SPECIAL FEATURE: AAPL'S ANNUAL CONFERENCE REVIEW The Official Magazine of AAPL | Winter 2023 ADVOCACY HMDA Rule Change Page 6 STRATEGY A Value-Add Tactic That Earns Customer Loyalty Page 46 OPERATIONS Protecting Your Business in a Changing Market Page 60 LENDER LIMELIGHT Ruben Izgelov Living the American Dream—and Transforming an Industry

Trust Knowledge Partner DEDICATED TO HELPING OUR CLIENTS BUILD WEALTH THROUGH REAL ESTATE ResidentialCapitalPartners.com

WINTER 2023 3 6 ADVOCACY Update on HDMA Rules 12 CASE STUDY 12 Baltimore Project Targets Renters Earning

Area Median Income 16 Finding the Right Partner Was

Deal 20 FUND

Starting

Management

Research, Research, Research 28 MARKET

28 Capital Market Movements Do Impact Private

Who

Wall Street Money 32 What

Market Downturn Means for Real Estate Investing

2023 CONTENTS WINTER 2023 38 2022

P 39 Photos & Testimonials 42 Award Recipients 46 STRATEGY Beyond Capital: Lenders Can Help Investors By Providing Expertise 50

Living the Am erican

and Transforming an Industry with Ruben

56 OPERATIONS 56 REO Management When the Property Isn't Local 60 Protecting Your Private Lending Business During a Capital Market Disruption 64 Closing Small-Balance Deals Amid CRE Market Uncertainty 70 Legal Considerations When Structuring Multi-Lender Loans 6 76

76 Getting

80

84

Capital

88 PROFESSIONAL DEVELOPMENT Titan of Real Estate

Garrett

94 VENDOR GUIDE 98 LAST CALL When Faced with

Difficult Choice – Make the Leap! 46 60

Between 60% and 100% of

Instrumental in Bayshore Property

MANAGEMENT

My Fund

Journey:

TRENDS

Lenders

Don't Use

a

in

CONFERENCE RECA

LENDER LIMELIGHT

Dream—

Izgelov

FUNDAMENTALS

Both Right: The “Horse” and the “Jockey”

Building a True Culture of Customer Service

Raising Private Lending

with Banks

Law:

Sutton

a

4 PRIVATE LENDER CORPORATE & SECURITIES • Securities Offerings and Compliance • Entity Formation • Corporate (Governance, M&A, Capital Markets) • Mortgage Licensing LITIGATION & BANKRUPTCY • Judicial Foreclosure • General Business Litigation (Partnership, Investor, and Vendor Disputes) • Creditor Representation in Bankruptcy • Other Mortgage Loan Litigation BANKING & FINANCE • Foreclosure/Loss Mitigation • Nationwide Loan Documents • Nationwide Lending Compliance LIGHTNING DOCS • Fully Automated, Customizable Loan Documents • Documents are Constantly Updated and are Capital Market Approved • Covers All 50 States • No Redraw Fees or Contract Period OTHER SERVICES • Conference Line • Originate Report Magazine • Lender Lounge Podcast

EDDIE WILSON CEO, AAPL

LINDA HYDE Managing Director, AAPL

KAT HUNGERFORD Executive Editor

DAVID RODRIGUEZ Design

CONTRIBUTORS

Katie Bean

Gregory Becker Daren Blomquist

Wade Comeaux

Ben Fertig

Tom Hallock

Pam Hoepfl

Linda Hyde Melissa Martorella

Madelaine Ryan

John Santilli

William J. Tessar

COVER PHOTOGRAPHY

Eugene Krasnaok

Private Lender is published quarterly by the American Association of Private Lenders (AAPL). AAPL is not responsible for opinions or information presented as fact by authors or advertisers.

SUBSCRIPTIONS

Visit aaplonline.com/subscribe.

BACK ISSUES

Visit aaplonline.com/magazine-archive, email PrivateLender@aaplonline.com, or call 913-888-1250.

For article reprints or permission to use Private Lender content including text, photos, illustrations, and logos: E-mail PrivateLender@aaplonline.com or call 913-888-1250. Use of Private Lender content without the express permission of the American Association of Private Lenders is prohibited.

www.aaplonline.com

Copyright © 2023 American Association of Private Lenders. All rights reserved.

FROM THE CORNER OFFICE

MAKING “OLD" NEW AGAIN

As we begin 2023, we wish you a happy and successful new year. Yet we can’t help but consider the various challenges of “new.” “New” can be invigorating, a reinvention, a fresh start. “New” can also suggest leaving behind the past, erasing hard - won lessons and undermining the value of wisdom and experience.

So, as we launch this year with a multitude of new ideas and fresh projects, we also challenge ourselves (and you, our reader) to reflect on the path taken to get to today, especially as we consider the unknowns ahead.

Where have you found the most success in your private lending business? The greatest challenge? The most professional satisfaction—or dissatisfaction? What is your most valuable “lesson learned?”

At AAPL, we’ve uncovered a common thread that has proven itself repeatedly, both internally and in discussions with industry professionals: We find the most success and sense of accomplishment when we are able to be nimble and flexible, while still holding fast to our underlying principles and mission.

Private lenders have built their businesses with an agility where institutional lenders lumber, a swiftness where banks are slow, and a flexibility where others can only return a “no.”

The reverse is also true: When we have tried too hard to conform to other’s expectations for how and when we perform, we have faltered. In uncertain times, being able to make decisions quickly while still maintaining our core tenets has enabled stable growth.

What decisions have brought your lending program the most stability? Or, conversely, the least? What are your “secret sauce” principles that reverberate throughout your operations and provide a guiding light for decision-making?

As we navigate the inevitable “news” of 2023 new normals, new market conditions, new shiny-penny opportunities, new challenges we encourage you to revisit and reconsider the value of “old”: wheels already invented, lessons already learned, and values already established.

Managing Director, American Association of Private Lenders

WINTER 2023 5

Gene Buccola Casey Busch

Michael Fordham Randy Fuchs

Update on HDMA Rules

AAPL sends letter to Congress urging definition change that exempts business-purpose loans.

Effective Jan. 1, 2018, Congress enacted new Home Mortgage Disclosure Act rules requiring most private lenders to furnish a 110-datapoint Loan Activity Report to the Consumer Financial Protection Bureau (CFPB) for each residential mortgage loan application taken, regardless of a loan’s business or consumer purpose.

Since then, AAPL has been communicating regularly with Congress and the CFPB, including meeting with congressional staff and CFPB leadership. Upon request, we submitted formal comments on the effectiveness of coverage, data points, disclosure requirements, and operational and compliance costs.

This year for our annual Day on the Hill advocacy outreach efforts, we took things a step further: We hope to work closely with policymakers to enact a simple definition change that not only aligns HMDA with precedent regulation but exempts business-purpose loans from HMDA reporting requirements entirely. Here is the letter we sent to our Capitol Hill contact as a summary and follow-up to that meeting. We hope to have more to update in the coming months, and we remind our constituents that change is often a long road.

ADVOCACY

November 14, 2022

Senator Thom Tillis

113 Dirksen Senate Office Building Washington, DC 20510

RE: 12 U.S.C. 2802(2) definition of a mortgage loan in the Home Mortgage Disclosure Act

Dear Senator Thom Tillis,

We are writing on behalf of the American Association of Private Lenders (AAPL). AAPL is the oldest and largest trade association for private lending professionals and represents more than 650 small-business members that make non-consumer loans secured by real estate.

These loans primarily go to other small businesses to return distressed property to the market, revitalize aging housing stock, increase affordable housing inventory, and support local jobs. Banks do not generally fund these kinds of loans due to a combination of regulation and risk, so our industry fills a crucial gap.

Earlier this year, we met with a member of your staff regarding the Home Mortgage Disclosure Act (HMDA), where we discussed the Act’s burden on our membership and industry. At the conclusion of that meeting, your representative indicated it would be helpful for us to provide specific language on our requested change for possible inclusion in a bill. We greatly appreciate the opportunity not only to meet with your representative, but to work together to reduce regulatory burden while improving the accuracy and fairness of HMDA compliance.

We request that Congress enact the following underlined addition to 12 U.S.C. 2802(2)’s definition of a mortgage loan:

the term “mortgage loan” means a loan which is secured by residential real property or a home improvement loan made primarily for personal, family, or household purposes

The requested addition follows precedent language in the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), which define credit transactions as “credit offered or extended to a consumer primarily for personal, family, or household purposes [12 C.F.R. 1024 et seq.].

We request this change because under the current definition of a mortgage loan, the Home Mortgage Disclosure Act requires small-business private lenders that transact non-consumer mortgage loans to submit information to the Consumer Financial Protection Bureau. Much of this information is not applicable to this type of loan and represents a significant compliance and operational cost burden.

WINTER 2023 7

HMDA was enacted to address concerns that financial institutions had contributed to the decline of some neighborhoods by failing to provide adequate home financing. It was intended to gather data to aid public officials in targeting public investment where it was needed most. It is a law that relies upon public scrutiny for effectiveness.

