Shifting Supply Chains: Alt Pro Expo Helps the Smoke Shop Industry Respond

New York State AG Sues

Major Vape Distributors FDA, U.S. Marshals Seize Vapes Worth $700,000 in Warehouse Raid

Proposed State Tax Bills Would Make Vaping More Expensive

“ ”

It decimates our industry,” said Connor Murray, Marketing Manager for Gold Spectrum, one of Tennessee’s largest hemp retailers. “We’re talking about eliminating 90% of our inventory.

(Source: NewsChannel9, May 2025)

Tennessee lawmakers have drawn a hard line: if a product delivers a psychoactive effect, even if derived from hemp, it will soon be treated like marijuana.

Unprecedented Taxation Structure

In addition to the bans, Tennessee will become one of the first states to impose aggressive taxation based on cannabinoid content:

• $0.02 per milligram of THC in all ingestible products such as gummies and tinctures

• $0.10 per milligram of THC in infused beverages

• $50 per ounce of THC-rich hemp flower

These rates are among the highest in the country and are expected to sharply reduce profit margins for vendors and increase shelf prices for consumers. Analysts say this could make the legal market uncompetitive with illicit alternatives, pushing many consumers to the black market.

A vape cartridge that once cost $20 wholesale may now carry taxes that nearly double the price. Retailers must prepare for new pricing realities that could reshape buyer behavior.

Moving oversight to the Alcoholic Beverage Commission may signal the state’s intent to treat hemp like liquor—heavily regulated, taxed, and controlled at every level.

Industry Fallout

Many hemp business owners feel blindsided by how rapidly the legislation moved through the statehouse. In March, the bill was viewed as a compromise measure, introducing age restrictions and childproof packaging. However, a last-minute amendment to ban THCa sales was inserted without industry consultation.

“Kelley Hess, CEO of the Tennessee Growers Coalition, said the process left many stakeholders feeling betrayed. “It was really a total backstab to the whole industry. We had been working in good faith. The amendment was slipped in at the last minute.

(Source: Tennessee Lookout, March 2025)

”According to Hess, the new law threatens thousands of jobs and millions in state tax revenue. She also warned of pending lawsuits challenging the bill’s constitutionality, citing vague definitions and unequal treatment compared to alcohol and tobacco products.

What It Means for Smoke Shops

For smoke shop operators, the new law is a wake-up call. The popular product categories of hemp flower, THC-infused gummies, and vapes will soon be illegal or heavily taxed. Retailers in Tennessee must begin rethinking inventory strategies, compliance requirements, and even their long-term viability in the market.

Wholesale buyers and national distributors are also watching closely. Tennessee’s law may set a precedent that other conservative states could follow, creating a patchwork of conflicting regulations that makes nationwide distribution a logistical and legal challenge.

Smoke shop owners who rely on hempderived SKUs should begin scenario-planning immediately—waiting until 2026 may be too late to adapt.

Looking Ahead

As Tennessee braces for the law’s rollout, many in the hemp and smoke shop communities hope for revisions, lawsuits, or new federal guidance that could reverse or ease some of the damage.

The federal 2024 Farm Bill, still in negotiation, may ultimately decide the future of hemp-derived cannabinoids nationwide. Until then, Tennessee’s new restrictions serve as a cautionary tale for any business operating in the hemp gray zone.

Key Takeaways for Retailers:

Sources:

Ban on THCa, Delta-8, and other alt-cannabinoids goes into effect January 1, 2026

New taxes on vapes, gummies, beverages, and flower will increase retail prices significantly

Industry groups plan legal action to challenge the law’s constitutionality

Oversight moves to the Alcoholic Beverage Commission—a major shift in enforcement

Retailers should begin transitioning inventory and reviewing compliance protocols immediately

• Nashville Banner. “Tennessee Hemp Sales Restrictions.” Nashville Banner, May 1, 2025.

• Tennessee Lookout. “Hemp Regulation Bill Moves Out of House Judiciary Committee.” Tennessee Lookout, March 5, 2025.

• NewsChannel 9. “New Bill Signals Big Changes for the Tennessee Hemp Industry.” WTVC NewsChannel 9, April 2025.

As import costs climb and vendors seek alternatives, this B2B trade show is becoming a go-to resource for real-time sourcing and strategy.

