Copies of SRA publications can be requested from Office of the Administrator

2nd Floor, Sugar Center Building

Sugar Regulatory Administration North Avenue, Diliman Quezon City

Email http://www.sra.gov.ph srahead@sra.gov.ph

Telephone Numbers

(632) 929-3633, (632) 455-2135

(034) 433-2553, (034) 434 5124

Office of the Administrator

(632) 929 9223, (632) 929-4493

Regulation Department – Quezon City Office of the Manager

(632) 455 7592

Sugar Transaction Division

(632) 926 4338

Licensing and Monitoring Division

(034) 435 3755, (034) 434 1470

Regulation Department – Bacolod City Office of the Manager

The power to regulate the sugar industry is vested upon the Sugar Regulatory Administration. This regulatory authority only seeks to put an orderly system in the entire gamut of sugar operations. It also seeks to level the playing field among the stakeholders so that that no one could have an undue advantage over the others.

Thus, SRA always ensures that sugar policies crafted and promulgated emanate from its mandate, are shielded with regulatory and legal bases and will redound to the industry’s common good.

This manuscript, “A Consolidated Compilation of Sugar Regulation Policies” was envisioned through the issuance of Special Order No. 142, dated October 1, 2012, which aimed to ensure more responsive compliance by stakeholders to regulatory policies and to enhance continuing policy formulation shielded from questions or challenges of enforceability. Ittells all with utmost transparency the sugar policies crafted and promulgated by SRA through the decades in the furtherance and interest of the sugar industry.

For the SRA and its leadership, this can ideally serve as a historical reference when crafting and promulgating sugar policies in the years to come particularly as it prepares for the coming of the ASEAN Economic Integration regime.

For the stakeholders, this seeks to instil their awareness to sugar policies as they program their year to year operations in compliance and adherence therewith.

Changing economic order likely to affect the sugar and the emerging sugar cane industry, free trade and economic integration could provide impetus for paradigm shift in regulation. But its twin essentials, that of balancing sugar supply and demand and stabilizing sugar prices profitable to producers and fair to consumers will always be transcendental.

Ma. Regina Bautista-Martin Administrator Sugar Regulatory Administration

Ma. Regina Bautista-Martin Administrator Sugar Regulatory Administration

This consolidated compilation of sugar regulation policies was prepared under the overall supervision of Ms. Aida F. Ignacio, Deputy Administrator. We would like to thank the many SRA colleagues, who provided valuable materials, advice, insights, and comments throughout the preparation and development of this manuscript, including: Ms. Daisy Fabia, Mr. Luis Marajas, Ms. Cora Boyero, Ms. Malou de los Reyes, Mr. Ian Pedalizo, Ms. Quennie Sevilla, Ms. Mafi Ramos, Mr. Arnold De Castro, Mr. John Paul Antes, Ms. Elsa Manangan, Mr. Louie Malagkit, Ms. Jocelyn Protesta, Ms. Lydia Gelera. We are also honored to be working with colleagues from the SRA Visayas region including: Ms. Mary Antoinette S. Tampo, Atty. Johana Jadoc, Mr. Jun Cordova, Ms. Luisa Bedayo. In addition, the author would like to thank the following people Ms. Jen Artates, Ms. Elsie Santos, Ms. Theresa Pamintuan, Mr. Dodie Silang, and Records Unit of SRA Quezon City for their assistance in finalizing this document. This project was carried out in the context of promoting the sugar regulation policies as it seeks awareness among stakeholders of the Philippine Sugar Industry on the SRA regulatory authority in pursuit of the growth and development of the sugarcane industry.

A Consolidated Compilation of Sugar Regulation Policies

Raphael Henri Mundo

160 pages

Keywords: Sugar, refined sugar, molasses, Custom Bonded Warehouse, food processors, sugar traders, Sugar Monitoring System, Sugar Order, Quedans, Sugar allocation, swapping, reinstatement, conversion, advance refining, Sugar Release Order, Compulsory disposition, home consumption, liens, physical inventory, Philippine National Standards, reclassification, shipping permit, sugar warehouse, MDDC

AEDS Automated Export Documentation System

“A” Sugar Sugar allocated for U.S. Market

BOC Bureau of Customs

“B” Sugar Sugar allocated for Domestic Market

Bagasse Is a sugarcane by-product form crashed to extract juice

“C” Sugar Sugar that is reserved temporarily unless reclassified into other class of sugar

CBW Custom Bonded Warehouse

CL Circular Letter

CY Crop Year

Calibration of Weighing Scale

An activity done by the mills before the start of milling season to ensure efficiency of measurements particularly weighing scales

“D” Sugar Sugar allocated for the World Market

“Dx” Sugar Another term for World Market Export Sugar

“E” Sugar Sugar allocated for Food Processors coming from D sugar allocation system

Exporter A registered trader that exports raw or refined sugar

Food Processor A food manufacturing establishment that uses significant amount of sugar as raw materials for their food products having granted an SRA sugar allocation

“F” Sugar Sugar allocated for ethanol producers coming from D sugar allocation system

GAO General Administrative Order

ITDI-DOST Industrial Technology and Development Institute- Department of Science and Technology

Lkg-Bag Fifty kilos of sugar in a bag

Lien A fee for certain frontline services such as import clearance fee, monitoring fee, swapping fee, etc.

MC Memorandum Circular

MO Molasses Order

Muscovado A generic term for all soft-brown sugar cooked through open pan evaporation

Outstanding Sugar Quedan

Quedans not yet surrendered to the mill

OFM Outward Foreign Manifest

PCRC Premix Commodity Release Clearance

PD Presidential Decree

PNS Philippine National Standard

PSO Philsucom Sugar Order

Picul A unit or measure equivalent to 63.25 kilos of sugar

Polarization Equivalent to sucrose content

RA Republic Act

Reclassification of Sugar Sugar quedan in its original class is being reclassified into another class

Reinstatement Process of making sugar quedans which were declared homeless be marketable/negotiable upon payment of certain reinstatement fee

Regular Swapping

The exchange of quedans of two (2) different classes of sugar with an equal quantity located in two different mills or warehouses

Shipping Permits A permit to ship sugar within Philippine territory issued by the SRA

SMDF Sugar Market Development Fund , formerly Export Market Development Fund

SO Sugar Order

Sugar Mills Mills that process cane into raw sugar

Sugar Trader

A company or person who has the authority to transact sugar provided that he has a certificate of registration

TCCP-AHTN Tariff and Customs Code of the Philippines - ASEAN Harmonized Tariff Nomenclature

Transfer of Sugar The physical transfer of sugar from mill to refinery

U.S. Quota

Withdrawal of Sugar

A certain amount of sugar allocated by U.S. government to the Philippines as part of the U.S. Quota System

An activity wherein sugar in withdrawn from the mill to refinery or from refinery to traders upon surrender of quedans, payment of liens and submission other SRA documents.

1. Setting Up The Week Ending Closing Of Sugar Production And The Sugar Allocation Policy As Mandated In All Sugar Order Nos. 1 SO No. 8 Series of 1999-2000

2. Policies On Refining / Advance Refining

E. PHILSURIN Lien

SO No. 5 Series of 2013-2014

Revocation of Sugar Order No. 2, Series of 1995-1996, Sugar Order No.8, Series of 2004-2005 and Sugar Order No.11, Series of 2009 Re Establishment and Extension of a lien of P2.00/Lkg-Bag on all Sugar Production to fund the Philippine Sugar Research Institute Foundation, Inc. (PHILSURIN)

SO No. 8 Series of 2004-2005

Extension of the Effectivity of Sugar Order No. 2, Series 1995-1996, providing for the establishment of a Lien of P2.00/Lkg-Bag on all Sugar Production to fund the Philippine Sugar Research Institute Foundation, Inc. (PHILSURIN)

SO No. 4 Series of 2001-2002

Rules & Regulations on the 56,933MT Imported Raw Sugar under the MAV for Year 2002

SO No. 2 Series of 1995-1996

Establishment of a Lien of P2.00/Lkg-Bag on all Sugar Production to fund the

SIFI (Sugar Industry Foundation, Inc.) and SIFI Lien

SO No. 9 Series of 2007-2008

Amendment to Sugar Order No. 7, Series of 2003-2004 Re: Rules and Regulations on Importation of Food Preparations under Tariff Heading 21.06 of the TCCP-AHTN

SO No. 7 Series of 2003-2004

Rules & Regulations on Importation of Food Preparations Under Tariff Heading 21.06 of the Tariff & Customs Code of the Phil – ASEAN Harmonized Tariff Nomenclature (TCCP-AHTN)

SO No. 7 Series of 1997-1998

Increasing the Clearance Fee for Imported Sugar from P7.70/Lkg-Bag to P10.30/Lkg-Bag.

SO No. 9 Series of 1994-1995 Regulations on the 38,000MT Imported Raw Sugar

SO No. 8 Series of 1994-1995 Rules and Regulations on Imported Sugar

1-A

Sugar Order No. 11, Series of 1997-1998 re: Penalty of Ph. 1,000 per day on delayed

No. 11 Series of 1997-1998

CL No. 26 Series of 1995-1996 Implementation of the Revised SMS 704 Form (Refinery Production and Inventory Report) of the Sugar Monitoring System

No. 11 Series of 1991-1992 Submission of Advanced weekly Report on Molasses

I. Regular Swapping

SO No. 10 Series of 2005-2006

Swapping and/or Physical Exchange of Raw “B-2” or NFA Sugar with Available Refined Sugar

CL No. 46 Series of 1997-1998

Implementing Guidelines on Double Exchange/Swapping of “B” or Domestic Sugar Quedan-Permits and Advance Refining of “A” sugar re: SO # 9, S of 1997-1998

SO No. 9 Series of 1997-1998 Double Exchange (“Swapping”) of “B” or Sugar Quedan-Permits issued during CY 1997-1998 and Previous CY 1996-1997 by Sugar Mills with Refineries (Integrated Mills)

CL No. 31 Series of 1997-1998 Implementing Guidelines Re: Sugar Quedan Swapping for CY 1997-1998 and thereafter

CL No. 3 Series of 1995-1996 Sugar Quedan Swapping

SO No. 6 Series of 1994-1995 Revised Rules on Exchange (Swapping) of “A” Quedan-Permits

SO No. 9 Series of 2012-2013

Advance Swapping of “A” or U.S. Quota Sugar Produced in CY 2012-2013 into “D” or World Market Sugar for Shipment or Export

SO No. 4 Series of 2011-2-12

Advance Swapping of “B” or Domestic Sugar produced during CY 2011-2012 into “D” or World Market Sugar for shipment to the World Market; Modified Sugar Order No. 11 Series of 2-10-2011

SO No. 10 Series of 2010-2011

Shipment of Advance-Swapped “B” or Domestic Sugar to “A” or US export

SO No. 9-A Series of 2010-2011

Advance swapping of CY 2010-2011 “B” or Domestic Sugar to “A” or US Market Sugar

SO No. 9 Series of 2010-2011

Advance Swapping of CY2010-2011 “B” or Domestic Sugar to “A” or US sugar market

SO No. 15 Series of 2008-2009

Swapping of “A” to “D” and D/DX to “A”

SO No. 7 Series of 2008-2009

Guidelines for the Replenishment of “B” sugar advance-swapped to “A” or “D 38

SO No. 4 Series of 2008-2009

Suspension of Verification of “A” and Advance Swapping of “B” to “A”; allowing Advance Swapping of new “B” (CY 2008-2009 to “D” 38

SO No. 15 Series of 2007-2008

Reclassification (Conversion) of all “C” (Reserve) Sugar of CY 2007-2008 to “B” (Domestic) Sugar; Advance Swapping “B” to “A” (US Quota) or “D” (World Market) Sugar. 39

SO No. 11 Series of 2005-2006

Allowing the Advance Swapping of “A” Quedans of Specific Week endings of CY 2005-2006

CL No. 33 Series of 2005-2006

Implementing Rules and Regulations in the Advance Swapping of “A” or US Quota sugar of Specific Week-endings of CY 2005-2006 into “B” or Domestic Sugar

SO No. 6 Series of 2001-2002

39

39

Advance Swapping of “A” or US Quota Sugar Produced During CY 2001-2002into “B” or Domestic Sugar 39

SO No. 7 Series of 2000-2001

Advance Swapping of “A” or US Sugar produced during CY 2000-2001 and covered by surrendered Certificates for Quota Eligibility (CQEs), into “B” or Domestic Sugar