HMDA requires financial institutions to compile and transmit over 110 data points (age, race, ethnicity, etc.) for each residential mortgage application processed on an annual basis. Lenders are subject to the regulation based on the type of property, rather than purpose of the loan or the borrower. As a result, both business-purpose and consumer loans are subject to HMDA reporting.

Private Lenders make business-purpose loans, usually to business entities, and are not in the business of making consumer residential mortgage loans. The required data points are largely irrelevant to their loans.

In our dialogue with the CFPB, representatives told us that because Congress defined a mortgage loan more broadly in HMDA than precedent regulation, it signaled a broader scope of CFPB oversight. Congress must revise the definition for any change. As small businesses, private lenders feel the additional operational cost keenly. The CFPB’s 2020 HMDA Small Entity Compliance Guide” is 132 pages and still includes links to additional explanatory/clarifying documentation. This represents the compliance requirement for just one regulation amid many to which lenders are subject. Even the CFPB has recognized that the opaqueness of its rules represents a significantly greater burden on small businesses than it does institutional lenders. CFPB Director Rohit Chopra wrote in his June 2022 Rethinking the approach to regulations” letter: … unnecessarily complex guidance and rules impede consumer protection, and instead simply increases compliance costs, which benefits larger market players and their high-priced lawyers. Unnecessary complexity places new entrants and small firms at a disadvantage compared to their larger competitors.”

Additionally, HMDA is a bright line example of unequal application of the law: certain minimum transaction threshold exemptions apply to some lenders (depository institutions) but not others (non-depository private lenders). There is no published reasoning on why this is. But it serves to punish small business private lenders with more red tape and time - consuming/costly compliance. Finally, HMDA’s inclusion of non - consumer loan reporting requirements hits another mark on impeding consumer protection: because the report contains no method to indicate a loan is not a consumer loan, these loans skew the results, regardless of the intent behind gathering non-consumer loan data. Private lenders expend a significant outlay to comply with complex guidance and rules, only for their good faith compliance to negatively impact the accuracy of the CFPB’s data set. In summary, we would like to see HMDA align with TILA, RESPA, and the SAFE Act in its definition of a mortgage loan to: More properly solely regulate consumer loan reporting to the Consumer Financial Protection Bureau.

Release our membership from a burden that even the CFPB recognizes creates an unfair disadvantage.

Increase the accuracy of HMDA reporting by removing uncategorized non-consumer loan information.

Sincerely,

Eddie Wilson CEO AAPL

Linda Hyde Managing Director AAPL

Nema Daghbandan AAPL General Counsel Geraci LLP

8 PRIVATE LENDER

Streamline your private and commercial loan operations from application to servicing with a modern, white-labeled experience.

Bridge · Fix & Flip · Rental/DSCR · Construction · CRE · SBA · Business Funding

CRM: Manage leads and referral partner relationships with built-in tools for email, SMS, dialers, and more.

LOS: Close more loans faster with webforms, doc/file upload portal, and doc generation engine.

Marketplace: Match your loans with lenders based on eligibility across verticals like bridge, fix & flip, construction, DSCR, CRE, SBA, equipment, term loans, line of credit, MCA, and factoring.

Price Engine: Industry’s first automated pricing engine for bridge, fix & flip, construction, DSCR, and business loans.

Loan Servicing: Manage all loan servicing activity including draws, payments, escrows, payoffs, fractional investors, and more.

Turnkey, cloud-based and fully customizable platform – no software download needed.

Multi-level broker channels for correspondents, net branches, and referral partners.

Prepopulate loan docs, forms, and disclosures in Word or PDF with unlimited e-signatures.

Third-party integrations and APIs for credit, AVM, BPO, income/asset verification, inspections, and more. 888-400-6516 LendingWise.com freetrial@lendingwise.com Made with love in Miami, FL

Schedule a tour today and receive a Risk Free Trial at lendingwise.com/demo.

We help brokers and lenders scale their business with our software.

We now offer our signature Certified Private Lender Associate and Certified Fund Manager courses online, so you can earn your AAPL-backed certified status from the comfort of anywhere — and promote it everywhere. CPLA Modules • Intro to Business-Purpose Lending • Legal Documentation • Underwriting • Loan Servicing • Workouts CFM Modules • Intro to Securities • Pros, Cons, & Considerations • Structure • Creation & Launch • Administration AAPL Certifications are members-only. Enroll online at aaplonline.com/courses for $349.

BALTIMORE PROJECT TARGETS RENTERS EARNING BETWEEN 60%

AND 100% OF AREA MEDIAN INCOME

Roc Capital demonstrates how private lending supports an ecosystem of affordable single-family workforce housing.

In today’s rising interest rate environment, single-family rental homes have become an attractive alternative for prospective homebuyers seeking an affordable and flexible solution to their housing needs. As demand shifts from owning to renting, private lending fills an important void by providing quick funding for the rehab of non-owner-occupied investments (1-4 units) and debt service coverage ratio (DSCR) loans for landlords. Private lenders are an essential component within the larger ecosystem by priming additional housing stock to be used either as single-family rentals or homes for first-time homebuyer

within a workforce community. They provide the needed capital to build, update, and stabilize single-family properties; convert office and retail units to residential workforce housing; and convert single -family properties to 1-4 unit multifamily properties (including adding ADUs).

Fix-and-flippers that acquire, rehab, and stabilize affordable properties usually live within close proximity to their investments and provide vital support to their communities by hiring locally. However, as capital becomes scarcer in today’s market, maintaining adequate liquidity for these types of workforce housing and

12 PRIVATE LENDER

CASE STUDY

Section 8 projects can be challenging. Private lenders can bridge the gap but have fewer options for capital sources as well.

ROC CAPITAL TEAMS WITH RIPARIAN CAPITAL PARTNERS

Roc Capital’s white-label table funding model provides reliable institutional capital that is balance-sheet-lite and operationally efficient. It is a less risky capital option for private lenders looking to diversify their product offerings and better align with the needs of entrepreneurial fix-and-flip and landlord investors. Most important, with Roc’s programs, the spigot of liquidity remains open to private lenders focused on lending into affordable housing communities, even as capital markets have been dislocating. The use cases for deploying private institutional capital to workforce communities extends beyond serving as a fast and efficient

ROC CAPITAL PROJECT DETAILS

Lender // Roc Capital

Broker // Eastern Union

Borrower // Riparian Capital Partners

Amount Borrowed // $54.7 million

Units // 2 single-family rental portfolios consisting of 461 units

Term // 5-year

Results // Riparian focuses on the workforce housing segment of the single-family rental market, with rents that are affordable for individuals and families. The 461 units target renters earning between 60% and 100% of the area median income. Section 8 and other voucher programs are being used.

funding source for private lenders working with entrepreneurial investors on a smaller local level. Roc Capital also works with commercial brokers who facilitate the funding of larger turnkey SFR portfolios within workforce neighborhoods. Many middle-market owner/operators are looking for turnkey, renovated workforce housing units they can stabilize with a bridge loan or longer-term financing if they plan to add the units to their portfolios.

Riparian Capital Partners, which has one of the largest single -family rental portfolios in the mid-Atlantic area, focuses on the workforce housing segment of the SFR market, with rents that are affordable for individuals and families.

WINTER 2023 13

The company, which owns more than $125 million in assets under management, secured $54.7 million in financing to incorporate two newly acquired single-family rental portfolios into their existing managed portfolio. Eastern Union arranged the financing, which was provided by Roc Capital. Both the acquisition loan for the former and refinancing for the latter carry five-year terms.

2020 cited the nation was short some 3.8 million units, up from 2.5 million in 2018. According to Census Bureau data, owner-occupied housing levels have increased by 11% during the past five years, yet the number of rental housing units has grown by less than 1.5%. In fact, the share of rental housing today (30.9%) is less than it was five years ago (31.8%).

The portfolios, acquired by Riparian Capital Partners in October 2020 and December 2021, are comprised of 461 units, all located in workforce communities within Baltimore, Maryland. The units target renters earning between 60% and 100% of the area median income. Section 8 and other voucher programs are being used.

WORKING WITH INSTITUTIONAL CAPITAL

Institutional capital is also being put to work on other new construction projects to meet the growing demand for rentals. Recently, JP Morgan and Haven Realty announced a joint venture to develop and acquire $1 billion in build-to-rent communities throughout the U.S. These types of ventures will help address the shortage of housing; however, demand for housing continues to grow faster than supply.

The lack of housing supply as well as rental stock is putting a major strain on affordable housing. A Freddie Mac report released in

Yet, the demand for single-family rentals appears to be growing at a fast pace. This is partly due to the rising costs of home ownership. A June 2022 New York Time’s article, “Cost of Owning a Home Surges Above Cost of Renting One,” cites a new report from John Burns Real Estate Consulting that reveals having a mortgage is far more expensive than having a lease. This could explain why a sizable share of current homeowners have an interest in single-family rentals. According to a July consumer survey of nearly 1,350 owners and renters, John Burns Real Estate Consulting discovered that “one in four owners would live in a rental house if they could find a place that meets their exact needs.”

