Spring 2024 The Official Magazine of the American Association of Private Lenders COMPLIANCE Investors Squeezing Single-Home Market? Page 6 MARKET TRENDS Capital Market Strategies Page 42 FUNDAMENTALS Building a Powerhouse Team Page 10 Right Place, Right Time LENDER LIMELIGHT

JOBS BOARD! Check out AAPL's Jobs Board Info on Page 5 NEW

Featuring Melissa Martorella

We are dedicated to helping our customers build wealth through real estate. By securing the right financial solution on each real estate investment in their portfolio, ResCap Borrowers have more control over their funds and their future.

ResidentialCapitalPartners.com

T: 866-441-0223

Scan me!

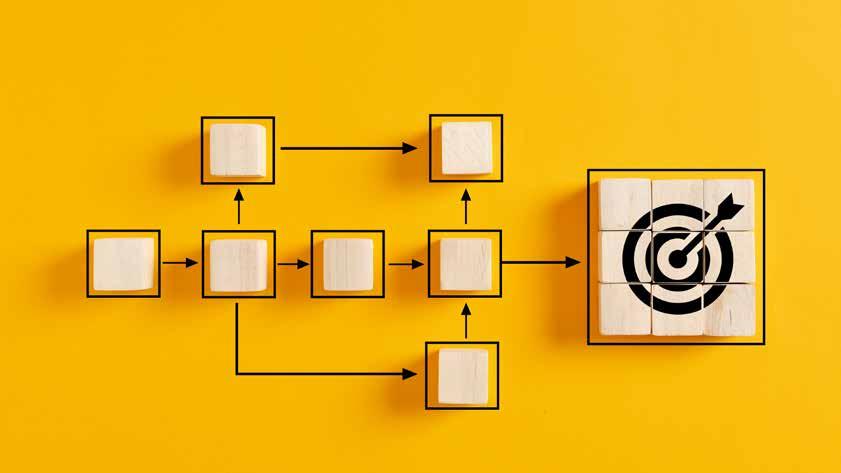

SPRING 2024 3 CONTENTS 06 ADVOCACY Is Predatory Investing Creating a Single-Family Home Shortage? 10 FUNDAMENTALS 10 Your People Are Your Power 16 Maximize Your Mortgage Broker Relationships 20 Instill Confidence With High-Petrformance Loan Servicing 24 Do You Really Know Your Cost Per Loan? 28 MARKET TRENDS 28 State of the Private Lending Industry: Reflecting on 2023 with an Eye Toward 2024 36 2024 Real Estate Investor Activity: Bull or Bust? 42 Ebb and Flow of Private Lender Capital Strategies 50 LENDER LIMELIGHT Right Place, Right Time with Melissa Martorella 58 FUND MANAGEMENT 2024 Market Update: Vintage Is In 62 CASE STUDY 62 Distressed Property Undergoes Impressive Rehab for Section 8 64 Operational Procedures for a Foreclosure 66 Land Value Creates Build-and-Flip Opportunity 68 OPERATIONS 68 Release Operational Pressure by Breaking Bottlenecks 76 Mastering Back-Office Operations in Private Equity 80 A Self-Servicing Portfolio Model 88 Leverage Virtual Employees for Flexibility and Efficiency 92 Comp Selection: Compliant Does Not Mean Good! 96 VENDOR GUIDE 98 LAST CALL Necessity Truly Is the Mother of Invention 6 10 42 SPRING 2024

OUR SERVICES

CORPORATE & SECURITIES

• Securities Offerings and Compliance

LAW FIRM & CONFERENCES

Geraci LLP is a full-service law firm and conference line specializing in representing non-conventional lenders.

(949) 379-2600

90 Discovery Irvine, CA 92618

https://geracilawfirm.com/

https://geracicon.com/

https://geracilawfirm.com/originate-report/

• Entity Formation

• Corporate (Governance, M&A, Capital Markets)

• Mortgage Licensing

LITIGATION & BANKRUPTCY

• Judicial Foreclosure

• General Business Litigation (Partnership, Investor, and Vendor Disputes)

• Creditor Representation in Bankruptcy

• Other Mortgage Loan Litigation

BANKING & FINANCE

• Foreclosure/Loss Mitigation

• Nationwide Loan Documents

• Nationwide Lending Compliance

OTHER SERVICES

• Conference Line

• Originate Report Magazine

• Lender Lounge Podcast

4 PRIVATE LENDER BY AAPL

CONNECT WITH US WE PROVIDE PEACE OF MIND

New Industry Jobs Board Launches

Despite the transition private lending has been experiencing, it’s gratifying to see that our industry has matured and even grown, proving its staying power and role in filling an essential gap among more traditional financial services.

As new private lenders enter the space and established businesses grow, where do they find the personnel to underpin that growth? Mentoring fresh faces is one way, but where and how do you connect with more established professionals?

Relevant side note: One of the ongoing complaints we hear is, “So-And-So hired my best employee! That’s got to be a Code of Ethics Violation!”

[Note: It is not. We do recommend taking operational steps to protect trade secrets and employee noncompetes where warranted and legal.]

When the only way to hire from within the industry is to headhunt and casually put out feelers at events (“So, are you happy at XYZ Company?”), almost any new hire can become fraught with drama.

There must be a better way.

Oh wait! There is!

We are thrilled to announce the launch of the AAPL Jobs Board at aaplonline.com/jobs. AAPL members may list unlimited jobs at no cost, with a nominal fee for job posts from nonmembers. Employers can also choose to take applications through the Jobs Board platform or link to an external service.

Current professionals now have one place to look for positions related to private lending or associated industry vendors.

Although this new service grew from frequent member requests (We heard you and finally built a “thing”!), its success is measured through activity. So please, post and peruse away! Oh, and back to hiring fresh faces or seasoned professionals: William Tessar wrote a well-timed article we’d like to highlight. Check out “Your People are Your Power” on page 10.

SPRING 2024 5

HYDE President, AAPL

HUNGERFORD Executive Editor

RODRIGUEZ Design CONTRIBUTORS

Bean

Chavez

Esq.

LINDA

KAT

DAVID

Katie

Erik Brown Alex Buriak Henry

Vinny Ciardullo Nema Daghbandan,

Daren Blomquist Evan Brody Bill Fairman

Michael Fogliano

Anthony F. Geraci Dana Georgiou

COVER PHOTOGRAPHY

Trujillo Private Lender is published quarterly by the American Association of Private Lenders (AAPL). AAPL is not responsible for opinions or information presented as fact by authors or advertisers. SUBSCRIPTIONS Visit aaplonline.com/subscribe. BACK ISSUES Visit aaplonline.com/magazine-archive, email PrivateLender@aaplonline.com, or call 913-888-1250. For article reprints or permission to use Private Lender content including text, photos, illustrations, and logos: E-mail PrivateLender@aaplonline.com or call 913-888-1250. Use of Private Lender content without the express permission of the American Association of Private Lenders is prohibited. www.aaplonline.com Copyright © 2024 American Association of Private Lenders. All rights reserved.

Benn Jackson Adonis Lockett Diana Luoma Rodney Mollen Sean Morgan Chris Ragland William J. Tessar Scott Ward

Elizabeth

President, American Association of Private Lenders CORNER OFFICE

Is Predatory Investing Creating a Single-Family Home Shortage?

The shortage of U.S. single-family homes is a multifaceted issue requiring a comprehensive and collaborative approach.

BILL FAIRMAN, CAROLINA CAPITAL

Stop predatory investing and end hedge fund control of American homes!

Sounds like a righteous cause, doesn’t it? Stopping large institutional investors from swooping in and buying up all the single-family home inventory, pushing out homeowners in favor of renters, while would-be homeowners cannot compete with an all-cash purchase, resulting in the soaring prices of single-family homes.

That’s the issue Senate bills S.2224 and S.3673 as well as House bill H.R.6608 try to fix. Unfortunately, they don’t address the actual issue and instead blame easy targets, Wall Street, and its accredited investor class. Although the target is the large institutional investors, in the text, these bills can trickle down to the mom-and-pop investors who are just trying to run small family businesses with 50 or more homes.

Let’s start with the myth that all the inventory of single-family homes are being gobbled up by institutional investors.

According to a Freddie Mac chart

published in a December 10, 2023, Housing Wire article by Logan Mohtashami, those who bought more than 100 homes in a 12-month period did not even reach a

2.5% market share going back to the year 2000. In fact, through second quarter 2023, only 1,959 homes were purchased by investors that own more than 1,000 homes. That is 0.03% of the market. The highest percentage of market share, at 19.6%, went to investors who own between one and nine properties. The vast majority of those folks are not cash buyers and would have to compete with would-be homeowners to get loans.