SO No. 6 Series of 2000-2001

Advance Swapping of “A” or US sugar produced during CY 2000-2001 into “B” or Domestic Sugar

SO No. 12 Series of 1999-2000

Advance Swapping of “A” or US Quota Sugar Produced During CY 19961997 to CY 1999-2000 into “B or Domestic Sugar

SO No. 3 Series of 1999-2000

Advance Swapping of “B” or Domestic Sugar Produced during CY 19992000 and previous CY 1998-1999 into “A” or US Sugar

CL No. 37 Series of 1998-1999

Implementing Guidelines on Advance Swapping of “A” Re: Sugar Order No. 12 dated June 8, 1999 S of 1998-1999

SO No. 12 Series of 1998-1999

Advance Swapping of “A” sugar produced during CY 1998-1999 into “B” or Domestic Sugar

SO No. 9 Series of 1997-1998

Double Exchange (Swapping) of “B” or domestic Sugar Quedan-Permits issued during CY 1997-1998 and previous CY 1996-1997 by Sugar Mills with Refineries (Integrated Mills)

SO No. 6 Series of 1987-1988

Replacement of 1986-1987 and 1987-1988 “A” Advance Swapped Sugar 41

SO No. 3 Series of 1987-1988 Withdrawal of 1986-1987 and 1987-1988 “B” Sugar, Release of 1987-1988 “C” Sugar for Withdrawal as “B” and Authorizing Advance Swap of 1987- 1988 “A” for Withdrawal as “B” and providing Penalties for Non-Withdrawal therefore

SO No. 2 Series of 1987-1988

Authorizing Advance Swap of 1986-1987 Excess “A” Sugar 41

M. Reinstatement of “A” and “D”

Note: There are various references to reinstatements but they were just repetitive and situational. The following are just examples of reinstatements

SO No. 8 Series of 2011-2012

Reinstatement and Verification of Homeless “A” or U.S. Export Sugar Quedans and “D” World Market Sugar Quedans of previous Crop Years

SO No.7 Series of 2010-2011 Deadline for the Reinstatement and Verification of Homeless “D” Sugar Quedans of Previous Crop Years

SO No.10 Series of 2007-2008

Amendment of Sugar Orders No. 6 & 8 Series of 2007-2008 Re: Reinstatement of Expired (Homeless) “A” Quedans Into “A” or U.S. Quota Sugar and Revised Verification and Shipment Schedules of “A” or U.S. Market

N. Reclassification (Conversion) Of ‘D’ World Market Sugar Into “E” CBW Food Processors/Exporters

SO No.3 Series of 2008-2009 Guidelines for the Disposition of “D” World Market Sugar for Export or for Consumption of Sugar-Based Food Exporters

CL No.9 Series of 2006-2007

Implementing Rules and Regulations in the Availment of “E” for CBW Food Processors/ Exporters Sugar

O. Inventory And Accounting Of Quedan Memorandum Order

Amendment of Crop Year on the Submission of Reports Re: Accounting of Sugar Quedan-Permit Forms issued for Crop Year 2011-2012