The goal of creating more affordable housing requires not only the construction of additional housing but also a harmonious balance of both homeowners and renters. According to a 2021 report by Harvard’s Joint Center for Housing Studies and AARP, “the most livable neighborhoods offer the most diverse set of housing options, including multifamily and rental opportunities as well as single-family and owner-occupied homes.”

Private lending has played a key role and will remain an essential component to connecting institutional capital sources with both small- and large-scale affordable housing projects across the U.S.

14 PRIVATE LENDER

∞

“The 461 units target renters earning between 60% and 100% of the area median income.”

WINTER 2023 15 Get immediate access to the capital sources, technology, service and tools you need to grow your business fast. Sign up with PeerStreet lenders.peerstreet.com +1(844) 733-7787 bizdev@peerstreet.com Private money lending just got easier ARE YOU TRYING TO REACH PRIVATE LENDERS? Try advertising with us. Digital • Print • Newsletter • Social • Webinar CALL, TEXT, EMAIL TODAY. 913-888-1250 sales@aaplonline.com NATIONWIDE APPRAISAL MANAGEMENT S G We help private lenders and their investors turn dream projects into dream homes.

Finding the Right Partner Was Instrumental in Bayshore Property Deal

The lender provided a jumbo bridge loan that closed in 10 days and structured the deal in a way that allowed the borrower to purchase at below-market price, flip the property, and turn a profit.

CASE STUDY

Tampa Growth LLC experienced such an opportunity when they found a 12,000-square-foot home in Tampa on famous Bayshore Boulevard for $5 million, which was under market value. The challenge? They needed to close quickly to make the deal happen.

WINTER 2023 17

AN OPPORTUNITY — AND A CHALLENGE

and exclusive property

What if a borrower approached you about purchasing an expensive

on the water in one of the hottest markets in the nation? They’ve done their research and feel confident they can make a great profit if they can purchase this property below fair market value and line up a buyer. And they believe the lender on the deal will benefit greatly too. Would you be prepared to be that lender?

Lender // Acra Lending Client/Borrower // Tampa Growth LLC Location // 3801 Bayshore Boulevard, Tampa, FL 33611 Original Architecture Style // DT2; traditional Square Footage // 12,600 Original Year Built // 1994 Loan Amount // $3,600,000 LTV // 80% Interest Rate // 9.999% Length of Loan // 12 months Credit Score Considered? // Yes

CASE STUDY

SOLUTION

Tampa Growth pulled it off by finding a partner in Acra Lending. Acra not only could fund the transaction but also could structure the deal favorably and get the funds to Tampa Growth in time to meet close of escrow (COE).

Tampa Growth knew that locking the property down quickly in a rapidly changing market was critical to making the purchase at under fair market value, doing a quick flip to the buyer they had lined up, and turning a great profit. Tampa Growth just needed a few months after purchase to close with the new potential buyer, earning great potential in profit, and assisting the new buyer with the purchase.

With Acra Lending as their partner, Tampa Growth was able to obtain a 12-month jumbo bridge loan that closed in 10 business

days from appraisal to loan submission. No PPP was involved, and terms included a minimum of four months interest only.

Acra Lending was able to educate Tampa Growth about their guidelines and how to structure the deal. In this syndicated transaction, multiple LLCs were set up to assist as grantors, with one entity holding the closing funds, assets, and liquidity.

The LLC established to hold the funds to close requested there be limited liability to the grantors due to millions in assets, their experience in the business, and the millions in liquidity offsetting the layered risk. The request was granted with certain clauses.

OUTCOME

All parties achieved their goals in profit and fees, and the transaction was a success. ∞

18 PRIVATE LENDER

WINTER 2023 19 (855) 972-7391 www.civicfs.com

all of the changes in today’s market, one thing remains the same ... CIVIC’s commitment to all of our valued partners. We are operating as strong as ever and our ability to provide access to capital continues, uninterrupted. If you need an experienced, reliable lender that provides superior service at competitive pricing, you're in the right place. RETAIL | WHOLESALE | CORRESPONDENT ® ©2022 CIVIC Financial Services, LLC. All Rights Reserved. This is not a commitment to lend. All offers of credit are subject to approval. Restrictions may apply. CIVIC Financial Services, LLC reserves the right to amend rates and guidelines. NMLS ID 1099109. Loans made or arranged pursuant to a California Finance Lenders Law License 603L321. AZ Mortgage Broker License 0928633. OR Mortgage Lending License ML-5282. CIVIC Financial Services, LLC is an Equal Housing Lender. See www.civicfs.com/Licensing.

Amidst

Here's how one lender is navigating the daunting task of establishing a private money fund.

by Gregory Becker

by Gregory Becker

20 PRIVATE LENDER FUND MANAGEMENT

STARTING MY FUND MANAGEMENT JOURNEY: RESEARCH, RESEARCH, RESEARCH

Last spring, I began meeting twice a week with a longtime friend and colleague, Eric Saiki, to pursue the establishment of a private mortgage fund. Saiki is a litigation attorney who represents businesses in a variety of matters.

There is a process to managing a fund. Fund managers must be disciplined, responsible, organized, and trustworthy. If they lack any of these characteristics, eventually a link in the chain will fail, mistakes will result, and the damage to the fund will be irreparable. Just having the characteristics isn’t enough though; fund managers must nurture them. Investors need to know their managers are working hard to make safe

investments with strong returns that cannot be realized elsewhere without more risk.

RESEARCHING THE ISSUES

Our initial goal was to identify issues. We listened to private lending podcasts, found online articles, and watched webinars. We also spent a day at the Los Angeles Law Library watching two legal seminars, and we reviewed vendor websites. We were even able to obtain private placement memorandums, which helped us understand some of the subissues that exist.

The American Association of Private Lenders (AAPL) was without a doubt the major source for our research. Its broad

online education portal provides hours of informative educational material.

AAPL’s two fund manager certification courses helped us see the forest through all the trees.

In addition, AAPL’s annual conference offered a strong selection of educational opportunities designed to deal with all aspects and levels of private lending. On the final morning of the conference, AAPL hosted small private lender and fund manager roundtables. At the fund manager roundtable, we sat with experienced and respected participants—attorneys, accountants, fund managers, and brokers— in the private lending field who tackled a long list of important issues.

The practical responses we heard from participants gave us a good jolt of reality, punching holes in the idealistic vision our ivory tower research created. As we sat in the airport waiting to return home, we discussed the next steps. Our main areas of focus going forward would be legal, tax and accounting, technology, and marketing. Let’s take a closer look at the four issues we agreed to focus on.

LEGAL CONSIDERATIONS: ENTITIES

Establishing a private mortgage fund requires establishing two entities: One manages the private mortgage fund, and the second is for the private mortgage fund itself.

Management Entity. The management entity is run by the manager(s), who manages investor capital retained inside the private mortgage fund. Managers

WINTER 2023 21

deploy investor funds according to the terms of a subscription agreement. Inside the “four corners” of the agreement are the rules the managers must follow. Failure to do so can lead to liability for the management entity.

It also oversees origination of loans, servicing of loans, regulatory filings, licensing, investor relationships, and distribution of profits.

Determining the structure of the management entity requires considering many variables that can vary from state to state, including taxation. Working with experienced lawyers and accountants helps with making the right choice.

Management compensation and investor return are two other major components to be decided. Some managers seek investors looking for a fixed return. In a “fixed” return fund, the investors receive an agreed-upon distribution. Any excess goes to the managers. This can be a very conservative approach for the investors, with envious returns to management.

In an effort to distribute the earnings more equitably, a “waterfall” approach can be used. This approach creates a “pecking” order in which distributions are allocated between managers and investors. This strategy often pays managers a small fee and prioritizes distributions to investors. Excess profits are then paid out to both managers and investors pursuant to a formula that incentivizes the managers to maximize fund profits.

A third common way of structuring management compensation and investors’ returns is through a “split return” approach. Some argue this approach is the best for aligning the interests of

management and investors. In general, expenses of administration are paid, and managers split the profits with investors.

It appears there is a move toward the split return approach to align interests better. Investors are becoming savvier, which can lead to disputes or resentment. Because there are many variables that can lead to additional income or expenses, it is an area where the problems arise.

Some of the variables include the annual management fee, origination fees, payment

of referral fees, receipt of referral fees from loans that do not fit the box, loan servicing fees, or construction management fees. There are other variables as well, including who receives gains arising out of REOs, whether payment is to be made to outside services from the profits versus payment by the fund managers, and whether managers should receive the late payment fees or default interest.

If fund managers are making two points on origination and two points on

22 PRIVATE LENDER

FUND MANAGEMENT

management fees, investors will not stay around if managers are taking revenue from other sources or reducing profits by running other expenses through the fund’s returns.

