FEATURING ALEX OFFUTT, CEO OF BUSINESS PURPOSE CAPITAL

CORPORATE

•

• Entity Formation and Governance

• Corporate Transactions and Combinations

• Mortgage Licensing

BANKING & FINANCE

• Nationwide Loan Document Preparation

• Foreclosure and Loss Mitigation

• Nationwide Lending Compliance

• Capital Markets Agreements and Negotiation

LITIGATION & BANKRUPTCY

• Foreclosure Related Litigation

• General Business Litigation (Partnership, Investor, and Vendor Disputes)

• Creditor Representation in Bankruptcy

• Other Mortgage Loan Litigation

• Collection Actions

• Defense of Claims from Borrowers

• Replevin

•

• Expert Interviews with Industry Leaders

• Explore What Drives Successful Companies

• Inspiring Stories and Insights

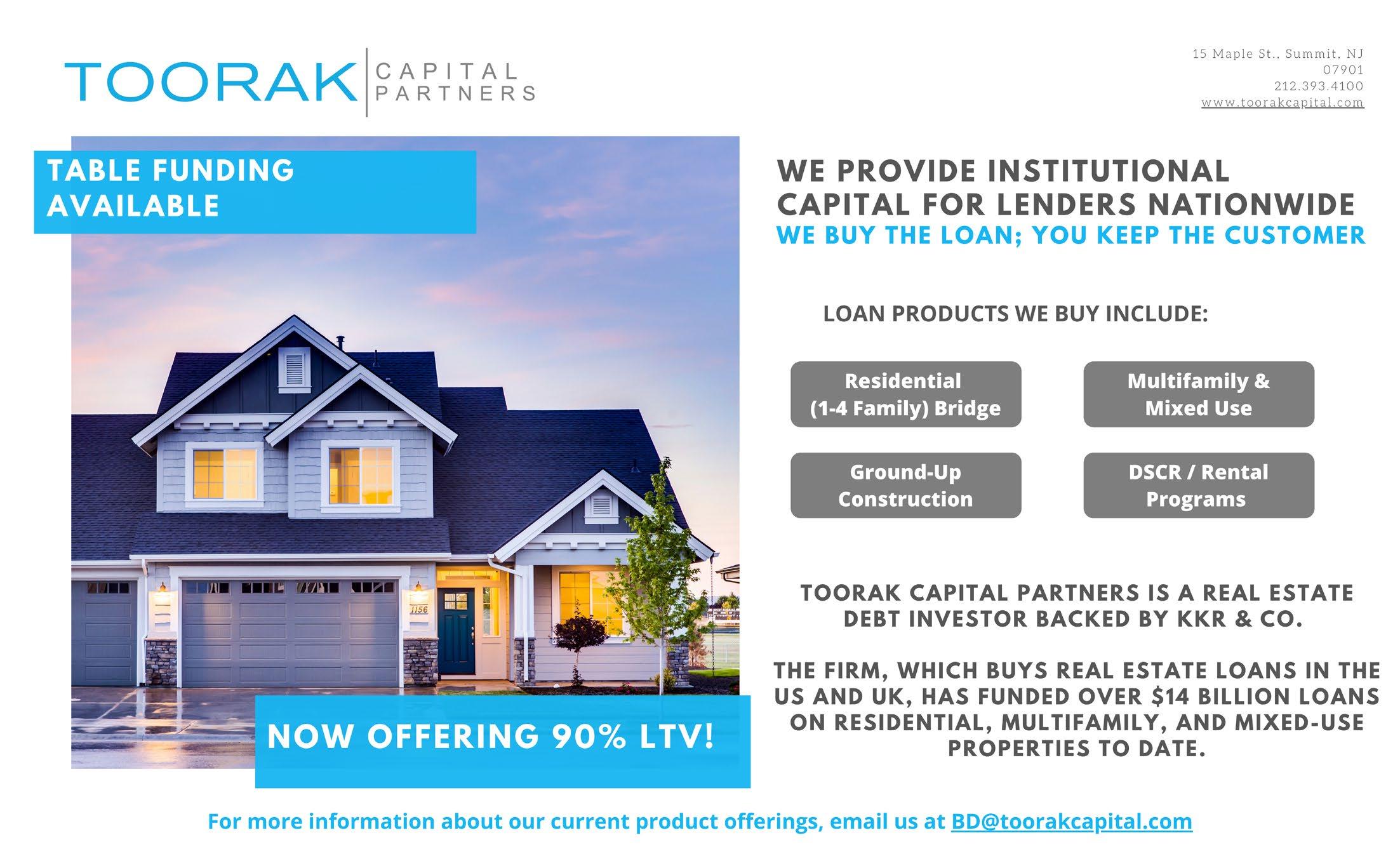

5 This is the Market

Linda Hyde, American Association of Private Lenders

6 Spot Straw Buyers Before They Burn You

Alesondra Mora, FlipCo Financial

12 Transactional Funding Fraud Nearly Killed Us

Robert Greenberg, Ternus

18 Appraised to Fail

Rodney Mollen, RicherValues

26 Proposed Law Adds Hurdles for Collecting Default Interest

American Association of Private Lenders

28 Dig Out Stalled Projects With the Right Developer

Jill Duke and Keith Tibbles, Level Capital LLC

34 Make Title an Advantage, Not a Bottleneck

Michelle Esparza, Priority Title & Escrow

38 Manage Every Loan Like It’s Day One

Evan Brody, Rehab Financial Group

48 The Hardest Deal You’ll Ever Close Might Be Your Own

Romney Navarro, Ragland Navarro Capital

52 Turn Broker Relationships into a Competitive Edge

Alan Tiongson, Constructive Capital

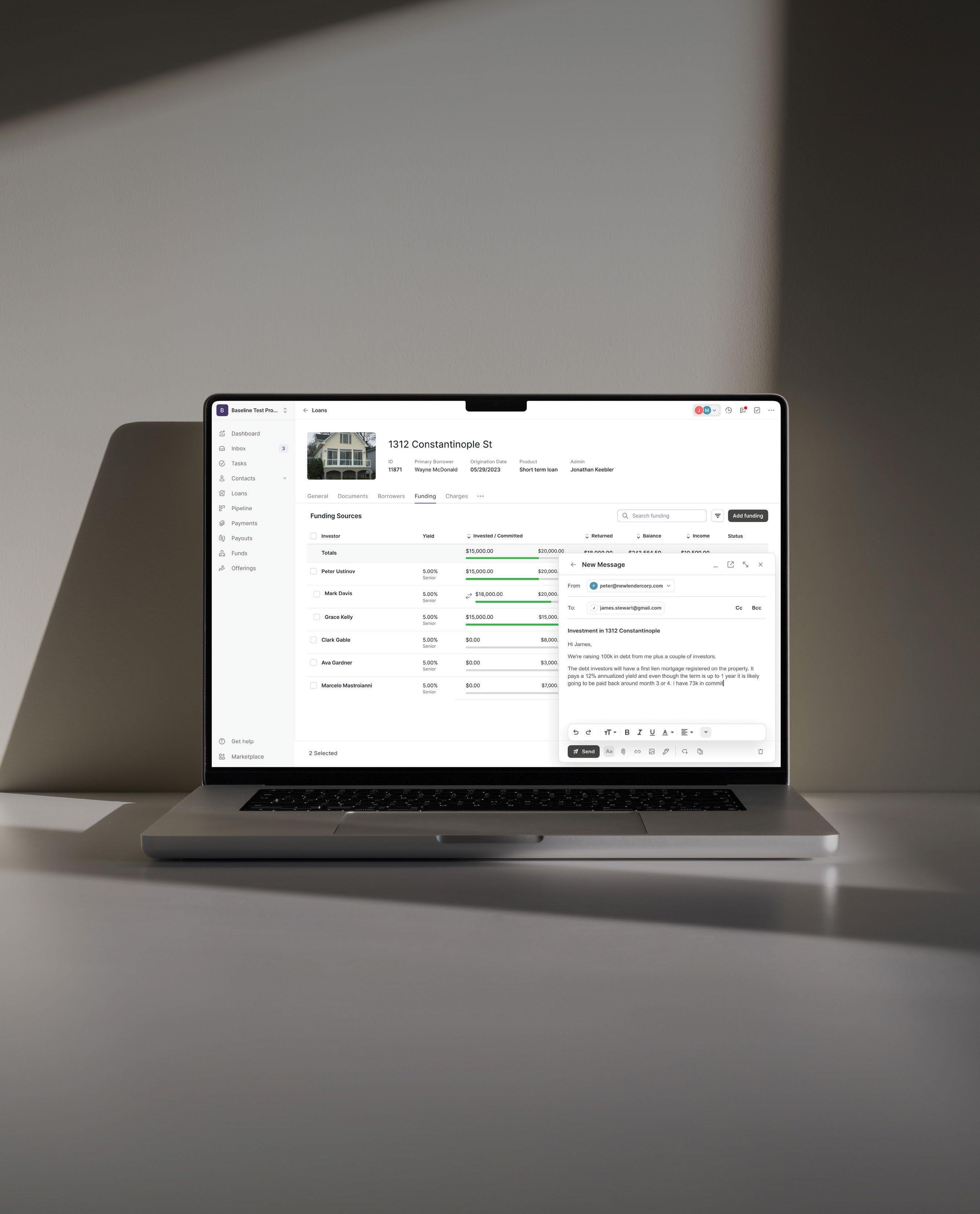

58 Lead from the Front with Alex Offutt, CEO of Business Purpose Capital

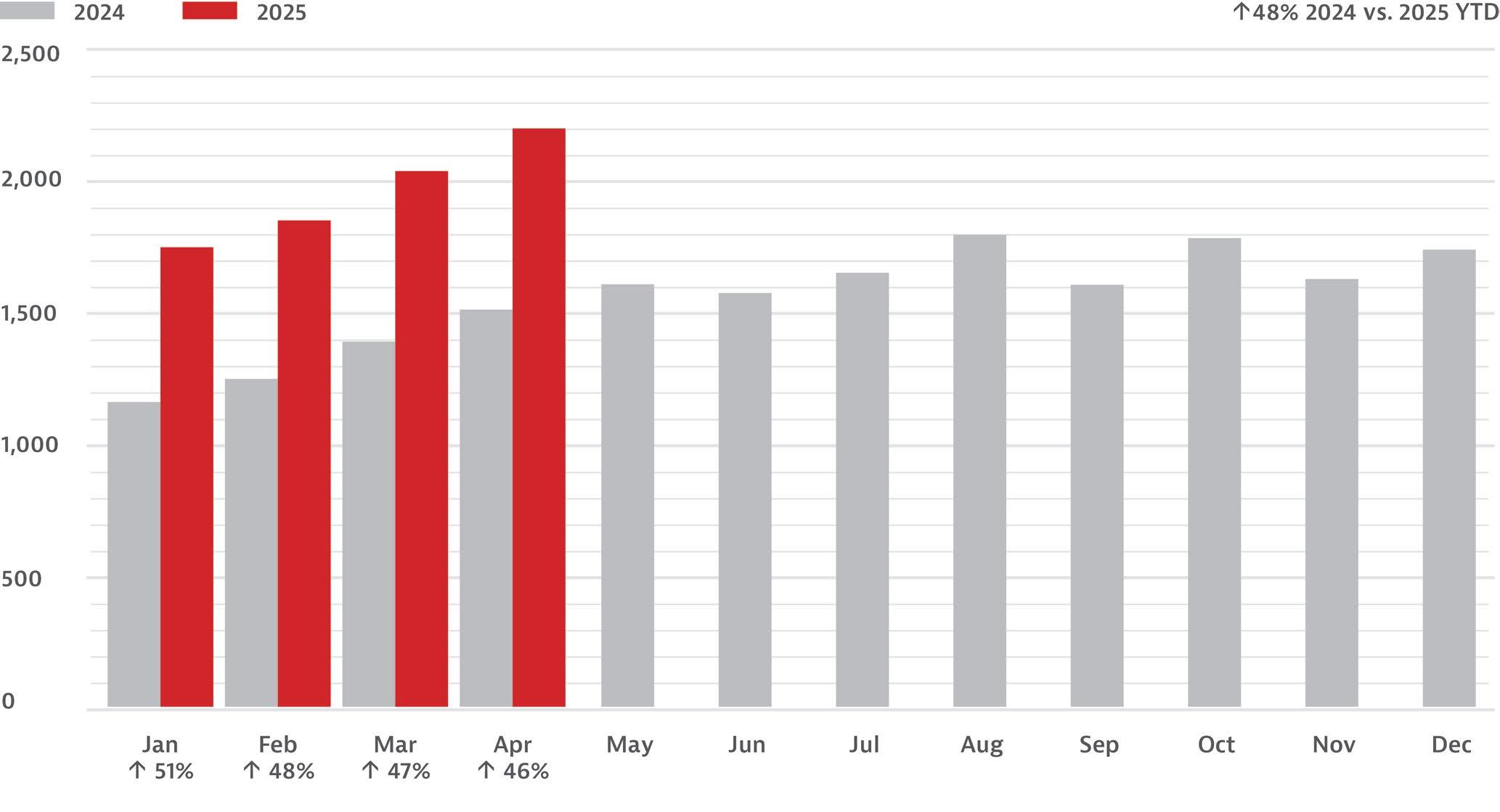

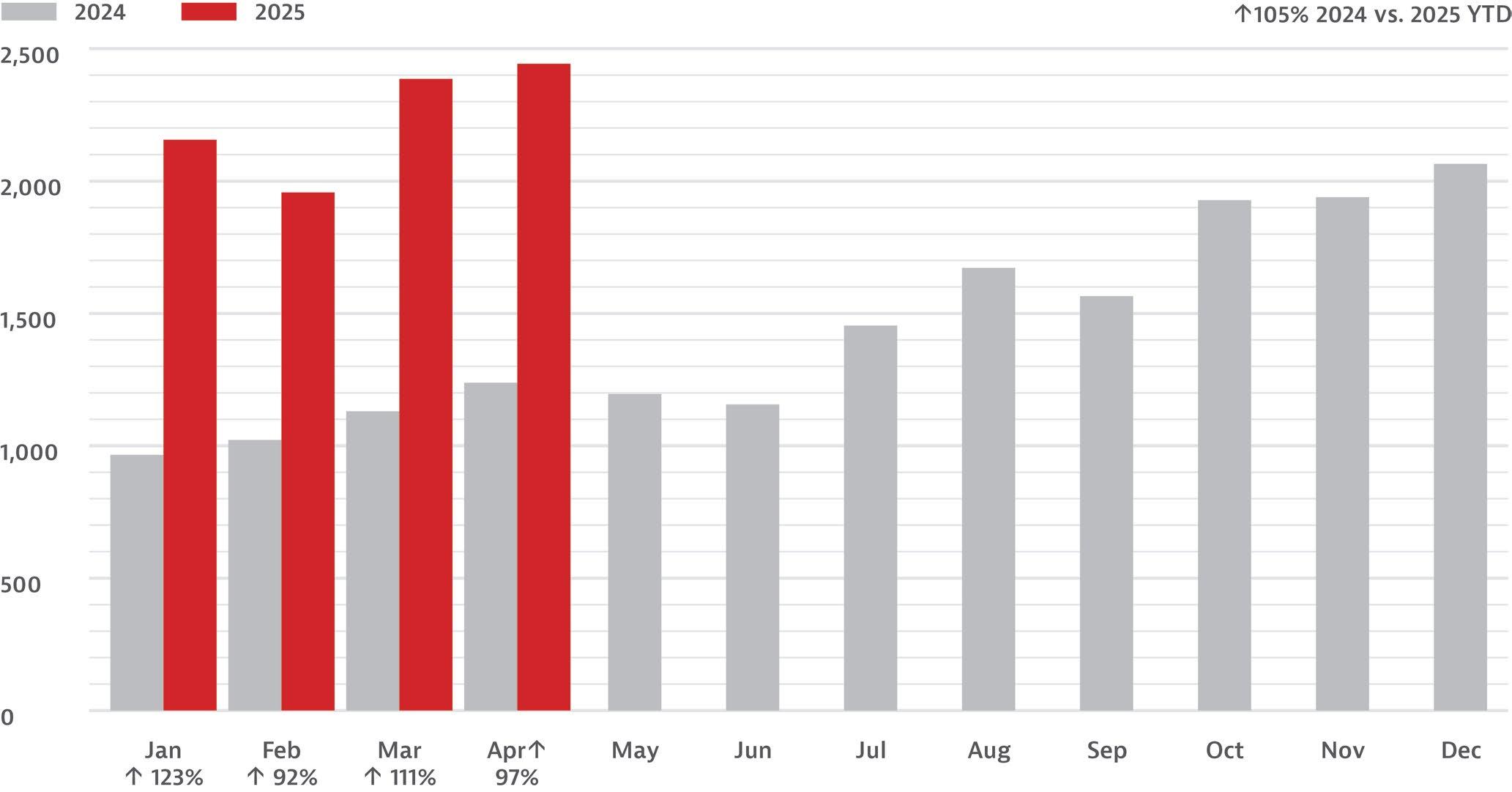

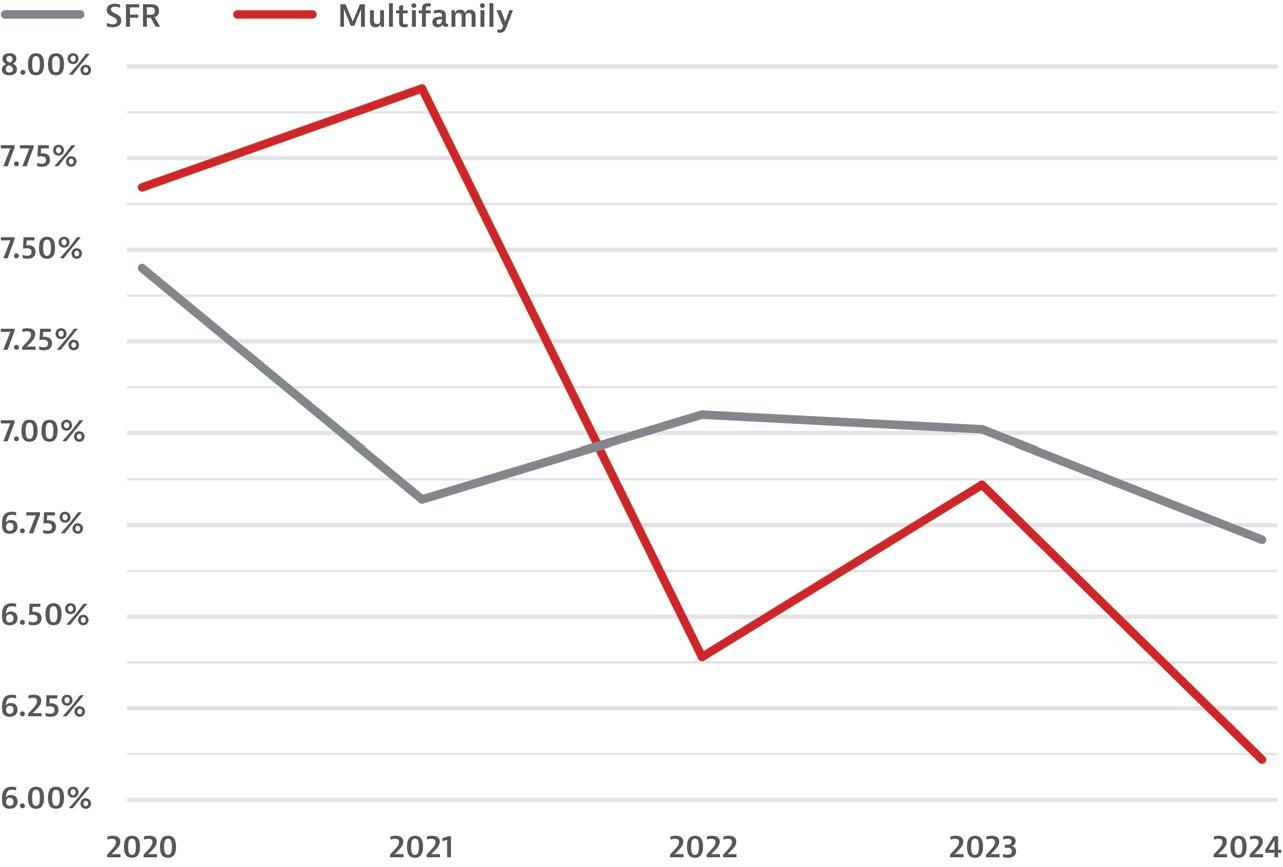

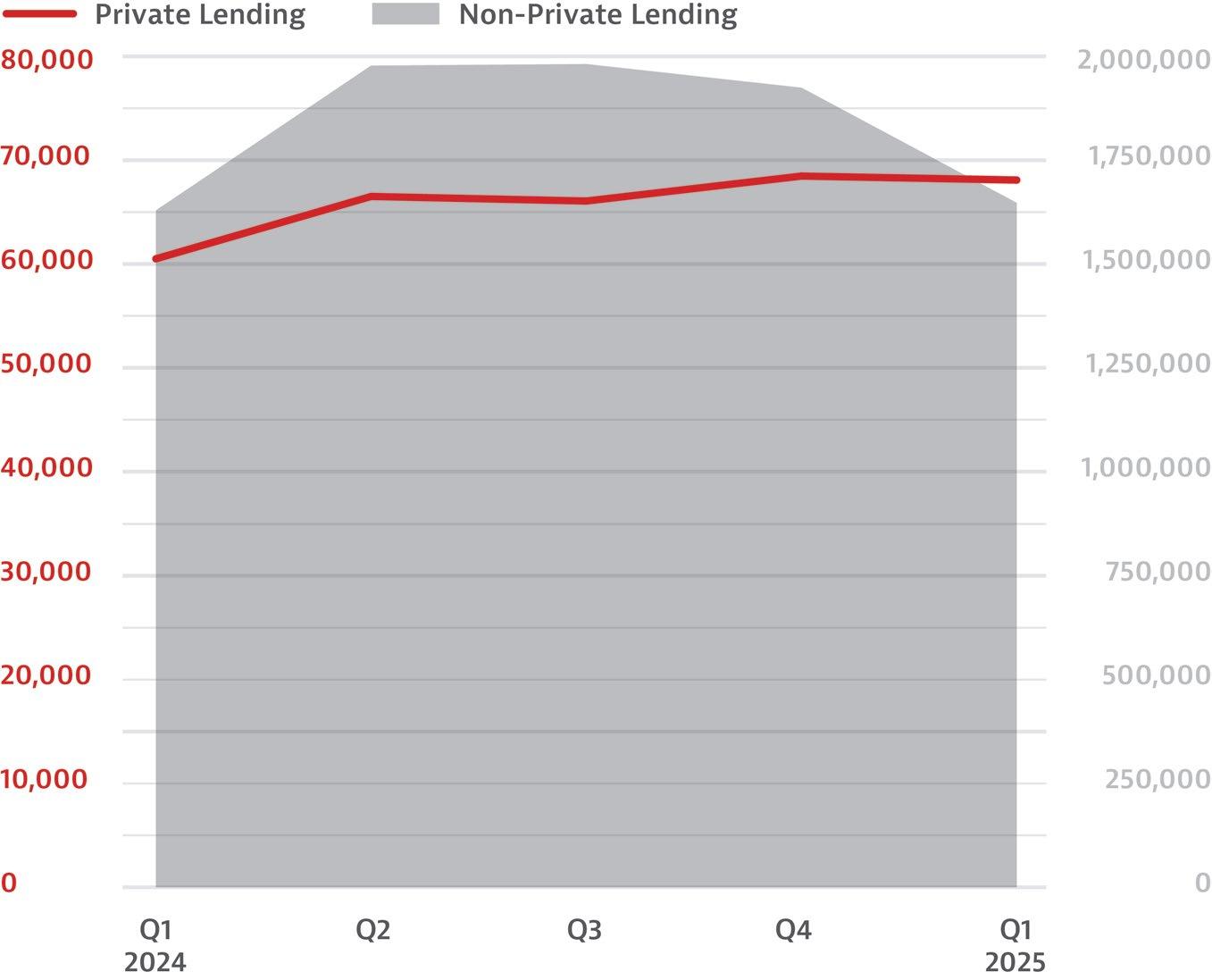

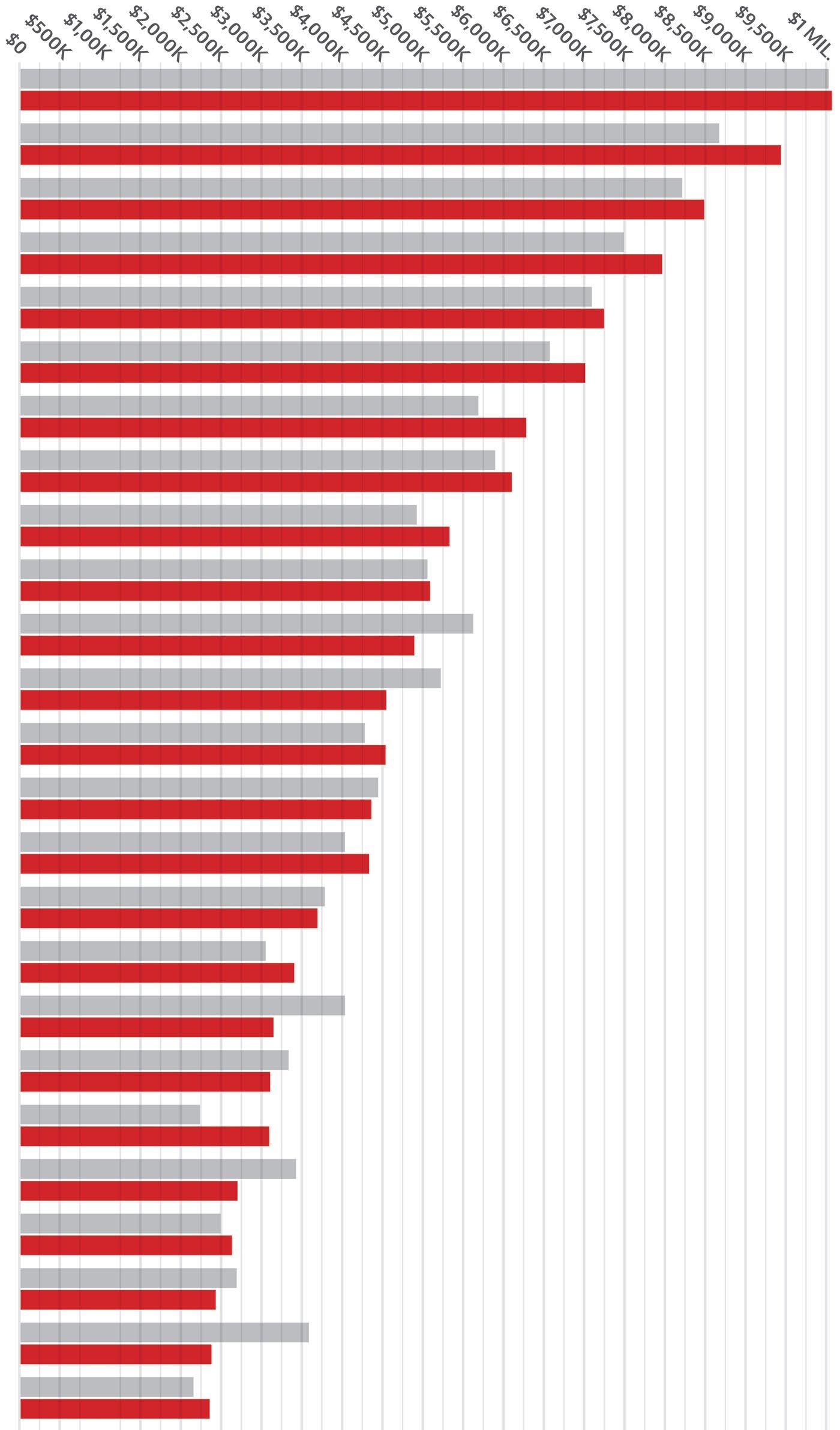

68 Same Market, Different Results: Why Some Lenders Are Winning Big

Nema Daghbandan, Esq., Lightning Docs

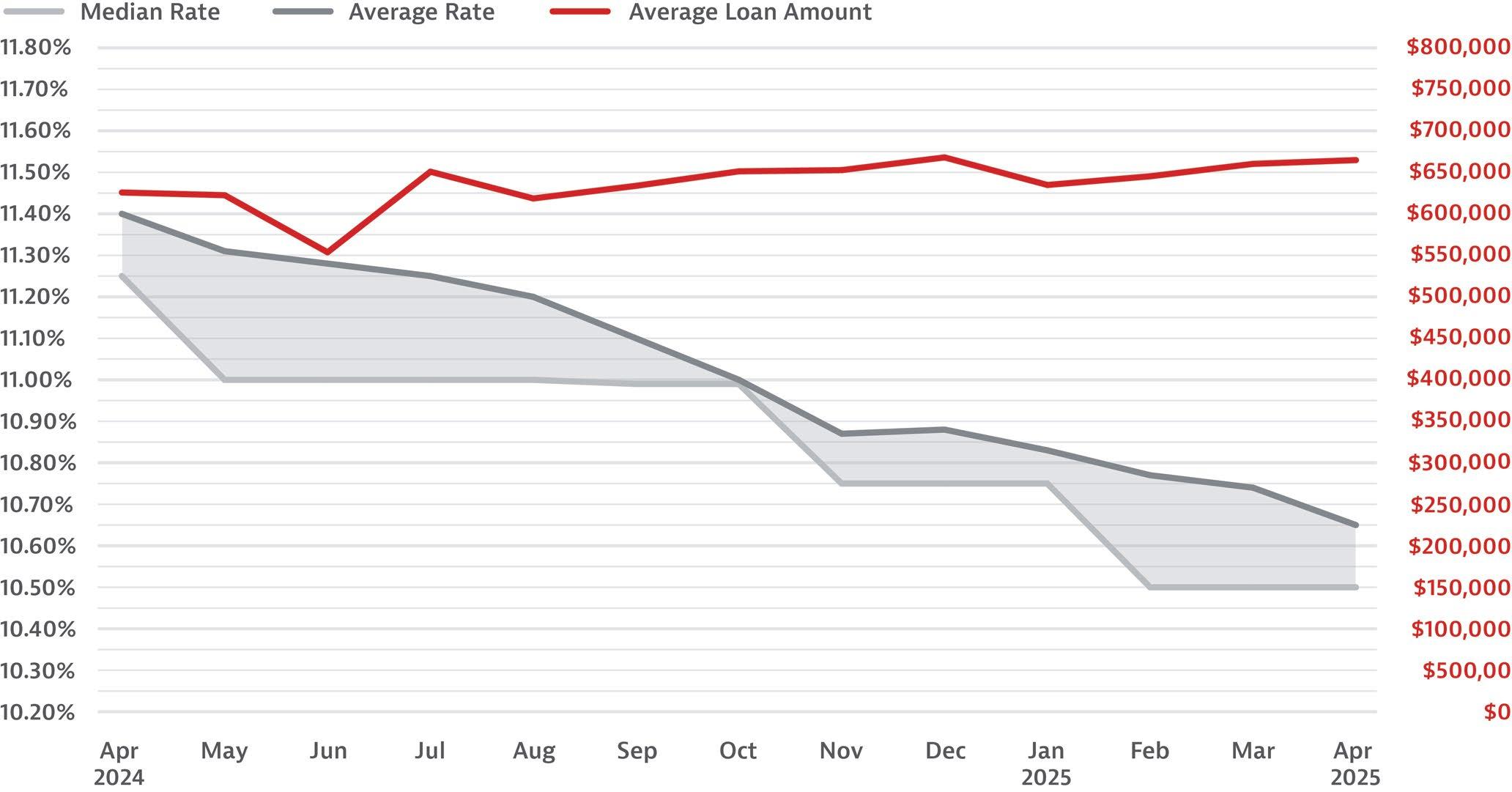

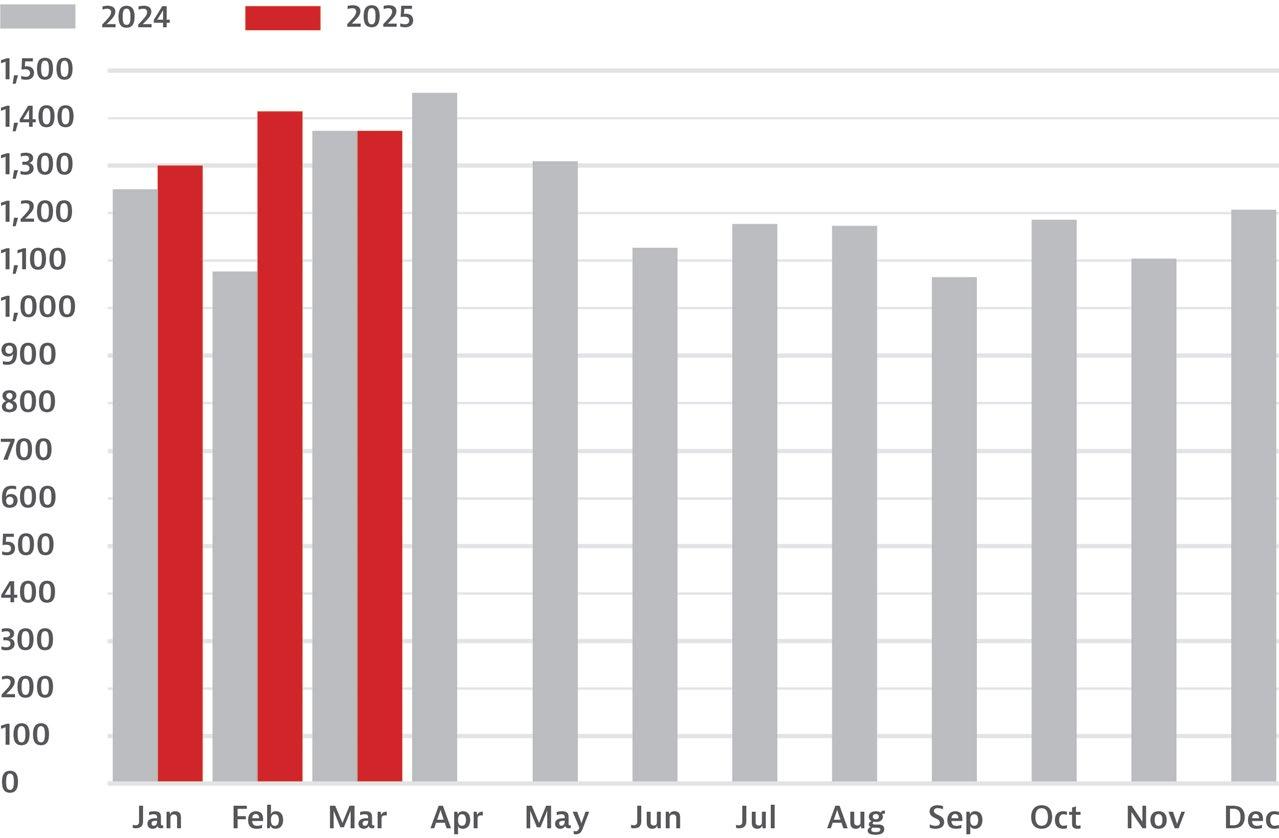

80 Multifamily Is Winning the RTL Recovery

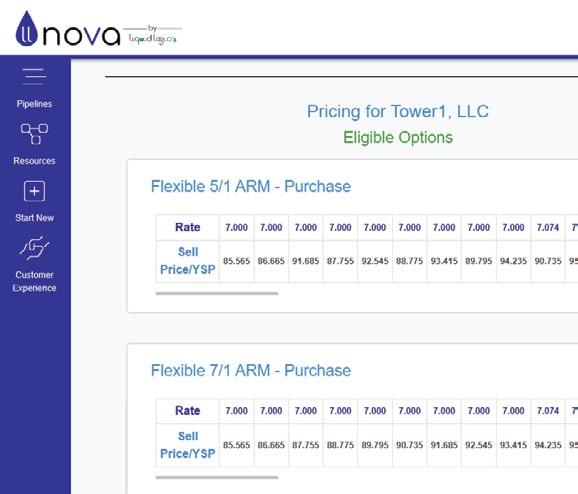

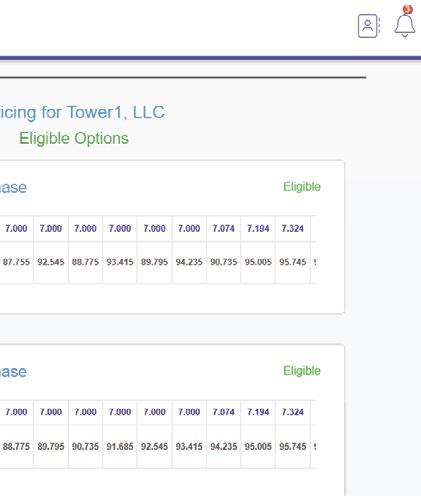

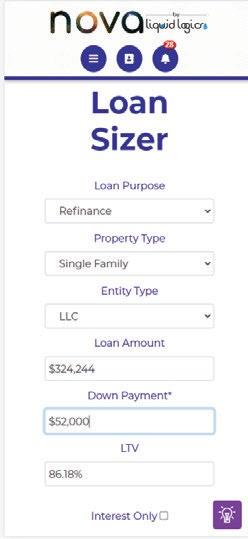

Sam Kaddah, Liquid Logics, and Aleksandra Simanovsky, Adige Advisory

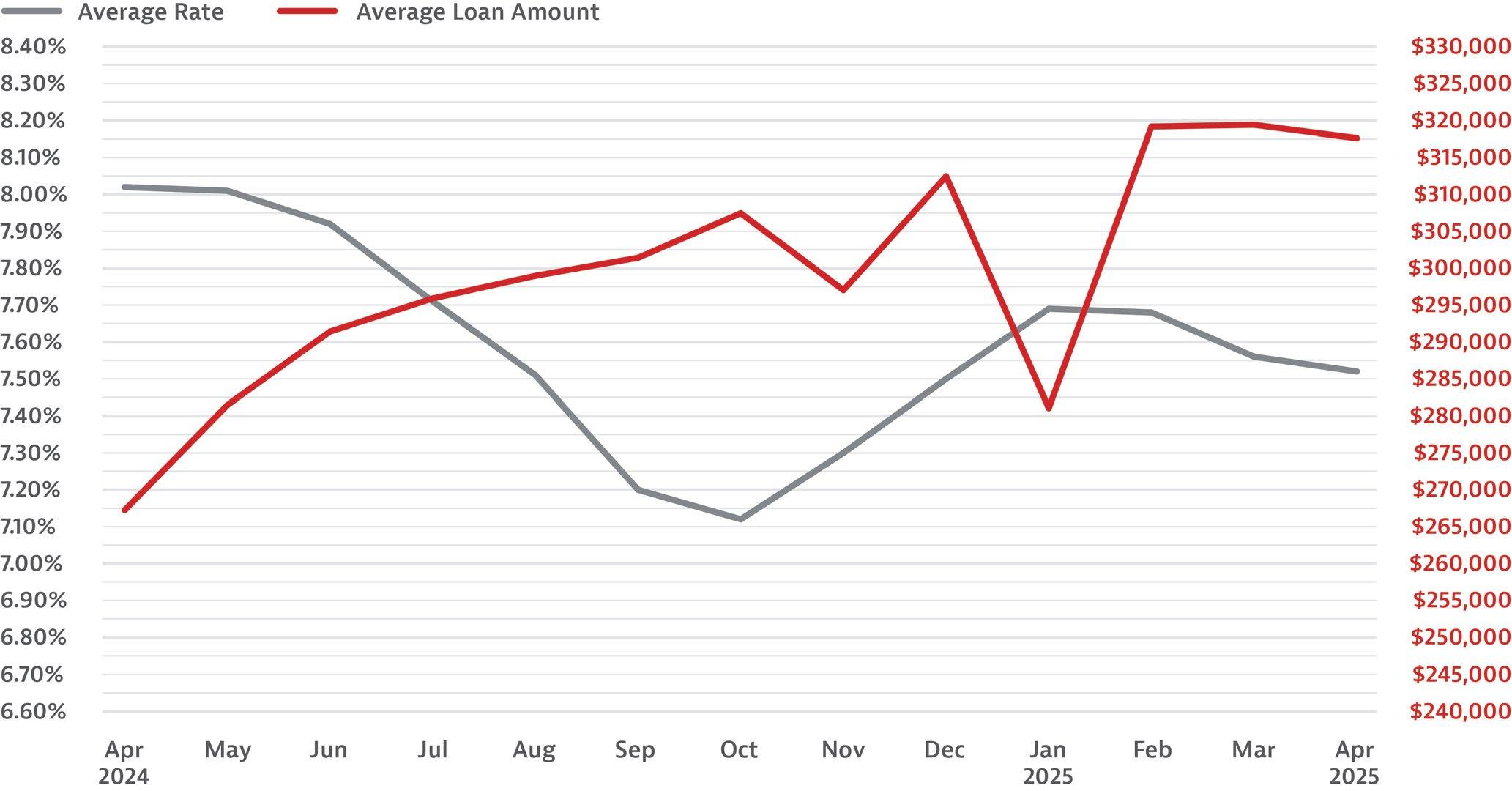

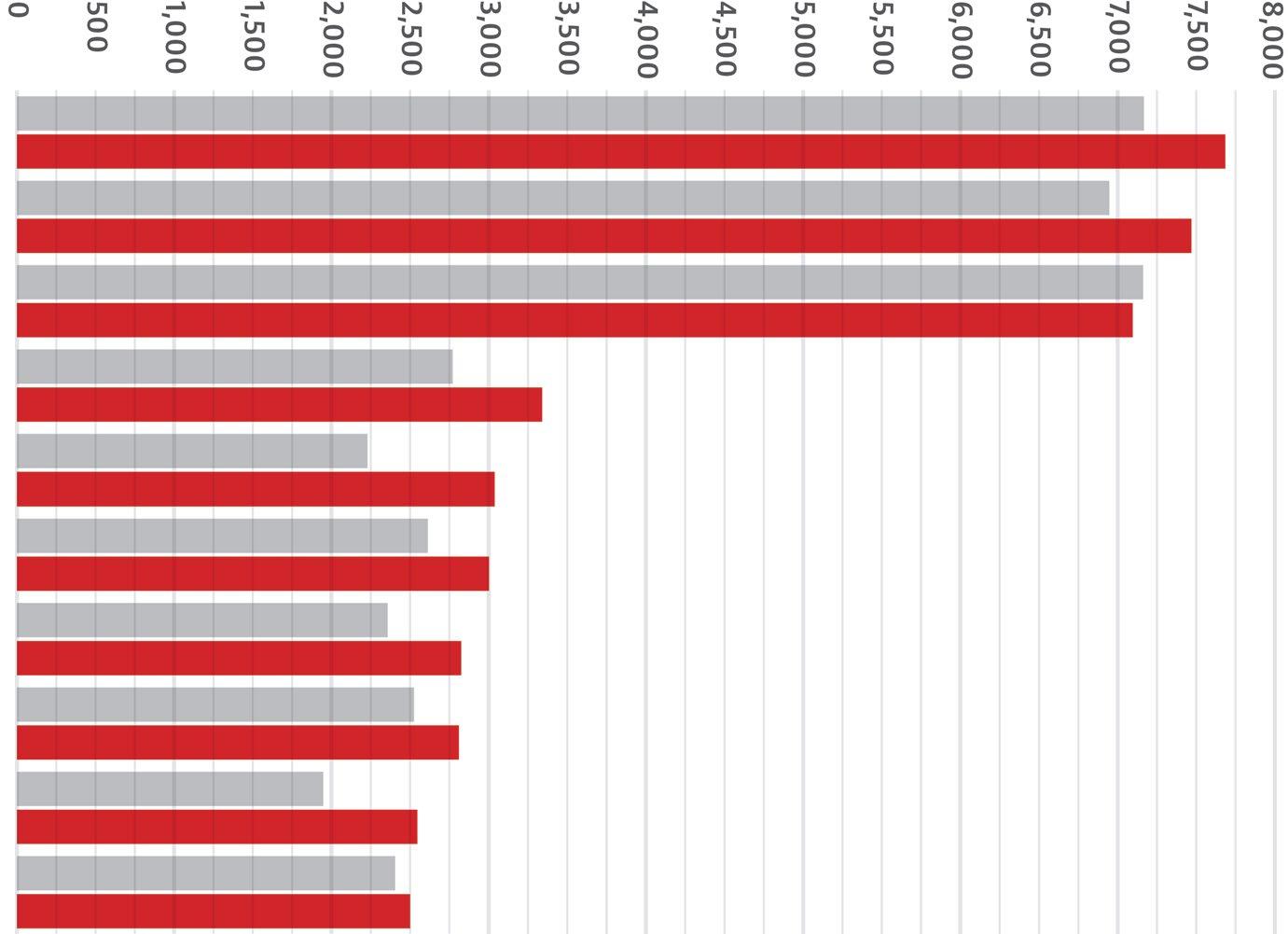

88 Tier II and III Markets Surge

Michael Fogliano and Sean Morgan, Forecasa

98 Find Your Purpose to Define Your Process

Larry Gilmore, ClearBlu Capital Group

100 The Contractor Vanished (But the Deal Didn’t)

Alex Buriak, Jet Lending

104 Don’t Let These 10 Misconceptions Get You Sued

Nichole Moore, Esq., and Jennifer Young, Esq., Fortra Law

108 Pay Now or Pay Later

Phil Feigenbaum, Huffman Associates LLC

112 Summer Guide

LAST CALL

114 Doubt Is My Edge

Janine Cascio, Simplending Financial

LINDA HYDE President, AAPL

KAT HUNGERFORD

Executive Editor

CONTRIBUTORS

Evan Brody

Alex Buriak

Janine Cascio

Nema Daghbandan, Esq.

Jill Duke

Michelle Esparza

Phil Feigenbaum

Michael Fogliano

Larry Gilmore

Robert Greenberg

Sam Kaddah

Rodney Mollen

Nichole Moore, Esq.