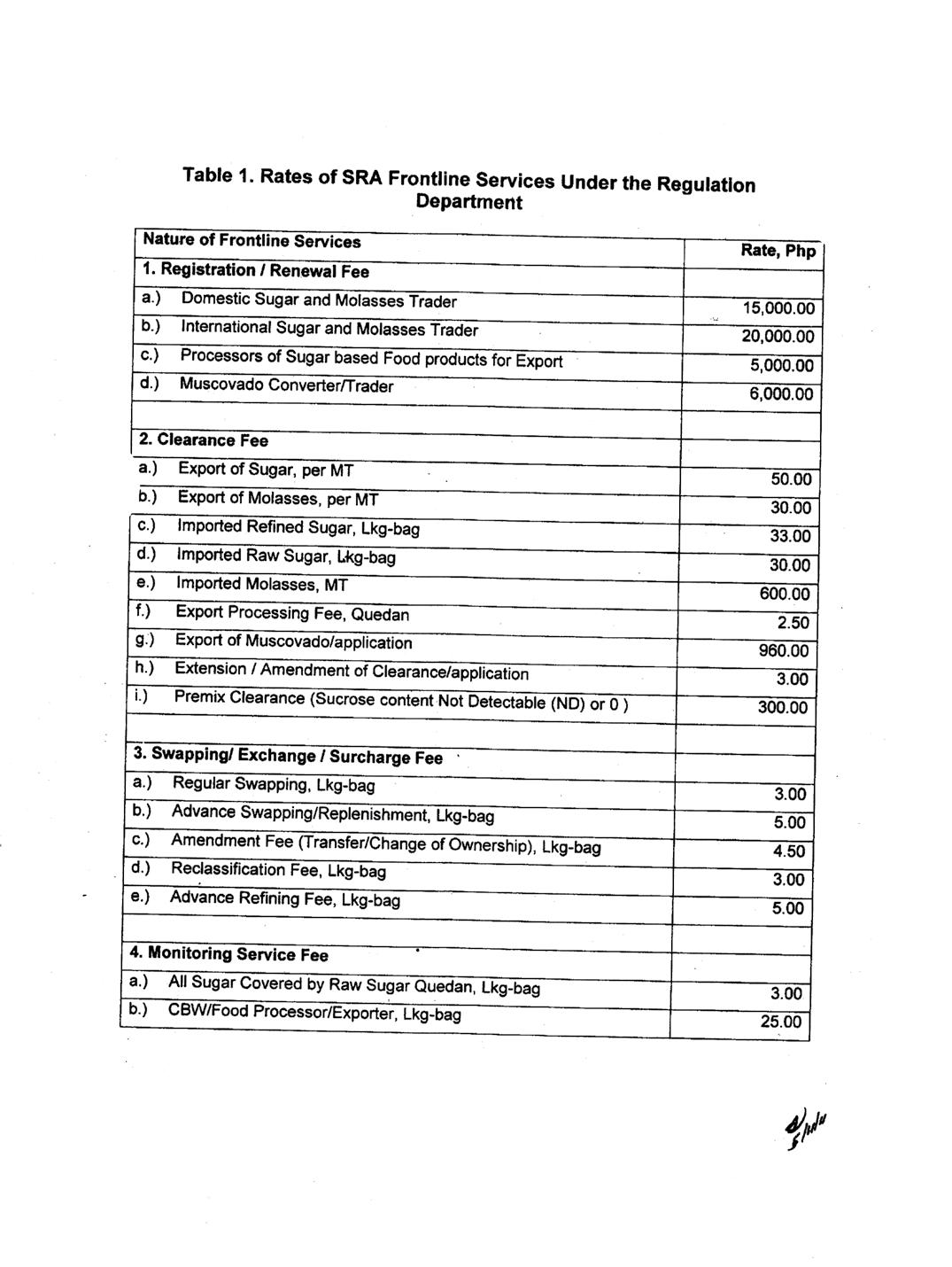

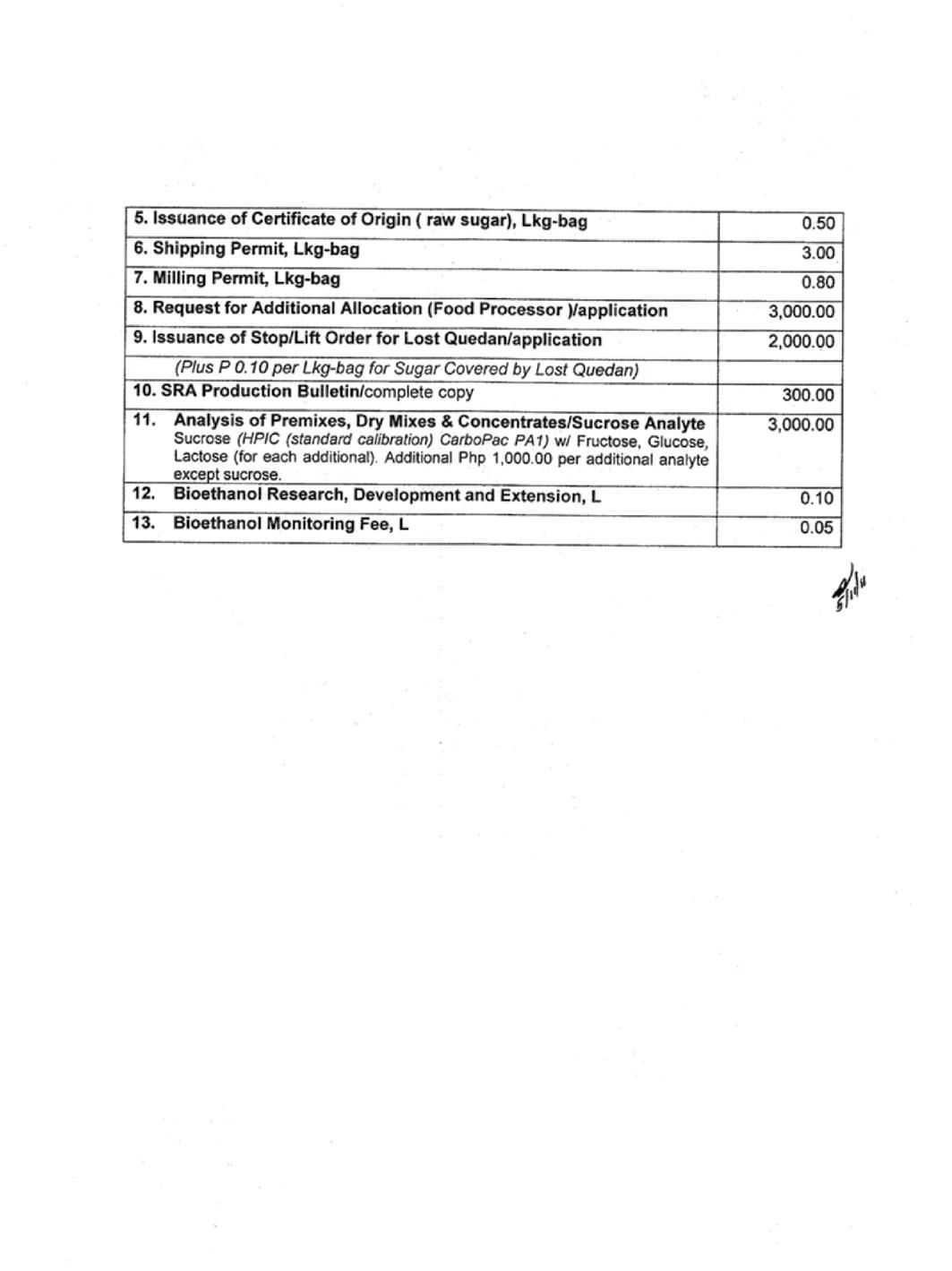

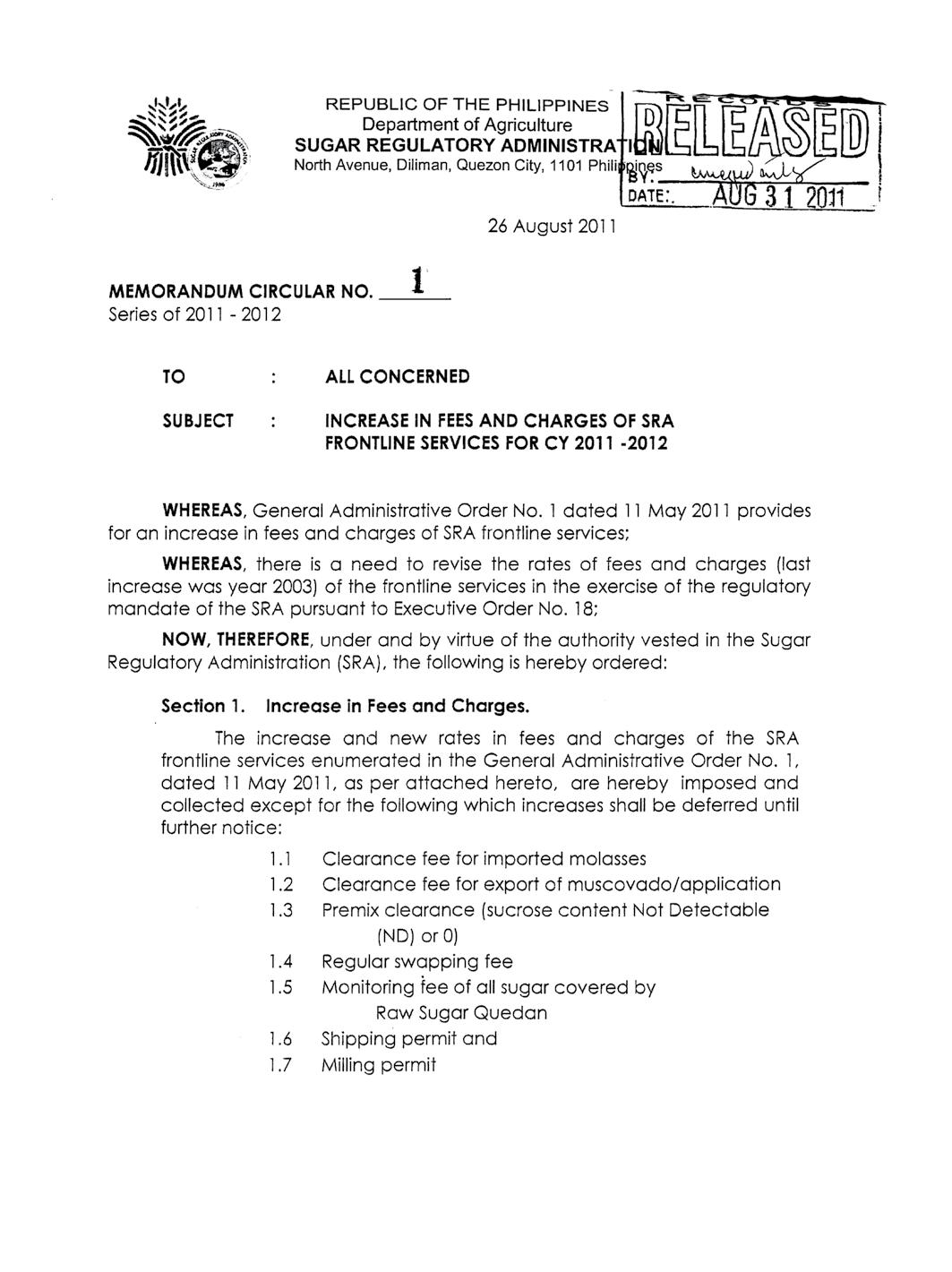

GAO No. 1 Series of 2010-2011 Increase in Fees and Charges of SRA Frontline Services

CL No. 43 Series of 1999-2000

Implementing Guidelines in the Accounting of the Quedan-Permit Forms and Shredding/Burning of Unused Quedan-Permit Forms

CL No.41 Series of 1990-1991

Dissemination and Publication of Guidelines to Implement General Administrative Order No. 1, Series of 1990-1991, dated. March 6, 1991

CL No. 28 Series of 1986-1987

Lost & Destroyed Sugar Quedan-Permits and Replacement thereof

SO No. 1 Series of 1986-1987

SO No. 12 of Series 2013-2014

Compulsory Disposition of Raw Sugar covered by Outstanding Quedans for previous Crop Year 2011-2012 and Prior Years

CL No.35 Series of 2013-2014

Implementing Rules and Regulations (IRR) Re: Compulsory Disposition of Raw Sugar covered by Outstanding Quedans for previous Crop Year 2011-2012 and Prior Years

CL No.5 Series of 2008-2009

Compulsory

CL No.16 Series of 2005-2006

Implementing Rules and Regulations (IRR) Re: Compulsory Disposition of the Raw Sugar covered by Outstanding Quedans of previous Crop Years

SO No. 4 Series of 2005-2006

Compulsory

Shipment Of “A” and “D”

SO No.3 Series of 2012-2013

for Verification and Disposition of “D” World Market Sugar

SO No.2 Series of 2012-2013

Filling Up the U.S. Quota for Quota Year 2012-2013 and Guidelines in the Verification and Shipment of “A” or U.S. Quota Sugar

SO No.4 Series of 1997-1998 Amendment to Sugar Order No. 6, Series of 1994-1995 by classifying Busco and Dacongcogon as Sugar Mills with Loading Ports or near Bulk Terminals

SO No.7 Series of 1994-1995

Physical Transfer of “A” or U.S. Quotas Sugar to Loading Ports/Bulk Terminals

CL No.41 Series of 1990-1991

Dissemination and publication of Guidelines to Implement General Administrative Order (GAO) No.1, Series of 1990-91, dated March 6, 1991

SO No.6 Series of 2010-11

Rules and Regulations Covering Imports of Sugar with Added Flavouring or Colouring Matter Classified under Tariff Heading 1701 of the Tariff and Customs Code of the Philippines, as amended

SO No.5 Series of 2010-11

Addendum to Section 2, of Sugar Order No. 7& 7-A, Series of 2003-2004

Re: Rules and Regulations on Importation of Food Preparations under Tariff Heading 21.06 of the Tariff and Customs Code of the Philippines- ASEAN Harmonized Tariff Nomenclature (TCCP-AHTN)

SO No.12 Series of 2006-07

Rules and Regulations on Importations of Food Preparations under AHTN Code 2106.90.52

SO No. 7-A Series of 2003-04

Amendment to Sugar Order No. 7, Series of 2003-2004 Re: Rules and Regulations on Importation of Food Preparations under Tariff Heading 21.06 of the Tariff and Customs Code of the Philippines - ASEAN Harmonized Tariff Nomenclature (TCCP-AHTN)

SO No. 7 Series of 2003-2004

Rules and Regulations on Importation of Food Preparations under Tariff Heading 21.06 of the Tariff and Customs Code of the Philippines - ASEAN Harmonized Tariff Nomenclature (TCCP-AHTN)

of 2003-2004

SO No.3 Series of 2012-2013

No.2 Series of 2012-2013

Filling Up the U.S. Quota for Quota Year 2012-2013 and Guidelines in the Verification and Shipment of “A” or U.S. Quota Sugar

SO No.4 Series of 1997-1998 Amendment to Sugar Order No. 6, Series of 1994-1995 by classifying Busco and Dacongcogon as Sugar Mills with Loading Ports or near Bulk Terminals

SO No.7 Series of 1994-1995

“A” or U.S. Quotas Sugar to

No.41 Series of 1990-1991 Dissemination and publication of Guidelines to Implement General Administrative Order (GAO) No.1, Series of 1990-91, dated March 6, 1991

No.10 Series of 1988-1989

CL No. 9 Series of 2006-2007 Implementing Rules and Regulations on the Availment of “E” or CBW Food Processors/Exporters

SO No. 4-A Series of 2006-2007

Amendment to and addendum to Sugar Order No. 4, Series of 2006-2007

Re: Conversion of “C” or Reserved Sugar into “D” or World Market Sugar and the Revised Sugar Classification and Percentage Allocation

CL No. 9, Series of 2004-2005

Making available the “D” or World Market Sugar Produced During CY 2004-2005 to CBW Processors / Exporters of Sugar Based Products

SO No. 2 Series of 2004-2005

Export of “D” Sugar For CY 2004-2005

CL No. 12 Series of 2000-2001

Amendment to Circular Letter No. 40 Re: Guidelines in the Issuance of Certification of Sugar Requirements for Food Processors/Manufacturers of Sugar-Based Products for Export

CL No. 40 Series of 1998-1999

Guidelines in the Issuance of Certificate of Sugar Requirements for Processors / Manufacturers of Sugar-Based Products for Exports

SO No. 13 Series of 1998-1999

Rules and Regulations on Sugar Imported by Processors/Manufacturers of Sugar-Based Products for Exports

SO No. 10 Series of 1998-1999

Amendment of Certain Provisions of Sugar Order No. 8, Series of 1995-1996 Re: Rules and Regulations on Sugar Imported by Manufacturers of Sugar-Based Products for Export

SO No. 6-A (Amended) Series of 1998-1999

Notice of Arrival of Importation Amendment of S.O. No.6, Series of 1998-1999 76

SO No. 6 Series of 1998-1999 Notice of Arrival of Sugar Importation

SO No. 10 Series of 1997-1998

Re-imposition of the Rules and Regulations on Sugar Imported by Manufacturers of Sugar-Based Products for Exports

SO No. 11 Series of 1996-1997

Revocation of Sugar Order No.8 Series of 1995-1996, Re: Rules and Regulations on Sugar Imported by Manufacturers of Sugar-Based Products for Export

CL No. 33 Series of 1995-1996

Guidelines In the Issuance of Certificate of Sugar Requirements for Processors/Manufacturers of Sugar-Based Products for Export

SO No. 8 Series of 1995-1996

Rules and Regulations on Sugar Imported by Manufacturers of Sugar-Based Products for Exports

CL No. 1 Series of 1994-1995

Guidelines to Implement Sugar Order No.2, Series of 1994-1995

SO No. 2 Series of 1994-1995

Authorizing the Use of “D” or World Market Sugar by Manufacturers of Sugar-Based Products for Export under certain conditions

CL No. 3 Series of 1993-1994

Guidelines to Implement SRA Sugar Order No.2, Series of 1993-1994

SO No. 2 Series of 1993-1994

Authorizing the Use of “D” or World Market Sugar by Manufacturers of Sugar-Based Food Products for Export to Foreign Countries under certain conditions

CL No. 16 Series of 1992-1993 Guidelines to Implement SRA Sugar Order No.7, Series of 1992-1993

SO No. 7, Series of 1992-1993

Authorizing the use of “D” or World Market Sugar by manufacturers of sugar-based products for export to foreign countries under certain conditions

U. Mill District Development Committee (MDDC)

SO No. 5 Series of 2002-2003

Strengthening the MDDC and Providing Guidelines for its Accreditation (Amendments to Sugar Order No. 8, Series of 1990-1991)

V. Voluntary P1.00/Lkg-Bag To Fund The Anti-Smuggling Program Of The Sugar Industry

SO No. 3 Series of 2013-2014

Revocation of Sugar Order No. 4, Series of 2012-2013 Re: Voluntary Contribution and Collection of Sugar Anti-Smuggling Fee of 1.00/Lkg-Bag

SO No. 4 Series of 2012-2013

Voluntary Contribution and Collection of Sugar Anti-Smuggling Fee of P1.00/Lkg-bag

SO No. 4 Series of 2010-2011

Voluntary Contribution and Collection of Sugar Monitoring and Anti-Smuggling Fee of Ph. 1.00/Lkg-Bag of Raw covered by Raw Sugar Quedans for CY 2010-2011

SO No. 5 Series of 2009-2010

Resumption of the Collection of Monitoring Service Fee of 1.00 Lkg Bag (Instead of Ph. 2.00/Lkg-Bag) of Raw Sugar covered by Raw Sugar Quedans of Crop Year 2009-2010

85

SO No. 7-A Series of 2007-2008

Revocation of Sugar Order No.7, Series of 2007-2008 and its replacement with Sugar Order No. 7-A, providing for the collection of Ph. 1.00 Lkg-Bag on the Raw Sugar Production of Sugar Planters and Millers who subscribe to Support the Sugar Monitoring and Anti-smuggling Program of the Sugar Industry

SO No. 7 Series of 2007-2008

Implementation of the Collection of Monitoring Fee of Php 1.00/Lkg-Bag (instead of Ph. 2.00 Lkg-Bag) of Raw Sugar covered by Raw Sugar Quedans

SO No. 7 Series of 2002-2003

Amendment to Sugar Order No. 3, Series of 2001-2002 Re: Policy on Coastwise

SO No. 11 Series of 1999-2000

Amendment to SRA Sugar Order No. 3 Series of 1998-1999, dated 15 October 1998

SO No. 4 Series of 1999-2000

Amendment to SRA Sugar Order No. 12 as Amended by Sugar Order No. 15 and Sugar Order No. 3, Series of 1998-1999 on Monitoring of Coastwise Movement of Sugar

GAO No. 1 Series of 1999-2000

Amendment to General Administrative Order No. 1, Series of 1994-1995 Re: Monitoring and Shipping Permit Fees

SO No. 3 Series of 1998-1999

Amendment to SRA Sugar Order No. 12 Series of 1987-1988, dated June 2, 1988

CL No. 41 Series of 1990-1991

Dissemination and Publication of Guidelines to Implement General Administrative Order No. 1, Series of 1990-1991 dated March 6, 1991

