4 Ways to Diversify Your Revenue Streams With B2B Page 14 Interior Wood Care Gets Trendy Page 32

See How Your Business Stacks Up Against Industry Peers Page 22

RetailWise is NHPA’s new AI-powered micro-training program, built exclusively for independent hardware, paint, and lumber retailers. Designed for today’s fast-paced retail environment, RetailWise delivers 52 professionally scripted, two-minute video lessons that fit seamlessly into your store’s daily rhythm — no long classroom sessions or complicated schedules required.

RetailWise can be accessed across multiple platforms including, mobile devices, desktops and in-store screens. COURSE CATEGORIES:

Have Questions? Contact Cody Goeppner at cgoeppner@YourNHPA.org.

4 Ways to Diversify Your Revenue Streams With B2B Page 14 Interior Wood Care Gets Trendy Page 32

See How Your Business Stacks Up Against Industry Peers Page 22

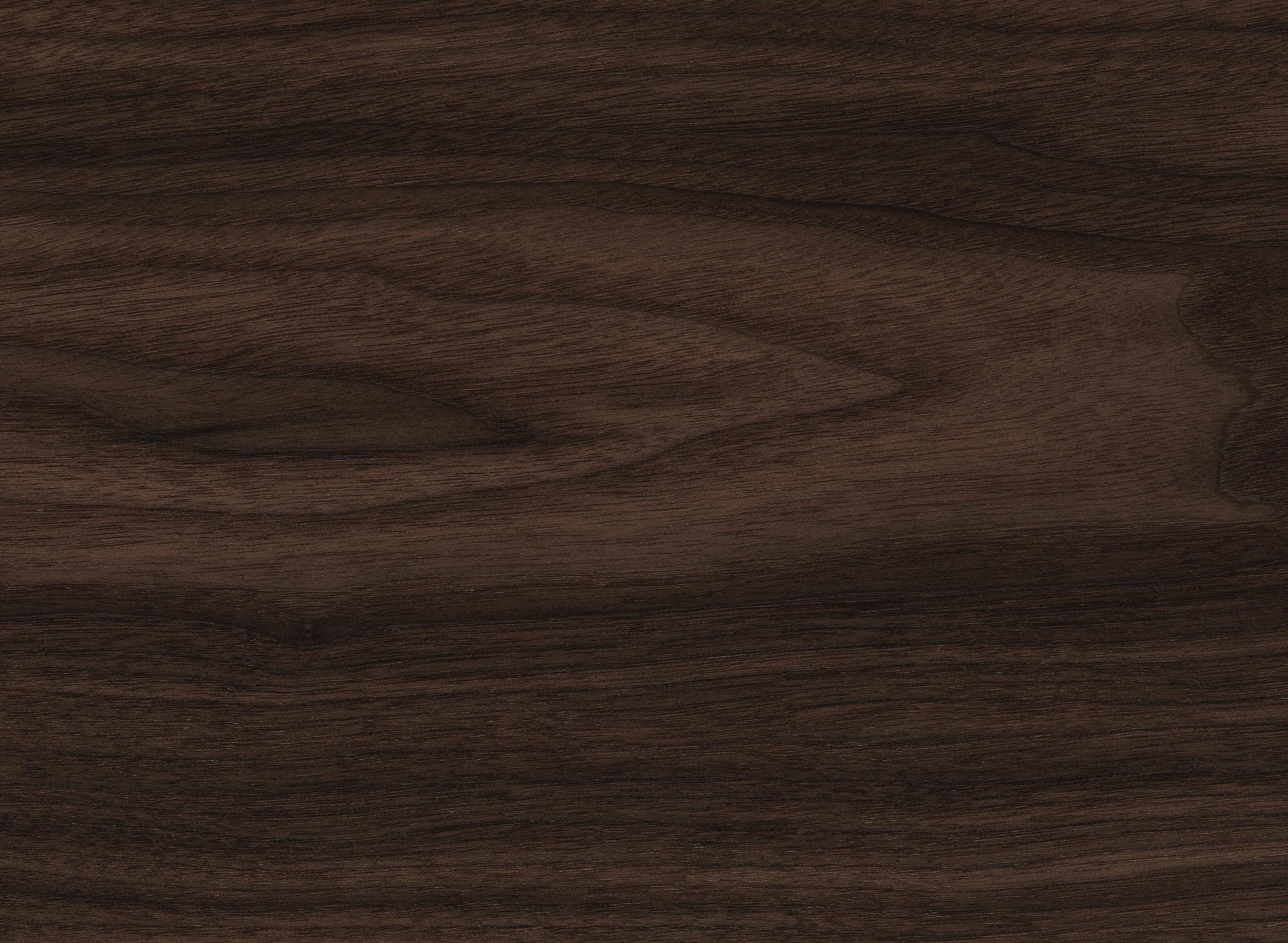

Old Masters is recognized for its comprehensive stains and finishes retail programs. We offer wood finishing products for the woodworking enthusiast and professional.

1025 E. 54th St. Indianapolis, Indiana 317-275-9400

NHPA@YourNHPA.org YourNHPA.org

Lindsey Thompson lthompson@YourNHPA.org Managing Editor

Austin Vance avance@YourNHPA.org Manager of Marketing & Partner Relations

Jacob Musselman jmusselman@YourNHPA.org News & Digital Editor

Annie Palmer apalmer@YourNHPA.org Content Development Coordinator

Autumn Ricketts Lead Graphic Designer

Olivia Shroyer Marketing & Design Specialist

Samantha Mitchell Production & Design Assistant

Cassie Reed Marketing & Digital Content Assistant

Freda Creech Sales & Production Assistant

ASSOCIATION PROGRAMS

800-772-4424 | NHPA@YourNHPA.org

Cody Goeppner cgoeppner@YourNHPA.org Director of Education & Training

Jesse Carleton jcarleton@YourNHPA.org Training Manager & Editor

Amy Hayes Operations Coordinator—Advanced Education & Training SALES

Jordan Rice 217-808-1641 | jrice@YourNHPA.org Regional Sales Director

Renee Changnon 217-621-7363 | rchangnon@YourNHPA.org

Senior Business Development Representative—West Coast

CIRCULATION, SUBSCRIPTION & LIST RENTAL INQUIRIES

CIRCULATION DIRECTOR

Richard Jarrett, 314-432-7511, Fax: 314-432-7665 gcscs8@gmail.com

OUR MISSION

The North American Hardware and Paint Association (NHPA) helps independent home improvement, paint and decorating retailers, regardless of affiliations, become better and more profitable retailers.

With the economy in a seemingly constant state of change, retailers are looking at the operational areas where they can find savings big and small to manage and protect margins. Hear from retailers who share their best practices to preserve margins through cost management, pricing strategies, operational efficiency improvements and other methods.

PAINT & DECORATING RETAILER

(ISSN 1096-6927): Published monthly except December by the North American Hardware and Paint Association, 1025 E. 54th St., Indianapolis, IN 46220. Phone: 800-737-0107. Subscription rates: January through November issues, $50 in U.S., payable in advance. Canada $75 per year. All other countries $100 per year. Single copy $7, except July issue, $25. Periodicals postage paid at Indianapolis, Indiana, and additional mailing offices. Postmaster: Send address changes to Paint & Decorating Retailer, P.O. Box 16709, St. Louis, MO 63105-1209. Returns (Canada): Return undeliverable magazines to P.O. Box 2600, Mississauga, Ontario L4T 0A8. PM# 41450540. Copyright © North American Hardware and Paint Association, 2024.