The Fund Itself: Private Mortgage Fund Entity. More complicated is the structuring of the fund entity. It requires a legal team to help guide managers through the various exemptions to the Securities Act of 1933 since a mortgage fund is a security—a financial asset with value that can be traded or sold.

Generally, securities require expensive and time-consuming registration with the Securities and Exchange Commission. For mortgage funds, however, private

placement exemptions exist that allow these smaller securities to avoid the costly filings. Three common exemptions mortgage funds use are Reg D Rule 506(b), Reg D Rule 506(c), and Reg A, Tier 2.

By analyzing and weighing the desired characteristics of the fund during the fund’s formation, managers can arrive at an exemption that best aligns with it.

Every decision made—or not made—sets off a chain reaction of other decisions. Here are some private money fund characteristics to consider:

Ethics. Fund managers have a fiduciary duty to investors; that is, they have an obligation to exercise loyalty and good

faith and act in the best interests of the person to whom they owe a duty.

Investors should disclose all material facts that one would find useful in making a decision. The disclosure should be updated when material facts change or arise.

Often, great deals arise the fund cannot handle. What does a fund manager do with that deal? Best practices suggest offering the deal to all investors and entering into a side agreement to disclose in writing the material aspects of the deal.

Conflicts of interest arise frequently, especially when fund managers

WINTER 2023 23

When other lenders won't, RFG will!™ Unique 100% Financing Purchase Price + Rehab Cost No Down Payment www.rehabfinancial.com | (610) 632-7043 | 1062 Lancaster Ave., Suite 15C, Rosemont, PA 19010

establish alternate funds that may impact originations in their other funds.

Ethics is an area to take seriously. When issues arise, and they will, a fund manager must be able to spot them. Knowing the answer is not required. Engage counsel who can advise the proper course of action. Seeking counsel is money well spent, because many shareholder suits against managers include causes of action for breach of fiduciary duty, failure to disclose material facts, and conflicts of interest.

Open or Closed. Most funds are “evergreen” funds; that is, they are open-ended and can continually receive investor funds. Closed funds can be good for liquidity because they pressure potential investors to make funding decisions. Restrictions on withdrawal of said funds is another characteristic of closed-end funds. However, open-ended funds can accomplish a similar result by using lock-out provisions—with gates for early exit. If you start up a closed fund, one day you may need to start up a new fund that will require more time, money, and headaches.

With open-ended funds, the private placement memorandum and financial disclosures must be updated annually. This may help avoid a claim for failure to disclose material facts arising out of changes that occurred during the prior year.

Investors. Investors can be accredited or non-accredited. Accredited investors are “sophisticated” investors who meet certain net worth or income thresholds. Verifications from accountants or attorneys regarding their accredited status can be relied upon in good faith. When non-accredited investors are in involved, there are landmines to avoid. Advertising to non-accredited investors is not permitted under Reg. 506(b), so managers should not meet someone at a cocktail party and discuss the fund. Doing so may be an inadvertent violation of securities laws.

Under Reg A, advertising to non-accredited investors is less restrictive, but the fund’s capital limits are also restrictive.

Beyond deciding whether to work with accredited versus non-accredited investors, other investor decisions

remain, including whether to take in-state investors only as well as the issues that accompany taking out-ofstate investors or even offshore investors who are willing to take a smaller return.

Warehouse Line of Credit. These LOCs are great for cash flow and help solve liquidity crunches. Short-term liquidity crunches are common while waiting for older loans to pay off. A line can provide capital to fund new loans while waiting for pay offs.

Warehouse lines can also be an effective tool to increase profitability through leverage. If a fund is paying 9% to investors but borrows part of the debt from a warehouse line at 6%, the cost of funds falls and profits inside the fund will rise.

There is a black cloud over warehouse lines. Terms can be very onerous and cause the fund to implode when economic downturns occur. Fortunately, many of the onerous provisions can be negotiated away. One such provision is “mark to market.” It allows a bank to revalue property and then call the loan based on debt-to-equity valuations that no longer adhere to the bank’s guidelines. Imagine a strong set of performing loans being revalued downward, requiring the fund to pay down the warehouse line.

Provisions in lines concerning delinquencies and aged loans are of concern as well. Negotiating the basis for calling delinquent and aged loans is prudent. To allow a bank to call such loans without specificity can lead to disaster. The term of a line is another important feature often overlooked. It is risky to

24 PRIVATE LENDER

FUND MANAGEMENT

establish a line that is good for one year when the loan term is 18 months.

The same can be said for adjustable-rate lines that secure fixed-rate loans. In this instance, terms should be rewritten to prevent shocks in the market from turning a fund’s delta upside down.

Self-Directed IRAs. Self-Directed IRAs are a popular source of fund capital. Fund managers must be aware that Unrelated Business Income Tax (UBIT) applies to an IRA when it leverages its purchasing power with debt. If an IRA

unrelated debt financed income (UDFI) and it causes UBIT.

Self-Directed IRAs generally defer income and capital gains tax on growth. No such privilege is afforded when it leverages using the money of others. Once a fund leverages through a warehouse line and the Self-Directed IRA generates growth or income, the investor may be required to pay taxes on the fraction of growth or income attributable to the leverage.

Another area of concern is when large investors pull out and the fund is left

subjecting them to increased regulation similar to that of financial advisors.

“Penguins,” or potential investors approached for the limited purpose of balancing the fund to meet regulatory requirements, can be hired to help reduce the percentage of Self-Directed IRA investments in a fund. The fund generally hires a firm to find these investors. Like penguins, investors start lining up on the beach and talk to each other about the opportunity versus risk of getting into the water. If one penguin goes into the water, often all the

www.buchalter.com

An alternative to “penguins” is a SubREIT inside of the fund. This provision can be created at inception but not used. The provisions can be awakened at any time.

Classes. Classes can be created inside a fund. Treating founders better incentivizes a team of initial investors to jump-start the fund. Classes can also be drawn to accept various types of investments (e.g., first loans and riskier second loans).

Reserves. Reserves for possible losses can be written into the agreement as well as liability clauses that limit management liability.

Non-Origination-Based Activities.

What about buying loans or selling loans to and from the fund? How about buying distressed properties, rehabilitating them, and flipping them? What are the various licensing issues for each of these activities?

Underwriting Guidelines. Each fund must estimate its tolerance for risk and weigh it against reward. Revisions of this strategy should occur when changes to the market are on the horizon. Some investors want big rewards and seek out funds that are willing to invest in riskier investments, such as junior financing with higher combined loans to value.

One of the challenges here is when the market takes a wrong turn. No manager wants an investor suit filed against them even if they lent pursuant to the “four corners” of the agreement, complied with their underwriting guidelines, and reassessed regularly in keeping with the standard of care.

Loan Origination. Business-purpose

loans for cash-out, bridging, fix-n-flip rehabilitation projects, construction, and debt service coverage ratio are the main vehicles. How will these vehicles be sold? Will there be only a retail component to origination? How about a wholesale division? If so, will the wholesale division seek licensed or even unlicensed brokers to originator loans? Establishing correspondent lenders is also an option.

Licensing. Licensing rules vary from state to state. Some of the areas that fall underneath the licensing umbrella include origination, loan servicing, and buying and selling loans.

In California, licenses from multiple entities may be required. Because entities have different rules and often overlap, managers run the risk of complying with one department’s guidelines while violating the others. During formation, consideration must be given to whether (1) the management entity and/or the fund will

be required to be licensed with either or both departments, (2) lending with out- of- state investors will take place, (3) there will be any licensing issues outside of California, and (4) reporting will occur in or out of state.

Liability. There are ways to limit fund manager liability. During formation experienced securities counsel use various techniques to protect managers. Here an ounce of prevention is worth a pound of cure.

TAXATION

Initially, we wanted to find a fund structure that would permit us to avoid audited financial returns. However, now we won’t move forward without them. Audited financials help build the credibility of the fund. Investors like to know they will be done and appreciate reviewing the audit results. For funds that use warehouse lines, the audited

26 PRIVATE LENDER

MANAGEMENT

FUND

financials are the cornerstone for a strong relationship with warehouse lenders.

Yes, audited financials can be expensive; however, using a fund administrator who can handle the back end of running the fund can reduce audit costs.

Audited financials in the private lending world are most efficiently performed by auditors with experience with private lenders. As such, selecting an accountant who can work with the securities lawyers and even fund administrators is a crucial part of fund formation.

Identifying tax issues early is a prerequisite to efficiently launching a fund. Each state has different income tax laws. There are also tax credits available to some and not others. Identifying these issues early helps managers formulate strategy for taking on investors.

TECHNOLOGY

Software can be helpful with client relationship management, origination of loans, post-close management of loans, and investor relationship management. There are many vendors in these spaces, and the fund manager’s job is to align its goals with the vendors’ technology.

With today’s software, an originator can completely set up the borrower’s experience in a few minutes. Loan applications and disclosures are created and emailed, a portal for uploading necessary documents is created, and e-signing is established to maintain compliance. The result is an efficient onboarding of borrowers and a shifting of processing burdens.