SO No. 12 Series of 1987-1988 To Monitor Coastwise Movement of Sugar

SO No. 4 Series of 2013-2014

Revocation of all Sugar Orders, Circular Letters RE Sugar Market and Development Fund remitted to the Confederation of Sugar Producers Associations, Inc. (CONFED), National Federation of Sugarcane Planters (NFSP), United Planters Federation of Sugarcane of the Phil., Inc. (UNIFED), Panay Federation of Sugarcane Planters (Panayfed), Luzon Federation of Sugarcane Growers Assn, Inc. (LUZONFED), Philippine Sugar Millers Association, Inc. (PSMA) and Philippine Independent Millers Association, Inc. (PIMA)

SO No. 7 Series of 1997-98

Increasing the Clearance Fee for Imported Sugar from Ph. 7.70 per Lkg-Bag to Php10.30 per Lkg-Bag

SO No. 14 Series of 1998-99

Payment of Lien on Sugar Importation under Executive Order (EO) No. 87, Series of 1999 Implemented By Administrative Order (AO) No. 20, Series of 1999

CL No. 4 Series of 1996-97

Additional Trustee for the Sugar Market Development Fund (SMDF)

SO No. 9 Series of 1995-96

Collection and Remittance of the Php 0.70 Lien per Lkg-Bag National Federation of Sugarcane Planters-Sugar Market Development Fund (NFSPSMDF) thru authorized PNB Branches

CL No. 29 Series of 1994-95

All Sugar Mills and all Mill District Regulation Officers

SO No. 8 Series of 1994-95 Rules and Regulations on Imported Sugar

CL No. 7 Series of 1994-95

Collection and Remittance of the Php 0.70 per Lkg-Bag Lien as Sugar Market Development Fund (SMDF) by authorized PNB Branches

SO No. 3 Series of 1994-95

Increasing the Imposition and Collection of Sugar Market Development Fund (SMDF)

MC No. 2 Series of 1993–94

Millers Sugar Market Development Fund (MSMDF) 95

SO No. 3 Series of 1992-93

Collection and Remittance of Ph. 0.50 per Picul Miller Sugar Market Development Fund (MSMDF) by authorized PNB Branches

SO No. 2 Series of 1992-1993

Collection and Remittance of CONFED SMDF by authorized Philippine National Bank (PNB) Branches

MC dated June 9, 1992

Delay In the Remittance of Sugar Market & Development Fund (SMDF) Liens

CL No. 15 Series of 1991-92

Authorized the mill companies to continue to impose and collect a lien of Php0.50 per picul (Php0.395 per Lkg) of sugar produced by planter and millers starting CY 1991-1992 as Sugar Market Development Fund (SMDF). 96

CL No. 41 Series of 1989-90 CONFED Dues and Sugar Development Foundation Inc. (SDFI). Fund as Liens on Sugar Quedans. 96

CL No. 42 Series of 1989 – 1990 Export Market Development Fund

96

Y. Social Amelioration Program (SAP)

Republic Act (RA) No. 809

An Act to Regulate the Relations Among Persons engaged in the Sugar Industry

PD 621

Vesting upon the Secretary of Labor General Supervision & Control over the Social Amelioration Program In the Sugar Industry

PD 1209

Creating an Agricultural & Rural Development Scholarship Fund and for other purposes.

PD 1365

Creating “Rural Workers Office” In the Dept. of Labor & for other purposes

RA 6982

An Act Strengthening the Social Amelioration Program in the Sugar Industry, providing the Mechanics for its Implementation, and for other purposes

Z. Policies On The Production Of Ethanol

SO No. 14 Series of 2008-2009 Policies on the Production of Bio-Ethanol

No. 30 Series of 2008-2009 Guidelines on the Production of

SO No. 3 Series of 2007-2008 Formation of Bio-Ethanol Consultative

SO No. 8 Series of 2003-2004 Creation of an Ethanol Consultative Committee (EPCC) and Technical Working Group and Secretariat (TWGS)