NHPA EXECUTIVE STAFF

Bob Cutter President & CEO

Dan Tratensek

Chief Operating Officer

David Gowan

Chief Financial Officer & Executive Vice President, Business Services

Scott Wright Vice President of Content Development & Publisher

NHPA BOARD OF DIRECTORS

CHAIRMAN OF THE BOARD

Ned Green, Weider’s Paint & Hardware, Rochester, New York

EXECUTIVE VICE CHAIRMAN

Joanne Lawrie, Annapolis Home Hardware Building Centre, Annapolis Royal, Nova Scotia DIRECTORS

Alesia Anderson, Handy Ace Hardware, Tucker, Georgia

Jay Donnelly, Flanagan Paint & Supply, Ellisville, Missouri

Ash Ebbo, Clement’s Paint, Austin, Texas Christian Herrick, Randy’s Do it Best Hardware, Jackson, Virginia

Michelle Meny, Meny’s True Value, Jasper, Indiana

Michael Sacks, FLC Holdings, LaGrange, Texas

SECRETARY-TREASURER

Bob Cutter, NHPA President & CEO

NHPA CANADA

EXECUTIVE ASSISTANT

Rebekah Doerksen Supply-Build Canada

Direct: 204.953.1692 | Cell: 204.990.3536 Toll-Free: 1.800.661.0253 ext. 103 102-226

As retailers look for ways to differentiate in a tight market, many are looking to launch or enhance B2B programs. Hear from retailers who share how their B2B programs have expanded their reach, deepened customer relationships and unlocked new revenue streams without adding square footage.

PROFILE Catalyzing Success

ALLPRO executive vice president Michael Beaudoin reflects on the upcoming Fall Show in Dublin and how the event solidifies the company’s goals of constantly evolving and growing together.

Benchmark Your Business

The data is in for the 2025 Cost of Doing Business Study . An industry standard for over 100 years, this study has helped countless retailers measure their business and find those key areas to focus on for growth—see how it can help yours.

PROFILE

Service Runs in the Family

It’s a family affair in this month’s Helmets to Home Improvement feature, which includes two honorees—Michael Wallace and John Wallace—brothers and colleagues at Wallace Distribution Company.

Inspiring Action to Purchase

Sharing the latest data, the Home Improvement Research Institute provides insights into the ways retailers can encourage spending in paint and stain among cautious DIYers.

Learn how one retailer keeps up with the latest wood stain trends to better cater to customer preferences and adapt to changing demand in both the exterior and interior stain categories.

PRO STRETCHTM is an Acrylic Urethane elastomeric sealant engineered to withstand wear, weather, and water with ease. Its exceptional strength and durability provide lifetime performance, ensuring your work stays protected in the toughest conditions. With the ability to fill gaps up to 2" wide and boasting 800% elongation, Pro Stretch offers the flexibility and resilience you need on any job site.

Once applied, Pro Stretch holds firm—no cracks, no leaks, no callbacks. ONCE & DONE means exactly that: a sealant you can trust for a job well-sealed and a result that lasts!

CONNECTIONS

How to Reach Dan Dan

Tratensek dant@YourNHPA.org

NOW THAT THERE IS a distinctly crisp chill in the air, leaves are beginning to darken and the subtle smell of pumpkin spice lattes is wafting through the air, it’s time for homeowners, like myself, to start thinking about prepping their house for winter’s imminent arrival.

Luckily, my wife and I have subscribed to our local HVAC company’s “service membership.” This membership entitles us to have a service rep come to our house four times each year to do a maintenance check. We fully realize that this “membership” is more about them getting four guaranteed opportunities to come to our house and try to sell us something, but because we get our filters changed and vents cleared, we agree to the compromise.

I bring this up because these HVAC companies have identified that more customer interactions equals more opportunities to sell something.

This is a pretty basic business formula, so it shouldn’t be surprising to anyone who sells for a living. Unfortunately, for those of us in the home improvement retailing industry, data continues to show that you are getting fewer and fewer opportunities to actually interact with your customers.

NHPA’s 2025 Cost of Doing Business Study came out last month and one of the most concerning bits of data it revealed was that transaction counts yet again declined for hardware stores.

“You have to continue to find opportunities to invite customers into your store. Events, clinics, parties, promotions…whatever it takes to drive traffic should all be part of this plan.”

This sinister trend has been taking place since the pandemic and shows little sign of abating.

The data also shows that transaction size has held steady or slightly increased during this same time frame, suggesting that consumers are making fewer trips to stores but potentially buying more while there.

Here’s the problem: every time a customer comes into your store, you have the opportunity to sell them something or sell them more than they might have originally intended to purchase. Fewer visits means fewer transactions and fewer opportunities.

This single metric should be among the most alarming trends retailers need to examine. The simple fact is that footsteps drive business and the increase we see in transaction size, while encouraging, does not offset the lost opportunity costs of slower traffic and fewer transactions.

Part of the solution can be found from our friends in the HVAC business. You have to continue to find opportunities to invite customers into your store. Events, clinics, parties, promotions…whatever it takes to drive traffic should all be part of this plan.

What you can’t do is sit back and do the same thing you’ve done in the past and just hope that it starts working. You should know what your transaction count is and how it has historically changed. You should monitor it on a weekly, if not daily basis, to see how it fluctuates and gauge the impact of any efforts you make to influence it.

The decline in transaction counts should be setting off alarm bells for retailers and serve as a call to action. The dire consequences of not reversing this trend should also be clear and send shivers down your spine that aren’t caused by cold autumn air or an HVAC system in need of service.

Dan M. Tratensek Chief Operating Officer

CONNECTIONS

How to Reach Lindsey lthompson@YourNHPA.org Lindsey Thompson

EVEN THOUGH online giants like Amazon dominate the retail environment, it feels to me that the overall sentiment is that most people still prefer to shop in a brick-and-mortar location.

Spending a majority of my formulative days as a consumer in the 1990s, the shopping mall was not only a destination for buying crop tops, combat boots and chokers, it was a hangout, a place to spend time with friends, the perfect date spot.

Shopping before the internet was an experience. Show any millennial a photo of Hollister and they can smell the cologne wafting out of the doors, hear the pounding club music coming from inside and start squinting from the low, dark lighting that definitely created a vibe but made it impossible to actually shop. I still remember what it felt like to walk into a Toys ‘R Us and have all these toys out of their boxes and ready for me to play with. And don’t even get me started on the olfactory overload that was Bath and Body Works—the scent of Cucumber Melon still defines my teens.

“ The combination of nostalgia and wanting to do more than just buy stuff when we shop is why brick-and-mortar is still relevant today.”

The combination of nostalgia and wanting to do more than just buy stuff when we shop is why brick-and-mortar is still relevant today. Consumers don’t want to shop; they want to experience shopping.

This spirit of experiential shopping is still alive in a number of retailers. The girls’ basketball team I coached would have a tournament in Springfield, Illinois, every season and we would always have to make a stop at Scheels. Billed as a sporting goods and outdoor living store, Scheels is so much more. The Springfield location has a full-size Ferris wheel inside (yes, inside!), a 16,000-gallon aquarium, an arcade and a candy store.

IKEA lets you try out the furniture before you buy and those room vignettes are not only fun but inspirational. When they were younger, I couldn’t get my kids out of the LEGO Store—they were so enthralled just looking at each of the LEGO sets fully built, not to mention the open bins of bricks available to create your own masterpieces.

My online story at PDRmag.com/5-senses shares more real-life examples from within and outside the independent channel of retailers engaging customers’ five senses to create a shopping experience worth remembering. It doesn’t take a full-size Ferris wheel to make a big impression; even those small aspects like fun background music or free food can generate memories and an experience that will make your customers return again and again.

Lindsey Thompson Managing Editor

Engaging your employees beyond just the work they are doing is crucial to building morale and a culture of care. Learn more at PDRmag.com/mission-retention-tips

Jared Brown is a director with The Aubuchon Co. He has a degree in kinesiology and biomechanics from Miami University and came to Aubuchon in 2015 from the banking world. Jared grew up in Ohio and moved to Massachusetts in 2012, where he currently lives with his wife and daughter. At Aubuchon, he is involved in inventory planning and forecasting, margin management and retail pricing and process improvement and operations. Jared has been integral in streamlining and modernizing Aubuchon’s inventory management strategies after the company closed its distribution operations and transitioned to a supplier-based model.

Growing up, when the streetlights came on, you went home. Sometime around then was the last time I said goodnight to my friends and ran inside. I couldn’t tell you the date. I don’t know how old I was. No one announced it. It just ended.

