attracting tourists, professionals and investment to the islands with our diverse portfolio in real estate, hospitality, retail and leisure.

But that only tells half the story.

We’ve also invested in education, healthcare and community projects. Built homes and offices with world-class sustainability credentials. Nurtured careers and empowered employees. Developed renewable energy solutions and resilient infrastructure. And created inspiring places to live, work and play.

Because we believe a better tomorrow starts with the foundations we lay today. dart.ky

Louise is the author of the Family Matters Chapter. Head of the Family Team at Travers Thorp Alberga, Louise is a highly experienced family law litigator and accredited mediator. Louise sits as an elected committee member for the CI Family Law Bar Association and a supervisor attorney for the Legal Assistance Clinic. Louise has almost 20 years’ experience, having been called to the Bar in England and Wales in 2006. She is an expert in dealing with nuptial agreements, divorce and ancillary financial matters. She has a wealth of experience with HNW divorces, that includes multi-jurisdictional asset tracking. She has an interest in family cases involving autistic children/parents, or those with additional needs.

Menelik helped us write and update the insurance information in the Cayman a Global Financial Centre chapter.

Counsel at Appleby in the Cayman Islands and Head of the Regulatory and Compliance group, Menelik practices in the area of financial services regulation, advising on regulatory issues and establishing newly regulated businesses, prudential regulatory considerations, corporate governance and strategic approaches and he has significant experience of regulatory inspections and other regulatory enforcement matters. Menelik has more than ten years of experience working with or for financial service regulators in the UK, Jersey, BVI and Cayman.

Benjamin helped us update the information we have on taxation in the Cayman a Global Financial Centre chapter.

Benjamin is a Senior Counsel based in Walkers’ Global Regulatory & Risk Advisory Group, which regularly acts for major financial services providers, investment banks, funds and investment managers. Benjamin advises on a range of regulatory matters, including FATCA and the Common Reporting Standard, economic substance, data protection and anti-money laundering and sanctions. He has also worked with large financial institutions on regulatory applications and submissions to the Cayman Islands Monetary Authority.

Louise helped us update the information we have in the Working in Cayman chapter, and she helped us understand the current state of the jobs market in Cayman.

Louise manages operations and leads the executive search function at the CML Group, which is comprised of CML Offshore Recruitment, Nova Recruitment, and the career development non-profit, Connect by Nova. Louise has 20+ years of HR and recruitment experience, starting her career as a recruiter in the UK’s fast-paced commercial search and selection industry before moving to Cayman in 2008 where she headed up the financial services recruitment arm of CML.

Lucy updated information on beneficial ownership, legislation to meet client needs, banking and jurisdiction of choice.

Lucy is a Partner and is the head of Walkers’ Global Regulatory & Risk Advisory Group. She brings more than 20 years’ experience as a specialist financial regulatory and risk management advisory lawyer. Lucy’s clients are financial institutions across the international and domestic spectrum, including a range of banks, investment funds, administrators, investment managers, advisers, brokerdealers, arrangers, trading venues and insurance and reinsurance sector clients. She also has significant experience in advising on FinTech and virtual assets.

Christine updated information on investment funds, fund administration, and funds and investment business in various chapters.

Christine is based in Walkers’ Cayman Islands office where she is a Partner in the Global Investment Funds Group. She advises primarily on the formation, operation and restructuring of investment funds and has extensive experience in both open and closed ended investment structures, as well as downstream corporate transactions. Christine advises a broad range of institutional asset managers, private equity sponsors, family offices and start-up and emerging managers.

Ian helped us update the information we have on FinTech and cryptocurrencies.

Ian Mason is a Partner in the Regulatory & Risk Advisory Group, having joined Walkers’ Cayman Islands office in 2023. Ian’s practice includes both contentious regulatory work and advising on compliance matters, and he has particular expertise in advising on FinTech and crypto-assets, as well as financial crime, AML and economic substance issues, and advising clients on dealing effectively with regulators, including CIMA inspections, regulatory investigations and enforcement proceedings on the defence side.

Monique helped us update the Trusts information that we have in Cayman Resident. Monique Bhullar is based in Walkers’ Cayman Islands office where she is a Partner in the Private Capital & Trusts Group. She advises high-net-worth individuals and families, trust companies, family offices and charitable organisations on all aspects of private trusts, foundation companies and other wealth and estate planning structures. She also advises on a wide range of Cayman Islands commercial trust matters, including the creation and administration of investment funds structured as unit trusts, securitisation trusts, liquidating trusts, employee benefit trusts and pension trusts.

Over the years Nick has written, added to and updated our Immigration chapter - all of it!

With a BA in Psychology and Languages, and an LLB (Hons) in Law, Nick was admitted as a Cayman Islands Attorney at Law in 1997. Nick is a well-known Cayman Islands specialist in Cayman immigration, employment and licensing matters. He is the Founder of Reside Cayman and he and his team work extensively in the field of residency as it relates to assisting qualified persons in securing and (for those already here) maintaining their residence in the Cayman Islands.

Michelle updated the information on home improvements in the Cayman Islands. Michelle is a trained architect who specialises in interior design. Working alongside her husband, David Wilson, they founded Design Studio Interiors Ltd, an award-winning firm based in Grand Cayman. Raised in both Canada and Cayman, Michelle combines her diverse cultural background with her passion for design to create stunning and functional spaces. Her ability to connect with people and understand their needs has been key to her success. Michelle is proud to contribute to the growth of the design community in Cayman, consistently delivering exceptional designs that enhance the lives of her clients.

Fleur is the author of a very detailed market analysis of the Cayman property market which she let us use to update our chapters.

Fleur is a Chartered Surveyor, registered valuer, member of the RICS and is the owner of Blue Point Consultants. She has 20 years’ experience in the property market having started her career in one of the top surveying firms in the UK. She has developed a strong reputation in the hotel and resorts sector on the valuations, consulting and sales side. Recent instructions include portfolio valuations of hotels for market value and insurance purposes, insurance negotiations after damage from hurricanes, as well as the sale of numerous hotels in Cayman.

JS updated the information on Independent Directors in Cayman Resident.

JS is the Managing Director of Cayman Management and has overall responsibility for the diverse range of services provided by Cayman Management and its affiliated companies. JS is a dual Cayman Islands (naturalized) and South African citizen and holds a Bachelor’s Degree in Accounting from the University of the Free State, South Africa. He has a broad professional and commercial accounting background, having worked as an accounting and corporate governance professional in both general practice and industry, including experience in South Africa before he moved to the Cayman Islands in 2007.

Claudia completely rewrote the ‘Overview of the Cayman Property Market’ in the Finding a Home chapter, and she reviewed the current status of buying homes, land and condominiums in Cayman.

Claudia has previously lived and worked in London, New York and Rio, and her past career in pharmaceutical sales – working under technical and extremely competitive conditions – has established a great foundation for working in real estate. As a member of the award-winning Bovell Team at RE/MAX, Claudia brings to the table her experience and contacts in the property industry, as well as her thorough knowledge of what it takes to live and work in the Cayman Islands.

Philip updated the single family offices and families relocating sections of Cayman Resident. Philip Paschalides is based in Walkers’ Cayman Islands office and is a Partner in the firm’s Private Capital & Trusts Group, representing private clients and family offices on the financing aspects of crossborder transactions in which they participate. Philip leads a unique, specialist team which structures and establishes single family offices in the Cayman Islands and assists with the deployment of private capital in acquisitions and other commercial transactions. Philip was originally a structured finance lawyer and continues to do some work involving structured finance in the reinsurance sector.

Joanne helped us with the structured finance information, as well as the information on CLOs. Joanne joined Walkers’ Cayman Islands office in 2014 and is a Partner in the Finance team. She specialises in debt capital markets and structured finance with extensive experience in CLOs, securitisation and note programme structures, as well as bespoke structured products. Joanne also advises on listings on the Cayman Islands Stock Exchange, and regularly acts for asset managers, leading investment banks, financial institutions, public and private companies and leading on-shore law firms, advising on a variety of finance transactions.

Hilary reviewed our End-of-Life Medical Laws and our Wills and Probate sections.