SCARCITY OF SINGLE-FAMILY HOMES

There are several reasons for the high prices. No. 1 is supply and demand, but it’s not because investors are buying up all the inventory. Builders have not been keeping up with new household formations.

Let’s take a deeper dive as to why.

Zoning Regulations and Land Use Policies. One significant factor contributing to the scarcity of single-family homes is the web of zoning regulations and landuse policies. Many municipalities have implemented restrictive zoning codes that prioritize high-density developments or commercial spaces, limiting the availability of land for single-family home construction. Stringent regulations often

create barriers, making it challenging for developers to secure permits for new single-family housing projects.

The NIMBYism (not in my backyard) Mentality. Prevalent in many communities across the United States, NIMBYism poses a substantial hurdle to the construction of single-family homes. Residents often resist new developments in their neighborhoods, fearing changes in property values, increased traffic, and strain on local resources. This resistance, though well-intentioned, contributes to the scarcity of available land and stifles efforts to address the growing demand for single-family homes.

Rising Construction Costs. The escalating costs of construction materials and labor play a crucial role in hindering the construction of single-family homes. From lumber and steel to skilled labor, the expense of building a home has risen significantly, causing developers to reconsider or scale back their projects. The affordability crisis has made it difficult for many families to enter the housing market, exacerbating the shortage.

Infrastructure Challenges. Insufficient infrastructure, such as roads, utilities, and public services, can impede the

6 PRIVATE LENDER BY AAPL ADVOCACY

construction of new single-family homes. Developing infrastructure to support residential areas is a costly and time-consuming process, deterring developers from investing in regions lacking the necessary amenities. Governments at various levels need to prioritize infrastructure development to encourage and accommodate the construction of single-family homes.

Strong Demand Outpacing Supply. One of the primary drivers of the shortage of existing single-family homes for sale is the robust demand from homebuyers. Favorable economic conditions, historically low interest rates, and a growing population have combined to create a surge in demand for housing from 2017 through 2022. Unfortunately, the supply of existing single-family homes has struggled to keep

pace, resulting in a highly competitive market with limited inventory.

Demographic shifts, such as the aging baby boomer population and millennials entering the homebuying market, have further intensified the demand for single-family homes. Baby boomers are often reluctant to sell their homes, contributing to a scarcity of available properties. Meanwhile, millennials, the largest generation in the United States, are actively seeking homeownership, putting additional pressure on the limited supply of existing single-family homes.

Homeowners Opting to Stay Put.

Economic uncertainty, coupled with high interest rates, has led many existing homeowners to choose remodeling or renovating their current homes instead of selling. This trend, known as “aging in place,” has resulted in fewer existing

single-family homes being listed for sale, as homeowners opt to improve their current living spaces rather than navigating the challenging process of selling and buying a new property.

Low Housing Turnover. The historical trend of homeowners moving less frequently than in previous decades has contributed to a lower housing turnover rate. Homeowners are increasingly choosing to stay in their homes for more extended periods, reducing the number of existing single-family homes available for sale. This trend is influenced by various factors already mentioned.

For comparison, 20 years ago the average home turnover was seven years; starting around 2008, it began increasing to a little over 10 years.

SPRING 2024 7

THE RISE IN SINGLE-FAMILY HOME RENTALS OVER OWNERSHIP

Let’s discuss the elephant in the room: If there was not a demand for rental houses, investors would not buy them, especially now at historically high price to rental ratios. (See tradingeconomics. com/united-states/price-to-rent-ratio.) The price-to-rent ratio in the United States measures the nominal house price index divided by the housing rent price index.

This shift in preference reflects evolving attitudes toward housing, shaped by a combination of economic, lifestyle, and demographic factors.

One of the primary drivers behind the surge in single-family home rentals is the desire for financial flexibility. Renting allows individuals to avoid the significant upfront costs associated with purchasing a home, such as a down payment, closing costs, and ongoing maintenance expenses. Renters can allocate their financial resources more freely, adapting to changing circumstances without being tied down by the financial commitments that come with homeownership.

Demographic shifts, particularly among younger generations, play a crucial role in the rising preference for renting single-family homes. Millennials, in particular, value mobility, career flexibility, and the ability to explore different living arrangements. As this generation postpones major life milestones such as marriage and starting a family, the appeal of renting over owning becomes more pronounced, aligning with their dynamic and fast-paced lifestyles.

Economic uncertainties, exacerbated by events like the 2008 financial crisis and the recent global pandemic, have left a lasting impact on individuals’

perceptions of financial security. Some people are wary of committing to a mortgage, preferring the flexibility and reduced financial risk that comes with renting. The ability to adapt to economic fluctuations without being tethered to a long-term mortgage commitment is an attractive prospect for those cautious about the housing market’s unpredictability.

Renting single-family homes provides individuals with the opportunity to live in desirable neighborhoods without the substantial financial investment required for homeownership. In cities with soaring real estate prices, renting allows residents to enjoy the amenities and lifestyle of sought-after areas without the burden of a mortgage. This increased flexibility aligns with the modern preference for experiences over ownership.

MULTIFACETED APPROACH NEEDED

The shortage of single-family homes in the United States is a multifaceted

issue that requires a comprehensive and collaborative approach. Addressing zoning regulations, tackling NIMBYism, and mitigating economic uncertainties are crucial steps in fostering an environment conducive to the construction of singlefamily homes. By overcoming these challenges, policymakers, developers, and communities can work together to ensure there is an adequate supply of housing to meet the needs of new families and promote sustainable growth in the housing market.

What is misguided about these bills is if the government forced institutional investors to sell every investment home they owned, it would only add 700,000 units of inventory—and we are 6 million homes behind new household formations in this country (see Realtor. com/research/us-housing-supply-gapmarch-2023). Forcing sales to homeowners will not address underlying affordable housing or inventory issues for the following reason: The immediate impact

8 PRIVATE LENDER BY AAPL ADVOCACY

of the bills is to forcibly displace less financially secure renting tenants in favor of prospective homeowners.

Even an immediate influx of institutional investment homes on the market will only temporarily impact owned housing supply/demand. It does nothing to close the real gap in the amount of sustained new construction needed.

The way to fix this is not by limiting or controlling who can have what; only by creating a greater supply of single-family homes will this problem be solved.

In 2008, the housing bubble burst because anyone with a pulse could qualify for a loan on a home. That problem has been fixed. It is now time

to address the under-supply of new homes, but not by artificially limiting the competition of who can buy homes.

Regarding the Senate and House bills currently pending: They are not likely to go any further, based on conversations with staffers of senators serving on the Finance and the Banking, Housing, and Urban Affairs committees.

Rest assured, AAPL is constantly monitoring all potential legislation that affects the private lending industry. We work diligently to pass that information along to you and to speak on your behalf to the stakeholders at the local, state, and federal levels.

BILL FAIRMAN

Bill Fairman is a best-selling author, national speaker, and serial entrepreneur who’s been in the mortgage banking industry for more than 30 years. The co-founder of Carolina Capital, he has worked with hundreds of highnet-worth clients to grow their wealth in his more than 10 years as a fund manager. Fairman is a member of AAPL‘s Government Relations Committee.

SPRING 2024 9

EXPERIENCE MAKES ALL THE DIFFERENCE DIRECT SHORT-TERM COMMERCIAL BRIDGE LOANS redoakcapitalholdings.com 4 Lending Programs Ranging from $1-20M Nationwide: Primary, Secondary, and Select Tertiary Markets

Your People Are Your Power

Three keys—experience level of originators, compensation, and office structure— empower you to build a powerhouse private lending team.

WILLIAM J. TESSAR, CV3 FINANCIAL SERVICES

n the world of private lending, success is often synonymous with the strength and cohesion of your team. The choices you make regarding the experience level of originators, your compensation models, and the structure of your office environment (i.e., inoffice/remote/hybrid) can significantly impact your team’s performance.

Let’s dive into how each one provides an opportunity to create a powerhouse private lender team.

THE EXPERIENCE DILEMMA: NEW TALENT VS. SEASONED PROFESSIONALS

Originators are the “hunters” of any lending organization. They bear the responsibility of finding, building, and nurturing client relationships to generate revenue. The pressure can mount, because the success of a lender often hinges on the originators. Originators also play a crucial role in assessing risks and structuring deals that align with the needs and objectives of the organization.

