Leading With Culture Before the First Day Page 32 Market Measure Industry Insights to Guide Your Strategic Planning in 2023 Page 20 What’s Sticking for Pros in Tape & Masking? Page 40 Published by the North American Hardware and Paint Association Vol. 62 • Issue 1 • January 2023 • PDRmag.com

Jan 31 - Feb 2, 2023 Las Vegas Convention Center | South Hall New Products. New Connections. New Experiences. Our ongoing efforts to reimagine NHS are intended to deliver you more value. Whether you’re looking to reconnect with customers, peers and colleagues, discover the latest trends in the home improvement & DIY industry or explore new products and innovations – your experience at NHS will provide you the tools to grow your business. NHS is focused on continuing to celebrate innovation, deepening industry connections and growing our global footprint. Register Today For NHS at nhs23.com/NHPA-Free REGISTER TODAY! USE CODE NHPA FOR A FREE EXPO PASS! Untitled-1 1 11/8/22 7:50 AM Untitled-1 1 12/12/22 3:44 PM JANUARY ISSUE SPONSOR

Leading With Culture Before the First Day Page 32 Market Measure Industry Insights to Guide Your Strategic Planning in 2023 Page 20 What’s Sticking for Pros in Tape & Masking? Page 40 Published by the North American Hardware and Paint Association Vol. 62 • Issue 1 • January 2023 • PDRmag.com

THE CLEAR CHOICE FOR WOOD Strong Enough for the Toughest Environments • Resists water and weather • Advanced ultraviolet protection • Clear, durable finish • Dries quickly and cleans easily • Designed for exterior application on wood, fiberglass, coated metal, or painted surfaces • Available in matte, satin, semi-gloss, and gloss sheens Ascend Exterior® Water-Based Clear Finish is a durable coating designed for exterior application, making it perfect for railings, outdoor furniture, doors, and windowsills. COME JOIN OUR FAMILY myoldmasters.com | (800) 747-3436 |

1025 E. 54th St. Indianapolis, Indiana 317-275-9400 NHPA@YourNHPA.org YourNHPA.org

COMMUNICATIONS

Melanie Moul Communications & Content Manager mmoul@YourNHPA.org

Lindsey Thompson Associate Editor lthompson@YourNHPA.org

Carly Froderman Associate Editor cfroderman@YourNHPA.org

Jess Tillman Retail Training Editor jtillman@YourNHPA.org

Autumn Ricketts Graphic Designer

Olivia Adam Graphic Designer

Austin Vance Production Manager

Kallahan Beatty Communications & Production Coordinator

Freda Creech Sales & Production Assistant

Kevin Trehan Digital Media Specialist

Julie Leinwand Marketing Manager

ASSOCIATION PROGRAMS

800-772-4424 | nhpa@YourNHPA.org

Katie McHone-Jones kmchone-jones@YourNHPA.org

Director, Member Services & Events

Kim Peffley kpeffley@YourNHPA.org

Director, Organizational Development & Consulting

Jesse Carleton jcarleton@YourNHPA.org Training Manager & Editor

Renee Changnon rchangnon@YourNHPA.org Retail Engagement Specialist

SALES

LeAnn Day lday@YourNHPA.org

Publisher Scott Gilcrest

317-508-7680 | sgilcrest@YourNHPA.org

Director of Sales & Southern Sales Director

Jordan Rice

217-808-1641 | jrice@YourNHPA.org

Northern Sales Director

YOUR NHPA

Keeping Up With Technology

From cell phones to vehicles to televisions, when it comes to technology, it can feel like the minute you implement the latest and greatest it’s already obsolete. Paint and Decorating Retailer spoke with several paint and decorating retailers who share their road maps for getting started and the routes you can take to successfully bring technology into your operation.

PAINT & DECORATING RETAILER

(ISSN 1096-6927): Published monthly except December by the North American Hardware and Paint Association, 1025 E. 54th St., Indianapolis, IN 46220. Phone: 800-737-0107. Subscription rates: January through November issues, $50 in U.S., payable in advance. Canada $75 per year. All other countries $100 per year. Single copy $7, except July issue, $25. Periodicals postage paid at Indianapolis, Indiana, and additional mailing offices. Postmaster: Send address changes to Paint & Decorating Retailer, P.O. Box 16709, St. Louis, MO 63105-1209. Returns (Canada): Return undeliverable magazines to P.O. Box 2600, Mississauga, Ontario L4T 0A8. PM# 41450540. Copyright © North American Hardware and Paint Association, 2023.

OUR MISSION

The North American Hardware and Paint Association (NHPA) helps independent home improvement and paint and decorating retailers, regardless of affiliations, become better and more profitable retailers.

NHPA EXECUTIVE STAFF

Bob Cutter President & CEO

Dan Tratensek

Chief Operating Officer

David Gowan

Chief Financial Officer & Executive Vice President, Business Services

Scott Wright

Executive Director, Advanced Retail Education Programs

Whitney Mancuso

Executive Director of Innovation & Engagement

NHPA BOARD OF DIRECTORS CHAIRMAN OF THE BOARD

Jared Smith, Jared’s Ace Hardware, Bishopville, South Carolina

EXECUTIVE VICE CHAIRMAN

Jackie Sacks, Round Top Mercantile Co., Round Top, Texas

DIRECTORS

Alesia Anderson, Handy Ace Hardware, Tucker, Georgia

Jay Donnelly, Flanagan Paint & Supply, Ellisville, Missouri

Ned Green, Weiders Paint & Hardware, Rochester, New York

Scott Jerousek, Farm and Home Hardware, Wellington, Ohio

Joanne Lawrie, Annapolis Home Hardware Building Centre, Annapolis Royal, Nova Scotia

Ryan Ringer, Gold Beach Lumber Yard Inc., Gold Beach, Oregon

SECRETARY-TREASURER

Bob Cutter, NHPA President & CEO

NHPA CANADA

NHPA CANADA

Michael McLarney, +1 416-489-3396, mike@hardlines.ca 330 Bay Street, Suite 1400 Toronto, ON, Canada M5H 2S8

CIRCULATION, SUBSCRIPTION & LIST RENTAL INQUIRIES

CIRCULATION DIRECTOR

Richard Jarrett, 314-432-7511, Fax: 314-432-7665

Follow Us Online

FEBRUARY

COMING IN

January 2023 | PAINT & DECORATING RETAILER 3

COVER STORY

Market Measure

With the new year brings the launch of the industry’s annual report. Explore the highlights on how the industry fared, including big-box operational metrics, see the projections for 2023 and beyond and get insights from industry wholesalers and partners. Read the industry’s only data-driven guide created for the independent channel.

32

OPERATIONS

Starting With Culture

40

CATEGORY Tape Talk

Discover tape and masking product insights from a contractor’s perspective and explore expert knowledge to share with your customers.

Volume 62 | Issue 1 | January 2023 PaintandDecoratingRetailer PDRMagazine CONT ENTS

On the Web 6 Viewpoint 8 The Big Picture 10 NHPA News 12 Product News 14 Fresh Coat 42 Calendar 44 Finish 46 DEPARTMENTS 40 32

20

Discover how creating descriptive job summaries with a focus on culture can bring in ideal candidates to build your business and retain your employees. PAINT & DECORATING RETAILER | January 2023 4

Jan 31 - Feb 2, 2023 Las Vegas Convention Center | South Hall New Products. New Connections. New Experiences.

Register Today For NHS at nhs23.com/NHPA-Free REGISTER TODAY! USE CODE NHPA FOR A FREE EXPO PASS!

Our ongoing efforts to reimagine NHS are intended to deliver you more value. Whether you’re looking to reconnect with customers, peers and colleagues, discover the latest trends in the home improvement & DIY industry or explore new products and innovations – your experience at NHS will provide you the tools to grow your business NHS is focused on continuing to celebrate innovation, deepening industry connections and growing our global footprint.

NEWS, PRODUCTS & TRENDS Get the Latest Updates

Scan this QR code or visit PDRmag.com/january to see these stories and more resources for your operation.

Beyond the Numbers

There is more to Market Measure than the numbers on the page. See what else there is to discover about the industry’s annual report online.

Details Abound

Download the full Market Measure report. The resource includes additional insights into the hardware, home center and lumberyard segments.

Expert Analysis

Read what the experts economists have to say about the market and how things have changed. Get insight into the projected trends for the 2023 market.

Watch or Listen

Join NHPA’s Dan Tratensek and Grant Farnsworth from The Farnsworth Group for a Market Measure podcast episode launching Jan. 9, or watch the conversation in the webinar later this month.