Life is full of those unmarked endings. There was a last time a parent picked us up and carried us before we got too big. None of us knew it was the last time, or we probably would’ve held on a second longer.

Retail has its own versions of this experience: the last Sunday night a crew worked together before someone took a new job, the last time we ordered a fad, never to be reordered (fidget spinners anyone?), the last visit from a longtime customer who always chatted at the register. These moments are ordinary until they aren’t, and then they’re gone.

I don’t reflect on this for the sake of nostalgia alone. Teams tend to run on motion—the next truck, the next promotion, the next conversion. Running at that pace is a strength, but if we never pause long enough to notice what’s good, we’ll have nothing banked for the hard week that inevitably shows up. Saying, “make your future self proud,” only works if you give future-you something to remember besides problems and punch lists. After all, as a friend reminded me recently, our jobs will probably not be listed in our obituaries.

Lately I’ve been trying to build memories on purpose. At a milestone, end of a project or end of a day, I try to notice what I’m proud of. I try to soak it in and take a mental picture. I’m not great at this and I wish I could do it more consistently, but that’s just not how I’m wired.

Why bother to reflect on these things? One day, when the chips are down and it seems all uphill, you can remember that you’ve done this before and succeeded.

I still don’t know the night the streetlights stopped deciding my schedule. I don’t know the last time my mom or dad picked me up and carried me. But I know this: I’m going to take a breath and a beat to look at a job well done, pat my team (and maybe myself) on the back and get back to work. Future-us will need it, and that’s reason enough to notice now.

Jared Brown Director The Aubuchon Co.

OPERATIONS

Makeover Motivations

See the types of information DIY customers search for before starting a project at PDRmag.com/diy-intentions

ACCORDING to the Farnsworth Group’s Paint Market: Trends & Sustainability Study, 73% of homeowners spend on home improvement materials and tools to do project themselves instead of hiring pros, with 70% citing cost saving as the main reason. And, many customers opt for a digital shopping

experience for ease and convenience when sourcing DIY materials, so ensuring your store’s online presence is simple to navigate and user-friendly is essential in winning customers and keeping sales consistent. See the most important factors among different generations when shopping for home improvement products online.

Source: Paint Market: Trends & Sustainability Study, The Farnsworth Group

Retailer Recommendations

Send an email to editorial@YourNHPA.org telling us about the products your customers love and why they are a hit in your business.

VELCRO

velcro.com

The All-Purpose Strap is a reusable hook-and-loop strap designed with an elastic build and D-ring buckle, offering an adjustable fit and up to 40-pound breaking strength. These straps are ideal for bundling cords, hoses, tools and gear, keeping items secure and organized indoors or outdoors. Durable and versatile, they provide a simple solution for storage, transport and everyday use.

LUXYSPLASH

luxysplash.com

Elsi Textured Glass Peel-and-Stick Wall Tile are 3-by-12-inch wall panels with a glossy finish and pre-applied adhesive backing. Installation requires no grout for a quick DIY project in kitchens, bathrooms or other walls and they have the same durability as traditional glass tiles in a stackable, pattern-friendly format.

CRESCENT TOOLS

crescenttool.com

Siterunner is a collapsible three-shelf utility cart with a T-channel accessory rail, 300-pound total capacity, palm grip handles, integrated tool strap and 5-inch non-marring casters, designed for easy transport and storage with an 8.3-inch folded profile.

oatey.com

The Hercules Silicone Plumbers Caulk from Oatey is a professional-grade sealant that adheres to a variety of surfaces, including wood, glass, porcelain, tile, concrete, grout, metals and most plastics. It creates a flexible, durable, UV-resistant and waterproof seal that resists mildew, cracking, crumbling and shrinking.

EMU SAFETY

emusafety.com

The Original Safety Glasses from Emu Safety are polycarbonate safety glasses with a matte-black frame and sides and polarized UV400 lenses. They are compliant with ANSI Z87.1+ and AS/NZS 1337.1 medium-impact standards.

wagnerspraytech.com

The Wagner FLEXiO 1500 Sprayer is a compact, single-speed handheld HVLP sprayer equipped with the X-Boost turbine, offering adjustable spray width, flow and pattern controls. This sprayer features a Lock-N-Go quick-disassembly system, five cup liners and two interchangeable nozzles for versatile use on small-to-medium interior and exterior painting and staining tasks.

WERNER CO.

wernerco.com

The Werner AP-2030 MP3 is an adjustable-height aluminum work platform featuring a 46-by-14-inch standing deck, dual self-locking legs and easy-grab handles, offering a 300-pound load capacity and up to 9 feet of reach in a compact, lightweight design.

FESTOOL

festoolusa.com

The Festool Granat Abrasives Systainer includes 100 sanding discs in four grits—P80, P120, P180 and P220—organized in a durable case with eight compartments for easy access and refill. Designed to keep discs free from dust and moisture, this systainer is compatible with T-LOC connections and sized for use with Festool sanders, including long-reach drywall sanders.

BY LINDSEY THOMPSON

One of the best ways to diversify your audience and differentiate your business is through business-to-business (B2B) sales. When you think of B2B, you probably picture outside sales teams making cold calls, and while that method is successful for many, retailers are finding success beyond traditional outside sales teams. Whether you’re looking to build B2B from the ground up or just evolve existing B2B programs, these four best practices can steer your strategies to success.

When it comes to building any area of your operation, developing positive relationships is key, but even more so in the B2B segment, as busy pros often want and need those extra touchpoints and involvement. Jay Donnelly, owner of Flanagan Paint & Supply with five locations in the St. Louis Metro area, says B2B makes up nearly 80% of his operation’s audience and is focused on contractor sales, which has grown thanks to purposeful engagement with those pro audiences.

Rewarding B2B customers through pro-only loyalty programs and appreciation events keeps them engaged and spending. Learn more at PDRmag.com/B2B-loyalty

“When I got into this business, the first thing my dad taught me was to make friends with customers, so I don’t know anything else,” Donnelly says. “We push our team and our salespeople to lean into friendships and be 100% relationship driven to align with our best-in-class product and service offerings. Our biggest competitors don’t want friendships because they want to be able to replace their people overnight. But building relationships, that’s our strength.”

As the third-generation owner of Hardware Sales based in Bellingham, Washington, Ty McClellan’s operation is unique in that 70% of the business comes from online sales. Of the 30% of business done in the store, 70% is B2B business.

Hardware Sales launched its B2B segment in the logging industry, and then branched into hardware B2B and moved to retail from there. In all segments of the business, relationships have been key to success, but nurturing those connections has been crucial to the B2B side.

“Face to face in relationships is everything,” McClellan says. “Customers having your salesman’s cell number in their pocket and knowing they can rely on that relationship is huge.”

As a lumberyard with contractors and homebuilders making up a large part of its customer base, Valley Ace Hardware has always had B2B as a part of its DNA.

“Focusing on B2B isn’t a new initiative, it’s how we’ve continuously operated. In fact, about half of our business today is B2B,” says Sarah Handy, who co-owns Valley Ace Hardware with her husband Jeremy Handy. “That’s not just a number; it reflects how deeply embedded we are in supporting local builders, contractors and businesses. Our motivation has always been simple: when our business customers succeed, our whole community grows stronger.”

Along with strong relationships, pros, contractors and other B2B audiences require efficiency and demand that from retail partners.

At Hardware Sales, McClellan says the industrial sales team put several systems in place to provide an extra layer of convenience for B2B customers, including a software program where each customer can access the quantity they buy on a regular basis, the current price and what is in stock.

When the outside sales team from Hardware Sales visits customers on-site, the customer can place orders directly with the salesperson.

Hardware Sales also has a fulfillment program, vendor maintained inventory (VMI), in place where it will keep products stocked at B2B customer locations. The team works with each B2B customer on what

Flanagan Paint & Supply employees are trained to say “Yes” to customers.

products to stock in the VMI and establishes maximum and minimum numbers for each product. This program allows employees of these B2B customers to grab what they need after morning meetings and head right to the job site rather than having to come into the store, saving time.