Alesondra Mora

Sean Morgan

Romney Navarro

Aleksandra Simanovsky

Keith Tibbles

Alan Tiongson

Jennifer Young, Esq.

COVER PHOTOGRAPHY

Rafe and Stephanie Grigar

PRIVATE LENDER

Private Lender is published quarterly by the American Association of Private Lenders (AAPL). AAPL is not responsible for opinions or information presented as fact by authors or advertisers.

SUBSCRIPTIONS

Visit aaplonline.com/subscribe.

BACK ISSUES

Visit aaplonline.com/magazine-archive, email PrivateLender@aaplonline.com, or call 913-888-1250. For article reprints or permission to use Private Lender content including text, photos, illustrations, and logos: E-mail PrivateLender@aaplonline.com or call 913-888-1250. Use of Private Lender content without the express permission of the American Association of Private Lenders is prohibited.

www.aaplonline.com

Copyright © 2025 American Association of Private Lenders. All rights reserved.

We’ve been hearing the same recycled phrases for half a decade now: “turbulent times,” “market uncertainty,” “volatility.” These aren’t excuses anymore. This is the market. Adapt.

At a recent leadership roundtable, a broker asked how to handle lenders quoting 12–16% on standard deals. The room practically exploded. Everyone agreed: Those rates were out of line unless the deals were riddled with risk. They weren’t.

So, how was the broker supposed to know what’s typical?

That’s exactly the problem.

Fortunately, several AAPL members were in the room. They pointed to the tools, standards, and education we’ve spent more than 15 years building—tools this broker should have already had access to. Tools we’ve been pushing so loudly and for so long, I didn’t have to open my mouth. The work spoke for itself.

But education isn’t enough. Enforcement matters just as much.

Doing the right thing when business is booming is easy. When things get tight, the cracks show—and lately, they’re looking more like canyons. We’ve seen a sharp rise in Code of Ethics complaints in the past two years. In fact, more than we saw in the entire decade before that. That tells us something: Some of you aren’t handling pressure well.

Even lacking poor intentions, the gunslinger way many operators respond to a crisis creates opportunities for negligence and outcomes that unjustifiably affect borrowers, investors, and other industry partners.

We’ve carefully refined our processes to handle complex situations where both sides may walk away dissatisfied. Fairness, impartiality, and transparency remain our priorities, especially when the market is anything but steady. We don’t step back when things get tough. Today, AAPL continues to stand as the industry’s only organization to comprehensively provide education on best practices—and enforcement of the same.

So, here’s the bottom line:

Your carrot: We’ve got your back. Real resources. Real support. Real accountability.

Your stick: If you fumble this “new normal” hard enough, don’t be surprised when you can’t make eye contact with us at the next conference.

LINDA HYDE President, American Association of Private Lenders

Assignment layering and masked entities are turning routine deals into high-risk traps.