OPERATIONS Attracting Applicants

Beyond writing a detailed, culture-focused job description is getting applicants into your business. Here are six tips on how to advertise your job opening and bring candidates in.

CATEGORY Going Above and Beyond

See five additional ways customers can use painters tape and advise them on which products to purchase for which projects.

FIND MORE ONLINE PODCAST A Year in Review

Listen to stand-out soundbites from five of the most popular episodes of “Taking Care of Business” in 2022. Featured guests range from paint and hardware retailers to wholesale and co-op leaders.

Scan the QR code or visit the website below to listen.

YourNHPA.org/podcasts

ON TH E WEB

PAINT & DECORATING RETAILER | January 2023 6

How to Reach Dan

It’s Show Time!

In just a few weeks, a good portion of the North American Hardware and Paint Association (NHPA) team will be headed to Las Vegas and the National Hardware Show (NHS).

That’s right, in case you haven’t heard, the National Hardware Show is being held Jan. 31-Feb. 2 in Las Vegas. It will be taking place in conjunction with a number of other shows including the NKBA Kitchen & Bath Industry Show, the NAHB International Builders’ Show and the Las Vegas Market.

That’s a lot of bang for your buck right there. The ability to buy one ticket and hit all these major industry shows at once offers time-pressed attendees a lot of value. And, as in the past, NHPA will have a big presence at the show, though the programming we have planned for Vegas has evolved a bit from what we would typically do.

This year, we will be hosting our first-ever Foundations of Merchandising Management Live! course during NHS. There’s no better place to host a group of retailers looking to hone their merchandising, buying, negotiation and assortment planning skills than in a live-show environment.

And while I’d strongly encourage anyone reading this to join us in Vegas, take advantage of all these great shows occurring in one location and connect with the team from your association, I also want to take a minute to talk about how we all got to this point.

In any business, your ultimate goal is to identify the needs of your customers and find ways to meet those needs, right? You likely do it all the time in your business, and it’s no different for folks like us here at NHPA or over at NHS. The industry changes, its needs change and the demands of our members and customers change.

In fact, the development of our Foundations of Merchandising Management Live! course was actually based on calls from retailers telling us they needed help in this area.

The same holds true for the staff of NHS. They are constantly talking to attendees and exhibitors to determine how to make the show more welcoming and responsive to their changing needs. This new combined show format and change in dates is all part of how the show is working to better suit the needs of its customers.

I know change can feel a bit uncomfortable at times, and we all get set in our ways, but just like you making changes to improve or better tailor your business to your market’s needs, I applaud any business willing to adapt.

So, as we start this new year full of promise and opportunity, I ask you to look at your business and think for a moment about what changes you might be able to make to adapt to the changing market.

And do me a favor, if you’re out in Vegas, make sure you stop by and say hello.

Dan M. Tratensek Chief Operating

VIEWPOINT PAINT & DECORATING RETAILER | January 2023 8

Officer

“I know change can feel a bit uncomfortable at times and I applaud any business willing to adapt.”

CONNECTIONS

Dan Tratensek dant@YourNHPA.org

FR EE S AMP LE C A N S NO modified oils; NO Water Visit our website ArmClark.com for stocking dealers OIL BASED WOOD STAINS Customer Favorite Good Old Fashioned Traditional Oil Stain Our high-quality exterior wood stain is the perfect solution for any level — from expert craftsmen to amateurs — and everyone in between. Craftsman Quality DIY Friendly TM

While New Look Decorating Center has a loyal DIYer following, with 60% of daily foot traffic coming from the retail segment, manager Brett Lanham was looking for new ways to connect in person with the store’s professional customers, which make up 70% of sales. In November 2022, the store hosted its first pro event, inviting contractors to visit the store for free food and a chance to network with fellow professionals.

“We’re constantly trying to connect professionals with other contractors who can

help them in their own projects, so this event was an easy way to get these guys together,” Lanham says. “It also allowed us to show them our appreciation. Plus, who doesn’t love free food?”

Lanham hopes to expand the events to every month and continue to provide food and opportunities to make connections.

“I want to get the events to a place where contractors will look at their calendars, see it’s the second Friday of the month and know they can come to our store for lunch and to grab supplies or make new connections,” Lanham says.

PAINT & DECORATING RETAILER | January 2023 10 OUTREACH Share Your Stories Send your merchandising tips, event recaps, employee morale boosters and other stories to editorial@YourNHPA.org THEBIG PICTURE

New Look Decorating Center Pulls in Professionals OPERATIONS

Connecting Audiences

To bring together its professional customers and attract new ones, New Look Decorating Center has started hosting monthly contractor events with free food.

Freebie Fridays

In an effort to bring customers in the door and provide a helpful service, Hadlock’s House of Paint, which has four locations in New York, started offering Free Paint Fridays in 2018. Each Friday of the month, customers can come into any of the stores and receive a free half-pint paint sample. The program is a simple way to connect with customers and guide them along as they start a painting project, says social media coordinator Todd Gonzalez.

The program took a hiatus during the pandemic because of the product shortages and supply chain issues. Plus, Gonzalez says retail sales were at an all-time high, and the stores had no problem bringing customers in the doors. As sales plateaued, Hadlock’s brought back Free Paint Fridays, and it’s once again popular with customers, Gonzalez says.

“We love that the promotion brings customers into the store,” he says. “Plus, it’s helped boost sales because most customers come back to purchase their paint from us.”

Unconventional Merchandising

“There is one place that is overlooked by most paint and hardware stores as a spot to demonstrate products: the store’s bathroom. When we remodeled our store bathroom recently, we hung wallpaper from our sample books so customers can see how the options look in real-life spaces,” says Steve Ozab, owner of Goleta Valley Paint.

January 2023 | PAINT & DECORATING RETAILER 11

MARKETING

ASSOCIATION

Membership

Visit YourNHPA.org/membership to make the most of your NHPA membership.

10 Ways NHPA Works For You

LEARN HOW THE North American Hardware and Paint Association (NHPA) can help you by taking advantage of our resources, tools, events and training. Below are 10 ways NHPA works for you.

1. Two Magazines

NHPA publishes Hardware Retailing and Paint & Decorating Retailer, which feature operations best practices, retailer stories and product trends.

2. Employee Training

The association offers online training, including compliance training and courses on product knowledge, project sales, customer service and more.

3. Manager Training

NHPA provides online training courses to help new and seasoned leaders with leadership, finances, team building and more.

4. Advanced Store Operations Training

The Retail Management Certification Program teaches business owners and key employees profit-focused retail operations.

5. Roundtables

NHPA hosts and moderates retailer roundtables on topics such as finance, human resources, technology and more.

6. Podcast

NHPA’s podcast features unique perspectives on industry trends, retail success stories and management advice.

7. E-Newsletters

NHPA produces several e-newsletters to help retailers dive into the topics most important to them, including industry news, products and more.

8. Business Services

The association offers a wide range of business services, including health insurance, to help retailers save time and money.

9. Cost of Doing Business Study

NHPA has fielded this study for more than 100 years to help retailers compare their businesses to industry averages.

10. Virtual and Live Events

NHPA hosts several events throughout the year, including the NHPA Independents Conference and Young Retailer of the Year Awards.

Subscribe to NHPA News and Content

To subscribe or update your preferences, visit YourNHPA.org/subscribe

NHPA News, Events, Education and Training

Get regular association updates, including events, new training programs, business service solutions and more.

NHPA Retail Marketplace

Receive the latest updates on businesses for sale, to see retailers interested in buying and open job postings.

Paint & Decorating Retailer Digital Edition

Once a month, the editors of Paint & Decorating Retailer pick highlights from the new issue. Plus access digital archives, online exclusives and more.

Paint & Decorating Retailer Newsmakers

Get industry headlines and retail insights in this biweekly newsletter curated by Paint & Decorating Retailer editors.

Paint & Decorating Retailer Hot Products

Delivered once monthly, read articles on today’s popular category trends and see some of the latest products.

PAINT & DECORATING RETAILER | January 2023 12 NHPA NEWS

ASSOCIATION

ASSOCIATION

Get on the List

For the latest updates on the 2023 NHPA Independents Conference, including registration details, visit YourNHPA.org/conference.

EVENTS

Keynote Speakers From Amazon, Google Announced

GAIN OPERATIONAL AND STRATEGIC INSIGHTS from former Amazon executive John Rossman and Google’s head of business innovation and strategy Chris Hood, keynote speakers for the 2023 NHPA Independents Conference. Held Aug. 2-3 in Dallas, the conference is focused on providing technology-based solutions for the independent home improvement retail channel. These keynote speakers will address how you can innovate like Amazon and how to navigate continuous technological change and grow customer loyalty like Google.