“If pros are in my store shopping, I love that, but that’s not efficient or profitable for them,” McClellan says. “The more efficient we can be to provide the inventory they need, the better we can serve customers. When they are away from the job, it costs them money. We build those relationships and let them know how we can make them more efficient.”

For Valley Ace Hardware’s B2B customers, quality service and convenience aren’t just nice to have—they’re essential. Handy says the operation’s B2B program is built around making customers feel valued at every step, with each business account paired with a dedicated team member who acts as a partner, not just a salesperson.

“For example, with our custom homebuilders, we don’t just supply materials. We sit down with them early in the process, help plan bids and map out a project timeline so everything runs smoothly,” Handy says. “Our B2B audience ranges from custom builders and contractors to property managers and local businesses, all of whom rely on us to anticipate their needs and deliver solutions that make their work easier.”

As those pro relationships grow and evolve, being able to go the extra mile can mean a lot in keeping those relationships strong.

Donnelly says he has trained his staff to do everything they can to serve customers and avoid saying, “No.”

“I always put myself in the shoes of my customers, and when a vendor tells me no, it can be aggravating and makes me want to move on,” Donnelly says. “A lot of your corporate stores are not going to bend over backwards, so that’s what moves you forward in the B2B category.”

For over 40 years, Ned Green, owner of Weider’s Paint & Hardware, has been a part of the independent channel, and during his tenure in the industry, he has always worked to find ways to grow and differentiate. His operation has three locations in western New York, with B2B sales making up 25% of sales at one of his locations and 16% of sales companywide.

Green strives to exceed expectations every day, but one instance sticks out to him. A customer came into Weider’s on a Sunday at closing time. Rather than turning him away, Green welcomed him into the store—lights off and all—and he bought 18 cans of spray paint and rented the striping machine. When the customer returned the striping machine the next day, he told Green how impressed he was with the extra level of service Green offered. That customer is now a $100,000-a-year customer.

“It wasn’t an overnight deal, but helping them out and going above and beyond just that one time was the start of a long-term relationship,” Green says.

When customers ask for an item that Hardware Sales doesn’t carry, the outside sales team works with the inside sales team to procure it.

“We might not know what it is or where to find it, but we always take the opportunity to go above and beyond,” McClellan says. “Recently, a customer wanted three truckloads of certified

“A lot of your corporate stores are not going to bend over backwards, so that’s what moves you forward in the B2B category.”

—Jay Donnelly, Flanagan Paint & Supply

weed-free straw. We didn’t say, ‘No, we don’t have it,’ but instead said, ‘Let’s go find it.’ Being that resource and having a team that doesn’t get scared and will dig underneath those rocks to find whatever customers need can go a long way.”

Every day, Handy and the team at Valley Ace Hardware prove to customers that they exist to go above and beyond to serve customers by offering competitive pricing, maintaining strong inventory and making their success the operation’s success.

“We don’t just sell products; we stand beside our builders and contractors, even meeting with their clients to explain the value of the materials being used,” Handy says. “And we stay connected long after the project is complete, ensuring homeowners are just as confident in those products as the builder who installed them. That dedication sets us apart.”

That willingness to go the extra mile is also how the operation attracts new business—their reputation for service precedes them. New customers often come because they’ve heard that Valley Ace is not just a hardware and building supply company but a trusted partner committed to helping them deliver quality and peace of mind.

Valley Ace Hardware proves it’s dedicated to B2B customers with a fully dedicated B2B team, an entire Pro Desk section within the store complete with its own entrance, pro parking and space for meetings and training. Pro team members are trained specifically in homebuilding and are equipped to offer services like site visits, equipment rentals, blueprint takeoffs and reliable delivery. The outside sales team takes it a step further by focusing on certifications and additional product training, particularly in installation.

“This ensures we’re not just supplying materials but also providing the expertise that helps our business customers work more efficiently and with confidence,” Handy says. “Ultimately, our staffing model reflects our philosophy: B2B deserves its own dedicated attention, and we’ve structured our team and resources to deliver exactly that.”

Building relationships, offering efficiency and going above and beyond are steps any operation can take to grow B2B businesses, but it’s also crucial for retailers to lean into the unique value propositions each offers to B2B audiences.

Offering services has brought in a number of additional B2B customers to Flanagan Paint and the revenue that comes with them, Donnelly says. The operation has been doing pump and spray equipment repair for nearly 40 years and employs an excellent small engine repair employee who has expanded into other areas, namely lawnmowers.

“Now we’re also doing zero-turn mowers and getting additional business from facilities that previously wouldn’t buy paint from us,” Donnelly says. “But now that we’re doing all their yard equipment, they’ve opened the door to us, and now we’re selling them paint.”

Green’s B2B program at Weider’s Paint & Hardware is fully tailored to what his local market needs, which includes leaning into smaller manufacturers and property management companies.

“We tend to be something a little different for each of them,” Green says. “We are finding what it is that makes a difference to them, finding that value proposition.”

For Weider’s, success is found in smaller B2B clients and being able to solve problems. Looking at the products it sells to B2B customers, Weider’s can match price close to 70% of the time. From there, it’s that extra layer of service and meeting customers where they are that gets the operation business. Green says he asks the customer about their pain points and looks for ways to make each customer more efficient, whether it is offering delivery, repair or another service.

“If it’s all about price, then that’s going to be problematic, but for us, it’s trying to find a value where they feel comfortable with price,” Green says. “It’s finding that solution, which is what we tend to be good at, to get you in the door. You solve the problem and one thing leads to another and you’ve gained a new customer.”

For McClellan, Hardware Sales’ value proposition is being a one-stop shop. The store has about 80,000 different SKUs in its inventory and is selling through several channels at once, including brick-and-mortar, online and B2B.

“If you’re hitting all those lines, then you’re really moving through some volume, and you’re growing your business in the right direction,” McClellan says. “It helps you with profitability, because you’re selling in every sector you possibly can then. And if we can find other sectors where those products fit, then we start getting a lot of overlap in those products and next thing you know, you’re able to buy in mass volumes, getting costs down.”

Punctuality has also been a key differentiator and value proposition for the sales team at Hardware Sales. The team has won numerous jobs just by getting their bids out in a timely fashion—typically within 24 hours—McClellan says.

“Punctuality today is not what it was 20 years ago. Customers are passing on those other companies because they don’t get the bids in on time,” McClellan says. “We strive to be punctual and utilize customers’ time efficiently.”

Adding value to B2B customers by utilizing technology sets Valley Ace Hardware apart. Beyond benefits like streamlined

communication, Handy says the team actively promotes its business partners. The company features them on its website, which has become the community’s go-to directory for trusted local contractors, from plumbers and masons to landscapers and builders.

“That free listing gives them visibility and credibility and many have gained new clients because of it,” Handy says.

Valley Ace Hardware also promotes business customers through in-store TVs, in its quarterly newsletter and on social media. Enhanced exposure is available in Valley’s Pro Directory, where marketing dollars are tied to sales with the company. The sales team will report back the results to B2B customers as an added value for their loyalty.

The key to keeping all of these extras managed is using a customer relationship management tool, Handy says, which allows them to communicate directly with customers based on their business type and makes newsletters and outreach far more relevant. Quarterly newsletters include building trends, economic reports on commodity pricing and invitations to “Builders and Brews” events, which are quarterly gatherings that combine vendor-led product knowledge with networking.

“At the end of the day, our B2B program is about relationships. We succeed when our customers succeed, and that means investing in their businesses as if they were our own,” Handy says. “Whether it’s through personalized service, innovative marketing tools, community events or just showing up when they need us most, our focus is always on adding value and earning their trust. B2B isn’t a side of our business—it’s at the heart of what we do, and it’s what allows us to keep serving and strengthening our community for years to come.”

BY LINDSEY THOMPSON

For over 65 years, the ALLPRO Corporation has operated as a business-to-business buying cooperative, serving a network of independently owned paint and decorating retailers throughout the U.S., Canada, Mexico and parts of Europe. ALLPRO’s mission is to serve its 300 member companies, which represent over 2,000 store fronts, by providing a distinct competitive advantage in

today’s marketplace through seeking out only those programs and initiatives that will help improve operations, market position and profitability.