Straw buyer fraud in hard money lending often reveals itself through contract assignments within wholesale transactions. Fraudsters often try to obscure their identity by layering multiple assignments, making it difficult to trace who originally entered into the purchase agreement and who ultimately controls the property.

This method is particularly common among transactions presented by a supposed wholesaler and often brokered deals. The broker can serve as a buffer, further obscuring the actual details of a transaction. For instance, a wholesaler might assign a contract and then reappear as a member of the borrowing entity, effectively masking their control of the deal.

Another common presentation involves the use of family members or associates as the borrower of record. In these cases, a bad actor who has previously defaulted or been flagged by a lender will enlist a relative or friend to serve as the publicfacing borrower. The true operator of the project stays behind the scenes, reaping the benefits of funding while evading lender scrutiny. Additionally, newly formed entities are often used in

these schemes to conceal past failures or default history. Without thorough vetting, a lender may unknowingly fund a deal involving a high-risk operator.

The primary goal of a straw buyer scheme is to gain access to funding while shielding the real operator’s identity and track record. Fraudsters seek to off-load liability onto a third party— someone with a clean name, no negative borrower history, and no immediate red flags. This allows the true controller to receive funding for a project without disclosing past issues (e.g., loan defaults, project failures, or credit red flags).

In addition to avoiding liability, these schemes often conceal profits through assignment fees or by holding undisclosed equity positions behind the scenes. Once the loan funds, the straw buyer may play little to no role in execution, which significantly increases the risk of mismanagement or default.

Straw buyer fraud is a recurring issue in the hard money space. Although it may

not appear in every pipeline, it happens often enough to merit continuous monitoring and cross-departmental discussions among underwriting, origination, and compliance teams.

Hard money’s appeal to investors combined with its relatively lax documentation requirements has fueled a rise in fraud attempts. Although this rise is based on anecdotal evidence, it tracks with the broader mortgage industry, where the fraud risk is also rising.

In the second quarter of 2024, the CoreLogic Mortgage Application Fraud Risk Index jumped 8.3% year-over-year, with one in 123 applications flagged, and applications for multiunit homes spiked to a 3.5% fraud rate (one in 27).

Though straw buyer fraud is more prevalent in wholesale and brokered channels, no lending channel is immune. It’s critical that all departments remain vigilant. Lenders must embed red flag checks, regular fraud training, and cross-functional case reviews to mitigate the evolving threat.