About John Rossman

John Rossman is a business strategist, operator and expert on digital transformation, leadership and business reinvention. He has consulted with notable companies including Novartis, Fidelity Investments, Microsoft, Walmart and Nordstrom. He served as senior innovation advisor at T-Mobile and senior technology advisor to the Gates Foundation. At Amazon, he was responsible for launching the Amazon marketplace business in 2002. He has authored three books: “The Amazon Way” series and The Digital Leader Newsletter.

About Chris Hood

Chris Hood is a digital strategist and technology entrepreneur with over 30 years of experience in online entertainment and marketing for tv, film, music and video games. As the head of business innovation and strategy for Google, Chris engages with some of the world’s top companies to develop digital transformation strategies that grow business value. Chris also teaches in the information technology department for Southern New Hampshire University and Colorado Technical University.

Formalize Your Training Program

For your free copy of the Train the Trainer Guide, go to YourNHPA.org/train-the-trainer

A CONSISTENT APPROACH to training leads to better results on the salesfloor. When all employees receive the same training in selling skills and product knowledge, they can deliver a consistent customer service experience. A formal training program increases accountability and ensures everyone has the knowledge you want them to have as they represent your business. Regular training also increases employee engagement, which is a key factor in reducing turnover.

If you’re looking for a way to jumpstart your training program for the new year, download NHPA’s free Train the Trainer Guide. The guide makes it easy to get started by outlining what it takes to have a successful training program. It includes best practices and easy-to-understand instructions, valuable either to retailers setting up a training program for the first time or those who want to refine an existing system.

After you’ve set up a formal program, select from a variety of courses from NHPA’s Academy for Retail Development. The Academy offers courses for all levels of employees on topics including selling skills, product knowledge and operations. Retailers must be NHPA Premier Members to register for courses. More information is available at YourNHPA.org/membership

TRAINING NEW EMPLOYEES?

If you’re hiring, you need a plan for onboarding the new members of your team. Get started with NHPA’s Onboarding Handbook, which includes checklists for the first three months, best practices, links to additional resources and more. Managers and trainers can use the handbook to develop an onboarding program customized for their business. The handbook is available as a downloadable PDF for $9.99 at YourNHPA.org/shop

January 2023 | PAINT & DECORATING RETAILER 13

TRAINING

OUTREACH

Retailer Recommendations

Send an email to editorial@YourNHPA.org telling us about the products your customers love and why they are such a hit in your business.

DECK BOARD SPACERS

ALTENLOH, BRINCK & CO. U.S. INC. | Spax.us

SPAX® Deck Board Spacers provide consistent spacing during deck construction. The durable, high-impact body prevents denting and marring of material, and the built-in spacer notch provides consistent screw alignment.

GEL STAIN

OLD MASTERS | myoldmasters.com

Gel Stain is a highly pigmented, oil-based stain designed to achieve intense colors on interior wood, fiberglass, primed metal and composition surfaces. It is a popular choice for cabinet updates where a new stain color can be applied over an existing wood finish. Gel Stain is available in the same 24 trend colors as Wiping Stain for easy coordination of color throughout a home.

PAINT & DECORATING RETAILER | January 2023 14

PRODUCT NEWS

METALLIC AND TEXTURE WALLPAPER

YORK WALLCOVERINGS

yorkwallcoverings.com or 717-846-4456

York Dazzling Dimensions

Wallpaper is prepasted, washable and strippable. Made from York’s Sure Strip material, it features straight match with repeating metallic and textured patterns. Rolls are 27 inches by 27 feet (60.75 square feet).

January 2023 | PAINT & DECORATING RETAILER 15

MORE PRODUCTS

Be In the Know

Visit YourNHPA.org/subscribe to join the mailing list for the Paint & Decorating Retailer Hot Products & Trends newsletter.

PAINTER’S STORAGE BOX PURDY | purdy.com or 800-547-0780

The Purdy® Painter’s Storage Box is a three-tiered interlocking system designed to keep professional painters organized, productive and able to transport their tools quickly to and from job sites. Each box features dedicated space for housing painting tools, including a bin for wet brushes or roller covers up to 18 inches, hanger bars for organizing paintbrushes and room for stowing two extension poles.

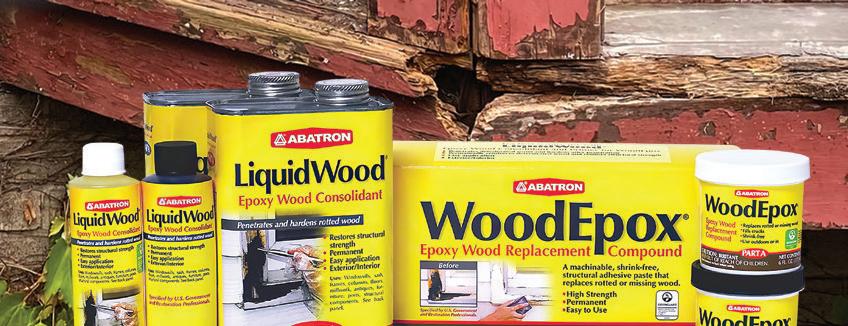

abatron.com seal-once.com

High performing and easy-to-use restoration and repair products that deliver professional results - Always!

PAINT & DECORATING RETAILER | January 2023 16

© 2022 ABATRON & SEAL-ONCE are part of the U-C Coatings family of wood protection and restoration products

Environmentally safe exterior wood protection, nonhazardous to aquatic life, and delivering exceptional results - each and every time!

BOOTH C2663

DETAIL PAINT BRUSH ZIBRA | enjoyzibra.com

The Round Brush is ideal for paint jobs involving anything round or cylindrical or with ornate details. Unlike traditional square brushes, the round brush head conforms to the shape of the object being painted, resulting in great coverage and a smooth finish.

January 2023 | PAINT & DECORATING RETAILER 17

SCAN & Learn More 85% REDUCE LANDFILL WASTE BY For product information call 866.897.7568 or email tech@towersealants.com

INNOVATIVE DISPENSER ent P SAVES MONEY

Eliminates need for single-use plastic cartridges

REDUCES WASTE

job site & landfill

by 85%

Sausage packs cost less than plastic cartridges

Reduces

waste

MORE PRODUCTS Be In the Know

Visit YourNHPA.org/subscribe to join the mailing list for the Paint & Decorating Retailer Hot Products & Trends newsletter.

CORDLESS POWER SCISSORS

BLACK + DECKER | blackanddecker.com

The BLACK+DECKER 4V MAX* Cordless Power Scissors provide faster cutting than manual scissors, and the extra-long trigger and nonslip handle make continuous use easy. It includes two blades, an ‘O’ blade for fabrics and paper and a ‘D’ blade for thick materials such as leather and plastic.

The industry’s marketplace for buying and selling independent home improvement businesses and posting jobs.

BUSINESS FOR SALE

Northwest Farm & Home Supply Co.

Location: Lemmon, SD

Gross Revenue: $3.21 million

The main building is a total 27,213 sq. ft. of retail and warehouse space on 4 acres. The main bldg. was constructed in 1994 with additions constructed in 2002 & 2004. Single story with 22’ clear height in 11,459 sq. ft. of lumber warehouse, three grade level doors and two dock height doors.

BUSINESS FOR SALE

Central Vermont Paint, Flooring, and Decorating

Business

Location: Vermont

Gross Revenue: $2.82 million

Price: $1.1 million

Full-service decorating store providing flooring, paint, window treatments, kitchen/bathroom remodeling, cabinetry product offerings, design assistance, specialized service, and professional installation.

SEEKING BUSINESSES The Aubuchon Company

BUSINESS FOR SALE

Home Improvement Supply Store

Location: Missouri

Gross Revenue: $1.04 million

This historic home improvement and hardware store is a staple of its community and operates from its headquarters in Missouri. The Company is a long-standing retailer and installer of consumer and commercial improvement products.

BUSINESS FOR SALE

Hoosick True Value

Location: Hoosick Falls, New York

Gross Revenue: $1.26 million

Price: $1.875 million

This opportunity offers a turnkey sale of a general hardware operation located in northeastern Rensselaer Co., New York. The business serves five towns, southwestern Bennington Co., Vermont, and 25 miles east of Troy, New York.