When it comes to building an origination team, you have many factors to consider. One is whether to hire new originators or experienced ones. There are advantages and considerations associated with both approaches.

It can be said that all originators should focus on two things: building a database with new customers and nurturing that database once they’ve built it. If you believe this to be true, you likely subscribe to the idea of hiring an

10 PRIVATE LENDER BY AAPL FUNDAMENTALS

experienced originator who already has an existing book of business; however, there is a strong argument to be made for hiring high-quality individuals, even those with little-to-no experience, and teaching them your best practices.

Embracing the Fresh Perspective of New Originators. Welcoming new originators into your private lender team injects a burst of innovation and fresh perspectives. These motivated professionals often come with creative solutions and the enthusiasm to tackle challenges in novel ways. Their adaptability to technology and willingness to learn can be assets in an industry that is rapidly changing, and there is something powerful to be said for starting fresh and not having to “unlearn” old ways of doing things. However, the cost of hiring and training new talent shouldn’t overshadow the value they bring to the table.

Today in lending it is rare for companies to invest in building tomorrow’s origination

professionals, but there is much truth to be had for the return on investment for developing new talent in-house. With the proper dedication of time and resources, including mentorship pairing, you can teach a rewarding career in lending and real estate. Investing in a training program ensures that the originators’ potential is maximized, allowing them to grow into valuable assets for your organization.

Leveraging the Wisdom of Seasoned Originators. On the flip side, experienced originators bring a wealth of industry knowledge and expertise. Having navigated various market conditions, they understand the intricacies of deal structuring, risk assessment, and market trends. Their established networks can open doors to new opportunities and enhance your private lending operation’s credibility.

Although experienced professionals may command higher salaries, the reduced learning curve and immediate impact they

can make on your team’s performance often justifies the investment. Striking a balance between new talent and seasoned professionals can create a well-rounded and powerful origination team.

Finding the Right Balance. Ideally, origination teams include both new and experienced originators. This balance ensures the team benefits from the innovation and cost-effectiveness of new talent while capitalizing on the industry knowledge and networks experienced professionals bring to the table.

COMPENSATION: NAVIGATING REV SHARE VS. BPS ON VOLUME

Whether your originators are seasoned or green, your compensation structures play a pivotal role in shaping the foundation of your team. Two prevalent compensation models in the private lending industry are

SPRING 2024 11

“

THE CHOICE BETWEEN REVENUE SHARING AND BASIS POINTS ULTIMATELY DEPENDS ON THE GOALS, CULTURE, AND LONG-TERM STRATEGY OF YOUR COMPANY.

revenue sharing (rev share) and basis points (BPS) on volume.

Revenue sharing. Revenue sharing fosters a collaborative environment where the success of the team is directly tied to the success of the company. This is a collaborative approach in which originators receive a percentage of the revenue generated from the deals they bring in, creating a shared

incentive to drive overall business growth. Rev share models inherently mitigate risks by aligning the interests of originators with the long-term success of the lending institution.

Since their compensation is tied to the performance of the deals they originate, originators are motivated to prioritize quality over quantity and to ensure the sustainability of the loans they bring in.

That being said, the capital structure needs to be one of shared ownership in which everyone believes they are building shared value. The downside risk for the originator in a rev share model is that although they make contributions to the company, there could be other items within the

12 PRIVATE LENDER BY AAPL

FUNDAMENTALS

company (unrelated to their day-to-day responsibilities) that result in loss, and that loss negatively impacts their comp.

In a true rev share model, there should be connectivity from a profit-and-loss perspective that aligns the company with the originator, including but not limited to:

Direct and indirect loan level costs.

Loan loss associated with default.

Gain on sale associated with loan sales.

Some form of allocated overhead.

By linking compensation to the overall revenue and profitability generated by the team, rev share models promote a sense of unity and collaboration among

team members. With this team cohesion, originators are more likely to share knowledge, support one another, and work toward collective success, ultimately benefiting the entire lending operation.

Considering Basis Points on Volume. With basis points on loan volume, originators earn fixed (or variable) basis points for each dollar of loan volume they generate, creating a direct correlation between results and compensation, and providing a clear incentive for originators to focus on closing deals and increasing loan volume. This model is both flexible and scalable, making it highly appealing to most private lenders. It allows lenders to adjust compensation structures based on

Secure

market conditions, ensuring adaptability to changing business landscapes.

Vastly different from the collaborative approach of rev share, BPS on volume has a much greater focus on individual origination performance. As loan volumes increase, originators can see their compensation grow proportionally. Originators are driven to maximize their personal loan production, which can lead to healthy competition within the team. However, striking a balance between individual achievement and collective success is essential to maintain a cooperative team culture.

Choosing the Best Fit. The choice between revenue sharing and basis points

SPRING 2024 13

Improve Loan Management While Reducing Portfolio Risk.

Manage draws and disbursements

Schedule inspections with ease

payments to Subcontractors

waiver

Digital lien

sign & store www.Sekady.com

ultimately depends on the goals, culture, and long-term strategy of your company. By carefully considering the strengths and potential pitfalls of each approach, you can tailor compensation structures that drive success, enhance team dynamics, and contribute to the sustainable growth of your lending operation.

IN-OFFICE COLLABORATION VS. REMOTE FLEXIBILITY

All organizations today face a new logistical decision: Where will our team members

“

THE SYNERGY OF MINDS CONVERGING IN ONE ROOM OFTEN SPARKS A CREATIVE COMBUSTION THAT GIVES RISE TO SOME OF THE MOST INNOVATIVE IDEAS. "

14 PRIVATE LENDER BY AAPL

FUNDAMENTALS

work? The choice between maintaining an in-office team structure or embracing the flexibility of remote work has become a dilemma for many private lenders.

The In-Office Allure. The in-office model has long been the hallmark of organizational structures— and for good reason. It fosters an irreplaceable energy through faceto-face collaboration, spontaneous interactions, and a shared sense of camaraderie and company culture. The synergy of minds converging in one room often sparks a creative combustion

that gives rise to some of the most innovative ideas. The physical presence of a team cultivates streamlined communication, team building, and a sense of collective identity, while also providing the invaluable opportunity to maximize performance through direct management and supervision.

Remote Flexibility. On the flip side, the rise of remote work is rewriting the rules of engagement for businesses. Technology has enabled seamless connectivity, allowing teams to collaborate effectively from diverse locations. Embracing remote flexibility opens doors to a broader geographic talent pool, reduces operational costs associated with physical office spaces, and fosters a better work-life balance for employees.

Do take heed, however. A successful remote environment requires mutual trust, which you can help foster through transparent communication, clear expectations, and empowering employees to take ownership of their work.

Hybrid Redefined. As organizations grapple with the decision between inoffice tradition and remote flexibility, a hybrid approach is a popular and compelling solution. Balancing the benefits of face-to-face collaboration with the advantages of remote work, this model can offer the best of both worlds. It can provide the needed work/life balance and flexibility many team members crave while maintaining the collaborative spirit crucial for synchronicity, camaraderie, and a positive, cohesive company culture.

As you navigate the nuanced decisions surrounding hiring the ideal origination team, structuring compensation models, and choosing between in-office vs. remote work, one truth becomes apparent: There is no one-size-fits-all

solution. Each consideration requires a tailored approach to the unique identity and objectives of your organization.

To put it simply, your people are your power . This holds true no matter what domain you operate within and can serve as a bold reminder of the impact your choices have on the quality and talent your organization stands for. By embracing adaptability, fostering a positive culture and work environment, and remaining attentive to the ever-changing landscape of the private lending industry, you can build and sustain an engaged, highperforming, powerhouse team.

WILLIAM J. TESSAR

William J. Tessar is CEO and president of CV3 Financial Services. During his 35 years of mortgage experience, Tessar has founded and served as president of four companies in the mortgage and private lending space, resulting in originations exceeding $40 billion.

With a fierce following of team members, Tessar launched CV3 in 2023 and quickly grew originations to surpass $400 million in the first six months, asserting CV3’s position as a leader in the private lending space.

Tessar was named 2021 AAPL Member Lender of the Year and is a leading voice in the private lending industry.

SPRING 2024 15

Maximize Your Mortgage Broker Relationships

When you implement strategies for nurturing the connections brokers bring to the table, you can unlock a wealth of opportunities for growth, profitability, and industry leadership.

BENN JACKSON, CONSTRUCTIVE CAPITAL

n the realm of private lending, cultivating and managing strong relationships with mortgage brokers is paramount to success. As a private lender, your ability to forge lasting connections with your broker partners not only ensures a steady stream of quality leads and business but also enhances your reputation and credibility in the industry. Understanding the dynamics of these relationships and implementing effective strategies can significantly elevate your business prospects.