Hilary is a Senior Associate at HSM and a highly experienced attorney with a proven track record in Private Client matters and Labour and Employment Law. Hilary has exclusively practiced in the Cayman Islands since 2012 and has been a Notary Public since 2008. Hilary is proficient in preparing Wills, codicils and estate administration. Hilary studied law at the University of Liverpool, graduating with honours in 2009. Hilary then achieved a commendation from the Professional Practice Course from the Cayman Islands Law School in 2010.

Cayman’s outlook, a history of the Cayman Islands, customs, traditions, festivals, legal and political systems, geology, flora and fauna, climate, business hours and dress code.

In April 2024, the revised National Energy Policy 2024-2045 was approved by Cabinet with an updated target to increase the amount of energy that Cayman derives from renewable energy to 70% by 2037 and 100% by 2045. Although the Caribbean Utilities Company (CUC) has allowed customers to connect their solar and wind generated power to CUC’s grid, only 3% of Cayman’s electricity currently comes from renewables. The ability for residents to generate and utilise up to 20 kilowatts of solar energy for personal consumption, as well as utilise battery energy storage is also included in the amended policy. It is hoped that this will reduce the Cayman Islands’ dependence on fossil fuels as the Islands try to adapt to the use of renewable energy.

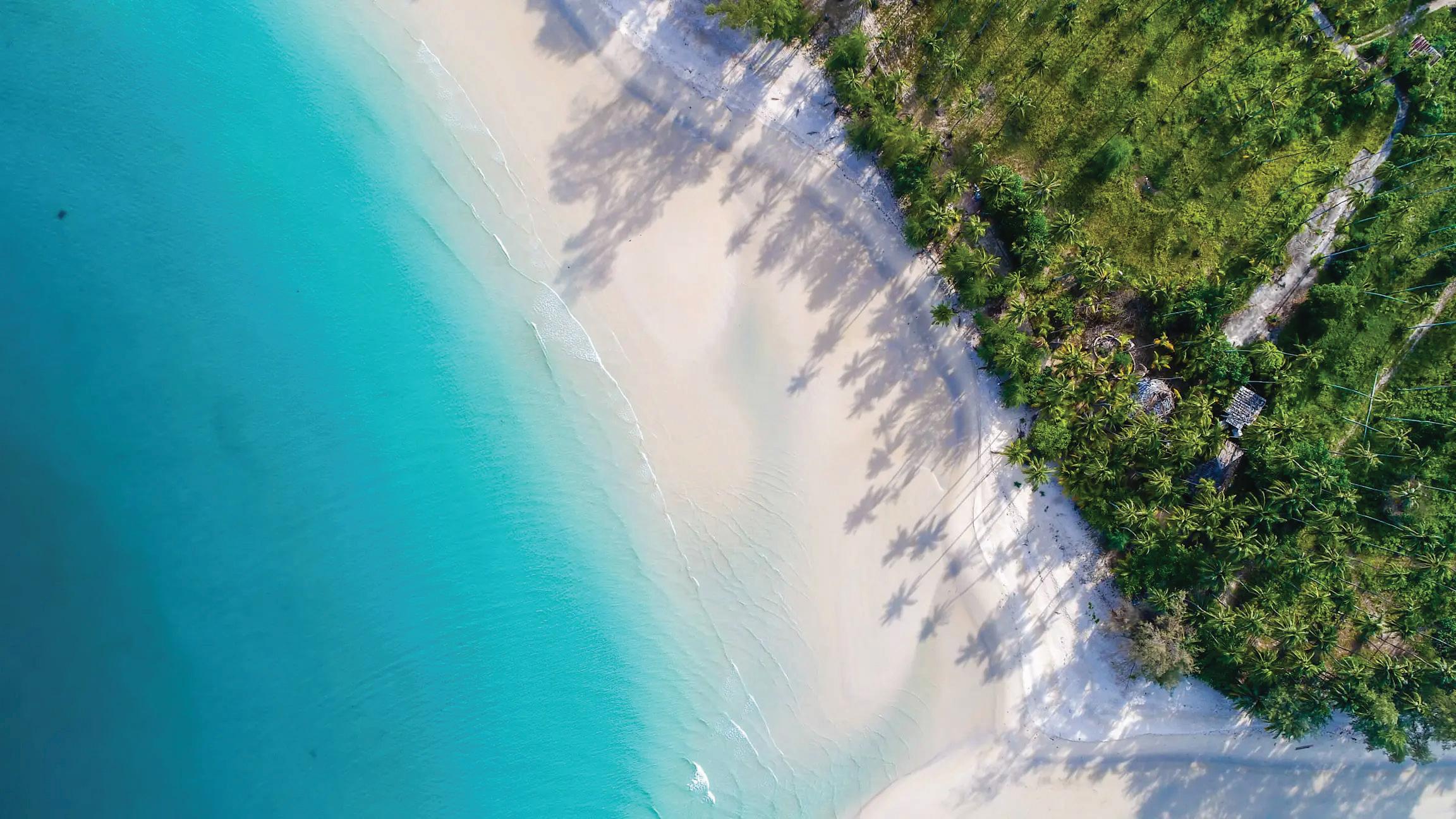

Cayman welcomed over a quarter-million stayover visitors in the first half of 2024, a 6.5% increase from the same period in 2023. This is the third-highest number of visitors on record. Most visitors came from the United States, followed by Canada and Europe. Increased aviation capacity and new hotel openings are helping to contribute to an optimistic outlook for the tourist sector, which generates substantial revenue for the government. Airlines have added additional routes and flights resulting in a 15% increase in the number of seats available to the Islands, and thanks to the construction of new hotels, the room stock has expanded to 8,022 rooms across the three islands. Conversely, there was a notable decline in cruise ship arrivals, down 14.6% from 2023, which reignited discussions about building a cruise birthing facility.

As development continues, and with land space in the George Town and Seven Mile Beach corridor running out, developers are building upwards. However, construction has been impacted by rising build costs, which have risen by 8.5% year-on-year according to a May 2024 analysis from BCQS. As a result of the rising costs to build, coupled with higher interest rates, land sales have slowed, and sellers have begun to reduce their listing prices.

Cayman’s prudent government planning and bonds issued in foreign and local currency, along with the Island’s strong fiscal policies, means that Cayman is financially one of the most robust countries in the Caribbean and is positioned to weather the challenges that the world economy faces due to rising costs and inflation rates. The Consumer Price Index for March 2024 revealed a 1.5% increase in total inflation from the previous year, with housing and utility costs increasing by 2.6%, healthcare prices by 2%, communication costs by 7.4%, education costs by 7.9%, and rents by 11.1%. CUC also increased their retroactive rate by 3.2% which will be partly offset by fuel efficiency savings from two of their large generating units.

Employees in the hospitality and service industry will see an increase in the minimum wage to CI$7 per hour starting 1st July 2025; the 25% gratuities benefit for these workers will be eliminated. However, the minimum wage for all other sectors remains unchanged at an impossible-to-live-on rate of CI$6 an hour. The Minimum Wage Advisory Committee (MWAC) recommended an increase to CI$8.75 per hour which would have benefited more than 10,000 people, but this has been rejected by the government due to the concern that this will lead to an increase in the cost of goods and services at a time when people are already struggling with the cost of living in Cayman. Instead, the MWAC will explore sector-specific minimum wages. Although this is a small step in the right direction, the overall unemployment rate has increased to 3.3% (October 2023) and prices continue to rise,

making living in Cayman very difficult for those on lower incomes.

In the first half of 2024, the Cayman Islands Monetary Authority issued 24 new international insurer licenses, representing a 50% increase compared to the same period in 2023. Currently, there are 700 Class B, C, and D insurance companies licensed in the Cayman Islands, with total premiums amounting to $40.39 billion and assets totaling $151.93 billion.

Moody’s credit rating for the Cayman Islands is Aa3 with a stable outlook due to Cayman’s political environment, strong policy continuity, high government effectiveness, sound financial management and economic growth. The Financial Action Task Force (FATF) has removed the Cayman Islands from its “Grey List” of jurisdictions under increased monitoring for anti-money laundering (AML) deficiencies. This decision follows Caymans’ successful implementation of all recommended actions and an on-site inspection by the FATF. The removal is expected to enhance our appeal for business and reflects the Islands strengthened regulatory framework and commitment to global AML standards.