Smoke shop brands are entering a new period of adjustment. Rising import costs, evolving product regulations, and supply chain vulnerabilities are prompting companies to reconsider where and how they source key products, including batteries, vape hardware, packaging, and disposables.

In response, many are turning to Alt Pro Expo. Known for its focus on alternative products such as hemp-derived goods, functional wellness, nicotine pouches, and accessories, the show is becoming a practical platform for companies looking to reduce exposure to unstable supply chains.

Industry shows are no longer just about visibility, they’ve become strategic checkpoints where businesses make fast decisions based on shifting realities.

A Trade Show Built for Real Business

Alt Pro Expo is structured around verified business connections. Two full days are dedicated exclusively to B2B engagement, where brands meet with wholesale buyers, distributors, and sourcing partners. A final day is open to consumers, giving vendors a chance to test products directly with end users and refine messaging before wider retail rollout.

This structure has made Alt Pro especially relevant as companies search for new sourcing strategies and partners with fewer overseas dependencies. In recent editions, attendees reported a clear shift in interest toward domestic manufacturing, diversified distribution, and more compliant, ready-to-ship inventory.

In the face of rising costs and global uncertainty, companies are using in-person trade shows to future-proof their supply networks, not just to sell products.

Regional Reach, Global Context

Alt Pro Expo continues to expand its geographic footprint, but it already has a long-established presence outside the United States. Its Medellín edition in Colombia, active for over five years, connects North American brands with Latin American buyers and manufacturers. This LATAM platform has taken on new relevance for companies exploring options beyond China for sourcing or production.

Upcoming U.S. shows in Nashville (June 19–21) and Houston (August 7-9) are expected to build on the momentum from Miami. Both are key regional markets with strong retail activity, making them strategic locations for vendors aiming to stay ahead of changing logistics and product trends.

A Response Platform, Not Just a Showcase

Alt Pro Expo is not a consumer expo or lifestyle event. It is a tool being used by decision-makers in the smoke shop channel to navigate a changing business landscape. As suppliers adapt, buyers reassess, and compliance grows more complex, the show offers a place for focused action. For companies responding to cost increases and sourcing instability, the opportunity to meet face to face with verified partners is becoming essential. Alt Pro Expo is proving to be one of the few places where those conversations are already happening.

If your business is seeking new partnerships, suppliers, or market access, you can exhibit or register as a buyer by contacting Alt Pro Expo at sales@altproexpo.com.