BUSINESS FOR SALE

Private Business

Location: Alabama

Gross Revenue: $2.21 million

Price: $649,000

For our next acquisition, we are looking for:

Single-store and multi-store hardware operations

• Located in northeast and southeast United States

• Store size of 5,000-30,000 ft2

• At least $3 million in average store sales

SEEKING BUSINESSES

Bolster Hardware

We are looking for:

• Geography agnostic With or without real estate

• Store revenues of $1.5M+

• We prefer to honor the family name and heritage in the local community by not changing the name

• We prefer to keep all employees as part of the acquisition

Post a Job | Sell Your Business | Buy a Store | Public and Private Listings Available

see full listings, visit YourNHPA.org/marketplace or email

Now Offering Business Valuations

To

marketplace@yournhpa.org

THE INDUSTRY’S ANNUAL REPORT

While we have all grown somewhat hardened to hearing terms like “uncertainty” and “unprecedented” over the past two years, as we close the books on 2022, we are still left trying to accurately define what the home improvement market is going through and how to measure its trajectory.

Factoring in decades-high inflation, fluctuations in sales through the pro versus consumer markets, and a supply chain that is still struggling to recover there remain a number of questions as we wrap up last year and head into 2023.

Looking back to the beginning of 2022, home improvement retailers were coming off of two of the strongest years the North American Hardware and Paint Association (NHPA) has ever recorded. The twoyear period of 2020-2021 saw consumers embrace investment in their homes and home improvement projects like never before. This pandemic-fueled spending propelled the U.S. home improvement

industry to a two-year stacked increase of more than 30%. In the 2022 Market Measure Report, NHPA estimated that the size of the U.S. home improvement retailing market hit nearly $527 billion in 2021.

Those consumer-led investments contributed to the unprecedented growth in the industry, which not only gave the independent channel an increase in its overall market share, but also saw independent retailers posting record-setting profits. According to the 2022 Cost of Doing Business Study, independent home improvement retailers’ net profits were as much as three times what we would see in a typical year in 2021. For example, in 2021, the average hardware store saw net operating profits of approximately 9.1% of sales—this is up from a typical average of about 3%.

Despite posting strong sales and profitability numbers, however, as 2021 wound down, most home improvement retailers were very cool on the prospects of additional growth in 2022.

PAINT & DECORATING RETAILER | January 2023 20

INSIGHTS From the Experts

Get additional recaps and forecasts from two analysts at PDRmag.com/2023-insights

Much of this conservative outlook was being driven by the major uncertainties the industry was facing in the supply chain and the economy overall, along with a pressing pessimism that there was no way the pace of the previous 24 months could persist.

Entering 2022, additional external factors gave rise to even more concerns about how the industry would perform. From rising gas prices, decades-high inflation, interest rate hikes, war in Eastern Europe and the continuing specter of COVID-19, it felt like everyone was bracing for a crash not seen since the Great Recession.

However, as we trudged along throughout 2022, it became apparent that despite all of these gail-force headwinds, the strength of consumers’ desire to spend money on their homes was not in steep decline. In fact, at the midway point in the year, roughly two-thirds of independent retailers were reporting sales increases over the previous year. As far as the overall home improvement market, NHPA pegged growth through June around 7%.

It is important to note a few things about this growth that do somewhat muddy the waters on how great a year the industry was actually having.

While sales for the industry were up, inflation of roughly 9.5% on home improvement items actually meant that, comparing apples to apples, the year was flat to down.

It’s also worth mentioning that while most home improvement retailers were reporting increases in transaction size over the

previous year, the number of transactions continued a downward trend throughout 2022. The same was true for transaction unit count, which was down by nearly 4%.

On the positive side, the majority of independent retailers are reporting that, despite inflation and price changes, they were managing to maintain or grow their gross margins through most of the year. However, as we entered the fourth quarter, this trend appeared to be wavering.

Entering the fourth quarter, most categories and regions appeared to be softening from the strength they had seen in the first three quarters of the year. This waning appears to be dragging industry growth back from the mid 6% range to high 5%. All in all, NHPA is predicting that the overall U.S. home improvement retail market will hit approximately $566.1 billion in sales in 2022, representing a year-over-year growth of 5.9%.

This growth, while primarily fueled by inflationary prices and strong sales to the pro market, should translate to another strong year of profitability for independent retailers who have managed to hold margins.

Looking ahead, we’re anticipating the word of the moment to shift to “sustainable.”

While we do anticipate industry sales to soften in 2023 and early 2024, there is normalcy on the horizon. Over the next two to three years, industry growth will return to slower growth in the mid 2% range through 2026.

Financial Profiles

Cost of Doing Business Study

January 2023 | PAINT & DECORATING RETAILER 21

This Market Measure report is compiled by Hardware Retailing staff from a variety of resources that are attributed throughout. What We’ll Cover Industry Insights 22 Industry Breakdown 25 Chain Results 26 27 28 HIRI Analysis 30

Michael Beaudoin Executive Vice President | ALLPRO

How did business change for ALLPRO in 2022 compared to 2021?

There were a tremendous amount of price increases that made going through the normal vetting process impossible. In addition, there were also product shortages that required larger more strategic purchases to ensure there were products to offer the group. Last year was a much “grittier” year than 2021, when sales were very robust and keeping up with demand was the main issue.

What were some challenges in 2022 and what were the solutions ALLPRO has taken to address them?

The challenges were to make smart purchases to acquire goods that were in demand but on allocation and then manage through a tremendous amount of backorders as a result. Managing the price increases was also a challenge. It led to an opportunity for price protection purchases although we had to consider cash flow.

What types of operational investments do you anticipate making in 2023 and what will be the impact on your customers?

We are in the process of launching a new platform with Enable that will provide better tracking of the Volume Incentive Program (rebates) along with a better reporting system creating a dashboard for members and suppliers to track. We are also exploring launching a vendor invoice portal to allow suppliers more visibility to invoicing with the group.

How are you helping your members address critical industry issues including technology, business transition and employee engagement?

We routinely invest in our own technology such as the latest SAP, new connectors, servers and all the necessary hardware. We also utilize our shows to allow our technology suppliers to showcase their new products and technologies.

At our stockholders’ meeting in the fall, we offered two popular seminars. One focused on succession planning to help members better plan for the future. In addition, succession planning is a routine topic for discussion at our Next Gen group meetings where succession planning is the most critical. Another seminar, called 5 Tips to Energize Your Employees,was the most popular breakout session at the stockholders’ event.

What are your projections for 2023 for the industry and for your organization?

I am budgeting a 5% increase next year in dollars which is basically flat considering price increases. The group had explosive growth over the past four years, and maintaining the market share gains in an era where other channels have gained supply will be a challenge. I anticipate the paint industry also being close to flat in 2023 given the slowdown in housing and the uncertainty in the economy.

PAINT & DECORATING RETAILER | January 2023 22 INDUSTRY INSIGHTS

F O R W A R D T HIN K I N G W I T H

Nick Weiner

How did business change for Lancaster in 2022 compared to 2021?

Even with the supply chain challenges in 2021 and 2022, Lancaster has been fortunate to maintain strong sales as a result of working more closely with our suppliers to obtain inventory when available. Even our customers have been more open to trying new products and brands due to disruption in the supply chain.

What were some challenges in 2022 and how did Lancaster address them?

The continuing supply chain issues have challenged us to be a more proactive company as far as purchasing and marketing. We have worked more closely with our vendor sales contacts, who have turned into inventory control specialists, to ensure we have product to sell.

What types of operational investments do you anticipate making in 2023 and what will be the impact on your customers/members?

We launched a new website in December in an effort to make our ordering process easier while providing more information to customers. Retailers can see the new site at lancasterco.com.

How are you helping your customers address technology?

We are now providing more instructional videos through our new website and through our e-newsletter. Lancaster’s Sundry Scene magazine also provides an outlet for information regarding technology in the industry. Customers who attend our buying shows can also meet with some of the key technology providers. Our sales team is trained to help our customers keep up with Lancaster’s technology advances. (Learn more about the Lancaster 2023 Buying Market taking place Feb. 17-18 in Orlando at lancasterco.com/events.)

What are your projections for 2023 for the industry and for your organization?

Despite inflationary pressures of 2022, we are still very optimistic for 2023 as the supply chain issues continue to improve. Lancaster also has several key initiatives launching in the coming months that we feel will keep our business strong in the coming year. Our customers will be exposed to many of these initiatives at our 2023 Buying Show in February.

January 2023 | PAINT & DECORATING RETAILER 23 INDUSTRY INSIGHTS

F O R W A R D T HIN K I N G W I T H

Senior Marketing Coordinator | Lancaster

Steve Synnott & Shari Kalbach CEO President

How did business change for HDA in 2022 compared to 2021?

Distribution America and PRO Group joined forces in April 2022 to form Hardlines Distribution Alliance (HDA). We are striving to become a larger, more impactful and more efficient organization by combining the best of both organizations. Generally, in 2022, supply chain issues improved (though not yet to pre-pandemic performance), while distributor sales outperformed 2021 in high single digits.