Early Cayman History - 1503 to 1670 Christopher Columbus is credited with discovering the Cayman Islands. The explorer was on his fourth voyage of discovery when his ships, ‘Santiago de Palos’ and ‘La Capitana’, sailed past Cayman Brac and Little Cayman, on 10th May 1503. His son Ferdinand noted in his journal, “We were in sight of two small, low islands, filled with tortoises, as was the sea all about.” Columbus named the islands ‘Las Tortugas’ after the large number of sea turtles he saw. Columbus and his men didn’t stop. Worm-eaten and leaking badly, their ships laboured on until they had to be beached and eventually abandoned in St. Ann’s Bay, Jamaica.

Historians question whether Columbus was really the first person or even European to set eyes on the Cayman Islands. A full

year prior to Columbus’ journey, the three islands appeared on the 1502 Cantino map. Moreover, Queen Isabella of Spain authorised four other voyages to the New World in 1499. Aside from these facts, even if Columbus was the first European explorer to set foot in Cayman, at the time of his visit, there were as many as a million Carib, Taíno and Arawak Indians living in the adjacent coastal areas in the region. Archival research suggests that Cayman is a word of Carib-Indian origin, meaning crocodile. The Caribs and Taíno were proficient mariners, known to make ocean journeys in canoes up to 80ft in length. In Jamaica, thousands of Taíno Indians were living just up the current from Cayman, so it is probable that the Taíno were among Cayman’s first visitors.

In 1586, Sir Frances Drake and a fleet of 23 ships stopped in Grand Cayman for two days and recorded that the island was not inhabited, but that there were numerous crocodiles, alligators, iguanas and turtles.

In 1655, Admiral William Penn and General Robert Venables were sent from Britain by Oliver Cromwell to take Hispaniola Island from the Spanish. The so-called ‘Western Design’ failed as the English did not capture the Spanish stronghold; however, they did manage to seize Jamaica. Shortly afterwards, Cayman became a possession of Great Britain, following the signing of the Treaty of Madrid in 1670.

By 1660, the English had established themselves in Jamaica and began treating the Cayman Islands as natural appendages of that larger territory. However, apart from small settlements on Grand Cayman and Little Cayman, most of the three islands were left untouched. This was ideal for pirates, since Cayman also lay astride the route of treasure galleons returning to Spain, laden with gold and silver from the New World. The promise of capturing Spanish treasure ships on their way home from the Caribbean soon attracted the attention of a motley crowd of buccaneers,

pirates and freebooters. The ‘Golden Age’ of piracy spanned from the 1650s to the 1730s. Cayman’s most notorious pirate was Edward Teach, also known as Blackbeard, who frequented the area from 1713 until his death on 22nd November 1718.

Despite the celebration of Cayman’s National Festival, Pirates Week, held in November each year, the piratical part of Cayman history is downplayed. However, some of the biggest names in buccaneering circles, including Lowther, Lowe, Morgan and Blackbeard, prowled the coasts of the Cayman Islands. According to Neville Williams’ book, ‘A History of the Cayman Islands’, the abundance of fresh water, turtle meat and wood, made Cayman an ideal landing spot. Furthermore, the islands offered pirate captains the possibility of finding crews to man captured vessels and a quiet location away from the authorities where pirates could hide their loot and careen and repair their vessels. This pirate’s haven, however, only lasted for about 110 years. By the 1730s, the scourge of the buccaneers had been largely tamed, if not discouraged, by the growing population.

The first Cayman land grants by the English Crown were made in 1734 and it is likely that these first settlers brought slaves. The holdings were granted to Campbell, Middleton, Bodden, Spofforth, Foster and Crymble. In 1773, the cartographer George Gauld drew the first map of Grand Cayman for the Royal Navy. He made a note in the margin, marking the population at 400 – half free and half slaves. By 1802, when Edward Corbett did his census, the population of Grand Cayman had grown to 933, of which 545 were slaves. Interestingly, only two of the original founding families, Foster and Bodden, remain. It is possible some of these families returned to Jamaica with their slaves having found Cayman unsuitable for planting on a large scale. According to the book ‘Cayman Emerges’ by Bertie Ebanks, when slavery was officially abolished in 1833, there were around 985 slaves owned by 116

families. During this time, the population was 2,000, resulting in a ratio of about one slave to one non-slave. This makes Cayman very unusual compared to other Caribbean islands, particularly Jamaica, where the ratio was 10 slaves to one free man at the time of emancipation. In exchange for their freedom, the claims of the 116 Caymanian slave-owners totalled £447,765 pounds sterling.

To this day, Cayman has very good race relations and according to the author Gary Lee Roper, quoting from his book ‘Antebellum Slavery’, “Grand Cayman differs greatly from its neighbour Jamaica, in that there were no large plantations on the three small Cayman Islands, slaves were limited to the trades and domestic arts”. This is part of what differentiated the Cayman Islands from other slave-owning nations at that time. Although slavery existed in Cayman for about a century, it was not ultimately able to prosper because the main sources of industry on the Island were not in areas that were conducive to the slave trade, like farming and agriculture.

In the 1700s, permanent settlement of Grand Cayman began with a few families, most notably the Boddens. Between 1734 and 1742, five land grants in Grand Cayman were made by the Governor of Jamaica. At this time, mahogany and logwood were exported to Jamaica. In 1780, William Eden, a mariner and early English settler, established a cotton and mahogany plantation in Savannah’s Pedro bluff, building St. James (now known as Pedro St. James Castle), a remarkable building for that period and the only house on Grand Cayman to survive the devastating hurricane of 1784. In 1794 the ‘Wreck of the Ten Sail’ occurred and Cayman’s most popular legend of how Cayman became tax-free was born. In 1798, the Governor of Jamaica appointed the first magistrate in Cayman.

The 1800s saw the first census in 1802, on 5th December 1831, Pedro St. James was the site of a historic meeting of residents

who came together to select representatives for the five different districts. The meeting allowed for local laws to be formed for better government. Cayman’s first elections took place five days later, and on 31st December, the first Legislative Assembly met in George Town. The population at that time was approximately 2,000. Between 1830 and 1840, the first missionaries from the Anglican and Wesleyan churches arrived and the first schools were established, the Mico Charity and the Wesleyan school. In 1835, Governor Sligo of Jamaica landed in Cayman to declare all slaves free, in accordance with the Emancipation Act of 1833, and to help keep the peace in the abolition period. In 1846, the Presbyterian Church was established by the Rev. James Elmslie. In 1898, Frederick Sanguinetti, a British national, was appointed by the Governor of Jamaica as the first Commissioner of the Cayman Islands.

1900 to 1970s

In 1920, a major Education Act paved the way for the establishment of government schools in all districts. In 1937, the first cruise ship, the ‘Atlantis’, visited Cayman and the beginnings of tourism commenced with the publication of the first tourist booklet. However, tourism did not really take off until the 1950s when several hotels opened. Then, in 1953, Grand Cayman’s first airfield was built, which replaced the seaplane service that had operated in the North Sound since the 1940s. The year 1953 was significant for two other reasons, the opening of the first commercial bank, Barclays, and the first hospital, the Cayman Islands Public Hospital.

In 1959, Cayman enacted its first written Constitution, which granted women the right to vote. In the same year, Cayman ceased to be a dependency of Jamaica. In 1962, following Jamaica’s independence from England, Cayman chose to remain as a Crown Colony. In 1965, the Mosquito Research Control Unit (MRCU) began operating. In that year, the Chamber of Commerce was established, the Caymanian Weekly newspaper (later the Caymanian

Compass) began publishing and the Rotary Club of Grand Cayman was chartered. In 1966, landmark legislation was introduced to encourage the banking industry. In 1968, Cayman Airways started flying, and in 1970, the population reached 10,249 with a total of 403 visitors arriving that year. In 1972, a new Constitution was introduced under which Cayman would be governed by a Legislative Assembly, Executive Council and a Governor. In this same year, Cayman introduced its own currency. In the early 1970s, Cayman’s banking industry took off.