I. SO No. 10 S. 2009-2010

II. SO Nos. 1 S. 1986-87 to 2013-14 Mandating the Sugar Allocation

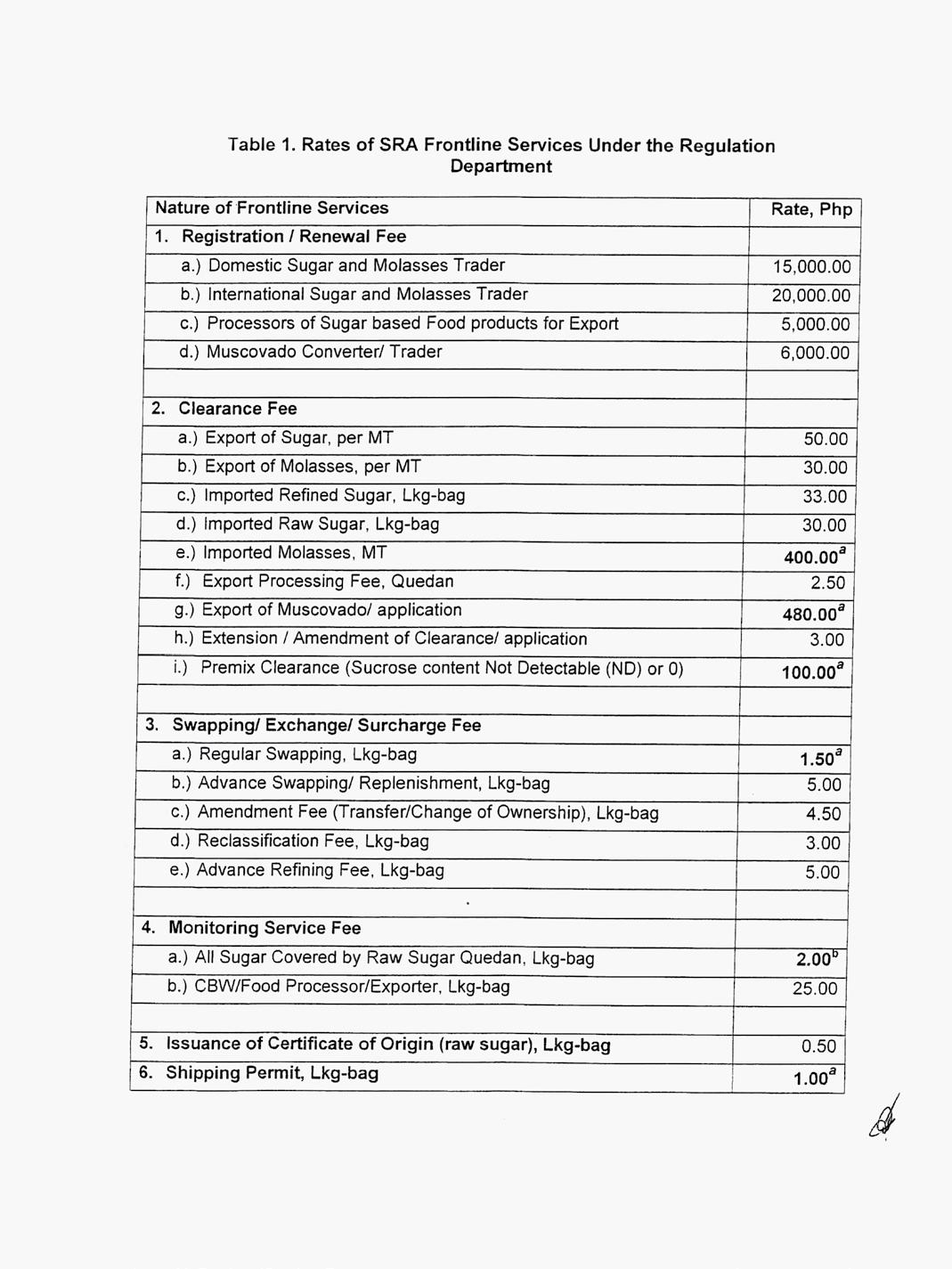

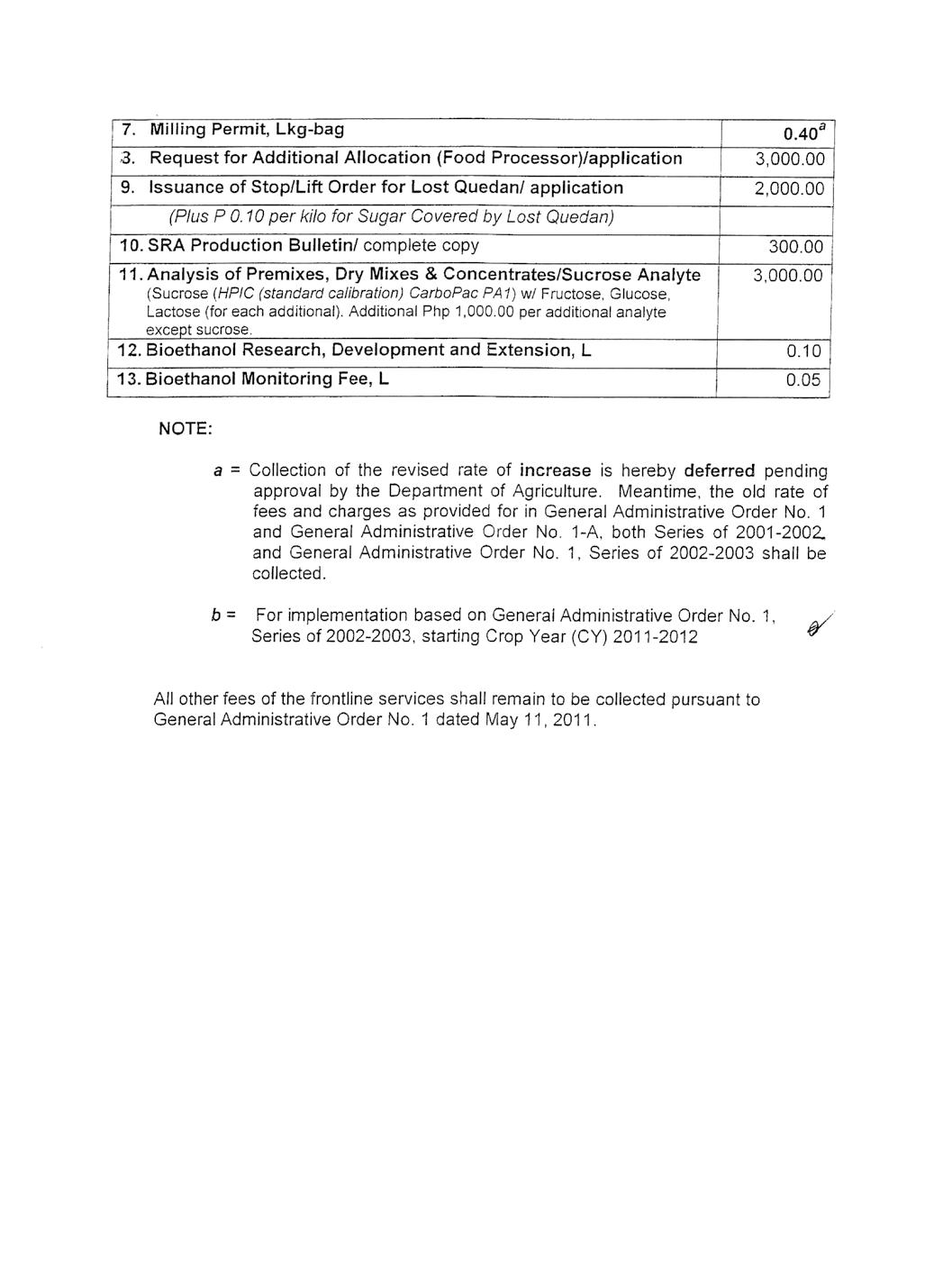

III. GAO No. 1 dated May 11, 2011 Re Increase in Fees and Charges of SRA Frontline Services

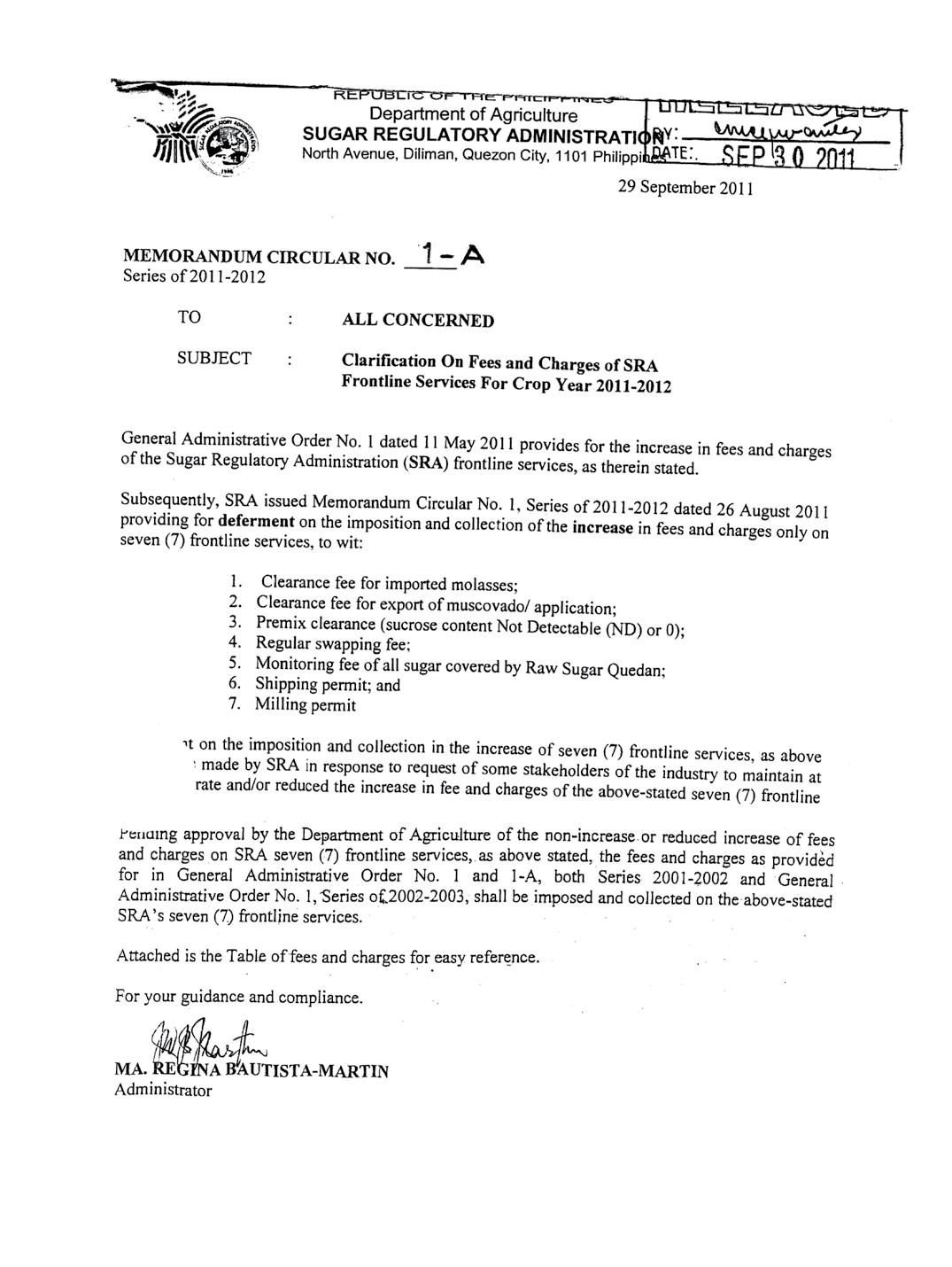

IV. Memorandum Circular No. 1 Dated August 26, 2011 Clarification

V. Memorandum Circular No.1-A Dated September 2011

VI. Republic Act No. 10659 - An Act Promoting and Supporting the Competitiveness of Sugarcane Industry and for other purposes.

Republic of the Philippines

SUGAR REGULATORY ADMINISTRATION

North Avenue, Diliman, Quezon City

On May 28, 1986, President Corazon C. Aquino issued Executive Order No. 18, which created the Sugar Regulatory Administration (SRA).

The principal office of SRA is located at North Avenue, Diliman, Quezon City. A regional office in Visayas was also established in Bacolod City to cater to the needs and interests of the area, the biggest sugar producing region of the country.

All corporate powers of the Sugar Regulatory Administration shall be vested in, and exercised by, the Sugar Board. The Board shall be composed of an Administrator, who shall act as its Chairman, to be appointed by the President of the Philippines, and two (2) members. The two members of the Board shall likewise be appointed by the President of the Philippines upon the recommendation of the sugar industry, with one member representing the millers and the other representing the planters.

The Administrator shall be the Chief Executive Officer of the Sugar Regulatory Administration.

The SRA is presently composed of six (6) Departments in SRA Quezon City namely; Regulation Department (RD), Research, Development and Extension (RD&E) Department, Administrative and Finance Department (AFD), Planning and Policy Department (PPD), Internal Audit and Services Department (IASD) and Legal Department (LD). On the other hand Visayas has two (2) operating Departments namely: Regulation Department (RD), Research, Development and Extension Department (RD&E).

An empowered government organization that ensures long-term viability, environmental sustainability and global competitiveness of Philippine sugarcane industries through greater and significant participation of the stakeholders.

To provide stakeholders of the Philippine sugarcane industries with pro-active and effective policies, regulatory, R&D and extension services.

Integrity, Innovativeness, Competence, Professionalism, Accountability

Enforces and implements SRA policies, rules and regulations pertaining to production, importation and exportation, withdrawals and disposition of sugar and sugar by-products.

It has three (3) Divisions with its functions, namely:

1. Sugar Regulation and Enforcement Division (SRED)

Issuance and verification of quedanning and Sugar Releases or Withdrawals at the mill

Collection of liens and monitoring fees, etc.

Issuance/verification of shipping permits for coastwise movement

Monitoring of production, withdrawals and stocks

Physical sugar/molasses stock inventory

Check/monitor scale calibration at the mill

2. Licensing and Monitoring Division (LMD)

Issuance of license/certificate and order of payment to sugar mills/ refineries and sugar/molasses/muscovado traders

Issuance of weekly production bulletin which provides timely and accurate information on sugar/molasses production, withdrawals, stock balance and prices

Monitoring of warehouses of food processors/exporters under the Customs Bonded Warehouses (CBWs)

Monitoring of sugar prices

Liquidation and monitoring of imported/local sugar availed by food processors

3. Sugar Transaction Division (STD)

Ensures the timely and proper disposition of sugar for domestic, U.S. and world markets

Evaluates and allocates sugar requirements of processors/exporters under the CBW

Supervision and monitoring of printing and distribution of sugar quedan-permit forms

Section 1. Purpose and Scope

(a) Purpose.

The policies and regulations in this manual are issued by Sugar Regulatory Administration (SRA) pursuant to Section 2 of Executive Order No. 18. This Manual prescribes the requirements in order to achieve the following regulatory objectives:

• To institute an orderly system in sugarcane production for the stable, sufficient and balanced production of sugar, for local consumption, exportation and strategic reserves;

• To establish and maintain such balanced relation between production and requirement of sugar and such marketing condition as will ensure stabilized prices at a level reasonably profitable to the producers and fair to consumers;

• To promote the effective merchandising of sugar and its by-products in the domestic and foreign markets so that those engaged in the sugar industry will be placed on a basis of economic viability;

• To undertake such relevant studies as may be needed in the formulation of policies and in the planning and implementation of action programs required in attaining the purposes and objectives set forth under the E.O. No. 18.

(b) Scope

The scope of the manual includes all the SRA issuances derived from Section 3 of E.O. No.18 which describes SRA regulatory powers and functions, to wit:

• To institute regulations for implementing, controlling and monitoring the production quotas;

• To establish domestic, export and reserve allocations;

• To explore and expand the domestic market and foreign markets for sugar and by-products, to assure mutual benefits to consumers and producers, and to promote and maintain a proper balance of production of sugar and its byproducts;

• To institute, implement and regulate an orderly system of quedanning, disposition and withdrawals of various forms of sugar from warehouses;

• To issue permits and licenses and collect corresponding fees and levies on the processing and manufacture of sugar and its by-products and other products derived from sugarcane and sugar;

• To do all such other things, transact such other businesses and perform such functions directly or indirectly necessary, incidental or conducive to the attainment of the purposes of the Sugar Regulatory Administration;

Section 2. Interpretation – No interpretation of the meaning of the regulations in this Codification Manual other than a written interpretation by the SRA will be recognized to be binding.

Section 3. Communications – All communications and reports concerning the regulations should be addressed to the Administrator, Sugar Regulatory Administration, North Avenue, Diliman, Quezon City, Metro Manila.

Section 4. Violation – Any person who willfully violates or attempts to violate any provision of the SRA rules and regulations or any order issued thereunder by the SRA, shall be punished in accordance with the penal provisions of Sugar Order No. 10, Series of 2009-2010 otherwise known as Codified Violations of SRA Regulations and Sugar Orders, Providing for Penalties and Simplified Rules and Procedures for Disposition of Cases Related Thereto.

Approved:

REGINA BAUTISTA-MARTIN Administrator AIDA F. IGNACIO Deputy AdministratorSugar Orders/ Issuances/ Subject

Circular Letter No. 30

Series of 2012-2013

Application for Milling and Refining License for Crop Year 2013-2014

MA. REGINA BAUTISTA MARTIN Administrator

Date Approved/ Effectivity

July 10, 2013

Circular Letter No. 44

Series of 2004-2005

Application for Milling/Refining License for CY 2004-2005

JAMES C. LEDESMA Administrator

Sugar Order No. 4

Series of 1992-1993

Application for Refining License

RODOLFO A. GAMBOA Administrator

June 8, 2005

Brief Summary of Regulatory Policy/ Penalty Clause

Directed All Sugar Mill/Refinery Companies to submit all requiremenats for CY 2013-2014 Milling season.

Requirements:

Application in (triplicate) for the issuance of a license to manufacture or refine centrifugal sugar subject to the conditions set under SRA S. O. No. 8 dated July 23, 1992 and SRA S. O. No. 4 dated September 17, 1992, respectively. Application in (triplicate) for the issuance of a license to manufacture or refine centrifugal sugar subject to the conditions set under SRA S. O. No. 8 dated July 23, 1992 and SRA S. O. No. 4 dated September 17, 1992, respectively. Duly accomplished Milling or Refining License QuestionnaireCrop Estimate for CY 2013-2014, only for sugar mill companies Duly notarized undertaking.

Directed all sugar mills to secure license to manufacture or refine sugar subject to the conditions under S.O. No. 8 dated July 23, 1992 and S.O. No. 4 dated September 17, 1992.

September 17, 1992 Required mills to secure license to manufacture or refined sugar and to submit reports of SMS and remit payment of monitoring fees per Admin. Order No. 1 dated August 5, 1992. With Sworn Statement that all information in the application are true and correct as shown in the books and records of the refinery and executed by the President of the refinery duly notarized.

Requirements:

Three (3) copies of Application for License to Manufacture Refined Sugar

Mayor’s Permit

DTI Registration

VAT Registration

SEC Registration and TIN

Sugar Order No. 8

Series of 1991-1992

Application for Milling License

RODOLFO A. GAMBOA Administrator

July 23, 1992

Required mills to submit application forms for the issuance to manufacture sugar, SMS reports and all sugar manufactured be stored in the mill site. All sugar shall be withdrawn from mill site prior to surrender of quedan permits.

Requirements:

Three (3) copies of Application for License to Manufacture Refined Sugar

Mayor’s Permit

DTI Registration

VAT Registration

SEC Registration and TIN

Required issuance of a license to manufacture sugar provided that strict adherence and compliance to the SRA rules and regulations are enforced by all mill companies relative to the manufacture, quality, warehousing and disposal of sugar.

Circular Letter No. 4

Series of 1991-1992

to Sugar Policies

ARSENIO B. YULO, JR. Administrator

Sept. 3, 1991

Circular Letter No. 2

Series of 1986-1987

Temporary Milling License for CY 1986-1987

ARSENIO B. YULO, JR. Administrator

June 23, 1986

The use of metric system in the sugar industry was introduced and mandated.

It also required the registration of mill warehouse/s and warehouseman. It also mandated the bagging of all “B” domestic sugar production (mill and planter’s shares) as well as all other sugar classes reclassified as B.

It also required the conduct of spot physical inventories of sugar stocks of warehouses by the Mill District Regulation Officers (MDROs).

Directed all mills to accomplish Milling License Questionnaire as a requirement for a Temporary Milling License for CY 1986-1987.

