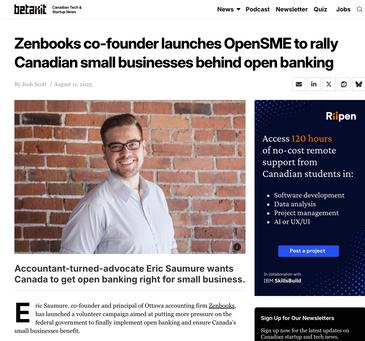

LaunchedonAugust11,2025, withonecleargoal:

To ensure Canada’s small and mediumsized enterprises (SMEs) interests are included in the first phase of open banking.

(SMEs = 50% of GDP, open banking launch set for early 2026, but scope undefined).

The Government of Canada launched its annual pre-budget consultations to hear from Canadians So we planned on putting together a comprehensive submission that supported small business owners towards Open Banking.

Business groups, accounting leaders, fintechs, nonprofits, policy makers, 250+ business owners.

Small business owners are the lifeblood of communities. They sponsor teams, make cool products, and give cities their character. But they’re also underserved and often overlooked when big policy changes roll out We saw open banking heading down the path of being “for consumers and fintechs only” and felt a duty to make sure business owners weren’t left out.

: Using Our Platform & Credibility:

We’ve built Zenbooks into a national firm with visibility, credibility in fintech circles, and relationships across media and policy. That gave us leverage that many small business owners don’t have. Launching OpenSME was about using that platform to amplify their voices at a critical moment.

: Frustration with “Policy from Above”:

We’ve often noted that decisions in Ottawa happen in rooms where small business owners rarely have a seat. Running this campaign from Eric’s “living room ” was a way of proving that an outsider, an accountant, not a banker or lobbyist, could shape the national conversation.

Kevin Judge - CEO & Founder - iNOBL (Business coaching)

. Legacy Philosophy: Advocacy as Legacy: Beyond numbers, we can show that our professional story is tied to advocacy and legacy OpenSME was another way of aligning our professional skills (accounting, strategy, communication) with a public good ensuring small business voices shape the future of Canada’s financial system

We successfully aligned during a pinnacle time to move Open Banking back into the conversation for small business owners.

We hosted a roundtable discussion with:

JOHNNGUYEN

Co-founder/CEO,HairRepublic

MICHAELCASCONE

VP,GovernmentRelationsandPublicPolicy,Xero

RYANLAZANIS , CPA–CEO,FutureFirm

which highlighted the need to include small businesses in the first phase of open banking and called for a clear rollout timeline along with support to help SMEs adopt it safely. It also emphasized the benefits of faster payments and better access to financial data.

We aligned Business groups, policy makers, accounting leaders, small business leaders, non profits, national fintech companies and +250 small business owners/supporters.

250+ small-business owners and supporters signed on National associations: CFIB, CGLCC, OFNC

Accounting leaders: Ryan Lazanis (Future Firm), Blake Oliver (Earmark), Rachel Fisch (the dt group)

SMEs and nonprofits: iNOBL, Hair Republic, Council Advancing WorkBased Learning

Fintech leaders: Fintechs Canada, Xero, Dext, Huumans, Remitian, Peloton Technologies, Ignition

Parliamentary Echoes: Senator Colin Deacon shared our concerns on socials.

Accountants deal with it every day. Outdated banking slows small businesses to a crawl Payments get stuck Loan approvals die because data isn't shared. That is friction our clients can't afford Open banking fixes this. And our profession should be leading the charge to make it happen.

Budget2025confirmedcleartimelinesandinclusionofsmall tionaboutopenbanking s,accountants,fintechs, acyintoBudget2025and

Corinne Pohlmann, Executive VP, Advocacy, CFIB

Open banking has the potential to give small businesses more choice, flexibility, and transparency in how they manage their finances. It’s important that the federal government keeps this issue on its radar to ensure Canada doesn’t fall behind other jurisdictions CFIB strongly supports progress on open banking and initiatives like OpenSME, which could help level the playing field for small businesses by driving competition, lowering banking costs, and expanding access to financial tools and services

REGIONALCOVERAGEIN

OTTAWABUSINESSJOURNAL

125,000 monthly readers

NATIONALTRADECOVERAGEIN

tens of thousands of Canadian tech readers

POLICYFOCUSEDCOVERAGEIN

pdfversionnopaywall

100,000+ policy readers across print & digital

SMALLBUSINESSOWNERCOVERAGEIN

small business owner readership nationwide

POLICYFOCUSEDCOVERAGEIN

One of Canada's most reputable policy think tanks