The Cayman Islands legal system is based on English common law, with the addition of local statutes which have, in many respects, changed and modernised the common law. The Islands have a good legal and judicial system, which is constantly being upgraded to enhance the Islands’ safety and reputation as a leading financial centre. The courts system is a simple one, with practice and procedure based on English law. Minor criminal and civil cases are tried by a Stipendiary Magistrate sitting in the Summary Court. All serious crimes and most civil cases are tried by the Grand Court, presided over by the Chief Justice and Grand Court Judges permanently residing in the Islands. Appeals lie from the Grand Court to the Cayman Islands Court of Appeal, which sits in Grand Cayman and, from there, to the Judicial Committee of the Privy Council in England. New residents, especially those from the US, may be surprised to find that barristers in court wear wigs and gowns.

The Cayman Islands is a parliamentary democracy with separate judicial, executive and legislative branches and holds its general elections every four years. Cayman has a ‘One Man, One Vote’ electoral system, with 19 districts and each represented by one Member of Parliament. As of December 2020, the LA became known as Parliament and MLAs became Members

of Parliament. Since the establishment of political parties in the Cayman Islands, a record number of candidates entered the 2021 race as independents and a total of eleven were elected. Six former Cabinet and Progressives members – Sir Alden McLaughlin, Roy McTaggart, Juliana O’Connor-Connolly, Dwayne Seymour, Joseph Hew and Moses Kirkconnell – were re-elected. However, after the much talked about ‘horse-trading’ – what locals call the period of time following an election when ministry assignments are decided – the independents, formed the government, and secured control of Cabinet.

Premier Juliana O’Connor-Connolly leads the Cabinet and holds responsibility for finance, education, district administration and lands. Deputy André Ebanks oversees financial services, commerce, investment, innovation, and social development. Kenneth Bryan is responsible for tourism and ports, while Isaac Rankine has youth, sports and heritage. Johany “Jay” Ebanks oversees planning, agriculture, housing, infrastructure, while Katherine EbanksWilks takes charge of sustainability and climate resiliency. Sabrina Turner has health, wellness, and home affairs, and Dwayne Seymour has border control, labour, and culture. Alden McLaughlin is the Speaker of the House. Roy McTaggart is the Leader of the Opposition, with Joey Hew as Deputy Leader. The next general election is scheduled to be held in 2025.

The Cayman Islands has been connected to Great Britain since the signing of the Treaty of Madrid in 1670. From that time until 1962, Cayman was linked to Jamaica as a dependency. In 1962, Jamaica chose to become independent, but the Cayman Islands decided to remain a British colony.

In 2002, the Foreign and Commonwealth Office discontinued the use of the term ‘Dependent Territory’ and the Islands are now called an ‘Overseas Territory’. The Foreign and Commonwealth Office appoints a Governor, whose responsibilities cover a number of areas, including

national security, foreign affairs, police, immigration, passport office, postal services and other portfolios, such as broadcasting, district administration and the civil service. There is little desire among Caymanians for the Islands to become independent; they have seen what has happened to Jamaica and the Bahamas and they want none of it.

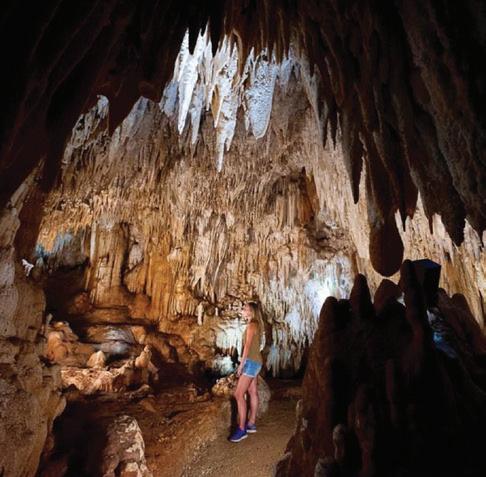

The Cayman Islands are the tops of seamount pinnacles reaching up from the Cayman Trench – one of the deepest sections of ocean in the world. The Cayman Ridge stretches from the Sierra Maestra mountain range in Cuba to the Gulf of Honduras. This ridge forms the northern margin of the Cayman Trench, which is 100 miles wide and reaches depths of around 25,000ft. The Islands’ position near the Oriente Transform Fault and the Mid-Cayman Rise means that the three Islands are separate uplifted fault blocks that were pushed up by friction between the North American and the Caribbean tectonic plates. According to the research of geologist Brian Jones, each Island appears to have a granodiorite foundation, which is succeeded by a cap of basalt and an uppermost layer composed of carbonates. These carbonates were created by living organisms such as corals, algae and shells, and were laid down during sea level changes over the past 30 million years.

Hidden away, under the jagged crust of Grand Cayman’s East End and the craggy cliffs of the Bluff in Cayman Brac, lie beautiful and mysterious mineral deposits. These rock strata, called Caymanite, are found only in the Cayman Islands and are well disguised by the surrounding limestone. Caymanite has layers of colours in earth tones, created by the different metallic contents of each stratum. Its hardness challenges any who work on it, but when cut and polished, the stone has radiant hues and can be transformed into unique jewellery and carvings. There is a

permanent Caymanite display at the Cayman Islands National Museum and pieces can be purchased at various places in Cayman, including the Museum, Artifacts and Pure Art Gallery.

Flora & Fauna

Cayman is world-renowned for its marine life, but there is much to see on land as well. Over 650 different species of plants, of which 415 are native, have been recorded in Cayman and the forests are far more diverse than those found in more temperate, northerly latitudes. Two of the best places to see the flora and fauna of Grand Cayman are the Queen Elizabeth II Botanic Park, where you’ll spot lots of the endangered Blue Iguanas, and the Mastic Reserve and Trail, which protects the largest contiguous area of untouched, old growth forest in Grand Cayman. Cayman Brac and Little Cayman are also particularly popular with bird watchers. In Cayman Brac, visit the Brac Parrot Reserve, and while on Little Cayman, see the Booby Nature Reserve, which is a major breeding ground for the Red-Footed Booby. Grand Cayman’s Bullfinch has recently been reclassified by the American Ornithological Society as an endemic species, Melopyrrha taylori, as it is only found in Grand Cayman. Cayman also has a colourful native green parrot that can be heard chattering amongst the trees on all three islands, especially at sunset. Frogs and lizards are common around houses, especially those near natural areas. Owls and bats can be seen at night while large, edible land crabs crawl across roads after heavy rains. The agouti is shy and rarely seen but can be spotted in the Eastern districts. Fresh water ponds attract migrating birds and are filled with hickatees, a species of aquatic tortoise, and tiny minnows. Much of Cayman is covered in wetland and large areas of mangrove wilderness, an essential breeding ground for fish and birds. Mangroves are now a protected habitat in Cayman and cannot be removed without authorisation. Their protection is a major objective of the National Trust for the Cayman Islands. To learn more about the practical health applications of Cayman’s flora and fauna, follow Bush Girl Medicine on Facebook and Instagram (@bushgirlmedicine).

Before the Mosquito Research and Control Unit (MRCU) was established in 1965, mosquito numbers were legendary. Reports were made of livestock being suffocated during the night and people did not venture outdoors without a smoke-pot to drive off the mosquitoes. In 1974 one mosquito trap, which is a tool still used today to survey mosquito numbers, caught 793,103 mosquitos in a single night. However, thanks to Dr Marco Giglioli, MRCU’s first director, numbers have fallen. He and his team dug a huge network of canals, ditches, dyke roads and paths into the wetlands and swamps, which serve as mosquito breeding habitat, and by manipulating the water levels of these wetland areas he controlled the pest by physical means. These dyke roads are maintained to this day and are used to survey standing water for the presence of developing mosquitoes.