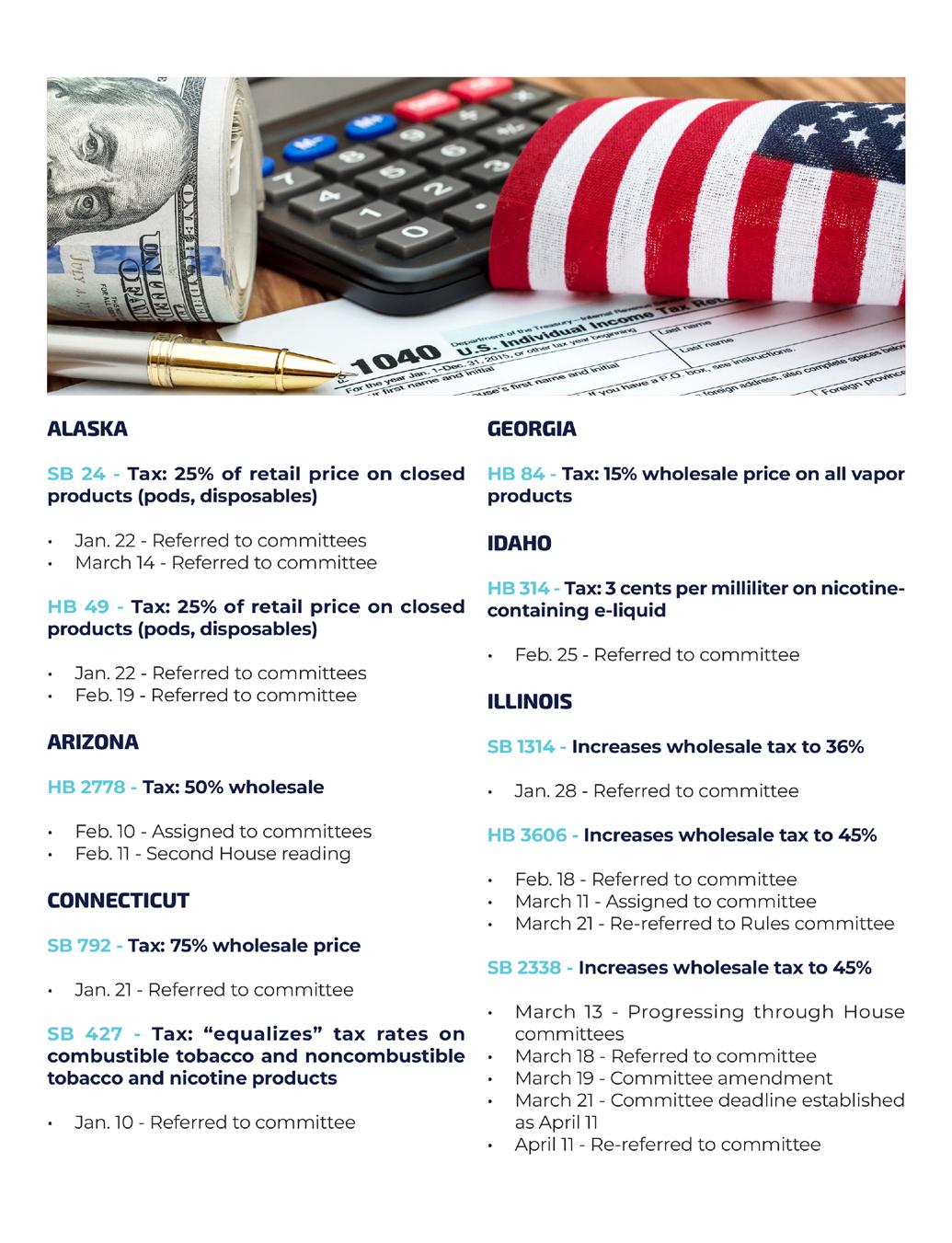

President Trump promised before the 2024 election that he would, if elected, “save flavored vaping,” and while that may eventually happen—at the federal level anyway—vape consumers and businesses are certainly facing more challenges at the state level than ever before.

In some states, vape retailers and distributors face lawsuits and other legal threats from their state attorneys general (AGs), and many Democratic legislators remain obsessed with banning flavored vapes—the preferred “solution” to youth vaping promoted by Democratic Party allies in tobacco control and public health.

In Republican-led states, lawmakers beholden to rich tobacco companies have adopted the strategy of PMTA registry (or directory) laws intended to block sales of products that compete with vapes (and cigarettes) sold by Big Tobacco. In many cases, the laws are created by tobacco industry lobbyists.

For small e-liquid manufacturers, importers of popular disposable vapes, Chinese vape device manufacturers, and consumers of all these products, it probably doesn’t matter whether the threat comes from friends of the Campaign for Tobacco-Free Kids or recipients of campaign donations from tobacco companies like Altria Group and R.J. Reynolds. In both cases, the laws are intended to restrict vaping product choice and access.

Today we’re looking at recent actions by state attorneys general. Next week, we’ll focus on proposed flavor bans and PMTA registry bills currently active in state legislatures.

The lawsuit, filed in the U.S. District Court for the Southern District of New York, seeks hundreds of millions of dollars in fines and damages. Defendants include major vape distributors Demand Vape, Midwest Goods and Mi-Pod.

James charges that flavored disposable vapes sold by the defendants are responsible for “fueling the youth vaping epidemic”—despite the fact that youth vaping peaked in 2019, before disposable vapes became widely available. According to the 2024 National Youth Tobacco Survey, middle and high school vaping has fallen by more than 70 percent since 2019.

“The vaping industry is taking a page out of Big Tobacco’s playbook: they’re making nicotine

seem cool, getting kids hooked, and creating a massive public health crisis in the process,” said James.

Last month, James and the New York State Department of Health filed a lawsuit in an attempt to shut down a single vape shop in New York State’s rural Herkimer County.

State attorneys keep the “youth vaping epidemic” in the news

This week’s New York lawsuit is the latest salvo in a coordinated effort by (mostly) Democratic AGs to keep youth vaping in the news, which improves the chances of passing more laws

Nearly every state, including those with Republican AGs, sued and accepted a settlement with Juul Labs. But it is Democratic state attorneys general that view the vape industry as a target-rich environment they can exploit again and again.

restricting vapes. They also intend to generate income (and headlines) by imposing fines or reaching settlements with vape industry scofflaws. Of course, those aren’t their stated purposes.