This guide delves into the importance of broker relationships, how brokers add value, and specific techniques to cultivate and manage those crucial connections.

THE VALUE OF MORTGAGE BROKERS

Mortgage brokers serve as intermediaries between borrowers and lenders, playing a pivotal role in the loan origination process. Their expertise lies in understanding the diverse needs of borrowers, navigating complex financial landscapes, offering a wider array of loan options than a typical lender could offer directly, and matching clients with suitable lending solutions.

For private lenders, collaborating with brokers offers numerous benefits.

Access to Quality Leads. Brokers have extensive local and national networks and connections within the real estate and financial industries. By partnering with them, private lenders gain access to a steady flow of pre-qualified leads, saving time and resources on prospecting.

Risk Mitigation. Brokers conduct thorough due diligence on borrowers, assessing their financial health, creditworthiness, and loan requirements. This diligent screening process reduces the risk of default and ensures that private lenders fund projects with promising prospects for repayment.

Market Insights. Brokers possess valuable insights into market trends, property values, and borrower preferences. For example, the broker may have in-depth knowledge of select geographies based on their historical and current book of business. Leveraging this expertise, private lenders can make informed decisions regarding loan terms, interest rates, and investment opportunities, thereby maximizing returns and minimizing risks.

Streamlined Process. Working with experienced brokers streamlines the loan origination process, from initial application to closing. Their knowledge of industry regulations, documentation requirements, and underwriting standards facilitates efficient transactions, enhancing overall operational efficiency. This allows private lenders to focus on what they do best, which is closing more loans.

CULTIVATING BROKER RELATIONSHIPS

Building and nurturing strong relationships with mortgage brokers requires a strategic approach and consistent daily effort. Consider these specific techniques to help you cultivate and manage these valuable connections effectively.

Understand the Broker’s Strengths and Goals. Before forging partnerships with mortgage brokers, delve into their strengths, processes, and objectives. Assess their industry network, client acquisition strategies, onboarding approach, and compliance practices to ensure alignment with your organization. Determine whether they prioritize relationships with private lenders and strive for preferred lender status.

Engage in open dialogue to understand their motivations and goals in working with private lenders. By aligning your efforts with their objectives and fostering mutual collaboration, you pave the way for enduring partnerships and mutual success. As you continue to refine your approach to broker relationship management, remember to adapt to changing market dynamics, embrace innovation, and prioritize the needs of your broker partners.

Establish Clear Communication Channels

Open and transparent communication is essential for fostering trust and

16 PRIVATE LENDER BY AAPL

FUNDAMENTALS

collaboration; simply put, be available. Provide brokers with multiple channels to reach you, such as phone, email, and messaging platforms. Be flexible with your time, promptly respond to inquiries, address concerns, and keep them informed

about your lending criteria, product offerings, and guideline updates.

Offer Competitive Loan Products. To attract brokers and their clients, design loan products that are competitive in terms of interest rates, loan-to-value ratios, and

flexibility. Conduct market research to understand prevailing rates and industry standards, and tailor your offerings to meet the needs of various borrower profiles.

Provide Timely Feedback. When brokers submit loan applications or proposals, prioritize timely review and feedback. Respect their time and effort by promptly evaluating submissions, providing constructive feedback, and communicating lending decisions within agreedupon timeframes. Clear and efficient feedback mechanisms demonstrate professionalism and reliability, fostering a positive reputation among brokers.

Offer Educational Resources and Training. Knowledge is power, and by empowering mortgage brokers with comprehensive training and educational resources, you position yourself as a trusted advisor and industry expert. Consider developing an online knowledge base or resource library containing articles, guides, and video tutorials on topics relevant to mortgage brokering and private lending. Cover subjects such as loan structuring, credit analysis, regulatory compliance, and market trends. Furthermore, offer periodic training sessions or workshops led by subject matter experts within your organization. These sessions can delve into advanced topics, case studies, and real-world scenarios, equipping brokers with the tools and insights they need to excel in their profession.

By investing in broker education and professional development, you foster a culture of continuous learning and collaboration, strengthening your relationships and positioning yourself as a thought leader in the industry.

Attend Networking Events. Actively participate in industry events,

SPRING 2024 17

conferences, and networking forums where mortgage brokers congregate. These venues provide opportunities to establish face-to-face connections, exchange business cards, and engage in meaningful discussions. By demonstrating your presence and commitment to the industry, you reinforce your credibility and visibility among brokers. In addition to networking events, your referral network is a tremendous channel for connecting with prospective brokers.

Offer Incentives and Rewards. Recognize and incentivize brokers who consistently bring quality business to your lending institution. Implement referral programs, commission structures, or bonus schemes to reward brokers for their efforts and contributions. By aligning their interests with yours, you encourage long-term partnerships built on mutual benefit and trust.

Seek Feedback and Collaboration. Actively seek feedback from brokers regarding their experiences working with your lending institution. Listen attentively to their suggestions, concerns, and areas for improvement. Strive to incorporate their input into your operations and service offerings. Collaborate with brokers on joint marketing initiatives, co-branded campaigns, or educational events, fostering a sense of ownership and partnership. Finally, on-site visits are an extremely valuable way to interact face-to-face with brokers; try to plan for one or two visits each year.

LEVERAGE TECHNOLOGY FOR RELATIONSHIP MANAGEMENT

In today’s digital age, technology plays a crucial role in streamlining communication and enhancing

collaboration between private lenders and mortgage brokers. Consider adopting customer relationship management (CRM) software tailored to the lending industry. These platforms enable you to centralize broker contacts, track interactions, and automate follow-up tasks. By leveraging CRM tools, you can stay organized, maintain detailed records of broker engagements, and provide personalized service to each broker partner.

Additionally, explore digital platforms and online portals that facilitate loan submissions, manage documents, and provide real-time status updates. Investing in user-friendly, cloud-based systems simplifies the loan origination process, reduces administrative overhead, and improves efficiency for both lenders and brokers. Embracing technology not only enhances operational effectiveness but also demonstrates your commitment to innovation and convenience, making you an attractive partner for tech-savvy brokers.

Maintain Professional Integrity

Uphold the highest standards of professionalism, integrity, and ethics in all your interactions with brokers. Honor commitments, adhere to regulatory guidelines, and prioritize the best interests of borrowers and stakeholders. By consistently demonstrating integrity and reliability, you earn the trust and respect of brokers, paving the way for enduring relationships. Understand there are many options for brokers these days and most lender programs have only slight differences. Integrity, professionalism, and consistency are key differentiating factors for many brokers.

Cultivating and managing relationships with mortgage brokers is both an art and a science. By recognizing the value brokers bring to the table and implementing

effective strategies to nurture these connections, private lenders can unlock a wealth of opportunities for growth, profitability, and industry leadership.

Remember, building strong broker relationships is not just about transactions; it’s about building trust, fostering collaboration, and creating long-lasting partnerships that benefit all parties involved. Embrace these principles, invest in relationship-building efforts, and watch your lending business thrive in today’s competitive landscape.

BENN JACKSON

Benn Jackson serves as the senior director of Wholesale Business Development at Constructive Capital, where his extensive real estate background adds value to the team. Before joining Constructive, Benn held senior roles at CoStar Group and ShowingTime (Zillow), showcasing his knack for sales and software solutions.

Jackson holds a real estate broker license in Illinois and maintains involvement in the real estate industry by operating a handful of rental properties. With a keen eye for investment opportunity, Jackson has completed two successful flips and managed renovation crews through multiple value-add projects.

18 PRIVATE LENDER BY AAPL

FUNDAMENTALS

LEARN. DIFFERENTIATE. GROW.

We now offer our signature Certified Fund Manager and Certified Private Lender Associate courses online, so you can earn your AAPL-backed certified status from the comfort of anywhere — and promote it everywhere.

CPLA Modules

• Intro to Business-Purpose Lending

• Legal Documentation

• Underwriting

• Loan Servicing

• Workouts

• Intro to Securities

CFM Modules

• Pros, Cons, & Considerations

• Structure

• Creation & Launch

• Administration

AAPL Certifications are members-only. Enroll online at aaplonline.com/courses for $349.

Instill Confidence With HighPerformance Loan Servicing

Regardless of your monthly volume, one aspect of lending that matters to all stakeholders in your operations is loan servicing, so vet these vendors carefully.