Composition: Grand Cayman, Cayman Brac and Little Cayman

Location:

Grand Cayman – Western Caribbean, about 150 miles south of Cuba, 480 miles southwest of Miami, 180 miles northwest of Jamaica

Cayman Brac – 89 miles northeast of Grand Cayman

Little Cayman – 5 miles west of Cayman Brac

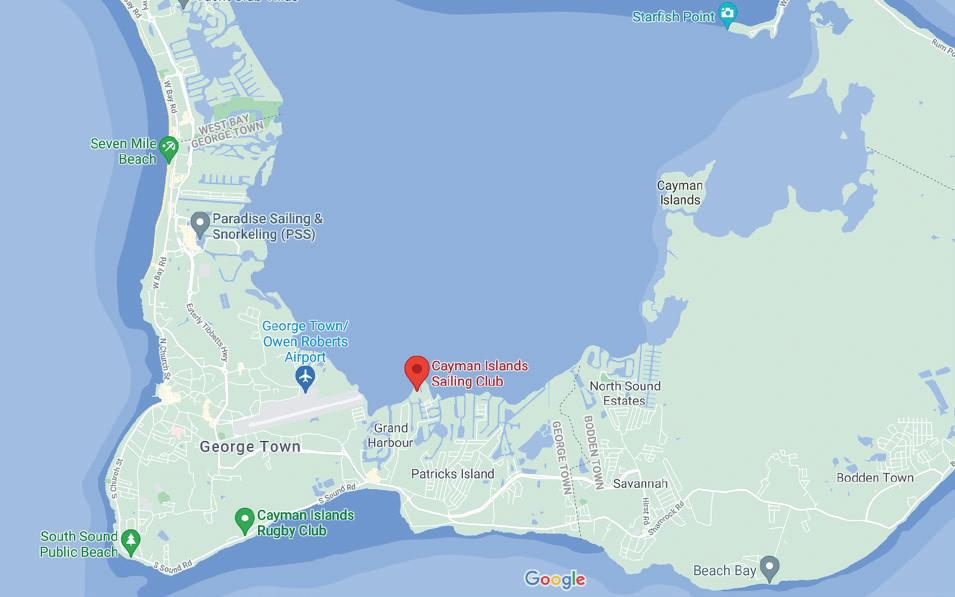

Capital: George Town, in southwest Grand Cayman

Size: 102sq miles/164sq km (total area of all three islands)

Grand Cayman – area: 76sq miles; length: 22 miles; average width: 4 miles; highest point: about 70ft above sea level

Cayman Brac – area: 15sq miles; length: 12 miles; average width: 1.5 miles; highest point: The Bluff – 141ft above sea level

Little Cayman – area: 11sq miles; length: 10 miles; average width: just over 1 mile; highest point: 40ft above sea level

Population: 84,738 (Fall Labour Force Report 2023)

National Income (2023):

Real GDP: CI$592.28 million (estimated)

Total Government Revenue: CI$846.1 million

Total Government Expenditure: CI$773.7 million

Net Operating Balance: CI$107.5 million

Core Government Debt: CI$469 million

Other Statistics (2023/2024):

Life Expectancy at Birth: 83.1

Hospital beds per 1,000 population: 2.7

Unemployment Rate: 3.3%

Total Work Permits: 37,334

Total Labour Force: 60,513

Total Civil Servants: 4,629

Average Inflation Rate: 1.7%

Total Imports: CI$1,112.1 million

Bank & Trust Licences: 94

Captive Insurance Licences: 673

Total Mutual Funds: 12,893

Private Funds: 17,020

Active Companies: 118,443

Air Arrivals 2023: 429,284; 2024 (Jan-Jun): 250,699

Cruise Arrivals 2023: 1,270,981; 2024 (Jan-Jun): 634,212

Main Industries:

Financial Services, Construction, Healthcare and Tourism

Political Status:

Overseas Territory of the United Kingdom (i.e. British dependency)

Nationalities:

Over 137 different nationalities are represented in Cayman, including Caymanian, Jamaican, Filipino, British, American, Canadian, Nepalese, a mix of Latin American and more.

When larval mosquitoes are found in the water MRCU uses a biorational insecticide to try to suppress the mosquito’s emergence. However, many thousands of inaccessible wetland acres produce mosquitoes as do areas of standing water, so trucks and planes are used to fog and spray these pests at dusk. MRCU’s Integrated Mosquito Management (IMM) programme has also been working hard at limiting mosquitoes produced in containers such as tyres, buckets, barrels and other water-bearing receptacles. The public are reminded to never leave water standing in upturned pots or tubs as mosquitos can breed in something as small as a bottle cap! Remember to check around your house after it rains.

Once known as the ‘Islands that time forgot,’ the Cayman Islands have been catapulted into the 21st century at, some say, an alarming rate. Over the last two decades there has been a determined effort to uphold a balance between preserving the essence and simplicity of the past, while still moving resolutely into the future. Many Caymanian customs and traditions are linked inextricably to religious holidays. Whether camping by the sea at Easter or hunting for land crabs during the rainy season, these events are social in nature and family-oriented. Visit East End on any given Sunday and you will see families and friends, recently returned from church, ‘shooting the breeze’ on their

front porches or enjoying a noisy game of dominoes under the shade of a breadfruit tree. Being up to date on the latest ‘Marl Road’ (gossip) is as important as drawing breath in the Cayman Islands!

The Traditional Cayman Home Caymanian homes, known as a ‘wattle and daub’ cottage, date back to the mid-18th century. Houses were usually rectangular, with foundation posts made from termiteresistant ironwood. Gaps between the ironwood or mahogany posts were filled with a basket weave of wattled sticks and then plastered on either side with lime daub made from burnt coral.

The earliest roofs were thatched using palm tree fronds, but in more recent times, wood, shingle or corrugated zinc have been used. Windows were simple openings with wood board shutters, while smoke-pots helped keep out mosquitoes. Normally, these one-storey dwellings would feature a steeply pitched roof. This would keep the houses cooler as hot air rises. The typical sandy yard would have been shaded with seagrape and popnut trees and there would be a separate ‘caboose’ for cooking.

Family outings to the beach on weekends are a major part of Caymanian culture, but sand plays another very important role in Cayman at Christmas time. Unlike many parents around the world, Caymanians have always been able to guarantee their children a ‘white Christmas’. The tradition

Wednesday, 1st January New Year’s Day

Monday, 27th January National Heroes Day

Wednesday, 5th March Ash Wednesday

Friday, 18th April Good Friday

Monday, 21st April Easter Monday

Monday, 5th May Emancipation Day

Wednesday, 14th or 21st May (TBC) Election Day

Monday, 19th May Discovery Day (3rd Monday in May)

Monday, 9th or 16th June (TBC) King’s Birthday

Monday, 7th July Constitution Day (1st Monday in July)

Monday, 10th November Remembrance Day

Thursday, 25th December Christmas Day

Friday, 26th December Boxing Day

of ‘backing sand’ has stood the test of time. Often, beginning as early as October, Caymanians could be seen by the light of the moon carrying ‘ground baskets’, woven from leaves of the magnificent thatch palm trees that tower loftily over the islands, brimming with powder-white sand from the beaches. The sand would be deposited in the front yard and on Christmas Eve, raked into intricate patterns and decorated with shiny new conch shell pathways.

Cayman’s proud maritime history has served to provide many lasting traditions. The Catboat, a simple sailing boat once used for fishing and turtling in and around Cayman waters, is enjoying a revival thanks to the efforts of the Cayman Islands Catboat Club. Regular regattas are held in Grand Cayman and the sight of these humble, yet skilfully crafted vessels tacking their way around George Town’s bustling harbour, vying for space amid cruise ships and dive boats, is a truly remarkable snapshot of the juxtaposition of past and present in Cayman.

Many years ago, the principal economic mainstay of the Cayman Islands was the hunting of sea turtles. However, there were other industries, including schooner building, sponge harvesting, gathering of seabird eggs, wrecking, guano collecting, catching sharks for the leather industry, felling and removal of hardwoods such as mahogany and cedar, barking of red mangrove trees and cutting of logwood for their use in dyes. Coconuts were exported, cotton was gathered, ropes were made from thatch and, from the late 19th century until the 1960s, Caymanians worked as merchant seamen on commercial ships.