Straw buyer fraud can have serious financial and operational consequences. One of the most concerning aspects is the lender never truly knows who is behind the project. The person executing the project is the single-most important variable in determining loan success. When that individual is hidden behind layers of assignments or shell entities, the lender’s risk assessment becomes fundamentally flawed. If the loan defaults, locating the real party behind the deal can be extremely difficult, especially if falsified documents or confusing ownership structures were used.

Although an asset in competitive markets, the speed of private lending can also be a liability. The pressure to close quickly may result in skipping due diligence steps, particularly when assignment paperwork appears clean on the surface.

Reputational harm is also a concern because repeated bad loans tied to undisclosed operators can erode trust among investors and partners. Finally, operational resources are drained when internal teams must spend hours investigating post-close issues, rereviewing documents, and initiating legal recourse that could have been avoided.

Lenders should adopt proactive measures to identify and prevent straw buyer schemes. First, incorporate onboarding processes for brokers and wholesale partners into funding review. Quality brokers vet deals thoroughly and willingly participate in a lender’s application process to access funding lines, rather than evading scrutiny.

For individual transactions, it’s crucial to require full transparency of contract assignments. Any deal involving assignments should include the original purchase contract, all assignment documentation, and disclosures of all parties receiving assignment fees. Conduct entity searches to identify overlapping ownership or shared registered agents between entities. Though layered entity structures can make this challenging, public records can still reveal patterns and relationships.

Borrower intake should involve more than a loan application. Take the time to learn how the borrower found your company, what experience they bring, and what they’re trying to achieve with the project.

In the absence of credit or background checks, which is common in agile hard money lending environments, it becomes even more important to gather narrative-based borrower insight.”

In the absence of credit or background checks, which is common in agile hard money lending environments, it becomes even more important to gather narrativebased borrower insight. Trust but verify. If the narrative and experience are adequate, a borrower should easily be able to provide documentation to support the claims. Client resistance to providing additional clarification or documents is a flag.

Be particularly cautious with newly formed entities. Although new LLCs with no track record are not inherently fraudulent, you should flag them for further review. A borrower who appears unfamiliar but is overly prepared with loan documentation may also indicate coaching or concealment.

Maintain consistency in tracking this information within a CRM so that multiple team members can detect patterns (e.g., repeated phone numbers, emails, or banking info linked to past bad actors). For example, if a loan application is for John Smith but the ACH authorization for interest payments lists another individual not shown on any entity or application paperwork, understanding how they are tied to the funding is imperative.