VINNY CIARDULLO, EASY STREET CAPITAL

oan servicing is more often a cost than a revenue generator, so it’s easy for private lenders to overlook the time and effort that should go into establishing and maintaining sub-servicing relationships. When servicing is neglected, the impact on your business is real; both your borrowers and employees bear the brunt.

Given the high-touch nature of business purpose loans, every contact with your borrower is either an opportunity to instill confidence in your platform or to sow the seeds of doubt that there may be a better ease-of-use option available. So, how does a private lender put the right pillars in place to optimize these touch points and monitor the performance of your servicer?

The simple answer is to start with a tight grasp of your own business capabilities and goals. Don’t look just at the present. What are you designing and executing that will have different requirements down the road?

Finding a servicer that best fits your business is more about understanding your abilities to work with the servicer than the servicer’s ability to perform within

20 PRIVATE LENDER BY AAPL

FUNDAMENTALS

the confines of “generally acceptable servicing practices.” The latter is certainly important and shouldn’t be discounted, but it’s also a conclusion that can be reached with relatively straightforward due diligence and a bit of market research.

The tougher nut to crack is what type of treatment your portfolio will get in the short term and long term as the servicer takes on more loans from you and potentially others. Subsequently, what burden does that leave to be shouldered by your organization to offer your borrowers the best experience possible?

WHAT TO ASK YOURSELF BEFORE ENGAGING A SERVICER

Before you engage a servicer, get clear about your intentions and how a servicer aligns with them. Some questions worth asking before you engage a servicer include:

What’s the strategy for your loans? If the loans are going to be sold, securitized, or financed, ensure your capital partners are comfortable with and will approve your servicing choice. More important for DSCR at this point, but if you are planning on securitizing DSCR loans, take the additional step of ensuring the servicer is satisfactory for rated execution as well.

How long are you going to hold the loans? The answer to this question will determine how quickly you will need to board loans to the servicer. Depending on whether loans are sold servicing released or retained may influence your decision to have the loans boarded at all. If loans are pledged or will be pledged to a financing facility, find a servicer familiar with the monthly remittance

requirements of repo lenders and procedures around depository account control agreements.

What’s the plan for ongoing involvement with the loans after sale? For RTL loans, and in some cases, DSCR, the lender will stay engaged after the sale of the loan and perform servicer oversight or asset management for the loans. If this is important to you as a seller of loans, consider what experience the servicer has with this type of transaction construct. Working with servicers that understand the needs of an asset manager will bolster your ability to better service your customers and keep the loan portfolio moving in a positive direction.

WHAT CAN A SERVICER PROSPECT HANDLE?

Once you’ve established a strategy for the loans, you can look into the capabilities of your counterparties. A logical place to start in these conversations is the servicer’s staffing and organizational structure.

What type of assembly line is in place, and how many people are required to make it function the correct way? Depending on the product and probability of delinquency in the loan portfolio, your expectations around experience and the number of loans that can be managed by a single servicing rep may vary. Additionally, are those reps also responsible for other lenders’ portfolios, and what impact will that have on their ability to service yours?

Another important question to consider is what access will you, as the lender, have to servicing personnel? Some servicers operate a “SPOC” or single-point-ofcontact model. In such cases, no matter the question, all traffic is filtered through

your account owner. This is great for consistency, but it is less effective for turn times related to specific loan-level inquiries because the SPOC is often removed from daily management of loans and acts more as a team lead.

Next, having a communication policy with your servicer is key for the success of the loan portfolio. It’s important to implement a system that creates as little confusion as possible for the borrowers and maintains a quality of contact any time the servicer communicates with the borrower. These scripts help keep the servicing notes up to date and align the servicer with the goals of the lender related to ongoing asset management and data collection. For example, on RTL loans that have a rehab component, any time the servicer is successful in reaching the borrower, it’s an opportunity to solicit updates on the rehab project or potential need for extensions.

Being proactive in the collection of this feedback can avoid chasing borrowers at later stages of their project when the focus should be on completion and the eventual exit of the loan. In assessing whether the servicer is the right fit for your communication needs, it’s also good to understand how the servicer is sending written notices, how quickly the servicer can run updated outreach campaigns, and what the call center or auto-dialer systems look like.

USING TECHNOLOGY

Technology is increasingly important as your portfolio grows. The good news for private lenders is there’s more focus on technology platforms that are used to originate and service business-purpose loans. Unfortunately, it’s still unlikely that you will see a larger-sized servicer using

SPRING 2024 21

servicing technology set up specifically for the management of RTL and DSCR loans.

The more likely scenario is they are using a version of their existing commercial loan servicing platform or 1-4 consumer residential servicing platform that’s been customized to handle the unique features of RTL and DSCR loans. A few areas to focus on, if this is the case, would be accrual of delinquent interest, cross-collateralization, the release of collateral from multiproperty loans, and correct treatment of interest for disbursements of Dutch vs. non-Dutch loans. This list has the potential to be much larger depending on the number of unique loan features offered.

Because the systems being used today to service these loans are not quite fit for purposes outside of the box, it results in calculations and tasks taking place outside of the system. As mentioned before, these gaps need to be filled by the servicer or within your organization. For this reason, ensure that audit procedures around balances and payments are

in place and frequently monitored. The servicer should be performing these audits on top of your own.

As our industry continues to become more institutionalized, there’s a growing need for actionable data. Most conversations that occur on the capital markets front begin with “Send me your performance history.” Being able to produce this data in a digestible format will pay dividends as you seek to introduce new partners to your platform for financing or sale. To make good on these requests, you must have a handle on the data received from the servicer:

What information will the servicer send?

How often will you receive this information?

Most importantly, does your organization have the ability to take this data and make it useful?

The cadence and type of data received will be more similar than not, but the terminology and purpose of specific data items can differ among servicers. As you

interview potential servicing partners, spend more time than you think is needed to get the onboarding completed correctly and the data mapping established. The efforts you put into this upfront will create the tools to monitor the portfolio as well as the performance of your servicer.

When it comes to the lender-servicer relationship, there’s a top for every kettle. The keyword here is relationship. Ask questions that will help focus efforts to serve your borrowers and capital providers and be prepared to fill in the gaps.

VINNY CIARDULLO

Vinny Ciardullo is the head of capital markets at Easy Street Capital. His background includes loan sales, securitizations, debt financing, and process and project management. For the past 10 years, Ciardullo has focused primarily on mortgage and real estate finance.

Prior to Easy Street Capital, Ciardullo was the senior vice president of capital markets for CIVIC Financial Services.

During his time with CIVIC, he managed the sale of more than $4 billion in loans. He also oversaw the use of more than $1 billion in senior secured financing and the execution of two businesspurpose securitizations. Ciardullo began his career in supply chain finance but transitioned to mortgage finance while working for the Royal Bank of Scotland.

22 PRIVATE LENDER BY AAPL

FUNDAMENTALS

BECOME A VALUED CORRESPONDENT LENDING PARTNER INTERESTED IN BECOMING AN APPROVED CORRESPONDENT? Access Financing For... White Labeled Origination Leverage to Scale Your Portfolio Nationwide Reach At RCN Capital, You’ll Experience: Visit RCNCapital.com \ Email CorrespondentLending@RCNCapital.com LONG-TERM RENTAL 30-Years FIX & FLIP 12-Months (Longer Term Options Available) NEW CONSTRUCTION 12 to 24-Months ©RCN CAPITAL, LLC. 2024 ALL RIGHTS RESERVED. NMLS #1045656. RCN CAPITAL, LLC IS LICENSED IN AZ (LICENSE #: 0932325), CA (LOANS MADE OR ARRANGED BY RCN CAPITAL, LLC PURSUANT TO A CALIFORNIA FINANCE LENDERS LAW LICENSE # 60DBO-46258), MN (MN-MO-1045656), AND OR (ML-5571). THIS IS NOT AN OFFER TO LEND. ALL OFFERS OF CREDIT ARE SUBJECT TO DUE DILIGENCE, UNDERWRITING AND APPROVAL. NOT ALL BORROWERS WILL QUALIFY AND NOT ALL BORROWERS THAT QUALIFY WILL RECEIVE THE LOWEST RATE OR BEST TERMS. ACTUAL RATES AND TERMS DEPEND ON A VARIETY OF FACTORS AND ARE SUBJECT TO CHANGE WITHOUT NOTICE.

Do You Really Know Your Cost Per Loan?

Lenders who have a comprehensive understanding of their costs can strategically position themselves in the market and leverage their knowledge to create a better profit margin.

