Anthony Goettl Career Counselor, University of Wisconsin – Stout, Wisconsin

T

he United States is suffering from a serious shortage of qualified teachers, which gives students seeking a career in education a clear advantage in terms of financial assistance. Not only are there various grants and scholarships available, but there are ample college loan opportunities specially designed to help students become teachers. Several loan forgiveness and loan cancellation programs are also available to repay a teacher`s student loan in exchange for years worked at a school district or in an urgently needed specialty. College loans for student teachers and teachers are provided by the federal and state governments, as well as private credit institutions. Teacher loan forgiveness programs are primarily sponsored by the federal and state governments, while some programs are by specialized organizations interested in increasing the availability of qualified teachers in certain high-demand subjects. Federal Loans for Students in Teaching Programs Federal student loans are the most common and affordable college loan option in the United States. These loans should be the first choice for any college student when looking to fund their education. Students pursuing a career in education will find that federal loans offer lower fixed rates and more attractive repayment options than private lender loans. At a federal level, these programs are the most common and popular among student-borrowers: • The Federal Teach Grant is an award available to students who have completed the coursework required to begin their educational career. Although not strictly a loan, TEACH grants provide up to $4000 to Education majors who agree to TEACH grant contracts and serve in high-need areas or low-income communities. Graduates who fail to meet their service obligations will return their scholarships to a federal loan that is not directly subsidized. • Federal Direct Subsidized Loans are available to undergraduate students who can demonstrate financial need. Students who receive a direct grant will be paid interest by the US Department of Education if they are in school. The maximum loan amount is set by the school the student attends and is based on your financial needs and the total cost of tuition. • The Federal Direct Unsubsidized Loan is available to both undergraduate and graduate students. In contrast to subsidized loans, you don`t have to prove financial need, and borrowers will be responsible for all accruing interest. Loan limits are set by the student's school and are based on the total tuition fee after deducting other financial assistance received by the student. • Federal Direct PLUS Loans are offered to graduate students seeking a professional degree from an accredited university. PLUS loan approval is based on the applicant's credit history. Currently, the fixed interest rate on Federal Direct PLUS loans is 7.54%. The maximum loan amount is set by the student's attendance and cannot exceed the total tuition fee.

Federal Student Loan Forgiveness for Teachers Students who have obtained a Federal Direct Subsidized Loan or a Federal Direct Unsubsidized Loan are eligible for three federal government Teacher Loan Forgiveness Programs: 1. Public Service Loan Forgiveness (PSLF) Program Forgives the remaining balance on your Federal Direct Loans after 120 qualifying payments (estimated over 10 years).

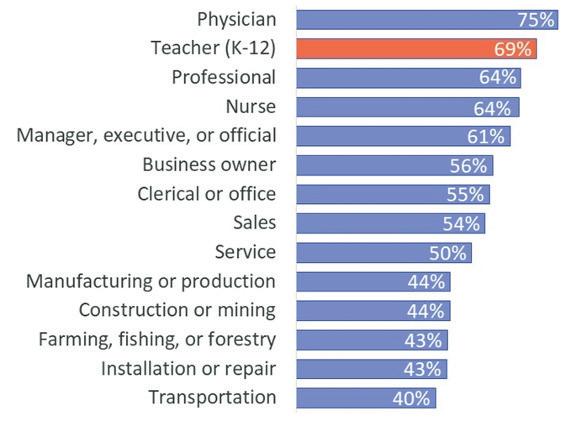

The Demand for Educators

Student Loans and Loan Forgiveness Options for Aspiring Educators

2. Teacher Loan Forgiveness (TLF) Forgives up to $17,500 of your Direct or FFEL Subsidized or Unsubsidized Loans after 5 complete and consecutive years of teaching at a qualifying school. 3. Perkins Loan Cancellation for Teachers Forgives up to 100% of your Federal Perkins Loan Program if you teach full-time at a low-income school, or if you teach certain subjects. State-Based Student Loans & Grants for Teachers State governments usually do not offer student loans directly. However, many state education departments work closely with private lenders to set up affordable loan programs for local students. A list of suggested lenders can be found on state Department of Education websites. For links to your state's higher education authorities, visit the U.S. Department of Education – State Contacts page. Nearly every state board offers at least one scholarship to residents, and many have an extensive directory of student aid resources. Qualifications are usually limited to state residents attending state colleges, but not always. Be aware, however, that many programs do have annual application deadlines. Utilize the State Financial Aid Programs page to see the financial support programs available in your state. There may potentially be resources and programs available through state and regional tuition committees, as well as other state-funded aid available through local nonprofit organizations. State-Based Teacher Loan Forgiveness All states across the country are suffering from a shortage of qualified teachers. Although these states cannot offer direct student loans, they often offer extensive loan exemption programs for students who have agreed to teach at a facility or school district with specific needs or qualifications after graduation. The standards for these programs vary from state to state, but all participants must fully meet their service obligations to be exempt or cancel their loan. Those interested in learning more about programs or eligibility can contact their state’s Department of Education or visit Student Loan Forgiveness Programs by State. Private Bank Loans for Student Teachers Even with scholarships, grants, and federal loans, many students struggle to pay for their college education. Personal student loans are often a feasible alternative. Private loans play an important role in helping students meet the unmet needs of university expenses. Typically, loans from private lenders should be the last resort when looking for college funding, as they usually have higher interest rates and stricter repayment terms than government loans. Loans

7 American Association for Employment in Education