A byproduct of creating the friendly borrower experience is extrication of the management and origination team(s) from tasks that distract them from bringing in new deals and keeping investors happy.

Also important is post-close software, which includes servicing, financial reporting, and investor interface. For those resigned to hiring a fund administrator, post-close software may be less important and lead them to pursue providers whose platform is stronger in the origination sector. For those that like to do it themselves, the postclose software can function as a backroom billing and accounting department that can monitor every aspect of a loan and make virtually any report available to investors and tax advisors.

Those that make client relationship management a big part of their daily operations should look for a standalone CRM. For others, CRMs imbedded in some private lending software provider’s platforms can be used to manage client relationships.

MARKETING

Marketing includes the origination of loans. It also includes bringing in investors. During the fund formation process, the strategy for marketing becomes a condition subsequent to the fund formation itself.

Once all the formation issues are decided upon, a strategy can be implemented. What we know now is that it will include a CRM, and our investors will be handled with velvet gloves.

In the meantime, I will continue to broker loans, fractionalize notes, and

establish white label arrangements at various wholesale lenders so business is conducted on a parallel path with properly forming the fund.

As part of our efforts, we intend to contact several of the participants at AAPL’s broker roundtable to discuss some of the finer points of the successes and failures they relayed to us at the conference. We will also seek referrals to various lenders who have exhibited mentorship qualities in the past. Through these contacts, we hope to create a focus that will help us hit the ground running. ∞

ABOUT THE AUTHOR

GREGORY BECKER

Gregory Becker is a wills and trusts lawyer as well as a mortgage broker with an office in Redondo Beach, California. With more than 20 years' experience in these areas, Becker is looking to start a PLF and researching various private lending associations.

As a law school student, he wrote for the school newspaper and now publishes a monthly article in his current city's local magazine.

WINTER 2023 27

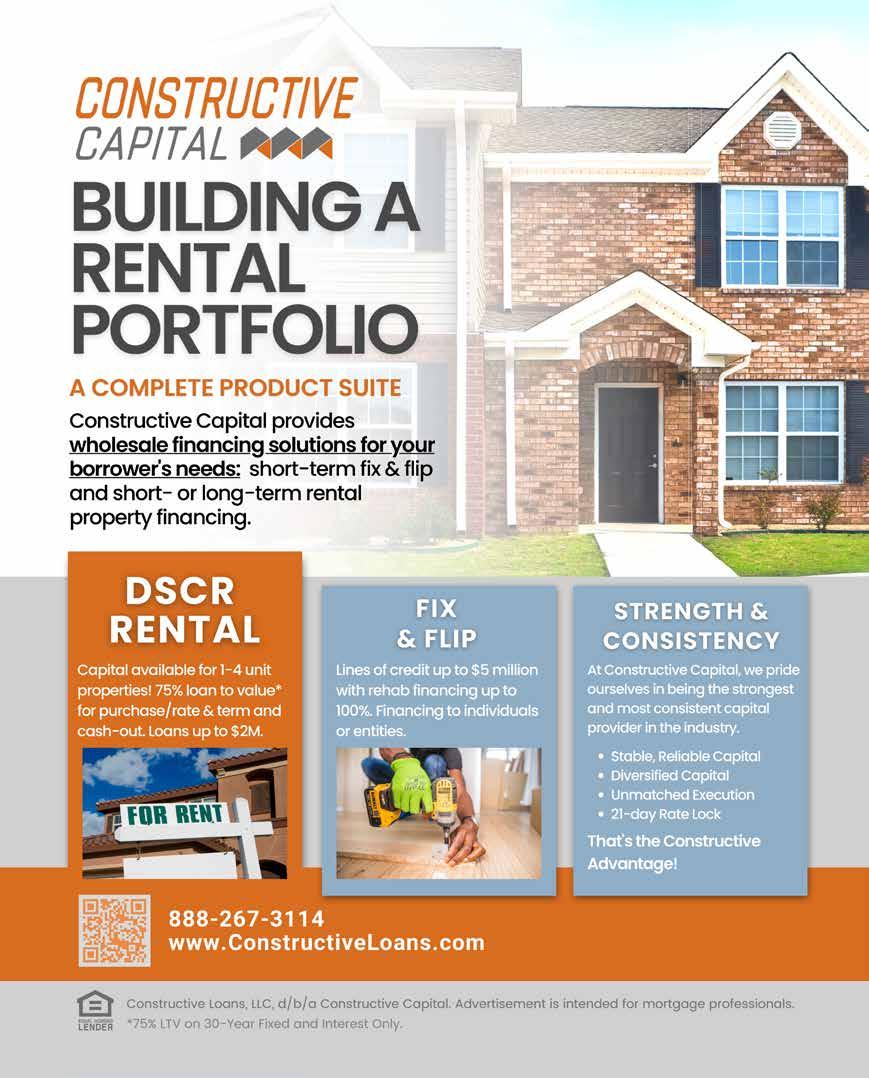

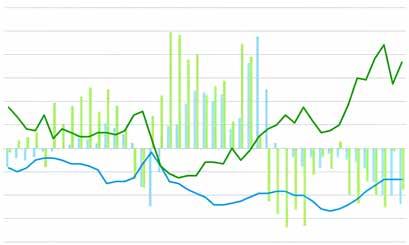

Capital Market Movements Do Impact Private Lenders Who Don't Use Wall Street Money

The term “capital markets” is broad — so is its reach and impact.

by Ben Fertig

In private lending circles, “capital markets” are often defined, at least implicitly, as the sources of institutional capital. Although often associated with fixed-income markets such as debt security or bonds, capital could also be derived from other institutional sources, including insurance companies, larger REITs, or even banks.

If one were to look at private lending through a rudimentary lens, it could be broken down into two primary asset classes: Debt Service Coverage Rental Loans (DSCR Loans) and Residential Transitional Loan (RTLs). Of course, there are many variations of both.

DEBT SERVICE COVERAGE RATIO LOANS

The capital markets’ impact on DSCR loans is fairly straightforward and direct.

As a function of price, there is usually some correlation to the 5-year Treasury rate. This is based on historical data and current assumptions that the weighted life of DSCR loans is close to five years.

The spread between the 5-year Treasury rate and offered DSCR rates depends on several factors, including the specific capital source, investors’ risk assumptions, market supply and demand, overall liquidity, and even sentiment. For most of 2022, rising interest rates have not only put pressure on DCSR pricing directly, but also adversely impacted the liquidity landscape and investor sentiment—it is all interrelated.

Investors and aggregators do not want to own DSCR loans at 7.5% rates if they assume the market price is going to be 8% next month, because the value of the loan will go down. Further, although there is ample performance data in the DSCR

space, there is uncertainty around how a borrower’s valuation calculus could change and its potential impact on loan performance. Consider the following three factors:

01 Single-family rents have increased approximately 10%-15% year over year.

02 Real wages (increase in wages less inflation) have decreased 2.3% year over year (10/2021 to 10/2022).

03 Payments on DSCR loans have increased more than 125%.

Given the relativity of markets, the lack of precedent data or information related to the third factor has increased the risk premium over the 5-year Treasury Rate required by many investors of DSCR loans. Combined with higher carrying costs of aggregation facilities, it is not difficult to rationalize the sharp upward trajectory of DSCR rates.

28 PRIVATE LENDER MARKET TRENDS

Whether you are a large or small originator, broker of DSCR loans, or a borrower, your correlation to these forces is direct and fairly obvious. Higher rates have a macro-level impact on borrower demand. They also put pressure on eligibility, because higher payments cause a smaller percentage of properties to cash flow, which is a primary qualifying factor in a DSCR Loan. A general tightening of credit in the asset class will also impact overall eligibility criteria.

At the very least, if you have built any infrastructure to facilitate the origination of these loans or have taken on a recurring cost load to originate them, capital markets forces will require you to adjust. If you actually fund DSCR Loans with your balance sheet, your risk is heightened.

As we have witnessed historical volatility in DSCR prices, even intraday, pipeline movement, and secondary market delivery

have not been able to keep up. This has forced industry participants that fund DSCR loans to reprice before closing, which causes reputational damage, or to take a secondary market loss. If a company chooses the latter, there is only so much you can take before economics do not justify this kind of risk.

The best plan is to diversify your sources of capital or find partners that are diversified. Although this will not eradicate the impact of capital market forces, it can mitigate some of the volatility.

RESIDENTIAL TRANSITIONAL LOANS (RTL s )

In the last 10 years, the progressive integration of institutional capital into the RTL market has been a primary contributor to the market’s exponential

growth. Equally (or even more) impressive, have been those companies, funds, and individuals who have capitalized their businesses with non-institutional sources. Their resilience, savvy, and ability to endure even the most difficult market conditions is admirable (March 2020 notwithstanding, when most participants reliant on institutional capital experienced a disruption).