DANA GEORGIOU, FIRE CAPITAL GROUP

In the intricate world of mortgage lending—regardless of forward, reverse, or private lending—understanding the costs associated with producing a loan is crucial. Such knowledge is necessary for mortgage origination companies to maintain or grow profitability and to offer competitive interest rates and fees to borrowers.

Understanding your cost to produce a loan is one area all private lenders should know and understand. However, many

private lenders entering the industry do not have a deep or extensive mortgage background and, therefore, may not know which best practices to use to measure their lending business’ success.

COST FORMULA

Although there are some variations among lenders regarding a standardized formula for determining the cost of a loan, the most widely used is:

Let’s do an example for a period we will call Q4 2024:

The lender shop produced 264 loans for just over $99 million with a gross revenue profit of $2,481,600.

The breakdown of costs based on the previous formula is $868,000 for loan officer compensation, $74,000 for marketing (origination costs) plus $205,000 in processing/underwriter salaries plus $1,500 in compliance/ regulatory costs plus $180,000 in closing/post-closing costs plus $32,000 in capital/carry costs. The total of these costs is $1,360,500.

The easy math here is in calculating profit pretax: Revenue minus costs, which in this exercise nets $1,121,100, which is a healthy profit margin of 45%. But to understand it as a cost per loan, the math needs to take another step. You must divide by the number of loans: Costs = $1,360,500/264 loans = $5,153 to produce each loan in Q4 of 2024.

Inaccurate calculations or not doing this exercise at all prevents you as a lender from intimately knowing your shop and where you are spending the dollars you have worked so hard to earn. Without understanding your cost per loan, how

24 PRIVATE LENDER BY AAPL

LET: EQUAL: Co Origination Cost Cpu Processing/Underwriting Costs Ccr Compliance/Regulatory Costs

cpc Closing/Post-Closing Costs

co Capital/Overhead Costs

Number of loans in a set period C o + C pu + C cr + C cpc + C co N C total = FUNDAMENTALS

C

C

N

will you assess where you have potential cost savings? Or whether you are able to lower your profit margin to lower rates and thereby potentially increase volume?

BREAKING DOWN THE COSTS

Let’s break down each of the cost categories:

1 Origination Costs. Loan officer compensation will usually be the largest cost in this formula. There are different schools of thought about compensating originators, but generally they are calculated based on basis points (BPS) times total loan production or by a percentage

of revenue per loan. Although loan origination compensation will be the largest cost in the origination bucket, marketing/advertising must also be part of the origination cost calculation. These expenses may include things like lead generation services, conferences, or the creation of a website.

2 Processing/Underwriting. There are two components to consider in the processing/underwriting category: personnel costs and technology. Depending on the size of your lending shop, you may not utilize processors; instead, the originator may fill that role. Whatever your model, the total salaries tied to a processor or underwriter

involved in the total loan production should be used. Technology costs would include any tool being used in your production model such as CRMs, LOS, and/or servicing platforms. Depending on the size of your shop, these tools can vary widely, as well as the costs associated with them.

3 Compliance and Regulatory. For the most part, private lending has very few regulatory requirements that have a significant impact on the cost of producing a loan. However, several states require lenders to be licensed. If you are lending in these states, or if you require your originators to be NMLS registered, make sure you

SPRING 2024 25

are including these types of costs in your calculation. An additional, often overlooked, oversight component is quality control. Whether you have an in-house QC group or you are using a vendor to provide this service, don’t forget to group that cost into the compliance and regulatory cost bucket.

4 Closing and Post-Closing. Much like processing and underwriting, this bucket is primarily made up of salaries for any positions supporting the closing and post-closing functions. However, if there are other costs (e.g., legal documents) and you don’t pass those costs through to the consumer, they should be included in your calculation.

5 Capital and Overhead. As a lender, the cash you are using to fund your loan production usually comes with a cost. This cost can vary with the source as well as the time that cash (capital) is being extended. Additionally, depending on the size, type of product you offer, and your overall model,

the cost of capital can wildly vary from lender to lender. While cash is most certainly king, don’t forget to include any general overhead costs. Things like rent, phone systems, etc. are part of the overhead associated with mortgage loan production.

Although what makes up the cost to produce a loan is generally considered to be standard, the actual cost to produce a loan varies. Lenders located in states with lower costs of living may be able to take advantage of lower salaries versus lenders in California, for example.

The dynamic nature of the private lending industry requires lenders to adapt continuously. Understanding costs enables you to identify areas of improvement and implement changes that help you stay competitive and resilient. By understanding the cost of producing a loan, you have a deeper understanding of the profit (or loss) within your shop, which is essential for making informed decisions about the types of loans to offer and the markets to

target or expand to. Lenders who have a strong or comprehensive understanding of their costs can strategically position themselves in the market and potentially leverage this knowledge in their loan products while creating a profit margin.

Consider doing a deep cost analysis of your lending firm if you haven’t already. The results can lead to a quicker, more efficient loan process and/or loan decision. This in turn can bring down the cost of producing a loan and improve the customer experience. Additionally, knowing the cost per loan will help you develop more accurate budgets and forecasts. This facilitates better financial planning and helps in allocating resources efficiently.

Depending on the size of your lending shop, you may want to consider a thirdparty financial consulting company to dig into your costs and evaluate your spending. If you do your review internally, at minimum, using an accounting tool or even a simple Excel spreadsheet will help illustrate your cost to produce a loan.

Dana Georgiou is a mortgage professional with nearly 30 years of mortgage lending experience, including senior/executive management roles in sales, marketing, and lending operations. She has a deep background in mortgage consulting and has worked in all channels of the mortgage business. Georgiou is an avid speaker and a staunch advocate for education in the mortgage lending space.

26 PRIVATE LENDER BY AAPL

FUNDAMENTALS

DANA GEORGIOU

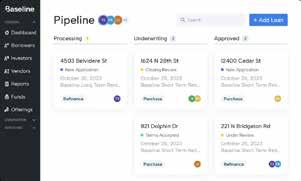

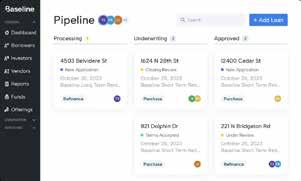

SPRING 2024 27 Streamline Your Private Real Estate Lending Business All your private lending operations in one place. Discover more at www.BaselineSoftware.com Eliminate point solutions Connect your entire ecosystem Create quotes, manage documents & more. Speed to close. Power to scale Offering a simpler, more reliable, and faster way for real estate investors to access financing for investment properties. • Fix and Flip / Bridge Loans • New Construction / Infill Loans • DSCR Single Asset Rental Loans • Rental Portfolio Loans • Cash-Out Refinance Loans Visit kiavi.com NMLS ID 1125207 NREIG provides customizable insurance solutions for real estate investment properties. Coverage for all phases of occupancy Monthly reporting Make changes as needed No minimum-earned premiums Force-placed alternative option for lenders Know your interest is adequately protected. Visit NREIG.com/PL to learn more or refer a borrower.

State of the Private Lending Industry: Reflecting on 2023 with an Eye Toward 2024

Lightning Docs, the official loan documents and loan document platform of the American Association of Private Lenders (AAPL), recently shared updated annual bridge and rental loan data that shows the current state of the private lending industry.

28 PRIVATE LENDER BY AAPL MARKET TRENDS

NEMA DAGHBANDAN, ESQ., LIGHTNING DOCS

ince 2018, Lightning Docs has tracked data for more than 54,000 loans at an aggregate of $29.7 billion, using information generated from users of its platform. During an average month, Lighting Docs sees about 200 users, more than 2,000 loans, and more than $1 billion in loan volume. In February, Lightning Docs released annual data for 2023, breaking down interest rates and loan volume for both bridge and rental loans.

The updated annual data confirms that 2023 did not turn out to be as bad a year for the private lending industry as some forecasters were initially concerned it would be. Overall, after a rough January and February, most markers of the industry arced up in March and then remained at a plateau for the remainder of the year.

BRIDGE LOAN VOLUME UP BY 25%

For our purposes, we are defining a bridge loan as an interest-only, short-term loan of 36 months or less that can be used for fix-and-flip projects, construction, including ground-up, or as a short-term financing mechanism with no construction (i.e., a true bridge). When we tracked the same pool of 123 users who used the system from Jan. 1, 2023, the data showed loan volume increased by 25% from January 2023 to January 2024 (see Table 1). Viewed from March 2023 to December 2023, volume was down by 8%, reflecting the plateau effect we saw across the board with seasonality decreasing from December through February annually.