‘Laying rope’ was once one of the few means of making a living for Caymanian women and children while the men were away at sea. This valuable custom has been passed down from generation to generation.

Certain districts were known to produce the best ‘tops’ for cutting and people would often walk for miles to collect bundles of thatch, which would later be stripped, dried and twisted into fine fathoms of rope. This would then be traded overseas for goods such as cloth, sugar or kerosene.

Folk music and dance have been a part of Caymanian culture for decades. In order to preserve, celebrate and propagate the musical traditions of the Cayman Islands, the Cayman National Cultural Foundation formed the Cayman Islands Folk Singers. The company exists to help revive the folk music tradition in the Cayman Islands. The work it produces is reflective of the Caymanian image and helps us appreciate our place in the Caribbean region and the wider world. Since its inception, the group has been showcasing Cayman’s rich musical heritage through song. The Folk Singers have an impressive repertoire of Caymanian composition, as well as beloved songs from around the region. For more information, email: info@artscayman.org or ysch-admin@gov.ky.

When the first Europeans came to Cayman, they found one of the largest turtle nesting grounds on Earth. For nearly 200 years, ships of all nations, particularly French, Dutch and English, came to these shores to ‘turn’ green and loggerhead turtles and dry their flesh, an easily obtainable source of protein for ship or plantation stores. Early on, Cayman became the centre of the Caribbean turtle industry. By 1800, the turtle population had dwindled and the local turtling fleet turned their attention to the south coast of Cuba and the coastline of Central America. Until the early 1960s, Cayman ships still supplied the largest share of turtles entering foreign markets from the Caribbean. These were mostly caught on the Mosquito Coast of Nicaragua.

The Cayman Islands officially banned turtle hunting in 1988 and the species is now protected under international conventions.

The Department of Environment (DoE) began sea turtle nest monitoring in 1998 and in November 2023 a total of 1,003 nests were counted across the Cayman Islands. Properties on the beach with nonturtle-friendly lighting are the number one major threat to turtle conservation, but property owners are being urged to install amber lights.

Camping by the sea at Easter is a longheld Caymanian tradition. Popular spots to camp are beaches along the Queen’s Highway, Rum Point, Cayman Kai and Seven Mile Beach. Camping in Cayman is legal, but there are strict guidelines. These include removing all garbage, disposing properly of human waste, not camping on land which has a ‘Do Not Trespass’ sign on it and being very careful with lighting and burying bonfires due to nesting turtles. Permission must be sought from the Public Lands Commission (Tel: (345) 946 7110) to light a bonfire on public land. To rent a public beach cabana, visit https://app. univerusrec.com/cipwpub/.

The Agricultural Show

Early Caymanians supplemented the sea’s bounty by subsistence farming. While organic farming has experienced a resurgence, the Department of Agriculture, in conjunction with the Agricultural Society, have been running the Agriculture Show for over 50 years. The show is a widely anticipated annual family event and provides farmers with an opportunity to sell their home-grown produce and display their livestock. There is also a wide selection of local produce, authentic dishes and handmade crafts available. Children participate in games, pageants, horseback riding and the petting zoo. The Agricultural Show is a testament to the love the people of these Islands have for the land. Held on Ash Wednesday, it is not to be missed!

Easter is a very festive time in Cayman.

Caymanians celebrate the occasion by camping on beaches and attending church services. Easter brunches also take place at numerous hotels and restaurants. Rum Point is a popular meeting point for groups with boats, and some families rent condos in Cayman Kai and enjoy the beach for the weekend.

Cayman has two carnivals which are both hugely popular and include a colourful street parade where people dress up in stunning costumes and dance to pulsating Soca music. The carnivals celebrate the Caribbean’s diverse African and religious roots, and they reflect the Island’s rich heritage. Thousands of Cayman’s locals and visitors flock to the streets. Cayman Brac has its own celebration, Braccannal.

Featuring a range of Cayman-specific comedic sketches, ‘Wha Happening’ delves into the topics and dialogues that resonate with the local community. This lively show is a dynamic blend of standup comedy and parodies that capture the essence of modern Cayman life. For more information, call (345) 949 5477.

Halloween is a very popular event in the Cayman Islands. The festivities start just as the sun goes down and are wrapped up around 9pm. Very popular areas to trickor-treat include South Sound and Snug Harbour, but people also trick-or-treat in

hath

their neighbourhoods. Check out Cayman Parent online (www.caymanparent.com) for a list of Halloween events.

Cayman’s National Festival, Pirates Week, begins in Little Cayman at the beginning of November, then moves to Grand Cayman where the famous Pirates Landing takes place in the second week of November and the float parade takes place the week after that. The festival then finishes in Cayman Brac at the end of November. For over 40 years Pirates Week has been the country’s largest celebration and it encompasses many additional events, including a street dance, running race, a sea swim, lots of wonderful steel pan music, song and costume competitions, delicious food and an amazing fireworks display that wows us all. For more information, visit their Facebook page (@ CaymanIslandsPiratesWeekFestival).

Christmas in Cayman is magical. There might not be snow, but we put up real Christmas trees, which need to be ordered in September, and fill our gardens with twinkling lights as the rounds of parties and good cheer begin. The festive season kicks off with the Christmas breeze, which starts to blow in November. Traditions include visiting Captain Theo Bodden’s magnificent garden, opposite Sunset House, which, from early-December, becomes a theatrical display of lights. Camana Bay’s annual tree lighting in November is a great family outing. The Rotary’s annual carol singing concert in early December is highly anticipated every year. Enjoy shopping at the local craft markets, and keep a look out for appearances from Father Christmas!

In the workplace, men and women dress similarly to how they do in Europe and the US, though jackets are typically not worn. If lawyers are attending court, formal business attire is expected. Outside of work,

people generally opt for a smart casual style. During the day, it’s common to see shorts, t-shirts, and dresses. For evenings out, the dress code varies by venue, ranging from glamorous and smart to very casual, where t-shirts, shorts, and flip-flops are perfectly acceptable.

Typical business opening hours are Monday to Friday 8.30am-5pm. Banks are open Monday to Thursday 9am-4pm and Friday 9am-4.30pm. Usually, only retail outlets, restaurants, pharmacies and supermarkets are open on Saturdays. The latter are also open on public holidays, but with reduced hours.

The most pleasant weather in the Cayman Islands is during the winter, from midNovember to April, as there is relatively less rain, brilliant sunshine and a constant, cool sea breeze, although the occasional nor’wester and cold front does blow through. These months coincide with peak tourist season. May to October is the rainy season, but unless a tropical system tracks over the Cayman Islands, the rain is normally only heavy for a few hours. During the summer months it is relatively hot and humid.

The Cayman Islands uses the English

date system of day/month/year. However, because of the influence of the US, some people write the date as month/day/year. It can be confusing, so make sure to check!

Greeting Customs & Caymankind

Say “Good morning” or “Good evening” on first meeting someone in Cayman. If you are talking to a Caymanian, then use the first name but preface it with a “Miss” or a “Mr”. “Mrs” is rarely used. If you do not know their name, and they are older than you, then “Sir” or “Ma’am” is appropriate. “CayMAN” (never the Caymans or CayMEN Islands) is a welcoming place and ‘Caymankindness’ is embodied by many, so be sure to engage with people you meet. Caymankindness is all about being kind and courteous.

By law, most businesses in Cayman close on Sundays. Places that remain open include pharmacies, gas stations, convenience stores, restaurants, bars and hotels, hair and beauty salons, gyms, Camana Bay’s cinema, and Kings Sports Centre.

Time Zone & Daylight Saving Time

Cayman is on Eastern Standard Time when the United Kingdom is on British Summer Time (BST), the time difference between the UK and Cayman is six hours. Daylight Saving Time is not observed in the Cayman Islands.

Cayman’s Climate at-a-glance (2024 figures)

An overview of the Island’s banking, fund management, captive insurance and trust industries, structured finance, currency, the stock exchange and aircraft/ship registration.