Sugar Orders/ Issuances/ Subject

Sugar Order No. 14

Series of 2007-2008

Amendment of Sugar Order No. 12, Dated 27 August 1991, Series of 19901991, Re: Calibration of Weighing Scales

RAFAEL L. COSCOLLUELA AdministratorDate Approved/ Effectivity

July 18, 2008

Sugar Order No. 12

Series of 1990-1991

Calibration of Weighing Scales

ARSENIO B. YULO. JR. AdministratorAugust 27, 1991

Brief Summary of Regulatory Policy/ Penalty Clause

Calibration of weighing scales being used by the mill shall be undertaken by a recognized Instrumentation Technician, acceptable to the mill company, the planters’ association or in the absence thereof, cooperative marketing association and the SRA whose representatives (one each) shall attest and certify to the calibration of said weighing scales. Each representative will be furnished a copy of the report.

Calibration of the scales shall be for the account of the mill company.

Breaking or removal of the seal shall require a Notice to SRA and Planters Representatives, or in case or urgent technical problems in the scale and time is of the essence to break the seal, notice shall be given within the next twenty-four (24) hours after breaking the seal.

Unauthorized breaking or removal of seal without prior notice to the planters Association/s and SRA Representatives shall be subject to the following penalties:

1st Offense Fine of Php 10,000.00

2nd Offense Fine of Php 20,000.00

3rd Offense Suspension of 30 days

4th Offense Cancellation of milling license

Authorized the calibration of weighing scales being used by mill and sugar centrals to be undertaken by the Industrial Technology Development Institute (ITDI-DOST) or by a surveyor acceptable to the mill company, the planters’ association or in the absence of cooperative marketing association and the SRA whose representatives (one each) shall witness and certify in writing to the calibration of said weighing scales.

Required that calibration be conducted one (1) month prior to the sugar centrals’ milling season or as directed by the SRA.

Unauthorized breaking or removal of seal shall be subject to such penalties as may be imposed by the Sugar Board.

Sugar Orders/ Issuances/ Subject

Sugar Order No. 12 Series of 2010-2011

Issuance of Separate License to Domestic Sugar Traders and International Sugar Trader (Exporters/Importers)

MA. REGINA BAUTISTA-MARTIN Administrator

Date Approved/ Effectivity

July 4, 2011

Brief Summary of Regulatory Policy/ Penalty Clause

Required separate requirements for the issuance of licenses for domestic and international traders in order to rationalize the granting of license to traders who are engaged in domestic and/or export/import trading.

Required the traders to submit a semi-annual Activity Report (AR) stated in Sec. 8 and imposed a penalty of P5,000.00 for failure to submit on time the AR.

Requirements:

For Domestic Sugar, Single Proprietorship -

1) Current Year Mayor’s Permit

2) Cert. of Registration from DTI

3) TIN

4) Passport size picture of applicant

5) Notarized Application

For Corporation -

1) Mayor’s Permit

2) SEC Registration

3) Current Year General Info Sheet submitted and received by SEC

4) Articles of Incorporation

5) TIN

6) Passport size picture of applicant

7) Notarized Application

For Cooperative -

1) Mayor’s Permit

2) CDA Registration

3) Current Year Certificate of Good Standing from CDA

4) By-Laws

5) TIN

General Administrative Order No.1

Series 2010-2011

Increase in Fees and Charges of SRA Frontline Services

MA. REGINA BAUTISTA-MARTIN Administrator

Sugar Order No. 10

Series of 2009-2010

Codified Violations of SRA Regulations and Sugar Orders, Providing for Penalties and Simplified Rules and Procedures for the Disposition of Cases Related Thereto

RAFAEL L. COSCOLLUELA

Administrator

Sugar Order No. 9

Series of 2008-2009

Amending Sugar Order No. 6 Series of 2004-2005 regarding the Registration of Sugar, Molasses and Muscovado Traders

RAFAEL L. COSCOLLUELA

Administrator

Sugar Order No. 6

Series of 2004-2005

Registration of Sugar, Molasses and Muscovado Traders

JAMES C. LEDESMA Administrator

May 11, 2011

6) Passport size picture of applicant

7) Notarized Application

For International Sugar -

Same as Domestic Trader requirements plus track record of domestic and export transactions.

Increased Fees in:

1) Domestic Sugar and Molasses Trader Registration - P15,000.00

2) International Sugar and Molasses Trader - P20,000.00

3) Muscovado Trader - P6,000.00

February 26, 2010

March 16, 2009

Imposed penalty on failure to submit semiannual trading activities within fifteen (15) days after the middle and end of every crop year, respectively.

June 24, 2005

Required random verification through warehouse and office inspection before a new applicant can secure a license for registration to make sure that grantees are legitimate business entities.

Imposed penalty of P2,000.00 for every month of delayed submission of Activity Report.

Imposed to pay one half of the registration fee for the remaining two months of CY.

Simplified procedures for registration of sugar, molasses, muscovado traders.

Authorized submission of Activity Report within fifteen (15) days after each Crop Year.

Authorized to penalize traders for a fee of Php 2,000.00 for late submission of the said report.

Circular Letter No. 20

Series of 2004-2005

Reconsideration for Failure to Submit Monthly Report

JAMES C. LEDESMA Administrator

General Administrative Order No. 1

Series of 2002-2003

Increase in Fees and Charges pursuant to Executive Order No. 197

JAMES C. LEDESMA Administrator

Sugar Order No. 10 Series of 2009-2010

Codified Violations of SRA Regulations and Sugar Orders, Providing for Penalties and Simplified Rules and Procedures for the Disposition of Cases Related Thereto

RAFAEL L. COSCOLLUELA Administrator

General Administrative Order No. 1 Series of 2001-2002

Increase in Fees and Charges pursuant to Executive Order No. 197

JAMES C. LEDESMA Administrator

Requirements:

1) Municipal License

2) Mayor’s Permit

3) BIR Privilage Tax

4) Certificate of Registration of the Business Name with the Bureau of Domestic Trade

5) Certificate of Registration with the SEC

6) Certificate of Registration for Tax Identification Number (TIN) and

7) Taxpayer Identification Card

January 28, 2005 Gave Traders a ninety (90) days period to submit their monthly Activity Report.

February 20, 2003

Increased in license fee of P12,000.00 for Sugar and Molasses License and P2,000.00 for Sugar Based Products for Export.

February 26, 2010 Imposed penalty on failure to submit semiannual trading activities within fifteen (15) days after the middle and end of every crop year, respectively.

January 17, 2005 Increased in license fee of P10,000.00 for Sugar/Molasses Trader.

Circular Letter No. 38

Series Of 1999-2000

List of Reinstated Sugar/Molasses Traders/Muscovado Converter

NICHOLAS A. ALONSO Administrator

Circular Letter No. 31

Series of 1999-2000

Cancellation of Licenses of Sugar/ Molasses Traders for Crop Year 1999-2000

NICOLAS A. ALONSO Administrator

General Administrative Order No 2

Series of 1999-2000

Increase in Fees and Charges pursuant to Executive Order No. 197

NICOLAS A. ALONSO Administrator

Circular Letter No. 12

Series of 1986-1987

Monthly Reports of Sugar and Molasses Traders

ARSENIO B. YULO, JR. Administrator

Circular Letter No. 11

Series of 1995-1996

Form SRA-03 A, Revised 1995: Application for License to operate as Trader

RODOLFO A. GAMBOA Administrator

General Administrative Order No. 1

Series of 1994-1995

Service Charges, Monitoring, Permit and Laboratory Analysis Fees, etc. in the Sugar Regulatory Administration (SRA)

RODOLFO A. GAMBOA Administrator

August 1, 2000

June 28, 2000

Issued the list of reinstated sugar/molasses traders/ muscovado converter whose Certificate of Registration has been cancelled as per SRA Circular Letter No. 31 Series of 1999-2000.

Authorized the cancellation of licenses for CY 1999-2000 of Sugar/Molasses Traders as stated in the listing.

March 22, 2000

Increased in fee of P5,000.00/application for sugar, molasses and muscovado.

Oct. 14, 1996

Required sugar trader or molasses trader to submit monthly report of trading activities even if there was no business transaction for the month. The same amount of penalty is authorized.

Nov. 21, 1995

Revised application form.

Included listing of authorized representatives and Specimen Signatures and attached Sworn Statement.

Oct. 12, 1994

Increased in fee of P1,750.00 per application for sugar and molasses trader registration/ renewal.

General Administrative Order No. 1

Series of 1990-1991

Service Charges and Laboratory Analysis Fees, etc. in the Sugar Regulatory Administration (SRA)

ARSENIO B. YULO, JR. Administrator

Sugar Order No. 2

Series of 1986-1987

Registration of Sugar and Molasses Traders and Muscovado Converters and License Fees, etc.

ARSENIO B. YULO, JR. Administrator

March 6, 1991

July 16, 1986

Required sugar and molasses traders to pay P1,000.00 and P500.00 respectively for registration/renewal fee.

Required submission of application forms with supporting documents for domestic sugar, molasses and muscovado traders to assigned Mill District Officers or to PCRO. A P100.00 registration fee is collected.

Requirements:

1) Municipal License

2) Mayor’s Permit

3) BIR Privilage Tax

4) Certificate of Registration of the Business Name with the Bureau of Domestic Trade

5) Certificate of Registration with the SEC

Sugar Orders/ Issuances/ Subject

Sugar Order No. 14

Series of 2008-2009

Policies on the Production of Bio-Ethanol

RAFAEL L. COSCOLLUELA

Administrator

Circular Letter No. 30

Series of 2008-2009

Guidelines on the Production of Ethanol

RAFAEL L. COSCOLLUELA

Administrator

Date Approved/ Effectivity

July 1, 2009

Sugar Order No. 3

Series of 2007-2008

Formation of Bio-Ethanol Consultative Board

RAFAEL L. COSCOLLUELA

Administrator

July 1, 2009

Brief Summary of Regulatory Policy/ Penalty Clause

Formulated policies on certification of existing sugarcane plantation as feedstock areas and plant site for bio-ethanol producers, registration of Bio-Ethanol feedstock traders /brokers and assignment of SRA Regulation Officers in Bio-Ethanol Production facilities.

Allowed the collection of Monitoring Fee on Bio-Ethanol.

Provided guidelines and requirements on certification of existing sugarcane plantation as feedstock areas and plant site for bioethanol production, registration of bio-ethanol producers/manufacturers, registration of bioethanol traders/brokers, etc.

Requirements:

1. Certification of existing sugarcane plantations as feedback areas.

2, Certification of existing sugarcane plantations for plant site/land conversion purposes only.

October 22, 2007 Formed the Bio-Ethanol consultative board to conduct studies and recommend guidelines to facilitate a system allocation for both sugarcane and ethanol.

Requirements:

1. SRA Administrator as Chairman of the Board

2, Five (5) members representing the existing national federation/ associations of sugar planters/ producers duly recognized by SRA (CONFED, NFSP, PANAYFED, UNIFED, LUZONFED)

3. Two (2) members representing the existing national association of sugar millers (PSMA, AIM)

4. Two (2) members representing the Department of Agriculture

5. One (1) member representing the unaffiliated planters

6. One (1) member representing the Philippine Sugar Technologists.

Sugar Order No. 8

Series of 2003-2004

Creation of an Ethanol Consultative Committee (EPCC) and Technical Working Group and Secretariat (TWGS)

JAMES C. LEDESMA AdministratorMarch 31, 2004

Provided technical and administrative assistance mandating DENR and other agencies in order to oversee the issues and concerns to promote the development of ethanol as a renewable fuel.

Sugar Orders/ Issuances/ Subject

Molasses Order No. 1

Series of 2006

Amendment to the Rules and Regulations to cover the Production of Molasses of Sugar Mills

JAMES C. LEDESMA Administrator

Circular Letter No. 51

Series of 2004-2005

Molasses Release Order

JAMES C. LEDESMA Administrator

Molasses Order No. 1

Series of 1997-1998

Increasing the Lien Applied to Imported Molasses from Php 50.00/MT to Php 200.00/MT

NICOLAS A. ALONSO Administrator

Molasses Order No. 2

Series of 1996-1997

Certain Rules and Regulations to cover Production of Molasses of Sugar Mills

WILSON P. GAMBOA Administrator

Molasses Order No. 1

Series of 1996-1997

Rules and Regulations on Imported Molasses

WILSON P. GAMBOA Administrator

Date Approved/ Effectivity

Brief Summary of Regulatory Policy/ Penalty Clause

April 18, 2006 All sugar mills and regulation officers there at must conduct a physical stock inventory of molasses at the start of their CY.