BRIDGE LOAN INTEREST RATES HOLD AT 11%, LOAN VOLUME INCREASES

The national average for interest rates for bridge loans last year stayed within 11%,

starting at 11.08% and reaching a low of 10.97% before steadily cresting upward to 11.48% by December. Average transaction sizes stayed mostly flat throughout the year, ultimately increasing slightly, starting at $407,801 and then dipping to a year-low of $401,402 before gradually climbing to a

high of $462,753 at the end of the year (see Table 2). To ensure meaningful results, we excluded outlier interest rates below 4% or above 15% and any loan amounts over $2 million or less than $50,000.

Behind the national average is a broad range of actual interest rates. Our data

SPRING 2024 29

January 2023–January 2024 11.60% 11.50% 11.40% 11.30% 11.20% 11.10% 11.00% 10.90% 10.80% 10.70% $470,000 $460,000 $450,000 $440,000 $430,000 $420,000 $410,000 $400,000 $390,000 $380,000 $370,000 $407,801 $428,581 $424,009 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Seo-23 Oct-23 Nov-23 Dec-23 Jan-24 $403,284 $401,402 $443,966 $435,790 $443,565 $427,754 $425,627 $462,753 11.08% 11.11% 11.15% 10.97% 11.23% 11.25% 11.20% 11.12% 11.24% 11.30% 11.40% 11.48% 11.44% $463,673 $411,117 768 731 1045 948 1018 1099 1071 1204 1059 1173 1174 995 962

1.

LOAN VOLUMES

SAME USERS January 2023–January 2024 Jan-23 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan-24 1400 1200 1000 800 600 400 200 0 123 Users 5% 43% 9% 7% 8% 13% 11% 0% 3% 12% 15% 3% 25% 8%

TABLE 2. BRIDGE LOAN RATES AND AVERAGE LOAN AMOUNTS

TABLE

BRIDGE

BY

shows that 38% of loans actually went for an 11% to 11.99% interest rate while 35% were at a 12%-12.99% rate. At the other end of the spectrum, a 10th of loans were at 10-10.99% (see Table 3).

Between 2022 and 2023, California, Florida, and Texas remained the top three states in terms of loan volume (see Table 4). Massachusetts dropped lower, while New Jersey moved into the top 10, which is surprising because of the state’s onerous foreclosure process and meaningfully lower average interest rates.

Given that bridge loans are intensely local business, we also take a look at loans at the county level from year to year (see Table 5). The top three counties

30 PRIVATE LENDER BY AAPL

T A B L E F U N D I N G N E W L Y L A U N C H E D CLOSED LOAN PRODUCTS WE BUY INCLUDE: Residential (1-4 Family) Bridge 1 5 M a p l e S t , S u m m i t N J 0 7 9 0 1 2 1 2 3 9 3 4 1 0 0 w w w t o o r a k c a p i t a l c o m W E P R O V I D E I N S T I T U T I O N A L C A P I T A L F O R L E N D E R S N A T I O N W I D E W E B U Y T H E L O A N ; Y O U K E E P T H E C U S T O M E R T O O R A K C A P I T A L P A R T N E R S I S A R E A L E S T A T E D E B T I N V E S T O R B A C K E D B Y K K R & C O . T H E F I R M , W H I C H B U Y S R E A L E S T A T E L O A N S I N T H E U S A N D U K , H A S F U N D E D O V E R $ 1 0 B I L L I O N L O A N S O N R E S I D E N T I A L , M U L T I F A M I L Y , A N D M I X E D - U S E P R O P E R T I E S T O D A T E . For more information about our current product offerings, email us at BD@toorakcapital.com Ground-Up Construction Multifamily & Mixed Use DSCR / Rental Programs O V E R 3 0 , 0 0 0 L O A N S F U N D E D T O D A T E MARKET TRENDS 15% 2% 10% 38% 35% TABLE 3. BRIDGE LOAN INTEREST RATES January 2024 <10% 10% 11% 12% >-13% Average Interest Rate: 11.4% 88% of loans were between 11.0%-12.99% Rate

Cook, IL Cook, IL

San Diego, CA San Diego, CA

Maricopa, AZ Miami-Dade, FL

Fulton, GA Orange, CA

Orange, CA Dallas, TX

Travis, TX Riverside, CA

Philadelphia, PA Lee, FL

Duval, FL Philadelphia, PA Riverside, CA Maricopa, AZ

SPRING 2024 31

TABLE 4. TOP BRIDGE STATES BY LOAN VOLUME

2023 California California Florida Florida Texas Texas Georgia Illinois Illinois Georgia Massachusetts North Carolina Pennsylvania New Jersey North Carolina Massachusetts Tennessee Pennsylvania Ohio Ohio 2022 2023

TABLE 5. TOP BRIDGE COUNTIES BY LOAN VOLUME

2022

Los Angeles, CA Los Angeles, CA

1% 6% 2% 1% 2% 2% 6% 1% 3% 6% 21% 3% 1%

for loan volume likewise retained their top spots—Los Angeles, California; Cook County, Illinois; and San Diego, California—while other counties saw dramatic movement. Maricopa, Arizona, plummeted from fourth to 10th place, while Miami leapt by 21 spots, landing in fourth place.

TERM RENTAL LOANS SHOW STEADY INCREASES

What we describe as term rental loans are 30-year DSCR (Debt Service Coverage Ratio) loans. In 2023, the trend lines for these loans reflect what we saw with

bridge loans. From January 2023 to January 2024, the rise in loan volume is even more pronounced, with an increase of 46%, based on our sample of 34 users (see Table 6). The biggest monthly jump—32%—occurred in March. For the remainder of the year, there were moderate ups and downs on a month-to-month basis but no massive sea change. When viewed from March 2023 to December 2023, the trend for term rental loans followed the same pattern as bridge loans, flattening out and ending with a loan volume slightly lower by 6%. (We used similar limits to exclude outlier interest rates and loan volumes.)

TERM RENTAL LOAN INTEREST RATES SHOW MORE SIGNIFICANT CHANGE

Unlike bridge loans, the national average for interest rates for term rental loans saw more of a swing, from a low of 7.87% in February to a peak of 8.76% in November last year (see Table 7). Loan volumes hit the highest point at the start of the year, at an average of $300,000 in January, before dipping to their lowest in the following month, at $246,278. After a spike in March, the changes in loan volumes evened out, with a series of upward and downward drifts, closing out at $249,765 in the final month of last year.

32 PRIVATE LENDER BY AAPL

MARKET TRENDS 469 490 647 653 738 717 827 697 805 715 611 685

January 2023–January 2024 Jan-23 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan-24 900 800 700 600 500 400 300 200 100 0 34 Users 605 4% 8% 13% 32% 6% 3% 15% 16% 15% 11% 15% 2% 46% 6%

TABLE 6. MONTHLY RENTAL LOAN VOLUME BY SAME USERS

SPRING 2024 33 973.241.3300 sociumllc.com suntera.com LET’S TALK

Expertise in Private Lending Funds • Fund launch consulting • Fund accounting & admin

Loan administration services

Portfolio reporting

Investor servicing

Tax & compliance

Unparalleled

•

•

•

•

January 2023–January 2024 9.00% 8.80% 8.60% 8.40% 8.20% 8.00% 7.80% 7.60% 7.40% 7.20% $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 $300,052 8.00% 7.87% 8.01% 7.93% 7.79% 7.89% 8.01% 8.14% 8.32% 8.60% Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Seo-23 Oct-23 Nov-23 Dec-23 Jan-24 $246,278 $286,659 $265,769 $258,179 $246,558 $255,239 $267,141 $270,843 $246,380 $237,636 $268,507 $249,765 8.76% 8.67% 8.26%

TABLE 7. RENTAL LOAN RATES AND AVERAGE LOAN AMOUNTS

Interest rates were also slightly more homogenous than those for bridge loans, with 50% of loans at the 8. % to 8.99% rate, leaving 39% of them above 9.0 % and just 11% under 8% (see Table 8).

The top 10 rental states by volume saw more movement last year as well (see Table 9). The top two states for 2022, Texas and Florida, each dropped a spot in 2023 as Pennsylvania moved from fourth to first and Ohio from 10th to fifth. California, a state where

it is difficult to do rental loans, now no longer registers in the top 10.

When discussing the migration changes with the largest DSCR originators, it’s a simple math problem. DSCR loans are rated based on the ratio of income produced at the property divided by the loan payment inclusive of property insurance and property taxes. When interest rates were low, many markets penciled well, but as interest rates effectively doubled from 2022 to 2023,

the dynamic shifted dramatically toward more affordable real estate markets such as Ohio and Pennsylvania.