Technology plays a vital role in fraud prevention. A customer relationship management (CRM) system such as Salesforce or HubSpot can log contact

information, flag repeated behavior, and track entity overlap. State-level business registries and tools like LexisNexis, Clearbit, or even OpenCorporates can help verify business ownership and identify common actors. Lenders can also create assignment tracking templates or flow charts to visualize the movement of property contracts. This creates transparency around who initially secured the deal, who assigned it, and how it reached the final borrower. Consistent use of these tools helps prevent assignment layering from going unnoticed.

Finally, most loan origination systems (LOS) have built-in capabilities for workflows and automations. A good first step is to speak with your account manager to understand how to leverage your existing tech stack.

To maximize your technology, determine the data points most helpful to your deal analysis. Email, phone numbers, social security numbers, and employer identification numbers are good unique identifiers to start with. Include those trackable fields in your LOS. (If you don’t have a field to track, you cannot aggregate the data for your system to automatically raise flags.) Then, build monitoring processes and reporting around those criteria.

Use this guide to equip your team with practical steps for preventing and mitigating straw buyer fraud at every stage of the lending process. A layered defense that combines human judgment, legal safeguards, and targeted technology offers the strongest protection against today’s increasingly sophisticated straw buyer fraud schemes.

PREVENTION: BUILD STRONG FRONT-END SAFEGUARDS

» IMPLEMENT FORMAL BROKER VETTING. Set minimum experience, performance, and referral standards before allowing access to funding lines.

» REQUIRE FULL TRANSPARENCY ON ASSIGNMENTS. Collect complete documentation of the original purchase contract and all subsequent assignments.

» CONDUCT LAYERED ENTITY VERIFICATION. Research ownership overlaps and shared agents using public business registries.

» FLAG NEWLY FORMED LLCS. Request supporting documentation to verify credibility and purpose.

» CONFIRM BORROWER SOURCING. Ask how and why the borrower found your company; probe for undisclosed relationships or brokers.

» TRACK BORROWER CONTACT INFORMATION CONSISTENTLY IN A CRM. Capture emails, phone numbers, and banking details to detect patterns and repeat behaviors.

» UNDERSTAND EXACTLY WHO IS RECEIVING ASSIGNMENT FEES. Ensure recipients are not tied to the borrowing entity or obscured parties.

» CREATE AND USE ASSIGNMENT TRACKING TEMPLATES. Visualize contract flow and associated parties to detect layering or hidden control.

» IN ANY TRANSACTION INVOLVING ASSIGNMENTS, ALWAYS OBTAIN FULL COPIES OF THE ORIGINAL CONTRACT. This includes all assignment documents to prevent unauthorized or hidden borrower cash-outs.

RED FLAGS

» SHARED INTEREST OR OVERLAPPING OWNERSHIP THAT VIOLATES ARM’S LENGTH TRANSACTION STANDARDS

» SHARED REGISTERED AGENTS BETWEEN ENTITIES

» NEWLY FORMED ENTITIES WITH LIMITED/NO TRACKABLE HISTORY OR FINANCIALS

» BORROWER APPEARS UNFAMILIAR WITH PRIVATE LENDING PROCESSES BUT PRESENTS FULLY PREPARED LOAN DOCUMENTATION

» CONFLICTING BORROWER CONTACT INFORMATION (e.g., phone numbers, emails, or bank accounts not directly associated with the borrower or previously linked to flagged entities)

MITIGATION: BUILD PROTECTIONS FOR WHEN FRAUD OCCURS

» INCLUDE LOAN ACCELERATION CLAUSES IN AGREEMENTS. Allow immediate recall of loans in cases of misrepresentation or undisclosed assignments.

» REQUIRE PERSONAL GUARANTEES. Include cross-default clauses to provide additional leverage and recourse.

» INSERT STRONG INDEMNIFICATION CLAUSES. Hold borrowers financially responsible for losses or legal costs tied to undisclosed third-party involvement.

» USE LANGUAGE THAT VOIDS THE LOAN if undisclosed parties or control relationships are discovered post-closing.

» MAINTAIN AN INTERNAL DATABASE OF FLAGGED BORROWERS AND ENTITIES. It should include names, emails, phone numbers, and banking details; make it accessible to relevant departments while keeping it strictly internal.

» REQUIRE TRUSTED TITLE COMPANIES TO VALIDATE RECENT PROPERTY HISTORY AND OWNERSHIP CHAIN. Look for rapid resales, unusual transfers, or gaps in documentation.

» CONDUCT POST-CLOSE QUALITY ASSURANCE REVIEWS ON FIRSTTIME BORROWER DEALS. Verify that contact information, wiring details, and account ownership match authorized parties.

» ENSURE BORROWER BANKING DETAILS ALIGN WITH THE ENTITY ON RECORD. ACH authorizations and wire instructions should match verified borrower identity and documentation.

TECHNOLOGY

» PROPERTY HISTORY PLATFORMS (DATATREE, PROPSTREAM)

» WIRE VERIFICATION (CERTIFID OR SIMILAR PLATFORMS)

» CRM-BASED PATTERN TRACKING AND FLAGGED CONTACT MONITORING

» AI-DRIVEN TOOLS TO DETECT FRAUD PATTERNS ACROSS MULTIPLE DEALS

If straw buyer fraud makes it past closing, strong legal protections are the next line of defense.

Your loan agreements should include acceleration clauses that allow for immediate callback of the loan in cases of borrower misrepresentation or undisclosed changes in ownership. Personal guarantees tied to individuals with verifiable assets can provide leverage in recovery. Cross-default clauses can be effective when dealing with borrowers who operate multiple entities.

Indemnification clauses should explicitly state the borrower will be held financially responsible for any losses or legal expenses arising from undisclosed third-party involvement. In extreme cases, clauses that void funding obligations upon discovery of fraud can offer additional protection. Where feasible, requiring full recourse terms for first-time borrowers or those with complex assignments can act as a deterrent.

When a borrower is discovered to have committed fraud, their information should be recorded immediately in an internal watchlist maintained by each lender. This list should include flagged names, emails, phone numbers, and bank accounts. Maintaining a centralized internal list ensures institutional memory, even as staff and leadership change, helping your team avoid inadvertently approving future deals from known bad actors.

[EDITOR’s NOTE: It is critical that this information remain strictly internal. Sharing such a list across companies or attempting to create an industry-wide blacklist raises serious legal risks, including liability and potential antitrust violations. Although it may seem helpful to coordinate across lenders, doing so could expose participants to significant legal and reputational consequences. You must avoid

any perception of cooperative blacklisting efforts. Each company should maintain and act upon its own internal records, based solely on its underwriting processes and findings.]

Work only with trusted title companies that perform rigorous legal and due diligence checks. Title officers can offer valuable insight into unusual deal structuring or recent property transfers. Require them to provide complete property histories and flag rapid resales that might indicate a recycled fraud attempt. Post-closing audits of first-time borrower deals should be standard, and borrower banking information must always match the entity on record to confirm legitimacy.

Several tools are available to aid in mitigation. Property research platforms like DataTree and PropStream offer deep visibility into property ownership history. CertifID and similar platforms can verify wire instructions and prevent funds from being misrouted to unauthorized accounts. AI-driven software can identify behavioral patterns across deals, flagging repeat behaviors associated with known fraud risks. Additionally, custom modules within loan origination systems can be programmed to automatically flag suspicious borrower or deal characteristics.

Further, the AAPL Vendor Guide (aaplonline.com/vendors or Private Lender’s Winter issue) can help you find attorneys with experience in private lending documentation. It is important the attorney has specific private lending experience, not just real estate experience, to ensure state-level compliance related to borrowers, collateral, and loan products.

Straw buyer fraud is a persistent and evolving threat within the hard money

lending ecosystem. As the industry continues to grow and attract new players, the risk of fraud increases, particularly when speed and flexibility are prioritized over rigorous borrower scrutiny. Lenders must remain vigilant, balancing their desire to serve investors quickly with the need to protect capital.

By implementing structured onboarding, transparent deal documentation, and consistent borrower intake procedures, lenders can minimize exposure. Leveraging technology helps to detect patterns, store historical data, and assist with decisionmaking. Remember, however, technology—particularly AI—should be used as a tool to enhance processes, not as your only line of defense. If fraud does occur, a well-prepared mitigation strategy can contain the damage and preserve long-term operational integrity. Proactive awareness and coordinated prevention are essential to maintaining trust, performance, and safety in today’s private lending market.

Alesondra Mora is AVP of marketing for Streamline Funding. She has been cultivating creative approaches to real estate marketing for the last decade. Alesondra has worked within various areas of the real estate industry, ranging from real estate brokerages, legal, finance management, active investing to private lending.

EDITOR’S NOTE

This is the second reported instance of a private lender encountering this specific fraud scheme within AAPL’s membership. The recurrence underscores an urgent need for lenders to review their verification protocols and implement preventive measures immediately. Awareness and proactive action are critical to protecting your business in today’s lending environment.

Our private lending startup almost lost more than half a million dollars to fraud. Here’s what you can learn from our experience.

ROBERT GREENBERG, TERNUS

In hindsight, that initial interaction was a reconnaissance mission; it was our first glimpse of a fraudster preparing to launch a sophisticated social engineering scheme.”

Ternus is a young private lending company that prides itself on operating differently. We’re investorfocused, values-driven, and transparent. But in March, we came terrifyingly close to losing $645,000 in a sophisticated wire fraud scheme. What followed our discovery was an all-hands-on-deck response that tested our systems, our culture, and our core values. Thankfully, we caught the fraud in time—but just barely. We are sharing our story not to sensationalize, but to spotlight how fraud really happens and how others in the private lending industry can protect themselves.

The fraud began weeks earlier with a seemingly ordinary transaction that ultimately fell through. In hindsight, that initial interaction was a reconnaissance mission; it was our first glimpse of a fraudster preparing to launch a sophisticated social engineering scheme.

Our transactional funding product, a short-term bridge loan facilitating A-toB-to-C property deals, was at the center of the fraud. This product allows the buyer to close on a property and resell the same property in a separate deal for a profit—either on the same day or within

a few days. As the lender, we wire funds to the title company and get our money back within 24 to 48 hours. That short timeline turned out to be a blessing. When the first deal did not close, a title company representative circled back to one of our processors, suggesting they had another borrower in the same market seeking a similar type of deal. We were thrilled to get the referral, and the borrower completed all the necessary documentation. Since we’d “worked” with this title company before, everything seemed to check out.

But this was all part of their plan.

The title company appeared to be a local branch of a well-known, national company; the required documentation all came in quickly; and the email communication was all very typical, even including the name of the actual branch manager on emails (using a slight variation to the email address). But subtle inconsistencies—like a domain name ending in .org instead of .com—started to stand out. Grammatical mistakes in emails raised flags. The phone number appeared to be associated with a burner phone. The emails seemed to be written from a common template. And when our wired funds didn’t come back on schedule, our internal alarms went off.

The

title company appeared to be a local branch of a well-known, national company; the required documentation all came in quickly; and the email communication was all very typical

On the Friday morning we were expecting our funds to be returned, a simple checkin about the wire repayment triggered a cascade of action. Our head of closing

...”

reviewed the transaction chain with our chief operating officer, and suddenly everything clicked: This wasn’t a delay. It was a setup.

Within the hour, we had escalated the issue to our bank, initiated a wire recall,

Our footprint in local markets is continuing to grow. Look for us in California and join top tier talent offering the Renovo Experience to local investors.

locked down our bank accounts, activated our IT team, and started tracing every digital breadcrumb. At the same time, the operations team informed our CEO and the leadership team. We didn’t waste time with blame or cover-ups. Our team operated according to the values we’ve ingrained from day one—speed, transparency, accountability, respect, and service. Our trust in each other allowed us to act quickly and decisively, without fear of finger-pointing.

Because we acted within the allowable window for wire reversals, the bank flagged the transaction, coordinated with the receiving bank, and successfully returned our funds.

The emotional rollercoaster of nearly losing $645,000 was real. For a startup company, that kind of loss could have been devastating, perhaps even existential. Over that weekend, some employees worried the company might not survive. But by Monday morning, we were able to call an all-staff meeting, put the rumors to rest, and share that we had recovered the money.

But we also knew we couldn’t just celebrate and move on. We took immediate steps to investigate. Everyone involved was interviewed. We combed through access logs and asked our third-party verification provider for a full breakdown of where their validation process failed. We even collected IP addresses and other digital identifiers from the communications trail, and our general counsel sent a detailed fraud report to the FBI and local law enforcement.

This wasn’t an opportunistic scam; it was a carefully staged, multilayered deception, likely part of a sophisticated fraud network. Our hope is that the data we provided

will be added to a database of fraudulent activity that, over time, may help authorities identify patterns and catch the perpetrators.

Although we are proud of how our team responded, we also had to admit that our systems had vulnerabilities. The experience revealed gaps we didn’t know existed. Although we had controls in place, we learned that even strong systems can be sidestepped by smart, persistent bad actors.

So, we took action. First, we eliminated any reliance on email-only communication for onboarding new borrowers. Now, every borrower must be contacted by phone through our official company line, and those conversations are recorded and documented. This shift ensures auditability. Importantly, it also creates a layer of human interaction that can help detect suspicious behavior or inconsistencies that might not show up on paper. We also implemented a policy of independently verifying all title company contact information. Rather than calling the number listed in the email or wiring instructions, our staff now cross-checks phone numbers and email domains independently.

Another major change was adopting more advanced identity verification tools. We have partnered with services like LexisNexis to help confirm identities at the application stage, enabling us to flag suspicious applicants before they get too far into the pipeline. We also now use identity verification technology that allows realtime photo and ID comparisons to confirm applicants are who they say they are.