Required all mills to submit one (1) molasses sample for every three-month operations ninety (90) days and at the end of the milling to the SRA for laboratory analyses and quality characterization. Those operating for less than three months must submit one sample at the end of the milling for the same purpose.

August 1, 2005

August 11, 1998

Released the Raw Molasses Release Order forms for solicitation of comments and suggestions on the plan to prescribe the said forms for CY 2005-2006 in order to enhance its effectiveness to monitor the withdrawals of molasses from the mills and refineries.

Increased the fee for imported molasses application from P50.00/MT to P200.00/MT.

Required the importer/consignee of the imported molasses covered by this order to apply for clearance from the SRA prior to release of the commodity by the BOC.

September 25, 1996

September 25, 1996

Required the conduct of molasses inventory of Regulation Officers assigned in the mill to determine the beginning balance of said molasses for the current year and submission of the result of the inventory to SRA for consolidation of report.

Required molasses importer to apply for clearance prior to the release of the commodity by the BOC by submitting to SRA a letter request for clearance stating country of origin, purpose of importation with other attached documents and paying the lien of P50.00 per Metric Tons (MT) to SRA.

Sugar Order No. 7

Series of 1986-1987

Authorized sugar producers to withdraw and/or dispose their 1986-1987

Five per cent (5%) Retention Molasses

CARLOS LEDESMA Acting Chairman/AdministratorSeptember 10, 1986

Authorized sugar producers to withdraw and/ or dispose their 1986-1987 five (5%) per cent retention molasses provided that upon orders of SRA, sugar producers (mills and planters) replenish the same from their future production share in accordance with LOI No. 57.

1. Setting up the week ending closing of sugar production and the sugar allocation policy as mandated in all Sugar Order No. 1

Sugar Orders/ Issuances/ Subject

Sugar Order No. 8

Series of 1999-2000

Revocation of Sugar Order No. 5, Series of 1999-2000 Re: Resetting the Week-End closing of Raw and Refined Sugar Productions from 2400 Hours Sunday to 0800 Hours Monday

NICOLAS A. ALONSO Administrator

Sugar Order No. 5

Series of 1999-2000

Resetting the Week-End Closing of Raw and Refined Sugar Productions from 2400 Hours Sunday to 0800 Hours Monday

NICOLAS A. ALONSO Administrator

Sugar Order No. 6

Series of 1992-1993

Quedanning of Refined Sugar

RODOLFO A. GAMBOA Administrator

Sugar Order No. 1

Series of 1986-1987 and all succeeding Sugar Orders No. 1

Sugar Policy for CY 1986-1987 and Production Quota for 1987-1988

ARSENIO B. YULO, JR. Administrator

Date Approved/ Effectivity

Brief Summary of Regulatory Policy/ Penalty Clause

November 12, 1999 Restored the closing time of Raw and Refined Sugar Production to its original time of 2400 Hours Sunday.

October 20, 1999 Re-set the date of week-end closing of raw and refined sugar productions from 2400 hours Sunday to 0800 hours Monday.

September 17, 1992 Authorized the quedanning of all refined sugar produced by sugar refineries. Only raw ‘B” sugar may be refined by non-integrated refineries and same shall be issued refined sugar quedans.

July 15, 1986 Implemented the percentage allocation of sugar classes and the periodic assessments of the 1987-1988 sugar production and on the basis of such assessments, it shall adjust, from time to time the percentage distribution of the classes of sugar.

All succeeding issuances of Sugar Order No. 1 after CY 1986-1987 prescribed the sugar allocation as market destinations.

Sugar Orders/ Issuances/ Subject

Sugar Order No.8 Series of 2012-2013

Harmonizing the Fees and Penalty Charges on Advance Refining

Date Approved/ Effectivity

July 18, 2013

Brief Summary of Regulatory Policy/ Penalty Clause

Procedures for the application for approval of request for Advance Refining:

Requesting refineries must submit a letterrequest for the advance refining of “A” and “D” sugars or both for SRA’s approval. All approvals shall be further subject to the following terms and conditions:

1. A letter of application for advance refining shall be filed with the SRA, Diliman, Quezon City attached thereto the physical “A” and “D” quedans with listing, sorted chronologically by mill and date of production and affidavit of ownership of the above-mentioned quedans, duly notarized

2. Advance Refining Fee of P5.00/LkgBag.

3. The “A” and “D” quedan permits subject of advance refining shall be stamped “AUTHORIZED FOR ADVANCE REFINING” by the Regulation Department.

4. The refined “A” shall be stored as a separate pile, apart and distinct from the refined sugar for domestic market covered by Refined Sugar Quedans.

5. Only one (1) Refined Sugar Quedan (RSQ) per Trader shall be issued to cover the equivalent refined sugar indicating therein the date of production/week ending and the date of issuance of RSQ. The classification of the raw quedans supporting the approval of advance refining shall be rubber stamped at the upper left portion of the refined sugar quedan.

6. The advance refined “A” and “D” sugar quedans cannot be withdrawn unless its RSQ have been swapped into “B” quedans permits.

7. The mills shall prepare Weekly Production and Withdrawal Reports on their refined “A” and “D” sugar and submit the same verified and certified by the SRA’s SPRO assigned thereat, to the RD, SRA Quezon City for control purposes.

Memorandum Circular No. 5

Series of 2011-2012

Assessment and Collection of Advanced Refining Fee

MA. REGINA BAUTISTA-MARTIN

Administrator

Sugar Order No.5

Series of 2011-2012

Reiteration of SRA Policies on Advance Refining

MA. REGINA BAUTISTA-MARTIN

Administrator

1. The volume of advance refining shall be the negative (-) difference between the physical raw stock balance and the book balance of “A” and “D” sugars, both parameters are taken from the SMS of the last week of refining period. The negative difference confirms that unauthorized advance refining of “A” and “D” sugars has taken place, since the sugar mill with integrated refinery has exceeded the allowable allocation of “B” sugar for refining.

2. The post milling/refining inventory report shall be further made as a reference so that the determined volume is not purely documentary with only the SMS as the basis. The mill shall be notified by these findings.

3. The final volume shall be established by SRA after verification with the Sugar Transactions that the refined sugar involved has no appropriate swapping/replenishment covers before the termination of the refining period. These quedans shall be surrendered for withdrawal before the end of the crop year, otherwise it shall not qualify as covers of advance refining.

4. The refined “A” shall be stored as a separate pile, apart and distinct from the refined sugar for domestic market covered by Refined Sugar Quedans.

August 17, 2012 Authorized the collection of the assessed Refining Fee at the end of Crop Year. No license to operate for the incoming CY shall be issued by the SRA to the refinery unless the assessed Refining Fee is fully settled.

December 21, 2011 Authorized the advance refining when there is appropriate application and approval to refine non-B sugar with market classifications or those with maturity before conversion / reclassification to “B” sugar.

Sugar Order No. 10

Series of 2009-2010

Codified Violations of SRA Regulations and Sugar Orders, providing for Penalties and Simplified Rules and Procedures for the Disposition of cases related thereto

RAFAEL L. COSCOLLUELA Administrator

Sugar Order No. 8

Series of 2002-2003

Advance Refining of “A” Export Sugar of Current and prior Crop Year/s

JAMES C. LEDESMA Administrator

Sugar Order No. 4

Series of 2002-2003

Advance Refining of the “A” Export Sugar of Previous Crop Years by Sugar Mills with Refineries (Integrated Mills)

JAMES C. LEDESMA Administrator

Circular Letter No. 34

Series of 1995-1996

Advance Refining of Imported Raw Sugar classified as “C” or Reserve Sugar

ROLLEO L. IGNACIO Undersecretary, DA Acting Administrator

Sugar Order No. 6

Series of 1992-1993

Quedanning of Refined Sugar

RODOLFO A. GAMBOA Administrator

February 26, 2010

June 26, 2003

Implemented the issuance of an order integrating and incorporating all past and future issuances, prescribing the imposition of penalties and simplifying the procedure for the disposition of such cases, providing a ready guide to producers, regulators and other stakeholders of the sugar industry for the fast resolution of cases.

December 17, 2002

Authorized the advance refining of “A” sugar with an Advance Refining Fee of P3.00 per Lkg-Bag. Said refined “A” sugar cannot be withdrawn for domestic market unless its RSQ has been swapped/surcharged (regular or advance) into “B” or Domestic Sugar.

June 4, 1996

Authorized the advance refining of “A” sugar covered by “A” quedan permits of previous crop year/s issued by sugar mills refineries (integrated mills).

Authorized the advance refining of imported raw sugar classified as “C” or Reserve Sugar requiring the importer to pay for the Advance Refining Fee of P2.00 per Lkg-Bag.

September 17, 1992

Authorized the refining of Raw “B” Sugar by Integrated Refineries.

Sugar Orders/ Issuances/ Subject

Memorandum Circular No. 2 Series of 2011

Prescribing New Sets of Standard for Raw Cane Sugar and White Sugar

MA. REGINA BAUTISTA MARTIN Administrator

PNS for Raw Cane Sugar

Date Approved/ Effectivity

January 3, 2011

Brief Summary of Regulatory Policy/ Penalty Clause

Advised all raw sugar mills and refineries on the approval of the Philippine National Standards (PNS) for Raw Cane Sugar and White Sugar.

2010

The essential composition and quality factors including methods of analysis for the sugars covered by the Standard are as follows:

Quality Factors

Specified as Produced Methods of Analysis

Polarization, percent, minimum 97.4

Safety Factor, maximum 0.3

ICUMSA GS 1/2/3/9-1(2007

ICUMSA GS 2/1/3/9-15(2007

Color (ICUMSA COLOR Units), maximum Affined raw 1300 Whole raw 5000 ICUMSA Modified Method 4

Grain Size, percent through 28-mesh

Ash Content, percent of raw sugar

Maximum 45

Minimum & maximum standard ash content is derived by multiplying percent non-sucrose solids by the factor listed below which corresponds to the final polarization of the cargo:

U.S. Contract Method Form 202191G (Domino corp.)

ICUMSA GS 11-10(1998)

Single Sulphation

Dextran Not exceeding 400 ppm

Sulphur Dioxide

Maximum 20 ppm

ICUMSA GS1-15(2007) Modified Alcohol Haze Roberts Method

ICUMSA GS 2/3-25(2000)

Memorandum Circular

Submission of Raw Sugar Samples for Analysis

RAFAEL L. COSCOLLUELA Administrator

Circular Letter No. 10

Series of 1983-84

Implementing Guidelines for the Execution of Philsucom Sugar Order No. 4

ARSENIO B. YULO, Jr. Administrator

Philsucom Sugar Order No. 4

Series of 1983-1984

Establishment of Raw Sugar Quality Standards for Philippine Sugar

ARSENIO B. YULO, Jr. Administrator

NMKL 135 (1990) EN 18988-2 (1998) ICUMSA GS 2/1/7-33 (2005) Rosaniline Colorimetric Method

SUGAR DESCRIPTION

White sugar, Premium Grade Purified & crystallised sucrose (saccharose) with a polarisation not less than 99.8 Z

White sugar Standard Grade Purified & crystallised sucrose (saccharose) with a polarisation not less than 99.7 Z

Plantation or mill White sugar

1. Scope and description: 2. Sulphur Dioxide

Purified & crystallised sucrose (saccharose) with a polarisation not less than 99.5 Z

SUGAR DESCRIPTION

White sugar, Premium & Standard Grade 15

Plantation or mill White sugar 20

Sept. 12, 2007 Required all sugar mills/companies to submit raw sugar samples for routine analyses on a bi-weekly. Sugar mill companies having problems on quality and operations may still submit their raw samples for special analysis subject to analysis fees/charges.

March 23, 1984 Implemented the guidelines on compliance of Philippine Sugar Mills to the raw sugar quality standards.

March 23, 1984 Established Quality Standards for Philippine sugar.

Sugar Order No. 1

Series of 1986-187

Sugar Policy

Sugar Policy for 1986-87 and Production Quota for 1978-1988

Arsenio B. Yulo, Jr. Administration

Sugar Order No. 8

Series of 1991-1992

Application for Miling License

Rodolfo A. gamboa Administration

July 15,1986

July 15,1986

-Sugar quedans or warehouse receipts form shall be issued by the company to cover various classes of sugar during the crop year.