What were some challenges in 2022 and how did HDA address them?

Staffing, fuel costs and transportation were three top challenges experienced by HDA members. A gradual return to face-to-face office environments validated the importance of physical presence that platforms like Zoom and Teams simply cannot deliver. Staff have adapted once again to an office environment, but we did learn the importance of virtual interactions during the pandemic, prompting hybrid schedules and more regular, interactive virtual communications. A portion of rising fuel and transportation costs had to be passed on to customers, but members also absorbed a portion of these costs. We are optimistic that 2023 will be less inflationary with respect to fuel and transportation.

How are you helping your members address technology?

HDA has just signed a commitment to outsource software that will streamline rebates and member purchase data, improving the accuracy and turnaround time to members in 2023.

Periodically, we conduct an operational performance survey that gathers key metrics and

comparables that help members identify how their companies compare to their peers. Access to this data helps prioritize member technology investments that make the most sense. We have scheduled a warehouse operations workshop in April 2023 where members will bring in their top logistics personnel to share best practices in material handling and order fulfillment to retailers. Automation is a major focus of the workshop, and it’s the first time we have been able to gather in-person since the pandemic.

Additionally, we have updated and streamlined the Central Pay process to accommodate more frequent payments that improves benefits to wholesalers and suppliers.

How are you helping your members address succession planning?

We have several members who are focused on growth via acquisition. HDA is in a good position to identify and then facilitate communication between members who have transition and succession opportunities over the next several years.

What are your projections for 2023 for the industry and for your organization?

We believe the economy will show less growth than 2022, but we still see solid opportunities for business improvement by becoming more efficient as an organization. By continuing to communicate, share best practices and adopt the most efficient processes and technology available, we will strive to help all member businesses capture margin and productivity gains that will lead to a stronger overall performance in 2023.

PAINT & DECORATING RETAILER | January 2023 24 INDUSTRY INSIGHTS

OF R W A R D T HIN K I N G W I TH

Hardlines Distribution Alliance

U.S. Home Improvement Industry Sales

Home Improvement Product Sales Performance

Home Improvement Retail Sales

January 2023 | PAINT & DECORATING RETAILER 25 INDUSTRY BREAKDOWN Sales Growth 2021 vs. 2022 January 9.3% February 14.5% March 3.4% April -0.8% May 8.2% June 7.3% July 5.6% August 14.1% September 9.6% YTD 7.5% 2022 Home Improvement Sales by Month (in billions) January $33.8 February $33.5 March $44.5 April $46.1 May $50.1 June $48.2 July $43.5 August $45.2 Septmber $42.6 YTD $387.5 Source: U.S. Department of Census/Monthly Retail Sales Report NAICS 444/NSA

Home Improvement Research Institute/IHS Projections at Current Prices Compound Annual Growth 2021-2026 = 3.2% 100 200 300 400 500 600 0 2021 2022 2023 2024 2025 2026 $526.7 15.8% $564.5 7.2% $573.2 1.5% $588.5 2.7% $603.5 2.6% $618.0 2.4% IN USD BILLIONS Sales YOY Growth LEGEND

North American Hardware and Paint Association Projections Compound Annual Growth 2021-2026 = 3.2% 100 200 300 400 500 600 0 2021 2022 2023 2024 2025 2026 $534.6 7.5% $566.1 5.9% $578.0 2.1% $593.1 2.6% $609.7 2.8% $626.1 2.7% IN USD BILLIONS 700 100 200 300 400 500 600 0 2016 2017 2018 2019 2020 2021 IN USD BILLIONS

U.S. Department of Census Monthly Retail Sales Report NAICS 444/NSA Compound Annual Growth 2016-2021 = 6.5% $349.4 5.4% $365.7 4.7% $377.5 3.2% $384.5 1.9% $425.6 10.7% $477.8 12.3%

Top Chains: Individual Performance

Sources: Company reports and NHPA research

‡Store counts include operations in the U.S., Canada, Mexico and all other locations

^Store counts include operations in the U.S. and Canada, including RONA operations

*Source: National Retail Federation Top 100 Retailers 2022 List

#includes locations in U.S., Canada, Latin American and the Caribbean region

Market Share Profile

Top Chains: Combined Performance

Source: NHPA calculations

Note: For the 2023 Market Measure Report, NHPA eliminated lumber chains from its data. As such, compound annual growth rate is not represented in this year’s report.

PAINT & DECORATING RETAILER | January 2023 26

CHAIN RESULTS

2021 Sales (in billions) Stores at End of FY2021 Stores in 2022 (as of Dec. 1, 2022) Home Depot Atlanta $151.2 2,317‡ 2,319‡ Lowe’s Mooresville, North Carolina $96.3 1,971^ 1,969^ Menards Inc. Eau Claire, Wisconsin $13.1* 328* Sherwin-Williams Cleveland, Ohio $19.9 4,859# 4,891#

Net Sales (in billions) No. of Stores (at the end of FY2021) 2017 $195.2 9,362 2018 $207.3 9,314 2019 $210.2 9,351 2020 $251.9 9,379 2021* $280.5 9,475

FINANCIAL PROFILES

2021 Financial Profiles of Leading Publicly Held Chains

January 2023 | PAINT & DECORATING RETAILER 27

Operating and Productivity Profile Sherwin-Williams Home Depot Lowe’s Number of Stores (at end of FY2021) 4,859# 2,317 1,971 Distribution Centers 23# ~200 37* Average Size of Selling Area (sq. ft.) 104,000 106,000 Total Sales $19.9 billion $151.2 billion $96.3 billion Total Asset Investment $20.7 billion $71.9 billion $44.6 billion Total Inventory $1.9 billion $22.1 billion $17.6 billion Sales Per Square Foot $604 $908 Inventory Turnover 6.0x 1.5x 3.6x Net Sales to Inventory 10.5x 6.9x 5.5x Total Sales Per Employee $414,925 $308,194 $283,236 Average Size of Transaction $83.04 $96.09 Gross Margin Return on Inventory 443.3% 230.3% 182.1% Income Statement Sherwin-Williams Home Depot Lowe’s Net Sales 100.0% 100.0% 100.0% Cost of Goods Sold 57.3% 66.4% 66.7% Gross Margin 42.8% 33.6% 33.3% Total Operating Expenses 27.9% 18.4% 19.0% Net Income (Before Taxes) 14.9% 15.2% 14.3% Balance Sheet Sherwin-Williams Home Depot Lowe’s Total Current Assets 25.4% 19.2% 21.4% Cash 3.3% 0.8% 1.2% Receivables 11.4% 2.3% n/a Inventory 9.3% 14.6% 18.3% Other 2.9% 0.8% 1.1% Fixed Assets 74.6% 80.8% 78.6% Total Assets 100.0% 100.0% 100.0% Current Liabilities 27.7% 39.9% 44.1% Long-Term Liabilities 60.5% 62.5% 66.7% Net Worth 11.8% -2.4% -10.8% Total Liabilities and Net Worth 100.0% 100.0% 100.0% Sources: Company annual reports *Includes U.S., Canada and the Caribbean; #includes locations in U.S., Canada, Latin American and the Caribbean region

RESEARCH Benchmark Your Business

To get your copy of the 2022 Cost of Doing Business Study to analyze your operation, visit YourNHPA.org/codb

THE COST OF DOING BUSINESS

ANNUAL BENCHMARKING STUDY

The 2022 Cost of Doing Business Study presents the North American Hardware and Paint Association’s (NHPA) annual financial and operational profile of independent hardware stores, home centers, lumber and building materials (LBM) outlets and paint and decorating outlets. This study assesses the financial performance of home improvement retailers who graciously submitted confidential financial reports for fiscal year 2021 to NHPA. The study presents composite income statements and balance sheets plus averages for key financial performance ratios.

Retailers can use this data to measure their own performance against industry averages. The data develops benchmarks retailers can use to establish financial plans to improve profitability.

While paint is the newest segment to the study, paint retailers have been slow to participate. Data for this year is limited to 10 companies representing

27 units, which is not a significant subset for comparison. No other segment is affected as much by it being a function of the data.

Comparable store sales were up 10.7% on top of the 10.7% in the previous year. Customer count fell the most of any segment by 19%, but sales per customer was up $3, so sales were driven all by price.

Cost of goods sold (58.4%), payroll expense (19.7%) and occupancy expense (4.8%) were all at the lowest levels since we’ve added this segment, and each contributed to the highest profits ever at 14.5%.

Paint retailers are sitting on a tremendous amount of cash, as it represents 22% of their assets, but inventory is at an all-time low, which supports the supply chain issues.