The Cayman Islands continues to maintain its dominant position as a leading global financial hub, efficiently connecting law-abiding users with providers of investment capital and financing worldwide, benefitting both developed and developing countries. Cayman’s commitment to excellence and modern legislation are two key elements of its performance, particularly in capital markets and investments, and Cayman is strengthened by its close connections to the United Kingdom as a British Overseas Territory. Cayman is the number one domicile for healthcare and group captives and continues to excel globally in banking, capital markets, trusts and fiduciary services. The success of the financial services industry is attributed to our sound regulatory regime and political and economic stability, which are supported by highly skilled and experienced service providers. Additionally, we ensure adherence to international standards and we are committed to supporting global efforts to fight financial crime.

Cayman is a leading jurisdiction worldwide for mutual funds. Its strong international reputation is a result of our commitment to the principles of openness and transparency, and we have continuously improved our legislation to meet international demands.

The Cayman Islands has implemented the highest global standards for transparency and cross-border co-operation, which are regularly reviewed and enhanced. In order to comply with

international standards and commitments to combat money laundering, tax evasion and terrorist financing, the Cayman Islands implemented a beneficial ownership reporting regime in 2017 which requires: (i) each Cayman Islands company, limited liability company, foundation company and limited liability partnership to, amongst other things, instruct its corporate service provider (CSP) to establish and maintain a beneficial ownership register at its registered office unless an exemption applies; and (ii) the competent authority to maintain a centralised electronic platform on which this beneficial ownership information is stored (the Beneficial Ownership Reporting Regime). The beneficial ownership information stored on this platform is not currently publicly available but can be searched by the competent authority on its own behalf or on behalf, and at the request of, specified Cayman Islands or UK law enforcement authorities. There are possible fines and imprisonment for breaching the Beneficial Ownership Reporting Regime.

Following industry consultation, the Beneficial Ownership Transparency Act, 2023 (BOTA) was gazetted on 15th December 2023, updating the Beneficial Ownership Reporting Regime in line with evolving international standards and the Financial Action Task Force recommendations. At the time of print, the BOTA was expected to come into force in summer 2024. When it does so, the BOTA will expand the scope of the Beneficial Ownership Reporting Regime by bringing exempted limited partnerships and limited partnerships within the scope of the regime, and also by removing a number of the current exemptions to establishing and maintaining beneficial ownership registers. The BOTA also provides that certain regulated entities will be able to access beneficial ownership information.

The Cayman Islands Government made a commitment in 2019 to introduce public registers of beneficial ownership information following an international campaign to encourage more countries to

commit to publicly accessible registers by the end of 2023. However, a judgment of the Court of Justice of the European Union in November 2022 on this topic has raised questions on the constitutionality of implementing a public register. Consequently, the BOTA currently provides that beneficial ownership information can only be made available to the public if and when regulations have been proposed by Cabinet and affirmed by a future resolution of Parliament, and when that happens a resolution will be passed that it allows public access on a “legitimate interest” basis only.

The Cayman Islands’ regulatory framework is continuously evolving to ensure it meets the needs of market participants, their clients and investors. The Cayman Islands has continuously amended its antimoney laundering, terrorist financing, proliferation financing and financial sanctions requirements to ensure it remains in line with developing global standards, in particular those of the Financial Action Task Force (FATF). Cayman is rated by FATF as being largely or wholly compliant with all 40 of the FATF Recommendations on combating money laundering and the financing of terrorism and proliferation, which is a level of compliance that almost none of the EU member states, G20 members or other FATF members currently meet.

The Tax Information Authority Act has been in place since 2005 and has enforced

the laws and regulations necessary to implement the automatic exchange of information regimes. In 2016, the Limited Liability Company was introduced at the request of US clients. In 2017, the Foundation Companies Act was introduced, which provides clients with a flexible vehicle for offshore structuring. In particular, the Foundation Companies Act has recently proved to be useful for emerging virtual asset businesses looking for corporate vehicles without traditional shareholders.

Following consultation with the Organisation for Economic Co-operation and Development (OECD), the EU and Cayman Islands stakeholders, the Cayman Islands and other international financial centres adopted economic substance requirements in 2019. Cayman was assessed by the OECD as fully compliant and continues to ensure compliance by updating its guidance accordingly (with the latest version being introduced in July 2022). In 2020, the Cayman Islands amended the existing Mutual Funds Act and enacted a new Private Funds Act to provide a regulatory regime for smaller closed-ended investment funds. The Cayman Islands had already introduced legislative changes to allow the funds sector to participate in the EU’s Alternative Investment Fund Managers Directive.

Also in 2020, the Cayman Islands introduced the Virtual Assets (Service Providers) Act (VASP Act), which sets out the legal and regulatory framework for virtual assets service providers seeking to do

business in and from the Cayman Islands. This framework continues to develop with proposed amendments to the VASP Act in the pipeline and, in May 2024, the Cayman Islands Monetary Authority issued the Regulatory Policy – Registration or Licencing of Virtual Asset Service Providers.

On the dark and moonless night of the 8th February 1794, a navigational error resulted in 10 British ships, including a Royal Navy vessel, being wrecked on the treacherous coral reefs off East End, Grand Cayman. Local people saved everyone aboard the ships, including, so the story goes, a royal prince. When Britain’s King George III heard of this act of gallantry, he is said to have decreed that the people of the Cayman Islands should forever be free from taxes and conscription. There is no doubt that the Wreck of the Ten Sail, as it is now known, took place, but there is no documented evidence of the royal decree. However, this has not stopped the story from becoming one of Cayman’s favourite legends.

The real reason for the Cayman Islands being a tax-free jurisdiction is rather more prosaic. Until the mid-1960s, the population was below 8,000, and most Caymanians made their living from subsistence farming, fishing, turtling, schooner building and making thatch-rope, while many of the men served as merchant seamen on ocean-going ships, usually ones flying the American or Liberian flag.

This meant that most of the residents in Cayman were living on meagre earnings. There were only a few companies at the time and capital gains were virtually nonexistent, so there was nothing worth taxing. However, in 1952, an aircraft runway was constructed, and the following year Barclays Bank opened a branch in Grand Cayman. In fact, Cayman’s status as an international financial centre derives from the foresight of some early legal practitioners and a receptive Government which, in the mid-1960s, drafted and enacted legislation together to build on this modest beginning.

In the following decades, more international banks were attracted to Cayman, together with law and accounting firms. When the Bahamas became independent from the UK in 1973, several expatriate workers from that jurisdiction were attracted to Cayman as a stable place to do business. Co-operation between the Government and the private sector has continued to this day. This, combined with a policy of welcoming expatriates with special skills to the Islands and a population of welleducated Caymanians, has kept Cayman at the forefront of the international financial industry.

To be successful in the highly competitive global financial industry requires political and economic stability, tax neutrality, a responsive legal system, reliable service providers, a sound regulatory regime, a stable banking environment and an absence of exchange controls. In addition to these factors, Cayman’s status as an overseas territory of the United Kingdom and its international co-operation regimes in the areas of tax information exchange, regulation and law enforcement provide the necessary level of confidence in Cayman’s sophisticated, hospitable and predictable financial environment. That confidence is built on Cayman’s status as a transparent, co-operative jurisdiction that already meets or exceeds the full range of globally accepted standards for transparency and cross-border co-operation with law enforcement and tax authorities, together with jurisdictional commitment to maintaining that status quo. Cayman became an early adopter of automatic data exchange, signing onto agreements such as the OECD’s Common Reporting Standard, US FATCA and country-by-country reporting principles under BEPS. The OECD’s Global Forum in 2022 named the Cayman Islands as one of 65 jurisdictions that achieved the highest rating of ‘on track’ in the first round of the Global Forum’s AEOI peer reviews. The Cayman Islands was appointed to the Global Forum’s Steering Group for the period of 1st

January 2023 to 31st December 2025.

Regulated by the Cayman Islands Monetary Authority (CIMA), banking in the Cayman Islands is a major part of Cayman’s financial sector, with 86 banks licensed as of March 2024. Of these 86 banks, 11 hold Class A licences and are permitted to carry out local and international business. The other 75 banks hold Class B licences and are mainly restricted to offshore transactions with non-residents. The majority of these banks are branches, subsidiaries and affiliates of established international financial institutions conducting business in international markets. Of these banks, 11 are from Europe, 8 from the US, 16 from the Caribbean and Central America, 16 from Asia and Australia, 10 from Canada and Mexico, 23 from South America and two from the Middle East and Africa.