The highest-ranked counties (see Table 10) look very different for rental loans than bridge loans, except Cook County, Illinois, which sits on both lists due to the diversity of the housing stock between the city of Chicago and its immediate suburbs.

For rental loans, the top three counties held their places between 2022 and 2023: Cook County, Philadelphia, and Essex County, New Jersey. Meanwhile, Harris and Dallas counties sank while the counties of New Haven, Connecticut, and Miami fell below the top-10 threshold.

For more information about Lightning Docs, visit https://lightningdocs.com/.

Nema Daghbandan, Esq., a partner with Geraci LLP manages the firm’s Real Estate Finance Group. Daghbandan’s practice entails all facets of lending matters across the country, including but not limited to the preparation of loan documents and addenda in all 50 states, loss mitigation efforts, preparation and negotiation of secondary market documents, including loan sales and participation agreements, line of credit/ warehouse facilities, hypothecations, and securitizations. Daghbandan advises financial institutions on various lending matters, including licensing, usury and foreclosure. Daghbandan is also an expert in default management and leads the firm’s nonjudicial trustee group.

34 PRIVATE LENDER BY AAPL

NEMA DAGHBANDAN, ESQ.

MARKET TRENDS 39% 11% 50%

9. TOP RENTAL STATES BY LOAN VOLUME 2022 2023 Texas Pennsylvania Florida Texas New Jersey Florida Pennsylvania New Jersey Illinois Ohio New York Illinois Connecticut New York California North Carolina North Carolina Maryland Ohio Indiana 3% 1% 1% 1% 5% 1% 1% 1% 5% 1% TABLE 10. TOP RENTAL COUNTIES BY LOAN VOLUME 2022 2023 Cook, IL Cook, IL Philadelphia, PA Philadelphia, PA Essex, NJ Essex, NJ Harris, TX Baltimore, MD Dallas, TX Franklin, OH New Haven, CT Harris, TX Duval, FL Cuyahoga, OH Baltimore, MD Duval, FL Miami-Dade, FL Dallas, TX Tarrant, TX Wayne, MI 4% 25% 2% 8% 1% 4% 2% Average Interest Rate: 8.3% 89% of loans were between 8.0-9.99% <8% Rate 8% >9%

TABLE 8. JANUARY 2024 RENTAL LOAN INTEREST RATES

January 2024 TABLE

You won’t find REI news there.

Stay up to date on the issues your borrowers care about with a free Think Realty membership. We are the premier media platform for real estate investors, offering news, education, tools, and resources across every sector of the industry.

Learn more and start for free today at thinkrealty.com/join.

2024 Real Estate Investor Activity: Bull or Bust?

Institutional investors may be pulling back, but smaller, local investors see opportunity.

DAREN BLOMQUIST, AUCTION.COM

There’s been some recent buzz about institutional investors pulling back on property acquisitions, but the small-volume local investors who account for the majority of investment property purchases are bullish about ramping up acquisitions in 2024 after being constrained by a lack of inventory in 2023.

“We just need more inventory,” wrote one Tennessee-based real estate investor in response to an Auction.com

buyer survey in January 2024. “How I long for the days when we’d win two or three auctions a month!”

That sentiment was echoed by a majority of survey respondents, with 60% saying they expect their investment property acquisitions to increase in 2024 compared to 2023. Another 34% said they expect their investment property acquisitions to stay the same in 2024. Only 6% said they expect their acquisitions to decrease in 2024.

1. OUTLOOK FOR 2024 INVESTMENT PROPERTY ACQUISITIONS

CARING FOR COMMUNITIES

Buyers with a primary investing strategy of renovate-and-rent were more likely to say they plan to increase property acquisitions next year (see Table 1), with 67% of survey respondents with renovate-and-rent as their primary investing strategy saying they expect acquisitions to increase in 2024.

Fifty-six percent of buyers who said their primary investing strategy was renovating and reselling to owner-occupants expect their property acquisitions to increase in 2024, while 37% expect acquisitions to remain the same as in 2023, and 7% expect acquisitions to decrease.

Regardless of investing strategy, most Auction.com buyers are typically local community developers who purchase properties locally and care about the communities where they invest.

“We’ve revitalized entire areas … and have greatly increased property values and decreased crime rates in every area we buy,” wrote the Tennessee-based investor, contrasting his small business with mammoth institutional investors who buy thousands of properties a year across the country in a variety of markets.

More than three-fourths (78%) of survey respondents described themselves as

36 PRIVATE LENDER BY AAPL

MARKET TRENDS

Expecting Decrease Expecting No Change Expecting Increase

Renovate-and-Rent Investors (Outer Ring) 31% 2% 7% 37% 56% 67% Renovate-and-Resell Investors (Inner Ring)

TABLE

Source: Auction.com January 2024 Buyer Survey

TABLE 2. INVESTOR HOME PURCHASES BY VOLUME BAND

local community developers or local investors. Another 13% described themselves as owner-occupant buyers, while only 3% described themselves as institutional investors.

INSTITUTIONAL INVESTOR RETREAT

An analysis of public record data from ATTOM Data Solutions in Table 2 shows that the biggest decrease in investor

purchases in 2023 came among the large institutional investors purchasing more than 1,000 properties a year. Purchases by those investors were down 84% from 2022 to 2023, while purchases among investors purchasing between 100 and 1,000 properties a year were down 60%.

Notably, buying entities associated with many iBuyers and single-family rental operators saw property acquisitions decrease dramatically in 2023 compared

to 2022. Purchases by Opendoor Property Trust 1 were down 67%, and purchases by SFR JV 2 Property LLC, an entity associated with Tricon Homes, were down 86%.

Purchases among all investors were down 30% between 2022 and 2023, which was just slightly higher than the overall decline in home sales of 26%. Purchases by investors buying 10 or fewer properties a year were down 18% in 2023, outperforming the overall decline in home sales by 8 points.

SPRING 2024 37

Total Investor Purchases Share of All Investor Purchases

Source:Auction.com analysis of public record data from ATTOM Data Solutions

10 or Fewer 11 to 100 101 to 1,000 More than 1,000 Total Investor Purchases 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 6% 6% 11% 78% 2% 6% 10% 81% 68% 11% 9% 12% 9% 9% 11% 10% 5% 2% 1200% 1000% 800% 600% 400% 200% O% 2019 2020 2021 2022 2023 72% 83%

And purchases by those smaller-volume buyers accounted for the majority of investor purchases in 2023. Buyers purchasing 10 or fewer properties a year accounted for 83% of all 2023 home sales to investors, while buyers purchasing 100 or fewer properties a year accounted for 93% of all investor purchases, leaving just 7% for buyers purchasing more than 100 properties a year. Buyers purchasing more than 1,000 properties a year accounted for only 2% of all 2023 home sales.

LOCAL INVESTOR PROFILE

Data from the survey of Auction.com buyers align with the public record data: 70% surveyed said they purchased two or fewer properties in 2023, and an additional 26% said they purchased between three and 10 properties for the year. Only 4% said they purchased 11 or more properties in 2023.

Many of the smaller-volume investors driving the majority of investor purchases are buying close to where they live. The median distance between properties purchased and buyer mailing addresses was just 16 miles for properties purchased on the Auction.com platform in 2023. Even for sales of properties sold via online auction, which allows buyers from anywhere in the country to bid, the median distance was 21 miles.

Although most small-volume investors using Auction.com are buying locally, many prefer to leverage technology to make buying more convenient: 46% said their preferred acquisition method was an online auction or remote bid auction, both of which allow buyers to bid from anywhere with an internet connection. Another 37% said their preferred acquisition method

Q&A WITH DAREN BLOMQUIST: WHY INSTITUTIONAL/IBUYERS ACTIVITY IS DOWN

AAPL: Why is institutional activity/iBuyers down so much compared to mom-and-pop investors?

Blomquist: There are a lot of factors at play, but I think it mostly boils down to most of the institutional investors being more monolithic and more susceptible to changes in market conditions, namely mortgage rates. Just a few of those investors pulling back has a big impact on the overall volume of the group. And these investors are operating on pretty rigid business models that can be disrupted more easily by shifts in the market.

Meanwhile, smaller investors are such a diverse group with more flexible investing models that they can adjust to market conditions. Even if some of them pull back on purchasing many others are not pulling back. And even if renovating and reselling a home doesn’t make sense, many of these investors can switch to holding for rent as a backup exit strategy (or vice versa).