Although non-institutional funds may not be particularly appropriate for funding a 30-year single-digit coupon loan in today’s market environment, they have been proven extremely effective for RTLs. The non-institutional capital is diverse in its own right, and many of the platforms that deploy it are well managed, often by exceptional principals. These platforms thrive on flexibility, speed, and targeted market knowledge to provide reliability and quality service to their borrower bases. It is no wonder they have

WINTER 2023 29

maintained impressive market share, even at times when institutionally sourced lenders offered very low price levels to the RTL market.

Overall, the cost of institutional RTL capital has increased dramatically during the last 120 days (as of this writing). RTL capital is correlated to the shorter end of the treasury curve. The rise in the 2- and 3-year Treasury rates has contributed to the upward move in RTL interest rates. When you add to that several RTL securitizations from strong sponsors hitting the market at unattractive levels of execution and aggregators of RTL adjusting their risk assumptions related to the direction of the real estate market in general, you can see why institutional rates have been under pressure. Beyond that, RTL credit conditions have tightened, and maximum loan-to-cost and loan-to -value levels have come in in many cases.

When a company’s source of capital is insulated (even somewhat) from the aforementioned market dynamics, the long arm of the capital markets may create opportunity. Privately funded platforms generally win with the RTL borrower based on flexibility, speed, and other knowledge—local or otherwise—that institutional-based providers have difficulty folding into the origination process. The great equalizer has historically been price, but that advantage could be diluted or negated altogether in the current market conditions.

There is a flip side though. Unless you are one of the few who lends to own, a successful RTL requires the borrower to effectuate a liquidity event to satisfy their

obligation in full. When that does not happen, we all know what does—legal fees, loss of interest income, potential losses, and other risk factors associated with an unsuccessful transaction.

When it comes to many of today’s RTL portfolios, approximately 30%-40% of loan liquidations are the result of a refinance into some variation of longerterm credit, such as a DSCR loan. In the last 12 months, DSCR rates have more than doubled. As discussed, the impact on eligibility, feasibility, or desirability of a refinance could be demonstrably different from when an RTL loan was originated. Although your mileage may vary relative to how your book exits, the capital markets still have an influence.

To reiterate, the capital markets are broad. They also encapsulate the conventional owner-occupied mortgage rate, which has more than doubled since the beginning of 2022. It comes back to the impact on the valuation calculus. In this case, it would be the property’s end user. Whether that end user is a prospective homeowner or landlord, the current cost of financing changes the lens a purchaser looks through, in general and from the time the RTL was originated.

The risk profiles have changed, and that impacts non-institutional capital directly and indirectly, even if the impact is not the cost of funds. You should anticipate the effect on performance, default costs, and the durations (how does it impact when money cycles back in compared to before) of RTL loans as the demand curve has shifted in concert with the rate landscape. These simple dynamics just scratch the surface of how capital markets impact the

wide range and variety of capital sources in private lending markets. The arm is long, and its influence can be both positive and negative. Either way, recognize, understand, and appreciate its reach. ∞

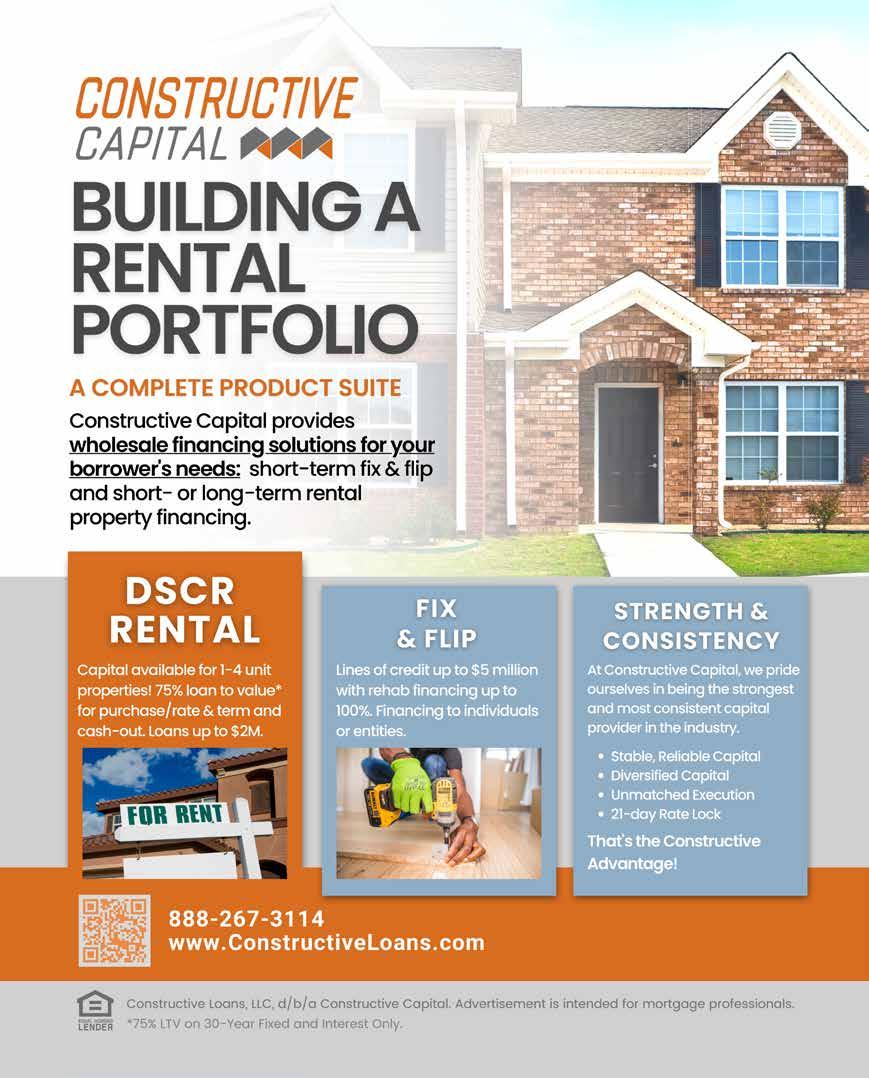

ABOUT THE AUTHOR

BEN FERTIG

Ben Fertig is the president of Constructive Capital. Constructive originates, services, and securitizes single-asset rental loans and originates, services, and asset manages Residential Transitional Loans.

Prior to Constructive, Fertig ran credit and asset management at Finance of America Commercial and served as chief operator officer of Jordan Capital Finance, where he managed originations, credit policy, and capital markets. Fertig was instrumental in the sale of the Jordan Capital Finance platform to Blackstone and Finance of America in 2017.

Fertig began his mortgage banking career more than 25 years ago and has served in a senior leadership role in the Residential Investor Loan market since 2012.

30 PRIVATE LENDER

MARKET TRENDS

Reach your ideal audience with our new ad targeting services. We’re bringing you three new ways to grow awareness and increase conversions by digitally targeting your ideal audience beyond aaplonline.com. BY HOUSEHOLD // Serve ads to households that match your specified demographics, interests, and metro area. WITH A GEO-FENCE // Get in front of individuals whose device GPS data places them in a specified location, then serve them ads for up to 30 days. THROUGH RETARGETING // Deliver ads on apps and other websites your target audience visits after they land at aaplonline.com. FOR MORE INFORMATION // sales@aaplonline.com • 913-888-1250 1 2 Find the right people, in the right place, at the right time. Every time. 3 1 2 3

What a Market Downturn Means for Real Estate Investing in 2023

As the housing market transitions, here’s what real estate investors can expect — and how they can adjust.

by Daren Blomquist

32 PRIVATE LENDER

MARKET TRENDS

Real estate investing can be profitable in any market, but successful investing strategies often vary widely depending on broader market conditions. As the housing market transitions quickly from frenzy to flatline, here’s what real estate investors can expect and how they can adjust accordingly.

“When there are speed bumps, there are typically opportunities for investors who are ready to act,” said Andy Heller, a veteran real estate investor and founder of the Regular Riches training program for real estate investors. “A potentially generational opportunity for investors to buy property below market. Those opportunities typically last one to four years.”

According to Heller, investors preparing to take advantage of that opportunity should do three things in advance of the downturn:

Identify one or two acquisition strategies to focus on.

Identify funding sources.

Identify both preferred and backup exit strategies.

“Right now, they should be identifying an acquisition method such as REOs or short sales or buying on the courthouse steps,” said Heller, whose preferred acquisition source during downturns is real estate owned by the bank (REO). “Identify a source and get good at it. … Don’t be a jack of all trades, be a master of one or two.”

WHERE’S THE INVENTORY?

With housing demand dwindling in the face of surging mortgage rates, the inventory of homes available for sale is

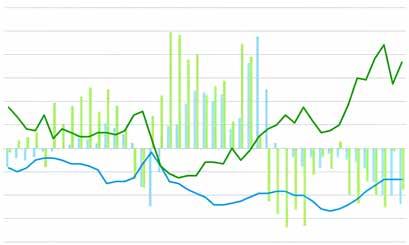

DOWNSHIFTING HOUSING MARKET

Annual Change in Sales Existing Annual Change in Sales New Months Supply New Months Supply Existing

Annual Change in Sales

60% 50% 40% 30% 20% 10% 0% -10% -20% -30% -40 Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Sep-21 Nov-21 Jan-22 Mar-22 May-22 Jul-22 Sep-22

Sources: NAR, U.S. Census

gradually rising and will likely increase further in early 2023 as a growing number of would-be sellers will no longer be able to put off listing their homes for sale.