Beyond implementing technological solutions, we have doubled down on training, especially around social

Verify via recorded phone calls. Independently verify all title company contact info.

Use third-party identification tools (e.g., LexisNexis) at the application stage.

Implement real-time photo and ID matching.

Hold regular fraud and phishing awareness training.

Update a red-flag checklist with the latest scam tactics.

Hit pause on anything unusual: odd formatting, mismatched emails, or rushed timelines.

Social Engineering White Paper aaplonline.com/social-engineering/

Wire Fraud White Paper aaplonline.com/wire-fraud/

Wire Fraud Case Study aaplonline.com/fraud-case-study/

Fraud Priority Survey aaplonline.com/comments/

engineering and phishing red flags. We now hold regular fraud-awareness sessions and update our internal red-flag checklists based on the latest tactics scammers use. And our team is encouraged to take a moment to slow down, especially on high-dollar deals. Rushing, we’ve learned, is the enemy of good judgment. Even subtle anomalies, like odd punctuation or mismatched contact domains, are considered reasons to pause.

Our experience underscored the uncomfortable truth that private lending is fertile ground for fraud. The combination of fast-moving transactions, online interactions, and limited regulation makes us a prime target.

Although we had transaction-level insurance coverage to protect us from wire fraud through a third-party provider, we discovered the limitations of relying on a safety net. Even if they had paid out, it would have taken months—months that would have crippled our liquidity. Worse, it gave us a false sense of security that nearly cost us everything.

Today’s fraud isn’t amateur hour. It’s calculated and often rehearsed against your own systems. Scammers are learning your workflow and your patterns. They probe, they test, and then they strike.

The core takeaway is vigilance. Don’t rely on “green checkmarks” from third-party tools. Read the reports. Scrutinize the source. If a title company has a name that matches a national brand, dig deeper. If a borrower sounds just a little too polished or too desperate, pay attention.

And perhaps most important, don’t let empathy cloud your judgment. Borrowers often tell urgent, compelling stories. They push timelines, insist on speed, and may even try to guilt lenders into shortcuts.

We were fortunate. Our people responded quickly. Our systems gave us just enough information to piece things together. And our bank acted in time.”

Some of those stories will be real. But you must treat every transaction as if it could be a setup. Because sometimes it is.

That doesn’t mean abandoning relationshipbuilding, but it does mean establishing guardrails that apply to every borrower, every title company, and every funding request.

We were fortunate. Our people responded quickly. Our systems gave us just enough information to piece things together. And our bank acted in time.

But our real advantage came from our culture. The values we instilled from the beginning—speed, transparency, accountability, respect, and service— aren’t just words painted on the wall. We practice them. When something felt wrong, no one waited. No one tried to fix it quietly or protect their own reputation. Instead, they sounded the alarm, collaborated across departments, and did what needed to be done. Everyone made their best effort to stop the damage.

If this happened to us despite our use of sophisticated third-party tools, experienced staff, and internal protocols, it can happen to anyone. Fraudsters are getting smarter. They adapt. They evolve. So must we. Let our close call be your early warning.

Fraud prevention isn’t a one-time checklist. It’s a living, breathing exercise that needs to be reviewed and reinforced constantly. As Sergeant Phil Esterhous from “Hill Street Blues” used to say, “Let’s be careful out there!”

Robert Greenberg is the Chief Strategy Officer at Ternus Lending. Robert’s focus on innovation and long-term vision guides Ternus in crafting groundbreaking loan products and strategic partnerships that set the company apart from its competitors.

Greenberg’s role is centered on creating a forward-thinking, scalable infrastructure that streamlines product sales, underwriting, closing, servicing, and post-closing liquidity transfers. His approach to strategy emphasizes efficiency and growth, while his deep understanding of the real estate and lending markets helps him anticipate industry trends and adapt swiftly.

From comps to construction costs, lenders who question everything stand the best chance of protecting themselves from fraud.

Private lenders face a material risk of fraud, and the cases have become increasingly more sophisticated. Mix in the complicated nature of lending for renovation or construction in the residential space, and you have a recipe for unwanted and challenging situations.

Some of the fraudulent issues lenders and industry leaders have faced —and are speaking up about—related to valuation and construction include:

» PRICE COLLUSION TO INFLATE VALUE

» BRIBES TO APPRAISER

» BORROWER PERSUASION/ MISREPRESENTATION

» BRIBES TO SITE INSPECTORS

» BUDGET SHORTFALLS

» EXCESSIVE BUDGET

» BUDGET AND ARV MISMATCH (OVERINFLATING TARGET CONDITION)

Fraud related to valuation and construction often involves subtle manipulation or misrepresentation, but real-world case studies reveal practical strategies lenders can use to detect and prevent these risks. Let’s take a look at three case studies, each related to either price collusion, borrower persuasion/ misrepresentation, or excessive budget.

The standard appraisal process typically uses the existing purchase contract to help determine the property’s current “as is” market value. This assumes that an independent buyer and seller have agreed on a fair price, reflecting true market conditions. Appraisers also review the property’s historical listing and sales activity to provide additional context.

Relying simply on the contract price or recent sales of the subject property to determine the As-Is Value (AIV) becomes an issue when the contract price is significantly out of line with other market pricing activity in the immediate area, especially when the home is in moderate, poor, or very poor condition.

This issue often arises in deals sourced through wholesale buyers who assign contracts. In such cases, prices may be inflated to convince a seller to accept an offer. Sometimes, an unsophisticated buyer may not realize they are overpaying. In other situations, it can be worse: The buyer may be colluding with the seller or wholesaler.

The incentive for such collusion typically involves a promise to share in the profits, which often amount to thousands, tens of thousands, or hundreds of thousands of

dollars in cash the seller or wholesaler will generate from the fraudulent transaction.

Traditional appraisals can be vulnerable to valuation issues, especially when the appraisal ordered is a “Subject to Completion” or After Repair Value (ARV) appraisal. In these situations, appraisers often focus heavily on ARV and give little attention to analyzing As Is Value with much rigor, if at all.

To protect against this, it’s important to independently assess market comparables and establish a market-based value for the property in its current condition. Lenders can take several approaches, including (1) perform that analysis internally, (2) order valuation products that apply equal rigor to both AIV and ARV, or (3) order a secondary valuation product such as Automated Valuation Model (AVM), Evaluation, or similar to gain an independent perspective of current market value.

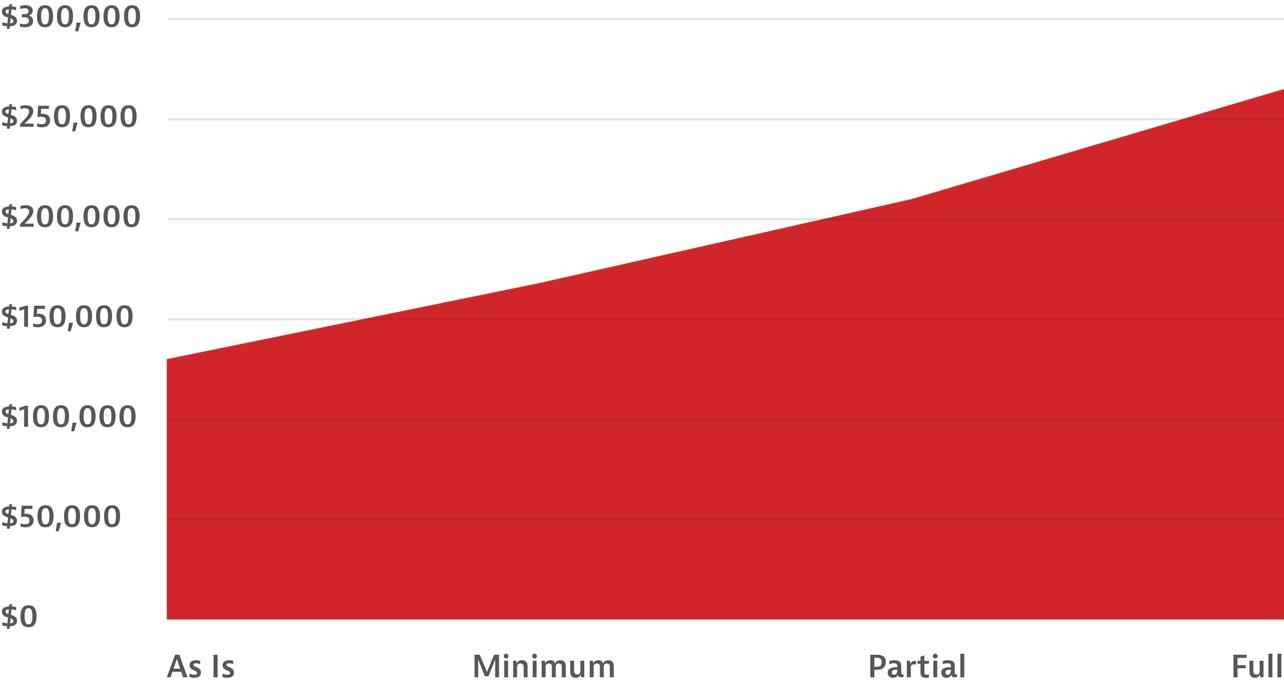

In an example from 2023, a Florida-based lender was evaluating a fix-and-flip loan for a deal in Springfield, Missouri. The borrower provided the purchase contract to the lender at a price of $260,000, telling the lender their expectations for AIV was $260,000 with an ARV of $325,000. The lender ordered a third-party evaluation to assess the AIV, borrower budget, and ARV. The RicherValues report reviewed hyperlocal market activity, and conducted an interior inspection, assessing the AIV at $130,000 with ARV for the proposed budget (conducting a partial remodel) as $245,000, numbers substantially lower than the existing contract price (see Fig. 1).

After receiving the report, the lender conducted a deeper investigation and uncovered that the wholesale seller and the buyer were colluding to inflate the purchase price, likely to pull material

APPRAISAL CONDITION CATEGORIES

Maintained Doesn’t exist for traditional appraisals; can be aligned with C3.5 Marketable condition, with good upkeep on maintenance repair items.

cash out of the deal significantly above value. But because the lender pursued market-based diligence, the fraud was

discovered up-front, preventing the lender from a potentially damaging situation and material financial loss.

Describe the condition of the property (including needed repairs, deterioration, renovations, remodeling, etc.). C2;No updates in the prior 15 years;PER CONTRACTOR BID SUPPLIED AND CONVERSATIONS WITH BORROWER, IT APPEARS THE HOME WILL BE REMODELED TO INCLUDE A NEW ROOF COVERING, PLUMBING, ELECTRICAL, HVAC KITCHEN AND BATHROOM REMODEL. HOW WILL ALSO BE PAINTED INSIDE AND OUTSIDE AND BASEMENT AREA RENOVATED INTO LIVABLE SPACE (SUBJECT TO ITEMS).

Indicated Value by Sales Comparison Approach $ 375,000

The standard appraisal process usually includes direct interaction between the borrower and the appraiser, often during the site inspection and any communications before or after the visit. Because many appraisers lack hands-on construction experience, they tend to rely on the borrower’s input to understand the scope and intent of the proposed renovations. Using this information, the appraiser conducts the analysis and identifies comparable properties that reflect the finished condition described by the borrower.

The challenge arises when the borrower’s description to the appraiser doesn’t match the actual renovation budget provided to the lender. Borrowers are aware that most “Subject To” appraisals don’t involve detailed scrutiny of the budget, as appraisers lack the data and construction expertise to determine whether line items are realistic, inflated or missing. Many appraisers therefore base their assessments on conversations with borrowers rather than on the budget itself. As long as the borrower is being truthful, that approach works fine.

The issue arises when the borrower intentionally embellishes the budget to misrepresent what the finished product

will look like. The goal is to influence the appraisal or third-party results to secure an overinflated ARV that doesn’t match the actual work being performed.

In a Q4 2024, a client ran a test on several properties by ordering side-by-side valuation reports for the same property: one using a standard ARV appraisal and the other using a RicherValues Renovation Analysis. The results were revealing.

Traditionally, the appraisal process involves the appraiser scheduling and conducting the onsite visit, opening the door for direct communication with the borrower. In contrast some valuation providers intentionally use a bifurcated process, where the person scheduling and conducting the on-site inspection has zero involvement in analyzing the renovation budget, selecting market comps, or determining value. This eliminates a key channel for potential persuasion and significantly reduces risk.

In one example from this test, the ARV appraisal assigned a value of $375,000 based on fully remodeled C2 comparables due to “conversations with the borrower” about the proposed renovations. The appraiser also assumed the basement would be fully finished and counted as livable square footage, an assumption the documented renovation budget did not support.

(See Fig. 2 for appraisal definitions.)

The budget included no line items to finish the basement, and the scope was too limited to bring the property to a true, market-based C2 or fully remodeled condition (see Fig. 3). The budget line items and costs were only sufficient to bring the property to a partially remodeled C3 condition, leading to a more conservative ARV estimate of $288,000.

The important lesson is that a traditional “Subject To” appraisal alone is often not enough to protect against borrower manipulation or misrepresentation. For an ARV to be reliable, it needs to accurately reflect a qualitative and quantitative analysis of the borrower’s proposed renovation budget.

Lender’s can conduct this analysis internally—either through appraisal review or a separate budget evaluation— or they can engage an outside vendor that separates the site inspection from the valuation process and conducts a detailed budget review based on proven residential construction expertise.