When assessing productivity ratios: sales, gross margin and inventory, as they relate to square footage, are all down. However, even with the drop in headcount of two employees, sales per employee and gross margin per employee are at all-time highs.

Paint and Decorating Outlets

PAINT & DECORATING RETAILER | January 2023 28

Key Business Indicators Sales Per Customer 0% 10% 20% 30% 40% 50% Gross Margin After Rebate Total Payroll Profit Before Taxes $0 Typical $200 $250 $300 $150 $100 Typical High-Profit 43.1% 43.1% 19.7% 19.7% 14.5% 14.5% High-Profit Single Multi-Store $109 $109 $109 $271

Quarterly Report: Independent Retailer Index

The Independent Retailer Index, developed with the North American Hardware and Paint Association and The Farnsworth Group, is a regular measure of the independent channels’ performance. Access data at YourNHPA.org/retailer-index each quarter. All data is presented in aggregate. The Index tracks quarterly and year-over-year changes in various business areas including:

• Total sales

Transaction count

• Inventory investment

Cost of goods

• Gross profit margins

Future expectations

• Investment plans: inventory, staff, property, plant and equipment

Source: Independent Retailer Index, Q3 2021-2022 YOY Performance Survey, NHPA & The Farnsworth Group, November 2022

Q1 2023 Anticipated Investments

56% of retailers intend to make some investment in technology solutions

54% of retailers intend to make some investment in inventory

50% of retailers intend to make some investment in property, plant or equipment

47% of retailers intend to make some investment in employees

How to Use This Study

To get the most out of these selected results from the 2021 Cost of Doing Business Study, follow these tips.

• Compare numbers. Determine your operating expenses as a percentage of sales and calculate your balance sheet as a percentage of total assets. Compare those numbers to the study results for typical and high-profit stores.

• Look beyond the percentages. Compare your real-dollar expenditures as well.

• Consider the results. If you find your store’s individual data veers sharply from what’s contained within the study, explore the cause behind the discrepancy and develop a plan to bring your numbers on par with highprofit stores.

• Participation counts. Overall figures can vary from year to year based on the group of participating operations. Year-to-year comparisons are helpful for illustrating general trends over time.

Figures to Know

• Average transaction size is the total sales over a period of time divided by the total number of transactions in that same period.

Use It: Measure your average transaction size weekly to spot shopping trends and establish a baseline for your business.

• Payroll is the total cost of owner and employee salaries, insurance payments and benefit plans.

Use It: Compare your payroll expenses to typical and high-profit operations to find areas you could cut.

January 2023 | PAINT & DECORATING RETAILER 29

THEME OF 2022: UNMET EXPECTATIONS

Provided by the Home Improvement Research Institute

To a start 2022, the U.S. market was expected to transition out of the supply chain and labor difficulties caused by the pandemic. However, continued product and staffing shortages remained and were only intensified by inflation and subsequent interest rate increases made by the Federal Reserve throughout the year.

At the start of 2022, inflation was expected to level off at around 4.5%, but it ended up peaking at about 9% in June. Subsequently, consumer confidence has decreased throughout the year to levels not seen in over a decade. At the end of the year, inflation remained high—close to 8%—but it’s forecasted to drop to close to 4% or 5% by the end of 2023. The Fed is expected to ease rate hikes this year as the economy slows, but it will likely continue rate increases until inflation begins to come down more.

With increasing interest rates in 2022, new and existing home sales slowed significantly from where they were in 2021. To begin 2022, expectations for housing starts were around 1.7 million and trailed off to be about 1.4 million at the end of 2022. All regions continue to show significant decreases in single-family housing starts compared to 2021. Single-family building permits have also continued their steady decline since February, now decreasing 21.9% since 2021. Compared to 2021, new home sales are down 5.8%.

Additionally, housing affordability has decreased 34% over the last year while housing prices remain 13% above 2021. The introduction of interest rate hikes will likely slow demand for housing in 2023 as it is greatly increasing the total cost of purchasing a home compared to 2021.

The Home Improvement Research Institute’s (HIRI) Size of the Home Improvement Products Market report shows the extent to which much of the industry flourished over recent years; overall sales in 2021 are estimated to have grown 15.8% following a 14.2% growth in 2020.

While 2020 was very much led by consumers doing DIY projects, the pro market was the driver in 2021 showing over a 20% year-over-year growth. Although the market is cooling, expectations for 2022 are for an increase of 7.2% and then an increase of 1.5% in 2023.

So far, 2023 is shaping up to be another uncertain year, less robust than 2022, and certainly less so than 2021 and 2020. The overall outlook for the home improvement market in 2023 is becoming more tempered. As we walk into 2023 with some uncertainty relative to how the Federal Reserve will continue to address inflation, the outlook from pros appears to be muted but more stable than consumers; HIRI projects pro spending to grow in 2023 by 3.6%, and the consumer market is forecasted to remain relatively flat, growing 0.6% in 2023.

Projected housing starts for 2023 are forecasted to be like 2022 with multi-family starts increasing and singlefamily starts decreasing slightly. While declining home prices remain a challenge as the availability of home equity and credit standards tighten, there is a reason for hope. There is a backlog of work for pros, and as current homeowners opt to delay a new home purchase, there will be an increase in remodeling activity in 2023.

About HIRI

The Home Improvement Research Institute (HIRI) is the only nonprofit organization dedicated to home improvement research. The organization empowers its members with exclusive, ongoing home improvement data and information for making better business decisions. Members are the home improvement industry’s leading manufacturers, retailers and allied organizations. Learn more at hiri.org.

PAINT & DECORATING RETAILER | January 2023 30 INDUSTRY INSIGHTS HIRI ANALYSIS

WEBINAR Tune Into the Data

Join NHPA and HIRI for an exploration of the data in a Market Measure webinar on Jan. 18. Watch it at YourNHPA.org/

2022 Housing Starts

Over 2021, affordability has decreased 34%

Pro Market Expectations

2022: 7.2% 2023: 1.5%

In 2021, prices are up 13%

2023

Pro Vs. DIY Spending Projections

Pro Spending

3.6% Consumer Spending

0.6%

January 2023 | PAINT & DECORATING RETAILER 31

JAN 121.0 FEB 126.1 MAR 142.6 APR 164.3 MAY 140.6 JUNE 144.9 JULY 123.7 AUG 134.5 SEPT 129.7 OCTp 120.6

Source: Monthly New Residential Construction NSA data, U.S. Census Bureau, October 2022

CREATING CULTURE

(BEFORE THEY APPLY)

CRAFTING JOB DESCRIPTIONS TO ATTRACT HIGH-CALIBER CANDIDATES

BY JESS TILLMAN

With ongoing labor shortages and hiring challenges, keeping your business properly staffed can be a daunting task. According to the World Economic Forum, there are currently more than 10.7 million job openings but only 5.7 million potential employees to fill those spots. With an available job force that can only fill half of the job openings, finding ways to make your operation stand out with job candidates is crucial. Attracting employees begins with company culture and how your business is perceived to potential and current employees alike. Discover the steps to bring in and retain quality employees through well-crafted job descriptions with details of your company's culture and why employees should work for your operation.

PAINT & DECORATING RETAILER | January 2023 32

OPERATIONS

Register Today! www.lancasterco.com Scan for more information* and to register on-line 3M Bestt Liebco Cabot Stain DAP Duckback Dumond Dripless GDB International GE Sealants Gemini Kabosh Krud Kutter Krylon Loctite McCloskey Minwax Modern Masters Old Masters OSI Paint Scentsations Purdy Ready Seal PRIZE SPONSOR VENDORS Rust-Oleum Sashco Symn Industries Trimaco Valspar Vibac White Lightning Wooster XIM Zinsser ✓ Deep Discounts ✓ Cash Spiffs ✓ Extended Payment Terms ✓ Networking ✓ Travel & Lodging Reimbursements ✓ Luau Entertainment ✓ Educational Seminars ✓ Discounted Room Rates ✓ Prize Giveaways Friday, February 17 9:00am *Seminar I - Flooring 101 Presented by Andy McWilliams & Nate Hohenstein with Novalis Flooring 10:30am *Seminar II - Taking Sales Outside Presented by Dan Tratensek, COO NHPA 1:00pm - 7:00pm Lancaster Buying Show 1:00pm - 3:00pm Early Bird Specials 5:00pm - 7:00pm Show Floor Reception Saturday, February 18 7:30am - 9:00am Breakfast 9:00am - 4:00pm Lancaster Buying Show 12:00pm - 1:30pm Lunch 3:00pm *Wooster Booth Truck Drawing 6:00pm - 9:00pm Lancaster Luau Reception & Prize Giveaway Drawings All events are located at the Hyatt Regency. Over $100,000 in prizes will be given away at the Lancaster Luau Buying Show! Visit the prize sponsor vendors during the event and earn as many points as possible for your chances to win! Join the Lancaster Team and our exhibitors in Orlando, Florida for the return of our in-person buying show! By attending the Lancaster Buying Show you get to take advantage of these great benefits:

Starting Out Strong

Discover more ideal job descriptions and how to write your own with the NHPA Hiring Toolkit. Download the kit at YourNHPA.org/human-resources

Introducing Culture

Before you can incorporate your company culture into your job descriptions, you need to be sure you understand your company culture from top to bottom. While culture is a set of expectations that contribute to the energy that exists within an organization, there are specific components that must be established and agreed upon by the entire leadership team.