“Our members’ major value proposition is their ability to pivot and evolve and change; it’s that ability to recreate themselves to stay competitive,” says Michael Beaudoin, ALLPRO executive vice president. “We strive to help them do just that.”

The ALLPRO Women’s Empowerment Group brings together females in the paint industry from all generations. Stronger Together

Learn more about ALLPRO’s history serving the independent channel for more than six decades at PDRmag.com/ALLPRO-history

A key initiative for ALLPRO is the Women’s Empowerment Group the organization launched at the 2025 Spring Show, which brought together female retailers and vendors in the independent paint channel. Attendees enjoyed a moderated panel discussion with representatives from several generations who shared their experiences of being a woman in the male-dominated paint industry and the challenges and opportunities moving forward together.

“When looking at our Next Gen group, one of the things I saw was the group is about 40 to 50% women. These women are really smart, motivated and they need a voice too,” says Michael Beaudoin, ALLPRO executive vice president. “This group is another example of how ALLPRO is working to champion our youth, women and everyone in the paint industry.”

“From my own experiences, when it’s tough that’s when you really go out and be more offensive and look for opportunities. I think talent shines more in tough times than it does in great times.”

—Michael Beaudoin, ALLPRO

One of those initiatives that is top of mind is the 2025 Fall Show. Later this month, ALLPRO will celebrate its legacy and the stakeholders it serves in a big way, gathering everyone in Dublin, Ireland.

The dream to host an ALLPRO show in Ireland started in 2016 when Beaudoin visited members there. It was also during this time when ALLPRO leadership was beginning to reinvent the Fall Shows, which were never known for being large or exciting, Beaudoin says.

“I was overwhelmed by the beauty of the country and the warmth of the people when I first visited,” he says. “And I felt like this would be a really unique experience for a lot of our members, if we could ever pull it off.”

The leadership team began improving the Fall Show by moving the location around to vibrant cities, featuring engaging keynote speakers to add an extra layer of excitement, increasing the number of vendors present and bringing in professional trainers.

“We kept tweaking the agenda to find the sweet spot and attendance started to improve dramatically,” Beaudoin says.

“Since then, we’ve done New Orleans, Los Angeles, Nashville, San Antonio, Denver and Austin, and I’m excited to finally have everything fall into place for it to be in Dublin. We’re looking forward to a very well-attended event, with over 800 people. I’m most excited about the toast of Guinness beer we’ll all share to open the show and celebrate being together.”

More important than offering a marvelous location, the Fall Show will continue to build the culture of loyalty ALLPRO is known for and solidify relationships in the channel.

“This will be something that brings people closer together and creates that special moment; it adds to our culture, which makes us a stronger group,” Beaudoin says. “We’ve also grown significantly, so this event will be a good investment to bring to our stakeholders. This is as much for our suppliers as it is for our members.”

At the 2025 Fall Show and beyond, Beaudoin and ALLPRO leadership will be focused on the success of members. To accomplish that goal, not being complacent in the current challenging economy will be No. 1 on Beaudoin’s list. In late Q3, the company was looking at minus 2% for the year, although Beaudoin hopes that by the end of 2025, that number will be back to even or plus 1%.

“From my own experiences, when it’s tough that’s when you really go out and be more offensive and look for opportunities,” he says. “I think talent shines more in tough times than it does in great times.”

Beaudoin says he wants to keep pushing the organization forward, which includes expanding distribution, adding a new updated technology to the member portal to modernize how members pay their bill and adding a business-to-business website for the distribution centers.

“These are some pretty large initiatives that will take quite a bit of programming to

More Than Just Sales

From networking groups to training, ALLPRO focuses on building a stronger and more profitable future for its members.

get everything to work out, but we’re investing for the future,” Beaudoin says. “I want to acknowledge that we’re in a tougher time and not gloss over that, but I also want our members to know that we’re not laying low.”

ALLPRO is also encouraging its members to look peripherally, continue to grow their business and position themselves for when things turn around, heading into 2026 with a positive outlook.

“I think next year’s going to be a better year. The uncertainty we faced in the first six months of this year was challenging—we had 144 price increases in four months and none of them fell into a consistent pattern,” he says. “We had all these uncertainties that seem to have calmed down for the back half of the year, so hopefully we can get a bit of tailwind.”

Thanks to their ability to pivot, Beaudoin believes ALLPRO’s retailers and the independent channel as a whole are well prepared to face whatever the next year brings. Retailers proved this during the first half of 2025, when if one supplier was not able to service the group due to challenges, there were other options in the category to choose from.

“Their nimbleness is their strength and it has been since the pandemic,” Beaudoin says. “If a product doesn’t meet their market’s needs, they can quickly find another solution.”

ALLPRO helps facilitate this flexibility, offering thought-out curation and a select number of vendors in each category to help members make those changes between suppliers when needed.

“We’re very deliberate with how many suppliers we have in each category,” Beaudoin says. “This gives the supplier the

advantage of only having to compete with a couple of similar suppliers within our group, but it also gives the members the ability to choose from well-vetted options.”

ALLPRO’s focus on building a stronger future can be seen in the investments the company has made in its Next-Gen Group. While the group was formed before Beaudoin took the helm at ALLPRO, he understands the importance of the group to the company. He also believes that the retailers in this group are the future of the industry and helping them find their place in the channel will be crucial to the channel’s future success.

“I saw an opportunity to give them their own ALLPRO experience,” Beaudoin says. “I’ve been in this industry for 30 years, so when I go to an ALLPRO show, I know a lot of people, and it’s easy for me. But if my son, Ian, who works at ALLPRO now, would go to that same show, he wouldn’t know a soul. When you start to build those relationships at the bottom level, it becomes their show and it’s a better experience for everyone.”

The independent channel’s model of independent owners with an entrepreneurial spirit is core to progress and prosperity in the industry, but the channel’s weakest point is when those owners age out and need to sell, Beaudoin says.

“The only way an owner is going to want their son or daughter to take over the business is if they think there’s a bright future,” he says. “Our Next Gen group promises a bright future. They inject youth into our group and help us all to think more long term strategically because they are in for the long haul.”

Purchase your copy of the 2025 Cost of Doing Business Study and begin benchmarking your business for future success. Learn more at YourNHPA.org/CODB

The 2025 Cost of Doing Business Study presents the North American Hardware and Paint Association’s (NHPA) annual financial and operational profile of independent hardware stores, home centers, lumber and building materials (LBM) outlets and paint and decorating outlets.

This study assesses the financial performance of home improvement retailers who graciously submitted confidential financial reports for fiscal year 2024 to NHPA. The study presents composite income statements and balance sheets plus averages for key financial performance ratios.

The data is segmented for hardware stores, home centers, LBM outlets and paint and decorating outlets. In each segment, data is presented for the typical store, for high-profit stores, for single-unit and multiple-unit companies and for sales volume categories. In addition, there is a five-year historical trend for typical stores in each segment, including paint.

Retailers can use this data to measure their own performance against industry averages. The data develops benchmarks retailers can use to establish financial plans to improve profitability.

The annual Cost of Doing Business Study is made possible through the cooperation of hardware store, home center, LBM outlet and paint and decorating outlet owners and managers throughout the U.S. who provide detailed financial and operational information on their individual companies.

Questionnaires were mailed to a sampling of hardware stores, home centers, LBM outlets and paint and decorating outlets in the U.S. to collect detailed financial and operational information for 2024.

The analysis in this report is the result of extensive review by NHPA. All individual company responses are completely confidential.

Most of the figures in this report are medians. The median for a particular calculation is the middle number of all values reported when arranged from lowest to highest. The median represents the typical company’s results and is not influenced by extremely high or low reports.

To determine high-profit stores, all participating companies were ranked based on operating profits. The high-profit companies in each segment are those that make up the top 25%. The figures reported for each of the high-profit segments represent the median for that group.