The final example highlights an important oversight in how many lenders evaluate borrower budgets. Many rely on internal processes or third-party reports to evaluate whether a budget is sufficient. If no shortfalls are identified, the projects

are given a green light, particularly when using third-party feasibility reports.

The problem is this one-sided review can leave a major blind spot, one that savvy borrowers realize they can exploit. In a 2024 case, a national lender evaluated a proposed fix-and-flip loan for a 1,247-square-foot, three-bedroom, twobathroom single-family home in moderate (C4) condition in Henderson, Nevada. The borrower submitted a $170,000 renovation budget, and the lender’s usual third-party feasibility report approved it, citing no shortfalls and deeming the budget sufficient to complete the work.

However, the $170,000 figure amounted to $136 per square foot, which was well above the norm for a home of that size, condition, and market finish. As part of its risk process, the lender ordered a RicherValues report to analyze the renovation budget alongside the AIV and ARV. That report raised a construction fraud warning, identifying several line items that were priced significantly higher than market expectations. Based on local benchmarks, the report estimated the renovation should cost between $55,000 to $65,000, making the submitted $170,000 budget more than three times higher than the reasonable cost.

The warning helped the lender to catch the issue early and avoid a material financial loss.

The real estate field is not always friendly. Some actors in the space try to push into the gray areas or worse. At the end of the day, lenders must protect themselves.

To reduce risk and strengthen your defenses:

1 USE A MARKET-BASED APPROACH FOR ESTABLISHING AIV.

... The $170,000 figure amounted to $136 per square foot, which was well above the norm for a home of that size, condition, and market finish.”

2 ENSURE YOUR ARV REFLECTS BOTH QUALITATIVE AND QUANTITATIVE BUDGET ANALYSIS.

3 EVALUATE BUDGETS FOR BOTH SHORTFALLS AND EXCESSIVE OVERAGES.

As we’ve seen, renovation and construction deals can expose gaps in traditional diligence tools; unfortunately, bad actors know how to exploit them. Stay diligent. Stay protected. And stay on the winning side.

Rodney Mollen is the founder and CEO of RicherValues, a software and valuation services provider that delivers comprehensive intelligence on any residential asset nationwide. Mollen has more than 20 years of experience, including acquiring, managing, renovating, and selling over $1.2 billion in REO and NPLs nationwide.

We now offer our signature Certified

Private Lender Associate and Certified Fund Manager courses online, so you can earn your AAPL-backed certified status from the comfort of anywhere — and promote it everywhere.

CPLA Modules

• Intro to Business-Purpose Lending

• Legal Documentation

• Underwriting

• Loan Servicing

• Workouts

CFM Modules

• Intro to Securities

• Pros, Cons, & Considerations

• Structure

• Creation & Launch

• Administration

AAPL Certifications are members-only. Enroll online at aaplonline.com/courses for $349.

The State of Florida already requires that, at minimum, lenders provide borrowers with an annual statement of the payments they’ve made. SB 392 “Requirements of Lenders of Money” sought to clarify the contents of the annual statement, but also added a new provision: Lenders must issue a written notice of default in order to collect default interest.

Additionally, at the borrower’s request following the sale or assignment of a loan, the assigning lender must provide a loan history report. Within 30 days of assignment, the assigned lender must provide a statement to the borrower that includes detailed breakdowns of loan history and any balance changes.

Key points:

» LENDERS MAY NOT COLLECT DEFAULT INTEREST WITHOUT FIRST ISSUING A WRITTEN NOTICE OF DEFAULT.

» THE ASSIGNING LENDER MUST ISSUE A LOAN HISTORY REPORT FOLLOWING LOAN SALE/ASSIGNMENT, BUT ONLY IF THE BORROWER REQUESTS IT.

» THE ASSIGNEE LENDER MUST ISSUE

A LOAN HISTORY AND BALANCE CHANGE STATEMENT WITHIN 30 DAYS OF ASSIGNMENT. It is not clear if this statement is always required

or only triggered by “changes to outstanding balances.”

» THIS IS RETROACTIVE TO ALL EXISTING LOANS.

With a proposed start date of July 1, 2025, AAPL worked with our Florida partner organizations and contacts in the Senate to determine the bill’s likelihood of passing and next steps.

As of the time of this writing, the bill appears to have died in committee when the 2025 session ended May 2, 2025. AAPL will continue to monitor should it be reintroduced when the Senate reconvenes in 2026.

AAPL is the oldest and largest national organization representing the private lending profession. The association supports industry best practices by providing educational resources, instilling oversight processes, and fighting regulatory encroachment. Find more information at aaplonline.com.

December 2-4, 2025 | Fairmont Scottsdale Princess | Scottsdale, AZ

1,800+ SFR decision-makers

250+ expert speakers 950+ owners and operators

Where great connections lead to great deals. The SFR industry’s largest West Coast event. Boost your knowledge, your network and your business.

Save 20% with discount code REU2333APL

*IMN is offering the first 20 investors who have not attended IMN’s SFR Forums with a complimentary pass to attend. Please reach out to stacey.kelly@imn.org to apply.

When construction restarts after a standstill, it takes a nuanced set of developer skills that even some seasoned pros may lack.

JILL DUKE AND KEITH TIBBLES, LEVEL CAPITAL LLC

One of the most effective ways to mitigate risks as you take over a mid-construction project is to partner with a developer who has the right mix of specialized skill and experience. Seasoned developers bring a deep understanding of project management, construction processes, regulatory navigation, and financial structuring. They have the knowledge to identify problems, develop effective solutions, and manage the project efficiently. Importantly, they can help overcome many of the hurdles that stalled a project in the first place.

Let’s explore how selecting the right developer can drive project success, best practices for forming a partnership, and real-world case studies that illustrate successful collaboration.

Mid-construction projects often stall due to one or more of the following: financial mismanagement, poor planning, inexperience with a particular type of project, regulatory challenges, or a lack of regional knowledge.

An experienced developer can add value in a multitude of ways.

Guidance from a local professional is critical to navigate complex permitting and zoning requirements. Choose someone who knows the community politics, the accepted building design style norms, and the typical building seasonality required to complete the project in a timely manner and within budget for market positioning.

An experienced developer will also bring a trusted network of contractors and suppliers, helping to secure muchneeded resources and avoid workforce challenges and supply chain disruptions. In addition to being knowledgeable about the area, a seasoned partner can identify cost-saving opportunities without compromising quality. Their experience ensures coordination among stakeholders, enabling smoother project execution and helping rebuild lender and investor confidence in a previously troubled project.

Selecting the right development partner is crucial. Criteria to watch for include

track record and reputation, regulatory and compliance expertise, and a strong alignment of vision and values.

VALIDATE TRACK RECORD AND REPUTATION. Begin by reviewing the developer’s project completion history. Request a current resume and a detailed schedule of builds that includes project descriptions, budgets, and start and end dates from the past several years. Review marketing materials, MLS listings, and inspection reports to determine the quality of completed work.

Confirm the developer’s financial stability through a credit report, background check, and recent bank statements that validate access to capital and established credit lines. Gather multiple references and customer and vendor reviews. Speak directly with recent clients, lenders and local officials to gain firsthand information about the developer’s reputation. An experienced, reputable developer should be willing to provide this information.

REGULATORY AND COMPLIANCE. Regulatory and compliance expertise is essential when evaluating an experienced developer. Confirm the developer has direct experience with the same type of project in the target community. Ensure they have worked with local planning departments, zoning boards, and environmental agencies. Conduct thorough legal background checks as part of your due diligence; and avoid any company with a history of legal issues, fines, or code violations.

An experienced developer should be able to identify and secure grants, abatements, or tax credits to help reduce financing costs.

ALIGNMENT OF VISION AND VALUES. Begin by establishing clear strategic objectives and ensure these are openly discussed and documented. Quality of work is part of the vision. A long-tenured developer

will have pride in their work. When possible, personally walk completed sites to assess the quality of construction. Quality not only affects safety and code compliance but also resale or rental value.

Finally, the developer should demonstrate a commitment to transparency and maintain a solid reputation. Integrity reduces reputational risks for lenders.

A well-structured partnership can protect all parties involved and maximize the chances of success; an inadequate partnership, on the other hand, can negatively impact a project.

Criteria to watch for include track record and reputation, regulatory and compliance expertise, and a strong alignment of vision and values.”

The scope of work should outline who is responsible for design, permitting, budgeting, subcontracting, construction management, go-to-market strategy, or take-out financing. Document in writing milestone deadlines with specific deliverables and target

completion dates for each stage. Also specify how decisions will be made, who has authority, and escalation paths for disputes. Leaving goals or deadlines open-ended leads to future risks and, possibly, legal action. Proper expectations, consequences, and details are important for a successful project.

A joint venture agreement, performancebased compensation, equity stakes, or claw back clauses can be viable options for building a sound partnership structure.

When involved in a joint venture agreement, clearly state each party’s financial contribution and profit-sharing arrangement. For performance-based compensation arrangements, bonuses for early or ontime delivery and budget adherence are good incentives to keep projects on track and the lines of communication open. In some cases, using an equity stake is a viable option in exchange for reduced upfront fees. If claw back clauses are considered, they should include terms for recovering losses if the developer does not deliver on their obligations.

SECURE LEGAL PROTECTIONS AND EXIT STRATEGIES. Protect your investment by proactively building legal safeguards and contingency options into the project structure. To help avoid potential liens and other payment-related risks, partner with a reputable fund control company. These firms have experienced staff as well as professional processes and procedures that protect the lender.

Incorporate clear dispute resolution mechanisms into all agreements. Define specific arbitration or mediation paths to efficiently resolve disagreements without costly litigation. Another protection to include is force majeure clauses to protect all parties against unforeseen external disruptions (e.g., natural disasters, war). Finally, structure buy-sell provisions that allow one party to exit the contract under predefined terms.

Over time, developers complete multiple projects of the same type, and they become

Choosing the right development partner can make or break a project. A structured approach to due diligence, oversight, and communication helps lenders and investors reduce risk while maximizing project outcomes.

A disciplined, relationship-based approach to developer selection and oversight protects your investment and helps ensure long-term success. Choose partners who demonstrate experience, financial strength, transparency, and shared values. Then monitor consistently to keep the project on track.

Clean background check.

Verified positive references from similar completed projects.

Interviews and references indicate that culture aligns in work style and values to reduce conflict, increase trust, and increase prductivity.

Track record of on-time, comparable project completions verfied via county records, permit reviews, and certificants of occupancy in the developer’s name.

Recent, like-kind project experience to decrease risk of delay and budget overrun.

Schedule and obligations across all owned entities are free of signs of overextension that may dilute focus and resources.

Financial statements and organizational charts validate stability, liquidity/ capital access, and timely payments to subcontractors.

Local expertise and community knowledge indicate understanding deep of local building codes, climate considerations, and regional design styles.

Demonstrates established local subcontractor and supplier network.

No indication of conflicts of interest or history of non-arm’s length transactions/ self dealing that expose lender to liability.

Local weather patterns and construction cycles are accounted for in the timeline.

Budget and insurance expectations are aligned and agreed upon up front to reduce financial risk and cost surprises.

Legal counsel has reviewed all documentation, ensuring clarity and enforceability of contracts between all parties.

Communication expectations are established for weekly reports and calls, monthly reviews, and consistent on-site walkthroughs.

Real-time project visibility via technology tools such as shared dashboards and construction draw management platforms have been implemented.

For large projects: Phased project management is implemented to include short-term contracts with performance reviews prior to allowing developer’s full project control.

experts. Research, validate, and select an experienced developer for your project type. Doing so will help streamline approvals, target marketing strategies, bring deep regulatory knowledge, and ultimately result in a successful project. Examples of projects requiring a specialized developer are luxury condominiums, historic properties, and affordable housing complexes.

Luxury condominium mid-stream projects may require experience with re-permitting and redesigning. That prior experience with urban luxury housing includes knowledge of both jurisdictional and agency approvals, including the marketing strategy.

Adaptive reuse of a historic property requires a preservation-savvy developer to tackle regulatory issues. A prior history of understanding and navigating community rapport and securing landmark status may be needed to complete a unique project.

A developer with a proven track record in nonprofit or public-private partnership projects is well-suited to restructure a distressed project. Their experience enables them to optimize costs through the use of alternative materials and phased scheduling, increasing the likelihood of turning the project into a success.

Partnering with an experienced developer is one of the most effective ways to mitigate risks in mid-construction financing. These knowledgeable partners offer invaluable technical insight, local regulatory fluency, and a tested ability to rescue and complete troubled projects.

Taking the extra time needed to find the right partner is critical to successful project completion. By evaluating a developer’s financial health, track record, and alignment with your goals—and structuring the partnership with clarity and accountability—you can transform a

distressed asset into a profitable investment. In today’s unpredictable construction climate, a strategic development partner isn’t just an asset; it’s a necessity.

Jill Duke is the chief operating officer at Level Capital LLC. She has more than 20 years of experience in mortgage and construction lending, including correspondent, wholesale, and retail channels. Throughout her career, Duke has led teams in operations, risk, quality control, post-closing, and product development for regional and national banks as well as national non-bank mortgage lenders.

Keith Tibbles is a co-founder and partner at Level Capital LLC. He has more than 30 years of experience in mortgage and construction lending, serving as a director of Pacifica Bank, president of Washington Mortgage Lenders Association, and an advisory board member for Fannie Mae. Tibbles also served on several task forces for the Mortgage Bankers Association.

A strategic title partner can accelerate closings, safeguard reputation, and support long-term portfolio growth.