In January, AGs in California, Connecticut, Hawaii, Illinois, Minnesota, New Jersey, New York, Ohio (the lone Republican AG in the group), Vermont, and Washington D.C., announced the creation of “a coordinated, multi-state enforcement initiative to address the unlawful sales of flavored e-cigarettes, vape pens, and accessories.”

Since January 15, officials in most of those states have engaged in enforcement actions of some sort:

• California AG Rob Bonta filed lawsuits against businesses associated with disposable vape brand FLUM

• Connecticut AG William Tong “served civil investigative demands” to a handful of retailers and distributors of disposable vapes

• Hawaii’s AG office sent a bizarre warning to retailers that reads like a ZYN promotion

• Illinois AG Kwame Raoul took legal action against sellers of the Posh disposable brand and distributor Midwest Goods

• Minnesota Attorney General Keith Ellison filed a lawsuit against various entities connected to High Light vapes, the infamous disposable vape that looks like a highlighter pen (and may or may not actually exist)

• New Jersey sent 11,000 warning letters to state retailers “reminding them that selling flavored vapor products is unlawful and directing them to cease any such sales immediately”

“

” a coordinated, multi-state enforcement initiative to address the unlawful sales of flavored e-cigarettes, vape pens, and accessories.

Of course, squeezing vape businesses for headlines and profit isn’t exclusive to Democratic politicians (and, yes, AGs are certainly politicians). Nearly every state, including those with Republican AGs, sued and accepted a settlement with Juul Labs. But it is Democratic state attorneys general that view the vape industry as a target-rich environment they can exploit again and again.

“Since the FDA began enforcing against vaping manufacturers and sellers, the agency says it has issued about 1,220 warning letters, and filed more than 150 civil money penalty complaints...

”

Since the FDA began enforcing against vaping manufacturers and sellers, the agency says it has issued about 1,220 warning letters, and filed more than 150 civil money penalty complaints.

“ “

FDA targets “youthappealing brands”

The date of the seizure is unknown, although the action came after April 5, when the U.S. Attorney’s Office in Los Angeles filed a civil forfeiture complaint in the Central California U.S. District Court on behalf of the FDA.

The FDA action originally targeted vape distributor the MDM Group (doing business as Eliquidstop.com), but during the raid “the agencies were informed that several firms may have an ownership interest” in the seized products. The FDA has not named the other companies who had a stake in the seized products.

The number of seized products was relatively small, at least compared to the last FDA seizure the agency announced publicly. In that action, FDA and U.S. Customs and Border Protection employees seized 1.4 million vape devices at Los Angeles International Airport—more than 30 times as many as the Alhambra raid produced.

The FDA says the products seized at the California warehouse were mostly disposable vapes, including “youthappealing brands such as Puff Bar/Puff, Elf Bar/EB Design, Esco Bar, Kuz, Smok, and Pixi.”

FDA’s whack-a-mole war on vapes shifts into high gear

The FDA has authorized just seven e-liquid-based vaping devices (six remain on the market)—all available only in tobacco flavors, and none popular among the millions of American adults who use e-cigarettes. All FDA-authorized vaping products are made by major tobacco companies.

The agency has rejected millions of premarket tobacco applications (PMTAs), forcing many companies out of business, and pushing others to appeal FDA marketing denial orders (MDOs) in federal court. The FDA has not authorized any bottled e-liquid or any product in a non-tobacco flavor, and has authorized no new vaping products since Brian King was appointed CTP director nearly two years ago.

Since Vaping360 last covered an FDA vape enforcement action (civil money penalties assessed to 21 retailers in late January), the agency has announced three rounds of warning letters (80 total), and civil money penalties for 22 more retailers—all actions against sellers of disposable vapes.

Since the FDA began enforcing against vaping manufacturers and sellers, the agency says it has issued about 1,220 warning letters, and filed more than 150 civil money penalty complaints. It has also sought permanent injunctions to shut down six tiny vape businesses in 2022 and another one last year.