While reviewing the numbers on the following pages, it is extremely important to note that each year, this report contains figures from a different sample group of stores. That means overall figures have the potential to vary widely from year to year based on the respondent group of stores participating each year. We use year-to-year comparisons to illustrate general trends over time, not to draw specific year-over-year conclusions.

In this year’s study, 1,082 independent home improvement stores participated, which represents a 1.3% decrease from the prior year, but is the fifth highest since the study began.

To purchase the 2025 Cost of Doing Business Study, visit YourNHPA.org/CODB.

48 out of 50 states participated

NEW STORES PARTICIPATED 90

1,082 PARTICIPANTS IN THE 2025 STUDY

5th highest participation in history 1.3% DECREASE VS PRIOR YEAR

Another helpful tool from NHPA, RetailWise offers micro-training videos that allow you to train smarter, not harder. Learn more at YourNHPA.org/retailwise

O Sales Per Customer of $39 is an all-time high

O Profit Before Taxes of 4.7% dropped for the third year in a row but is the fifth highest on record

O Gross Margin After Rebate of 42.6% is the highest since 2016

O Comp Sales were down 1.18%

O Inventory Turnover (2.0) and Sales Per Inventory (2.9) are the lowest levels ever recorded

O Typical store Gross Margin After Rebate of 32.4% is the same as the prior year

O Comp Sales were up 1.57%

O Purchase Rebates of 2.0% is the highest ever recorded

O Sales Per Employee of $521,494 is the third highest since the study began

O Owners’ Salary (0.4%) is the lowest since the paint segment became part of the study

O Comp Sales were down more than any other segment at 2.22%

O Employee Headcount is up +2, the highest level since 2020

O E-Commerce and Delivery: Average percentage of sales online across all segments was 2% and the median was 1%

O Inventory and Loss Prevention: Shrink expense as a percent of sales across all segments was an average of 1.7% and median of 1%

O Staff and Wages: Employee Turnover across all segments was at an average of 28.4% and median of 27%

Key performance metrics separated by store type so you can gauge your operation’s performance against industry standards including:

O Average sales per customer

O Annual customer count

O Sales per employee

O Inventory turns

O Total payroll expenses

O IT & communications expenses

O As a percentage of assets...

O Inventory

O As a percentage of sales... And more!

O Accounts payable/receivable

The Cost of Doing Business Study presents financial and operational data for you to evaluate your business and plan strategic changes. Here are ways you can use this report.

• Determine your expenses as a percent of sales and calculate your balance sheet as a percent of total assets. Compare your numbers to the study results for both typical and high-profit stores.

• Don’t look at percentages alone. Compare your real-dollar expenditures as well.

• Compare your results with key profitability and productivity measurements summarized.

• Compare your numbers to stores of a similar size. Don’t limit your comparison to one type of store. Defining hardware stores, home centers, LBM outlets and paint and decorating outlets is practical for statistical purposes, but your store may have attributes of more than one type.

• If your numbers differ significantly, determine the cause. Then develop a plan to bring your numbers more in line with high-profit stores.

“The CODB allows retailers to see direct results between their income statement and balance sheet versus the rest of the industry. They can use the ratios included in the study to guide a plan for revenue growth and to help cut expenses.”

Dave Gowan, NHPA Chief Financial Officer

BY LINDSEY THOMPSON

With the vision to create a successful wholesale hardware business, W.B. Whittaker, S.M. Holtsinger and D.M. Wallace chartered the Whittaker-Holtsinger Company in 1922 in Morristown, Tennessee. In 1932, D.M.

became president, and in 1944, he changed the name to the Wallace Hardware Company, Inc. D.M.’s brother J.G. and his son John D. would follow as company presidents, and in 2008, John D’s son Doyle began serving in the role.

An Honor to Serve

NHPA is sharing the stories of these hometown heroes in all of its media brands. Visit YourNHPA.org/veterans to read more about these honorees.

While there is no way to repay the sacrifices made by veterans of the armed forces, the North American Hardware and Paint Association (NHPA) recognizes that not only have these individuals made a lasting impact on their country, but they are also a prominent and positive influence within the home improvement industry.

To honor the ongoing impact military veterans make throughout the home improvement industry, in 2025 NHPA launched the Helmets to Home Improvement recognition program, with the National Hardware Show (NHS) as the program’s official founding sponsor and venue partner.

We need your help honoring these amazing men and women. Please visit YourNHPA.org/veterans to nominate a Helmets to Home Improvement honoree.

Help us honor those who have served our country and our channel. Visit YourNHPA.org/veterans to nominate a veteran from your business to be recognized.

Along with being a household name in the independent home improvement channel, the Wallace family also has a legacy of service in the U.S. military. The latest members of the Wallace family to serve in both the independent industry at Wallace Distribution Co. and the military are Doyle’s sons John Wallace and Michael Wallace.

John has been a member of the Tennessee Army National Guard since 2010, serving as a Blackhawk pilot out of the Medvac unit in Knoxville.

“I’ve always felt a strong sense of duty to serve the wonderful nation we live in,” John says.

Michael joined the Army National Guard after graduating from high school in 2014 and served for six years.

“We have a number of veterans in our family, so that has always made me want to join and serve,” Michael says. “Ultimately, I love my country, and I wanted to serve it.”

Michael drilled at 278 Cavalry Regiment in Mount Carmel, Tennessee, headquarters, and trained as a “68 Whiskey,” which is the Military Occupational Specialty (MOS) code for combat medic specialist.

“When I was going in, I remember my mom was pretty worried, and she told my dad to help me pick a job in intel so I would be safer,” Michael says. “I was looking at those jobs and couldn’t see how I would ever use those skills again, but when I looked at the combat jobs, I thought those were skills I could always use, even if I didn’t become an EMT outside of the military. When my mom found out I had picked combat medicine, she was pretty mad at my dad, but it worked out.”

The camaraderie and brotherhood that have come along with his time in the Army National Guard are John’s favorite parts of serving.

When it came to his time in the service, Michael says his favorite part was the routine, especially during training.

“You are definitely always tired at the end of the day and ready for bed, because you’re waking up early and you’re eating well and doing a ton of physical labor,” Michael says. “They squeeze a lot of activity in a short amount of time. For instance, it normally takes nine months to become an EMT basic but we did that course in two months.”

During his time in the Army National Guard, John has also been a part of the Wallace Distribution Co., currently serving as vice president of operations.

“My family has been serving independent dealers for over 100 years; it’s been an honor to step into that legacy and serve them as well,” John says. “As in the military, there is a deep vein of loyalty, trust and brotherhood within the independent hardlines market. Our market is filled with honest and hardworking people that support each other.”

While he loved his time in the military, Michael says he knew he wanted to serve and then move to what was next, which was back to the family business, where he had been working since age 11.

“Whether I was washing trucks out on the farm or helping give birth to baby cows, I’ve always had a part with the company,” Michael says.

Now he serves in the same sales territory in the Knoxville area that was his grandfather Doyle’s territory when he was Michael’s age. Michael’s uncle Lynn Dawson and John also did a stint in this territory. Beyond the medical skills he gained from his time as a combat medic, Michael has utilized other skills in his role in the independent industry, including punctuality, efficiency, leadership and more.

John has found that his military skills also cross over, and says his experience has given him better judgment for how to earn the respect of those following him, how to challenge teammates to reach their full potential and how to support his team in stressful times, like peak season during a show.

“In my time as an Army officer and pilot, I was able to serve alongside many remarkable and talented individuals. In many

ways, managing soldiers during military operations is much like managing teammates in a business, with lower stakes,” John says. “The military teaches servant leadership, leading from the front and a genuine care for your soldiers.

I’m thankful to have that experience.”

Those experiences make military veterans a good fit for the independent channel, John says, as they have been tested under extreme amounts of pressure and responsibility, and this exposure and general broadening allows them to bring tremendous value to the organizations they serve.