Not all title companies are created equal, especially when it comes to business-purpose loans. The right title partner understands the urgency, complexity, and nontraditional nuances of investment transactions. They provide more than just a service; they act as a strategic ally, offering speed, accuracy, and seamless coordination with lenders, attorneys, and closing agents to keep deals moving forward.

Let’s examine what truly sets a great title partner apart from others.

A title partner well-versed in investment properties, fix-and-flip projects, and commercial transactions brings more to the table than basic title clearance. These deals aren’t cookie-cutter; they fall outside traditional consumer mortgage regulations, often involve complex ownership or funding structures, and typically move at a much faster pace than conventional home loans.

An experienced title team knows where issues typically arise and proactively

addresses them before they impact the closing timeline. Your deal isn’t treated like a standard go-forward mortgage—it’s handled with the nuanced attention business-purpose lending demands.

As you evaluate a potential title partner, ask the following questions:

» DO YOU SPECIALIZE IN BUSINESSPURPOSE LOANS? Walk me through your experience with business-purpose loans like fix-and-flips or rental portfolios.

» HOW DO YOU HANDLE TRANSACTIONS THAT INVOLVE COMPLEX OWNERSHIP STRUCTURES OR INVESTOR GROUPS?

» WHAT ARE SOME COMMON ISSUES YOU’VE ENCOUNTERED?

» WHAT’S YOUR AVERAGE TURNAROUND TIME FOR INVESTOR DEALS?

For private lenders working across multiple states, having a title partner with true national reach is a competitive advantage. Be sure to ask a potential title partner if they have experience handling multistate transactions with centralized coordination.

Unlike local firms that operate in siloed geographies, a national title company gives you a single point of contact, consistent processes, and unified service across the board. One partner, one process— there’s no need for spreadsheets full of vendors or onboarding a new title agent

every time you enter a new market. That’s not just convenient; it’s scalable.

When deals span states, consistency matters. A centralized title partner can ensure legal compliance, and local nuances are accounted for without the delays or errors that come from juggling multiple local providers. This operational efficiency becomes a major asset as you grow.

Working with a national title company also provides a critical layer of fraud prevention. You know exactly who you’re working with on every transaction, eliminating the need to vet a new vendor each time and reducing the risk of falling victim to fraudulent actors. In today’s environment, that added peace of mind is not just beneficial, it’s essential.

One investor working on a multistate portfolio acquisition faced unexpected roadblocks when title defects surfaced in three of the properties. Because the title partner had both the reach and the expertise to act fast, the issues were resolved within days—not weeks—

avoiding costly delays in closing. This responsiveness preserved the investor’s financing window and helped them move forward with confidence.

The investor later noted that having a title team who knew the businesspurpose lending landscape was critical, not just for resolving issues but for preventing future ones.

Many title companies talk about integration, but only a few truly deliver. The right partner leverages technology to integrate with platforms, provide realtime status updates, and reduce manual work across the board. That said, we also recognize that although systems matter, so does human communication. Whether you prefer to receive updates in your production system or via a well-timed email, flexibility and familiarity are key. The best partners strike the right balance between automation and personal connection.

Look for providers who continuously invest in improving their tech stack, not just those who adopt off-the-shelf solutions. Cutting-edge tools like API integrations, e-signature platforms, and automated progress notifications create smoother workflows and reduce friction at closing. Consider asking questions like these of any title company you are considering partnering with:

» WHAT PLATFORMS DO YOU INTEGRATE WITH?

» WILL I HAVE A DEDICATED POINT OF CONTACT?

» HOW DO YOU COMMUNICATE STATUS UPDATES?

In the fast-paced world of investment lending, a revolving door of contacts leads to frustration and inefficiency. A reliable title partner provides a consistent, dedicated team that not only knows your business but also understands how you like to work. Over time, these professionals become an extension of your team. They anticipate your preferences, navigate challenges with you, and build trust that follows you even as you change roles or organizations.

This continuity means fewer miscommunications, quicker resolutions, and stronger partnerships. Your title team becomes a strategic asset that’s empowered to think ahead, troubleshoot, and support your evolving business needs.

One of the most overlooked advantages of working with the right title partner is risk mitigation. Real estate investment comes with its fair share of uncertainty, especially with regard to liens, unresolved encumbrances, or

conflicting ownership records. A seasoned title team has seen it all and knows how to spot red flags early, giving investors and brokers the confidence to proceed—or the caution to pivot. Don’t hesitate to ask a potential title partner to give you examples of how they’ve resolved complex title issues.

Their role in identifying potential pitfalls, clearing title clouds, and ensuring legal ownership transfer doesn’t just protect a single deal; it protects your reputation and your long-term portfolio health too. Simply put, avoiding a costly post-close surprise is worth its weight in gold.

When you work with a title partner you trust, that confidence translates directly to your clients. Investors can feel the difference when deals are handled smoothly, timelines are respected, and communication is proactive. In an industry where reputation matters, partnering with the right title company helps private lenders and their business analysts build credibility and strengthen their client relationships.

A dependable title team allows brokers to focus on growth and origination. They know that once the deal hits the closing table, it’s in expert hands. That peace of mind is priceless in today’s competitive market.

Private lending is all about leverage—and not just financial leverage. Operational leverage matters too. Partnering with a title company that understands your strategy, aligns with your pace, and scales with your goals gives you a strategic edge over competitors.

In a space where everyday counts, and every misstep costs money, the right

title partner isn’t just a vendor, they’re an accelerator for your business.

The best title partners don’t just support your deals today. They help position you for growth tomorrow. By staying current with regulatory changes, investing in their own infrastructure, and understanding market shifts, these companies become a future-proof asset to your business.

In a volatile market, adaptability is key. The right partner evolves with you, ensuring you’re not just closing deals but building something sustainable. From speed and scale to support and strategy, they’re an essential part of your competitive edge.

Michelle Esparza is senior vice president of national sales at Priority Title & Escrow. In this role she helps private lenders, investors, brokers, and lenders streamline real estate transactions.

Esparza has more than 30 years’ experience, including leadership roles at national underwriters and private lender-focused agencies. She is known for her deep industry knowledge, client-first mindset, and ability to navigate complex, multistate deals.

Esparza is a frequent participant at industry events and an active member of multiple real estate and mortgage associations. Learn more at PriorityTitle.com.

Tailored funding for fix & flip and ground-up construction - powered by 25+ years of experience and a team that moves fast and closes strong.

Sekady streamlines the entire draw process—from inspection to title report. Giving you complete visibility without the headaches. • Draw Management

Great servicing teams drive loyalty and stop losses before they start.

EVAN

Private lenders spend considerable effort building, fostering, and maintaining relationships. Often, this experience allows them to understand the operational risk associated with a loan, the anatomy and warning signs associated with each loan, and when it’s time to call it quits. A servicing team, particularly one that’s in-house, provides a bridge between borrower and lender and is often on the front line of making difficult decisions.

Relationship building is essential to the success of any lender. In a hypercompetitive lending space, small factors often differentiate one lender from another. Although pricing (fees and interest rate), duration, leverage, and loan structure all play a critical role in a borrower’s decision, the overall experience and ease of the transaction create repeat customers.

This especially rings true for balance sheet lenders who service their loans in-house. Understanding a borrower, educating them, and going the extra mile to restructure a deal to get it closed (with a high probability of success and mitigation of risk) is the goal of any lender.

Understanding a borrower starts from Day One, often with the initial inquiry. A simple call, email, or video chat with a prospect

can yield a wealth of information. They can help a lender understand a borrower’s background, liquidity, experience, and goals—and how those factors fit into the lender’s guidelines and credit matrix.

The initial fact-finding mission often yields red flags and outright warnings. Some are subtle, and some are extreme: Is this a new borrower with little experience? Are they going too big, too soon (heavy vs. light rehab)? Are they investing in high-risk areas, which include risk related to insurability, crime, economic compression, or oversaturation? Are there geographical complexities related to distance? What are the current micro and macroeconomic climate conditions that will impact this particular investment?

Private lending, like many industries, is a function of sales. An intelligent, highly trained sales staff with a great product will drive originations and loan volume. The sales team cultivates the relationship with the customer, processing ensures proper documentation is provided, underwriting qualifies the loan, and closing/quality control ensures the loan makes it to the closing table without hiccups.

Now, any proud, experienced servicing team member will tell you this is where

the real fun (challenge) begins. The servicing team is the ultimate guardian of a company’s capital resources and must police and monitor the progress of each project, maintain a positive relationship (hopefully) with each borrower, and know how to spot warning signs in a complex, dynamic industry that can be suffused with fraud.

On the surface, one may think a servicing team member’s job is simple: collect interest, release draws, provide payoffs, and nothing more. That could not be further from the truth. Servicers are the

backbone of the borrower relationship, providing guidance and education on construction budgets, while navigating simple to complex change order requests, contractor matters, and the many issues that arise between business partners. In addition, the servicing department must guide loan modifications and extensions when they are (or are not) appropriate. They must do all this while managing collection issues, monitoring property insurance and tax compliance, issuing notices of defaults, and working closely with internal and external legal counsel.

Now that the loan has closed, the servicing department must “welcome” a borrower to the business and familiarize them with several important details related to both planning and process. Although many, if not all, these details should have been explained during the sales process, it is good practice to outline them in a “cheat-sheet” for the borrower to reference. Often, a lender sends a welcome letter that incorporates several important pieces of information.

Communication is vital, so be sure to include key contacts. Who does the borrower contact for a draw, what needs to be included, and what is the typical turnaround time from the initial request to the deposit of draw funds?

Additionally, costs related to the loan should be spelled out. These include the interest rate and how it is calculated (e.g., Dutch vs. Non-Dutch, inspection fees, wire fees, NSF fees, late fees, etc.). Be sure to note when interest is billed and subsequently due.

How fees will be paid also must be clarified. As part of the closing package, many lenders require borrowers to provide banking information that will be used for monthly direct ACH payments. This allows the lender and borrower a hassle-free payment transaction each month and minimizes the risk of missed payments and late fees.

It should provide a “refresher” of the borrower’s budget (Scope of Work) and, importantly, how best to follow it to maximize draw releases and minimize delays.

The welcome letter also should cover whether release of draw funds is dependent on each line item being

100% complete, installed (properly with acceptable workmanship), and on-site. If the lender allows for partial releases, it should specify what is required and how percentages are determined. Any additional documentation needed for specific repairs (e.g., roof warranties, septic certification and inspections, special permits and invoices) that must be submitted in conjunction with the inspection report should be noted as well.

Finally, details on the final holdback funds, when they are released, and what is required to access them (e.g., lien waivers, certificate of occupancy, clean/complete project, etc.) should be spelled out.

The servicing department will educate even experienced buyers (or remind them) about the details of their loan and the nuances of each lender, especially if they are new to the organization. This education allows the borrower to quickly and efficiently access draw funds and expedite their rehab.

As the eyes and ears on every project, the servicing department is tasked with monitoring the progress of each loan. They treat every draw as a mini underwrite, examine the progress in detail, and look for red flags and warning signs. The servicing

AAPL membership is the standard of excellence among private lenders and the foundation supporting the industry’s viability and growth.

Join the oldest and largest association providing for private lender education, ethics, and advocacy at aaplonline.com/join.

department should constantly communicate with the borrower, understanding each project’s budget and complexities.

Yes, first and foremost, a servicer must ensure the financial liabilities for each borrower are met—including timely interest payments, sufficient and current insurance coverage, current tax liabilities—as well as monitor for any mechanics’ liens that could jeopardize a project or a lender’s first lien status.

However, the construction draws are where the rubber meets the road. The servicing department is tasked with reviewing each draw in detail. What does a draw review consist of?

PERMITTING AND PLANS. Are the necessary and proper permits in place, and do the plans match the progress of the project? Look for warning signs. Differences in project scope can be subtle and less impactful, such as changing flooring materials. At other times, changes will severely impact the overall feasibility of a project, threatening the original ARV that the loan was underwritten to. For example, has an addition been added or deleted, a planned finished basement scrapped, or worse, an entire structure demolished?! Heed the warning signs and question everything.

SPEED AND CONSISTENCY OF DRAWS. How often are draws being taken? Every borrower is unique in their plan and scope. Some borrowers take smaller, more frequent draws, while others fund the entire project and will not take a draw until the very end. Communicate with the borrower and remain involved. If regular draws are not being taken, discuss the reason with the borrower. These conversations can often unearth issues with permits, liquidity issues, contractor woes, or disagreements between partners.

SIGNS OF FRAUD. Inspect every picture, every angle, and every detail of each draw. Unfortunately, fraud can be pervasive, especially in private lending. Whether you allow your borrowers to submit their pictures or rely on a third-party inspector, make sure what you are reviewing is the actual property on which the loan was made. Compare each draw report to the original appraisal and the original inspection/feasibility report (if available). Ensure there are clear, current exterior photos with proper address markings. Use online street view services to compare the surroundings. Releasing draw funds on fraudulent reports and pictures can and will cost a lender dearly.

CHANGE ORDERS. Exercise cautious skepticism with every change order request. Although many lenders enforce strict rules (no change orders or no change orders after the first draw), one must speak with a borrower to understand the unique circumstances for each reallocation request. A lender must use common sense, especially with smaller change requests that have little to no risk to the overall viability of the project.

Large reallocation requests often come with increased risk (and may be predicated on other underlying issues). Is the borrower attempting to “frontload” the budget, drawing more funds earlier, which will negatively impact cash flow to finish the

project? Will changes impact the overall ARV of the project (for better or for worse) and require a new appraisal? Are these changes indicative of the borrower’s (or contractor’s) lack of experience and pose threats to the successful completion of the project?