Data from the National Association of Realtors (NAR) shows how this dynamic is playing out. Weakening demand is evident in slowing home sales, which were down 24% year-over-year in September on an annualized basis—the ninth consecutive month with a year-over-year decrease and the fourth consecutive month with a double-digit decrease.

As demand weakens, inventory of homes for sale is gradually rising and home price appreciation is quickly slowing. The NAR data shows a 3.2-month supply of inventory in September, unchanged from the previous two months but up from a 2.4-month supply in September 2021. Median home prices were up 8.4% from a year ago in September, but that pace of

12.0 10.0 8.0 6.0 4.0 2.0 0.0

Months Supply of Inventory for Sale

appreciation is nearly half of the 16.2% pace just six months ago, in March 2022, and it is one-third of the 25.2% pace at the peak of the pandemic market in May 2021.

A more dramatic rise in housing inventory is showing up in the new homes market. There were 462,000 new homes for sale in September 2022, up 23% from a year earlier, according to data from the Census Bureau. September was the 16th consecutive month with an increase. Meanwhile, the inventory of distressed properties, which represent prime valueadd acquisition opportunities for investors, has been gradually increasing in 2022 and is poised to increase even further in 2022.

The volume of properties brought to foreclosure auction in second-quarter 2022 increased to a new pandemic high, up 55% from foreclosure moratorium-suppressed volumes a year earlier, according to proprietary data from the Auction.com

WINTER 2023 33

platform. Even with the increase, secondquarter foreclosure volumes were still 50% below the pre-pandemic levels of 2019.

Foreclosure auction volume plateaued in the third quarter, but foreclosure start data indicates more increases are coming in 2023 and beyond. More than 67,000 properties started the foreclosure process in thirdquarter 2022, up 167% from a year ago, according to ATTOM Data Solutions. The third quarter marked the third consecutive quarter in which foreclosure starts were up by triple-digit percentages from a year ago.

An Auction.com historical regression analysis of the relationship between foreclosure starts and completed foreclosure auctions indicates the

34 PRIVATE LENDER

MARKET TRENDS

O V E R 2 6 , 0 0 0 L O A N S F U N D E D T O D A T E CLOSED LOAN PRODUCTS WE BUY INCLUDE: Residential (1-4 Family) Bridge 1 5 M a p l e S t S u m m i t N J 0 7 9 0 1 2 1 2 3 9 3 4 1 0 0 w w w t o o r a k c a p i t a l c o m W E P R O V I D E I N S T I T U T I O N A L C A P I T A L F O R L E N D E R S N A T I O N W I D E W E B U Y T H E L O A N ; Y O U K E E P T H E C U S T O M E R T O O R A K C A P I T A L P A R T N E R S I S A R E A L E S T A T E D E B T I N V E S T O R B A C K E D B Y K K R & C O . T H E F I R M , W H I C H B U Y S R E A L E S T A T E L O A N S I N T H E U S A N D U K , H A S F U N D E D O V E R $ 1 0 B I L L I O N L O A N S O N R E S I D E N T I A L , M U L T I F A M I L Y , A N D M I X E D - U S E P R O P E R T I E S T O D A T E . For more information about our current product offerings, email us at BD@toorakcapital.com Ground-Up Construction Multifamily & Mixed Use Stabilized Bridge / Rental Programs Foreclosure Starts Completed Foreclosures 600,000 500,000 400,000 300,000 200,000 100,000 0 350,000 300,000 250,000 200,000 150,000 100,000 50,000 0 2006 2006 2007 2007 2008 2008 2009 2009 2010 2010 2011 2011 2012 2012 2013 2013 2014 2014 2015 2015 2016 2016 2017 2017 2018 2018 2019 2019 2020 2020 2021 2021 2022 2022 2023 2023 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 PREDICTING COMPLETED FORECLOSURES WITH FORECLOSURE STARTS Sources: ATTOM Data Solutions, Auction.com Foreclosure Starts (Actual) Completed Foreclosures (Actual) Completed Foreclosures (Predicted)

foreclosure starts in the first three quarters of 2022 should produce about 137,000 completed foreclosure auctions in the first three quarters of 2023. That would be more than double the volume in the first three quarters of 2022, although it’s likely the actual increase will be lower, given continued aggressive foreclosure prevention efforts.

DEEPER DISCOUNTS

More distressed inventory will likely translate into more discounted acquisition opportunities and deeper discounts, especially in an environment where home prices are falling. In that environment, distressed property sellers—and other sellers—will need to adjust their pricing expectations lower to avoid the danger of catching a falling knife by holding out for the higher, but outdated, price point.

One California-based real estate investor said many distressed property sellers have yet to adjust pricing to match with the market, but he expects more to do so by early 2023.

“In 90 days or so, it could be a lot better if banks come to their senses on pricing,” he said, adding that he was still “buying heavy” in late 2022 thanks to enough distressed property sellers who have already adjusted

pricing to align with the downshifting market. “It’s harder to find the properties. You just have to search more. But there is a lot of money to be made.”

Proprietary data from Auction.com shows many distressed property buyers are pursuing deeper discounts as the market turns. In the third quarter, buyers at foreclosure auction purchased for an average discount of 23% below estimated “as-is” property value, up from an average discount of 15% in the previous quarter and more than double the pandemic low of a 9% discount in the first quarter of 2021.

These distressed property buyers are, in effect, hedging against a possible home price correction in many markets.

“I think Boise will get whalloped. I think Maricopa County will get whalloped. I think Florida will get whalloped,” said Tomasi. “Central and South Florida are just overpriced.”

Atlanta-based investor Jared Garfield doesn’t think the middle-America markets where he buys are as likely to experience a home price correction because they didn’t experience a massive run-up in home prices during the pandemic. Those

WINTER 2023 35

“It’s harder to find the properties. You just have to search more. But there is a lot of money to be made.”

REBOUNDING FORECLOSURE DISCOUNTS Average Sales Price Average Discount $200,000 $180,000 $160,000 $140,000 $120,000 $100,000 $80,000 $60,000 $40,000 $20,000 $0 30% 25% 20% 15% 10% 5% 0% 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 2020 2021 2021 2021 2021 2022 2022 2022 :Q1 :Q2 :Q3 :Q4 :Q1 :Q2 :Q3 :Q4 :Q1 :Q2 :Q3 :Q4 :Q1 :Q2 :Q3 :Q4 :Q1 :Q2 :Q3 :Q4 :Q1 :Q2 :Q3 :Q4 :Q1 :Q2 :Q3 :Q4 :Q1 :Q2 :Q3 Avg Discount Below As-Is Property Value (No Interior Interior Inspection) Avg Sales Price at Foreclosure Auction Source: Auction.com

WHERE FORECLOSURE BUYERS ARE HEDGING AGAINST HOME PRICE CORRECTION

are markets like South Bend, Indiana; Montgomery Alabama; and the Quad Cities in Iowa and Illinois.

“Some of the markets that have gone up 25% a year for five years—of course, there’s room for a correction,” said Garfield, who also helps run Housefolios, a real estate investing software designed to help investors identify good deals. “(But) the news for Salt Lake City for real estate is not the same as for Davenport, Iowa.”

Garfield said an increasing number of his deals are coming from other investors who are skittish about the possibility of a home price correction or crash.

“I’m finding a lot of investors that are selling properties right now because they

The Private Lending Industry is saturated with lenders who answer to Wall Street. Stormfield stands out as the leader among truly direct and private hard money lenders

S P E E D

By leveraging technology and applying common sense, Stormfield streamlines the loan underwriting process to provide true 2-week-or-less closings when capital is needed urgently.

F L E X I B I L I T Y

Our loan programs are not subject to FICO minimums or experience requirements. We can accept other lenders’ underwriting documents and often don’t require appraisals for 1-4-unit residential properties.

E X P E R T I S E

Stormfield’s team of Senior Investment Professionals each personally invest in real estate and offer experience-based underwriting and decision making.

Up to 90% LTC

First-time borrowers considered

36 PRIVATE LENDER

TRENDS

MARKET

stormfieldcapital.com

| @stormfieldcapital | @stormfieldcapitalfunding

F

☑

☑

R

☑

☑

C O

☑

☑

☑

☑

☑

☑

☑

I X & F L I P L O A N S

$250k-$2.5M

E S I D E N T I A L I N V E S T O R B R I D G E L O A N S

Quick-closing acquisitions

Cash-out refinances

M M E R C I A L B R I D G E L O A N S

Up to 85% LTC

5+ unit multifamily & mixed-use ☑ All FICOs considered

Construction completion

Foreclosure bailouts

$500k-$15.0M

Warehouse & flex-use space

-23%

© 2022 Mapbox © OpenStree Map 100% 370% © 2022 Mapbox © OpenStree Map Six-Month Change in Foreclosure Auction -61% 0% 100% 200% 300% 370%

Three-Year Change in Average Foreclosure Purchase Discounts

23%

and realize a greater equity gain by selling down the road in three to five years after the market has started to rebound.