“The military teaches many things, but I think that service members are generally going to understand how to contribute to a team, lead a team, work a problem from different perspectives, ignore the noise in a situation and get results,”

John says. “I believe most service members are going to have experience with technology and administration that will aid them in areas they wouldn’t expect. I also think that specifically in the hardware channel, service members will fit right in with the hardworking and relationship oriented industry that we operate in.”

Coating Connection

Turn to the Category Focus on Page 32 to see how one retailer follows trends in wood care to keep his customers stocked with the latest and greatest.

Provided by the Home Improvement Research Institute

With homeowners still adjusting to a high-cost environment, the key to unlocking paint and decorating purchases this season lies in inspiration, not just inventory. Current Home Improvement Research Institute (HIRI) research reveals that home improvement activities that cost less than $5,000 remains strong. These activities are increasingly driven by the emotional value and perceived payoff of the project, rather than large-scale investment.

According to the Recent Home Buyer/Seller Study from HIRI, the most common reasons homeowners undertook work on their current homes included to beautify the home (45%), freshen up the space (40%) and replace worn-out materials (35%). These motivations reflect a desire for visual renewal and personal expression, both of which are goals suited for interior wood care and paint projects. But to convert interest into action, retailers must do more than stock products. They must spark the idea that “I can do this and it’s worth it.”

The Home Improvement Research Institute (HIRI) is the only nonprofit organization primarily dedicated to home improvement research. The organization empowers its members with exclusive, ongoing home improvement data and information for making better business decisions. Members are the home improvement industry’s leading manufacturers, retailers and allied organizations. Learn more at hiri.org

In HIRI’s Q2 2025 Homeowner Project Activity Tracker, eight in ten homeowners said they planned to start a home improvement project in the next 90 days, the highest in five quarters. However, most of that activity skewed toward maintenance-focused and budget-conscious consumers. Home repair and upkeep continued to outpace full renovations by nearly 2 to 1. Keep an eye out for HIRI’s release of the Q3 2025 Tracker later this month. At the same time, cash reserves are rising even as income growth slows, further supporting homeowners spending with caution and intention. Paint and wood care projects are particularly well-positioned here because they offer a high return in perceived value for a relatively low cost.

Today’s DIYers are not just reacting to budget constraints; they’re actively choosing to take on projects themselves, thanks to better tools, improved confidence and easy access to how-to content.

Wood finishing and paint projects are seen as manageable, transformative and empowering, especially when supported by clear guidance.

This makes inspiration more important than ever. Retailers can lead with lifestyle messaging that connects paint and wood care to bigger themes of restoration, renewal and pride in ownership, while also offering clear, actionable steps for getting started.

Tell Visual Stories: Use before-and-after transformations, seasonal palettes or style boards that help homeowners see the end result before they buy.

Make It Personal: Think “Refresh your nursery” or “Give your entryway new life.”

Simplify DIY Pathways: Curate beginner-friendly project kits and signage that reduce decision fatigue and highlight weekend-ready upgrades.

Focus on Benefits: Showcase products that combine aesthetics with durability, like scratch-resistant finishes or quick-dry stains, catering to both emotional and functional needs.

In a market defined by caution, inspiration is currency. Retailers who connect with customers’ aspirations and equip them for success will not only drive sales but help homeowners fall in love with their spaces again.

To get the latest actionable insights from HIRI, become a member and get enterprise-wide access to $1M+ annually in home improvement research. Learn more at HIRI.org/pricing

BY ANNIE PALMER

Staining a building’s exterior or interior wood surfaces is a popular way to upgrade a space or add a new feel to a home. Keeping up with stain trends is crucial in guiding customers on what to purchase and preparing paint and stain professionals for future requests from homeowners.

Finishers Depot, an industrial coatings distributor in Texas, supplies professionals with industrial products. Paint & Decorating Retailer spoke with Zach Saviano, lead technical specialist at Finishers Depot, about the day-to-day trends in wood stains and the staining products customers are purchasing and using across various Texas cabinet and millwork shops.

From offering color matching to following the latest trends to guide customers, Finishers Depot caters to professionals throughout Texas.

In 2025, Finishers Depot customers are favoring warm stains that enhance the natural character of wood. Moving into 2026, Saviano anticipates neutrals will dominate, complimenting both cool color palettes and warm tones.

“This year, we’ve seen a clear preference for warm, midtone finishes—especially walnut, greige and soft taupe shades that highlight wood character without overwhelming it,” Saviano says. “We’re expecting to see deeper, earth-toned neutrals take the lead in 2026—clay, olive-brown and soft amber tones that pair well with both cool and warm design schemes.”

When purchasing stains, consumers consider a wide range of factors, like color, price and durability. Saviano says longevity, application consistency and design are the top factors influencing stain purchases at Finishers Depot.

“There’s a broader design shift toward natural minimalism—earthy palettes, light wood floors and softer contrasts that complement open-plan spaces,” he says. “These warm neutrals tend to be easier to apply and touch up, which reduces rework and helps crews stay on schedule. Builders and production teams are also leaning into finishes with longer shelf life—colors that won’t look dated two years after install.”

Observing purchasing patterns from year to year, Saviano says customers tend to choose stain finishes that last longer than the newest color trend or craze.

“It’s less about trend cycles and more about finishes that hold up both visually and practically over time,” he says. “There’s been a real shift from extremes to balance. Just a few years ago, it was all about dark espresso or bleached-out whites. Now, customers are opting for softer, more versatile tones that feel grounded and timeless.”

The ability of retailers in the independent channel to adapt and be flexible is especially helpful when staying on top of the latest trends. Offering in-store services like color matching and paint equipment rentals also sets independent retailers apart from big-box competitors. Saviano has seen this in his operation and has noticed an increase in demand for custom-matched colors and specialty stain products like water-based stains.

“There’s a noticeable rise in interest around waterborne stain systems—especially those that can match the warmth and clarity of solvent-based finishes,” he says. “As production teams look for lower-odor, faster-drying solutions without sacrificing appearance, waterborne options are gaining traction. It’s a shift driven by both environmental considerations and shop efficiency.”

Increase basket size with these must-have products customers will need when working on any interior or exterior wood care project.

1

A disposable alternative to bristle brushes, stain pads provide better durability than a foam brush and more control than a shop towel or rag.

2

Pad applicators work stain into wood fibers while providing even coverage and reducing application time compared to traditional brushing methods.

3

These felt-tipped markers help hide minor scratches and nicks in stained wood.

4

High-quality respirators provide professional-grade protection against dust, fumes and particles and are easy to wear for extended periods.

5

Reusable hand sanding sheets are ideal for heavy-duty sanding projects, lasting longer than traditional sandpaper.

RetailWise is NHPA’s new AI-powered micro-training program, built exclusively for independent hardware, paint, and lumber retailers. Designed for today’s fast-paced retail environment, RetailWise delivers 52 professionally scripted, two-minute video lessons that fit seamlessly into your store’s daily rhythm — no long classroom sessions or complicated schedules required.

RetailWise can be accessed across multiple platforms including, mobile devices, desktops and in-store screens.

Subscribe to our weekly newsletters at PDRmag.com/subscribe to get the latest news and trends.

The new CEO of Pittsburgh Paint Co. Brian Carson sat down with Paint & Decorating Retailer to share his insights on the last five months and what’s on deck for the next five and beyond.

The company reported total net sales of $6.31 billion, a 0.7% increase year over year, attributing the increase to higher sales in its paint store group (PSG). Total net income dropped to $754 million, a 15.2% decrease year over year.

PPG announced the appointment of Joe Gette to senior vice president, general counsel and secretary of the company. Gette currently serves as vice president, deputy general counsel and secretary.

In an email to employees, Sherwin-Williams’ CEO Heidi Petz announced that the company will no longer match its employees’ 401(k) plans because of weak sales in the first half of the year.

To read these news stories and other news, visit PDRmag.com/industry-news

BUSINESS FOR SALE

Northwest Farm & Home Supply Co.

Location: Lemmon, SD

Gross Revenue: $3.21 million

The main building is a total 27,213 sq. ft. of retail and warehouse space on 4 acres. The main bldg. was constructed in 1994 with additions constructed in 2002 and 2004.

