Introduction:AnnualFilingforLLPs

AllLimitedLiabilityPartnerships(LLPs)arerequiredtocompletetheannualfilinginordertocomplywithregulatory standards.Ourarticleprovidesacomprehensive,step-by-stepguidetothesuccessfulsubmissionofyourannualfiling forLLPcompliance.

WhatisAnnualFilingforanLLP?

ForLLPs,filingannuallyisnotjustaroutinetask,butacrucialprocessthatensurescompliancewithregulatory standards.ItinvolvessubmittingavarietyofpaperworkandfinancialstatementstotheRegistrarofCompanies(RoC) beforetheendofeachfiscalyear.Failuretomeetthisdeadlinecouldresultinfinesandpenalties.Therefore,itisof utmostimportancetoensurethatallrequiredpaperworkissentinontime.Letusmakepromptfilingofthesedocuments ourprioritytoavoidanypossiblefines.Regards.

WhyisAnnualfilingimportant?

LLPsthatfileannuallynotonlymeettheirregulatoryobligationsbutalsobenefitfrommaintainingresponsibilityand opennessintheirfinancialoperations.Thistransparencyreassuresstakeholders,suchaspartnersandcreditors,who receiveimportantinformationonthefinancialhealthandperformanceoftheLLP.It'satestamenttoyourLLP's credibilityandcommitmenttogoodgovernance.

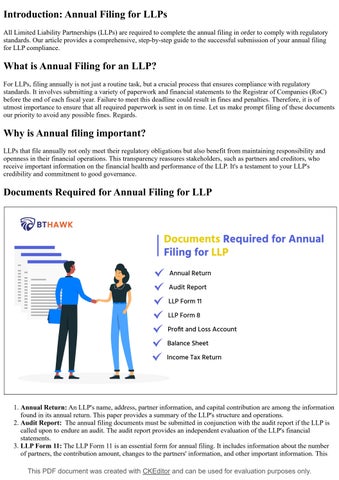

DocumentsRequiredforAnnualFilingforLLP

1.AnnualReturn:AnLLP'sname,address,partnerinformation,andcapitalcontributionareamongtheinformation foundinitsannualreturn.ThispaperprovidesasummaryoftheLLP'sstructureandoperations.

2.AuditReport: TheannualfilingdocumentsmustbesubmittedinconjunctionwiththeauditreportiftheLLPis calledupontoendureanaudit.TheauditreportprovidesanindependentevaluationoftheLLP'sfinancial statements.

3.LLPForm11:TheLLPForm11isanessentialformforannualfiling.Itincludesinformationaboutthenumber ofpartners,thecontributionamount,changestothepartners'information,andotherimportantinformation.This

PDF

created

used

evaluation purposes only

This

document was

with CKEditor and can be

for

4.LLPForm8:LLPForm8includestheStatementofAccountandSolvency,whichmustbefiledwiththeRoC within30daysoftheconclusionofthefirstsixmonthsofthefiscalyear.ItcomprisesinformationabouttheLLP's currentsituation,suchasassetsandliabilities.

5.ProfitandLossAccount:Aprofitandlossaccountisatypeoffinancialstatementthatlistsalloftherevenues, costs,andexpensesforagiventimeframe—typicallythefiscalyear.ItshowstheLLP'sfinancialperformance; hence,itisanecessarydocumentfortheyearlyfiling.

6.BalanceSheet:ThebalancesheetisanotherimportantfinancialdocumentthatshowstheLLP'sfinancialsituation atacertainpointintime.ItistobefiledalongsidetheProfitandLossAccountandliststheLLP'sassets, liabilities,andshareholders'equity

7.IncomeTaxReturn(ITR):TheIncomeTaxReturn(ITR)isarecordthatLLPsmustfilewiththeIncomeTax Departmenteveryyear.ItisnecessarytofileeveryyearbecauseitshowstheLLP'sincome,expenses,andtax obligations.Ifyoudon'tfileyourITR,youcouldbefined.