“You’re not going to have to sell the property at a severe discount as you would have to if you sold the property quickly in a severely depressed market,” he said. “If you’re buying in a down cycle and you’re not utilizing a lease purchase, then you’re leaving money on the table.” ∞

ABOUT THE AUTHOR

are anticipating a crash and they want to be liquid,” he said, providing as an example a duplex he recently purchased in the Quad Cities for $64,000, 26% below its original listing price of $99,000. “They’ll still sell it at decent discounts because they have had so much appreciation. … They might give up 10, 15, or 20% of their equity on a deal.”

“I’m increasing my purchases. We’ve done 35 deals in the last two months that we have bought to renovate,” said Garfield, who primarily renovates and resells turnkey rentals to other investors. “We’re buying every deal that makes sense.”

MITIGATING RISK

Tampa, Florida-based investor Lee Kearney is employing a more cautious strategy given both his market, which is at more risk for a price correction, and his primary investing strategy—selling renovated homes to owner-occupant buyers.

“We’re just trying to move inventory quickly,” said Kearney, who has invested

during multiple down cycles in the housing market. “If it’s not moving, change the pricing so it does move. These are market-based decisions."

“We try to buy properties at a price where it doesn’t matter what the market does,” Kearney added. “I don’t see any rise in prices in the next couple of years. I see prices continuing to decline with this current environment.”

Kearney’s strategy reflects both sides of the double-edged sword that is real estate investing during a market downturn, according to Heller.

“Clearly, if the economy is softening, there will be plenty of opportunities to acquire properties below market,” he said. “The problem is on the back end, what you’re going to do with the property after you buy it. Many investors don’t think about that, and that is greatly impacted in a downturn.”

Heller’s exit strategy of choice during a downturn is leasing properties with an option to purchase. That allows him to receive rental income from the property in the short-term

DAREN BLOMQUIST

Daren Blomquist is vice president of market economics at Auction.com. In this role, Blomquist analyzes and forecasts complex macro and microeconomic data trends within the marketplace and greater industry to provide value to both buyers and sellers using the Auction. com platform.

Blomquist’s reports and analysis have been cited by thousands of media outlets nationwide, including all the major news networks and leading publications such as The Wall Street Journal, The New York Times, and USA TODAY. He has been quoted in hundreds of national and local publications and has appeared on many national network broadcasts, including CBS, ABC, CNN, CNBC, FOX Business, and Bloomberg.

WINTER 2023 37

“I’m finding a lot of investors that are selling properties right now because they are anticipating a crash and they want to be liquid."

2022 Conference Recap

Each year, the American Association of Private Lenders hosts the industry’s largest conference, lauded for its second-to-none “culture of collaboration” and ability to draw decisionmakers - all while covering key subjects impacting the profession both today and in the future.

But don’t just take our word for it. On the following pages, check out conference stats, photos, and testimonials.

ANNUAL CONFERENCE HIGHLIGHTS 3 DAYS 25+ SESSIONS & ACTIVITIES 65+ SPONSORS 8,043 APP CONNECTIONS MADE 700+ ATTENDEES

13TH

ERIC ABRAMOVICH ROC Capital

Our Annual Conference is lauded by the industry’s Who’s Who as the single best event for private lender education, networking, and value. Read what leaders from across the space had to say about our 2022 event.

ROC Capital has been attending the AAPL conference since 2014, and it has been an integral part of our growth story. This is the one annual event that no industry participant dare miss out on. It is jam-packed with events, content, and networking opportunities and choreographed by experts who live and breathe private lending.

—Eric Abramovich, ROC Capital

AAPL has consistently been a great conference for networking and meeting with our industry partners. This year, in particular, I found the main sessions and several panel discussions to be interesting. They provided great content with new, relevant information. Particularly good was the keynote from Ali Wolf, chief economist at Zonda. What a great presentation!

—Robert Greenberg, Patch Lending ROBERT GREENBERG Patch Lending

G.O.A.T. Champion's belt for AAPL's inaugural Charity Poker Tournament, brought to the 13th Annual Conference with the support of Appraisal Nation.

This conference was the best of all the AAPL conferences I have attended. In the past, it has been great for networking and touching base with friends and providers in the private lending space. This was the first year I attended when there was distress and instability in the capital markets. The presenters were excellent in discussing the situation and giving guidance for strategies for success and traps to avoid. I got invaluable information in real time that helped me establish a go-forward strategy for Rehab Financial Group that safeguards the company but also provides growth opportunities within this market.

—Susan Naftulin, Rehab Financial Group

SUSAN NAFTULIN Rehab Financial Group

WINTER 2023 39

2022 Conference Recap

The AAPL conference is an annual highlight for me. It is a great place to connect with industry leaders and keep up with trends affecting our space.

We sent a huge team to the AAPL conference, and we’re so glad we did. The networking was nonstop, the content was incredibly informative, the industry intel was in-depth and insightful, and to top it all off, the parties were off the charts. Absolutely amazing event.

Vendors brought their A-game to the exhibit hall this year with gold, espresso bars, giveaways, and more.

40 PRIVATE LENDER

Camee Adams, professional MMA fighter, speaking during the 2nd Annual Women in Private Lending Luncheon.

Camee Adams, professional MMA fighter, posing during the 2nd Annual Women in Private Lending Luncheon.

—John Beacham, Toorak Capital

JOHN BEACHAM Toorak Capital

—AJ Poulin, The Mortgage Office

AJ POULIN

The Mortgage Office

AAPL's annual conference is one of my favorite industry events, and I have not missed a single one since 2013. The conference gets bigger and better every year and continually attracts new attendees that I haven't met at other events. Many lenders and brokers have told me it's the only private lending conference they attend.

—Rocky Butani, Private Lender Link

—Rocky Butani, Private Lender Link

Our title sponsor, Residential Capital Partners, taking a brief moment away from their crowded booth for a photo op.

The AAPL conference brings together the top leaders within the lending community, giving attendees access to key playmakers they may not have otherwise had the opportunity to connect with. With a variety of daily activities apart from the conference itself, everyone is sure to find an event for them to take advantage of additional networking and business development. Integrating professional development through certification training as well as supporting groups such as Women in Private Lending is a testament to how this organization is uplifting the members of our industry as a whole!

—Alesondra Mora, Streamline Funding

WINTER 2023 41

ALESONDRA MORA Streamline Funding

ROCKY BUTANI

Private Lender Link

Ali Wolf, chief economist for Zonda, gave a riveting market analysis during her keynote presentation.

Players stategizing their next move during the Charity Poker Tournament.

The VIP Reception on the OMNIA Terrace set the stage for a busy, networking-packed event.

2022 Conference Recap: Award Recipients

Rising Star

What helfrich had to say about being our 2022 rising star:

As champions for the private lending industry’s reputation and future growth, AAPL realizes it’s crucial to recognize those in the industry who look beyond their own businesses to help our mission.

Our Excellence Awards showcase peer-nominated members who have leveraged their resources to solve problems, kick-start innovation, and improve their communities.

The Member of the Year and Rising Star awardees are determined by popular vote, and Community Impact nominees are evaluated by AAPL.

Read on for our 2022 Excellence Award recipients!

HELFRICH // CIVIC Financial Services

Jack Helfrich’s star has been rising since he launched his career as one of the five original founders of CIVIC eight years ago. Starting as an account executive, through grit and determination, he learned the business and earned the trust and respect of his customers, peers, and industry colleagues.

Today, as senior vice president of retail lending, Helfrich is a key member of the team that has built CIVIC into one of the premier private lenders in the nation. To say that he cares about his team, his customers, and the private lending industry is an understatement. Helfrich is the human equivalent of a golden retriever—loyal, kind, and lots of fun, creating a contagiously positive impact wherever he goes. There’s just no stopping this rising star!

—Elizabeth Hillestad, Civic Financial Services

Winning the Rising Star Award was an honor, especially from such a reputable organization as AAPL. Their presence within the industry is undeniable. AAPL’s support for lenders, borrowers, brokers, and all other private lending service providers is unparalleled. AAPL has been a major contributor to legitimizing and commercializing the real estate finance microcosm of private lending. As an industry, we would not be where we are today without their service. Receiving the Rising Star award from AAPL was certainly a highlight of my career and a privilege I will remember forever.”

42 PRIVATE LENDER

Rising Stars are members who have accomplished outstanding growth in their companies during the past year.

JACK

Member of the Year

CARRIE COOK // Ignite Funding

As the president of Ignite Funding for the past 15 years, Carrie Cook has led the company to be one of the most reliable private lenders in the western U.S. and an investment sponsor private investors can depend on for portfolio diversification, growth, and mitigated risk.