-Sugar quedans shall be provided by the mill company at its own expense.

-Sugar quedans shall be printed under the supervision and in accordance with the rules and regulations issued by the Sugar Relatory Administration.

-All classes of sugar manufactured shall be issued the corresponding quedan permits and shall be stored in millsite/ subsidiary warehouse.

-Advance quedanning (based on sugar in process) is prohibited.

Sugar Orders/ Issuances/ Subject

Circular Letter No. 4-A

Series of 1999-2000

Supplemental Guidelines on the Revised Procedures in the Collection and Remittance of SRA Sugar Liens/ Fees and Charges pursuant to Sugar Order No. 6, Series of 1999-2000

NICOLAS A. ALONSO Administrator

Circular Letter No. 4

Series OF 1999-2000

Implementing Guidelines on the Revised Procedures In the Collection and Remittance of SRA Sugar Liens/Fees and Charges pursuant to Sugar Order No. 6, Series of 1999-2000

NICOLAS A. ALONSO Administrator

Circular Letter No. 52

Series of 1998-1999

Implementing Guidelines on the Revised Procedures in the Collection & Remittance of SRA Sugar Liens/ Charges pursuant to Sugar Order No. 16, Series of 1998-1999

ARSENIO B. YULO, JR. Administrator

Date Approved/ Effectivity

Brief Summary of Regulatory Policy/ Penalty Clause

January 17, 2000 Implemented additional guidelines covering the revised procedures in the collection and remittance of SRA liens/fees and charges imposed on sugar quedans covering sugar withdrawals and production of mills and refineries.

Authorized the collection of a monitoring fee of P1.20/Lkg-Bag based on a total raw sugar melted for refining for a given week instead of refined sugar produced. Payment shall be made to SPCROs and SPRAs every Monday of the following week.

October 19, 1999 Implemented the revised procedures in the collections and remittances of SRA liens/ fees and charges imposed on sugar quedans covering withdrawal and production of mills and refineries.

August 20, 1999

Revised the procedures in the collections and remittances of SRA liens/fees/charges imposed on sugar quedans covering sugar productions of mills and refineries.

Revisions:

A. Collection of liens and charges - authorized all mill and refinery companies to collect liens and charges, the total value of which shall correspond to the sum of the liens and fees.

B. Remittance thru the on-line collection facility of Land Bank

C. Required all mill and refinery to submit a weekly report of its collections and remittances.

Sugar Order No. 12

Series of 1988-1989

Storage of “C” or Reserve Sugar

ARSENIO B. YULO, JR. Administrator

Circular Letter No. 4

Series of 1987-1988

Guideline to Implement SRA Sugar Order No. 1

Series of 1987-1988, dated August 20, 1987

ARSENIO B. YULO, JR. Administrator

Sugar Order No. 1

Series OF 1986-1987

Sugar Policy for 1986-1987 and Production

Quota for 1987-1988

ARSENIO B. YULO, JR. Administrator

April 27, 1989

August 20, 1987

Implemented the no storage fee for “C” sugar. Storage charges shall commence immediately upon reclassification of the “C” reserve and only upon expiration of the free storage period.

July 15, 1986

Required the mill company to register with SRA their outside subsidiary warehouse.

Authorized that the transfers of raw sugar from the mill company’s mill site warehouse to its subsidiary warehouses, whether within or outside the mill/sugar central premises, shall not be considered as withdrawal of sugar and does not require the surrender of sugar quedan permits.

Required the surrender of sugar quedans or warehouse receipts-permits to the mill company/warehouseman for the delivery of the sugar, otherwise, failure of the mill company/warehouse man to take possession of the sugar quedan or warehouse receiptpermit prior to the release or withdrawal of the sugar shall be penalized provided under the Warehouse Receipts Act.

Sugar Orders/ Issuances/ Subject

Circular Letter No. 10

Series of 2012-2013

List of Registered International/ Domestic Sugar Traders

MA. REGINA BAUTISTA MARTIN Administrator

Date Approved/ Effectivity

Circular Letter No. 2

Series of 2012-2013

List of Registered International/ Domestic Sugar Traders

MA. REGINA BAUTISTA-MARTIN

Administrator

Brief Summary of Regulatory Policy/ Penalty Clause

December 14, 2012 Advised sugar mill companies and Mill District Regulation Officers that only persons and entities duly registered with Sugar Regulatory Administration as International and/or Domestic sugar traders are authorized to withdraw sugar for export and domestic use from the warehouses of mill companies and sugar refineries in accordance with the existing rules and regulations promulgated by SRA.

Authorized sugar producers to withdraw domestic sugar from their respective shares of their own sugar production from mill/refinery warehouses for their own domestic/local consumption only in the quantity of three (3) Lkg-Bag per family per crop year.

October 11, 2012 Authorized registered international/ domestic traders to withdraw sugar for export and domestic use from warehouses of mill companies and sugar refineries.

Authorized sugar producers to withdraw from their respective shares of their production from mill/refinery warehouse for their own sugar production from mill/refinery warehouses for their own domestic/local consumption only in the quantity of three (3) Lkg-Bag per family per crop year.

Sugar Orders/ Issuances/ Subject

Sugar Order No. 5

Series of 2013-2014

Revocation of Sugar Order No. 2, Series of 1995-1996, Sugar Order No.8, Series of 2004-2005 and Sugar Order No.11, Series of 2009 Re Establishment and Extension of a lien of P2.00/Lkg-Bag on all Sugar Production to fund the Philippine Sugar Research Institute Foundation, Inc. (PHILSURIN)

MA. REGINA BAUTISTA-MARTIN

AdministratorSugar Order No. 8

Series of 2004-2005

Extension of the Effectivity of Sugar OrderNo. 2, Series 1995-1996, providing for the establishment of a Lien of P2.00/Lkg-Bag on all Sugar Production to fund the Philippine Sugar Research Institute Foundation, Inc. (PHILSURIN)

JAMES C. LEDESMA Administrator

Sugar Order No. 4

Series of 2001-2002

Rules & Regulations on the 56,933MT Imported Raw Sugar under the MAV for Year 2002

JAMES C. LEDESMA

AdministratorSugar Order No. 2

Series of 1995-1996

Establishment of a Lien of P2.00/LkgBag on all Sugar Production to fund the PHILSURIN

RODOLFO. A. GAMBOA

AdministratorDate Approved/ Effectivity

November 4, 2013

Aug. 17, 2005

Brief Summary of Regulatory Policy/ Penalty Clause

Effectively revoked various Sugar Orders relative to the collection and remittance of a Php 2.00 Lien for PHILSURIN based on the Audit Observation Memorandum No. 13-007 of the Commission on Audit (COA) dated September 3, 2013.

It further instructed all mill companies to cease collecting the Php 2.00 per Lkg-bag on all sugar production.

May 10, 2002

Extended the effectivity of Sugar Order No. 2 series of 1995-1996 imposing a P2.00/LkgBag on all raw sugar quedan permits both planters and mill shares for a period of five (5) years until August 31, 2010.

Sept. 14, 1995

Required lien payment for all importation under the Minimum Access Volume (MAV) for the year 2002 which included P3.00/Lkg-Bag for raw sugar and P3.24/Lkg-Bag for refined sugar for PHILSURIN.

Authorized the collection of P2.00/Lkg-Bag to fund Philippine Sugar Research Institute Foundation, Inc. (PHILSURIN) which shall be reflected in all raw sugar quedan permits, both planters and mill shares and shall apply to any other form of sugar (Improved Raw, Washed, Blanco Directo, White or Refined) if the same is the original product output of the mill. The lien shall be paid in the name of PHILSURIN to be collected by the mill company and remitted to PHILSURIN.

PHILSURIN

August 11, 1995

PHILSURIN is a private sector initiative created through the efforts of the NCSP. It was a response to E.O. 18 which mandates that sugarcane research, development and extension activities are the responsibility of the private sector.

It is funded by the P2.00 per Lkg-Bag sugar contributions from all sugar producers. Other sources are donor agencies here and abroad.

PHILSURIN Members:

a). Planters - CONFED, NFSP, UNIFED and PANAYFED.

b). Millers - PSMA and AIM

c). SRA Administrator

Sugar Orders/ Issuances/ Subject

Sugar Order No. 9

Series of 2007-2008

Amendment to Sugar Order No. 7, Series of 2003-2004 Re: Rules and Regulations on Importation of Food Preparations under Tariff Heading 21.06 of the TCCP-AHTN

RAFAEL COSCOLLUELA Administrator

Sugar Order No. 7

Series of 2003-2004

Rules & Regulations on Importation of Food Preparations Under Tariff Heading 21.06 of the Tariff & Customs Code of the Phil – ASEAN Harmonized Tariff Nomenclature (TCCP-AHTN)

JAMES C. LEDESMA

AdministratorSugar Order No. 7

Series of 1997-1998

Increasing the Clearance Fee for Imported Sugar from P7.70/Lkg-Bag to P10.30/Lkg-Bag.

MICHAEL K. SUAREZ Administrator

Sugar Order No. 9

Series of 1994-1995

Regulations on the 38,000MT Imported Raw Sugar

RODOLFO A. GAMBOA Administrator

Sugar Order No.8

Series of 1994-1995

Rules and Regulations on Imported Sugar

RODOLFO A. GAMBOA Administrator

Date Approved/ Effectivity

Mar. 27, 2008

Mar. 30, 2004

Brief Summary of Regulatory Policy/ Penalty Clause

Listed and enumerated the new classification of the Tariff and Customs Code of the Philippines – ASEAN Harmonized Tariff Nomenclature (TCCP-AHTN) and authorized the continued payment of liens provided for by Sugar Order No. 4 Series of 2001-2002 which included SIFI liens for raw (P7.90/Lkg-Bag) and refined sugar (P8.55/Lkg-Bag).

April 29, 1998

Required the payment of all tariff and duties for all importations with more than 65% sucrose contents and payment of liens provided for by Sugar Order No. 4 Series 2001-2002 which included SIFI lien of P7.90/Lkg-Bag for raw sugar and P8.55/Lkg-Bag for refined sugar.

June 7, 1995

Amended Sugar Order No. 8 Series of 19941995 by increasing the total Clearance Fee for SRA from P7.70 to P10.30/Lkg-Bag which included the SIFI Lien of P4.75/Lkg-Bag.

May 17, 1995

Provided for the rules in the Importation of sugar and authorized payment of liens which included SIFI Lien of P4.75/Lkg-Bag.

Provided for the rules and regulations on Imported Sugar (Raw and Refined) for use of local processors/ manufacturers of sugar based products for export and required clearance from SRA prior to release of sugar by BOC and authorized payment of liens that included SIFI Lien of P4.75/Lkg-Bag.

Industry Foundation, Inc. (SIFI) 1971 Composed of sugarcane growers, sugar millers and organized labor to complement the social amelioration program for sugar workers and their families to be funded from the contributions of producers of locally produced sugar in the country.

Board of Trustees is composed of 15 members, 9 represents the planters, 4 from the millers and 2 from organized labor. The planters are represented in the Board by CONFED, PANAYFED and LUZONFED, the millers by PSMA and the labor representative from NACUSIP and ALU. The President and COO is Ms. Edith Y. Villanueva who is also a member of the Board.

SIFI main funding is derived from the 9% socio-economic fund of the sugar liens under Republic Act No. 6982 or the Social Amelioration Act.

Sugar Orders/ Issuances/ Subject

General Administrative Order No. 1

Series of 2010-2011

Increase In Fees and Charges of SRA Frontline Services

MA. REGINA BAUTISTA-MARTIN

AdministratorSugar Order No. 6

Series of 1999-2000

Repeal of Sugar Order No. 16 and Circular Letter No. 52, Series of 19981999 Re: Revised Procedures in the collection and remittance of SRA Liens/Fees and Charges

NICOLAS A. ALONSO

AdministratorCircular Letter No. 4

Series of 1999-2000

Implementing Guidelines on the Revised Procedures in the Collection and Remittance of SRA Sugar Liens/Fees and Charges pursuant to Sugar Order No. 6 Series of 1999-2000

NICOLAS A. ALONSO Administrator

Sugar Order No. 16

Series of 1998-1999