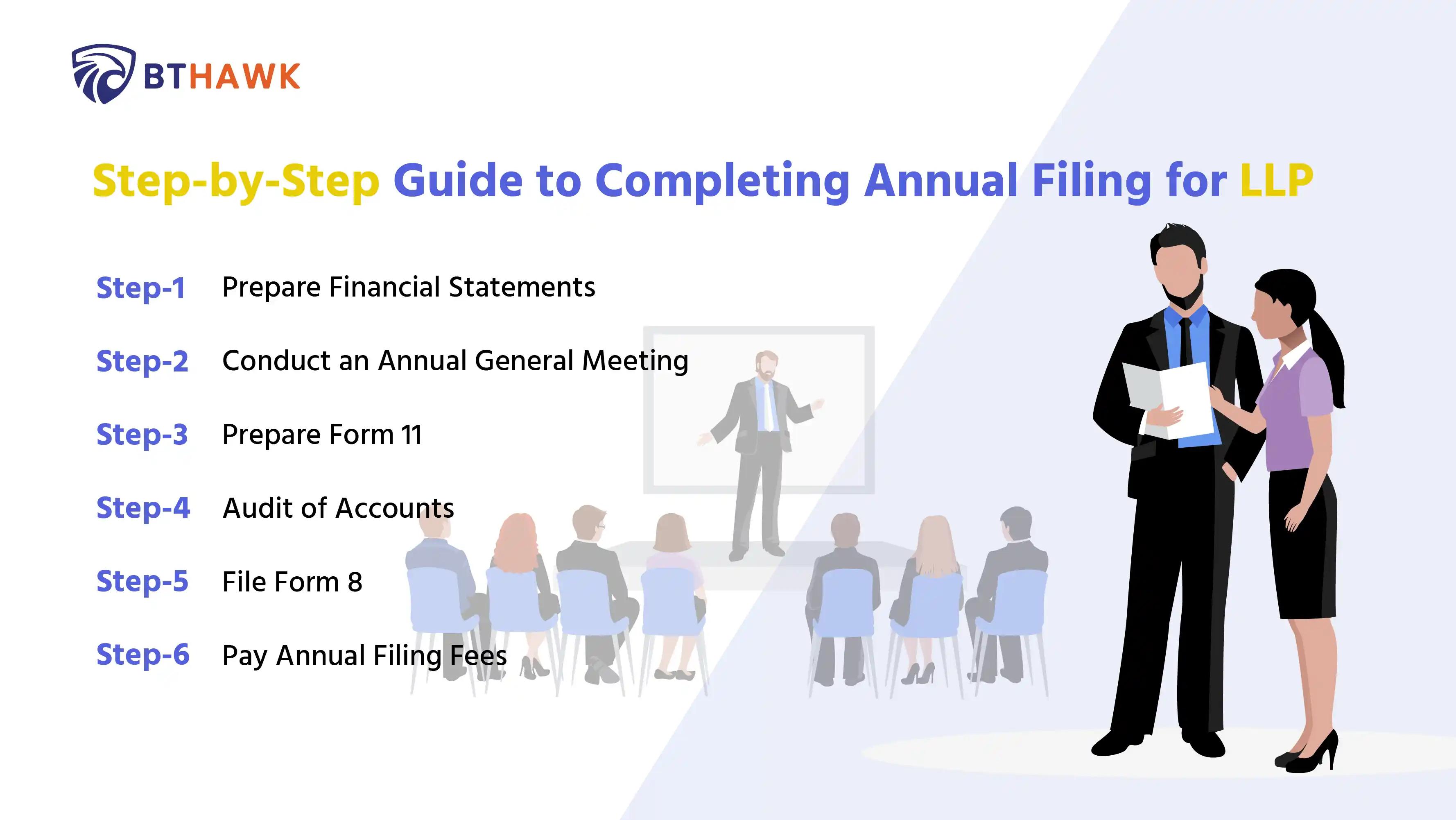

Step-by-StepGuidetoCompletingAnnualFilingforLLP

Step1:PrepareFinancialStatements

ThefirststepincompletingyourLLPyearlyfilingiscreatingyourfinancialstatements.Someoftheseaccountsinclude thebalancesheet,theprofitandlossaccount,andthestatementofcashflows.Makesurethattheseclaimsarecorrect andup-to-date.