Single story with 22’ clear height in 11,459 sq. ft. of lumber warehouse, three grade level doors and two dock height doors.

BUSINESS FOR SALE

Hoosick True Value

Location: Hoosick Falls, NY

Gross Revenue: $1.26 million

Price: $1.875 million

This opportunity offers a turnkey sale of a general hardware business located in northeastern Rensselaer Co., New York. The business serves five towns and southwestern Bennington Co., Vermont, and 25 miles east of Troy, New York.

SEEKING BUSINESSES

The Aubuchon Company

For our next acquisition, we are looking for:

• Single-store and multi-store hardware operations

• Located in northeast and southeast United States

• Store size of 5,000-30,000 ft 2

• At least $3 million in average store sales

SEEKING BUSINESSES

BUSINESS FOR SALE

Home Improvement Supply Store

Location: Missouri

Gross Revenue: $1.04 million

This historic home improvement and hardware store is a staple of its community and operates from its headquarters in the Kansas City Metropolitan Area of Missouri. The Company is a long-standing retailer and installer of consumer and commercial improvement products.

BUSINESS FOR SALE

Albrights Hardware & Garden Center

Location: Allentown, PA

Gross Revenue: $1.9 million

Price: $800,000

Albrights Hardware is an established hardware store with strong neighborhood ties and has been a Lehigh Valley staple for over 50 years. The current owners have owned the store since 1992. Albrights serves its loyal customer base by providing quality products and exceptional customer service.

SEEKING BUSINESSES

Bolster Hardware

We are looking for:

• Geography agnostic

• With or without real estate

• Store revenues of $1.5M+

• We prefer to honor the family name and heritage in the local community by not changing the name

• We prefer to keep all employees as part of the acquisition

JOB LISTING

The Helpful Hardware Company

We are looking for:

• Single-store units in the southeast and multi-store groups with 3+ units nationwide

• Store size of 5,000 ft2-35,000 ft2

• Supplier agnostic

• Store revenue: $1.75M+

BUSINESS FOR SALE

Central Vermont Paint, Flooring and Decorating Business

Location: Vermont

Gross Revenue: $2.82 million

Price: $1.1 million

Full-service decorating store providing flooring, paint, window treatments, kitchen/bathroom remodeling, cabinetry product offerings, design assistance, specialized service, and professional installation.

BUSINESS FOR SALE

Private Business

Location: Alabama

Gross Revenue: $2.21 million

Price: $649,000

BUSINESS FOR SALE

Private Business

Location: Pennsylvania

Gross Revenue: $1.6 million

SEEKING BUSINESSES

Gold Beach Lumber Yard

We are looking for:

• Single-store and multi-store hardware operations

• Located in the Pacific Northwest

• Store size of 5,000 ft2-30,000 ft2

Randall Lumber & Hardware, Inc.

Position: Hardware, Ranch and Feed Department Manager

• Annual Salary: $48,000-$55,000

• Bachelor’s Degree or 5 years of experience in similar role preferred

• Strong leadership skills and creative thinking are a bonus

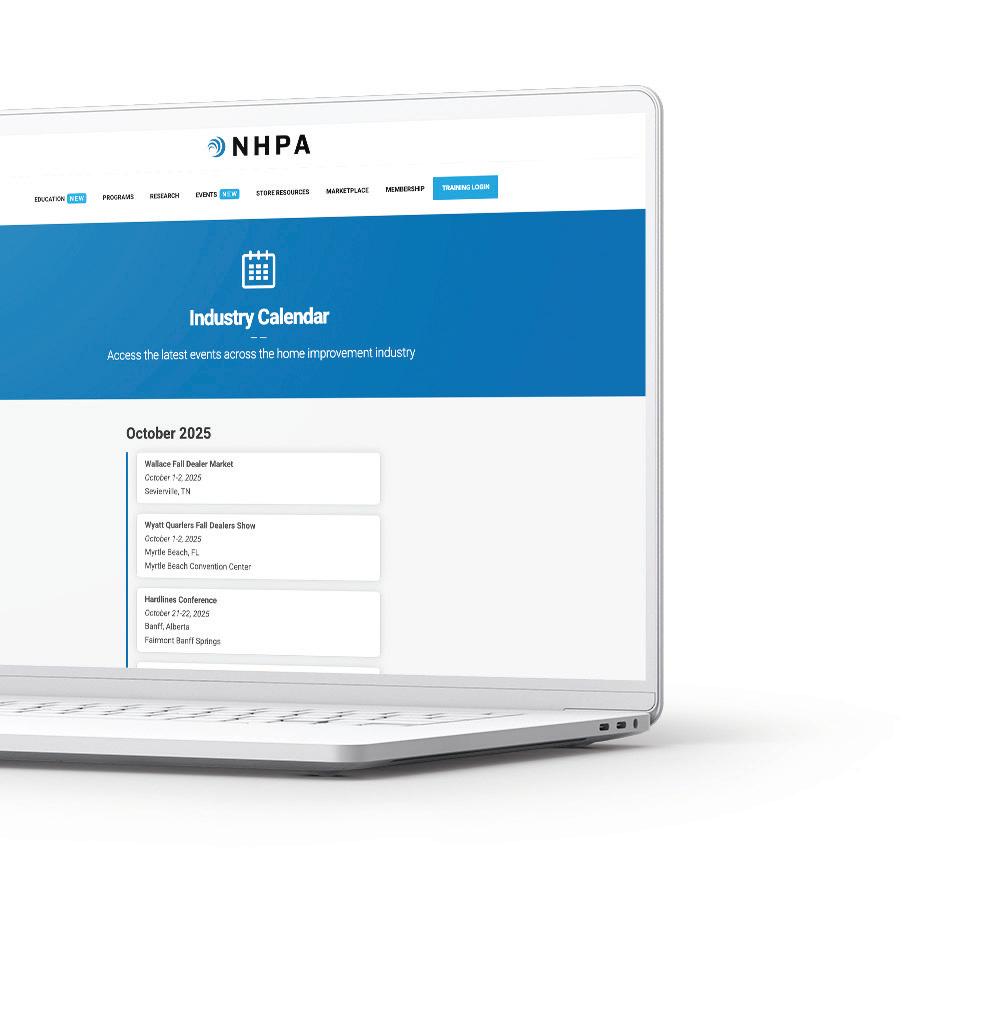

OCT

Hardlines Conference

October 21-22 | BANFF, ALBERTA

HIRI Summit

October 22-23 | CHICAGO, IL

House-Hasson Dealer Market

October 23-25 | SEVIERVILLE, TN

November 3-16 | VIRTUAL NOV

Orgill Winter Online Buying Event

ISSA Show North America

November 11-13 | LAS VEGAS, NV

Hardlines Distribution Alliance Executive Planning Conference

November 18-20 | PONTE VEDRA BEACH, FL

To add your event to the industry calendar, send an email to editorial@YourNHPA.org. *Events are current as of press day. Scan the QR code to see our full list of events. YourNHPA.org/cal

Find solutions for growing your business with the NHPA Academy for Retail Development. Learn more at YourNHPA.org/education/academy

When it comes to knowing where to start with B2B in your business, retailers who have found success in this area suggest starting small to attract these pro customers.

Jay Donnelly, owner of Flanagan Paint & Supply with five locations in the St. Louis Metro area, says posting regularly on LinkedIn has helped bring in new B2B customers. He has had contractors start buying from his stores after seeing posts on LinkedIn.

• Anticipate customer needs

• Talk about price later

• Be a product expert

• Start small and focus on long-term value

“These customers are seeing the content we’re putting out on LinkedIn and seeing the value we can offer,” Donnelly says. “I’ll post pictures of our deliveries so they see we are doing volume and that makes a big impact.”

Donnelly also makes a point to call at least one customer a week and thank them for coming in and making a purchase.

Paint and Decorating Retailer shares seven additional ways to earn the business of and retain loyal B2B customers.

• Learn from industry peers and share ideas

• Refine your elevator pitch

• Hire a consultant