The agency shifted its whack-a-mole war against disposables into high gear last year, and has gotten help from tobacco giants R.J. Reynolds and Altria Group, which have carried on their own campaigns to wipe out disposable vapes and independent vape manufacturers and pass state PMTA registry laws that ban the competition’s products. The cigarette companies have lost ground in recent years and blame growing retail competition from “unauthorized” disposable vapes.

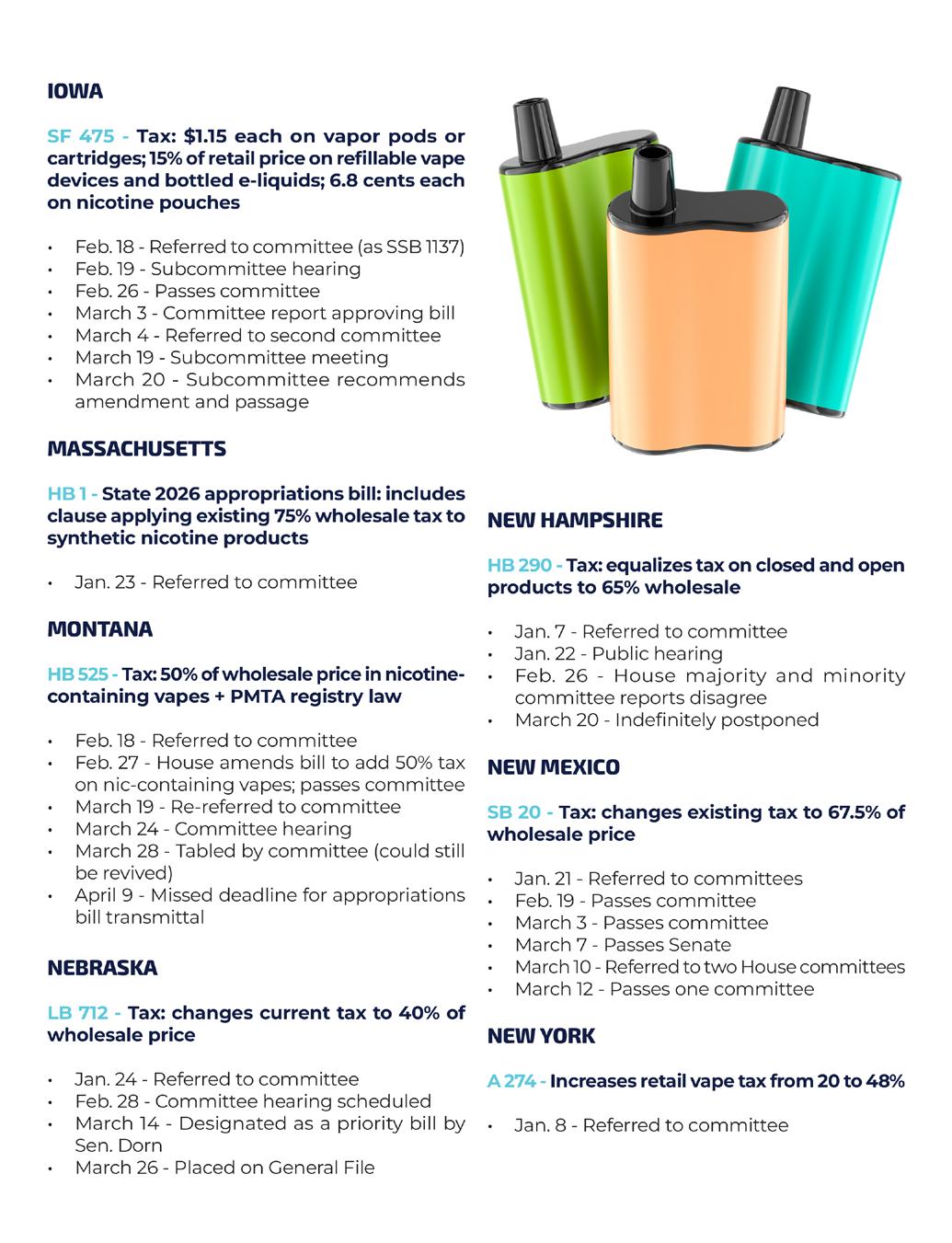

Proposed State Tax Bills Would Make Vaping More Expensive

Taxes range from states that assess a fivecents-per-milliliter e-liquid tax to Vermont’s champion 92 percent wholesale tax.