Step2:ConductanAnnualGeneralMeeting(AGM)

Onceyou'vefinishedmakingyourfinancialstatements,youneedtoholdanAnnualGeneralMeeting(AGM)toaccept themand,ifrequired,chooseauditors.MakesurethatallpartnersareawareoftheAGMandthatthemeetingfollows therulessetoutintheLLPAgreement.

Step3:PrepareForm11

Annually,LLPsarerequiredtofileForm11withtheRoC.Importantdetailsconcerningthelimitedliabilitypartnership, includingcapitalcontributionsandmanagementchanges,areincludedinthisform.Pleaseverifythatyouhave completedthisformandsentitinbeforethedeadline.

This PDF document was created with CKEditor and can be used for evaluation purposes only documentmustbefiledwiththeRegistrarofCompanies(RoC)within60daysoftheendofthefiscalyear

IfyourLLPisrequiredtohaveitsfinancesaudited,hireaqualifiedauditortoconducttheaudit.Theauditorwillreview yourfinancialaccountsandprovideanauditreport,whichmustbesubmittedwithForm11.

Step5:FileForm8.

AnaccountandsolvencystatementcalledForm8isrequired.Thisformliststheassets,liabilities,andsolvencystatus ofthelimitedliabilitypartnership.EnsurethatyousubmitForm8beforethedeadline.

Step6:PayAnnualFilingFees

Lastly,itisimportanttoremembertosubmittheannualfilingfeestotheRoC.Thefeesarepayableatthetimeoffiling Forms8and11andarecontingentontheLLP'scapital.Non-complianceissuesandpenaltiesmayariseasaresultof failingtopaythefees.

HowCanBTHAWKHelpwithAnnualFiling?

Whenitcomestopreparingandturninginannualreports,financialstatements,andregulatorydocuments,Limited LiabilityPartnerships(LLPs)canrelyonBTHAWKComplianceServices.Ourknowledgeablestaffensuresthecorrect andtimelysubmissionofimportantinformation,astheyarefamiliarwiththeintricaciesofyearlyfilingrequirements. WorkingwithBTHAWKnotonlyhelpsLLPsreducecompliancerisksbutalsoprovidesasenseofsecurity,knowing thattheyareingoodhandsandcanavoidcostlyfinesforbreakingthelaw

Conclusion:StaycompliantwithBTHAWKAnnualFilingServices.

LLPsmustfileanannualreporttostayinlinewiththerules.ByworkingwithBTHAWKComplianceServices,youcan getexperthelptomeetallofyourfilingneedseasilyandcorrectly Thisnotonlyensurescompliancebutalsofreesup yourtimeandresources,allowingyoutofocusonyourcorebusiness.Complianceissuesshouldnothinderyour businessgrowth.ContactBTHAWKtodaytolearnmoreabouttheirannualfilingservicesandhowtheycanhelpyour LLPstaycompliantandthriveintoday'scompetitivebusinessenvironment.Don'twaituntilthelastminute,start preparingforyourannualfilingnowtoavoidanypotentialissues.We'reheretohelpyoueverystepoftheway Kindlybeinformedthattheinformationsharedaboveisstrictlyintendedforeducationalpurposesonly.Itis highlyrecommendedtoseektheguidanceofaskilledprofessionalforanyfinancialtransactionsorcompliance servicestoguaranteelegaladherenceandmitigateanypotentialchallenges.

This PDF document was created with CKEditor and can be used for evaluation purposes only

ofAccounts

Step4:Audit