Additionally, having a mission or values statement and a set of goals or affirmations that explain how each employee or role contributes to the company’s mission will help everyone on staff understand the expectations as well as any potential candidates. Your company mission should be reflected in the atmosphere that employees contribute to and should be visible to your customers at every level of the organization.

To be sure you are attracting candidates who will contribute positively to your company culture, including your mission statement and goals in each job description is critical. A mission statement is the overall goal you have for your company. For example,

“Offering positive customer experience and top quality products to the local community,” is a mission statement for a company that is looking to create a positive environment both within the business and the community. For a business that looks to expand, using words such as “growth” and “expansion” will help convey how you see your company moving forward. Also be sure to explain how the specific role contributes to the company’s goals. Potential candidates will know what the company is about before they begin to look at each specific role they may want to apply to.

First Steps

As you establish the types of employees you want to attract to your business, assess your current job descriptions and what they're saying about your operation. A well-written job description should cover the job summary and expectations regarding an employee’s tasks and responsibilities in that specific role. It should also emphasize how the employee should act in their role and their expected attitude toward customers or clients, other employees and management.

PAINT & DECORATING RETAILER | January 2023 34

OPERATIONS

Use descriptive job summaries to bring in ideal candidates for your business. Putting an emphasis on company culture during the hiring process can bring in like-minded candidates.

Culturally Minded

Creating job descriptions focused on company culture can improve your application pool. To see examples of potential job description, visit PDRmag.com/effective-job-listings

Setting clear expectations upfront can lead to more applicants because they know what to expect in the role. If the role appears to be a good fit for them, they're more likely to apply.

According to the World Economic Forum, 41% of employees who quit their jobs from April 2021 to April 2022 did so because of a lack of career development and advancement. That’s why the North American Hardware and Paint Association (NHPA) recommends including a goals section in each job description. This section outlines the role’s daily goals and the potential for advancement. Offering candidates a glimpse at a potential career path is becoming more important for candidates so they can see the effort and engagement they put into that position will be worth the effort.

This is not to say that previous work experience should be ignored. It’s still important to see what kind of work history an individual has to make sure they would, again, be a good fit for your company. For example, if an applicant for a management position has worked in the retail industry before, they could be a better candidate than someone who hasn’t worked in retail.

Word Choice Matters

A job description not only needs to attract employees and emphasize your company’s culture, but it should also show it in the words you choose. Using phrases like

“creating an inviting environment for customers” and “helping develop staff” spell out the type of environment you want your staff to build for your customers. If candidates are introduced to your business culture through positive word choice in the job description, then they know what is expected of them and what they can bring to the table.

Putting It All Together

Once you have your job description written, share it where potential employees can find it. Outlets to share your job openings can range from social media platforms like Facebook, Twitter and even TikTok to job search websites such as Indeed and LinkedIn. Each platform will attract different potential candidates; social media sites are geared toward younger generations, like young millennials and Gen Z, while Indeed and LinkedIn will bring in older millennials and Gen X candidates. After reviewing candidates’ resumes, invite promising candidates in for an interview. What looks good on paper doesn’t always translate in-person, so interviews, either with just management or other staff members, allow you to see how the candidate handles themselves, interacts with your current employees and how their behavior could translate to your business.

PAINT & DECORATING RETAILER | January 2023 36 OPERATIONS

41%

of employees who quit their jobs from April 2021 to April 2022 did so because of a lack of career development and advancement.

Analysis of a Job Description

Now that you understand the basics of what goes into an engaging job description, it’s time to build one. We’ll use the sales associate job description from NHPA’s hiring toolkit, which has over a dozen job description samples, as an example. By including each of these elements into your job descriptions, candidates will know what is expected of them, what kind of environment they are going to be a part of and contribute to long and short-term development goals for their continued employment with your company.

5

Job Title

The job title is displayed prominently to catch a potential candidate’s interest. It should include who they report to and the typical schedule Here, we see this role reports to the store manager and is a 40-hour per week full-time position.

Job Summary

The job description, or job summary, describes what the position is and who the ideal candidate would be. Our sample clearly outlines the overall job duties and how a candidate is expected to interact with customers and team members.

Responsibilities

Responsibilities break down the day to day tasks a potential candidate would conduct as well as any potential responsibilities the job may evolve into based on the candidate and what is required of them at the time. Make sure to emphasize the company’s culture and how candidates are expected to maintain it.

Qualifications

Goals

Having goals and knowing where they can grow as individuals and with the company is incredibly important to job seekers. The sample short term goal shows that employees who continue to learn about the products you sell can lead to more responsibilities on the sales floor beyond what they were hired to do. The long term goal gives candidates an idea of what else they can do for the company within their position.

Signature

Finally, make sure there is a section for both the candidate and the employer to sign and date the job description should the individual be offered the position and take it. This then becomes a reference document to look back on as the candidate becomes an employee and grows from there. It’s a set of expectations they acknowledged and can be held accountable for.

6

Qualifications include any previous job experiences or education you are looking for in a potential candidate. However, keep in mind your company’s culture and how that plays a significant role. You may have to decide between someone who has experience but not the best attitude and someone with less experience but who better fits the company culture. Sometimes going with experience is what you need in the short term, but creating a positive and inclusive culture your employees can thrive in will be better in the long run.

PAINT & DECORATING RETAILER | January 2023 38

1

2

4

3

Examine Other Hiring Processes

See how other stores have revamped their hiring process, including job descriptions at PDRmag.com/effective-job-listings

January 2023 | PAINT & DECORATING RETAILER 39 2 4 3 5 6 1 OPERATIONS

TAPE AND MASKING PRODUCT TIPS AND CONTRACTOR INSIGHTS

BY CARLY FRODERMAN

BY CARLY FRODERMAN

While tape and masking products are the most effective way to protect surfaces during a painting project, your customers may be tempted to skip this step to save time or money. Educating them on these important prep tools and which ones to use for their specific project helps your customers avoid issues and results in happier customers who will turn to you for all their painting needs.

A fifth-generation painter, Luke Reynolds opened ALL IN Painting in 2016. Since that time, it has grown from Reynolds as the only painter to a team of 24 painters and an eight-person administrative management sales team. Paint & Decorating Retailer spoke with Reynolds, who shared tape and masking product best practices and insights into this category from a contractor’s perspective. See what products contractor businesses purchase and why, and discover expert knowledge to share with your customers.

PAINT & DECORATING RETAILER | January 2023 40

CATEGORY FOCUS

OPERATIONS Stocking Specialty Options

Educate your customers on which specialty tapes to use for different projects to boost add-on sales and position yourself as an expert. Learn more at PDRmag.com/specialty-tapes.

Sometimes Less Is More

ALL IN Painting primarily takes on residential projects, but also completes some commercial jobs and offers cabinet painting services. Despite the range of jobs, its painters only use four types of tapes.

“When we’re purchasing tape for all our painters and projects, my goal is to keep it simple, which keeps everything efficient and costs low,” Reynolds says. “If you get caught up in the different varieties of tapes and masking products, you end up wasting material because the wrong products end up getting purchased, or they are only used for one specific job and never again.”

The Knowledge You Need

Understanding the environment where the product will be used is important.

“Not only do some products work better on certain surfaces, many have different pull times, which is how long they can stay on a surface before leaving behind adhesive,” Reynolds says. “Factors such as sunlight also affect each type of tape differently. For example, when used on an exterior window, white tape melts the adhesive onto the glass.”

The best way to avoid residue from tape and masking products is to remove it as soon as possible, but being cognizant of the sun and its potentially harmful effects on the tape is also important. When tape is left on too long, Reynolds recommends Goo Gone, rubbing alcohol and plenty of elbow grease to remove adhesive.

Additional Advice

Protection is key to achieving optimal results.