In December 2022, Cayman was ranked 18th internationally based on the value of cross-border assets and 18th in terms of cross-border liabilities, at US$472.5 billion and US$424.3 billion, respectively. A testament to the worldwide recognition of the quality of Cayman’s financial industry is the fact that over 40 of the world’s top 50 banks hold licences in Cayman. The banking sector hires highly skilled professionals and is one of the most prominent employers on the Island. Cayman Islands’ banks are bound by strict anti-money laundering, counter-terrorism and proliferation financing laws, which are recognised as meeting or exceeding those of all major onshore jurisdictions.

To see a list of the banks licensed in the Cayman Islands visit www.cima.ky.

Cayman imposes no income, capital gains, payroll or other direct tax on corporations or individuals resident in the Cayman Islands. Taxes are, however, imposed on most goods imported to the Islands, and stamp duty (especially on direct and indirect transfers of Cayman Islands real estate) represents a significant amount of taxation in the Cayman Islands. Through this tax system, total

Government tax revenues, as a percentage of GDP, are similar to tax rates in G20 countries and are sufficient to fund Government operations. This makes additional, direct taxation unnecessary.

Cayman signed its first Mutual Legal Assistance Treaty with the US in the 1980s and now has bilateral tax information exchange agreements with 36 jurisdictions. Cayman also participates in the Multilateral Convention on Mutual Administrative Assistance in Tax Matters, which allows tax information exchange with more than 140 countries. Cayman has adopted and implemented US FATCA and the OECD’s Common Reporting Standard to facilitate the automatic exchange of tax information with such jurisdictions. In addition, Cayman requires multinational enterprises which meet certain criteria to file a report with tax administrations or authorities, pursuant to its Countryby-Country Reporting regime which the Cayman Islands has implemented in accordance with the OECD/G20 Action Plan on Base Erosion and Profit Shifting (BEPS). Cayman joined the OECD/G20 Inclusive Framework on BEPS in 2017 and continues to implement and comply with BEPS global minimum standards.

‘Tax haven’ is a phrase that is often thrown around in the global media and by overseas politicians; however, it is incorrectly assigned to the Cayman Islands. Cayman does not meet any of the tax haven definitions set out by the OECD, Transparency International or Tax Justice Network. It does not offer tax incentives designed to favour non-resident individuals and businesses. Cayman does not have differing tax rates for foreign entities, nor does it have legal mechanisms or treaties (such as double taxation agreements) in place with other countries that (legally) affect the transfer of tax bases from one country to another in order to reduce taxes. Cayman does not promote itself as a jurisdiction for aggressive tax planning.

The Cayman Islands is the world’s leading offshore centre for the establishment of hedge funds and private equity funds. Almost 13,000 mutual funds are licensed, registered or administered with the Cayman Islands Monetary Authority (CIMA). Following the enactment of the Private Funds Act in 2020, there are over 17,000 private funds registered with CIMA. Most investment funds are aimed at institutional or sophisticated/ high-net-worth investors, which is reflected in the types of funds that are regulated in the jurisdiction and their assets under management.

Investment funds, like other entities established in the Cayman Islands, must have a registered office provided by a licensed corporate services provider, which maintains, among other things, the corporate records of the entity. Funds will typically appoint a suite of service providers both within and outside of the Cayman Islands and, in certain circumstances, must appoint Cayman Islands providers. Thus, funds will engage Cayman

Islands legal counsel, approved Cayman Islands-based auditors, administrators (who may need to be locally licensed in certain circumstances) as well as directors and/or advisory boards, licensed Cayman Islands trustees and (if listing) an approved listing agent. In keeping with international standards, each fund is required to appoint anti-money laundering (AML) officers and AML compliance officers and there are several qualified professional organisations that can provide this service.

Asset managers may be based in the Cayman Islands or overseas. While most managers are located outside of the jurisdiction, in recent years there has been increased interest by managers in establishing a business with a physical presence in the Cayman Islands. With the amendment of the Securities Investment Business Act in 2019, there is an enhanced regulatory and supervisory framework for securities investment business in the jurisdiction.

The success of the investment funds industry in the Cayman Islands is due to a

combination of factors, including its marketleading reputation, freedom of investment decisions for asset managers, tax-neutral status and the availability of world-class professional service providers. It has a highly regarded legal and regulatory system, with the final appellate court being the Judicial Committee of the Privy Council. The funds industry is a key pillar of the Cayman Islands financial services sector, which is responsible for the direct employment of hundreds of professionals. These advantages will ensure that Cayman continues to lead the way as the jurisdiction of choice for investment funds.

As of June 2024, CIMA records indicate that there are 12,893 regulated mutual funds, comprising 8,769 Registered Funds, 267 Administered Funds, 48 Licensed Funds and 3,182 Master Funds. CIMA records also indicate that there were 17,020 regulated private funds.

As a global centre of excellence for trusts, the Cayman Islands financial sector has serviced international clients for decades, providing modern, flexible and robust structures for wealth structuring, estate planning and commercial applications. Cayman offers a well-regulated, politically stable and tax-neutral environment in which to form and administer a trust. While deriving originally from English law, Cayman’s Trusts Act has been reviewed and updated regularly over the past 50 or so years to ensure that it remains cuttingedge, competitive and appropriate to meet the evolving needs of a global client base.

The Cayman Islands stands out with its progressive and innovative legislation, and the Foundation Companies Act (enacted in 2017) is an excellent example of this. Foundation companies can be an attractive alternative to trusts, particularly for clients in civil law jurisdictions where a trust is often unfamiliar or the tax treatment of trusts uncertain. Foundation Companies are also commonly used as succession planning and asset protection vehicles,

often to hold bespoke assets such as real estate or a yacht, or as part of a private trust company and family office structures.

Cayman boasts a deep bench of specialist and experienced trustees, legal advisors, accountants, administrators, regulatory professionals and other service providers, and a highly regarded, reliable and independent judiciary and courts system. The Islands’ trust industry is overseen by CIMA, which is responsible for the licensing and supervision of regulated financial businesses, ensuring compliance with anti-money laundering and other regulatory laws, and liaising with its counterparts in other countries. With steady and dependable growth, trusts and foundation companies remain an important component of the financial services industry in Cayman. According to CIMA, as of March 2024, there were 132 Active Trust Licences, of which 56 were Full Trust Licences, 55 were Restricted Trust Licences and 21 were Nominee (Trust) Licences. In addition, there were 152 Private Trust Companies registered in Cayman as of the same date.

The Cayman Islands is a popular jurisdiction for the establishment of business vehicles because of its stable legal system, modern and flexible corporate structures, businessfriendly culture and tax-neutral status. The main forms of business vehicles established in the Cayman Islands are exempted companies, limited liability companies, limited liability partnerships, exempted limited partnerships, segregated portfolio companies, special economic zone companies and local ordinary companies. In particular, the Cayman Islands is a pre-eminent jurisdiction for the formation of alternative investment funds.

In recent years there have been significant developments in Cayman Islands regulation as it applies to business vehicles, particularly with respect to anti-money laundering, beneficial ownership, economic substance, data protection and the regulation of closedended alternative investment funds. These developments underpin the jurisdiction’s

ongoing commitment to adherence to the very highest international standards.

In addition to law firms, which are available to provide specialist legal advice and assistance in the establishment and ongoing management of Cayman Islands business entities, there are also many highly qualified professional firms licensed to provide corporate services in the Cayman Islands.

Several of Cayman’s law firms specialise in capital markets and structured finance transactions for international clients.

The Cayman Islands has become one of the world’s leading providers of Special Purpose Vehicles (SPVs) for structured finance transactions and is recognised by international rating agencies as a preeminent jurisdiction for rated debt capital market transactions. SPVs are often used in securitisation transactions which involve the acquisition of financial assets by the SPV and the subsequent issuance of securities to institutional investors.