“When using rollers for painting projects, it is especially important to use optimal protection,” Reynolds says. “Rollers will splatter; it doesn’t matter how good the painter is.”

While utilizing training to make sure employees understand the uses and importance of tape and masking products, it is also beneficial to teach employees the add-on potential of these products.

“If a customer walks in for paint, retailers should always have a conversation with them about what they are doing for protection and make sure they understand how to go about it and the products they need,” Reynolds says.

The Blunder

The Advice

LukeReynolds, ALL INPainting

MISTAKES MADE

When visiting job sites, Reynolds sees missteps made by both experienced and novice painters. Share his advice with customers to help them avoid the same mistakes.

“Painters will use blue tape on brick, which doesn’t stick very well or for very long, leading to time and product being wasted.”

“Orange tape, or tape with more adhesion, should be used on brick because it will stick better on the rough surface.”

The Blunder

“When using brown paper to protect a surface, I see painters apply the tape horizontally parallel to the edge of the paper.”

The Advice

“The tape should be applied perpendicular to the paper so a good six inches of the tape is on the surface. This is especially true when taping on brick.”

January 2023 | PAINT & DECORATING RETAILER 41

OPERATIONS Stay in the Know

For the full list of Colors of the Year for 2023, visit PDRmag.com/2023-colors

A HELPING

HAND

PROMOTE KNOWLEDGE TO ASSIST YOUNGER DIYERS

SOME SKILLS ARE LEARNED over a lifetime, so for younger generations, like Gen Z and Millennials, developing DIY skills can be tough. When it comes to painting a room, for example, only 66% of Gen Zers and 68% of Millennials hold the knowledge to complete the task compared to 82% of Gen Xers and 88% of Baby Boomers, according to a survey conducted by TheSeniorList.com. Promoting the skills young customers are lacking, along with the products they need to complete these projects, allows you to build relationships with your younger customers and create lifelong customer loyalty and trust.

Top Trends

Along with products and knowledge, sharing the latest trends goes a long way to connecting with younger customers. Explore some of the 2023 Colors of the Year to discover what’s hot in paint colors.

PAINT & DECORATING RETAILER | January 2023 42

FRESH COAT

Benjamin Moore

RASPBERRY BLUSH

C2 Paint TIRAMISU York Wallcoverings AMBER

PPG and GLIDDEN™ VINING IVY

Recognizing young leaders who represent the future of independent home improvement retailing

Nominations are now open for the 2023 Young Retailer of the Year awards.

Do you know an inspiring young retailer? Submit your nomination by January 28, 2023. Learn more at Your NHPA.org/yroty

NOMINATIONS

CALL FOR 2023

• 2023 NHPA YOUN G RETAILE 2

ANNUAL AWA R DS PROG Young Retailer Year ofthe NHPA North American Hardware and Paint Association

7TH

44 PAINT & DECORATING RETAILER | January 2023 Abatron 16 abatron.com Armstrong-Clark 9 armclark.com Arroworthy/Blue Dolphin 35 dolphinsundries.com Benjamin Moore IBC benjaminmoore.com/inslx Corona Brushes 7 coronabrushes.com Golden Paintworks 44 goldenpaintworks.com Lancaster 7 lancasterco.com Old Masters IFC myoldmasters.com NHPA Organizational Development 45 YourNHPA.org/development NHPA Retail Marketplace 19 YourNHPA.org/marketplace NHPA Young Retailer of the Year 43 YourNHPA.org/yroty PPG BC ppgpaints.com Richard’s Paint 18 richardspaint.com Shurtape Technologies 37 frogtape.com/contractors Tower Sealants 17 towersealants.com NETWORK Make a Plan Visit YourNHPA.org/cal to find more industry events online. CALE NDAR To add your event to the industry calendar, send an email to editorial@YourNHPA.org. Events are current as of press day. This index is provided for the convenience of our advertisers and readers. The publisher assumes no liability for errors or omissions. Industry Events EFFECTIVE EXCELLENCE Compare it to Studio Finishes™ N405 Glaze! Professional water-based glaze with good open time Comparable to N405 Glaze in working properties and functionality Can be used for a wide variety of decorative finishing effects Designed to be mixed with a quality brand, water-based house paint goldenpaintworks.com New Berlin, NY 607-847-6154 paintworks@goldenpaints.com NEW! Golden Paintworks® Acrylic Glaze ©2022 Golden Artist Colors, Inc. 31-2 TUE-THU National Hardware Show LAS VEGAS, NV FEB JAN 17-18 FRI-SAT 2023 Lancaster Buying Show ORLANDO, FL 31-1 TUE-WED FEB JAN Foundations of Merchandising Management Live! at NHS LAS VEGAS, NV

Grow Your Business From the Inside Out

NHPA offers a variety of programs and assessments to help build the people side of your business and improve communication, reduce conflict and increase overall productivity.

TeamBuilder TeamBuilder is an assessment of the people side of your business. It analyzes your current organizational structure and staff members to help you maximize their potential.

DiSC

Everything DiSC® is a personal development learning experience measuring an individual’s communication preferences and tendencies based on the DiSC model, resulting in a more engaged and collaborative workforce.

Vision Process

The Vision Process is a year-long journey toward strengthening your team, defining company values and building processes and best practices that fit your goals

Consulting

Retailers looking for other solutions can take advantage of our hourly consulting options, ranging from owner support, manager mentoring, operational support and more.

HERE TO HELP Kim Peffley

Director of Organizational Development & Consulting, NHPA

Kim Peffley began her career over 25 years ago, working at her family-owned True Value, and then served as General Manager for a seven-store Ace chain. She established development and mentoring programs, created merchandising procedures and was instrumental in driving sales, decreasing expenses and growing the business.

As a certified Everything DiSC® Facilitator and Consultant, Peffley uses her industry-specific retail management and leadership experience to offer professional training and support to retailers.

CONTACT KIM PEFFLEY

kpeffley@YourNHPA.org

219-776-0094

NHPA Organizational Development Start Your Journey Today! YourNHPA.org/development

OPERATIONS

Becoming a Manager

Read how new managers have handled the transition to a new position and advice they have for others at PDRmag.com/new-managers

The Manager Difference

CRAFTING A JOB DESCRIPTION FOR A MANAGER

Not every job description is created equal. While entry level positions, such as the sales associate position broken down on Page 32, are generally the same, upper level positions are not. Managers will require different qualifications, such as higher education and previous experience. Here are 5 things to keep in mind when you are writing your job description for a manager position.

1

COACHING

Managers are expected to teach and develop current employees to bring out the best in each of them to improve the company’s culture.

3

CULTURE

Keeping the company’s culture alive throughout the store, from the sales floor to the breakroom, helps create a positive atmosphere.

EXPERIENCE

2

COMMUNICATION

Employees in leadership roles must provide documentation and foster open communication for both entry level and upper level management positions.

4

TRAINING

Help to train new employees on sales, products, stocking and contributing to the culture of the business they are a part of

Having a higher education or appropriate work experience is required for this position to help customers, guide employees and cultivate and grow the business culture both on the entry level and the upper level. 5

PAINT & DECORATING RETAILER | January 2023 46

FIN ISH

Learn more at benjaminmoore.com/inslx Stain blocking Peeling paint Adhesion to hard-to-coat surfaces Providing a Level-5 finish ©2022 Benjamin Moore & Co. All marks are the property of their respective owner. 10/22 NO MATTER THE CHALLENGE, INSL-X® HAS THE PRIMER INSL-X ® offers a complete line of problem-solving primers for:

THE QUALITY AND EXPERTISE YOU DEMAND FROM

A BRAND THAT YOU TRUST

MANOR HALL® INTERIOR

• DELIVERS EXCEPTIONAL DURABILITY & HIDE

• OUTSTANDING WASHABILITY & SCRUBBABILITY

• 100% ACRYLIC LATEX PAINT & PRIMER* IN ONE

• ADVANCED LEVELING FOR A SMOOTH FINISH

MANOR HALL® EXTERIOR

• EXCELLENT DURABILITY RESISTS CRACKING, PEELING & FLAKING

• EXCEPTIONAL COVERAGE & HIDE

• PROVIDES A MOLD, MILDEW & ALGAE RESISTANT COATING

• PAINT & PRIMER*

AVAILABLE EXCLUSIVELY AT INDEPENDENT DEALERS**

© 2023 PPG Industries, Inc. All Rights Reserved. The PPG Logo is a registered trademark of PPG Industries Ohio, Inc. Manor Hall is a registered trademark of PPG Architectural Finishes, Inc. PPG_1047272 Find unrivaled products, performance, service and more at ppgpaints.com

*Separate primer or multiple coats may be required. **Phased exit from PPG company-owned stores